UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

HUTCHINSON TECHNOLOGY INCORPORATED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HUTCHINSON TECHNOLOGY INCORPORATED

40 West Highland Park Drive NE

Hutchinson, Minnesota 55350

(320) 587-3797

December 10, 2010

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders to be held at the principal executive offices of Hutchinson Technology Incorporated, 40 West Highland Park Drive NE, Hutchinson, Minnesota, commencing at 10:00 a.m., central time, on Thursday, January 20, 2011. The Secretary’s notice of annual meeting and the proxy statement that follow describe the matters to come before the meeting.

This year we are again taking advantage of a Securities and Exchange Commission rule allowing companies to furnish proxy material to shareholders over the Internet. If you are a shareholder who holds shares of our common stock in an account at a brokerage firm, bank or similar organization, you will receive a Notice Regarding the Availability of Proxy Material by mail from the organization holding your account. The Notice contains instructions on how you can access our proxy material and vote your shares over the Internet. It also will tell you how to request a paper or e-mail copy of our proxy material.

If you are a shareholder whose shares are registered directly in your name with our transfer agent, Wells Fargo Bank, N.A., you will continue to receive a printed copy of the proxy statement and our Annual Report on Form 10-K by mail as in previous years.

We hope that you will be able to attend the meeting in person and we look forward to seeing you. Whether or not you plan to attend the meeting, your vote is important and we encourage you to vote promptly. You may vote your shares over the Internet, by telephone or, if you receive a paper copy of the proxy card, by mail. If you choose to vote by mail, please mark, sign and date the proxy card you receive and return it in the envelope provided. Instructions regarding all three methods of voting are contained on the following page and on the proxy card.

Sincerely,

Wayne M. Fortun

Chief Executive Officer

VOTING METHOD

If your shares are registered directly in your name: If you are a shareholder of record, you may vote your shares through the Internet, by telephone or by mail as described below. Please help us save time and postage costs by voting through the Internet or by telephone. Each method is available 24 hours a day and will ensure that your vote is confirmed and posted immediately. To vote:

| | a. | Go to the website at http://www.eproxy.com/htch/, 24 hours a day, seven days a week, until 12 p.m. (noon) (CT) on January 19, 2011. |

| | b. | Please have your proxy card and the last four digits of your Social Security Number or Tax Payer Identification Number to obtain your records and create an electronic ballot. |

| | c. | Follow the simple instructions provided. |

| | a. | On a touch-tone telephone, call toll-free 1-800-560-1965, 24 hours a day, seven days a week, until 12 p.m. (noon) (CT) on January 19, 2011. |

| | b. | Please have your proxy card and the last four digits of your Social Security Number or Tax Payer Identification Number. |

| | c. | Follow the simple instructions provided. |

| | 3. | BY MAIL (if you vote by Internet or telephone, please do not mail your proxy card) |

| | a. | Mark, sign and date your enclosed proxy card. |

| | b. | Return it in the enclosed postage-paid envelope or return it to Hutchinson Technology Incorporated, c/o Shareowner Services,SM P.O. Box 64873, St. Paul, Minnesota 55164-0873. |

If your shares are held in a brokerage, bank or similar account:You will receive voting instructions from the organization holding your account and you must follow those instructions to vote your shares. You will receive a Notice Regarding the Availability of Proxy Material that will tell you how to access our proxy material on the Internet and vote your shares over the Internet. It also will tell you how to request a paper or e-mail copy of our proxy material.

Your vote is important. Thank you for voting.

HUTCHINSON TECHNOLOGY INCORPORATED

Notice of Annual Meeting of Shareholders

to be held on January 20, 2011

The annual meeting of shareholders of Hutchinson Technology Incorporated will be held at the principal executive offices of Hutchinson Technology Incorporated, 40 West Highland Park Drive NE, Hutchinson, Minnesota 55350, commencing at 10:00 a.m., central time, on Thursday, January 20, 2011, for the following purposes:

| | 1. | To elect a board of eight directors to serve until the next annual meeting of shareholders or until their successors have been duly elected and qualified. |

| | 2. | To approve adoption of the 2011 Equity Incentive Plan. |

| | 3. | To approve an amendment and restatement of our Employee Stock Purchase Plan. |

| | 4. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending September 25, 2011. |

| | 5. | To transact other business that may properly be brought before the meeting. |

Our board of directors has fixed December 1, 2010 as the record date for the meeting, and only shareholders of record at the close of business on that date are entitled to receive notice of and vote at the meeting.

Your proxy is important to ensure a quorum at the meeting. Even if you own only a few shares, and whether or not you expect to be present, we urge you to vote your shares through the Internet or by telephone in accordance with the voting instructions provided to you. If you received a paper copy of the proxy card by mail, you may also mark, sign and date the paper proxy card you received to vote your shares and return it in the envelope provided.

By Order of the Board of Directors,

Peggy Steif Abram

Secretary

Hutchinson, Minnesota

December 10, 2010

PROXY STATEMENT

GENERAL INFORMATION

Our board of directors is soliciting proxies from our shareholders to vote their shares of our common stock at the annual meeting of shareholders to be held on Thursday, January 20, 2011 at our principal executive offices located at 40 West Highland Park Drive NE, Hutchinson, Minnesota, commencing at 10:00 a.m., central time, and at any adjournments thereof. Our telephone number is (320) 587-3797.

Availability of Proxy Material

As permitted by rules of the Securities and Exchange Commission (“SEC”), we are making our proxy material, which includes our notice of annual meeting, proxy statement and Annual Report on Form 10-K, available to our shareholders over the Internet. Any shareholder who holds shares of our common stock in an account at a brokerage firm, bank or similar organization will receive a Notice Regarding the Availability of Proxy Material by mail from the organization holding the shareholder’s account. The Notice contains instructions on how these shareholders can access our proxy material and vote their shares over the Internet. These shareholders will not receive proxy material by mail unless they specifically request that printed copies of the proxy material be sent to them. The Notice tells these shareholders how to request printed or e-mail copies of our proxy material.

Any shareholder whose shares are registered directly in the shareholder’s name with our transfer agent, Wells Fargo Bank, N.A., will receive a printed copy of our proxy material by mail.

On or about December 13, 2010, we will begin mailing to the registered holders of our common stock at the close of business on December 1, 2010 our proxy material, including the form of proxy solicited by our board of directors. On or about the same date, the Notice Regarding the Availability of Proxy Material will be mailed to each shareholder who holds shares of our common stock in an account at a brokerage firm, bank or similar organization.

Record Date and Quorum

Only shareholders of record at the close of business on December 1, 2010 will be entitled to vote at the annual meeting or adjournment. At the close of business on the record date, we had 23,371,105 shares of our common stock outstanding and entitled to vote. A majority of the shares outstanding on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business at the meeting.

Voting of Proxies

Proxies that are voted through the Internet or by telephone in accordance with the voting instructions provided, and proxy cards that are properly signed, dated and returned to us, will be voted in the manner specified. A proxy card that is signed and returned without voting instructions will be voted FOR the eight director nominees, FOR ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending September 25, 2011, FOR the approval of the 2011 Equity Incentive Plan and FOR the amendment and restatement of our Employee Stock Purchase Plan. A shareholder submitting a proxy may revoke it at any time before it is exercised by sending a written revocation to one of our officers, by delivering a signed proxy card bearing a later date, by submitting a subsequent proxy through the Internet or by telephone or by voting in person at the annual meeting. A shareholder’s most current proxy card or Internet or telephone proxy will be the one that is voted.

