| UNITED STATES | OMB APPROVAL |

| SECURITIES AND EXCHANGE COMMISSION | OMB Number: 3235-00595 |

| Washington, D.C. 20549 | Expires: February 28, 2006 |

| SCHEDULE 14A | Estimated average burden hours per response......... 12.75 |

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: | |

| SEC 1913 (03-04) Persons who are to respond to the Collection of information contained in this form are not required to respond unless the form displays a currently valid OMB cotrol number. | ||

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1. | Amount Previously Paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: | |

3111 West Allegheny Avenue

Philadelphia, Pennsylvania 19132

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To our Shareholders:

| (Item 1) | The election of the full Board of Directors for a one-year term. |

| (Item 2) | The approval of the appointment of our independent auditors. |

| (Item 3) | A shareholder proposal regarding our Shareholder Rights Plan, if presented by its proponent. |

Brian D. Zuckerman

Secretary

3111 West Allegheny Avenue

Philadelphia, Pennsylvania 19132

PROXY STATEMENT

TABLE OF CONTENTS

| GENERAL INFORMATION | 1 | |||||

| SHARE OWNERSHIP | 3 | |||||

| (ITEM 1) ELECTION OF DIRECTORS | 5 | |||||

| What is the makeup of the Board of Directors? | 5 | |||||

| Retirees | 5 | |||||

| Nominees for Election | 5 | |||||

| Corporate Governance | 6 | |||||

| Meetings and Committees of the Board of Directors | 7 | |||||

| Can a shareholder nominate a candidate for director? | 7 | |||||

| How are candidates identified and evaluated? | 8 | |||||

| How are directors compensated? | 8 | |||||

| Report of the Audit Committee of the Board of Directors | 9 | |||||

| Independent Auditor’s Fees | 10 | |||||

| EXECUTIVE COMPENSATION | 11 | |||||

| Summary Compensation Table | 11 | |||||

| Employment Agreements with the Named Executive Officers | 12 | |||||

| Stock Option Grants | 13 | |||||

| Stock Option Exercises and Holdings | 13 | |||||

| Human Resources Committee Interlocks and Insider Participation | 13 | |||||

| Performance Graph | 14 | |||||

| Report of the Human Resources Committee of the Board of Directors on Executive Compensation | 15 | |||||

| Pension Plans | 16 | |||||

| (ITEM 2) PROPOSAL TO APPROVE THE APPOINTMENT OF INDEPENDENT AUDITORS | 17 | |||||

| (ITEM 3) SHAREHOLDER PROPOSAL REGARDING OUR SHAREHOLDER RIGHTS PLAN | 18 | |||||

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 20 | |||||

| COST OF SOLICITATION OF PROXIES | 20 | |||||

| PROPOSALS OF SHAREHOLDERS | 21 | |||||

| ANNUAL REPORT ON FORM 10-K | 21 | |||||

| AUDIT COMMITTEE CHARTER | A-1 |

GENERAL INFORMATION

What is the purpose of the meeting?

| • | The election of directors |

| • | The approval of the appointment of our independent auditors |

| • | A shareholder proposal regarding our Shareholder Rights Plan, if presented by its proponent |

Who may vote at the meeting?

What are the voting rights of Pep Boys’ shareholders?

How do I vote before the meeting?

| • | FOR election of the nominated slate of directors, subject to the proxies’ discretion to cumulate votes |

| • | FOR the approval of the appointment of our independent auditors |

| • | AGAINST the shareholder proposal regarding our Shareholder Rights Plan |

Can I vote at the meeting?

Can I change my vote after I return my proxy card?

How many votes must be present to hold the meeting?

How many votes are needed to elect directors?

How many votes are needed to approve the other matters to be acted on at the meeting?

What are the Board of Directors’ recommendations?

| • | FOR election of the nominated slate of directors, subject to the proxies’ discretion to cumulate votes |

| • | FOR the approval of the appointment of our independent auditors |

| • | AGAINST the shareholder proposal regarding our Shareholder Rights Plan |

2

A note about certain information contained in this Proxy Statement

SHARE OWNERSHIP

Who are Pep Boys’ largest shareholders?

| Name | Number of Shares Owned | Percent of Outstanding Shares | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

FMR Corp. 82 Devonshire Street, Boston, Massachusetts 021091 | 7,817,930 | 13.60 | % | |||||||

Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 904012 | 3,901,255 | 6.79 | % | |||||||

