0000773840hon:CorporateAndReconcilingItemsMemberus-gaap:ServiceMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-8974

Honeywell International Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 22-2640650 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

| 855 South Mint Street | | 28202 |

| Charlotte, | North Carolina | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (704) 627-6200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $1 per share | | HON | | The Nasdaq Stock Market LLC |

| 3.500% Senior Notes due 2027 | | HON 27 | | The Nasdaq Stock Market LLC |

| 2.250% Senior Notes due 2028 | | HON 28A | | The Nasdaq Stock Market LLC |

| 3.375% Senior Notes due 2030 | | HON 30 | | The Nasdaq Stock Market LLC |

| 0.750% Senior Notes due 2032 | | HON 32 | | The Nasdaq Stock Market LLC |

| 3.750% Senior Notes due 2032 | | HON 32A | | The Nasdaq Stock Market LLC |

| 4.125% Senior Notes due 2034 | | HON 34 | | The Nasdaq Stock Market LLC |

| 3.750% Senior Notes due 2036 | | HON 36 | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the Registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of the common stock held by non-affiliates of the Registrant was approximately $138.7 billion at June 30, 2024.

There were 649,918,551 shares of Common Stock outstanding at January 24, 2025.

Documents Incorporated by Reference

Certain information required by Part III is incorporated by reference from the Registrant's definitive proxy statement for the Annual Meeting of Shareowners, or an amendment to this Form 10-K, which the Registrant intends to file with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

ORGANIZATION OF OUR ANNUAL REPORT ON FORM 10-K

The order and presentation of content in our Annual Report on Form 10-K (Form 10-K) differs from the traditional U.S. Securities and Exchange Commission (SEC) Form 10-K format. We believe that our format improves readability and better presents how we organize and manage our business. See Form 10-K Cross-Reference Index for a cross-reference to the traditional SEC Form 10-K format.

CAUTIONARY STATEMENT ABOUT

FORWARD-LOOKING STATEMENTS

We describe many of the trends and other factors that drive our business and future results in the section titled Management’s Discussion and Analysis of Financial Condition and Results of Operations and in other parts of this report (including under the section titled Risk Factors). Such discussions contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). Forward-looking statements are those that address activities, events, or developments that management intends, expects, projects, believes, or anticipates will or may occur in the future and include statements related to the proposed spin-off of the Company's Advanced Materials business into a stand-alone, publicly traded company and the proposed separation of Automation and Aerospace. They are based on management’s assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments, and other relevant factors, many of which are difficult to predict and outside of our control. They are not guarantees of future performance, and actual results, developments, and business decisions may differ significantly from those envisaged by our forward-looking statements. We do not undertake to update or revise any of our forward-looking statements, except as required by applicable securities law. Our forward-looking statements are also subject to material risks and uncertainties, including ongoing macroeconomic and geopolitical risks, such as lower GDP growth or recession, supply chain disruptions, capital markets volatility, inflation, and certain regional conflicts, that can affect our performance in both the near- and long-term. In addition, no assurance can be given that any plan, initiative, projection, goal, commitment, expectation, or prospect set forth in this Form 10-K can or will be achieved. These forward-looking statements should be considered in light of the information included in this Form 10-K, including, in particular, the factors discussed within the section titled Risk Factors. Such factors may be revised or supplemented in subsequent reports on Forms 10-Q and 8-K. Any forward-looking plans described herein are not final and may be modified or abandoned at any time.

1 Honeywell International Inc.

ABOUT HONEYWELL

Honeywell International Inc. (Honeywell, we, us, our, or the Company) is an integrated operating company serving a broad range of industries and geographies around the world. Our products and solutions enable a safer, more comfortable, and more productive world, enhancing the quality of life of people around the globe. Our business is aligned with three powerful megatrends – automation, the future of aviation, and energy transition – underpinned by our Honeywell Accelerator operating system and Honeywell Forge Internet of Things (IoT) platform. Our portfolio of solutions is uniquely positioned to blend physical products with software to serve customers worldwide. As a trusted partner, we help organizations solve the world's toughest, most complex challenges, providing actionable solutions and innovations through our Aerospace Technologies, Industrial Automation, Building Automation, and Energy and Sustainability Solutions business segments that help make the world smarter and safer, as well as more secure and sustainable. The Honeywell brand dates back to 1906, and the Company was incorporated in Delaware in 1985.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, are available free of charge on our Investor Relations website (investor.honeywell.com) under the heading Financials (see SEC Filings) immediately after they are filed with, or furnished to, the SEC. Honeywell uses our Investor Relations website, along with press releases on our primary Honeywell website (honeywell.com) under the heading News & Media, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our Investor Relations website and Honeywell News feed, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media. Information contained on or accessible through, including any reports available on, our website is not a part of, and is not incorporated by reference into, this Form 10-K or any other report or document we file with the SEC. Any reference to our website in this Form 10-K is intended to be an inactive textual reference only.

In addition, in this Form 10-K, the Company incorporates by reference certain information from its definitive Proxy Statement for the 2025 Annual Meeting of Stockholders (the Proxy Statement), which we expect to file with the SEC not later than 120 days after December 31, 2024, and which will also be available free of charge on our website.

2 Honeywell International Inc.

EXECUTIVE SUMMARY

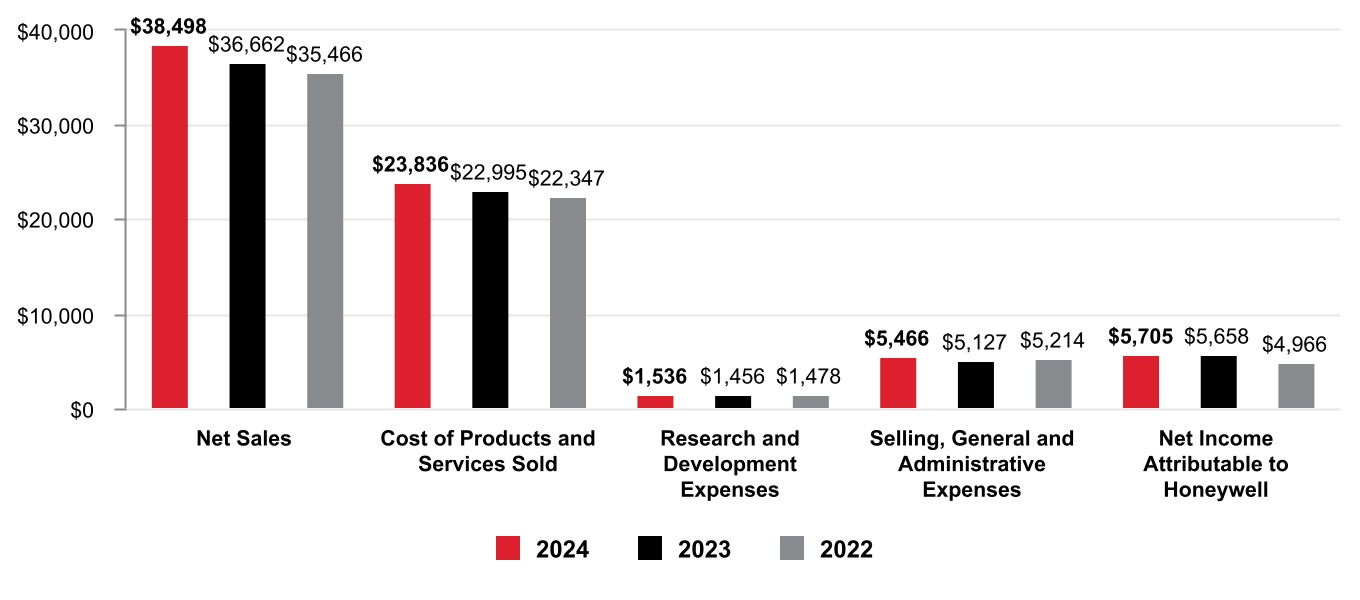

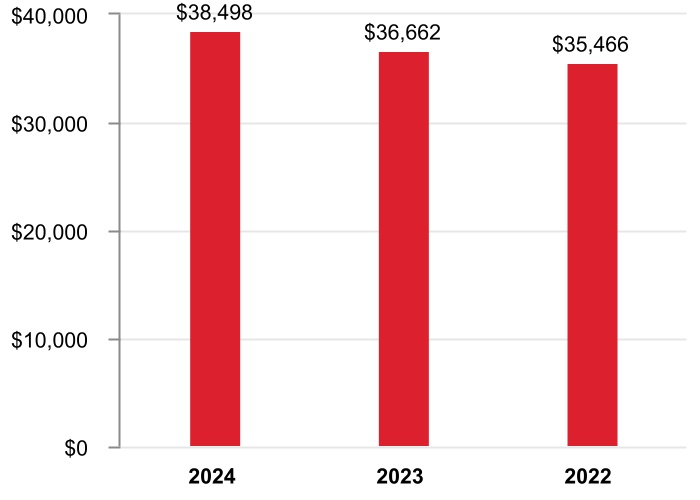

Leveraging our Honeywell Accelerator operating model, we demonstrated our commitment to portfolio transformation, growth, and operational execution while remaining focused on creating long-term shareowner value. In 2024, we delivered sales growth of 5%, achieving sales of $38.5 billion, with increases in three of our four reportable business segments, led by double-digit growth in our Aerospace Technologies business segment.

In 2024, we continued our portfolio realignment to three powerful megatrends (automation, the future of aviation, and the energy transition), and deployed $9 billion of capital across four acquisitions: Carrier Global Corporation's Global Access Solutions business (Access Solutions), CAES Systems Holdings LLC (CAES), Air Products' liquefied natural gas process technology and equipment business (LNG), and Civitanavi Systems S.p.A. We also committed to two strategic divestitures of non-core businesses announced in 2024, including the sale of our personal protection equipment (PPE) business and our intent to spin off our Advanced Materials business into an independent, U.S. publicly traded company. Additionally, we announced in February 2025 our intent to pursue the separation of our Automation and Aerospace Technologies businesses into independent, U.S. publicly traded companies, forming three industry-leading public companies in Automation, Aerospace Technologies, and Advanced Materials. Refer to the section titled Management's Discussion and Analysis of Financial Condition and Results of Operations for further information. Also in 2024, we announced Honeywell Connected Enterprise (HCE) 3.0, advancing our software strategy by integrating HCE into each strategic business group, while maintaining our robust software development expertise at the center. We expect this strategy to deliver improved outcomes for our customers and drive sustained, accretive software growth across the portfolio. We further progressed Accelerator, deploying best practices by business model consistently across the portfolio and scaling our capabilities across business models to drive growth. We also leveraged Accelerator to support the integration of each of our acquisitions.

