Table of Contents

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive additional materials

¨ Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12

PepsiCo, Inc.

(Names of Registrant as Specified in Its Charters)

(Names of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| x | No fee required. | |||||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

(1) Title of each class of securities to which transaction applies: | ||||||

(2) Aggregate number of securities to which transaction applies: | ||||||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act | ||||||

Rule 0-11 (set forth the amount on which the filing fee calculated and state how it was determined): | ||||||

(4) Proposed maximum aggregate value of transaction: | ||||||

| (5) Total fee paid: | ||||||

| ¨ | Fee paid previously with preliminary materials. | |||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, the form or schedule and the date of its filing. | |||||

(1) Amount Previously Paid: | ||||||

(2) Form, Schedule or Registration Statement No.: | ||||||

(3) Filing Party: | ||||||

(4) Date Filed: | ||||||

Table of Contents

700 Anderson Hill Road

Purchase, New York 10577-1444

March 25, 2004

Dear Fellow PepsiCo Shareholder:

You are invited to attend our Annual Meeting of Shareholders on Wednesday, May 5, 2004, at 11:00 a.m. local time at the headquarters of Frito-Lay, Inc., 7701 Legacy Drive, Plano, Texas.

At the meeting, we will ask you to elect the Board of Directors, to ratify the appointment of independent auditors, to approve the 2004 Executive Incentive Compensation Plan, and to consider two shareholder proposals. We will also review the progress of the Company during the past year and answer your questions. The attached Proxy Statement describes the business we will conduct and provides information about the Company that you should consider when you vote your shares.

Cordially,

Steven S Reinemund

Table of Contents

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

PepsiCo will hold its Annual Meeting of Shareholders at the headquarters of Frito-Lay, Inc., 7701 Legacy Drive, Plano, Texas, on Wednesday,May 5, 2004, at11:00 a.m. local time, to:

| n | Elect the Board of Directors. |

| n | Ratify the appointment of independent auditors. |

| n | Approve the 2004 Executive Incentive Compensation Plan. |

| n | Act upon two shareholder proposals described in the attached Proxy Statement. |

| n | Transact any other business that may properly come before the Meeting. |

Holders of record of the Company’s Common and Convertible Preferred Stock as of the close of business on March 12, 2004 (the “Record Date”) will be entitled to vote at the Meeting.

Please refer to the General Information page in this Proxy Statement for additional information about the Annual Meeting and voting.

March 25, 2004

David R. Andrews

Secretary

Table of Contents

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Who can attend the Annual Meeting?

Only shareholders of record as of the close of business on March 12, 2004, their authorized representatives and guests will be able to attend the Annual Meeting. Admission will be by ticket only, and those attending the Annual Meeting must bring photo identification. Frito-Lay headquarters is accessible to disabled persons. Upon request, we will provide wireless headsets for hearing amplification.

How do I receive an admission ticket?

If you are a registered shareholder (your shares are held in your name) and plan to attend the Annual Meeting, you can obtain an admission ticket by checking the appropriate box on your enclosed proxy card or by contacting PepsiCo’s Manager of Shareholder Relations at (914) 253-3055. An admission ticket will then be sent to you.

If you are a beneficial owner (your shares are held in the name of a bank, broker or other holder of record) and plan to attend the Annual Meeting, you can obtain an admission ticket in advance by writing to Investor Relations, PepsiCo, Inc., 700 Anderson Hill Road, Purchase, NY 10577 or by contacting PepsiCo’s Manager of Shareholder Relations at (914) 253-3055. Please be sure to include proof of ownership, such as a bank or brokerage account statement. Shareholders who do not obtain tickets in advance may obtain them upon verification of their ownership at the registration desk on the day of the Annual Meeting.

How do I vote at the Annual Meeting?

If you wish to vote at the Annual Meeting, written ballots will be available from the ushers at the meeting. If your shares are held in the name of a bank, broker or other holder of record and you decide to attend and vote at the Annual Meeting, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the meeting. However, if you vote by proxy and also attend the meeting, there is no need to vote again at the Annual Meeting unless you wish to change your vote.

How do I vote if I am a registered shareholder and cannot attend the Annual Meeting?

All shareholders who are entitled to vote on the matters that come before the Annual Meeting have the opportunity to do so whether or not they attend the meeting in person. If you hold your shares through a bank, broker or other holder of record, please refer to the information provided by that entity for instructions on how to vote your shares. If you are a registered shareholder and are unable to attend the Annual Meeting, you can vote your shares by proxy in one of the following manners:

Via Internet at https://www.proxyvotenow.com/pep and following the instructions;

By Telephone at 1-866-358-4697 in the United States, Canada or Puerto Rico on a touch-tone phone and following the recorded instructions; or

By Mailby signing and returning the enclosed proxy card.

Choosing to vote via the Internet or calling the toll-free number listed on the proxy card will save the Company expense. Instructions for using these convenient services appear on the proxy card. You can also vote your shares by marking your votes on the proxy card, signing and dating it and mailing it promptly using the envelope provided. Proxy votes are tabulated by an independent agent and reported at the Annual Meeting.

Can I Revoke My Proxy?

You may revoke your proxy by casting a ballot at the Annual Meeting. Any proxy not revoked will be voted as specified on your proxy card. If you return your proxy and no vote is specified (and you do not withhold authority for a nominee or you do not indicate that you abstain), your proxy will be voted in accordance with the Board of Directors’ recommendations.

i

Table of Contents

Can Employees Who Participate in PepsiCo’s 401(k) Plan Vote?

Participants can vote shares held in PepsiCo’s 401(k) plan (a portion of which constitutes an Employee Stock Ownership Plan (the “ESOP”)). To do so, the participant must sign and return a proxy card. If cards representing shares held in the 401(k) plan are not returned, the trustees will not vote those shares for which signed cards are not returned, unless required by law.

What Constitutes a Quorum at the Annual Meeting?

Under North Carolina law and the Company’s By-laws, the presence in person or by proxy of the holders of record of a majority of the votes entitled to be cast constitutes a quorum. Abstentions and broker non-votes are counted as present to determine whether a quorum exists at the meeting.

How are Votes Counted?

Election of Directors. Under North Carolina law and the Company By-laws, the nominees for directors who receive a majority of all the votes cast shall be elected to the Board of Directors.

Ratification of Independent Auditors.Under North Carolina law and the Company By-laws, ratification of the appointment of the independent auditors will be approved if a majority of all the votes cast are in favor of ratification.

2004 Executive Incentive Compensation Plan.Under North Carolina law and the Company By-laws, the 2004 Executive Incentive Compensation Plan will be approved if a majority of all the votes cast are in favor of the plan.

Shareholder Proposals.For each of the shareholder proposals, the affirmative vote of a majority of the votes cast is required for adoption of each resolution.

Note on Abstentions. If you abstain from voting on a particular matter, your vote will not be treated as present and, therefore, will not be treated as cast either for or against that proposal.

Note on “Broker Non-Votes.”The rules of the New York Stock Exchange determine whether a broker may cast votes related to shares held by the broker for the benefit of the actual owner where the broker does not receive specific voting instructions from the actual owner. On routine matters, such as the Election of Directors, Ratification of Independent Auditors and the 2004 Executive Incentive Compensation Plan, brokers may cast a vote on such shares. On nonroutine matters, such as the Shareholder Proposals, brokers may not vote such shares and these “broker non-votes” will not be treated as present.

Are My Votes Confidential?

PepsiCo’s policy is that proxies identifying individual shareholders are private except as necessary to determine compliance with law or assert or defend legal claims. Proxies may also not be kept confidential in a contested proxy solicitation or in the event that a shareholder makes a written comment on a proxy card or an attachment to it. PepsiCo retains an independent organization to tabulate shareholder votes and certify voting results. The tabulating agent maintains the confidentiality of the proxies throughout the process.

ii

Table of Contents

PepsiCo, Inc.

700 Anderson Hill Road

Purchase, New York 10577-1444

www.pepsico.com

March 25, 2004

PROXY STATEMENT

The Board of Directors of PepsiCo, Inc. (“PepsiCo” or the “Company”) is soliciting proxies to be voted at the Annual Meeting of Shareholders to be held on Wednesday, May 5, 2004, and at any adjournment of the Meeting. We are sending this Proxy Statement in connection with the proxy solicitation.

