UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04379

Plan Investment Fund, Inc.

(Exact name of registrant as specified in charter)

2 Mid America Plaza

Suite 200

Oakbrook Terrace, IL 60181

(Address of principal executive offices) (Zip code)

ALEXANDER D. HUDSON

Chief Operating Officer

Plan Investment Fund, Inc.

2 Mid America Plaza, Suite 200

Oakbrook Terrace, Illinois 60181

(Name and Address of Agent for Service)

Copy to:

JOSEPH M. MANNON

Vedder Price P. C.

222 North LaSalle Street

Chicago, Illinois 60601

Registrant’s telephone number, including area code: (630) 472-7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

TABLE OF CONTENTS

| Item 1. | Reports to Stockholders. |

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows: |

1

Annual Shareholder Report | as of December 31, 2024

This Annual Shareholder Report contains important information about the Government Portfolio (the "Portfolio") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Portfolio at www.pif.com/fund/government-portfolio. You can also request this information by contacting us at (800) 621-9215.

What were the Portfolio’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Ticker | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| PIFXX | $10 | 0.10% |

|---|

| Total Net Assets | $1,918,111,850 |

|---|

| # of Portfolio Holdings | 90 |

|---|

| Investment Advisory Fees Paid | $913,008 |

|---|

| Value | Value |

|---|

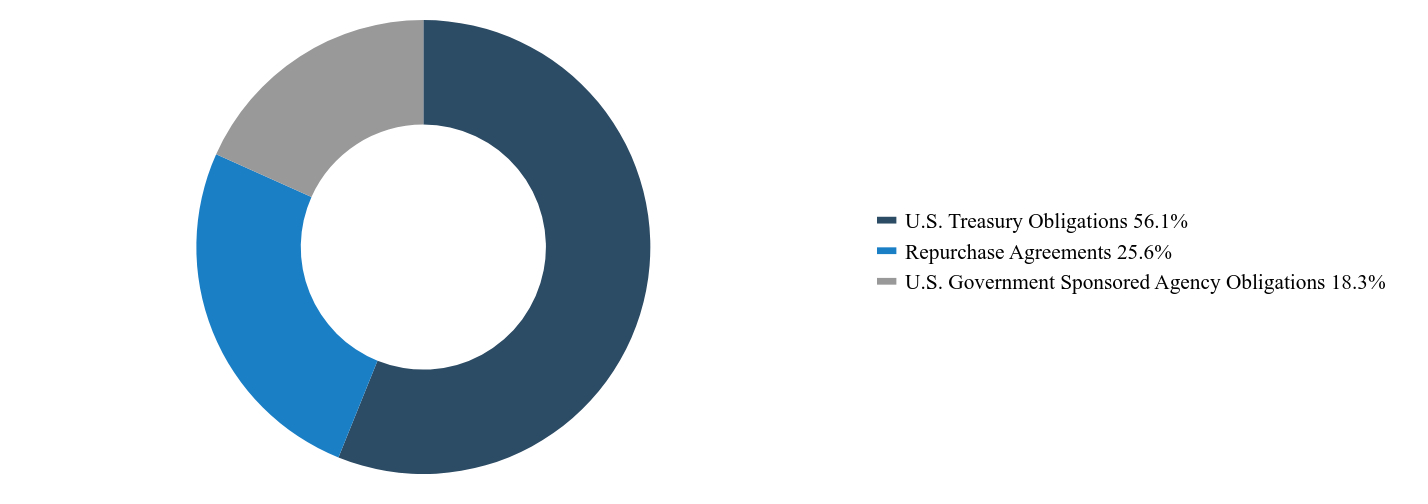

| U.S. Treasury Obligations | 56.1% |

| Repurchase Agreements | 25.6% |

| U.S. Government Sponsored Agency Obligations | 18.3% |

On November 6, 2024, Cohen & Company, Ltd. (the “Prior Auditor”) resigned as the independent registered public accounting firm of the Portfolio. There were no disagreements with the Prior Auditor on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure during the Portfolio’s two most recent fiscal years and the subsequent interim period through November 6, 2024. On November 6, 2024, the Portfolio's Board of Trustees approved Tait, Weller & Baker LLP as the independent registered public accounting firm of the Portfolio for the fiscal period ending December 31, 2024.

Where can I find additional information about the Portfolio?

If you wish to view additional information about the Portfolio, including the Portfolio's financial statements, month-end holdings, prospectus and statement of additional information, please visit www.pif.com/fund/government-portfolio.

tel: (800) 621-9215 | www.pif.com/fund/government-portfolio

Annual Shareholder Report | as of December 31, 2024

Annual Shareholder Report | as of December 31, 2024

This Annual Shareholder Report contains important information about the Money Market Portfolio (the "Portfolio") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Portfolio at www.pif.com/fund/money-market-portfolio. You can also request this information by contacting us at (800) 621-9215.

What were the Portfolio’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Ticker | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| PIMXX | $17 | 0.17% |

|---|

| Total Net Assets | $173,604,380 |

|---|

| # of Portfolio Holdings | 144 |

|---|

| Investment Advisory Fees Paid | $50,233 |

|---|

| Value | Value |

|---|

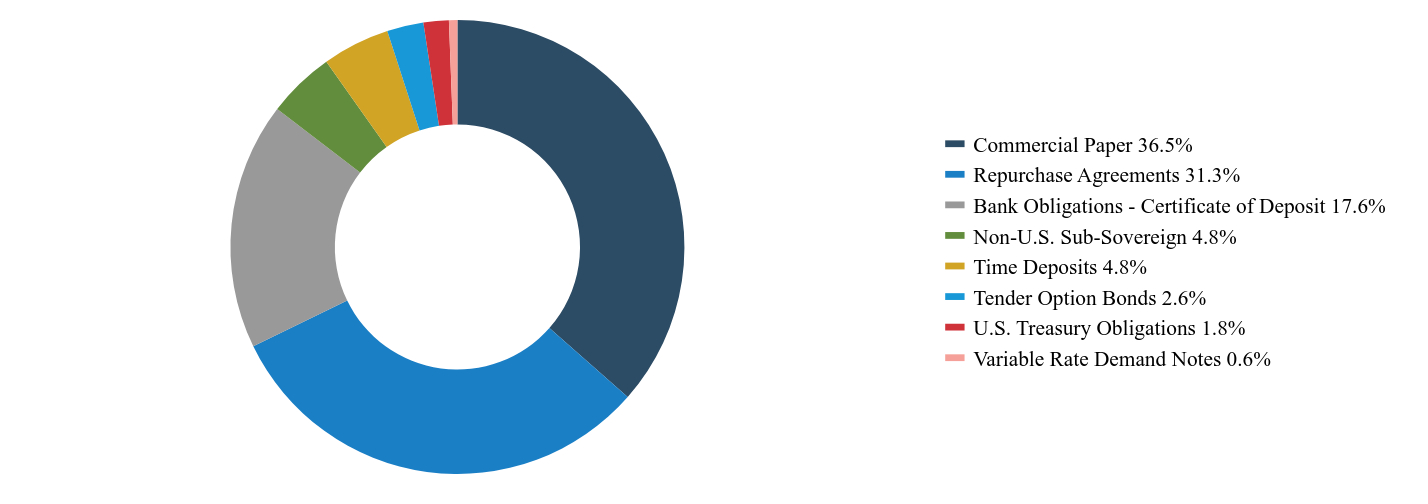

| Commercial Paper | 36.5% |

| Repurchase Agreements | 31.3% |

| Bank Obligations - Certificate of Deposit | 17.6% |

| Non-U.S. Sub-Sovereign | 4.8% |

| Time Deposits | 4.8% |

| Tender Option Bonds | 2.6% |

| U.S. Treasury Obligations | 1.8% |

| Variable Rate Demand Notes | 0.6% |

On November 6, 2024, Cohen & Company, Ltd. (the “Prior Auditor”) resigned as the independent registered public accounting firm of the Portfolio. There were no disagreements with the Prior Auditor on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure during the Portfolio’s two most recent fiscal years and the subsequent interim period through November 6, 2024. On November 6, 2024, the Portfolio's Board of Trustees approved Tait, Weller & Baker LLP as the independent registered public accounting firm of the Portfolio for the fiscal period ending December 31, 2024.

Where can I find additional information about the Portfolio?

If you wish to view additional information about the Portfolio, including the Portfolio's financial statements, month-end holdings, prospectus and statement of additional information, please visit www.pif.com/fund/money-market-portfolio.

tel: (800) 621-9215 | www.pif.com/fund/money-market-portfolio

Annual Shareholder Report | as of December 31, 2024

| (a) | The registrant has adopted a code of ethics that applies to its principal executive officer and principal financial officer. |

| (b) | No disclosures are required pursuant to this Item 2(b). |

| (c) | During the period covered by this report, there were no amendments to the provisions of the registrant’s code of ethics that apply to the registrant’s principal executive officer and principal financial officer and that relate to any element of the code of ethics definition enumerated in Item 2(b) of Form N-CSR. |

| (d) | During the period covered by this report, the registrant did not grant any waivers, including implicit waivers, from any provision of its code of ethics that apply to the registrant’s principal executive officer or principal financial officer and that relate to one or more of the items set forth in Item 2(b) of Form N-CSR. |

| (f) | A copy of the registrant’s code of ethics that applies to its principal executive officer and principal financial officer is filed as Exhibit 19(a)(1) to this Form N-CSR. |

| Item 3. | Audit Committee Financial Expert. |

The registrant’s Board of Trustees has determined that Jennifer J. Allen and Mitch W. Perry, independent trustees who serve on the audit committee of the Board of Trustees (the “Audit Committee”), qualify as “audit committee financial experts” (as such term is defined in Item 3(b) of Form N-CSR). An “audit committee financial expert” is not an “expert” for any purpose, including for purposes of Section 11 of the Securities Act of 1933, as a result of being designated as an “audit committee financial expert.” Further, the designation of a person as an “audit committee financial expert” does not mean that the person has any greater duties, obligations, or liability than those imposed on the person without the “audit committee financial expert” designation. Similarly, the designation of a person as an “audit committee financial expert” does not affect the duties, obligations, or liability of any other member of the registrant’s Audit Committee or Board of Trustees.

| Item 4. | Principal Accountant Fees and Services |

(a) through (d) Audit and Non-Audit Fees

The following table sets forth the aggregate audit and non-audit fees billed to the registrant for the fiscal years ended December 31, 2024 and 2023 for professional services rendered by the registrant’s independent registered public accounting firm, Tait, Weller & Baker LLP (“Tait Weller”), with respect to the fiscal year ended December 31, 2024, and prior independent registered public accounting firm, Cohen & Company, Ltd. (“Cohen”), with respect to the fiscal year ended December 31, 2023.

