| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM 10-K/A Amendment No. 2 |

| (Mark One) | |

| | | |

R | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF |

| THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended SEPTEMBER 30, 2006 |

| OR |

£ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Commission | Exact Name of Registrant as Specified in Charter, State of Incorporation, | IRS Employer |

| File Number | Address of Principal Executive Office and Telephone Number | Identification Number |

1-5540 | PEOPLES ENERGY CORPORATION | 36-2642766 |

2-26983 | THE PEOPLES GAS LIGHT AND COKE COMPANY | 36-1613900 |

2-35965 | NORTH SHORE GAS COMPANY | 36-1558720 |

| | | |

| | (an Illinois Corporation) | |

| | 130 East Randolph Drive, 24th Floor | |

| | Chicago, Illinois 60601-6207 | |

| | Telephone (312) 240-4000 | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | Name of each exchange |

| Title of Each Class | | on which registered |

| Peoples Energy Corporation | | New York Stock Exchange, |

| Common Stock, without par value | | Chicago Stock Exchange, |

| | | and Pacific Exchange |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| Peoples Energy Corporation | Yes R No £ |

| The Peoples Gas Light and Coke Company | Yes £ No R |

| North Shore Gas Company | Yes £ No R |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. |

| Peoples Energy Corporation | Yes £ No R |

| The Peoples Gas Light and Coke Company | Yes R No £ |

| North Shore Gas Company | Yes R No £ |

Indicate by check mark whether the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. Yes R No £ |

| | | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one): |

| |

| Peoples Energy Corporation |

Large accelerated filer R Accelerated filer £ Non-accelerated filer £ |

| |

| The Peoples Gas Light and Coke Company |

Large accelerated filer £ Accelerated filer £ Non-accelerated filer R |

| |

| North Shore Gas Company |

Large accelerated filer £ Accelerated filer £ Non-accelerated filer R |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). |

| Peoples Energy Corporation | Yes £ No R |

| The Peoples Gas Light and Coke Company | Yes £ No R |

| North Shore Gas Company | Yes £ No R |

| The aggregate market value of the voting stock held by non-affiliates of the registrants as of the last business day of the registrant's most recently completed second fiscal quarter: |

| | |

| Peoples Energy Corporation | Approximately $1.4 billion computed on the basis of the closing market price of $35.64 for a share of Common Stock on March 31, 2006. |

| | |

| The Peoples Gas Light and Coke Company | None. |

| | |

| North Shore Gas Company | None. |

| Indicate the number of shares outstanding of each of the registrant's classes of Common Stock, as of the latest practicable date (November 30, 2006): |

| | |

| Peoples Energy Corporation | Common Stock, no par value, 38,572,918 shares outstanding |

| | |

| The Peoples Gas Light and Coke Company | Common Stock, no par value, 25,357,566 shares outstanding (all of which are owned beneficially and of record by Peoples Energy Corporation) |

| | |

| North Shore Gas Company | Common Stock, no par value, 3,625,887 shares outstanding (all of which are owned beneficially and of record by Peoples Energy Corporation) |

This combined Form 10-K is separately filed by Peoples Energy Corporation, The Peoples Gas Light and Coke Company, and North Shore Gas Company. Information contained herein relating to any individual company is filed by such company on its own behalf. Each company makes no representation as to information relating to the other companies. The Peoples Gas Light and Coke Company and North Shore Gas Company meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are therefore filing this Form 10-K with the reduced disclosure format permitted by General Instruction I(2). |

Documents Incorporated by Reference |

| | | |

| | Document | Part of Form 10-K |

| | | |

| Peoples Energy Corporation | None | |

| | | |

| The Peoples Gas Light and Coke Company | None | |

| | | |

| North Shore Gas Company | None | |

EXPLANATORY NOTE

This second amendment to the combined Annual Report on Form 10-K of Peoples Energy Corporation (the Company), The Peoples Gas Light and Coke Company (Peoples Gas) and North Shore Gas Company (North Shore Gas) for the fiscal year ended September 30, 2006, which was filed with the Securities and Exchange Commission (SEC) on December 14, 2006, is being filed to reflect the following changes:

| · | to include Part III, Items 10, 11, 12, 13, and 14 of the Form 10-K; and |

| · | to amend the “Equity Compensation Plan Information” table and related footnote (3) of Item 12 for the correction of the number of securities remaining available for future issuance under equity compensation plans approved by security holders as previously reported in the Company’s Annual Report on Form 10-K filed with the SEC on December 14, 2006. |

Except as described above, this Amendment No. 2 does not reflect events that have occurred after the original filing of the Form 10-K or update the information set forth in the Form 10-K subsequent to such original filing date. In connection with the filing of this Amendment No. 2, the reporting companies are including as exhibits to this Amendment No. 2 currently dated certifications from the Chief Executive Officer and Chief Financial Officer.

PART III

ITEM 10. Directors and Executive Officers of the Company

The directors of the Company are as follows:

Keith E. Bailey, 64. Director since 2005. Former Chairman and Chief Executive Officer of The Williams Companies, Inc. (1994-2002). Mr. Bailey also served as President of The Williams Companies, Inc. (1992-2001). Mr. Bailey is also a director of Apco Argentina Inc., Associated Electric and Gas Insurance Services Limited and MarkWest Energy Partners, L.P.

James R. Boris, 62. Serves as Lead Director and has been a director since 1999. Retired Chairman and Chief Executive Officer of Everen Capital Corporation (2000) and EVEREN Securities, Inc. and its predecessor, Kemper Securities, Inc. (1990-1999). Mr. Boris is also a director of Midwest Air Group, Inc., Smurfit-Stone Container Corporation and The Chicago Board Options Exchange.

William J. Brodsky, 63. Director since 1997. Chairman and Chief Executive Officer (1997) of The Chicago Board Options Exchange. Prior to that, Mr. Brodsky was President and CEO of The Chicago Mercantile Exchange (1985-1997). He serves on the Board of Directors of Sustainable Forestry Management Limited, a private company, the International Advisory Committee of the Federal Reserve Bank of New York, and the Board of Directors of the World Federation of Exchanges.

Pastora San Juan Cafferty, 66. Director since 1988. Professor emerita, University of Chicago, Chicago, Illinois, where she has been on the faculty since 1971. Mrs. Cafferty is also a director of Harris Financial Corp., Kimberly-Clark Corporation and Waste Management, Inc.

Diana S. Ferguson, 43. Director since 2005. Senior Vice President and CFO of Sara Lee Foodservice (2006). Prior to that Ms. Ferguson was Senior Vice President Strategy and Corporate Development of Sara Lee Corporation (2005-2006). Senior Vice President Corporate Development and Treasurer (2004-2005) and Vice President and Treasurer of Sara Lee Corporation (2001-2004). Prior to her employment at Sara Lee Corporation, Ms. Ferguson served as Vice President and Treasurer of Fort James Corporation. Ms. Ferguson is also a director of Franklin Electric Co., Inc.

John W. Higgins, 60. Director since 2003. Chief Executive Officer (1980) of Higgins Development Partners, LLC, a developer of commercial real estate, which Mr. Higgins founded in 1980. Prior to founding Higgins Development Partners, LLC, Mr. Higgins was responsible for real estate equity and debt structuring at Percy Wilson Mortgage and Finance Corporation and was in the Commercial Real Estate Finance Division at the First National Bank of Chicago.

Dipak C. Jain, 49. Director since 2002. Dean, since 2001, at the Kellogg School of Management, Northwestern University, where he has been on the faculty since 1986. Mr. Jain is also the Sandy & Morton Goldman Professor of Entrepreneurial Studies and a Professor of Marketing at Kellogg and a visiting Professor of Marketing, Sasin Graduate Institute of Business Administration, Chulalongkorn University, Bangkok (since 1989). Mr. Jain is also a director of Northern Trust Corporation, John Deere & Company and Hartmarx Corporation.

Michael E. Lavin, 60. Director since 2003. Former Midwest Area Managing Partner of KPMG LLP (1993-2002). Mr. Lavin retired from KPMG in January 2003, having been with the firm since 1967. Mr. Lavin is also a member of the Boards of Directors of Tellabs, Inc and SPSS Inc.

