QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

PEOPLES ENERGY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Notice of Annual Meeting of Shareholders

and Proxy Statement

February 27, 2004 at 11:00 a.m.

Harris Trust and Savings Bank

Eighth Floor - Auditorium

115 S. LaSalle Street

Chicago, Illinois

PEOPLES ENERGY CORPORATION • 130 East Randolph Drive • Chicago, Illinois 60601

THOMAS M. PATRICK

Chairman of the Board

January 6, 2004

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Peoples Energy Corporation, to be held on Friday, February 27, 2004. The meeting will begin at 11:00 a.m. in the auditorium on the eighth floor of Harris Trust and Savings Bank, located at 115 S. LaSalle Street, Chicago, Illinois.

It is important that your shares be represented at this meeting. Therefore, whether or not you plan to attend, please sign the enclosed proxy and return it promptly in the envelope provided. If you attend the meeting, you may, at your discretion, withdraw your proxy and vote in person.

If you plan to attend the meeting, please save the admission ticket that is attached to your proxy and present it at the door.

Let me again urge you to return your proxy at your earliest convenience.

| | Sincerely, |

|

|

|

Chairman of the Board |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 27, 2004

The regular Annual Meeting of Shareholders of PEOPLES ENERGY CORPORATION will be held in the auditorium on the eighth floor of Harris Trust and Savings Bank, located at 115 S. LaSalle Street, Chicago, Illinois, at 11:00 a.m. on Friday, February 27, 2004, for the following purposes:

- 1.

- To elect directors of Peoples Energy Corporation.

- 2.

- To approve the 2004 Incentive Compensation Plan.

- 3.

- To act upon such other matters as may properly come before the meeting.

All shareholders, whether or not they expect to be present at the meeting, are requested to sign, date, and mail the accompanying proxy in the envelope enclosed with this Notice. Shareholders who are present at the meeting may withdraw their proxies and vote in person.

If you plan to attend the meeting, please save the admission ticket that is attached to your proxy and present it at the door. Attendance at the meeting will be limited to shareholders of record as of the record date and their guests or their authorized representatives, not to exceed two per shareholder, and to guests of the Company.

Shareholders of record as of December 31, 2003, will be entitled to vote at the meeting and at any adjournment thereof.

| | |

|

PETER KAUFFMAN

Secretary |

Chicago, Illinois

January 6, 2004 |

|

PEOPLES ENERGY CORPORATION • 130 East Randolph Drive • Chicago, Illinois 60601

January 6, 2004

PROXY STATEMENT

This Proxy Statement is being mailed to shareholders on or about January 6, 2004, in connection with the solicitation of proxies on behalf of the Board of Directors of Peoples Energy Corporation (the Company), to be voted at the Annual Meeting of Shareholders of the Company. The meeting will be held at 11:00 a.m. on Friday, February 27, 2004, in the auditorium on the eighth floor of Harris Trust and Savings Bank, located at 115 S. LaSalle Street, Chicago, Illinois. The shares represented by the proxies received are to be voted in accordance with the specifications contained in the proxy.Proxies are revocable at any time prior to use.

The Company has borne the cost of preparing, assembling, and mailing this proxy soliciting material. In addition to solicitation by mail, there may be incidental personal solicitations made by directors, officers, and regular employees of the Company. The cost of solicitation, including payments to brokers, nominees, or fiduciaries who mail such material to their clients, will be borne by the Company.

The Company has retained Georgeson Shareholder Communications, Inc., 17 State Street, 10th Floor, New York, New York 10004, to assist with the solicitation of proxies from certain shareholders, for which services Georgeson Shareholder Communications will receive a fee that is expected to be about $6,500, plus reimbursement for certain expenses.

Outstanding Voting Securities

Only holders of common shares of record as of December 31, 2003, are entitled to vote at the meeting or any adjournment thereof. As of December 31, 2003, there were outstanding 36,985,080 shares of common stock of the Company.

The Annual Report of the Company for the fiscal year ended September 30, 2003, including financial statements, is being mailed on or about January 6, 2004 with this Proxy Statement to all shareholders of record as of December 31, 2003.

Voting Rights

Other than in the election of directors, each shareholder shall be entitled to one vote for each share of common stock owned. In the election of directors, shareholders have cumulative voting rights. Cumulative voting rights entitle each shareholder to the number of votes equal to the number of shares of common stock the shareholder owns multiplied by the number of directors to be elected—in this case ten. All votes can be cast for one nominee or divided among more than one. A vote marked "withheld" from a nominee(s) on the proxy card will not be treated as an indication of an intention to vote cumulatively. To vote cumulatively, the shareholder should line through the names of the nominees from whom votes are withheld and write "cumulate" or "vote all shares for other nominees" on the proxy card. In a case where a proxy is signed but not marked, the proxy will not be voted cumulatively; shares will be voted for all nominees. If you wish to vote cumulatively, you must vote by proxy card rather than by telephone or through the internet. To vote by telephone or through the internet, see the instructions attached to your proxy card.

1

ITEM 1. ELECTION OF DIRECTORS

All directors are to hold office for a term of one year or until their respective successors shall be duly elected.

Information Concerning Nominees for Election as Directors

| | James R. Boris, 59. Director since 1999. Chairman of JB Capital Management, LLC. Former Chairman and Chief Executive Officer of EVEREN Capital Corporation (1995-1999) and EVEREN Securities, Inc., a wholly owned subsidiary (1990-1999). Mr. Boris was concurrently an Executive Vice President of Kemper Corporation (1994-1995) and a director of Kemper Financial Companies, Inc. and its major subsidiaries (1990-1995). Mr. Boris is also a director of Smurfit-Stone Container Corporation and The Chicago Board Options Exchange. |

|

|

William J. Brodsky, 59. Director since 1997. Chairman and Chief Executive Officer (1997) of The Chicago Board Options Exchange. Prior to that, Mr. Brodsky was President and CEO of The Chicago Mercantile Exchange (1985-1997). Mr. Brodsky also serves on the Board of the International Advisory Committee of the Federal Reserve Bank of New York, the Board of Directors of Sustainable Forestry Management Limited, a private company, and the Board of Directors of the Futures Industry Association. |

|

|

Pastora San Juan Cafferty, 63. Director since 1988. Professor, since 1985, at the University of Chicago, Chicago, Illinois, where she has been on the faculty since 1971. Mrs. Cafferty is also a director of Harris Financial Corp. (formerly Bankmont Financial Corp.), Kimberly-Clark Corporation, and Waste Management, Inc. |

|

|

John W. Higgins, 57. Director since 2003. Chief Executive Officer (1980) of Higgins Development Partners, LLC, a developer of commercial real estate, which Mr. Higgins founded in 1980. Prior to founding Higgins Development Partners, LLC, Mr. Higgins was responsible for real estate equity and debt structuring at Percy Wilson Mortgage and Finance Corporation and was in the Commercial Real Estate Finance Division at the First National Bank of Chicago. |

|

|

Dipak C. Jain, 46. Director since 2002. Dean, since 2001, at the Kellogg School of Management, Northwestern University, where he has been on the faculty since 1986. Mr. Jain is also the Sandy & Morton Goldman Professor of Entrepreneurial Studies and a Professor of Marketing at Kellogg (since 1994) and a visiting Professor of Marketing, Sasin Graduate Institute of Business Administration, Chulalongkorn University, Bangkok (since 1989). Mr. Jain is also a director of John Deere & Co., United Air Lines, Inc. and Hartmarx Corp. |

| | | |

2

|

|

Michael E. Lavin, 57. Director since 2003. President and Chief Executive Officer of Keystone Advisors, LLC, an advisory firm to audit committees (2003). Former Midwest Area Managing Partner of KPMG LLP (1993-2002). Mr. Lavin retired from KPMG in January 2003, having been with the firm since 1967. Mr. Lavin is also a member of the Board of Directors of Tellabs, Inc. |

|

|

Homer J. Livingston, Jr., 68, serves as Lead Director and has been a director since 1989. Mr. Livingston is Chairman of the Board of Evanston Northwestern Healthcare (since 1999). He formerly served as President and Chief Executive Officer of the Chicago Stock Exchange, President and CEO of LaSalle National Bank of Chicago and as the Trustee of the Southern Pacific Railroad. |

