UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

|

| Oshkosh Corporation |

| (Name of Registrant as Specified In Its Charter) |

|

Icahn Partners LP Icahn Partners Master Fund LP Icahn Partners Master Fund II L.P. Icahn Partners Master Fund III L.P. High River Limited Partnership Hopper Investments LLC Barberry Corp. Icahn Onshore LP Icahn Offshore LP Icahn Capital L.P. IPH GP LLC Icahn Enterprises Holdings L.P. Icahn Enterprises G.P. Inc. Beckton Corp. Carl C. Icahn A.B. Krongard Vincent J. Intrieri Samuel Merksamer José Maria Alapont Daniel A. Ninivaggi Marc F. Gustafson |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

| | | | |

On January 11, 2012, Carl C. Icahn and affiliated entities filed amendment No. 6 to Schedule 13D relating to Oshkosh Corporation, a copy of which is filed herewith as Exhibit 1.

ON DECEMBER 15, 2011, THE PARTICIPANTS (AS DEFINED BELOW) FILED A DEFINITIVE PROXY STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION. SECURITY HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN, A.B. KRONGARD, VINCENT J. INTRIERI, SAMUEL MERKSAMER, JOSE MARIA ALAPONT, DANIEL A. NINIVAGGI AND MARC F. GUSTAFSON, ICAHN PARTNERS LP, ICAHN PARTNERS MASTER FUND LP, ICAHN PARTNERS MASTER FUND II L.P., ICAHN PARTNERS MASTER FUND III L.P., HIGH RIVER LIMITED PARTNERSHIP, HOPPER INVESTMENTS LLC, BARBERRY CORP., ICAHN ENTERPRISES G.P. INC., ICAHN ENTERPRISES HOLDINGS L.P., IPH GP LLC, ICAHN CAPITAL L.P., ICAHN ONSHORE LP, ICAHN OFFSHORE LP, AND BECKTON CORP. (COLLECTIVELY, THE “PARTICIPANTS”) FROM THE SHAREHOLDERS OF OSHKOSH CORPORATION FOR USE AT ITS 2012 ANNUAL MEETING OF SHAREHOLDERS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY IS AVAILABLE TO SHAREHOLDERS OF OSHKOSH CORPORATION FROM THE PARTICIPANTS AT NO CHARGE AND IS ALSO AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV OR BY CONTACTING D.F. KING & CO., INC. BY TELEPHONE AT THE FOLLOWING NUMBERS: SHAREHOLDERS CALL TOLL–FREE: (800) 659–5550 AND BANKS AND BROKERAGE FIRMS CALL: (212) 269–5550.

EXHIBIT 1

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

(Name of Issuer)

|

| Common Stock, Par Value $0.01 |

(Title of Class of Securities)

(CUSIP Number)

|

Keith Schaitkin, Esq. Icahn Capital LP 767 Fifth Avenue, 47th Floor New York, New York 10153 (212) 702-4300 |

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Section 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

NOTE: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D

Item 1. Security and Issuer

This statement constitutes Amendment No. 6 to the Schedule 13D relating to the Common Stock, par value $0.01 (the “Shares”), issued by Oshkosh Corporation (the “Issuer”), and hereby amends the Schedule 13D filed with the Securities and Exchange Commission on June 30, 2011 and amended by Amendment Nos. 1 through 5 thereto (as amended, the “Initial Schedule 13D”), on behalf of the Reporting Persons (as defined in the Initial Schedule 13D), to furnish the additional information set forth herein. All capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Initial Schedule 13D.

Item 4. Purpose of Transaction

Item 4 of the Initial Schedule 13D is hereby amended by adding the following:

On January 11, 2012, the Reporting Persons delivered a presentation regarding the Issuer. A copy of the presentation is filed herewith as an exhibit and incorporated herein by reference, and any descriptions herein of the presentation are qualified in their entirety by reference to the presentation filed herewith.

