QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

ISCO, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Isco, Inc.

4700 Superior Street Lincoln, Nebraska 68504

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held December 12, 2002

The annual meeting of shareholders of Isco, Inc. will be held at Isco, Inc.'s corporate headquarters, 4700 Superior Street, Lincoln, Nebraska on December 12, 2002 at 2:00 p.m. for the purpose of:

- 1.

- The election, as Directors, of four persons listed in the accompanying Proxy Statement dated November 1, 2002.

- 2.

- Whatever other business may properly be brought before the meeting or any adjournment thereof.

Only those shareholders of record at the close of business on October 11, 2002 (the "Record Date") shall be entitled to notice of the meeting and to vote at the meeting.

In order to assure a quorum, all shareholders are urged to attend the meeting or to vote by proxy.

Shareholders who attend the annual meeting may vote in person even though they have voted by proxy.

If you plan to attend the annual meeting and your Isco shares are held by your broker for your account and you do not personally hold the certificates for the shares, you should mark the proxy to indicate that you plan to attend the annual meeting. You will then receive a "legal proxy" showing the number of shares you own. Bring that "legal proxy" to the annual meeting and you will then be credited with voting your shares in person at the meeting.

| | | By Order of the Board of Directors |

|

|

Robert W. Allington

Chairman and Chief Executive Officer |

November 1, 2002

PROXY STATEMENT

November 1, 2002

GENERAL INFORMATION.

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Isco, Inc. (the "Company") for use at the annual meeting of shareholders to be held on December 12, 2002. Shareholders of record at the close of business on October 11, 2002 are entitled to notice of and to vote at the meeting and any adjournment thereof.

This Proxy Statement was first mailed to shareholders on November 15, 2002.

As of the close of business on October 11, 2002, the Company had 5,673,971 shares of common stock outstanding ("Common Stock"), all of which are entitled to vote at the annual meeting.

As of the record date, Robert W. Allington of 4700 Superior Street, Lincoln, NE 68504 owned 2,752,061 shares or 45.87 percent of the Company's outstanding Common Stock plus currently exercisable stock options. On the record date, Dimensional Fund Advisors, Inc. of 1299 Ocean Avenue, 11th floor, Santa Monica, CA 91401 and UMB Bank, n.a. of 928 Grand Avenue, Kansas City, MO 64141 owned 485,251 and 353,300 shares, respectively, or 8.55 percent and 6.23 percent, respectively, of the Common Stock outstanding. Neither Dimensional Fund Advisors, Inc., nor UMB Bank, n.a. hold any stock options.

Each shareholder is entitled to one vote for each share on each matter presented, except that in the election of Directors each shareholder shall have the right to vote the number of shares owned by him or her for as many persons as there are Directors to be elected, or to cumulate such shares and give one candidate as many votes as the number of Directors multiplied by the number of his or her shares, or to distribute them on the same principle among as many candidates as he or she shall determine.

Proxies which are properly signed and returned will be voted at the annual meeting. Shareholders may specify their preference by marking the appropriate boxes on the proxy and the proxy will then be voted in accordance with such specifications. In the absence of such specifications the proxy will be voted "FOR" the election of the four nominees for Director and in accordance with the instructions of the Board of Directors as to any other matters. A proxy is revocable at any time before it is voted and a proxy is automatically revoked upon the giving of a subsequent proxy. The Company will bear the cost of solicitation of proxies, including the charges and expenses of brokers and others for forwarding solicitation material to shareholders. In addition to the use of mail, proxies may be solicited by personal interview, telephone, facsimile or telegraph.

Shareholders who attend the annual meeting may vote in person even though they have voted by proxy.

If you plan to attend the annual meeting and your Isco shares are held by your broker for your account and you do not personally hold the certificates for the shares, you should mark the proxy to indicate that you plan to attend the annual meeting. You will then receive a "legal proxy" showing the number of shares you own. Bring that "legal proxy" to the annual meeting and you will then be credited with voting your shares in person at the meeting.

SHAREHOLDER PROPOSALS.