|

|

Thomas M. Patrick, 58. Director since 1998. Chairman of the Board, President and Chief Executive Officer (2002) of the Company. Prior to becoming Chairman of the Board, President and Chief Executive Officer, Mr. Patrick was President and Chief Operating Officer (1998-2002). Mr. Patrick has also held the positions of Executive Vice President (1997-1998) of the Company and its subsidiaries and Vice President (1989-1996) of both the Company's utility subsidiaries. Mr. Patrick has been an employee of the Company and/or its subsidiaries since 1976. Mr. Patrick is also a Director of Associated Electric and Gas Insurance Services Limited. |

|

|

Richard P. Toft, 67. Director since 1988. Non-executive Chairman of Alleghany Asset Management, Inc. (2000-2001). Former Chairman of the Board and Chief Executive Officer of Alleghany Asset Management, Inc., Chicago, Illinois, an investment management and advisory service subsidiary of Alleghany Corp. (1995-2000). Mr. Toft was also Chairman of the Board of Chicago Title Corporation and was Chairman and CEO of its predecessor company, Chicago Title & Trust Co. Mr. Toft also served as a director of The Cologne Life Reinsurance Company (1994-1999), Alleghany Underwriting Holdings, Ltd. (London, England 2000-2001) and Fidelity National Financial, Inc. (2000-2002). Mr. Toft is a Director of Underwriter Laboratories, Inc. and a Director of Capitol Transamerica Corp. |

|

|

Arthur R. Velasquez, 65. Director since 1985. Chairman, President and Chief Executive Officer, since 1989, of Azteca Foods, Inc., Chicago, Illinois, a Mexican food products company. Prior to that, Mr. Velasquez was President and Chief Executive Officer of Azteca Corn Products Corporation. Mr. Velasquez is also a director of LaSalle Bank National Association. |

3

VOTE REQUIRED FOR APPROVAL

There are ten director positions authorized by the Company's By-Laws for the one-year term commencing on the date of the annual meeting of shareholders. Nominees who receive a plurality of votes will be elected. Abstentions will have the effect of votes against the nominee. Broker non-votes will not be counted for or against any nominee. Unless otherwise specified, votes represented by the proxies will be cast equally for the election of the above-named nominees to the office of director; however, the votes may be cast cumulatively for less than the entire number of nominees if any situation arises that, in the opinion of the proxy holders, makes such action necessary or desirable. If any of the nominees should be unable to serve or will not serve, which is not anticipated, management reserves discretionary authority to vote for a substitute.

Meetings and Fees of the Board of Directors

The Board of Directors held nine meetings during fiscal 2003. Mr. Jain attended 73.68% of the aggregate number of meetings of the Board and of those committees on which he served due to domestic and international commitments during fiscal 2003 that Mr. Jain made prior to being recommended as a nominee for director. All other incumbent directors attended at least 95.83% of the aggregate number of meetings of the Board and of those committees on which such directors served. The Company does not maintain a formal policy regarding the Board's attendance at annual shareholder meetings; however, Board members are expected to attend such meetings barring unforeseen circumstances. At the 2003 annual meeting of shareholders, all members of the Board were present.

During fiscal year 2003, directors who were not employees of the Company received an annual retainer of $35,000 and a meeting fee of $3,000 for each Board meeting attended and for each committee meeting attended as a committee member. In addition, any nonemployee director who served as chairman of a committee of the Board received a $6,000 annual retainer. The Lead Director, whose duties are explained below, receives an additional annual retainer of $25,000 and a meeting fee of $3,000 for each committee meeting attended as anex officio member. Officers of the Company who serve on the Board receive no compensation as directors.

Nonemployee directors also participate in the Company's Directors Stock and Option Plan ("DSOP"). The purpose of the DSOP is to provide nonemployee directors with a proprietary interest in the Company and to improve the Company's ability to attract and retain highly qualified individuals to serve as directors of the Company. Under the DSOP, each nonemployee director of the Company receives, as part of his or her annual retainer an annual award of 1,000 deferred shares of common stock of the Company. Deferred shares are automatically deferred until the earliest of (i) the director's retirement from the Company's Board of Directors following attaining the age of 70; (ii) one year after the director ceases to be a director of the Company for any other reason, or (iii) a change of control of the Company, and are not delivered by the Company until such date. Directors may elect to defer receipt of common stock in whole or in part for a period of time after the date on which distribution would otherwise occur by making an election to receive shares of common stock in installments no later than the calendar year prior to the year in which the distribution would otherwise occur. The director is entitled to receive amounts representing dividends from such deferred shares equal to dividends paid with respect to a like number of shares of common stock of the Company. Each director can make an election from time to time as to whether to receive dividends in the form of cash payments or in the form of additional deferred shares. A bookkeeping account is maintained for each nonemployee director. Each grant of deferred shares is automatically deferred and credited to the account of the director. The account of a director who elects to receive dividends in the form of additional deferred shares is credited with a number of deferred shares determined by dividing the amount of the dividend by the mean price of a share of Company common stock on the New York Stock Exchange on the dividend payment date. Deferred shares do not entitle a director to vote on any matter to be considered by the Company's shareholders prior to the date of distribution of common stock and are generally not transferable other than upon a director's death. During

4

the fiscal year ended September 30, 2003, participants in the DSOP as a group were credited with 9,113 deferred shares, with an average per-share base price of $38.80.

The Company offers nonemployee directors an opportunity to defer their compensation, except for options and stock received upon the exercise thereof. Under the Directors Deferred Compensation Plan, a director may elect to defer the receipt of compensation earned as a director until a future date. Cash compensation may be deferred in the form of cash, Company common stock, or a combination of both; stock compensation may be deferred only in the form of Company common stock. An election to defer, or to cease to defer, compensation earned as a director of the Company is effective only with respect to compensation earned in the calendar year following the year in which the election is made, but in no event with respect to compensation earned within six months after the date on which the election is made.

A bookkeeping account is maintained for each participant. The account reflects the amount of cash and/or the number of share equivalents to which the participant is entitled under the terms of the plan.

The account of a participant who elects to defer compensation in the form of cash is credited with the dollar amount of compensation so deferred on each date that the participant is entitled to payment for services as a director. Interest on the cash balance of the account is computed and credited quarterly as of March 31, June 30, September 30, and December 31 of each year at the prime commercial rate in effect at Harris Trust and Savings Bank, Chicago, Illinois.

The account of a participant who elects to defer compensation in the form of stock is credited with share equivalents on each date that the participant is entitled to payment for services as a director. The number of share equivalents so credited is determined by dividing the compensation so deferred by the mean price of a share of Company common stock on the New York Stock Exchange on such date. Additional share equivalents are credited to the director's account on each date that the Company pays a dividend on the common stock. During the fiscal year ended September 30, 2003, plan participants as a group were credited with 10,628 share equivalents for compensation deferred in the form of stock, with an average per-share base price of $38.32. During the same period, no participants were credited with compensation deferred in the form of cash.

Director Independence

The Board has determined that all nominees for election to the Board at the 2004 Annual Meeting are independent under the revised listing standards of the New York Stock Exchange, except Mr. Patrick, Chairman, CEO and President of the Company. Accordingly, 9 of the 10 nominees are independent. In making its determination of independence, the Board applied its Categorical Standards for Director Independence (Appendix A to this Proxy Statement). Mr. Boris will satisfy the Categorical Standards until November 4, 2004. Thereafter, he will become regarded as non-independent until the end of his one-year term.

Committees of the Board of Directors

The standing committees of the Board of Directors of the Company at the commencement of fiscal 2003 were the Audit, Compensation-Nominating, Public Policy and Executive Committees. Effective December 4, 2002, the Board of Directors of the Company amended the charter for its Audit Committee and established two new committees, the Compensation Committee and the Nominating-Governance Committee, replacing the Compensation-Nominating Committee and the Public Policy Committee and approved written charters for the new committees.

The charters for each of the Audit, Compensation and Nominating-Governance Committees can be found on the Company's website atwww.peoplesenergy.com.