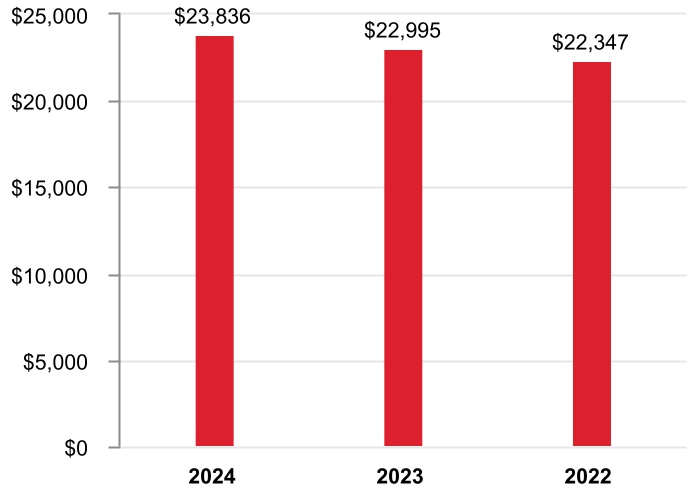

During the year, we deployed $14.6 billion to capital expenditures, dividends, share repurchases, and mergers and acquisitions. We opportunistically repurchased shares to maintain our commitment to reduce share count by at least 1% per year and increased our dividend for the fifteenth time in the last fourteen years.

As we look forward, we intend to continue deploying capital to high-return opportunities. We continue to carry a robust backlog of $35.3 billion as of December 31, 2024, that provides a strong foundation for future and sustained capital deployment to accelerate growth.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| YEAR IN REVIEW | |

| | | | | | | | |

| | | | | | | | |

| Sales up 5% | | | Robust backlog of | | | Operating cash flows of | |

| | | | | | | | |

| $38.5 BILLION | | | $35.3 BILLION | | | $6.1 BILLION | |

| as we remain focused on leveraging and evolving our Honeywell Accelerator operating model to deliver growth | | | as of year-end, demonstrating continued strong demand in our end markets and positioning us well to convert for future growth | | | as we remain focused on increasing operating cash flows through revenue growth, margin expansion, and improved working capital turnover | |

| | | | | | | | |

3 Honeywell International Inc.

BUSINESS OBJECTIVES

Our businesses focus on the following objectives:

4 Honeywell International Inc.

MAJOR BUSINESSES

We globally manage our business operations through four reportable business segments: Aerospace Technologies, Industrial Automation, Building Automation, and Energy and Sustainability Solutions. The remainder of Honeywell's operations is presented in Corporate and All Other, which is not a reportable business segment. Financial information related to our reportable business segments is included in Note 22 Segment Financial Data of Notes to Consolidated Financial Statements. | | | | | | | | | | | |

| | | |

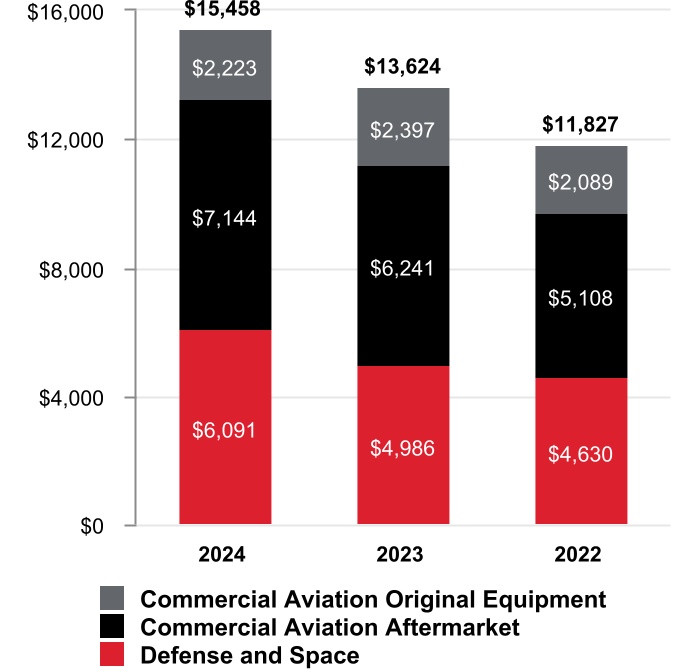

AEROSPACE TECHNOLOGIES Aerospace Technologies1 is a leading global supplier of products, software, and services for aircrafts that it sells to original equipment manufacturers (OEM) and other customers in a variety of end markets including air transport, regional, business and general aviation aircraft, airlines, aircraft operators, and defense and space contractors. Aerospace Technologies products and services include auxiliary power units, propulsion engines, environmental control systems, integrated avionics, wireless connectivity services, electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, management and technical services, advanced systems and instruments, satellite and space components, aircraft wheels and brakes, and thermal systems. Aerospace Technologies also provides spare parts, repair, overhaul, and maintenance services (principally to aircraft operators), and sells licenses or intellectual property to other parties. Our Honeywell Forge solutions enable our customers to turn data into predictive maintenance and predictive analytics to enable better fleet management and make flight operations more efficient. | |

| 1 | | On February 6, 2025, the Company announced its intention to separate its Automation and Aerospace Technologies businesses into independent, U.S. publicly traded companies. |

| | | | | | | | |

| 2024 Full-year revenue of $15,458 million | |

| 2024 Full-year revenue by business unit | |

| | |

| $2,223 million | $7,144 million | $6,091 million |

| Commercial Aviation Original Equipment | Commercial Aviation Aftermarket | Defense and Space |

| | | | | | | | | | | |

| | | |

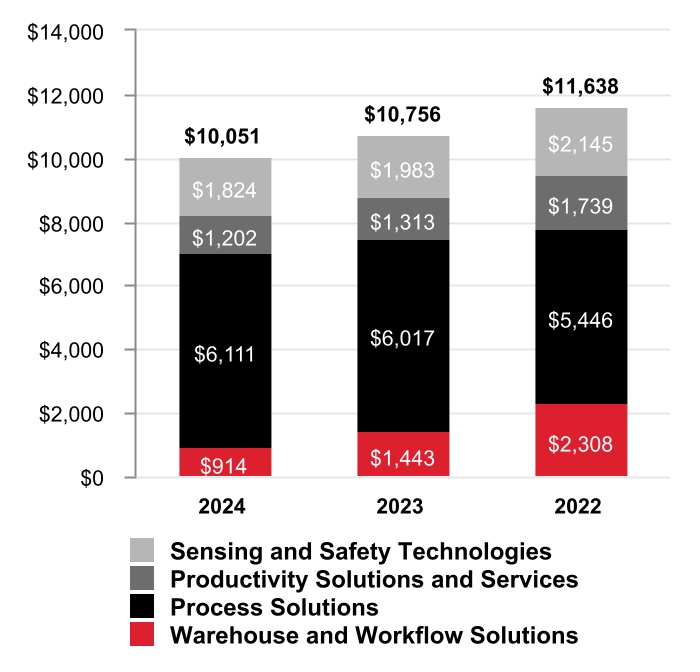

INDUSTRIAL AUTOMATION Industrial Automation is a global provider of industrial automation solutions that deliver intelligent, sustainable, and secure operations for customers in refining/petrochemicals, life sciences, utilities, and warehouse and logistics segments. With millions of installed assets, Industrial Automation deploys outcome-based solutions to increase asset utilization; improve operational efficiency and labor productivity; reduce carbon emissions with less energy consumption; and enhance cyber security for critical infrastructure and operational assets. Industrial Automation offerings include automation control and instrumentation products and services; smart energy products; sensing technologies with an array of custom-engineered sensors and services; gas detection technologies and personal protective equipment1; and system design, advanced automation equipment, software and analytics for manufacturing, distribution, and fulfillment operations. These products and services are combined with proprietary machine learning and artificial intelligence algorithms in products and projects which are digitally enabled through our industry leading industrial IoT platform, Honeywell Forge. | |

| 1 | | On November 22, 2024, the Company announced it reached an agreement to sell its personal protective equipment business. |

| | | | | | | | | | | |

| 2024 Full-year revenue of $10,051 million | |

| 2024 Full-year revenue by business unit | | |

| | | |

| $1,824 million | $1,202 million | $6,111 | $914 million |

| Sensing and Safety Technologies | Productivity Solutions and Services | Process Solutions | Warehouse and Workflow Solutions |

5 Honeywell International Inc.

| | | | | | |

| | |

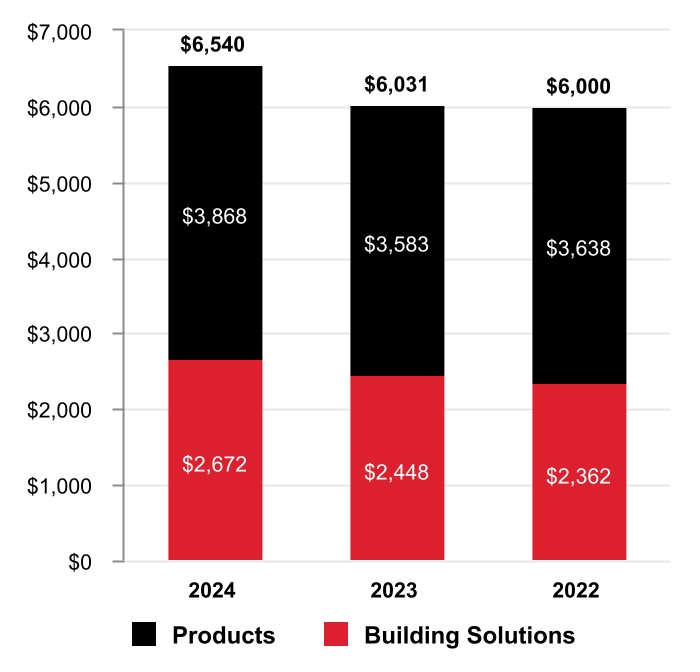

BUILDING AUTOMATION Building Automation is a leading global provider of products, software, solutions, and technologies that enable building owners and occupants to ensure their facilities are safe, energy efficient, sustainable, and productive. Building Automation products and services include advanced software applications for building control and optimization; sensors, switches, control systems, and instruments for energy management; access control; video surveillance; fire products; and installation, maintenance, and upgrades of systems. Our Honeywell Forge solutions enable our customers to digitally manage buildings, connecting data from different assets to enable smart maintenance, improve building performance, and even protect from incoming security threats. | |

| |

| | |

| | | | | |

| 2024 Full-year revenue of $6,540 million | |

| 2024 Full-year revenue by business unit | |

| |

| $3,868 million | $2,672 million |

| Products | Building Solutions |

| | | | | | | | | | | |

| | | |

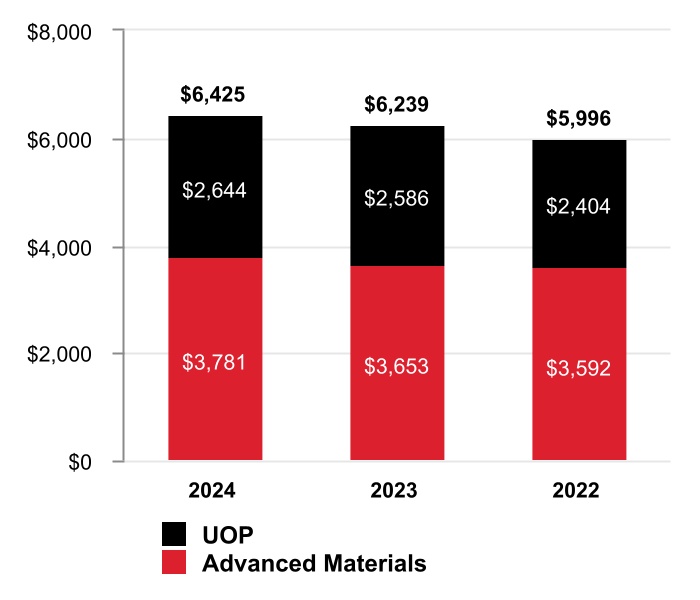

ENERGY AND SUSTAINABILITY SOLUTIONS Energy and Sustainability Solutions is a leading global provider of industry leading technology, processing, and licensing capabilities combined with material science capabilities and innovative chemistry to offer focused solutions integral to facilitating the world's energy transition. The reportable business segment is comprised of UOP and Advanced Materials1 business units. The UOP business provides sustainable aviation fuels, petrochemical, refining, and natural gas liquefaction technologies, and carbon management solutions across multiple sectors through process technology solutions, products, including catalysts and adsorbents, equipment and aftermarket services. The Advanced Materials business provides customers with its Solstice lower global warming potential refrigeration and heating solutions, Spectra fibers for high end protective armor and medical applications, and leading-edge semiconductor materials. Our Honeywell Forge solutions serve customer asset productivity and efficiency needs by providing connectivity, data integration, and software solutions to generate a holistic view of their operations. | |