ON DECEMBER 15, 2011, THE PARTICIPANTS (AS DEFINED BELOW) FILED A DEFINITIVE PROXY STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION. SECURITY HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN, A.B. KRONGARD, VINCENT J. INTRIERI, SAMUEL MERKSAMER, JOSE MARIA ALAPONT, DANIEL A. NINIVAGGI, MARC F. GUSTAFSON, ICAHN PARTNERS LP, ICAHN PARTNERS MASTER FUND LP, ICAHN PARTNERS MASTER FUND II L.P., ICAHN PARTNERS MASTER FUND III L.P., HIGH RIVER LIMITED PARTNERSHIP, HOPPER INVESTMENTS LLC, BARBERRY CORP., ICAHN ENTERPRISES G.P. INC., ICAHN ENTERPRISES HOLDINGS L.P., IPH GP LLC, ICAHN CAPITAL L.P., ICAHN ONSHORE LP, ICAHN OFFSHORE LP, AND BECKTON CORP. (COLLECTIVELY, THE “PARTICIPANTS”) FROM THE SHAREHOLDERS OF OSHKOSH CORPORATION FOR USE AT ITS 2012 ANNUAL MEETING OF SHAREHOLDERS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY IS AVAILABLE TO SHAREHOLDERS OF OSHKOSH CORPORATION FROM THE PARTICIPANTS AT NO CHARGE AND IS ALSO AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV OR BY CONTACTING D.F. KING & CO., INC. BY TELEPHONE AT THE FOLLOWING NUMBERS: SHAREHOLDERS CALL TOLL–FREE: (800) 659–5550 AND BANKS AND BROKERAGE FIRMS CALL: (212) 269–5550.

Item 7. Material to be Filed as Exhibits

SIGNATURE

After reasonable inquiry and to the best of each of the undersigned knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: January 11, 2012

| | | | |

ICAHN PARTNERS MASTER FUND LP ICAHN PARTNERS MASTER FUND II LP ICAHN PARTNERS MASTER FUND III LP ICAHN OFFSHORE LP ICAHN PARTNERS LP ICAHN ONSHORE LP BECKTON CORP. HOPPER INVESTMENTS LLC BARBERRY CORP. HIGH RIVER LIMITED PARTNERSHIP |