Homer J. Livingston, Jr., 71. Director since 1989. Mr. Livingston formerly served as Chairman of the Board of Evanston Northwestern Healthcare (1999-2005). Mr. Livingston has also served as President and Chief Executive Officer of the Chicago Stock Exchange, President and CEO of LaSalle National Bank of Chicago and as the Trustee of the Southern Pacific Railroad. Mr. Livingston is also a director of Midwest Banc Holdings, Inc.

Thomas M. Patrick, 61. Director since 1998. Chairman of the Board, President and Chief Executive Officer (2002) of the Company. Prior to becoming Chairman of the Board, President and Chief Executive Officer, Mr. Patrick was President and Chief Operating Officer (1998-2002). Mr. Patrick has also held the positions of Executive Vice President (1997-1998) of the Company and its subsidiaries and Vice President (1989-1996) of both the Company’s utility subsidiaries. Mr. Patrick has been an employee of the Company and/or its subsidiaries since 1976.

Richard P. Toft, 70. Director since 1988. Non-executive Chairman of Alleghany Asset Management, Inc., Chicago, Illinois, an investment management and advisory service subsidiary of Alleghany Corp. (2000-2001). Former Chairman of the Board and Chief Executive Officer of Alleghany Asset Management, Inc. (1995-2001). Mr. Toft was also Chairman of the Board of Chicago Title Corporation and was Chairman and CEO of its predecessor company, Chicago Title & Trust Co. Mr. Toft also served as a director of Capitol Transamerica Corporation (2002-2005), Alleghany Underwriting Holdings, Ltd. (London, England 2000-2001) and Fidelity National Financial, Inc. (2000-2002). Mr. Toft is also a Director of Underwriters Laboratories, Inc.

All directors are to hold office for a term of one year or until their respective successors shall be duly elected.

Information relating to the executive officers of the Company is set forth in Part I of the Company’s Annual Report on Form 10-K filed with the SEC on December 14, 2006 under the caption “Executive Officers of the Company.”

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, as well as persons who are beneficial owners of more than 10 percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission and the New York Stock Exchange, and to furnish the Company with copies of these forms. To the Company’s knowledge, based solely on its review of the Forms 3, 4 and 5 submitted to the Company, the Company believes that all officers and directors of the Company complied with all filing requirements imposed by Section 16(a) of the Exchange Act during fiscal year 2006. Currently, there are no persons who hold more than 10 percent of the common stock of the Company.

Code of Ethics

The Company has disclosed its code of ethics on its website at www.peoplesenergy.com.

Audit Committee

The Company has a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934. The members of the Audit Committee are Messrs. Lavin (Chairman), Bailey, Jain, Toft, and Mrs. Cafferty. All of the members of the Audit Committee are independent (as that term is defined in Section 303A.02 of the New York Stock Exchange’s listing standards). The Board of Directors has determined that Messrs. Bailey, Lavin, Toft and Mrs. Cafferty of the Audit Committee are audit committee financial experts (as that term is defined under Item 407 (d) of Regulation S-K).

Director Independence

The Board has determined that all members of the Board of Directors are independent under the listing standards of the New York Stock Exchange, except for Mr. Patrick, Chairman, President and CEO of the Company. Accordingly, 10 of the 11 directors are independent. In making its determination of independence, the Board applied its Categorical Standards For Director Independence, which are available on the Company’s website at www.peoplesenergy.com.

ITEM 11. Executive Compensation

The following tables set forth information concerning annual and long-term compensation and grants of stock options, stock appreciation rights (SARs) and restricted stock awards under the Company’s Long-Term Incentive Compensation Plans. All compensation was paid by the Company and its subsidiaries for services in all capacities during the three fiscal years set forth below, to (i) the Chief Executive Officer and (ii) the five most highly compensated executive officers of the Company other than the Chief Executive Officer.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | Long Term Compensation |

| | | | Annual Compensation | | Awards | | Payouts |

Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | Other Annual Compensation ($) (1) (2) | | Restricted Stock Awards ($) (3) (4) | | LTIP Payouts ($) | | All Other Compensation ($) (5) |

Thomas M. Patrick Chairman, President and Chief Executive Officer | | 2006 2005 2004 | | 669,800 650,300 637,500 | | 0 0 151,100 | | 5,864 11,471 6,678 | | 426,231 465,212 426,701 | | 0 0 0 | | 7,920 7,560 7,380 |

| | | | | | | | | | | | | | | |

William E. Morrow Executive Vice President | | 2006 2005 2004 | | 360,500 350,000 313,083 | | 0 87,500 96,100 | | 5,388 6,454 5,388 | | 147,825 159,267 121,162 | | 0 0 0 | | 7,920 7,560 7,380 |

| | | | | | | | | | | | | | | |

Thomas A. Nardi Executive Vice President and Chief Financial Officer | | 2006 2005 2004 | | 360,500 325,000 300,900 | | 0 56,900 82,300 | | 5,388 5,990 5,566 | | 147,825 145,556 119,073 | | 0 0 0 | | 7,920 7,560 7,380 |

| | | | | | | | | | | | | | | |

Desiree G. Rogers Senior Vice President | | 2006 2005 2004 | | 305,000 285,000 251,092 | | 0 139,500 80,800 | | 5,388 5,388 5,388 | | 125,013 129,734 97,139 | | 0 0 0 | | 7,920 7,560 7,556 |

| | | | | | | | | | | | | | | |

Steven W. Nance President, Peoples Energy Production | | 2006 2005 2004 | | 325,000 310,000 300,000 | | 0 0 135,800 | | 4,999 5,487 4,730 | | 133,225 54,847 52,225 | | 80,372 82,824 386,114 | | 0 7,560 7,380 |

| | | | | | | | | | | | | | | |

Theodore R. Tetzlaff General Counsel, Ungaretti & Harris LLP (6) | | 2006 2005 2004 | | 750,000 250,000 0 | | 0 0 0 | | 0 0 0 | | 0 0 0 | | 0 0 0 | | 0 0 0 |

_______________________

| (1) | Figures shown only reflect amounts reimbursed for the payment of taxes, except for the following which contain above market interest accrued on deferred compensation under the Company's Executive Deferred Compensation Plan, for the following officers: fiscal 2005, Messrs, Patrick, $5,608; Morrow, $1,066; and Nardi, $601; and fiscal 2006, Messrs. Patrick, $5,913; Morrow, $2,402 and Nardi, $1,355. Figures do not include any perquisite or other personal benefit amounts as the aggregate amount of such compensation was less than the lesser of $50,000 or 10% of the officer's total annual salary and bonus. |

| (2) | Perquisites or other personal benefits that exceed 25% of the total perquisites and other personal benefits received are as follows. In fiscal 2004, Messrs. Patrick, Morrow, and Nardi, Ms. Rogers and Mr. Nance each received a $9,000 auto allowance, and Mr. Nance received a $9,317 club membership allowance. During fiscal 2005, Messrs. Patrick, Morrow, and Nardi, Ms. Rogers and Mr. Nance each received a $9,000 auto allowance. Also, during fiscal 2005, Mr. Patrick received an $8,597 club membership allowance, Mr. Nance received a $9,616 club membership allowance, and Ms. Rogers received a $13,355 club membership allowance. During fiscal 2006, Messrs. Patrick, Morrow and Nardi, Ms. Rogers and Mr. Nance each received a $9,000 auto allowance. Also, during 2006, Mr. Patrick received a $10,017 club membership allowance and $7,500 financial planning allowance; Ms. Rogers received a $4,680 club membership allowance; and Mr. Nance received an $11,771 club membership allowance. |

| (3) | Restricted stock award amounts represent the dollar value of the restricted shares based upon the closing market price of the Company's common stock on the New York Stock Exchange on the date of grant. The total number of restricted shares held by the named executive officers and the aggregate market value of such shares at September 30, 2006 were as follows: Mr. Patrick, 33,515 shares, valued at $1,362,385; Mr. Morrow, 10,735 shares, valued at $436,378; Mr. Nardi, 10,385 shares, valued at $422,150; Ms. Rogers, 8,790 shares, valued at $357,314 and Mr. Nance, 5,440 shares, valued at $221,136. Dividends are paid on the restricted shares at the same time and at the same rate as dividends paid to all shareholders of common stock. Aggregate market value is based on a per share price of $40.65, the closing price of Peoples Energy’s stock on the New York Stock Exchange Composite Transactions on September 29, 2006, as September 30 falls on a weekend. |