| 1 | | On October 8, 2024, the Company announced its intention to spin off its Advanced Materials business into an independent, U.S. publicly traded company. |

| | | | | |

| 2024 Full-year revenue of $6,425 million |

| 2024 Full-year revenue by business unit |

| |

| $2,644 million | $3,781 million |

| UOP | Advanced Materials |

6 Honeywell International Inc.

COMPETITION

We are subject to competition in substantially all product and service areas. Some of our key competitors include but are not limited to:

| | | | | | | | | | | |

| | | |

| AEROSPACE TECHNOLOGIES | BUILDING AUTOMATION |

•Garmin •L3 Harris •Northrop Grumman | •RTX Corporation •Safran •Thales | •Johnson Controls •Schneider Electric | •Siemens |

| | | | | | | | | | | |

| | | |

| ENERGY AND SUSTAINABILITY SOLUTIONS | INDUSTRIAL AUTOMATION |

•Arkema •Axens

| •Chemours •Haldor Topsoe

| •Dematic •Emerson Electric •Itron •MSA Safety Incorporated

| •Rockwell Automation •TE Connectivity •Zebra Technologies

|

Our businesses compete on a variety of factors such as performance, applied technology, product innovation, product recognition, quality, reliability, customer service, delivery, and price. Brand identity, service to customers, and quality are important competitive factors for our products and services. Our products face considerable price competition. While our competitive position varies among our products and services, we are a significant competitor in each of our major product and service areas.

BACKLOG

Our backlog represents the estimated remaining value of work to be performed under firm contracts. Backlog is equal to our remaining performance obligations under the contracts that meet the guidance on revenue from contracts with customers as discussed in Note 3 Revenue Recognition and Contracts with Customers of Notes to Consolidated Financial Statements. Backlog was $35,277 million and $31,777 million as of December 31, 2024, and 2023, respectively. We expect to recognize approximately 54% of our remaining performance obligations as revenue in 2025, and the remaining balance thereafter. U.S. GOVERNMENT SALES

The Company, principally through our Aerospace Technologies reportable business segment, sells to the U.S. government acting through its various departments and agencies and through prime contractors, including the U.S. Department of Defense (as both a prime contractor and subcontractor). We do not expect our overall operating results to be significantly affected by any proposed changes in 2025 federal defense spending due to the varied mix of the government programs which impact us (OEM production, engineering development programs, aftermarket spares and repairs, and overhaul programs), as well as our diversified customer base with commercial dual-use technologies.

| | | | | | | | | | | | | | | | | |

| U.S. government sales ($ in millions) | Years Ended December 31, |

| 2024 | | 2023 | | 2022 |

| Sales to the U.S. Department of Defense | $ | 3,830 | | | $ | 2,933 | | | $ | 2,886 | |

| Sales to other U.S. government departments and agencies | 516 | | | 508 | | | 546 | |

| Total sales to the U.S. government | $ | 4,346 | | | $ | 3,441 | | | $ | 3,432 | |

7 Honeywell International Inc.

INTERNATIONAL OPERATIONS

We engage in manufacturing, sales, service, and research and development globally. U.S. exports and non-U.S. manufactured products are significant to our operations. U.S. exports represented 14% of our total sales in 2024, 13% in 2023, and 12% in 2022. Non-U.S. manufactured products and services, mainly in Europe and Asia, were 43% of our total sales in 2024, 42% in 2023, and 40% in 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Manufactured products and systems and performance of services | Year Ended December 31, 2024 |

| Aerospace Technologies | | Industrial Automation | | Building Automation | | Energy and Sustainability Solutions |

| | (% of Segment Sales) |

| U.S. exports | 23 | % | | 3 | % | | 2 | % | | 23 | % |

| Non-U.S. manufactured products/services | 29 | % | | 56 | % | | 58 | % | | 42 | % |

Information related to risks associated with our foreign operations is included in the section titled Risk Factors under the caption “Macroeconomic and Industry Risks.” RAW MATERIALS

The vast majority of principal raw materials used in our operations are readily available. We maintain mitigation strategies to reduce the impact of disruptions, including digital solutions to assist in identifying and managing shortages, pricing actions, longer term planning for constrained materials, material supply tracking tools, and direct engagement with key suppliers to meet customer demand. We assist certain suppliers facing manufacturing challenges by committing our own resources to their sites and facilities. Our relationships with primary and secondary suppliers allow us to reliably source key components and raw materials. Where we cannot procure key components or raw materials, we consider altering existing products and developing new products to satisfy customer needs. Alterations to existing products and the development of new products undergo product quality controls and engineering qualification, prior to releasing to our customers. We continue to leverage existing supplier relationships and are not dependent on any one supplier for a material amount of our raw materials. We believe these mitigation strategies enable us to reduce supply risk, accelerate new product innovation, and expand our penetration in the markets we serve. Additionally, due to the strenuous quality controls and product qualification we perform on a new or altered product, these mitigation strategies have not impacted, and we do not expect them to impact, product quality or reliability.

Prices of certain key raw materials are expected to fluctuate. We offset potential raw material cost increases with formula-driven or long-term supply agreements, price increases, and hedging activities, where feasible. Tariffs on key components, particularly those resulting from trade tensions between major economies, continue to affect pricing and availability. We believe our short-term and long-term mitigation strategies position us well to mitigate and reduce the impact these factors may have on our businesses. As such, we do not presently anticipate that a shortage of raw materials will cause any material adverse impacts during 2025.

See the section titled Risk Factors for additional information on supply chain constraints. PATENTS, TRADEMARKS, LICENSES, AND DISTRIBUTION RIGHTS

Our reportable business segments are not dependent upon any single patent or related group of patents, trademarks, licenses, or distribution rights. In our judgment, our intellectual property rights are adequate for the conduct of our business. We believe that, in the aggregate, the rights under our patents, trademarks, licenses, and distribution rights are generally important to our operations, but we do not consider any individual patent, trademark, or any licensing or distribution rights related to a specific process or product to be of material importance in relation to our total business.

8 Honeywell International Inc.

REGULATIONS

Our operations are subject to various federal, state, local, and foreign government regulations, including requirements regarding the protection of human health and the environment. We design our policies, practices, and procedures to provide a safe operating environment, to prevent unreasonable risk of environmental damage, and of resulting financial liability, in connection with our business. Some risk of environmental damage is, however, inherent in some of our operations and products, as it is with other companies engaged in similar businesses.

We engage in the handling, manufacturing, use, and disposal of many substances classified as hazardous by one or more regulatory agencies. We design policies, practices, and procedures to prevent unreasonable risk of personal injury or environmental damage, and to ensure that our handling, manufacture, use, and disposal of these substances meet or exceed environmental and safety laws and regulations. It is possible that future knowledge or other developments, such as improved capability to detect substances in the environment or increasingly strict environmental laws and standards and enforcement policies, could bring into question our current or past handling, manufacture, use, or disposal of these substances.

Among other environmental requirements, we are subject to the Federal Superfund and similar state and foreign laws and regulations, under which we have been designated as a potentially responsible party that may be liable for cleanup costs associated with current and former operating sites and various hazardous waste sites, some of which are on the U.S. Environmental Protection Agency’s National Priority List. While there is a possibility that a responsible party might be unable to obtain appropriate contribution from other responsible parties, we do not anticipate having to bear significantly more than our proportional share in multi-party situations taken as a whole.

We do not believe that federal, state, and local provisions regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, or any existing or pending climate change legislation, regulation, or international treaties or accords are reasonably likely to have a material adverse effect in the foreseeable future on our business and we will continue to monitor emerging developments in this area.

Beyond our compliance requirements with environmental regulations, compliance with other government regulations has not had, and based on laws and regulations currently in effect, is not expected to have a material effect on our capital expenditures, earnings, or competitive position. See the section titled Risk Factors for additional information on government regulation that could impact our business. 9 Honeywell International Inc.

SUSTAINABILITY COMMITMENTS

Our commitment to being environmentally responsible is reflected in the extensive work we do to reduce greenhouse gas (GHG) emissions, increase energy efficiency, conserve water, minimize waste, manage air emissions, and drive efficiency throughout our operations. Our operating system – which drives sustainable improvements and the elimination of waste in our manufacturing operations – is a critical component in how we approach environmental stewardship within Honeywell.

We commit resources each year to projects that support these objectives:

•Energy Efficiency Improvements. We continue to implement sustainability projects at our facilities, including energy management and control systems, automation systems for boilers, LED lighting, HVAC controls and refrigerants, variable frequency drives, occupancy sensors, metering, and renewable energy. We require our largest sites to identify their significant energy use in line with ISO 50001, obtain an energy audit on an established cycle, train personnel on energy management, and track identified projects via our standard database. This ensures a robust pipeline of both low-cost and capital projects that can be considered for execution.

•Managing Air Emissions. We manage air emissions in accordance with all regulatory requirements while also seeking to minimize our environmental impact. We require all of our manufacturing locations to meet the requirements of our Air Emissions procedure that is part of the Health, Safety, Environment, Product Stewardship, and Sustainability (HSEPS) Management System. These requirements include, but are not limited to, identifying and detailing all emissions to air on an inventory that captures them, developing operational controls, and standardized compliance obligation tracking for permit conditions and regulatory requirements. Where there are industrial air emissions that do not have specific legal or permit requirements, we implement best management practices, where available.

•Wastewater Management. We require our locations and functions to manage water use and wastewater effluent in accordance with our HSEPS Management System. In addition to meeting all legal and regulatory requirements, the HSEPS Management System requires Honeywell manufacturing locations to complete actions such as maintain an inventory of its uses, discharges, and consumption of water, develop location-specific operation controls to manage wastewater, and provide training for employees and contractors who perform critical activities related to wastewater.

•Environmental Remediation. We recognize idle properties as assets that can be revitalized to mutually benefit communities and the company. The properties that emerge from this approach ignite civic pride and catalyze further community development initiatives. Using cutting-edge science, design, and engineering to protect human health and the environment, we work cooperatively with governments and engage with local communities and other external stakeholders to implement effective solutions.

•Reducing Greenhouse Gas Emissions. As part of our commitment to reduce GHG emissions, we have been implementing solar projects to reduce dependency on conventional power sources, including installing rooftop and carport solar systems at various facilities to offset the sites' energy usage.