2

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2024 | | | 2023 | |

Audit fees | | $ | 38,000 | | | $ | 49,000 | |

Audit-related fees | | $ | 0 | | | $ | 0 | |

Tax fees | | $ | 5,000 | | | $ | 7,000 | |

All other fees | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

Total | | $ | 43,000 | | | $ | 56,000 | |

| | | | | | | | |

Audit fees include fees billed for professional services associated with the annual audits and filings of the registrant’s Form N-1A, Form N-CSR, and Form N-CEN and audits. Audit-related fees are fees billed for assurance and related services that are reasonably related to the performance of the audit. Tax fees represent fees billed for professional services rendered for tax compliance and tax advice by the registrant’s independent registered public accounting firm. All other fees would be for services rendered other than those included in the audit, audit-related or tax categories. All services for 2024 and 2023 for which fees are included in the table above were pre-approved by the Audit Committee.

(e) Audit Committee Pre-Approval Policies

The Audit Committee has adopted policies that require that each engagement of the registrant’s independent auditors to render audit or non-audit services to the registrant be pre-approved by the Audit Committee, or if the committee shall determine to delegate such matter to one of its members, such member shall have the authority to pre-approve audit or non-audit services to the registrant. The Audit Committee, or if the Audit Committee shall determine to delegate such matter to one of its members, such member, also pre-approves all engagements by the independent auditors for engagements for non-audit services to the registrant’s investment advisor and any entity controlling, controlled by or under common control with the advisor that provides ongoing services to the registrant, if the engagement relates directly to the operations or financial reporting of the registrant. The foregoing pre-approval requirements will not apply to certain non-audit services, provided that such services are limited in amount and other requirements are satisfied with respect thereto, in accordance with the applicable provisions of Rule 2-01 of Regulation S-X.

(f) None of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

3

(g) and (h) Aggregate Non-Audit Fees

The aggregate non-audit fees billed by Tait Weller for professional services for the registrant totaled $5,000 for the fiscal year ended December 31, 2024. The aggregate non-audit fees billed by Cohen for professional services for the registrant totaled $7,000 for the fiscal year ended December 31, 2023.

The Audit Committee also is required to pre-approve services by the registrant’s independent auditors to certain affiliated entities as defined by Securities and Exchange Commission (“SEC”) rules, including the registrant’s investment advisor and any entity controlling, controlled by or under common control with the advisor. The aggregate non-audit fees billed by Tait Weller and Cohen for professional services for the registrant’s investment advisor and all the advisor’s control affiliates as defined by SEC rules, totaled $0 in 2024, with respect to Tait Weller, and $0 in 2023, with respect to Cohen. The Audit Committee has considered the compatibility of the non-audit services that were not subject to pre-approval, if any, with the independent registered public accounting firm’s independence.

(i) Not applicable.

(j) Not applicable.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to the registrant.

(a) Included as part of the financial statements filed under Item 7 of this Form N-CSR.

(b) Not applicable.

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

4

Annual Financials and Other Information

December 31, 2024

ADMINISTRATOR

BCS Financial Services Corporation

2 Mid America Plaza, Suite 200

Oakbrook Terrace, IL 60181

(800) 621-9215

| | | | |

| | Government Portfolio Schedule of Investments December 31, 2024 | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Amortized

Cost | |

| | TOTAL INVESTMENTS - 74.4% | |

| | U.S. TREASURY OBLIGATIONS - 56.1% | |

| $ | 32,936,700 | | | U.S. Treasury Bill(1) | | | 4.51 | % | | | 01/02/25 | | | $ | 32,932,571 | |

| | 154,210,000 | | | U.S. Treasury Bill(1) | | | 4.34 | % | | | 01/07/25 | | | | 154,095,416 | |

| | 22,427,500 | | | U.S. Treasury Bill(1) | | | 5.08 | % | | | 01/09/25 | | | | 22,403,142 | |

| | 106,765,000 | | | U.S. Treasury Bill(1) | | | 4.39 | % | | | 01/16/25 | | | | 106,569,922 | |

| | 13,460,000 | | | U.S. Treasury Bill(1) | | | 4.66 | % | | | 01/21/25 | | | | 13,425,153 | |

| | 32,125,000 | | | U.S. Treasury Bill(1) | | | 4.50 | % | | | 01/28/25 | | | | 32,017,974 | |

| | 13,800,000 | | | U.S. Treasury Bill(1) | | | 4.27 | % | | | 01/30/25 | | | | 13,747,552 | |

| | 2,345,000 | | | U.S. Treasury Bill(1) | | | 4.44 | % | | | 02/06/25 | | | | 2,334,600 | |

| | 6,100,000 | | | U.S. Treasury Bill(1) | | | 4.26 | % | | | 02/11/25 | | | | 6,070,460 | |

| | 7,253,000 | | | U.S. Treasury Bill(1) | | | 4.78 | % | | | 02/13/25 | | | | 7,211,460 | |

| | 31,200,000 | | | U.S. Treasury Bill(1) | | | 4.43 | % | | | 03/04/25 | | | | 30,961,961 | |

| | 23,970,000 | | | U.S. Treasury Bill(1) | | | 4.37 | % | | | 03/18/25 | | | | 23,748,863 | |

| | 4,110,000 | | | U.S. Treasury Bill(1) | | | 4.25 | % | | | 03/20/25 | | | | 4,072,154 | |

| | 29,100,000 | | | U.S. Treasury Bill(1) | | | 4.38 | % | | | 03/25/25 | | | | 28,806,139 | |

| | 11,607,800 | | | U.S. Treasury Bill(1) | | | 4.22 | % | | | 04/03/25 | | | | 11,482,765 | |

| | 144,675,000 | | | U.S. Treasury Bill(1) | | | 4.31 | % | | | 04/08/25 | | | | 143,002,782 | |

| | 3,504,900 | | | U.S. Treasury Bill(1) | | | 4.30 | % | | | 04/10/25 | | | | 3,463,467 | |

| | 4,405,000 | | | U.S. Treasury Bill(1) | | | 4.23 | % | | | 04/15/25 | | | | 4,351,114 | |

| | 18,500,000 | | | U.S. Treasury Bill(1) | | | 4.27 | % | | | 04/17/25 | | | | 18,267,404 | |

| | 29,200,000 | | | U.S. Treasury Bill(1) | | | 4.22 | % | | | 04/22/25 | | | | 28,820,059 | |

| | 7,310,000 | | | U.S. Treasury Bill(1) | | | 4.31 | % | | | 04/24/25 | | | | 7,210,853 | |

| | 19,000,000 | | | U.S. Treasury Bill(1) | | | 4.33 | % | | | 05/01/25 | | | | 18,726,083 | |

| | 94,596,600 | | | U.S. Treasury Bill(1) | | | 4.26 | % | | | 05/08/25 | | | | 93,174,971 | |

| | 8,340,000 | | | U.S. Treasury Bill(1) | | | 4.31 | % | | | 05/22/25 | | | | 8,199,214 | |

| | 33,100,000 | | | U.S. Treasury Bill(1) | | | 4.34 | % | | | 05/29/25 | | | | 32,509,422 | |

| | 6,355,000 | | | U.S. Treasury Bill(1) | | | 4.31 | % | | | 06/05/25 | | | | 6,237,207 | |

| | 22,300,000 | | | U.S. Treasury Bill(1) | | | 4.20 | % | | | 06/12/25 | | | | 21,878,530 | |

| | 42,022,100 | | | U.S. Treasury Bill(1) | | | 4.16 | % | | | 06/20/25 | | | | 41,196,599 | |

| | 5,222,400 | | | U.S. Treasury Bill(1) | | | 4.06 | % | | | 10/02/25 | | | | 5,061,190 | |

| | 5,700,000 | | | U.S. Treasury Bill(1) | | | 4.19 | % | | | 11/28/25 | | | | 5,482,307 | |

| | 24,200,000 | | | U.S. Treasury Bill(1) | | | 4.07 | % | | | 12/26/25 | | | | 23,217,796 | |

| | 380,000 | | | U.S. Treasury Note | | | 1.13 | % | | | 02/28/25 | | | | 377,705 | |

| | 380,000 | | | U.S. Treasury Note | | | 2.75 | % | | | 02/28/25 | | | | 378,647 | |

| | 480,000 | | | U.S. Treasury Note | | | 3.88 | % | | | 03/31/25 | | | | 478,663 | |

| | 30,530,000 | | | U.S. Treasury Note(2)

(3 Month U.S. Treasury Money Market) | | | 4.40 | % | | | 07/31/25 | | | | 30,528,088 | |

| | 1,000,000 | | | U.S. Treasury Note | | | 0.38 | % | | | 11/30/25 | | | | 964,086 | |

| | 5,190,000 | | | U.S. Treasury Note | | | 0.38 | % | | | 12/31/25 | | | | 4,995,414 | |

| | 2,170,000 | | | U.S. Treasury Note | | | 4.25 | % | | | 12/31/25 | | | | 2,169,855 | |

See accompanying notes to financial statements.

