Investor Presentation James M. Gasior – President & Chief Executive Officer Timothy Carney – Executive Vice President & Chief Operations Officer (OTCQX: CLDB) Exhibit 99.1

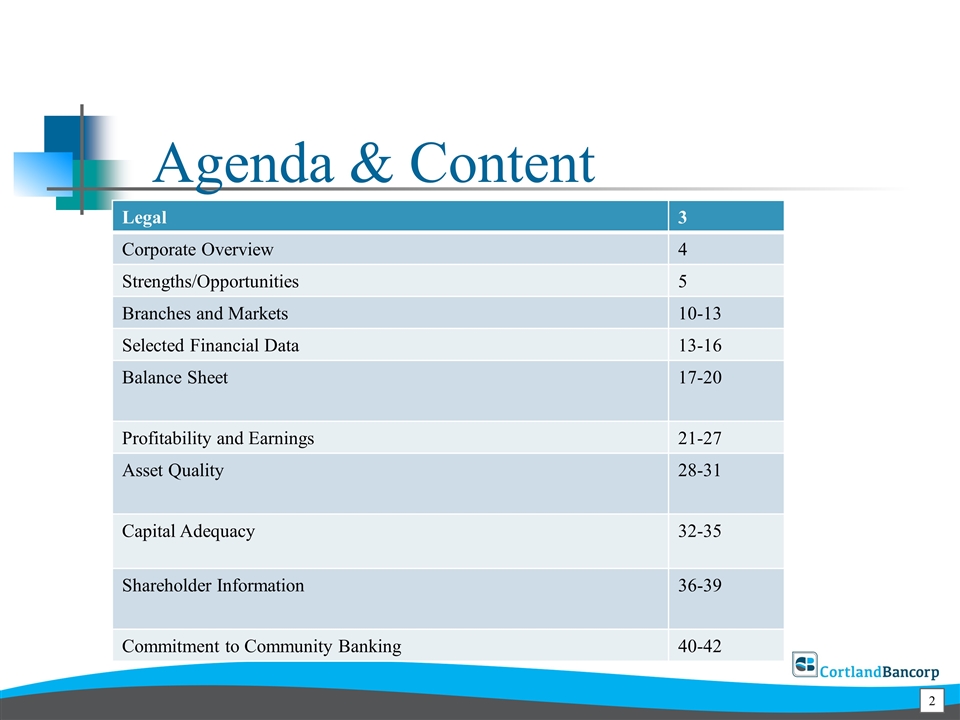

Agenda & Content Legal 3 Corporate Overview 4 Strengths/Opportunities 5 Branches and Markets 10-13 Selected Financial Data 13-16 Balance Sheet 17-20 Profitability and Earnings 21-27 Asset Quality 28-31 Capital Adequacy 32-35 Shareholder Information 36-39 Commitment to Community Banking 40-42

Forward-Looking Statement The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Any forward-looking statement is not a guarantee of future performance and actual future results could differ materially from those contained in forward-looking information. Factors that could cause or contribute to such differences include, without limitation, risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the risk factors disclosed in Item 1A, “Risk Factors” In the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017. Many of these factors are beyond the Company’s ability to control or predict, and readers are cautioned not to put undue reliance on these forward-looking statements. The following list, which is not intended to be an all-encompassing list of risks and uncertainties affecting the Company, summarizes several factors that could cause the Company’s results to differ materially from those anticipated or expected in these forward-looking statements: Conditions in the financial markets, the real estate markets and economic conditions generally. Enactment of new legislation and increased regulatory oversight. Changes in interest rates. Future expansions including new branch openings, acquisition of other financial institutions and new business lines or new product or service offerings. Changes in accounting standards Other factors not currently anticipated may also materially and adversely affect the Company’s results of operations, cash flows and financial position. There can be no assurance that future results will meet expectations. While the Company believes that the forward-looking statements in this presentation are reasonable, you should not place undue reliance on any forward-looking statement. In addition, these statements speak only as of the date made. The Company does not undertake, and expressly disclaims, any obligation to update or alter any statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Founded in 1892. Headquartered in Cortland, Ohio One of 183 Ohio bank and mutual 6th largest stock bank in Northeast Ohio with total assets of $663 million 13 branch locations and 1 loan production office. Operates in five Ohio counties encompassing three NE Ohio Markets – the Mahoning Valley, Cleveland and Akron-Canton Approximately 160 employees Corporate Overview

Strengths/Opportunities Experienced management and service team Senior executive and lending staff are experienced in commercial real estate, commercial and industrial and working capital lending and are uniquely qualified to compete well against the larger community and regional banks on larger complex deals. Director Recruitment in Target Markets Strategically target individuals in target markets who are committed to community banking, stock ownership and business development and assisting management in building a community bank presence in their community. Established Markets The bank has long standing relationships with its customers particularly in the established Trumbull County markets. The life of non-maturity deposits at the bank exceeds the industry average. The opportunity to maintain and/or grow the deposit relationships is vital to our ability to generate loans. Introduction of our community bank brand into growth markets Placement of LPO’s and full service branch facilities in communities which are being served predominantly by regional and national banks provides consumers and businesses with a “local” community bank focus. Positioned to compete Cortland Bank has a legal lending limit of $10 million and an in-house limit of approximately $8.5 million which provides sufficient scale to compete against the larger regionals while providing a competitive advantage over community bank market competitors Understands industry operations and business needs The bank team has years of experience servicing business operators. The team is knowledgeable and lends to an array of industries including Skilled Nursing, Hotel/Motel, Manufacturing, non-residential real estate, multi-family, trucking and auto dealership Disciplined underwriting/Industry concentration analysis Asset quality focus with minimal loss history. Expanded stress testing for CRE Industry concentrations and specific credits. Expanded service capabilities The bank service team has expanded its service team capabilities and is positioned to cater to small to medium size business providing treasury management, “private” banking and wealth management services to business owners and guarantors.

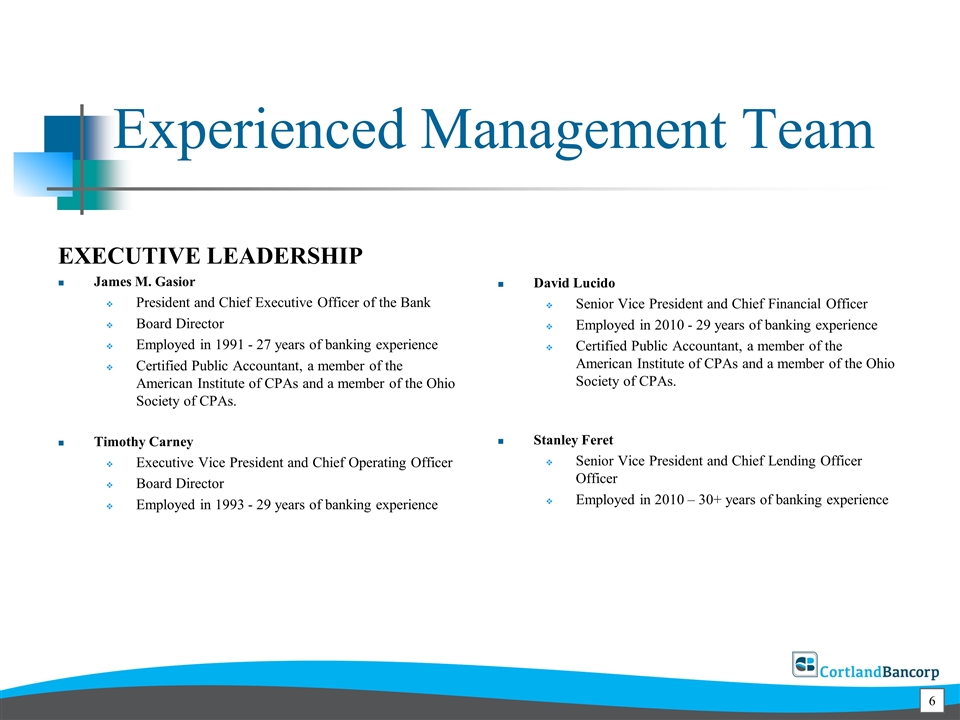

EXECUTIVE LEADERSHIP James M. Gasior President and Chief Executive Officer of the Bank Board Director Employed in 1991 - 27 years of banking experience Certified Public Accountant, a member of the American Institute of CPAs and a member of the Ohio Society of CPAs. Timothy Carney Executive Vice President and Chief Operating Officer Board Director Employed in 1993 - 29 years of banking experience David Lucido Senior Vice President and Chief Financial Officer Employed in 2010 - 29 years of banking experience Certified Public Accountant, a member of the American Institute of CPAs and a member of the Ohio Society of CPAs. Stanley Feret Senior Vice President and Chief Lending Officer Officer Employed in 2010 – 30+ years of banking experience Experienced Management Team

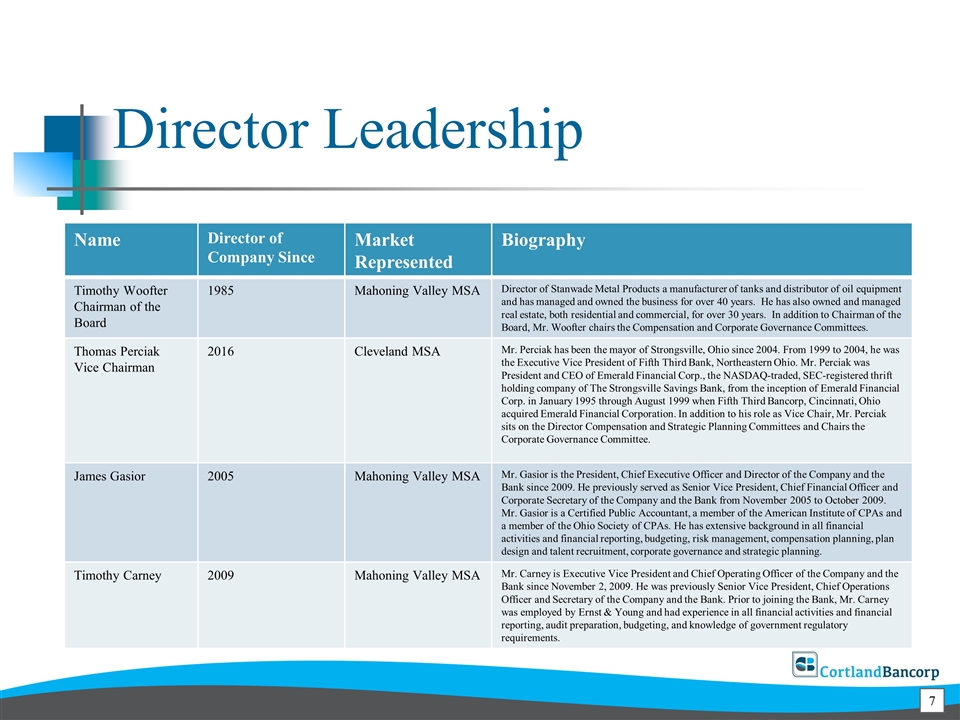

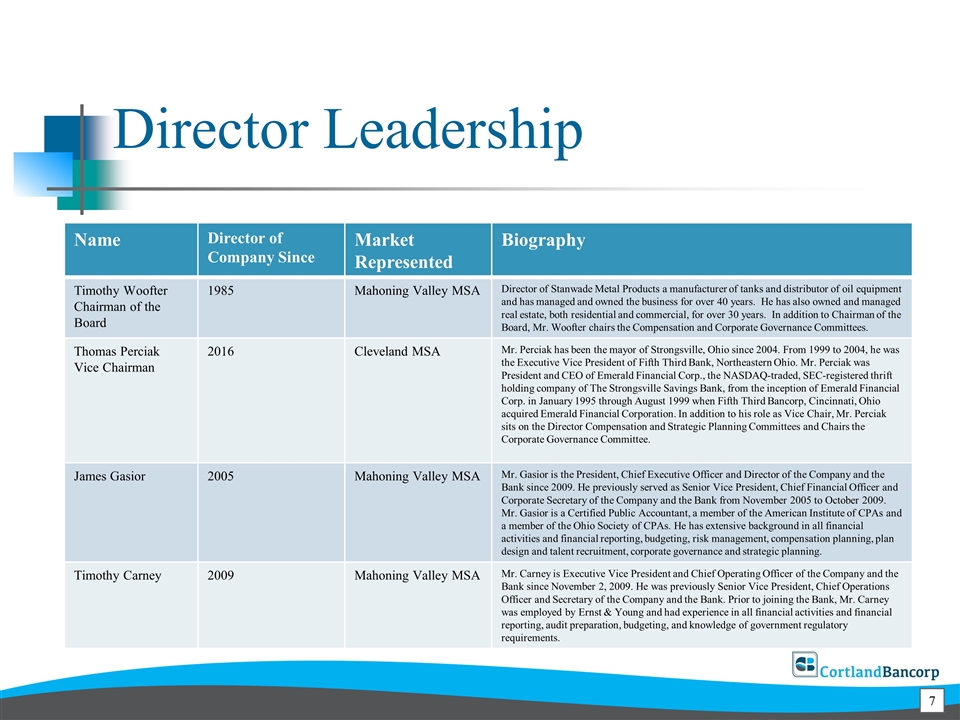

Director Leadership Name Director of Company Since Market Represented Biography Timothy Woofter Chairman of the Board 1985 Mahoning Valley MSA Director of Stanwade Metal Products a manufacturer of tanks and distributor of oil equipment and has managed and owned the business for over 40 years. He has also owned and managed real estate, both residential and commercial, for over 30 years. In addition to Chairman of the Board, Mr. Woofter chairs the Compensation and Corporate Governance Committees. Thomas Perciak Vice Chairman 2016 Cleveland MSA Mr. Perciak has been the mayor of Strongsville, Ohio since 2004. From 1999 to 2004, he was the Executive Vice President of Fifth Third Bank, Northeastern Ohio. Mr. Perciak was President and CEO of Emerald Financial Corp., the NASDAQ-traded, SEC-registered thrift holding company of The Strongsville Savings Bank, from the inception of Emerald Financial Corp. in January 1995 through August 1999 when Fifth Third Bancorp, Cincinnati, Ohio acquired Emerald Financial Corporation. In addition to his role as Vice Chair, Mr. Perciak sits on the Director Compensation and Strategic Planning Committees and Chairs the Corporate Governance Committee. James Gasior 2005 Mahoning Valley MSA Mr. Gasior is the President, Chief Executive Officer and Director of the Company and the Bank since 2009. He previously served as Senior Vice President, Chief Financial Officer and Corporate Secretary of the Company and the Bank from November 2005 to October 2009. Mr. Gasior is a Certified Public Accountant, a member of the American Institute of CPAs and a member of the Ohio Society of CPAs. He has extensive background in all financial activities and financial reporting, budgeting, risk management, compensation planning, plan design and talent recruitment, corporate governance and strategic planning. Timothy Carney 2009 Mahoning Valley MSA Mr. Carney is Executive Vice President and Chief Operating Officer of the Company and the Bank since November 2, 2009. He was previously Senior Vice President, Chief Operations Officer and Secretary of the Company and the Bank. Prior to joining the Bank, Mr. Carney was employed by Ernst & Young and had experience in all financial activities and financial reporting, audit preparation, budgeting, and knowledge of government regulatory requirements.

