UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04369

The FBR Rushmore Fund, Inc.

(Exact name of registrant as specified in charter)

4922 Fairmont Avenue Bethesda, MD 20814

(Address of principal executive offices) (Zip code)

FBR National Trust Company, 4922 Fairmont Avenue Bethesda, MD 20814

(Name and address of agent for service)

Registrant’s telephone number, including area code: (301) 657-1500

Date of fiscal year end: August 31, 2003

Date of reporting period: August 31, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | | REPORT TO SHAREHOLDERS |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1)

ANNUAL REPORT, August 31, 2003

THE FBR RUSHMORE FUND, INC.

888.888.0025

October 10, 2003

Dear Shareholder,

Market Overview

The past six months have provided unprecedented volatility in the U.S. Treasury market, as interest rates experienced dramatic swings in both directions over very short periods of time. Ironically, U.S. Treasury yield levels finished September not very far from where they began April, but the path from there to here was by no means a straight line.

As the “official” portion of the war with Iraq came to a close, the domestic economy seemed poised to remove the shackles of geopolitical uncertainty and react instead to more conventional, and fundamental information. Instead, a series of major market events turned the spring and summer of 2003 into one of the most volatile periods in recent market history. The first salvo was fired by the Federal Reserve (“Fed”), who surprised the markets with an uncharacteristic warning on deflation at its May 6th meeting. The resulting bond market rally brought U.S. Treasury yields to multi-decade lows, culminating in mid-June. At the same time, the economic data was beginning to show signs of a true recovery, the U.S. dollar had weakened considerably, stocks were climbing higher, and a fiscal stimulus package was in the pipeline. This combination, along with a smaller-than-expected 25 basis point rate cut by the Fed, prompted a sharp reversal of the interest rate trend in late June. This trend continued in July as a technical phenomenon known as the mortgage convexity trade accelerated rates upward through all reasonable expectations. But the volatility was not over. With 10-year yields reaching levels 150 basis points higher than their June lows, the market stabilized somewhat in August before a series of weaker-than-expected economic reports, especially in the labor market, brought the buyers back in and yields back down as September came to a close.

Fund Performance

For the fiscal year ended August 31, 2003, the FBR Total Return Bond Fund (the “Fund”) underperformed the benchmark, posting a –16.87% return vs. 2.98% for the Lehman Brothers Government Bond Index. In May and early June we were in a falling interest rate environment while the Fund, through its options and futures strategy, was positioned for stable or rising rates. As rates turned upward in June, the Fund maintained its strategy and benefited from rising rates. As rates rose, we began to invest further out on the Treasury curve, lengthening the cash duration and allowing the Fund’s options overlay to position the Fund longer as rates rose further. However, rates accelerated upward through all reasonable expectations in July, before stabilizing and falling again in August and September.

As the Fund was comprised of U.S. government bonds with an overlay of fixed-income options and futures, the Fund’s returns tended to be more volatile than the Treasury market itself. The Fund is authorized to enter into futures contracts for the purposes of bona fide hedging, enhancing investment performance or remaining fully invested. The risks of loss in trading futures contracts in some strategies can be substantial, due to both the

margin deposit and the extremely high degree of leverage involved in futures pricing. Small price movements in futures contract may result in immediate and substantial loss (as well as gain) to the Fund.

With such unusual volatility, the Fund has unfortunately endured a period of very disappointing returns. The Fund regained its footing in the months of August and September, posting monthly returns of 6.34% and 10.71%, respectively. Below are comparative returns for the Fund and its benchmark as of September 30, 2003.

Average Annual Returns as of September 30, 2003

| | | One-Year

| | | Five-Year

| | | Ten-Year

| |

FBR Total Return Bond Fund | | -4.78 | % | | 1.64 | % | | 4.75 | % |

| | |

|

| |

|

| |

|

|

Lehman Brothers Government Bond Index* + | | 3.55 | % | | 6.34 | % | | 6.73 | % |

| | |

|

| |

|

| |

|

|

Total returns represent past performance, which is no guarantee of future results.

Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be worth

more or less than their original cost. Returns shown assume reinvestment of distributions.

| * | Investors should note that the indices are unmanaged, do not incur expenses and are not available for investment. The performance of the indices do not include a deduction for fees, expenses, or taxes. |

| + | The Lehman Brothers Government Bond Index is a market value weighted index of U.S. Government agency fixed-rate debt issues with maturities of one year or more. |

Outlook

With all this volatility behind us, we believe that we have entered a period of relative stability in interest rates until clarity emerges on the health of the U.S. economy into 2004. The Fed has made it clear that they will remain accommodative until such clarity is achieved, and key economic data will bear this out. Please read carefully the enclosed letter to shareholders regarding the recent development on the Fund.

Money Management Advisers, Inc.

2

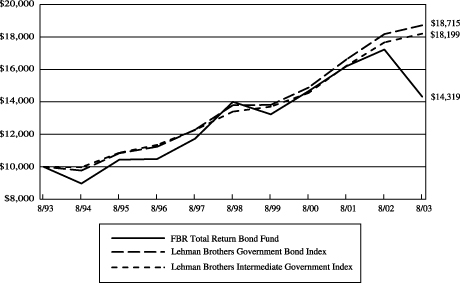

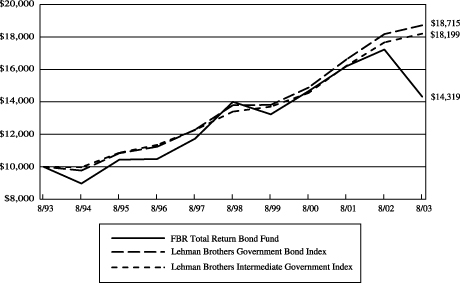

FBR Total Return Bond Fund

Comparison of Change in Value of $10,000 Investment in

Fund Shares vs. Indices

(unaudited)

Average Annual Total Return*

For the Years Ended August 31, 2003

| | | One Year

| | | Five Year

| | | Ten Year

| |

FBR Total Return Bond Fund | | -16.87 | % | | 0.45 | % | | 3.66 | % |

Lehman Brothers Government Bond Index | | 2.98 | % | | 6.29 | % | | 6.47 | % |

Lehman Brothers Intermediate Government Index | | 3.04 | % | | 6.31 | % | | 6.17 | % |

| * | TOTAL RETURNS REPRESENT PAST PERFORMANCE, WHICH IS NO GUARANTEE OF FUTURE RESULTS. Investment return and principal value will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Returns shown assume reinvestment of distributions. The indices are unmanaged and unlike the Fund have no management fees or operating cost that reduce reported returns. The Lehman Brothers Government Bond Index, the Fund’s benchmark, is a market value weighted index of U.S. Government and government agency fixed-rate debt issues with maturities of one year or more. The Lehman Brothers Intermediate Government Index is a market value weighted index of U.S. Government fixed-rate debt issues with maturities between five and ten years. The graph assumes a hypothetical investment of $10,000 initial investment in the Fund and reflects all Fund expenses and reinvestment of distributions. |

For more complete information on the Fund, including fees and expenses, call 888.888.0025 for a free prospectus. Investing in the Fund involves certain risks that are fully discussed in the Fund’s prospectus. Please read the prospectus carefully before you invest or send money.

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

STATEMENT OF NET ASSETS

August 31, 2003

| | | Face

Amount

| | Value

(Note 1)

| |

U.S. TREASURY OBLIGATIONS: 75.3% | | | | | | | |

U.S. Treasury Bonds, 7.625%, 11/15/22 | | $ | 2,500,000 | | $ | 3,199,513 | |

U.S. Treasury Bonds, 7.625%, 02/15/25 | | | 2,050,000 | | | 2,645,861 | |

U.S. Treasury Notes, 3.875%, 02/15/13 | | | 3,441,000 | | | 3,296,640 | |

U.S. Treasury Bonds, 5.375%, 02/15/31 | | | 6,697,000 | | | 6,840,878 | |

| | | | | |

|

|

|

Total U.S. Treasury Obligations (Cost $ 16,024,082) | | | | | | 15,982,892 | |

| | | | | |

|

|

|

SHORT-TERM INVESTMENTS: 26.7% | | | | | | | |

Repurchase Agreement: 8.1% | | | | | | | |

With Mizuho Securities, Inc. dated 8/29/03 at 0.90% to be repurchased at $1,721,172 on 9/2/03, collateralized by $1,755,688 in U.S. Treasury Bonds, due 8/15/14 (Cost $1,721,000) | | | 1,721,000 | | | 1,721,000 | |

| | | | | |

|

|

|

| | |

Government Agency Obligations: 18.6% | | | | | | | |

Federal National Mortgage Association Discount Note at 1.10%, due 09/24/03 | | | 962,000 | | | 961,404 | * |