1

| | | | |

| | Government Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Amortized

Cost | |

| | U.S. TREASURY OBLIGATIONS (continued) | |

| $ | 15,200,000 | | | U.S. Treasury Note(2)

(3 Month U.S. Treasury Money Market + 0.15%) | | | 4.43 | % | | | 04/30/26 | | | $ | 15,201,693 | |

| | 13,770,000 | | | U.S. Treasury Note(2)

(3 Month U.S. Treasury Money Market) | | | 4.46 | % | | | 07/31/26 | | | | 13,758,429 | |

| | 56,575,000 | | | U.S. Treasury Note(2)

(3 Month U.S. Treasury Money Market + 0.21%) | | | 4.48 | % | | | 10/31/26 | | | | 56,610,041 | |

| | | | | | | | | | | | | | | | |

| | | | Total U.S. Treasury Obligations

(Cost $1,076,141,751) | | | | | | | | | | | 1,076,141,751 | |

| | | | | | | | | | | | | | | | |

| | AGENCY OBLIGATIONS - 18.3%(3) | |

| | 6,410,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.17%) | | | 4.54 | % | | | 01/23/25 | | | | 6,410,000 | |

| | 2,504,000 | | | Federal Farm Credit Banks Funding Corp. | | | 5.00 | % | | | 04/04/25 | | | | 2,503,535 | |

| | 9,755,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 05/27/25 | | | | 9,755,000 | |

| | 700,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.05%) | | | 4.42 | % | | | 06/20/25 | | | | 700,000 | |

| | 3,200,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.07%) | | | 4.44 | % | | | 11/17/25 | | | | 3,200,000 | |

| | 1,000,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.10%) | | | 4.47 | % | | | 06/24/26 | | | | 1,000,000 | |

| | 2,465,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.10%) | | | 4.47 | % | | | 06/26/26 | | | | 2,465,000 | |

| | 12,600,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 10/15/26 | | | | 12,598,752 | |

| | 7,400,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(3 Month U.S. Treasury Money Market + 0.27%) | | | 4.54 | % | | | 10/16/26 | | | | 7,400,000 | |

| | 1,500,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 12/23/26 | | | | 1,500,000 | |

| | 1,400,000 | | | Federal Farm Credit Banks Funding Corp.(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 12/30/26 | | | | 1,400,000 | |

| | 36,960,000 | | | Federal Home Loan Banks(1) | | | 4.51 | % | | | 01/02/25 | | | | 36,955,369 | |

| | 35,000,000 | | | Federal Home Loan Banks(1) | | | 4.61 | % | | | 01/03/25 | | | | 34,991,036 | |

| | 18,300,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.50%) | | | 4.38 | % | | | 01/13/25 | | | | 18,300,000 | |

| | 1,940,000 | | | Federal Home Loan Banks(1) | | | 4.79 | % | | | 01/24/25 | | | | 1,934,069 | |

| | 2,900,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.02%) | | | 4.39 | % | | | 01/27/25 | | | | 2,900,000 | |

| | 6,500,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR) | | | 4.37 | % | | | 02/03/25 | | | | 6,500,000 | |

| | 10,620,000 | | | Federal Home Loan Banks(1) | | | 4.28 | % | | | 02/07/25 | | | | 10,573,284 | |

See accompanying notes to financial statements.

2

| | | | |

| | Government Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Amortized

Cost | |

| | AGENCY OBLIGATIONS (continued) | |

| $ | 4,864,000 | | | Federal Home Loan Banks(1) | | | 4.76 | % | | | 02/10/25 | | | $ | 4,838,275 | |

| | 8,385,000 | | | Federal Home Loan Banks(1) | | | 4.76 | % | | | 02/11/25 | | | | 8,339,544 | |

| | 2,500,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.05%) | | | 4.38 | % | | | 02/25/25 | | | | 2,500,000 | |

| | 4,400,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.01%) | | | 4.38 | % | | | 02/27/25 | | | | 4,400,000 | |

| | 3,600,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.01%) | | | 4.38 | % | | | 03/05/25 | | | | 3,600,000 | |

| | 16,300,000 | | | Federal Home Loan Banks(1) | | | 4.35 | % | | | 03/07/25 | | | | 16,172,179 | |

| | 17,455,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.03%) | | | 4.40 | % | | | 03/25/25 | | | | 17,455,000 | |

| | 20,125,000 | | | Federal Home Loan Banks(1) | | | 4.34 | % | | | 04/04/25 | | | | 19,899,365 | |

| | 6,900,000 | | | Federal Home Loan Banks(1) | | | 4.30 | % | | | 05/02/25 | | | | 6,800,276 | |

| | 9,655,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR) | | | 4.37 | % | | | 05/20/25 | | | | 9,655,000 | |

| | 1,400,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR) | | | 4.37 | % | | | 05/22/25 | | | | 1,400,000 | |

| | 23,750,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR) | | | 4.37 | % | | | 05/27/25 | | | | 23,750,000 | |

| | 3,900,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.01%) | | | 4.38 | % | | | 06/23/25 | | | | 3,900,000 | |

| | 13,740,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.16%) | | | 4.53 | % | | | 07/21/25 | | | | 13,740,000 | |

| | 7,080,000 | | | Federal Home Loan Banks(2)

(1 Day USD SOFR + 0.10%) | | | 4.47 | % | | | 06/26/26 | | | | 7,080,000 | |

| | 3,800,000 | | | Federal Home Loan Mortgage Corp.(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 09/23/26 | | | | 3,800,000 | |

| | 3,400,000 | | | Federal Home Loan Mortgage Corp.(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 10/16/26 | | | | 3,400,000 | |

| | 14,530,000 | | | Federal National Mortgage Association(2)

(1 Day USD SOFR + 0.12%) | | | 4.49 | % | | | 07/29/26 | | | | 14,530,000 | |

| | 4,300,000 | | | Federal National Mortgage Association(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 08/21/26 | | | | 4,300,000 | |

| | 5,270,000 | | | Federal National Mortgage Association(2)

(1 Day USD SOFR + 0.14%) | | | 4.37 | % | | | 10/23/26 | | | | 5,270,000 | |

| | 7,000,000 | | | Federal National Mortgage Association(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 11/20/26 | | | | 7,000,000 | |

See accompanying notes to financial statements.

3

| | | | |

| | Government Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Amortized

Cost | |

| | AGENCY OBLIGATIONS (continued) | |

| $ | 7,800,000 | | | Federal National Mortgage Association(2)

(1 Day USD SOFR + 0.14%) | | | 4.51 | % | | | 12/11/26 | | | $ | 7,800,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Agency Obligations

(Cost $350,715,684) | | | | | | | | | | | 350,715,684 | |

| | | | | | | | | | | | | | | | |

| | | | Total Investments 74.4%

(Cost $1,426,857,435) | | | | | | | | | | | 1,426,857,435 | |

| | | | | | | | | | | | | | | | |

| | REPURCHASE AGREEMENTS - 25.5% | |

| | 85,000,000 | | | BNP Paribas Securities Co.

Dated 12/31/2024, To be repurchased at $85,021,014 (collateralized by $84,668,464 par amount of U.S. Treasury Notes and U.S. Treasury Strips, 0.00% to 2.38%; due 10/15/28 to 11/15/52; Total Fair Value $86,700,000) | | | 4.45 | % | | | 01/02/25 | | | | 85,000,000 | |

| | 73,000,000 | | | Goldman Sachs & Co.

Dated 12/31/2024, To be repurchased at $73,018,088 (collateralized by $72,812,793 par amount of Government National Mortgage Association, 2.50% to 6.50%; due 12/15/35 to 11/20/54; Total Fair Value $74,460,000) | | | 4.46 | % | | | 01/02/25 | | | | 73,000,000 | |

| | 20,000,000 | | | HSBC Securities (USA), Inc.

Dated 12/31/2024, To be repurchased at $20,004,944 (collateralized by $19,979,809 par amount of a U.S. Treasury Bond and U.S. Treasury Strips, 0.00% to 4.63%; due 2/15/40 to 11/15/51; Total Fair Value $20,400,001) | | | 4.45 | % | | | 01/02/25 | | | | 20,000,000 | |

| | 69,000,000 | | | HSBC Securities (USA), Inc.

Dated 12/31/2024, To be repurchased at $69,017,097 (collateralized by $68,988,693 par amount of U.S. Treasury Bonds and U.S. Treasury Strips, 0.00% to 4.63%; due 5/15/41 to 8/15/47; Total Fair Value $70,380,001) | | | 4.46 | % | | | 01/02/25 | | | | 69,000,000 | |

See accompanying notes to financial statements.

4

| | | | |

| | Government Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Amortized

Cost | |

| | REPURCHASE AGREEMENTS (continued) | |

| $ | 56,000,000 | | | Mitsubishi UFG Securities Co.

Dated 12/31/2024, To be repurchased at $56,013,876 (collateralized by $55,786,466 par amount of Government National Mortgage Association, 2.00% to 7.00%; due 2/20/26 to 12/20/53; Total Fair Value $57,120,000) | | | 4.46 | % | | | 01/02/25 | | | $ | 56,000,000 | |

| | 12,000,000 | | | Natixis S.A.

Dated 12/31/2024, To be repurchased at $12,002,967 (collateralized by $11,847,111 par amount of U.S. Treasury Bonds, 2.25% to 6.25%; due 5/15/30 to 8/15/53; Total Fair Value $12,240,015) | | | 4.45 | % | | | 01/02/25 | | | | 12,000,000 | |

| | 75,000,000 | | | TD Securities (USA), LLC

Dated 12/31/2024, To be repurchased at $75,018,583 (collateralized by $74,532,368 par amount of U.S. Treasury Notes, 1.75% to 4.00%; due 2/29/28 to 12/31/30; Total Fair Value $76,500,001) | | | 4.46 | % | | | 01/02/25 | | | | 75,000,000 | |

| | 25,000,000 | | | TD Securities (USA), LLC

Dated 12/31/2024, To be repurchased at $25,006,222 (collateralized by $24,890,301 par amount of Federal Home Loan Mortgage Corporation, 5.00% to 5.50%; due 9/1/54 to 12/1/54; Total Fair Value $25,750,000) | | | 4.48 | % | | | 01/02/25 | | | | 25,000,000 | |

| | 75,000,000 | | | The Bank of Nova Scotia

Dated 12/31/2024, To be repurchased at $75,018,542 (collateralized by $74,782,919 par amount of U.S. Treasury Bills, U.S. Treasury Bonds and U.S. Treasury Notes, 0.00% to 4.52%; due 3/11/25 to 5/15/52; Total Fair Value $76,518,919) | | | 4.45 | % | | | 01/02/25 | | | | 75,000,000 | |

| | | | Total Repurchase Agreements

(Cost $490,000,000) | | | | | | | | | | | 490,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Investments in Securities 99.9%

(Cost $1,916,857,435) | | | | | | | | | | | 1,916,857,435 | |

| | | | | | | | | | | | | | | | |

| | | | Other Assets in excess of Liabilities - 0.1% | | | | | | | | | | | 1,254,415 | |

| | | | | | | | | | | | | | | | |

| | | | Net Assets - 100.0% | | | | | | | | | | $ | 1,918,111,850 | |

| | | | | | | | | | | | | | | | |

| | | | Net Asset Value Per Participation Certificate | | | | | | | | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

5

| | | | |

| | Government Portfolio Schedule of Investments December 31, 2024 (Concluded) | | |

| (1) | Interest Rate disclosed represents the discount rate at the time of purchase. |

| (2) | Variable rate security. The rate shown is the rate in effect at December 31, 2024. The rate floats based upon the published reference rate and spread disclosed in the Schedule of Investments. |

| (3) | This obligation of a U.S. Government sponsored entity is not issued or guaranteed by the U.S. Treasury. |

SOFR: Secured Overnight Financing Rate

See accompanying notes to financial statements.