In the event that any shareholder desires to submit a proposal for action at the 2003 annual meeting of shareholders, such proposal must be received at the Company's office at 4700 Superior Street, Lincoln, Nebraska 68504-1398, marked to the attention of the President or Secretary of the Company, no later than July 11, 2003. It is suggested that any shareholder desiring to submit a proposal, do so by Certified Mail, Return Receipt Requested. Shareholders should also note that, in

2

addition to the requirement of timely receipt by the Board of Directors of a proposal as stated above, such proposal will not be included in the proxy solicitation material for the 2003 annual meeting of shareholders unless it otherwise complies with the requirements of Section 14(a) of the Securities Exchange Act of 1934 and the rules and regulations promulgated and in effect thereunder.

1. ELECTION OF DIRECTORS.

The Bylaws of the Company provide that the number of Directors shall be not more than nine, such number to be set annually by the Board of Directors.

The Bylaws also provide that the Directors shall be divided into classes and that there be two classes if the number of Directors is less than nine. The first class has a term expiring December 11, 2003 and the second class has a term expiring upon the adjournment of the 2004 annual meeting of shareholders, currently scheduled for December 9, 2004. The Board of Directors has nominated James L. Carrier, Douglas M. Grant, Ronald K. Jester, and Harvey S. Perlman for election to the second class to serve a two-year term.

The Board of Directors recommends a vote "FOR" item No. 1.

The proxy holders named in the proxy intend to vote "FOR" the election of the four nominees listed above unless authority to so vote is withheld. In the unexpected event that any of the nominees are unable to serve, or for good cause will not serve as a Director, the proxy holders reserve the right to vote for such substitute nominees as are designated by the Board of Directors.

Following is a list of the names and ages of the four nominees, each of whom is presently serving as a Director, with the exception of Harvey S. Perlman. Mr. Perlman is being nominated by the Board of Directors to fill the vacancy created by Philip W. Wittig, who is retiring from the Board at the end of his current term. Also listed are the three Directors whose terms expire in 2003. Included is the past five-year business history of each nominee and each Director, the year in which each became a

3

Director of the Company, and the number and the percentage of outstanding shares of Common Stock of the Company beneficially owned by each as of October 11, 2002.

| |

| |

| |

| | Common Stock

Beneficially Owned as

of October 11, 2002

|

|---|

Name of Individual

| | Age

| | Employment History

| | Director

Since

| | Number

of

Shares(1)

| | Percent(2)

|

|---|

| Nominees for election to the second class (term expiring December 9, 2004): | | |

James L. Carrier |

|

53 |

|

President and Chief Executive Officer, Lester Electrical, Inc., since 1979. |

|

1997 |

|

5,417 |

|

..09 |

Douglas M. Grant |

|

56 |

|

President and Chief Operating Officer since October 6, 1995; Vice President August 31, 1989 to October 5, 1995; Environmental Division General Manager May 26, 1987 to July 15, 1996. |

|

1988 |

|

99,475 |

|

1.66 |

Ronald K. Jester |

|

48 |

|

Partner, Labenz & Associates, LLC, since 1998; Senior Manager, KPMG LLP, January 1, 1987 to September 30, 1998. |

|

2000 |

|

5,600 |

(5) |

..09 |

Harvey S. Perlman |

|

60 |

|

Chancellor of the University of Nebraska-Lincoln (UNL), since 2001; UNL Interim Chancellor, 2000 to 2001; UNL Professor of Law, 1998 to 2000; UNL Dean of the Law College, 1983 to 1998. |

|

|

|

0 |

|

..00 |

First class (term expiring December 11, 2003): |

|

|

|

|

|

|

Robert W. Allington |

|

67 |

|

Chairman of the Board and Chief Executive Officer since 1959; President 1959 to October 5, 1995. |

|

1959 |

|

2,752,061 |

(3) |

45.87 |

James L. Linderholm |

|

64 |

|

Chairman of the Board and President since 1986 and 1984, respectively, of HWS Consulting Group, Inc. |

|

1994 |

|

12,000 |

|

..20 |

Dale L. Young |

|

74 |

|

Corporate Secretary since 1991; Retired Executive Vice President and Cashier of FirsTier Bank, NA, Lincoln, NE. |

|

1966 |

|

43,120 |

(4) |

..72 |

Executive Officers of the Company collectively hold 2,946,986 shares or 49.11 percent of the outstanding Common Stock including currently exercisable options.