Federal National Mortgage Association Discount Note at 1.10%, due 10/01/03 | | | 3,000,000 | | | 2,997,475 | * |

| | | | | |

|

|

|

Total Government Agency Obligations (Cost $ 3,958,879) | | | | | | 3,958,879 | |

| | | | | |

|

|

|

Total Short-term Investments (Cost $ 5,679,879) | | | | | | 5,679,879 | |

| | | | | |

|

|

|

Total Investments: 102.0% (Cost $ 21,703,961) | | | | | | 21,662,771 | |

Written Options, at fair value: (0.8)% (Premium $194,919) | | | | | | (178,031 | ) |

Variation Margin on Financial Futures Contracts: (0.3)% | | | | | | (61,087 | ) |

Liabilities in excess of Other Assets: (0.9)% | | | | | | (194,044 | ) |

| | | | | |

|

|

|

Net Assets: 100.0% | | | | | $ | 21,229,609 | |

| | | | | |

|

|

|

Net Asset Value Per Share (Based on 2,277,334 Shares Outstanding) | | | | | $ | 9.32 | |

| | | | | |

|

|

|

Net Assets Consist of: | | | | | | | |

Paid-in Capital | | | | | $ | 26,320,782 | |

Accumulated Net Realized Loss on Investments, Options, and Futures | | | | | | (2,729,236 | ) |

Net Unrealized Depreciation of Investments, Options, and Futures | | | | | | (2,361,937 | ) |

| | | | | |

|

|

|

Net Assets | | | | | $ | 21,229,609 | |

| | | | | |

|

|

|

4

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

STATEMENT OF NET ASSETS (continued)

August 31, 2003

| | | Expiration

Date

| | Actual

Contracts

| | Fair Value

| |

Written Options | | | | | | | | |

U.S. Treasury Bond Future Call, Strike Price $108 (Premium $194,919) (Note 2) | | October 2003 | | 211 | | $ | (178,031 | ) |

| | | | |

| |

|

|

|

| | | |

| | | | | | | Depreciation

| |

Futures Contracts Purchased | | | | | | | | |

U.S. Treasury Bond Futures | | September 2003 | | 325 | | $ | (2,337,635 | ) |

| | | | |

| |

|

|

|

| * | A portion of the security is pledged for options written. |

See Notes to Financial Statements.

5

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

STATEMENT OF OPERATIONS

For the Year Ended August 31, 2003

Interest Income | | $ | 1,139,854 | |

| | |

|

|

|

Expenses | | | | |

Investment Advisory Fee (Note 4) | | | 156,143 | |

Administrative Fee (Note 4) | | | 120,102 | |

| | |

|

|

|

Total Expenses | | | 276,245 | |

| | |

|

|

|

Net Investment Income | | | 863,609 | |

| | |

|

|

|

Net Realized Gain (Loss) from: | | | | |

Investments, Purchased Options, and Futures | | | (7,548,110 | ) |

Written Options | | | 4,416,654 | |

Net Change in Unrealized Appreciation/Depreciation on Investments, Options, and Futures | | | (3,178,770 | ) |

| | |

|

|

|

Net Realized and Unrealized Loss on Investments | | | (6,310,226 | ) |

| | |

|

|

|

Net Decrease in Net Assets Resulting from Operations | | $ | (5,446,617 | ) |

| | |

|

|

|

See Notes to Financial Statements.

