SCHEDULE 14A

Joint Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| x | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material under §240.14a-12. |

Columbia Funds Series Trust I

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

Columbia Funds Series Trust I

One Financial Center, Boston, Massachusetts 02111

| | |

| Columbia Balanced Fund | | Columbia Intermediate Municipal Bond Fund |

| Columbia Bond Fund | | Columbia International Bond Fund |

| Columbia California Tax-Exempt Fund | | Columbia Large Cap Growth Fund |

| Columbia Connecticut Tax-Exempt Fund | | Columbia Pacific/Asia Fund |

| Columbia Contrarian Core Fund | | Columbia Real Estate Equity Fund |

| Columbia Corporate Income Fund | | Columbia Select Large Cap Growth Fund |

| Columbia Emerging Markets Fund | | Columbia Select Small Cap Fund |

| Columbia Energy and Natural Resources Fund | | Columbia Small Cap Core Fund |

| Columbia High Yield Municipal Fund | | Columbia Strategic Income Fund |

| Columbia High Yield Opportunity Fund | | Columbia Strategic Investor Fund |

| Columbia Intermediate Bond Fund | | Columbia Value and Restructuring Fund |

(each, a “Fund” and collectively, the “Funds”)

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND

AND VOTE ON THE PROPOSALS

This is a brief overview of the matters on which you are being asked to vote. The accompanying Joint Proxy Statement contains more detailed information about each proposal, and we encourage you to read it in its entirety before voting. Your vote is important.

| Q. | Why are you sending me this information? |

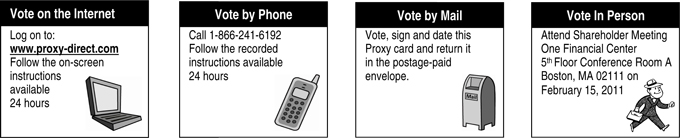

| A. | On February 15, 2011, a Joint Special Meeting of Shareholders of each Fund and Columbia Funds Series Trust I (the “Trust”) as a whole (the “Meeting”) will be held at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111, at 1:00 p.m. (Eastern). You are receiving the Joint Proxy Statement and one or more proxy cards (the “Proxy Cards”) because you own shares of one or more of the Funds and have the right to vote on these important proposals concerning your investment. |

| Q. | What are the proposals? |

| A. | Shareholders are being asked to vote on the following proposals: |

| | • | | For certain Funds, the approval of an amendment to the Investment Management Services Agreement to increase the investment advisory fee rate payable by those Funds at various asset levels (Proposal 1). |

| | • | | For Columbia California Tax-Exempt Fund and Columbia Connecticut Tax-Exempt Fund, a proposal to change the classification of such Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the Investment Company Act of 1940 (the “1940 Act”) (Proposal 2). |

| | • | | For Columbia Real Estate Equity Fund, a proposal to approve the conversion of its investment objective and a related 80% policy from “fundamental” (requiring shareholder approval to modify in the future) to “non-fundamental” (not requiring shareholder approval to modify in the future). There are no current proposals to make any substantive changes to the objective or this policy (Proposal 3). |

| Q. | For certain Funds, why am I being asked to vote on an amendment to the Investment Management Services Agreement? |

| A. | Proposal 1 requests your vote on an amendment to the Investment Management Services Agreement (the “IMS Agreement”) between Columbia Management Investment Advisers, LLC (“Columbia Management”) and the Trust, on behalf of the following Funds: |

| | |

Columbia Balanced Fund | | Columbia International Bond Fund |

Columbia Bond Fund | | Columbia Large Cap Growth Fund |

Columbia Contrarian Core Fund | | Columbia Pacific/Asia Fund |

Columbia Corporate Income Fund | | Columbia Select Large Cap Growth Fund |

Columbia Emerging Markets Fund | | Columbia Select Small Cap Fund |

Columbia Energy and Natural Resources Fund | | Columbia Small Cap Core Fund |

Columbia High Yield Municipal Fund | | Columbia Strategic Income Fund |

Columbia High Yield Opportunity Fund | | Columbia Strategic Investor Fund |

Columbia Intermediate Bond Fund | | Columbia Value and Restructuring Fund |

Columbia Intermediate Municipal Bond Fund | | |

(each, an “IMS Fee Fund” and collectively, the “IMS Fee Funds”)

The proposed amendment is part of a group of related proposals that, if approved, are designed to achieve consistent investment management service and fee structures across most of the Columbia-branded funds and the funds that were formerly (and in some cases, currently) branded as RiverSource, Seligman and Threadneedle funds (collectively, the “Combined Fund Complex”). Specifically, the proposed amendment to the IMS Agreement for each IMS Fee Fund would increase the investment advisory fee rate payable by such IMS Fee Fund to Columbia Management at various asset levels. Each IMS Fee Fund’s operations and the manner in which Columbia Management manages the IMS Fee Fund are not expected to change as a result of this amendment. More specifically, except for the investment advisory fee rates payable by an IMS Fee Fund, the IMS Agreement for such IMS Fee Funds would remain the same in all respects.

| Q. | For the IMS Fee Funds, why should I approve an amendment that would or could increase the investment advisory fee rates payable by my Fund? |

| A. | The proposed amendment to the IMS Agreement is part of a group of related proposals that are designed to enhance consistency and uniformity across the Combined Fund Complex. These proposals are intended to provide shareholders of the Combined Fund Complex with the potential to realize the full range of benefits resulting from a much larger mutual fund group, including: |

| | • | | Standardizing investment advisory fee rates and total management fee rates (i.e., the investment advisory fee rates and the administration/administrative fee rates), to the extent practicable, across funds in the Combined Fund Complex that are in the same investment category (e.g., the amendment would align the investment advisory fee rates of Columbia Select Small Cap Fund with those of other actively managed small-cap funds in the Combined Fund Complex) to promote uniformity of pricing among similar funds; |

| | • | | Implementing contractual expense limitations that will generally cap total annual operating expense ratios for each fund in the Combined Fund Complex at levels that are at or below the median net operating expense ratio of funds in the respective fund’s peer group (as determined annually after the initial term by an independent third-party data provider); and |

| | • | | Correlating investment advisory and administration/administrative fee rates across the Combined Fund Complex commensurate with the level of services being provided. |

ii

The investment advisory fee rates payable by the IMS Fee Funds would increase at various asset levels (with current effective advisory fees increasing by up to 0.16% of average daily net assets depending on your IMS Fee Fund), as described in the accompanying Joint Proxy Statement. Even though certain fee rates will increase for certain funds, including the IMS Fee Funds, the net effect of the larger group of proposals, which for many of the funds comprising the Combined Fund Complex include reductions in administration/administrative fee rates and contractual expense limitations, is expected to be a reduction in the overall fees paid, on a cumulative basis, by the various funds comprising the Combined Fund Complex. Thus, on a cumulative basis, shareholders, many of whom own shares of more than one fund, may pay lower fees overall even if the fee rate of a particular fund is increasing.

| Q. | How would the proposed increase in investment advisory fee rates affect my Fund’s expenses? |

| A. | Although the proposed amendment to the IMS Agreement would result in higher investment advisory fee rates payable by the IMS Fee Funds at various asset levels, it would not necessarily result in higher gross expenses for most of those Funds in light of their current asset levels and contemporaneous reductions in other fee rates. In this regard, for most IMS Fee Funds at all or most asset levels, reductions in administrative fee rates will fully offset increases in advisory fee rates.Unlike investment advisory fee rates, administrative fee rates may be increased in the future without a shareholder vote. |

Moreover, the fees actually paid by the IMS Fee Funds will be limited by contractual expense limitations that will generally cap total annual operating expense ratios at levels that are at or below the median net operating expense ratio of the funds in the respective Fund’s peer group. These commitments may mitigate the impact of any fee rate increases resulting from the amended fee schedules.