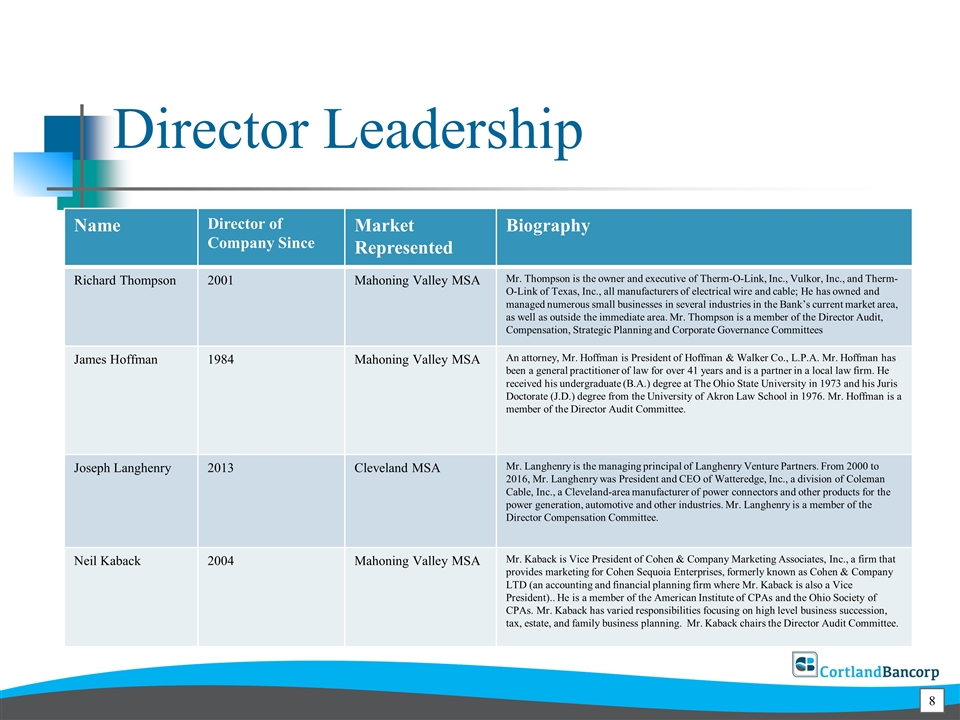

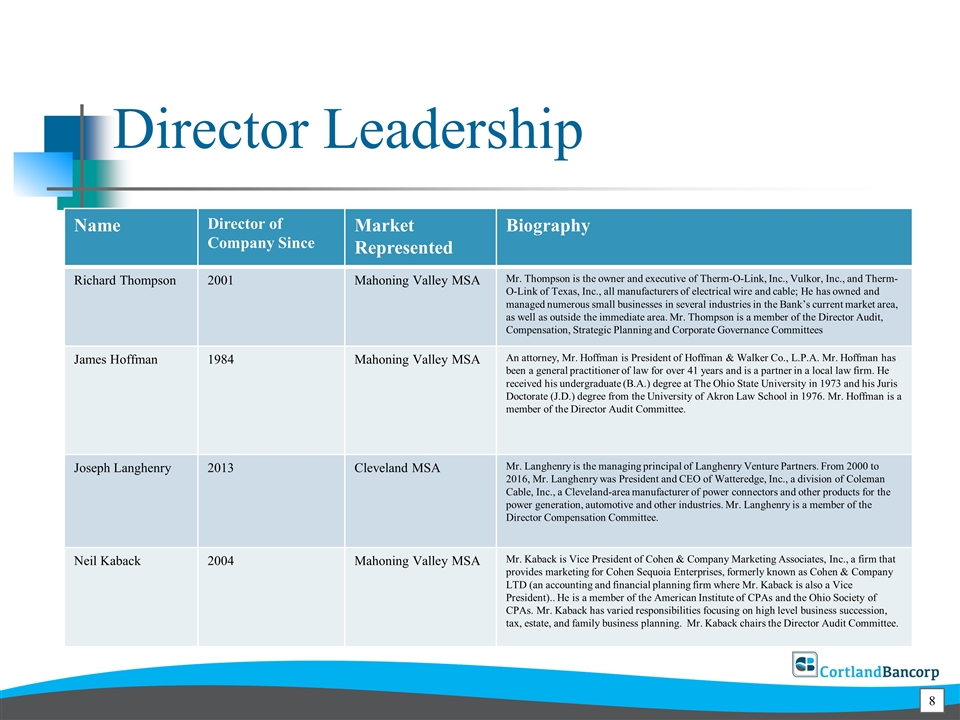

Director Leadership Name Director of Company Since Market Represented Biography Richard Thompson 2001 Mahoning Valley MSA Mr. Thompson is the owner and executive of Therm-O-Link, Inc., Vulkor, Inc., and Therm-O-Link of Texas, Inc., all manufacturers of electrical wire and cable; He has owned and managed numerous small businesses in several industries in the Bank’s current market area, as well as outside the immediate area. Mr. Thompson is a member of the Director Audit, Compensation, Strategic Planning and Corporate Governance Committees James Hoffman 1984 Mahoning Valley MSA An attorney, Mr. Hoffman is President of Hoffman & Walker Co., L.P.A. Mr. Hoffman has been a general practitioner of law for over 41 years and is a partner in a local law firm. He received his undergraduate (B.A.) degree at The Ohio State University in 1973 and his Juris Doctorate (J.D.) degree from the University of Akron Law School in 1976. Mr. Hoffman is a member of the Director Audit Committee. Joseph Langhenry 2013 Cleveland MSA Mr. Langhenry is the managing principal of Langhenry Venture Partners. From 2000 to 2016, Mr. Langhenry was President and CEO of Watteredge, Inc., a division of Coleman Cable, Inc., a Cleveland-area manufacturer of power connectors and other products for the power generation, automotive and other industries. Mr. Langhenry is a member of the Director Compensation Committee. Neil Kaback 2004 Mahoning Valley MSA Mr. Kaback is Vice President of Cohen & Company Marketing Associates, Inc., a firm that provides marketing for Cohen Sequoia Enterprises, formerly known as Cohen & Company LTD (an accounting and financial planning firm where Mr. Kaback is also a Vice President).. He is a member of the American Institute of CPAs and the Ohio Society of CPAs. Mr. Kaback has varied responsibilities focusing on high level business succession, tax, estate, and family business planning. Mr. Kaback chairs the Director Audit Committee.

Director Leadership Name Director of Company Since Market Represented Biography J. Martin Erbaugh 2016 Akron Markets MSA Mr. Erbaugh has been the President of JM Erbaugh Co., a private investment firm focusing on real estate development and service-oriented start-ups. From 1978 to 1995, Mr. Erbaugh was the founder and Chief Executive Officer of Lawnmark, which served customers in 6 states. Prior to that, he served as Director of Legal Affairs of Kent State University and was a General Manager of Davey Tree Expert Company, currently serving as its Senior Advisor for Business Growth. Mr. Erbaugh was a founder and director of Morgan Bank, N.A. and Morgan Bancorp, Inc., Hudson, Ohio, from 1990 to 2007, and served as Chairman of the Board from 2002 to 2007. Mr. Erbaugh serves on the Director Audit, Compensation and Strategic Planning Committees Anthony Vross 2013 Mahoning Valley MSA Mr. Vross is co-owner of Simon Roofing and has over 31 years of experience in executive administration, manufacturing, operations, distribution, sales, and marketing. He has brought many new concepts and technologies to the roofing industry, such as the Fume Recovery System. Mr. Vross holds a Bachelor of Science degree in Business Administration from Youngstown State University, where he serves on the Business Advisory Council for the Williamson College of Business Administration and was recognized as the 2015 Outstanding Business Alumnus. Mr. Vross is a member of the Director Audit and Strategic Planning Committees. David Cole 1989 Mahoning Valley MSA Mr. Cole is a Partner and President of Cole Valley Motor Company, an automobile dealership. He is President of JDT, Inc., Cole Valley Chevrolet, CJB Properties, and David Tom LTD, automobile sales, since 2001. As President of a family-owned automobile dealership located in Warren, Ohio, Mr. Cole is responsible for the management and day-to-day operations of the business. Mr. Cole is a member of the Director Strategic Planning, Corporate Governance and Compensation Committees. Joseph Koch 2010 Mahoning Valley MSA Mr. Koch is President of Joe Koch Construction, Inc., a homebuilding, developing and remodeling company since 1988. He is President of Joe Koch Realty, Inc., a real estate brokerage firm. Mr. Koch is a member of Eagle Ridge Properties, LLC since 2002. He is the President of Koch Family Charitable Foundation, a 501(c)(3) organization. Mr. Koch is a member of the Corporate Governance Committee.

Northeast Ohio Branches

Established Markets Mahoning Valley Market $ 342,636,000 in loans $ 486,623,000 in deposits 70.41% Loan to Deposit Ratio 9 locations 2017 Market share rank - #1 rank in deposit market share in Cortland, Ohio with 51% market share $132,859,000 in loans and $43,922,000 in deposits in Canfield Ohio since September 2015 opening Ashtabula Market $ 1,994,000 in loans $ 11,372,000 in deposits 17.53% Loan to Deposit Ratio 1 location

Attractive Target Markets Akron Market $121,818,000 in loans $ 60,004,000 in deposits 203.02% Loan to Deposit Ratio 3 locations $50,446,000 in loans and $17,097,000 in deposits in Hudson Ohio since January 2017 opening. Cleveland Market Coming Fall 2018

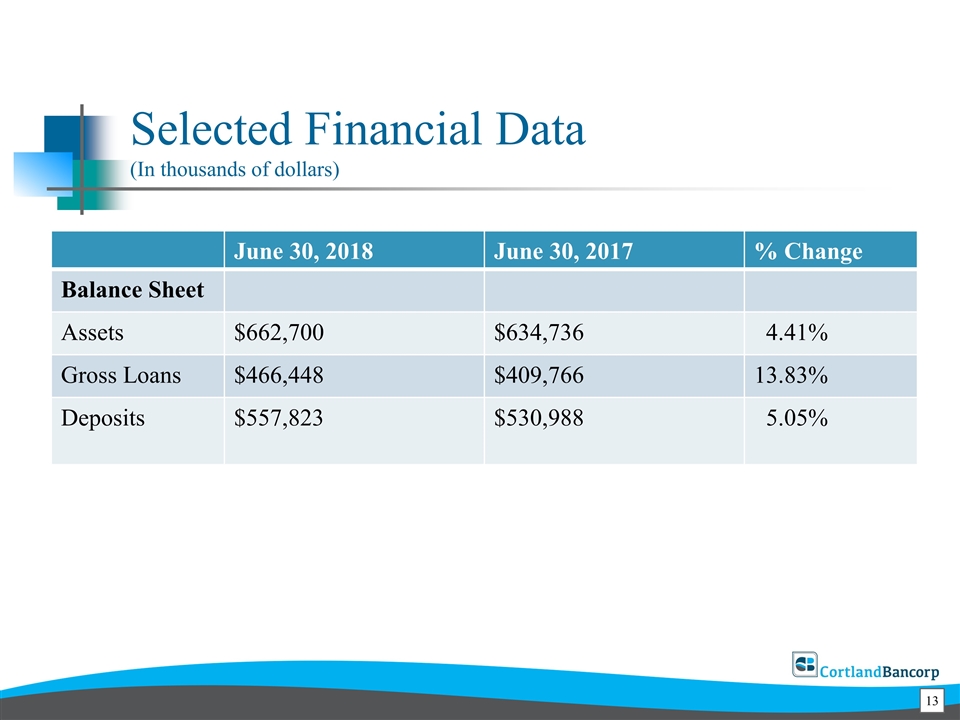

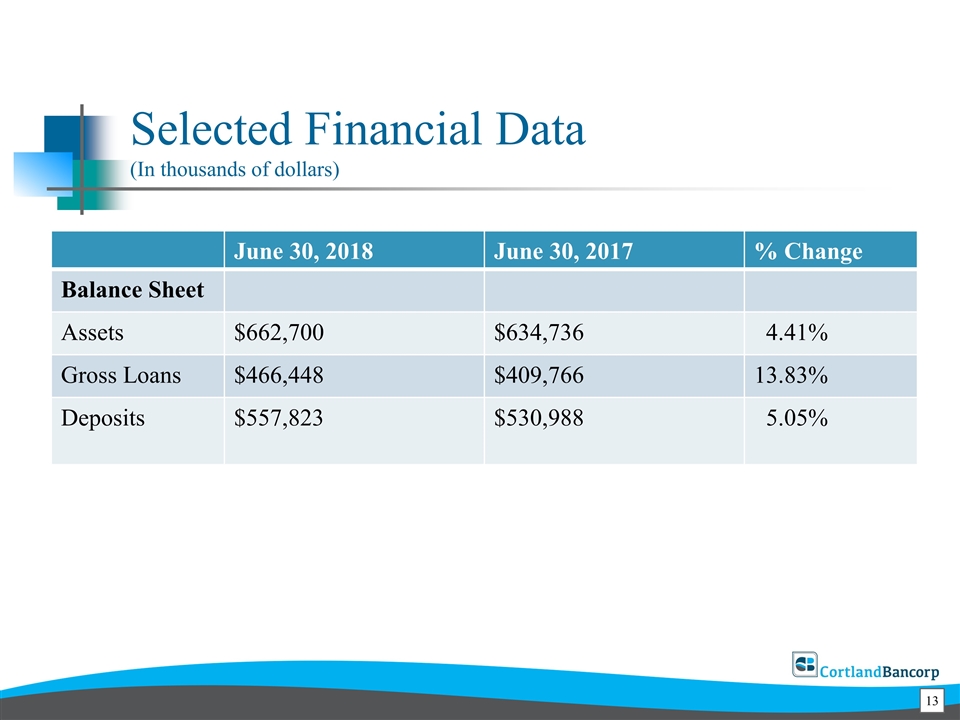

Selected Financial Data (In thousands of dollars) June 30, 2018 June 30, 2017 % Change Balance Sheet Assets $662,700 $634,736 4.41% Gross Loans $466,448 $409,766 13.83% Deposits $557,823 $530,988 5.05%