| (4) | Restricted stock awards granted to date vest in equal annual increments over a five-year period. If a recipient’s employment with the Company terminates, other than by reason of death, disability, or retirement after attaining age 65, the recipient forfeits all rights to the unvested portion of the restricted stock award. In addition, the Management Development And Compensation Committee (and with respect to the CEO, the Management Development And Compensation Committee, subject to the approval of the nonemployee directors) may, in its sole discretion, accelerate the vesting of any restricted stock awards granted under the Long-Term Incentive Compensation Plan. Total restricted stock awarded to the named individuals for 2004 constitutes 19,900 shares, of which 3,980 shares vested in 2005; 3,980 shares vested in 2006; 3,980 shares will vest in 2007; 3,980 shares will vest in 2008; and the remaining 3,980 shares will vest in 2009. Total restricted stock awarded to the named individuals for 2005 constitutes 22,500 shares, of which 4,500 shares vested in 2006, 4,500 shares will vest in 2007; 4,500 shares will vest in 2008; 4,500 shares will vest in 2009; and the remaining 4,500 shares will vest in 2010. Total restricted stock awarded to the named individuals for 2006 constitutes 26,875 shares, of which 5,375 shares will vest in 2007; 5,375 shares will vest in 2008; 5,375 shares will vest in 2009; 5,375 shares will vest in 2010; and 5,375 shares will vest in 2011. All unvested restricted stock awards will vest upon a change in control as defined in the Company’s Long-Term Incentive Compensation Plans. The consummation of the pending Merger with WPS Resources would qualify as a change in control of the Company. |

| (5) | Company contributions to the Capital Accumulation Plan accounts of the named executive officers during the above fiscal years. Employee contributions under the plan are subject to a maximum limitation under the Internal Revenue Code of 1986, as amended. |

| (6) | Mr. Tetzlaff is a partner in the law firm of Ungaretti & Harris LLP and is not an employee of the Company or its subsidiaries. Mr. Tetzlaff resigned as General Counsel of the Company in December of 2006. |

AGGREGATED OPTION/SAR EXERCISES IN FISCAL 2006 AND FISCAL YEAR-END OPTION/SAR VALUES

| | | | | | | | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year-End (#) (1) | | Value of Unexercised In-the- Money Options/SARs at Fiscal Year-End ($) |

Name and Principal Position | | Shares Acquired on Exercise (#) | | Value Realized ($) | | | Exercisable | | | Unexercisable | | | Exercisable | | Unexercisable | |

Thomas M. Patrick Chairman, President and Chief Executive Officer | | | 0 | | $ | 0 | | | 112,400 | | | 0 | | | $ | 380,436 | | $ | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

William E. Morrow Executive Vice President | | | 0 | | | 0 | | | 21,000 | | | 0 | | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

Thomas A. Nardi Executive Vice President and Chief Financial Officer | | | 0 | | | 0 | | | 18,600 | | | 0 | | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

Desiree Rogers Senior Vice President | | | 0 | | | 0 | | | 16,800 | | | 0 | | | | 0 | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

Steven W. Nance President, Peoples Energy Production Company | | | 0 | | | 0 | | | 12,100 | | | 0 | | | | 40,174 | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | |

Theodore R. Tetzlaff General Counsel, Ungaretti & Harris LLP | | | 0 | | | 0 | | | 0 | | | 0 | | | | 0 | | | 0 | |

_________________

(1) Effective February 27, 2004, no further awards of stock options or stock appreciation rights may be granted.

LONG-TERM INCENTIVE PLANS-AWARDS IN LAST FISCAL YEAR

| | Fiscal Year | Number of Shares, Units or Other Rights (#) | Performance or Other Period Until Maturation or Payout | Estimated Future Payouts Under Non-Stock Price-Based Plans |

Threshold (#) | Target (#) | Maximum (#) |

| Thomas M. Patrick | 2006 | 18,400 | 9-30-2008 | 9,200 | 18,400 | 27,600 |

| | 2005 | 14,025 | 9-30-2007 | 7,012 | 14,025 | 21,037 |

| | 2004 | 12,700 | 9-30-2006 | 6,350 | 12,700 | 19,050 |

| | | | | | | |

| William E. Morrow | 2006 | 4,950 | 9-30-2008 | 2,475 | 4,950 | 7,425 |

| | 2005 | 4,525 | 9-30-2007 | 2,262 | 4,525 | 6,787 |

| | 2004 | 3,475 | 9-30-2006 | 1,737 | 3,475 | 5,212 |

| | | | | | | |

| Thomas A. Nardi | 2006 | 4,950 | 9-30-2008 | 2,475 | 4,950 | 7,425 |

| | 2005 | 4,150 | 9-30-2007 | 2,075 | 4,150 | 6,225 |

| | 2004 | 3,500 | 9-30-2006 | 1,750 | 3,500 | 5,250 |

| | | | | | | |

| Desiree G. Rogers | 2006 | 4,200 | 9-30-2008 | 2,100 | 4,200 | 6,300 |

| | 2005 | 3,700 | 9-30-2007 | 1,850 | 3,700 | 5,550 |

| | 2004 | 2,900 | 9-30-2006 | 1,450 | 2,900 | 4,350 |

| | | | | | | |

| Steven W. Nance | 2006 | 0 | n/a | 0 | 0 | 0 |

| | 2005 | 0 | n/a | 0 | 0 | 0 |

| | 2004 | 0 | n/a | 0 | 0 | 0 |

| | | | | | | |

| Theodore R. Tetzlaff | 2006 | 0 | n/a | 0 | 0 | 0 |

| | 2005 | 0 | n/a | 0 | 0 | 0 |

| | 2004 | 0 | n/a | 0 | 0 | 0 |

The purpose of the 2004 Long-Term Incentive Plan (the “Long-Term Plan”) is to align the interests of key management employees with those of shareholders, thereby increasing those employees’ interest in the financial growth of the Company.

Key employees of the Company and its subsidiaries may be granted performance shares under the Long-Term Plan, either alone or in combination with other Long-Term Plan awards. A performance share is a contingent right to receive a share of common stock of the Company in the future, pursuant to the terms of a grant made under the Long-Term Plan and a related award agreement. For any grant of performance shares, the Management Development And Compensation Committee of the Board of Directors will establish (i) one or more performance goals, and (ii) a performance cycle (period) of not less than one year.

For the performance share awards made in fiscal 2004, the Management Development And Compensation Committee established a three-year performance period ending September 30, 2006. The performance measures selected by the Management Development And Compensation Committee are (i) three-year average return on capital (ROC), and (ii) annualized three-year total shareholder return relative to peers (TSR)1. No performance shares awarded in fiscal 2004 vested.

For the performance period ending September 30, 2006, the target level award opportunity was based on a ROC of 7.25% and a TSR in the 55th percentile. The ROC needed to be at least 6.75% or the TSR needed to be at least in the 35th percentile for any percentage of the grant to be paid. The maximum possible payment was 150% of the target grant for a ROC of 7.75% and a TSR in or above the 75th percentile.

For the performance share awards made in fiscal 2005, the Management Development And Compensation Committee established a three-year performance period ending September 30, 2007. The performance measures selected by the Management Development And Compensation Committee are (i) three-year average return on capital, and (ii) annualized three-year total shareholder return relative to peers.

For the performance period ending September 30, 2007, the target level award opportunity is based on a return on capital of 7.1% and an annualized three-year shareholder return ranking in the 55th percentile. The return on capital must be at least 6.4% or the total shareholder return must at least be in the 35th percentile for any percentage of the grant to be paid. The maximum possible payment is 150% of the target grant for a return on capital of 7.9% and a total shareholder return in or above the 75th percentile.

For the performance share awards made in fiscal 2006, the Management Development And Compensation Committee established a three-year performance period ending September 30, 2008. The performance measures selected by the Management Development And Compensation Committee are (i) three-year average return on equity, and (ii) annualized three-year total shareholder return relative to peers.