The charter for the Audit Committee has since been further revised and expands the duties and responsibilities of the Audit Committee. In particular, the Audit Committee has sole authority for

5

retaining and replacing the Company's independent auditors. The Audit Committee is charged with assisting the Board in its oversight of (i) the quality and integrity of the Company's financial statements, accounting, internal controls, and auditing; (ii) the Company's compliance with legal and regulatory requirements; (iii) the qualifications and independence of the independent auditor responsible for the annual financial audit and other independent public accountants; (iv) the performance of the Company's internal audit function, the Independent Auditor and other independent public accountants; (v) the Company's Code of Business Conduct and Ethics; and (vi) such other matters as the Chairman of the Audit Committee deems appropriate. The Audit Committee is also responsible for establishing procedures for (i) the receipt, retention and treatment of complaints, questions and other information received by the Company regarding accounting, internal accounting controls or auditing matters; and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. The members of the Audit Committee are Messrs. Boris (Chairman), Brodsky, Higgins, Lavin, Velasquez, and Mrs. Cafferty. All of the members of the Audit Committee are independent (as that term is defined in Section 303A.02 of the New York Stock Exchange's listing standards). The Board of Directors has determined that all members of the Audit Committee are audit committee financial experts (as that term is defined under Item 401(h) of Regulation S-K). The Audit Committee held five meetings in fiscal 2003.

The Compensation Committee's responsibilities include (i) assisting the Board to discharge its responsibilities relating to the compensation of the executives of the Company and its subsidiaries and the long term incentive compensation of other key employees; (ii) making recommendations to the Board regarding the compensation of non-management directors and (iii) nominating individuals to become elected officers. The members of the Compensation Committee are Messrs. Brodsky (Chairman), Boris, Jain, Lavin, and Toft and Mr. Lester H. McKeever, who is not standing for re-election to the Board. All of the members of the Compensation Committee except Mr. McKeever are independent (as that term is defined in Section 303A.02 of the New York Stock Exchange's listing standards). The Compensation Committee held four meetings in fiscal 2003.

The Nominating-Governance Committee has responsibility for (i) developing criteria for selecting directors; (ii) identifying individuals qualified to become members of the Board of Directors and recommending director nominees for the next annual meeting of shareholders; (iii) overseeing the evaluation of the Board and executive management; (iv) developing and recommending to the Board corporate governance guidelines applicable to the Company; and (v) advising the Board and management regarding public policy matters. The Nominating-Governance Committee will consider written recommendations from shareholders of the Company regarding potential nominees for election as directors. To be considered for inclusion in the slate of nominees proposed by the Board at the next Annual Meeting of Shareholders of the Company, such recommendations should be received in writing by the Secretary of the Company no later than September 8, 2004. In addition, the Nominating-Governance Committee maintains, with the approval of the Board, formal criteria for selecting directors and also considers other matters, such as the size and composition of the Board. The criteria used for selecting directors are included in the Company's "Guidelines for Membership on the Board of Directors," which is attached hereto as Appendix B (the "Membership Guidelines"). Nominees for the Board are typically identified by non-management members of the Board. Nominees are evaluated based on their background, experience and other relevant factors as described in the Membership Guidelines. The Nominating-Governance Committee does not intend to evaluate nominees proposed by shareholders any differently than other nominees to the Board. John Higgins is the only nominee approved by the Nominating-Governance Committee for inclusion on the Company's proxy card for the annual meeting, other than directors standing for re-election. Mr. Higgins was nominated by a non-management director.

The Nominating-Governance Committee also considers and makes recommendations to the Board regarding the Company's Contributions Program and Budget, and reviews and monitors corporate policy with respect to charitable and philanthropic giving. Members of the Nominating-Governance Committee

6

are Mrs. Cafferty (Chairman), Messrs. Higgins, Jain, McKeever, Toft, and Velasquez. All of the members of the Nominating-Governance Committee except Mr. McKeever are independent (as that term is defined in Section 303A.02 of the New York Stock Exchange's listing standards). The Nominating-Governance Committee held five meetings in fiscal 2003.

The Board has appointed Mr. Livingston as Lead Director. Among other responsibilities, Mr. Livingston presides over regular meetings of the non-management Directors and participates in the work of the Audit, Compensation, and Nominating-Governance Committees as anex officio member. During fiscal 2003, the non-management Directors held five meetings without management present.

Shareholders or other interested parties may contact the Lead Director, other non-management directors or the Board by calling 1-800-732-0399. A majority of the Board's independent directors has approved the process for determining which communications are forwarded to various members of the Board.

The Executive Committee, in the recess of the Board, has the authority to act upon most corporate matters that require Board approval. The members of the Executive Committee are Messrs. Patrick (Chairman), Boris, Brodsky, Jain, Livingston, McKeever, Toft, Velasquez, and Mrs. Cafferty. The Executive Committee did not hold any meetings in fiscal 2003.

Report of the Audit Committee

The Audit Committee is comprised of Messrs. Boris, Brodsky, Higgins, Lavin, Velasquez, and Mrs. Cafferty. The Board of Directors has adopted a written charter for the Audit Committee, the current copy of which is attached as Appendix C to this Company's proxy statement.

The Audit Committee has reviewed and discussed the Company's audited financial statements with management. The Audit Committee has discussed with the Company's independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards AU 380), as may be modified or supplemented. The Audit Committee has received and reviewed the written disclosures and the letter from the independent accountant required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as may be modified or supplemented, and has discussed the independent accountant's independence with the independent accountant.

The Audit Committee, based upon its reviews and discussions described in the immediately preceding paragraph, has recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2003.

Submitted by:

THE AUDIT COMMITTEE

James R. Boris (Chairman)

William J. Brodsky

Pastora San Juan Cafferty

John W. Higgins

Michael E. Lavin

Arthur R. Velasquez

Homer J. Livingston, Jr.ex officio

7

Information Regarding Change in Independent Public Accountants:

As recommended by the Audit Committee, the Board of Directors decided, effective June 1, 2002, to terminate the services of Arthur Andersen LLP as the Company's independent public accountants and engaged Deloitte & Touche LLP to serve as the Company's independent public accountants for 2002.

Arthur Andersen's reports on the Company's consolidated financial statements for fiscal 2001 and 2002 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company's 2001 and 2002 fiscal years, there were no disagreements with Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen's satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company's consolidated financial statements for such years; there were no reportable events, as listed in Item 304(a)(1)(v) of Regulation S-K; and the Company did not consult Deloitte & Touche LLP with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or any other matters or reportable events listed in Items 304(a)(2)(i) and (ii) of Regulation S-K.

Independent Public Accountants:

The Audit Committee of the Board of Directors has engaged Deloitte & Touche LLP as independent accountants to examine the Company's accounts for the fiscal year ending September 30, 2004. A representative of Deloitte & Touche LLP is expected to be present at the meeting and will be available to respond to appropriate questions or to make a statement if said representative so desires.

Set forth below is a summary of certain fees paid to Arthur Andersen LLP, the Company's former independent accountants, and to Deloitte & Touche LLP, the Company's current independent public accountants, for services in the fiscal years ended September 30, 2002, and September 30, 2003. In determining the independence of Arthur Andersen LLP and Deloitte & Touche LLP, the Audit Committee considered whether the provision of non-audit services is compatible with maintaining Arthur Andersen LLP's and Deloitte & Touche LLP's independence.

| | 2002

| | 2003

|

|---|

| | Arthur Andersen LLP

| | Deloitte & Touche LLP

| | Deloitte & Touche LLP

|

|---|

| Audit Fees | | $ | 178,000 | | $ | 762,000 | | $ | 698,000 |

| Audit-Related Fees | | | 0 | | | 8,000 | | | 40,900 |

| Tax Fees | | | 5,100 | | | 30,200 | | | 116,900 |

| All Other Fees | | | 5,000 | | | 32,900 | | | 0 |

| | |

| |

| |

|

| Total | | $ | 188,100 | | $ | 833,100 | | $ | 855,800 |

| | |

| |

| |

|

Below is a description of the nature of services comprising the fees disclosed for each category above.