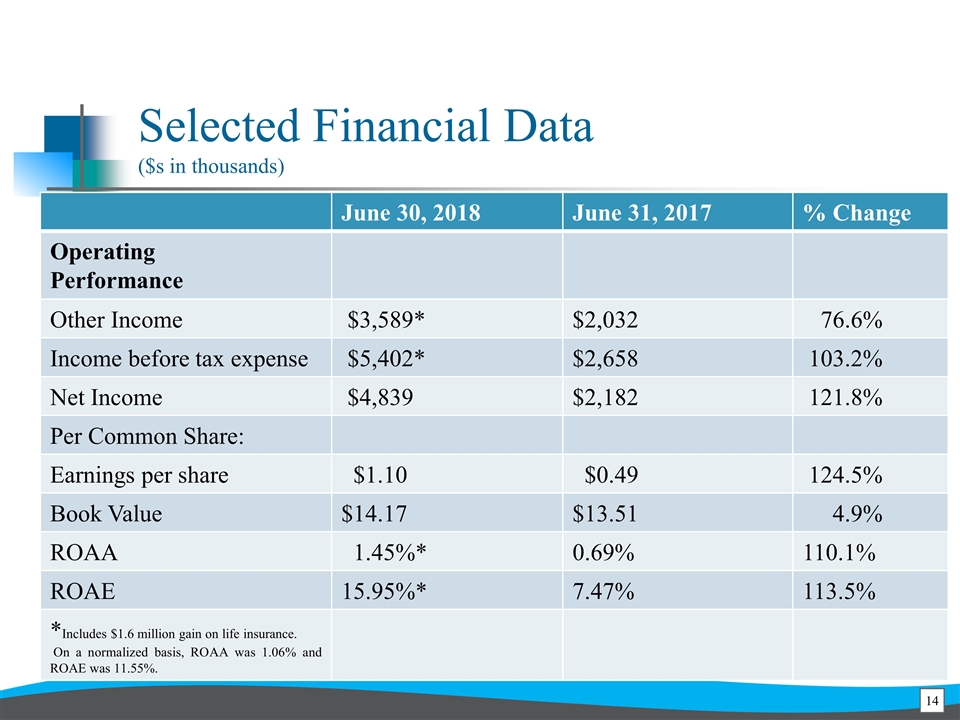

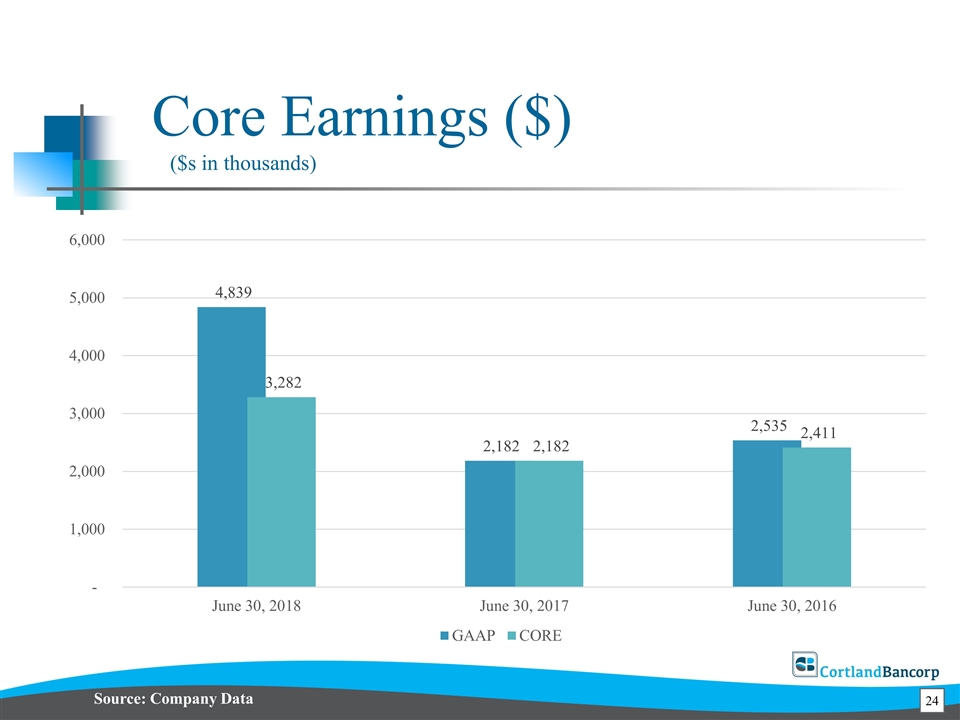

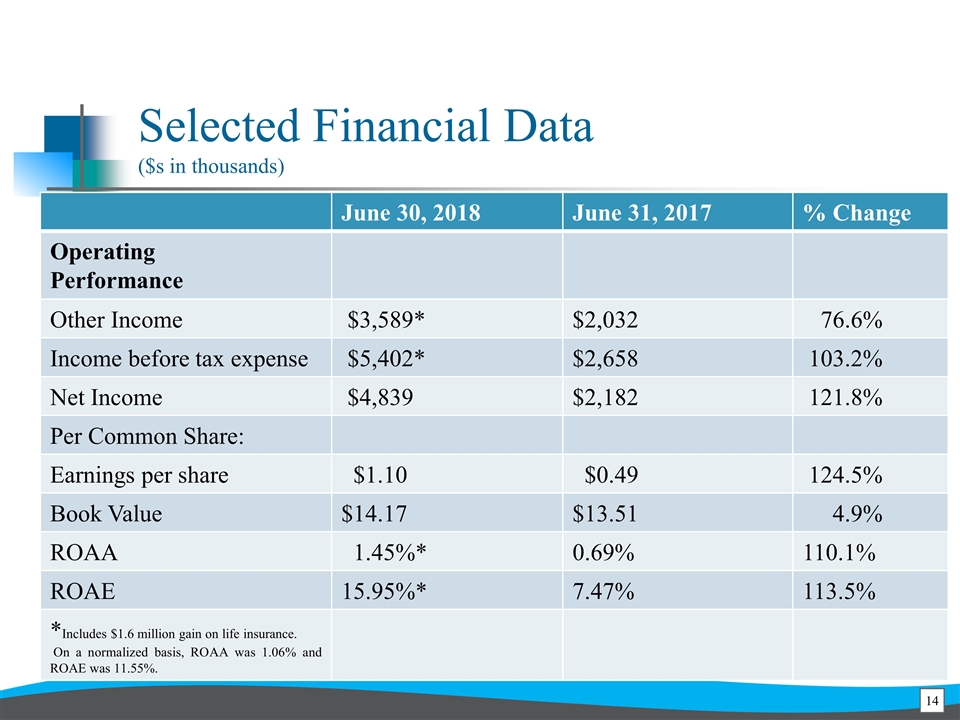

Selected Financial Data ($s in thousands) June 30, 2018 June 31, 2017 % Change Operating Performance Other Income $3,589* $2,032 76.6% Income before tax expense $5,402* $2,658 103.2% Net Income $4,839 $2,182 121.8% Per Common Share: Earnings per share $1.10 $0.49 124.5% Book Value $14.17 $13.51 4.9% ROAA 1.45%* 0.69% 110.1% ROAE 15.95%* 7.47% 113.5% *Includes $1.6 million gain on life insurance. On a normalized basis, ROAA was 1.06% and ROAE was 11.55%.

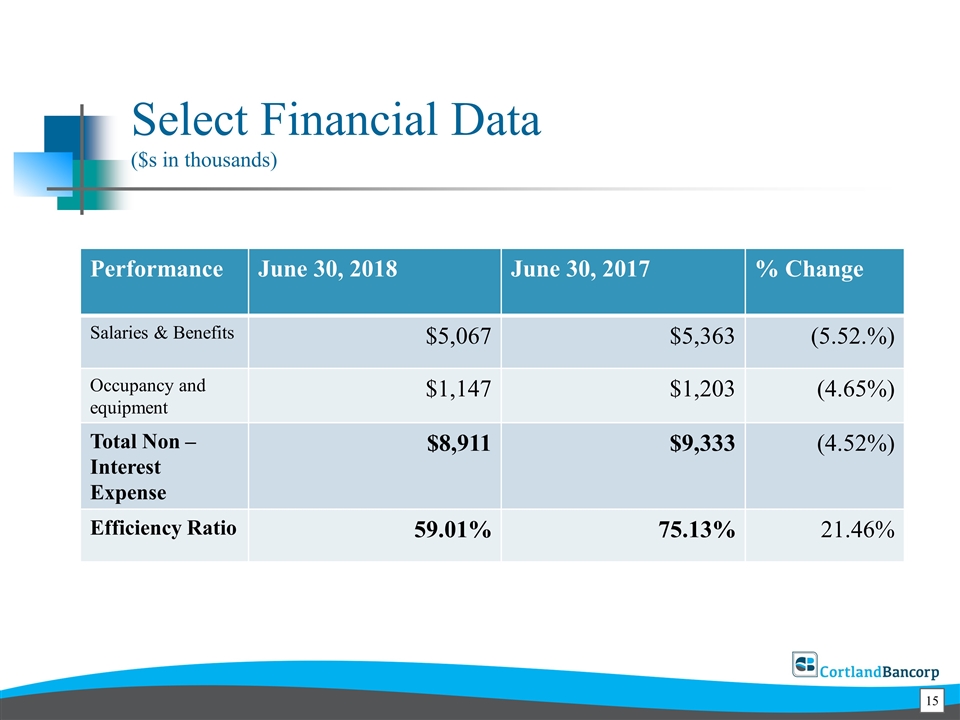

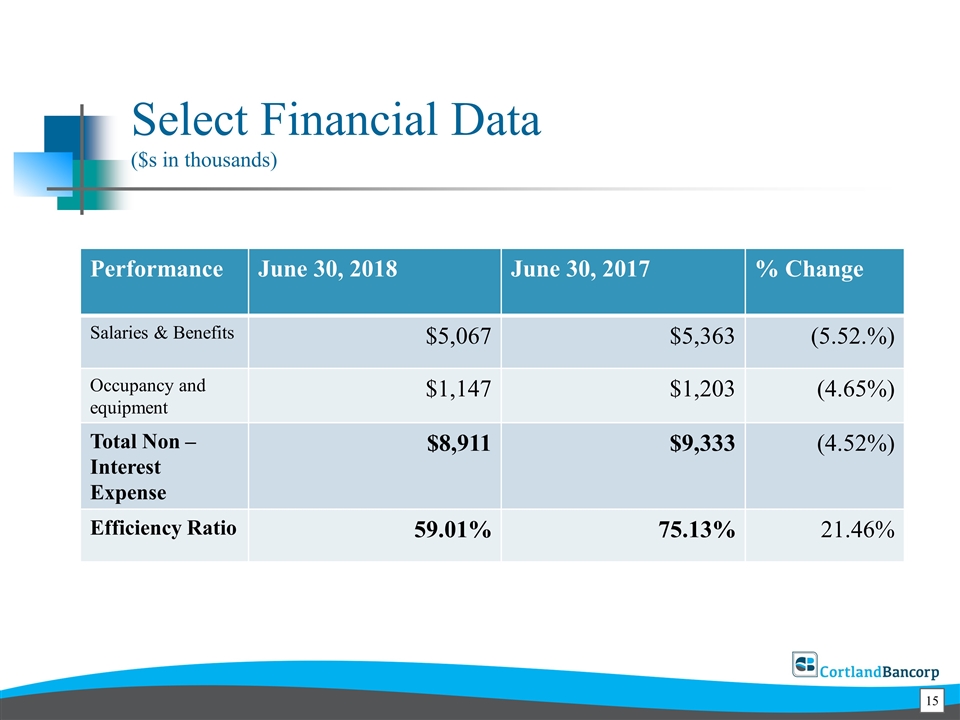

Select Financial Data ($s in thousands) Performance June 30, 2018 June 30, 2017 % Change Salaries & Benefits $5,067 $5,363 (5.52.%) Occupancy and equipment $1,147 $1,203 (4.65%) Total Non – Interest Expense $8,911 $9,333 (4.52%) Efficiency Ratio 59.01% 75.13% 21.46%