Executive Officers and Directors collectively hold 3,053,268 shares or 50.89 percent of the outstanding Common Stock including currently exercisable options.

- (1)

- Unless otherwise noted, all shares are held with sole investment and voting power. The number of shares includes the number of shares outstanding on October 11, 2002 and currently exercisable options.

- (2)

- Percentage computed by dividing the number of shares beneficially owned, including options currently exercisable, by the total shares outstanding on October 11, 2002, including currently exercisable options.

4

- (3)

- Includes 100,000 shares as to which Robert W. Allington has shared voting rights and investment power.

- (4)

- Includes 10,000 shares as to which Dale L. Young has shared voting rights and investment power.

- (5)

- Includes 600 shares as to which Ronald K. Jester has shared voting rights and investment power.

Additional Information Concerning Board of Directors.

The Company's Board of Directors has not established a Nominating Committee.

The Audit Committee, during fiscal 2002, was comprised of Directors, James L. Linderholm, Chairman; Ronald K. Jester, Secretary and James L. Carrier. All are independent members of the Board. The Audit Committee assists the Board in fulfilling its fiduciary responsibilities with respect to accounting policies, reporting practices, and the sufficiency of the Company's annual audit. The Committee met four times during fiscal year 2002.

The Compensation Committee, during fiscal 2002, was comprised of Directors, Philip M. Wittig, Chairman; James L. Carrier, Secretary; and Dale L. Young. The Committee recommends to the Board the compensation programs and salaries for the elected officers and also acts as the stock option committee. The Committee also approves the salary and incentive compensation of the other executives of the Company. The Committee met seven times during fiscal 2002.

The Board of Directors met 12 times in fiscal 2002. All of the directors attended greater than 75 percent of the total meetings held by the Board and its committees in fiscal 2002.

List of Current Executive Officers of the Company.

The following is a list of the names and ages of the current executive officers of the Company and their business history for the last five years.

Name of Individual

| | Age

| | Position and Principal Occupation

Since July 25, 1997

| | Year first became

Executive Officer of

the Company

|

|---|

| Robert W. Allington | | 67 | | Chairman of the Board and Chief Executive Officer since 1959. | | 1959 |

Douglas M. Grant |

|

56 |

|

President and Chief Operating Officer since October 6, 1995. |

|

1987 |

Alfred G. Craske |

|

59 |

|

Vice President, Sales and Marketing since July 18, 1996. |

|

1996 |

Vicki L. Benne |

|

40 |

|

Chief Financial Officer and Treasurer since December 18, 1999; Assistant Treasurer January 2, 1999 to December 18, 1999; Controller and Chief Accounting Officer October 21, 1989 to January 2, 1999. |

|

1991 |

John J. Korab, Jr. |

|

53 |

|

Vice President, Corporate Development since December 11, 1989. |

|

1989 |

Donald E. Wademan |

|

38 |

|

Controller and Chief Accounting Officer since January 2, 1999; Assistant Controller, June 15, 1998 to January 2, 1999; Division Controller, Hoover Materials Handling Group Inc., June 1995 to June 1998. |

|

1999 |

5

Executive Compensation.

The following table sets forth a summary of the compensation earned by the chief executive officer and the four other most highly paid executive officers of the Company for the fiscal year ended, July 26, 2002. Compensation is provided for the past three fiscal years for each officer.

| |

| |

| |

| |

| | Long-Term Compensation

| |

|

|---|

| |

| | Annual Compensation

| | Awards

| | Payouts

| |

|

|---|

Name and Principal

Position

| | Fiscal

Year

| | Salary

($)

| | Bonus

($)

| | Other

annual

compensation

($)(2)

| | Restricted

stock

Awards

($)

| | Securities

underlying

options/

SARs(#)

| | LTIP

payouts

($)

| | All other

compensation

($)(4)

|

|---|

Robert W. Allington

Chairman and Chief

Executive Officer | | 2002

2001

2000 | | 228,961

221,657

205,521 | | 58,374

22,172

— | (1)

(1)

| 19,236

40,939

41,181 | | —

—

— | | 11,906

3,797

— | (1)