Effect of Abstentions and “Broker Non-Votes”

If shareholders indicate on their proxies that they wish to abstain from voting, including brokers holding their customers’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to vote at the annual meeting. These shares will count toward determining whether or not a quorum is present. However, these shares will not be taken into account in determining the outcome of any of the proposals and these shareholders are in effect casting a negative vote. A shareholder (including a broker) who does not give authority to a proxy to vote, or withholds authority to vote, on a certain proposal will not be considered present and entitled to vote on that proposal.

1

If a shareholder does not give instructions to its broker as to how to vote the shares, the broker has authority under New York Stock Exchange rules to vote those shares for or against “routine” proposals, such as the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. Brokers cannot vote on their customers’ behalf on “non-routine” proposals such as the approval of an equity compensation plan or the election of directors. These rules apply to us even though the shares of our common stock are traded on the NASDAQ Global Select Market. If a broker votes shares that are unvoted by its customers for or against a “routine” proposal, these shares are counted for the purpose of establishing a quorum and also will be counted for the purpose of determining the outcome of “routine” proposals. If a broker does not receive voting instructions as to a non-routine proposal, or chooses to leave shares unvoted on a routine proposal, a “broker non-vote” occurs and those shares will be counted for the purpose of establishing a quorum, but not for determining the outcome of those proposals. Shares that are subject to broker non-votes are considered not entitled to vote on the particular proposal, and effectively reduce the number of shares needed to approve that proposal.

Required Vote

Shareholders are entitled to one vote for each share of our common stock held as of the record date. Directors are elected by a plurality of the voting power of the outstanding shares of our common stock present and entitled to vote. The affirmative vote of the holders of at least a majority of the voting power of the outstanding shares of our common stock present and entitled to vote is required for approval of the other proposals presented in this proxy statement. Shareholders do not have the right to cumulate their votes in the election of directors. Negative votes will not affect the outcome of the election of directors.

Adjournment of Meeting

If a quorum is not present to transact business at the meeting or if we do not receive sufficient votes in favor of the proposals by the date of the meeting, the persons named as proxies may propose one or more adjournments of the meeting to permit solicitation of proxies. Any adjournment would require the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting.

Expenses of Soliciting Proxies

We will pay the cost of soliciting proxies in the accompanying form. Our directors, officers and regular employees may solicit proxies personally or by e-mail, telephone, fax or special letter, and may request brokerage firms and custodians, nominees and other record holders to forward soliciting materials to the beneficial owners of our stock and will reimburse them for their reasonable out-of-pocket expenses in forwarding these materials.

Shareholder Proposals

We must receive at our principal executive office no later than August 15, 2011 any shareholder proposals that are requested to be included in the proxy statement for our annual meeting of shareholders to be held in January 2012. We must receive any other shareholder proposals intended to be presented at our annual meeting of shareholders to be held in January 2012 at our principal executive office no later than October 22, 2011.

2

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Composition of Our Board of Directors

Our bylaws provide that our business will be managed by or under the direction of a board of directors of not less than three nor more than twelve directors, which number will be determined by the shareholders at their annual meeting. Each director will be elected at the annual meeting for a term of one year or until a successor has been elected and qualified. Our board of directors has recommended that the number of directors to be elected for the ensuing year be set at eight and has nominated the eight persons named below for election as directors. Proxies solicited by our board of directors will, unless otherwise directed, be voted to elect the eight nominees named below to constitute the entire board of directors.

Directors and Director Nominees

All of the nominees named below are current directors of our company. Martha Goldberg Aronson was appointed by the board of directors to fill a newly created seat in June 2010, and she is standing for election by our shareholders for the first time. A director search firm recommended Ms. Goldberg Aronson to our governance and nominating committee, which subsequently recommended her for election to our board of directors.

In addition to the nominees named below, W. Thomas Brunberg and Richard B. Solum are currently serving as directors but are not seeking re-election at the annual meeting of shareholders.

Each nominee has indicated a willingness to serve as a director for the ensuing year, but in case any nominee is not a candidate at the meeting for any reason, the proxies named in our form of proxy may vote for a substitute nominee in their discretion. The following table sets forth certain information regarding each director nominee:

| | | | | | | | | | |

Name | | Age | | | Position | | Director

Since | |

Jeffrey W. Green | | | 70 | | | Chairman of the Board of Directors and Director | | | 1965 | |

Wayne M. Fortun | | | 61 | | | President, Chief Executive Officer and Director | | | 1983 | |

Mark A. Augusti | | | 45 | | | Director | | | 2010 | |

Martha Goldberg Aronson | | | 43 | | | Director | | | 2010 | |

Gary D. Henley | | | 61 | | | Director | | | 2008 | |

Russell Huffer | | | 61 | | | Lead Director | | | 1999 | |

William T. Monahan | | | 63 | | | Director | | | 2000 | |

Thomas R. VerHage | | | 57 | | | Director | | | 2006 | |

Jeffrey W. Green co-founded our company. He has been chairman of our board of directors since January 1983, and served as our chief executive officer from January 1983 to May 1996.

As a founder of our company, Mr. Green possesses intimate familiarity with the history and growth of our company. He has deep knowledge of its complex operations and the technologies associated with our production processes and products. This background and his ongoing participation in business efforts and strategy development uniquely position him as a valuable contributor to our board of directors.

Wayne M. Fortun has been with our company since 1975, was elected president and chief operating officer in 1983 and chief executive officer in May 1996, and is now president and chief executive officer. He is also a director of G&K Services, Inc. and C.H. Robinson Worldwide, Inc.

During Mr. Fortun’s 35 years with our company, he has developed extensive experience and critical knowledge of our company and the disk drive and medical device industries in which we operate. As our Chief Executive Officer, he is responsible for developing and implementing our strategy as well as communicating that strategy and motivating our workforce to achieve our goals. His service on the boards of two other public companies provides him with additional valuable operational and managerial perspectives. These competencies, in addition to Mr. Fortun’s intense familiarity with our company, make him uniquely qualified to serve on our board of directors.

Mark A. Augusti has been an executive with Smith & Nephew, a global health-care company focused on orthopaedic products and services, since April 2003. He has served as President of the Biologics and Spine business unit since January 2008, was President of the Orthopaedic Trauma and Clinical Therapies business unit from February 2006 to January 2008 and was Senior Vice President and General Manager of the Trauma Division from

3

April 2005 to February 2006. Before joining Smith & Nephew, Mr. Augusti served as Vice President at JPMorgan Chase & Co. from 2000 to 2002 and held various positions with GE Medical Systems from 1987 to 2000.

Mr. Augusti’s substantial experience in the medical device and health-care industry gives our board of directors important business management, regulatory and marketing insights, in particular in connection with these industries. His operations experience in Europe and Asia is particularly helpful as our company establishes assembly operations in Thailand and expands sales of our BioMeasurement products in Europe. In addition, Mr. Augusti’s financial experience provides an additional valuable perspective in the development of our company’s strategy.

Gary D. Henley is President and Chief Executive Officer and a director of Wright Medical Group, Inc., a global orthopedic medical device company, a position he has held since April 2006. Prior to joining Wright Medical, Mr. Henley was an executive with Orthofix International N.V., a diversified orthopedic products company, most recently serving as President of its Americas Division from 2002 to 2006.

