Exhibit (a)(5)(f)

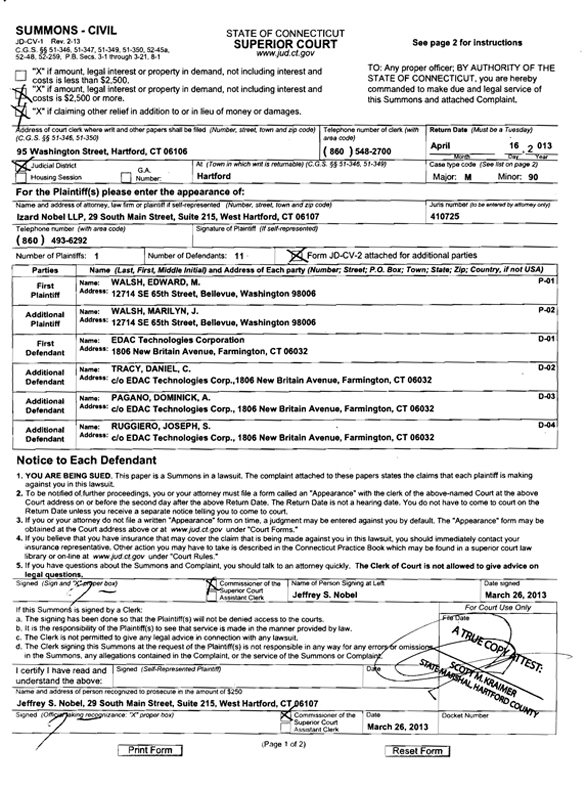

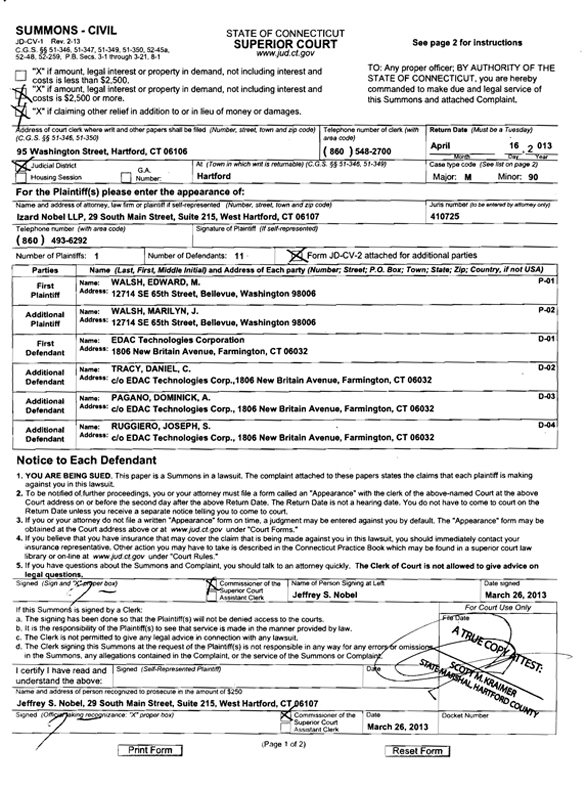

SUMMONS—CIVIL JO-C V-i Rev. 2-13 C.G.S. % 51-346, 51-347, 51-349, 51-350, 52-45a, 52-48, 52-259, P.8. Secs. 3-1 through 3-21, 8-1 E“X” if amount, legal interest or property in demand, not including interest and costs is less than $2500. -p “X” if amount, legal interest or property in demand, not including interest and Lf%,costs is $2,500 or more. “X” if claiming other relief in addition to or in lieu of money or damages. Mress of court clerk where writ and other papers shall be filed (Number, street, town and zip code) Telephone number of clerk (with (C.G.S. § 51-346, 51-350) area code) (860 ) 548-2700 Notice to Each Defendant 1. You ARE BEING SUED. This paper is a Summons in a lawsuit. The complaint attached to these papers states the claims that each plaintiff is making against you in this lawsuit. 2. To be notified of.further proceedings, you or your attorney must tile a form called an “Appearance” with the clerk of the above-named Court at the above Court address on or before the second day after the above Return Date. The Return Date is not a hearing date. You do not have to come to court on the Return Date unless you receive a separate notice telling you to come to court. 3. If you or your attorney do not Ii le a written “Appearance” form on time, a judgment may be entered against you by default. The “Appearance” form may be obtained at the Court address above or at www.jud.ctgov under “Court Forms.” 4. If you believe that you have insurance that may cover the claim that is being made against you in this lawsuit, you should immediately contact your insurance representative. Other action you may have to take is described in the Connecticut Practice Book which may be found in a superior court law library or on-line at ww-w.jud.ct.gov under “Court Rules,” 5. If you have questions about the Summons and Complaint, you should talk to an attorney quickly. The Clerk of Court is not allowed to give advice on aI I certify I have read and understand the above: Name and address of person Jeffrey S. Nobel, 29 South Main Street, Suite 215, West Hartford, STATE OF CONNECTICUT SUPERIOR COURT www.jud. ct.gov See page 2 for instructions TO: Any proper officer; BY AUTHORITY OF THE STATE OF CONNECTICUT, you are hereby commanded to make due and legal service of this Summons and attached Complaint.