6

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 | | |

| | | | | | | | | | | | | | | | |

Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | TOTAL INVESTMENTS - 70.2% | | | | | | | | | | | | |

| | U.S. TREASURY OBLIGATIONS - 1.8% | | | | | | | | | | | | |

| $ | 1,500,000 | | | U.S. Treasury Bill(1) | | | 4.76 | % | | | 01/23/25 | | | $ | 1,496,287 | |

| | 500,000 | | | U.S. Treasury Bill(1) | | | 4.79 | % | | | 02/20/25 | | | | 497,158 | |

| | 900,000 | | | U.S. Treasury Bill(1) | | | 4.10 | % | | | 10/30/25 | | | | 869,922 | |

| | 250,000 | | | U.S. Treasury Note(2)

(3 Month U.S. Treasury Money Market + 0.17%) | | | 4.44 | % | | | 04/30/25 | | | | 250,049 | |

| | | | | | | | | | | | | | | | |

| | | | Total U.S. Treasury Obligations

(Cost $3,111,371) | | | | | | | | | | | 3,113,416 | |

| | | | | | | | | | | | | | | | |

| | BANK OBLIGATIONS - 18.0% | | | | | | | | | | | | |

| | CERTIFICATE OF DEPOSIT - 1.8% | | | | | | | | | | | | |

| | 400,000 | | | Bank of America NA | | | 5.15 | % | | | 01/22/25 | | | | 400,126 | |

| | 300,000 | | | Bank of America NA | | | 5.18 | % | | | 02/03/25 | | | | 300,158 | |

| | 460,000 | | | Bank of America NA | | | 5.22 | % | | | 02/06/25 | | | | 460,283 | |

| | 1,000,000 | | | Bank of America NA(2)

(1 Day USD SOFR + 0.27%) | | | 4.73 | % | | | 07/15/25 | | | | 1,000,117 | |

| | 500,000 | | | Citibank NA(2)

(1 Day USD SOFR + 0.27%) | | | 4.73 | % | | | 06/20/25 | | | | 500,157 | |

| | 400,000 | | | Wells Fargo Bank NA | | | 5.18 | % | | | 02/07/25 | | | | 400,241 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 3,061,082 | |

| | | | | | | | | | | | | | | | |

| | YANKEE CERTIFICATE OF DEPOSIT - 16.2% | | | | | | | | | | | | |

| | 250,000 | | | Bank of Montreal, Chicago | | | 5.50 | % | | | 06/11/25 | | | | 250,990 | |

| | 500,000 | | | Bank of Montreal, Chicago | | | 4.56 | % | | | 11/10/25 | | | | 500,110 | |

| | 250,000 | | | Bank of Nova Scotia, Houston(2)

(1 Day USD SOFR + 0.30%) | | | 4.67 | % | | | 02/21/25 | | | | 250,055 | |

| | 400,000 | | | Canadian Imperial Bank of Commerce, New York | | | 5.17 | % | | | 02/07/25 | | | | 400,227 | |

| | 1,000,000 | | | Canadian Imperial Bank of Commerce, New York(2)

(1 Day USD SOFR + 0.26%) | | | 4.63 | % | | | 06/04/25 | | | | 1,000,165 | |

| | 400,000 | | | Canadian Imperial Bank of Commerce, New York(2)

(1 Day USD SOFR + 0.35%) | | | 4.72 | % | | | 09/23/25 | | | | 400,170 | |

| | 500,000 | | | Commonwealth Bank of Australia, New York | | | 5.07 | % | | | 01/31/25 | | | | 500,198 | |

| | 400,000 | | | Cooperative Rabobank UA | | | 5.27 | % | | | 02/05/25 | | | | 400,252 | |

| | 500,000 | | | Cooperative Rabobank UA | | | 5.17 | % | | | 06/24/25 | | | | 501,498 | |

| | 750,000 | | | Mizuho Bank Ltd., New York(2)

(1 Day USD SOFR + 0.22%) | | | 4.68 | % | | | 04/09/25 | | | | 749,970 | |

| | 900,000 | | | Mizuho Bank Ltd., New York(2)

(1 Day USD SOFR + 0.23%) | | | 4.69 | % | | | 05/01/25 | | | | 900,060 | |

| | 1,000,000 | | | Mizuho Bank Ltd., New York | | | 4.64 | % | | | 05/13/25 | | | | 1,000,377 | |

| | 3,000,000 | | | MUFG Bank Ltd., New York | | | 4.35 | % | | | 01/06/25 | | | | 2,999,986 | |

| | 600,000 | | | MUFG Bank Ltd., New York(2)

(1 Day USD SOFR + 0.24%) | | | 4.70 | % | | | 02/20/25 | | | | 600,109 | |

See accompanying notes to financial statements.

7

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | BANK OBLIGATIONS (continued) | | | | | | | | | | | | |

| | YANKEE CERTIFICATE OF DEPOSIT (continued) | | | | | | | | | | | | |

| $ | 500,000 | | | MUFG Bank Ltd., New York(2)

(1 Day USD SOFR + 0.23%) | | | 4.69 | % | | | 05/01/25 | | | $ | 499,983 | |

| | 500,000 | | | MUFG Bank Ltd., New York | | | 4.50 | % | | | 06/16/25 | | | | 499,997 | |

| | 700,000 | | | MUFG Bank Ltd., New York(2)

(1 Day USD SOFR + 0.25%) | | | 4.62 | % | | | 06/20/25 | | | | 699,832 | |

| | 500,000 | | | Royal Bank of Canada, New York | | | 4.44 | % | | | 12/12/25 | | | | 499,898 | |

| | 400,000 | | | State Street Bank And Trust Company(2)

(1 Day USD SOFR + 0.32%) | | | 4.78 | % | | | 11/12/25 | | | | 400,066 | |

| | 1,000,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.24%) | | | 4.61 | % | | | 02/05/25 | | | | 1,000,104 | |

| | 750,000 | | | Sumitomo Mitsui Banking Corp., New York | | | 5.21 | % | | | 02/05/25 | | | | 750,524 | |

| | 600,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.23%) | | | 4.60 | % | | | 03/05/25 | | | | 600,090 | |

| | 1,000,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.22%) | | | 4.71 | % | | | 04/09/25 | | | | 1,000,021 | |

| | 1,000,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.22%) | | | 4.59 | % | | | 04/16/25 | | | | 999,995 | |

| | 1,000,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.22%) | | | 4.59 | % | | | 04/21/25 | | | | 1,000,110 | |

| | 500,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.22%) | | | 4.59 | % | | | 04/23/25 | | | | 500,054 | |

| | 1,000,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.23%) | | | 4.60 | % | | | 05/12/25 | | | | 999,949 | |

| | 750,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.23%) | | | 4.69 | % | | | 06/02/25 | | | | 750,049 | |

| | 600,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.25%) | | | 4.71 | % | | | 06/11/25 | | | | 599,967 | |

| | 500,000 | | | Sumitomo Mitsui Banking Corp., New York(2)

(1 Day USD SOFR + 0.27%) | | | 4.64 | % | | | 07/03/25 | | | | 499,972 | |

| | 300,000 | | | Svenska Handelsbanken AB, New York | | | 5.35 | % | | | 04/09/25 | | | | 300,635 | |

| | 1,000,000 | | | Svenska Handelsbanken AB, New York(2)

(1 Day USD SOFR + 0.25%) | | | 4.71 | % | | | 07/10/25 | | | | 1,000,119 | |

| | 1,000,000 | | | Swedbank AB, New York(2)

(1 Day USD SOFR + 0.25%) | | | 4.71 | % | | | 06/05/25 | | | | 1,000,401 | |

| | 1,000,000 | | | Toronto-Dominion Bank, New York(2)

(1 Day USD SOFR + 0.20%) | | | 4.66 | % | | | 03/07/25 | | | | 1,000,107 | |

| | 500,000 | | | Toronto-Dominion Bank, New York | | | 5.33 | % | | | 03/18/25 | | | | 500,683 | |

| | 500,000 | | | Toronto-Dominion Bank, New York | | | 5.10 | % | | | 08/25/25 | | | | 501,629 | |

| | 750,000 | | | Westpac Banking Corporation, New York | | | 5.32 | % | | | 03/14/25 | | | | 750,962 | |

See accompanying notes to financial statements.

8

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | BANK OBLIGATIONS (continued) | | | | | | | | | | | | |

| | YANKEE CERTIFICATE OF DEPOSIT (continued) | | | | | | | | | | | | |

| $ | 400,000 | | | Westpac Banking Corporation, New York | | | 5.40 | % | | | 06/06/25 | | | $ | 401,342 | |

| | 1,000,000 | | | Westpac Banking Corporation, New York(2)

