- HON Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Honeywell International (HON) DEF 14ADefinitive proxy

Filed: 15 Mar 04, 12:00am

| Section 240.14a-101 Schedule 14A. Information required in proxy statement. |

| Schedule 14A Information |

| Proxy Statement Pursuant to Section 14(a) of the Securities |

| Exchange Act of 1934 |

| (Amendment No. ) |

| Filed by the Registrant [X] |

| Filed by a party other than the Registrant [ ] |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

| Honeywell International Inc. | |

| (Name of Registrant as Specified In Its Charter) | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): | |

| [X] | No fee required |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: | |

| ——————————————— | ||

| (2) | Aggregate number of securities to which transaction applies: | |

| ——————————————— | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| ——————————————— | ||

| (4) | Proposed maximum aggregate value of transaction: | |

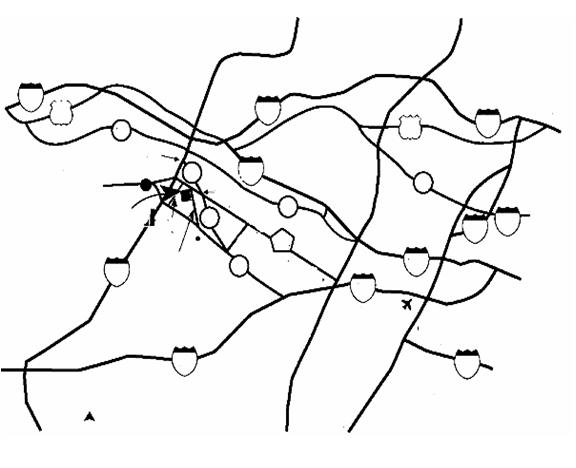

| ——————————————— | ||

| (5) | Total fee paid: | |

| ——————————————— | ||

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| ——————————————— | ||

| (2) | Form, Schedule or Registration Statement No.: | |

| ——————————————— | ||

| (3) | Filing Party: | |

| ——————————————— | ||

| (4) | Date Filed: | |

| ——————————————— | ||

If you are a shareowner of record or a participant in a Honeywell savings plan, you can vote your The vote of a plurality of the shares of Common Stock present or represented and entitled to vote at the Annual Meeting is required for election as a director. The affirmative vote of a majority of shares present or represented and entitled to vote on each of Proposals 2 through 7 is required for approval. 2 3 4 5 6 7 JAMES J. HOWARD, Chairman Emeritus of Xcel Energy Inc. (formerly known as Northern States Power Company) Mr. Howard was Chairman of the Board of Xcel Energy Inc., an energy company, from August 2000 until August 2001. He was Chairman and Chief Executive Officer of Northern States Power since 1988, and President since 1994. Prior to 1987, Mr. Howard was President and Chief Operating Officer of Ameritech Corporation. Mr. Howard is also a director of Ecolab, Inc. and Walgreen Company. He was a director of Honeywell Inc. from July 1990 to December 1999. BRUCE KARATZ, Chairman of the Board and Chief Executive Officer of KB Home Mr. Karatz was elected Chief Executive Officer of KB Home, an international residential and commercial builder, in 1986, and Chairman of the Board in 1993. Mr. Karatz is also a director of Edison International and Avery Dennison Corporation. He was a director of Honeywell Inc. from July 1992 to December 1999. 8 RUSSELL E. PALMER, Chairman and Chief Executive Officer of the Palmer Group Mr. Palmer established The Palmer Group, a private investment firm, in 1990, after serving seven years as Dean of The Wharton School of the University of Pennsylvania. He previously served as Managing Director and Chief Executive Officer of Touche Ross International and Managing Partner and Chief Executive Officer of Touche Ross & Co. (USA) (now Deloitte and Touche). He is a director of The May Department Stores Company, Safeguard Scientifics, Inc. and Verizon Communications Inc. IVAN G. SEIDENBERG, Chairman and Chief Executive Officer of Verizon Communications Inc. Mr. Seidenberg assumed his current position with Verizon Communications, a telecommunications and information services provider, in January 2004. Mr. Seidenberg served as President and Chief Executive Officer of Verizon from April 2002 until December 2003. Mr. Seidenberg was President and Co-Chief Executive Officer from June 2000, when Bell Atlantic Corporation and GTE Corporation merged and Verizon Communications Inc. was created. He served as Chairman and Chief Executive Officer of Bell Atlantic from 1999 to June 2000, Vice Chairman, President and Chief Executive Officer from June 1998 to 1999, and Vice Chairman, President and Chief Operating Officer following the merger of NYNEX Corporation and Bell Atlantic in 1997. He is also a director of Viacom Inc. and Wyeth. ERIC K. SHINSEKI, General United States Army (Ret.) General Shinseki served in the United States Army for 38 years, most recently as Chief of Staff from June 1999 until June, 2003. Prior to that he held a number of key command positions, including Commander of U.S. Army, Europe and Commander of the NATO-led Peace Stabilization Force in Bosnia-Herzegovina. General Shinseki is the highest-ranking Asian-American in U.S. military history, a West Point graduate, and the recipient of numerous U.S. and foreign military decorations. 9 MARSHALL N. CARTER, Senior Fellow at the Center for Business and Government, John F. Kennedy School of Government, Harvard University Mr. Carter assumed his current position in January 2001 upon his retirement from State Street Corporation, a worldwide provider of services to institutional investors. He joined State Street Corporation and its principal subsidiary, State Street Bank and Trust Company, as President and Chief Operating Officer in 1991. He became Chief Executive Officer in 1992 and Chairman of the Board in 1993. Prior to joining State Street, Mr. Carter was with Chase Manhattan Bank for 15 years, and before that he served as an officer in the U.S. Marine Corps. DAVID M. COTE, Chairman and Chief Executive Officer of Honeywell International Inc. Mr. Cote has been Chairman and Chief Executive Officer since July 2002. He joined Honeywell as President and Chief Executive Officer in February 2002. Prior to joining Honeywell, he served as Chairman, President and Chief Executive Officer of TRW Inc., a provider of products and services for the aerospace, information systems and automotive markets, from August 2001 to February 2002. From February 2001 to July 2001, he served as President and Chief Executive Officer and from November 1999 to January 2001 he served as President and Chief Operating Officer of TRW. Mr. Cote was Senior Vice President of General Electric Company and President and Chief Executive Officer of GE Appliances from June 1996 to November 1999. ROBERT P. LUCIANO, Chairman Emeritus of Schering-Plough Corporation Mr. Luciano joined Schering-Plough Corporation, a manufacturer and marketer of pharmaceuticals and consumer products, in 1978. He served as President from 1980 to 1986, Chief Executive Officer from 1982 through 1995, and Chairman of the Board from 1984 through October 1998. He became Chairman Emeritus in October 1999. 10 JOHN R. STAFFORD, Retired Chairman of the Board of Wyeth Mr. Stafford served as Chairman of the Board of Wyeth, a manufacturer of pharmaceutical, health care and animal health products, from 1986 until his retirement at the end of 2002. He also served as Chief Executive Officer from 1986 to 2001. Mr. Stafford joined Wyeth in 1970 and held a variety of positions before becoming President in 1981. He is also a director of J.P. Morgan Chase & Co. and Verizon Communications Inc. MICHAEL W. WRIGHT, Retired Chairman, President and Chief Executive Officer of SUPERVALU INC. Mr. Wright was elected President and Chief Operating Officer of SUPERVALU INC., a food distributor and retailer, in 1978, Chief Executive Officer in 1981, and Chairman of the Board in 1982. He retired as President and CEO in June 2001, and as Chairman in May 2002. He joined SUPERVALU INC. as Senior Vice President of Administration and as a member of the board of directors in 1977. Prior to 1977, Mr. Wright was a partner in the law firm of Dorsey & Whitney. Mr. Wright is also a director of Canadian Pacific Railway Company and Wells Fargo & Company. He was a director of Honeywell Inc. from April 1987 to December 1999. HANS W. BECHERER, Former Chairman and Chief Executive Officer of Deere & Company Mr. Becherer began his business career with Deere & Company, a manufacturer of mobile power machinery and a supplier of financial services, in 1962. After serving in a variety of managerial and executive positions, he became a director of Deere in 1986 and was elected President and Chief Operating Officer in 1987, President and Chief Executive Officer in 1989 and Chairman and Chief Executive Officer in 1990 until his retirement in 2000. He is also a director of J.P. Morgan Chase & Co. and Schering-Plough Corporation. 11 GORDON M. BETHUNE, Chairman of the Board and Chief Executive Officer of Continental Airlines, Inc. Mr. Bethune joined Continental Airlines, an international commercial airline company, in February 1994 as President and Chief Operating Officer. He was elected President and Chief Executive Officer in November 1994 and Chairman of the Board and Chief Executive Officer in 1996. Prior to joining Continental, Mr. Bethune held senior management positions with the Boeing Company, Piedmont Airlines, Western Airlines, Inc. and Braniff Airlines. He was a director of Honeywell Inc. from April 1999 to December 1999. JAIME CHICO PARDO, Vice Chairman and Chief Executive Officer of Telefonos de Mexico, S.A. de C.V. (TELMEX) Mr. Chico Pardo joined TELMEX, a telecommunications company based in Mexico City, as its Chief Executive Officer in 1995. Prior to joining TELMEX, Mr. Chico Pardo served as President and Chief Executive Officer of Grupo Condumex, S.A. de C.V., a manufacturer of products for the construction, automobile and telecommunications industries, and Euzkadi/General Tire de Mexico, a manufacturer of automotive and truck tires. Mr. Chico Pardo is also Vice-Chairman of Carso Global Telecom and a director of America Movil, America Telecom and Grupo Carso. He was a director of Honeywell Inc. from September 1998 to December 1999. CLIVE R. HOLLICK, Chief Executive, United Business Media plc Since 1996, Lord Hollick has been Chief Executive of United Business Media, a London-based, international information and publishing group whose operations include periodicals, magazines, newspapers, electronic news distribution, exhibitions and financial information and market research. Prior to that time, and since 1974, he held various leadership positions with United Business Media and its predecessor companies. Lord Hollick is also a director of United Business Media plc and Diageo plc. 12 The Corporate Governance and Responsibility Committee reviews and makes recommendations to the Board regarding the form and amount of compensation for non-employee directors. Directors who are employees of Honeywell receive no compensation for service on the Board. Honeywell’s director compensation program is designed to enable continued attraction and retention of highly qualified directors by ensuring that director compensation is in line with peer companies competing for director talent, and is designed to address the time, effort, expertise and accountability required of active Board membership. In general, the Corporate Governance and Responsibility Committee and the Board believe that annual compensation for non-employee directors should consist of both a cash component, designed to compensate members for their service on the Board and it Committees, and an equity component, designed to align the interests of directors and shareowners and, by vesting over time, to create an incentive for continued service on the Board. Each non-employee director receives an annual Board cash retainer of $60,000. Each also receives a fee of $2,500 for Board meetings attended on any day (eight during 2003), an annual retainer of $10,000 for each Board Committee served ($15,000 for Audit Committee), and an additional Committee Chair retainer of $15,000 for the Audit Committee and $10,000 for all other Board Committees. While no fees are