—95 Washington Street, Hartford, CT 06106 Return Date (Must be a Tuesday) April 16 , 2 013 Month DSj Year Judicial District GA At (Town in which wnt is returnable) (C.G.S. § 51-346. 51-349) Housing Session Number: Hartford case type code (See list on page 2) Major: M Minor: 90 For the Plaintiff(s) please enter the appearance of: Name and address of attorney, law firm or plaintiff if self-represented (Number, street, town and zip code) Juris number (to be entered by attorney only) Izard Nobel LLP, 29 South Main Street, Suite 215, West Hartford, CT 06107 410725 Telephone number (with area code) 1 Signature of Plaintiff (If self-represented) (860) 493-6292 L Number of Plaintiffs: I Number of Defendants: 11 “,,Form JD-CV-2 attached for additional parties V Parties First Plaintiff Name (Last, First, Middle Initial) and Address of Each party (Number; Street; P.O. Box; Town; State; Zip; Country, if not USA) Name: WALSH, EDWARD, M. P-01 Address: 12714 SE 65th Street, Bellevue, Washington 98006 Additional Plaintiff Name: WALSH, MARILYN, J. P02 Address: 12714 SE 65th Street, Bellevue, Washington 98006 First Defendant Name: EDAC Technologies Corporation 0-01 Address: 1806 New Britain Avenue, Farmington, CT 06032 Additional Defendant Name: TRACY, DANIEL, C, , 0-02 Address: do EDAC Technologies Corp.,1806 New Britain Avenue, Farmington, CT 06032 Additional Defendant Name: PAGANO, DOMINICK, A. 0-03 Address: do EDAC Technologies Corp., 1806 New Britain Avenue, Farmington, CT 06032 Additional Defendant Name: RUGGIERO, JOSEPH, S. , 0-04 Address: do EDAC Technologies Corp., 1806 New Britain Avenue, Farmington, CT 06032 V If this Summon is signed by a Clerk: a. The signing has been done so that the Plaintiff(s) will not be denied access to the courts. b. It is the responsibitity of the Plaintiff(s) to see that service is made in the manner provided by law. c. The Clerk is not permitted to give any legal advice in connection with any lawsuit. d. The Clerk signing this Summons at the request of the Plaintiff(s) is not responsible in any way for any in the Summons, any allegations contained in the Complaint, or the service of the Summons or Signed 15 “X’proper box) Ppnj.fpnj Page 1 of 2) Reset ForrJ