Audit Fees. The total fees, including reimbursement of expenses, the Company paid Arthur Andersen LLP for professional services rendered for the audit of the annual financial statements for the fiscal year ended September 30, 2002, and the reviews of the financial statements included in the Company's Forms 10-Q for the first two quarters in fiscal 2002, were $178,000. The total audit fees and reimbursement of expenses paid to Deloitte & Touche LLP were $412,000 for the audit for fiscal year 2002 and the reviews of the quarterly financial statements and regulatory filings. In addition, $350,000 was paid to Deloitte & Touche LLP for the re-audit of the financial statements for fiscal years 2001 and 2000 which was required due to a change in the Company's accounting for acquisition, exploration and development activities related to oil and gas reserves. The total audit fees and reimbursement of expenses paid to Deloitte &

8

Touche LLP were $698,000 for the audit for fiscal year 2003, the reviews of the quarterly financial statements, the review of regulatory filings and the preparation of comfort letters and consents, $171,000 of which was for comfort letters and consents relating to financings which the Company and its subsidiaries completed during fiscal 2003.

Audit-Related Fees. There were no audit-related fees paid to Arthur Andersen LLP in fiscal 2002. The total audit-related fees, including reimbursement of expenses, paid to Deloitte & Touche LLP in fiscal 2002 were $8,000 for review of compensation plans. The total audit-related fees, including reimbursement of expenses, paid to Deloitte & Touche LLP in fiscal 2003 were $40,900 for review of compensation plans and internal control advisory services.

Tax Fees. The total tax fees, including reimbursement of expenses, paid to Arthur Andersen LLP in fiscal 2002 were $5,100 for tax advisory services. The total tax fees, including reimbursement of expenses, paid to Deloitte & Touche LLP in fiscal 2002 were $30,200 for tax advisory services. The total tax fees, including reimbursement of expenses, paid to Deloitte & Touche LLP in fiscal 2003 were $116,900 for tax advisory services.

All Other Fees. The total fees, including reimbursement of expenses, the Company paid Arthur Andersen LLP for professional services rendered in fiscal 2002, other than for the services described above, were $5,000 for financial planning services for the officers of the Company. The total fees, including reimbursement of expenses, paid to Deloitte & Touche LLP for professional services rendered in fiscal 2002, other than for the services described above, were $32,900 for litigation related services. There were no other fees paid to Deloitte & Touche LLP for professional services rendered in fiscal 2003, other than for the services described above.

Before an independent public accountant is engaged by the Company to render audit or non-audit services, the engagement is approved by the Audit Committee or the engagement to render services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee. The Pre-approval Policy adopted by the Audit Committee on December 4, 2003 is attached as Appendix D. All of the fees and services described above under "audit fees", "audit-related fees", "tax fees" and "all other fees" were pre-approved by the Audit Committee.

9

Share Ownership of Directors

and Executive Officers

The following table sets forth certain information regarding the beneficial ownership, as of October 31, 2003, of the Company's Common Stock by (a) each director, nominee, the Chief Executive Officer and the five most highly paid executive officers of the Company and (b) all directors, nominees and executive officers as a group.

Directors & Officers

| | Shares Beneficially

Owned as of

October 31, 2003(1)

| | Percent of

Class

| |

|---|

| James R. Boris | | 18,895 | (2)(3)(5) | * | |

| William J. Brodsky | | 23,566 | (2)(3)(5) | * | |

| Pastora San Juan Cafferty | | 13,857 | (3)(5) | * | |

| Donald M. Field | | 107,094 | (4)(5) | * | |

| John W. Higgins | | 0 | (6) | * | |

| James Hinchliff | | 91,713 | (5) | * | |

| Dipak C. Jain | | 4,325 | (3)(5) | * | |

| Michael E. Lavin | | 1,025 | (3) | * | |

| Homer J. Livingston, Jr. | | 22,397 | (2)(3)(5) | * | |

| Lester H. McKeever | | 18,591 | (2)(3)(5) | * | |

| William E. Morrow | | 66,407 | (4)(5) | * | |

| Steven W. Nance | | 19,366 | (4)(5) | * | |

| Thomas A. Nardi | | 59,387 | (4)(5) | * | |

| Thomas M. Patrick | | 166,575 | (4)(5) | * | |

| Richard P. Toft | | 21,539 | (2)(3)(5) | * | |

| Arthur R. Velasquez | | 27,672 | (2)(3)(5) | * | |

| Directors and executive officers as a group | | 844,929 | (2)(3)(4)(5) | 2.29 | % |

- *

- Percentage of shares beneficially owned does not exceed one percent.

- (1)

- Unless otherwise indicated, each individual has sole voting and investment power with respect to the shares of common stock attributed to him or her in the table.

- (2)

- Includes the following number of shares to which the following are prospectively entitled pursuant to the Directors Deferred Compensation Plan of the Company: Messrs. Boris, 6,969; Brodsky, 11,041; Livingston, 11,372; McKeever, 7,565; Toft, 10,313; and Velasquez, 17,647.

- (3)

- Includes the following number of shares to which the following are prospectively entitled pursuant to the Directors Stock and Option Plan of the Company: Messrs. Boris, 1,025; Brodsky, 1,025; Mrs. Cafferty, 1,025; Messrs. Jain, 1,025; Lavin, 1,025; Livingston, 1,025; McKeever, 1,025; Toft, 1,025; and Velasquez, 1,025.

- (4)

- Includes shares of restricted stock awarded under the Long-Term Incentive Compensation Plan of the Company, the restrictions on which had not lapsed as of October 31, 2003, as follows: Messrs. Field, 9,275; Morrow, 8,945; Nance, 2,250; Nardi, 7,045; Patrick, 18,830; and all directors and executive officers as a group, 70,795. Owners of shares of restricted stock have the right to vote such shares and to receive dividends thereon, but have no investment power with respect to such shares until the restrictions thereon lapse.

- (5)

- Includes shares that the following have a right to acquire within 60 days following October 31, 2003, through the exercise of options granted under the Directors Stock and Option Plan, in the case of nonemployee directors, or the Long-Term Incentive Compensation Plan of the Company, in the case of executive officers: Messrs. Boris, 9,000; Brodsky, 9,000; Mrs. Cafferty, 9,000; Messrs. Jain, 3,000; Livingston, 9,000; McKeever, 9,000; Toft, 9,000; Velasquez, 9,000; Field, 78,900; Hinchliff, 55,800;

10

Morrow, 47,500; Nance, 12,100; Nardi, 45,100; Patrick, 112,400; and all directors and executive officers of the Company as a group, 550,300.

- (6)

- Mr. Higgins has been nominated for his first elected term as a member of the Board of Directors of the Company.

Certain Relationships and Related Transactions

On August 15, 2003, Theodore R. Tetzlaff was elected General Counsel of the Company and Mark J. McGuire was elected General Counsel of the Company's subsidiaries, including The Peoples Gas Light and Coke Company and North Shore Gas Company. Messrs. Tetzlaff and McGuire are also partners in the law firm of McGuireWoods LLP. During fiscal year 2003, the Company and its subsidiaries paid McGuireWoods LLP approximately $907,000 for legal services provided to the Company and its subsidiaries in the ordinary course of business. The Company and its subsidiaries have contracted with McGuireWoods LLP to provide most of the legal services required by the Company and its subsidiaries. Messrs. Tetzlaff and McGuire have agreed to devote whatever time is necessary to attend to the responsibilities of their respective positions as General Counsel and will not receive from McGuireWoods LLP any part of the fees paid by the Company and its subsidiaries to that firm during such period as each serves as General Counsel.

11

Executive Compensation

The following tables set forth information concerning annual and long-term compensation and grants of stock options, stock appreciation rights (SARs) and restricted stock awards under the Company's Long-Term Incentive Compensation Plan. All compensation was paid by the Company and its subsidiaries for services in all capacities during the three fiscal years set forth below, to (i) the Chief Executive Officer and (ii) the five most highly compensated executive officers of the Company other than the Chief Executive Officer.