Comparisons of the investment advisory fee rates for each IMS Fee Fund, and, if its effective investment advisory fee rates would increase, gross and net expense ratios, are included in the accompanying Joint Proxy Statement. If you do not hold shares of an IMS Fee Fund, the investment advisory fee rates payable by your Fund under the proposed amendment will not increase from the investment advisory fee rates currently payable by your Fund.

| Q. | For certain Funds, why am I being asked to approve a change to my Fund’s diversification status? |

| A. | Proposal 2 asks the shareholders of each of Columbia California Tax-Exempt Fund and Columbia Connecticut Tax-Exempt Fund (each, a “Policy Change Fund” and collectively, the “Policy Change Funds”) to approve a change in the classification of their Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the 1940 Act (the “Reclassification”). Currently, the Policy Change Funds are classified as “diversified” funds. This means that each Policy Change Fund may not, with respect to 75% of its total assets, invest more than 5% of its total assets in securities of any one issuer or purchase more than 10% of the outstanding voting securities of any one issuer, except obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities and except securities of other investment companies. With respect to the remaining 25% of the Fund’s total assets, there is no limitation on the amount of assets the Policy Change Fund may invest in any one issuer. |

By changing its classification to a “non-diversified” fund, each Policy Change Fund would no longer be subject to these restrictions, but would continue to be subject to other diversification restrictions and would continue to invest principally in municipal bonds that pay interest that is exempt from a particular state’s individual income tax. As a result of this change, Columbia Management, on behalf of each Policy Change Fund, would be able to invest the Fund’s assets in a smaller number of issuers. Thus, the Reclassification enhances Columbia Management’s flexibility to invest each Policy Change Fund’s assets by easing a restriction on Columbia Management’s ability to manage the portfolios. Columbia Management believes this increased investment flexibility may provide each Policy Change Fund with more opportunities to enhance its performance. However, because the appreciation or depreciation of a single bond may have a greater impact on the net asset value of each Policy Change Fund, its share price may fluctuate more than a comparable fund which is classified as diversified.

iii

| Q. | For Columbia Real Estate Equity Fund, why am I being asked to approve the conversion of my Fund’s investment objective and a related 80% policy from “fundamental” to “non-fundamental”? |

| A. | Proposal 3 asks shareholders of Columbia Real Estate Equity Fund (the “Real Estate Fund”) to approve the conversion of its investment objective from “fundamental” to “non-fundamental”. By changing the investment objective and policy to non-fundamental, the Board of Trustees (the “Board”) of the Trust will be able to modify Columbia Real Estate Equity Fund’s investment objective and the related policy in the future without having to obtain shareholder approval. |

Columbia Management and the Board are not currently proposing to change Columbia Real Estate Equity Fund’s investment objective or the related policy, nor are there currently any plans to change Columbia Real Estate Equity Fund’s investment objective or the related policy in the future. Any future changes, however, would require the approval only of the Board. Columbia Real Estate Equity Fund would be required to provide shareholders with at least 60 days’ prior notice of any future change to its policy of investing at least 80% of its net assets in equity securities of companies principally engaged in the real estate industry, including real estate investment trusts.

Changing the investment objective from “fundamental” to “non-fundamental” will give Columbia Management and the Board additional flexibility to make changes to Columbia Real Estate Equity Fund’s investment objective or the related policy that they deem appropriate in the future, to address changing market conditions or performance issues, while saving Columbia Real Estate Equity Fund shareholders the cost of a proxy solicitation.

| Q. | How does the Board recommend that I vote? |

| A. | The Board unanimously recommends that you vote FOR each proposal. |

| Q. | Will my Fund pay for this proxy solicitation? |

| A. | No. Columbia Management or an affiliated company will bear all of these costs. |

| A. | You can vote in one of four ways: |

| | • | | By telephone: Call the toll-free number printed on the enclosed Proxy Card(s) and follow the directions. |

| | • | | By internet: Access the website address printed on the enclosed Proxy Card(s) and follow the directions on the website. |

| | • | | By mail: Complete, sign and return the enclosed Proxy Card(s) in the enclosed self-addressed, postage-paid envelope. |

| | • | | In person at the Meeting scheduled to occur on February 15, 2011 at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111, at1:00 p.m. (Eastern). If you decide to vote in person, you must attend the Meeting at the time and place described in the accompanying Joint Proxy Statement. To attend the Meeting in person, you will need proof of ownership of the shares of the relevant Fund, such as your Proxy Card (or a copy thereof) or, if your shares are held of record by a financial intermediary, such as a broker, or nominee, a Proxy Card from the record holder or other proof of beneficial ownership, such as a brokerage statement showing your holdings of the shares of the relevant Fund. |

| Q. | Why might I receive more than one Proxy Card? |

| A. | If you own shares of more than one Fund or own shares of a Fund in more than one account, you may receive a separate Proxy Card for each such Fund or account, and should vote each Proxy Card received. |

iv

| Q. | Will I be notified of the results of the vote? |

| A. | The final voting results will be included in each Fund’s next report to shareholders following the Meeting. |

| Q. | Whom should I call if I have questions? |

| A. | If you have questions about any of the proposals described in the Joint Proxy Statement or about voting procedures, please call the Funds’ proxy solicitor, Computershare Fund Services, toll free at (800) 708-7953. |

v

NOTICE OF A JOINT SPECIAL MEETING OF SHAREHOLDERS

| | |

| Columbia Balanced Fund | | Columbia Intermediate Municipal Bond Fund |

| Columbia Bond Fund | | Columbia International Bond Fund |

| Columbia California Tax-Exempt Fund | | Columbia Large Cap Growth Fund |

| Columbia Connecticut Tax-Exempt Fund | | Columbia Pacific/Asia Fund |

| Columbia Contrarian Core Fund | | Columbia Real Estate Equity Fund |

| Columbia Corporate Income Fund | | Columbia Select Large Cap Growth Fund |

| Columbia Emerging Markets Fund | | Columbia Select Small Cap Fund |

| Columbia Energy and Natural Resources Fund | | Columbia Small Cap Core Fund |

| Columbia High Yield Municipal Fund | | Columbia Strategic Income Fund |

| Columbia High Yield Opportunity Fund | | Columbia Strategic Investor Fund |

| Columbia Intermediate Bond Fund | | Columbia Value and Restructuring Fund |

to be held on February 15, 2011

A Joint Special Meeting of Shareholders (the “Meeting”) of each Fund and of Columbia Funds Series Trust I (the “Trust”), as a whole, will be held at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111, at 1:00 p.m. (Eastern) on February 15, 2011. At the Meeting, shareholders will be asked to:

| | | | |

Proposal | | Funds Covered by Proposal |

| 1. | | Approve a proposed amendment to the Investment Management Services Agreement between the Trust, on behalf of the Fund, and Columbia Management Investment Advisers, LLC to increase the investment advisory fee rate payable by the Fund at various asset levels. | | Columbia Balanced Fund Columbia Bond Fund Columbia Contrarian Core Fund Columbia Corporate Income Fund Columbia Emerging Markets Fund Columbia Energy and Natural Resources Fund Columbia High Yield Municipal Fund Columbia High Yield Opportunity Fund Columbia Intermediate Bond Fund Columbia Intermediate Municipal Bond Fund Columbia International Bond Fund Columbia Large Cap Growth Fund Columbia Pacific/Asia Fund Columbia Select Large Cap Growth Fund Columbia Select Small Cap Fund Columbia Small Cap Core Fund Columbia Strategic Income Fund Columbia Strategic Investor Fund Columbia Value and Restructuring Fund |

| | |

| 2. | | Approve a reclassification of the Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the Investment Company Act of 1940. | | Columbia California Tax-Exempt Fund Columbia Connecticut Tax-Exempt Fund |

| | |

| 3. | | Approve the conversion of the Fund’s investment objective and a related 80% policy from “fundamental” to “non-fundamental”. | | Columbia Real Estate Equity Fund |

Please take some time to read the enclosed Joint Proxy Statement. It discusses these proposals in more detail. If you were a shareholder of a Fund as of the close of business on December 17, 2010, you may vote at the Meeting or at any adjournment of the Meeting on the proposal(s) applicable to your Fund(s). You are welcome to attend the Meeting in person. If you cannot attend in person to cast your vote, please vote by mail, telephone or internet. Just follow the instructions on the enclosed Proxy Card. If you have questions, please call the Funds’ proxy solicitor toll free at (800) 708-7953. It is important that you vote. The Board of Trustees of the Trust unanimously recommends that you vote FOR each nominee and FOR all other proposals in the Joint Proxy Statement.