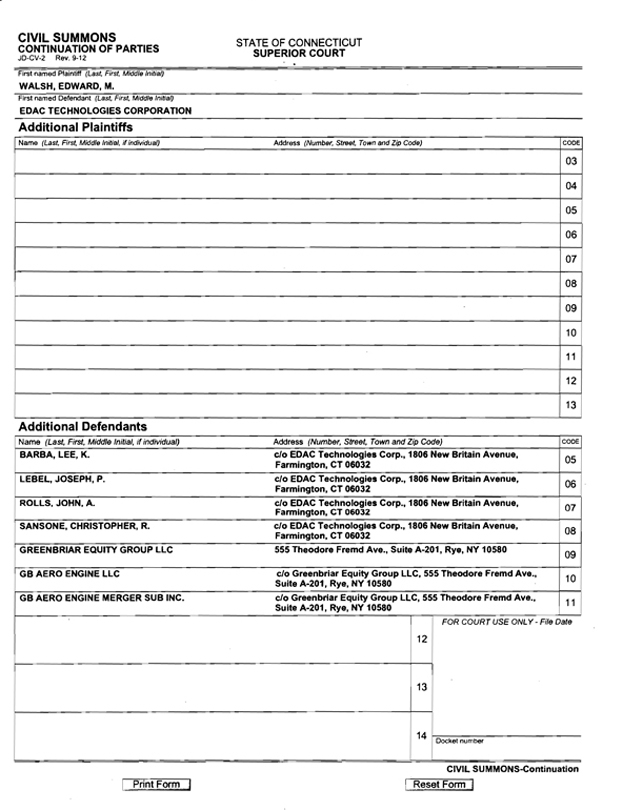

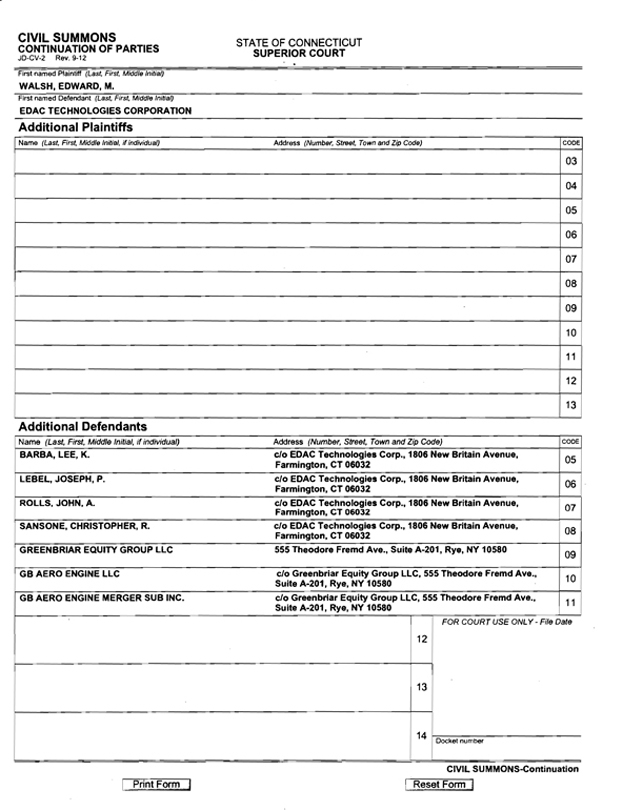

CIVIL SUMMONS CONTINUATION OF PARTIES ,JD-CV-2 Rev. 9-12 STATE OF CONNECTICUT SUPERIOR COURT First named Plaintiff (Last, First, Middle Initial) WALSH, EDWARD, M. First named Defendant (Last, First, Middle Initial) EDAC TECHNOLOGIES CORPORATION Additional Plaintiffs Name (Last, First, Middle Initial, if individual) Address (Number, Street, Town and Zip Code) 03 04 05 1 08 09 10 11 12 13 Additional Defendants Name (Last, First, Middle Initial, if individual) Address (Number, Street, Town and Zip Code) CODE BARBA, LEE, K. c/o EDAC Technologies Corp., 1806 New Britain Avenue, Farmington, CT 06032 06 LEBEL, JOSEPH, P. c/o EDAC Technologies Corp., 1806 New Britain Avenue, Farmington, CT 06032 ROLLS, JOHN. A. c/o EDAC Technologies Corp., 1806 New Britain Avenue, Farmington, CT 06032 07 SANSONE, CHRISTOPHER, R. do EDAC Technologies Corp., 1806 New Britain Avenue, Farmington, CT 06032 08 GREENBRIAR EQUITY GROUP LLC 555 Theodore Fremd Ave., Suite A-201, Rye, NY 10580 09 GB AERO ENGINE LLC c/o Greenbriar Equity Group LLC, 555 Theodore Fremd Ave., Suite A-201, Rye, NY 10580 10 GB AERO ENGINE MERGER SUB INC. c/o Greenbriar Equity Group LLC, 555 Theodore Fremd Ave., Suite A-201, Rye, NY 10580 12 FOR COURT USE ONLY—File Date 13 14 Docket number CIVIL SUMMONS-Continuation Print Form Reset Form

| | |

| | |

| RETURN DATE: APRIL 16, 2013 | | SUPERIOR COURT |

| | |

| EDWARD WALSH and MARILYN WALSH, on behalf of themselves and all others similarly situated, | | JUDICIAL DISTRICT OF HARTFORD |

| | |

Plaintiffs, | | AT HARTFORD |

| | |

| v. | | |

| | |

| EDAC TECHNOLOGIES CORP., DANIEL C. TRACY, DOMINICK A PAGANO, LEE K. BARBA, JOSEPH P. LEBEL, JOHN A ROLLS, JOSEPH S. RUGGIERO, CHRISTOPHER R. SANSONE, GB AERO ENGINE LLC, GB AERO ENGINE MERGER SUB INC, and GREENBRIAR EQUITY GROUP LLC. | | |

| | |

| | |

Defendants. | | MARCH 26, 2013 |

CLASS ACTION COMPLAINT

Plaintiffs Edward and Marilyn Walsh (“Plaintiffs”), by their undersigned attorneys, for their Class Action Complaint against EDAC Technologies Corp., Daniel C. Tracy, Dominick A. Pagano, Lee K. Barba, Joseph P. Lebel, John A. Rolls, Joseph S. Ruggiero, Christopher R. Sansone, GB Aero Engine LLC, GB Aero Engine Merger Sub Inc., and Greenbriar Equity Group LLC allege upon personal knowledge as to their own acts and upon information and belief as to all other matters, based on the investigation of their counsel, which included,inter alia, review of news articles, analyst reports, United States Securities and Exchange Commission (“SEC”) filings, and other publicly available information, as follows:

INTRODUCTION

1. This is a class action on behalf of the public shareholders of EDAC Technologies Corporation (“EDAC” or “the Company”) against the members of EDAC’s Board of Directors (the “Board” or the “Individual Defendants”), seeking to enjoin a proposed transaction pursuant to which EDAC will be acquired by GB Aero Engine LLC (“GB”), an affiliate of Greenbriar Equity Group LLC (“GBE”), for inadequate consideration (the “Proposed Transaction” or the “Merger”).

2. On March 18, 2013, EDAC issued a press release announcing that it had entered into a merger agreement (the “Merger Agreement”) with GB, pursuant to which the Company’s shareholders will receive $17.75 in cash for every EDAC share they own, in a tender offer valued at approximately $104.1 million.

3. The consideration offered in the Proposed Transaction is unfair and inadequate because the intrinsic value of EDAC’s common shares is materially in excess of the amount offered, given the Company’s significant potential for growth, anticipated operating results, and future profitability. Defendants have breached their fiduciary duties or aided and abetted in breaches of fiduciary duty in negotiating, agreeing to, approving, and/or effectuating the Proposed Transaction.

4. Accordingly, Plaintiffs seek to enjoin, preliminarily and permanently, the Merger under the terms stated in the Merger Agreement, and to recover damages caused by the Board’s breaches of fiduciary duty.

THE PARTIES

5. Plaintiffs are and were, at all relevant times, the beneficial owners of 3,550 shares of EDAC common stock.

6. Defendant EDAC is a Wisconsin corporation, headquartered at 1806 New Britain Avenue, Farmington, Connecticut. The Company is, and at all times relevant hereto was, listed and traded on the NASDAQ under the symbol “EDAC.” EDAC is named as a Defendant solely for the purpose of effectuating the equitable relief prayed for herein.

2

7. Defendant GB is a Delaware limited liability company formed for the purpose of effectuating the Proposed Transaction. GB is an affiliate of Greenbriar Equity Group, LLC.

8. Defendant GB Aero Engine Merger Sub Inc. (“Merger Sub”) is a Wisconsin corporation formed for the purpose of effectuating the Proposed Transaction. Merger sub is a wholly-owned subsidiary of GB.

9. Defendant GBE is a private equity firm, and the real party in interest in the acquisition of EDAC. Defendants GB and Merger Sub are affiliates of GBE

10. Defendant Daniel C. Tracy (“Tracy”) is Chairman of EDAC’s Board of Directors.

11. Defendant Dominick A. Pagano (“Pagano”) is EDAC’s President and Chief Executive Officers, and is a member of EDAC’s Board of Directors.

12. Defendant Lee K. Barba (“Barba”) is a member of EDAC’s Board of Directors.

13. Defendant Joseph P. Lebel (“Lebel”) is a member of EDAC’s Board of Directors.

14. Defendant John A. Rolls (“Rolls”) is a member of EDAC’s Board of Directors.

15. Defendant Joseph S. Ruggiero is a member of EDAC’s Board of Directors.

16. Defendant Christopher R. Sansone is a member of EDAC’s Board of Directors.

17. The Defendants named in paragraphs 10-16 are collectively referred to herein as the “Individual Defendants” or the “Board.” The Individual Defendants, as directors and/or officers of EDAC, have a fiduciary relationship with Plaintiffs and other public shareholders of the Company, and owe them the highest obligations of loyalty, due care, and candor.

3

CLASS ACTION ALLEGATIONS

18. Plaintiffs bring this action individually and as a class action, on behalf of all of EDAC’s public shareholders who are being and will be harmed by Defendants’ actions as described herein (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation or other entity related to or affiliated with any Defendants.

19. This action is properly maintainable as a class action because:

(a) The Class is so numerous that joinder of all members is impracticable. As of March 11, 2013, there were 5,317,440 shares of the Company’s common shares outstanding, which were owned by hundreds, if not thousands, of public shareholders. The holders of these shares are believed to be geographically dispersed throughout the United States.

(b) There are questions of law and fact, which are common to the Class members, includinginter alia: (1) whether the Individual Defendants have breached their fiduciary duties of loyalty and due care owed to Plaintiffs and other members of the Class in connection with the Proposed Transaction; (2) whether GBE, GB, and Merger Sub have aided and abetted the Individual Defendants’ breaches of fiduciary duties; and (3) whether Plaintiffs and the other members of the Class will suffer irreparable injury were the Proposed Transaction complained of herein consummated.