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long Term Compensation

Awards

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary ($)

| | Bonus ($)

| | Restricted Stock

Awards(1)(3)

($)

| | Options/SARs

(#)

| | All Other

Compensation

(4)($)

| |

|---|

Thomas M. Patrick

Chairman, President and

Chief Executive Officer | | 2003

2002

2001 | | 625,000

512,500

451,300 | | 602,800

229,800

261,573 | | 456,438

270,010

220,056 | | 85,000

49,400

52,000 | | 12,825

18,450

17,562 | |

James Hinchliff(2)

Senior Vice President

and General Counsel |

|

2003

2002

2001 |

|

327,000

317,500

303,500 |

|

210,100

125,200

156,363 |

|

117,250

120,466

103,603 |

|

26,500

23,100

25,800 |

|

1,097,282

11,430

11,304 |

(5)

|

Steven W. Nance

President, Peoples

Energy Production |

|

2003

2002

2001 |

|

255,000

245,000

225,000 |

|

235,000

73,500

174,400 |

|

0

0

80,313 |

|

6,500

5,600

10,000 |

|

8,325

7,200

7,762 |

|

William E. Morrow

Executive Vice

President |

|

2003

2002

2001 |

|

300,000

287,700

264,400 |

|

186,300

180,900

200,309 |

|

117,250

109,043

103,603 |

|

26,500

21,000

25,800 |

|

9,900

10,357

10,148 |

|

Thomas A. Nardi

Senior Vice President

and Chief Financial

Officer |

|

2003

2002

2001 |

|

295,000

255,000

230,000 |

|

189,500

100,500

195,000 |

|

117,250

96,581

0 |

|

26,500

18,600

24,000 |

|

8,527

7,458

7,650 |

|

Donald M. Field

Executive Vice

President |

|

2003

2002

2001 |

|

304,800

295,900

271,000 |

|

167,800

144,800

139,619 |

|

117,250

112,158

103,603 |

|

26,500

21,600

25,800 |

|

9,943

10,652

10,428 |

|

- (1)

- Restricted stock awards are valued at the closing market price as of the date of grant. The total number of restricted shares held by the named executive officers and the aggregate market value of such shares at September 30, 2003 were as follows: Mr. Patrick, 26,090 shares, valued at $1,079,604; Mr. Hinchliff, 0 shares; Mr. Nance, 1,500 shares, valued at $62,070; Mr. Morrow, 8,295 shares, valued at $343,247; Mr. Nardi, 5,360 shares, valued at $221,797; and Mr. Field, 9,140 shares, valued at $378,213. Dividends are paid on the restricted shares at the same time and at the same rate as dividends paid to all shareholders of common stock. Aggregate market value is based on a per share price of $41.38, the closing price of Peoples Energy's stock on the New York Stock Exchange Composite Transactions on September 30, 2003.

- (2)

- Mr. Hinchliff resigned his position as General Counsel of the Company effective August 15, 2003, and retired October 1, 2003.

- (3)

- Restricted stock awards granted to date vest in equal annual increments over a five-year period. If a recipient's employment with the Company terminates, other than by reason of death, disability, or

12

retirement after attaining age 65, the recipient forfeits all rights to the unvested portion of the restricted stock award. In addition, the Compensation Committee (and with respect to the CEO, the Compensation Committee, subject to the approval of the nonemployee directors) may, in its sole discretion, accelerate the vesting of any restricted stock awards granted under the Long-Term Incentive Compensation Plan. Total restricted stock awarded to the named individuals for 2001 constitutes 19,025 shares, of which 3,805 shares vested in 2002; 5,740 shares vested in 2003; 3,160 shares will vest in 2004; 3,160 shares will vest in 2005; and the remaining 3,160 shares will vest in 2006. Total restricted stock awarded to the named individuals for 2002 constitutes 17,050 shares, of which 5,730 shares vested in 2003; 2,830 shares will vest in 2004; 2,830 shares will vest in 2005; 2,830 shares will vest in 2006; and the remaining 2,830 shares will vest in 2007. Total restricted stock awarded to the named individuals for 2003 constitutes 27,625 shares, of which 3,500 vested in 2003; 4,825 shares will vest in 2004, 4,825 shares will vest in 2005; 4,825 shares will vest in 2006; 4,825 shares will vest in 2007; and the remaining 4,825 shares will vest in 2008.

- (4)

- Company contributions to the Capital Accumulation Plan accounts of the named executive officers during the above fiscal years. Employee contributions under the plan are subject to a maximum limitation under the Internal Revenue Code of 1986, as amended. Through December 2002, it was the practice of the Company to pay an employee who was subject to this limitation an additional 60 cents for each dollar that the employee was prevented from contributing solely by reason of such limitation. The amounts shown in the table above reflect, if applicable, this additional Company payment.

- (5)

- Includes compensation provided according to the terms of the severance agreement between Mr. Hinchliff and the Company. See discussion of Mr. Hinchliff's severance agreement on page 19.

13

OPTIONS/SAR GRANTS IN FISCAL 2003

| | Individual Grants

| |

|

|---|

Name and Principal Position

| | Options/SARs

Granted

(#)(1)

| | % of Total

Options/SARs

Granted to Employees

in Fiscal Year(2)

| | Exercise or

Base Price

($/Sh)

| | Expiration

Date

| | Grant Date

Present Value

($)(3)

|

|---|

Thomas M. Patrick

Chairman, President and

Chief Executive Officer | | 85,000 | | 18.8 | | $ | 34.03 | | Oct. 2, 2012 | | $ | 285,600 |

James Hinchliff

Senior Vice President

and General Counsel |

|

26,500 |

|

5.9 |

|

|

34.03 |

|

Oct. 1, 2006 |

|

|

89,040 |

Steven W. Nance

President, Peoples

Energy Production,

Company |

|

6,500 |

|

1.4 |

|

|

34.03 |

|

Oct. 2, 2012 |

|

|

21,840 |

William E. Morrow

Executive Vice

President |

|

26,500 |

|

5.9 |

|

|

34.03 |

|

Oct. 2, 2012 |

|

|

89,040 |

Thomas A. Nardi

Senior Vice President

and Chief Financial

Officer |

|

26,500 |

|

5.9 |

|

|

34.03 |

|

Oct. 2, 2012 |

|

|

89,040 |

Donald M. Field

Executive Vice

President |

|

26,500 |

|

5.9 |

|

|

34.03 |

|

Oct. 2, 2012 |

|

|

89,040 |

- (1)

- The grant of an Option enables the recipient to purchase Peoples Energy common stock at a purchase price equal to the fair market value of the shares on the date the Option is granted. The grant of an SAR enables the recipient to receive, for each SAR granted, cash in an amount equal to the excess of the fair market value of one share of Peoples Energy common stock on the date the SAR is exercised over the fair market value of such common stock on the date the SAR was granted. Options or SARs that expire unexercised become available for future grants. Before an Option or SAR may be exercised, the recipient must generally complete 12 months of continuous employment subsequent to the grant of the Option or SAR. Options and SARs may be exercised within 10 years from the date of grant, subject to earlier termination in case of death, retirement, or termination of employment for other reasons.

- (2)

- Based on 426,900 Options and 25,000 SARs granted to all employees under Peoples Energy's Long-Term Incentive Compensation Plan during fiscal 2003.

- (3)

- The Present Value of each option grant used to determine pro forma net income is estimated as of the date of grant using a variation of the Black-Scholes option-pricing model with the following weighted-average assumptions: expected volatility of 25.81 percent, dividend yield of 5.1 percent, risk-free interest rate of 2.12 percent, and expected life of three years. The weighted-average fair value of options granted was $3.36 for the year ended September 30, 2003.