By order of the Board of Trustees,

Scott R. Plummer, Secretary

December 20, 2010

-2-

Columbia Funds Series Trust I

One Financial Center, Boston, Massachusetts 02111

| | |

Columbia Balanced Fund | | Columbia Intermediate Municipal Bond Fund |

Columbia Bond Fund | | Columbia International Bond Fund |

Columbia California Tax-Exempt Fund | | Columbia Large Cap Growth Fund |

Columbia Connecticut Tax-Exempt Fund | | Columbia Pacific/Asia Fund |

Columbia Contrarian Core Fund | | Columbia Real Estate Equity Fund |

Columbia Corporate Income Fund | | Columbia Select Large Cap Growth Fund |

Columbia Emerging Markets Fund | | Columbia Select Small Cap Fund |

Columbia Energy and Natural Resources Fund | | Columbia Small Cap Core Fund |

Columbia High Yield Municipal Fund | | Columbia Strategic Income Fund |

Columbia High Yield Opportunity Fund | | Columbia Strategic Investor Fund |

Columbia Intermediate Bond Fund | | Columbia Value and Restructuring Fund |

(each, a “Fund” and collectively, the “Funds”)

JOINT PROXY STATEMENT

Joint Special Meeting of Shareholders to be held on February 15, 2011

This Joint Proxy Statement is furnished to you in connection with the solicitation of proxies by the board of trustees (the “Board”) of Columbia Funds Series Trust I (the “Trust”) relating to a Joint Special Meeting of Shareholders (the “Meeting”) of the Funds and the Trust as a whole to be held at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111 on February 15, 2011 at 1:00 p.m. (Eastern). It is expected that this Joint Proxy Statement will be mailed to shareholders on or about January 5, 2011.

The purpose of the Meeting is to ask Fund shareholders to:

| | | | |

Proposal | | Funds Covered by Proposal |

| 1. | | Approve a proposed amendment to the Investment Management Services Agreement between the Trust, on behalf of the Fund, and Columbia Management Investment Advisers, LLC to increase the investment advisory fee rate payable by the Fund at various asset levels. | | Columbia Balanced Fund Columbia Bond Fund Columbia Contrarian Core Fund Columbia Corporate Income Fund Columbia Emerging Markets Fund Columbia Energy and Natural Resources Fund Columbia High Yield Municipal Fund Columbia High Yield Opportunity Fund Columbia Intermediate Bond Fund Columbia Intermediate Municipal Bond Fund Columbia International Bond Fund Columbia Large Cap Growth Fund Columbia Pacific/Asia Fund Columbia Select Large Cap Growth Fund Columbia Select Small Cap Fund Columbia Small Cap Core Fund Columbia Strategic Income Fund Columbia Strategic Investor Fund Columbia Value and Restructuring Fund |

| | | | |

Proposal | | Funds Covered by Proposal |

| 2. | | Approve a reclassification of the Fund from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the Investment Company Act of 1940 (“1940 Act”). | | Columbia California Tax-Exempt Fund Columbia Connecticut Tax-Exempt Fund |

| | |

| 3. | | Approve the conversion of the Fund’s investment objective and a related 80% policy from “fundamental” to “non-fundamental”. | | Columbia Real Estate Equity Fund |

Additional information about the Funds is available in their respective prospectuses, statements of additional information and semi-annual and annual reports to shareholders. The Funds’ most recent semi-annual and annual reports previously have been mailed to shareholders. Additional copies of any of these documents are available without charge upon request by writing Columbia Management Investment Services, Corp., P.O. Box 8081, Boston, MA 02266-8081 or by calling (800) 345-6611. All of these documents also are filed with the U.S. Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov.

-2-

TABLE OF CONTENTS

-3-

GENERAL OVERVIEW

Proposal 1: Approve Amendment to Investment Management Services Agreement

The shareholders of certain Funds are being asked to approve a proposed amendment to the Investment Management Services Agreement between the Trust, on behalf of the Funds, and Columbia Management Investment Advisers, LLC (“Columbia Management”). The proposed amendment, if approved, is designed to achieve consistent investment management service and fee structures across the Columbia-branded funds (the “Columbia Fund Complex”) and the funds that were formerly (and in some cases, currently) branded as RiverSource, Seligman and Threadneedle funds (the “RiverSource Fund Complex,” and together with the Columbia Fund Complex, the “Combined Fund Complex”). Except for the investment advisory fee rates payable by these Funds, the Investment Management Services Agreement for such Funds would remain the same in all respects. Information about the proposed amendment to the Investment Management Services Agreement is set forth under Proposal 1.

Proposal 2: Approve Reclassification of Fund from a “Diversified” Fund to a “Non-Diversified” Fund

The shareholders of Columbia California Tax-Exempt Fund and Columbia Connecticut Tax-Exempt Fund (each, a “Policy Change Fund” and collectively, the “Policy Change Funds”) are being asked to approve a change in the classification of their Fund (each, a “Reclassification” and collectively, the “Reclassifications”) from a “diversified” fund to a “non-diversified” fund, as such terms are defined in the 1940 Act. The Reclassifications would enhance Columbia Management’s flexibility to invest each Policy Change Fund’s assets by easing a restriction on Columbia Management’s ability to manage the portfolios. Information about the Reclassifications is set forth under Proposal 2.

Proposal 3: Approve Conversion of Fundamental Objective and Policy of Columbia Real Estate Equity Fund

The shareholders of Columbia Real Estate Equity Fund are being asked to approve the conversion of the Fund’s investment objective and a related 80% policy from “fundamental” (requires shareholder approval to modify in the future) to “non-fundamental” (does not require shareholder approval to modify in the future) (the “Conversion”). Changing the investment objective and the related policy from “fundamental” to “non-fundamental” will give Columbia Management and the Board additional flexibility to make changes to Columbia Real Estate Equity Fund’s investment objective that they deem appropriate in the future, to address changing market conditions or performance issues, while saving Columbia Real Estate Equity Fund the cost of a proxy solicitation. Information about the Conversion is set forth under Proposal 3.

Effectiveness of the Proposals

None of the proposals is contingent on the outcome of any other proposal. In addition, approval of a proposal by one Fund is not contingent on the approval of the same proposal by any other Fund.

-4-

PROPOSAL 1 – APPROVE AMENDMENT TO IMS AGREEMENT

| | |

Columbia Balanced Fund | | Columbia International Bond Fund |

Columbia Bond Fund | | Columbia Large Cap Growth Fund |

Columbia Contrarian Core Fund | | Columbia Pacific/Asia Fund |

Columbia Corporate Income Fund | | Columbia Select Large Cap Growth Fund |

Columbia Emerging Markets Fund | | Columbia Select Small Cap Fund |

Columbia Energy and Natural Resources Fund | | Columbia Small Cap Core Fund |

Columbia High Yield Municipal Fund | | Columbia Strategic Income Fund |

Columbia High Yield Opportunity Fund | | Columbia Strategic Investor Fund |

Columbia Intermediate Bond Fund | | Columbia Value and Restructuring Fund |

Columbia Intermediate Municipal Bond Fund | | |

(each, an “IMS Fee Fund” and collectively, the “IMS Fee Funds”)

Background

The Board has unanimously approved an amendment to the Investment Management Services Agreement (the “IMS Agreement”) between Columbia Management and the Trust, on behalf of each of the IMS Fee Funds. Under the 1940 Act, shareholder approval is required before any Fund can implement the proposed amendment. If shareholders of a Fund do not approve the proposed amendment, such Fund will continue operating pursuant to the IMS Agreement currently in effect.

The proposed amendment is part of a larger group of proposals aimed at further integrating the Columbia Fund Complex and the Combined Fund Complex following the acquisition by Ameriprise Financial, Inc., the parent company of Columbia Management, of the long-term asset management business of Columbia Management Group, LLC and certain of its affiliated companies from Bank of America, N.A. (the “Transaction”). The proposed amendment, if approved, is designed to achieve consistent investment management service and fee structures across the Combined Fund Complex. Under the proposed amendment, the Funds would continue to be managed by Columbia Management and are expected to receive services that are the same as the services provided under the current IMS Agreement. The proposed amendment to the IMS Agreement for each IMS Fee Fund would increase the investment advisory fee rate payable by such IMS Fee Fund to Columbia Management at various asset levels. Depending on the Fund, current effective advisory fees would increase by up to 0.16% of average daily net assets depending on the IMS Fee Fund. Each IMS Fee Fund’s operations and the manner in which Columbia Management manages the IMS Fee Fund are not expected to change as a result of this amendment. More specifically, except for the investment advisory fee rates payable by an IMS Fee Fund, the IMS Agreement for such IMS Fee Funds would remain the same in all respects. In addition, as described in more detail below, the proposed amendment would not necessarily result in higher gross expenses for many of these Funds in light of their current asset levels and contemporaneous reductions in other fee rates.