Mr. Henley’s significant leadership experience and first-hand knowledge of both manufacturing companies and the medical device industry are valuable resources to our board of directors. In his executive roles, he has had key experience in developing growth and marketing strategies for medical device products as well as providing leadership on product and operations management. In addition, as the chief executive of a public company, he provides significant insight on the wide range of management and operational matters faced by public companies.

Martha Goldberg Aronson has been Senior Vice President and President, North America, of Hill-Rom Holdings, Inc., a leading worldwide manufacturer and provider of medical technologies and related services for the health-care industry, since August 2010. Prior to joining Hill-Rom, she served as Senior Vice President at Medtronic, Inc., a leading manufacturer of medical devices, from March 2008 to November 2009, as Medtronic’s Vice President – Investor Relations from May 2006 to March 2008 and as its Vice President, Western Europe, from 2003 to 2006. Prior to joining Medtronic in 1991, Ms. Goldberg Aronson was an associate consultant at Bain & Company, a global management consulting firm.

Ms. Goldberg Aronson’s years of experience in management consulting and the medical technology and health-care industry provide her with knowledge and expertise in the development and communication of effective business strategies and the pursuit of technological innovation. She provides useful perspective on international business matters, drawing upon her tenure in an international executive position. In addition, her general experience in engaging and communicating with investors provides particular insight to the board of directors in connection with our company’s investors.

Russell Huffer has been Chairman of Apogee Enterprises, Inc., a manufacturer of glass products, services and systems, since June 1999. He has been President, Chief Executive Officer and a director of Apogee since January 1998, and has served in various senior management positions with Apogee or its subsidiaries since 1986. On October 9, 2009, Mr. Huffer was appointed to serve as lead director of our board of directors.

Mr. Huffer’s experience as a chief executive officer and in other senior management positions at Apogee provides extensive operational and management insight to our company. His many years at Apogee provide a deep familiarity with the issues associated with technology excellence and operations in a manufacturing company. As the chief executive of a public company, he also has a keen understanding of the management and operational requirements of a publicly traded company.

William T. Monahan spent 24 years at 3M Co. leading numerous business and international operations. He was Chairman of the Board, President, Chief Executive Officer and a director of Imation Corp., a developer, manufacturer and marketer of data storage and imaging products and services, from March 1996 to June 2004. He is also a director of Pentair, Inc., The Mosaic Company and Solutia Inc.

Mr. Monahan has extensive experience in the data storage industry with specific experience in cost structure, marketing and pricing strategy, operations excellence and investor relations. He has led large manufacturing businesses and companies, and serves on boards of other industrial manufacturing companies. His broad experience in managing and overseeing global operations provides valuable expertise to our board of directors.

Thomas R. VerHage has been Vice President and Chief Financial Officer of Donaldson Company, Inc., a worldwide provider of filtration systems and replacement parts, since March 2004. Prior to that time, he was a partner at Deloitte & Touche LLP, an independent registered public accounting firm, from 2002 to 2004, and a partner at Arthur Andersen LLP from 1987 to 2002. He is also a director of Franklin Electric Co., Inc.

4

Mr. VerHage has extensive public company finance, accounting and audit experience, in his current role as chief financial officer of a global manufacturing company and in his past positions in the public accounting industry. Mr. VerHage’s financial and public accounting experience provide him with broad knowledge related to financial oversight and management of financial resources. As the chief financial officer of a public company, he also has relevant and valuable expertise in providing guidance on financial and risk management processes and in communicating with investors. In addition, Mr. VerHage has valuable insights into our Disk Drive Components Division’s end markets and customers through his work with Donaldson Company’s disk drive filter business.

None of the above nominees is related to each other or to any of our executive officers.

Board of Directors Meetings and Attendance

Our board of directors held eight meetings during our fiscal year that ended September 26, 2010. Each director attended at least 90% of the meetings of our board of directors and committees on which he or she served during fiscal 2010.

Committees of Our Board of Directors

The following table summarizes the composition of each of the committees of our board of directors:

| | | | | | | | |

| | | Audit Committee | | Compensation

Committee | | Governance and

Nominating

Committee | | Competitive

Excellence

Committee |

Independent Directors: |

Mark A. Augusti | | Member | | — | | — | | — |

W. Thomas Brunberg | | Member | | — | | — | | — |

Martha Goldberg Aronson | | — | | Member | | — | | Member |

Gary D. Henley | | — | | Member | | — | | Member |

Russell Huffer | | — | | Member | | — | | Member |

William T. Monahan | | — | | Chair | | Member | | — |

Richard B. Solum | | — | | — | | Chair | | — |

Thomas R. VerHage | | Chair | | — | | Member | | — |

Inside Directors: |

Jeffrey W. Green, Chairman | | — | | — | | — | | Chair |

Wayne M. Fortun, President and CEO | | — | | — | | — | | — |

Audit Committee

Our board of directors has determined that all members of our audit committee are “independent” as that term is used in Section 10A(m) of the Securities Exchange Act of 1934 and as that term is defined in Rule 5605(a)(2) of the NASDAQ Stock Market Rules. Our audit committee held eight meetings in fiscal 2010. Our audit committee’s function is one of oversight and, in that regard, our audit committee meets with our management and internal auditor, and our independent registered public accounting firm, to review and discuss our financial reporting and our controls respecting accounting and risk of material loss. The responsibilities of our audit committee are set forth in the Audit Committee Charter, which is regularly reviewed in light of SEC regulations and NASDAQ Stock Market Rules and is available on our website atwww.htch.com.

Our audit committee received information from management and pre-approved all auditing services and non-audit services provided by our independent registered public accounting firm, and considered, prior to engagement, whether the provision of the non-audit services was compatible with maintaining the independent registered public accounting firm’s independence. Our board of directors has determined that Messrs. Brunberg and VerHage are “audit committee financial experts” as defined by SEC regulations.

Compensation Committee

Our board of directors has determined that all members of our compensation committee are “independent” as that term is defined in Rule 5605(a)(2) of the NASDAQ Stock Market Rules, “non-employee directors” as that term is defined in Rule 16b-3 under the Securities Exchange Act of 1934, and “outside directors” as that term is used in Section 162(m) of the Internal Revenue Code (the “Code”). Our compensation committee held five meetings in fiscal 2010. As described more fully in the following paragraphs, our compensation committee is responsible for (i) reviewing and approving a program regarding all forms of compensation for executive officers, (ii) reviewing and approving policies and processes for carrying out executive officer evaluations and compensation reviews, (iii)

5

approving the grant of equity-based incentive awards to each of our executive officers and non-employee directors, and (iv) reviewing and recommending for approval by the board of directors or our independent directors, as appropriate, compensation actions involving our executive officers and our non-employee directors. The responsibilities of our compensation committee are set forth in the Compensation Committee Charter, which is regularly reviewed in light of SEC regulations and NASDAQ Stock Market Rules and is available on our website atwww.htch.com.