generally paid for attending Committee meetings, a $1,000 fee is paid for attendance at a Committee meeting, or other extraordinary meeting related to Board business, which occurs apart from a regularly scheduled Board meeting. Non-employee directors are also provided with $350,000 in business travel accident insurance, and are eligible to elect $100,000 in term life insurance and medical and dental coverage for themselves and their eligible dependents. At the commencement of each year, $60,000 in common stock equivalents is automatically credited to each director’s account in the Deferred Compensation Plan for Non-Employee Directors, which amounts are only payable after termination of Board service, and may be paid as either a lump sum or in equal annual installments. Directors may also elect to defer, until a specified calendar year or retirement from the Board, all or any portion of their annual cash retainers and fees that are not automatically deferred, and to have such compensation credited to their account in the Deferred Compensation Plan. Amounts credited either accrue interest (8 percent for 2004) or are valued as if invested in common stock equivalents or one of the other funds available to participants in our savings plan. Amounts deferred in a common stock account earn amounts equivalent to dividends. Upon a change of control, a director will be entitled to a lump-sum payment of all deferred amounts. Under the Stock Plan for Non-Employee Directors, each new director receives a one-time grant of 3,000 shares of common stock, which are subject to transfer restrictions until the director’s service terminates with the consent of a majority of the Board, provided termination occurs at or after age 65. During the restricted period, the director has the right to receive dividends on and the right to vote the shares. At the end of the restricted period, a director is entitled to one-fifth of the shares granted for each year of service (up to five). However, the shares will be forfeited if the director’s service terminates (other than for death or disability) prior to the end of the restricted period. The Plan also provides for an annual grant to each director of options to purchase 5,000 shares of common stock at the fair market value on the date of grant, which is the date of the Annual Meeting of Shareowners. Option grants vest in cumulative installments of 40 percent on April 1 of the year following the grant date and an additional 30 percent on April 1 of each of the next two years. These options also become fully vested at the earliest of the director’s retirement from the board at or after age 70, death, or disability. Director stock ownership guidelines have been adopted under which (1) distribution from common stock equivalent accounts (with respect to shares funded on or after the adoption of such guidelines) cannot commence until one-year post retirement, and (2) net gain shares from option exercises are subject to a one-year holding period (restriction lapses upon death or retirement). 13 * Approximately $40,000 Audit, audit-related and tax compliance fees, in the aggregate, comprised 95% and 86% of the total fees paid by Honeywell to PwC in 2003 and 2002, respectively. In accordance with its Charter, the Audit Committee reviews non-audit services proposed to be provided by PwC to determine whether they would be compatible with maintaining PwC’s independence. The Audit Committee has established policies and procedures for the engagement of PwC to provide non-audit services. At its first meeting in each fiscal year, the Audit Committee reviews and approves an annual budget for specific categories of non-audit services (that are detailed as to the particular services) which PwC is to be permitted to provide (which categories do not include any of the prohibited services set forth under the auditor independence provisions of the Sarbanes-Oxley Act of 2002). Such review includes an evaluation of the possible impact of the provision of such services by PwC on the firm’s independence in performing its audit and audit-related services. On a quarterly basis, the Audit Committee reviews the non-audit services performed by, and amount of fees paid to, PwC, by category in comparison to the pre-approved budget. The engagement of PwC to provide non-audit services that do not fall within a specific category of pre-approved services, or that would result in the total fees payable to PwC in any category exceeding the approved budgeted amount, requires the prior approval of the Audit Committee. Between regularly scheduled meetings of the Audit Committee, the Chair of the Committee may represent the entire Committee for purposes of the review and approval of any such engagement, and the Chair is required to report on all such interim reviews at the Committee’s next regularly scheduled meeting. Honeywell has been advised by PwC that it will have a representative present at the Annual Meeting who will be available to respond to appropriate questions. The representative will also have the opportunity to make a statement if he or she desires to do so. The Board of Directors recommends that the shareowners vote FOR the approval of the appointment of PricewaterhouseCoopers LLP as independent accountants. 14 The Audit Committee of the Honeywell International Inc. Board of Directors is comprised of the six directors named below. Each member of the Audit Committee is an independent director as defined by applicable Securities and Exchange Commission (SEC) rules and New York Stock Exchange (NYSE) listing standards. In addition, our Board of Directors has determined that Russell E. Palmer is an “audit committee financial expert” as defined by applicable SEC rules and satisfies the “accounting or related financial management expertise” criteria established by the NYSE. The Audit Committee operates under a written charter adopted by the Board of Directors (see pages 16 – 17). Management is responsible for the Company’s internal controls and preparing the Company’s consolidated financial statements. The Company’s independent accountants are responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Committee is responsible for overseeing the conduct of these activities and, subject to shareowner ratification, appointing the Company’s independent accountants. As stated above and in the Committee’s charter, the Committee’s responsibility is one of oversight. The Committee does not provide any expert or special assurance as to Honeywell’s financial statements concerning compliance with laws, regulations or generally accepted accounting principles. In performing its oversight function, the Committee relies, without independent verification, on the information provided to it and on representations made by management and the independent accountants. The Audit Committee reviewed and discussed the Company’s consolidated financial statements for the year ended December 31, 2003 with management and the independent accountants. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standard No. 61, Communication with Audit Committees. The Company’s independent accountants provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and the Committee discussed with the independent accountants their independence. The Audit Committee concluded that PwC’s provision of non-audit services, as described in the preceding section of this proxy statement, to the Company and its affiliates is compatible with PwC’s independence. Based on the Audit Committee’s discussion with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants, the Committee recommended that the Board of Directors include the audited consolidated financial statements in the Form 10-K for the year ended December 31, 2003 filed with the Securities and Exchange Commission. THE AUDIT COMMITTEE 15 16 17 Section 16(a) Beneficial Ownership Reporting Compliance The rules of the Securities and Exchange Commission require that we disclose late filings of reports of stock ownership (and changes in stock ownership) by our directors and executive officers. To the best of Honeywell’s knowledge, all of the filings for our executive officers and directors were made on a timely basis in 2003, except that (i) Supplemental Savings Plan contributions totaling 15.615 equivalent shares for Nance K. Dicciani, President and Chief Executive Officer, Specialty Materials, made during January of 2003, were reported in a late filing filed on January 23, 2003, and (ii) stock options and restricted units awarded on July 25, 2003, to David J. Anderson, Senior Vice President and Chief Financial Officer, and to John J. Tus, Controller, were reported in a late filing filed on July 31, 2003. Five Percent Owners of Company Stock The following table sets forth information as to those holders known to Honeywell to be the beneficial owners of more than 5% of the outstanding shares of Honeywell Common Stock as of December 31, 2003. 18 Stock Ownership of Directors and Executive Officers The following table sets forth information as of February 27, 2004 with respect to the beneficial ownership of Common Stock by each executive officer named in the Summary Compensation Table herein, by each director, and by all directors and executive officers of Honeywell as a group. In general, “beneficial ownership” includes those shares a director or executive officer has the sole power to vote or transfer, except as otherwise noted, and stock options that are exercisable currently or within 60 days. Directors and executive officers also have interests in stock-based units under Company plans. While these units may not be voted or transferred, we have included them in the table below as they represent the total economic interest of the directors and executive officers in Honeywell stock. 19 Report of the Management Development and Compensation Committee The Management Development and Compensation Committee of the Board of Directors (the Committee) determines the compensation of Honeywell’s executive officers and oversees the administration of executive compensation programs. The Committee is comprised entirely of independent directors and is advised by an independent consultant retained by the Committee. Executive Compensation Policies and Programs Honeywell’s executive compensation programs are designed to attract and retain highly qualified executives and to motivate them to maximize shareowner returns by achieving aggressive goals. The programs link each executive’s compensation directly to Honeywell’s performance. A significant portion of each executive’s compensation is dependent upon achieving business and financial goals, realizing other individual performance objectives, and upon stock price appreciation. Each year, the Committee reviews the executive compensation policies with respect to the linkage between executive compensation and the creation of shareowner value, as well as the competitiveness of the programs. The Committee approves salary actions and determines the amount of annual bonuses and the number and amount of long-term incentive awards for officers. The Committee also determines what changes, if any, are appropriate in the compensation programs of the Company. The Internal Revenue Code restricts deductibility of annual individual compensation to its top executive officers in excess of $1 million if certain conditions set forth in the Code are not fully satisfied. Honeywell intends, to the extent practicable, to preserve deductibility under the Internal Revenue Code of compensation paid to its executive officers while maintaining compensation programs that effectively attract and retain exceptional executives