A description of key terms and provisions of the IMS Agreement follows. Additional details about the effects of the proposed amendment on the IMS Fee Funds’ fee rates are set forth under “Changes to Investment Advisory Fee Rates” and “Board Considerations” below. Additional information about Columbia Management is provided inAppendix A.

Description of IMS Agreement

The current IMS Agreement is dated as of May 1, 2010 and was last approved by shareholders of the Funds at a joint special meeting of such shareholders that was held on March 3, 2010, in connection with the Transaction, which resulted in the termination of the Funds’ prior investment advisory agreement with the Funds’ prior investment adviser.

-5-

The IMS Agreement generally provides that, subject to oversight by the Board and the authorized officers of the Trust, Columbia Management agrees to: continuously furnish the Funds with investment advice; decide what securities are to be purchased, held or sold, consistent with the Funds’ respective investment objectives, strategies and policies; perform investment research; prepare and make available to the Board all research and statistical data in connection therewith; and execute or cause the execution of purchase and sell orders for the Funds. The IMS Agreement adds that Columbia Management will determine which investments to make consistent with the Fund’s investment strategies, recommend changes to investment objectives, strategies and policies to the Board and furnish to the Board such reports, statistical data and other information relating to the investment management of the relevant Fund in the form and at such intervals that the Board may reasonably request.

Under the IMS Agreement, Columbia Management, in executing portfolio transactions and selecting brokers or dealers for a Fund, agrees to seek best execution. Columbia Management may consider not only the price of the security being traded (including commission or mark-up), but also other relevant facts such as, without limitation, the size and difficulty of the transaction, the characteristics of the security being traded, the broker-dealer’s financial condition and execution capabilities, or research or other information furnished to Columbia Management. The IMS Agreement explicitly contemplates that Columbia Management may, except where otherwise directed by the Board, execute transactions or pay to a broker or dealer who provides brokerage and research services a commission for executing a portfolio transaction for a Fund that is in excess of the amount of commission another broker or dealer would have charged for effecting the transaction, to the extent consistent with applicable law.

The IMS Agreement contemplates the engagement by Columbia Management of subadvisers for the Funds, and provides that Columbia Management may subcontract and pay for certain of the services described under the IMS Agreement, with the further understanding that the quality and level of services required to be provided under the agreement will not be diminished thereby and with the understanding that Columbia Management will obtain the approval of the Board and/or a Fund’s shareholders as required by applicable law, rules, regulations promulgated thereunder, the terms of the IMS Agreement, resolutions of the Board and Columbia Management’s commitments.

The IMS Agreement contemplates that Columbia Management will provide support as required or requested by the Board with respect to voting proxies solicited by or with respect to the issuers of securities owned by a Fund. The IMS Agreement also contemplates that Columbia Management may vote proxies and provide or withhold consents as directed by the Board from time to time.

The IMS Agreement generally requires that all information provided by a Fund to Columbia Management and vice versa be treated as confidential and non-disclosable to unaffiliated third parties except under limited circumstances. The IMS Agreement generally requires books and records to be maintained by Columbia Management on behalf of a Fund.

Fees

Under the IMS Agreement, each Fund pays a fee that is based on a percentage of the daily net assets of the Fund. The IMS Agreement provides for such fees to be accrued daily and paid monthly. Columbia Management is solely responsible for compensating any subadviser(s) for performing any of the duties delegated to them.

The aggregate amounts actually paid by each IMS Fee Fund to the prior investment adviser pursuant to the prior investment advisory agreement (which included fee schedules identical to those currently in effect) prior to May 1, 2010, and to Columbia Management under the current IMS Agreement for periods since May 1, 2010, in each case during such Fund’s last fiscal year, and the amounts that would have been paid if the proposed fee rates had been in effect, are set forth inAppendix B to this Joint Proxy Statement. The amounts paid by the IMS Fee Funds to Columbia Management and its affiliated persons during each

-6-

such Fund’s last fiscal year are also set forth inAppendix B. Information about the current and proposed fee rates for each IMS Fee Fund are set forth below under “Changes to Investment Advisory Fee Rates –Current and Proposed Management Fee Rates”. In addition, current and proposed fee tables for each IMS Fee Fund that would experience an increase in its effective investment advisory fee rate are set forth inAppendix C to this Joint Proxy Statement. Except for the fee rate changes described in this Proposal 1, there are no proposed fee rate changes that could increase the investment advisory fee rates payable under the IMS Agreement.

As noted below, Columbia Management has agreed to implement contractual expense limitations that will generally cap total annual operating expense ratios at levels that are at or below the median net operating expense ratio of the funds in the respective Fund’s peer group (as determined annually after the initial term by an independent third-party data provider), pursuant to a methodology mutually agreed upon by the Board and Columbia Management. These commitments may mitigate the impact of any fee increases resulting from any proposed investment advisory fee rate increases. Any contractual expense limitation may be revised or discontinued upon its expiration, unless sooner terminated by the Board in its discretion.

Payment of Expenses

The IMS Agreement requires Columbia Management to furnish at its expense the office space, supplies, equipment, clerical help and other personnel and services required to render its investment management services and to pay the compensation of the trustees or officers of the Trust who are directors, officers, or employees of Columbia Management (except to the extent that the Board specifically approves the payment by the Fund of all or a portion of such compensation). The IMS Agreement specifically notes that, except to the extent expressly assumed by Columbia Management, and except to the extent required by law to be paid or reimbursed by Columbia Management, Columbia Management will have no duty to pay any Fund operating expenses incurred in the organization and operation of the Fund.

Limits of Liability

Under the IMS Agreement, and subject to U.S. federal securities laws, neither Columbia Management nor any of its directors, officers, partners, principals, employees or agents will be liable for any acts or omissions or for any loss suffered by a Fund or the Fund’s shareholders or creditors, except for a loss resulting from willful misfeasance, bad faith or negligence on its part in the performance of its duties under the IMS Agreement or reckless disregard of its obligations or duties under the IMS Agreement.

Changes to Investment Advisory Fee Rates

The Board has approved, and recommends that shareholders of such IMS Fee Funds approve, an amendment to the IMS Agreement between Columbia Management and the Trust, on behalf of the IMS Fee Funds, that would increase the investment advisory fee rates payable by each IMS Fee Fund to Columbia Management at various asset levels. Except for the investment advisory fee rates payable, an IMS Agreement for such IMS Fee Fund would remain the same in all respects.

As indicated above, the proposed amendment to the IMS Agreement is part of a group of related proposals that are designed to enhance consistency and uniformity across the Combined Fund Complex. These proposals are intended to provide shareholders of the Combined Fund Complex with the potential to realize the full range of benefits resulting from a much larger mutual fund group, including:

| | • | | Standardizing investment advisory fee rates and total management fee rates (i.e., the investment advisory fee rates and the administration/administrative fee rates), to the extent practicable, across funds in the Combined Fund Complex that are in the same investment category (e.g., the amendment would align the investment advisory fee rates of Columbia Select Small Cap Fund with those of other actively managed small-cap funds in the Combined Fund Complex) to promote uniformity of pricing among similar funds; |

-7-

| | • | | Implementing contractual expense limitations that will generally cap total annual operating expense ratios for each fund in the Combined Fund Complex at levels that are at or below the median net operating expense ratio of funds in the respective fund’s peer group (as determined annually after the initial term by an independent third-party data provider); and |

| | • | | Correlating investment advisory and administration/administrative fee rates across the Combined Fund Complex commensurate with the level of services being provided. |

The investment advisory fee rates payable by the IMS Fee Funds would increase at various asset levels (with current effective advisory fees increasing by up to 0.16% of average daily net assets depending on the IMS Fee Fund). Even though certain fee rates will increase for certain funds, including the IMS Fee Funds, the net effect of the larger group of proposals, which for many of the funds comprising the Combined Fund Complex include reductions in administrative fee rates and contractual expense limitations, is expected to be a reduction in the overall fees paid, on a cumulative basis, by the various funds comprising the Combined Fund Complex. Thus, on a cumulative basis, shareholders, many of whom own shares of more than one fund, may pay lower fees overall even if the fee rate of a particular fund is increasing.

