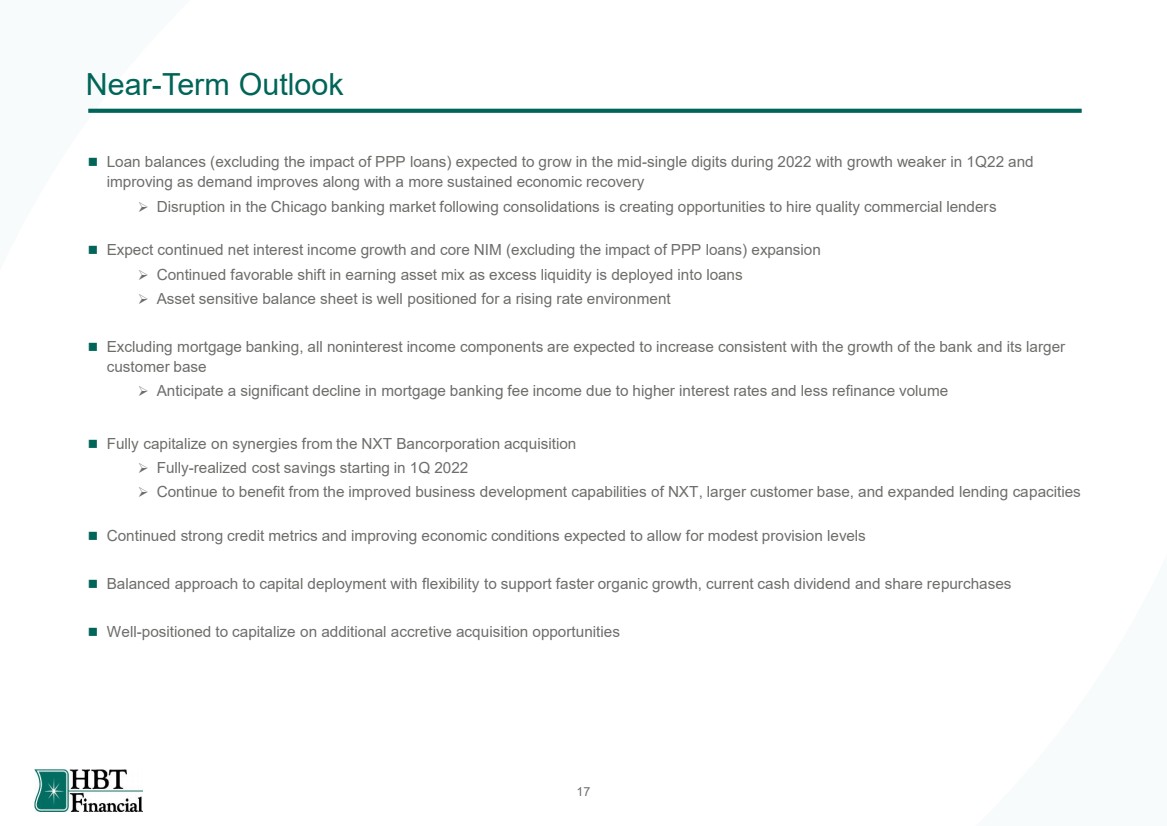

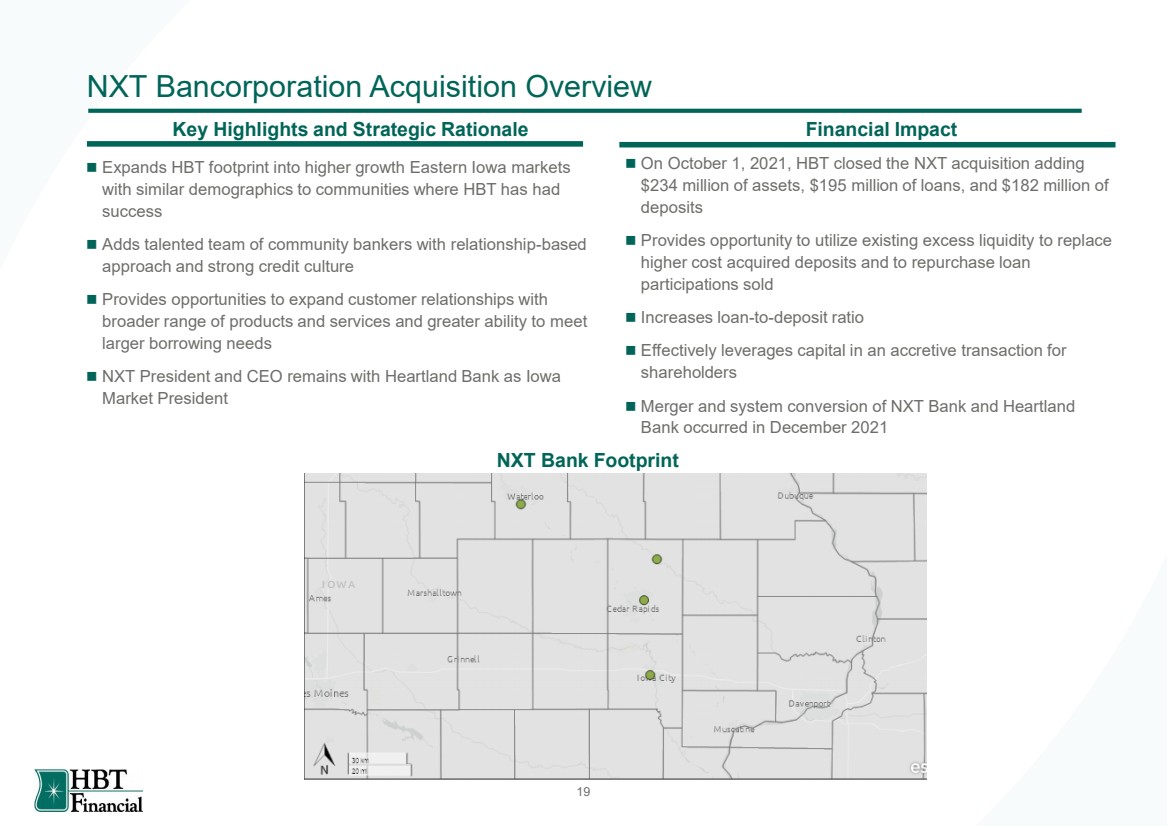

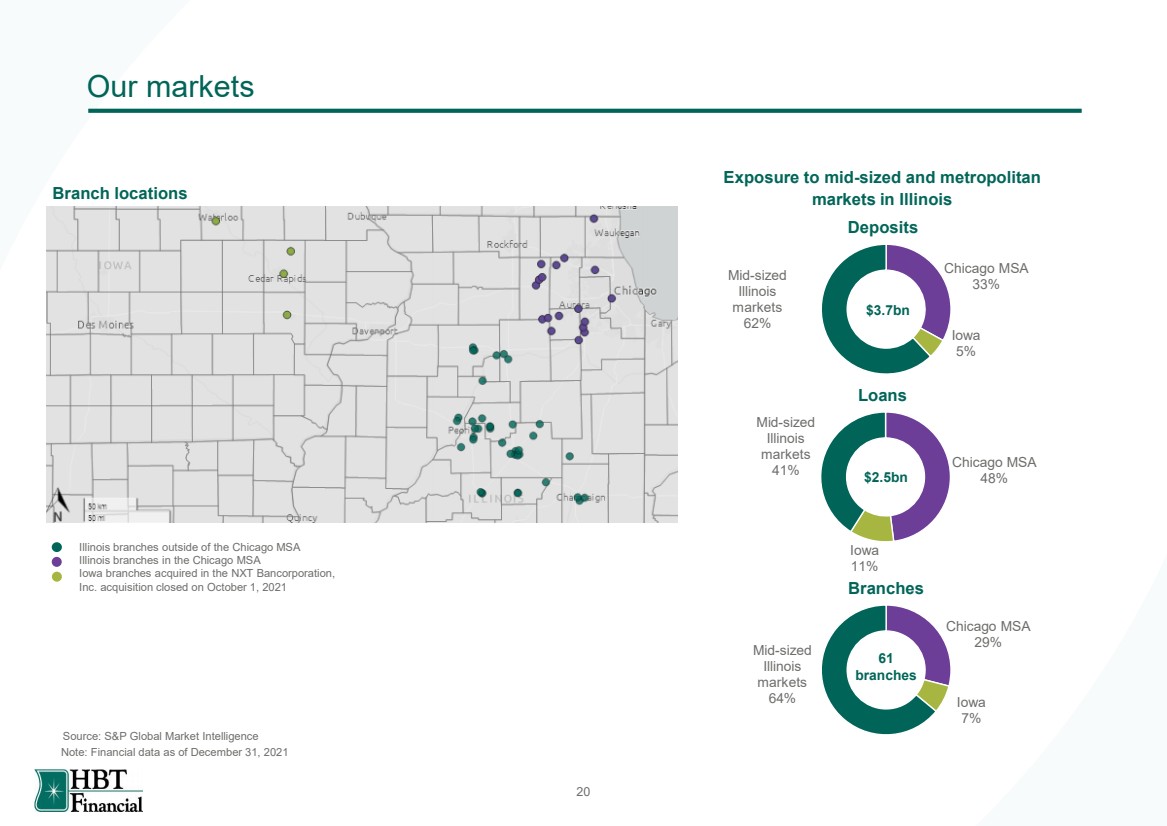

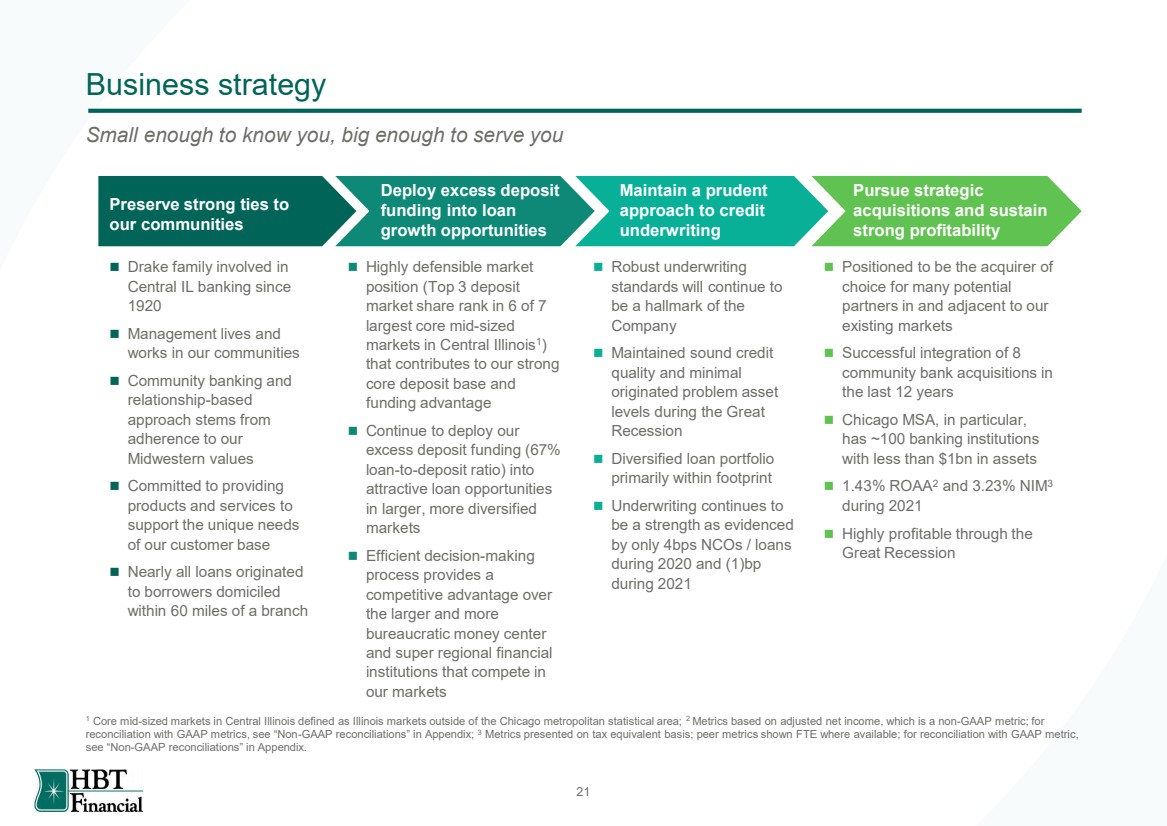

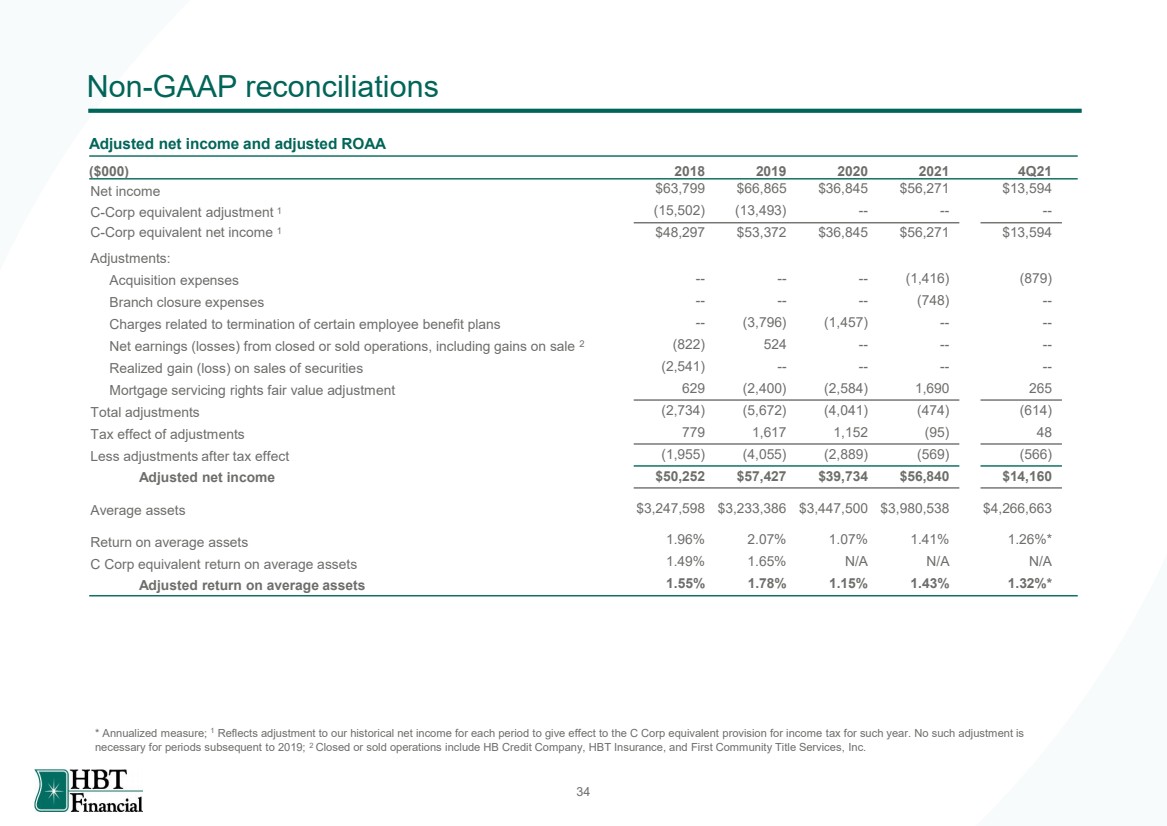

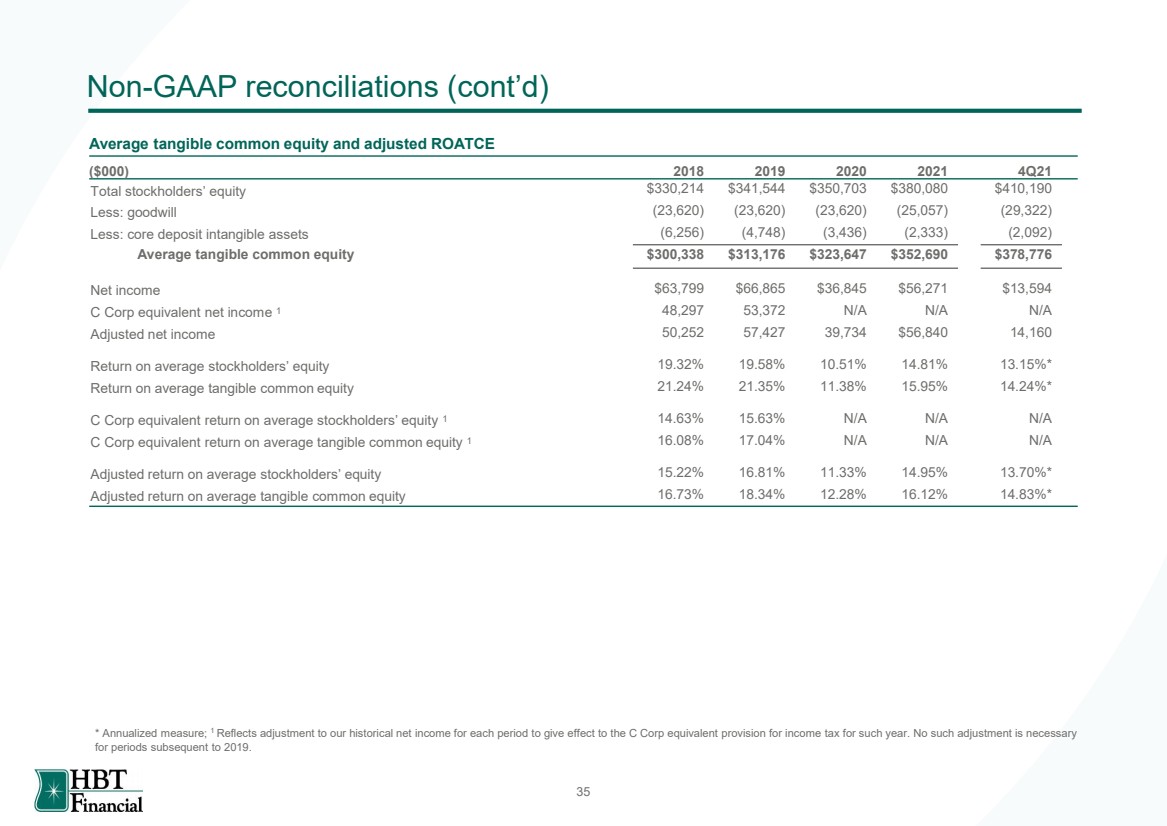

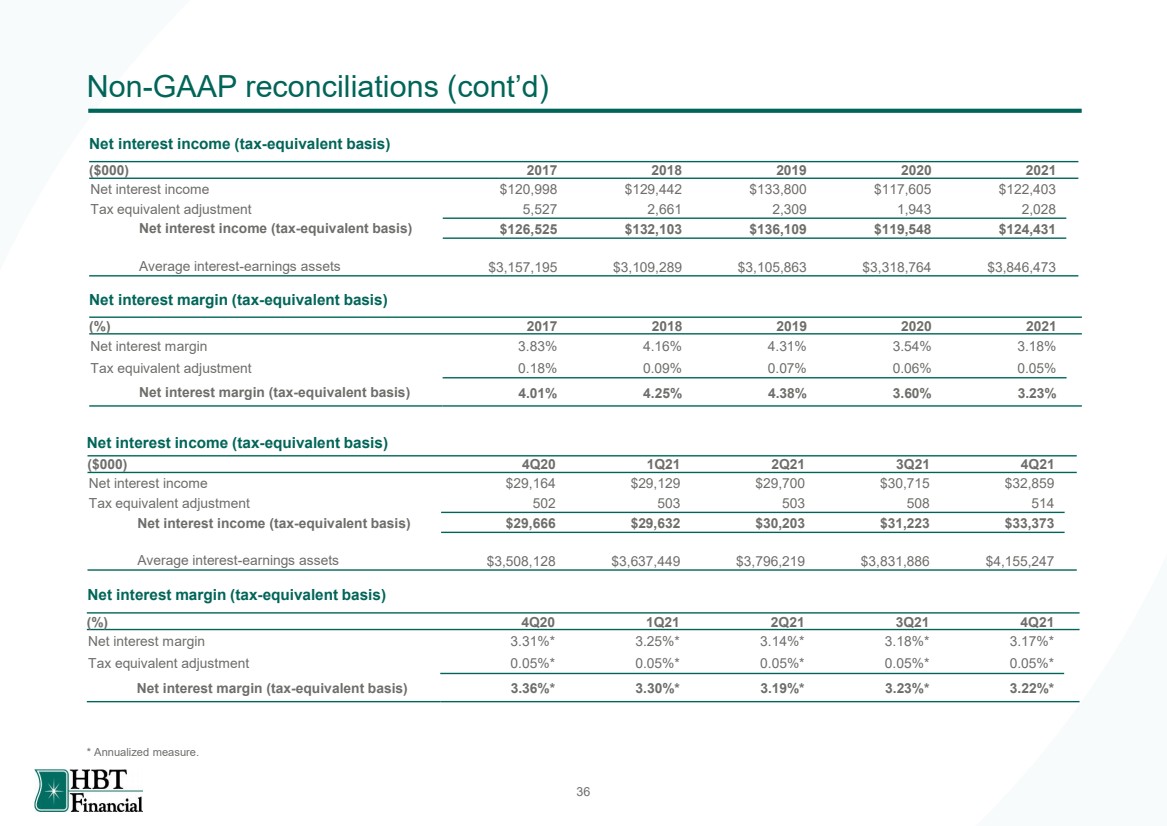

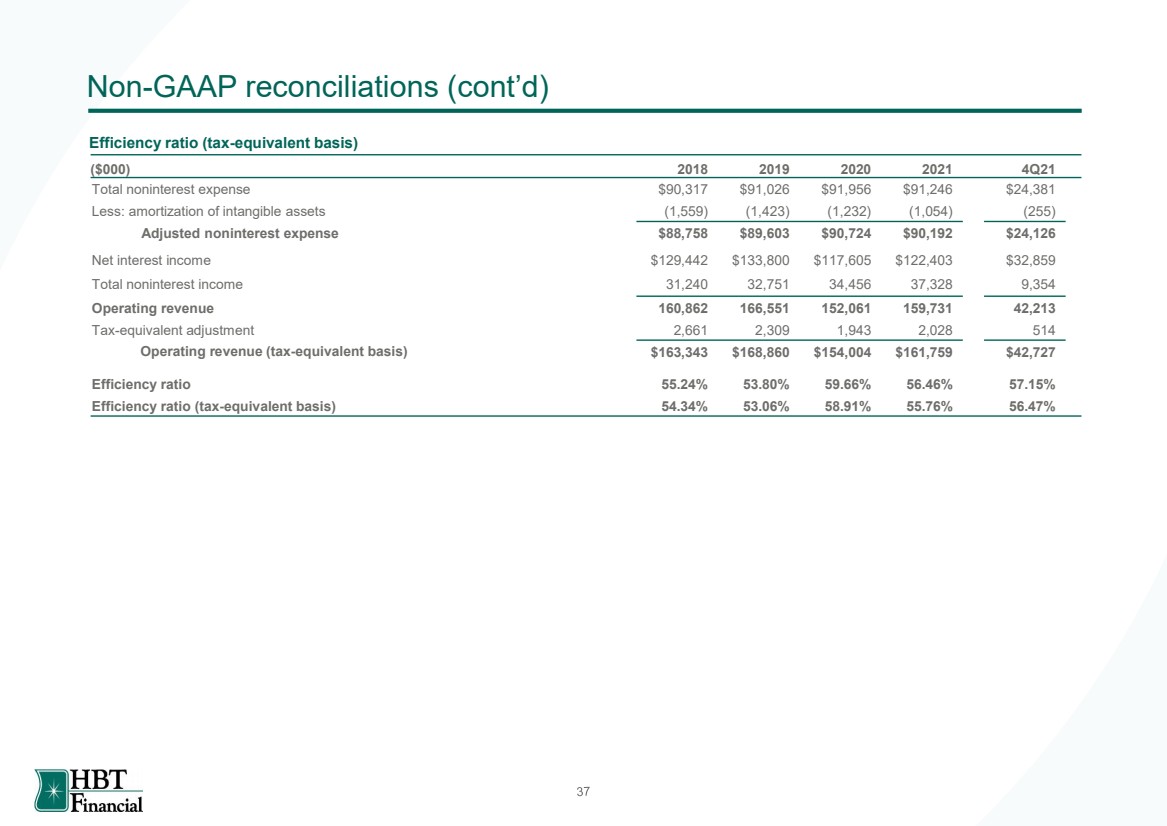

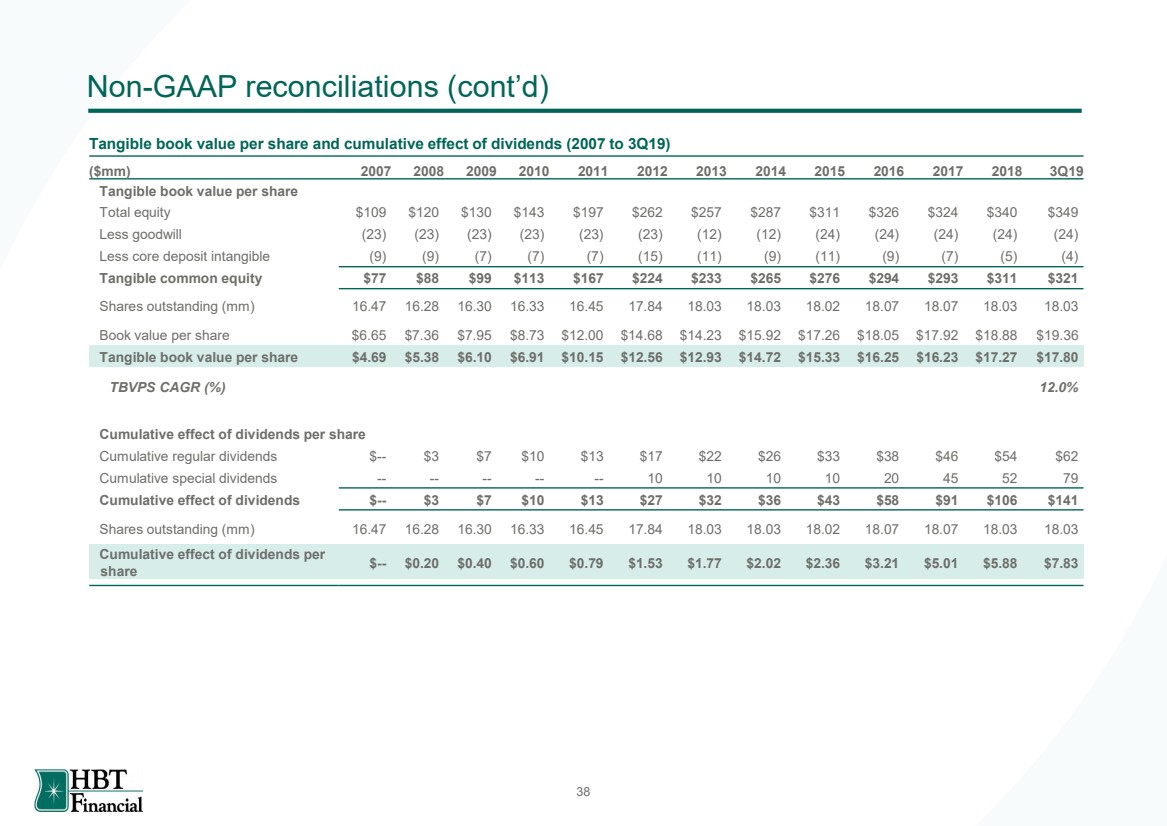

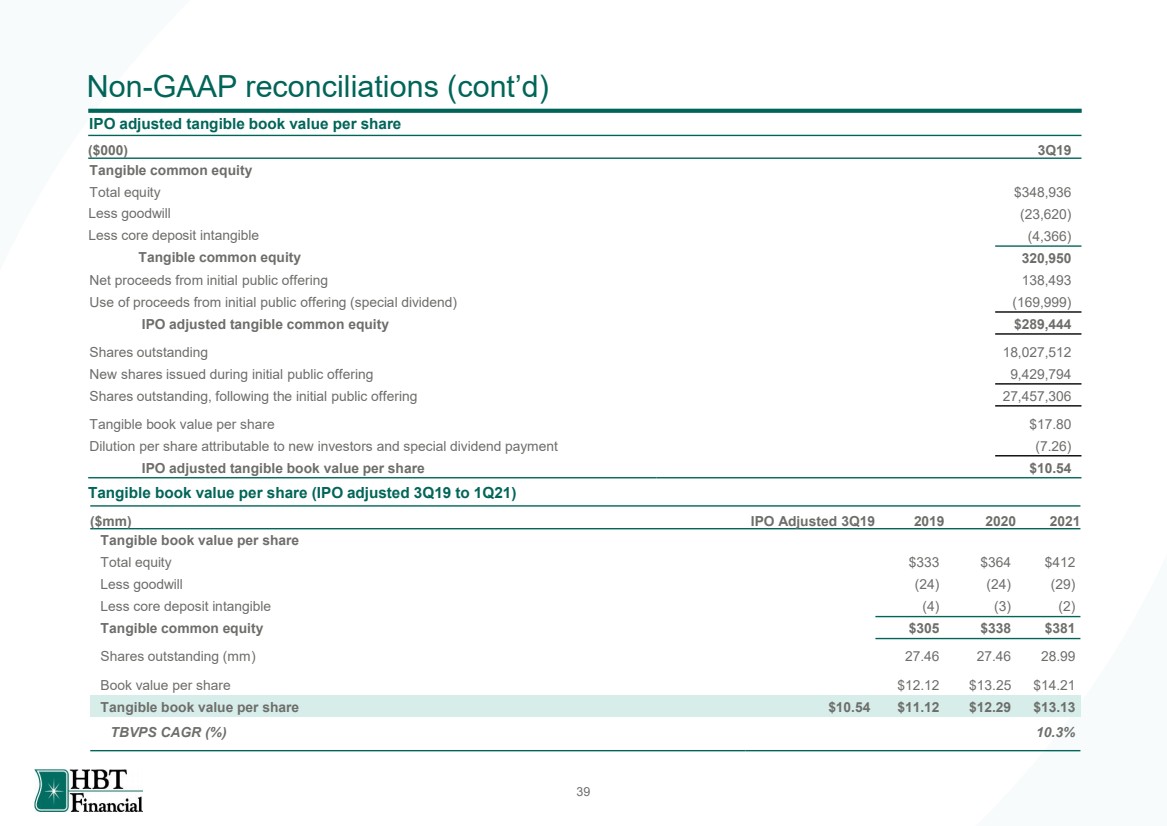

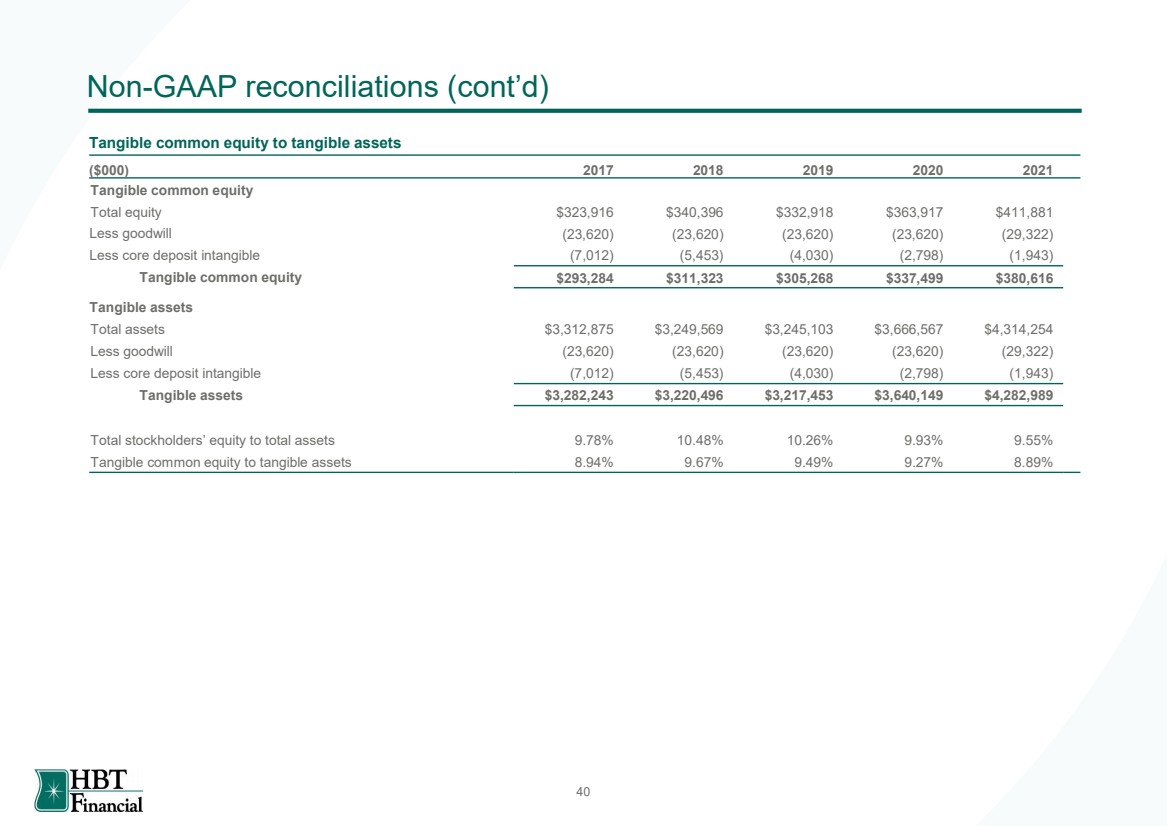

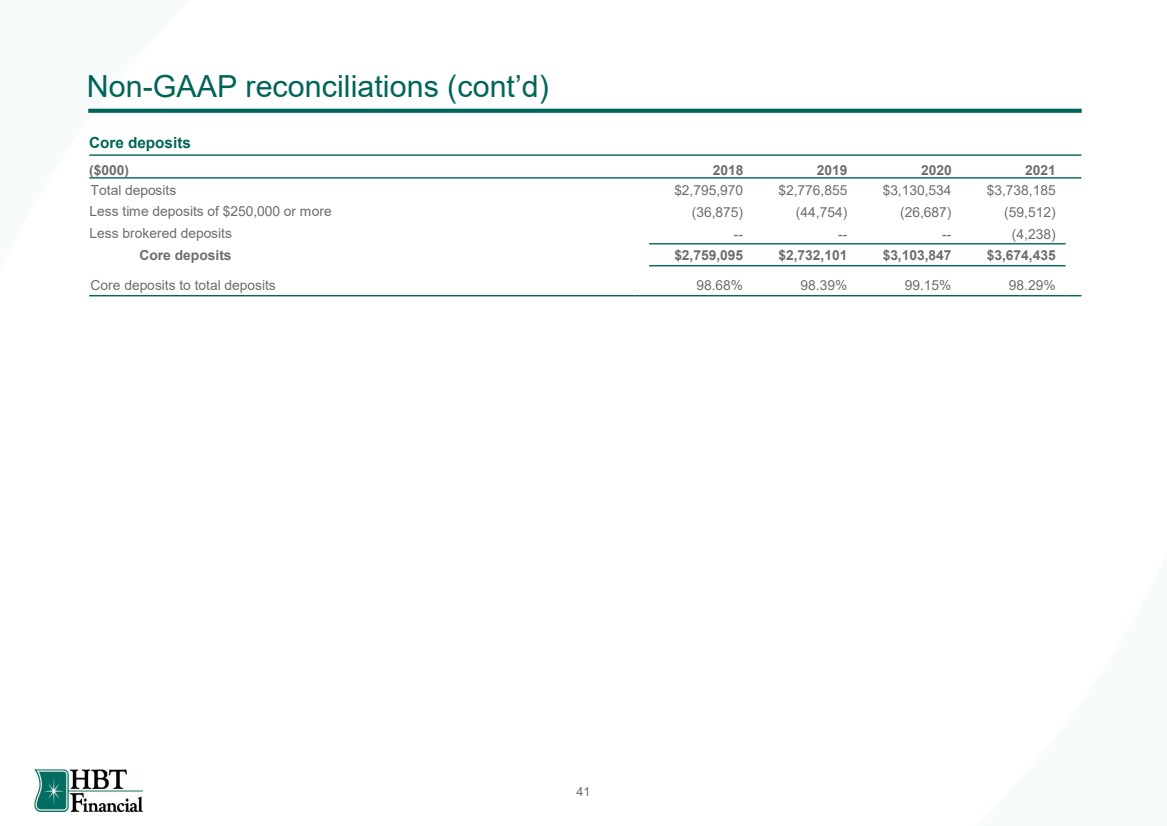

| Forward - Looking Statements Certain statements contained in this presentation are forward - looking statements. Forward - looking statements may include stateme nts relating to our future plans, strategies and expectations, as well as the economic impact of COVID - 19 and the related impacts on our future financial results and statements about our near - term outlo ok, including near - term