(1 Day USD SOFR + 0.25%) | | | 4.62 | % | | | 07/10/25 | | | | 1,000,119 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 28,210,775 | |

| | | | | | | | | | | | | | | | |

| | | | Total Bank Obligations

(Cost $31,259,159) | | | | | | | | | | | 31,271,857 | |

| | | | | | | | | | | | | | | | |

| | CORPORATE DEBT - 37.3% | | | | | | | | | | | | |

| | COMMERCIAL PAPER - 37.3% | | | | | | | | | | | | |

| | ASSET BACKED SECURITIES - 20.5%(3) | | | | | | | | | | | | |

| | 1,000,000 | | | Albion Capital LLC(1) | | | 4.65 | % | | | 02/20/25 | | | | 993,662 | |

| | 500,000 | | | Alinghi Funding Company LLC(1) | | | 5.33 | % | | | 01/08/25 | | | | 499,510 | |

| | 1,000,000 | | | Alinghi Funding Company LLC(1) | | | 4.55 | % | | | 04/03/25 | | | | 988,478 | |

| | 1,000,000 | | | Aquitaine Funding Company LLC(1) | | | 4.42 | % | | | 01/06/25 | | | | 999,266 | |

| | 1,000,000 | | | Aquitaine Funding Company LLC(1) | | | 4.70 | % | | | 01/10/25 | | | | 998,771 | |

| | 1,000,000 | | | Aquitaine Funding Company LLC(1) | | | 4.77 | % | | | 01/15/25 | | | | 998,148 | |

| | 1,000,000 | | | Bedford Row Funding Corp.(1) | | | 4.35 | % | | | 01/07/25 | | | | 999,150 | |

| | 500,000 | | | Britannia Funding Company LLC(1) | | | 5.00 | % | | | 02/12/25 | | | | 497,319 | |

| | 4,000,000 | | | Cabot Trail Funding LLC(1) | | | 4.33 | % | | | 01/02/25 | | | | 3,999,034 | |

| | 900,000 | | | Cabot Trail Funding LLC(1) | | | 5.01 | % | | | 01/08/25 | | | | 899,125 | |

| | 750,000 | | | Cancara Asset Securitisation LLC(1) | | | 4.93 | % | | | 02/13/25 | | | | 745,912 | |

| | 1,000,000 | | | Charta LLC(1) | | | 4.62 | % | | | 02/06/25 | | | | 995,411 | |

| | 4,000,000 | | | Chesham Finance LLC Series 3(1) | | | 4.37 | % | | | 01/02/25 | | | | 3,999,029 | |

| | 2,000,000 | | | Chesham Finance LLC Series 4(1) | | | 4.36 | % | | | 01/06/25 | | | | 1,998,541 | |

| | 1,000,000 | | | Columbia Funding Company LLC(1) | | | 4.73 | % | | | 01/10/25 | | | | 998,781 | |

| | 500,000 | | | Columbia Funding Company LLC(1) | | | 5.30 | % | | | 01/16/25 | | | | 499,021 | |

| | 1,000,000 | | | Columbia Funding Company LLC(1) | | | 4.50 | % | | | 03/26/25 | | | | 989,406 | |

| | 500,000 | | | Columbia Funding Company LLC(1) | | | 4.41 | % | | | 03/27/25 | | | | 494,640 | |

| | 1,000,000 | | | Columbia Funding Company LLC(1) | | | 4.58 | % | | | 04/25/25 | | | | 985,710 | |

| | 1,460,000 | | | Concord Minutemen Capital Co., LLC Series B(1) | | | 4.57 | % | | | 04/14/25 | | | | 1,440,891 | |

| | 500,000 | | | Concord Minutemen Capital Co., LLC Series C(2)

(1 Day USD SOFR + 0.30%) | | | 4.67 | % | | | 03/04/25 | | | | 500,043 | |

| | 500,000 | | | Constellation Funding Company LLC(1) | | | 4.75 | % | | | 06/04/25 | | | | 490,054 | |

| | 1,100,000 | | | Endeavour Funding Company LLC(1) | | | 5.20 | % | | | 02/04/25 | | | | 1,095,216 | |

| | 500,000 | | | Liberty Street Funding LLC(1) | | | 5.33 | % | | | 01/06/25 | | | | 499,635 | |

| | 500,000 | | | Liberty Street Funding LLC(1) | | | 4.45 | % | | | 03/17/25 | | | | 495,275 | |

| | 1,000,000 | | | Lion Bay Funding, LLC(1) | | | 4.35 | % | | | 01/02/25 | | | | 999,758 | |

| | 500,000 | | | LMA Americas LLC(1) | | | 4.72 | % | | | 02/12/25 | | | | 497,325 | |

| | 1,000,000 | | | Mackinac Funding Company LLC(1) | | | 5.00 | % | | | 01/07/25 | | | | 999,148 | |

See accompanying notes to financial statements.

9

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | CORPORATE DEBT (continued) | | | | | | | | | | | | |

| | COMMERCIAL PAPER (continued) | | | | | | | | | | | | |

| | ASSET BACKED SECURITIES (continued) | | | | | | | | | | | | |

| $ | 500,000 | | | Mackinac Funding Company LLC(1) | | | 5.30 | % | | | 01/16/25 | | | $ | 499,020 | |

| | 500,000 | | | Old Line Funding LLC(1) | | | 5.15 | % | | | 02/14/25 | | | | 497,200 | |

| | 700,000 | | | Podium Funding Trust(1) | | | 5.28 | % | | | 02/03/25 | | | | 697,081 | |

| | 1,000,000 | | | Podium Funding Trust(1) | | | 4.40 | % | | | 04/16/25 | | | | 986,901 | |

| | 500,000 | | | Ridgefield Funding Company LLC(1) | | | 4.87 | % | | | 02/10/25 | | | | 497,462 | |

| | 844,000 | | | Ridgefield Funding Company LLC(1) | | | 4.65 | % | | | 02/28/25 | | | | 837,818 | |

| | 500,000 | | | Versailles Commercial Paper LLC(1) | | | 4.80 | % | | | 01/17/25 | | | | 498,956 | |

| | 500,000 | | | Versailles Commercial Paper LLC(1) | | | 4.60 | % | | | 04/03/25 | | | | 494,131 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 35,604,828 | |

| | | | | | | | | | | | | | | | |

| | FINANCIAL COMPANIES - 14.2% | | | | | | | | | | | | |

| | 500,000 | | | ANZ New Zealand International Ltd., London(1),(3) | | | 5.08 | % | | | 02/28/25 | | | | 496,441 | |

| | 1,000,000 | | | Australia And New Zealand Banking Group Ltd.(2),(3)

(1 Day USD SOFR + 0.17%) | | | 4.54 | % | | | 03/04/25 | | | | 1,000,164 | |

| | 1,000,000 | | | Australia And New Zealand Banking Group Ltd.(2),(3)

(1 Day USD SOFR + 0.26%) | | | 4.63 | % | | | 08/21/25 | | | | 999,856 | |

| | 750,000 | | | Bank of Montreal(1),(3) | | | 5.20 | % | | | 03/31/25 | | | | 741,806 | |

| | 500,000 | | | BNG Bank NV(1),(3) | | | 4.78 | % | | | 01/31/25 | | | | 498,132 | |

| | 400,000 | | | BPCE SA(1),(3) | | | 5.21 | % | | | 01/31/25 | | | | 398,484 | |

| | 500,000 | | | BPCE SA(2),(3)

(1 Day USD SOFR + 0.25%) | | | 4.62 | % | | | 03/03/25 | | | | 500,093 | |

| | 500,000 | | | BPCE SA(1),(3) | | | 4.87 | % | | | 03/03/25 | | | | 496,193 | |

| | 1,000,000 | | | Canadian Imperial Bank of Commerce, New York(1),(3) | | | 4.58 | % | | | 01/31/25 | | | | 996,232 | |

| | 500,000 | | | Canadian Imperial Bank of Commerce, New York(1),(3) | | | 5.00 | % | | | 04/09/25 | | | | 494,039 | |

| | 300,000 | | | Commonwealth Bank of Australia(2),(3)

(1 Day USD SOFR + 0.30%) | | | 4.79 | % | | | 01/31/25 | | | | 300,051 | |

| | 1,000,000 | | | Commonwealth Bank of Australia(2),(3)

(1 Day USD SOFR + 0.17%) | | | 4.54 | % | | | 03/05/25 | | | | 1,000,085 | |

| | 500,000 | | | Commonwealth Bank of Australia(2),(3)

(1 Day USD SOFR + 0.25%) | | | 4.74 | % | | | 07/10/25 | | | | 500,138 | |

| | 500,000 | | | Dexia SA(1) | | | 4.69 | % | | | 03/11/25 | | | | 495,687 | |

| | 750,000 | | | Dexia SA(1) | | | 4.40 | % | | | 04/02/25 | | | | 741,399 | |

| | 400,000 | | | DNB Bank ASA(1),(3) | | | 4.92 | % | | | 01/22/25 | | | | 398,954 | |

| | 700,000 | | | DNB Bank ASA(1),(3) | | | 4.32 | % | | | 11/05/25 | | | | 674,425 | |

| | 1,000,000 | | | HSBC Bank PLC(2),(3)

(1 Day USD SOFR + 0.28%) | | | 4.74 | % | | | 07/16/25 | | | | 1,000,114 | |

See accompanying notes to financial statements.

10

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | CORPORATE DEBT (continued) | | | | | | | | | | | | |

| | COMMERCIAL PAPER (continued) | | | | | | | | | | | | |

| | FINANCIAL COMPANIES (continued) | | | | | | | | | | | | |

| $ | 700,000 | | | ING US Funding LLC(1),(3) | | | 5.13 | % | | | 02/18/25 | | | $ | 695,786 | |

| | 500,000 | | | ING US Funding LLC(2),(3)

(1 Day USD SOFR + 0.18%) | | | 4.64 | % | | | 03/25/25 | | | | 500,012 | |

| | 1,000,000 | | | ING US Funding LLC(2),(3)

(1 Day USD SOFR + 0.26%) | | | 4.72 | % | | | 06/05/25 | | | | 1,000,164 | |

| | 600,000 | | | ING US Funding LLC(1) | | | 4.48 | % | | | 06/20/25 | | | | 587,451 | |

| | 700,000 | | | Macquarie Bank Ltd.(1),(3) | | | 5.22 | % | | | 01/21/25 | | | | 698,196 | |

| | 500,000 | | | Macquarie Bank Ltd.(1),(3) | | | 4.87 | % | | | 02/12/25 | | | | 497,343 | |

| | 500,000 | | | Macquarie Bank Ltd.(1),(3) | | | 5.08 | % | | | 03/03/25 | | | | 496,143 | |

| | 1,000,000 | | | Macquarie Bank Ltd.(2),(3)

(1 Day USD SOFR + 0.24%) | | | 4.70 | % | | | 06/20/25 | | | | 999,805 | |

| | 1,000,000 | | | Macquarie Bank Ltd.(2),(3)

(1 Day USD SOFR + 0.28%) | | | 4.74 | % | | | 07/21/25 | | | | 999,862 | |

| | 1,000,000 | | | National Australia Bank Ltd.(2),(3)

(1 Day USD SOFR + 0.28%) | | | 4.65 | % | | | 06/27/25 | | | | 1,000,381 | |

| | 500,000 | | | National Securities Clearing Corp.(1),(3) | | | 5.11 | % | | | 01/31/25 | | | | 498,114 | |

| | 1,000,000 | | | National Securities Clearing Corp.(1),(3) | | | 5.08 | % | | | 02/03/25 | | | | 995,861 | |

| | 500,000 | | | Royal Bank of Canada(1),(3) | | | 4.35 | % | | | 11/07/25 | | | | 481,448 | |

| | 1,000,000 | | | Skandinaviska Enskilda Banken AB, New York(2),(3)