(1)

| —

—

— | | 910

3,947

4,173 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Douglas M. Grant

President and Chief

Operating Officer | | 2002

2001

2000 | | 207,693

196,152

179,999 | | 53,298

20,896

— | (1)

(1)

| 4,113

1,998

6,998 | | —

—

— | | 9,882

3,152

30,000 | (1)

(1)

(3) | —

—

— | | 6,126

6,103

6,311 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Alfred G. Craske

Vice President, Sales

and Marketing | | 2002

2001

2000 | | 152,614

146,845

139,846 | | 37,661

10,960

16,673 | (1)

(1)

| 75

5,483

318 | | —

—

— | | 4,518

2,321

12,500 | (1)

(1)

(3) | —

—

— | | 4,008

6,339

6,407 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

Vicki L. Benne

Chief Financial Officer

and Treasurer | | 2002

2001

2000 | | 126,538

112,499

96,252 | | 32,994

17,146

8,578 | (1)

(1)

| 2,575

2,287

4,927 | | —

—

— | | 5,200

3,429

10,000 | (1)

(1)

(3) | —

—

— | | 4,506

3,786

2,854 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

John J. Korab, Jr.

Vice President,

Corporate Development | | 2002

2001

2000 | | 118,538

114,038

105,347 | | 27,364

12,293

13,025 | (1)

(1)

| 4,445

2,661

1,266 | | —

—

— | | 4,059

2,169

10,000 | (1)

(1)

(3) | —

—

— | | 3,936

5,105

5,225 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

- (1)

- During fiscal 2001, the Board of Directors of the Company implemented a new Executive Incentive Compensation plan for fiscal years 2001 through 2005. Details of this program are provided under the headings "Incentive Bonuses" and "Stock Options" within the Compensation Committee Report on Executive Compensation. In addition to the bonuses earned under this plan, Mr. Craske was granted an additional bonus in fiscal 2002 and Dr. Allington and Mr. Grant were granted additional bonuses in fiscal 2001. The maximum number of stock options granted under this 5-year plan for each officer is as follows: Dr. Allington 59,529, Mr. Grant 49,412, Mr. Craske 30,706, Ms. Benne 26,000, and Mr. Korab 20,294. The actual number of shares vested as a result of a fiscal year's performance are listed above under the column "Securities underlying options/SARs". The options under this plan were granted pursuant to the 1996 Stock Option Plan.

- (2)

- During fiscal 1996, the Company modified its vacation policy to limit the number of accrued vacation hours an employee could have on each anniversary of his or her employment. Those hours in excess of the established limit related to length of service were valued, frozen, and scheduled for payment over a maximum period of six years. In addition, the policy included a future paid-in-lieu-of provision whereby following the employee's anniversary he or she would be paid for hours of accrued vacation which were in excess of the established limit provided, however, that the employee had actually taken a minimum number of vacation hours during the preceding year. These combined payment amounts are included in "Other annual compensation" and for fiscal 2002, 2001, and 2000, respectively, were as follows: Dr. Allington, $11,060, $34,289, and $31,351; Mr. Grant, $0, $0, and $0; Mr. Craske, $0, $5,408, and $243; Ms. Benne, $0, $0, and $0; and Mr. Korab, $0, $2,586, and $1,191.

6

- (3)

- These options were incentive stock option grants with fixed vesting schedules and granted pursuant to the 1996 Stock Option Plan.

- (4)

- The amounts set forth under "All other compensation", include profit-sharing contributions, and forfeitures plus 401(k) matching contributions and forfeitures. Profit sharing contributions including forfeitures and 401(k) matching contributions including forfeitures, respectively, for fiscal 2002 were as follows: Dr. Allington, $910 and $0; Mr. Grant, $910 and $5,216; Mr. Craske, $883 and $3,125; Ms. Benne, $784 and $3,722; and Mr. Korab, $727 and $3,209.

Options/SAR Grants in Last Fiscal Year.

The following table sets forth information with respect to options and SARs that were granted during the last completed fiscal year to each of the executives.