Glen J. Krevlin Krevlin Advisors, LLC 598 Madison Avenue 12th Floor New York, NY 100223 | 3,128,200 | 5.44 | % | |||||||

American Express Trust Company 928 AXP Financial Center Minneapolis, MN 554744 | 2,916,234 | 5.07 | % | |||||||

| 1 | Based upon information disclosed in a Schedule 13G/A dated February 14, 2005. |

| 2 | Based upon information disclosed in a Schedule 13G/A dated February 9, 2005. Dimensional Fund Advisers Inc. disclaims beneficial ownership of such shares. |

| 3 | Based upon information disclosed in a Schedule 13G dated January 18, 2005. |

| 4 | Based upon information disclosed in a Schedule 13G dated February 11, 2005. American Express Trust Company, the trustee of certain Pep Boys retirement plans, which beneficially own shares, disclaims beneficial ownership of such shares. |

3

How many shares do Pep Boys’ directors and executive officers own?

| Name | Number of Shares Owned1 | Percent of Outstanding Shares | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Benjamin Strauss2 | 800,869 | 1.39 | % | |||||||

| Lawrence N. Stevenson | 758,172 | 1.30 | % | |||||||

| Mark L. Page | 236,511 | + | ||||||||

| Harry F. Yanowitz | 234,648 | + | ||||||||

| Hal Smith | 126,980 | + | ||||||||

| William Leonard | 26,000 | + | ||||||||

| Peter A. Bassi | 21,000 | + | ||||||||

| Jane Scaccetti | 19,950 | + | ||||||||

| Malcolmn D. Pryor | 19,500 | + | ||||||||

| John T. Sweetwood | 19,070 | + | ||||||||

| M. Shân Atkins | �� | 3,500 | + | |||||||

| Robert H. Hotz | 1,500 | + | ||||||||

George Babich, Jr.3 | 13,148 | + | ||||||||

| All nominees and current executive officers as a group (13 people) | 2,297,300 | 3.91 | % | |||||||

| + | Represents less than 1%. |

| 1 | Includes shares for which the named person has sole voting and investment power and non-voting interests including restricted stock units and deferred compensation accounted for as Pep Boys Stock. Also includes the following shares that can be acquired through stock option exercises through June 7, 2005: Strauss – 23,700; Stevenson – 627,724; Page – 222,100; Yanowitz – 58,000; Smith – 74,000; Leonard – 4,000; Bassi – 16,000; Scaccetti – 12,000; Pryor – 18,500; Sweetwood – 16,000; Atkins – 3,000; Hotz – 1,500; and as a group – 1,086,524. |

| 2 | These amounts include the following shares for which Mr. Strauss has sole voting and investment power: |

| • 66,384 shares owned by a trust in which Mr. Strauss has a beneficial interest |

| • 49,036 shares owned in custody or trust for the benefit of Mr. Strauss’ minor child |

| These amounts also include the following shares for which Mr. Strauss may be deemed to have shared voting and investment power, but disclaims beneficial interest: |

| • 217,600 shares owned by The Strauss Foundation, a non-profit charitable foundation, of which Mr. Strauss is a co-trustee |

| • 1,931 shares owned by Mr. Strauss’ spouse |

| 3 | Mr. Babich’s beneficial ownership is reported as of January 7, 2005, the date of his retirement from Pep Boys. |

4

(ITEM 1) ELECTION OF DIRECTORS

What is the makeup of the Board of Directors?

Retirees

Nominees for Election

Benjamin Strauss Director since 1970

Malcolmn D. Pryor Director since 1994

Peter A. Bassi Director since 2002

Jane Scaccetti Director since 2002

John T. Sweetwood Director since 2002

William Leonard Director since 2002

5

Lawrence N. Stevenson Director since 2003

M. Shân Atkins Director since 2004

Robert H. Hotz Director since February 25, 2005

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR”

EACH OF THESE NOMINEES FOR DIRECTOR

Corporate Governance

6

Meetings and Committees of the Board of Directors

Can a shareholder nominate a candidate for director?

| • | the name and address of the shareholder making the nomination |

| • | a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the proposed nominee |

| • | the name of the proposed nominee |

| • | the proposed nominee’s principal occupation and employment for the past 5 years |

| • | a description of any other directorships held by the proposed nominee |

| • | a description of all arrangements or understandings between the nominee and any other person or persons relating to the nomination of, and voting arrangements with respect to, the nominee |

7

How are candidates identified and evaluated?

