- HON Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-3ASR Filing

Honeywell International (HON) S-3ASRAutomatic shelf registration

Filed: 22 Oct 21, 4:02pm

Exhibit 25.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939

OF A CORPORATION DESIGNATED TO ACT AS TRUSTEE

CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO SECTION 305(b)(2)

DEUTSCHE BANK TRUST COMPANY AMERICAS

(formerly BANKERS TRUST COMPANY)

(Exact name of trustee as specified in its charter)

| NEW YORK | 13-4941247 | |

| (Jurisdiction of Incorporation or organization if not a U.S. national bank) | (I.R.S. Employer Identification no.) | |

60 WALL STREET NEW YORK, NEW YORK (Address of principal executive offices) | 10005 (Zip Code) | |

Deutsche Bank Trust Company Americas

Attention: Mirko Mieth

Legal Department

60 Wall Street, 36th Floor

New York, New York 10005

(212) 250 – 1663

(Name, address and telephone number of agent for service)

HONEYWELL INTERNATIONAL INC.

(Exact name of obligor as specified in its charter)

| Delaware | 22-2640650 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

855 S. Mint Street Charlotte, North Carolina | 28202 | |

| (Address of principal executive offices) | (Zip code) | |

Debt Securities

(Title of the Indenture securities)

| Item 1. | General Information. | |||

| Furnish the following information as to the trustee. | ||||

| (a) Name and address of each examining or supervising authority to which it is subject. | ||||

Name | Address | |||

| Federal Reserve Bank (2nd District) | New York, NY | |||

| Federal Deposit Insurance Corporation | Washington, D.C. | |||

| New York State Banking Department | Albany, NY | |||

(b) Whether it is authorized to exercise corporate trust powers. Yes. | ||||

| Item 2. | Affiliations with Obligor. | |||

| If the obligor is an affiliate of the Trustee, describe each such affiliation. | ||||

None | ||||

| Item 3. -15. | Not Applicable | |||

| Item 16. | List of Exhibits. | |||

| Exhibit 1 - | Restated Organization Certificate of Bankers Trust Company dated August 31, 1998; Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated September 25, 1998; Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated December 18, 1998; Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated September 3, 1999; and Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated March 14, 2002, incorporated herein by reference to Exhibit 1 filed with Form T-1 Statement, Registration No. 333-201810. | |||

| Exhibit 2 - | Certificate of Authority to commence business, incorporated herein by reference to Exhibit 2 filed with Form T-1 Statement, Registration No. 333-201810. | |||

| Exhibit 3 - | Authorization of the Trustee to exercise corporate trust powers, incorporated herein by reference to Exhibit 3 filed with Form T-1 Statement, Registration No. 333-201810. | |||

| Exhibit 4 - | Existing By-Laws of Deutsche Bank Trust Company Americas, dated July 24, 2014, incorporated herein by reference to Exhibit 4 filed with Form T-1 Statement, Registration No. 333-201810. | |||

| Exhibit 5 - | Not applicable. | |||

| Exhibit 6 - | Consent of Bankers Trust Company required by Section 321(b) of the Act, incorporated herein by reference to Exhibit 6 filed with Form T-1 Statement, Registration No. 333-201810. | |||

| Exhibit 7 - | A copy of the latest report of condition of the trustee published pursuant to law or the requirements of its supervising or examining authority. | |||

| Exhibit 8 - | Not Applicable. | |||

| Exhibit 9 - | Not Applicable. | |||

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, Deutsche Bank Trust Company Americas, a corporation organized and existing under the laws of the State of New York, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in The City of New York, and State of New York, on this 29th day of September, 2021.