in a highly competitive environment and, accordingly, compensation paid under Honeywell’s stock plan and incentive compensation plans is generally tax-deductible. However, on occasion it may not be possible to satisfy all conditions of the Internal Revenue Code for deductibility and still meet Honeywell’s compensation needs, and in such limited situations, certain compensation paid to some executives may not be tax-deductible. Components of Compensation There are three basic components to Honeywell’s “pay for performance” system: base salary, annual incentive bonus, and long-term incentive compensation. Each component is addressed in the context of competitive conditions. In determining competitive compensation levels, Honeywell analyzes information from several independent executive compensation surveys and consultants, which includes information regarding large diversified industrial companies and other companies that compete with Honeywell for executive talent (“Peer Companies”). Base Salary: Base pay is designed to be competitive compared with prevailing market rates at Peer Companies for equivalent positions. The executive’s actual salary relative to this competitive framework varies based on individual performance and the individual’s skills, experience and background. Annual Incentive Bonus: Award levels, like base salary levels, are set with reference to competitive conditions and are intended to motivate executives by providing substantial bonus payments for the achievement of aggressive goals. Incentive compensation awards are made pursuant to the terms of the Honeywell International Inc. Incentive Compensation Plan for Executive Employees. Each executive has a bonus target expressed as a percentage of base salary. The actual amounts paid for 2003 were determined by performance based on two factors: first, financial performance, which was measured against objectives established for revenue, free cash flow and earnings per share; and, second, the individual executive’s performance against other specific management objectives, such as improving customer satisfaction, driving growth, driving process excellence by increasing the use of Six Sigma Plus processes and DigitalWorks, and promoting learning and innovation in the workplace. For 2003, the financial objectives were weighted relatively (i.e., EPS 40%; revenue 30% and free cash flow 30%) in determining the Company-wide incentive compensation pools. The types and relative importance of 20 specific financial and other business objectives varied among Honeywell’s executives depending upon their positions and the particular operation or functions for which they were responsible. In December 2003, the Committee approved the following financial objectives and relative weights for the 2004 Incentive Compensation Plan: EPS 50% and free cash flow 50%. In addition, incentive compensation pools will be adjusted up or down based on Honeywell’s relative EPS growth performance versus a pre-established group of specific peer companies. The revenue metric has been eliminated on a prospective basis, but is included in Honeywell’s new cash-based long-term incentive program discussed below. Long-term Incentive Compensation: The principle purpose of the long-term incentive compensation program is to encourage Honeywell’s executives to enhance the value of Honeywell and, hence, the price of the Common Stock and the shareowners’ return. The long-term incentive component of the compensation system (through extended vesting) is also designed to create retention incentives for the individual. The long-term, equity-based compensation program consists primarily of stock option grants that vest over a multi-year period of service and is tied directly to shareowner returns. Like the annual bonus and base salary, long-term incentive award levels are set with regard to competitive considerations and each individual’s actual award is based upon the individual’s performance, potential for increased responsibility and contributions, leadership ability and potential and commitment to Honeywell’s strategic efforts. In February 2003, the Committee established a new long-term cash-based compensation program (the “Growth Plan”) and granted awards in the form of Growth Plan Units to select executives for the 2003-2004 performance period. Unlike stock options that reward executives for enhancing stockholder value through Honeywell stock price increases, Growth Plan Units encourage executives to focus on achieving multi-year goals consistent with our strategic business plan and growth initiatives. Payment of these awards is contingent upon the achievement over the performance period of specified financial objectives for revenue growth and return on investment, each weighted equally. In addition, no awards are payable if Honeywell does not achieve a specified minimum annual EPS growth over the performance period. In addition to stock options and Growth Plan Units, awards of restricted units, each of which entitles the holder to one share of Common Stock on vesting, may be made on a selective basis to individual executives in order to enhance the incentive for them to remain with Honeywell. These units vest over an extended period of service of up to seven years. A limited number of restricted unit grants will be used on a proactive basis to retain and reward executives who have exhibited sustained exceptional performance and who are determined to be high potential resources. On a limited and highly selective basis, restricted units were granted during 2003 in order to retain certain key performers. Stock Ownership Guidelines: In February 2003, the Committee adopted minimum stock ownership guidelines for all Honeywell officers. The ownership requirement for the CEO is Honeywell stock equal in value to six times the current annual base salary. Mr. Cote exceeds the ownership guidelines required of the CEO. Other officers named in the Summary Compensation Table, as well as a group of other key global business and corporate executives, are required to own shares approximately equivalent in value to either two or four times the current annual base salary. In addition, we decided executives subject to stock ownership guidelines should be required to hold for at least one year the net shares from restricted stock unit vesting or the net gain shares of our stock that they receive by exercising stock options. For this purpose, “net shares” means the number of shares obtained from restricted stock unit vesting, less the number of shares the executive sells to pay Company withholding taxes. “Net gain shares” means the number of shares obtained by exercising the option, less the number of shares the executive sells to: (a) cover the exercise price of the options; and (b) to pay the Company withholding taxes. After minimum ownership levels are met, officers would be able to sell shares above the minimum required level after satisfying the one-year holding period. These guidelines are subject to periodic review to ensure the levels are appropriate. 21 Compensation of the Chief Executive Officer The Committee retained an independent consulting firm to evaluate competitive compensation levels and make recommendations for the compensation of the Chief Executive Officer. Pursuant to his employment agreement, Mr. Cote received a base salary of $1,500,000 in 2003. Mr. Cote was awarded an annual incentive bonus for 2003 of $2,100,000. In determining the level of award, in addition to factors listed above under the description of the Company’s Incentive Compensation Plan for Executive Employees, the Committee considered the Company’s high quality earnings, the strength of its balance sheet, achievement of above target cash flow results in a difficult business environment, funded growth plans for new product and service introductions, the initiation of cycle time process improvements aimed at improving both productivity and customer satisfaction, continued progress on restructuring the Company’s portfolio of businesses, the development and implementation of process improvements relating to the identification, valuation, execution and integration of acquisitions, and the significant mitigation of future pension funding requirements. In February 2003, Mr. Cote was granted 600,000 stock options and 51,752 Growth Plan Units for the 2003-2004 performance cycle. The total annual value of these long-term awards was consistent with the minimum required amount in his employment agreement (details of Mr. Cote’s employment agreement are discussed below in the Employment and Termination Arrangements disclosure, page 27). Also, in 2003, Mr. Cote received a final cash make whole payment of $2.25 million for incentive compensation arrangements earned in prior years to which he would have been entitled from his former employer, but which he forfeited upon acceptance of employment with Honeywell. The Management Development and Compensation Committee: 22 Summary Compensation Table The following table provides a summary of cash and non-cash compensation paid to, earned by or awarded to Honeywell’s Chief Executive Officer during 2003 and the other four most highly compensated executive officers of Honeywell during 2003. (1) Other Annual Compensation consists of the following: 23 The stock options included in the following table were all granted with an exercise price equal to 100 percent of the fair market value of the Common Stock on the date of grant. 24 25 Each of the named executive officers has been granted contingent long-term performance awards denominated in dollars ($100 per unit) under Honeywell’s 2003 Stock Incentive Plan (the “Growth Plan”). 26 27 28 29 30 31 32 RETURN TO SIMPLE MAJORITY VOTE Board of Directors’ Recommendation — The Board of Directors recommends that the shareowners vote AGAINST this proposal for the following reasons: Most proposals submitted to a vote of Honeywell’s shareowners, whether by management or the shareowners, currently require a vote of a majority of the shares represented at a meeting, whether in person or by proxy. Upon our incorporation in 1985, however, our shareowners approved a Certificate of Incorporation and By-laws that contained provisions requiring the vote of 80% of the outstanding shares for certain actions. These limited provisions relate to the elimination of the classified Board of Directors, removal of directors, the calling of special meetings of shareowners and the requirement that shareowner action be taken at a meeting. These special voting provisions of our Certificate of Incorporation and By-laws are intended to preserve and maximize the value of Honeywell for all shareowners by providing protection against self-interested actions by one or a few large shareowners. Voting provisions similar to ours are included in the governing documents of many public corporations. They are intended to encourage a person making an unsolicited bid for Honeywell to negotiate with the Board of Directors to reach terms that are fair and provide the best results for all shareowners, large and small. Under the law, the Board has a fiduciary duty to act in a manner it believes to be in the best interest of Honeywell and all of its shareowners. The Board believes that it is in the best position to evaluate the adequacy and fairness of proposed offers, to negotiate on behalf of all shareowners and to protect shareowners from abusive tactics during a takeover process. Without such provisions, it may be possible for the holders of a majority of the shares represented at a meeting to take actions that would give them effective control of Honeywell without negotiating with the Board to