Individual Grants

| | Potential realizable

value at assumed

annual rate of stock

price appreciation

for option term(1)

|

|---|

Name

| | Number of

securities

underlying

options/SARs

granted(#)(1)

| | Percent of total

options/SARs

granted to

employees in fiscal

year(1)

| | Exercise or

base price

($/Sh)

| | Expiration

date

| | 5%

($)

| | 10%

($)

|

|---|

| Robert W. Allington | | 11,906 | | 25.7 | % | 4.675 | | 08/16/05 | | 68,384 | | 86,961 |

| Douglas M. Grant | | 9,882 | | 21.3 | % | 4.250 | | 08/16/10 | | 89,403 | | 148,648 |

| Alfred G. Craske | | 4,518 | | 9.8 | % | 4.250 | | 08/16/10 | | 40,875 | | 67,961 |

| Vicki L. Benne | | 5,200 | | 11.2 | % | 4.250 | | 08/16/10 | | 47,045 | | 78,220 |

| John J. Korab, Jr. | | 4,059 | | 8.8 | % | 4.250 | | 08/16/10 | | 36,722 | | 61,057 |

- (1)

- During fiscal 2001, the Board of Directors of the Company implemented a new Executive Incentive Compensation plan for fiscal years 2001 through 2005. Details of this program are provided under the headings "Incentive Bonuses" and "Stock Options" within the Compensation Committee Report on Executive Compensation. Under this program officers and other executives each were granted a total maximum number of stock options. Stock options vest annually based on achieving various annual goals. Annually the maximum number of shares available to vest is 20% of the total granted. Annually any non-vested stock options (20% of the total grant less annual vested) are released back into the stock option plan for future grants. The total number of stock options granted for each reported officer above is as follows: Dr. Allington 59,529, Mr. Grant 49,412, Mr. Craske 30,706, Ms. Benne 26,000, and Mr. Korab 20,294. The information reported under the columns "Percent of total options/SARs granted to employees in fiscal year" and "Potential realizable value at assumed annual rate of stock price appreciation for option term" is based on the number of stock options vested for fiscal year 2002.

7

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Options/SAR Values.

The following table sets forth information with respect to exercised options and SARs, if any, during fiscal 2002 and exercised and unexercised options and SARs, if any, held by the executive officers of the Company at July 26, 2002.

Name

| | Shares

acquired

on

exercise

(#)

| | Value

realized

($)

| | Number of securities

underlying unexercised

options/SARs at

fiscal year end (#)

Exercisable ("Ex")

Unexercisable ("Un")(1)

| | Value of unexercised

in-the-money

options/SARs

at fiscal year end ($)

Exercisable ("Ex")

Unexercisable ("Un")(1)

|

|---|

| Robert W. Allington | | — | | — | | 15,703 shares ("Ex")

0 shares ("Un") | | $67,915 ("Ex")

N/A |

| Douglas M. Grant | | — | | — | | 94,636 shares ("Ex")

9,150 shares ("Un") | | $200,662 ("Ex")

N/A |

| Alfred G. Craske | | — | | — | | 33,584 shares ("Ex")

0 shares ("Un") | | $88,110 ("Ex")

N/A |

| Vicki L. Benne | | — | | — | | 26,759 shares ("Ex")

1,734 shares ("Un") | | $71,613 ("Ex")

N/A |

| John J. Korab, Jr. | | — | | — | | 21,913 shares ("Ex")

414 shares ("Un") | | $60,208 ("Ex")

N/A |

- (1)

- The number of share exercisable and the value of the unexercised shares that are in-the-money include the number of shares vested under the Executive Incentive Compensation plan. For details on this plan see the note listed under the chart titled "Options/SAR Grants in Last Fiscal Year."

Compensation Committee Report On Executive Compensation.

The Compensation Committee ("Committee") of the Board is responsible for reviewing and recommending for approval by the Company's Board of Directors the cash and equity compensation of the Chairman/CEO, the President/COO, and other elected officers of the Company. The Committee is comprised of independent, non-employee Directors. Cash compensation is comprised of salary and incentive bonuses. Equity compensation is comprised of stock options. The Committee also approves the salary and incentive compensation of the other executives of the Company. In addition, the Committee functions as the stock option committee. This report is for the fiscal year ended July 26, 2002.