| | | | |

| | |

| | By: | | Hopper Investments LLC, general partner |

| | |

| | | By: | | /s/ Edward E. Mattner |

| | Name: | | Edward E. Mattner |

| | Title: | | Authorized Signatory |

|

| ICAHN CAPITAL LP |

| | |

| | By: | | IPH GP LLC, its general partner |

| | By: | | Icahn Enterprises Holdings L.P., its sole member |

| | By: | | Icahn Enterprises G.P. Inc., its general partner |

|

| IPH GP LLC |

| | |

| | By: | | Icahn Enterprises Holdings L.P., its sole member |

| | By: | | Icahn Enterprises G.P. Inc., its general partner |

|

| ICAHN ENTERPRISES HOLDINGS L.P. |

| | |

| | By: | | Icahn Enterprises G.P. Inc., its general partner |

| | |

|

| ICAHN ENTERPRISES G.P. INC. |

| |

| By: | | /s/ Dominick Ragone |

| Name: | | Dominick Ragone |

| Title: | | Chief Financial Officer |

|

/s/ Carl C. Icahn |

| CARL C. ICAHN |

|

A RESPONSE TO RECENTLY FILED PROXY MATERIAL Oshkosh Corporation Exhibit 1 |

|

Special note regarding this presentation 2 |

|

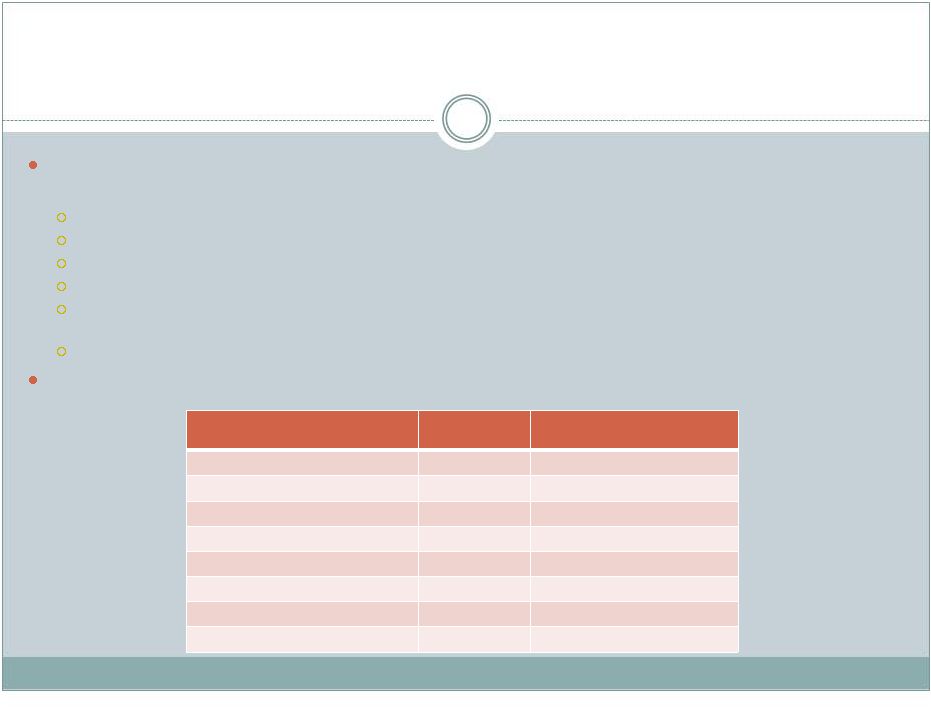

Sources: Bloomberg, 2012 Estimates are Bloomberg consensus A new set of comps Oshkosh management has recently argued that their low SGA margins relative to a peer group should be a positive benchmark SGA margins alone do not drive shareholder returns… Compared to that same peer group Oshkosh has: The LOWEST projected operating income margin The LOWEST 2012 projected EPS growth The LOWEST 2011 shareholder return 3 Ticker 2012 Operating Income Margin 2012 EPS Growth 2011 Total Shareholder Return ATK 11.7% -5.4% -34.42% CRDN 18.9% -12.6% 39.33% CMI 14.2% 12.5% 96.87% DOV 16.1% 9.0% 45.52% FSS 6.2% 250.4% -28.51% FRPT 5.7% 83.1% 6.53% GD 12.0% 5.3% 2.41% MTW 8.3% 169.9% -6.59% NAV 5.2% 14.6% -1.99% NOC 11.1% -2.7% 22.99% PCAR 9.7% 21.9% 8.27% RTN 11.1% 4.4% -0.41% TEX 5.4% 252.0% -31.80% DHR 17.5% 16.5% 25.59% ETN 16.1% 10.9% 44.85% PH 11.1% 16.5% 46.37% OSK 3.6% -52.5% -42.26% |

|

MOVE without urgency The company has claimed they have taken “decisive action” and initiated what was allegedly a “comprehensive review” but recently stated that the primary result of that review was simply – “business model reaffirmed” As a shareholder, we would expect, given recent “unprecedented "challenges, Oshkosh would look for ways to enhance shareholder value and drive operating performance rather than continuing with the existing business model How did this reaffirmation help shareholders? It seems to us that the only beneficiary is the management team who has allegedly been reaffirmed The company has disclosed their time frames and goals for restructuring activities 250 basis points of operating income margin opportunity by a portion of which seems to be simply related to an eventual market recovery through the absorption of fixed costs; it is not clear what portion if any is actually related to reduction of costs The company has stated that their manufacturing footprint rationalizations (20% reduction on a company that has over $7 Billion in sales) will take 5 years to generate $33 million of savings In our opinion this calls into question the company’s ability to generate any meaningful cost savings on a going forward basis 4 2016 |