PepsiCo’s authorized stock includes both Common Stock and Convertible Preferred Stock. As of March 12, 2004, the record date, there were 1,711,296,430 shares of PepsiCo Common Stock outstanding and entitled to one vote each at the Annual Meeting and 501,253 shares of PepsiCo Convertible Preferred Stock outstanding and entitled to 2,487,468 votes at the Annual Meeting, which number is equal to the number of shares of Common Stock into which such shares of Convertible Preferred Stock could be converted on the record date, rounded to the nearest one-tenth. Holders of the Common Stock and the Convertible Preferred Stock vote together on all matters as a single class. The outstanding shares of Common Stock were registered in the names of 211,875 shareholders and the outstanding shares of Convertible Preferred Stock were registered in the names of 3,704 shareholders. As far as we know, no person owns beneficially more than 5% of the outstanding Common or Convertible Preferred Stock.

PepsiCo is making its first mailing of this Proxy Statement on or about March 25, 2004.

| Page | ||

| 2 | ||

Ownership of PepsiCo Common Stock by Directors and Executive Officers | 5 | |

| 6 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 15 | ||

| 16 | ||

Aggregated Option Exercises in Last Fiscal Year and FY-End Option Values | 16 | |

| 17 | ||

| 18 | ||

| 19 | ||

| 19 | ||

Table of Contents

| Page | ||

| 20 | ||

| PROXY ITEM NO. 3 - APPROVAL OF THE 2004 EXECUTIVE INCENTIVE COMPENSATION PLAN | 20 | |

| 22 | ||

| 22 | ||

| 23 | ||

| 25 | ||

| 25 | ||

| 25 | ||

Exhibits | ||

| A-1 | ||

| B-1 | ||

| C-1 | ||

| D-1 | ||

ELECTION OF DIRECTORS (PROXY ITEM NO. 1)

The Board of Directors proposes the following thirteen nominees for election as directors at the Annual Meeting. The directors will hold office from election until the next Annual Meeting of Shareholders, or until their successors are elected and qualified. If any of these nominees for director becomes unavailable, the persons named in the enclosed proxy intend to vote for any alternate designated by the current Board of Directors.

| JOHN F. AKERS, 69, former Chairman of the Board and Chief Executive Officer of International Business Machines Corporation, has been a member of PepsiCo’s Board since 1991 and is Chairman of its Compensation Committee. Mr. Akers joined IBM in 1960 and was Chairman and Chief Executive Officer from 1986 until 1993. He is also a director of Hallmark Cards, Inc., Lehman Brothers Holdings, Inc., The New York Times Company, and W.R. Grace & Co. | |

| ROBERT E. ALLEN, 69, former Chairman of the Board and Chief Executive Officer of AT&T Corp., has been a member of PepsiCo’s Board since 1990 and is Chairman of its Nominating and Corporate Governance Committee. He began his career at AT&T in 1957 when he joined Indiana Bell. He was elected President and Chief Operating Officer of AT&T in 1986, and was Chairman and Chief Executive Officer from 1988 until 1997. He is also a director of Bristol-Myers Squibb Company and WhisperWire, and a Trustee of The Mayo Foundation and Wabash College.

| |

| RAY L. HUNT, 60, Chairman and Chief Executive Officer of Hunt Oil Company and Chairman, Chief Executive Officer and President, Hunt Consolidated, Inc., was elected to PepsiCo’s Board in 1996. Mr. Hunt began his association with Hunt Oil Company in 1958 and has held his current position since 1976. He is also a director of Halliburton Company, Electronic Data Systems Corporation, King Ranch, Inc., Verde Group, LLC and Chairman of the Board of Directors of the Federal Reserve Bank of Dallas. | |

2

Table of Contents

| ARTHUR C. MARTINEZ, 64, former Chairman of the Board, President and Chief Executive Officer of Sears, Roebuck and Co., was elected to PepsiCo’s Board in 1999. Mr. Martinez was Chairman and Chief Executive Officer of the former Sears Merchandise Group from 1992 to 1995 and served as Chairman of the Board, President and Chief Executive Officer of Sears, Roebuck and Co. from 1995 until 2000. He served as Vice Chairman and a director of Saks Fifth Avenue from 1990 to 1992. He is also a director of Liz Claiborne, Inc., International Flavors and Fragrances, Inc. and Martha Stewart Living Omnimedia, Inc. Mr. Martinez is a member of the Supervisory Board of ABN AMRO Holding, N.V.

| |

| INDRA K. NOOYI, 48, was elected to PepsiCo’s Board and became President and Chief Financial Officer in May 2001, after serving as Senior Vice President and Chief Financial Officer since February 2000. Ms. Nooyi also served as Senior Vice President, Strategic Planning and Senior Vice President, Corporate Strategy and Development from 1994 until 2000. Prior to joining PepsiCo, Ms. Nooyi spent four years as Senior Vice President of Strategy, Planning and Strategic Marketing for Asea Brown Boveri, Inc. She was also Vice President and Director of Corporate Strategy and Planning at Motorola, Inc. Ms. Nooyi is also a director of Motorola, Inc.

| |

| FRANKLIN D. RAINES, 55, was elected to PepsiCo’s Board in 1999, and is Chairman of its Audit Committee. Mr. Raines has been Chairman of the Board and Chief Executive Officer of Fannie Mae since January 1999. He was Director of the U.S. Office of Management and Budget from 1996 to 1998. From 1991 to 1996, he was Vice Chairman of Fannie Mae and in 1998 he became Chairman and CEO-Designate. Prior to joining Fannie Mae, Mr. Raines was a general partner at Lazard Freres & Co., an investment banking firm. Mr. Raines is also a director of Time Warner Inc. and Pfizer Inc.

| |

| STEVEN S REINEMUND, 55, has been PepsiCo’s Chairman and Chief Executive Officer since May 2001. He was elected a director of PepsiCo in 1996 and before assuming his current position, served as President and Chief Operating Officer from September 1999 until May 2001. Mr. Reinemund began his career with PepsiCo in 1984 as a senior operating officer of Pizza Hut, Inc. He became President and Chief Executive Officer of Pizza Hut in 1986, and President and Chief Executive Officer of Pizza Hut Worldwide in 1991. In 1992, Mr. Reinemund became President and Chief Executive Officer of Frito-Lay, Inc., and Chairman and Chief Executive Officer of the Frito-Lay Company in 1996. Mr. Reinemund is also a director of Johnson & Johnson.

| |

| SHARON PERCY ROCKEFELLER, 59, was elected a director of PepsiCo in 1986. She is President and Chief Executive Officer of WETA public stations in Washington, D.C., a position she has held since 1989, and was a member of the Board of Directors of WETA from 1985 to 1989. She is a member of the Board of Directors of Public Broadcasting Service, Washington, D.C. and was a member of the Board of Directors of the Corporation for Public Broadcasting until 1992. Mrs. Rockefeller is also a director of Sotheby’s Holdings, Inc.

| |

3

Table of Contents

| JAMES J. SCHIRO, 58, was elected to PepsiCo’s Board in January 2003. Mr. Schiro became Chief Executive Officer of Zurich Financial Services in May 2002, after serving as Chief Operating Officer – Group Finance since March 2002. He joined Price Waterhouse in 1967, where he held various management positions. In 1994 he was elected Chairman and senior partner of Price Waterhouse, and in 1998 became Chief Executive Officer of PricewaterhouseCoopers, after the merger of Price Waterhouse and Coopers & Lybrand. | |

| FRANKLIN A. THOMAS, 69, was elected to PepsiCo’s Board in 1994. From 1967 to 1977, he was President and Chief Executive Officer of the Bedford-Stuyvesant Restoration Corporation. From 1977 to 1979 Mr. Thomas had a private law practice in New York City. Mr. Thomas was President of the Ford Foundation from 1979 to April 1996 and is currently a consultant to the TFF Study Group, a non-profit organization assisting development in southern Africa. He is also a director of ALCOA Inc., Citigroup Inc., Cummins, Inc. and Lucent Technologies. | |

| CYNTHIA M. TRUDELL, 50, President of Sea Ray Group since 2001, was elected to PepsiCo’s Board in January 2000. From 1999 until 2001, Ms. Trudell served as General Motors’ Vice President, and Chairman and President of Saturn Corporation, a wholly owned subsidiary of GM. Ms. Trudell began her career with the Ford Motor Co. as a chemical process engineer. In 1981, she joined GM and held various engineering and manufacturing supervisory positions. In 1995, she became plant manager at GM’s Wilmington Assembly Center in Delaware. In 1996, she became President of IBC Vehicles in Luton, England, a joint venture between General Motors and Isuzu.