loan growth, net interest margin, provision for loan losses, service charges on deposit accounts, mortgage banking profits, wealth management fees, expenses, a sse t quality, capital levels and continued earnings, including as a result of expected improvement in economic conditions with respect to COVID - 19; and about the expected benefits, synergies, resu lts and growth resulting from the acquisition of NXT Bancorporation, Inc. (“NXT”) and NXT Bank. Forward looking statements are generally identifiable by use of the words ‘‘believe,’’ “may,” “will,” “should,” “could,” “exp ec t,” “estimate,” “intend,” “anticipate,” “project,” “plan” or similar expressions. Forward looking statements are frequently based on assumptions that m ay or may not materialize and are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the forward - looking statements. Factors that could cau se actual results to differ materially from the results anticipated or projected and which could materially and adversely affect our operating results, financial condition or prospects include, bu t a re not limited to: the severity, magnitude and duration of the COVID - 19 pandemic; the direct and indirect impacts of the COVID - 19 pandemic and governmental responses to the pandemic on our operations and our customers’ businesses; the continued disruption or worsening of global, national, state and local economies associated with the COVID - 19 pandemic, including in connection with inf lationary pressures and supply chain constraints, which could affect our capital levels and earnings, impair the ability of our borrowers to repay outstanding loans, impair collateral values and fu rther increase our allowance for credit losses; our asset quality and any loan charge - offs; the composition of our loan portfolio; time