At the beginning of each fiscal year, our compensation committee reviews and recommends to our board of directors certain compensation actions involving our executive officers, other than the chief executive officer, including any merit increases to base salary, the payout of annual incentive awards for the prior fiscal year’s performance and performance targets for the annual incentive plan for the current fiscal year, and approves the grant of equity awards to all of our executive officers. The compensation committee bases these determinations on its review of competitive market data from nationally recognized compensation surveys, financial and operational performance data for the prior fiscal year, projections for the current fiscal year, and the recommendations of our chief executive officer with respect to compensation actions involving executive officers other than himself. Determinations regarding the compensation of our chief executive officer are made by the compensation committee in executive session without the chief executive officer present and are based on the committee’s evaluation of the chief executive officer’s performance for the prior fiscal year, considering feedback from each of the chief executive officer’s direct reports and all members of the board of directors. The compensation committee’s recommendations on base salary, annual cash incentive payout for the prior fiscal year’s performance and performance targets for the current fiscal year’s annual cash incentive plan for the chief executive officer and the chairman of the board are presented to the independent directors for approval, and the compensation committee’s recommendations for the remaining executive officers are presented to the full board for approval. Our human resources department provides the compensation committee with regular updates at its scheduled meetings and various tools and resources to keep the committee informed about current trends in executive compensation and market information on pay philosophies, compensation elements separately and in total, and incentive mix.

Our compensation committee also reviews compensation provided to our non-employee directors and, at the beginning of each fiscal year, recommends to our independent directors any changes the committee considers appropriate in the amount or form of such compensation. The compensation committee bases these determinations primarily on its review of competitive market data from nationally recognized compensation surveys.

Our compensation committee is authorized to retain outside compensation consultants at such times and for such purposes as the committee deems appropriate, but has not routinely retained an outside consultant. In fiscal 2010, the committee engaged Towers Watson to provide advice and assistance in connection with the design and approval of the 2011 Equity Incentive Plan that is being presented to our shareholders for their approval at the 2011 annual meeting of shareholders.

The compensation committee delegates to the chief executive officer authority to approve stock option awards involving up to an aggregate of 20,000 shares per year to employees who are not executive officers of the company. No delegation of the compensation committee’s authority is permitted with regard to compensation actions involving executive officers or non-employee directors of our company.

Governance and Nominating Committee

All members of our governance and nominating committee are “independent” as that term is defined in Rule 5605(a)(2) of the NASDAQ Stock Market Rules. Our governance and nominating committee held three meetings in fiscal 2010. Our governance and nominating committee assists our board of directors in developing and implementing our Principles of Corporate Governance, identifying candidates for director positions, determining the composition of our board of directors and our board committees, and maintaining a high standard of governance, care and due diligence in carrying out its responsibilities. The responsibilities of our governance and nominating committee are set forth in the Governance and Nominating Committee Charter, which is regularly reviewed in light of SEC regulations and NASDAQ Stock Market Rules and is available on our website atwww.htch.com.

Competitive Excellence Committee

Our competitive excellence committee assesses the value to our customers of our products and services in each of our target markets. The committee bases its assessment on our competitive standing in those competencies that are central to sustaining better value in a target market. The committee evaluates management’s identification of areas that afford opportunities for increasing our competitive standing, management’s effectiveness in achieving the

6

increases and management’s effectiveness in increasing the value proposition of our products and services in our markets. Our competitive excellence committee held three meetings in fiscal 2010. The responsibilities of our competitive excellence committee are set forth in the Competitive Excellence Committee Charter, which is available on our website atwww.htch.com.

Director Independence

Our board of directors has determined that Messrs. Augusti, Brunberg, Henley, Huffer, Monahan, Solum and VerHage and Ms. Goldberg Aronson are “independent,” as that term is defined in Rule 5605(a)(2) of the NASDAQ Stock Market Rules.

Director Compensation

Directors who are employees receive no additional compensation for serving on our board of directors. The following table describes the compensation arrangements with our non-employee directors for the one-year period between our annual shareholder meetings in 2010 and 2011.

| | |

Compensation Element | | Amount Payable |

| Annual cash retainers | | |

• Board member | | $33,295(1) |

• Audit committee chair | | $15,000 |

• Compensation committee and governance and nominating committee chairs | | $5,000 |

• Audit committee member (excluding the chair) | | $5,000 |

| Meeting fee(2) | | $1,250 |

| Stock option award(3) | | 5,000 shares |

| Shares in lieu of cash retainer | | Unrestricted shares equal in value to 100% of cash retainer elected to be paid in equity. |

| (1) | On December 1, 2010, the board of directors reduced the annual cash retainer amount to be paid to board members for the one-year period between our annual shareholder meetings in 2011 and 2012 by 5%. |

| (2) | We pay a meeting fee for each board of directors and committee meeting attended by a non-employee director in person or by telephone. We also reimburse directors for travel and lodging expenses incurred in connection with their attendance at board of directors and committee meetings and shareholder meetings, and for traveling to visit company operations. |

| (3) | We provide a stock option award of 5,000 shares to each non-employee director on the date he or she is first elected or appointed to the board and provide a stock option award of 5,000 shares to each non-employee director whose service will continue beyond the annual meeting of shareholders on the date of each annual meeting. |

7

The following table summarizes compensation provided to each non-employee director for services provided during fiscal 2010.

Director Compensation for Fiscal 2010

| | | | | | | | | | | | |

Name | | Fees Earned or Paid in

Cash ($)(1) | | | Option Awards

($)(2) | | | Total

($) | |

Mark A. Augusti | | | 50,795 | | | | 58,030 | | | | 108,825 | |

W. Thomas Brunberg | | | 58,295 | | | | 29,015 | | | | 87,310 | |

Martha Goldberg Aronson | | | 28,454 | | | | 22,107 | | | | 50,561 | |

Gary D. Henley | | | 54,545 | | | | 29,015 | | | | 83,560 | |

Russell Huffer | | | 57,045 | | | | 29,015 | | | | 86,060 | |

William T. Monahan | | | 57,045 | | | | 29,015 | | | | 86,060 | |

Richard B. Solum | | | 50,795 | | | | 29,015 | | | | 79,810 | |

Thomas R. VerHage | | | 72,045 | | | | 29,015 | | | | 101,060 | |

| (1) | For fiscal 2010, each non-employee director could elect to receive some or all of the retainer payments to which he or she was entitled in the form of shares of our common stock, with the number of shares determined by dividing the amount of the retainer payment to be received in shares by the fair market value of a share of our common stock on the date the cash retainer payment would have been made, rounded down to the nearest whole share. The following directors made such elections and received the number of shares indicated during fiscal 2010: |

| | | | | | | | |

Name | | Shares Received

(#) | | | Cash Retainer

Foregone ($) | |

Mark A. Augusti | | | 4,957 | | | | 21,648 | |

Gary D. Henley | | | 3,812 | | | | 16,648 | |

Russell Huffer | | | 3,812 | | | | 16,648 | |

| (2) | Each director who was a member of our board on January 27, 2010, the date of our 2010 Annual Meeting of Shareholders, received a non-statutory stock option award of 5,000 shares with an exercise price of $7.20 per share on that date. Mr. Augusti received an additional stock option award of 5,000 shares, for an aggregate award of 10,000 shares, to reflect his election to the board at the 2010 Annual Meeting of Shareholders. Ms. Goldberg Aronson received a non-statutory stock option award of 5,000 shares with an exercise price of $5.51 per share on June 2, 2010, the day she was appointed to the board. The amounts shown in the “Option Awards” column represent the aggregate grant date fair value of these awards computed in accordance with FASB ASC Topic 718. For additional information regarding our calculation of the grant date fair value of options granted in fiscal 2010, see Note 5, “Employee Benefits — Stock Options,” in the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for fiscal 2010. |