How are directors compensated?

| • | options to purchase 2,500 shares of Pep Boys Stock for serving on the Board |

| • | options to purchase an additional 17,500 shares of Pep Boys Stock for serving as Chairman of the Board |

| • | options to purchase an additional 5,000 shares of Pep Boys Stock for each committee membership |

| • | options to purchase an additional 2,500 shares of Pep Boys Stock for each committee chair held |

8

Report of the Audit Committee of the Board of Directors

| J. Richard Leaman, Jr. (Chairman) M. Shân Atkins Robert H. Hotz Malcolmn D. Pryor Jane Scaccetti |

9

Independent Auditor’s Fees

| Fiscal Year | 2004 | | 2003 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Audit Fees | $ | 891,810 | $ | 461,470 | ||||||

| Audit-Related Fees | 119,700 | 120,595 | ||||||||

| Tax Fees | 242,328 | 169,880 | ||||||||

| All Other Fees | 0 | 0 | ||||||||

| Total | $ | 1,253,838 | $ | 751,945 | ||||||

| Ratio of Tax Planning and Advice Fees to Audit Fees, Audit-Related Fees and Tax Compliance Fees | 0.2:1 | 0.2:1 | ||||||||

10

EXECUTIVE COMPENSATION

Summary Compensation Table

| Annual Compensation | Long Term Compensation Awards | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Restricted Stock Award ($)(a) | Securities Underlying Options (#) | All Other Comp. ($)(b) | ||||||||||||||||||||

| Lawrence N. Stevenson | 2004 | 900,000 | 305,200 | 999,151 | 125,000 | 315,268 | ||||||||||||||||||||

Chairman & CEO(c) | 2003 | 590,614 | 1,130,000 | — | 919,540 | 43,399 | ||||||||||||||||||||

| Hal Smith | 2004 | 414,615 | 95,100 | 599,500 | 25,000 | 199,927 | (e) | |||||||||||||||||||

| EVP – Merchandising | 2003 | 206,922 | 190,000 | — | 150,000 | 303 | ||||||||||||||||||||

& Marketing(d) | ||||||||||||||||||||||||||

| Mark L. Page | 2004 | 360,493 | 54,100 | 59,950 | 2,500 | 19,018 | ||||||||||||||||||||

| SVP – Service Center | 2003 | 343,077 | 242,880 | — | 15,000 | 4,350 | ||||||||||||||||||||

| Operations | 2002 | 334,038 | 109,780 | — | 25,000 | 1,710 | ||||||||||||||||||||

| Harry F. Yanowitz | 2004 | 326,654 | 74,200 | 359,700 | 15,000 | 71,313 | ||||||||||||||||||||

SVP – CFO(f) | 2003 | 181,393 | 221,000 | — | 125,000 | 13,869 | ||||||||||||||||||||

| George Babich, Jr. | 2004 | 554,800 | — | 119,900 | 5,000 | 5,878,981 | (h) | |||||||||||||||||||

| Former President & | 2003 | 513,708 | 463,500 | — | 50,000 | 8,816 | ||||||||||||||||||||

CFO(g) | 2002 | 480,769 | 193,500 | — | 300,000 | 6,295 | ||||||||||||||||||||

| (a) | For fiscal 2004, represents the value of restricted stock units on their date of grant. All restricted stock units vest 20% on their date of grant and additional 20% on each of the next four anniversaries of the date of grant and receive dividend equivalents – for fiscal 2004: Stevenson $8,437; Smith – $5,063; Page – $506; Yanowitz – $3,038; and Babich $1,013. As of the end of fiscal 2004, the named executive officers held the following number of restricted stock units having the values indicated based on the closing market price of a share of Pep Boys’ Stock on January 28, 2005 ($16.50): Stevenson – 41,666 ($687,489); Smith – 25,000 ($412,500); Page – 2,500 ($41,250); and Yanowitz – 15,000 ($247,500). |