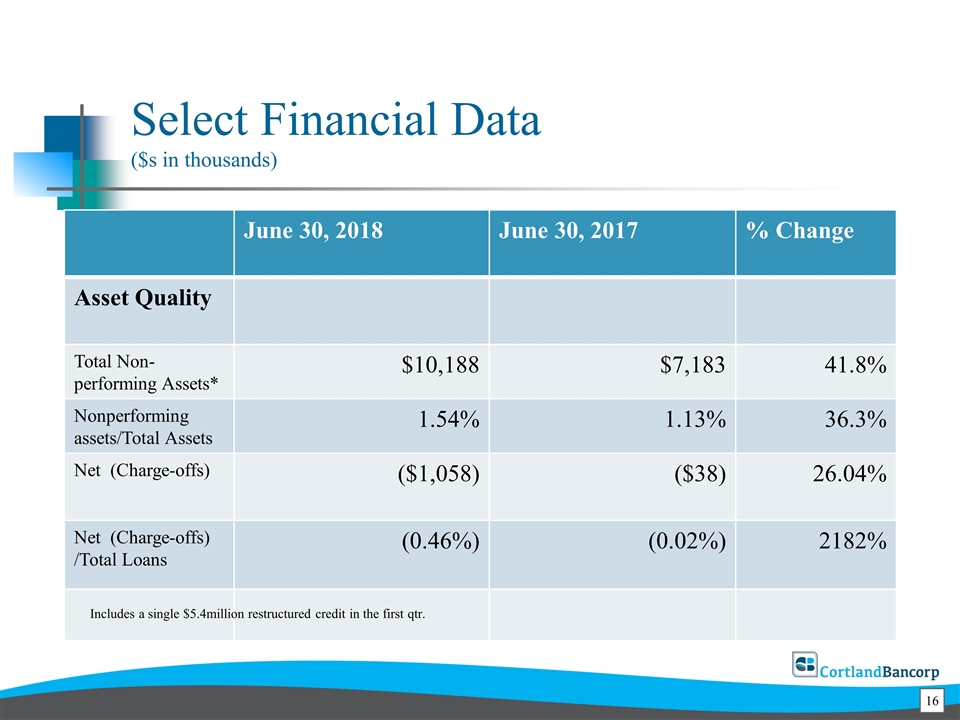

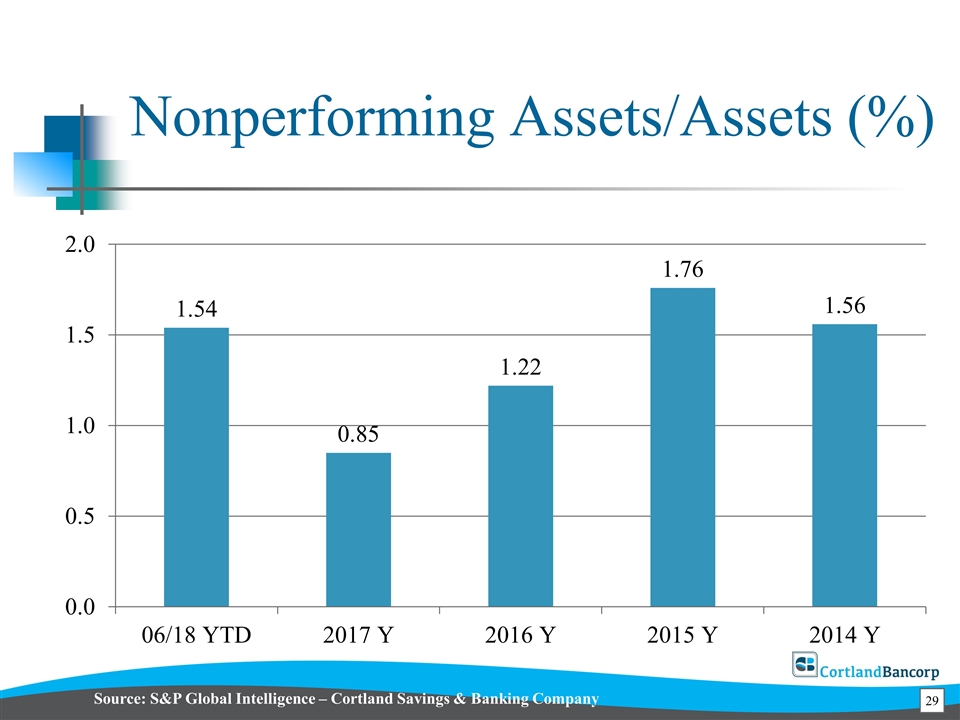

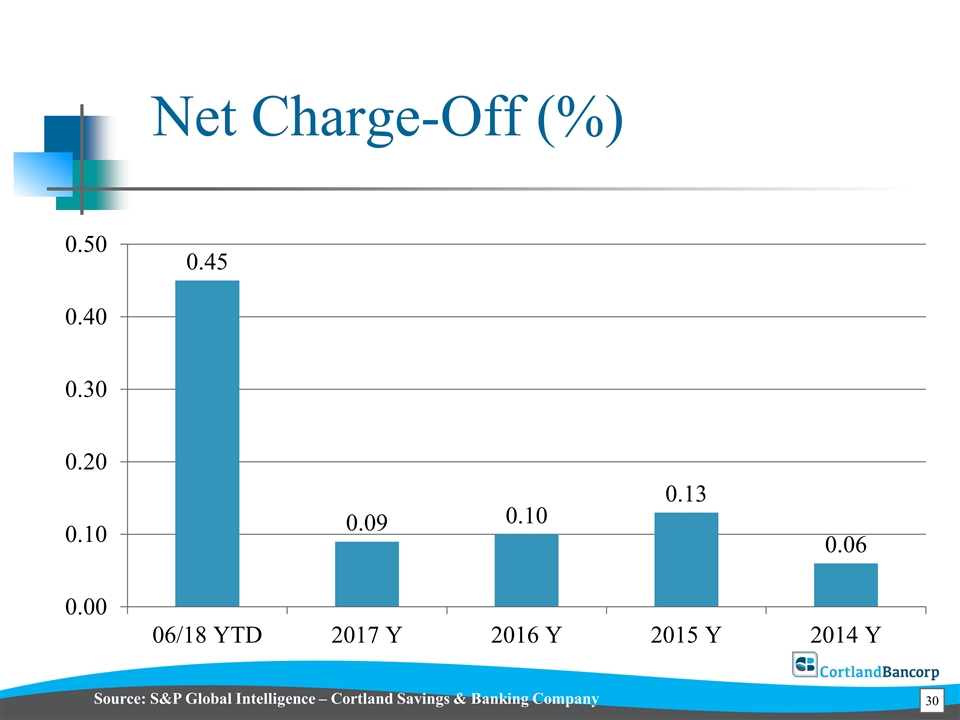

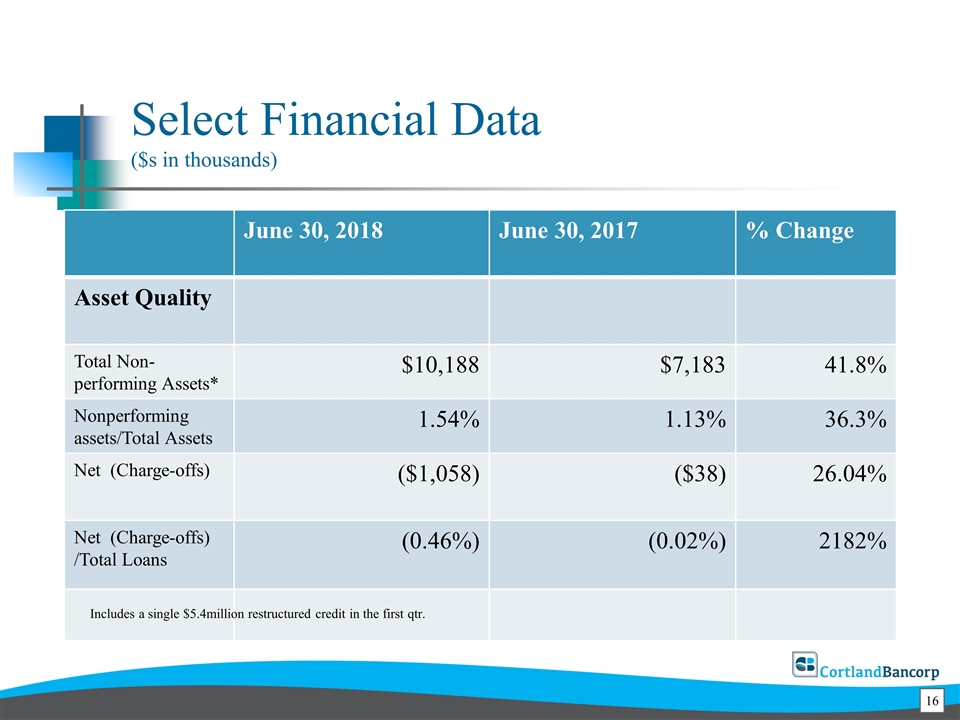

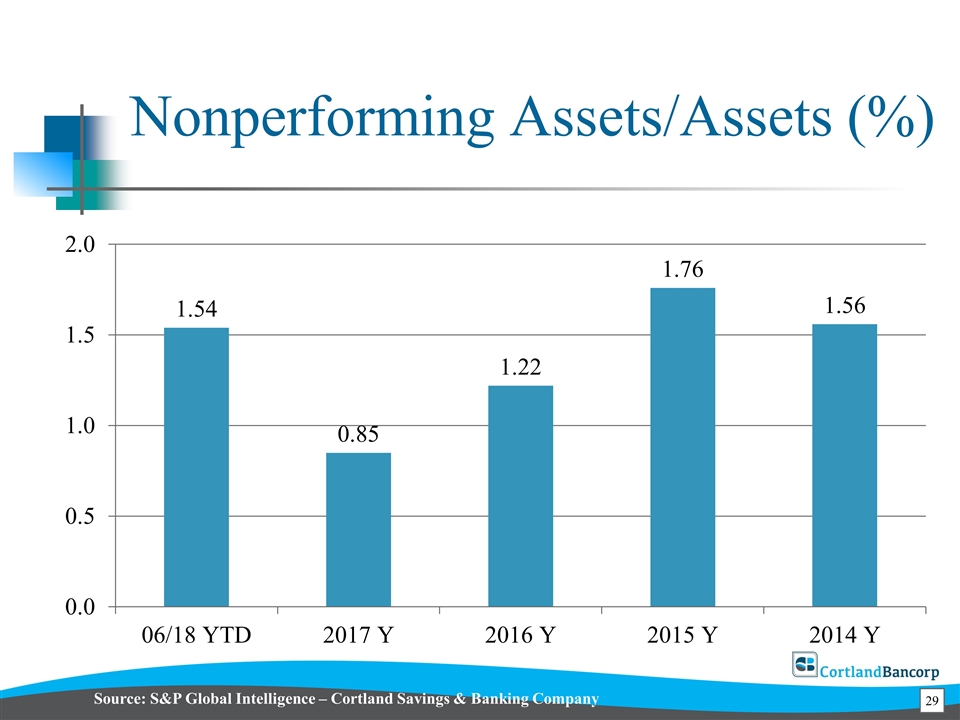

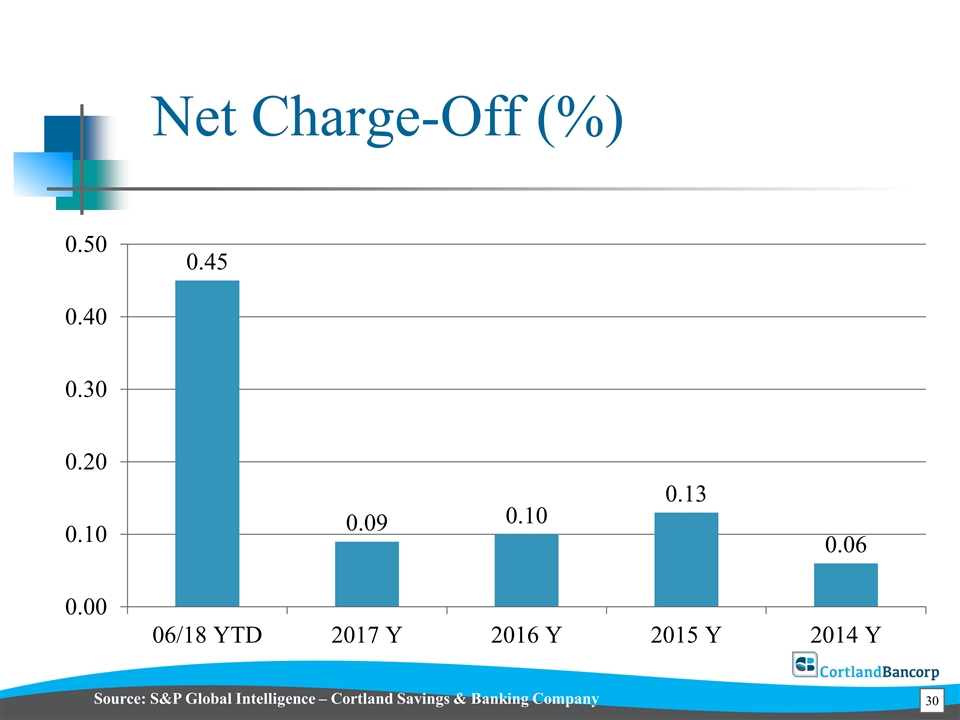

Select Financial Data ($s in thousands) June 30, 2018 June 30, 2017 % Change Asset Quality Total Non-performing Assets* $10,188 $7,183 41.8% Nonperforming assets/Total Assets 1.54% 1.13% 36.3% Net (Charge-offs) ($1,058) ($38) 26.04% Net (Charge-offs) /Total Loans (0.46%) (0.02%) 2182% Includes a single $5.4million restructured credit in the first qtr.

Balance Sheet Loan Composition Deposit Composition Balance Sheet Utilization: Loan/Deposit