6

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the Year Ended August 31,

| | | 2003

| | | 2002

| |

From Investment Activities | | | | | | | | |

Net Investment Income | | $ | 863,609 | | | $ | 620,742 | |

Net Realized Gain (Loss) from: | | | | | | | | |

Investments, Purchased Options, and Futures | | | (7,548,110 | ) | | | 360,914 | |

Written Options | | | 4,416,654 | | | | 296,591 | |

Change in Net Unrealized Appreciation/Depreciation on Investments, Options, and Futures | | | (3,178,770 | ) | | | (198,218 | ) |

| | |

|

|

| |

|

|

|

Net Increase (Decrease) in Net Assets Resulting from Operations | | | (5,446,617 | ) | | | 1,080,029 | |

| | |

|

|

| |

|

|

|

Distributions to Shareholders | | | | | | | | |

From Net Investment Income | | | (863,609 | ) | | | (620,742 | ) |

| | |

|

|

| |

|

|

|

From Share Transactions | | | | | | | | |

Net Proceeds from Sales of Shares | | | 31,558,028 | | | | 30,479,994 | |

Reinvestment of Distributions | | | 831,379 | | | | 587,674 | |

Cost of Shares Redeemed | | | (38,861,267 | ) | | | (10,905,354 | ) |

| | |

|

|

| |

|

|

|

Net Increase (Decrease) in Net Assets Resulting from Share Transactions | | | (6,471,860 | ) | | | 20,162,314 | |

| | |

|

|

| |

|

|

|

Total Increase (Decrease) in Net Assets | | | (12,782,086 | ) | | | 20,621,601 | |

Net Assets — Beginning of Year | | | 34,011,695 | | | | 13,390,094 | |

| | |

|

|

| |

|

|

|

Net Assets — End of Year | | $ | 21,229,609 | | | $ | 34,011,695 | |

| | |

|

|

| |

|

|

|

| | |

Number of Shares | | | | | | | | |

Sold | | | 2,765,576 | | | | 2,666,760 | |

Issued in Reinvestment of Distributions | | | 76,045 | | | | 51,765 | |

Redeemed | | | (3,515,122 | ) | | | (954,858 | ) |

| | |

|

|

| |

|

|

|

Net Increase (Decrease) in Shares | | | (673,501 | ) | | | 1,763,667 | |

| | |

|

|

| |

|

|

|

See Notes to Financial Statements.

7

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

FINANCIAL HIGHLIGHTS

| | | For the Years Ended August 31,

| |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Per Share Operating Performance: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value — Beginning of Year | | $ | 11.53 | | | $ | 11.28 | | | $ | 10.71 | | | $ | 10.17 | | | $ | 11.27 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | 0.31 | | | | 0.45 | | | | 0.52 | | | | 0.52 | | | | 0.50 | |

Net Realized and Unrealized Gain (Loss) on Investments, Options, and Futures | | | (2.21 | ) | | | 0.25 | | | | 0.57 | | | | 0.54 | | | | (1.10 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | (1.90 | ) | | | 0.70 | | | | 1.09 | | | | 1.06 | | | | (0.60 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Distributions to Shareholders: | | | | | | | | | | | | | | | | | | | | |

From Net Investment Income | | | (0.31 | ) | | | (0.45 | ) | | | (0.52 | ) | | | (0.52 | ) | | | (0.50 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Increase (Decrease) in Net Asset Value | | | (2.21 | ) | | | 0.25 | | | | 0.57 | | | | 0.54 | | | | (1.10 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value — End of Year | | $ | 9.32 | | | $ | 11.53 | | | $ | 11.28 | | | $ | 10.71 | | | $ | 10.17 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Investment Return | | | (16.87 | )% | | | 6.34 | % | | | 10.46 | % | | | 10.82 | % | | | (5.51 | )% |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

Expenses. | | | 0.89 | % | | | 0.80 | % | | | 0.80 | % | | | 0.80 | % | | | 0.80 | % |

Net Investment Income | | | 2.77 | % | | | 3.62 | % | | | 4.79 | % | | | 5.12 | % | | | 4.57 | % |

Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover Rate | | | 351 | % | | | 29 | % | | | 0 | % | | | 9 | % | | | 46 | % |

Net Assets at End of Year (in thousands) | | $ | 21,230 | | | $ | 34,012 | | | $ | 13,390 | | | $ | 11,789 | | | $ | 12,837 | |

Number of Shares Outstanding at End of Year (in thousands) | | | 2,277 | | | | 2,951 | | | | 1,187 | | | | 1,101 | | | | 1,262 | |

See Notes to Financial Statements.