The target level award opportunity is based on a return on equity of 10.6% and an annualized three-year shareholder return ranking in the 55th percentile. The return on equity must be at least 9.1% or the shareholder return must at least be in the 35th percentile for any percentage of the grant to be paid. The maximum possible payment is 150% of the target grant for a return on equity of 12.1% and a total shareholder return in or above the 75th percentile.

Grants between the threshold, target and maximum performance measurements will be interpolated.

_____________________

| 1 | The Peer Group consists of the following companies: AGL Resources Inc., Ameren Corporation, Atmos Energy Corporation, Cascade Natural Gas Company, Dominion Resources, Inc., DTE Energy Company, Energen Corporation, Equitable Resources, Inc., KeySpan Corporation, The Laclede Group, Inc., MGE Energy, Inc., National Fuel Gas Company, New Jersey Resources Corporation, Nicor Inc., NiSource Inc., Northwest Natural Gas Company, OGE Energy Corp., Oneok, Inc., Piedmont Natural Gas Company, Inc., Questar Corporation, SEMCO Energy, Inc., Sempra Energy, Southern Union Company, South Jersey Industries, Inc., Southwest Gas Corporation, UGI Corporation, Vectren Corporation, WGL Holdings, Inc., Wisconsin Energy Corporation and WPS Resources Corporation. |

Pension Plan Table

The following table illustrates various annual straight-life benefits at normal retirement (age 65) for the indicated levels of average annual compensation and various periods of service, assuming no future changes in the Company’s pension benefits. The benefit amounts shown reflect reduction for applicable Social Security benefits. Mr. Tetzlaff is not covered by the Company’s pension plan because he was not an employee of the Company or its subsidiaries.

| | | Years of Service | |

Average Annual Compensation | | 20 | | 25 | | 30 | | 35 | | 40 | |

| $ 300,000 | | 112,108 | | 140,135 | | 168,162 | | 186,912 | | 205,662 | |

| 350,000 | | 132,108 | | 165,135 | | 198,162 | | 220,037 | | 241,912 | |

| 400,000 | | 152,108 | | 190,135 | | 228,162 | | 253,162 | | 278,162 | |

| 450,000 | | 172,108 | | 215,135 | | 258,162 | | 286,287 | | 314,412 | |

| 500,000 | | 192,108 | | 240,135 | | 288,162 | | 319,412 | | 350,662 | |

| 550,000 | | 212,108 | | 265,135 | | 318,162 | | 352,537 | | 386,912 | |

| 600,000 | | 232,108 | | 290,135 | | 348,162 | | 385,662 | | 423,162 | |

| 650,000 | | 252,108 | | 315,135 | | 378,162 | | 418,787 | | 459,412 | |

| 700,000 | | 272,108 | | 340,135 | | 408,162 | | 451,912 | | 495,662 | |

| 750,000 | | 292,108 | | 365,135 | | 438,162 | | 485,037 | | 531,912 | |

| 800,000 | | 312,108 | | 390,135 | | 468,162 | | 518,162 | | 568,162 | |

| 850,000 | | 332,108 | | 415,135 | | 498,162 | | 551,287 | | 604,412 | |

| 900,000 | | 352,108 | | 440,135 | | 528,162 | | 584,412 | | 640,662 | |

| 950,000 | | 372,108 | | 465,135 | | 558,162 | | 617,537 | | 676,912 | |

| 1,000,000 | | 392,108 | | 490,135 | | 588,162 | | 650,662 | | 713,162 | |

Average annual compensation is the average 12-month compensation for the highest 60 consecutive months of the last 120 months of service prior to retirement. Compensation is total salary paid to an employee by the Company and/or its affiliates, including prior to October 1, 2002, all of the bonus and effective October 1, 2002 the lesser of 50% of the bonus target or 50% of the bonus paid, pre-tax contributions under the Company’s Capital Accumulation Plan, pre-tax contributions under the Company’s Health and Dependent Care Spending Accounts Plan, and pre-tax contributions for life and health care insurance, but excluding moving allowances, exercise of stock options and SARs, and other compensation that has been deferred. The salary and bonus discussed above and used in the computation of annual retirement benefits are reported in the Summary Compensation Table. On July 1, 2001, the Company amended the above-described pension plan. The revised pension plan allows employees of the Company who began their employment with the Company prior to July 1, 2001, to receive pension benefits equal to the greater of the amount determined by the above-described formula or the amount equal to the employee’s compensation during the five years of employment with the Company preceding termination multiplied by an age based percentage credited to the employee for each year of the employee’s participation in the plan. These amendments will not affect the pension benefits set forth in the table above for Mr. Patrick and Mr. Morrow. Due to the date Mr. Nance became employed with the Company, his pension benefits are determined according to the pension equity formula described below.

At September 30, 2006, the credited years of retirement benefit service for the individuals listed in the Summary Compensation Table were as follows; Mr. Patrick, 30 years; Mr. Morrow, 28 years; Mr. Nardi, 5 years; Ms. Rogers, 9 years, and Mr. Nance, 5 years. The benefits shown in the foregoing table are subject to maximum limitations under the Employee Retirement Income Security Act of 1974, as amended, and the Internal Revenue Code of 1986, as amended. Should these benefits at the time of retirement exceed the then-permissible limits of the applicable Act, the excess would be paid by the Company as supplemental pensions pursuant to the Company’s Supplemental Retirement Benefit Plan. The benefits shown give effect to these supplemental pension benefits.

Mr. Nance’s pension is determined under the Company’s pension equity formula. Under the pension equity formula, participants accumulate set credit percentages based on their age during each year of benefit service. The credit percentages are 6% for each year of benefit service under age 40, 12% for each year of benefit service between age 40 and 49, and 18% for each year of benefit service at age 50 and over. The sum of the credit percentages is multiplied by the participants five year final average pay to determine the lump sum benefit payable to the participant. An annuity payable can be determined by dividing the lump sum benefit payable by an appropriate factor that is based on the participant’s age and the then current interest rate. The estimated annual benefit payable to Mr. Nance upon his retirement at normal retirement age is $116,868 assuming $510,450 total salary and bonus for each fiscal year after fiscal 2006 until his normal retirement age, and an interest rate of 4.69%.

Compensation of Directors

During fiscal year 2006, directors who were not employees of the Company received an annual retainer of $35,000 and a meeting fee of $3,000 for each Board meeting attended and for each committee meeting attended as a committee member. In addition, any nonemployee director who served as chairman of the Audit Committee or the Management Development and Compensation Committee of the Board received a $12,000 annual retainer. Any non-employee director who served as chairman of any other committees of the Board received a $6,000 annual retainer. The Lead Director, Mr. Boris, received an additional annual retainer of $25,000 and a meeting fee of $3,000 for each committee meeting attended as an ex officio member. Officers of the Company who serve on the Board receive no compensation as directors.

Nonemployee directors also participate in the Company’s Directors Stock and Option Plan (“DSOP”). The purpose of the DSOP is to provide nonemployee directors with a proprietary interest in the Company and to improve the Company’s ability to attract and retain highly qualified individuals to serve as directors of the Company. Under the DSOP, each nonemployee director of the Company receives, as part of his or her annual retainer an annual award of 1,000 deferred shares of common stock of the Company. Deferred shares are automatically deferred until the earliest of (i) the director’s retirement from the Company’s Board of Directors following attaining the age of 70; (ii) one year after the director ceases to be a director of the Company for any other reason; or (iii) a change in control of the Company, and are not delivered by the Company until such date. The consummation of the pending Merger with WPS Resources would qualify as a change in control of the Company. Directors may elect to defer receipt of common stock in whole or in part for a period of time after the date on which distribution would otherwise occur by making an election to receive shares of common stock in installments. The director is entitled to receive amounts representing dividends from such deferred shares equal to dividends paid with respect to a like number of shares of common stock of the Company. Each director can make an election as to whether to receive dividends in the form of cash payments or in the form of additional deferred shares. A bookkeeping account is maintained for each nonemployee director. Each grant of deferred shares is automatically deferred and credited to the account of the director. The account of a director who elects to receive dividends in the form of additional deferred shares is credited with a number of deferred shares determined by dividing the amount of the dividend by the mean price of a share of Company common stock on the New York Stock Exchange on the dividend payment date. Deferred shares do not entitle a director to vote on any matter to be considered by the Company’s shareholders prior to the date of distribution of common stock and are generally not transferable other than upon a director’s death. During the fiscal year ended September 30, 2006, participants in the DSOP as a group were credited with 11,736 deferred shares, with an average per-share base price of $36.53.