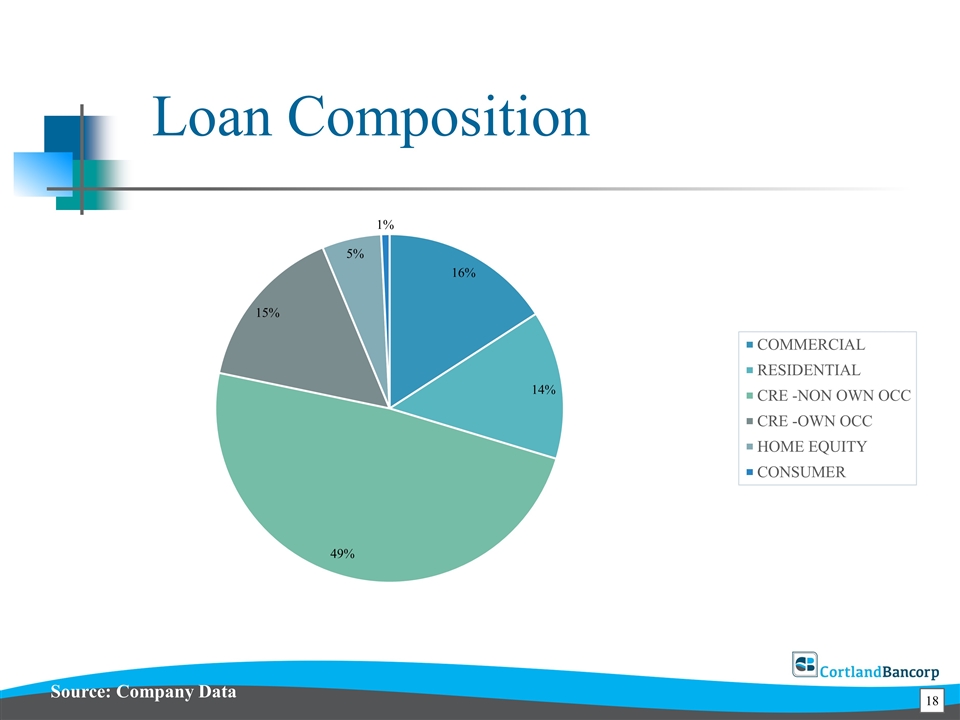

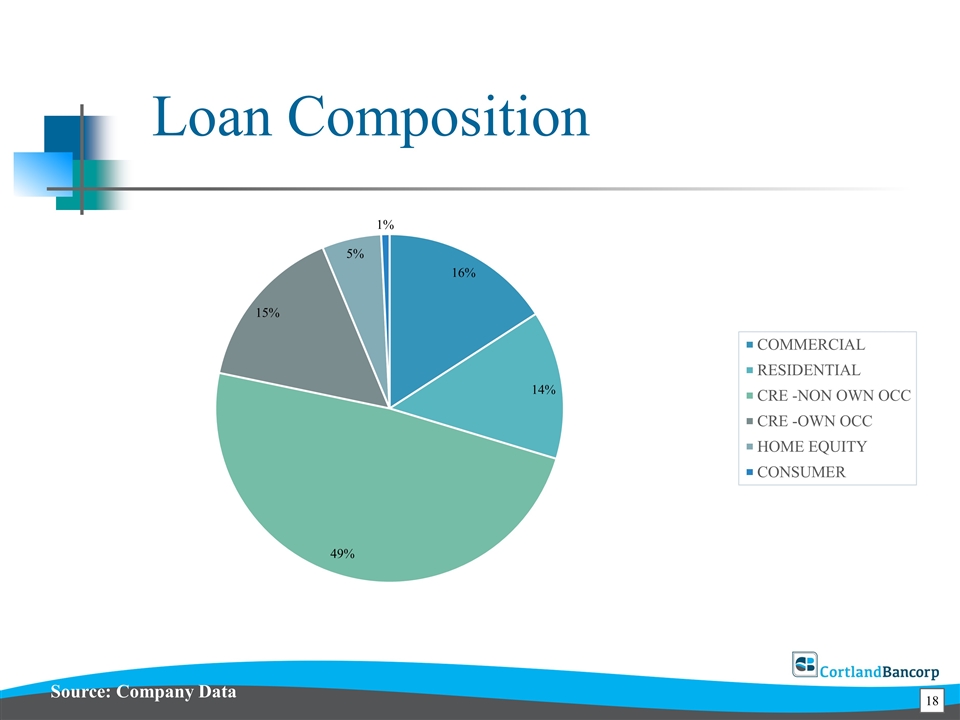

Loan Composition Source: Company Data

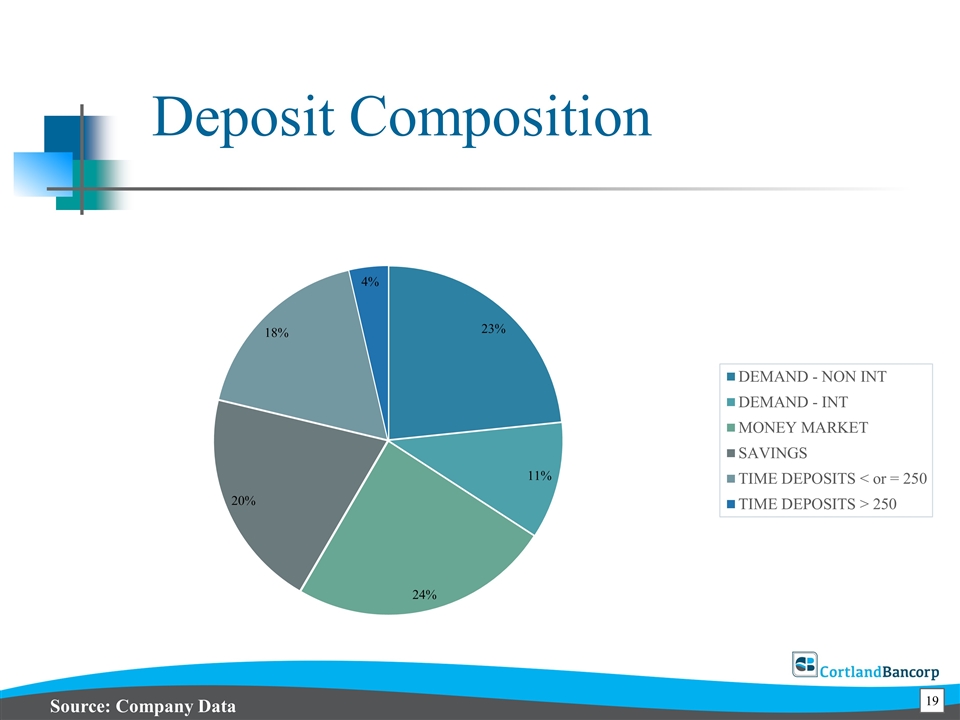

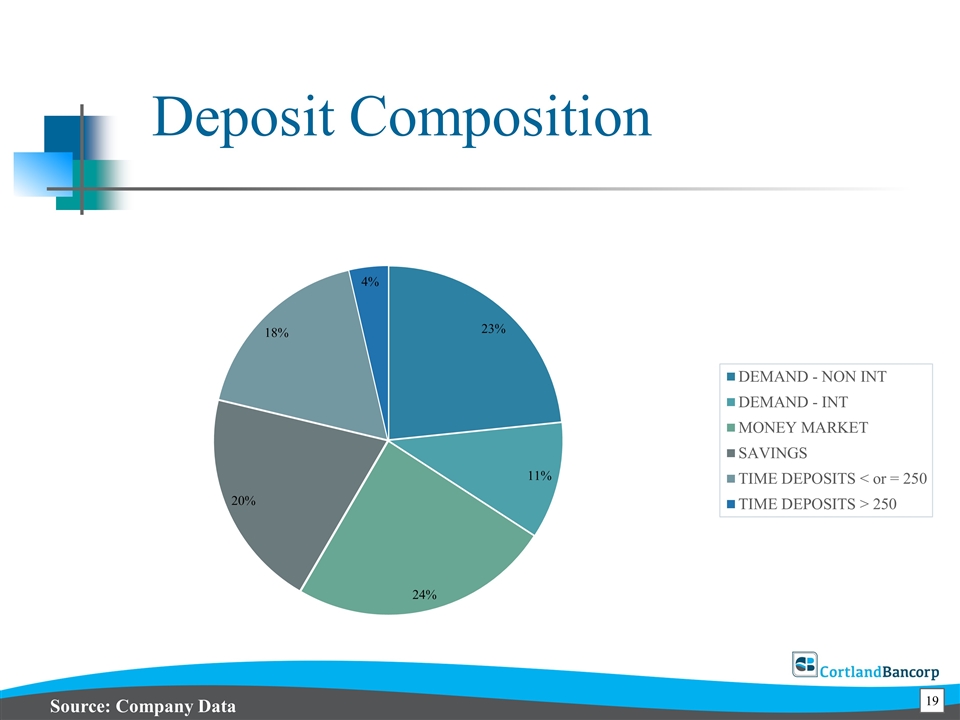

Deposit Composition Source: Company Data

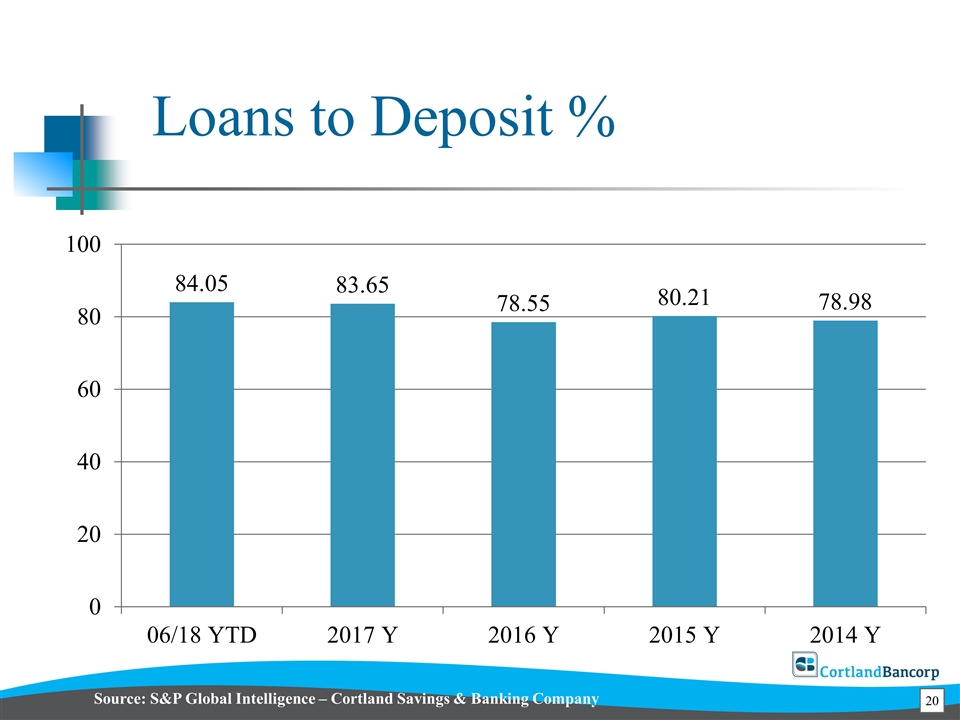

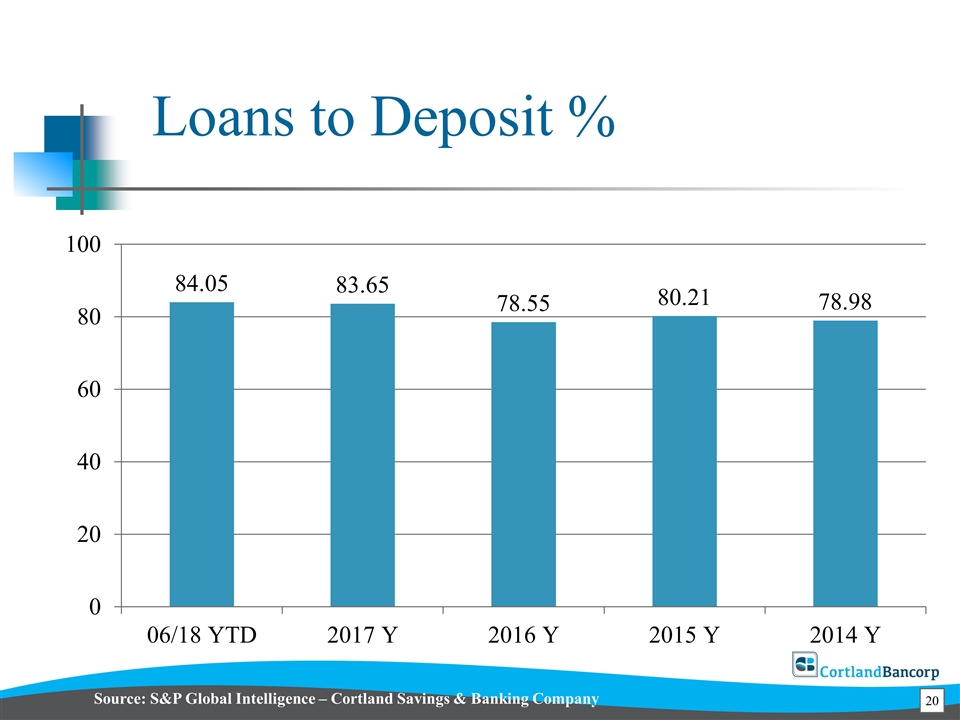

Loans to Deposit % Source: S&P Global Intelligence – Cortland Savings & Banking Company

Profitability and Earnings Net Interest Margin Operating Efficiency Core Operating Earnings ROAA ROAE

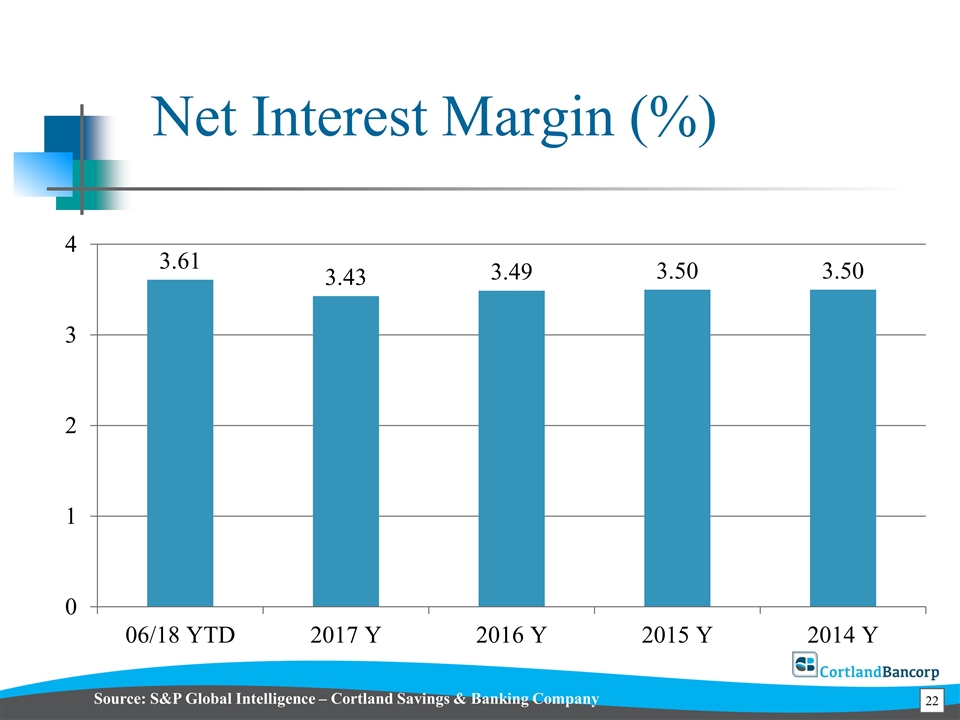

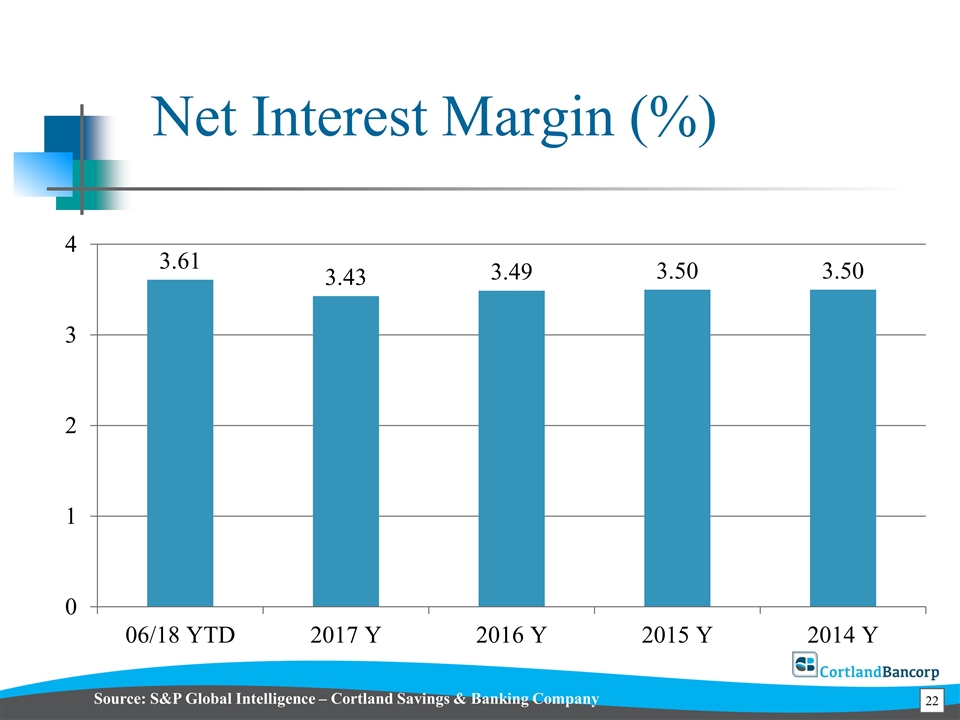

Net Interest Margin (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

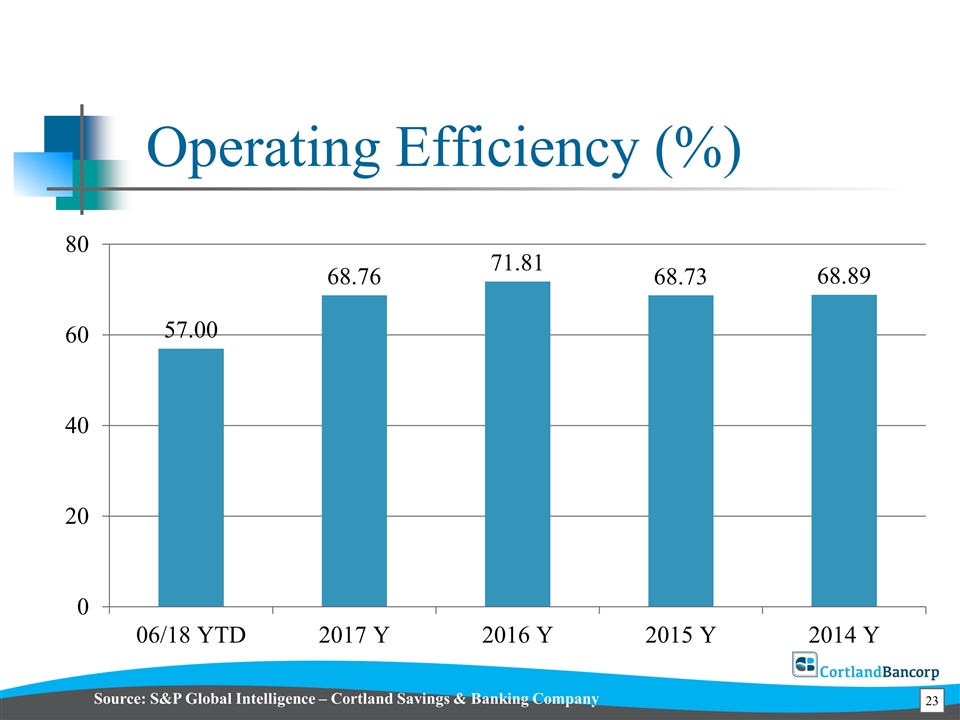

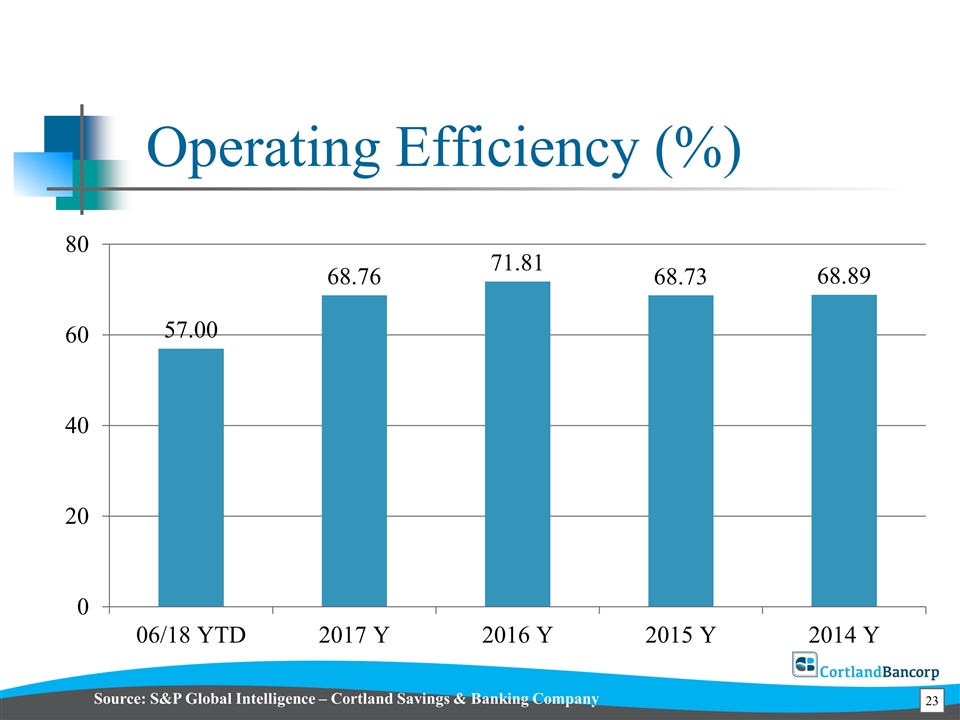

Operating Efficiency (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

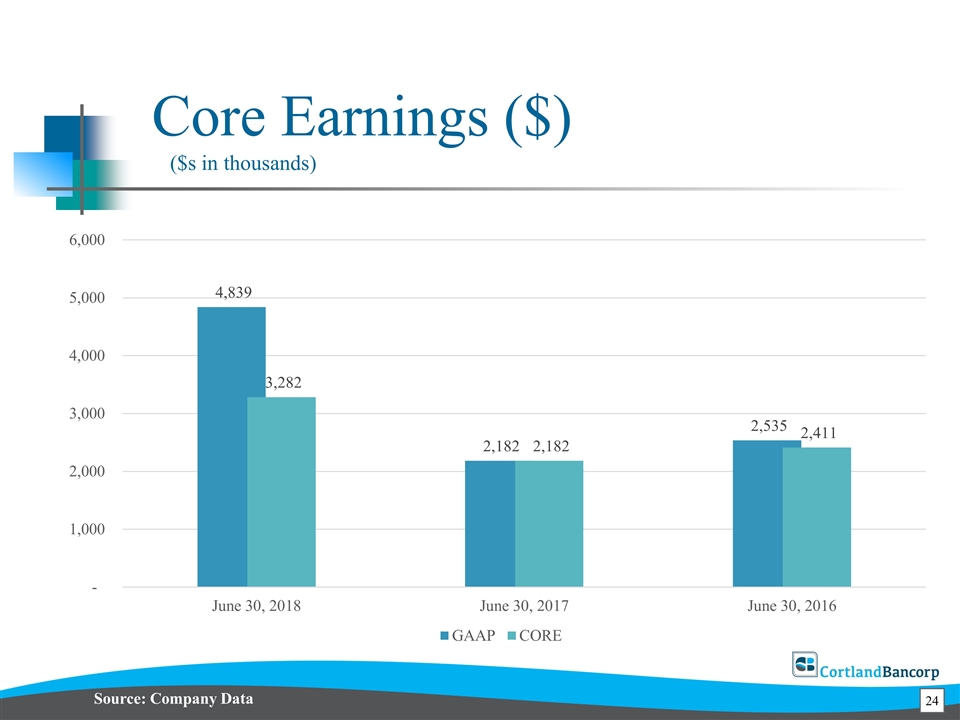

Core Earnings ($) Source: Company Data ($s in thousands)