8

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

NOTES TO FINANCIAL STATEMENTS

August 31, 2003

1. SIGNIFICANT ACCOUNTING POLICIES

The FBR Rushmore Fund, Inc. (the “Fund”) is registered with the Securities and Exchange Commission under the Investment Company Act of 1940, as amended, as an open-end, diversified investment company. The Fund currently consists of one portfolio, the FBR Total Return Bond Fund, formerly the FBR U.S. Government Bond Portfolio. On August 31, 2003, there were 1,000,000,000 shares of $0.001 par value capital stock authorized. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America which may require management to make certain estimates and assumptions at the date of the financial statements.

Security Valuation Securities are valued at the last quoted sales price. If a sale is not reported on a given day, the security is valued at the mean between the most recent quoted bid and asked prices. Options are all exchange traded and are valued at the last sale price. Financial futures contracts are traded on exchanges and are stated at market value. The value of assets for which no quotations are readily available, including restricted securities, are valued at fair value in good faith by the Board of Directors or at their direction.

Investment Transactions Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Interest income is accrued on a daily basis. Realized gain and loss from security transactions are computed on an identified cost basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities.

Repurchase Agreements The Fund invests in securities pursuant to repurchase agreements. Under such agreements, the counterparty agrees to repurchase the security at a mutually agreed upon time and price. The Fund’s custodian takes possession of the underlying securities, marks-to-market such securities and, if necessary, receives additional securities daily to ensure that the contract is fully collateralized. If the counterparty defaults, and the fair value of the collateral declines, liquidation of the collateral by the Fund may be delayed or limited.

Distributions Net investment income is computed and dividends are declared daily in the Fund. Income dividends in this portfolio are paid monthly. Distributions paid by the Fund are recorded on the ex-dividend date. Dividends are reinvested in additional shares unless shareholders request payment in cash. Capital gains, if any, are distributed annually.

Options The Fund is authorized to purchase and write call and put options. When the Fund purchases an option, the premium paid is recorded as an investment and its value is marked-to-market daily. The risk associated with purchasing options is limited to the premium originally paid. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current market value of the option written. Premiums received from writing options which expire unexercised are recorded by the Fund on the expiration date as realized gains from

9

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

NOTES TO FINANCIAL STATEMENTS (continued)

options transactions. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying securities in determining whether the Fund has a realized gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund’s use of written options involves, to varying degrees, elements of market risk in excess of the amount recognized in the Statements of Net Assets. The contract or notional amounts bears the market risk of an unfavorable change in the price of the security underlying the written option. Exercise of an option written by the Fund could result in the Fund selling or buying a security at a price different from the current market value. The Fund’s activities in written options are conducted through regulated exchanges which do not result in counter party credit risks. Written and purchased options are non-income producing securities.

Futures Contracts The Fund may enter into futures contracts and options on futures contracts for the purposes of hedging investments, enhancing investment performance, remaining fully invested and reducing transaction costs. Upon entering into a financial futures contract, the Fund is required to pledge to the broker an amount of cash, U.S. government securities, or other assets, equal to a certain percentage of the contract amount (initial margin deposit). After a futures contract position is opened, the value of the contract is marked-to-market daily. Subsequent payments, known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the fair value of the underlying security. The Fund recognizes an unrealized gain or loss equal to the daily variation margin. When the contract is closed the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund’s ability to effectively utilize futures involves the risk of imperfect price correlation between the futures contracts and their underlying security.

Federal Income Taxes The Fund intends to distribute all taxable income and capital gains to shareholders and to otherwise comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no federal tax provision is required.