and effort necessary to resolve nonperforming assets; environmenta l liability associated with our lending activities; the effects of the current low interest rate environment or changes in interest rates on our net interest income, net interest margin, our investments, and our loan originations, and our modelling estimates relating to interest rate changes; our access to sources of liquidity and capital to address our liquidity needs; our inability to receive dividen ds from Heartland Bank and Trust Company (the “Bank”), pay dividends to our common stockholders or satisfy obligations as they become due; the effects of problems encountered by other financial institu tio ns; our ability to achieve organic loan and deposit growth and the composition of such growth; the timing, outcome and results of integrating the operations of NXT into those of HBT Financial, In c. (“HBT”); the possibility that expected benefits, synergies and results from the acquisition are delayed or not achieved; the effects of the merger in HBT’s future financial condition, results of operations, strategy and plans; potential adverse react ion s or changes to customer or employee relationships resulting from the completion of the transaction; the diversion of management time on inte gra tion - related issues; our ability to attract and retain skilled employees or changes in our management personnel; any failure or interruption of our information and communications systems; our abilit y t o identify and address cybersecurity risks; the effects of the failure of any component of our business infrastructure provided by a third party; our ability to keep pace with technological changes; our ability to successfully develop and commercialize new or enhanced products and services; current and future business, economic and market conditions in the United States generally or in Illin ois and Iowa in particular; the geographic concentration of our operations in Illinois and Iowa; our ability to effectively compete with other financial services companies and the effects of competiti on in the financial services industry on our business; our ability to attract and retain customer deposits; our ability to maintain the Bank’s reputation; possible impairment of our goodwill and other intang ibl e assets; the impact of, and changes in applicable laws, regulations and accounting standards and policies; our prior status as an “S Corporation” under the applicable provisions of the Internal Rev enu e Code of 1986, as amended; possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations; t he effectiveness of our risk management and internal disclosure controls and procedures; market perceptions associated