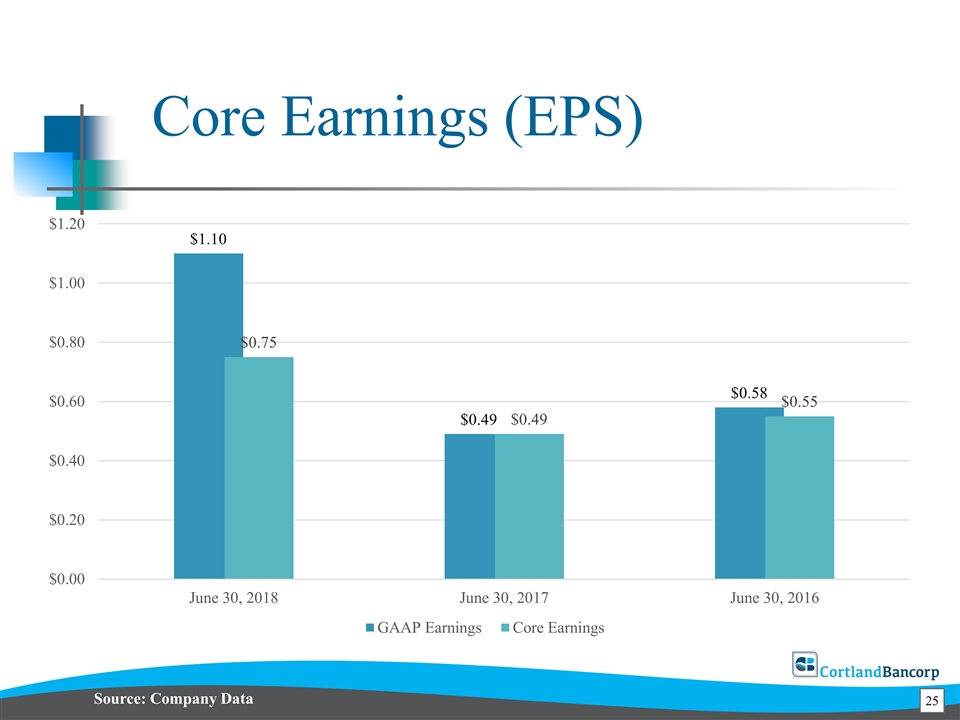

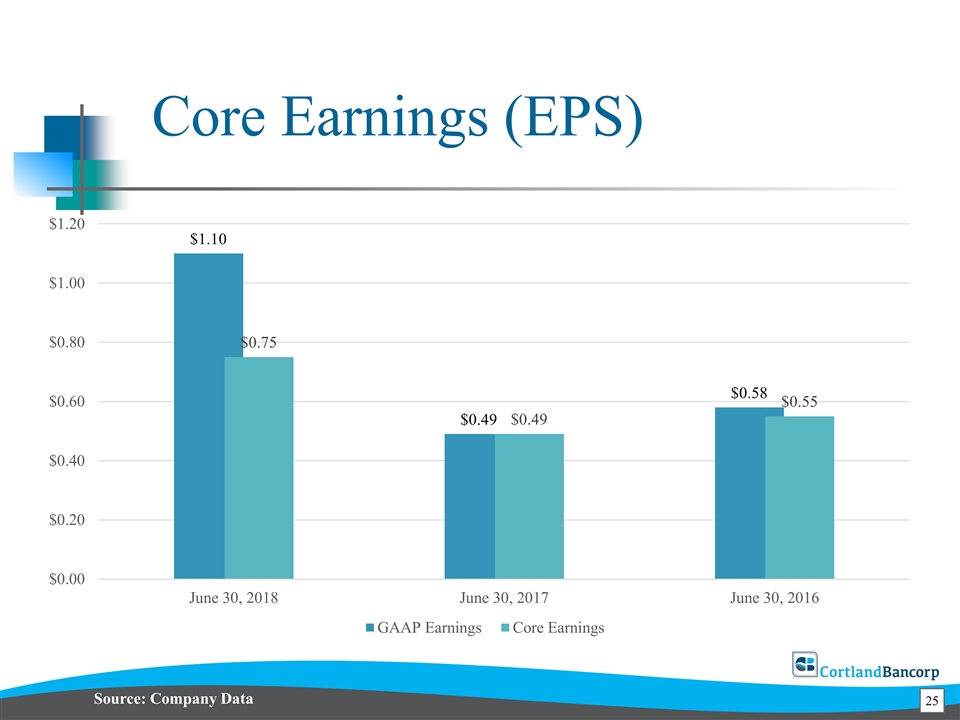

Core Earnings (EPS) Source: Company Data

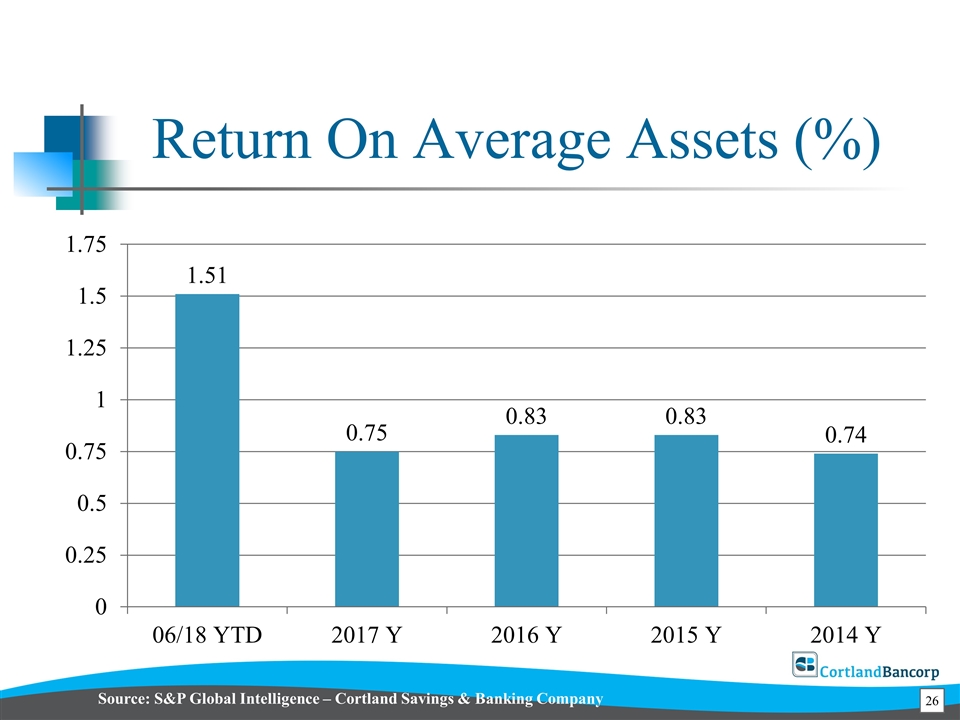

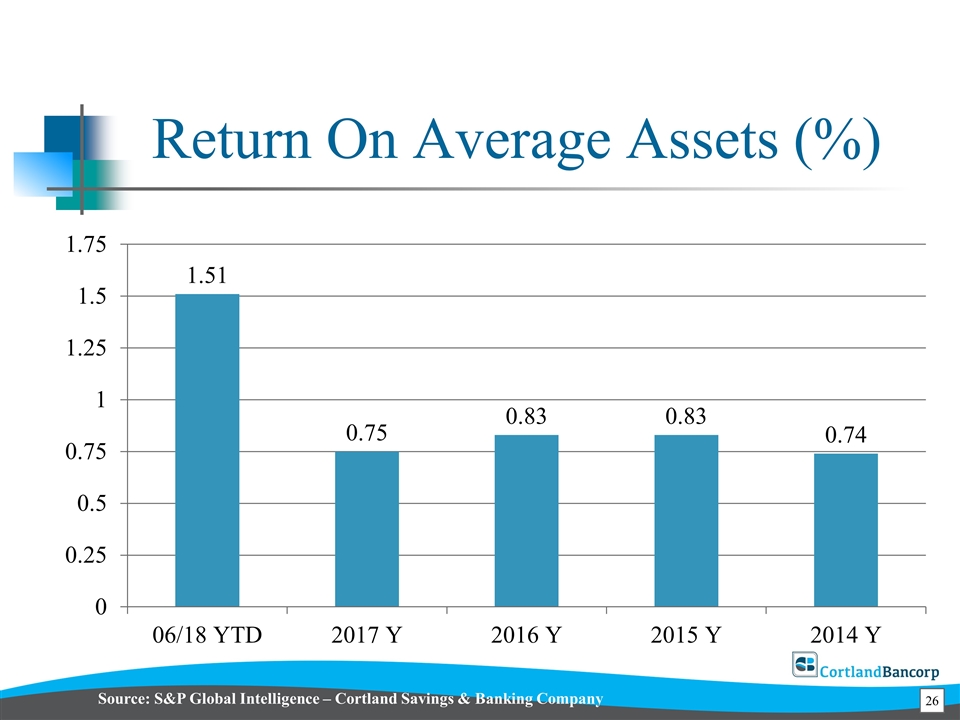

Return On Average Assets (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

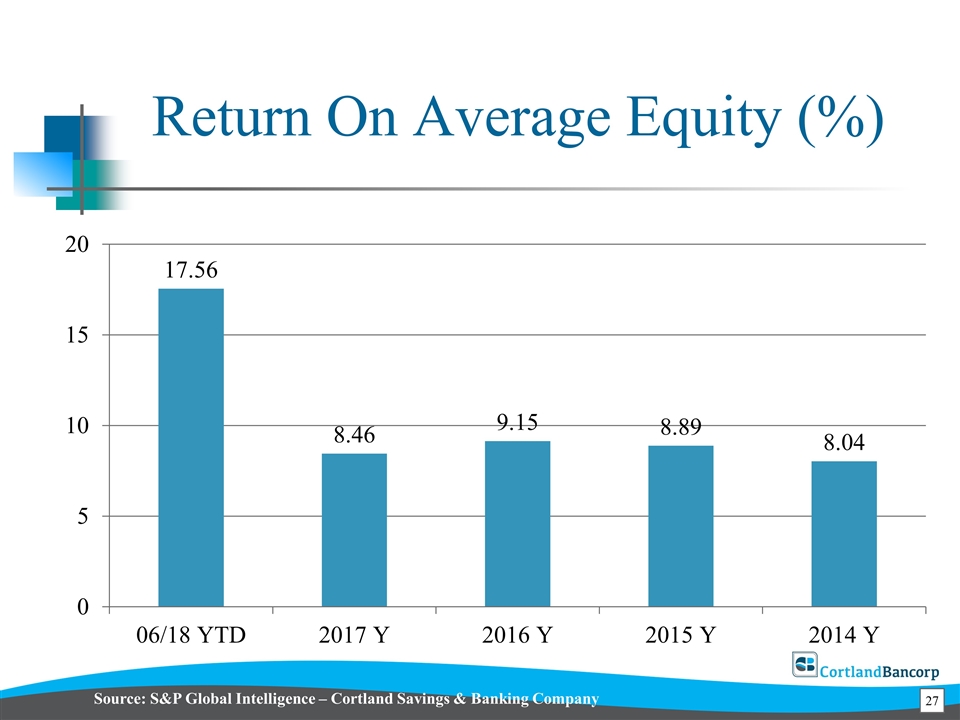

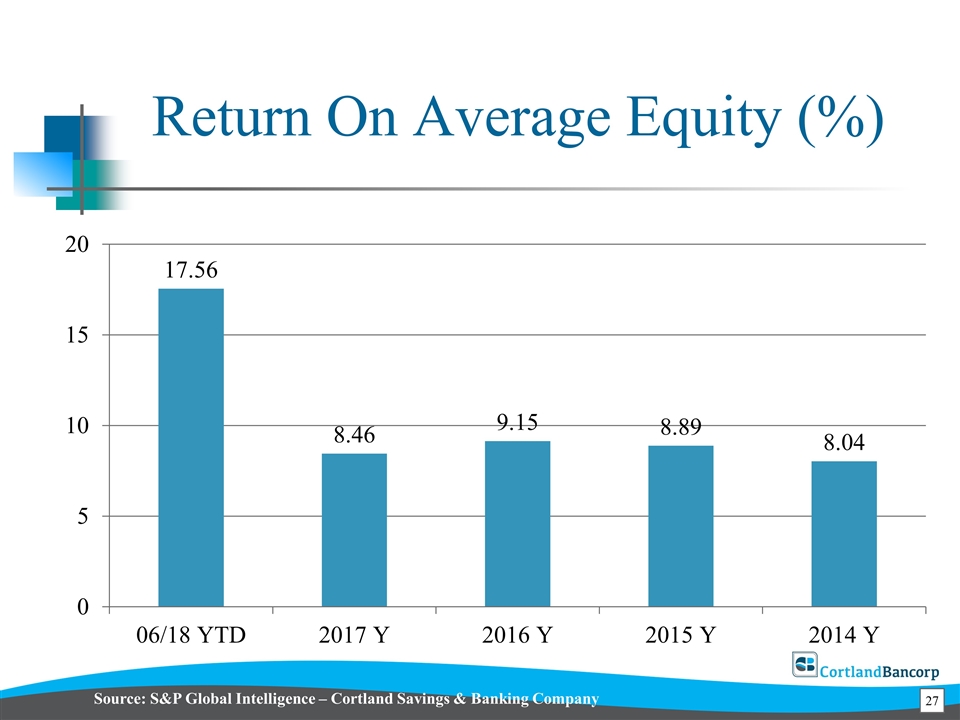

Return On Average Equity (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

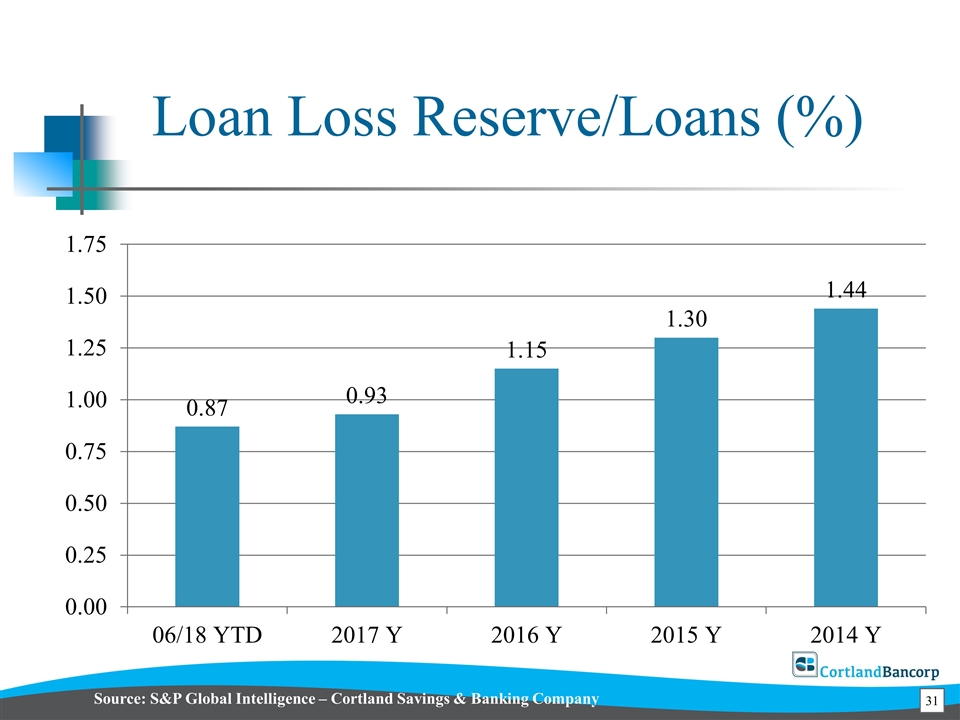

ASSET QUALITY Nonperforming Assets/Assets Net Charge-off (%) Loan Loss Reserve/Loans