| DEUTSCHE BANK TRUST COMPANY AMERICAS | ||||||||

| /s/ Chris Niesz | ||||||||

| By: | Name: | Chris Niesz | ||||||

| Title: | Vice President | |||||||

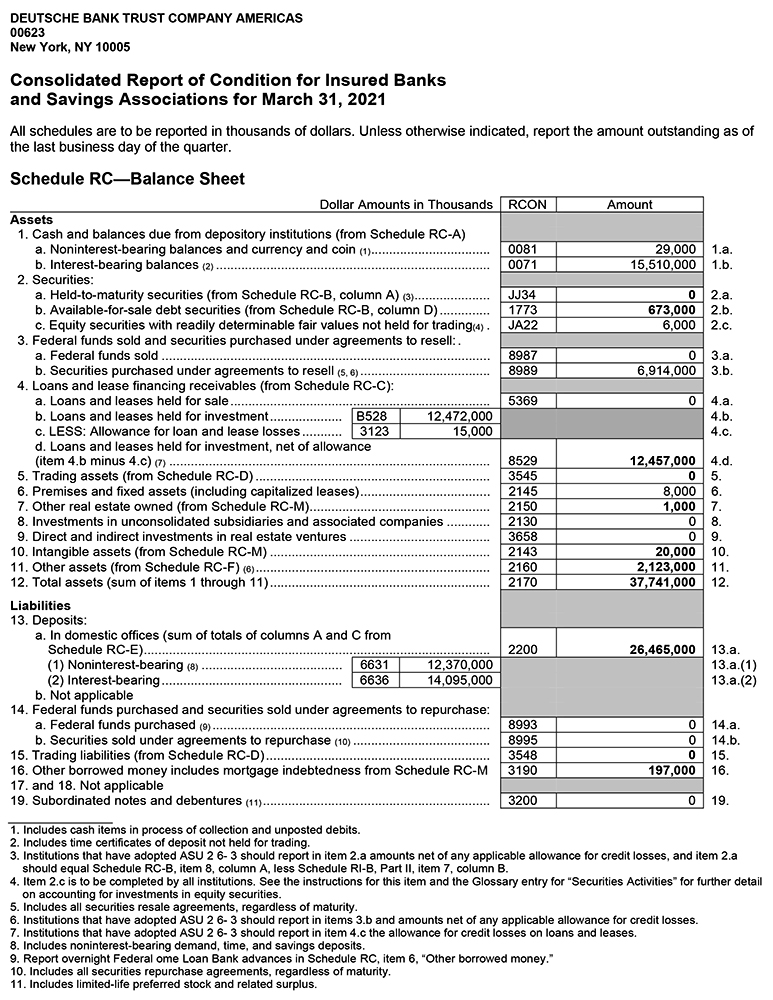

DEUTSCHE BANK TRUST COMPANY AMERICAS

00623

New York, NY 10005

| Board of Governors of the Federal Reserve System | OMB Number 7100-0036 | |||

| Federal Deposit Insurance Corporation | OMB Number 3064-0052 | |||

| Office of the Comptroller of the Currency | OMB Number 1557-0081 | |||

| Approval expires March 31 2024 | ||||

| Page 1 of 87 |

Federal Financial Institutions Examination Council

| Consolidated Reports of Condition and Income for a Bank with Domestic Offices Only—FFIEC 041 |

| Report at the close of business March 31, 2021 | 20210331 | |

| (RCON 9999) |

This report is required by law: 12 U.S.C. § 324 (State member banks); 12 U.S.C. §1817 (State nonmember banks); 12 U.S.C. §161 (National banks); and 12 U.S.C. §1464 (Savings associations). Unless the context indicates otherwise the term “bank” in this report form refers to both banks and savings associations.

| This report form is to be filed by banks with domestic offices only and total consolidated assets of less than $100 billion, except those banks that file the FFIEC 051 and those banks that are advanced approaches institutions for regulatory capital purposes that are required to file the FFIEC 031.

| |||||||||

NOTE: Each bank’s board of directors and senior management are responsible for establishing and maintaining an effective system of internal control including controls over the Reports of Condition and Income. The Reports of Condition and Income are to be prepared in accordance with federal regulatory authority instructions. The Reports of Condition and Income must be signed by the Chief Financial Officer (CFO) of the reporting bank (or by the individual performing an equivalent function) and attested to by not less than two directors (trustees) for state nonmember banks and three directors for state member banks national banks and savings associations.