| (b) | For fiscal 2004 includes the following dollar amounts (i) contributed under the defined contribution portion of Pep Boys Executive Supplemental Retirement Plan: Stevenson – $246,150; Smith – $92,625; and Yanowitz – $49,850 (Mr. Page participates in the defined benefit portion of such plan, see “– Pension Plans.”); (ii) contributed (company match) under Pep Boys’ Deferred Compensation Plan: Stevenson – $61,040; Smith – $19,020; Page – $10,820; and Yanowitz – $14,840; (iii) contributed/distributed (company match) in connection with Pep Boys 401(k) Savings Plan: Stevenson – $6,500; Smith – $5,988; Page – $6,501; Yanowitz – $6,353; and Babich – $6,501; and (iv) representing group term life insurance premiums: Stevenson – $1,578; Smith – $2,624; Page – $1,697; Yanowitz – $270; and Babich – $1,827. |

| (c) | Mr. Stevenson joined Pep Boys effective April 28, 2003. |

| (d) | Mr. Smith joined Pep Boys effective August 1, 2003. |

| (e) | Also includes $79,670 for reimbursement of certain relocation expenses. |

| (f) | Mr. Yanowitz joined Pep Boys effective June 9, 2003. |

| (g) | Mr. Babich resigned on January 7, 2005. |

| (h) | Also includes $1,856,377 in contractual obligations, $1,014,276 in benefits due under Pep Boys Executive Supplemental Retirement Plan and $3,000,000 for the repurchase of outstanding stock options, paid to Mr. Babich in connection with his resignation. |

11

Employment Agreements with the Named Executive Officers

12

Stock Option Grants

Stock Option Grants in Last Fiscal Year

| Individual Grants | Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Number of Securities Underlying Options Granted (#)(a) | % of Total Options Granted to Employees in Fiscal Year (%)(b) | Exercise or Base Price ($/Share) | Expiration Date | 5% ($) | 10% ($) | |||||||||||||||||||||

| Lawrence N. Stevenson | 125,000 | 50.6 | 23.42 | 03/03/11 | 1,191,786 | 2,777,369 | |||||||||||||||||||||

| Hal Smith | 25,000 | 10.1 | 23.42 | 03/03/11 | 238,357 | 555,474 | |||||||||||||||||||||

| Mark L. Page | 2,500 | 1.0 | 23.42 | 03/03/11 | 23,836 | 55,547 | |||||||||||||||||||||

| Harry F. Yanowitz | 15,000 | 6.1 | 23.42 | 03/03/11 | 143,014 | 333,284 | |||||||||||||||||||||

| George Babich, Jr. | 5,000 | 2.0 | 23.42 | 03/03/11 | 47,671 | 111,095 | |||||||||||||||||||||

| (a) | The stock options were granted at a price equal to the fair market value on the date of grant with 20% exercisable immediately and an additional 20% exercisable on each of the next four anniversaries of the grant date. |

| (b) | In fiscal 2004, options to purchase 247,250 shares of Pep Boys Stock were granted to 30 employees. |

Stock Option Exercises and Holdings

| Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(a) | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||||||||||||

| Lawrence N. Stevenson | — | — | 392,816 | 651,724 | 2,868,965 | 4,303,447 | |||||||||||||||||||||

| Hal Smith | — | — | 65,000 | 110,000 | 42,500 | 76,500 | |||||||||||||||||||||

| Mark L. Page | 3,100 | 64,205 | 233,100 | 26,000 | 164,978 | 80,100 | |||||||||||||||||||||

| Harry F. Yanowitz | — | — | 53,000 | 87,000 | 303,750 | 455,625 | |||||||||||||||||||||

| George Babich, Jr. | 25,000 | 409,979 | — | — | — | — | |||||||||||||||||||||

| (a) | Based on the New York Stock Exchange composite closing price as published by Yahoo, Inc. for the last business day of fiscal 2004 ($16.50). |

Human Resources Committee Interlocks and Insider Participation

13

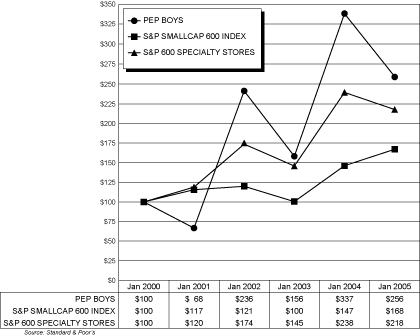

Performance Graph

the S&P 600 SmallCap Index and the S&P 600 Specialty Stores Group

14

Report of the Human Resources Committee of the Board of Directors on Executive Compensation

15

| William Leonard (Chairman) Peter A. Bassi Malcolmn D. Pryor |

Pension Plans

| Name | Annualized Benefit($) | |||||

|---|---|---|---|---|---|---|

| Mark L. Page | $ | 19,162 | ||||

16

| • | for unmarried participants, at 100% (of the amounts specified below) for the longer of ten years or life |

| • | for married participants, at 100% during the participant’s life and at 50% during the participant’s surviving spouse’s life |