achieve the best results for the other shareowners. It is important to note that Honeywell’s Board is an independent board, consisting of 13 outside directors and one inside director, providing further assurance that the existing shareowner voting provisions will not be used for entrenchment purposes. Furthermore, each committee of the Board is comprised entirely of independent, non-employee directors. The Board is firmly committed to both ensuring effective corporate governance and maximizing shareowner value. The Corporate Governance and Responsibility Committee of the Board of Directors is primarily responsible for analyzing corporate governance issues and making recommendations to the full Board. This Committee and the full Board have reviewed the issues raised in this proposal and, after careful consideration and for the reasons indicated above, continue to believe that the shareowner voting provisions contained in our Certificate of Incorporation and By-laws help to preserve and maximize the value of Honeywell for all shareowners and should be maintained. Adoption of this proposal would not in itself effectuate the changes contemplated by the proposal. Further action by the shareowners would be required to amend the By-laws and the Certificate of Incorporation. Under these documents, an 80% vote of the outstanding shares would be required for approval. Last year, only 47.4% of our outstanding shares were voted in favor of this proposal, reflecting that its support among our shareowners falls far short of what would be required to effect a change. Under Delaware law, amendments to the Certificate of Incorporation require a recommendation from the Board of Directors prior to submission to shareowners. While the Board would consider such amendments, it would do so consistent with its fiduciary duty to act in a manner it believes to be in the best interest of Honeywell and all of its shareowners. For the reasons stated above, your Board of Directors recommends a vote AGAINST this proposal. 33 34 35 Two-thirds of respondents believed that rewards in the workplace were distributed less fairly than they had been five years before (Harris Interactive press release, 10/18/02). RESOLVED: Shareholders request the Board’s Compensation Committee initiate a review of our company’s executive compensation policies and program and make available, upon request, a report of that review by January 1, 2005 (omitting confidential information and processed at a reasonable cost). We request the report include: A comparison of the total compensation package of top executives and our company’s lowest paid workers in the United States in July, 1994 and July, 2004. An analysis of changes in the relative size of the gap between the two groups and the rationale justifying this trend. An evaluation of whether our top executive compensation packages (including, but not limited to, options, benefits, perks, loans and retirement agreements) are “excessive” and should be modified. An explanation of whether the issues of sizable layoffs or the level of pay of our lowest paid workers should result in an adjustment of pay to “to more reasonable and justifiable levels” as suggested by William J. McDonough above. Supporting Statement When our top officials are given such excessive packages shareholders need to provide checks and balances. Please support this resolution. Board of Directors’ Recommendation — The Board of Directors recommends that the shareowners vote AGAINST this proposal for the following reasons: The Board of Directors believes that implementation of this proposal would impose a significant time, cost and resource burden on Honeywell, while not providing any reasonable benefit to Honeywell or its shareowners. Honeywell recognizes that all of its employees make important contributions to the Company’s success. Honeywell works diligently to ensure that all employees are compensated fairly according to their responsibilities, their performance, and their ability to impact overall corporate performance and results, taking into account competitive, geographic and market factors. The Management Development and Compensation Committee of the Board of Directors, which is comprised entirely of independent, non-employee directors, determines the compensation of Honeywell’s executive officers. The Committee also oversees the administration of its executive compensation programs designed to attract and retain highly qualified executives and to motivate them to maximize shareowner returns by achieving aggressive goals. The Committee reviews and approves corporate and individual goals and objectives relevant to the compensation of Honeywell’s executive officers, and evaluates the officers’ performance and sets compensation in view of the degree of achievement of those goals and objectives. In light of the independence of both the Board and the Management Development and Compensation Committee, the Board believes that the current procedures for establishing executive compensation levels ensure that such decisions are made in the best interests of Honeywell and its shareowners, taking into account all relevant factors. For the reasons stated above, your Board of Directors recommends a vote AGAINST this proposal. 36 ITEM — 7 CUMULATIVE VOTING This proposal has been submitted by June Kreutzer and Cathy Snyder, 54 Argyle Place, Orchard Park, New York 14127 (the owners of 260 shares of Common Stock). RESOLVED: Shareholders recommend that our Board of Directors increase shareholder rights by adopting a cumulative voting bylaw. Cumulative voting means that each shareholder may cast as many votes as equal the number of shares owned, multiplied by the number of directors to be elected. Each shareholder may thus cast all such cumulated votes for a single candidate or multiple candidates. This proposal topic received 46% of our yes-no shareholder vote in 2003. Looking toward our 2004 ballot mutual funds are expected to cast their ballots more in favor of shareholder-rights, “Tossing Out the Rubber Stamp,” Under SEC pressure, mutual funds are making waves in their proxy voting, Business Week, November 17, 2003. We believe cumulative voting increases the possibility of electing at least one director with an independent viewpoint. Cumulative voting is more likely to broaden the perspective of the Board, particularly in encouraging directors independent of management and help achieve the objective of the Board representing all shareholders in our view. Cumulative voting provides a voice for minority holdings, while not interfering with the voting majority of the Board in our view. Only cumulative voting gives proportionate weight to votes by stockholders whose holdings are sufficiently large to elect at least one but not a majority of our directors. Our company, particularly in the post-Enron era, could benefit from an increased opportunity to elect one independent director more focused on increasing shareholder rights and making our board more accountable to shareholders in our view. For example with cumulative voting shareholders could focus their votes on one director more interested in adopting the shareholder-rights proposal topics which won more than 57% of the yes-no shareholder vote in 2000 through 2003. Between 2000 and 2003 seven shareholder proposals each won greater than 57% of the yes-no vote. The topics were: Poison pills to be subject to shareholder vote 37 38 39 EXIT 37 80 46 10 80 24 280 EXIT MORRISTOWN Honeywell 287 N 78 Park Ave. MADISON Normandy 24 24 510 10 78 280 NEWARK Garden New STATEN Goethals Bridge 278 495 95 3 46 80 George Lincoln Tunnel Holland Tunnel So. Orange JFK Columbia Appendix I Annual Meeting of Shareowners April 26, 2004 You May Vote by YOUR VOTE IS IMPORTANT Electronic Distribution PROXY HONEYWELL This Proxy is Solicited on Behalf of the Board of Directors of Honeywell International Inc. Annual Meeting of Shareowners - April 26, 2004 Your vote on the election of Directors and the other proposals described in the accompanying Proxy Statement may be specified on the reverse side. The nominees for Director are: James J. Howard, Bruce Karatz, Russell E. Palmer, Ivan G. Seidenberg and Eric K. Shinseki. IF PROPERLY SIGNED, DATED AND RETURNED, THIS PROXY WILL BE VOTED AS SPECIFIED ON THE REVERSE SIDE OR, IF NO CHOICE IS SPECIFIED, THIS PROXY WILL BE VOTED “FOR” THE ELECTION OF ALL NOMINEES FOR DIRECTOR, “FOR” PROPOSAL 2 AND “AGAINST” PROPOSALS 3 THROUGH 7. Please date and sign your Proxy on the reverse side and return it promptly. ANNUAL MEETING OF SHAREOWNERS OF HONEYWELL O James J. Howard o Appendix II ANNUAL MEETING OF SHAREOWNERS OF HONEYWELL n O James J. Howard o PROXY HONEYWELL The undersigned hereby appoints David M. Cote, Peter M. Kreindler and Thomas F. Larkins as proxies (each with the power to act alone and with full power of substitution) to vote, as designated herein, all shares the undersigned is entitled to vote at the Annual Meeting of Shareowners of Honeywell International Inc. to be held on April 26, 2004, and at any and all adjournments thereof. The proxies are authorized to vote in their discretion upon such other business as may properly come before the Meeting and any and all adjournments thereof. Your vote on the election of Directors and the other proposals described in the accompanying Proxy Statement may be specified on the reverse side. The nominees for Director are: James J. Howard, Bruce Karatz, Russell E. Palmer, Ivan G. Seidenberg and Eric K. Shinseki. IF PROPERLY SIGNED, DATED AND RETURNED, THIS PROXY WILL BE VOTED AS SPECIFIED ON THE REVERSE SIDE OR, IF NO CHOICE IS SPECIFIED, THIS PROXY WILL BE VOTED “FOR” THE ELECTION OF ALL NOMINEES FOR DIRECTOR, “FOR” PROPOSAL 2 AND “AGAINST” PROPOSALS 3 THROUGH 7. Please date and sign your Proxy on the reverse side and return it promptly. COMMENTS: Appendix III Annual Meeting of Shareowners April 26, 2004 You May Direct Your Vote by Pursuant to the YOUR VOTING DIRECTION IS IMPORTANT PROXY VOTING DIRECTION HONEYWELL This Proxy Voting Direction is Solicited on Behalf of the Board of Directors of Honeywell International Inc. Annual Meeting of Shareowners - April 26, 2004 The undersigned hereby directs State Street Bank and Trust Company, Trustee under the Plans, to vote, as designated herein, all shares of common stock with respect to which the undersigned is entitled to direct the Trustee as to voting under the plans at the Annual Meeting of Shareowners of Honeywell International Inc. to be held on April 26, 2004, and at any and all adjournments thereof. The Trustee is also authorized to vote such shares in connection with the transaction of such other business as may properly come before the Meeting and any and all adjournments thereof. Your voting direction on the election of Directors and the other proposals described in the accompanying Proxy Statement may be specified on the reverse side. The nominees for Director are: James J. Howard, Bruce Karatz, Russell E. Palmer, Ivan G. Seidenberg and Eric K. Shinseki. IF PROPERLY SIGNED, DATED AND RETURNED, THE SHARES ATTRIBUTABLE TO YOUR ACCOUNT WILL BE VOTED BY THE TRUSTEE AS SPECIFIED ON THE REVERSE SIDE OR, IF NO CHOICE IS SPECIFIED, SUCH SHARES WILL BE VOTED “FOR” THE ELECTION OF ALL NOMINEES FOR DIRECTOR, “FOR” PROPOSAL 2 AND “AGAINST” PROPOSALS 3 THROUGH 7. THE TRUSTEE WILL VOTE SHARES AS TO WHICH NO DIRECTIONS ARE RECEIVED IN THE SAME RATIO AS SHARES WITH RESPECT TO WHICH DIRECTIONS HAVE BEEN RECEIVED FROM OTHER PARTICIPANTS IN THE PLANS. Please date and sign your Proxy on the reverse side and return it promptly. ANNUAL MEETING OF SHAREOWNERS OF HONEYWELL O James J. Howard o David M. Cote ![]()