The aggregate number of shares subject to exercisable and non-exercisable options held by each non-employee director as of September 26, 2010 was as follows:

| | | | | | | | |

Name | | Number of Shares Underlying

Exercisable Options at 9/26/10 | | | Number of Shares Underlying

Unexercisable Options at 9/26/10 | |

Mark A. Augusti | | | — | | | | 10,000 | |

W. Thomas Brunberg | | | 25,500 | | | | 12,500 | |

Martha Goldberg Aronson | | | — | | | | 5,000 | |

Gary D. Henley | | | 2,500 | | | | 12,500 | |

Russell Huffer | | | 16,500 | | | | 12,500 | |

William T. Monahan | | | 25,500 | | | | 12,500 | |

Richard B. Solum | | | 16,500 | | | | 12,500 | |

Thomas R. VerHage | | | 10,500 | | | | 12,500 | |

8

In addition, the aggregate number of shares of restricted stock held by each non-employee director as of September 26, 2010 was as follows:

| | | | |

Name | | Number of Shares of Restricted Stock

at 9/26/10 | |

Mark A. Augusti | | | — | |

W. Thomas Brunberg | | | 6,994 | |

Martha Goldberg Aronson | | | — | |

Gary D. Henley | | | — | |

Russell Huffer | | | 7,636 | |

William T. Monahan | | | 6,977 | |

Richard B. Solum | | | 7,563 | |

Thomas R. VerHage | | | 870 | |

Stock Option Grants

We grant each non-employee director a non-statutory stock option award under our 1996 Incentive Plan, as amended and restated on October 10, 2008 (the “1996 Incentive Plan”), on the date he or she is first elected or appointed to the board and grant an award to each non-employee director whose service will continue beyond the annual meeting of shareholders on the date of each annual meeting. Each option provides the right to purchase 5,000 shares of our common stock at an exercise price equal to the fair market value per share of the common stock on the day the option was granted. Each option becomes exercisable as to 50% of the shares subject to the option on each of the second and third anniversaries of the date of grant. Exercisability of an option will be accelerated if a director dies or becomes disabled or upon a change in control of our company. The normal term of a stock option is 10 years from the date of grant. If a director’s service on our board of directors ends prior to that time, an option will remain exercisable for three months, unless the director’s service ended due to death or disability or after at least five years of service as a director, in which case an option will remain exercisable for three years after service ends (but not beyond the end of its original 10-year term). If a director has reached age 65 and has completed at least five years of service when his or her service as a director ends, each option will remain exercisable until the end of its originally scheduled term. Our compensation committee retains discretion to accelerate the exercisability of any option, and to cancel any option in connection with certain mergers, sales of corporate assets or statutory share exchanges, or any dissolution or liquidation involving our company (see “Potential Payments Upon Termination or Change in Control” on page 43 of this proxy statement for more information).

Required Vote

Election to our board of directors of each of the eight nominees named above requires a plurality of the voting power of the outstanding shares of our common stock present and entitled to vote on the election of directors.

Our board of directors recommends that the shareholders vote FOR the election of each of the eight nominees listed above to constitute our board of directors.

CORPORATE GOVERNANCE

Principles of Corporate Governance

Our board of directors has adopted Principles of Corporate Governance, available on our website atwww.htch.com, to assist in the performance of its responsibilities. In addition to corporate governance policies and practices discussed elsewhere in this proxy statement, our Principles of Corporate Governance and related board of directors and board committee actions provide that:

| | • | | All Directors Elected Annually. Our entire board of directors will stand for election at each annual meeting of shareholders. |

| | • | | Executive Sessions of Independent Directors. Regularly scheduled board of directors meetings will include executive sessions of the independent directors without management present. |

| | • | | Lead Director. If the chairman of our board of directors is our company’s chief executive officer or is not an independent director, the independent directors will select from among themselves a lead director. |

9

| | • | | Evaluating Board and Committee Performance. Annual evaluations of the performance of the board of directors, each of its committees and the individual members of each will be conducted. |

| | • | | Share Ownership by Directors. Non-employee directors are expected to accumulate and hold common stock of our company whose value is at least five times the amount of the annual board retainer. |

| | • | | Limitations on Other Board Memberships. None of our non-employee directors should serve on the board of directors of more than five other public companies, our chief executive officer should not serve on the board of more than two other public companies, and no member of our audit committee should serve on the audit committee of more than two other public companies. |

| | • | | Change in Status. Any independent director whose affiliation or position of principal employment changes materially will offer his or her resignation as a director, and any inside director will offer his or her resignation as a director upon termination of service as an employee of our company. |

| | • | | Access to Outside Advisors. Our board of directors and each of its committees may retain independent outside financial, legal or other advisors or consultants as they deem necessary or advisable. |

| | • | | Succession Planning. Our board of directors will regularly review succession planning involving the chief executive officer and other senior management positions. |

| | • | | Director Orientation and Continuing Education. Each new director will participate in an orientation program, which will include briefings by senior management on the company’s strategic plans, structure, significant operations, and accounting, financial and risk management issues. In addition, our company will provide all directors with continuing education relevant to their duties as directors. |

| | • | | Code of Ethics and Conduct. Our board of directors has adopted a Code of Ethics and Conduct applicable to all of our officers, directors and employees, which also serves as our company’s Code of Ethics for Senior Financial Management. A copy of this code can be found as Appendix 2 to our Principles of Corporate Governance, which is available on our website atwww.htch.com. |

Board’s Leadership Structure

Our company does not have a written policy with respect to separation of the roles of chief executive officer and chairman of the board of directors, because our board of directors believes it is in the best interests of our company to make that determination based on the circumstances. Our chief executive officer does not currently serve as chairman of the board of directors. In addition to other customary duties as chairman of the board of directors, Mr. Green consults regularly with our chief executive officer regarding the strategic direction of the company and provides input on the schedules and agendas for meetings of our board of directors. Because Mr. Green is an inside director, our independent directors have selected Mr. Huffer from among themselves to serve as lead director.

As lead director, Mr. Huffer (i) presides as chair of meetings of our board of directors when the chairman of the board of directors is absent, (ii) organizes, convenes and presides over executive sessions of the independent directors, (iii) serves as the principal liaison between the independent directors and the chairman of the board of directors and chief executive officer, (iv) consults with the chairman of the board of directors in establishing schedules and agendas for meetings of our board of directors, and (v) serves in such other capacities with such other duties as the independent directors may determine from time to time.

Our company’s current leadership structure recognizes the day-to-day management role of the chief executive officer, the depth of company and industry experience of our current chairman of the board of directors, and the benefits of having a leader among independent directors to facilitate both compliance with listing requirements and communication among our independent directors and the chairman of the board of directors and chief executive officer. Our board of directors has determined that this leadership structure is appropriate given the specific characteristics and circumstances of our company because it strengthens the board of directors’ role in fulfilling its risk oversight and general oversight responsibilities and its fiduciary duties to our company’s shareholders.