Compensation Philosophy

The philosophy of the Company with regard to executive compensation is to design the executive compensation program in a manner intended to enhance Company performance and shareholder value by achieving the following objectives:

- •

- Provide reasonable and appropriate levels of salary and cash incentive compensation that will attract, motivate, and retain highly qualified executives;

- •

- Integrate executive compensation with the Company's business and strategic plans;

- •

- Reward both team and individual performance; and

- •

- Encourage stock ownership by executives, thereby aligning executive compensation with shareholder value.

8

Executives Compensation Program

The Company's compensation program for all executives, including non-officers, consists of salary, bonuses, and stock options to purchase company common stock. In addition, executives are entitled to customary benefits, including medical, vacation, and retirement benefits that are generally available to employees of the Company.

Salary:The Committee believes that the base salary should provide the executive with a base compensation that is competitive for the position and the task performed. Annually, the Committee reviews the salary levels of the Company's executives by comparing specific job responsibilities of each executive with prevailing salary levels of companies of comparable size and complexity. An executive compensation consulting firm assists the Committee by surveying the prevailing executive compensation levels at instrumentation manufacturing companies locally, regionally, and nationally. The survey includes those manufacturing companies (public and private) that are comparable in size to the Company with respect to annual revenue and number of employees.

Incentive Bonuses:The Committee believes that cash incentives (bonuses) reward the executive for achieving corporate (team) and individual performance goals. The Committee and the Board of Directors adopted the current Executive Incentive Compensation Plan ("Plan") in August 2000. The Plan is effective for fiscal years 2001 through 2005. In addition to the formal Plan, the Committee reserves the right to grant cash bonuses to executives outside of the Plan in special circumstances. Under the current Plan, the team incentive bonuses are based upon two components: revenue/orders received and net/operating income, with the relative weighting of the components for each executive determined annually. The executives are not eligible to receive the team incentive unless the applicable income threshold is achieved. Individual goals are also established annually for each executive. Previous to fiscal year 2002, the cash incentives of the CEO and President were based solely on team performance goals. Beginning in fiscal year 2002, the Committee established individual performance goals for the CEO and President. For fiscal year 2002, all executives earned team and individual incentives, and one executive was granted an additional bonus outside of the plan.

Last year the Committee reported that it had amended the Executive Incentive Compensation Plan to provide performance incentives to executives based on a year-over-year improvement in the Company's revenue/orders and net/operating income rather than against annual targets, effective fiscal year 2003. The Committee decided to rescind this decision based on the advice of counsel. The Committee will review the overall design of the compensation program before a new executive incentive compensation plan is established for fiscal year 2006 and beyond.

Stock Options:The Committee believes that stock options provide the executives with incentives for long-term performance that is directly linked to the interests of the shareholders because the value of the options increase or decrease in relationship to the price of the Company's common stock. Under the Company's Executive Incentive Compensation Plan, effective for fiscal years 2001 through 2005, executives were granted stock options exercisable over five years, subject to annual performance vesting. A maximum of twenty percent of the total options granted can be vested each year. The actual amount vested per year is based on the achievement of the combined team and individual incentives earned out of the annual maximum established incentives. In any Plan year, options that do not vest are returned to the 1996 Stock Option Plan. As a result of the Company's performance and individual performances during fiscal year 2002, all executives vested a portion of their stock options.

CEO Compensation:Based on a review of the performance of the CEO by the Committee, the CEO received a salary increase during fiscal 2002 equivalent to normal market increases. In addition, the Committee worked with the CEO to establish individual performance goals for fiscal year 2002.

COMPENSATION COMMITTEE

James L. Carrier, Chairman

Dale L. Young, Secretary

Philip M. Wittig

9

Audit Committee Report.

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the responsibility for the financial statements and the reporting process including the systems of internal controls. The Company's Board of Directors has adopted a written charter for the Audit Committee.

In fulfilling its oversight responsibilities, the Committee reviewed and discussed the audited financial statements of the Company and its subsidiaries to be set forth in the Company's 2002 Annual Report to Shareholders and the Company's Annual Report on Form 10-K for the year ended July 26, 2002 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Committee reviewed with Deloitte & Touche LLP, independent accountants for the Company, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed by the Statement on Auditing Standards No. 61, "Communication with Audit Committees," as amended. The Statement on Auditing Standards No. 61 includes, among other items, matters related to the conduct of an audit of the Company's financial statement under generally accepted auditing standards.