The Company offers nonemployee directors an opportunity to defer their compensation, except for options and stock received upon the exercise thereof. Under the Directors Deferred Compensation Plan, a director may elect to defer the receipt of compensation earned as a director until a future date. Cash compensation may be deferred in the form of cash, Company common stock, or a combination of both; stock compensation may be deferred only in the form of Company common stock. An election to defer, or to cease to defer, compensation earned as a director of the Company is effective only with respect to compensation earned in the calendar year following the year in which the election is made. A bookkeeping account is maintained for each participant. The account reflects the amount of cash and/or the number of share equivalents to which the participant is entitled under the terms of the plan.

The account of a participant who elects to defer compensation in the form of cash is credited with the dollar amount of compensation so deferred on each date that the participant is entitled to payment for services as a director. Interest on the cash balance of the account is computed and credited quarterly as of March 31, June 30, September 30, and December 31 of each year at the prime commercial rate as reported in The Wall Street Journal.

The account of a participant who elects to defer compensation in the form of stock is credited with share equivalents on each date that the participant is entitled to payment for services as a director. The number of share equivalents so credited is determined by dividing the compensation so deferred by the mean price of a share of Company common stock on the New York Stock Exchange on such date. Additional share equivalents are credited to the director’s account on each date that the Company pays a dividend on the common stock. During the fiscal year ended September 30, 2006, plan participants as a group were credited with 11,749 share equivalents for compensation deferred in the form of stock, with an average per-share base price of $36.84. During the same period, no participants were credited with compensation deferred in the form of cash.

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

The Company has entered into separate severance agreements with certain key executives, including each of the executives named in the Summary Compensation Table, other than Mr. Patrick, who has entered into an Employment and Retention Agreement with the Company, as described below, and other than Mr. Tetzlaff. The intent of the severance agreements is to assure the continuity of the Company’s administration and operations in the event of a change in control of the Company (as described below). The severance agreements were developed in accordance with the advice of outside consultants.

The term of each severance agreement is for the longer of 36 months after the date in which a change in control of the Company occurs or 24 months after the date of consummation of a transaction described in clause (ii) below of the description of a change in control. A change in control is defined as occurring when: (i) any person, group, corporation, or other entity (except the Company or a wholly-owned subsidiary), after acquiring common stock of the Company, becomes the beneficial owner, directly or indirectly, of 20% or more of the Company’s outstanding common stock; (ii)(A) any consolidation or merger is consummated, other than a consolidation or merger of the Company in which holders of the Company’s common stock immediately prior to the consolidation or merger hold proportionately at least 55% of the outstanding common stock of the continuing or surviving corporation; (B) there is any sale, lease, exchange or other transfer of all or substantially all of the assets of the Company, except where the Company owns all of the outstanding stock of the transferee entity or the Company’s common shareholders immediately prior to such transaction own proportionately at least 55% of the transferee entity or group of transferee entities immediately after such transaction; or (C) there is any consolidation or merger of the Company where, after the consolidation or merger, one entity or group of entities owns 100% of the shares of the Company, except where the Company’s common shareholders immediately prior to such merger or consolation own proportionately at least 55% of the outstanding stock of such entity or group of entities immediately after such consolidation or merger; or (iii) there is a change in the members of the Company’s Board of Directors within a 24-month period such that the individuals who are members of the Company’s Board of Directors at the beginning of such 24-month period cease to comprise two-thirds of the members, unless approved by two-thirds of the directors then still in office who were in office at the beginning of the 24-month period. The Company’s pending Merger with WPS Resources qualifies as a change in control.

Each severance agreement provides for payment of severance benefits to the executive in the event that, during the term of the severance agreement (i.e. the longer of 36 months after the date in which a change in control of the Company occurs or 24 months after the date of consummation of a transaction as described in clause (ii) in the preceding paragraph of the description of a change in control), (i) the executive’s employment is terminated by the Company, except for “cause” as defined therein, death or disability; or (ii) the executive’s employment is terminated due to a constructive discharge, which includes (a) a material change in the executive’s responsibilities, which change would cause the executive’s position with the Company to become of less dignity, responsibility, prestige or scope; (b) reduction, which is more than de minimis, in total compensation; (c) assignment without the executive’s consent to a location more than 50 miles from the current place of employment; or (d) liquidation, dissolution, consolidation, merger, or sale of all or substantially all of the assets of the Company, unless the successor corporation has a net worth at least equal to that of the Company immediately prior to such transaction and expressly assumes the obligations of the Company under the executive’s severance agreement.

The principal severance benefits payable under each severance agreement consist of the following: (i) the executive’s base salary and accrued benefits through the date of termination; and (ii) a lump sum cash payment equal to three years of the sum of the executive’s base salary, the average of the short-term incentive (bonus) compensation paid to the executive during the three years preceding termination of employment and the economic equivalent value of any long-term incentive compensation awards received by the executive in the calendar year preceding termination (items (i) and (ii) are collectively referred to as “Salary & Incentive-Based Compensation”).

The Company and Mr. Patrick have entered into an Employment and Retention Agreement, effective August 31, 2006, that replaced his severance agreement. Under the new agreement, Mr. Patrick gave up the severance payments he would have otherwise received under his severance agreement, including without limitation the obligation of the Company to pay Mr. Patrick an amount sufficient on an after-tax basis to satisfy any golden parachute excise tax liability imposed by Section 4999 of the Internal Revenue Code of 1986, as amended. Mr. Patrick has also waived the obligation of the Company to fund certain of his nonqualified retirement benefits under a trust maintained by the Company, commonly called a rabbi trust; instead, such benefits will be paid with general corporate assets.

The Company has agreed to retain Mr. Patrick on an at will basis at his current salary, subject to increase from time to time in accordance with salary increases generally granted to company executives. Mr. Patrick shall remain eligible to participate in all bonus programs, incentive arrangements, employee benefit plans and perquisite plans for which he is eligible in accordance with their terms. The Company has also agreed that if Mr. Patrick elects to receive his supplemental retirement benefit in the form of an annuity and such payments are delayed six months to comply with tax laws, Mr. Patrick’s first payment will equal the total of the annuity payments he otherwise would have received during the six months immediately following his employment termination.

Under the agreement, Mr. Patrick received an incentive bonus and is eligible for a success bonus. Mr. Patrick received an incentive bonus in consideration for, among other things, terminating his change in control severance agreement and remaining employed by the Company through November 30, 2006. $1,000,000 of this bonus was paid on December 1, 2006 and the remainder of $1,775,000 will be paid six months after his employment termination.

Mr. Patrick will be paid a success bonus of $2,000,000 if he remains employed with the Company as of:

(i) the later of (A) the completion date of the Merger with WPS Resources or (B) at the Company’s option on the three-month anniversary date of the completion date of the Merger; or

(ii) if the Merger is abandoned and does not close, the later of (A) the date the Company hires a new chief executive officer and he or she commences service in such position, or (B) at the Company’s option on the three-month anniversary date of the new chief executive officer’s first day of service; or

(iii) the date the Company terminates his employment due to death, disability or a reason other than cause, as cause is defined in the agreement, before the occurrence of an event described in (i) or (ii) above.

The success bonus will be paid six months after Mr. Patrick’s employment termination.

Mr. Morrow’s severance agreement provides that in addition to the Salary & Incentive-Based Compensation, Mr. Morrow would be entitled to receive from the Company, within ten business days after termination (or such later date as provided in the agreement), the amount of his vested accrued benefit under the Company’s Supplemental Retirement Benefits Plan (“SRB Plan”) on the date of his termination. Mr. Morrow’s severance agreement further provides that Mr. Morrow is entitled to continuation of coverage under the Company’s welfare benefit plans until the date Mr. Morrow reaches age 65, provided that such benefits shall cease upon Mr. Morrow becoming eligible for such coverage under another employer’s plans.

