Pennsylvania Real Estate Investment Trust

QUARTERLY SUPPLEMENTAL DISCLOSURE

(March 31, 2005)

www.preit.com

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

Table of Contents

| | |

Company Information | | 1 |

| |

Timeline/Recent Developments | | 2 |

| |

Stock Information | | 3 |

| |

Market Capitalization and Capital Resources | | 4 |

| |

Balance Sheet—Wholly Owned and Partnerships Detail | | 5 |

| |

Balance Sheet—Property Type | | 6 |

| |

Income Statement—Wholly Owned and Partnerships Detail - Quarterly Comparison | | 7 |

| |

Income Statement—Property Type - Quarterly Comparison | | 8 |

| |

Income Statement—Retail (Property Status) - Quarterly Comparison | | 9 |

| |

Income Statement—Retail (Property Subtype) - Quarterly Comparison | | 10 |

| |

FFO and FAD | | 11 |

| |

Key Ratios | | 12 |

| |

Property Debt Schedule—Wholly Owned | | 13 |

| |

Property Debt Schedule—Partnerships | | 14 |

| |

Debt Analysis | | 15 |

| |

Debt Ratios | | 16 |

| |

Portfolio Summary—Retail | | 17 |

| |

Property Acquisitions/Dispositions—Quarterly Summary | | 18 |

| |

Property Development/Redevelopment Summary | | 19 |

| |

Top Twenty Tenants Schedule | | 20 |

| |

Lease Expiration Schedule—Anchor Tenants | | 21 |

| |

Lease Expiration Schedule—Non-Anchor Tenants | | 22 |

| |

New Lease/Renewal Summary and Analysis | | 23 |

| |

Capital Expenditures—Quarterly | | 24 |

| |

Enclosed Mall—Summary and Occupancy | | 25 |

| |

Enclosed Mall—Rent Summary | | 26 |

| |

Power Center—Summary and Occupancy | | 27 |

| |

Strip Center—Summary and Occupancy | | 28 |

| |

Retail Overall—Summary and Occupancy | | 29 |

| |

Summary of Portfolio Services | | 30 |

| |

Flash Report—Quarterly | | 31 |

| |

RECONCILIATION TO GAAP: | | |

| |

Balance Sheet-Reconciliation to GAAP | | 32 |

| |

Income Statement-Reconciliation to GAAP—Quarterly | | 33 |

| |

Flash Report-Reconciliation to GAAP—Quarterly | | 34 |

| |

Definitions page | | 35 |

THIS QUARTERLY SUPPLEMENTAL DISCLOSURE CONTAINS CERTAIN “FORWARD-LOOKING STATEMENTS” THAT RELATE TO EXPECTATIONS, PROJECTIONS, ANTICIPATED EVENTS, TRENDS AND OTHER MATTERS THAT ARE NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS REFLECT PREIT’S CURRENT VIEWS ABOUT FUTURE EVENTS AND ARE SUBJECT TO RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT MAY CAUSE FUTURE EVENTS, ACHIEVEMENTS OR RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED BY THE FORWARD-LOOKING STATEMENTS. PREIT’S BUSINESS IS SUBJECT TO UNCERTAINTIES REGARDING THE REVENUES, OPERATING EXPENSES, LEASING ACTIVITIES, OCCUPANCY RATES, AND OTHER COMPETITIVE FACTORS RELATING TO PREIT’S PORTFOLIO AND CHANGES IN LOCAL MARKET CONDITIONS AS WELL AS GENERAL ECONOMIC, FINANCIAL AND POLITICAL CONDITIONS, WHICH MAY CAUSE FUTURE EVENTS, ACHIEVEMENTS OR RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED BY THE FORWARD-LOOKING STATEMENTS. PREIT DISCLAIMS ANY DUTY TO UPDATE ANY FORWARD-LOOKING STATEMENTS SET FORTH IN THIS QUARTERLY SUPPLEMENTAL DISCLOSURE TO REFLECT NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. INVESTORS ARE ALSO DIRECTED TO CONSIDER THE RISKS DISCUSSED IN DOCUMENTS PREIT HAS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AND, IN PARTICULAR, PREIT’S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2004.

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

COMPANY INFORMATION

PENNSYLVANIA REIT

200 South Broad Street, Philadelphia, PA 19102

http://www.preit.com

Pennsylvania Real Estate Investment Trust, founded in 1960 and one of the first equity REITs in the U.S., has a primary investment focus on retail shopping malls and power centers (approximately 33.6 million square feet) located in the eastern United States. PREIT’s portfolio consists of 56 properties in 12 states. PREIT’s portfolio includes 38 shopping malls, 13 strip and power centers and five industrial properties. PREIT is headquartered in Philadelphia, Pennsylvania.

Research Coverage

| | | | |

Company

| | Analyst

| | Phone Number

|

| Green Street Advisors | | Gregory R. Andrews | | (949) 640-8780 |

| | |

| JP Morgan | | Michael W. Mueller | | (212) 622-6689 |

| | | Anthony Paolone | | (212) 622-6682 |

| | | Joshua Bederman | | (212) 622-6530 |

| | |

| Legg Mason Wood Walker | | David M. Fick | | (410) 539-0000 |

| | | Nathan Isbee | | (410) 454-4143 |

| | |

| Lehman Brothers | | David Harris | | (212) 526-1790 |

| | | Alexander D. Goldfarb | | (212) 526-5232 |

| | |

| UBS | | Ian C. Weissman | | (212) 713-8602 |

| | | Keith A. Mills | | (212) 713-3098 |

| | | Frank Rybinski | | (212) 713-2364 |

Quarterly Earnings Schedule

PREIT’s quarterly results will be announced in accordance with the following schedule:

| | | | | |

Quarter

| | 2005

| | | 2004

|

First Quarter | | 5/2/2005 | | | 5/5/2004 |

| | |

Second Quarter | | 8/4/2005 | (1) | | 8/5/2004 |

| | |

Third Quarter | | 11/3/2005 | (1) | | 11/8/2004 |

| | |

Fourth Quarter | | 2/28/2006 | (1) | | 3/3/2005 |

Quarterly conference calls are arranged by KCSA Worldwide. To participate, please contact Garth Russell at (212) 896-1250.

For additional information, please contact:

Robert McCadden or Nurit Yaron

200 South Broad Street

Philadelphia, PA 19102

Phone (215) 875-0700 Toll Free (866) 875-0700

Fax (215) 546-7311 Email yaronn@preit.com

PAGE 1

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

Time Line/Recent Developments

April 26, 2005 - Pennsylvania Real Estate Investment Trust announced its plans for $360 million in financings for Cherry Hill Mall in Cherry Hill, New Jersey, and Willow Grove Park in Willow Grove, Pennsylvania.

April 25, 2005 -Pennsylvania Real Estate Investment Trust announced that it intended to release its financial results for the first quarter ended March 31, 2005, on Monday May 2, 2005. It also announced that management will hold a conference call on Monday, May 2, 2005, at 3:00PM EDT to review the Company’s first quarter results, market trends and future outlook.

April 4, 2005 -Pennsylvania Real Estate Investment Trust announced that it had completed the acquisition of Gadsden Mall in Gadsden, Alabama, for approximately $58.8 million.

March 4, 2005 -Pennsylvania Real Estate Investment Trust announced that Jonathan Weller would be presenting at the 2005 Smith Barney REIT CEO Conference on March 9, 2005.

March 3, 2005 -Pennsylvania Real Estate Investment Trust announced its results for the fourth quarter and twelve months ended December 31, 2004. Net income available to common shareholders for the fourth quarter of 2004 was $0.43 per diluted share. FFO per common share and Operating Partnership unit (“share”) for the fourth quarter of 2004 was $1.12.

February 17, 2005 - Pennsylvania Real Estate Investment Trust announced that a partnership in which it holds a 40% interest has entered into a definitive agreement to sell Laurel Mall in Hazelton, Pennsylvania. The sale is expected to be completed in the second quarter of 2005.

February 17, 2005 -Pennsylvania Real Estate Investment Trust announced that it intended to release its financial results for the fourth quarter and twelve months ended December 31, 2004, on Thursday, March 3, 2005. It also announced that management will hold a conference call on Thursday, March 3, 2005 at 3:00PM EDT to review the Company’s fourth quarter and twelve month results, market trends and future outlook.

February 17, 2005 -Pennsylvania Real Estate Investment Trust announced that its Board of Trustees declared a quarterly cash dividend of $0.54 per common share. PREIT also announced that its Board of Trustees has declared a regular quarterly dividend of $1.375 per share on its 11.00% senior preferred shares.