Board’s Role in Risk Oversight

Management is responsible for day-to-day risk assessment and mitigation activities, and our board of directors is responsible for risk oversight. The board of directors has delegated to the audit committee primary responsibility for reviewing and discussing with management our company’s policies and procedures with respect to risk

10

assessment and management. Management has established a Risk Management Team, which consists of company personnel representing multiple functional areas and is led by the company’s internal audit director, to actively assess the company’s risks and to create and implement strategies to mitigate those risks. The Risk Management Team reports its activities and current assessments at every audit committee meeting. The audit committee periodically reports to the board of directors on risk oversight issues and concerns.

The board of directors may delegate specific areas of risk oversight to other committees as well. The compensation committee currently is responsible for reviewing management’s assessment of the relationship of the company’s compensation policies and practices to risk.

Director Qualifications

Candidates for director nominees are reviewed in the context of the current composition of our board of directors, our operating requirements and the long-term interests of our shareholders. Our governance and nominating committee will consider, at a minimum, the following factors in recommending to our board of directors potential new members, or the continued service of existing members, in addition to other factors it deems appropriate based on the current needs and desires of our board of directors:

| | • | | demonstrated character and integrity, an inquiring mind, experience at a strategy/policy-setting level, sufficient time to devote to our affairs and high-level managerial experience; |

| | • | | whether the member/potential member is subject to a disqualifying factor, such as relationships with our competitors, customers, suppliers, contractors, counselors or consultants, or recent previous employment with us; |

| | • | | the member’s/potential member’s independence; |

| | • | | whether the member/potential member assists in achieving a mix of members that represents a diversity of background and experience, including with respect to age, gender, international background, race and specialized experience; |

| | • | | whether the member/potential member, by virtue of particular experience, technical expertise or specialized skills, will add specific value as a member; |

| | • | | any factors related to the ability and willingness of a new member to serve, or an existing member to continue his or her service; |

| | • | | experience in one or more fields of business, professional, governmental, communal, scientific or educational endeavor; and |

| | • | | whether the member/potential member has a general appreciation regarding major issues facing public companies of a size and scope similar to ours. |

Director Nomination Process

Our governance and nominating committee selects nominees for directors pursuant to the following process:

| | • | | the identification of director candidates by our governance and nominating committee based upon suggestions from current directors and senior management, recommendations by shareholders and/or use of a director search firm; |

| | • | | a review of the candidates’ qualifications by our governance and nominating committee to determine which candidates best meet our board of directors’ required and desired criteria; |

| | • | | interviews of interested candidates among those who best meet these criteria by the entire governance and nominating committee; |

| | • | | a report to our board of directors by our governance and nominating committee on the selection process; and |

| | • | | formal nomination by our governance and nominating committee for inclusion in the slate of directors for election at the annual meeting of shareholders or appointment by our board of directors to fill a vacancy or a newly created board position during the intervals between shareholder meetings. |

11

Our governance and nominating committee will reassess the qualifications of a director, including the director’s attendance and contributions at board of directors and board committee meetings, prior to recommending a director for re-election to another term.

Our governance and nominating committee will consider director candidates recommended by shareholders. Shareholders who wish to recommend individuals for consideration by our governance and nominating committee to become nominees for election to our board of directors may do so by submitting a written recommendation to our Governance and Nominating Committee, c/o Chief Financial Officer, 40 West Highland Park Drive NE, Hutchinson, Minnesota 55350. Submissions must include a written recommendation and the reason for the recommendation, biographical information concerning the recommended individual, including age, a description of the recommended individual’s past five years of employment history and any past and current board memberships. The submission also must include certain information regarding the shareholder making the submission, including a description of all securities or contracts with a value derived in whole or in part from the value of any shares of our company’s common stock held by the shareholder or to which the shareholder is a party and a description of any material relationships between the shareholder and the recommended individual. The submission must be accompanied by a written consent of the individual to stand for election if nominated by our governance and nominating committee and to serve if elected by our board of directors or our shareholders, as applicable. Alternatively, shareholders may directly nominate a person for election to our board of directors by complying with the procedures set forth in our bylaws, any applicable rules and regulations of the SEC and any applicable laws.

Attendance at Annual Meeting

Our board of directors encourages each of its members to attend all annual meetings of shareholders that occur during a member’s service on our board of directors. All of the members of our board of directors who were serving on the board at the time attended the 2010 Annual Meeting of Shareholders.

Compensation Committee Interlocks and Insider Participation

No member of the compensation committee has ever been an officer or employee of our company or of any of our subsidiaries or affiliates, or has had any relationship with our company requiring disclosure in our proxy statement other than service as a director. None of our executive officers has served on the board of directors or on the compensation committee of any other entity, any officers of which served either on our board of directors or on our compensation committee.

Communication with Our Board of Directors

You may contact our board of directors or any member of our board of directors by mail addressed to the attention of our board of directors or the specific director identified by name or title, at Hutchinson Technology Incorporated, 40 West Highland Park Drive NE, Hutchinson, Minnesota 55350. All communications will be submitted to our board of directors or the specified board member on a periodic basis.

Related Person Transactions

Our audit committee must approve any related person transaction in which our company is a participant before commencement of the transaction, provided, however, that if a related person transaction is identified after it commences, it will be brought to the audit committee for review and possible ratification. The audit committee will approve or ratify a transaction only if it determines that the transaction is beneficial to our company and that the terms of the transaction are fair to our company.

For these purposes, a “related person” includes our directors, nominees for director, executive officers, any holder of more than 5% of our common stock, and any immediate family member of any of the foregoing persons. A “related person transaction” means any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which our company is a participant and in which a related person has a direct or indirect interest, other than the following:

| | • | | payment of compensation by us to a related person for service as a director or executive officer; |

| | • | | transactions available to all employees or all shareholders on the same terms; and |

| | • | | transactions that, when aggregated with the amount of all other transactions between the related person and us, involve less than $120,000 in a fiscal year. |

12

In determining whether to approve a related person transaction, our audit committee will analyze factors such as whether the transaction is material to our company, the role the related person has played in arranging the transaction, the structure of the transaction and the interests of all related persons in the transaction.

Our audit committee may, in its sole discretion, approve or disapprove any related person transaction. Approval of a related person transaction may be conditioned upon our company and the related person following certain procedures designated by the audit committee. With regard to any transaction for which ratification is sought, the audit committee may require amendment or termination of the transaction.

No related person transactions were approved or identified in fiscal 2010.

PROPOSAL NO. 2 — APPROVAL OF THE ADOPTION

OF THE 2011 EQUITY INCENTIVE PLAN

Introduction

On December 1, 2010 our board of directors adopted the Hutchinson Technology Incorporated 2011 Equity Incentive Plan (the “2011 Plan”), subject to shareholder approval at the annual meeting. Upon approval of the 2011 Plan by our shareholders, no further awards will be made under the existing 1996 Incentive Plan.

The 2011 Plan is intended to advance the interests of our company and its shareholders by enabling the company and its subsidiaries to attract and retain qualified individuals through opportunities for equity participation in the company, and to reward those individuals who contribute to the achievement of the company’s financial and strategic business goals.