(1 Day USD SOFR + 0.25%) | | | 4.71 | % | | | 07/02/25 | | | | 999,606 | |

| | 1,000,000 | | | Svenska Handelsbanken AB(2),(3)

(1 Day USD SOFR + 0.26%) | | | 4.72 | % | | | 07/18/25 | | | | 1,000,149 | |

| | 500,000 | | | Swedbank AB(2),(3)

(1 Day USD SOFR + 0.27%) | | | 4.73 | % | | | 07/16/25 | | | | 500,210 | |

| | 1,000,000 | | | Westpac Banking Corp.(2),(3)

(1 Day USD SOFR + 0.25%) | | | 4.62 | % | | | 07/02/25 | | | | 1,000,143 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 24,682,967 | |

| | | | | | | | | | | | | | | | |

| | NON-FINANCIAL COMPANIES - 2.6% | | | | | | | | | | | | |

| | 2,000,000 | | | Accenture Capital, Inc.(1),(3) | | | 4.60 | % | | | 01/13/25 | | | | 1,996,869 | |

| | 1,000,000 | | | Cisco Systems, Inc.(1),(3) | | | 4.41 | % | | | 05/08/25 | | | | 984,410 | |

| | 1,500,000 | | | John Deere Financial, Inc.(1),(3) | | | 4.64 | % | | | 01/13/25 | | | | 1,497,653 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 4,478,932 | |

| | | | | | | | | | | | | | | | |

| | | | Total Commercial Paper | | | | | | | | | | | 64,766,727 | |

| | | | | | | | | | | | | | | | |

| | | | Total Corporate Debt

(Cost $64,758,686) | | | | | | | | | | | 64,766,727 | |

| | | | | | | | | | | | | | | | |

| | NON-U.S. SUB-SOVEREIGN - 5.0% | | | | | | | | | | | | |

| | 500,000 | | | British Columbia (Province of)(1) | | | 4.89 | % | | | 02/10/25 | | | | 497,520 | |

See accompanying notes to financial statements.

11

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 (Continued) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | NON-U.S. SUB-SOVEREIGN (continued) | | | | | | | | | | | | |

| $ | 500,000 | | | British Columbia (Province of)(1) | | | 4.79 | % | | | 02/14/25 | | | $ | 497,275 | |

| | 1,370,000 | | | British Columbia (Province of)(1) | | | 4.46 | % | | | 04/14/25 | | | | 1,352,544 | |

| | 1,000,000 | | | British Columbia (Province of)(1) | | | 4.50 | % | | | 05/12/25 | | | | 983,911 | |

| | 3,000,000 | | | CDP Financial Inc.(1) | | | 4.35 | % | | | 01/06/25 | | | | 2,997,841 | |

| | 800,000 | | | CDP Financial Inc.(1) | | | 5.02 | % | | | 04/28/25 | | | | 788,406 | |

| | 500,000 | | | Ontario Teachers Finance Trust(1) | | | 4.91 | % | | | 05/01/25 | | | | 492,691 | |

| | 1,000,000 | | | PSP Capital, Inc.(1) | | | 5.02 | % | | | 01/24/25 | | | | 997,119 | |

| | | | | | | | | | | | | | | | |

| | | | Total Non-U.S. Sub-Sovereign

(Cost $8,604,244) | | | | | | | | | | | 8,607,307 | |

| | | | | | | | | | | | | | | | |

| | TENDER OPTION BONDS - 2.6% | | | | | | | | | | | | |

| | 2,800,000 | | | Tender Option Bond Trust Receipts/Certificates(2) | | | 4.45 | % | | | 01/07/25 | | | | 2,800,000 | |

| | 1,800,000 | | | Tender Option Bond Trust Receipts/Certificates(2) | | | 4.60 | % | | | 01/07/25 | | | | 1,800,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Tender Option Bonds

(Cost $4,600,000) | | | | | | | | | | | 4,600,000 | |

| | | | | | | | | | | | | | | | |

| | TIME DEPOSITS - 4.9% | | | | | | | | | | | | |

| | 1,000,000 | | | Credit Agricole Corporate And Investment Bank SA | | | 4.32 | % | | | 01/02/25 | | | | 1,000,000 | |

| | 3,000,000 | | | Mizuho Bank Ltd., New York | | | 4.33 | % | | | 01/02/25 | | | | 3,000,000 | |

| | 2,000,000 | | | Royal Bank of Canada, Toronto | | | 4.35 | % | | | 01/02/25 | | | | 2,000,000 | |

| | 2,500,000 | | | Skandinaviska Enskilda Banken AB, New York | | | 4.33 | % | | | 01/02/25 | | | | 2,500,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Time Deposits

(Cost $8,500,000) | | | | | | | | | | | 8,500,000 | |

| | | | | | | | | | | | | | | | |

| | VARIABLE RATE DEMAND NOTES - 0.6% | | | | | | | | | | | | |

| | 400,000 | | | ECMC Group Inc.(2) | | | 4.37 | % | | | 01/07/25 | | | | 400,000 | |

| | 396,000 | | | Iowa Student Loan Liquidity Corp.(2) | | | 4.37 | % | | | 01/07/25 | | | | 396,000 | |

| | 300,000 | | | North Tex Higher Ed Auth Inc.(2) | | | 4.37 | % | | | 01/07/25 | | | | 300,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Variable Rate Demand Notes

(Cost $1,096,000) | | | | | | | | | | | 1,096,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Investments 70.2%

(Cost $121,929,460) | | | | | | | | | | | 121,955,307 | |

| | | | | | | | | | | | | | | | |

| | REPURCHASE AGREEMENTS - 32.0% | | | | | | | | | | | | |

| | 5,000,000 | | | Bank of America Securities Inc.

Dated 12/31/2024, To be repurchased at $5,001,239 (collateralized by $4,970,561 par amount of a Federal National Mortgage Association REMIC and Government National Mortgage Association REMICS, 0.00% to 2.33%; due 3/25/41 to 9/20/68; Total Fair Value $5,250,000) | | | 4.46 | % | | | 01/02/25 | | | | 5,000,000 | |

See accompanying notes to financial statements.

12

| | | | |

| | Money Market Portfolio Schedule of Investments December 31, 2024 (Concluded) | | |

| | | | | | | | | | | | | | | | |

| Par Value | | | Issuer | | Interest Rate | | | Maturity | | | Fair

Value | |

| | REPURCHASE AGREEMENTS (continued) | | | | | | | | | | | | |

| $ | 23,000,000 | | | Citigroup Global Markets Inc.

Dated 12/31/2024, To be repurchased at $23,005,699 (collateralized by $22,995,168 par amount of a U.S. Treasury Note, 0.25%; due 5/31/25; Total Fair Value $23,460,098) | | | 4.46 | % | | | 01/02/25 | | | $ | 23,000,000 | |

| | 2,500,000 | | | J.P. Morgan Chase & Co.(2)

(1 Day USD OBFR + 0.12%) Dated 12/31/2024, To be repurchased at $2,500,618 (collateralized by $2,500,000 par amount of a Commercial Paper, 0.00%; due 4/2/25; Total Fair Value $2,575,000) | | | 4.45 | % | | | 01/02/25 | | | | 2,500,000 | |

| | 25,000,000 | | | J.P. Morgan Chase & Co.

Dated 12/31/2024, To be repurchased at $25,006,194 (collateralized by $24,928,483 par amount of a Government National Mortgage Association, 3.00%; due 4/20/52; Total Fair Value $25,500,001) | | | 4.46 | % | | | 01/02/25 | | | | 25,000,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Repurchase Agreements

(Cost $55,500,000) | | | | | | | | | | | 55,500,000 | |

| | | | | | | | | | | | | | | | |

| | | | Total Investments in Securities 102.2%

(Cost $177,429,460) | | | | | | | | | | | 177,455,307 | |

| | | | | | | | | | | | | | | | |

| | | | Liabilities in excess of Other Assets - (2.2)% | | | | | | | | | | | (3,850,927 | ) |

| | | | | | | | | | | | | | | | |

| | | | Net Assets - 100.0% | | | | | | | | | | $ | 173,604,380 | |

| | | | | | | | | | | | | | | | |

| | | | Net Asset Value Per Participation Certificate | | | | | | | | | | $ | 1.0001 | |

| | | | | | | | | | | | | | | | |

| (1) | Interest Rate disclosed represents the discount rate at the time of purchase. |

| (2) | Variable rate security. The rate shown is the rate in effect at December 31, 2024. The rate floats based upon the published reference rate and spread disclosed in the Schedule of Investments. |

| (3) | Securities exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2024, these securities amounted to $62,942,190 or 36.26% of net assets. Securities have been deemed to be liquid based on procedures performed by BlackRock Advisors, LLC, the investment advisor to the Money Market Portfolio. |

OBFR: Overnight Bank Fund Rate

SOFR: Secured Overnight Financing Rate

See accompanying notes to financial statements.