The tax character of distributions paid for the years ended August 31, 2003 and 2002 is as follows:

| | | 2003

| | 2002

|

From ordinary income | | $ | 863,609 | | $ | 620,742 |

| | |

|

| |

|

|

10

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

NOTES TO FINANCIAL STATEMENTS (continued)

The following information is computed on a tax basis for each item as of August 31, 2003:

Cost of investment securities | | $ | 21,703,961 | |

| | |

|

|

|

Gross unrealized appreciation | | $ | 666,333 | |

Gross unrealized depreciation | | | (707,523 | ) |

| | |

|

|

|

Net unrealized depreciation | | | (41,190 | ) |

Post-October losses | | | (2,489,975 | ) |

Capital loss carryforward | | | (2,560,008 | ) |

| | |

|

|

|

Accumulated deficit | | $ | (5,091,173 | ) |

| | |

|

|

|

The difference between book basis and tax basis unrealized depreciation is attributable to the tax treatment of derivative investments.

The capital loss carryforwards as of August 31, 2003 in the table above expire as follows:

Amount

| | Expires August 31,

|

| $ 85,134 | | 2005 |

| $ 167,754 | | 2008 |

| $ 2,396 | | 2009 |

| $ 230,487 | | 2010 |

| $2,074,237 | | 2011 |

The Post-October losses and capital loss carryforwards may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

11

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

NOTES TO FINANCIAL STATEMENTS (continued)

2. OPTIONS WRITTEN

As of August 31, 2003, portfolio securities valued at $3,696,510 were held by the custodian as collateral for call and put options written by the Fund. Transactions in options written during the year ended August 31, 2003 were as follows:

| | | Number of

Contracts

| | | Premiums

Received

| |

Options written outstanding at August 31, 2002 | | 1,223 | | | $ | 1,018,609 | |

Options written | | 22,784 | | | | 14,797,000 | |

Options terminated in closing purchase transactions | | (18,809 | ) | | | (12,410,299 | ) |

Options expired | | (4,553 | ) | | | (3,030,007 | ) |

Options exercised | | (434 | ) | | | (180,384 | ) |

| | |

|

| |

|

|

|

Options written outstanding at August 31, 2003 | | 211 | | | $ | 194,919 | |

| | |

|

| |

|

|

|

3. INVESTMENT TRANSACTIONS

For the year ended August 31, 2003, excluding short term securities, there were only purchases and sales (including maturities) of U.S. Government securities. They were $70,360,229 and $67,247,231, respectively.

4. INVESTMENT ADVISORY FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Investment advisory and management services are provided by Money Management Advisers, Inc. (the “Adviser”), formerly Money Management Associates, a subsidiary of FBR National Trust Company (the “Administrator”), formerly FBR National Bank & Trust. Under an agreement with the Adviser, the Fund pays a fee for such services at an annual rate of 0.50% of the Fund’s average daily net assets. Certain officers and directors of the Fund are affiliated with the Adviser. Both the Adviser and the Administrator are wholly-owned subsidiaries of Friedman, Billings, Ramsey Group, Inc.

On December 28, 2001, shareholders approved Bradford & Marzec, Inc. to serve as the Fund’s investment subadviser. The Adviser pays Bradford & Marzec, Inc. a fee at an annual rate of 0.20% on the Fund’s average daily net assets. During the year ended August 31, 2003, Bradford & Marzec received $62,461 for its services.

The Administrator provides transfer agency, dividend-disbursing and shareholder services to the Fund. In addition, the Administrator serves as custodian of the Fund’s assets and pays the operating expenses (not including extraordinary legal fees, marketing costs outside of routine shareholder communications and interest cost) of the Fund, in accordance with the administrative service agreement. Effective November 1, 2002 for these services, the Administrator receives an annual fee of 0.40% of the average daily net assets of the Fund. Prior to November 1, 2002, the Administrator received 0.30% of the average daily net assets.

12

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

NOTES TO FINANCIAL STATEMENTS (continued)

Pursuant to a Distribution Agreement dated September 4, 2001, the Board of Directors of the Fund appointed FBR Investment Services, Inc. (“FBRIS”) as the distributor of the Fund. FBRIS is an affiliate of the Adviser and serves as principal underwriter and distributor of the Fund’s shares.

5. BORROWING AGREEMENT

The Fund has an agreement with Custodial Trust Company to receive short-term borrowings to cover share redemptions. Borrowings pursuant to the credit facility are subject to interest at 100 basis points (100 basis points = 1%) over the 30-day LIBOR rate. The credit facility may be drawn upon for temporary purposes and is subject to certain other customary restrictions. For each short-term borrowing the Fund pledges collateral. No borrowings were outstanding at August 31, 2003.