February 4, 2005 -Pennsylvania Real Estate Investment Trust announced that it had completed the acquisition of Cumberland Mall in Vineland, New Jersey for approximately $59.5 million.

February 3, 2005 -Pennsylvania Real Estate Investment Trust announced that it had amended its credit facility effective January 31, 2005.

January 24, 2005- Pennsylvania Real Estate Investment Trust reported the tax status of its dividend distribution for 2004.

NOTE: The press releases are available on the Company’s website at www.preit.com.

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

Stock Information

PREIT’s common stock trades on the New York Stock Exchange (symbol: PEI).

PREIT’s preferred stock trades on the New York Stock Exchange (symbol: PEIPRA).

| | | | | | | | | | | | | | | |

| | | Q1:3/31/05

| | CY:12/31/04

| | Q1:3/31/04

| | CY:12/31/03

| | CY 12/31/02

|

High Price | | $ | 43.21 | | $ | 43.70 | | $ | 37.85 | | $ | 36.30 | | $ | 27.20 |

Low Price | | $ | 38.91 | | $ | 30.25 | | $ | 33.30 | | $ | 24.70 | | $ | 20.55 |

Close | | $ | 40.32 | | $ | 42.80 | | $ | 37.66 | | $ | 36.30 | | $ | 26.00 |

Average Daily Trading Volume | | | 146,698 | | | 161,659 | | | 220,144 | | | 109,892 | | | 41,495 |

Common Shares Outstanding | | | 36,474,699 | | | 36,272,162 | | | 35,778,863 | | | 35,544,265 | | | 16,697,119 |

O.P. Units | | | 4,686,418 | | | 4,413,559 | | | 3,834,714 | | | 3,691,516 | | | 1,763,318 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total Shares Outstanding | | | 41,161,117 | | | 40,685,721 | | | 39,613,577 | | | 39,235,781 | | | 18,460,437 |

Weighted Average of Common Shares | | | 35,972,274 | | | 35,609,350 | | | 35,403,257 | | | 20,389,577 | | | 16,162,327 |

Weighted Average of O.P. units | | | 4,583,338 | | | 4,183,059 | | | 3,836,144 | | | 2,303,449 | | | 1,804,779 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Weighted Average Common Shares and O.P. Units | | | 40,555,612 | | | 39,792,409 | | | 39,239,401 | | | 22,693,026 | | | 17,967,106 |

Preferred Shares, Nominal Value | | $ | 123,750,000 | | $ | 123,750,000 | | $ | 123,750,000 | | $ | 123,750,000 | | | — |

Market Value of Shares (based on closing price) | | $ | 1,783,366,237 | | $ | 1,865,098,859 | | $ | 1,615,597,310 | | $ | 1,548,008,850 | | $ | 479,971,362 |

Shareholder Information

| | | |

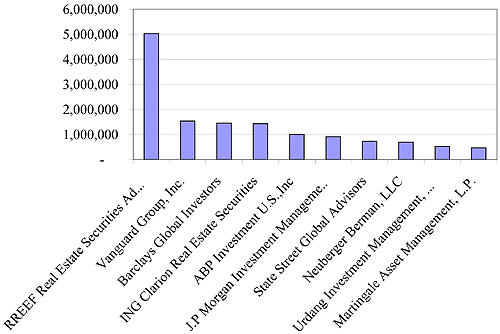

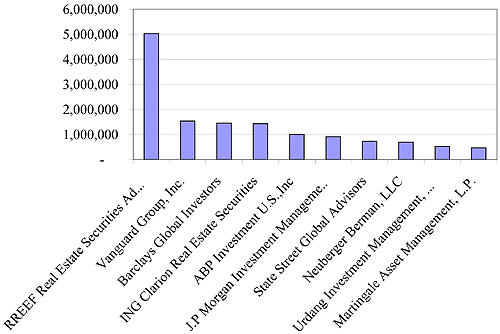

Ten Largest Institutional Shareholders: Common Shares Held(1)

| | 3/31/2005

| |

RREEF Real Estate Securities Advisers, L.P. | | 5,023,996 | |

Vanguard Group, Inc. | | 1,536,972 | |

Barclays Global Investors | | 1,450,053 | |

ING Clarion Real Estate Securities | | 1,428,553 | |

ABP Investment U.S., Inc | | 994,800 | |

J.P Morgan Investment Management Inc. (NY) | | 908,541 | |

State Street Global Advisors | | 725,243 | |

Neuberger Berman, LLC | | 686,590 | |

Urdang Investment Management, Inc. | | 525,585 | |

Martingale Asset Management, L.P. | | 466,073 | |

TOTAL of Ten Largest Institutional: | | 13,746,406 | |

TOTAL of all Institutional holders: | | 21,682,751 | |

Ten Largest as % of Total Institutional: | | 63.4 | % |

| (1) | Based on 13F filings as of 3/31/05 or most recent filings. |

| | | | | | | | | | | | | |

Share Ownership by Insiders: Shares Held (including O.P. Units, Beneficial Ownership and Exercisable Options)

| | As of 4/1/05 (1)

| | % of

Total (2)

| | | Interim

Net

Purchases

of Shares

(3)

| | | As of 4/1/04 (4)

| | % of

Total (5)

| |

Mark Pasquerilla | | 2,289,005 | | 5.6 | % | | (109,068 | ) | | 2,398,073 | | 6.1 | % |

Ronald Rubin | | 1,532,162 | | 3.7 | % | | 672,693 | | | 859,469 | | 2.2 | % |

George F. Rubin | | 785,773 | | 1.9 | % | | 350,848 | | | 434,925 | | 1.1 | % |

Stephen B. Cohen | | 471,030 | | 1.1 | % | | N/A | | | N/A | | N/A | |

Leonard I. Korman | | 365,100 | | 0.9 | % | | 1,625 | | | 363,475 | | 0.9 | % |

Edward A. Glickman | | 255,598 | | 0.6 | % | | 29,742 | | | 225,856 | | 0.6 | % |

Jonathan B. Weller | | 172,709 | | 0.4 | % | | 6,973 | | | 165,736 | | 0.4 | % |

Joseph F. Coradino | | 142,808 | | 0.3 | % | | 17,765 | | | 125,043 | | 0.3 | % |

Jeffrey A. Linn | | 71,868 | | 0.2 | % | | (582 | ) | | 72,450 | | 0.2 | % |

Douglas S. Grayson | | 55,582 | | 0.1 | % | | 10,276 | | | 45,306 | | 0.1 | % |

Robert F. McCadden | | 47,356 | | 0.1 | % | | N/A | | | N/A | | N/A | |

David J. Bryant | | 29,857 | | 0.1 | % | | 4,963 | | | 24,894 | | 0.1 | % |

Bruce Goldman | | 22,128 | | 0.1 | % | | 5,629 | | | 16,499 | | 0.0 | % |

Lee H. Javitch | | 17,000 | | 0.0 | % | | 1,625 | | | 15,375 | | 0.0 | % |

Rosemarie B. Greco | | 11,000 | | 0.0 | % | | 1,625 | | | 9,375 | | 0.0 | % |

Ira Lubert | | 7,750 | | 0.0 | % | | 2,250 | | | 5,500 | | 0.0 | % |

Donald Mazziotti | | 4,307 | | 0.0 | % | | 2,322 | | | 1,985 | | 0.0 | % |

John J. Roberts | | 3,250 | | 0.0 | % | | 2,250 | | | 1,000 | | 0.0 | % |

| | |

| |

|

| |

|

| |

| |

|

|

TOTAL(6) | | 6,009,515 | | 14.6 | % | | 1,000,936 | | | 4,708,120 | | 11.9 | % |

| | |

| |

|

| |

|

| |

| |

|

|

| (1) | Source of Insider Ownership: Proxy dated April 18, 2005. Refer to footnotes in proxy for details on beneficial ownership. |

| (2) | Based on fully diluted shares outstanding as of March 31, 2005. |

| (3) | Includes purchases and sales of shares, issuance of restricted stocks awards, issuances of O.P. units, and exercisable options. |

| (4) | Source of Insider Ownership: Proxy dated April 29, 2004. Refer to footnotes in proxy for details on beneficial ownership. |

| (5) | Based on fully diluted shares outstanding as of March 31, 2004. |

| (6) | In certain instances, two trustees beneficially own the same shares because they share voting or investment power over the shares. These shares have been counted only once in the total. |

Distribution Information for Common Shares

| | | | | | | | | | | | | | | | | | | | |

| | | Q1:3/31/05

| | | CY:12/31/04

| | | Q1:3/31/04

| | | CY:12/31/03

| | | CY 12/31/02

| |

Dividend per share | | $ | 0.540 | | | $ | 2.160 | | | $ | 0.540 | | | $ | 2.070 | | | $ | 2.040 | |