| |

| SOLOMON D. TRUJILLO, 52, Chief Executive Officer of Orange SA since March 2003, was elected to PepsiCo’s Board in January 2000. Previously, Mr. Trujillo was Chairman, Chief Executive Officer and President of Graviton, Inc. from November 2000, Chairman of US WEST from May 1999, and President and Chief Executive Officer of US WEST beginning in 1998. He served as President and Chief Executive Officer of US WEST Communications Group and Executive Vice President of US WEST from 1995 until 1998 and President and Chief Executive Officer of US WEST Dex, Inc. from 1992 to 1995. Mr. Trujillo is also a director of Gannett Company, Inc., Orange SA and Target Corporation.

| |

| DANIEL VASELLA, 50, was elected to PepsiCo’s Board in February 2002. Dr. Vasella became Chairman of the Board and Chief Executive Officer of Novartis AG in 1999, after serving as President since 1996. From 1992 to 1996, Dr. Vasella held the positions of Chief Executive Officer, Chief Operating Officer, Senior Vice President and Head of Worldwide Development and Head of Corporate Marketing at Sandoz Pharma Ltd. He also served at Sandoz Pharmaceuticals Corporation from 1988 to 1992. | |

4

Table of Contents

OWNERSHIP OF PEPSICO COMMON STOCK

BY DIRECTORS AND EXECUTIVE OFFICERS

The following table shows, as of March 12, 2004, the shares of PepsiCo Common Stock beneficially owned by each director (including each nominee), by each of our five most highly compensated executive officers, and by all directors and all executive officers as a group:

| Name of Individual or Group | Number of Shares of Common Stock | |

John F. Akers | 91,637 | |

Robert E. Allen | 54,133 | |

Abelardo E. Bru | 963,971 | |

Ray L. Hunt (2) | 531,897 | |

Arthur C. Martinez | 25,645 | |

Indra K. Nooyi | 714,903 | |

Franklin D. Raines | 30,504 | |

Steven S Reinemund (2) | 2,938,707 | |

Sharon Percy Rockefeller | 83,408 | |

Gary M. Rodkin | 837,812 | |

James J. Schiro | 12,462 | |

Franklin A. Thomas | 43,883 | |

Cynthia M. Trudell | 26,866 | |

Solomon D. Trujillo | 41,762 | |

Daniel Vasella | 15,584 | |

Michael D. White | 811,654 | |

All directors and executive officers as a group (21 persons) | 8,495,556 |

| (1) | The shares shown include the following shares that directors and executive officers have the right to acquire within 60 days after March 12, 2004 through the exercise of vested stock options: John F. Akers, 66,711 shares; Robert E. Allen, 46,997 shares; Abelardo E. Bru, 959,468 shares; Ray L. Hunt, 65,911 shares; Arthur C. Martinez, 23,645 shares; Indra K. Nooyi, 675,571 shares; Franklin D. Raines, 29,504 shares; Steven S Reinemund, 2,828,943 shares; Sharon Percy Rockefeller, 38,508 shares; Gary M. Rodkin, 834,001 shares; James J. Schiro, 10,377 shares; Franklin A. Thomas, 42,883 shares; Cynthia M. Trudell, 26,866 shares; Solomon D. Trujillo, 37,762 shares; Daniel Vasella, 10,417 shares; Michael D. White, 776,670 shares; and all directors and executive officers as a group, 7,698,869 shares. |

| (2) | The shares shown for Mr. Hunt include (i) 26,700 shares held in a corporation over which Mr. Hunt has sole voting and investment power, (ii) 262,286 shares held in trusts over which Mr. Hunt has shared voting power and sole investment power, and (iii) 152,500 shares held in a trust over which Mr. Hunt has sole voting power and no investment power. The shares shown for Mr. Reinemund include 103,631 shares over which Mr. Reinemund shares voting and investment power with his spouse. |

5

Table of Contents

The following table shows the number of PepsiCo Common Stock equivalents held in the PepsiCo deferred income program by each director (including each nominee), by each of our five most highly compensated executive officers, and by all directors and all executive officers as a group:

| Name of Individual or Group | Number of PepsiCo Deferred Income Program | |

John F. Akers | 7,268 | |

Robert E. Allen | 19,890 | |

Abelardo E. Bru | 0 | |

Ray L. Hunt | 7,050 | |

Arthur C. Martinez | 11,297 | |

Indra K. Nooyi | 48,965 | |

Franklin D. Raines | 9,719 | |

Steven S Reinemund | 231,014 | |

Sharon Percy Rockefeller | 0 | |

Gary M. Rodkin | 42,561 | |

James J. Schiro | 0 | |

Franklin A. Thomas | 13,077 | |

Cynthia M. Trudell | 5,582 | |

Solomon D. Trujillo | 4,399 | |

Daniel Vasella | 0 | |

Michael D. White | 0 | |

All directors and executive officers as a group (21 persons) | 400,822 |

Directors and executive officers as a group own less than 1% of outstanding PepsiCo Common Stock. No directors or executive officers own any PepsiCo Convertible Preferred Stock.

CORPORATE GOVERNANCE AT PEPSICO

Our business and affairs are overseen by our Board of Directors pursuant to the North Carolina Business Corporation Act and our By-Laws. Members of the Board of Directors are kept informed of the Company’s business through discussions with the Chairman and Chief Executive Officer, and with key members of management, by reviewing materials provided to them and by participating in Board and Committee meetings. Members of the Board of Directors are elected annually.

Regular attendance at Board meetings is required of each Director. PepsiCo’s Board held seven meetings during 2003. Average attendance by incumbent directors at Board and standing Committee meetings was 96%. No incumbent director attended fewer than 75% of the total number of Board and standing Committee meetings. The non-employee directors met in executive session at all but one of the seven Board meetings in 2003. All Directors attended the 2003 Annual Meeting.

In 2002, the Board of Directors adopted Corporate Governance Guidelines. These Guidelines were amended in accordance with the recently revised New York Stock Exchange Listing Standards and rules adopted by the Securities and Exchange Commission. The revised Guidelines are attached to this Proxy Statement asExhibit A. The Company’s Worldwide Code of Conduct was also revised in 2003 and filed as Exhibit 14 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 27, 2003. Annually, all of PepsiCo’s executive officers, other senior employees and directors have signed certifications with respect to their compliance with the Company’s Worldwide Code of Conduct.

6

Table of Contents

The Board of Directors has determined that all eleven of the non-employee directors have met the independence standards within the meaning of the rules of the New York Stock Exchange, based on the application of categorical standards that were recommended by the Nominating and Corporate Governance Committee and adopted by the Board of Directors. No Director receives any fees from the Company other than those received in his or her capacity as a Director.

In September 2002, the Board of Directors appointed Robert E. Allen, the Chairman of our Nominating and Corporate Governance Committee, the Presiding Director of the Board. In his capacity as the Presiding Director, Mr. Allen presides at the regularly-scheduled executive sessions of the Board, at which only non-employee directors are present. He also advises the Chairman of the Board and, as appropriate, Committee chairs with respect to agendas and information needs relating to the Board and Committee meetings, and performs other duties that the Board may from time to time delegate to assist the Board in the fulfillment of its responsibilities. Shareholders may communicate with Mr. Allen by sending a letter addressed to PepsiCo, Inc., 700 Anderson Hill Road, Purchase, New York, 10577, Attention: Presiding Director, or by utilizing one of the means through which the Board may be contacted, as provided at www.pepsico.com under “Contacts.”

Communications to the Board of Directors

The Board of Directors has established a process for contacting the Board or an individual member of the Board. The means through which the Board may be contacted are provided at www.pepsico.com under “Contacts.” All communications to the Board of Directors will be reviewed by the PepsiCo Corporate Law Department. The Corporate Law Department will maintain a log of all communications and will regularly provide a summary and copies of communications to the Board that relate to the functions of the Board or a Board committee or that otherwise require Board attention. Directors may at any time review the log of Board communications received by the Company and request copies or summaries of such communications. In addition, the Corporate Law Department may forward certain communications only to the Presiding Director, the Chair of the relevant committee or the individual Board member to whom a communication is directed. Complaints or concerns relating to PepsiCo’s accounting, internal accounting controls or auditing matters will be referred directly to members of the Audit Committee.

