- OSK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Oshkosh (OSK) DEFA14AAdditional proxy soliciting materials

Filed: 16 Oct 06, 12:00am

Exhibit 99.2

DRIVING FORCE Oshkosh Truck Corporation Acquisition of JLG Industries, Inc. Investor Presentation October 16, 2006 |

Forward Looking Statements Our remarks that follow, including answers to your questions and these slides, include statements that we believe are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act. All of our statements, other than statements of historical fact, including statements regarding Oshkosh Truck’s future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures and debt levels, and plans and objectives of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of words such as “expect,” “intend,” “estimates,” “anticipate,” “believe,” “should,” “plans,” or similar words. We cannot give any assurance that such expectations will prove to be correct. Some factors that could cause actual results to differ materially from our expectations include the accuracy of assumptions made with respect to our expectations for fiscal 2007, the Company’s ability to successfully close and integrate the JLG Industries, Inc. acquisition and integrate the AK Acquisition Corporation and its wholly-owned subsidiaries and Iowa Mold Tooling Co., Inc. acquisitions, the Company’s ability to continue the turnaround of the business of the Geesink Norba Group sufficiently to support its valuation resulting in no non-cash impairment charge for Geesink Norba Group goodwill, the Company’s ability to sustain flat operating income in its commercial segment and to raise operating income in its fire & emergency segment in fiscal 2007 despite anticipated lower industry demand resulting from changes to diesel engine emission standards effective January 1, 2007, the expected level of U.S. Department of Defense procurement of the Company’s products and services, the cyclical nature of the Company’s commercial and fire and emergency markets, risks related to reductions in government expenditures, the uncertainty of government contracts, the challenges of identifying, completing and integrating acquisitions, the success of the launch of the RevolutionÒ drum, and risks associated with international operations. We disclaim any obligation to update such forward-looking statements. |

Today’s Speakers Bob Bohn, Oshkosh Truck Chairman, President and Chief Executive Officer Bill Lasky, JLG Industries Chairman, President and Chief Executive Officer Charlie Szews, Oshkosh Truck Executive Vice President and Chief Financial Officer |

Oshkosh’s Next Phase of Transformation Outstanding track record of shareholder value creation and acquisition integration Agreement to acquire JLG, the world leader in aerial work platforms and telehandlers Acquisition objectives: Support growth rate of >15% Diversify to complement fast-growing defense business Execute within goals of long-term acquisition strategy Our Kind of Company |

Oshkosh Truck Overview |

Oshkosh Truck Profile $3.4 billion annual sales(1) 17% international 9,400 employees Global manufacturing footprint Nearly 6 million sq. ft. 11 states 7 countries Named one of “Best Managed Companies” by Forbes multiple times Proven, strategic acquirer 14 acquisitions in 10 years (1) Estimated fiscal 2006 sales as of October 16, 2006 |

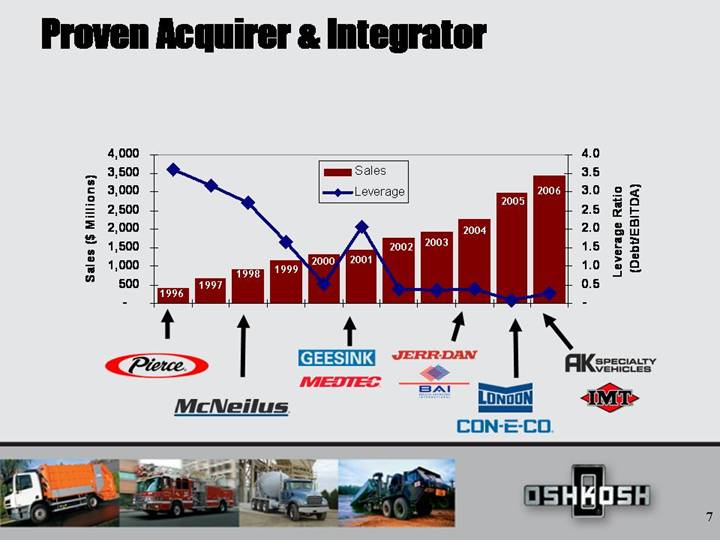

Proven Acquirer & Integrator 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Sales ($ Millions) - 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Leverage Ratio (Debt/EBITDA) Sales Leverage |