14

AGGREGATED OPTION/SAR EXERCISES IN FISCAL 2003

AND FISCAL YEAR-END OPTION/SAR VALUES

| |

| |

| | Number of Unexercised Options/SARs at Fiscal Year-End(#)

| | Value of Unexercised In-the-Money Options/SARs at Fiscal Year-End($)

|

|---|

| | Shares

Acquired on

(Option/SAR)

Exercise(#)(1)

| |

|

|---|

Name and Principal Position

| | Value

Realized($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

Thomas M. Patrick

Chairman,

President and Chief Executive Officer | | 52,000 | | $ | 448,880 | | 55,400 | | 85,000 | | $ | 32,108 | | $ | 624,750 |

James Hinchliff

Senior Vice President

and General Counsel |

|

25,800 |

|

|

296,958 |

|

62,000 |

|

0 |

|

|

250,537 |

|

|

0 |

Steven W. Nance

President, Peoples

Energy Production

Company |

|

10,000 |

|

|

122,450 |

|

5,600 |

|

6,500 |

|

|

1,232 |

|

|

47,775 |

William E. Morrow

Executive Vice

President |

|

12,900 |

|

|

99,137 |

|

21,000 |

|

26,500 |

|

|

4,620 |

|

|

194,775 |

Thomas A. Nardi

Senior Vice President

and Chief Financial

Officer |

|

24,000 |

|

|

261,690 |

|

18,600 |

|

26,500 |

|

|

4,092 |

|

|

194,775 |

Donald M. Field

Executive Vice

President |

|

0 |

|

|

0 |

|

83,200 |

|

26,500 |

|

|

436,332 |

|

|

194,775 |

- (1)

- Cash-only SARs exercised by named executive officers in the following amounts: Mr. Patrick, 26,000; Mr. Hinchliff, 12,900; Mr. Nance, 5,000; and Mr. Nardi, 12,000.

15

LONG-TERM INCENTIVE PLANS-AWARDS IN LAST FISCAL YEAR

The Company's Long-Term Incentive Plan For Diversified Business Units (DBU LTIP) is designed (i) to align management interests with value creation at the business unit level, (ii) to reflect the early lifecycle stages of the Company's diversified businesses and the unique performance measurement challenges each poses, (iii) to advance the interests of the Company by attracting and retaining identified business unit officers, and (iv) to motivate the selected officers to act in the long-term best interests of the shareholders. As President of Peoples Energy Production Company, Mr. Nance is a participant in this plan. Performance Awards under the DBU LTIP are cash payments that are contingent on a recipient's business unit achieving specified levels of performance in measurable areas during a three-year period, as selected by the Compensation Committee for that business unit.

For Peoples Energy Production Company, for the three-year performance periods ending September 30, 2005 and September 30, 2006, the performance measures selected by the Compensation Committee are (i) the compound annual growth rate in proven gas and oil reserves at fiscal year end owned by PEPCO (CAGR), and (ii) PEPCO's average return on capital employed (ROCE). For a recipient, an award under the DBU LTIP represents the opportunity to receive a cash payout. When granted, an award opportunity is expressed as a percentage of the recipient's average annual base salary at target level of performance (e.g., a target level award opportunity of 50% of base salary).

For the performance period ending September 30, 2005, the CAGR must be at least 10% and the ROCE must be at least 7% for any payment to be made with respect to an award. The maximum possible payment is 300% of the target opportunity for a CAGR of 40% and a ROCE of 20%.

For the performance period ending September 30, 2006, the CAGR must be at least 0% and the ROCE must be at least 7% for any payment to be made with respect to an award. The maximum possible payment is 300% of the target opportunity for a CAGR of 30% and a ROCE of 17%.

| |

| |

| | Estimated Future Payouts Under Non-Stock Price-Based Plans

| |

|---|

| |

| | Performance or Other Period Until Maturation or Payout

| |

|---|

| | Number of Shares, Units or Other Rights(1)

| |

|---|

| | Threshold

(0%)

| | Target

(100%)

| | Maximum

(300%)

| |

|---|

| Steven W. Nance | | NA | | 9-30-2005 | | $ | 0 | | $ | 149,625 | (2) | $ | 448,875 | (2) |

| | | NA | | 9-30-2006 | | $ | 0 | | $ | 157,500 | | $ | 472,500 | |

- (1)

- Not Applicable. As described above, payouts under the DBU LTIP are calculated based on a percentage of the recipient's annual base salary for the three-year performance period.

- (2)

- Based on annual base salary of $255,000 for fiscal 2003 and assumed annual base salary of $300,000 for fiscal 2004 and fiscal 2005.

16

PENSION PLAN TABLE

The following table illustrates various annual straight-life benefits at normal retirement (age 65) for the indicated levels of average annual compensation and various periods of service, assuming no future changes in the Company's pension benefits. The benefit amounts shown reflect reduction for applicable Social Security benefits.

| | Years of Service

|

|---|

Average Annual

Compensation

|

|---|

| | 20

| | 25

| | 30

| | 35

| | 40

|

|---|

| $ 300,000 | | 112,635 | | 140,794 | | 168,953 | | 187,703 | | 206,453 |

| 350,000 | | 132,635 | | 165,794 | | 198,953 | | 220,828 | | 242,703 |

| 400,000 | | 152,635 | | 190,794 | | 228,953 | | 253,953 | | 278,953 |

| 450,000 | | 172,635 | | 215,794 | | 258,953 | | 287,078 | | 315,203 |

| 500,000 | | 192,635 | | 240,794 | | 288,953 | | 320,203 | | 351,453 |

| 550,000 | | 212,635 | | 265,794 | | 318,953 | | 353,328 | | 387,703 |

| 600,000 | | 232,635 | | 290,794 | | 348,953 | | 386,453 | | 423,953 |

| 650,000 | | 252,635 | | 315,794 | | 378,953 | | 419,578 | | 460,203 |

| 700,000 | | 272,635 | | 340,794 | | 408,953 | | 452,703 | | 496,453 |

| 750,000 | | 292,635 | | 365,794 | | 438,953 | | 485,828 | | 532,703 |

| 800,000 | | 312,635 | | 390,794 | | 468,953 | | 518,953 | | 568,953 |

| 850,000 | | 332,635 | | 415,794 | | 498,953 | | 552,078 | | 605,203 |

| 900,000 | | 352,635 | | 440,794 | | 528,953 | | 585,203 | | 641,453 |

| 950,000 | | 372,635 | | 465,794 | | 558,953 | | 618,328 | | 677,703 |

| 1,000,000 | | 392,635 | | 490,794 | | 588,953 | | 651,453 | | 713,953 |

| 1,050,000 | | 412,635 | | 515,794 | | 618,953 | | 684,578 | | 750,203 |

| 1,100,000 | | 432,635 | | 540,794 | | 648,953 | | 717,703 | | 786,453 |

Average annual compensation is the average 12-month compensation for the highest 60 consecutive months of the last 120 months of service prior to retirement. Compensation is total salary paid to an employee by the Company and/or its affiliates, including prior to October 1, 2002, all of the bonus and effective October 1, 2002 the lesser of 50% of the bonus target or 50% of the bonus paid under the Company's Short-Term Incentive Compensation Plan, pre-tax contributions under the Company's Capital Accumulation Plan, pre-tax contributions under the Company's Health and Dependent Care Spending Accounts Plan, and pre-tax contributions for life and health care insurance, but excluding moving allowances, exercise of stock options and SARs, and other compensation that has been deferred. The salary and bonus discussed above and used in the computation of annual retirement benefits are reported in the Summary Compensation Table. On July 1, 2001, the Company amended the above-described pension plan. The revised pension plan allows employees of the Company who began their employment with the Company prior to July 1, 2001, to receive pension benefits equal to the greater of the amount determined by the above-described formula or the amount equal to the employee's compensation during the five years of employment with the Company preceding termination multiplied by an age based percentage credited to the employee for each year of the employee's participation in the plan. The Company does not expect that these amendments will affect the pension benefits set forth in the table above for the individuals listed in the Summary Compensation Table.

At September 30, 2003, the credited years of retirement benefit service for the individuals listed in the Summary Compensation Table were as follows; Mr. Patrick, 27 years; Mr. Hinchliff, 31 years; Mr. Nance, 2 years; Mr. Morrow, 24 years; Mr. Nardi, 2 years; and Mr. Field, 32 years. The benefits shown in the foregoing table are subject to maximum limitations under the Employee Retirement Income Security Act of 1974, as amended, and the Internal Revenue Code of 1986, as amended. Should these benefits at the time of retirement exceed the then-permissible limits of the applicable Act, the excess would be paid by the Company as supplemental pensions pursuant to the Company's Supplemental Retirement Benefit Plan. The benefits shown give effect to these supplemental pension benefits.

17

Severance Agreements and Employment Agreements

The Company has entered into separate severance agreements with certain key executives, including each of the executives named in the Summary Compensation Table. The intent of the severance agreements is to assure the continuity of the Company's administration and operations in the event of a Change in Control of the Company (as described below). The severance agreements were developed in accordance with the advice of outside consultants.

