2 0 0 8 A N N U A L R E P O R T |

|

|

|

|

|

|

|

OUR VISION: At United, we're committed to making a difference every day by providing the right solution delivered with the best client experience on Planet Earth.

FINANCIAL HIGHLIGHTSUNITED BANCORP, INC. AND SUBSIDIARIES

In thousands, where applicable | 2008 |

| 2007 |

| % CHANGE | |||

BALANCE SHEET (at December 31) |

|

|

|

|

|

|

|

|

Securities | $ | 85,093 |

| $ | 85,898 |

| -0.9 | % |

Loans |

| 702,007 |

|

| 650,300 |

| 8.0 | % |

Deposits |

| 709,549 |

|

| 671,537 |

| 5.7 | % |

Total assets |

| 832,393 |

|

| 795,687 |

| 4.6 | % |

|

|

|

|

|

|

|

|

|

INCOME STATEMENT PERFORMANCE |

|

|

|

|

|

|

|

|

Interest income | $ | 47,041 |

| $ | 51,634 |

| -8.9 | % |

Interest expense |

| 17,297 |

|

| 21,873 |

| -20.9 | % |

Net interest income |

| 29,744 |

|

| 29,761 |

| -0.1 | % |

Noninterest income |

| 13,510 |

|

| 13,652 |

| -1.0 | % |

Net income (loss) |

| (36 | ) |

| 5,582 |

| -100.6 | % |

Basic and diluted earnings (loss) per share |

| (0.01 | ) |

| 1.06 |

| -100.9 | % |

Return on average assets |

| 0.00 | % |

| 0.72 | % | -100.0 | % |

Return on average shareholders' equity |

| -0.05 | % |

| 7.44 | % | -100.7 | % |

|

|

|

|

|

|

|

|

|

CAPITAL PERFORMANCE |

|

|

|

|

|

|

|

|

Year-end shareholders' equity | $ | 69,451 |

| $ | 72,967 |

| -4.8 | % |

Year-end book value per share |

| 13.75 |

|

| 14.33 |

| -4.1 | % |

Cash dividends per share |

| 0.70 |

|

| 0.79 |

| -11.4 | % |

Dividend payout ratio |

| NA |

|

| 74.5 | % | NA |

|

Average equity to average total assets |

| 9.09 | % |

| 9.65 | % | -5.8 | % |

|

|

|

|

|

|

|

|

|

ASSET QUALITY |

|

|

|

|

|

|

|

|

Net charge-offs to average gross loans |

| 1.28 | % |

| 0.66 | % | 93.9 | % |

Nonperforming loans to gross loans |

| 3.09 | % |

| 2.33 | % | 32.6 | % |

Allowance for loan losses to gross loans |

| 2.63 | % |

| 1.91 | % | 37.7 | % |

Allowance for loan losses to nonperforming loans |

| 85.1 | % |

| 81.2 | % | 4.8 | % |

| 2008 |

| 2007 |

| 2006 |

| 2005 |

| 2004 |

|

FIVE YEAR PERFORMANCE RECORD |

|

|

|

|

|

|

|

|

|

|

Five year average ROA | 0.87 | % | 1.12 | % | 1.24 | % | 1.19 | % | 1.21 | % |

Five year average ROE | 9.10 |

| 11.76 |

| 13.08 |

| 12.69 |

| 12.76 |

|

Compound growth in earnings per share | -24.0 |

| -5.1 |

| 11.7 |

| 7.6 |

| 7.9 |

|

Compound growth in book value | 4.3 |

| 6.2 |

| 8.6 |

| 8.0 |

| 8.4 |

|

Five year average dividend yield | 3.21 |

| 2.73 |

| 2.45 |

| 2.41 |

| 2.50 |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 03

LETTER TO SHAREHOLDERS.

It is no secret that the banking industry is facing tough challenges in today's economic times. While these issues may be making headlines, United's clients should feel secure that their money is safe and sound. As with other banks, credit quality is still a major issue, and funding is our number-one focus day by day; however, we have many reasons to be optimistic and very positive about our future.

Please know that we are a community bank, not an investment or money-center bank. We are considered well capitalized and well positioned to weather the coming months. Are we operating in difficult and unprecedented times? Yes; however, as an organization, we continue to meet these challenges, and we are confident that United will come out a stronger organization in the long run. We are still in the business of helping our clients achieve their financial goals. There are a lot of loan opportunities in our markets right now, and in order to take advantage of them, we must increase our funding and stay focused on looking for opportunities that grow deposits in the markets we serve. These local deposits stay local, which fosters small business growth, creates jobs, and equips us to provide loans to the people in our communities. Larger regional and national banks take your deposits, but they don't always reinvest the money here - the deposits may end up across the country or around the world. That's why it's so important to support the businesses that support us; the same businesses that make our community a good place to live and keep our standard of living rising - not falling.