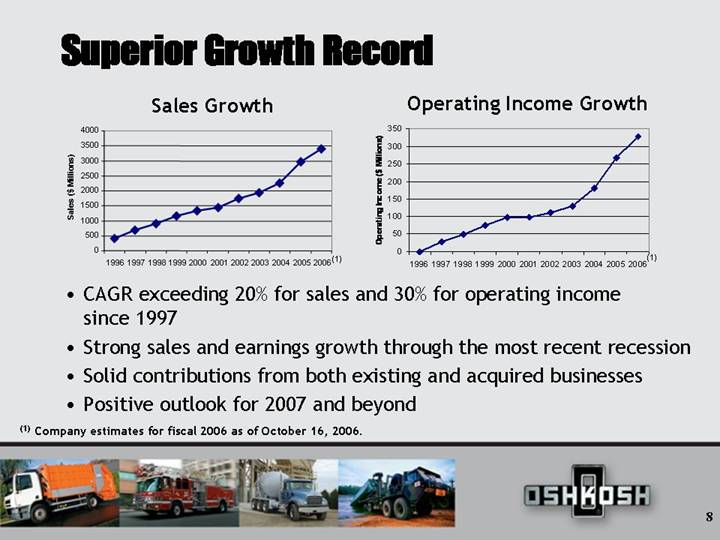

Superior Growth Record CAGR exceeding 20% for sales and 30% for operating income since 1997 Strong sales and earnings growth through the most recent recession Solid contributions from both existing and acquired businesses Positive outlook for 2007 and beyond Sales Growth Operating Income Growth 0 500 1000 1500 2000 2500 3000 3500 4000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Sales ($ Millions) (1) (1) Company estimates for fiscal 2006 as of October 16, 2006. (1) 0 50 100 150 200 250 300 350 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Operating Income ($ Millions) |

Growth Fueled by Core Growth Strategies Lead in new product development Seek operational excellence through Lean Pursue strategic, complementary acquisitions |

Current Business Mix Broad mix of federal, municipal and commercial customers Iraq conflict has driven dramatic growth in defense business Opportunity for addition of late cycle business to provide additional earnings balance Sales (1) Operating Income (1) (1) Company estimates for fiscal 2006 as of October 16, 2006 Defense 38% Commercial 34% Fire & Emergency 28% Defense 61% Commercial 16% Fire & Emergency 23% |

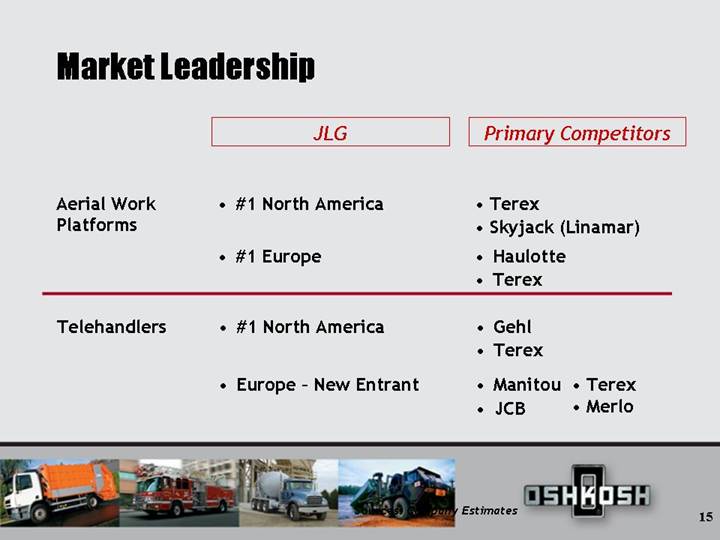

JLG: Structurally Sound, Attractive Business Leading market shares in scale-intensive products Highly regarded by distributors and end users Nationwide presence in availability-centric business Strong growth prospects $ Based Market Positions (1) North America Europe Aerial work platforms #1 #1 Telehandlers with CAT #1 #4 (1) Sources: Company estimates |

JLG Overview Boom Lifts Scissor Lifts Telehandlers |

JLG History – 37 Years of Excellence 1st boom lift produced 1st scissor lift produced 1st vertical mast lift produced Acquired Gradall 1st all- wheel-steer telehandler 1st European design telehandler Acquired SkyTrak & Lull brands; Military-design telehandlers Established AFS Acquired Delta Manlift; Liftlux brands Launched ServicePLUS initiative in Houston, TX Global alliance with Caterpillar, Inc. 2004 2003 2002 2001 1991 1970 1969 1973 1999 2005 2006 Sold excavator product line to Alamo Group Inc. |