Although the proposed amendment to the IMS Agreement would result in higher investment advisory fee rates payable by the IMS Fee Funds at various asset levels, it would not necessarily result in higher gross expenses for most of those Funds in light of their current asset levels and contemporaneous reductions in other fee rates. In this regard, for many of the IMS Fee Funds, at all or most asset levels, reductions in administrative fee rates (which do not require shareholder approval but are contingent on shareholder approval of Proposal 1) will fully offset increases in advisory fee rates.Unlike investment advisory fee rates, administrative fee rates may be increased in the future without a shareholder vote.

The following chart provides additional information on a Fund-by-Fund basis about current and proposed investment advisory fee rates and administrative fee rates for the IMS Fee Funds and illustrates the impact of the changes to investment advisory fee rates and administrative fee rates on a consolidated basis.

-8-

Current and Proposed Management Fee Rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Current

Administrative | | | Total | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Proposed

Administrative | | | Total | |

Columbia Balanced Fund | | | All Assets | | | | 0.500 | % | | | 0.00 | % | | | 0.500 | % | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$12,000 >$12,000 |

| |

| 0.660

0.615 0.570 0.520 0.510 0.490 0.490 | %

% % % % % % | |

| 0.060

0.055 0.050 0.050 0.040 0.040 0.030 | %

% % % % % % | |

| 0.720

0.670 0.620 0.570 0.550 0.530 0.520 | %

% % % % % % |

| | | | | | | | |

Columbia Bond Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.650

0.350 0.320 0.290 0.280 0.270 | %

% % % % % | |

| 0.150

0.150 0.150 0.150 0.150 0.150 | %

% % % % % | |

| 0.800

0.500 0.470 0.440 0.430 0.420 | %

% % % % % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$9,000 $9,000-$12,000 $12,000-$20,000 $20,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.430

0.430 0.420 0.400 0.400 0.380 0.365 0.360 0.350 0.340 0.320 0.300 | %

% % % % % % % % % % % | |

| 0.070

0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % | |

| 0.500

0.495 0.480 0.460 0.450 0.430 0.415 0.410 0.390 0.380 0.360 0.340 | %

% % % % % % % % % % % |

| | | | | | | | |

Columbia Contrarian Core Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.700

0.650 0.600 0.550 0.530 0.510 | %

% % % % % | |

| 0.067

0.067 0.067 0.067 0.067 0.067 | %

% % % % % | |

| 0.767

0.717 0.667 0.617 0.597 0.577 | %

% % % % % | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$12,000 >$12,000 |

| |

| 0.710

0.665 0.620 0.570 0.560 0.540 0.540 | %

% % % % % % | |

| 0.060

0.055 0.050 0.050 0.040 0.040 0.030 | %

% % % % % % | |

| 0.770

0.720 0.670 0.620 0.600 0.580 0.570 | %

% % % % % % |

| | | | | | | | |

Columbia Corporate Income Fund | |

| $0-$250

$250-$500 $500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.420

0.420 0.375 0.370 0.340 0.330 0.320 | %

% % % % % % | |

| 0.150

0.125 0.125 0.100 0.100 0.100 0.100 | %

% % % % % % | |

| 0.570

0.545 0.500 0.470 0.440 0.430 0.420 | %

% % % % % % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$9,000 $9,000-$12,000 $12,000-$20,000 $20,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.430

0.430 0.420 0.400 0.400 0.380 0.365 0.360 0.350 0.340 0.320 0.300 | %

% % % % % % % % % % % | |

| 0.070

0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % | |

| 0.500

0.495 0.480 0.460 0.450 0.430 0.415 0.410 0.390 0.380 0.360 0.340 | %

% % % % % % % % % % % |

| | | | | | | | |

Columbia Emerging Markets Fund | |

| $0-$750

$750-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 1.150

1.000 0.670 0.620 0.570 0.520 | %

% % % % % | |

| 0.200

0.200 0.200 0.200 0.200 0.200 | %

% % % % % | |

| 1.350

1.200 0.870 0.820 0.770 0.720 | %

% % % % % | |

| $0-$750

$750-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 1.270

1.125 0.800 0.750 0.710 0.660 | %

% % % % % | |

| 0.080

0.075 0.070 0.070 0.060 0.060 | %

% % % % % | |

| 1.350

1.200 0.870 0.820 0.770 0.720 | %

% % % % % |

| | | | | | | | |

Columbia Energy and Natural Resources Fund | |

| $0-$1,000

$1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.600

0.520 0.470 0.450 0.430 | %

% % % % | |

| 0.150

0.150 0.150 0.150 0.150 | %

% % % % | |

| 0.750

0.670 0.620 0.600 0.580 | %

% % % % | |

| $0-$1,000

$1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.690

0.620 0.570 0.560 0.540 | %

% % % % | |

| 0.060

0.050 0.050 0.040 0.040 | %

% % % % | |

| 0.750

0.670 0.620 0.600 0.580 | %

% % % % |

-9-

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Current

Administrative | | | Total | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Proposed

Administrative | | | Total | |

Columbia High Yield Municipal Fund | |

| $0-$100

$100-$200 >$200 |

| |

| 0.450

0.425 0.400 | %

% % | |

| 0.150

0.125 0.100 | %

% % | |

| 0.600

0.550 0.500 | %

% % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$10,000 $10,000-$12,000 $12,000-$15,000 $15,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.470

0.470 0.445 0.420 0.395 0.370 0.360 0.350 0.350 0.340 0.320 0.300 | %

% % % % % % % % % % % | |

| 0.070

0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % | |

| 0.540

0.535 0.505 0.480 0.445 0.420 0.410 0.400 0.390 0.380 0.360 0.340 | %

% % % % % % % % % % % |

| | | | | | | | |

Columbia High Yield Opportunity Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 >$1,500 |

| |

| 0.600

0.550 0.520 0.490 | %

% % % | |

| 0.000

0.000 0.000 0.000 | %

% % % | |

| 0.600

0.550 0.520 0.490 | %

% % % | |

| $0-$250

$250-$500 $500-$750 $750-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$9,000 $9.000-$10,000 $10,000-$12,000 $12,000-$15,000 $15,000-$20,000 $20,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.590

0.575 0.570 0.560 0.550 0.540 0.515 0.490 0.475 0.450 0.435 0.435 0.425 0.400 0.385 0.360 | %

% % % % % % % % % % % % % % % | |

| 0.070

0.070 0.065 0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % % % % % | |

| 0.660

0.645 0.635 0.625 0.610 0.600 0.565 0.540 0.525 0.500 0.485 0.475 0.465 0.440 0.425 0.400 | %

% % % % % % % % % % % % % % % |

| | | | | | | | |

Columbia Intermediate Bond Fund | |

| $0-$1,000

$1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.350

0.300 0.290 0.280 0.270 | %

% % % % | |

| 0.150

0.150 0.150 0.150 0.150 | %

% % % % | |

| 0.500

0.450 0.440 0.430 0.420 | %

% % % % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$9,000 $9,000-$12,000 $12,000-$20,000 $20,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.430

0.430 0.420 0.400 0.400 0.380 0.365 0.360 0.350 0.340 0.320 0.300 | %

% % % % % % % % % % % | |

| 0.070

0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % | |

| 0.500

0.495 0.480 0.460 0.450 0.430 0.415 0.410 0.390 0.380 0.360 0.340 | %

% % % % % % % % % % % |

| | | | | | | | |

Columbia Intermediate Municipal Bond Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.480

0.430 0.400 0.370 0.360 0.350 | %

% % % % % | |

| 0.067

0.067 0.067 0.067 0.067 0.067 | %

% % % % % | |

| 0.547

0.497 0.467 0.437 0.427 0.417 | %

% % % % % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$9,000 $9,000-$10,000 $10,000-$12,000 $12,000-$15,000 $15,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.410