Exercise and Hold Policy and Stock Ownership Guidelines

To ensure that our senior executives exhibit a strong commitment to PepsiCo share ownership, the Board of Directors adopted an Exercise and Hold Policy and Stock Ownership Guidelines that apply to all directors and certain senior executives of the Company. Under the Exercise and Hold Policy, the aggregate amount of cash that may be received by an individual upon the exercise of stock options during each calendar year is limited to 20% of the pre-tax gains on all vested outstanding options as of February 1 of that year. Amounts in excess of the 20% limit must be held in PepsiCo shares for at least one year after exercise. Under the Company’s Stock Ownership Guidelines, certain senior executives and directors are required to own PepsiCo stock worth between two times and eight times base compensation, depending on their position.

7

Table of Contents

Committees of the Board of Directors

The Board of Directors has three standing committees: Audit, Compensation, and Nominating and Corporate Governance. The table below indicates the members of each standing Board committee:

| Name | Nominating and Corporate Governance | Compensation | Audit | |||

John F. Akers | X | Chair | ||||

Robert E. Allen* | Chair | X | ||||

Ray L. Hunt | X | X | ||||

Arthur C. Martinez | X | |||||

Indra K. Nooyi | ||||||

Franklin D. Raines | Chair | |||||

Steven S Reinemund | ||||||

Sharon P. Rockefeller | X | X | ||||

James J. Schiro | X | |||||

Franklin A. Thomas | X | |||||

Cynthia M. Trudell | X | |||||

Solomon D. Trujillo | X | |||||

Daniel Vasella | X | X | ||||

| * Mr. Allen is the Presiding Director of our Board. | ||||||

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, which was established in 1997 and renamed in 2002, held four meetings in 2003. The Nominating and Corporate Governance Committee: (a) identifies and recommends to the Board for election and/or appointment qualified candidates for membership on the Board and the Committees of the Board; (b) develops and recommends to the Board corporate governance principles and the Worldwide Code of Conduct applicable to the Company and monitors compliance with all such principles and policies; (c) develops and recommends to the Board criteria to assess the independence of members of the Board; (d) makes recommendations to the Board concerning the composition, size, structure and activities of the Board and its committees; (e) assesses and reports to the Board on the performance and effectiveness of the Board and its committees; and (f) reviews and reports to the Board with respect to director compensation and benefits. The Nominating and Corporate Governance Committee Charter is available on the Company’s website at www.pepsico.com under Corporate Governance in the “Investors” section.

The Committee does not solicit director nominations, but will consider recommendations, from shareholders. Such recommendations should be sent to the Secretary of PepsiCo at 700 Anderson Hill Road, Purchase, New York 10577. As set forth in the Company’s Corporate Governance Guidelines (attached asExhibit A), when seeking candidates for the Board of Directors, the Nominating and Corporate Governance Committee will generally look for individuals who have displayed high ethical standards and sound business judgment.

Nominations received by the Secretary of the Company from shareholders are reviewed by the Chairman of the Nominating and Corporate Governance Committee to determine whether the candidate possesses the minimum qualifications set forth in the Corporate Governance Guidelines, and if so, whether the candidate’s expertise and particular set of skills and background fit the current needs of the Board. If the candidate meets the requirements for a current vacancy on the Board, the submission materials are reviewed with the Nominating and Corporate Governance Committee and are responded to by the Chairman of the Committee or his designee.

8

Table of Contents

The process of reviewing and evaluating candidates submitted by shareholders is designed to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to the business of the Company. The process for evaluation of candidates submitted by non-shareholders of the Company is handled similarly.

From time to time, the Nominating and Corporate Governance Committee engages consulting firms to perform searches for director candidates who meet the current needs of the Board. If a consulting firm is retained to assist in the search process for a director, a fee is typically paid to such firm only if the candidate is elected to the Board or is recommended to the Board by the Nominating and Corporate Governance Committee for inclusion in the slate of nominees to be elected at the Annual Meeting of Shareholders.

The Audit Committee, which was established in 1967, held five meetings in 2003. The Audit Committee’s primary responsibilities are to assist the Board’s oversight of: (a) the quality and integrity of the Company’s financial statements, including the appropriateness of its critical accounting policies; (b) the Company’s compliance with legal and regulatory requirements; (c) the independent auditor’s qualifications and independence; and (d) the performance of the Company’s internal audit function and the independent auditors. The report of the Audit Committee is set forth below. The Audit Committee Charter is attached asExhibit B and is available on the Company’s website at www.pepsico.com under Corporate Governance in the “Investors” section.

Audit Committee Financial Experts

The Board of Directors has determined that Arthur C. Martinez, Franklin D. Raines and James J. Schiro, members of our Audit Committee, satisfy the criteria adopted by the Securities and Exchange Commission to serve as “audit committee financial experts” and are independent directors, pursuant to the standards set forth in the Corporate Governance Guidelines, attached asExhibit A to this Proxy Statement, and the requirements under the Securities Exchange Act of 1934.

Directors on Multiple Audit Committees

Mr. Arthur C. Martinez serves as a member of the audit committee of five public companies, including the Company. The Board of Directors has determined that Mr. Martinez’s simultaneous service on the audit committees of more than three public companies does not impair his ability to serve effectively on the Company’s Audit Committee.

The Compensation Committee, which has been active since 1955, held four meetings during 2003. The Compensation Committee: (a) oversees the policies of the Company relating to compensation of the Company’s executives and makes recommendations to the Board with respect to such policies; (b) produces a report on executive compensation for inclusion in the Company’s proxy statement; and (c) monitors the development and implementation of succession plans for the Chief Executive Officer and other key executives, and makes recommendations to the Board with respect to such plans. The Compensation Committee report on executive compensation is set forth below. The Compensation Committee Charter is attached asExhibit C and is available on the Company’s website at www.pepsico.com under Corporate Governance in the “Investors” section.

Compensation Committee Interlocks and Insider Participation

None of PepsiCo’s independent directors is an executive officer of a public company of which a PepsiCo executive officer is a director.

9

Table of Contents

PepsiCo’s Audit Committee is comprised entirely of directors who meet the independence, financial experience and other qualification requirements of the New York Stock Exchange and applicable securities laws. The Audit Committee operates under a written charter adopted by the Board of Directors, which was reviewed and revised in November 2003 and which is attached asExhibit B to this Proxy Statement.

The Audit Committee reviewed and discussed the Company’s audited financial statements with management, which has primary responsibility for the financial statements, and the Company’s independent auditors, KPMG LLP (“KPMG”), who are responsible for expressing an opinion on the conformity of the Company’s audited financial statements with accounting principles generally accepted in the United States. The Committee discussed with Company management the critical accounting policies applied by the Company in the preparation of its financial statements. These policies arise in conjunction with: revenue recognition; brand and goodwill valuations; income tax expense and accruals; stock compensation expense; and pension and retiree medical plans. The Committee discussed with KPMG the matters required to be discussed by Statement on Auditing Standards No. 61 (Communications with Audit Committees) and the Sarbanes-Oxley Act of 2002, and had the opportunity to ask KPMG questions relating to such matters. The discussions included the quality, and not just the acceptability, of the accounting principles utilized, the reasonableness of significant accounting judgments, and the clarity of disclosures. The Committee also discussed with Company management the process for certifications by the Company’s Chief Executive Officer and Chief Financial Officer, which is required by the Securities and Exchange Commission and the Sarbanes-Oxley Act of 2002 for certain of the Company’s filings with the Securities and Exchange Commission.

The Audit Committee reviewed with the Company’s internal and independent auditors the overall scope and plans for their respective audits for 2003. The Audit Committee also received regular updates from the Company’s General Auditor on internal control and business risks.

The Audit Committee reviewed KPMG’s independence and, as part of that review, received the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) relating to KPMG’s independence from the Company. The Committee also reviewed and pre-approved all fees paid to the independent auditors; these fees are described in the next section of this Proxy Statement. The Committee also considered whether KPMG’s provision of non-audit services to the Company was compatible with the auditor’s independence. The Committee has adopted a formal policy on Audit, Audit Related and Non-Audit Services, which is published on the Company’s website and which is briefly described in the next section of this Proxy Statement.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 27, 2003, for filing with the Securities and Exchange Commission. The Committee has also retained KPMG as the Company’s independent auditors for the fiscal year 2004, and the Committee and the Board have recommended that shareholders ratify the appointment of KPMG as the Company’s independent auditors for the fiscal year 2004.