Nonperforming Assets/Assets (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

Net Charge-Off (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

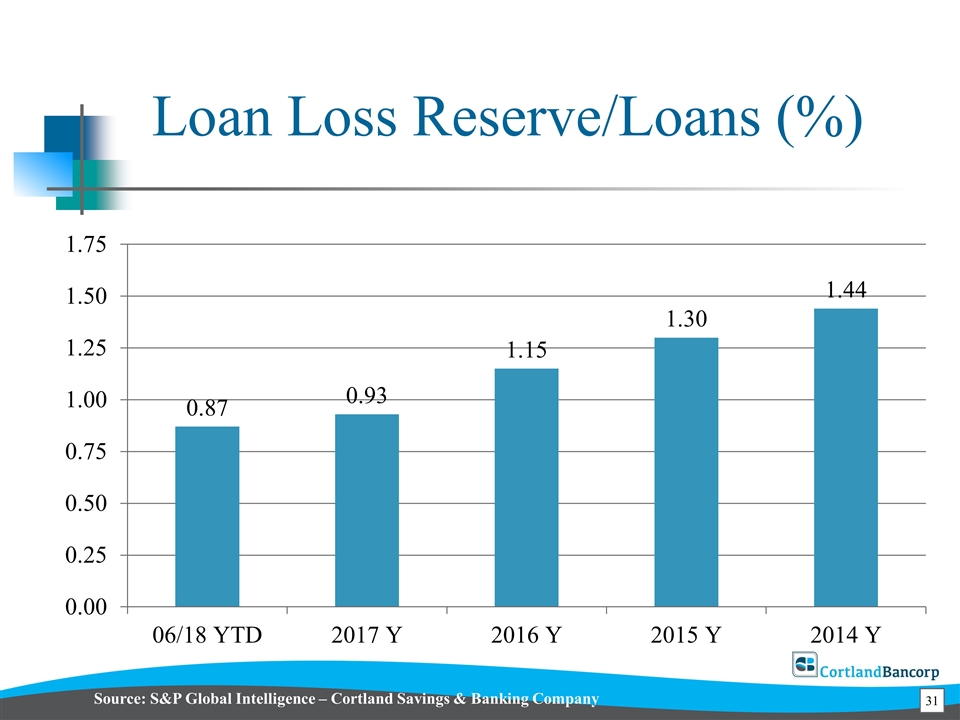

Loan Loss Reserve/Loans (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

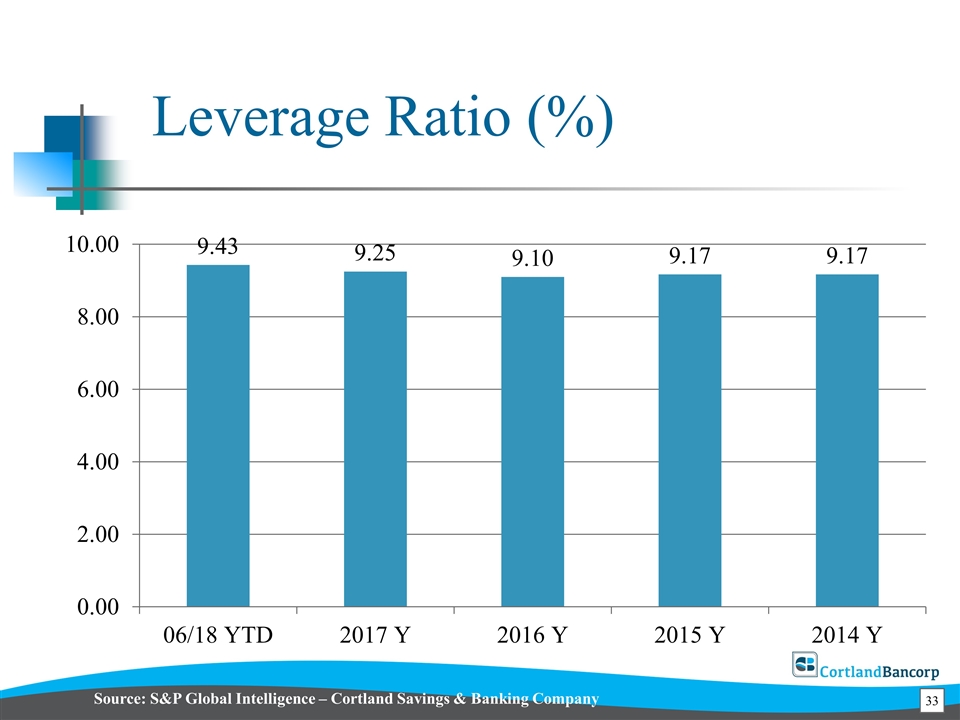

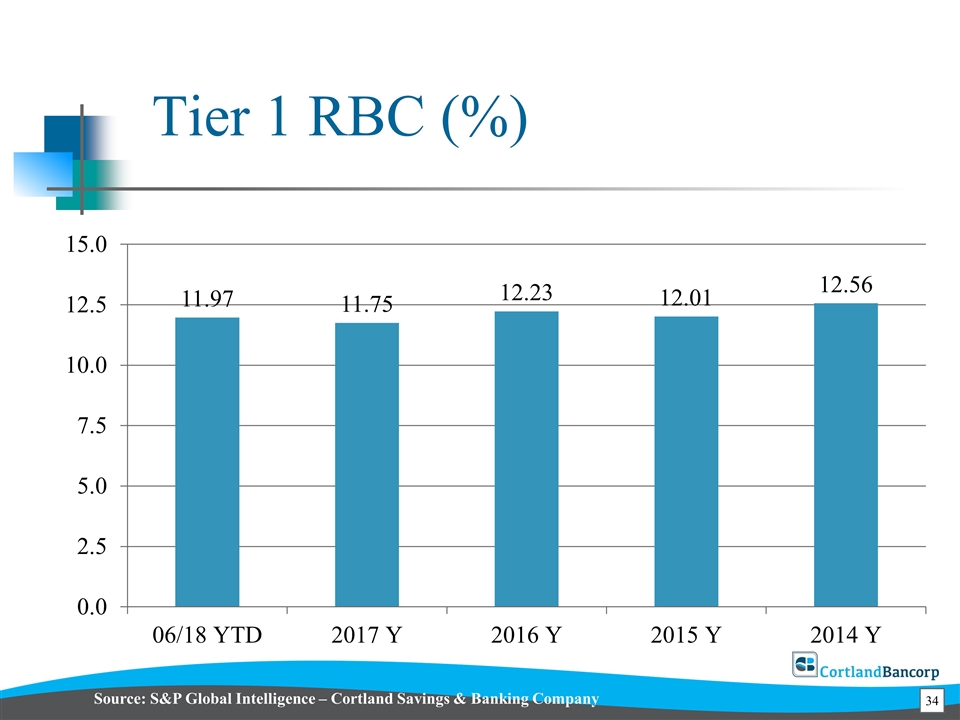

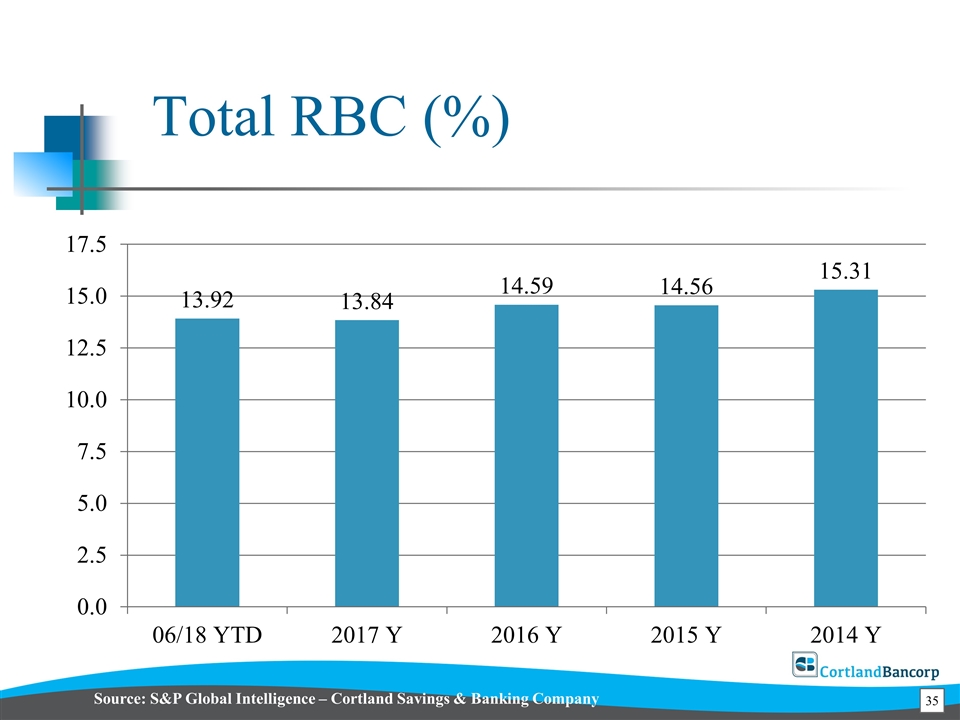

Capital Adequacy Leverage ratio Tier 1 Risk Based Capital Total Risk Based Capital

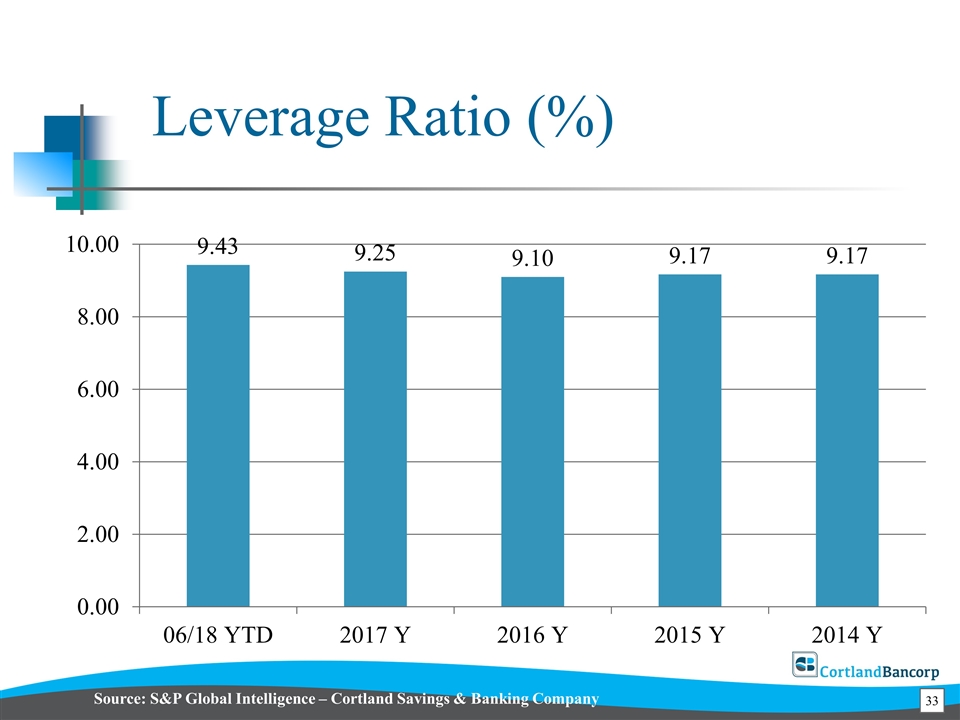

Leverage Ratio (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

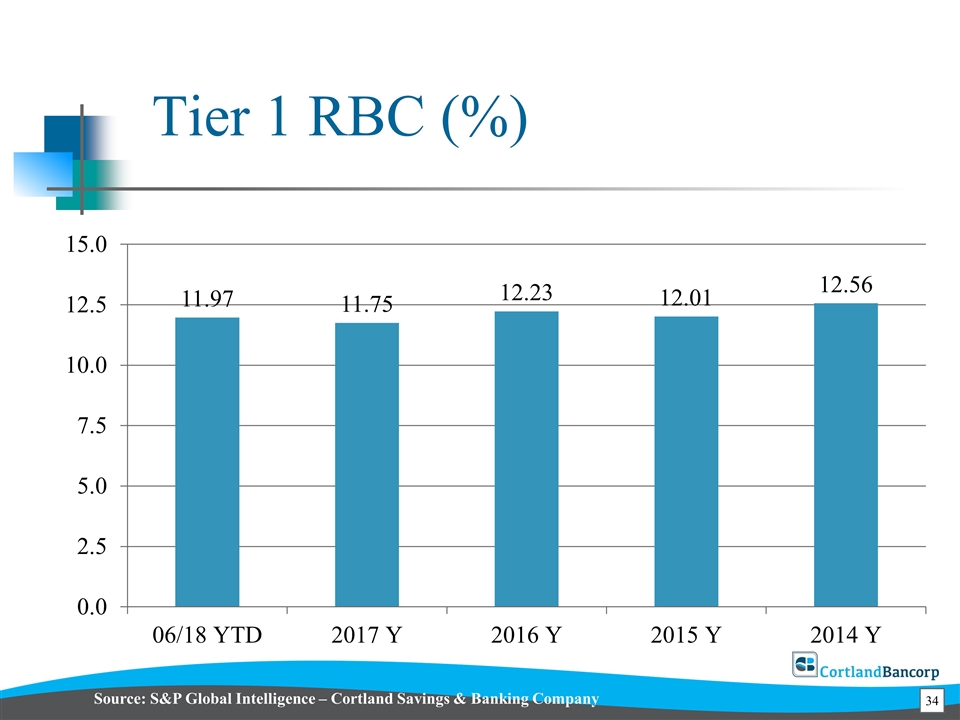

Tier 1 RBC (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

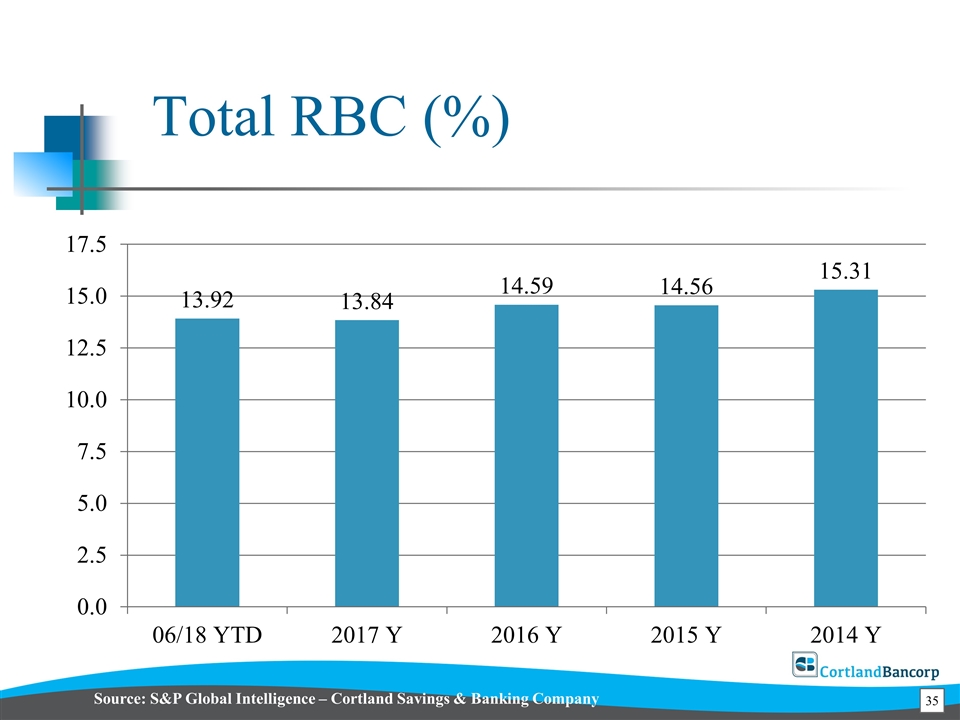

Total RBC (%) Source: S&P Global Intelligence – Cortland Savings & Banking Company