The term of each severance agreement is for the longer of 36 months after the date in which a Change in Control of the Company occurs or 24 months after the completion of the transaction approved by shareholders described in (iii) below of the description of a Change in Control. A Change in Control is defined as occurring when (i) the Company receives a report on Schedule 13D filed with the Securities and Exchange Commission pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, disclosing that any person, group, corporation, or other entity is the beneficial owner, directly or indirectly, of 20% or more of the common stock of the Company; (ii) any person, group, corporation, or other entity (except the Company or a wholly-owned subsidiary), after purchasing common stock of the Company in a tender offer or exchange offer, becomes the beneficial owner, directly or indirectly, of 20% or more of such common stock; (iii) the shareholders of the Company approve (a) any consolidation or merger of the Company in which the Company is not the continuing or surviving corporation, other than a consolidation or merger in which holders of the Company's common stock prior to the consolidation or merger have substantially the same proportionate ownership of common stock of the surviving corporation immediately after the consolidation or merger as immediately before such transaction; (b) any consolidation or merger in which the Company is the continuing or surviving corporation, but in which the common shareholders of the Company immediately prior to the consolidation or merger do not hold at least 90% of the outstanding common stock of the Company; (c) any sale, lease, exchange or other transfer of all or substantially all of the assets of the Company, except where the Company owns all of the outstanding stock of the transferee entity or the Company's common shareholders immediately prior to such transaction own at least 90% of the transferee entity or group of transferee entities immediately after such transaction; or (d) any consolidation or merger of the Company where, after the consolidation or merger, one entity or group of entities owns 100% of the shares of the Company, except where the Company's common shareholders immediately prior to such merger or consolation own at least 90% of the outstanding stock of such entity or group of entities immediately after such consolidation or merger; or (iv) a change in the majority of the members of the Company's Board of Directors within a 24-month period, unless approved by two-thirds of the directors then still in office who were in office at the beginning of the 24-month period.

Each severance agreement provides for payment of severance benefits to the executive in the event that, during the term of the severance agreement, (i) the executive's employment is terminated by the Company, except for "cause" as defined therein; or (ii) the executive's employment is terminated due to a constructive discharge, which includes (a) a material change in the executive's responsibilities, which change would cause the executive's position with the Company to become of less dignity, responsibility, prestige or scope; (b) reduction, which is more thande minimis, in total compensation; (c) assignment without the executive's consent to a location more than 50 miles from the current place of employment; or (d) liquidation, dissolution, consolidation, merger, or sale of all or substantially all of the assets of the Company, unless the successor corporation has a net worth at least equal to that of the Company and expressly assumes the obligations of the Company under the executive's severance agreement.

The principal severance benefits payable under each severance agreement consist of the following: (i) the executive's base salary and accrued benefits through the date of termination, including a pro rata portion of awards under the Company's Short-Term Incentive Compensation Plan ("STIC Plan"); (ii) three times the sum of the individual's base salary, the average of the STIC Plan awards for the prior three years and the value of the Long Term Incentive Compensation Plan ("LTIC Plan") awards in the prior calendar year; and (iii) the present value of the executive's accrued benefits under the Company's Supplemental Retirement Benefits Plan (SRBP) that would be payable upon retirement at normal retirement age,

18

computed as if the executive had completed three years of additional service. Mr. Nardi's severance agreement provides that in addition to the amount described in clause (ii) of the preceding sentence, if Mr. Nardi has been employed by the Company for at least five years, Mr. Nardi would be entitled to receive from the Company an amount equal to the remainder of (x) the present value of the benefits that would have been accrued by Mr. Nardi under the Company's retirement plan and the SRBP on the date of termination of employment, determined as if Mr. Nardi had received credit for an additional twenty-one years of service, less (y) the present value of Mr. Nardi's benefits accrued under the retirement plan and the SRBP on the date of termination of his employment. If Mr. Nardi has been employed by the Company for less than five years, the additional years of service under clause (x) of the preceding sentence would be determined by dividing the number of months Mr. Nardi was employed by the Company by 60 and multiplying the resulting ratio by 20.

In addition, the executive will be entitled to continuation of life insurance and medical benefits for the longer of (a) a period of three years after termination or (b) a period commencing after termination and ending when the executive may receive pension benefits without actuarial reduction, provided that the Company's obligation for such benefits under the severance agreement shall cease upon the executive's employment with another employer that provides life insurance and medical benefits. Each severance agreement also provides that the executive's non-qualified stock options ("Options") and SARs shall become exercisable upon a Change in Control and that all Options and SARs shall remain exercisable for the shorter of (a) three years after termination or (b) the term of such Options and SARs. Any restricted stock previously awarded to the executive under the LTIC Plan would vest upon a Change in Control if such vesting does not occur due to a Change in Control under the terms of the LTIC Plan. The Company is also obligated under each severance agreement to pay an additional amount to the executive sufficient on an after-tax basis to satisfy any excise tax liability imposed by Section 4999 of the Internal Revenue Code of 1986, as amended. The benefits received by the executive under each agreement are in lieu of benefits under the Company's termination allowance plan and the executive's benefits under the SRBP. Each executive would be required to waive certain claims prior to receiving any severance benefits.

The Company and Mr. Nardi are parties to a confidentiality and employment agreement dated May 22, 2002. Under the agreement, Mr. Nardi agrees to observe certain covenants and confidentiality restrictions, to refrain from soliciting or encouraging others to leave employment with the Company, and to release and discharge the Company from claims he may then have. The agreement also provides that if Mr. Nardi's employment is terminated other than for "cause" (as defined in Mr. Nardi's severance agreement) and prior to a Change in Control (as defined in the severance agreement), then Mr. Nardi is entitled to be paid by the Company an amount representing an enhanced retirement benefit as if Mr. Nardi were credited under the retirement plan and the SRBP with additional years of service. The additional years of service are determined in the same manner as described above under Mr. Nardi's severance agreement.

The Company and Mr. Hinchliff entered into an agreement whereby Mr. Hinchliff resigned his position as General Counsel as of August 15, 2003 and retired on October 1, 2003. Mr. Hinchliff's previous severance agreement was terminated and the Company agreed to pay Mr. Hinchliff $613,125 in February, 2004. In addition, all of Mr. Hinchliff's unvested options and restricted stock awarded to him under the Company's Long Term Incentive Compensation Plan were vested prior to his retirement. Under the terms of the agreement, the award that Mr. Hinchliff received under the Short-Term Incentive Compensation Plan was determined as if Mr. Hinchliff were Senior Vice President and General Counsel for the entire 2003 plan year. As part of the agreement, the Company and Mr. Hinchliff agreed to enter into a consulting services agreement whereby the Company can request Mr. Hinchliff to provide advice and perform other consulting services for the Company. The consulting services agreement is effective through December 31, 2004.

19

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Committee Responsibilities

The Committee is composed of Messrs. Brodsky, Chairman, Boris, Jain, Lavin, Livingston, and McKeever. The Committee's responsibilities include the setting of policy related to and oversight of executive compensation for Peoples Energy Corporation.

In 2003, we worked with an outside executive compensation consulting firm to conduct a comprehensive review of current executive compensation practices and policies. This included a review of the overall philosophy and a detailed review of all elements of executive compensation, resulting in a series of changes in how the programs are designed and administered.

The purpose of this report is to summarize our philosophy of executive compensation, identify the key elements of the executive compensation program, describe the process in which compensation decisions were made and other factors considered by the Committee in making decisions about compensation.

Compensation Philosophy

The following are the core principles on which our decisions are founded:

Emphasis is on alignment between pay and performance. All elements of executive compensation are evaluated in light of the underlying principle that pay should have a direct and observable relationship with performance.

Stock ownership is emphasized. Stock compensation is a central component of the compensation program. It is our belief that the use of stock provides a fundamental tool in supporting executive and employee motivation. Furthermore, requiring senior executives to hold a fixed amount of stock under specific ownership guidelines supports the overall alignment of executive and shareholder interests.