THE AUDIT COMMITTEE

FRANKLIN D. RAINES, CHAIRMAN | FRANKLIN A. THOMAS | |

ARTHUR C. MARTINEZ | CYNTHIA M. TRUDELL | |

JAMES J. SCHIRO | SOLOMON D. TRUJILLO |

10

Table of Contents

The following table presents fees for professional audit services rendered by KPMG LLP, the Company’s independent auditor, for the audit of the Company’s annual financial statements for 2002 and 2003, and fees billed for other services rendered by KPMG LLP.

| 2002 | 2003 | |||||

Audit fees | $ | 7,246,000 | $ | 9,764,000 | ||

Audit-related fees (1) | $ | 1,054,000 | $ | 1,799,000 | ||

Tax fees (2) | $ | 5,419,000 | $ | 1,041,000 | ||

All other fees | $ | 0 | $ | 0 | ||

| (1) | Audit-related fees for 2002 and 2003 consisted primarily of information technology and other internal control reviews, assistance with international statutory filings, audits of the financial statements of certain employee benefit plans, and due diligence of certain businesses acquired. Audit-related fees for 2003 also included advisory services related to the Company’s preparation for compliance with Section 404 of the Sarbanes-Oxley Act of 2002. |

| (2) | Tax fees for 2002 consisted primarily of tax advisory services and international tax compliance services. Tax fees for 2003 consisted primarily of international tax compliance services. |

We understand the need for the independent auditors to maintain their objectivity and independence, both in appearance and in fact, in their audit of the Company’s financial statements. Accordingly, the Audit Committee has adopted the PepsiCo Policy for Audit Services. The Policy provides that the Audit Committee will engage the auditor for the audit of the Company’s consolidated financial statements and other audit-related work. The auditor may also be engaged for tax and other non-audit related work if those services: enhance and support the attest function of the audit; are an extension to the audit or audit related services; or are services with respect to which, under the circumstances, KPMG offers unique qualification and there is clearly no question regarding their independence in providing such service. The policy further provides that on an annual basis the auditor’s Global Lead Audit Partner will review with the Audit Committee the services the auditor expects to provide in the coming year and the related fee estimates. In addition, PepsiCo will provide the Audit Committee with a quarterly status report regarding the Committee’s pre-approval of audit related, tax or other non-audit services that the auditor has been pre-approved to perform, has been asked to provide or may be expected to provide in the following quarter. PepsiCo’s Policy for Audit Services is available on the Company’s website at www.pepsico.com under Corporate Governance in the “Investors” section.

Directors who are employees of the Company receive no additional pay for serving as directors. All other directors receive an annual retainer of $100,000 and an annual equity award. Committee chairs receive an additional $10,000 retainer for the supplemental duties associated with serving as a committee chair. All newly appointed directors receive a one-time grant of 1,000 shares of PepsiCo Common Stock when they join the Board. Directors are reimbursed their expenses incurred for attending Board and committee meetings.

Directors may elect to receive their retainer in cash or defer their retainer into PepsiCo Common Stock equivalents, which are payable in cash at the end of the deferral period.

The annual equity award to directors is comprised of restricted stock units, stock options, or a combination of both, as elected by each director. In the absence of any election, the award to a

11

Table of Contents

director is made all in restricted stock units. The number of restricted stock units awarded is determined by dividing $75,000 by the fair market value of PepsiCo Common Stock on the date of grant (October 1 in 2003). In substitution of the foregoing, the director may elect to receive all or a portion (in 10% increments) of the award in stock options. If a director elects to receive stock options, the number of stock options awarded is determined by multiplying the number of restricted stock units to be converted by four. Restricted stock units and stock options normally vest after three years and vest earlier in the case of the director’s death, disability or retirement.

As part of their normal Board duties, directors do not receive any meeting fees. In 2003, the Board formed a temporary special committee of the Board to consider a potential civil litigation matter raised by a shareholder regarding our relationship with our bottlers. Mr. Martinez chaired the committee, on which Mr. Schiro and Ms. Trudell also served as members. The committee evaluated and conducted an inquiry related to the matter and concluded that the matter had no merit. In 2003, in consideration for their participation on the committee, Mr. Martinez, Mr. Schiro and Ms. Trudell each received $1,500 per committee meeting attended.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board (the “Committee”) oversees PepsiCo’s compensation and stock-based programs. The Committee makes recommendations to the Board regarding the compensation of all executive officers and establishes the principles and strategies that serve to guide the design of compensation plans and benefit programs for all employees within PepsiCo. The Board approves all compensation actions regarding the Chief Executive Officer (“CEO”) and all other executive officers. The Committee is composed entirely of independent members of the Board.

Annually, with the assistance of independent advisors, who report directly to the Committee, the Committee evaluates PepsiCo’s plans and policies against current and emerging competitive practices, legal and regulatory developments and corporate governance trends. In 2003, the review provided assurance that PepsiCo’s compensation programs will continue to help attract and retain the talent necessary to maintain our long history of strong sales growth, long-term financial performance and shareholder returns. In May, the shareholders approved the 2003 Long Term Incentive Plan, resulting in PepsiCo having a single equity-based compensation plan.

Compensation Philosophy

PepsiCo’s compensation programs help recruit, retain and motivate a large group of talented and diverse domestic and international employees and are designed to pay above market compensation for above market performance.

Our philosophy is that PepsiCo will achieve its best results if its employees act and are rewarded as business owners. Ownership is not only about owning stock, but is also about being accountable for business results, in good times and bad. Owners act with the conviction that their business is personal and that they can make a difference. Owners take initiative and they take responsibility for the assets of the business, including employees. As executives progress to higher levels at PepsiCo, their responsibilities, risks and rewards will progress as well.

Towards these ends, the Committee examines the ongoing competitiveness of PepsiCo’s compensation programs, reviews both company and individual executive performance and establishes compensation levels for each executive officer. The Committee works with outside, independent consultants in establishing the compensation and equity-based programs provided to the CEO, other executive officers, and all PepsiCo employees.

12

Table of Contents

Annually, the Committee:

| • | Approves performance targets based on the achievement of specific performance goals, which are either company or business unit focused depending on the executive officer’s position and scope of responsibility. |

| • | Ensures that a significant portion of the total compensation package for the CEO, executive officers and other executives are performance-based and that compensation opportunities are designed to create incentives for superior performance and consequences for below target performance. |

| • | Validates that total compensation is above the average of the peer group of companies for target performance and that the target performance correlates to superior performance when compared to performance of the peer group. Compensation levels and overall corporate performance are benchmarked against a survey of leading consumer product companies. This review is validated against surveys of a broader range of major companies, including the Fortune 100. |

| • | Approves annual and long-term incentive awards for the year based on performance achieved in the prior year relative to the pre-approved targets. In determining the final awards, the Committee considers objective data concerning PepsiCo’s financial performance, with a particular focus on earnings per share, sales volume, cash flow and long-term shareholder returns. The Committee also considers other strategic achievements, such as improved operating efficiencies and customer and employee satisfaction. |

Stock Ownership and Hold Policy

To reinforce the Company’s ownership philosophy, senior executives are required to own multiples of their salary in PepsiCo stock under the Board approved stock ownership guidelines.

The ownership guidelines operate along with a policy that limits annual option exercises for cash to 20% of vested gains. Any proceeds in excess of this 20% limit must be held in PepsiCo shares for at least one year after the date of exercise.

Specific Compensation Programs

For 2003, the primary components of PepsiCo’s compensation program were base salary, annual incentive, and long-term incentive awards primarily in the form of stock options. Executive officers also participated in PepsiCo’s various qualified and certain nonqualified employee benefit plans designed to provide retirement income. During 2003, certain executive officers, including the CEO, also received a payout of a performance unit award made in 2000, the amount of which was based on performance during the three-year period between 2000-2002.

It is the Committee’s intention that substantially all executive compensation be fully deductible for federal income tax purposes. Thus, the Committee ensured that the compensation decisions relating to executive officers were made with full consideration of the implications of Internal Revenue Code Section 162(m).

Base Salary. The relative levels of base salary for the CEO and the other executive officers are based on the underlying accountabilities of each executive’s position and reflect each executive officer’s scope of responsibility. The salaries are reviewed on a regular basis and are benchmarked against similar positions among the peer group companies. Individual salaries are capped at $1 million.

Annual Incentive Compensation. PepsiCo provides performance-related annual incentive compensation to its executive officers under the shareholder-approved 1994 Executive Incentive Compensation Plan (“EIC Plan”). Awards under the EIC Plan are intended to constitute “performance-based compensation” under Internal Revenue Code Section 162(m). Provided pre-approved targets

13

Table of Contents

are achieved, the Committee may exercise negative discretion to determine the exact amount of the incentive to be paid to each executive officer. In exercising this discretion, the Committee considers a broad range of company and individual performance indicators including PepsiCo’s financial results, strategic position and how well the executive manages and develops people. A payment would not be made if the minimum earnings target was not met. For 2003, the amount of the award an executive was eligible to receive was dependent upon PepsiCo achieving pre-approved earnings per share targets.