13

| | | | |

| | Plan Investment Fund, Inc. Statements of Assets and Liabilities December 31, 2024 | | |

| | | | | | | | |

| | | Government

Portfolio | | | Money Market

Portfolio | |

ASSETS | | | | | | | | |

Investments at amortized cost, and fair value, respectively | | $ | 1,426,857,435 | (1) | | $ | 121,955,307 | |

Repurchase Agreements, at cost, which approximates fair value | | | 490,000,000 | | | | 55,500,000 | |

Cash | | | 473,468 | | | | — | |

Accrued interest receivable | | | 2,147,136 | | | | 404,914 | |

Other assets | | | 8,216 | | | | — | |

| | | | | | | | |

Total Assets | | | 1,919,486,255 | | | | 177,860,221 | |

| | | | | | | | |

LIABILITIES | | | | | | | | |

Dividends payable | | | 1,111,324 | | | | 35,179 | |

Payable for securities purchased | | | — | | | | 2,800,341 | |

Accrued expenses payable | | | | | | | | |

Investment advisory fees (Note 4) | | | 109,221 | | | | 10,411 | |

Administration fees (Note 4) | | | 44,611 | | | | 5,927 | |

Custodian fees (Note 4) | | | 25,952 | | | | 13,513 | |

Transfer agent fees (Note 4) | | | 1,204 | | | | 4,894 | |

Trustee expenses | | | 24,129 | | | | 5,645 | |

Due to custodian | | | — | | | | 1,352,593 | |

Other liabilities | | | 57,964 | | | | 27,338 | |

| | | | | | | | |

Total Liabilities | | | 1,374,405 | | | | 4,255,841 | |

| | | | | | | | |

NET ASSETS | | $ | 1,918,111,850 | | | $ | 173,604,380 | |

| | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid-in Capital | | $ | 1,918,054,936 | | | $ | 173,582,243 | |

Distributable Earnings | | | 56,914 | | | | 22,137 | |

| | | | | | | | |

TOTAL NET ASSETS | | $ | 1,918,111,850 | | | $ | 173,604,380 | |

| | | | | | | | |

Total Participation Certificates (PCs) outstanding | | | | | | | | |

Government Portfolio (5 billion shares authorized, $0.001 Par Value) | | | | | | | | |

Money Market Portfolio (3 billion shares authorized, $0.001 Par Value) | | | 1,918,054,936 | | | | 173,583,331 | |

| | | | | | | | |

Net Asset Value Per PC

(net assets/PCs outstanding) | | $ | 1.00 | | | $ | 1.0001 | |

| | | | | | | | |

Investments in securities, at cost | | $ | 1,916,857,435 | | | $ | 177,429,460 | |

| | | | | | | | |

| (1) | Investments, at amortized cost, which approximates fair value. |

See accompanying notes to financial statements.

14

| | | | |

| | Plan Investment Fund, Inc. Statements of Operations For the Year Ended December 31, 2024 | | |

| | | | | | | | |

| | | Government

Portfolio | | | Money Market

Portfolio | |

INTEREST INCOME | | $ | 93,766,256 | | | $ | 8,576,877 | |

| | | | | | | | |

EXPENSES | | | | | | | | |

Investment advisory and servicing fees (Note 4) | | | 2,073,350 | | | | 322,335 | |

Administration fees (Note 4) | | | 905,219 | | | | 80,584 | |

Custodian fees (Note 4) | | | 160,302 | | | | 75,702 | |

Audit and tax fees | | | 21,500 | | | | 21,500 | |

Transfer agent fees (Note 4) | | | 13,960 | | | | 31,110 | |

Fund compliance fees | | | 61,709 | | | | 5,468 | |

Legal fees | | | 58,023 | | | | 4,964 | |

Insurance expense | | | 53,353 | | | | 6,838 | |

Trustee expense | | | 29,871 | | | | 2,685 | |

S&P Rating fees | | | 26,019 | | | | 2,882 | |

Printing fees | | | 23,394 | | | | 6,736 | |

Miscellaneous | | | 17,529 | | | | 7,328 | |

Registration fees | | | 492 | | | | 2,130 | |

| | | | | | | | |

Total expenses | | | 3,444,721 | | | | 570,262 | |

Less fee waived and/or reimbursed (Note 4) | | | (1,634,284 | ) | | | (288,219 | ) |

| | | | | | | | |

Net Expenses | | | 1,810,437 | | | | 282,043 | |

| | | | | | | | |

NET INVESTMENT INCOME | | | 91,955,819 | | | | 8,294,834 | |

NET REALIZED GAIN/(LOSS) ON SECURITIES SOLD | | | 355,417 | | | | 752 | |

NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) ON SECURITIES | | | — | | | | (18,354 | ) |

| | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 92,311,236 | | | $ | 8,277,232 | |

| | | | | | | | |

See accompanying notes to financial statements.

15

| | | | |

| | Government Portfolio Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the

Year Ended

December 31, 2024 | | | For the

Year Ended

December 31, 2023 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 91,955,819 | | | $ | 74,490,935 | |

Net realized gain/(loss) on securities sold | | | 355,417 | | | | (28,799 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 92,311,236 | | | | 74,462,136 | |

| | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS TO PARTICIPATION CERTIFICATE (PC) HOLDERS: | | | | | | | | |

From total distributable earnings $0.0511 and $0.0494 per PC, respectively | | | (92,209,038 | ) | | | (74,490,935 | ) |

| | | | | | | | |

Decrease in net assets from dividends and distributions to PC Holders | | | (92,209,038 | ) | | | (74,490,935 | ) |

| | | | | | | | |

CAPITAL TRANSACTIONS: | | | | | | | | |

Proceeds from sale of PCs | | | 17,950,784,337 | | | | 12,509,569,122 | |

Reinvestment of dividends | | | 75,931,339 | | | | 61,456,556 | |

Cost of PCs repurchased | | | (18,000,393,043 | ) | | | (11,988,088,381 | ) |

| | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 26,322,633 | | | | 582,937,297 | |

| | | | | | | | |

Total increase in net assets | | | 26,424,831 | | | | 582,908,498 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 1,891,687,019 | | | | 1,308,778,521 | |

| | | | | | | | |

End of year | | $ | 1,918,111,850 | | | $ | 1,891,687,019 | |

| | | | | | | | |

OTHER INFORMATION: | | | | | | | | |

SUMMARY OF PC TRANSACTIONS: | | | | | | | | |

PCs sold | | | 17,950,784,337 | | | | 12,509,569,122 | |

Reinvestments of dividends | | | 75,931,339 | | | | 61,456,556 | |

PCs repurchased | | | (18,000,393,043 | ) | | | (11,988,088,381 | ) |

| | | | | | | | |

Net increase in PC’s outstanding | | | 26,322,633 | | | | 582,937,297 | |

| | | | | | | | |

See accompanying notes to financial statements.

16

| | | | |

| | Money Market Portfolio Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the

Year Ended

December 31, 2024 | | | For the

Year Ended

December 31, 2023 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 8,294,834 | | | $ | 8,004,945 | |

Net realized gain on securities sold | | | 752 | | | | — | |

Net change in unrealized appreciation/(depreciation) on securities | | | (18,354 | ) | | | 43,533 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 8,277,232 | | | | 8,048,478 | |

| | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS TO PARTICIPATION CERTIFICATE (PC) HOLDERS: | | | | | | | | |

From total distributable earnings $0.0517 and $0.0504 per PC, respectively | | | (8,301,029 | ) | | | (8,004,124 | ) |

| | | | | | | | |

Decrease in net assets from dividends and distributions to PC Holders | | | (8,301,029 | ) | | | (8,004,124 | ) |

| | | | | | | | |

CAPITAL TRANSACTIONS: | | | | | | | | |

Proceeds from sale of PCs | | | 166,328,997 | | | | 402,618,109 | |

Reinvestment of dividends | | | 7,842,487 | | | | 6,130,262 | |

Cost of PCs repurchased | | | (155,203,920 | ) | | | (320,905,876 | ) |

| | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 18,967,564 | | | | 87,842,495 | |

| | | | | | | | |

Total increase in net assets | | | 18,943,767 | | | | 87,886,849 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 154,660,613 | | | | 66,773,764 | |

| | | | | | | | |

End of year | | $ | 173,604,380 | | | $ | 154,660,613 | |

| | | | | | | | |

OTHER INFORMATION: | | | | | | | | |

SUMMARY OF PC TRANSACTIONS: | | | | | | | | |

PCs sold | | | 166,309,869 | | | | 402,611,336 | |

Reinvestments of dividends | | | 7,841,890 | | | | 6,130,226 | |

PCs repurchased | | | (155,180,303 | ) | | | (320,898,507 | ) |

| | | | | | | | |

Net increase in PC’s outstanding | | | 18,971,456 | | | | 87,843,055 | |

| | | | | | | | |

See accompanying notes to financial statements.

17

| | | | |

| | Government Portfolio Financial Highlights | | |

For a Participation Certificate (PC) Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

12/31/24 | | | Year

Ended

12/31/23 | | | Year

Ended

12/31/22 | | | Year

Ended

12/31/21 | | | Year

Ended

12/31/20 | |

Net Asset Value, Beginning of year | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | |

Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.0510 | | | | 0.0494 | | | | 0.0152 | | | | 0.0001 | | | | 0.0041 | |

Net Realized Gain (Loss) on Investments | | | 0.0001 | | | | — | (1) | | | — | (1) | | | — | (1) | | | 0.0002 | |

| | | | | | | | | | | | | | | | | | | | |

Total From Investment Operations | | | 0.0511 | | | | 0.0494 | | | | 0.0152 | | | | 0.0001 | | | | 0.0043 | |

| | | | | | | | | | | | | | | | | | | | |

Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends to PC holders from: | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.0511 | ) | | | (0.0494 | ) | | | (0.0152 | ) | | | (0.0001 | ) | | | (0.0043 | ) |

Net Realized Capital Gains | | | — | | | | — | | | | — | | | | — | | | | — | (1) |

| | | | | | | | | | | | | | | | | | | | |

Total Dividends and Distributions | | | (0.0511 | ) | | | (0.0494 | ) | | | (0.0152 | ) | | | (0.0001 | ) | | | (0.0043 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of year | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.23 | % | | | 5.05 | % | | | 1.53 | % | | | 0.02 | % | | | 0.43 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000) | | $ | 1,918,112 | | | $ | 1,891,687 | | | $ | 1,308,779 | | | $ | 1,117,653 | | | $ | 1,751,033 | |

Ratio of Net Expenses to Average Net Assets(2) | | | 0.10 | % | | | 0.10 | % | | | 0.10 | % | | | 0.08 | % | | | 0.10 | % |

Ratio of Net Investment Income to Average Net Assets(3) | | | 5.08 | % | | | 4.99 | % | | | 1.58 | % | | | 0.01 | % | | | 0.36 | % |

| (1) | Less than $0.0001 per share. |

| (2) | Without the waiver and/or reimbursement of a portion of advisory and administration fees (see Note 4), the ratio of total expenses to average net assets would have been 0.19%, 0.21%, 0.21%, 0.21% and 0.20% for the years ended December 31, 2024, 2023, 2022, 2021 and 2020, respectively. |

| (3) | Without the waiver and/or reimbursement of a portion of advisory and administration fees (see Note 4), the ratio of net investment income/(loss) to average net assets would have been 4.99%, 4.88%, 1.47%, 0.12% and 0.26% for the years ended December 31, 2024, 2023, 2022, 2021 and 2020, respectively. |

See accompanying notes to financial statements.