The 2011 Plan authorizes the issuance of 1,200,000 shares of our common stock, plus the number of shares remaining available for future grants under the 1996 Incentive Plan on the date our shareholders approve the 2011 Plan. Following the December 1, 2010 grant of options to acquire 803,831 shares under the 1996 Incentive Plan, there were 1,089,722 shares of our common stock remaining available for future grants under the 1996 Incentive Plan. This number is not expected to change to any significant degree prior to the date of our 2011 annual meeting of shareholders. The following table summarizes information regarding option awards outstanding under the 1996 Incentive Plan as of December 2, 2010:

| | | | |

Shares Subject

to Outstanding Options | | Weighted-Average

Exercise Price | | Weighted-Average

Remaining Term |

| 4,292,684 | | $15.34 | | 6.6 years |

The number of shares available for issuance under the 2011 Plan will be increased by the number of shares subject to awards (made under the 2011 Plan or that are outstanding under the 1996 Incentive Plan on the date the shareholders approve the 2011 Plan) that expire, are forfeited, or are settled in cash.

Under the terms of the 2011 Plan, the pool of shares available for issuance may be used for all types of awards available under the 2011 Plan, which include stock options, stock appreciation rights (“SARs”), restricted stock awards, stock unit awards and other stock-based awards, as described in more detail below. Under the fungible pool formula in the 2011 Plan, the authorized share limit will be reduced by one share of our common stock for every one share subject to an option or SAR granted under the 2011 Plan and by 1.25 shares of our common stock for every one share subject to an award other than an option or SAR.

Shareholder Approval Requirement

Shareholder approval of the 2011 Plan is necessary in order for us to (i) meet the shareholder approval requirements of the NASDAQ Stock Market, (ii) take tax deductions for certain compensation resulting from awards granted under the 2011 Plan qualifying as performance-based compensation under Section 162(m) of the Code, and (iii) grant incentive stock options under the 2011 Plan.

13

Compensation Best Practices

The 2011 Plan incorporates a range of compensation best practices, including the following key features:

| | • | | No Repricing or Replacement of Underwater Options or Stock Appreciation Rights. The 2011 Plan prohibits, without shareholder approval, actions to reprice, replace or repurchase options or SARs when the exercise price per share of an option or SAR exceeds the fair market value of the underlying shares. |

| | • | | No In-the-Money Option or Stock Appreciation Right Grants. The 2011 Plan prohibits the grant of options or SARs with an exercise price less than the fair market value of our common stock on the date of grant (except in the limited case of “substitute awards” as described below). |

| | • | | Double Trigger Accelerated Vesting/Payment Following a Change in Control. The 2011 Plan provides that if outstanding awards are continued, assumed or replaced in connection with a corporate transaction involving the company, accelerated vesting or payment of an award will occur only if employment is terminated involuntarily without cause within one year of the change in control. |

| | • | | Minimum Vesting Period for Awards.For awards other than options and SARs, a minimum vesting period of three years is prescribed for awards subject only to service-based vesting conditions and one year for awards subject to performance-based vesting conditions, subject only to limited exceptions. |

| | • | | No Liberal Share Counting. Shares delivered or withheld to pay the exercise price or satisfy a tax withholding obligation in connection with any award, shares repurchased by the company using option exercise proceeds and any shares subject to a SAR that are not issued in connection with the stock settlement of the SAR upon its exercise may not be used again for new grants. |

| | • | | Independent Administration. The compensation committee of our board of directors, which consists of only independent directors, will have overall administrative authority over the 2011 Plan if it is approved by shareholders, and only this committee may make awards to executive officers and directors. |

| | • | | Compensation Recovery Policy. Awards under the 2011 Plan may be made subject to any compensation recovery policy adopted by our board of directors or the compensation committee. |

The major features of the 2011 Plan are summarized below. The summary is qualified in its entirety by reference to the full text of the 2011 Plan, which is attached to this proxy statement asAppendix A.

Eligible Participants

All employees, consultants and advisors of our company or any subsidiary, as well as all non-employee directors of the company, will be eligible to receive awards under the 2011 Plan. As of December 1, 2010, there were approximately 2,570 persons employed by or otherwise in the service of our company and its subsidiaries who would be eligible to receive awards under the 2011 Plan. Although not necessarily indicative of future grants under the 2011 Plan, approximately 270 of the 2,570 eligible recipients have been granted awards under the predecessor 1996 Incentive Plan.

Administration

The 2011 Plan will be administered by the compensation committee of our board of directors. The compensation committee is referred to in this description of the 2011 Plan as the “Committee.” To the extent consistent with applicable law, the Committee may delegate its duties, power and authority under the 2011 Plan to any of its members, to officers of the company with respect to awards to participants who are not directors or executive officers of the company or, in connection with non-discretionary administrative duties, to one or more agents or advisors.

The Committee has the authority to determine the persons to whom awards will be granted, the timing, type and number of shares covered by each award, and the terms and conditions of the awards. The Committee may also establish and modify rules to administer the 2011 Plan, interpret the 2011 Plan and any related award agreement, cancel or suspend an award or the exercisability of an award, or modify the terms of outstanding awards to the extent permitted under the 2011 Plan. Unless an amendment to the terms of an award is necessary to comply with applicable laws or stock exchange rules, a participant who would be adversely affected by such an amendment must consent to it.

14

Except in connection with equity restructurings and other situations in which share adjustments are specifically authorized, the 2011 Plan also prohibits the Committee from repricing any outstanding “underwater” option or SAR without prior approval of the company’s shareholders. For these purposes, “repricing” includes amending the terms of an underwater option or SAR to lower the exercise price, canceling an underwater option or SAR and granting in exchange replacement options or SARs having a lower exercise price or other forms of awards, or repurchasing the underwater option or SAR.

Subject to certain limits in the 2011 Plan, the Committee may also establish subplans or modify the terms of awards under the 2011 Plan with respect to participants resident outside of the United States or employed by a non-U.S. subsidiary in order to comply with local legal requirements or meet the objectives of the 2011 Plan.

Available Shares and Limitations on Awards

A maximum of 1,200,000 shares of common stock are available for issuance under the 2011 Plan, plus the number of shares remaining available for future grants under the 1996 Incentive Plan on the date our shareholders approve the 2011 Plan. Under the terms of the 2011 Plan, the number of shares of common stock subject to options or SARs granted to any one participant during a calendar year may not exceed 250,000, and the number of shares subject to performance-based awards other than options or SARs that may be granted to any one participant during any calendar year may not exceed 150,000. These share limitations are subject to adjustment for changes in the corporate structure or shares of the company, as described below. The shares of common stock covered by the 2011 Plan are authorized but unissued shares.

Shares of common stock that are issued under the 2011 Plan or that are potentially issuable pursuant to outstanding awards will reduce the maximum number of shares remaining available for issuance under the 2011 Plan by one share for each share issued or issuable pursuant to an option or SAR award, and by 1.25 shares for each share issued or issuable pursuant to an award other than an option or SAR.

Any shares of common stock subject to an award under the 2011 Plan, or to an award under the 1996 Incentive Plan that is outstanding on the date our shareholders approve the 2011 Plan, that expires, is forfeited, or is settled or paid in cash will, to the extent of such expiration, forfeiture or settlement, automatically again become available for issuance under the 2011 Plan. Each share that again becomes available for issuance will be added back as (i) one share if the share was subject to an option or SAR granted under either the 2011 Plan or the 1996 Incentive Plan, or (ii) as 1.25 shares if the share was subject to an award other than an option or SAR granted under the 2011 Plan or the 1996 Incentive Plan. However, any shares tendered or withheld to pay the exercise price or satisfy a tax withholding obligation in connection with any award, any shares repurchased by the company using option exercise proceeds and any shares subject to a SAR that are not issued in connection with the stock settlement of the SAR on its exercise may not be used again for new grants.