Long-Term Incentive Compensation. Consistent with PepsiCo’s compensation philosophy, the Committee believes that stock ownership and stock-based incentive awards are the best way to align the interests of the executive officers with those of PepsiCo’s shareholders. PepsiCo has a long history of linking pay to its long-term stock performance for all employees, not just executives. This is best demonstrated by the fact that, since 1989, PepsiCo has provided an annual grant of stock options to virtually all full-time U.S. employees under its broad-based stock option program, SharePower. Target grant guidelines are developed based on competitive benchmarking. Grants awarded to executive officers are based on each officer’s individual performance, retention considerations and other special circumstances. The Committee requires that awards made under the long-term incentive plans include vesting terms that encourage an executive officer to remain with PepsiCo over a period of years. All stock option grants have an exercise price equal to the fair market value of PepsiCo common stock on the day of grant. There has been no repricing of awards and, under the approved 2003 Long-Term Incentive Plan, any repricing of awards would require shareholder approval.

Historically, following competitive market practice, PepsiCo has utilized stock options as the primary form of long-term incentive compensation and, in some years, issued performance units. Performance units have been paid after three years based on performance against specific targets, which have included cash flow and net sales volume.

CEO Compensation

Mr. Reinemund has held the position of Chairman and Chief Executive Officer since May 2001. The Committee recommends and the Board approves Mr. Reinemund’s compensation following the general policies and guidelines described above for the compensation of executive officers. The Committee uses peer company competitive information to establish Mr. Reinemund’s target total compensation package and then uses performance to determine his actual compensation.

For the fiscal year 2003, Mr. Reinemund’s base salary was capped at $1,000,000 and he was eligible for an annual incentive award if the pre-approved earnings per share targets were met. In addition, Mr. Reinemund was eligible for awards under the Company’s long-term incentive programs at the Committee’s discretion.

In the analysis of performance, the Committee considered PepsiCo’s operating profit, volume and net revenue results in combination with PepsiCo’s performance relative to the peer group companies. In determining the final awards, the overall performance measures were weighted by the Committee along with a subjective assessment of the strength of PepsiCo’s strategic position and total return to shareholders as compared to the peer group companies.

The awards made to Mr. Reinemund are shown in the followingSummary Compensation Table for the fiscal year 2003. Mr. Reinemund’s annual incentive compensation was based on 2003 performance. His long-term incentive was awarded in February 2003 based on 2002 performance. Mr. Reinemund also received a payout of performance units awarded in 2000, the amount of which was based on performance over the three-year period between 2000-2002.

14

Table of Contents

Summary

The Committee believes that PepsiCo’s compensation practices and compensation philosophy align executive interests with those of shareholders. As the scope and level of an executive’s business responsibilities expand, the portion of their compensation package that is “at risk” also increases.

We believe that the actions taken over the past year have allowed the Company to attract, retain and motivate the key talent PepsiCo needs to continue to compete and provide strong return to shareholders.

THE COMPENSATION COMMITTEE

JOHN F. AKERS | SHARON PERCY ROCKEFELLER | |

ROBERT E. ALLEN | DANIEL VASELLA | |

RAY L. HUNT |

| Annual Compensation | Long-Term Compensation(2) | ||||||||||||||

| Awards | Payouts | ||||||||||||||

Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Other Compensation($) | Securities Under- lying Options (#) | Long-Term Incentive Plan Payouts ($) | All Other sation ($) | ||||||||

Steven S Reinemund | 2003 | 1,000,000 | 3,800,000 | 149,393 | (3) | 864,717 | 809,325 | 0 | |||||||

Director; Chairman of the | 2002 | 1,000,000 | 3,150,000 | 158,013 | (3) | 758,357 | 844,800 | 0 | |||||||

Board and Chief Executive | 2001 | 984,615 | 3,500,000 | 159,490 | (3) | 2,105,672 | 864,600 | 0 | |||||||

Officer | |||||||||||||||

Indra K. Nooyi | 2003 | 721,154 | 1,486,620 | 125,790 | (3) | 235,379 | 0 | 0 | |||||||

Director; President and | 2002 | 700,000 | 1,350,000 | 7,064 | 175,932 | 0 | 0 | ||||||||

Chief Financial Officer | 2001 | 680,769 | 1,525,970 | 119,782 | (3) | 947,293 | 0 | 0 | |||||||

Michael D. White | 2003 | 721,154 | 1,449,590 | 1,462,024 | (4) | 235,966 | 0 | 0 | |||||||

Chairman and Chief Executive | 2002 | 600,000 | 782,700 | (49,652 | )(4) | 147,180 | 0 | 0 | |||||||

Officer, PepsiCo International | 2001 | 565,931 | 1,012,380 | (48,028 | )(4) | 460,603 | 0 | 0 | |||||||

Gary M. Rodkin | 2003 | 721,154 | 1,377,320 | 60,018 | (3) | 186,932 | 503,415 | 0 | |||||||

Chairman and Chief Executive | 2002 | 673,076 | 1,057,470 | 8,684 | 569,782 | 389,813 | 0 | ||||||||

Officer, PepsiCo Beverages | 2001 | 642,308 | 963,440 | 156,903 | (5) | 438,377 | 0 | 0 | |||||||

And Foods North America | |||||||||||||||

Abelardo E. Bru | 2003 | 721,154 | 1,154,270 | 82,266 | (3) | 231,366 | 0 | 0 | |||||||

Chairman and Chief Executive | 2002 | 650,000 | 531,700 | 52,399 | (3) | 495,565 | 0 | 0 | |||||||

Officer, Frito-Lay North | 2001 | 634,615 | 894,140 | 59,139 | (3) | 172,205 | 0 | 0 | |||||||

America | |||||||||||||||

| (1) | Bonuses are paid after the end of the year based on performance for that year (e.g., 2003 bonus reflects 2003 performance). |

| (2) | Long-Term Awards are made at the beginning of the year based on performance during the prior year (e.g., the 2003 Long Term Award reflects 2002 performance). Long-Term payouts are based on performance during the prior three-year period (e.g., the 2003 payout reflects performance during 2000-2002). |

| (3) | This amount includes benefits from the use of corporate transportation of $125,256 in 2003, $134,065 in 2002 (including $2,128 that the Company inadvertently omitted from the total for 2002 that was reported in our prior year’s proxy statement), and $133,105 in 2001 for Mr. Reinemund; $102,852 in 2003 and $98,168 in 2001 for Ms. Nooyi; $29,616 in 2003 for Mr. Rodkin; and $58,597 in 2003, $28,730 in 2002 and $35,190 in 2001 for Mr. Bru. Mr. Reinemund’s amounts also include $2,437 in 2001 paid in connection with his relocation to assume his new responsibilities as Chairman and Chief Executive Officer. Mr. Rodkin’s amount for 2003 also includes $7,468 paid in connection with his relocation to assume his new responsibilities as Chairman and Chief Executive Officer of PepsiCo Beverages and Foods North America. |

| (4) | These amounts include customary payments generally applicable to employees temporarily assigned outside their home countries. In 2003, for Mr. White, amounts include $11,930 for the use of corporate transportation, $167,954 paid in connection with his repatriation from Switzerland to assume his new responsibility as Chairman and Chief Executive Officer of PepsiCo International, and incremental taxes of $1,173,313 that were required to be paid primarily to Switzerland as a result of his multi-year assignment outside of the United States. |

| (5) | This amount includes a payment of $150,000 made to Mr. Rodkin as part of his promotion to President and Chief Executive Officer of Pepsi-Cola North America. |

15

Table of Contents

OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Option Term | |||||||||||||

Name | Number of Securities Underlying Options Granted(#) | % of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/Sh) | Expiration Date | 5% ($)(3) | 10% ($)(3) | ||||||||

Steven S Reinemund | 864,717(1) | 2.08% | $39.75 | 1/31/13 | $ | 21,616,681 | $ | 54,780,914 | ||||||