In addition, the Committee discussed with the independent auditors the auditors' independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board's Standard No. 1 "Independence Discussion with Audit Committees" and considered the compatibility of nonaudit services with the auditors' independence.

The Committee discussed with the Company's independent auditors the overall scope and plans for their respective audits. The Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Committee held four meetings during fiscal year 2002.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Annual Report on Form 10-K for the year ended July 26, 2002 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Ronald K. Jester, Chairman

James L. Carrier, Secretary

James L. Linderholm

10

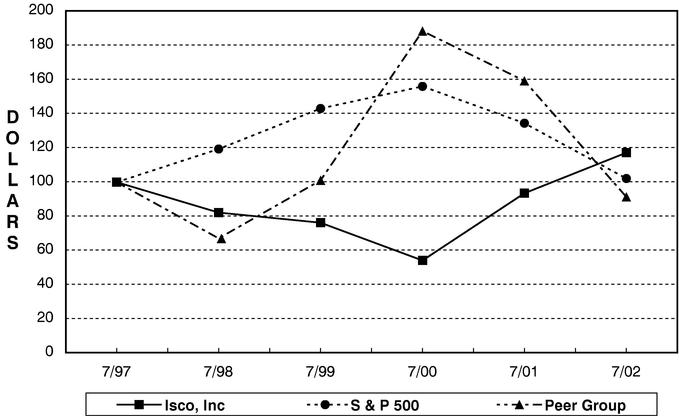

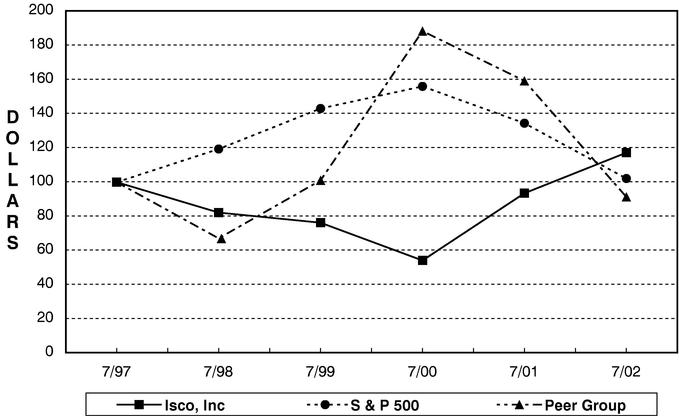

PERFORMANCE GRAPH.

The following performance graph compares the performance of the Company's Common Stock to the Nasdaq peer group and the Standard and Poor's 500 Stock Index. The industry peer group, selected by the Company, is comprised of 65 companies whose stock is traded on Nasdaq and historically have been included in the Standard Industrial Code Classification No. 382 entitled "Measuring and Controlling Devices". The graph assumes that $100 was invested on July 31, 1997 in the Company's stock and the indices. Also, it is assumed that dividends were reinvested when paid and that the fiscal year ends July 31.

Retirement Plan.

The Company's defined contribution retirement plan includes a profit sharing provision and a 401(k) provision that covers all employees meeting age and service requirements. Significant provisions of the plan include the following: (i) an employee may reduce his or her salary by up to 12 percent, and the Company will match the reduction, up to five percent, with a 50 percent matching contribution; (ii) the Company's profit sharing contribution to the plan is equal to 15 percent of the current net profit of the Company less the company matching contribution; (iii) the Company's aggregate contribution to the plan is limited to 15 percent of the aggregate compensation of the plan participants; (iv) participants vest 20 percent of employer profit sharing and employer 401(k) matching contributions upon completion of one year credited service, increasing 20 percent per year until fully vested upon completion of five years of credited service at years of service. Management and administrative costs of the plan are borne by the Company. Amounts contributed to the plan for the chief executive officer and the four other most highly compensated executive officers of the Company are set forth as part of the table appearing in the Executive Compensation section.

11

Compensation of Directors for Fiscal 2002.

The Directors' Deferred Compensation Plan has been in effect since January 1996. Under the Directors' Deferred Compensation Plan, all Directors receive 50 Deferred Stock Units for each Board and Committee meeting attended, and 350 Deferred Stock Units for the annual Board retainer. In addition, the Corporate Secretary receives an additional 350 Deferred Stock Units annually for serving as Corporate Secretary. At the time the Director ceases to be a member of the Board, the Director's accumulated Deferred Stock Units are converted to shares of the Company's common stock at a ratio of 1 to 1 and distributed.