Mr. Nardi’s severance agreement provides that in addition to the Salary & Incentive-Based Compensation, Mr. Nardi would be entitled to receive from the Company, within ten business days after termination (or such later date as provided in the agreement), an amount equal to the remainder of (x) the value of the benefits that would have been accrued by Mr. Nardi under the Company’s retirement plan and the SRB Plan on the date of termination of employment, determined as if Mr. Nardi had received credit for an additional twenty-one years of service and had commenced participation in the Company’s retirement plan and the SRB Plan as of his first day of actual employment with Peoples Energy Services Corporation, less (y) the value of Mr. Nardi’s benefits accrued under the retirement plan on the date of termination of his employment. The amount payable to Mr. Nardi is computed without actuarial reduction for early receipt of the benefit and is calculated using the formula under the Company’s retirement plan which would result in the greater benefit. Mr. Nardi’s severance agreement further provides that Mr. Nardi is entitled to a continuation of coverage under the Company’s welfare benefit plans (e.g., life insurance and medical benefits) or equivalent individual coverage for the longer of: (i) three years after termination, or (ii) the period commencing with the date of termination and ending on the date that Mr. Nardi reaches age 65, provided that such benefits shall cease upon Mr. Nardi becoming eligible for such coverage under another employer’s plans.

Ms. Rogers’ severance agreement provides that in addition to the Salary & Incentive-Based Compensation, if Ms. Rogers is vested under the Company’s retirement plan, Ms. Rogers would be entitled to receive from the Company, within ten business days after termination (or such later date as provided in the agreement), the amount of her vested accrued benefit under the SRB Plan on the date of her termination, computed as if Ms. Rogers had completed three years of additional service. If on the date of termination, Ms. Rogers is at least age 47 but less than age 50, the portion of Ms. Rogers’ severance benefit resulting from the additional three years of benefit service under the SRB Plan shall be calculated based on the benefits percentage under the SRB Plan that Ms. Rogers would be entitled to if she had reached age 50 by the time of termination. Ms. Rogers’ severance agreement further provides that Ms. Rogers is entitled to continuation of coverage under the Company’s welfare benefit plans (e.g., life insurance and medical benefits) or equivalent individual coverage for a period of three years after termination, provided that such benefits shall cease upon Ms. Rogers becoming eligible for such coverage under another employer’s plans.

Mr. Nance’s severance agreement provides that in addition to his Salary & Incentive-Based Compensation, unless an accelerated pay-out of Mr. Nance’s Performance Awards under the Company’s Long-Term Incentive Plan for Diversified Business Units (the “DBU Long-Term Plan”) has been made in cash, restricted stock or in options to purchase common stock of an entity resulting from either the initial public offering of a business unit or the divestiture of a business unit, Mr. Nance would be entitled to a cash payment equal to the amount payable with respect to any outstanding Performance Award, in accordance with the DBU Long-Term Plan for payments upon the occurrence of a Change in Control. If, on the date of Mr. Nance’s termination, he is vested under the Company’s retirement plan, Mr. Nance would be entitled to a payment, within ten business days after his termination, equal to the amount of the benefit accrued under the Company’s SRB Plan on the date of termination, plus an additional three years accrued benefit (as determined in accordance with Mr. Nance’s severance agreement). If Mr. Nance is not vested under the Company’s retirement plan, he would receive a payment, within ten business days after his termination, in an amount equal to the sum of the value of the benefit accrued under the SRB Plan on the date of termination plus an additional three years accrued benefit (as determined in accordance with Mr. Nance’s severance agreement with reference to the Company’s retirement plan but payable under the SRB Plan), with the value of Mr. Nance’s benefit accrued under the SRB Plan on his date of termination determined as if (i) Mr. Nance had commenced participation in the Company’s retirement plan and the SRB Plan as of the date of his actual employment with Peoples

Energy Production Company, (ii) received credit for one year of benefit service under the Company’s retirement plan and the SRB Plan for each year or partial year during which he was employed by the Company, and (iii) Mr. Nance were fully vested in his accrued benefit under the SRB Plan at all times. Mr. Nance’s severance agreement further provides that Mr. Nance is entitled to a continuation of coverage under the Company’s welfare benefit plans (e.g., life insurance and medical benefits or equivalent individual coverage for the longer of: (i) three years after termination, or (ii) the period commencing with the date of termination and ending on the date Mr. Nance reaches age 65, provided that such benefits shall cease upon Mr. Nance becoming eligible for such coverage under another employer’s plans.

The Company is also obligated under each severance agreement to pay an additional amount to the executive sufficient on an after-tax basis to satisfy any excise tax liability imposed by Section 4999 of the Internal Revenue Code of 1986, as amended.

Finally, during the first twenty-four months of the coverage period under each of the severance agreements, the executive may request the Company to provide him or her with outplacement services. In the event such a request is made, the Company may, at its election, reimburse the executive for the cost of outplacement services actually incurred by the executive up to a maximum of $20,000, or arrange for the provision of outplacement services for the executive of an approximate value to the executive of $20,000.

The benefits received by the executive under each agreement are in lieu of benefits under the Company’s termination allowance plan and the executive’s benefits under the SRB Plan. Each executive would be required to generally waive employment-related claims prior to receiving any severance benefits and to enter into a confidentiality and non-solicitation agreement.

Equity Compensation Awards. Any unvested restricted stock previously awarded to the executive under the Company’s Long-Term Incentive Compensation Plans, shall be vested upon a change in control as defined under the plans. Upon completion of the pending Merger with WPS Resources, each share of restricted stock held by executive officers will be exchangeable for 0.825 shares of WPS Resources common stock. Also, upon completion of the Merger, each performance share award granted under the Company’s Long-Term Incentive Compensation Plan prior to the date of the Merger will vest, as provided in the plan, and each share of Company common stock distributed pursuant to such award shall be exchangeable for 0.825 shares of WPS Resources common stock.

Each stock option and stock appreciation right of the Company, including those held by executive officers of the Company, will be converted into WPS Resources common stock options and stock appreciation rights upon completion of the Merger with WPS Resources based upon the 0.825 exchange ratio for common stock.

Long-Term Cash Awards. The Company’s DBU Long-Term Plan provides cash awards based upon the achievement of operating and financial performance measures over a three-year performance cycle. As provided in the plan, upon a change in control, the Company may cause the performance period applicable to any outstanding performance award to lapse and the performance award to be paid out either (i) based on actual satisfaction or attainment of the applicable performance measures at such time or (ii) as if the applicable performance measures were satisfied at the minimum, target or maximum level. As provided under the plan, maximum cash awards that may be paid to executives of the Company for current performance cycles that may lapse are listed in the table below.

Executive | | Cash Award |

| William E. Morrow | | $ | 0 | |

| Steven W. Nance | | $ | 2,555,850 | |

| Thomas A. Nardi | | $ | 0 | |

| Thomas M. Patrick | | $ | 0 | |

| Desiree G. Rogers | | $ | 0 | |

| Theodore R. Tetzlaff | | $ | 0 | |

| All other executive officers | | $ | 0 | |

Directors Stock and Option Plan. Upon completion of the Merger, the deferred shares held under the plan will be distributed as Company common stock to the directors. Each of the distributed shares will be exchangeable for 0.825 shares of WPS Resources common stock.

With respect to the directors’ stock options, upon completion of the Merger with WPS Resources, these options will be converted into WPS Resources stock options based upon the 0.825 exchange ratio for WPS Resources common stock.

Directors Deferred Compensation Plan. Upon completion of the Merger, each share equivalent of the Company’s common stock under the Company’s Directors Deferred Compensation Plan will be converted into 0.825 shares equivalents of WPS Resources common stock. Shares of common stock of under the plan will be paid on the same schedule as provided by participating director’s elections under the plan.