0.410 0.385 0.360 0.335 0.310 0.300 0.290 0.290 0.280 0.260 0.250 | %

% % % % % % % % % % % | |

| 0.070

0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % | |

| 0.480

0.475 0.445 0.420 0.385 0.360 0.350 0.340 0.330 0.320 0.300 0.290 | %

% % % % % % % % % % % |

-10-

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Current

Administrative | | | Total | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Proposed

Administrative | | | Total | |

Columbia International Bond Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 >$1,500 |

| |

| 0.550

0.500 0.470 0.440 | %

% % % | |

| 0.050

0.050 0.050 0.050 | %

% % % | |

| 0.600

0.550 0.520 0.490 | %

% % % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$12,000 $12,000-$20000 $20,000-$50,000 >$50,000 |

| |

| 0.570

0.570 0.525 0.520 0.515 0.510 0.500 0.490 0.480 0.470 | %

% % % % % % % % % | |

| 0.080

0.075 0.070 0.070 0.060 0.060 0.060 0.050 0.050 0.050 | %

% % % % % % % % % | |

| 0.650

0.645 0.595 0.590 0.575 0.570 0.560 0.540 0.530 0.520 | %

% % % % % % % % % |

| | | | | | | | |

Columbia Large Cap Growth Fund | |

| $0-$250

$250-$500 >$500 |

| |

| 0.700

0.575 0.450 | %

% % | |

| 0.050

0.050 0.050 | %

% % | |

| 0.750

0.625 0.500 | %

% % | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$12,000 >$12,000 |

| |

| 0.710

0.665 0.620 0.570 0.560 0.540 0.540 | %

% % % % % % | |

| 0.060

0.055 0.050 0.050 0.040 0.040 0.030 | %

% % % % % % | |

| 0.770

0.720 0.670 0.620 0.600 0.580 0.570 | %

% % % % % % |

| | | | | | | | |

Columbia Pacific/Asia Fund | |

| $0-$1,000

$1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.750

0.670 0.620 0.570 0.520 | %

% % % % | |

| 0.200

0.200 0.200 0.200 0.200 | %

% % % % | |

| 0.950

0.870 0.820 0.770 0.720 | %

% % % % | |

| $0-$1,000

$1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.870

0.800 0.750 0.710 0.660 | %

% % % % | |

| 0.080

0.070 0.070 0.060 0.060 | %

% % % % | |

| 0.950

0.870 0.820 0.770 0.720 | %

% % % % |

| | | | | | | | |

Columbia Select Large Cap Growth Fund | |

| $0-$1,000

$1,000-$1,500 $1,500-$3,000 $3,000-$6,000 >$6,000 |

| |

| 0.750

0.520 0.470 0.450 0.430 | %

% % % % | |

| 0.150

0.150 0.150 0.150 0.150 | %

% % % % | |

| 0.900

0.670 0.620 0.600 0.580 | %

% % % % | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$12,000 >$12,000 |

| |

| 0.710

0.665 0.620 0.570 0.560 0.540 0.540 | %

% % % % % % | |

| 0.060

0.055 0.050 0.050 0.040 0.040 0.030 | %

% % % % % % | |

| 0.770

0.720 0.670 0.620 0.600 0.580 0.570 | %

% % % % % % |

| | | | | | | | |

Columbia Select Small Cap Fund | |

| $0-$1,000

>$1,000 |

| |

| 0.750

0.620 | %

% | |

| 0.150

0.150 | %

% | |

| 0.900

0.770 | %

% | |

| $0-$500

$500-$1,000 $1,000-$3,000 $3,000-$12,000 >$12,000 |

| |

| 0.790

0.745 0.700 0.700 0.700 | %

% % % % | |

| 0.080

0.075 0.070 0.060 0.050 | %

% % % % | |

| 0.870

0.820 0.770 0.760 0.750 | %

% % % % |

| | | | | | | | |

Columbia Small Cap Core Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$2,000 >$2,000 |

| |

| 0.750

0.700 0.650 0.600 0.550 | %

% % % % | |

| 0.067

0.067 0.067 0.067 0.067 | %

% % % % | |

| 0.817

0.767 0.717 0.667 0.617 | %

% % % % | |

| $0-$500

$500-$1,000 $1,000-$3,000 $3,000-$12,000 >$12,000 |

| |

| 0.790

0.745 0.700 0.700 0.700 | %

% % % % | |

| 0.080

0.075 0.070 0.060 0.050 | %

% % % % | |

| 0.870

0.820 0.770 0.760 0.750 | %

% % % % |

| | | | | | | | |

Columbia Strategic Income Fund | |

| $0-$500

$500-$1,000 $1,000-$1,500 >$1,500 |

| |

| 0.600

0.550 0.520 0.490 | %

% % % | |

| 0.000

0.000 0.000 0.000 | %

% % % | |

| 0.600

0.550 0.520 0.490 | %

% % % | |

| $0-$500

$500-$1,000 $1,000-$2,000 $2,000-$3,000 $3,000-$6,000 $6,000-$7,500 $7,500-$9,000 $9,000-$10,000 $10,000-$12,000 $12,000-$15,000 $15,000-$20,000 $20,000-$24,000 $24,000-$50,000 >$50,000 |

| |

| 0.530

0.525 0.515 0.495 0.480 0.455 0.440 0.431 0.419 0.419 0.409 0.393 0.374 0.353 | %

% % % % % % % % % % % % % | |

| 0.070

0.065 0.060 0.060 0.050 0.050 0.050 0.050 0.050 0.040 0.040 0.040 0.040 0.040 | %

% % % % % % % % % % % % % | |

| 0.600

0.590 0.575 0.555 0.530 0.505 0.490 0.481 0.469 0.459 0.449 0.433 0.414 0.393 | %

% % % % % % % % % % % % % |

-11-

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Management Fees | | | Proposed Management Fees | |

Fund | | Fund Average

Daily Net Assets

(in millions) | | | Current

Advisory | | | Current

Administrative | | | Total | | | Fund Average

Daily Net

Assets

(in millions) | | | Proposed

Advisory | | | Proposed

Administrative | | | Total | |

| | | | | | | | |

Columbia Strategic Investor Fund | |

| $0-$500

$500-$1,000 >$1,000 |

| |

| 0.600

0.550 0.500 | %

% % | |

| 0.150

0.150 0.125 | %

% % | |

| 0.750

0.700 0.625 | %

% % | |

| $0-$500

$500-$1,000 $1,000-$1,500 $1,500-$3,000 $3,000-$6,000 $6,000-$12,000 >$12,000 |

| |

| 0.710

0.665 0.620 0.570 0.560 0.540 0.540 | %

% % % % % % | |

| 0.060

0.055 0.050 0.050 0.040 0.040 0.030 | %

% % % % % % | |

| 0.770

0.720 0.670 0.620 0.600 0.580 0.570 | %

% % % % % % |

| | | | | | | | |

Columbia Value and Restructuring Fund | |

| $0-$10,000

>$10,000 |

| |

| 0.600

0.430 | %

% | |

| 0.150

0.150 | %

% | |

| 0.750

0.580 | %

% | |

| $0-$7,000

$7,000-$8,000 $8,000-$10,000 $10,000-$12,000 >$12,000 |

| |

| 0.690

0.650 0.610 0.540 0.540 | %

% % % % | |

| 0.060

0.060 0.055 0.040 0.030 | %

% % % % | |

| 0.750

0.710 0.665 0.580 0.570 | %

% % % % |

The fees shown in the above table do not account for any contractual expense limitation agreements between Columbia Management and the IMS Fee Funds. In this regard, Columbia Management has agreed to implement contractual expense limitations that will generally cap total annual operating expense ratios for each IMS Fee Fund at levels that are at or below the median net expense ratio of the funds in the respective IMS Fee Fund’s peer group. These commitments may mitigate the impact of any fee changes resulting from the adoption of standardized fee schedules.Appendix C shows current and proposed fee tables for each IMS Fee Fund that would experience an increase in its effective advisory fee rate.While Columbia Management does not currently expect to change its practice of establishing annual contractual expense limitations, as described below, any contractual expense limitation may be revised or discontinued upon its expiration, unless sooner terminated by the Board in its discretion.