Such a forward focus is all the more challenging because the outlook for growth from those businesses that drove our earnings gains in recent years is not as strong. We are fortunate because our diverse business model provides us with unique opportunities in 2009, with our mortgage company, United Structured Finance Company™, the Wealth Management Group, and our small business initiative. These areas are not only drivers for growth, but also vehicles for bringing new relationships to the bank. We know that clients are looking for financial planning expertise; therefore, delivering our team-based consultative expertise is imperative as clients and prospects look for advisors to help them develop plans to achieve their long-term goals. The team approach we started in 2008 is truly our unique value proposition, and allows us to deliver on our financial champion mission. By offering our traditional banking services with business advisory capabilities and wealth management services, we continu e to enhance the value delivered to our clients and are well positioned for future growth.

04 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

Along with our team approach for our business lines, our other focus for 2009 is centered on refining our business model with the following key initiatives: |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 05

EXPERIENCE THE UNITED DIFFERENCE. It may be the area, it may be because we grew up here, or maybe it's something in the water, but we can truthfully say that our people are what really make the difference between us and other financial institutions. When our clients walk in, they feel welcomed, they feel at home, and most importantly, they feel valued. Ours is a culture of cooperation, enthusiasm, and commitment to excellence in everything we do, every day. That's why we really do make a difference at United - in the lives of our clients and in the community itself.

06 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

UNITED IN OURCULTURE. |

|

|

|

UNITED IN OURFOCUS. |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 07

| UNITED INGROWTH. |

|

|

| UNITED ININTEGRATION. |

08 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

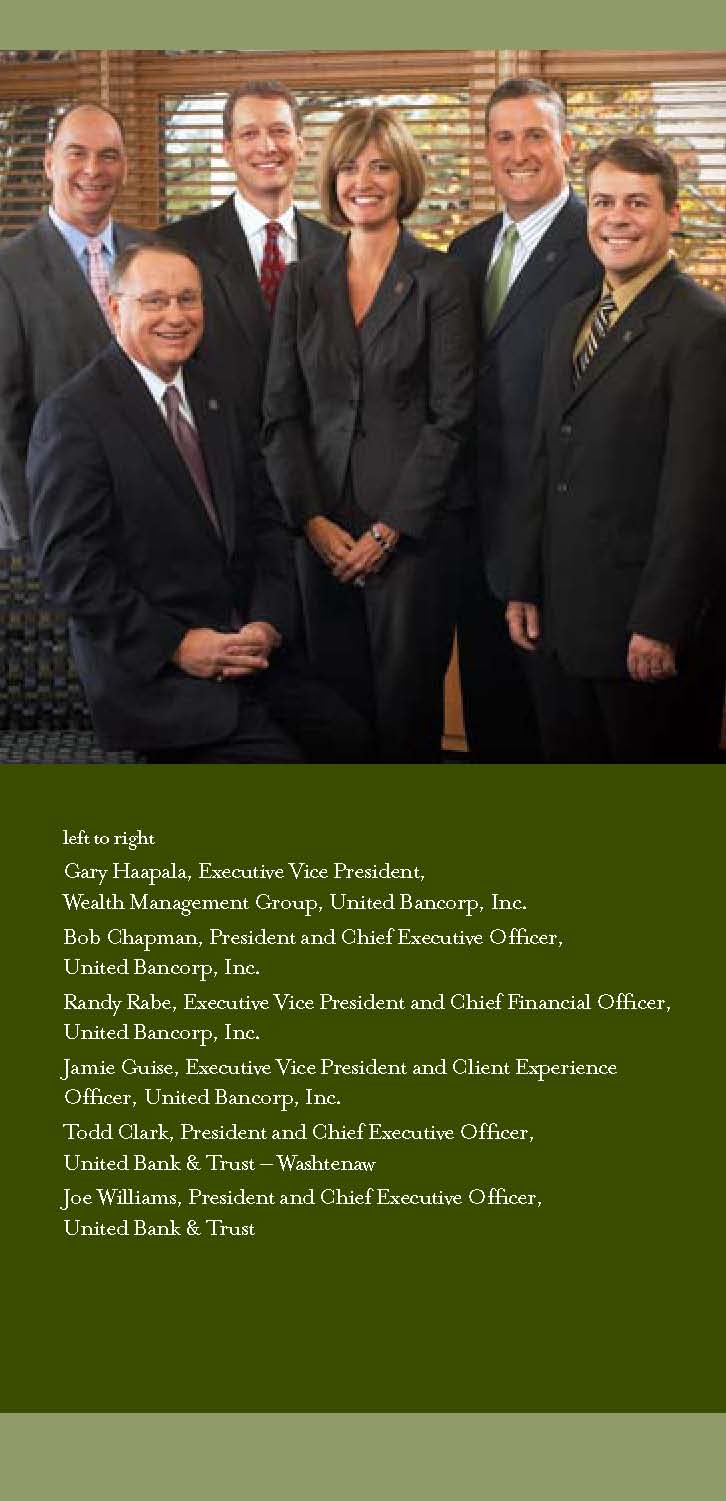

UNITED INLEADERSHIP. |

|

|

|

UNITED INSERVICE. |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 09

THE UNITED EXPERIENCE. Whether it's creating processes to be more efficient, recognizing ways to make clients happier, or looking to the future, there is a real difference in the way United does business. Time and time again, it comes back to people - the relationships we build with our clients and the relationships we have with our co-workers. Here's one example of how that experience works, both inside and outside the bank.