Annualized Dividend Yield(1) | | | 5.4 | % | | | 5.0 | % | | | 5.7 | % | | | 5.7 | % | | | 7.8 | % |

Capital Gain Pre-May 6 | | | N/A | | | $ | 0.026 | | | $ | — | | | $ | 0.096 | | | $ | 0.082 | |

Capital Gain Post-May 5 | | | N/A | | | $ | — | | | $ | — | | | $ | 0.213 | | | $ | — | |

Section 1250 Gain | | | N/A | | | $ | 0.026 | | | $ | — | | | $ | 0.480 | | | $ | — | |

Return of Capital/Non-Taxable | | | N/A | | | $ | 0.517 | | | $ | — | | | $ | 0.085 | | | $ | 0.134 | |

Qualified 5 Year Gain (incl. in cap. Gain) | | | N/A | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Ordinary Income | | | N/A | | | $ | 1.617 | | | $ | 0.540 | | | $ | 1.196 | | | $ | 1.824 | |

| (1) | Based on closing stock price for the period. |

| | | | | | | |

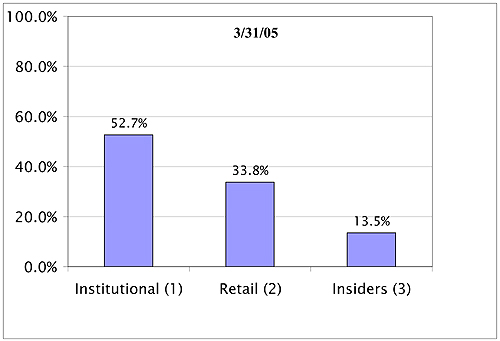

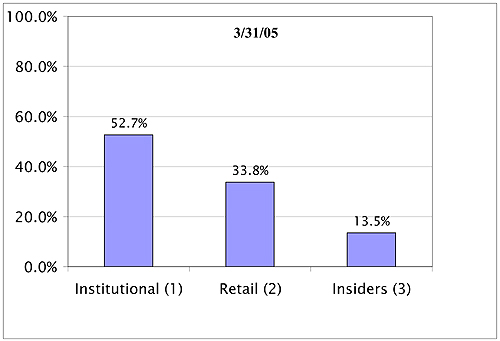

Breakdown of Share & Unit Ownership: Shares Held

| | 3/31/2005

| | 12/31/04

| | % of 3/31/05

total

| |

Institutional(1) | | 21,682,751 | | 21,655,541 | | 52.7 | % |

Retail(2) | | 13,902,716 | | 14,796,395 | | 33.8 | % |

Insiders(3) | | 5,575,650 | | 4,233,785 | | 13.5 | % |

| | |

| |

| |

|

|

TOTAL | | 41,161,117 | | 40,685,721 | | 100.0 | % |

| | |

| |

| |

|

|

| (1) | Based on 13F filings as of 3/31/05 or most recent filings. |

| (2) | Retail ownership equals total shares outstanding minus institutional and insider ownership. |

| (3) | Insider holdings as of 4/1/05. (Shares and O.P. Units only. Excludes 433,865 exercisable options). |

PAGE 3

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

MARKET CAPITALIZATION

| | | | | | | | | | | | | | | | | | | | |

| | | March 31,

2005

| | | December 31,

2004

| | | March 31,

2004

| | | December 31,

2003

| | | December 31,

2002

| |

EQUITY CAPITALIZATION | | | | | | | | | | | | | | | | | | | | |

Shares Outstanding | | | 36,474,699 | | | | 36,272,162 | | | | 35,778,863 | | | | 35,544,265 | | | | 16,697,119 | |

O.P. Units Outstanding | | | 4,686,418 | | | | 4,413,559 | | | | 3,834,714 | | | | 3,691,516 | | | | 1,763,318 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL Shares and O.P. Units | | | 41,161,117 | | | | 40,685,721 | | | | 39,613,577 | | | | 39,235,781 | | | | 18,460,437 | |

Market Price (at end of period) | | $ | 40.32 | | | $ | 42.80 | | | $ | 37.66 | | | $ | 36.30 | | | $ | 26.00 | |

Preferred Shares, Nominal Value | | $ | 123,750,000 | | | $ | 123,750,000 | | | $ | 123,750,000 | | | $ | 123,750,000 | | | | | |

Equity Market Capitalization | | $ | 1,783,366,237 | | | $ | 1,865,098,859 | | | $ | 1,615,597,310 | | | $ | 1,548,008,850 | | | $ | 479,971,362 | |

DEBT CAPITALIZATION | | | | | | | | | | | | | | | | | | | | |

Unsecured Debt Balance | | $ | 402,000,000 | | | $ | 271,000,000 | | | $ | 182,000,000 | | | $ | 170,000,000 | | | $ | — | |

Secured Debt Balance | | | 1,307,545,347 | | | | 1,326,127,000 | | | | 1,386,313,775 | | | | 1,396,262,538 | | | | 617,279,770 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Debt Capitalization | | $ | 1,709,545,347 | | | $ | 1,597,127,000 | | | $ | 1,568,313,775 | | | $ | 1,566,262,538 | | | $ | 617,279,770 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL MARKET CAPITALIZATION | | $ | 3,492,911,584 | | | $ | 3,462,225,859 | | | $ | 3,183,911,085 | | | $ | 3,114,271,388 | | | $ | 1,097,251,132 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Preferred Shares/Total Market Capitalization | | | 3.5 | % | | | 3.6 | % | | | 3.9 | % | | | 4.0 | % | | | | |

Shares and O.P. Units/Total Market Capitalization | | | 47.5 | % | | | 50.3 | % | | | 46.9 | % | | | 45.7 | % | | | 43.7 | % |

Debt Capitalization/Total Market Capitalization | | | 48.9 | % | | | 46.1 | % | | | 49.3 | % | | | 50.3 | % | | | 56.3 | % |

Equity Capitalization/Total Market Capitalization | | | 51.1 | % | | | 53.9 | % | | | 50.7 | % | | | 49.7 | % | | | 43.7 | % |

| Unsecured Debt Balance/Total Debt | | | 23.5 | % | | | 17.0 | % | | | 11.6 | % | | | 10.9 | % | | | 0.0 | % |

|

| | |

| | | | | |

| | |  | | | |  | | | |  | | | |  | | | |  | |

| | | | | |

| CAPITAL RESOURCES | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | March 31,

2005

| | | December 31,

2004

| | | March 31,

2004

| | | December 31,

2003

| | | December 31,

2002

| |

Cash on Hand | | $ | 34,378,813 | | | $ | 45,949,300 | | | $ | 37,024,603 | | | $ | 46,883,041 | | | $ | 18,628,137 | |

Line of Credit Capacity(1) | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 200,000,000 | |

Amount Used (includes letters of credit) | | | (410,054,533 | ) | | | (279,054,533 | ) | | | (183,195,000 | ) | | | (170,500,000 | ) | | | (131,473,671 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Available LOC(2) | | $ | 89,945,467 | | | $ | 220,945,467 | | | $ | 316,805,000 | | | $ | 329,500,000 | | | $ | 68,526,329 | |

Shelf Registration | | $ | 1,000,000,000 | | | $ | 1,000,000,000 | | | $ | 1,000,000,000 | | | $ | 1,000,000,000 | | | $ | 500,000,000 | |

Amount Used | | | (344,146,042 | ) | | | (344,146,042 | ) | | | (344,146,042 | ) | | | (344,146,042 | ) | | | (155,977,292 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Available Shelf | | $ | 655,853,958 | | | $ | 655,853,958 | | | $ | 655,853,958 | | | $ | 655,853,958 | | | $ | 344,022,708 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL CAPITAL RESOURCES | | $ | 780,178,238 | | | $ | 922,748,725 | | | $ | 1,009,683,561 | | | $ | 1,032,236,999 | | | $ | 431,177,174 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | The unsecured revolving line of credit established in November 2003 and amended in January 2005, gives PREIT the ability to increase the facility to $650 million under prescribed conditions. |

| (2) | The available line of credit is subject to covenants that may restrict amounts that can be borrowed. |

PAGE 4

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

BALANCE SHEET

(Wholly Owned vs. Partnerships)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2005

| | | December 31, 2004

| |

| | | PREIT Wholly

Owned

| | | PREIT’s % of

Partner-

ships (5)

| | | Corporate

| | | Combined

TOTAL

| | | PREIT Wholly

Owned

| | | PREIT’s % of

Partner-

ships (5)

| | | Corporate

| | | Combined

TOTAL

| |

ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in Real Estate, at cost | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retail Properties(1) | | $ | 2,626,902,140 | | | $ | 131,361,106 | | | | — | | | $ | 2,758,263,246 | | | $ | 2,518,364,388 | | | $ | 131,343,981 | | | | — | | | $ | 2,649,708,369 | |