(c) Plaintiffs are committed to prosecuting this action and have retained competent counsel experienced in litigation of this nature. The claims of Plaintiffs are typical of the claims of other members of the Class and Plaintiffs have the same interests as other members of the Class. Plaintiffs will fairly and adequately represent the Class.

4

20. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class which would establish incompatible standards of conduct for the Individual Defendants and other Defendants, or adjudications with respect to individual members of the Class, which would, as a practical matter, be dispositive of the interests of other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

21. Defendants have acted, or refused to act, on grounds generally applicable to the Class as a whole, and are causing injury to the entire Class. Therefore, final injunctive relief on behalf of the Class is appropriate.

THE INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

22. Plaintiffs allege herein that the Individual Defendants, separately and together, violated the fiduciary duties they owe to the Company’s public shareholders, insofar as they have failed to act in good faith and with due care to maximize the value of EDAC. Each Individual Defendant is sued individually in his or her respective capacity as a director and/or officer of EDAC. The liability of each arises from the fact that each agreed to the Merger at an unfair price, and subject to unfair deal protection measures.

23. By reason of Individual Defendants’ positions with the Company as officers or Directors, or both, they are in a fiduciary relationship with Plaintiffs and the other public shareholders of the Company and owe them, as well as the Company, a duty of highest good faith, fair dealing, loyalty, and full, candid, and adequate disclosure, as well as a duty to maximize shareholder value. They are required to exercise good faith and subordinate their own personal interests to those of the public stockholders where their interests conflict.

24. By virtue of their positions as directors and/or officers of EDAC, the Individual Defendants, at all relevant times, had the power to control and influence, and did control and influence and cause EDAC to engage in the practices complained of herein.

5

25. As alleged below, the Individual Defendants have breached their fiduciary duties to EDAC’s public shareholders by agreeing to the Merger.

SUBSTANTIVE ALLEGATIONS

26. EDAC was founded in 1946. The Company provides design, manufacturing, and services for tooling, fixtures, molds, jet engine components, and machine spindles in the aerospace, industrial, semiconductor, and medical device markets. The Company produces low pressure turbine cases, hubs, rings, disks, and other tolerance components for various aircraft engine and ground turbine manufacturers. It also offers rotating components, such as disks, rings, and shafts; and precision assembly services, including the assembly of jet engine sync rings, aircraft welding and riveting, post-assembly machining, and sutton barrel finishing. In addition, the Company provides jet engine parts; services, such as electron beam laser welding, laser cutting and laser drilling, EDM, vacuum heat treating, and abrasive waterjet cutting conventional machining, fabrication and welding, and surface texturing services; and precision machining services for the maintenance and repair of components in the aircraft engine industry. Further, it designs and manufactures fixtures, precision gauges, close tolerance plastic injection molds, and precision component molds for composite parts and specialized machinery. Additionally, the Company designs, manufactures, and repairs various types of precision grinders, as well as precision rolling element bearing spindles, including hydrostatic and other precision rotary devices for machine tool manufacturers, special machine tool builders and integrators, industrial end-users, and powertrain machinery manufacturers and end-users. It also serves a range of industries in areas, which include special tooling, equipment and gauges, and components used in the manufacture, assembly, and inspection of jet engines in the United States, Canada, Mexico, Europe, and Asia.

6

27. The Company is financially solid, experiencing unprecedented growth, and poised for excellent future performance. According to EDAC’s most recent Form 10-K filed with the SEC, the Company reported:

| | • | | Sales of $106.5 million for the 2012 fiscal year, a 22.9% improvement compared to $86.6 million in 2011; |

| | • | | Net income of $5.9 million for the 2012 fiscal year, a 65.4% improvement compared to $3.6 million in 2011; |

| | • | | Basic earnings per common share of $1.13 for the 2012 fiscal year, a 56.9% improvement compared to $0.72 in 2011; and |

| | • | | Diluted earnings per common share of $1.04, a 52.9% improvement compared to $0.68 in 2011 |

28. Indeed, EDAC has recently made public statements rightfully extolling its record-setting performance. On March 7, 2013—just two weeks before the Proposed Transaction was announced—the Company issued a press release commenting on its 2012 fourth quarter financial results, which stated, in relevant part:

EDAC Technologies Reports Strong Results for Fiscal 2012 Fourth Quarter

- Sales Reach Record $28.4 Million, including $2.9 Million of EBTEC Sales

- Net Income Rises 31% to $1.5 Million, or $0.26 per Diluted Share

- Full Year Sales of $106.5 Million and EPS of $1.04 also at Record Levels

- Backlog at Quarter-End Totals $304 Million

FARMINGTON, Conn., March 7, 2013 – EDAC Technologies Corporation (NASDAQ: EDAC), a diversified designer, manufacturer and servicer of precision components for aerospace and industrial applications, reported today that sales for the fourth quarter of fiscal 2012 were a record $28.4 million, an increase of 25% from the fourth quarter of fiscal 2011. The 2012 fourth quarter included sales of $2.9 million from EBTEC Corporation, which the Company acquired on June 1, 2012. Before including EBTEC, the Company’s sales increased 13% from the prior year fourth quarter.