Compensation programs will be designed to reflect the competitive market which will support the attraction and retention of talent. We regularly evaluate current compensation levels to ensure that our executive compensation program reflects the competitive market in which the Company competes for executive talent. Generally, this market is comprised of other energy companies that have a similar mix of gas distribution and diversified energy services.

Elements of Executive Compensation

Peoples Energy's executive compensation program consists of base salary, annual incentives and long-term incentives.

Base Salary

Base salary levels are generally targeted at the 50th percentile (median) of comparably sized energy organizations. This market position is targeted because it is our belief that the Company will primarily attract and retain future executives in competition with these organizations. The 50th percentile of the market reflects a reasonable level of the market.

All employees, including executives, are eligible for annual increases in salary based on an annual review of overall market movement. Annual merit adjustments will be made on the basis of performance of the job, meeting key job requirements and the organization's ability to make these adjustments based on affordability.

20

Annual Incentive

All officers are eligible for annual incentive compensation under the Short-Term Incentive Compensation ("STIC") Plan. Compensation under the STIC Plan is paid in cash in accordance with the Board approved plan document. The STIC Plan provides executives with an opportunity to earn a level of compensation that is expressed as a percentage of base salary. The level of compensation is targeted at the level that in combination with base salary approximates the 60th percentile of the market for total cash compensation. In our opinion, this level of the market reflects a reasonable market position because of the difficulty in attaining target on the performance metrics associated with the STIC Plan.

For fiscal year 2003, awards for certain participants, including Mr. Patrick, were based entirely on corporate performance measures. Other participants' awards were based partly on corporate performance measures and partly on individual or divisional performance measures. For Mr. Patrick and certain other senior executives of the Company, the STIC Plan award opportunities were weighted among six corporate measures—20 percent of the award based on earnings per share, 20 percent based on gas distribution return on equity, 20 percent based on gas distribution operating costs, 25 percent based on operating and equity investment income from diversified businesses, 10 percent based on customer satisfaction, and 5 percent based on vendor diversity. The scale of possible awards percentages ranges from 0 to 200 percent for each measure. The award for each of the measures was determined by comparing the Company's performance to the respective internally established goal for each measure.

The award percentages determined under the corporate performance measures were added together, resulting in a composite award percentage of 128.6 percent of the target award opportunity for Mr. Patrick and certain other participants whose award opportunity was based solely on corporate performance measures. Based on these results, we calculated, and the non-management directors approved, an award to Mr. Patrick of $602,800 as shown in the Summary Compensation Table on page 12 under the Bonus column.

For fiscal year 2004, we approved a new set of STIC Plan measures. These measures are financial in nature and financial performance must precede payments under the STIC Plan. For Mr. Patrick these measures are earnings per share, return on equity, and operating income-energy businesses. Performance against these measures is the only basis for annual incentive award payouts—there is no discretion or individual performance factor in the modified STIC Plan. We believe these measures will provide a sound foundation for the plan and will be aligned with the interests of both shareholders and customers. Furthermore, these measures will support greater motivational goals because there are fewer measures than under the previous STIC Plan which will provide a stronger focus on performance.

Long-Term Incentive

Peoples Energy provided executives with long-term incentive compensation opportunities in stock options, stock appreciation rights and restricted stock. For fiscal year 2003, stock options were granted to officers and approximately 60 other managers and key employees based upon their level of responsibility and ability to impact results.

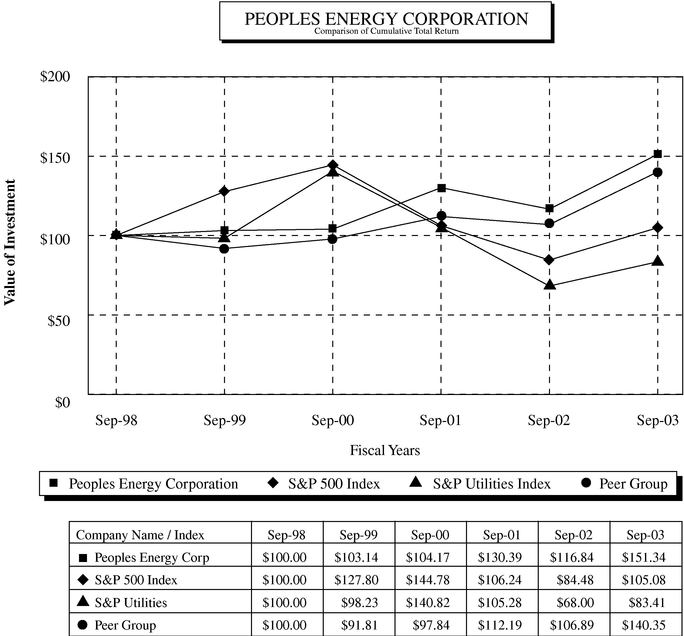

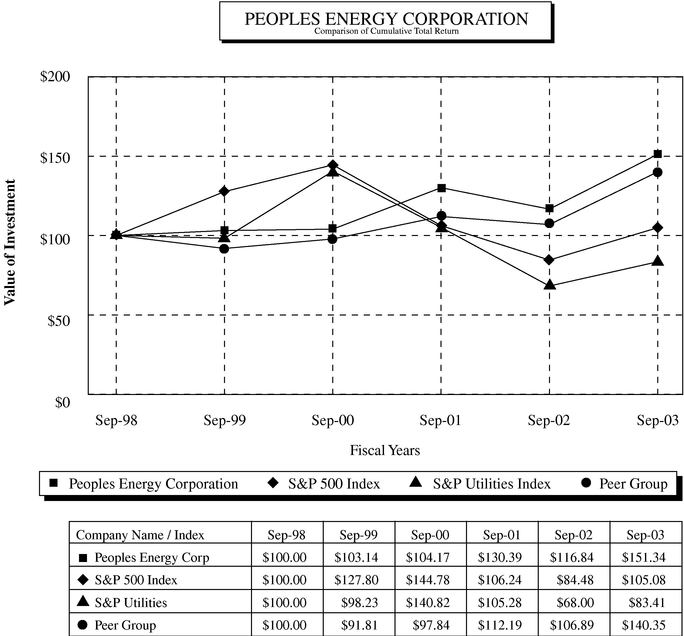

The number of stock options and other stock incentives are periodically reviewed against long-term incentive awards that other comparable energy organizations pay to their CEOs and other executives. Under the plan, the vesting of restricted stock grants is independent of Company performance. However, the organization performed above median on a three-year total shareholder return basis relative to its peers for 2003. The table on page 14 provides the total number of options granted for fiscal year 2003 to all employees as a group and the five highest paid executives.

In 2001, the Board of Directors approved, at the Committee's recommendation, a Long-Term Incentive Plan for Diversified Business Units. (the "DBU LTIP"). Certain designated officers of the Company's diversified business units are participants in the DBU LTIP, including one of the executives

21

named in the Summary Compensation Table of this proxy statement, Mr. Steven W. Nance, President of Peoples Energy Production Company, a subsidiary of the Company. The DBU LTIP is intended to more directly align the interests of certain business unit executives with value creation at the business unit level.

Under the DBU LTIP, participants may receive Performance Awards, which entitle participants to receive a percentage of their salary based upon the attainment of certain levels of business unit performance over a performance period, as measured by performance measures approved by the Committee. To date, the Committee has generally designated performance periods of three fiscal years, with annual awards to be made under the DBU LTIP based on the attainment of the applicable performance measures over the designated three fiscal year period. Performance measures applicable to the oil and gas production business unit are (1) the compound annual growth rate in proven oil and gas reserves owned at fiscal year end, and (2) the average return on capital employed. The performance measure applicable to the midstream services business unit is operating income of the unit.

Participants under the DBU LTIP are also eligible to receive Percentage Interest Awards and Equity Interest Awards. A Percentage Interest Award is the right to receive cash in an amount equal to a percentage of the increase in the fair market value of the business unit upon the sale or other divestiture of the business unit by the Company. An Equity Interest Award is a right to receive, in the Committee's discretion, a cash award, an award of restricted common stock, or options to purchase shares of common stock of the business unit following an initial public offering or spin-off of the business unit, expressed as the equivalent of a Percentage Interest.

Stock Ownership Objectives