Annually, after the initial term, an independent third-party data provider will determine the median net expense ratio of a Fund’s Class A shares peer group, which includes many (but not all) funds with similar strategies as the Fund, as determined by the independent third-party data provider. The independent third-party data provider’s determination will then be used to adjust the contractual expense limitation for Class A shares of such Fund, if necessary. Columbia Management may, from time to time, establish a contractual expense limitation that is lower than the median net expense ratio determined by the independent third-party data provider. Corresponding contractual expense limitations (adjusted to reflect differences in transfer agency and/or distribution and service (Rule 12b-1) fees) will be implemented for other share classes. Actual fees and expenses will vary based upon the size of the Fund and other factors, and may be higher or lower than the amounts shown inAppendix C. The expense caps shown inAppendix C reflect peer group median net expense ratios as of early 2010, which are likely to change from year to year but will remain in place until at least the date shown in Appendix C.The amounts that would have been paid to Columbia Management by the IMS Fee Funds during the most recently completed fiscal year under the proposed investment advisory fee rates are also set forth inAppendix C.

Columbia Management has informed the Board that the reductions in administrative fee rates shown above are contingent on shareholder approval of the proposed amendment for the particular IMS Fee Fund. If shareholders of an IMS Fee Fund fail to approve the proposed amendment on behalf of such Fund, then Columbia Management will continue to serve as investment manager to the Fund pursuant to the IMS Agreement. All terms and conditions of the current IMS Agreement that are currently in effect, including the current investment advisory fee rates, would remain in effect. In addition, for such an IMS Fee Fund, there would be no corresponding reduction in administrative fee rates as described above.

In a separate proxy solicitation, shareholders of several other funds within the Combined Fund Complex (each, a “Selling Fund”) are being asked to vote to approve a reorganization (a “Reorganization”) of their fund

-12-

into certain buying funds (each, a “Buying Fund”). The Reorganizations, which were proposed by Columbia Management following the Transaction, are intended to combine funds in the Combined Fund Complex with generally similar investment objectives, strategies and policies. As a result of a Reorganization, a Buying Fund would gain assets, which tends to lead to greater efficiency and may reduce total operating expenses. The Board has determined, among other things, that participation by each Fund that is a Buying Fund in the Reorganization is in the best interests of the Buying Fund and that the interests of shareholders of the Buying Fund would not be diluted as a result of the Reorganization.

Shareholders of the IMS Fee Buying Funds are not being asked to vote on the Reorganizations. However, the closing of the Reorganizations is subject to a number of conditions including, for the Reorganizations involving Columbia Balanced Fund and Columbia Large Cap Growth Fund, which are both Buying Funds and IMS Fee Funds, approval of this Proposal 1 by the shareholders of such Funds. Therefore, even though shareholders of these Buying Funds are not being asked to vote on the Reorganization, approval of this Proposal 1 by shareholders of each such Buying Fund would satisfy one of the conditions of the proposed Reorganization. If shareholders of either such Fund fail to approve Proposal 1, the proposed Reorganization would not proceed, absent a waiver of this condition by the Selling Fund.

Accordingly, approval of this Proposal 1 by shareholders of Columbia Balanced Fund and Columbia Large Cap Growth Fund could benefit shareholders of such Funds by facilitating a Reorganization that results in an increase in its assets. Because there are numerous other conditions to closing, there can be no assurance that the Reorganization would be consummated, even if this condition is satisfied.

Board Considerations

In September 2010, the Board unanimously approved the amendment to the IMS Agreement on behalf of the IMS Fee Funds which would increase the contractual investment advisory fee rates payable at various asset levels by each IMS Fee Fund to Columbia Management for investment advisory services. As detailed below, the Board held numerous meetings and discussions with the management team of Columbia Management and reviewed and considered materials in connection with the approval of the investment advisory fee rates before determining to approve the amendment. The schedules of the current and proposed investment advisory fee rates for each IMS Fee Fund under its IMS Agreement are set forth above in Changes to Investment Advisory Fee Rates –Current and Proposed Management Fee Rates.” The amounts that would have been paid to Columbia Management by the IMS Fee Funds during the most recently completed fiscal year under the amended IMS Agreement are set forth inAppendix B.

On April 30, 2010, Ameriprise Financial, Inc. acquired the long-term asset management business of Columbia Management Group, LLC, a subsidiary of Bank of America Corporation and the parent of the IMS Fee Funds’ prior investment adviser. In connection with that acquisition, the IMS Fee Funds entered into the current IMS Agreement with Columbia Management, a subsidiary of Ameriprise Financial, Inc.

Beginning in April 2010, Columbia Management presented to the Advisory Fees and Expenses Committee (the “Committee”) of the Board a proposal to rationalize the fees and expenses, including the investment advisory fees, of the various registered investment companies in the Columbia Fund Complex. Because these funds were organized at different times by many different sponsors, their fees and expenses did not reflect a common overall design, and Columbia Management proposed to implement a more consistent schedule of fees for similar funds based on a uniform pricing model across all of the funds. In this regard, Columbia Management presented the Committee with various data comparing current and proposed fee schedules to the fee schedules of peer funds, as selected by an independent third-party data provider.

While Columbia Management projected that the proposed rationalization would reduce the overall fees and expenses payable, on a cumulative basis, by the various funds comprising the Combined Fund Complex, it was expected that certain fees and expenses, including investment advisory fees, would increase for certain funds. At

-13-

the same time, Columbia Management presented the Committee with proposals to provide for consistent administration/administrative fee schedules across funds in the same asset class and a consistent transfer agency fee schedule across the funds, as well as initial proposals to merge various funds and reduce custody fees for the funds. In connection with these proposals, the Committee and the trustees considered a proposal by Columbia Management to contractually limit the total operating expenses (subject to certain exclusions, such as taxes, transaction fees or brokerage commissions, fees and expenses associated with investment in other pooled investment vehicles, including exchange traded funds, other affiliated and unaffiliated mutual funds, and other expenses that are deemed extraordinary by the Board) of funds, the expenses of which generally exceed the median net expenses of such fund’s Class A shares peer group (as determined annually by an independent third-party data provider), to such median net expenses (or a lower, agreed-upon rate), and to generally limit the total expenses of such funds’ other classes to a corresponding amount, adjusted to reflect any class-specific expenses (including transfer agency fees and payments under any distribution plan, shareholder servicing plan, and/or plan administration agreement).

The Committee and the trustees who are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”) requested and evaluated materials from, and were provided materials and information regarding the IMS Agreement by, Columbia Management. The Committee, at meetings held on April 20, 2010, May 3, 2010, June 7, 2010, July 27, 2010 and August 10, 2010, and the Independent Trustees, at meetings held on April 20, 2010, May 4, 2010, June 7, 2010 and August 11, 2010, reviewed the materials provided in connection with their consideration of the amendment to the IMS Agreement and other matters relating to the proposals and discussed them with representatives of Columbia Management. The Committee and the Independent Trustees also reviewed and considered information that they had previously received in connection with their most recent consideration and approval of the current IMS Agreement with Columbia Management. They also consulted with Fund counsel and with the Independent Trustees’ independent legal counsel, who advised on the legal standards for consideration by the trustees and otherwise assisted the trustees in their deliberations. The trustees also met with, and reviewed and considered a report prepared and provided by, the independent fee consultant (the “Fee Consultant”) appointed by the Independent Trustees pursuant to an assurance of discontinuance entered into in 2005 by Columbia Management Advisors, LLC, the IMS Fee Funds’ prior adviser, with the New York Attorney General (“NYAG”) to settle a civil complaint filed by the NYAG relating to trading in mutual fund shares (the “NYAG Settlement”). Under the NYAG Settlement, the Fee Consultant’s role is to manage the process by which management fees are negotiated so that they are negotiated in a manner that is at arms’ length and reasonable. On August 10, 2010, the Committee recommended that the trustees approve the amendment to the IMS Agreement. On September 14, 2010, the trustees, including a majority of the Independent Trustees, approved the amendment to the IMS Agreement for each IMS Fee Fund, subject to shareholder approval.