Industrial Properties | | | 4,006,922 | | | | — | | | | — | | | | 4,006,922 | | | | 2,504,211 | | | | — | | | | — | | | | 2,504,211 | |

Land Held for Development | | | 9,972,559 | | | | — | | | | — | | | | 9,972,559 | | | | 9,862,704 | | | | — | | | | — | | | | 9,862,704 | |

Construction In Progress | | | 11,867,813 | | | | 2,855,424 | | | | — | | | | 14,723,237 | | | | 10,952,450 | | | | 2,542,307 | | | | — | | | | 13,494,757 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL INVESTMENTS IN REAL ESTATE | | | 2,652,749,434 | | | | 134,216,530 | | | | — | | | | 2,786,965,964 | | | | 2,541,683,753 | | | | 133,886,288 | | | | — | | | | 2,675,570,041 | |

Accumulated Depreciation | | | (169,572,884 | ) | | | (34,988,197 | ) | | | — | | | | (204,561,081 | ) | | | (150,885,609 | ) | | | (34,023,363 | ) | | | — | | | | (184,908,972 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Real Estate | | | 2,483,176,550 | | | | 99,228,333 | | | | — | | | | 2,582,404,883 | | | | 2,390,798,144 | | | | 99,862,925 | | | | — | | | | 2,490,661,069 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | |

Other Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and Cash Equivalents | | | 17,203,491 | | | | 3,968,408 | | | | 13,206,914 | | | | 34,378,813 | | | | 25,096,539 | | | | 5,609,103 | | | | 15,243,658 | | | | 45,949,300 | |

Rents and Other Receivables | | | 30,932,767 | | | | 11,307,638 | | | | 1,721,293 | | | | 43,961,698 | | | | 27,286,042 | | | | 11,328,239 | | | | 4,691,310 | | | | 43,305,591 | |

Other assets held for sale(1) | | | 7,175,245 | | | | — | | | | — | | | | 7,175,245 | | | | 6,837,914 | | | | — | | | | — | | | | 6,837,914 | |

Intangible Assets(2) | | | 169,024,321 | | | | — | | | | 12,045,312 | | | | 181,069,633 | | | | 159,804,366 | | | | — | | | | 12,045,312 | | | | 171,849,678 | |

Deferred Costs,

Prepaid

Taxes & Exp.

& Other Assets | | | 45,215,337 | | | | 7,297,143 | | | | 23,301,848 | | | | 75,814,328 | | | | 42,573,601 | | | | 7,550,568 | | | | 19,782,031 | | | | 69,906,200 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL OTHER ASSETS | | | 269,551,161 | | | | 22,573,189 | | | | 50,275,367 | | | | 342,399,717 | | | | 261,598,462 | | | | 24,487,910 | | | | 51,762,311 | | | | 337,848,683 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL ASSETS | | | 2,752,727,711 | | | | 121,801,522 | | | | 50,275,367 | | | | 2,924,804,600 | | | | 2,652,396,606 | | | | 127,449,110 | | | | 51,762,311 | | | | 2,828,509,752 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | |

LIABILITIES AND

SHARE HOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage Notes Payable | | | 1,146,562,800 | | | | 106,947,723 | | | | — | | | | 1,253,510,523 | | | | 1,162,479,171 | | | | 107,513,205 | | | | — | | | | 1,269,992,376 | |

Mortgage Debt

Premium(3) | | | 54,034,824 | | | | — | | | | — | | | | 54,034,824 | | | | 56,134,624 | | | | — | | | | — | | | | 56,134,624 | |

Bank Loans Payable | | | — | | | | — | | | | 402,000,000 | | | | 402,000,000 | | | | — | | | | — | | | | 271,000,000 | | | | 271,000,000 | |

Liabilities Related to Assets held for sale | | | 1,616,876 | | | | — | | | | — | | | | 1,616,876 | | | | 1,156,442 | | | | — | | | | — | | | | 1,156,442 | |

Other Liabilities(4) | | | 50,402,033 | | | | 2,857,626 | | | | 24,548,313 | | | | 77,807,972 | | | | 50,292,594 | | | | 3,351,797 | | | | 40,147,000 | | | | 93,791,391 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL LIABILITIES | | | 1,252,616,533 | | | | 109,805,349 | | | | 426,548,313 | | | | 1,788,970,195 | | | | 1,270,062,831 | | | | 110,865,002 | | | | 311,147,000 | | | | 1,692,074,833 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | |

Minority Interest | | | 3,448,201 | | | | — | | | | 138,301,736 | | | | 141,749,937 | | | | 3,584,992 | | | | — | | | | 128,383,925 | | | | 131,968,917 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | |

Shareholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares of Beneficial Interest at $1 Par | | | — | | | | — | | | | 36,474,673 | | | | 36,474,673 | | | | — | | | | — | | | | 36,272,160 | | | | 36,272,160 | |

Preferred Shares $0.01 Par | | | — | | | | — | | | | 24,750 | | | | 24,750 | | | | — | | | | — | | | | 24,750 | | | | 24,750 | |

Capital Contributed in Excess of Par | | | — | | | | — | | | | 907,811,709 | | | | 907,811,709 | | | | — | | | | — | | | | 899,506,128 | | | | 899,506,128 | |

Restricted Stock | | | — | | | | — | | | | (14,945,044 | ) | | | (14,945,044 | ) | | | — | | | | — | | | | (7,736,812 | ) | | | (7,736,812 | ) |

Accumulated Other Comprehensive Loss | | | — | | | | — | | | | (1,812,340 | ) | | | (1,812,340 | ) | | | — | | | | — | | | | (1,821,457 | ) | | | (1,821,457 | ) |

Retained Earnings | | | — | | | | — | | | | 66,530,720 | | | | 66,530,720 | | | | — | | | | — | | | | 78,221,233 | | | | 78,221,233 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL SHARE HOLDERS’ EQUITY | | | — | | | | — | | | | 994,084,468 | | | | 994,084,468 | | | | — | | | | — | | | | 1,004,466,002 | | | | 1,004,466,002 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | |

TOTAL LIABILITIES

AND SHARE HOLDERS’ EQUITY | | $ | 1,256,064,734 | | | $ | 109,805,349 | | | $ | 1,558,934,517 | | | $ | 2,924,804,600 | | | $ | 1,273,647,823 | | | $ | 110,865,002 | | | $ | 1,443,996,927 | | | $ | 2,828,509,752 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | |

| | | March 31, 2004

| |

| | | PREIT Wholly

Owned

| | | PREIT’s % of

Partner-

ships (5)

| | | Corporate

| | | Combined

TOTAL

| |

ASSETS | | | | | | | | | | | | | | | | |

Investments in Real Estate, at cost | | | | | | | | | | | | | | | | |

Retail Properties(1) | | $ | 2,399,418,328 | | | $ | 135,981,353 | | | | — | | | $ | 2,535,399,681 | |

Industrial Properties | | | 2,504,211 | | | | — | | | | — | | | | 2,504,211 | |

Land Held for Development | | | 9,397,945.00 | | | | — | | | | — | | | | 9,397,945 | |

Construction In Progress | | | 21,849,530 | | | | 1,506,178 | | | | — | | | | 23,355,708 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL INVESTMENTS IN REAL ESTATE | | | 2,433,170,014 | | | | 137,487,531 | | | | — | | | | 2,570,657,545 | |

Accumulated Depreciation | | | (98,533,506 | ) | | | (32,248,911 | ) | | | — | | | | (130,782,417 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Real Estate | | | 2,334,636,508 | | | | 105,238,620 | | | | — | | | | 2,439,875,128 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

Other Assets: | | | | | | | | | | | | | | | | |

Cash and Cash Equivalents | | | 12,591,337 | | | | 4,459,678 | | | | 19,973,588 | | | | 37,024,603 | |

Rents and Other Receivables | | | 24,415,060 | | | | 7,921,525 | | | | 1,714,874 | | | | 34,051,459 | |

Other assets held for sale(1) | | | 37,383,935 | | | | — | | | | — | | | | 37,383,935 | |

Intangible Assets(2) | | | 159,907,867 | | | | — | | | | 12,085,313 | | | | 171,993,180 | |

Deferred Costs,

Prepaid

Taxes & Exp.