•Minimizing Waste. We require all of our locations and functions to handle waste in accordance with our HSEPS Management System, which includes but is not limited to, detailed characterization and classification for all waste streams, process of due diligence and impact assessment for all facilities receiving hazardous waste from our operations, and annual training for employees and contractors who perform waste-related activities.

We uphold our commitment to be carbon neutral by 2035 in our facilities and operations1. Our GHG reduction program initially began in 2004, setting us well on our way to achieving this commitment. In addition to being on a path to achieve our carbon neutrality goals, in 2023, we exceeded our 10-10-10 commitments that we established in 2019 to (i) reduce Scope 1 and 2 GHG emissions intensity by 10% from a 2018 baseline, (ii) deploy at least 10 renewable energy opportunities, and (iii) achieve certification to ISO 50001 Energy Management Standard at 10 facilities. In 2022, we joined the U.S. Department of Energy's Better Climate Challenge, pledging to reduce U.S. Scope 1 and 2 GHG emissions by 50% from a 2018 baseline. In addition, in 2023, our near-term science-based target, which includes Scope 3 emissions, was approved by the Science Based Target initiative (SBTi).

| | | | | |

| 1 | Methodology for identifying sustainability-oriented offerings is available at investor.honeywell.com (see “ESG/ESG Information/Identification of Sustainability-Oriented Offerings”). |

10 Honeywell International Inc.

SUSTAINABILITY-ORIENTED SOLUTIONS

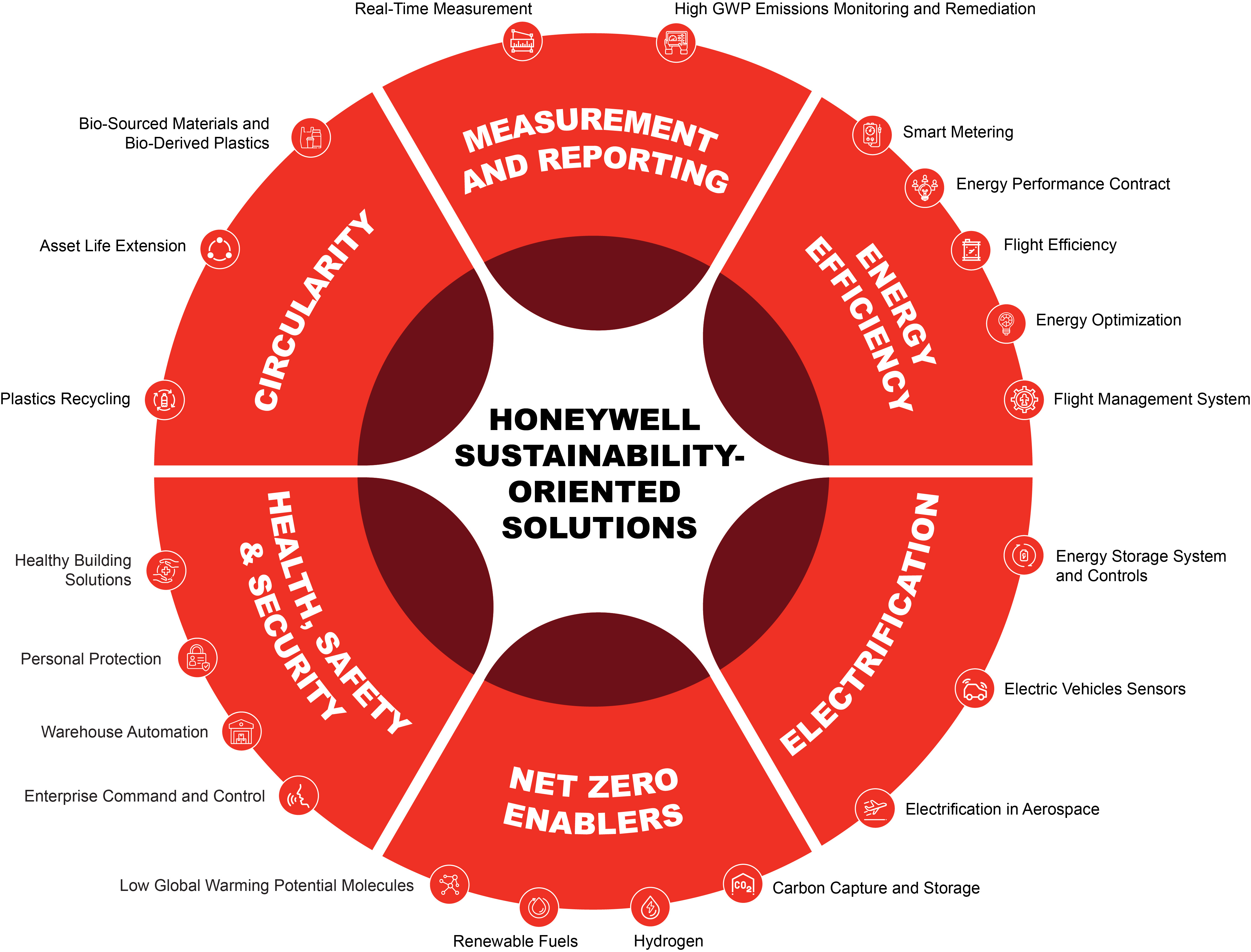

We strive to lead the marketplace in sustainable technology development and help our customers meet their sustainability goals. We are innovating to improve our operations as we progress toward carbon neutrality1. These innovations contribute to improvements in health, safety, security, environmental impact, and resiliency to help our customers with their most complex challenges in these areas. The graphic below demonstrates our multitude of sustainability-oriented solutions.

| | | | | |

| 1 | Methodology for identifying sustainability-oriented offerings is available at investor.honeywell.com (see “ESG/ESG Information/Identification of Sustainability-Oriented Offerings”). |

Additional information regarding our sustainability initiatives and strategy is included in our 2024 Impact Report, which can be found on our website (honeywell.com); this report is not incorporated into this Form 10-K by reference and should not be considered part of this Form 10-K.

11 Honeywell International Inc.

HUMAN CAPITAL MANAGEMENT

We believe investment in human capital management enables better decision-making, helps us build competitive advantage, and furthers our long-term success. Human capital management is the key driver of our performance culture, which enables our workforce to respond to the fast-changing needs of our customers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| As of December 31, 2024, we employed approximately 102,000 EMPLOYEES1 | | | across 77 COUNTRIES | | | ~38,0001 of whom are in the United States. | |

| | | | | |

| | | | | | | | |

| | | | | | | | |

| 1 | | Excludes Sandia National Laboratories (Sandia) and Kansas City National Security Campus (KCNSC) work forces of approximately 24,000 employees. Sandia and KCNSC are U.S. Department of Energy facilities. Honeywell manages these facilities as a contract operator and does not establish or control their human resource policies. |

OUR CULTURE

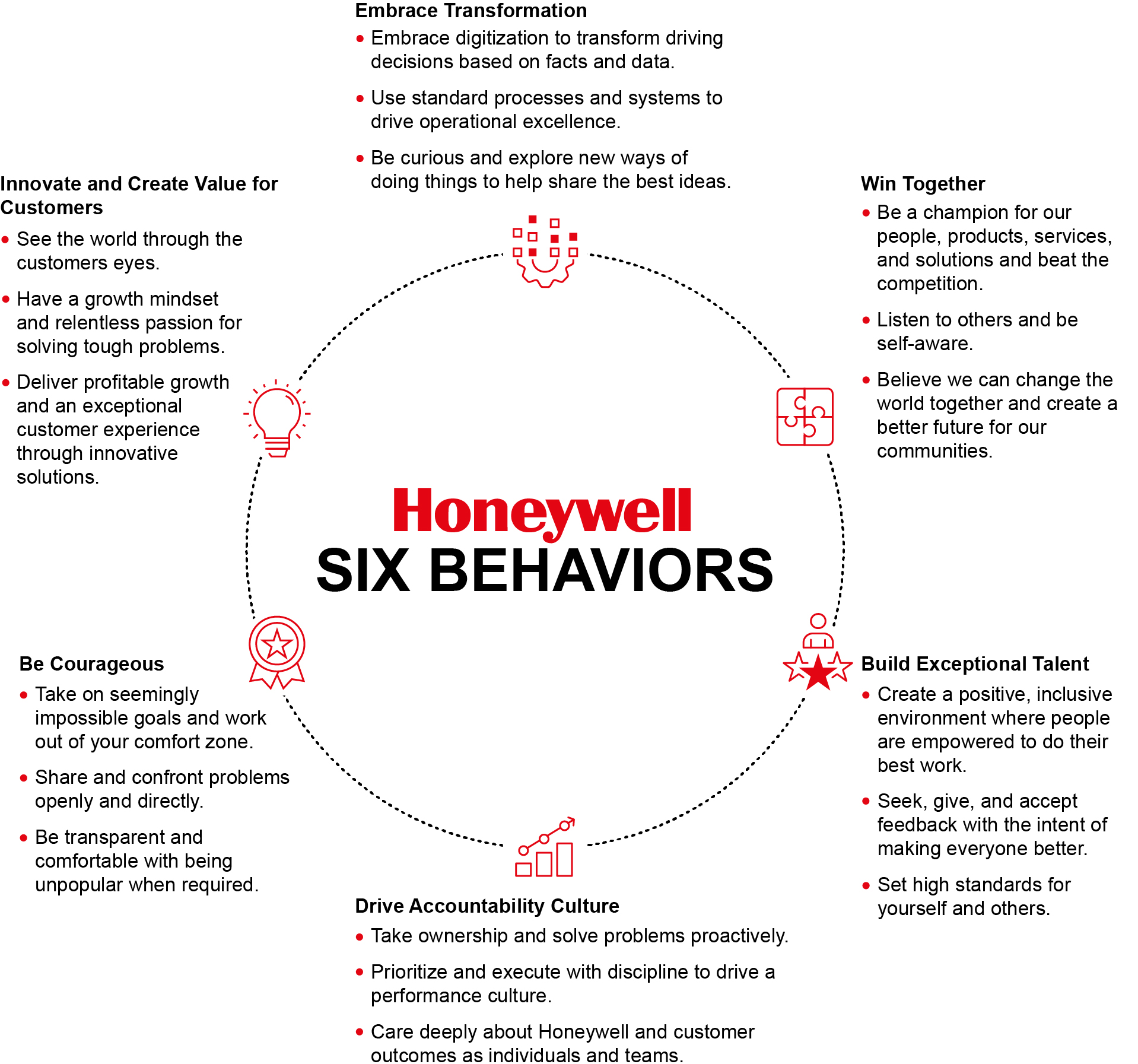

Honeywell has built a reputation of “doing what we say.” At the center of that commitment to excellence is a high-performance culture rooted in our Foundational Principles and driven by the Six Honeywell Behaviors. The Six Behaviors reflect the bold, entrepreneurial spirit we seek to foster while emphasizing our goal to operate with speed and precision. At their foundation is a commitment to Safety Always, Integrity and Ethics, Inclusion and Diversity, and Workplace Respect, fundamental values that underlie everything we do.

12 Honeywell International Inc.

Our Code of Business Conduct establishes the baseline requirements of our integrity and compliance program and promotes an environment where everyone is treated ethically and with respect. It outlines our pledge to recognize the dignity of each individual, respect each employee, provide compensation and benefits that are competitive, promote self-development through training, and value diversity of perspectives and ideas. All employees must complete Code of Business Conduct training and, where permitted by law, must also certify each year that they will comply with the Code.