Shareholder Total Shareholder Return Shareholder Value Shareholder Benefits

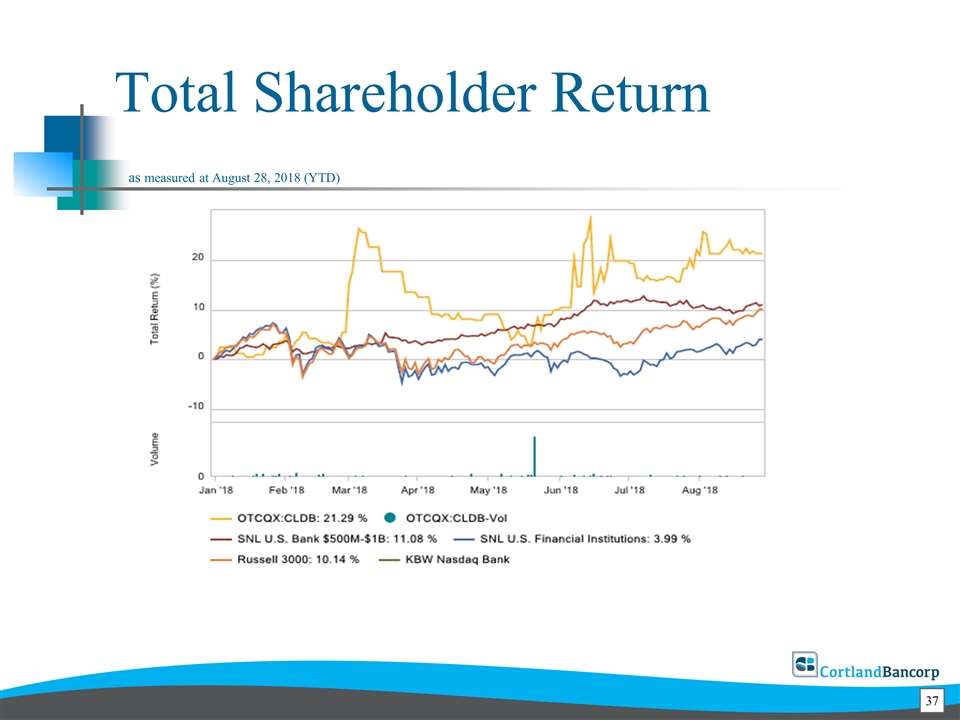

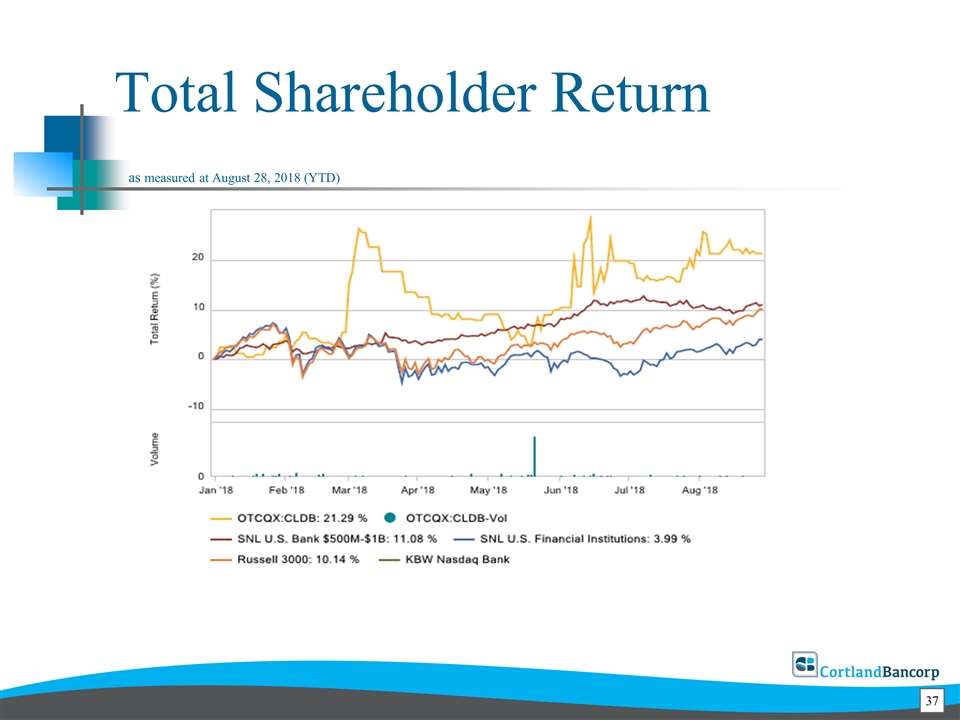

Total Shareholder Return as measured at August 28, 2018 (YTD)

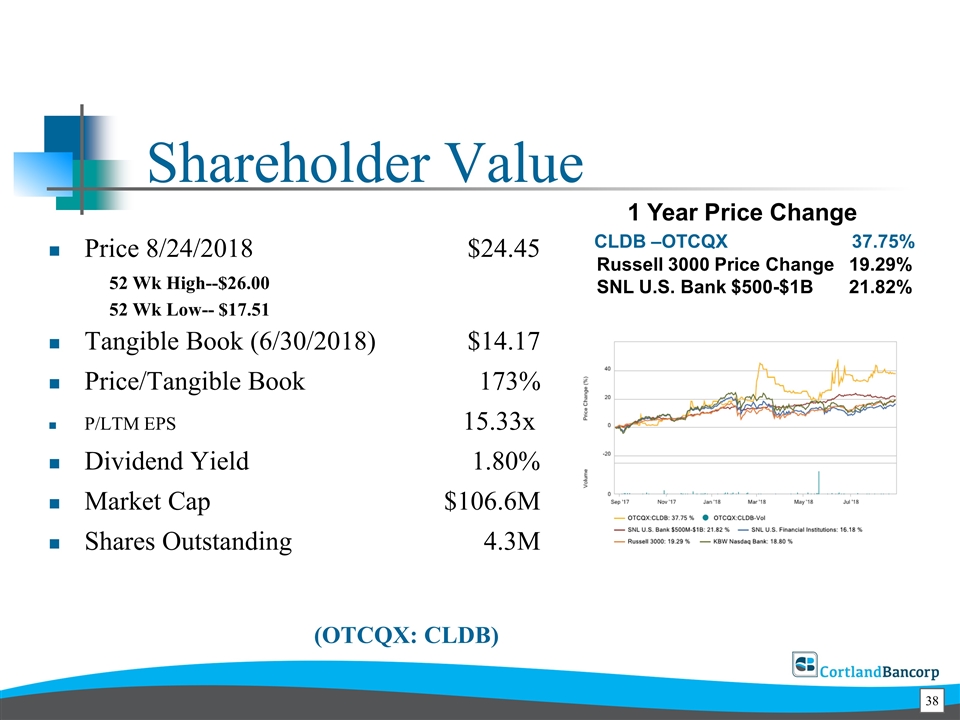

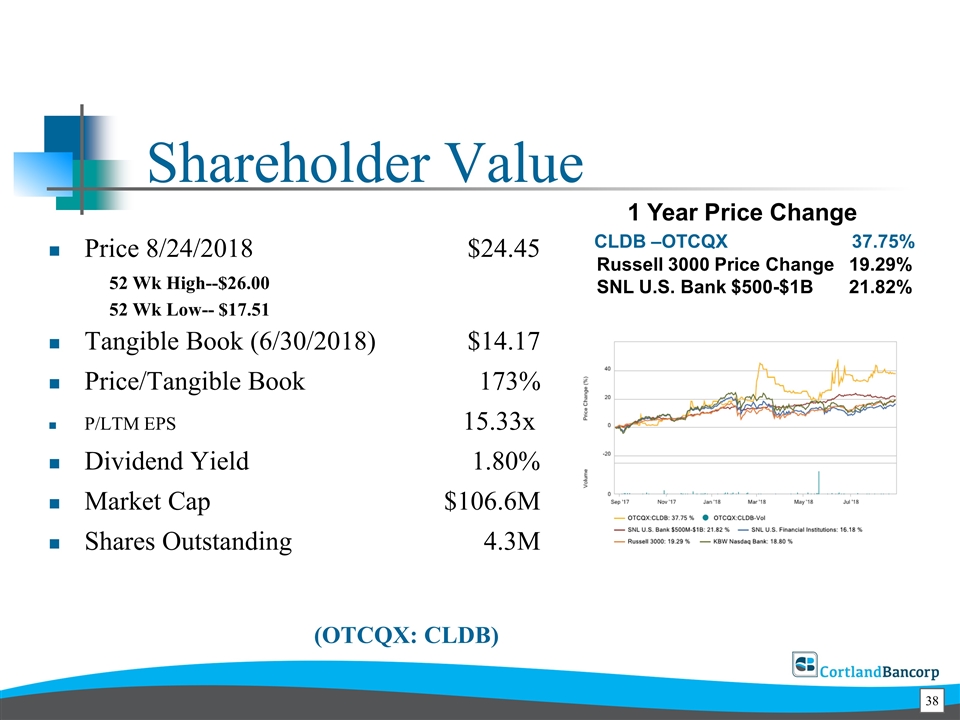

Price 8/24/2018 $24.45 52 Wk High--$26.00 52 Wk Low-- $17.51 Tangible Book (6/30/2018)$14.17 Price/Tangible Book 173% P/LTM EPS 15.33x Dividend Yield1.80% Market Cap$106.6M Shares Outstanding4.3M Shareholder Value CLDB –OTCQX 37.75% Russell 3000 Price Change 19.29% SNL U.S. Bank $500-$1B 21.82% 1 Year Price Change (OTCQX: CLDB)

Shareholder Benefits Competitive Dividend Yield (*) CLDB 1.80% Peer Ave. 2.4% Dividend Reinvestment Program offers convenient method for purchasing shares Supplemental cash contributions for the purchase of additional shares. Minimum supplemental investment of $100 per month up to $2,500 per month. Trade facilitation options available through Cortland share repurchase placement with market makers * Source: SNL Global Market Intelligence. Ohio Banks and Thrifts.

Commitment to Community Banking Directors have deep ties to the communities in which they live and work. Directors and Executives are typically stakeholders, aligning their interest with the interest of all shareholders. Company Insiders own 10% of CLDB shares. Community bankers offer nimble decision making on business loans because decisions are made locally. Decisions rest with officers and directors who are members of our communities.

Commitment to Community Banking Executives and Officers are leaders in community service The Company invests in the communities we serve American Heart Association Heart Walk United Way Day of Caring Junior Achievement at Lakeview Elementary

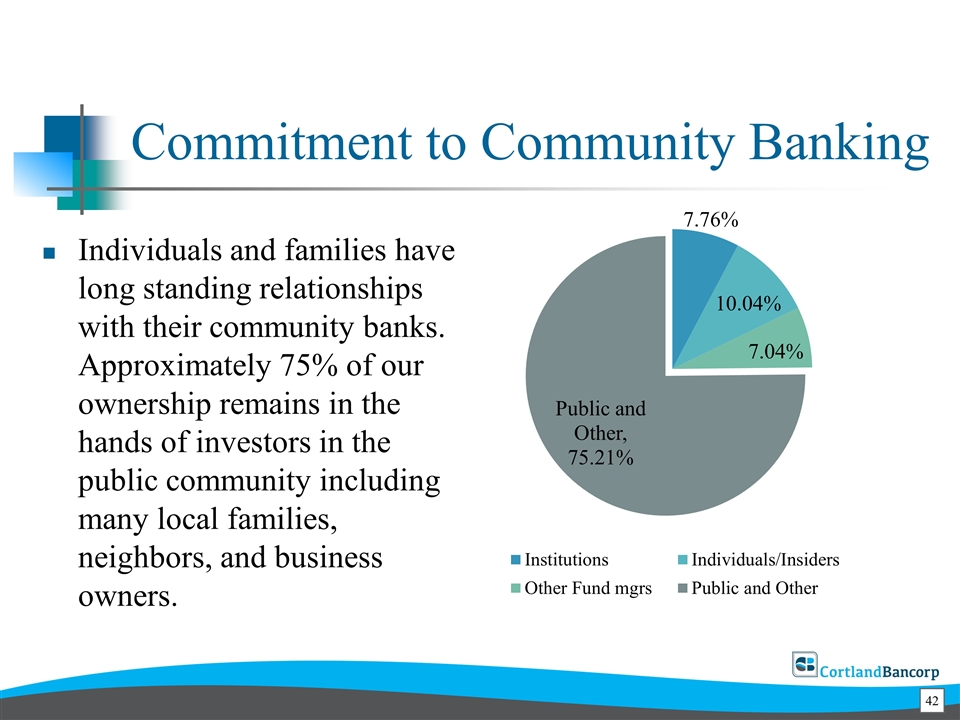

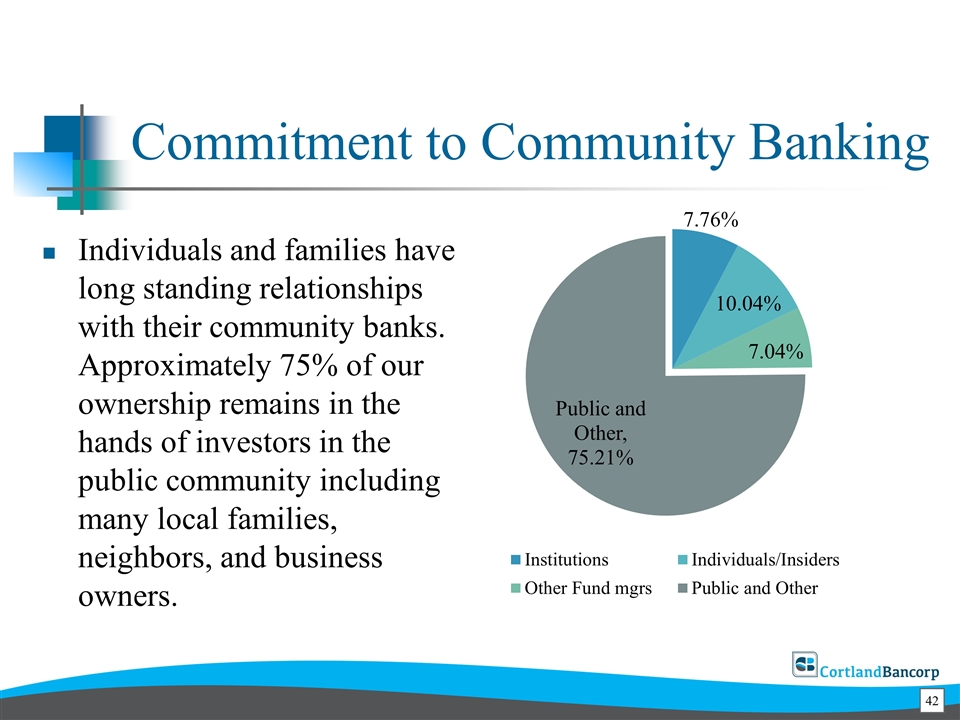

Commitment to Community Banking Individuals and families have long standing relationships with their community banks. Approximately 75% of our ownership remains in the hands of investors in the public community including many local families, neighbors, and business owners.

Questions????

We care about your security, Latest security updates. (OTCQX: CLDB) For more information, call us at 800.366.2334 or visit our website: www.cortlandbank.com/invest