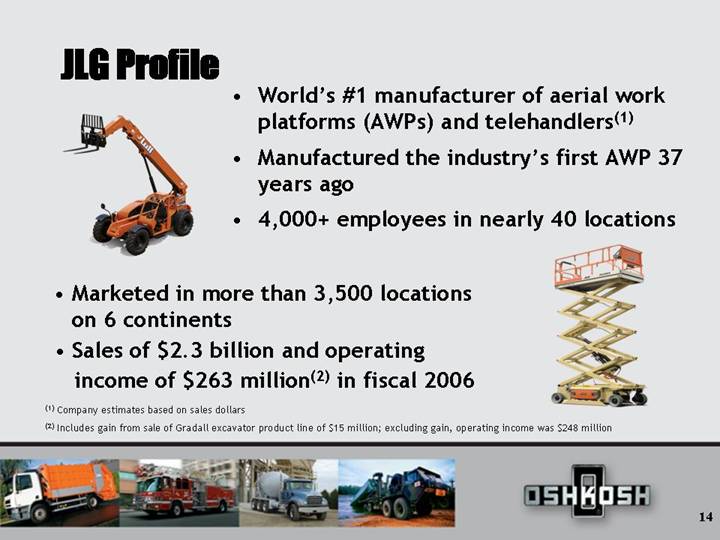

JLG Profile World’s #1 manufacturer of aerial work platforms (AWPs) and telehandlers(1) Manufactured the industry’s first AWP 37 years ago 4,000+ employees in nearly 40 locations (1) Company estimates based on sales dollars (2) Includes gain from sale of Gradall excavator product line of $15 million; excluding gain, operating income was $248 million Marketed in more than 3,500 locations on 6 continents Sales of $2.3 billion and operating income of $263 million(2) in fiscal 2006 |

Market Leadership Primary Competitors JLG Haulotte Terex #1 Europe Gehl Terex #1 North America Telehandlers Manitou JCB Europe – New Entrant Terex Skyjack (Linamar) #1 North America Aerial Work Platforms Sources: Company Estimates Terex Merlo |

The Transformation Continues |

Strategic Rationale |

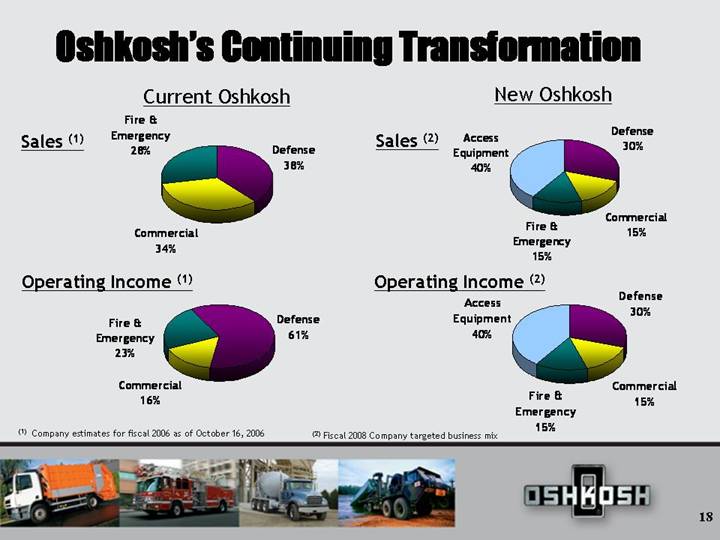

Oshkosh’s Continuing Transformation Current Oshkosh New Oshkosh Sales (1) Operating Income (1) Sales (2) Operating Income (2) (1) Company estimates for fiscal 2006 as of October 16, 2006 (2) Fiscal 2008 Company targeted business mix Defense 38% Commercial 34% Fire & Emergency 28% Defense 30% Commercial 15% Fire & Emergency 15% Access Equipment 40% Defense 30% Commercial 15% Fire & Emergency 15% Access Equipment 40% Defense 61% Commercial 16% Fire & Emergency 23% |

Significant Product Commonality Specialty vehicle manufacturer Extends aerial access portfolio/technology Staying Close to Home |

Strong Growth Opportunities Favorable non-residential construction spending outlook Execute margin expansion opportunities CAT alliance creates international opportunities Leverage combined operations Expand new product development |

Expect Transaction to Deliver Superior Returns Expect fiscal 2007 to be modestly accretive Estimate $75 million of net pre-tax synergies within 3 years Follow-on margin enhancement plan Lean initiatives |

Significant Synergies Expected $4 billion+ combined spend $1 billion+ in raw material & fabrications Drivetrain components commonality Low-cost country opportunities Consolidate corporate functions Longer-term synergies not estimated |