& Other Assets | | | 36,800,984 | | | | 11,737,284 | | | | 16,441,187 | | | | 64,979,455 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL OTHER ASSETS | | | 271,099,183 | | | | 24,118,487 | | | | 50,214,962 | | | | 345,432,632 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL ASSETS | | | 2,605,735,691 | | | | 129,357,107 | | | | 50,214,962 | | | | 2,785,307,760 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

LIABILITIES AND

SHARE HOLDERS’ EQUITY | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Mortgage Notes Payable | | | 1,206,593,974 | | | | 109,096,195 | | | | — | | | | 1,315,690,169 | |

Mortgage Debt

Premium(3) | | | 70,623,606 | | | | — | | | | — | | | | 70,623,606 | |

Bank Loans Payable | | | — | | | | — | | | | 182,000,000 | | | | 182,000,000 | |

Liabilities Related to Assets held for sale | | | 4,365,915 | | | | — | | | | — | | | | 4,365,915 | |

Other Liabilities(4) | | | 49,479,921 | | | | 3,839,170 | | | | 30,413,314 | | | | 83,732,405 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL LIABILITIES | | | 1,331,063,416 | | | | 112,935,365 | | | | 212,413,314 | | | | 1,656,412,095 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

Minority Interest | | | 4,546,973 | | | | — | | | | 112,836,314 | | | | 117,383,287 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

Shareholders’ Equity: | | | | | | | | | | | | | | | | |

Shares of Beneficial Interest at $1 Par | | | — | | | | — | | | | 35,781,922 | | | | 35,781,922 | |

Preferred Shares $0.01 Par | | | — | | | | — | | | | 24,750 | | | | 24,750 | |

Capital Contributed in Excess of Par | | | — | | | | — | | | | 884,677,043 | | | | 884,677,043 | |

Restricted Stock | | | — | | | | — | | | | (9,311,239 | ) | | | (9,311,239 | ) |

Accumulated Other Comprehensive Loss | | | — | | | | — | | | | (1,927,948 | ) | | | (1,927,948 | ) |

Retained Earnings | | | — | | | | — | | | | 102,267,850 | | | | 102,267,850 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL SHARE HOLDERS’ EQUITY | | | — | | | | — | | | | 1,011,512,378 | | | | 1,011,512,378 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

TOTAL LIABILITIES

AND SHARE HOLDERS’ EQUITY | | $ | 1,335,610,389 | | | $ | 112,935,365 | | | $ | 1,336,762,006 | | | $ | 2,785,307,760 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Investment in real estate as of March 31, 2005, December 31, 2004 and March 31, 2004 includes $9,611,074, $8,108,066 and $96,448,111, respectively, relating to the non-core properties. The non-core properties are classified as held-for-sale for GAAP purposes. Other assets held for sale represent intangible assets and current assets of the non-core properties. |

| (2) | Includes value of acquired in-place leases and above-market value of leases recorded in connection with the acquisition of properties since 2002. Purchase accounting rules require a purchaser to separately value the leases that are in place at the acquisition date, as well as the above- or below-market values of the leases. |

| (3) | Represents premium that is recorded in connection with debt assumed when a property is purchased. The debt is marked to market at the acquisition date and the premium is amortized through interest expense over the remaining term of the debt. |

| (4) | For Wholly Owned Properties, Other Liabilities includes Tenant Deposits and Deferred Rents, Accrued Pension and Retirement Benefits, Accrued Expenses and Other Liabilities including Deficit in Partnerships Investments. |

| (5) | Includes PREIT's percent of partnership investment that is “grossed up” to reflect the Company’s share of the Total Assets and Liabilities of the underlying properties. The Company calculates the “gross up” by applying its percentage ownership interest to the historical financial statements of its equity method investments. The consolidated financial statements, which are presented in accordance with GAAP, reflect only the Company’s equity in these properties. |

NOTE: A reconciliation of the proportionate consolidation method to GAAP is included on pages 32 to 35.

PAGE 5

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

BALANCE SHEET(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Property Type) | | March 31, 2005

| | | December 31, 2004

| |

| | | Malls

| | | Power and Strip Centers

| | | Total Retail

| | | Other

Properties

| | | Corporate

| | | Combined

TOTAL

| | | Malls

| | | Power and Strip Centers

| | | Total Retail

| | | Other

Properties

| | | Corporate

| | | Combined

TOTAL

| |

ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in Real Estate, at cost(2) | | $ | 2,443,131,571 | | | $ | 315,131,675 | | | $ | 2,758,263,246 | | | $ | 28,702,718 | | | $ | — | | | $ | 2,786,965,964 | | | $ | 2,336,629,574 | | | $ | 313,078,795 | | | $ | 2,649,708,369 | | | $ | 25,861,672 | | | $ | — | | | $ | 2,675,570,041 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Accumulated Depreciation | | | (152,307,877 | ) | | | (50,113,733 | ) | | | (202,421,610 | ) | | | (2,139,471 | ) | | | — | | | | (204,561,081 | ) | | | (135,017,071 | ) | | | (47,764,970 | ) | | | (182,782,041 | ) | | | (2,126,931 | ) | | | — | | | | (184,908,972 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Real Estate | | | 2,290,823,694 | | | | 265,017,942 | | | | 2,555,841,636 | | | | 26,563,247 | | | | — | | | | 2,582,404,883 | | | | 2,201,612,503 | | | | 265,313,825 | | | | 2,466,926,328 | | | | 23,734,741 | | | | — | | | | 2,490,661,069 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | | 17,555,470 | | | | 3,616,429 | | | | 21,171,899 | | | | — | | | | 13,206,914 | | | | 34,378,813 | | | | 26,115,513 | | | | 4,590,129 | | | | 30,705,642 | | | | — | | | | 15,243,658 | | | | 45,949,300 | |

Other assets held for sale | | | 7,173,946 | | | | — | | | | 7,173,946 | | | | 1,299 | | | | — | | | | 7,175,245 | | | | 6,837,914 | | | | — | | | | 6,837,914 | | | | — | | | | — | | | | 6,837,914 | |

Intangible Assets(3) | | | 169,024,321 | | | | — | | | | 169,024,321 | | | | — | | | | 12,045,312 | | | | 181,069,633 | | | | 159,804,366 | | | | — | | | | 159,804,366 | | | | — | | | | 12,045,312 | | | | 171,849,678 | |

Other Assets, Net(4) | | | 54,743,737 | | | | 25,964,746 | | | | 80,708,483 | | | | 14,044,402 | | | | 25,023,141 | | | | 119,776,026 | | | | 52,375,910 | | | | 23,813,146 | | | | 76,189,056 | | | | 12,549,394 | | | | 24,473,341 | | | | 113,211,791 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Other Assets | | | 248,497,474 | | | | 29,581,175 | | | | 278,078,649 | | | | 14,045,701 | | | | 50,275,367 | | | | 342,399,717 | | | | 245,133,703 | | | | 28,403,275 | | | | 273,536,978 | | | | 12,549,394 | | | | 51,762,311 | | | | 337,848,683 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL ASSETS | | | 2,539,321,168 | | | | 294,599,117 | | | | 2,833,920,285 | | | | 40,608,948 | | | | 50,275,367 | | | | 2,924,804,600 | | | | 2,446,746,206 | | | | 293,717,100 | | | | 2,740,463,306 | | | | 36,284,135 | | | | 51,762,311 | | | | 2,828,509,752 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

LIABILITIES AND SHARE HOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage Notes Payable | | | 1,149,707,279 | | | | 103,803,244 | | | | 1,253,510,523 | | | | — | | | | — | | | | 1,253,510,523 | | | | 1,165,736,877 | | | | 104,255,499 | | | | 1,269,992,376 | | | | — | | | | — | | | | 1,269,992,376 | |

Mortgage Debt Premium(5) | | | 52,787,437 | | | | 1,247,387 | | | | 54,034,824 | | | | — | | | | | | | | 54,034,824 | | | | 54,794,532 | | | | 1,340,092 | | | | 56,134,624 | | | | — | | | | | | | | 56,134,624 | |

Bank Loans Payable | | | — | | | | — | | | | — | | | | — | | | | 402,000,000 | | | | 402,000,000 | | | | | | | | | | | | — | | | | — | | | | 271,000,000 | | | | 271,000,000 | |

Liabilities Related to Assets held for sale | | | 1,214,096 | | | | — | | | | 1,214,096 | | | | 402,780 | | | | — | | | | 1,616,876 | | | | 1,156,442 | | | | — | | | | 1,156,442 | | | | — | | | | — | | | | 1,156,442 | |