Pension Plan Table

| Estimated Annual Retirement Income ($) Years of Service | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Average Included Compensation | 5 | 10 | 15 | 20 | 25 | ||||||||||||||||||

| 400,000 | 40,000 | 80,000 | 120,000 | 160,000 | 200,000 | ||||||||||||||||||

| 600,000 | 60,000 | 120,000 | 180,000 | 240,000 | 300,000 | ||||||||||||||||||

| 800,000 | 80,000 | 160,000 | 240,000 | 320,000 | 400,000 | ||||||||||||||||||

| 1,000,000 | 100,000 | 200,000 | 300,000 | 400,000 | 500,000 | ||||||||||||||||||

| 1,200,000 | 120,000 | 240,000 | 360,000 | 480,000 | 600,000 | ||||||||||||||||||

| 1,400,000 | 140,000 | 280,000 | 420,000 | 560,000 | 700,000 | ||||||||||||||||||

| 1,600,000 | 160,000 | 320,000 | 480,000 | 640,000 | 800,000 | ||||||||||||||||||

| 1,800,000 | 180,000 | 360,000 | 540,000 | 720,000 | 900,000 | ||||||||||||||||||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR”

THE APPROVAL OF THE APPOINTMENT OF THE INDEPENDENT AUDITORS

17

(ITEM 3) SHAREHOLDER PROPOSAL REGARDING OUR SHAREHOLDER RIGHTS PLAN

| Year | Rate of Support | |||||

|---|---|---|---|---|---|---|

| 2003 | 68% | |||||

| 2004 | 74% | |||||

| • | Adoption of this proposal topic. |

| • | Adoption of proposals, which wins one majority shareholder vote. We have given our Board two unanswered majority votes on this topic. |

Institutional Shareholder Services Takes Hard Line Against Poison Pills

Pills Entrench Current Management

The Potential of an Offer Can Motivate Our Directors

18

Progress Begins with a First Step

I believe that the reason for the above RESOLVED step is reinforced by viewing our overall corporate governance, which is not impeccable. For instance in 2004 it was reported (and concerns are highlighted):

| • | The Corporate Library, an independent investment research firm in Portland, Maine rated our company: “D” in CEO Compensation “D” in Shareholder Responsiveness |

| • | Our board failed to respond affirmatively to our 68% and 74% shareholder votes in 2003 and 2004 on the same topic as this proposal. |

| • | We had no Independent Chairman – independence concern. |

| • | The chairman of our key Audit Committee owned only 2,000 shares – after 13 years to accumulate stock as a director. |

| • | Our Chairman was allowed to hold 4 director seats each – over extension concern. |

| • | One Director had 34 years tenure – independence concern. |

| • | 2002 CEO pay of $6 million including stock option grants. Source:Executive Pay Watch Database, http://www.aflcio.org/corporateamerica/paywatch/ceou/database.cfm |

| • | If CEO pay is excessive – concern that our board is weak in CEO oversight. |

| • | Our Board had no formal governance policy. |

Stock Value

If a poison pill makes our stock difficult to sell – our stock may have less value.

Redeem or Vote Poison Pill

Yes on 3”

PEP BOYS’ STATEMENT IN OPPOSITION TO THE FOREGOING SHAREHOLDER PROPOSAL

19

| • | all of our directors, except our Chief Executive Officer, are independent |

| • | all committees of the Board of Directors consist solely of independent directors |

| • | all directors are subject to re-election annually |

| • | we have been active in adding new and diversified experience to our Board – seven new members since 2002 |

| • | we have adopted formal Codes of Ethics and Conduct, as posted on our website |

| • | we have appointed an “independent” Presiding Director |

ACCORDINGLY, THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“AGAINST”

THE FOREGOING SHAREHOLDER PROPOSAL

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

COST OF SOLICITATION OF PROXIES

20

PROPOSALS OF SHAREHOLDERS

Pep Boys

3111 West Allegheny Avenue

Philadelphia, PA 19132

Attention: Secretary

Pep Boys

3111 West Allegheny Avenue

Philadelphia, PA 19132

Attention: Secretary

| • | the name and address of the shareholder |

| • | a representation that the shareholder intends to appear in person or by proxy at the meeting |

| • | a general description of each item of business proposed to be brought before the meeting |