7

Both the Company’s Aerospace Segment, which includes EBTEC, and its Industrial Segment contributed to EDAC’s year-over-year sales growth and higher profitability.

Gross profit for the fourth quarter of 2012 increased 35% from the fourth quarter of 2011 to $5.5 million, and represented 19.3% of fourth quarter 2012 sales versus 17.9% of sales in the fourth quarter of 2011.

Operating income increased 27% to $2.6 million, compared with the fourth quarter of last year, yielding an operating margin of 9.1% of sales compared with 9.0% in the fourth quarter of 2011.

Net income for the fourth quarter of 2012 increased 31% to $1.5 million, or $0.26 per diluted share, compared with $1.2 million, or $0.21 per diluted share, reported for the fourth quarter of 2011. There were more diluted shares in the 2012 fourth quarter, including 150,523 shares issued as part of the EBTEC purchase.

For full year 2012, EDAC’s sales increased 23% to $106.5 million compared with full year sales of $86.6 million in 2011. Full year 2012 sales were up 15% before including EBTEC. Net income for 2012 increased 65% to $5.9 million or $1.04 per diluted share compared with $3.6 million or $0.68 per diluted share in 2011.

The Company’s total long-term debt, including current portion, at December 29, 2012 was $29.8 million. This includes mortgages on all its current facilities in Connecticut, including Plainville, which is in the process of being sold. The Company plans to sell other of its Connecticut facilities as it consolidates them into a recently-acquired world-class facility in Cheshire, Conn. and use the proceeds to retire the mortgage debt associated with each facility as it is sold.

The Company’s total sales backlog at December 29, 2012 was to $304.0 million compared with $313.7 million at September 29, 2012 and $252.1 million at the end of fiscal 2011.

Segment Review

The Company has two business segments: the Aerospace Segment, which consists of its EDAC AERO and EBTEC product lines; and the Industrial Segment, which includes the APEX Machine Tool and EDAC Machinery product lines.

Aerospace Segment sales for the fourth quarter of 2012 were a record $20.6 million, an increase of 36% from the fourth quarter of 2011. This included the sales of EBTEC as well as a 17% increase in the sales of the Company’s legacy EDAC AERO business.

8

Aerospace Segment operating income increased 15% from the fourth quarter of 2011 to $ 1.6 million and represented 7.8% of Aerospace Segment sales versus 9.2% of sales in the fourth quarter of 2011.

Industrial Segment sales for the fourth quarter of 2012 increased 4% to $7.8 million compared with the fourth quarter of 2011, reflecting a 4% increase in the sales of Apex Machine Tool and a 3% increase in the sales of EDAC Machinery.

Industrial Segment operating income increased 55% to $1.0 million, compared with the fourth quarter of 2011, and represented 12.4% of Industrial Segment sales versus 8.4% of segment sales in the 2011 fourth quarter.

Summary and Outlook

Dominick Pagano, President and Chief Executive Officer, stated: “Our strong fourth quarter performance capped a record year for EDAC. The 25% increase in fourth quarter sales was mainly driven by our aerospace segment. In addition to the contribution of EBTEC in the quarter, our legacy aerospace business grew 17% reflecting sales across legacy, current and emerging engine programs, with sales of military and replacement parts especially strong. Our sales also included stationary components for the Dreamliner, and for the GE 90, where we have reached full ramp-up, as well as rotating parts for industrial gas turbines and development parts for Pratt & Whitney’s geared turbofan engine. We also continued to ramp-up production of parts for Trent 800 and 900 engines. We expect our margins to improve on this program as we optimize the processes for individual parts.

“Our industrial segment also contributed to our fourth quarter growth. Sales for our Apex Machine Tool product line were better than expected, with favorable product mix and additional sales of complex ground-based turbine parts for power generation. Sales of our EDAC Machinery product line also increased, despite the further push out of a large order into 2013. The profitability of this segment is continuing to benefit from our focus on more full-scale programs and complex parts.

“A major strategic initiative for EDAC in 2012 was the purchase of a state-of-art manufacturing facility in Cheshire, Conn. The relocation of our operations to Cheshire remains on schedule, with the move and start-up of Apex Machine Tool nearly completed. We expect the majority of the relocation to be completed in 2013 and the majority of the expenses for the move to be recognized this year as well. Despite these expenses, we expect to achieve further growth in our margins with the efficiencies we will gain in the new facility along with the higher sales we are targeting.