March 15, 2004 To Our Shareowners: You are cordially invited to attend the Annual Meeting of Shareowners of Honeywell, which will be held at 10:30 a.m. on Monday, April 26, 2004 at our headquarters, 101 Columbia Road, Morris Township, New Jersey. The accompanying notice of meeting and proxy statement describe the matters to be voted on at the meeting. We will also take the opportunity to review our past business results and our outlook for the future. YOUR VOTE IS IMPORTANT. We encourage you to read the proxy statement and vote your shares as soon as possible. A return envelope for your proxy card is enclosed for convenience. Most shareowners will also have the option of voting via the Internet or by telephone. Specific instructions on how to vote via the Internet or by telephone are included on the proxy card. A map and directions to Honeywell’s headquarters appear at the end of the proxy statement. Sincerely, ![]()

DAVID M. COTE Chairman and Chief Executive Officer Table of Contents Page YOUR VOTE IS IMPORTANT

shares via the Internet or by telephone by following the instructions on your proxy card. If you hold

your shares through a bank or broker, you will be able to vote via the Internet or by telephone if your

bank or broker offers these options. If voting by mail, please complete, date and sign your proxy card

and return it as soon as possible in the enclosed envelope. • Election of five directors; • Appointment of PricewaterhouseCoopers LLP as independent accountants for 2004; • Five shareowner proposals described on pages 30 through 38 in the accompanying Proxy Statement; and to transact any other business that may properly come before the meeting. The Board of Directors has determined that shareowners of record at the close of business on February 27, 2004 are entitled to notice of and to vote at the meeting. By Order of the Board of Directors,