Overall, we believe our culture, along with our internal tools and initiatives, enable us to effectively execute our human capital strategy. For discussion on the risks relating to the ability to attract and retain top-performing talent, please see the section titled Risk Factors. TALENT ACQUISITION AND MANAGEMENT

Our internal talent acquisition and management platform is a key component to recruiting, hiring, and developing top-performing talent. We provide our hiring managers with training and toolkits to reinforce their role in bringing top talent into the Company. Further, we partner with top academic institutions and external professional organizations to attract and retain top talent. Our talent review process requires our people managers to have semi-annual career discussions with each member of their teams to discuss the best opportunity for growth and development, which enhances our identification of candidates for internal promotion and succession planning.

VOICE OF THE EMPLOYEE

The Voice of the Employee feedback survey is conducted annually with all global employees with the commitment to listening, learning, and taking action to make Honeywell an even better place to work. The survey provides data and tools to leaders at all levels to best drive actionable plans around employee engagement and build our desired culture that attracts and retains top talent, improves performance, and distinguishes the Company as a great place to work.

EMPLOYEE WELL-BEING

Our well-being focus addresses physical, mental, financial, individual, and community needs, providing benefits and resources to help employees and their families be their best, both personally and professionally. We facilitated several campaigns to promote well-being and help provide visibility to resources and available benefits across a range of topics from health and wellness programs to caring for your family and taking care of finances. We promoted mental health globally during Mental Health Awareness month, during which we offered a variety of benefits and resources, hosted live webinars, and introduced a new global forum for managers on how to support employee well-being. We offer Employee Assistance Programs or therapy sessions to all employees and family members globally, comprehensive mental health benefits to those enrolled in the U.S. medical plan, virtual mental health options and navigation tools to improve access and speed of care, and preventive/mental health resilience programs.

13 Honeywell International Inc.

TRAINING AND LEADERSHIP DEVELOPMENT

Investing in continuous learning and leadership development is at the core of our culture and long-term business growth strategy. Learning and training underscores our culture of development, continuous improvement, and integrity and compliance. We offer and encourage career and leadership development programs and learning available on Honeywell Accelerator.

| | | | | |

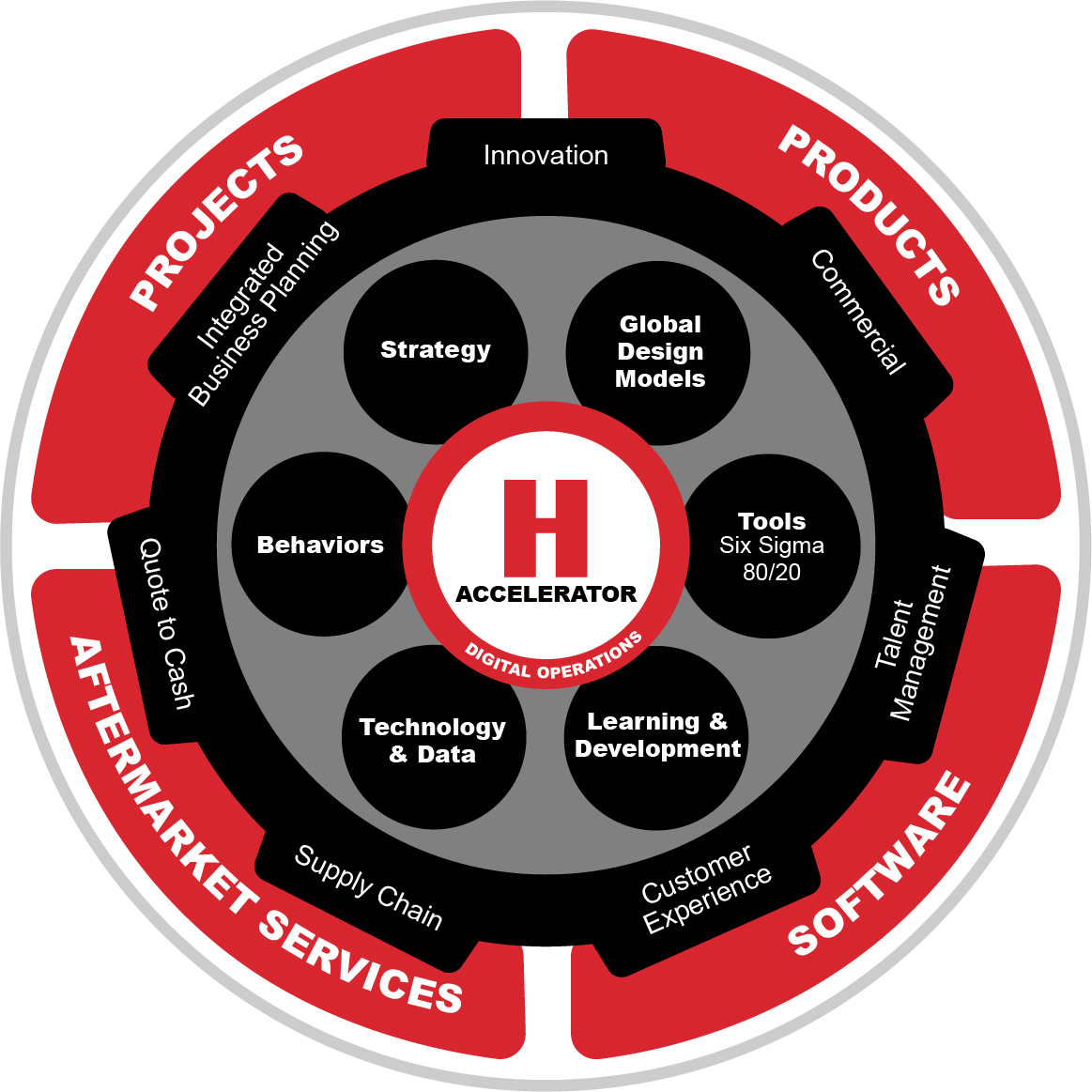

HONEYWELL ACCELERATOR | |

Honeywell Accelerator is the framework for how we think, run, and grow our business. It provides a unified approach to drive transformation and continuous improvement to give our teams the capabilities needed to win in the marketplace. This is accomplished by understanding our markets and our four dominant business models and how to most effectively operate them to grow. We design end-to-end digitized business processes, underpinned by global design models, lean and Six Sigma principles, 80/20 rules, and Digital Operations. Our contemporary, interactive, and accessible learning platform, Accelerator Learning, serves as a central source of information and supports our commitment to continuous learning, which is core to our culture and long-term business growth strategy. With over 600 virtual learning modules, this digital learning center creates common knowledge across the enterprise, helping new-joiner and long-time employees leverage the Honeywell operating system to make immediate, positive impacts. |

We expect our people managers to model behaviors that promote a culture that is open and inclusive for all employees. We help managers develop this skill as they do any other leadership skill through training programs, interactive learning, and real-time events, including the hiring and talent review processes. Our broad portfolio of leadership development programs provide training in core management skills to leaders across the organization. We deploy unconscious bias and inclusive leadership training to our global workforce to educate and influence behavior.

INCLUSION AND DIVERSITY

As a global enterprise serving customers from all backgrounds, in almost every geography, and in a wide array of end markets, Inclusion and Diversity is a fundamental value that enables our long-term strategy. We strive for an inclusive environment where all employees feel valued and respected, and can innovate to solve the world's most challenging problems. With our global programs and inclusive culture, we recruit, develop, retain, and promote top talent around the world. We continue to build partnerships and develop resources to support our employees globally.

Our commitment to Inclusion and Diversity starts at the top with a diverse Board of Directors (the Board) and executive management team, who represent a broad spectrum of backgrounds and perspectives. We believe that the diversity of the Board and the diversity of Honeywell’s executive leadership supports our evolving business strategy and is a testament to Honeywell’s ongoing commitment to the merit-based hiring of diverse talent, and the development and retention of that talent.

Our Global Inclusion and Diversity Steering Committee is co-sponsored by our Chairman and CEO, Senior Vice President and General Counsel, and Senior Vice President and Chief Human Resources Officer. The committee fortifies our inclusion and diversity governance structure and is augmented by the councils embedded in each of our business groups. The governance structure provides a scalable model that supports our nine employee networks. Each of our employee networks are open to all employees and participation is voluntary. Through our networks, we foster collaboration and belonging, enabling everyone to share and learn from one another and fully contribute at work and in the community in an inclusive and supportive environment.

14 Honeywell International Inc.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Dollars in tables and graphs in millions, except per share amounts)

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations is intended to help the reader understand the results of operations and financial condition of Honeywell International Inc. and its consolidated subsidiaries (Honeywell, we, us, our, or the Company) for the three years ended December 31, 2024. All references to Notes relate to Notes to Consolidated Financial Statements in the section titled Financial Statements and Supplementary Data. A detailed discussion of the prior year 2023 to 2022 year-over-year changes is not included herein and can be found in the Management's Discussion and Analysis of Financial Condition and Results of Operations section in Exhibit 99.1 to the Current Report on Form 8-K filed April 25, 2024, which updated our Form 10-K for the year ended December 31, 2023, by recasting historical segment information to reflect the realignment of certain of the Company's business units effective the first quarter of 2024 and impacted the composition of the Company's reportable segments. BUSINESS UPDATE

MACROECONOMIC CONDITIONS

We continue to monitor the impacts of ongoing macroeconomic conditions and geopolitical events. An escalation of geopolitical tensions or the implementation of global trade restrictions could impede disinflation and negatively impact growth prospects. Global conflicts, tariffs, labor disruptions, and regulations continue to create volatility in global markets and contribute to supply chain shortages and pricing volatility. We continue to actively collaborate with our suppliers to minimize shortages and reduce supply and price volatility. Global growth in the economy is projected to remain stable with further easing of inflation.

Our mitigation strategies include pricing actions and hedging strategies, longer term planning for constrained materials, new supplier development, material supply tracking tools, and direct engagement with key suppliers to meet customer demand. Our continued relationships with strategic primary and secondary suppliers allow us to reliably source key components and raw materials, which include considering altering existing products, developing new products, and committing our own resources to assist certain suppliers. We believe these mitigation strategies enable us to reduce supply risk, accelerate new product innovation, and expand our penetration in the markets we serve. Additionally, due to the strenuous quality controls and product qualification we perform on a new or altered product, these mitigation strategies have not impacted, and we do not expect them to impact, product quality or reliability.

To date, our strategies successfully mitigated our exposure to these conditions. However, if we are not successful in sustaining or executing these strategies, these macroeconomic conditions could have a material adverse effect on our consolidated results of operations or operating cash flows.

See the section titled Risk Factors for a discussion of risks associated with the potential adverse effects of inflationary cost pressures, supply chain disruptions, and labor shortages to our businesses. SPIN-OFF OF ADVANCED MATERIALS

On October 8, 2024, the Company announced its intention to spin off its Advanced Materials business into an independent, U.S. publicly traded company, which is targeted to be completed by the end of 2025 or early 2026. The planned spin-off is intended to be a tax-free spin to Honeywell shareowners for U.S. federal income tax purposes. The spin-off will be subject to the satisfaction of a number of customary conditions, including, among others, finalization of the financial statements of the Advanced Materials business, the filing and effectiveness of applicable filings (including a Form 10 registration statement) with the SEC, assurance that the spin-off of the Advanced Materials business will be tax-free to Honeywell’s shareowners, receipt of applicable regulatory approvals and final approval by Honeywell’s Board of Directors. The proposed spin-off is complex in nature, and may be affected by unanticipated developments, credit and equity markets, or changes in market conditions.