Indra K. Nooyi | 188,550(1) | 0.45% | $39.75 | 1/31/13 | $ | 4,713,479 | $ | 11,944,881 | ||||||

| 46,829(2) | 0.11% | $39.75 | 1/31/13 | $ | 1,170,658 | $ | 2,966,676 | |||||||

Michael D. White | 187,258(1) | 0.45% | $39.75 | 1/31/13 | $ | 4,681,181 | $ | 11,863,031 | ||||||

| 48,708(2) | 0.12% | $39.75 | 1/31/13 | $ | 1,217,630 | $ | 3,085,713 | |||||||

Gary M. Rodkin | 186,932(1) | 0.45% | $39.75 | 1/31/13 | $ | 4,673,031 | $ | 11,842,378 | ||||||

Abelardo E. Bru | 188,217(1) | 0.45% | $39.75 | 1/31/13 | $ | 4,705,154 | $ | 11,923,785 | ||||||

| 43,149(2) | 0.10% | $39.75 | 1/31/13 | $ | 1,078,663 | $ | 2,733,544 | |||||||

| (1) | These options become exercisable on February 1, 2006. |

| (2) | These options were granted and became exercisable on February 1, 2003. |

| (3) | The 5% and 10% rates of appreciation were set by the Securities and Exchange Commission and are not intended to forecast future appreciation, if any, of PepsiCo Common Stock. If PepsiCo Common Stock does not increase in value beyond the exercise or base price, then the option grants described in the table will be valueless. |

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION VALUES (1)

Name | Shares Acquired on Exercise(#) | Value Realized | Number of Securities Underlying Unexercised Options at FY-End | Value of Unexercised In-the-Money Options | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Steven S Reinemund | 430,409 | $ | 11,656,554 | 1,146,972 | 4,805,045 | $ | 16,496,424 | $ | 32,437,203 | ||||||

Indra K. Nooyi | 133,806 | $ | 3,351,255 | 629,829 | 1,245,398 | $ | 7,484,192 | $ | 2,472,978 | ||||||

Michael D. White | 105,138 | $ | 2,974,912 | 649,713 | 724,900 | $ | 7,686,301 | $ | 2,526,436 | ||||||

Gary M. Rodkin | — | — | 695,624 | 1,195,091 | $ | 8,639,405 | $ | 4,719,663 | |||||||

Abelardo E. Bru | 28,376 | $ | 804,603 | 620,895 | 1,197,741 | $ | 7,544,483 | $ | 6,341,380 | ||||||

| (1) | The closing price of PepsiCo Common Stock on December 26, 2003, the last trading day prior to PepsiCo’s fiscal year end, was $46.47. |

16

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of December 27, 2003 with respect to the shares of PepsiCo Common Stock that may be issued under our equity compensation plans.

Plan Category | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of | Number of Securities remaining available for future issuance under Equity Compensation Plans (excluding securities | ||||

| (a) | (b) | (c) | |||||

Equity Compensation Plans approved by Security holders (1) | 118,761,695(2) | $ | 38.55 | 72,168,530(3) | |||

Equity Compensation Plans not approved by Security holders (4) | 72,683,009 | $ | 39.08 | 0 | |||

Total (5) | 191,444,704 | $ | 38.72 | 72,168,530 | |||

| (1) | Includes the 2003 Long-Term Incentive Plan (the “2003 LTIP”), the 1994 Long-Term Incentive Plan, and the 1987 Incentive Plan. |

| (2) | This amount includes 8,065 restricted stock units that, if and when vested, will be settled in shares of PepsiCo Common Stock. |

| (3) | As of May 7, 2003, the shareholder-approved 2003 LTIP superseded all of our other equity compensation plans and is the only equity compensation plan under which future awards are permitted. All of our other equity compensation plans were terminated on May 7, 2003. The 2003 LTIP permits the award of stock options, stock appreciation rights, restricted shares, and restricted stock and/or performance units, which may be settled in shares of PepsiCo Common Stock. As approved by shareholders, the 2003 LTIP authorizes a number of shares for issuance equal to 70,000,000 plus the number of shares underlying awards issued under the Company’s other equity compensation plans which are canceled or expire after May 7, 2003; provided, however, that the number of shares authorized under the 2003 LTIP will not exceed 85,000,000. |

| (4) | Includes the 1995 Stock Option Incentive Plan, the SharePower Stock Option Plan, and the Director Stock Plan, each of which is described below. |

| (5) | The table does not include information for equity compensation plans assumed by PepsiCo in connection with PepsiCo’s merger with The Quaker Oats Company. Those plans include the Quaker Long Term Incentive Plan of 1990, the Quaker Long Term Incentive Plan of 1999 and the Quaker Stock Compensation Plan for Outside Directors (collectively, the “Quaker Plans”). As of December 27, 2003, a total of 6,735,943 shares of PepsiCo Common Stock were issuable upon the exercise of outstanding options which were granted under the Quaker Plans prior to the merger with PepsiCo. The weighted average exercise price of those options is $22.07 per share. An additional 397,106 shares of PepsiCo Common Stock which are related to awards issued under the Quaker Plans prior to the merger have been deferred and will be issued in the future. No additional options or shares may be granted under the Quaker Plans. |

1995 Stock Option Incentive Plan (“SOIP”). The SOIP was adopted by the Board of Directors on July 27, 1995. Under the SOIP, stock options were granted to middle management employees generally based on a multiple of base salary. SOIP options were granted with an exercise price equal to the fair market value of PepsiCo Common Stock on the date of grant. SOIP options generally become exercisable at the end of three years and have a ten-year term. At year-end 2003, options covering 26,155,377 shares of PepsiCo Common Stock were outstanding under the SOIP. As of May 7, 2003 the SOIP was terminated. The SOIP is included as Exhibit 10.14 in our 2002 Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 7, 2003.

SharePower Stock Option Plan. SharePower was adopted by the Board of Directors on July 1, 1989. Under SharePower, options were generally granted each year to virtually all of our full-time employees based on a formula tied to annual earnings and tenure. Each year, the Board of Directors authorized the number of shares required to grant options under the SharePower formula. SharePower options were granted with an exercise price equal to the fair market value of PepsiCo Common Stock on the date of grant. SharePower options generally become exercisable after three years and have a ten-year term. At year-end 2003, options covering 46,017,433 shares of PepsiCo

17

Table of Contents

Common Stock were outstanding under SharePower. As of May 7, 2003, the SharePower plan was terminated and superseded by the 2003 LTIP, from which all future SharePower awards will be made. The SharePower plan is included as Exhibit 10.13 in our 2002 Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 7, 2003.

Director Stock Plan. The Director Stock Plan was adopted by the disinterested members of the Board of Directors on July 28, 1988. Under the Director Stock Plan, stock options were granted and shares of PepsiCo Common Stock were issued to non-employee directors. Options granted under the plan were immediately exercisable and have a ten-year term. As of year-end 2003, options covering 510,199 shares of PepsiCo Common Stock were outstanding under the Director Stock Plan. The Director Stock Plan is included in Post-Effective Amendment #6 to the Form S-8 related to such plan, filed with the Securities and Exchange Commission on September 4, 2002. As of May 7, 2003, the Director Stock Plan was terminated and superseded by the 2003 LTIP, from which all future Director stock options will be granted.

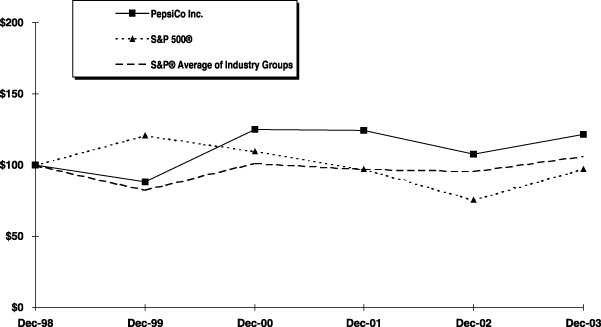

The Average of the two S&P Industry Groups reflected below is based upon PepsiCo’s sales in its two lines of business: Non-Alcoholic Beverages and Food. The return on PepsiCo stock investment is calculated through December 26, 2003, the last trading day prior to the end of PepsiCo’s fiscal year. The return for the S&P 500 and the S&P Average indices is calculated through December 31, 2003.