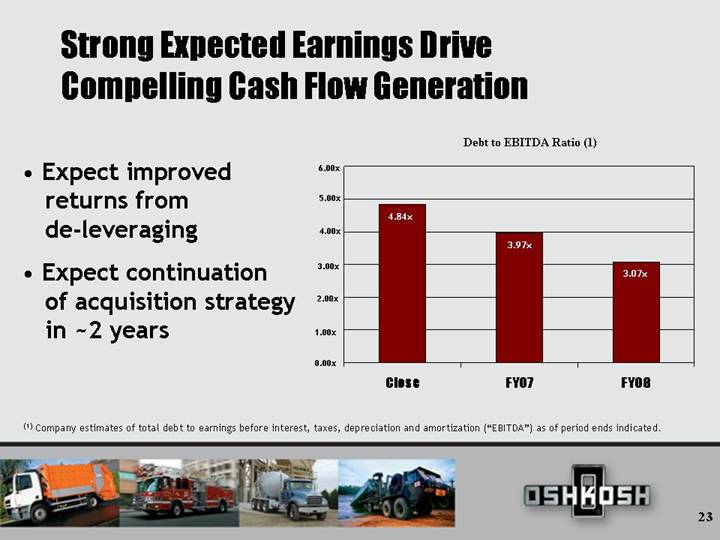

Strong Expected Earnings Drive Compelling Cash Flow Generation Expect improved returns from de-leveraging Expect continuation of acquisition strategy in ~2 years (1) Company estimates of total debt to earnings before interest, taxes, depreciation and amortization (“EBITDA”) as of period ends indicated. Debt to EBITDA Ratio (1) 4.84x 3.97x 3.07x 0.00x 1.00x 2.00x 3.00x 4.00x 5.00x 6.00x |

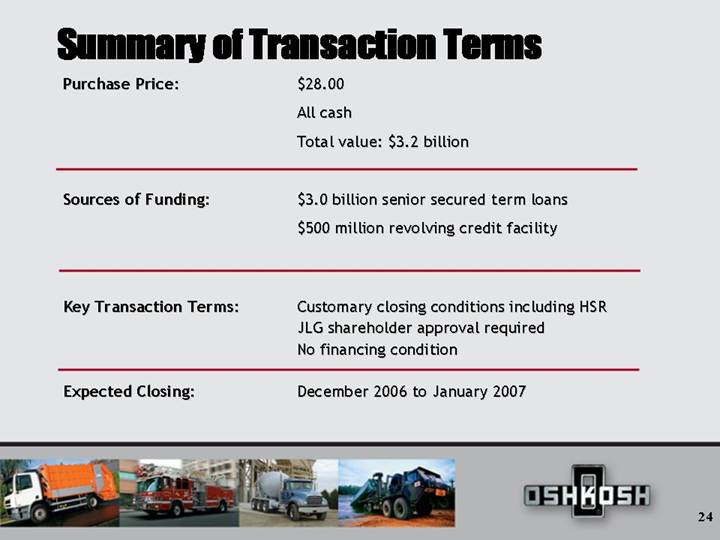

Purchase Price: $28.00 All cash Total value: $3.2 billion Sources of Funding: $3.0 billion senior secured term loans $500 million revolving credit facility Key Transaction Terms: Customary closing conditions including HSR JLG shareholder approval required No financing condition Expected Closing: December 2006 to January 2007 Summary of Transaction Terms |

Integration Joint Oshkosh-JLG approach Focused on high-synergy areas Dedicated integration teams Structured process with milestones Cross functional Participants from both OSK & JLG Supplemented by consultants to accelerate benefits |

Oshkosh Truck and JLG A formidable specialty vehicle growth company providing: Diversification Exceptional growth opportunities and solid financial returns Scale Significant cash flow generation Driven by an acquirer with a proven track record 14 acquisitions in the last 10 years All accretive in the first year De-levered quickly after previous acquisitions |

Questions & Answers |

Additional Information and Where to Find It This investor presentation may be deemed to be solicitation material in respect of the proposed acquisition of JLG Industries by Oshkosh Truck. In connection with the proposed acquisition, JLG Industries plans to file a proxy statement with the SEC. INVESTORS AND SECURITY HOLDERS OF JLG INDUSTRIES ARE ADVISED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION. The final proxy statement will be mailed to shareholders of JLG Industries. Investors and security holders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by JLG Industries with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the proxy statement, when it becomes available, and JLG Industries other filings with the SEC may also be obtained from JLG Industries. Free copies of JLG Industries filings may be obtained by directing a request to JLG Industries, Inc., 13224 Fountainhead Plaza, Hagerstown, Maryland 21742-2678, Attention: Investor Relations. Oshkosh Truck, JLG Industries and their respective directors, executive officers and other members of their management and employees may be deemed to be soliciting proxies from JLG Industries shareholders in favor of the proposed acquisition. Information regarding Oshkosh Truck’s directors and executive officers is available in Oshkosh Truck’s proxy statement for its 2006 annual meeting of shareholders, which was filed with the SEC on December 20, 2005. Information regarding JLG Industries directors and executive officers is available in JLG Industries proxy statement for its 2006 annual meeting of shareholders, which was filed with the SEC on October 2, 2006. Additional information regarding the interests of such potential participants will be included in the proxy statement and the other relevant documents filed with the SEC when they become available. |