6. SUBSEQUENT EVENTS

Effective September 8, 2003, Integrated Fund Services, Inc. (“Integrated”) will serve as sub-Transfer Agent and sub-Administrator to the Fund pursuant to an agreement between the Administrator and Integrated. Integrated is a Cincinnati-based mutual fund company that has been in operation since 1983.

On October 21, 2003, the Board of Directors unanimously approved a Plan of Liquidation. Effective October 24, 2003, the Fund is closed to both new and existing shareholders. The Board of Directors concluded that it is in the best interests of shareholders to liquidate the Fund effective November 28, 2003.

13

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

INDEPENDENT AUDITORS’ REPORT

To the Shareholders and Board of Directors

of The FBR Rushmore Fund, Inc.:

We have audited the accompanying statement of net assets of the FBR Total Return Bond Fund of The FBR Rushmore Fund, Inc., (the “Fund”), as of August 31, 2003, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2003, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the FBR Total Return Bond Fund of The FBR Rushmore Fund, Inc. as of August 31, 2003, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 6 to the financial statements, on October 21, 2003, the Board of Directors approved a plan of liquidation to the Fund, which is anticipated to be effective on November 28, 2003. Effective October 24, 2003, the Fund was closed to both new and existing shareholders.

DELOITTE & TOUCHE LLP

Baltimore, Maryland

October 28, 2003

14

THE FBR RUSHMORE FUND, INC.

FBR Total Return Bond Fund

SUPPLEMENTAL INFORMATION (unaudited)

Information pertaining to the Directors and Officers of the Fund is set forth below. The statement of additional information (SAI) includes additional information about the Directors and is available without charge, upon request by calling 888.888.0025.

| Name, Age, Address | | Term of Office*

Length of

Time Served | | Principal Occupation(s)

During Past 5 Years | | Portfolios Overseen

in the Fund and FBR

Mutual FundComplex | | Other

Directorships |

|

Independent Directors | | | | | | | | |

|

Louis T. Donatelli, 70 4922 Fairmont Avenue Bethesda, MD 20814 | | Director since June 2000 | | Chairman of Donatelli and Klein, Inc., engaged in the acquisition of real estate, primarily office buildings and multi-family housing projects since 2001 to present (President 1973-2001). | | 12 | | None. |

|

F. David Fowler, 70 4922 Fairmont Avenue Bethesda, MD 20814 | | Director since June 2000 | | Retired, 1997. Private investor. Dean, The George Washington University School of Business and Public Management, 1992-1997. | | 12 | | MicroStrategy |

|

| | | | |

Mitchell A. Johnson, 61 4922 Fairmont Avenue Bethesda, MD 20814 | | Director since October 2001 | | President, MAJ Capital Management, Inc., a private investment firm, June 1994 to present. | | 5 | | Federal Agricultural Mortgage Corporation and Citizens Funds (10 portfolios) |

|

| | | | |

Michael A. Willner, 47 4922 Fairmont Avenue Bethesda, MD 20814 | | Director since June 2000 | | CEO, AlphaGrip, Inc., January 2001 to present. President, Catalyst Advisers, Inc., a news organization, from September 1996 to December 2000. | | 12 | | None. |

|

Affiliated Director | | | | | | | | |

|

| | | | |

Webb C. Hayes, IV**, 55 1001 19th Street North Arlington, VA 22209 | | Director, Chairman and President since

October 2001 | | Senior Managing Director, Friedman, Billings, Ramsey & Co., Inc. and head of the Private Client Group since 1999. Director of the Adviser since April 2001. Vice Chairman, United Bank 1997-1999. | | 5 | | Chairman and Director of FBR National Trust Company (“FBR National”). |

|

Officers | | | | | | | | |

|

| | | | |

Susan L. Silva, 36

4922 Fairmont Avenue Bethesda, MD 20814 | | Vice President and Controller since 2002 | | Vice President, Mutual Fund Services, FBR National Trust Company since July 2002; Employee of FBR National Trust Company since January 2000. Assistant Treasurer of Legg Mason Global Trust and Assistant Secretary of five Legg Mason Funds, 1998-1999; Fund Accounting Manager, Legg Mason, Inc. from 1996 through 1999. | | 12 | | |