Thomas F. Larkins Vice President and Secretary Honeywell 101 Columbia Road Morris Township, NJ 07962 March 15, 2004 • All shareowners may vote by mail. • Shareowners of record, as well as participants in Honeywell stock funds within Honeywell savings plans, can vote via the Internet or by telephone. • Shareowners who hold their shares through a bank or broker can vote via the Internet or by telephone if the bank or broker offers these options. Please see your proxy card for specific voting instructions. Revoking Your Proxy Whether you vote by mail, telephone or via the Internet, you may later revoke your proxy by: • sending a written statement to that effect to the Secretary of Honeywell; • submitting a properly signed proxy with a later date; • voting by telephone or via the Internet at a later time; or • voting in person at the Annual Meeting (except for shares held in the savings plans). Vote Required Abstentions and Broker Non-Votes Abstentions are not counted as votes “for” or “against” a proposal, but are counted in determining the number of shares present or represented on a proposal. Therefore, since approval of Proposals 2 through 7 requires the affirmative vote of a majority of the shares of Common Stock present or represented, abstentions have the same effect as a vote “against” those proposals. New York Stock Exchange rules prohibit brokers from voting on Proposals 3 through 7 without receiving instructions from the beneficial owner of the shares. In the absence of instructions, shares subject to such “broker non-votes” will not be counted as voted or as present or represented on those proposals. Other Business The Board knows of no other matters to be presented for shareowner action at the meeting. If other matters are properly brought before the meeting, the persons named as proxies in the accompanying proxy card intend to vote the shares represented by them in accordance with their best judgment. The members of the Audit Committee are: • Russell E. Palmer (Chair) • Marshall N. Carter • James J. Howard • Eric K. Shinseki • John R. Stafford • Michael W. Wright The Audit Committee met five times in 2003. The primary functions of this Committee are to: appoint (subject to shareowner approval), and be directly responsible for the compensation, retention and oversight of, the firm that will serve as independent accountants to audit our financial statements and to perform services related to the audit (including the resolution of disagreements between management and the independent accountants regarding financial reporting); review the scope and results of the audit with the independent accountants; review with management and the independent accountants our interim and year-end operating results; consider the adequacy and effectiveness of our internal accounting and auditing procedures; review, approve and thereby establish procedures for the receipt, retention and treatment of complaints received by Honeywell regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and consider the accountants’ independence and establish policies and procedures for pre-approval of all audit and non-audit services provided to Honeywell by the independent accountants who audit its financial statements. At each meeting, Committee members meet privately with representatives of PricewaterhouseCoopers LLP, our independent accountants, and with Honeywell’s Vice President — Corporate Audit. The Board has determined that Mr. Palmer satisfies the “audit committee financial expert” criteria established by the Securities and Exchange Commission and the “accounting or related financial management expertise” criteria established by the New York Stock Exchange. See page 15 for the Audit Committee Report and page 16 for the Audit Committee Charter. Corporate Governance and Responsibility Committee The members of the Corporate Governance and Responsibility Committee are: • Bruce Karatz (Chair) • Gordon Bethune • Marshall N. Carter • Jaime Chico Pardo • Robert P. Luciano • Russell E. Palmer • Ivan G. Seidenberg • Eric K. Shinseki In May of 2003, the Corporate Governance and Corporate Responsibility Committees were consolidated into a single Committee of the Board to be known as the Corporate Governance and Responsibility Committee. Prior to that time, the Corporate Governance Committee and the Corporate Responsibility Committee had each met once in 2003. The combined Corporate Governance and Responsibility Committee met twice in 2003. The primary functions of this Committee are to: identify individuals qualified to become Board members, and recommend to the Board the nominees for election to the Board at the next Annual Meeting of Shareowners; develop and recommend to the Board a set of Corporate Governance Guidelines; lead the Board in its annual review of the performance of the Board and its committees; review policies and make recommendations to the Board concerning the size and composition of the Board, the qualifications and criteria for election to the Board, retirement from the Board, compensation and benefits of non-employee directors, the conduct of business between Honeywell and any person or entity affiliated with a director, and the structure and composition of Board committees; and review Honeywell’s policies and programs relating to compliance with its Code of Business Conduct, health, safety and environmental matters, equal employment opportunity and such other matters as may be brought to the attention of the Committee regarding Honeywell’s role as a responsible corporate citizen. See “Identification and Evaluation of Director Candidates” on page 6 and “Director Compensation” on page 13. Management Development and Compensation Committee The members of the Management Development and Compensation Committee are: • Robert P. Luciano (Chair) • Hans W. Becherer • Gordon M. Bethune • Clive R. Hollick • Bruce Karatz • Ivan G. Seidenberg • John R. Stafford The Management Development and Compensation Committee met five times in 2003. The primary functions of this Committee are to: evaluate and approve executive compensation plans, policies and programs, including review of relevant corporate and individual goals and objectives; review and set the annual salary and other remuneration of all officers; review the management development program, including executive succession plans; recommend individuals for election as officers; and review or take such other action as may be required in connection with the bonus, stock and other benefit plans of Honeywell and its subsidiaries. See pages 20-22 for the Report of the Management Development and Compensation Committee. Retirement Plans Committee The members of the Retirement Plans Committee are: • Michael W. Wright (Chair) • Hans W. Becherer • Jaime Chico Pardo • Clive R. Hollick • James J. Howard NOMINEES FOR ELECTION FOR TERM EXPIRING IN 2007

Director since 1999 Age 68

Director since 1999 Age 58

Director since 1987 Age 69

Director since 1995 Age 57

Director since 2003 Age 61 INCUMBENT DIRECTORS CONTINUING IN OFFICE FOR TERM EXPIRING IN 2005

Director since 1999 Age 63

Director since 2002 Age 51

Director since 1989 (Retiring) Age 70

Director since 1993 Age 66

Director since 1999 Age 65 INCUMBENT DIRECTORS CONTINUING IN OFFICE FOR TERM EXPIRING IN 2006

Director since 1991 Age 68

Director since 1999 Age 62

Director since 1999 Age 54

Director since June 2003 Age 58 (in millions of $) 2003 2002 Audit Fees 14.2 11.4 Annual audit of the Company’s consolidated financial statements, quarterly reviews of interim financial statements in the Company’s Form10-Q reports and statutory audits of foreign subsidiaries. Audit-Related fees 9.5 5.0 Audit-related services primarily associated with the Company’s merger and acquisition activity, audits of stand-alone financial statements of subsidiaries and, in 2003, services performed in connection with the Company’s initiatives to ensure compliance with Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting. Tax Fees 7.2 8.3 Tax compliance services were $5.8 in 2003 and $5.1 in 2002, relating primarily to extra-territorial income, expatriate and international tax compliance. Tax consultation and planning services were $1.4 in 2003 and $3.2 in 2002, relating primarily to expatriate tax, value-added tax and reorganizations. All Other Fees 0.0* 0.2 In 2003, the fee represents primarily licensing fees for electronic workpaper software used by our Corporate Audit Department. In 2002, the fees represent primarily analysis, report and testimony on damages in patent infringement actions. Total Fees 30.9 24.9