I, the undersigned CFO (or equivalent) of the named bank attest that the Reports of Condition and Income (including the supporting | schedules) for this report date have been prepared in conformance with the instructions issued by the appropriate Federal regulatory authority and are true and correct to the best of my knowledge and belief.

We the undersigned directors (trustees) attest to the correctness of the Reports of Condition and Income (including the supporting schedules) for this report date and declare that the Reports of Condition and Income have been examined by us and to the best of our knowledge and belief have been prepared in conformance with the instructions issued by the appropriate Federal regulatory authority and are true and correct.

| |||||||||

Director (Trustee)

| ||||||||||

Signature of Chief Financial Officer (or Equivalent)

| Director (Trustee) | |||||||||

| 04/30/2021 | ||||||||||

Date of Signature

| Director (Trustee)

| |||||||||

Submission of Reports | ||||||||||

Each bank must file its Reports of Condition and Income (Call Report) data by either:

(a) Using computer software to prepare its Call Report and then submitting the report data directly to the FFIEC’s Central Data Repository (CDR) an Internet-based system for data collection (https://cdr.ffiec.gov/cdr/) or (b) Completing its Call Report in paper form and arranging with a software vendor or another party to convert the data into the electronic format that can be processed by the software vendor or other party then must electronically submit the bank’s data file to the CDR | To fulfill the signature and attestation requirement for the Reports of Condition and Income for this report date attach your bank’s completed signature page (or a photocopy or a computer generated version of this page) to the hard-copy record of the data file submitted to the CDR that your bank must place in its files.

The appearance of your bank’s hard-copy record of the submitted data file need not match exactly the appearance of the FFIEC’s sample report forms but should show at least the caption of each CDR. The Call Report item and the reported amount.

DEUTSCHE BANK TRUST COMPANY AMERICAS | |||||||||

| For technical assistance with submissions to the CDR please contact the CDR Help Desk by telephone at (888) CDR-3111, by fax at (703) 774-3946 or by e-mail at cdr.help@cdr.ffiec.gov. | New York City (RSSD 9130) | |||||||||

| FDIC Certificate Number | 623 | NY | 10005 | |||||||

| (RSSD 9050) | State Abbreviation (RSSD 9200) | Zip Code (RSSD 9220) | ||||||||

Legal Entity Identifier (LEI) | ||||||||||

| 8EWQ2UQKS07AKK8ANH81 | ||||||||||

| (Report only if your institution already has an LEI.) (RCON 9224) | ||||||||||

|

| |||||||||

The estimated average burden associated with this information collection is 55.20 hours per respondent and is expected to vary by institution depending on individual circumstances. Burden estimates include the time for reviewing instructions gathering and maintaining data in the required form and completing the information collection but exclude the time for compiling and maintaining business records in the normal course of a respondent’s activities. A Federal agency may not conduct or sponsor and an organization (or a person) is not required to respond to a collection of information unless it displays a currently valid OMB control number. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Office of Information and Regulatory Affairs Office of Management and Budget Washington DC 20503 and to one of the following: Secretary Board of Governors of the Federal Reserve System 20th and C Streets N Washington DC 20551; Legislative and Regulatory Analysis Division Office of the Comptroller of the Currency Washington DC 20219; Assistant Executive Secretary Federal Deposit Insurance Corporation Washington DC 20429.