|

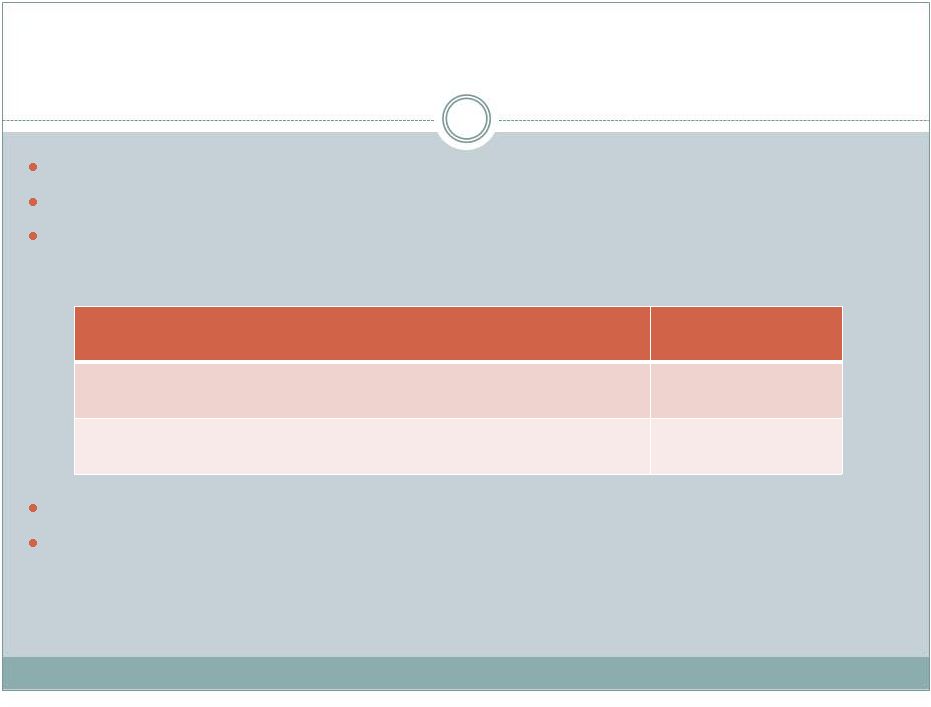

A more balance board The company has criticized the Icahn slate for lacking experience in Defense and Construction Equipment though the assertion is factually inaccurate Mr. Alapont was formerly President/CEO of Iveco which built defense, fire and construction products Mr. Intrieri is on the board of Motorola Solutions which sells to municipal, federal and defense customers Mr. Krongard spent several years as Executive Director for the CIA None of Oshkosh board members have substantial experience in construction equipment None of the Oshkosh board members that we are seeking to replace (other than founder’s son – Mosling and Szews) have defense experience 6 out of 13 board members at Oshkosh are former CFOs The Icahn slate brings key skills to the board 5 Key Skills & Experience brought to the board Icahn Slate Outside Oshkosh Directors we are seeking to replace International business YES NO Specialty Vehicle YES NO Fire Apparatus Manufacturing YES NO Commercial Vehicle Manufacturing YES NO Developing M&A Strategies YES NO Business turnaround YES ? Building strong management teams YES ? Strong Financial/Investing YES ? |

|

Relative track records The company has criticized Icahn’s investment track record We believe the Icahn track record speaks for itself Apparently Icahn and Oshkosh had a different strategy for weathering the turbulent markets of 2011 Oshkosh stock was lower at the end of 2011 than it was at the end of 2003 From 2007-2011 Oshkosh stock was down 55.84% 6 2011 Oshkosh Price Appreciation -39.3% Icahn Investment Funds Performance 34.73% |

|

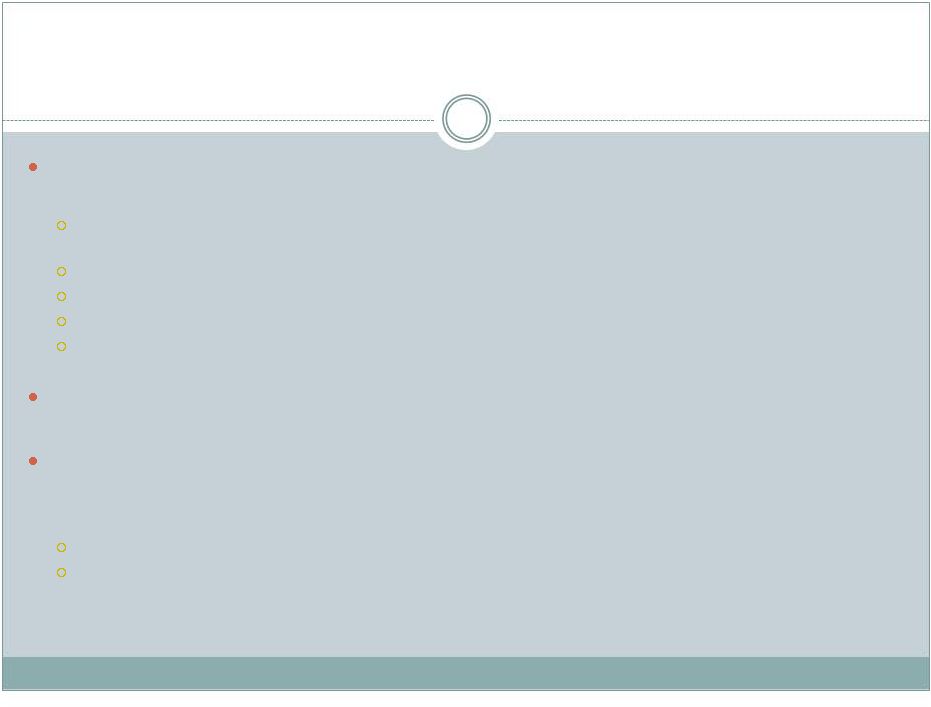

Management turnover problem 7 Oshkosh has experienced a surprising amount of turnover at the division head level in the last 5 years Defense – 4 separate division heads (including Szews on an interim basis) with the two recent appointees being outsiders JLG – Szews (for 5 months after the acquisition) and two other division heads Fire & Emergency – at least 4 different division heads Purchasing / Procurement – 3 different heads, the last two outsiders Manufacturing – Two different heads, most recently an outsider, the second of which recently left the company The inability to maintain stability or source management internally may contribute to operational instability All divisions are currently run by executives with sales/marketing background and the company has lost two separate manufacturing chiefs in the last few years Restructuring and FMTV execution issues are not surprising to us given reduced manufacturing expertise Shareholders should ask who is currently responsible for the facility optimization plans? |