The Company and Mr. Nardi are parties to a confidentiality and employment agreement dated May 22, 2002. Under the agreement, Mr. Nardi agrees to observe certain covenants and confidentiality restrictions, to refrain from soliciting or encouraging others to leave employment with the Company, and to release and discharge the Company from claims he may then have. The agreement also provides that if Mr. Nardi’s employment is terminated other than for “cause” (as defined in Mr. Nardi’s severance agreement) and prior to a Change in Control (as defined in the severance agreement), then Mr. Nardi is entitled to be paid by the Company an amount representing an enhanced retirement benefit as if Mr. Nardi were credited under the retirement plan and the SRB Plan with additional years of service, determined in the same manner as described above under Mr. Nardi’s severance agreement.

Compensation Committee Interlocks and Insider Participation

None.

REPORT OF THE MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Committee Responsibilities

The Committee’s responsibilities include, among other things, policy setting related to and oversight of executive compensation for Peoples Energy Corporation. A copy of the Committee’s charter is available on the Company’s website at www.peoplesenergy.com, and sets out the Committee’s responsibilities.

In 2006, we retained on behalf of the Committee an outside independent executive compensation consulting firm to conduct a comprehensive review of current executive compensation practices and policies. We confirmed our overall philosophy and the elements of executive compensation.

The purpose of this report is to summarize our philosophy of executive compensation, identify the key elements of the executive compensation program and describe the process by which compensation decisions were made for fiscal year 2007.

Compensation Philosophy

The following are the core principles on which our decisions are founded:

Emphasis is on alignment between pay and performance. All elements of executive compensation are evaluated in light of the underlying principle that pay should have a direct and observable relationship with performance.

Stock ownership is emphasized. Stock compensation is a central component of the compensation program. It is our belief that the use of stock provides a fundamental tool in supporting executive and employee motivation. Furthermore, requiring senior executives to hold a minimum level of share value in Company stock under specific ownership guidelines supports the overall alignment of executive and shareholder interests.

Compensation programs will be designed to reflect the competitive market that will support the attraction and retention of talent. We regularly evaluate current compensation levels to ensure that our executive compensation program reflects the competitive market in which the Company competes for executive talent. Generally, this market is comprised of other energy companies that have a similar mix of gas distribution and diversified energy services.

Elements of Executive Compensation

Peoples Energy’s executive compensation program consists primarily of base salary, annual incentives and long-term incentives. The Committee reviews the total compensation for each of the Company’s five most highly paid officers, including a review of each element of current compensation and any contingent future components individually and in the aggregate and the officer’s five-year compensation history.

Base Salary

Base salary levels are generally targeted at the 50th percentile (median) of comparably sized energy organizations. This market position is targeted because it is our belief that the Company will primarily attract and retain future executives in competition with these organizations. The 50th percentile of the market reflects a reasonable level of the market.

All employees, including executives, are eligible for annual increases in salary based on an annual review of overall market movement. Annual merit adjustments will be made on the basis of performance of the job, meeting key job requirements and the organization’s ability to make these adjustments based on affordability.

During fiscal year 2006 incentive compensation was made under the 2004 Incentive Compensation Plan (Plan). The Plan is comprised of two sub-plans: the Short-Term Incentive Compensation Plan (the “Short-Term Plan”) and the Long-Term Incentive Compensation Plan (the “Long-Term Plan”).

Annual Incentive

All officers are eligible for annual incentive compensation under the Short-Term Plan. Annual Compensation under the Plan is paid in cash, based on the level of performance actually attained with respect to performance measures established in the Board approved plan guidelines. The Short-Term Plan provides executives with an opportunity to earn a level of compensation that is expressed as a percentage of base salary. The level of compensation is targeted at the level that in combination with base salary, approximates the 60th percentile of the market for total cash compensation. In our opinion, this level of the market reflects a reasonable market position because of the difficulty in attaining the targets established for the performance metrics associated with the Short-Term Plan.

Performance measures may, in general, be measures of corporate performance, such as earnings per share, and/or measures of divisional or business unit performance, such as business unit operating costs or operating income. For fiscal year 2006, awards for the executives named in the Summary Compensation Table of this proxy statement were based on performance measures weighted in the following manner: Mr. Patrick: 100% on corporate performance; Mr. Morrow: 25% on corporate performance, 25% on gas distribution performance and 50% on midwest energy performance and operations; Mr. Nardi: 50% on corporate performance and 50% on divisional performance and operations; Ms. Rogers: 25% on corporate performance and 75% on gas distribution performance and operations; and Mr. Nance: 25% on corporate performance and 75% on oil and gas production performance and operations. The award for each of the measures was determined by evaluating the Company’s performance with respect to the internally established goal for each measure. No payments were made to officers under the Short-Term Plan for fiscal year 2006 as the award trigger was not met.

For fiscal year 2007, awards will be based on the following performance measures under the Short-Term Plan: Mr. Morrow: 25% on corporate performance, 25% on gas distribution performance and 50% on midwest energy performance and operations; Mr. Nardi: 75% on corporate performance and 25% on divisional performance and operations; Ms. Rogers: 25% on corporate performance and 75% on gas distribution performance and operations; and Mr. Nance: 25% on corporate performance and 75% on oil and gas production performance and operations. Mr. Patrick will not participate in the Short-Term Plan during fiscal year 2007, as he will be retiring and compensated for any remaining tenure through his Employment and Retention Agreement. The award for each of the measures will be determined by evaluating the Company’s performance with respect to the internally established goal for each measure. If the pending merger with WPS Resources Corporation (“Merger”) occurs during fiscal year 2007, the award will be determined under the Change in Control provision of the Short-Term Plan. This provision provides that the award will be computed and paid on a prorated basis at target levels.

Long-Term Incentive

Under the Long-Term Plan, long-term incentive compensation may be comprised of restricted stock, restricted stock units, performance shares or combinations of these awards. Up to 594,138 shares of the Company’s common stock are available for issuance of awards under the Long-Term Plan. However, no more than 244,138 shares may be granted for restricted stock and for awards of restricted stock units. The number of shares/units granted is periodically reviewed against long-term incentive awards that other comparable energy organizations pay to their CEO’s and other executives.

Restricted stock are shares of the Company’s common stock that are subject to forfeiture if the conditions to vesting set forth in the related award agreement are not met. Vesting of restricted stock is based on the continued service of the recipient.

A restricted stock unit is a contingent right to receive a share of common stock of the Company that is subject to forfeiture if the conditions to vesting that are set forth in the related award agreement are not met. Vesting of restricted stock units may be based on the continued service of the recipient, upon the achievement of one or more performance goals established by the Management Development And Compensation Committee (described in the next paragraph), or upon a combination of continued service and one or more performance goals.

A performance share is a contingent right to receive a share of common stock of the Company in the future, pursuant to the terms of a grant and the related award agreement. For each grant of performance shares, the Management Development And Compensation Committee establishes one or more performance goals and a performance cycle of not less than one year. The performance goals under the Plan are based on one or more of the following performance criteria: total shareholder

return; return on invested capital, equity or assets; operating profit; earnings per share; sales or revenues; operating expenses; common stock price appreciation; cash flow; increases in economic value of a subsidiary, division, business unit or asset or group of assets of the Company or any subsidiary, division or business unit; pre-tax income or after-tax income; or reductions in expenses.

For fiscal year 2006, 65,550 shares of restricted stock were granted under the Long-Term Plan to the five highest paid executives and selected employees as a group, based upon their level of responsibility and ability to impact results. Under the plan, vesting of restricted stock grants is based entirely on continued employment, with each grant vesting in equal installments over five years. If the pending Merger occurs during fiscal year 2007, the outstanding restricted stock awards will become fully vested per the provisions of the Long-Term Plan.

Performance shares were granted under the Long-Term Plan to substantially all officers in 2006. The performance shares granted in 2006 will be earned over a three-year period on a contingent basis relative to performance against two measures that were approved by the Committee. For the 2006-2008 performance period, these measures are total shareholder return relative to comparable energy companies and the Company’s performance against targeted return on capital. The comparable group of energy companies is different from that depicted in the stock performance graph on page 18 of this Form 10-K/A. The scale of possible performance shares earned ranges from 0 to 150 percent of the target performance share grant. Upon determination of the performance shares earned, participants receive one share of common stock for every performance share earned. The table on page 7 provides the total number of performance shares granted in fiscal 2006 to the five highest paid executives. 55,900 performance shares were granted to officers and selected employees as a group. If the pending Merger occurs during fiscal year 2007, the goals of the outstanding performance share awards will be deemed to have been achieved at target and shares will be distributed. The numbers of shares to be distributed will be determined on a prorated basis for each performance period in accordance with the provisions of the Long-Term Plan.