with certain aspects of our business; the one - time and incremental costs of operat ing as a standalone public company; our ability to meet our obligations as a public company, including our obligations under Section 404 of the Sarbanes - Oxley Act; and damage to our reputa tion from any of the factors described above or elsewhere in this presentation. These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance sho uld not be placed on such statements. Forward - looking statements speak only as of the date they are made. We do not undertake any obligation to update any forward - looking statement in the futur e, or to reflect circumstances and events that occur after the date on which the forward - looking statement was made. Non - GAAP Financial Measures This presentation includes certain non - GAAP financial measures. While HBT Financial, Inc. (“HBT” or the “Company”) believes thes e are useful measures for investors, they are not presented in accordance with GAAP. You should not consider non - GAAP measures in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Because not all companies use identical calculations, the presentation herein of non - GAAP financial measures may not be comparab le to other similarly titled measures of other companies. Tax equivalent adjustments assume a federal tax rate of 21% and state income tax rate of 9.5% during the three months ended Decem ber 31, 2021, September 30, 2021, June 30, 2021, March 31, 2021, and December 31, 2020, and the years ended December 31, 2021, 2020, 2019 and 2018, and a federal tax rate of 35% and state in com e tax rate of 8.63% for the year ended December 31, 2017. For a reconciliation of the non - GAAP measures we use to the most closely comparable GAAP measures, see the Appendix to this pres entation. 1 |