Marshall N. Carter

James J. Howard

Eric K. Shinseki

John R. Stafford

Michael W. Wright 1. Review the results of each external audit of the Company’s financial statements, including any certification, report, opinion or review rendered by the independent auditor in connection with the financial statements. 2. Review other matters related to the conduct of the audit which are communicated to the Committee under generally accepted auditing standards and rules of the Securities and Exchange Commission. 3. Based on the review under 1 and 2 above, the Committee will advise the Board of Directors whether it recommends that the audited financial statements be included in the Company’s Annual Report on Form 10-K and prepare the Committee report to be included in the Company’s proxy statement in accordance with Securities and Exchange Commission rules. 4. Review with management and the independent auditors, prior to the filing thereof, the Company’s annual and interim financial results (including Management’s Discussion and Analysis) to be included in Forms 10-K and 10-Q, respectively, and the matters required to be communicated to the Audit Committee under generally accepted auditing standards and rules of the Securities and Exchange Commission. The Chair of the Committee may represent the entire Committee for purposes of the interim review. 5. Appoint, and recommend to the shareowners for approval, the firm to be engaged as the Company’s independent auditor, which firm shall report directly to the Committee. The Committee shall be directly responsible for the compensation, retention and oversight of the independent auditor, including the resolution of disagreements between management and the independent auditor regarding financial reporting. The Committee shall have the sole authority to approve all audit engagement fees and terms. 6. Review and discuss the types of information to be disclosed and the types of presentations to be made in connection with earnings releases and financial information and earnings guidance provided to analysts and ratings agencies. 7. Evaluate the independent auditor’s performance and, if appropriate, recommend its discharge. 8. Receive from the independent auditor annually a formal written statement delineating the relationships between the auditors and the Company consistent with Independence Standards Board Standard No. 1. The Committee shall discuss with the auditor the scope of any disclosed relationships and their impact or potential impact on the auditor’s independence and objectivity, and recommend that the full Board take appropriate action to satisfy itself of the auditor’s independence. 9. Review reports by the independent auditor describing the auditor’s internal quality control procedures, material issues raised by its most recent internal quality control (or peer) review, all relationships between the auditor and the Company, and any audit problems or difficulties and management’s response. 10. Approve all non-audit engagements with the independent auditor, either through express prior review and approval or through the adoption of policies and procedures for engaging the independent auditor to perform services other than audit, review and attest services. Between regularly-scheduled meetings of the Committee, the Chair of the Committee may represent the entire Committee for purposes of the review and approval of the terms of non-audit engagements with the independent auditor. 11. Review reports of the independent auditor and the chief internal auditor related to the adequacy of the Company’s internal accounting controls, including any management letters and management’s responses to recommendations made by the independent auditor or the chief internal auditor. 12. Consider, in consultation with the independent auditor and the chief internal auditor, the scope and plan of forthcoming external and internal audits, the involvement of the internal auditors in the audit examination, and the independent auditor’s responsibility under generally accepted auditing standards. 13. Discuss the Company’s guidelines and policies with respect to risk assessment and risk management. 14. As appropriate, obtain advice and assistance from outside legal, accounting or other advisors. 15. Review, approve and thereby establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. 16. Review, approve and thereby establish clear hiring policies regarding employees or former employees of the independent auditor. 17. The Committee shall have the power to inquire into any financial matters not set forth above, and shall perform such other functions as may be assigned to it by law, or the Company’s charter or By-laws, or by the Board. 18. Undertake an annual performance evaluation of the activities of the Committee, including the Committee’s responsibilities as set forth above. Name and Complete Mailing Address Number

of Shares(1) Percent of

Common

Stock

Outstanding(2) State Street Bank and Trust Company

225 Franklin Street, Boston, MA 02101101,319,327 11.8 (1) State Street has sole voting power in respect of 25,628,857 shares; shared voting power in respect of 73,763,794 shares; sole dispositive power in respect of 27,355,284 shares; and shared dispositive power in respect of 73,964,043 shares. State Street disclaims beneficial ownership of all of the shares listed above. (2) State Street holds 8.6% of our outstanding common stock as trustee for certain Honeywell savings plans. Under the terms of the plans, State Street is required to vote shares attributable to any participant in accordance with instructions received from the participant and to vote all shares for which it does not receive instructions in the same ratio as the shares for which instructions were received. Name(1) Number of

Shares(2)(3)(4) Hans W. Becherer 52,462 Gordon M. Bethune 15,531 Marshall N. Carter 41,455 Jaime Chico Pardo 19,120 David M. Cote 1,854,911 Clive R. Hollick 6,005 James J. Howard 49,798 Bruce Karatz 49,341 Robert M. Luciano 40,045 Russell E. Palmer 30,792 Ivan G. Seidenberg 35,914 Eric K. Shinseki 5,135 John R. Stafford 55,107 Michael W. Wright 65,717 David J. Anderson 0 J. Kevin Gilligan 529,953 * Robert D. Johnson 727,961 Peter M. Kreindler 813,403 All directors and executive officers as a group,

including the above-named persons (22 people)5,333,061 * Mr. Gilligan’s last day of active employment was January 9, 2004. (1) c/o Honeywell International Inc., 101 Columbia Road, Morris Township, New Jersey 07962. (2) The total beneficial ownership for any individual is less than 0.22%, and the total for the group is approximately 0.62%, of the shares of Common Stock outstanding. (3) Includes the following number of shares or share-equivalents in deferred accounts, as to which no voting or investment power exists: Mr. Becherer, 29,427; Mr. Bethune, 6,331; Mr. Carter, 15,255; Mr. Chico Pardo, 9,867; Mr. Cote, 78,633; Mr. Hollick, 3,005; Mr. Howard, 39,331; Mr. Karatz, 33,750; Mr. Luciano, 9,870; Mr. Palmer, 9,592; Mr. Seidenberg, 16,714; Mr. Shinseki, 2,135; Mr. Stafford, 15,932; Mr. Wright, 54,267; Mr. Gilligan, 3,873; Mr. R. Johnson, 1,516; Mr. Kreindler, 24,956; and all directors and executive officers as a group, 358,256. Also includes the following number of shares subject to shared voting power and shared dispositive power: Mr. Stafford, 8,000 shares; and all directors and executive officers as a group, 43,170 shares. (4) Includes shares which the following have the right to acquire within 60 days through the vesting of restricted units and the exercise of stock options: Mr. Becherer, 16,200; Mr. Bethune, 6,200; Mr. Carter, 8,200; Mr. Chico Pardo, 6,200; Mr. Cote, 1,749,700; Mr. Howard, 6,200; Mr. Karatz, 6,200; Mr. Luciano, 16,200; Mr. Palmer, 14,200; Mr. Seidenberg, 16,200; Mr. Stafford, 16,200; Mr. Wright, 6,200; Mr. Gilligan, 460,000; Mr. R. Johnson, 700,000; Mr. Kreindler, 785,000 and all directors and executive officers as a group 4,706,400. Robert P. Luciano, Chairman Hans W. Becherer Gordon M. Bethune Clive R. Hollick Bruce Karatz Ivan G. Seidenberg John R. Stafford Annual Compensation Long-Term Compensation Awards Payouts Name and

Principal Position Year Salary($) Bonus($) Other Annual

Compensation($)(1) Restricted

Stock Awards($)(2) Securities

Underlying

Options/SARs

(Shares) LTIP

Payouts($) All Other

Compensation($)(3) David M. Cote (4) 2003 $ 1,500,000 $ 2,100,000 $ 596,954 $ — 600,000 — $ 2,665,027 Chairman of the Board 2002 1,292,308 1,875,000 723,543 25,140,500 2,202,200 — 2,837,741 and Chief Executive

Officer 2001 — — — — — — — Robert D. Johnson 2003 616,466 625,000 38,932 — 150,000 — 68,315 President and Chief 2002 590,000 615,000 105,117 3,392,000 — — 67,261 Executive Officer

Aerospace 2001 575,529 450,000 57,784 — 250,000 — 62,909 Peter M. Kreindler 2003 587,110 575,000 42,430 — 150,000 — 472,363 Senior Vice President 2002 495,000 550,000 317,320 3,692,000 — — 315,636 and General

Counsel 2001 495,000 510,000 40,449 — 200,000 — 214,617 J. Kevin Gilligan (5) 2003 576,466 500,000 42,706 — 150,000 — 1,805,147 President and Chief 2002 550,000 425,000 40,733 3,392,000 — — 71,855 Executive Officer