18

| | | | |

| | Money Market Portfolio Financial Highlights | | |

For a Participation Certificate (PC) Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

12/31/24 | | | Year

Ended

12/31/23 | | | Year

Ended

12/31/22 | | | Year

Ended

12/31/21 | | | Year

Ended

12/31/20 | |

Net Asset Value, Beginning of year | | $ | 1.0003 | | | $ | 1.0001 | | | $ | 1.0000 | | | $ | 1.0001 | | | $ | 0.9999 | |

| | | | | | | | | | | | | | | | | | | | |

Investment Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.0517 | | | | 0.0504 | | | | 0.0165 | | | | 0.0001 | | | | 0.0052 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (0.0002 | ) | | | 0.0002 | | | | 0.0001 | | | | (0.0001 | ) | | | 0.0002 | |

| | | | | | | | | | | | | | | | | | | | |

Total From Investment Operations | | | 0.0515 | | | | 0.0506 | | | | 0.0166 | | | | — | (1) | | | 0.0054 | |

| | | | | | | | | | | | | | | | | | | | |

Less Dividends and Distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends to PC holders from: Net Investment Income | | | (0.0517 | ) | | | (0.0504 | ) | | | (0.0165 | ) | | | (0.0001 | ) | | | (0.0052 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Dividends and Distributions | | | (0.0517 | ) | | | (0.0504 | ) | | | (0.0165 | ) | | | (0.0001 | ) | | | (0.0052 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of year | | $ | 1.0001 | | | $ | 1.0003 | | | $ | 1.0001 | | | $ | 1.0000 | | | $ | 1.0001 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.27 | % | | | 5.18 | % | | | 1.67 | % | | | — | % | | | 0.54 | % |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000) | | $ | 173,604 | | | $ | 154,661 | | | $ | 66,774 | | | $ | 58,081 | | | $ | 60,784 | |

Ratio of Net Expenses to Average Net Assets(2) | | | 0.17 | % | | | 0.17 | % | | | 0.17 | % | | | 0.16 | % | | | 0.18 | % |

Ratio of Net Investment Income to Average Net Assets(3) | | | 5.15 | % | | | 5.01 | % | | | 1.70 | % | | | 0.01 | % | | | 0.70 | % |

| (1) | Less than $0.0001 per share. |

| (2) | Without the waiver and/or reimbursement of a portion of advisory and administration fees (see Note 4), the ratio of total expenses to average net assets would have been 0.35%, 0.36%, 0.49%, 0.44% and 0.35% for the years ended December 31, 2024, 2023, 2022, 2021 and 2020, respectively. |

| (3) | Without the waiver and/or reimbursement of a portion of advisory and administration fees (see Note 4), the ratio of net investment income/(loss) to average net assets would have been 4.97%, 4.82%, 1.39%, (0.27)% and 0.53% for the years ended December 31, 2024, 2023, 2022, 2021 and 2020, respectively. |

See accompanying notes to financial statements.

19

Plan Investment Fund, Inc.

Notes to Financial Statements

December 31, 2024

Note 1. Organization

Plan Investment Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act’’), as an open-end management investment company and is organized as a Maryland Corporation governed by a Board of Trustees (the “Board of Trustees” or the “Board”). The Fund consists of two portfolios: the Government Portfolio and the Money Market Portfolio (each, a “Portfolio” and collectively, the “Portfolios”). Each Portfolio is a “diversified” series of the Fund, as that term is defined under the 1940 Act. The assets and liabilities of each Portfolio are segregated and a shareholder’s interest is limited to the Portfolio in which Participation Certificates (“PCs”) are held. BlackRock Advisors, LLC, a wholly-owned indirect subsidiary of BlackRock, Inc., serves as the Portfolios’ investment advisor and service agent (“BALLC” or the “Investment Advisor”). The Board has designated the Investment Advisor as the valuation designee, pursuant to Rule 2a-5 under the 1940 Act, to make fair value determinations relating to the Money Market Portfolio’s holdings.

Government Portfolio — a government money market fund which seeks a high level of current income and stability of principal by investing in U.S. Government obligations and repurchase agreements relating to such obligations.

Money Market Portfolio — an institutional prime money market fund which seeks a high level of current income and stability of principal by investing in a broad range of U.S. dollar-denominated money market instruments, including U.S. Government obligations, repurchase agreements and U.S. and foreign bank obligations and commercial obligations.

The Fund’s prospectus provides a description of each Portfolio’s investment objective, principal investment strategies, and principal risks.

Note 2. Significant Accounting Policies

The Fund follows accounting and reporting guidance in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. The Fund’s financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The following is a summary of significant accounting policies followed by the Fund.

Portfolio Classification and Valuation: Rule 2a-7 under the 1940 Act effectively created three categories of money market funds: Government, Retail and Institutional. Rule 2a-7 provides that Government and Retail money market funds may seek to transact at a stable $1.00 net asset value (“NAV”) per share and use amortized cost to value their portfolio holdings, subject to certain conditions. Institutional money market funds are required to “float” their NAV per share by pricing their shares to four decimal places (e.g., $1.0000) and valuing their portfolio securities using fair value rather than amortized cost (except as noted below). In addition, the Money Market Portfolio has adopted policies and procedures for the imposition of liquidity fees under certain conditions.

The Government Portfolio operates as a Government money market fund and accordingly: (1) invests at least 99.5% of its total assets in: (i) cash; (ii) securities or instruments issued or guaranteed as to principal and interest by the United States or certain U.S. Government agencies or instrumentalities; and/or (iii) repurchase agreements that are collateralized fully by U.S. Government obligations or cash; and (2) uses amortized cost, which approximates fair value, to value its portfolio securities and seeks to transact at a stable $1.00 NAV per PC.

The Money Market Portfolio operates as an institutional money market fund and accordingly: (1) is limited to institutional investors; (2) utilizes market-based prices to value its portfolio holdings, except to the extent that market information is not readily available or deemed by the Investment Advisor to be unreliable in which case the portfolio holding is fair valued by the Investment Advisor, as valuation designee, pursuant to procedures approved by the Board; (3) transacts at a floating NAV per PC that uses four decimal place precision (e.g., $1.0000) (except that the Portfolio may use amortized cost to value short- term investments with remaining maturities of 60 days or less, subject to the Investment Advisor’s oversight); and (4) has adopted policies and procedures to impose mandatory liquidity fees of up to 2% of the value of the PC’s redeemed shares, subject to the Board’s determination that a liquidity fee is in the best interests of the Portfolio. In addition, the Money

20

Plan Investment Fund, Inc.

Notes to Financial Statements

December 31, 2024

(Continued)

Market Portfolio is required to impose mandatory liquidity fees, based on liquidity costs as determined by the Investment Advisor, on redemptions of PCs of the Money Market Portfolio that are made on a day in which the Portfolio’s total net redemptions exceed 5% of the Portfolio’s net assets. The Money Market Portfolio calculates its NAV once each business day at 3:00 p.m. Eastern time.

Investments in other open-end management investment companies, if held, are valued based on the NAV of the management investment companies (which are to be determined pursuant to procedures discussed in their prospectuses). If price quotes are unavailable or deemed unreliable, securities will be fair valued by the Investment Advisor, as valuation designee, in accordance with procedures approved by the Board.

Securities Transactions and Investment Income: For financial reporting purposes, investment transactions are recorded on the trade date. Realized gains and losses on investments sold are recorded on the identified cost basis. Gains and losses on principal paydowns from mortgage-backed securities are recorded as interest income on the Statements of Operations. Interest income is recorded on an accrual basis. Market discounts and premiums on securities purchased are amortized on an effective yield basis over the estimated lives of the respective securities for the Portfolios.

Dividends and Distributions to Participation Certificate Holders: Dividends from net investment income of the Portfolios are declared daily and paid monthly. The Government Portfolio and the Money Market Portfolio intend, subject to the use of offsetting capital loss carryforwards, to distribute net realized short and long-term capital gains, if any, throughout each year. Income dividends and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications within the components of net assets.

Federal Income Taxes: No provision is made for federal income taxes as it is each Portfolio’s intention to continue to qualify as a regulated investment company by complying with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and to distribute substantially all of its net investment income to Participation Certificate holders, which will be sufficient to relieve each Portfolio from all, or substantially all, federal income and excise taxes.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. As of December 31, 2024, the Fund did not have any interest or penalties associated with the underpayment of any income taxes.

Repurchase Agreements: Under a repurchase agreement, a counterparty sells a security to a Portfolio and agrees to repurchase the subject security at an agreed upon date and price. The repurchase price generally equals the price paid by the Portfolio plus interest negotiated on the basis of current short-term rates. Collateral for repurchase agreements may have longer maturities than the maximum permissible remaining maturity of Portfolio investments. The repurchase agreement is conditioned upon the collateral being deposited under the Federal Reserve book entry system or held in a separate account by the Fund’s custodian, sub-custodian or an authorized securities depository. For the Government Portfolio, collateral generally consists of U.S. Government and U.S. Government agency securities, and cash, and for the Money Market Portfolio, collateral generally consists of U.S. Government and U.S. Government agency securities and obligations of issuers in the financial services industry, and cash. The market value of repurchase agreement collateral must be maintained, on a daily basis, at an amount equal to at least 100% of the repurchase price of the securities subject to the repurchase agreement plus accrued interest. Upon an event of default under the terms of the Master Repurchase Agreement, both parties have the right to set-off. If the seller defaults or enters into an insolvency proceeding, liquidation of the collateral by the purchaser may be delayed or limited. As of December 31, 2024, the Government Portfolio and the Money Market Portfolio held repurchase agreements, which are included under “Repurchase Agreements, at cost, which approximates fair value” in the Statements of Assets and Liabilities. The value of the related collateral that the Portfolios hold for each of their repurchase agreements is disclosed in the Schedules of Investments for each Portfolio and exceeded the value of the corresponding repurchase agreement at December 31, 2024.

21

Plan Investment Fund, Inc.

Notes to Financial Statements

December 31, 2024

(Continued)

Expenses: Expenses are recorded on an accrual basis. Each Portfolio pays the expenses that are directly related to its operations, such as investment advisory and servicing fees, custodian fees, and transfer agent fees. Expenses incurred by the Fund on behalf of each Portfolio, such as trustee expenses or legal fees, are allocated among each of the Portfolios either proportionately based upon the Portfolios’ relative net assets or using another reasonable basis such as equally across each Portfolio, depending on the nature of the expense.