15 Honeywell International Inc.

| | | | | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

SEPARATION OF AUTOMATION AND AEROSPACE TECHNOLOGIES

On February 6, 2025, the Company announced its intention to pursue a separation of its Automation and Aerospace Technologies businesses into independent, U.S. publicly traded companies, which is targeted to be completed in the second half of 2026. The planned separation is intended to be a tax-free separation to Honeywell shareowners for U.S. federal income tax purposes. The separation will be subject to the satisfaction of a number of customary conditions, including, among others, finalization of the financial statements of the Automation and Aerospace Technologies businesses, the filing and effectiveness of applicable filings (including a Form 10 registration statement) with the SEC, assurance that the separation of the businesses will be tax-free to Honeywell’s shareowners, receipt of applicable regulatory approvals and final approval by Honeywell’s Board of Directors. The proposed separation is complex in nature, and may be affected by unanticipated developments, credit and equity markets, or changes in market conditions.

RESULTS OF OPERATIONS

Consolidated Financial Results

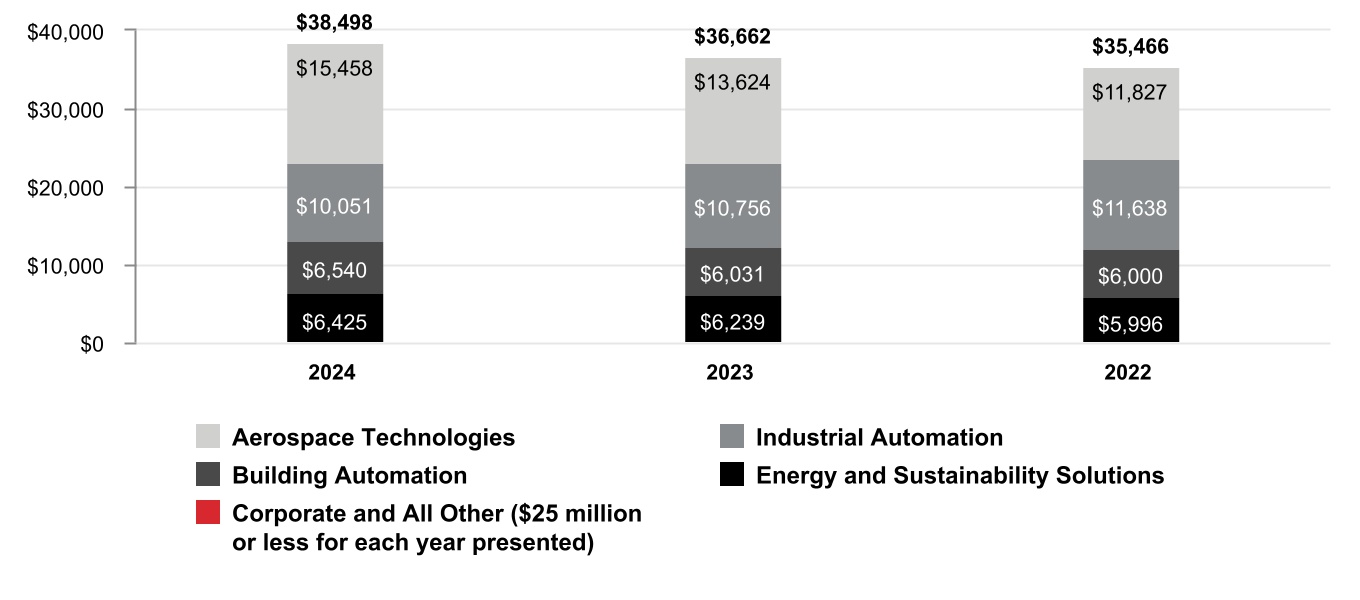

Net Sales by Segment

16 Honeywell International Inc.

| | | | | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

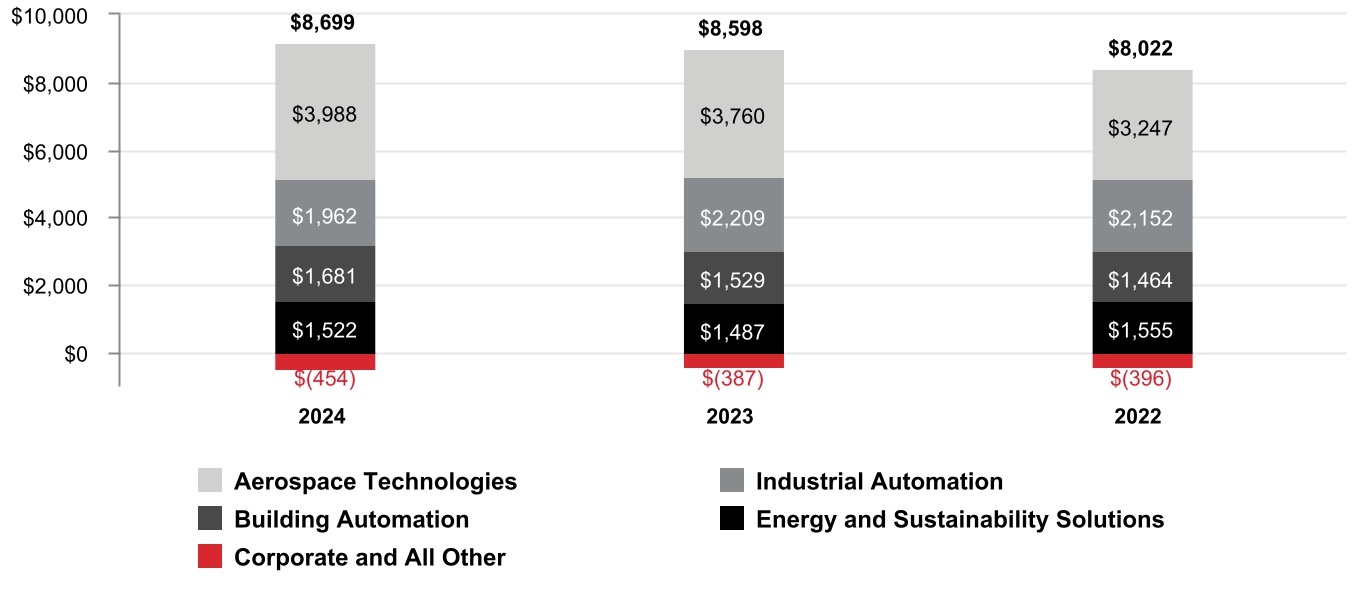

Segment Profit by Segment

CONSOLIDATED OPERATING RESULTS

Net Sales

The increase in Net sales was attributable to the following: | | | | | | | | |

| 2024 Versus 2023 | 2023 Versus 2022 |

| Volume | 1 % | —% |

| Price | 2 % | 4 % |

| Foreign currency translation | —% | (1 %) |

| Acquisitions, divestitures, and other, net | 2 % | —% |

| Total % change in Net sales | 5 % | 3 % |

A discussion of Net sales by reportable business segment can be found in the Review of Business Segments section of Management's Discussion and Analysis. 17 Honeywell International Inc.

| | | | | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

2024 compared with 2023

Net sales increased due to the following:

•Incremental sales from recent acquisitions,

•Increased pricing and price adjustments to offset inflation, and

•Higher sales volumes.

Cost of Products and Services Sold

2024 compared with 2023

Cost of products and services sold increased due to the following:

•Higher direct and indirect material costs and higher labor costs of approximately $0.8 billion or 3%, and

•Incremental costs from recent acquisitions of approximately $0.5 billion or 2%,

•Partially offset by higher productivity of approximately $0.4 billion or 2%.

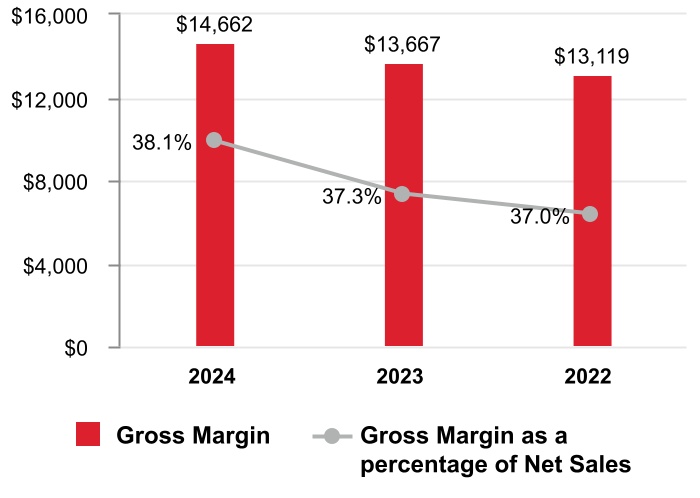

Gross Margin

2024 compared with 2023

Gross margin increased by approximately $1.0 billion and gross margin percentage increased 80 basis points to 38.1% compared to 37.3% for the same period of 2023.

18 Honeywell International Inc.

| | | | | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

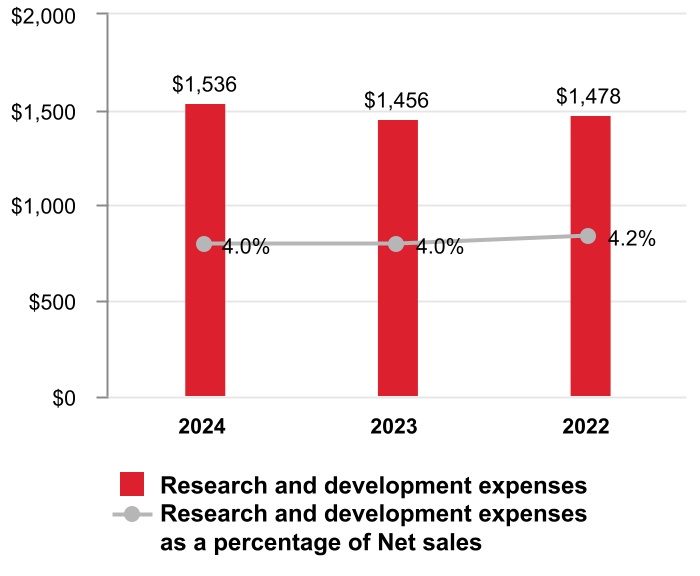

Research and Development Expenses

2024 compared with 2023

Research and development expenses slightly increased but were flat as a percentage of Net sales.