CUMULATIVE TOTAL RETURN,

using quarterly revenue weightings

18

Table of Contents

When an executive retires at the normal retirement age (65), the approximate annual benefits payable after January 1, 2003 for the following pay classifications and years of service are:

| Remuneration | Years of Service | |||||||||||

| 15 | 20 | 25 | 30 | 35 | 40 | |||||||

$1,000,000 | 347,100 | 396,130 | 445,160 | 494,200 | 543,230 | 593,230 | ||||||

$1,250,000 | 434,600 | 496,130 | 557,660 | 619,200 | 680,730 | 743,230 | ||||||

$1,500,000 | 522,100 | 596,130 | 670,160 | 744,200 | 818,230 | 893,230 | ||||||

$1,750,000 | 609,600 | 696,130 | 782,660 | 869,200 | 955,730 | 1,043,230 | ||||||

$2,000,000 | 697,100 | 796,130 | 895,160 | 994,200 | 1,093,230 | 1,193,230 | ||||||

$2,500,000 | 872,100 | 996,130 | 1,120,160 | 1,244,200 | 1,368,230 | 1,493,230 | ||||||

$2,750,000 | 959,600 | 1,096,130 | 1,232,660 | 1,369,200 | 1,505,730 | 1,643,230 | ||||||

$3,000,000 | 1,047,100 | 1,196,130 | 1,345,160 | 1,494,200 | 1,643,230 | 1,793,230 | ||||||

$3,250,000 | 1,134,600 | 1,296,130 | 1,457,660 | 1,619,200 | 1,780,730 | 1,943,230 | ||||||

$3,500,000 | 1,222,100 | 1,396,130 | 1,570,160 | 1,744,200 | 1,918,230 | 2,093,230 | ||||||

$4,000,000 | 1,397,100 | 1,596,130 | 1,795,160 | 1,994,200 | 2,193,230 | 2,393,230 | ||||||

$4,500,000 | 1,572,100 | 1,796,130 | 2,020,160 | 2,244,200 | 2,468,230 | 2,693,230 | ||||||

$5,000,000 | 1,747,100 | 1,996,130 | 2,245,160 | 2,494,200 | 2,743,230 | 2,993,230 | ||||||

The pay covered by the Pension Plans noted below is based on the salary and bonus shown in theSummary Compensation Table in this Proxy Statement for each of our five most highly compensated executive officers. The years of credited service as of January 1, 2004 for the executive officers named on theSummary Compensation Table are: Steven S Reinemund—19 years; Indra K. Nooyi—9 years; Michael D. White—14 years; Gary M. Rodkin—8 years; and Abelardo E. Bru—27 years.

Computation of Benefits

PepsiCo’s executive officers generally participate in PepsiCo’s Retirement Plan and PepsiCo’s Pension Equalization Plan (which has been adopted to provide benefits that would have been payable under the Retirement Plan except for ERISA and Internal Revenue Code limitations). The annual benefits payable under these two Pension Plans to employees with 5 or more years of service at age 65 are, for the first 10 years of credited service, 3% of the employee’s highest consecutive five-year average annual earnings plus an additional 1% of the employee’s highest consecutive five-year average annual earnings for each additional year of credited service over 10 years, less 0.43% of final average earnings not to exceed Social Security covered compensation multiplied by years of service (not to exceed 35 years).

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Securities Exchange Act of 1934 requires PepsiCo’s directors and executive officers to file reports of ownership and changes in ownership of PepsiCo Common and Convertible Preferred Stock. We received written representations from each such person who did not file an annual report with the SEC on Form 5 that no Form 5 was due. To the best of PepsiCo’s knowledge, in 2003, all required forms were filed on time with the Securities and Exchange Commission, except one stock option holding for each of Abelardo E. Bru and Margaret D. Moore was not reported on their respective Form 3, which were timely filed. Once the omissions were discovered, amended Forms 3 were promptly filed.

19

Table of Contents

RATIFICATION OF APPOINTMENT OF AUDITORS (PROXY ITEM NO. 2)

The Audit Committee engaged KPMG LLP (“KPMG”) as PepsiCo’s independent auditors for 2004, subject to ratification by shareholders. KPMG has been PepsiCo’s independent auditors since 1990.

Representatives of KPMG will be available to answer appropriate questions at the Annual Meeting and are free to make statements during the meeting.

The Board of Directors recommends that shareholders vote FOR the ratification of the appointment of KPMG as PepsiCo’s independent auditors for 2004.

|

APPROVAL OF THE 2004 EXECUTIVE INCENTIVE COMPENSATION PLAN

(PROXY ITEM NO. 3)

Approval of the 2004 Executive Incentive Compensation Plan (the “2004 EIC Plan”) is recommended so that annual incentive awards to executive officers constitute “performance-based compensation” and are tax deductible by PepsiCo under Section 162(m) of the Internal Revenue Code (the “Code”).

PepsiCo’s compensation program includes annual incentive awards to attract, retain, and motivate key employees. For executive officers, currently a group of 10 senior executives, PepsiCo awards annual incentives under a separate plan called the 1994 Executive Incentive Compensation Plan (the “1994 EIC Plan”). This plan was established and approved by shareholders in 1994 and, since that time, all annual incentive awards to executive officers have been performance-based and tax deductible to PepsiCo. However, the 1994 EIC Plan expires at the end of 2004.

The Compensation Committee of the Board of Directors (the “Committee”) believes it is important that executive officer compensation continue to be performance-based and tax deductible. Therefore, PepsiCo is submitting the 2004 EIC Plan to shareholders for approval, and the Board recommends that PepsiCo shareholders approve the 2004 EIC Plan. The 2004 EIC Plan is substantially similar to the 1994 EIC Plan. The principal features of the 2004 EIC Plan are described below and the full text of the plan is annexed hereto asExhibit D.

Awards. The 2004 EIC Plan provides award opportunities for senior officers of PepsiCo and its subsidiaries and divisions on an annual basis. Awards are approved by the Committee. If approved by shareholders, it is anticipated that the first awards under the 2004 EIC Plan will be made in the first quarter of 2005.

Administration. The 2004 EIC Plan will be administered by the Committee, which is composed entirely of non-employee directors who meet the criteria of “outside director” under Section 162(m) of the Code and “independent director” under the rules of the Securities and Exchange Commission and New York Stock Exchange. The Committee’s powers include the authority, within the limitations set forth in the plan, to select the persons to be granted awards, to determine the time when awards will be granted, to determine whether objectives and conditions for earning awards have been met, to determine whether payment of an award will be made at the end of an award period or deferred, and to determine whether an award or payment of an award should be reduced or eliminated.

Eligibility to Receive Awards. The Committee shall select the key executives of PepsiCo, its divisions and subsidiaries, who shall be eligible to receive awards under the 2004 EIC Plan. Generally, executive officers of PepsiCo will be granted, and other officers may at the discretion of the Committee be granted, annual incentive awards under the 2004 EIC Plan. It is expected that approximately 10

20

Table of Contents

individuals, including PepsiCo’s Chief Executive Officer, will receive awards in 2005 under the 2004 EIC Plan.

Annual Incentive Awards. The amount of annual incentive awards paid to eligible executives under the 2004 EIC Plan will be based upon the achievement by PepsiCo of specified performance targets, which shall be established annually in advance by the Committee.

No payment will be made if the minimum performance target is not met. The targets to be used for purposes of awards may be set by the Committee using any of the following business performance measures: stock price, market share, sales revenue, cash flow, sales volume, earnings per share, return on equity, return on assets, return on sales, return on invested capital, economic value added, net earnings, total shareholder return, gross margin, and/or costs. The targets may be established based on objectives related to the participant or to objectives that are Company-wide or related to a subsidiary, division, department, region, function or business unit of the Company in which the participant is employed. The Committee may adjust the targets, or provide for the manner in which performance will be measured against the targets, to reflect the impact of specified corporate transactions (such as a stock split or stock dividend), special charges, accounting or tax law changes and other extraordinary or nonrecurring events, provided such awards would not be adversely affected under Section 162(m) of the Code.

Negative Discretion. Notwithstanding attainment of a target established for an award under the 2004 EIC Plan, the Committee has the discretion to reduce, but not increase, some or all of an award that would otherwise be paid.

Award Maximum. No participant may receive more than $9 million under the 2004 EIC Plan in any calendar year.

Amendment and Termination. The Committee may amend or terminate the 2004 EIC Plan so long as such action does not adversely affect any rights or obligations with respect to awards already outstanding under the plan. Unless the shareholders of PepsiCo shall have first approved thereof, no amendment of the plan may increase the maximum amount per year which can be paid to any one participant under the plan, change the business performance measures for the awards or modify the requirements as to eligibility for participation in the plan. No awards may be made under the 2004 EIC Plan after December 31, 2014 or, if earlier, the date the plan no longer satisfies the requirements of “performance-based compensation” under the regulations promulgated under Section 162(m) of the Code.