Other Liabilities(6) | | | 47,108,708 | | | | 4,276,216 | | | | 51,384,924 | | | | 1,874,735 | | | | 24,548,313 | | | | 77,807,972 | | | | 44,391,004 | | | | 5,723,480 | | | | 50,114,484 | | | | 3,529,907 | | | | 40,147,000 | | | | 93,791,391 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL LIABILITIES | | | 1,250,817,520 | | | | 109,326,847 | | | | 1,360,144,367 | | | | 2,277,515 | | | | 426,548,313 | | | | 1,788,970,195 | | | | 1,266,078,855 | | | | 111,319,071 | | | | 1,377,397,926 | | | | 3,529,907 | | | | 311,147,000 | | | | 1,692,074,833 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Minority Interest | | | 3,448,201 | | | | | | | | 3,448,201 | | | | — | | | | 138,301,736 | | | | 141,749,937 | | | | 3,584,992 | | | | | | | | 3,584,992 | | | | — | | | | 128,383,925 | | | | 131,968,917 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Shareholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares of Beneficial Interest at $1 Par | | | — | | | | — | | | | — | | | | — | | | | 36,474,673 | | | | 36,474,673 | | | | — | | | | — | | | | — | | | | — | | | | 36,272,160 | | | | 36,272,160 | |

Preferred Shares $0.01 Par | | | — | | | | — | | | | — | | | | — | | | | 24,750 | | | | 24,750 | | | | — | | | | — | | | | — | | | | — | | | | 24,750 | | | | 24,750 | |

Capital Contributed in Excess of Par | | | — | | | | — | | | | — | | | | — | | | | 907,811,709 | | | | 907,811,709 | | | | — | | | | — | | | | — | | | | — | | | | 899,506,128 | | | | 899,506,128 | |

Restricted Stock | | | — | | | | — | | | | — | | | | — | | | | (14,945,044 | ) | | | (14,945,044 | ) | | | — | | | | — | | | | — | | | | — | | | | (7,736,812 | ) | | | (7,736,812 | ) |

Accumulated Other Comprehensive Loss | | | — | | | | — | | | | — | | | | — | | | | (1,812,340 | ) | | | (1,812,340 | ) | | | — | | | | — | | | | — | | | | — | | | | (1,821,457 | ) | | | (1,821,457 | ) |

Retained Earnings | | | — | | | | — | | | | — | | | | — | | | | 66,530,720 | | | | 66,530,720 | | | | — | | | | — | | | | — | | | | — | | | | 78,221,233 | | | | 78,221,233 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL SHAREHOLDERS’ EQUITY | | | — | | | | — | | | | — | | | | — | | | | 994,084,468 | | | | 994,084,468 | | | | — | | | | — | | | | — | | | | — | | | | 1,004,466,002 | | | | 1,004,466,002 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 1,254,265,721 | | | $ | 109,326,847 | | | $ | 1,363,592,568 | | | $ | 2,277,515 | | | $ | 1,558,934,517 | | | $ | 2,924,804,600 | | | $ | 1,269,663,847 | | | $ | 111,319,071 | | | $ | 1,380,982,918 | | | $ | 3,529,907 | | | $ | 1,443,996,927 | | | $ | 2,828,509,752 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2004

| |

| | | Malls

| | | Power and Strip Centers

| | | Total Retail

| | | Other

Properties

| | | Corporate

| | | Combined

TOTAL

| |

ASSETS | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in Real Estate, at cost(2) | | $ | 2,225,064,658 | | | $ | 310,335,023 | | | $ | 2,535,399,681 | | | $ | 35,257,864 | | | $ | — | | | $ | 2,570,657,545 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Accumulated Depreciation | | | (87,461,869 | ) | | | (41,231,237 | ) | | | (128,693,106 | ) | | | (2,089,311 | ) | | | — | | | | (130,782,417 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Real Estate | | | 2,137,602,789 | | | | 269,103,786 | | | | 2,406,706,575 | | | | 33,168,553 | | | | — | | | | 2,439,875,128 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | | 13,487,669 | | | | 3,563,345 | | | | 17,051,014 | | | | — | | | | 19,973,588 | | | | 37,024,602 | |

Other assets held for sale | | | 37,383,935 | | | | — | | | | 37,383,935 | | | | — | | | | — | | | | 37,383,935 | |

Intangible Assets(3) | | | 159,907,867 | | | | — | | | | 159,907,867 | | | | — | | | | 12,085,313 | | | | 171,993,180 | |

Other Assets, Net(4) | | | 44,085,265 | | | | 25,771,864 | | | | 69,857,129 | | | | 11,017,725 | | | | 18,156,061 | | | | 99,030,915 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Other Assets | | | 254,864,736 | | | | 29,335,209 | | | | 284,199,945 | | | | 11,017,725 | | | | 50,214,962 | | | | 345,432,632 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL ASSETS | | | 2,392,467,525 | | | | 298,438,995 | | | | 2,690,906,520 | | | | 44,186,278 | | | | 50,214,962 | | | | 2,785,307,760 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

LIABILITIES AND SHARE

HOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage Notes Payable | | | 1,226,803,245 | | | | 88,886,924 | | | | 1,315,690,169 | | | | — | | | | — | | | | 1,315,690,169 | |

Mortgage Debt Premium(5) | | | 70,623,606 | | | | — | | | | 70,623,606 | | | | — | | | | — | | | | 70,623,606 | |

Bank Loans Payable | | | — | | | | — | | | | — | | | | — | | | | 182,000,000 | | | | 182,000,000 | |

Liabilities Related to Assets held for sale | | | 4,365,915 | | | | — | | | | 4,365,915 | | | | — | | | | — | | | | 4,365,915 | |

Other Liabilities(6) | | | 42,981,162 | | | | 5,330,612 | | | | 48,311,774 | | | | 5,007,317 | | | | 30,413,314 | | | | 83,732,405 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL LIABILITIES | | | 1,344,773,928 | | | | 94,217,536 | | | | 1,438,991,464 | | | | 5,007,317 | | | | 212,413,314 | | | | 1,656,412,095 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Minority Interest | | | 4,420,258 | | | | 126,715 | | | | 4,546,973 | �� | | | — | | | | 112,836,314 | | | | 117,383,287 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Shareholders’ Equity: | | | | | | | | | | | | | | | | | | | | | | | | |

Shares of Beneficial Interest at $1 Par | | | — | | | | — | | | | — | | | | — | | | | 35,781,922 | | | | 35,781,922 | |

Preferred Shares $0.01 Par | | | — | | | | — | | | | — | | | | — | | | | 24,750 | | | | 24,750 | |

Capital Contributed in Excess of Par | | | — | | | | — | | | | — | | | | — | | | | 884,677,043 | | | | 884,677,043 | |

Restricted Stock | | | — | | | | — | | | | — | | | | — | | | | (9,311,239 | ) | | | (9,311,239 | ) |

Accumulated Other Comprehensive Loss | | | — | | | | — | | | | — | | | | — | | | | (1,927,948 | ) | | | (1,927,948 | ) |

Retained Earnings | | | — | | | | — | | | | — | | | | — | | | | 102,267,850 | | | | 102,267,850 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL SHARE

HOLDERS’ EQUITY | | | — | | | | — | | | | — | | | | — | | | | 1,011,512,378 | | | | 1,011,512,378 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL LIABILITIES AND SHARE

HOLDERS’ EQUITY | | $ | 1,349,194,186 | | | $ | 94,344,251 | | | $ | 1,443,538,437 | | | $ | 5,007,317 | | | $ | 1,336,762,006 | | | $ | 2,785,307,760 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (1) | Includes PREIT’s percent of partnership investments that is “grossed up” to reflect the Company's share of the Total Assets and Liabilities of the underlying properties. The Company calculates the “gross up” by applying its percentage ownership interest to the historical financial statements of its equity method investments.The consolidated financial statements, which are presented in accordance with GAAP, reflect only the Trust’s Equity in these properties. |

| (2) | Investment in real estate as of March 31, 2005, December 31, 2004 and March 31, 2004 includes $9,611,074, $8,108,066 and $96,448,111, respectively relating to the non-core properties. The non-core properties are classified as held-for-sale for GAAP purposes. Other assets held for sale represents intangible assets and current assets of the non-core properties. |

| (3) | Includes value of acquired in-place leases and above-market value of leases recorded in connection with the acquisition of properties since 2002. Purchase accounting rules require a purchaser to separately value the leases that are in place at the acquisition date, as well as the above- or below-market values of the leases. |

| (4) | Deferred Costs, Prepaid Taxes and Expenses and Other Assets include Rents and Other Receivables for Partnerships. |

| (5) | Represents premium that is recorded in connection with debt assumed in connection with property purchases. The debt is marked to market at the acquisition date and the premium is amortized through interest expense over the remaining term of the debt. |

| (6) | For Wholly Owned Properties, Other Liabilities includes Tenant Deposits and Deferred Rents, Accrued Pension and Retirement Benefits, Accrued Expenses and Other Liabilities including Deficit Partnership Investments. |

NOTE: A reconciliation of the proportionate consolidation method to GAAP is included on pages 32 to 35.