9

“Based on our strong backlog and current shipment schedule, we expect first quarter 2013 sales, including EBTEC, to be in-line with the 2012 fourth quarter. We are fully focused on executing our plan to achieve profitable growth in 2013 and beyond.”

(emphasis in original).

29. Despite EDAC’s record-setting recent performance and potential for future growth, the Company’s Board has now determined to sell the Company for consideration below its intrinsic value, to the detriment of EDAC’s common shareholders.

The Proposed Transaction

30. On March 18, 2013, EDAC issued a press release announcing that it had entered into a merger agreement (the “Merger Agreement”) with GB, pursuant to which the Company’s shareholders will receive $17.75 in cash for every EDAC share they own, in a tender offer valued at approximately $104.1 million.

31. On March 26, EDAC and GBE issued a joint press release announcing that the tender offer had commenced, and would close on April 23, 2013, unless extended or terminated earlier under the terms of the Merger Agreement.

32. The consideration offered to EDAC’s public shareholders in the Proposed Transaction is unfair and inadequate because, among other things, the intrinsic value of EDAC’s common shares is materially in excess of the amount offered for those securities in the Proposed Transaction, given the Company’s prospects for future growth and earnings.

The Preclusive Deal Protection Devices

33. In addition to approving the inadequate consideration provided to EDAC’s shareholders under the terms of the Proposed Transaction, the Individual Defendants have agreed in the Merger Agreement to certain onerous and preclusive deal protection devices that will deter superior proposals, rendering the Proposed Transaction a virtualfait accompli.

10

34. Section 6.04(a) of the Merger Agreement contains a restrictive “no-shop” provision that prohibits the members of the Board from taking any affirmative action to comply with their fiduciary duties to maximize shareholder value, including soliciting or entering into a superior acquisition proposal with third parties. Section 6.04(a) prohibits the Board from even discussing such proposals with third parties, or providing non-public information to third parties that would allow them to effectively consider making superior acquisition proposals. Further, Section 6.04(a) requires the Board to immediately cut off any pre-existing negotiations that could result in a superior acquisition proposal.

35. Section 6.04(c) provides an ostensible “fiduciary out” provision, allowing the Board to conduct negotiations with a potential third-party acquirer if it receives abona fide, unsolicited acquisition proposal. However, the combined effects of several of the other terms of the Merger Agreement effectively ensure that no such competing offer will emerge, rendering this provision illusory.

36. First, Section 6.04(e) requires that, after receiving abona fide, unsolicited acquisition proposal, EDAC must keep GB informed regarding the negotiations, including relating all material terms of any proposal, and providing GB with copies of any written offers.

37. Should negotiations with a competing suitor ripen into a viable alternate transaction, Section 6.04(f) requires the Board to reopen negotiations with GB, and provides GB matching rights over the alternate proposal. This allows GB to top any competing proposal by a nominal amount and complete its acquisition of EDAC, thus discouraging potential suitors from investing the time and money needed to prepare a competing proposal.

38. Further, Sections 8.06 and 9.01 of the Merger Agreement provide for a termination fee of $4.5 million, or approximately 4.3% of the total value of the Proposed

11

Transaction, in the event EDAC terminates the Merger Agreement to enter into an alternative transaction. Thus, competing bidders will be forced to pay a naked premium to even receive consideration by the Company.

Pagano’s Conflict of Interest

39. The fiduciary duty of loyalty prohibits the Board from agreeing to a change of corporate control under circumstances that benefit them to the exclusion of EDAC public shareholders. The Merger Agreement contains terms that place Pagano in such a conflict situation.

40. Section 2.06 of the Merger Agreement provides that EDAC’s officers will receive identical positions as officers of the surviving company upon consummation of the Merger, ensuring that Pagano will remain as President and CEO of the surviving company.

41. Thus, Pagano was conflicted in his deliberations as a member of the Company’s Board by the prospect of lucrative employment following consummation of the Proposed Transaction.

FIRST CAUSE OF ACTION

Breach of Fiduciary Duty

Against the Individual Defendants

42. Plaintiffs incorporate by reference and realleges each and every allegation contained above, as if fully set forth herein.

43. The Individual Defendants have violated their fiduciary duties of care and loyalty and owed to the public shareholders of EDAC.

12

44. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants are attempting to unfairly deprive Plaintiffs and other members of the Class of the true value of their investment in the Company.

45. As demonstrated by the allegations above, the Individual Defendants failed to exercise the care required, and breached their duties of loyalty owed to EDAC’ shareholders.