No performance measures were approved and no performance shares were granted for the 2007-2009 performance period due to the pending Merger.

Certain designated officers of the Company’s diversified business units are participants in the Long-Term Incentive Plan for Diversified Business Units (the “DBU Long-Term Plan”), including one of the executives named in the Summary Compensation Table of this proxy statement, Mr. Steven W. Nance, President of Peoples Energy Production Company, the subsidiary of the Company engaged in oil and gas production. The DBU Long-Term Plan is intended to more directly align the interests of certain business unit executives with value creation at the business unit level.

Under the DBU Long-Term Plan, participants may receive Performance Awards, which entitle participants to receive cash equal to a percentage of their salary based upon the attainment of certain levels of business unit performance over a performance period, as measured by performance measures approved by the Committee. To date, the Committee has generally designated performance periods of three consecutive fiscal years, with annual awards to be made under the DBU Long-Term Plan based on the attainment of the applicable performance measures over the designated three fiscal year period. Performance measures applicable to the oil and gas production business unit are (1) the compound annual growth rate in proven oil and gas reserves owned at fiscal year end, and (2) the average return on capital employed. The performance measure applicable to the midstream services business unit is operating income of the unit.

Participants under the DBU Long-Term Plan are also eligible to receive Percentage Interest Awards and Equity Interest Awards. A Percentage Interest Award is the right to receive cash in an amount equal to a percentage of the increase in the fair market value of the business unit upon the sale or other divestiture of the business unit by the Company. An Equity Interest Award is a right to receive, in the Committee’s discretion, a cash award, an award of restricted common stock, or options to purchase shares of common stock of the business unit following an initial public offering or spin-off of the business unit, expressed as the equivalent of a Percentage Interest.

Perquisites

In addition to the primary elements of executive compensation described above, officers of the Company are given the option of receiving various perquisites. The Company believes that providing these perquisites to executives assists in attracting and retaining executive talent and enhances an executive’s ability to devote more time to performing his or her duties. The Committee reviewed with the assistance of its independent consultant the level of perquisites made available to officers. The perquisites offered by the Company, including any applicable annual limit, are as follows: comprehensive executive physical examination for executives and spouses, plus a gross-up amount to satisfy the payment of taxes; automobile allowance plus a gross-up amount to satisfy the payment of taxes; luncheon club memberships; an airline lounge membership; a parking pass for the officer’s primary office; and an allowance of $8,500 for each officer other than the CEO, and $12,000 for the CEO, to be used for the purchase of home office equipment, life insurance, excess personal liability insurance, and/or personal financial counseling.

Stock Ownership Objectives

The Company has stock ownership guidelines that require officers to hold a minimum level of share value in Company stock. The shares that may be counted for purposes of an officer meeting the required ownership level include all unvested restricted shares, as well as other shares held in the Company’s existing qualified plans and credited to the officer, such as the 401(k) plan. Ownership guidelines only apply to officers of the organization. These targets are three times salary for the CEO and for other officers range from one-half to two times salary. As of November 1, 2006 the value of the shares counted for Mr. Patrick under the guidelines is approximately 5 times his salary.

We believe that having such stock ownership guidelines will provide a strong linkage with the interests of shareholders and that share ownership by executives and employees fosters a performance-oriented culture and has contributed to the successes of the Company. Accordingly, we continue to endorse their use in the overall executive compensation program.

CEO Compensation and Performance

We determined and the non-management directors of the Board approved the level for base salary, annual incentive and long-term incentive using methods consistent with those used for other senior executives.

In determining Mr. Patrick’s 2006 merit increase and incentive awards, we evaluated his performance based on input from all non-management directors as well as the Company’s financial and operating performance for fiscal 2006. Based on our evaluation, Mr. Patrick received a merit increase of 3.0% in 2006. This increase was consistent with the merit budget for all officers and maintains his salary level within reasonable market parameters.

Mr. Patrick received no annual incentive award for 2006 based on the Company’s performance as measured by the applicable performance measures under the Short-Term Plan described above — namely, earnings per share (50%) and normalized corporate operating income (50%). Since the Company’s performance did not exceed the minimum threshold levels required under the guidelines, no award was paid.

For fiscal year 2006, we recommended, and the non-management members of the Board approved, the granting to Mr. Patrick of 11,700 shares of restricted stock and 18,400 performance shares under the Long-Term Plan. The number and mix of shares of restricted stock and performance shares granted to Mr. Patrick reflects target grant guidelines established by the Committee for the CEO that are consistent with competitive practices. The Committee may increase or decrease the awards relative to those targets and in 2006 the Committee awarded a restricted stock grant at the midpoint of the grant guidelines and a performance share grant at the high end of the grant guidelines for Mr. Patrick based on the assessment of his performance and contribution.

For fiscal year 2007, due to the pending Merger with WPS Resources and Mr. Patrick’s announced retirement, no merit increases or incentive awards were awarded to Mr. Patrick.

Deductibility of Executive Compensation

The Internal Revenue Code precludes the Company from taking a deduction for compensation in excess of $1 million for officers named in the Summary Compensation Table. Certain performance-based compensation is specifically exempt from the deduction limit. The Company’s policy is generally to qualify, to the extent deemed reasonable by the Committee, the compensation of executive officers for deductibility under applicable tax laws and the shareholder approved plans. A portion of Mr. Patrick’s compensation, in the amount of $118,037 was not deductible by the Company in fiscal year 2006.

Conclusion

We are satisfied that the Company’s compensation plans are designed and administered to support a strong performance-oriented culture that is aligned with the interests of the Company and its shareholders. In addition, the program reflects reasonable levels of compensation as compared to a peer group of companies.

SUBMITTED BY THE MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE

William J. Brodsky, (Chairman)

Keith E. Bailey

Diana S. Ferguson

Homer J. Livingston, Jr.

Richard P. Toft

James R. Boris, ex officio

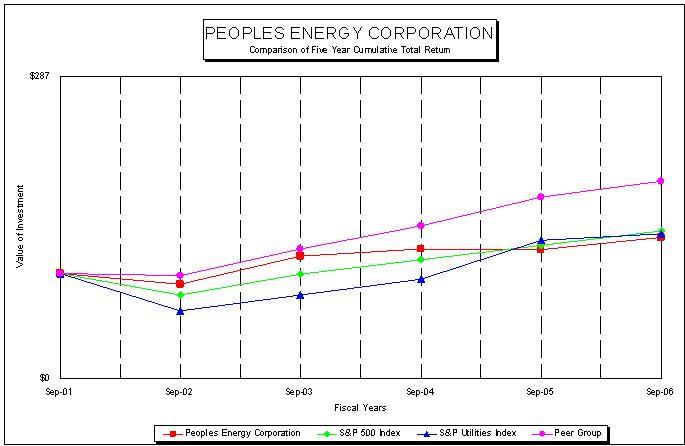

PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on Company common stock to the cumulative total return of the S&P 500 Index, the S&P Utilities Index, and a peer group selected by the Company comprised of energy companies with substantial gas distribution operations, weighted by market capitalization, over a five-year period ending September 30, 2006. The graph assumes that the value of investment in Company common stock and each index was $100 on September 30, 2001, and that all dividends were reinvested.

| Company Name/Index | Sep-01 | Sep-02 | Sep-03 | Sep-04 | Sep-05 | Sep-06 |

| Peoples Energy Corp | $100.00 | $89.61 | $116.07 | $122.92 | $122.26 | $133.90 |

| S & P 500 Index | $100.00 | $79.52 | $98.91 | $112.63 | $126.42 | $140.09 |

| S & P 500 Utilities Index | $100.00 | $64.59 | $79.23 | $94.70 | $131.27 | $137.52 |

| Peer Group | $100.00 | $97.98 | $122.90 | $144.99 | $172.41 | $187.09 |