PAGE 6

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

INCOME STATEMENT(1)

QUARTERLY COMPARISON

(Wholly Owned vs. Partnerships)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q1 05 (3 months ended 3/31/05)

| | | TOTAL %

CHANGE

| | | Q1 04 (3 months ended 3/31/04)

| |

| | | Wholly Owned

| | | Partnerships

| | | Corporate

| | | Combined

TOTAL

| | | | Wholly Owned

| | | Partnerships

| | | Corporate

| | | Combined

TOTAL

| |

Base Rents | | $ | 65,799,597 | | | | | | $ | 5,254,075 | | | | | | $ | — | | | | | | | 71,053,672 | | | 1.3 | % | | $ | 64,966,521 | | | | | | $ | 5,155,520 | | | | | | $ | — | | | | | | $ | 70,122,041 | |

Straight-Lining of Base Rents | | | 1,004,214 | | | | | | | 31,186 | | | | | | | — | | | | | | | 1,035,400 | | | -23.3 | % | | | 1,309,785 | | | | | | | 39,437 | | | | | | | — | | | | | | | 1,349,222 | |

Percentage Rents | | | 2,333,543 | | | | | | | 21,670 | | | | | | | — | | | | | | | 2,355,213 | | | -7.7 | % | | | 2,315,761 | | | | | | | 237,047 | | | | | | | — | | | | | | | 2,552,808 | |

Expense Reimbursables | | | 31,076,163 | | | | | | | 1,564,405 | | | | | | | — | | | | | | | 32,640,568 | | | 0.8 | % | | | 30,785,238 | | | | | | | 1,590,403 | | | | | | | — | | | | | | | 32,375,641 | |

Lease Termination | | | 1,438,241 | | | | | | | 138,444 | | | | | | | — | | | | | | | 1,576,685 | | | 5807.6 | % | | | 26,689 | | | | | | | — | | | | | | | — | | | | | | | 26,689 | |

Other Real Estate Revenues | | | 2,037,650 | | | | | | | 121,658 | | | | | | | — | | | | | | | 2,159,308 | | | -6.2 | % | | | 2,137,110 | | | | | | | 165,436 | | | | | | | — | | | | | | | 2,302,546 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

TOTAL REAL ESTATE REVENUES | | | 103,689,408 | | | 94 | % | | | 7,131,438 | | | 6 | % | | | — | | | 0 | % | | | 110,820,846 | | | 1.9 | % | | | 101,541,104 | | | 93 | % | | | 7,187,843 | | | 7 | % | | | — | | | 0 | % | | | 108,728,947 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Operating and Maintenance | | | (29,512,240 | ) | | | | | | (1,665,637 | ) | | | | | | — | | | | | | | (31,177,877 | ) | | -3.8 | % | | | (30,687,690 | ) | | | | | | (1,717,568 | ) | | | | | | — | | | | | | | (32,405,258 | ) |

Real Estate Taxes | | | (9,624,476 | ) | | | | | | (624,793 | ) | | | | | | — | | | | | | | (10,249,269 | ) | | 5.1 | % | | | (9,174,902 | ) | | | | | | (577,269 | ) | | | | | | — | | | | | | | (9,752,171 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

TOTAL PROPERTY OPERATING EXPENSES | | | (39,136,716 | ) | | 94 | % | | | (2,290,430 | ) | | 6 | % | | | — | | | 0 | % | | | (41,427,146 | ) | | -1.7 | % | | | (39,862,592 | ) | | 95 | % | | | (2,294,837 | ) | | 5 | % | | | — | | | 0 | % | | | (42,157,429 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

NET OPERATING INCOME | | | 64,552,692 | | | 93 | % | | | 4,841,008 | | | 7 | % | | | — | | | 0 | % | | | 69,393,700 | | | 4.2 | % | | | 61,678,512 | | | 93 | % | | | 4,893,006 | | | 7 | % | | | — | | | 0 | % | | | 66,571,518 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Management Company Revenue | | | — | | | | | | | — | | | | | | | 1,438,896 | | | | | | | 1,438,896 | | | -30.2 | % | | | — | | | | | | | — | | | | | | | 2,061,769 | | | | | | | 2,061,769 | |

Interest and Other Income | | | — | | | | | | | — | | | | | | | 189,906 | | | | | | | 189,906 | | | -25.2 | % | | | — | | | | | | | — | | | | | | | 253,728 | | | | | | | 253,728 | |

General & Administrative: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Payroll and Benefits | | | — | | | | | | | — | | | | | | | (7,123,909 | ) | | | | | | (7,123,909 | ) | | -11.3 | % | | | — | | | | | | | — | | | | | | | (8,028,893 | ) | | | | | | (8,028,893 | ) |

Other G&A Expenses | | | — | | | | | | | — | | | | | | | (2,094,131 | ) | | | | | | (2,094,131 | ) | | -19.9 | % | | | — | | | | | | | — | | | | | | | (2,613,826 | ) | | | | | | (2,613,826 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Earnings before interest, taxes, depreciation and amortization (EBITDA) | | | 64,552,692 | | | 104 | % | | | 4,841,008 | | | 8 | % | | | (7,589,238 | ) | | -12 | % | | | 61,804,462 | | | 6.1 | % | | | 61,678,512 | | | 106 | % | | | 4,893,006 | | | 8 | % | | | (8,327,222 | ) | | -14 | % | | | 58,244,296 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Interest Expense(2) | | | (16,559,871 | ) | | | | | | (2,039,920 | ) | | | | | | (3,106,246 | ) | | | | | | (21,706,037 | ) | | 4.6 | % | | | (17,041,328 | ) | | | | | | (2,050,359 | ) | | | | | | (1,657,535 | ) | | | | | | (20,749,222 | ) |

Depreciation & Amortization | | | (25,773,193 | ) | | | | | | (1,150,965 | ) | | | | | | (338,800 | ) | | | | | | (27,262,958 | ) | | 2.3 | % | | | (25,413,320 | ) | | | | | | (1,077,961 | ) | | | | | | (168,126 | ) | | | | | | (26,659,407 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

OTHER EXPENSES | | | (42,333,064 | ) | | | | | | (3,190,885 | ) | | | | | | (3,445,046 | ) | | | | | | (48,968,995 | ) | | 3.3 | % | | | (42,454,648 | ) | | | | | | (3,128,320 | ) | | | | | | (1,825,661 | ) | | | | | | (47,408,629 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Gains (loss) on sales of interests in Real Estate | | | 60,536 | | | | | | | — | | | | | | | — | | | | | | | 60,536 | | | N/A | | | | — | | | | | | | — | | | | | | | — | | | | | | | — | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Income before Minority Interest | | | 22,280,164 | | | | | | | 1,650,123 | | | | | | | (11,034,284 | ) | | | | | | 12,896,003 | | | 19.0 | % | | | 19,223,864 | | | | | | | 1,764,686 | | | | | | | (10,152,883 | ) | | | | | | 10,835,667 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Minority Interest in Properties | | | (45,459 | ) | | | | | | — | | | | | | | — | | | | | | | (45,459 | ) | | -87.3 | % | | | (357,959 | ) | | | | | | — | | | | | | | — | | | | | | | (357,959 | ) |

Minority Interest of O.P. Unitholders | | | — | | | | | | | — | | | | | | | (1,431,250 | ) | | | | | | (1,431,250 | ) | | 82.6 | % | | | — | | | | | | | — | | | | | | | (783,938 | ) | | | | | | (783,938 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Income from Operations | | | 22,234,705 | | | | | | | 1,650,123 | | | | | | | (12,465,534 | ) | | | | | | 11,419,294 | | | 17.8 | % | | | 18,865,905 | | | | | | | 1,764,686 | | | | | | | (10,936,821 | ) | | | | | | 9,693,770 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Discontinued Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Minority Interest of O.P. Unitholders | | | — | | | | | | | — | | | | | | | (21,037 | ) | | | | | | (21,037 | ) | | N/A | | | | — | | | | | | | — | | | | | | | (180,440 | ) | | | | | | (180,440 | ) |

Adjustments to gains on disposition of discontinued operations | | | — | | | | | | | — | | | | | | | — | | | | | | | — | | | N/A | | | | — | | | | | | | — | | | | | | | (550,000 | ) | | | | | | (550,000 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

TOTAL DISCONTINUED OPERATIONS | | | — | | | | | | | — | | | | | | | (21,037 | ) | | | | | | (21,037 | ) | | N/A | | | | — | | | | | | | — | | | | | | | (730,440 | ) | | | | | | (730,440 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

NET INCOME | | $ | 22,234,705 | | | 195 | % | | $ | 1,650,123 | | | 14 | % | | $ | (12,486,571 | ) | | -110 | % | | $ | 11,398,257 | | | 27.2 | % | | $ | 18,865,905 | | | 210 | % | | $ | 1,764,686 | | | 20 | % | | $ | (11,667,261 | ) | | -130 | % | | $ | 8,963,330 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

| (1) | Includes PREIT’s percent of partnership investments that is “grossed up” to reflect the Company’s share of the Total Revenues and Expenses of the underlying properties. The Company calculates the “gross up” by applying its percentage ownership interest to the historical financial statements of its equity method investments. |

| (2) | Capitalized interest expense of $390,000 is not included in the quarter ended 3/31/05 and $195,000 is not included in the quarter ended 3/31/04. |

NOTE: A reconciliation of the proportionate consolidation method to GAAP is included on pages 32 to 35.