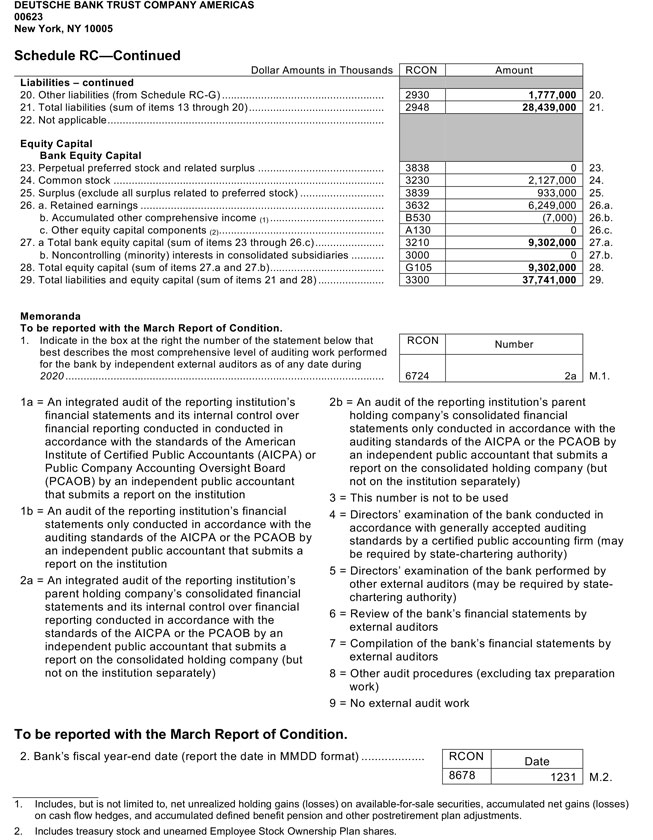

2

Schedule RC—Continued Dollar Amounts in Thousands RCON Amount Liabilities – continued 20. Other liabilities (from Schedule RC-G) 2930 1,777,000 20. 21. Total liabilities (sum of items 13 through 20) 2948 28,439,000 21. 22. Not applicable Equity Capital Bank Equity Capital 23. Perpetual preferred stock and related surplus 3838 0 23. 24. Common stock 3230 2,127,000 24. 25. Surplus (exclude all surplus related to preferred stock) 3839 933,000 25. 26. a. Retained earnings 3632 6,249,000 26.a. b. Accumulated other comprehensive income (1) B530 (7,000) 26.b. c. Other equity capital components (2) A130 0 26.c. 27. a Total bank equity capital (sum of items 23 through 26.c) 3210 9,302,000 27.a. b. Noncontrolling (minority) interests in consolidated subsidiaries 3000 0 27.b. 28. Total equity capital (sum of items 27.a and 27.b) G105 9,302,000 28. 29. Total liabilities and equity capital (sum of items 21 and 28) 3300 37,741,000 29. Memoranda To be reported with the March Report of Condition. 1.Indicate in the box at the right the number of the statement below that best describes the most comprehensive level of auditing work performed for the bank by independent external auditors as of any date during 2020 RCON Number M.1. 6724 2a 1a = An integrated audit of the reporting institution’s financial statements and its internal control over financial reporting conducted in conducted in accordance with the standards of the American Institute of Certified Public Accountants (AICPA) or Public Company Accounting Oversight Board (PCAOB) by an independent public accountant that submits a report on the institution 1b = An audit of the reporting institution’s financial statements only conducted in accordance with the auditing standards of the AICPA or the PCAOB by an independent public accountant that submits a report on the institution 2a = An integrated audit of the reporting institution’s parent holding company’s consolidated financial statements and its internal control over financial reporting conducted in accordance with the standards of the AICPA or the PCAOB by an independent public accountant that submits a report on the consolidated holding company (but not on the institution separately) 2b = An audit of the reporting institution’s parent holding company’s consolidated financial statements only conducted in accordance with the auditing standards of the AICPA or the PCAOB by an independent public accountant that submits a report on the consolidated holding company (but not on the institution separately) 3 = This number is not to be used 4 = Directors’ examination of the bank conducted in accordance with generally accepted auditing standards by a certified public accounting firm (may be required by state-chartering authority) 5 = Directors’ examination of the bank performed by other external auditors (may be required by state-chartering authority) 6 = Review of the bank’s financial statements by external auditors 7 = Compilation of the bank’s financial statements by external auditors 8 = Other audit procedures (excluding tax preparation work) 9 = No external audit work To be reported with the March Report of Condition. 2. Bank’s fiscal year-end date (report the date in MMDD format) RCON Date M.2. 8678 1231 1. Includes, but is not limited to, net unrealized holding gains (losses) on available-for-sale securities, accumulated net gains (losses) on cash flow hedges, and accumulated defined benefit pension and other postretirement plan adjustments. 2. Includes treasury stock and unearned Employee Stock Ownership Plan shares.