The trustees considered all materials that they, their legal counsel or Columbia Management believed reasonably necessary to evaluate and to determine whether to approve the amendment to the IMS Agreement. The factors considered by the Committee and the trustees in recommending approval and approving the amendment to the IMS Agreement for each IMS Fee Fund included the following:

| | • | | The expected benefits of continuing to retain Columbia Management as the IMS Fee Funds’ investment manager; |

| | • | | The terms and conditions of the IMS Agreement, including the increase in the advisory fee schedule for each IMS Fee Fund; |

| | • | | The impact of the proposed changes in investment advisory fee rates, as well as proposed changes in administrative services, transfer agency and custody fee rates, on each IMS Fee Fund’s total expense ratio; |

| | • | | For IMS Fee Funds other than Columbia Balanced Fund, Columbia High Yield Opportunity Fund, Columbia Intermediate Municipal Bond Fund, Columbia International Bond Fund, Columbia Large Cap Growth Fund, Columbia Small Cap Core Fund and Columbia Strategic Income Fund, the reduction in the rates payable under that IMS Fee Fund’s administrative services agreement; |

-14-

| | • | | The willingness of Columbia Management to agree to contractually limit or cap total operating expenses for IMS Fee Funds, so that total operating expenses (subject to certain exclusions, such as taxes, transaction fees or brokerage commissions, fees and expenses associated with investment in other pooled investment vehicles, including exchange traded funds, other affiliated and unaffiliated mutual funds, and other expenses that are deemed extraordinary by the Board) of class A shares were not expected to exceed the median net expenses of such fund’s class A shares peer group (as determined by an independent third-party data provider); |

| | • | | That Columbia Management, and not any IMS Fee Fund, would bear the costs of obtaining any necessary shareholder approvals of the amendment to the IMS Agreement; |

| | • | | The expected impact on expenses for certain IMS Fee Funds of proposed mergers; and |

| | • | | The expected benefits of further integrating the Combined Fund Complex by: |

| | • | | Standardizing investment advisory fee rates and total management fee rates (i.e., the investment advisory fee rates and the administration/administrative fee rates), to the extent practicable, across funds in the Combined Fund Complex that are in the same investment category to promote uniformity of pricing among similar funds; |

| | • | | Implementing contractual expense limitations that will generally cap total annual operating expense ratios for each fund in the Combined Fund Complex at levels that are at or below the median net operating expense ratio of funds in the respective fund’s peer group (as determined annually after the initial term by an independent third-party data provider); and |

| | • | | Correlating investment advisory and administration/administrative fee rates across the Combined Fund Complex commensurate with the level of services being provided. |

Nature, Extent and Quality of Services

The trustees considered the nature, extent and quality of services provided to the IMS Fee Funds by Columbia Management under the IMS Agreement, and the resources dedicated to the IMS Fee Funds by Columbia Management and its affiliates. The trustees considered, among other things, the ability of Columbia Management to attract, motivate and retain highly qualified research, advisory and supervisory investment professionals (including Columbia Management’s personnel and other resources, compensation programs for personnel involved in fund management, reputation and other attributes), the portfolio management services provided by those investment professionals, the trade execution services provided on behalf of the IMS Fee Funds and the quality of Columbia Management’s investment research capabilities and the other resources that it devotes to each IMS Fee Fund. For each IMS Fee Fund, the trustees also considered the potential benefits to shareholders of investing in a mutual fund that is part of a fund complex offering exposure to a variety of asset classes and investment disciplines and providing a variety of fund and shareholder services. The trustees also considered that the nature, extent and quality of services proposed to be provided under the amended IMS Agreement were not expected to change. After reviewing these and related factors, the trustees concluded, within the context of their overall conclusions, that the nature, extent and quality of the services to be provided to each IMS Fee Fund under the amended IMS Agreement supported the approval of the amended IMS Agreement.

Investment Performance

The trustees reviewed information about the performance of each IMS Fee Fund over various time periods, including information prepared by an independent third-party data provider that compared the performance of each IMS Fee Fund to the performance of peer groups of mutual funds and performance benchmarks. The trustees also reviewed a description of the third party’s methodology for identifying each Fund’s peer group for purposes of performance and expense comparisons. In the case of each IMS Fee Fund whose performance lagged that of a relevant peer group for certain (although not necessarily all) periods, the trustees concluded that other factors relevant to performance were sufficient, in light of other considerations, to warrant approval of the amendment to the IMS Fee Fund’s IMS Agreement. Those factors varied from Fund to Fund, but included one or

-15-

more of the following: (i) that the IMS Fee Fund’s performance, although lagging in certain recent periods, was stronger over the longer term; (ii) that the underperformance was attributable, to a significant extent, to investment decisions that were reasonable and consistent with the IMS Fee Fund’s investment strategy and policies and that the IMS Fee Fund was performing within a reasonable range of expectations, given those investment decisions, market conditions and the IMS Fee Fund’s investment strategy; (iii) that the IMS Fee Fund’s performance was competitive when compared to other performance benchmarks or peer groups; and (iv) that Columbia Management had taken or was considering steps designed to help improve the IMS Fee Fund’s investment performance, including, but not limited to, replacing portfolio managers, enhancing the resources supporting the portfolio managers, or modifying investment strategies.

The trustees noted the performance of each IMS Fee Fund, as of February 28, 2010, relative to that of a peer group selected by an independent third-party data provider for the purposes of performance comparisons, as set forth below.

| | | | |

IMS Fee Fund | | One Year Performance* | | Three Year Performance* |

Columbia Balanced Fund | | 3rd quintile | | 1st quintile |

Columbia Bond Fund | | 1st quintile | | 2nd quintile |

Columbia Contrarian Core Fund | | 2nd quintile | | 1st quintile |

Columbia Corporate Income Fund | | 2nd quintile | | 3rd quintile |

Columbia Emerging Markets Fund | | 3rd quintile | | 4th quintile |

Columbia Energy and Natural Resources Fund | | 5th quintile | | 2nd quintile |

Columbia High Yield Municipal Fund | | 4th quintile | | 3rd quintile |

Columbia High Yield Opportunity Fund | | 4th quintile | | 5th quintile |

Columbia Intermediate Bond Fund | | 2nd quintile | | 3rd quintile |

Columbia Intermediate Municipal Bond Fund | | 4th quintile | | 5th quintile |

Columbia International Bond Fund | | 5th quintile | | 5th quintile |

Columbia Large Cap Growth Fund | | 3rd quintile | | 3rd quintile |

Columbia Pacific/Asia Fund | | 3rd quintile | | 3rd quintile |

Columbia Select Large Cap Growth Fund | | 1st quintile | | 2nd quintile |

Columbia Select Small Cap Fund | | 2nd quintile | | 3rd quintile |

Columbia Small Cap Core Fund | | 2nd quintile | | 2nd quintile |

Columbia Strategic Income Fund | | 5th quintile | | 3rd quintile |

Columbia Strategic Investor Fund | | 2nd quintile | | 1st quintile |

Columbia Value and Restructuring Fund | | 1st quintile | | 2nd quintile |

| * | The best performance is in the first quintile. |

After reviewing these and related factors, the trustees concluded, within the context of their overall conclusions regarding the proposed amendment to the IMS Agreement, that the performance of each IMS Fee Fund and Columbia Management was sufficient to warrant the approval of the amendment to the IMS Agreement pertaining to that Fund.

Investment Advisory Fee Rates and Other Expenses

The trustees considered that the proposed amendment to the IMS Agreement would increase the contractual investment advisory fee rates payable by each IMS Fee Fund at all or certain assets levels and would be otherwise identical to each IMS Fee Fund’s current IMS Agreement. In addition, the trustees considered that, with the proposed fee reductions under the administrative services agreement, the combined contractual fee rates

-16-

under the IMS Agreement and the proposed administrative services agreement would be lower than the current combined contractual fee rates under those agreements at most asset levels for certain funds. The trustees also considered that based on its expenses for its most recent fiscal year, adjusted to give effect to the IMS Agreement and other proposed contractual changes, including the contractual expense limitations described above for IMS Fee Funds, each IMS Fee Fund’s contractual management fees and total net expenses would have been in the quintile of the peer group selected by an independent third-party data provider for purposes of expense comparisons, as set forth below.

| | | | |

IMS Fee Fund | | Contractual Management Fees* | | Total Net Expenses* |

Columbia Balanced Fund | | 4th quintile | | 2nd quintile |

Columbia Bond Fund | | 3rd quintile | | 1st quintile |