PAGE 7

Pennsylvania REIT

QUARTERLY SUPPLEMENTAL DISCLOSURE (March 31, 2005)

INCOME STATEMENT(1)

QUARTERLY COMPARISON

(Line of Business)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q1 05 (3 months ended 3/31/05)

| | | TOTAL %

CHANGE

| | | Q1 04 (3 months ended 3/31/04)

| |

| | | RETAIL

| | | OTHER

PROPERTIES

| | | CORPORATE

| | | Combined

TOTAL

| | | | RETAIL

| | | OTHER

PROPERTIES

| | | CORPORATE

| | | Combined

TOTAL

| |

Base Rents | | $ | 70,941,570 | | | | | | $ | 112,102 | | | | | | $ | — | | | | | | $ | 71,053,672 | | | 1.3 | % | | $ | 70,036,885 | | | | | | $ | 85,156 | | | | | | $ | — | | | | | | $ | 70,122,041 | |

Straight-Lining of Base Rents | | | 1,035,400 | | | | | | | — | | | | | | | — | | | | | | | 1,035,400 | | | -23.3 | % | | | 1,349,222 | | | | | | | — | | | | | | | — | | | | | | | 1,349,222 | |

Percentage Rents | | | 2,355,213 | | | | | | | — | | | | | | | — | | | | | | | 2,355,213 | | | -7.7 | % | | | 2,552,808 | | | | | | | — | | | | | | | — | | | | | | | 2,552,808 | |

Expense Reimbursables | | | 32,628,133 | | | | | | | 12,435 | | | | | | | — | | | | | | | 32,640,568 | | | 0.8 | % | | | 32,363,966 | | | | | | | 11,675 | | | | | | | — | | | | | | | 32,375,641 | |

Lease Termination | | | 1,576,685 | | | | | | | — | | | | | | | — | | | | | | | 1,576,685 | | | 5807.6 | % | | | 26,689 | | | | | | | — | | | | | | | — | | | | | | | 26,689 | |

Other Real Estate Revenues | | | 2,159,308 | | | | | | | — | | | | | | | — | | | | | | | 2,159,308 | | | -6.2 | % | | | 2,302,546 | | | | | | | — | | | | | | | — | | | | | | | 2,302,546 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

TOTAL REAL ESTATE REVENUES | | | 110,696,309 | | | 100 | % | | | 124,537 | | | 0 | % | | | — | | | — | | | | 110,820,846 | | | 1.9 | % | | | 108,632,116 | | | 100 | % | | | 96,831 | | | 0 | % | | | — | | | — | | | | 108,728,947 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Operating and Maintenance | | | (31,171,933 | ) | | | | | | (5,944 | ) | | | | | | — | | | | | | | (31,177,877 | ) | | -3.8 | % | | | (32,402,033 | ) | | | | | | (3,225 | ) | | | | | | — | | | | | | | (32,405,258 | ) |

Real Estate Taxes | | | (10,239,684 | ) | | | | | | (9,585 | ) | | | | | | — | | | | | | | (10,249,269 | ) | | 5.1 | % | | | (9,743,121 | ) | | | | | | (9,050 | ) | | | | | | — | | | | | | | (9,752,171 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

TOTAL PROPERTY OPERATING EXPENSES | | | (41,411,617 | ) | | 100 | % | | | (15,529 | ) | | 0 | % | | | — | | | — | | | | (41,427,146 | ) | | -1.7 | % | | | (42,145,154 | ) | | 100 | % | | | (12,275 | ) | | 0 | % | | | — | | | — | | | | (42,157,429 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

NET OPERATING INCOME | | | 69,284,692 | | | 100 | % | | | 109,008 | | | 0 | % | | | — | | | — | | | | 69,393,700 | | | 4.2 | % | | | 66,486,962 | | | 100 | % | | | 84,556 | | | 0 | % | | | — | | | — | | | | 66,571,518 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Management Company Revenue | | | — | | | | | | | — | | | | | | | 1,438,896 | | | | | | | 1,438,896 | | | -30.2 | % | | | — | | | | | | | — | | | | | | | 2,061,769 | | | | | | | 2,061,769 | |

Interest and Other Income | | | — | | | | | | | — | | | | | | | 189,906 | | | | | | | 189,906 | | | -25.2 | % | | | — | | | | | | | — | | | | | | | 253,728 | | | | | | | 253,728 | |

General and Administrative: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | | | | — | |

Corporate Payroll and Benefits | | | — | | | | | | | — | | | | | | | (7,123,909 | ) | | | | | | (7,123,909 | ) | | -11.3 | % | | | — | | | | | | | — | | | | | | | (8,028,893 | ) | | | | | | (8,028,893 | ) |

Other General & Administrative | | | — | | | | | | | — | | | | | | | (2,094,131 | ) | | | | | | (2,094,131 | ) | | -19.9 | % | | | — | | | | | | | — | | | | | | | (2,613,826 | ) | | | | | | (2,613,826 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Earnings before interest, taxes, depreciation and amortization (EBITDA) | | | 69,284,692 | | | 112 | % | | | 109,008 | | | 0 | % | | | (7,589,238 | ) | | -12 | % | | | 61,804,462 | | | 6.1 | % | | | 66,486,962 | | | 114 | % | | | 84,556 | | | 0 | % | | | (8,327,222 | ) | | -14 | % | | | 58,244,296 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Interest Expense(2) | | | (18,599,791 | ) | | | | | | — | | | | | | | (3,106,246 | ) | | | | | | (21,706,037 | ) | | 4.6 | % | | | (19,091,687 | ) | | | | | | — | | | | | | | (1,657,535 | ) | | | | | | (20,749,222 | ) |

Depreciation & Amortization | | | (26,911,618 | ) | | | | | | (12,540 | ) | | | | | | (338,800 | ) | | | | | | (27,262,958 | ) | | 2.3 | % | | | (26,478,741 | ) | | | | | | (12,540 | ) | | | | | | (168,126 | ) | | | | | | (26,659,407 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

OTHER EXPENSES | | | (45,511,409 | ) | | | | | | (12,540 | ) | | | | | | (3,445,046 | ) | | | | | | (48,968,995 | ) | | 3.3 | % | | | (45,570,428 | ) | | | | | | (12,540 | ) | | | | | | (1,825,661 | ) | | | | | | (47,408,629 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Gains on sales of interests in Real Estate | | | 60,536 | | | | | | | — | | | | | | | — | | | | | | | 60,536 | | | N/A | | | | | | | | | | | | | | | | | | — | | | | | | | — | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| | | | | | | | | | | | | | | |

|

|

| | | | |

|

|

|

Income before Minority Interest | | | 23,833,819 | | | | | | | 96,468 | | | | | | | (11,034,284 | ) | | | | | | 12,896,003 | | | 19.0 | % | | | 20,916,534 | | | | | | | 72,016 | | | | | | | (10,152,883 | ) | | | | | | 10,835,667 | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Minority Interest in Properties | | | (45,459 | ) | | | | | | — | | | | | | | — | | | | | | | (45,459 | ) | | | | | | (357,959 | ) | | | | | | — | | | | | | | — | | | | | | | (357,959 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Minority Interest of O.P. Unitholders | | | — | | | | | | | — | | | | | | | (1,431,250 | ) | | | | | | (1,431,250 | ) | | 82.6 | % | | | — | | | | | | | — | | | | | | | (783,938 | ) | | | | | | (783,938 | ) |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| |

|

| |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

|

Income from Operations | | | 23,788,360 | | | | | | | 96,468 | | | | | | | (12,465,534 | ) | | | | | | 11,419,294 | | | 17.8 | % | | | 20,558,575 | | | | | | | 72,016 | | | | | | | (10,936,821 | ) | | | | | | 9,693,770 | |

| | |

|

|

| | | | |