Awards granted under the 2011 Plan upon the assumption of, or in substitution for, outstanding equity awards previously granted by an entity acquired by our company or any of its subsidiaries (referred to as “substitute awards”) will not reduce the number of shares of common stock authorized for issuance under the 2011 Plan. Additionally, if a company acquired by our company or any of its subsidiaries has shares available under a pre-existing plan approved by shareholders and not adopted in contemplation of such acquisition, the shares available for grant pursuant to the terms of that pre-existing plan may be used for awards under the 2011 Plan and will not reduce the shares authorized for issuance under the 2011 Plan, but only if the awards are made to individuals who were not employed by or providing services to our company or any of its subsidiaries immediately prior to such acquisition.

Share Adjustment Provisions

If certain transactions with the company’s shareholders occur that cause the per share value of the common stock to change, such as stock splits, spin-offs, stock dividends or certain recapitalizations (referred to as “equity restructurings”), the Committee will equitably adjust (i) the class of shares issuable and the maximum number and kind of shares subject to the 2011 Plan, (ii) outstanding awards as to the class, number of shares and price per share, and (iii) award limitations prescribed by the 2011 Plan. Other types of transactions may also affect the common stock, such as reorganizations, mergers or consolidations. If there is such a transaction and the Committee determines that adjustments of the type previously described in connection with equity restructurings would be appropriate to prevent any dilution or enlargement of benefits under the 2011 Plan, the Committee will make such adjustments as it may deem equitable.

15

Types of Awards

The 2011 Plan allows the company to award eligible recipients stock options, SARs, restricted stock awards, stock unit awards and other stock-based awards. These types of awards are described in more detail below.

Options. Employees of our company or any subsidiary may be awarded options to purchase common stock that qualify as “incentive stock options” within the meaning of Section 422 of the Code, and any eligible recipient may be awarded options to purchase common stock that do not qualify as incentive stock options, referred to as “non-statutory options.” The exercise price to be paid by a participant at the time an option is exercised may not be less than 100% of the fair market value of one share of common stock on the date of grant, unless the option is granted as a substitute award as described earlier. “Fair market value” under the 2011 Plan as of any date means the closing sale price for a share of common stock on the NASDAQ Stock Market on that date. As of December 1, 2010, the closing sale price of a share of common stock on the NASDAQ Stock Market was $3.03.

The total purchase price of the shares to be purchased upon exercise of an option will be paid by the participant in cash unless the Committee allows exercise payments to be made, in whole or in part, (i) by means of a broker-assisted sale and remittance program, (ii) by delivery to the company (or attestation as to ownership) of shares of common stock already owned by the participant, or (iii) by a “net exercise” of the option in which a portion of the shares otherwise issuable upon exercise of the option are withheld by the company. Any shares delivered or withheld in payment of an exercise price will be valued at their fair market value on the exercise date.

An option will vest and become exercisable at such time, in such installments and subject to such conditions as may be determined by the Committee, and no option may have a term greater than 10 years from its date of grant.

The aggregate fair market value of shares of common stock with respect to which incentive stock options granted to any participant may first become exercisable during any calendar year may not exceed $100,000. Any incentive stock options that become exercisable in excess of this amount will be treated as non-statutory options.

Stock Appreciation Rights. A SAR is the right to receive a payment from the company, in the form of shares of common stock, cash or a combination of both, equal to the difference between (i) the fair market value of a specified number of shares of common stock on the date of exercise of the SAR, and (ii) the aggregate exercise price under the SAR of that number of shares. SARs will be subject to such terms and conditions, consistent with the other provisions of the 2011 Plan, as may be determined by the Committee. The Committee will have the sole discretion to determine the form in which payment of SARs will be made to a participant.

The exercise price per share of a SAR will be determined by the Committee, but may not be less than 100% of the fair market value of one share of common stock on the date of grant, unless the SAR is granted as a substitute award as described earlier. A SAR will vest and become exercisable at such time, in such installments and subject to such conditions as may be determined by the Committee, and no SAR may have a term greater than 10 years from its date of grant.

Restricted Stock Awards. A restricted stock award is an award of common stock that vests at such times and in such installments as may be determined by the Committee. Until it vests, the shares subject to the award are subject to restrictions on transferability and the possibility of forfeiture. The Committee may impose such restrictions or conditions to the vesting of restricted stock awards as it deems appropriate, including that the participant remain continuously employed by, or in the service of, the company or a subsidiary for a certain period or that the participant or the company (or any division of the company) satisfy specified performance criteria.

Unless otherwise specified by the Committee, a participant who receives a restricted stock award is entitled to vote and receive any regular cash dividends on the unvested shares, except that regular cash dividends paid on restricted shares whose vesting is subject to performance conditions will be subject to the same restrictions as the underlying shares. Any dividends other than regular cash dividends or distributions paid with respect to unvested restricted shares will also be subject to the same restrictions as the underlying shares unless the Committee determines otherwise.

Stock Unit Awards. A stock unit award is a right to receive the fair market value of one or more shares of common stock, payable in cash, shares of common stock, or a combination of both, that vests at such times and in such installments as may be determined by the Committee. Until it vests, a stock unit award is subject to restrictions on transferability and the possibility of forfeiture. Stock unit awards will be subject to such terms and conditions, consistent with the other provisions of the 2011 Plan, as may be determined by the Committee.

16

Other Stock-Based Awards. The Committee may grant awards of common stock and other awards that are valued by reference to and/or payable in common stock under the 2011 Plan. The Committee has complete discretion in determining the terms and conditions of such awards.

For awards other than options and SARs, a minimum vesting period of three years is prescribed for awards subject only to service-based vesting conditions and one year for awards subject to performance-based vesting conditions. Limited exceptions to these minimum vesting period requirements are available under the 2011 Plan in situations involving: termination due to death, disability or retirement; a change in control of the company; awards granted in payment of compensation already earned; substitute awards that do not reduce the vesting period of the awards being replaced; and awards that do not involve more than 5% of the shares authorized for issuance under the 2011 Plan.

Term and Amendment of the 2011 Plan

Unless terminated earlier, the 2011 Plan will terminate on the tenth anniversary of its approval by the company’s shareholders. Awards outstanding under the 2011 Plan at the time it is terminated may continue to be exercised, earned or become free of restriction, according to their terms. The board of directors may suspend or terminate the 2011 Plan or any portion of it at any time. The board of directors may amend the 2011 Plan from time to time, but no amendments to the 2011 Plan will be effective without shareholder approval if such approval is required under applicable laws or regulations or under the rules of the NASDAQ Stock Market, including shareholder approval for any amendment that seeks to modify the prohibition on underwater option re-pricing discussed above.

Termination, suspension or amendment of the 2011 Plan will not adversely affect any outstanding award without the consent of the affected participant, except for amendments necessary to comply with applicable laws or stock exchange rules.

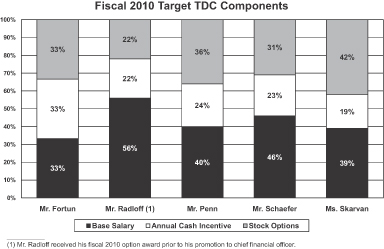

Transferability of Awards