|

| | | | |

Kimberly J. Ochterski, 28 4922 Fairmont Avenue Bethesda, MD 20814 | | Secretary and Assistant Vice President since July 2003 | | Secretary and Assistant Vice President of FBR Fund for Government Investors, FBR Fund for Tax-Free Investors, Inc., FBR American Gas Index Fund, Inc., and The FBR Rushmore Fund, Inc., since July 2003. Employee of FBR National Trust Company since August 1998, serving in various capacities, including Fund Accounting Supervisor and Transfer Agent Operations Manager. | | 12 | | |

|

| * | Directors serve until the madatory retirement requirement which is a the end of the calendar year in which a Director reaches the age of 75 pursuant to the Board of Directors’ retirement policy, with such exceptions as deemed appropriate by a majority of the Board. |

| ** | Mr. Hayes is an “interested” person of the Fund as that term is defined by the Investment Company Act of 1940. |

15

[LOGO]

| FBR MUTUAL FUNDS | | The FBR Rushmore Fund, Inc. |

888.888.0025 www.fbr.com/funds/ | | |

| |

| Investment Adviser | | |

| MONEY MANAGEMENT ADVISERS, INC. | | |

| 1001 NINETEENTH STREET NORTH | | Annual Report |

| ARLINGTON, VIRGINIA 22209 | | August 31, 2003 |

| |

| Distributor | | |

| FBR INVESTMENT SERVICES, INC. | | |

| 4922 FAIRMONT AVENUE | | |

| BETHESDA, MARYLAND 20814 | | |

| |

| Administrator, Custodian, and Transfer Agent | | |

| FBR NATIONAL TRUST COMPANY | | |

| 4922 FAIRMONT AVENUE | | |

| BETHESDA, MARYLAND 20814 | | |

| |

| Sub-Transfer Agent | | |

| INTEGRATED FUND SERVICES, INC. | | |

| P.O. BOX 5354 | | |

| CINCINNATI, OHIO 45202 | | |

| |

| Independent Public Accountants | | |

| DELOITTE & TOUCHE, LLP | | |

| 100 SOUTH CHARLES STREET | | |

| BALTIMORE, MARYLAND 21201 | | |

| |

This report is not authorized for distribution to prospective investors unless it is preceded or accompanied by a current prospectus. | | |

The registrant undertakes to provide a copy of such code to any person upon request, without charge, by calling 888.888.0025.

| ITEM 3. | | AUDIT COMMITTEE FINANCIAL EXPERT. |

The Board of Directors determined at a meeting held October 21, 2003 that F. David Fowler qualifies as an Audit Committee Financial Expert and he is “independent” as defined under the relevant Securities and Exchange Commission rules and releases.

| ITEM 4. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable at this time. Applicable for annual reports filed for the first fiscal year ending after December 15, 2003.

| ITEM 7. | | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT |

Not applicable. Registrant is an open-end management investment company.

| ITEM 9. | | CONTROLS AND PROCEDURES. |

| (a) | Based upon their evaluation of the registrant’s disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant’s principal financial officer and principal executive officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant in this Form N-CSR has been recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. |

| (b) | There were no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. |

File the exhibits listed below as part of this Form. Letter or number the exhibits in the sequence indicated.

| (a) | Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit: Not applicable. |

| (b) | A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2): Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The FBR Rushmore Fund, Inc.

| By: | | /s/ Susan L. Silva | | 10/29/03 | | |

| |

| | |

| | | Susan L. Silva Vice President & Controller The FBR Rushmore Fund, Inc. | | Date | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | | /s/ Webb C. Hayes IV | | 10/29/03 | | |

| |

| | |

| | | Webb C. Hayes IV Chairman, President, and Treasurer The FBR Rushmore Fund, Inc. (Principal Executive Officer) | | Date | | |

| By: | | /s/ Susan L. Silva | | 10/29/03 | | |

| |

| | |

| | | Susan L. Silva Vice President & Controller The FBR Rushmore Fund, Inc. (Principal Financial Officer and Accounting Officer) | | Date | | |