46. As a result of the actions of the Individual Defendants, Plaintiffs and the Class will suffer irreparable injury in that they have not will not receive their fair portion of the value of EDAC’s assets.

47. Plaintiffs and the members of the Class have no adequate remedy at law.

SECOND CAUSE OF ACTION

Aiding and Abetting

Against EDAC, GBE, GB, and Merger Sub

48. Plaintiffs incorporate by reference and realleges each and every allegation contained above, as though fully set forth herein.

49. EDAC, GBE, GB, and Merger Sub have aided and abetted the Individual Defendants’ wrongdoing alleged herein. GBE, GB and Merger sub are also active and necessary participants in the Individual Defendants’ plan to complete the Proposed Transaction on terms that are unfair to the Company’s shareholders, as GBE, GB and Merger Sub seek to provide as little consideration as possible to EDAC’s shareholders, under terms that are unfair to Plaintiffs and the members of the Class.

50. As a result of this conduct by EDAC, GBE, GB, and Merger Sub, Plaintiffs and the other members of the Class have been and will be damaged by being denied the opportunity to receive the full value of their investments in EDAC.

13

51. Plaintiffs and the members of the Class have no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, Plaintiffs demands judgment against Defendants, jointly and severally, as follows:

A. Declaring that this action is properly maintainable as a class action, appointing Plaintiffs as class representatives, and appointing Plaintiffs’ counsel as class counsel;

B. Declaring that the Merger Agreement was entered into in breach of the fiduciary duties of the Individual Defendants;

C. Enjoining the Individual Defendants and the Company, their agents, counsel, employees, and all persons acting in concert with them from consummating the Proposed Transaction;

D. Rescinding, to the extent already implemented, the Merger Agreement or any of the terms thereof;

E. Directing Defendants to account to Plaintiff and the Class for the damages sustained because of the wrongs complained of herein;

F. Awarding Plaintiffs the costs and disbursements of this action, including reasonable attorneys’ and experts’ fees; and

G. Granting such other and further equitable relief as this Court may deem just and proper.

14

JURY TRIAL DEMANDED

Plaintiffs and the Class demand a trial by jury as to all issues so triable.

| | |

Dated: March 26, 2013 | | Respectfully submitted, |

| |

| | /s/ Jeffrey S. Nobel |

| | Jeffrey S. Nobel IZARD NOBEL LLP Juris Number 410725 29 South Main Street, Suite 215 West Hartford, CT 06107 Tel: (860) 493-6292 Fax: (860) 493-6290 |

| |

| | -and- |

| |

| | FINKELSTEIN THOMPSON LLP Burton H. Finkelstein L. Kendall Satterfield Rosalee B.C. Thomas Robert O. Wilson James Place 1077 30th Street, NW, Suite 150 Washington, D.C. 20007 (202) 337-8000 Attorneys for Plaintiffs |

APPEARANCE

Jeffrey S. Nobel of the law firm. Nobel Izard LLP appears for the Plaintiffs

|

/s/ IZARD NOBEL LLP |

Jeffrey S. Nobel |

IZARD NOBEL LLP (Juris # 410725) |

15

| | |

| | |

| RETURN DATE: APRIL 16, 2013 | | SUPERIOR COURT |

| | |

| EDWARD WALSH and MARILYN WALSH, on behalf of themselves and all others similarly situated, | | JUDICIAL DISTRICT OF HARTFORD |

| | |

Plaintiffs, | | AT HARTFORD |

v. EDAC TECHNOLOGIES CORP., DANIEL C. TRACY, DOMINICK A PAGANO, LEE K. BARBA, JOSEPH P. LEBEL, JOHN A ROLLS, JOSEPH S. RUGGIERO, CHRISTOPHER R. SANSONE, GB AERO ENGINE LLC, GB AERO ENGINE MERGER SUB INC, and GREENBRIAR EQUITY GROUP LLC. | | |

| | |

Defendants. | | MARCH 26, 2013 |

STATEMENT OF AMOUNT IN DEMAND

The amount, legal interest or property in demand is in excess of FIFTEEN THOUSAND DOLLARS ($15,000.00), exclusive of interest and costs.

|

/s/ Jeffrey S. Nobel |

Jeffrey S. Nobel IZARD NOBEL LLP Juris Number 410725 29 South Main Street, Suite 215 West Hartford, CT 06107 Tel: (860) 493-6292 Fax: (860) 493-6290 |

|

-and- |

|

FINKELSTEIN THOMPSON LLP Burton H. Finkeistein L. Kendall Satterfield Rosalee B.C. Thomas Robert O. Wilson James Place 1077 30th Street, NW, Suite 150 Washington, D.C. 20007 (202) 337-8000 |

Attorneys for Plaintiffs

16