Automation and Control

Solutions 2001 488,233 275,000 40,305 451,125 250,000 — 52,030 David J. Anderson (6) 2003 368,219 700,000 149,310 4,323,000 262,000 — 2,260,719 Chief Financial 2002 — — — — — — — Officer 2001 — — — — — — — Mr. Cote Mr. Johnson Mr. Kreindler Mr. Gilligan Mr. Anderson Legal fees 2003 $ — — — — — 2002 118,667 — — — — 2001 — — — — — Personal use of company aircraft 2003 107,175 — 3,300 1,700 15,000 2002 61,475 20,291 10,350 — — 2001 — 24,677 — — — Personal financial planning 2003 29,350 — — — — 2002 15,354 — — — — 2001 — — — — — Cash flexible perquisite payments 2003 12,500 27,250 38,000 38,000 26,096 2002 43,056 27,250 38,000 38,000 — 2001 — 27,250 38,000 38,000 — Temporary housing 2003 73,194 — — — 20,227 2002 60,300 — 33,156 — — 2001 — — — — — Excess liability insurance 2003 1,130 1,130 1,130 1,130 471 2002 844 1,125 1,125 1,125 — 2001 — 1,105 1,105 1,105 — Personal use of company car 2003 66,651 9,125 — — — 2002 28,944 — — — — 2001 — 4,752 1,344 — — Executive auto insurance 2003 — — — 1,200 — 2002 — — — 1,200 — 2001 — — — 1,200 — Security 2003 169,978 — — — — 2002 — — — — — 2001 — — — — — Tax reimbursement payments 2003 136,976 1,427 — 676 87,516 2002 394,903 56,451 234,689 408 — 2001 — — — — — Total 2003 $ 596,954 $ 38,932 $ 42,430 $ 42,706 $ 149,310 2002 723,543 105,117 317,320 40,733 — 2001 0 57,784 40,449 40,305 — (2) The information in this column is based upon the closing price of Common Stock on the date of grant. Each restricted unit entitles the holder to a share of Common Stock on vesting. Common Stock dividend equivalents are payable on each restricted unit prior to vesting. The restricted units held by the individuals set forth below vest as follows: Mr. Cote, 55,500 vested on November 11, (footnotes continued on next page) (footnotes continued from previous page) 2002, 14,137 vested on February 22, 2003, 6,963 vested on February 22, 2004, 315,200 will vest on February 1, 2006 and 378,200 on July 1, 2012; Mr. Johnson, 50,000 vested on February 7, 2004 and 50,000 will vest on February 7, 2005; Mr. Kreindler, 100,000 will vest on April 26, 2005; Mr. Gilligan, 50,000 vested on February 7, 2004 and 12,500 will vest on July 16, 2004 and 12,000 on January 28, 2005; Mr. Anderson, 24,750 will vest on July 25, 2006, 49,500 on July 25, 2007, 50,250 on July 25, 2008 and 25,500 on July 25, 2009. The total number of unvested restricted units held and their value, both as of December 31, 2003, are as follows: Mr. Cote, 700,363 ($23,413,135); Mr. Johnson, 100,000 ($3,343,000); Mr. Kreindler, 100,000 ($3,343,000); Mr. Gilligan, 124,500 ($4,162,035); and Mr. Anderson, 150,000 ($5,014,500). All restricted units would vest in the event of the Normal/Full retirement, death or Total Disability of the grantee, or upon a Change in Control of Honeywell, as such terms are defined in the 1993 Stock Plan for Employees of Honeywell International and the 2003 Stock Incentive Plan for Employees of Honeywell International. (3) All other compensation for 2003 consists of the following: Mr. Cote Mr. Johnson Mr. Kreindler Mr. Gilligan Mr. Anderson Make whole payments* $ 2,250,000 — — — $ 2,260,000 Above market interest 318,906 $ 6,169 $ 413,094 $ 46,726 719 Matching contributions 53,077 49,246 46,885 47,846 — Executive life insurance 2,532 12,900 12,384 — — Above plan relocation 40,512 — — — — Amounts accrued in connection with resignation, retirement or

termination** — — — 1,710,575 — Total $ 2,665,027 $ 68,315 $ 472,363 $ 1,805,147 $ 2,260,719 * Represents bonus payments to which Mr. Cote and Mr. Anderson would have been entitled from their former employers, but which they forfeited upon acceptance of employment with Honeywell. ** Represents amounts accrued to Mr. Gilligan under the Company’s Severance Plan for Senior Executives (see “Employment and Termination Arrangements” on page 27 for a full description of such Plan and additional amounts payable to Mr. Gilligan in consideration for a non-compete arrangement). (4) Mr. Cote was hired on February 18, 2002. (5) Mr. Gilligan’s last day of active employment was January 9, 2004. (6) Mr. Anderson was hired on June 23, 2003. Mr. Anderson was granted 150,000 restricted units and 262,000 stock options upon approval by the MDCC on July 25, 2003 (of which 75,000 restricted units and 62,000 stock options were to compensate him for equity interests in his former employer that were forfeited when he joined Honeywell, and the remaining 75,000 restricted units and 200,000 stock options (100,000 of which are performance-accelerated vesting options) were granted as sign-on equity awards). In addition, Mr. Anderson was guaranteed a minimum target bonus of $700,000 for 2003. Option Grants in Last Fiscal YearName Number of

Securities

Underlying

Options

Granted(#) % of Total

Options

Granted to

Employees in

Fiscal Year Exercise

Price

($/Sh) Expiration

Date Grant Date

Present

Value(1) D. M. Cote 600,000 (2) 6.4 % $ 23.93 02/06/13 $ 5,382,000 R. D. Johnson 150,000 (2) 1.60 % 23.93 02/06/13 1,345,500 P. M. Kreindler 150,000 (2) 1.60 % 23.93 02/06/13 1,345,500 J. K. Gilligan 150,000 (2) 1.60 % 23.93 02/06/13 1,345,500 D. J. Anderson 262,000 (3) 2.79 % 28.13 07/24/13 2,719,560 (1) Options are valued using a Black-Scholes option pricing model which assumes: for Mr. Anderson, a historic five-year average volatility of 47.0%, the average dividend yield for the three years ended (footnotes continued on next page) (footnotes continued from previous page) December 31, 2003 (2.1%), a 3.0% risk-free rate of return (based on the average zero coupon five-year U.S. Treasury note yield for the month of grant), and an expected option life of 5.0 years based on past experience; for all other grants above, the historic five-year average volatility used to calculate the Black-Scholes value was 46.7%, the average dividend yield 1.9%, the risk-free rate of return 2.9%, and the expected option life 5.0 years. No adjustments are made for non-transferability or risk of forfeiture. Options will have no actual value unless, and then only to the extent that, the Common Stock price appreciates from the grant date to the exercise date. (2) 40% vested on January 1, 2004 and 30% will vest on each of January 1, 2005 and January 1, 2006. Pursuant to the terms of the 1993 Stock Plan for Employees of Honeywell International Inc., these options will immediately vest upon the normal retirement, death or Total Disability of the grantee, or upon a Change in Control of Honeywell, as such terms are defined in the 1993 Stock Plan. (3) Mr. Anderson was awarded 162,000 regular stock options and 100,000 performance-accelerated vesting stock options. These stock options vest as follows: 52,400 (all regular options) will vest on July 25, 2004. 42,400 (all regular options) will vest on July 25, 2005. 42,400 (all regular options) will vest on July 25, 2006. 52,400 (40,000 performance-accelerated vesting options and 12,400 regular stock options) will vest on July 25, 2007. 42,400 (30,000 performance-accelerated vesting options and 12,400 regular stock options) will vest on July 25, 2008. 30,000 (all performance-accelerated vesting stock options) will vest on July 25, 2009. However, 40,000 of the performance-accelerated vesting stock options are subject to acceleration to the end of the first consecutive twenty-day trading period following July 25, 2003 during which the average closing price of Honeywell Common Stock exceeds $35.17; 30,000 of the performance- accelerated vesting stock options are subject to acceleration to the end of the first consecutive twenty-day trading period following July 25, 2003 during which the average closing price of Honeywell Common Stock exceeds $42.20; and 30,000 of the performance-accelerated vesting stock options are subject to acceleration to the end of the first consecutive twenty-day trading period following July 25, 2003 during which the average closing price of Honeywell Common Stock exceeds $49.23. Pursuant to the terms of the 2003 Stock Incentive Plan for Employees of Honeywell International Inc., these options will immediately vest upon the Full retirement, death or Total Disability of the grantee, or upon a Change in Control of Honeywell, as such terms are defined in the 2003 Stock Incentive Plan. Aggregated Option Exercises in Last Fiscal

Year and FY-End Option Values Number of Securities

Underlying Unexercised

Options at Year-End(#) Value of Unexercised

In-the-Money Options

at Year-End($) Shares

Acquired on

Exercise(#) Value

Realized($) Name Exercisable Unexercisable Exercisable Unexercisable D. M. Cote — — 1,093,624 1,708,576 $ 54,681 $ 5,755,429 R. D. Johnson — — 565,000 225,000 — $ 1,425,000 P. M. Kreindler — — 665,000 210,000 — $ 1,425,000 J. K. Gilligan — — 325,000 225,000 — $ 1,425,000 D. J. Anderson — — — 262,000 — $ 1,388,600 LONG-TERM INCENTIVE PLANS — AWARDS IN LAST FISCAL YEAR Estimated Future Payouts Under Non-

Stock-Price-Based Plans(2) Name Number of

Units(1) Performance