A summary of our research and development costs for the years ended December 31, 2024, 2023, and 2022, is as follows:

| | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | 2022 |

| Company funded research and development expenses | $ | 1,536 | | | $ | 1,456 | | | $ | 1,478 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Customer-sponsored research and development1 | 1,105 | | | 1,145 | | | 1,102 | |

| Total Research and development costs | $ | 2,641 | | | $ | 2,601 | | | $ | 2,580 | |

| | | | | |

| | | | | |

| |

| 1 | Includes deferred customer funded nonrecurring engineering and development activities and expenditures on customer programs with a significant engineering performance obligation, included in Cost of products and services sold in the Consolidated Statement of Operations. |

| |

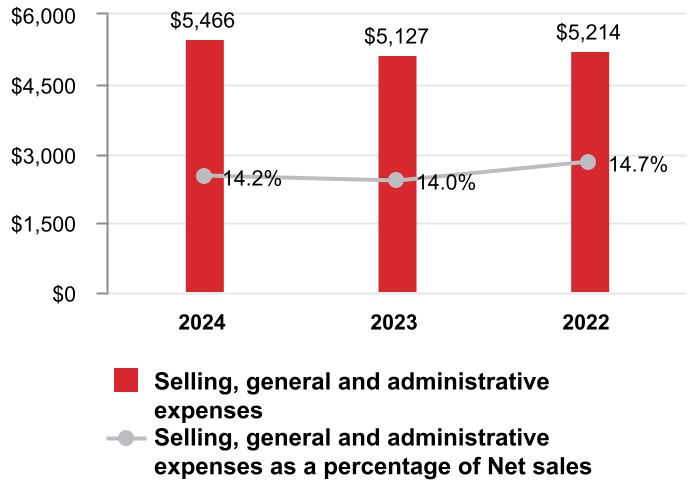

Selling, General and Administrative Expenses

2024 compared with 2023

Selling, general and administrative expenses increased due to the following:

•Higher labor costs of approximately $0.2 billion or 4%, and

•Incremental costs from acquisitions of approximately $0.2 billion or 4%,

•Partially offset by higher productivity of approximately $0.1 billion or 2%.

19 Honeywell International Inc.

| | | | | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

Impairment of Assets Held for Sale

| | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | 2022 |

| Impairment of assets held for sale | $ | 219 | | | $ | — | | | $ | — | |

2024 compared with 2023

An impairment charge was recorded on assets held for sale related to the personal protective equipment business during the twelve months ended December 31, 2024.

Other (Income) Expense

| | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | 2022 |

| Other (income) expense | $ | (830) | | | $ | (840) | | | $ | (366) | |

2024 compared with 2023

Other income was flat due to the following:

•Higher interest income of approximately $0.1 billion, and

•Higher pension and post-retirement income of $0.1 billion,

•Partially offset by higher acquisition-related costs of $0.1 billion.

Interest and Other Financial Charges

| | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | 2022 |

| Interest and other financial charges | $ | 1,058 | | | $ | 765 | | | $ | 414 | |

2024 compared with 2023

Interest and other financial charges increased due to issuances of long-term debt during the twelve months ended December 31, 2024.

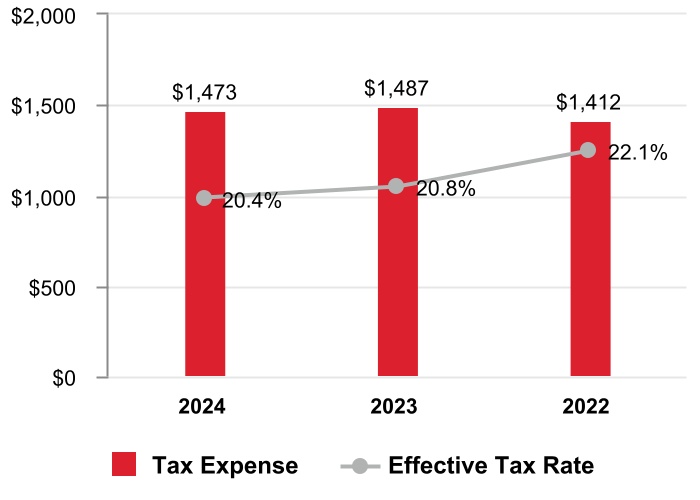

Tax Expense

2024 compared with U.S. Statutory Rate

The effective tax rate for 2024 was lower than the U.S. federal statutory rate of 21% as a result of the following:

•Tax credits, representing a 200 basis point decrease, and

•Tax benefits on non-U.S. earnings, representing a 140 basis point decrease,

•Partially offset by state, local, and global minimum taxes, representing a 170 basis point increase, and

•Change in accruals on global tax matters, representing a 120 basis point increase.

See Note 5 Income Taxes of Notes to Consolidated Financial Statements for further discussion of changes in the effective tax rate. 20 Honeywell International Inc.

| | | | | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

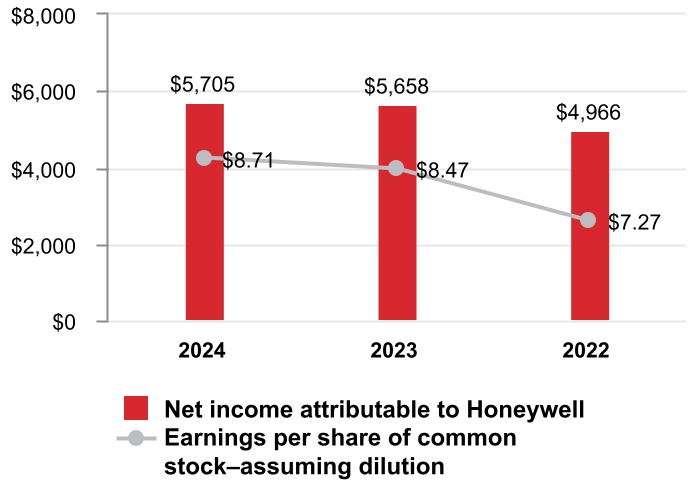

Net Income Attributable to Honeywell

2024 compared with 2023

Earnings per share of common stock–assuming dilution increased due to the following:

•Lower repositioning and other charges ($0.73 after tax), and

•Lower share count ($0.17 after tax),

•Partially offset by higher interest expense ($0.35 after tax), and

•Impairment charges on assets held for sale ($0.33 after tax).

21 Honeywell International Inc.

REVIEW OF BUSINESS SEGMENTS

During the first quarter of 2024, the Company realigned certain of its business units, which impacted the composition of its reportable segments. The Company recast historical periods to reflect this change in segment presentation. See Note 22 Segment Financial Data of Notes to Consolidated Financial Statements for further discussion. We globally manage our business operations through four reportable business segments: Aerospace Technologies, Industrial Automation, Building Automation, and Energy and Sustainability Solutions.

AEROSPACE TECHNOLOGIES

Net Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | Change 2024 vs. 2023 | | 2022 | | Change 2023 vs. 2022 |

| Net sales | $ | 15,458 | | | $ | 13,624 | | | 13 | % | | $ | 11,827 | | | 15 | % |

| Cost of products and services sold | 9,781 | | | 8,362 | | | | | 7,183 | | | |

| Selling, general and administrative and other expenses | 1,689 | | | 1,502 | | | | | 1,397 | | | |

| Segment profit | $ | 3,988 | | | $ | 3,760 | | | 6 | % | | $ | 3,247 | | | 16 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Factors Contributing to Year-Over-Year Change | 2024 vs. 2023 | | 2023 vs. 2022 |

Net

Sales | | Segment

Profit | | Net

Sales | | Segment

Profit |

Organic1 | 11 | % | | 5 | % | | 15 | % | | 16 | % |

| Foreign currency translation | — | % | | — | % | | — | % | | — | % |

| Acquisitions, divestitures, and other, net | 2 | % | | 1 | % | | — | % | | — | % |

| Total % change | 13 | % | | 6 | % | | 15 | % | | 16 | % |

| | | | | | | | |

| 1 | | Organic sales percent change, presented for all of our reportable business segments, is defined as the change in Net sales, excluding the impact on sales from foreign currency translation and acquisitions, net of divestitures, for the first 12 months following the transaction date. We believe this non-GAAP measure is useful to investors and management in understanding the ongoing operations and analysis of ongoing operating trends. |

22 Honeywell International Inc.

| | | | | |

| REVIEW OF BUSINESS SEGMENTS |

2024 compared with 2023

Sales increased $1,834 million due to higher organic sales of $907 million in Commercial Aviation Aftermarket driven by higher sales volumes in air transport due to an increase in flight hours and higher organic sales of $772 million in Defense and Space driven by higher sales volumes due to increased shipments. Additionally, the acquisitions of CAES and Civitanavi Systems contributed $332 million to 2024 sales.

During the fourth quarter of 2024, our Commercial Aviation Original Equipment business entered into a strategic agreement with Bombardier (the Agreement) to provide advanced technology for current and future Bombardier aircraft in avionics, propulsion, and satellite communications technologies. Sales and segment profit for the twelve months ended December 31, 2024, decreased by approximately $370 million due to the Agreement.

Segment profit increased $228 million and segment margin percentage decreased 180 basis points to 25.8% compared to 27.6% for the same period of 2023.

On February 6, 2025, the Company announced its intention to separate its Automation and Aerospace Technologies businesses into independent, U.S. publicly traded companies.

INDUSTRIAL AUTOMATION

Net Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | Change 2024 vs. 2023 | | 2022 | | Change 2023 vs. 2022 |

| Net sales | $ | 10,051 | | | $ | 10,756 | | | (7) | % | | $ | 11,638 | | | (8) | % |

| Cost of products and services sold | 5,880 | | | 6,379 | | | | | 7,230 | | | |

| Selling, general and administrative and other expenses | 2,209 | | | 2,168 | | | | | 2,256 | | | |

| Segment profit | $ | 1,962 | | | $ | 2,209 | | | (11) | % | | $ | 2,152 | | | 3 | % |

23 Honeywell International Inc.

| | | | | |

| REVIEW OF BUSINESS SEGMENTS |

| | | | | | | | | | | | | | | | | | | | | | | |

| Factors Contributing to Year-Over-Year Change | 2024 vs. 2023 | | 2023 vs. 2022 |

Net

Sales | | Segment

Profit | | Net

Sales | | Segment

Profit |

| Organic | (7) | % | | (11) | % | | (8) | % | | 3 | % |

| Foreign currency translation | (1) | % | | (1) | % | | (1) | % | | (1) | % |

| Acquisitions, divestitures, and other, net | 1 | % | | 1 | % | | 1 | % | | 1 | % |

| Total % change | (7) | % | | (11) | % | | (8) | % | | 3 | % |

2024 compared with 2023

Sales decreased $705 million due to lower organic sales of $527 million in Warehouse and Workflow Solutions driven by lower demand for projects and lower organic sales of $155 million in Sensing and Safety Technologies driven by lower demand for personal protective equipment.

During the second quarter of 2022, our Productivity Solutions and Services business entered into a license and settlement agreement (the Agreement). Under the Agreement, we received $360 million, paid in equal quarterly installments over eight quarters, beginning with the second quarter of 2022 and ending with the first quarter of 2024. The Agreement provides each party a license to its existing patent portfolio for use by the other party’s existing products and resolved the patent-related litigation between the parties.

Segment profit decreased $247 million and segment margin percentage decreased 100 basis points to 19.5% compared to 20.5% for the same period in 2023.

On November 22, 2024, we announced an agreement to sell our PPE business for $1.3 billion, with the assets and liabilities of the business classified as held for sale until the closing date of the sale. The transaction is expected to be completed in the first half of 2025.