ANNUAL REPORT ON FORM 10-K

Pep Boys

3111 West Allegheny Avenue

Philadelphia, PA 19132

Attention: Secretary

21

APPENDIX A

PEP BOYS—MANNY, MOE & JACK

AUDIT COMMITTEE CHARTER

| I. | COMPOSITION |

| II. | AUTHORITY |

| III. | PURPOSE |

| IV. | MEETINGS |

A-1

| V. | SPECIFIC DUTIES |

| (a) | Annual Report. |

A-2

A-3

ANNUAL MEETING OF SHAREHOLDERS OF

THE PEP BOYS - MANNY, MOE & JACK

June 8, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

| Please detach along perforated line and mail in the envelope provided. |

|

g |

|

|

|

|

| |||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HEREx | ||||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||

The Board of Directors recommends a vote FOR all of the nominees. |

| The Board of Directors recommends a vote FOR Item 2. | ||||||||||||||||||||||||||

1. Election of Directors: | (ONLY mark circles to withhold authority, |

|

| FOR | AGAINST | ABSTAIN | ||||||||||||||||||||||

c |

|

| NOMINEES: See Instructions below) | 2. | To approve the appointment of Deloitte & | c | c | c | ||||||||||||||||||||

FOR ALL NOMINEES | | Benjamin Strauss |

| Touche LLP as the Company’s independent | ||||||||||||||||||||||||

|

| | Malcolmn D. Pryor |

| auditors. | |||||||||||||||||||||||

c | WITHHOLD AUTHORITY | | Peter A. Bassi |

|

|

|

|

| ||||||||||||||||||||

FOR ALL NOMINEES | | Jane Scaccetti |

| The Board of Directors recommends a vote AGAINST Item 3. | ||||||||||||||||||||||||

|

| | John T. Sweetwood |

|

| FOR | AGAINST | ABSTAIN | ||||||||||||||||||||

c | FOR ALL EXCEPT | | William Leonard | 3. | Shareholder Proposal regarding our Shareholder | c | c | c | ||||||||||||||||||||

(See instructions below) | | Lawrence N. Stevenson |

| Rights Plan. | ||||||||||||||||||||||||

|

| | M. Shân Atkins |

|

|

|

|

| ||||||||||||||||||||

|

| | Robert H. Hotz |

|

|

|

|

| ||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||

INSTRUCTION: | To withhold authority to vote for any individual nominee(s), mark“FOR ALL EXCEPT” and fill in the circle next to each nominee |

| ||||||||||||||||||||||||||

| you wish to withhold, as shown here: | ˜ |

|

|

|

|

| |||||||||||||||||||||

|

|

|

|

|

|

| ||||||||||||||||||||||

|

|

|

|

|

|

| ||||||||||||||||||||||

|

|

|

|

|

|

| ||||||||||||||||||||||

|

|

|

|

|

|

| ||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | c |

|

| |||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||

Signature of Shareholder |

| Date: |

| Signature of Shareholder |

| Date: |

| |||||||||||||||||||||

| Note: | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. |

| |||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||

g |

| g | ||||||||||||||||||||||||||

0 | n |

THE PEP BOYS –– MANNY, MOE & JACK

Annual Meeting of Shareholders – To Be Held June 8, 2005

THE BOARD OF DIRECTORS SOLICITS THIS PROXY

The undersigned hereby appoint(s) Harry F. Yanowitz, Brian D. Zuckerman, and each of them, attorney, agent and proxy of the undersigned, with full power of substitution, to vote all shares of common stock of the The Pep Boys–Manny, Moe & Jack that the undersigned would be entitled to vote if personally present at the 2005 Annual Meeting of Shareholders of the Company, and at any postponement or adjournment thereof.

THIS PROXY WILL BE VOTED AS SPECIFIED BY THE UNDERSIGNED. IF NO CHOICE IS SPECIFIED, THIS PROXY WILL BE VOTEDFOR THE ELECTION OF ALL NOMINEES FOR DIRECTOR LISTED ON THE REVERSE SIDE,FOR PROPOSAL NUMBER 2,AGAINST PROPOSAL NUMBER 3, AND ACCORDING TO THE DISCRETION OF THE PROXY HOLDERS ON ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY POSTPONEMENT OR ADJOURNMENT THEREOF.

(Continued and to be signed on the reverse side)

n | 14475 n |