The number of Deferred Stock Units earned by each of the directors during fiscal 2002 is as follows: Dr. Allington 914, Mr. Carrier 1,571, Mr. Grant 1,022, Mr. Jester 1,128, Mr. Linderholm 1,234, Mr. Wittig 1,584, and Mr. Young 1,403.

During fiscal 2002 the Board approved payment of cash compensation to outside board members for their attendance at board and committee meetings and for their services as chairpersons or secretaries of committees and serving as acting secretary of the board. The cash compensation earned by each director during fiscal year 2002 is as follows: Mr. Carrier $6,100, Mr. Jester $3,950, Mr. Linderholm $4,200, Mr. Wittig $5,450, and Mr. Young $4,000.

ADDITIONAL INFORMATION.

Compliance with Section 16(a) of the Securities Exchange Act of 1934. Section 16(a) of the Securities Exchange Act of 1934 requires the Company's executive officers and directors, and persons who beneficially own more than 10 percent of the Company's stock, to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission ("SEC"). Executive officers, directors, and greater than 10 percent beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

For fiscal 2002 all required forms 3, 4, and 5 were filed timely by all executive officers and directors.

Independent Public Accountants. Deloitte & Touche LLP, certified public accountants, is the independent public accountant for the Company.

Representatives of Deloitte & Touche LLP are expected to be present at the annual meeting and will be given the opportunity to make any statement they might desire and will also be available to respond to appropriate questions from shareholders. Deloitte & Touche LLP has been selected as independent public accountants for the Company for fiscal year 2003. Deloitte & Touche LLP has advised the Company that neither the firm, nor any member of the firm, has any financial interest, direct or indirect, in any capacity in Isco or its subsidiaries.

Audit fees for last fiscal year were $101,587, while all other fees were $80,933. Audit fees relate to services rendered in connection with the audit of the Company's consolidated financial statements and the quarterly reviews of financial statements included in the Company's Form 10-Q's. All other fees relate to non-financial statement audit related services and include fees for items such as annual tax returns, tax consultations, and a major benefit plan audit.

Other Matters. The Board of Directors does not know of any other matters to be presented at the annual meeting. In the event that other business is properly brought before the meeting, it is the intention of the proxy holders named in the proxy to vote the proxies in accordance with the recommendation of the Board of Directors.

| | | Robert W. Allington

Chairman and Chief Executive Officer |

12

Isco, Inc.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF SHAREHOLDERS DECEMBER 12, 2002.

The undersigned hereby constitutes and appoints ROBERT W. ALLINGTON and PHILIP M. WITTIG, or either of them, with full power to act alone, or any substitute appointed by either of them as the undersigned's agents, attorneys and proxies to vote the number of shares the undersigned would be entitled to vote if personally present at the Annual Meeting of the Shareholders of Isco, Inc., to be held at Isco, Inc., 4700 Superior Street, Lincoln, Nebraska, on the 12th day of December 2002, at 2:00 p.m., or any adjournments thereof, as indicated below.

- (1)

- Election of Directors(The Board of Directors recommends voting "FOR" all nominees.)

Nominees:James L. Carrier, Douglas M. Grant, Ronald K. Jester, and Harvey S. Perlman

- o

- Vote For all four nominees (except as marked to the contrary below)

- o

- Withhold authority to vote for all four nominees

INSTRUCTIONS: To withhold authority to vote for any individual nominee, write that nominee's name in the following space.

- (2)

- In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF ALL NOMINEES AND WITH DISCRETIONARY AUTHORITY ON ALL OTHER MATTERS.

| | | Dated: , 2002 |

| | | |

|

|

Signature of Shareholder |

|

|

Signature of Shareholder |

|

|

Please sign exactly as your name appears at the left. When signing as attorney, executor, administrator, trustee, guardian or conservator, give full title. All joint tenants must sign. |

|

|

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE. |

| | | o I (we) plan to attend the Annual Meeting. |

QuickLinks

PROXY STATEMENT