24 Honeywell International Inc.

| | | | | |

| REVIEW OF BUSINESS SEGMENTS |

BUILDING AUTOMATION

Net Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | Change 2024 vs. 2023 | | 2022 | | Change 2023 vs. 2022 |

| Net sales | $ | 6,540 | | | $ | 6,031 | | | 8 | % | | $ | 6,000 | | | 1 | % |

| Cost of products and services sold | 3,482 | | | 3,240 | | | | | 3,250 | | | |

| Selling, general and administrative and other expenses | 1,377 | | | 1,262 | | | | | 1,286 | | | |

| Segment profit | $ | 1,681 | | | $ | 1,529 | | | 10 | % | | $ | 1,464 | | | 4 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Factors Contributing to Year-Over-Year Change | 2024 vs. 2023 | | 2023 vs. 2022 |

Net

Sales | | Segment

Profit | | Net

Sales | | Segment

Profit |

| Organic | 2 | % | | — | % | | 2 | % | | 4 | % |

| Foreign currency translation | (1) | % | | — | % | | (1) | % | | — | % |

| Acquisitions, divestitures, and other, net | 7 | % | | 10 | % | | — | % | | — | % |

| Total % change | 8 | % | | 10 | % | | 1 | % | | 4 | % |

2024 compared with 2023

Sales increased $509 million due to higher organic sales of $245 million in Building Solutions driven by higher demand for building projects and services, partially offset by lower organic sales of $124 million in Products driven by lower demand. The acquisition of Access Solutions contributed $424 million to 2024 sales.

Segment profit increased $152 million and segment margin percentage increased 30 basis points to 25.7% compared to 25.4% for the same period of 2023.

25 Honeywell International Inc.

| | | | | |

| REVIEW OF BUSINESS SEGMENTS |

ENERGY AND SUSTAINABILITY SOLUTIONS

Net Sales

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 | | Change 2024 vs. 2023 | | 2022 | | Change 2023 vs. 2022 |

| Net sales | $ | 6,425 | | | $ | 6,239 | | | 3 | % | | $ | 5,996 | | | 4 | % |

| Cost of products and services sold | 4,030 | | | 3,950 | | | | | 3,673 | | | |

| Selling, general and administrative and other expenses | 873 | | | 802 | | | | | 768 | | | |

| Segment profit | $ | 1,522 | | | $ | 1,487 | | | 2 | % | | $ | 1,555 | | | (4) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Factors Contributing to Year-Over-Year Change | 2024 vs. 2023 | | 2023 vs. 2022 |

Net

Sales | | Segment

Profit | | Net

Sales | | Segment

Profit |

| Organic | 2 | % | | — | % | | 4 | % | | (3) | % |

| Foreign currency translation | — | % | | — | % | | — | % | | (1) | % |

| Acquisitions, divestitures, and other, net | 1 | % | | 2 | % | | — | % | | — | % |

| Total % change | 3 | % | | 2 | % | | 4 | % | | (4) | % |

2024 compared with 2023

Sales increased $186 million due to higher organic sales of $144 million in Advanced Materials driven by higher demand for fluorine products. Additionally, the acquisition of LNG contributed $64 million to sales in 2024.

Segment profit increased $35 million and segment margin percentage decreased 10 basis points to 23.7% compared to 23.8% for the same period of 2023.

On October 8, 2024, the Company announced its intention to spin off its Advanced Materials business into an independent, U.S. publicly traded company.

CORPORATE AND ALL OTHER

Corporate and All Other primarily includes unallocated corporate costs, interest expense on holding-company debt, and the controlling majority-owned interest in Quantinuum. Corporate and All Other is not a separate reportable business segment as segment reporting criteria is not met. The Company continues to monitor the activities in Corporate and All Other to determine the need for further reportable business segment disaggregation.

26 Honeywell International Inc.

| | | | | |

| REVIEW OF BUSINESS SEGMENTS |

REPOSITIONING CHARGES

See Note 4 Repositioning and Other Charges of Notes to Consolidated Financial Statements for a discussion of our repositioning actions and related charges incurred in 2024, 2023, and 2022. Cash spending related to our repositioning actions was $195 million, $294 million, and $275 million in 2024, 2023, and 2022, respectively, and was funded through operating cash flows. 27 Honeywell International Inc.

RISK FACTORS

Our business, operating results, cash flows, and financial condition are subject to the material risks and uncertainties set forth below, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results. Disclosures of risks should not be interpreted to imply that the risks have not already materialized, and there may be additional risks that are not presently material or known.

MACROECONOMIC AND INDUSTRY RISKS

Each of our businesses is subject to unique industry and economic conditions that may adversely affect the markets and operating conditions of our customers, which in turn can affect demand for our products and services and our results of operations.

•Aerospace Technologies—Our Aerospace business is impacted by customer buying patterns of aftermarket parts, supplier stability, factory transitions, and global supply chain capacity constraints that may lead to shortages of crucial components. Operating results may be adversely affected by downturns in the global demand for air travel, which may impact new aircraft production or result in the delay or cancellation of new aircraft orders, delays in launch schedules for new aircrafts, the retirement of aircrafts, and reductions in global flying hours, which impacts air transport and regional, business, and general aviation aircraft utilization rates. Operating results may also be adversely affected by any decrease in air travel demand due to regional restrictions or suspension of service for events related to public health, safety, the environment, or regional conflicts. Operating results could also be impacted by changes in overall trends related to end market demand for the product portfolio, as well as new entrants and non-traditional players entering the market. Operating results in our Defense and Space business unit may be affected by the mix of U.S. and foreign government appropriations for defense and space programs and by compliance risks. Results may also be impacted by the potential introduction of counterfeit parts into our global supply chain.

•Industrial Automation—Operating results may be adversely impacted by reduced investments in process automation, safety monitoring, and plant capacity utilization initiatives, fluctuations in retail markets, a slowdown in demand for safety products, changes in the competitive landscape, including new market entrants and new technologies that may lead to product commoditization, and adverse industry economic conditions, all of which could result in lower market share, reduced selling prices, and lower margins.

•Building Automation—Operating results may be adversely impacted by downturns in the level of global buildings and infrastructure construction activity (including retrofits and upgrades), lower capital spending and operating expenditures on projects, changes in the competitive landscape, including new market entrants and new technologies, and fluctuations in inventory levels in distribution channels.

•Energy and Sustainability Solutions—Operating results may be adversely impacted by downturns in capacity utilization for chemical, industrial, refining, petrochemical, and semiconductor plants, our customers’ availability of capital for refinery construction and expansion, raw material demand and supply, product commoditization, continued illegal imports of hydrofluorocarbons into Europe, and our ability to maximize our facilities’ production capacity and minimize downtime. Periods of increased volatility in oil and natural gas prices may result in less investment by our customers and therefore, lower demand for our products and services.

A significant percentage of our sales and operations is in non-U.S. jurisdictions and is subject to the economic, political, regulatory, foreign exchange, and other risks of international operations.

Our international operations, including U.S. exports, represent more than half of the Company’s sales. Risks related to international operations include exchange control regulations, wage and price controls, fluctuations in foreign currency exchange rates, antitrust regulations, employment regulations, foreign investment laws, import, export, and other trade restrictions and barriers (such as tariffs, sanctions, and embargoes), differing levels of protection of intellectual property, acts of industrial espionage, violations by our employees of anti-corruption laws (despite our efforts to mitigate such risk), changes in regulations regarding transactions with state-owned enterprises, nationalization of private enterprises, acts of terrorism, acts of war, civil strife, and our ability to hire and maintain qualified staff and maintain the safety of our employees in these regions. Instability and uncertainties arising from the global geopolitical environment and the evolving international and domestic political, regulatory, and economic landscape, including the potential for changes in global trade policies, such as sanctions and trade barriers, and trends such as populism, economic nationalism, and negative sentiment toward multinational companies, as well as the cost of compliance with increasingly complex and often conflicting regulations worldwide, can impair our flexibility in modifying product, marketing, pricing, or other strategies for growing our businesses, as well as our ability to improve productivity and maintain acceptable operating margins.

Existing free trade laws and regulations provide certain beneficial duties and tariffs for qualifying imports and exports. Changes in laws or policies governing the terms of foreign trade, and in particular increased trade restrictions, tariffs, or taxes on imports from countries where we manufacture products or from where we import products or raw materials, either directly or through our suppliers, could have an impact on our competitive position and financial results.

28 Honeywell International Inc.

The U.S. continues to implement certain trade actions, including imposing tariffs on certain goods imported from China and other countries, which has resulted in retaliatory tariffs by China and other countries. More significant tariffs have been proposed by the new administration in the U.S., although it is not possible to predict the extent or focus of any such tariffs at this time. Additional tariffs, export controls, and sanctions laws imposed by the U.S. on a broader range of imports, or further retaliatory trade measures taken by China or other countries in response, could increase the cost of our products.

In response to the conflict between Russia and Ukraine, the U.S. and other countries imposed actions including sanctions, export and import controls, and trade restrictions with respect to Russian and Belarusian governments, government-related entities, and other entities and individuals. Further, the Russian government implemented retaliatory actions against the U.S. and other nation members of the North Atlantic Treaty Organization (NATO) as well as certain other nations. Given the uncertainty inherent in our remaining obligations related to our contracts with Russian counterparties, we do not believe it is possible to develop estimates of reasonably possible loss in excess of current accruals for these matters. As the conflict continues to evolve, existing conditions may worsen, or other impacts, including escalation of the conflict in other regions of Europe where there is a material portion of our business, increased tension between Russia and the U.S. and other NATO members and other countries, or other impacts that are unknown at this time, could lead to increased charges and could have a material adverse effect on our consolidated financial position. These impacts may result in increased costs or additional impacts on our operations and may adversely affect our ability to meet contractual and financial obligations, results of operations, and financial condition.

To the extent the current conflict between Russia and Ukraine continues to escalate, including as a result of the policies of the new administration in the U.S. (which we are unable to predict at this time), it may also negatively impact other risk factors disclosed in this Form 10-K and further impact our financial results. Such risks include, but are not limited to, adverse effects on macroeconomic conditions, including inflation and consumer spending; cybersecurity incidents and other disruptions to our information technology (IT) infrastructure or that of our customers and suppliers, including disruptions at our cloud computing, server, systems, and other third party IT service providers; adverse changes in international trade policies and relations; our ability to implement and execute our business strategy, particularly in Eastern Europe and surrounding regions; disruptions in global supply chains; energy shortages; terrorist activities targeting U.S. government contractors and/or critical infrastructure; our exposure to foreign currency fluctuations; and constraints, volatility, or disruption in the capital markets.

Operating outside of the U.S. also exposes us to foreign exchange risk, which we monitor and seek to reduce through hedging activities. However, foreign exchange hedging activities bear a financial cost and may not always be available to us or be successful in eliminating such volatility. Finally, we generate significant amounts of cash outside of the U.S. that is invested with financial and non-financial counterparties. While we employ comprehensive controls regarding global cash management to guard against cash or investment loss and to ensure our ability to fund our operations and commitments, a material disruption to the counterparties with whom we transact business could expose Honeywell to financial loss.

Operating outside the U.S. also exposes us to additional intellectual property risk. The laws and enforcement practices of certain jurisdictions in which we operate may not protect our intellectual property rights to the same extent as in the U.S. and may impose joint venture, technology transfer, local service or other foreign investment requirements, and restrictions that potentially compromise control over our technology and proprietary information. Failure of foreign jurisdictions to protect our intellectual property rights, an inability to effectively enforce such rights in foreign jurisdictions, or the imposition of foreign jurisdiction investment or sourcing restrictions or requirements could result in loss of valuable proprietary information and could impact our competitive position and financial results.

Risks related to our defined benefit pension plans may adversely impact our results of operations and cash flow.