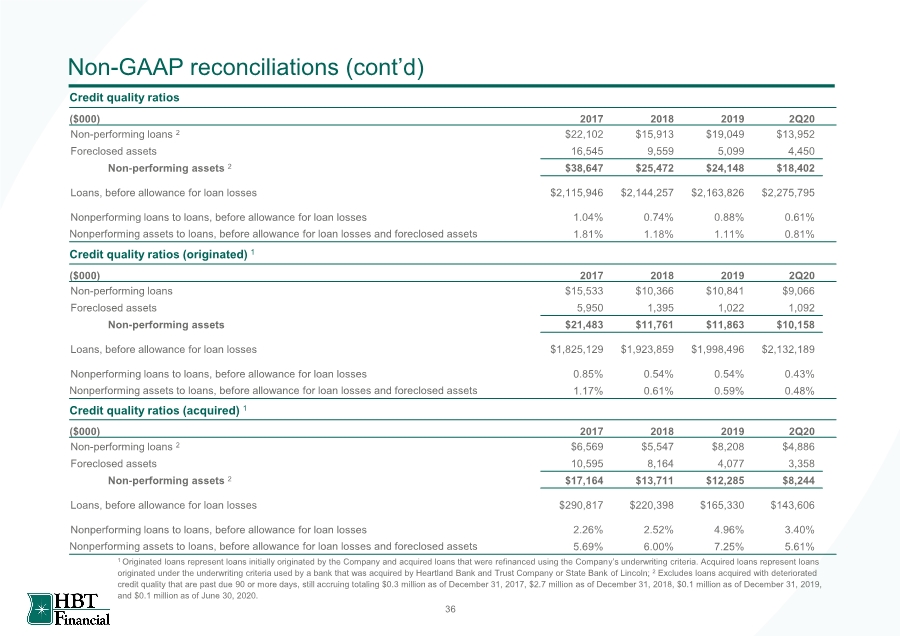

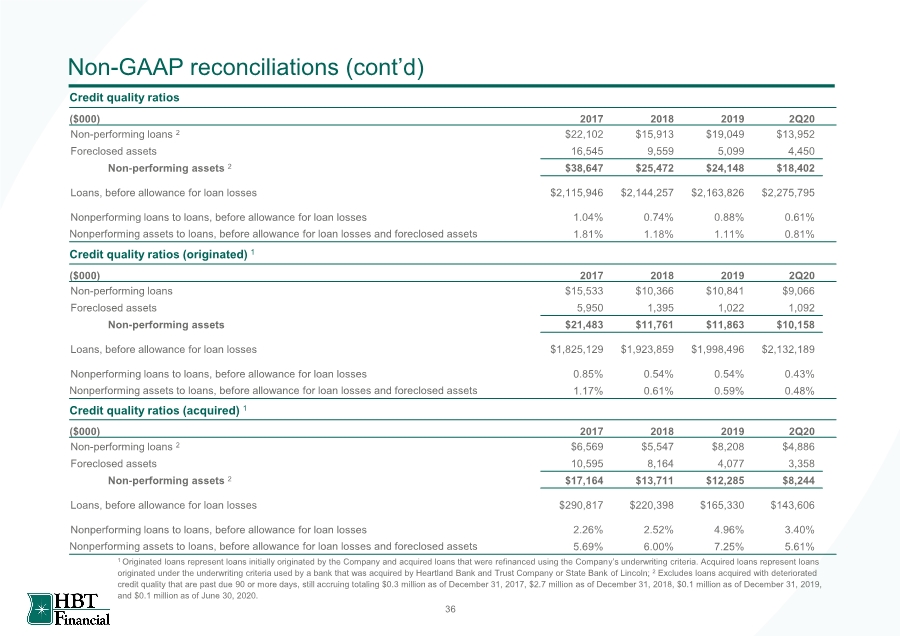

| Non-GAAP reconciliations (cont’d) ($000) 2017 2018 2019 2Q20 Non-performing loans 2 $22,102 $15,913 $19,049 $13,952 Foreclosed assets 16,545 9,559 5,099 4,450 Non-performing assets 2 $38,647 $25,472 $24,148 $18,402 Loans, before allowance for loan losses $2,115,946 $2,144,257 $2,163,826 $2,275,795 Nonperforming loans to loans, before allowance for loan losses 1.04% 0.74% 0.88% 0.61% Nonperforming assets to loans, before allowance for loan losses and foreclosed assets 1.81% 1.18% 1.11% 0.81% Credit quality ratios 36 ($000) 2017 2018 2019 2Q20 Non-performing loans $15,533 $10,366 $10,841 $9,066 Foreclosed assets 5,950 1,395 1,022 1,092 Non-performing assets $21,483 $11,761 $11,863 $10,158 Loans, before allowance for loan losses $1,825,129 $1,923,859 $1,998,496 $2,132,189 Nonperforming loans to loans, before allowance for loan losses 0.85% 0.54% 0.54% 0.43% Nonperforming assets to loans, before allowance for loan losses and foreclosed assets 1.17% 0.61% 0.59% 0.48% Credit quality ratios (originated) 1 Credit quality ratios (acquired) 1 ($000) 2017 2018 2019 2Q20 Non-performing loans 2 $6,569 $5,547 $8,208 $4,886 Foreclosed assets 10,595 8,164 4,077 3,358 Non-performing assets 2 $17,164 $13,711 $12,285 $8,244 Loans, before allowance for loan losses $290,817 $220,398 $165,330 $143,606 Nonperforming loans to loans, before allowance for loan losses 2.26% 2.52% 4.96% 3.40% Nonperforming assets to loans, before allowance for loan losses and foreclosed assets 5.69% 6.00% 7.25% 5.61% 1 Originated loans represent loans initially originated by the Company and acquired loans that were refinanced using the Company’s underwriting criteria. Acquired loans represent loans originated under the underwriting criteria used by a bank that was acquired by Heartland Bank and Trust Company or State Bank of Lincoln; 2 Excludes loans acquired with deteriorated credit quality that are past due 90 or more days, still accruing totaling $0.3 million as of December 31, 2017, $2.7 million as of December 31, 2018, $0.1 million as of December 31, 2019, and $0.1 million as of June 30, 2020. |