10 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

FROM THEOUTSIDE. |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 11

FROM THEINSIDE.

BRIANFALZON

SENIORVICEPRESIDENT ANDCOMMUNITY

BANKINGOFFICER,

UNITEDBANK &TRUST -WASHTENAW

I was a patron of Dexter's Pub, and I got to know Peter Theocharakis. He wanted to restructure his business, and I wanted to help him. Working with Mike Chatas, from United Structured Finance Company, our team put together a few options for Peter.

The United team quickly recognized that Peter needed something other than a conventional loan, which would not have provided the terms he required. We were able to be more flexible than the larger banks, which allowed us to find a way to reach Peter's goal. It's unusual for a community bank to offer small business loans, but we think that's something a community bank should do. United Structured Finance Company allows us to offer more creative solutions for people like Peter.

Being a community bank means that we know the people, know the businesses, and want to keep our money invested locally to help support the whole community. We live here, we work here, and our kids go to school here. That's why our whole team is interested and invested in helping people like Peter stay in business, be prosperous, and enrich all of our lives. In fact, Peter was so happy with our service, he decided to consolidate all of his commercial deposits, wealth management, personal accounts, and mortgage with United.

12 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

DOUGMERVIS |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 13

| CO-WORKER OF THE YEAR. |

|

|

| VOLUNTEERSOF THE YEAR. MAKE ADIFFERENCEDAYTEAM |

14 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

UNITED BANCORP, INC. BOARD OF DIRECTORS.

FRONT ROW LEFT TO RIGHT: Robert K. Chapman, Joseph D. Butcko SECOND ROW LEFT TO RIGHT: Stephanie H. Boyse, David S. Hickman,

Kathryn M. Mohr, D.J. Martin, Robert G. Macomber, David E. Maxwell THIRD ROW LEFT TO RIGHT: James D. Buhr, John H. Foss, James C. Lawson

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 15

UNITEDBANCORP, INC. |

|

|

|

BOARD OF DIRECTORS | UNITED MORTGAGE COMPANY *David H. Kersch - Senior Vice President Betsy L. Cavanaugh - Vice President, Mortgage Lending Charles E. Chapell - Vice President, Mortgage Lending Denise L. McPherson-Pratt - Vice President, Mortgage Lending Ramona S. Meadows - Vice President, Mortgage Lending Timothy D. Shoemaker - Vice President, Mortgage Lending Joseph P. Zuchowski - Vice President, Mortgage Lending Stephen C. Anderson - Mortgage Origination Officer Kelly D. Rinne - Mortgage Origination Officer Terrie L. Hall - Manager, Mortgage Operations UNITED STRUCTURED FINANCE COMPANY *Michael H. Chatas - President Kenneth E. Leonard - Vice President TECHNO LOGY Jay S. Patterson - Vice President and Chief Information Officer D. Arell Chapman - Assistant Vice President, Network Administration John L. Dudas - Assistant Vice President, Information Systems OPERATIONS Amanda M. Hart - Vice President, Deposit Operations Annette D. Kurowicki - Assistant Vice President, Manager, Deposit Operations Rachel R. Emery - Assistant Vice President, Office Administration Dawn N. Kangas - Operations Officer SUPPORT GROUP *Jamice W. Guise - Executive Vice President and Client Experience Officer *Thomas C. Gannon - Senior Vice President, Human Resources and Communications Kathleen R. McCrate - Senior Vice President, Risk Management Lisa A. Mason - Vice President and Auditor Marsha A. Whitehouse - Vice President, Treasury Management Michelle M. Brasseur - Vice President, Small Business Banking Tiffaney P. Gruber - Assistant Vice President, Human Resources John R. Holly - Treasury Management Services Officer Pamela L. Meade - Marketing Officer LOAN SUPPORT *Steven F. Terhaar - Chief Credit Officer John J. Wanke - Executive Vice President, Special Assets Loan Officer Marilyn L. Buka - Vice President, Personal Lending Amy L. Kohrman - Vice President, Credit Administration Donald E. Skivers - Vice President, Loan Servicing Michele L. Allen - Assistant Vice President and Loan/Quality Review Officer Alan J. Spadafore - Assistant Vice President, Personal Lending Diane K. Higgins - Collections Officer Dana J. Stump - Personal Lending Officer *Denotes United Bancorp, Inc. Management Committee Member |

16 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

UNITEDBANK &TRUST |

|

|

|

BOARD OF DIRECTORS | OFFICERS |

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 17

UNITEDBANK &TRUST -WASHTENAW |

|

|

|

BOARD OF DIRECTORS | OFFICERS |

18 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

Report of Independent Registered Public Accounting Firm

We have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of United Bancorp, Inc. as of December 31, 2008 and 2007, and the related consolidated statements of operations, changes in shareholders' equity, and cash flows for the three years ended December 31, 2008, appearing in the Annual Report Supplement to the proxy statement for the April 28, 2009, annual meeting of the shareholders and the Annual Report on Form 10-K, not appearing herein. in our report dated February 25, 2009, also appearing in the Annual Report Supplement to the proxy statement and the Annual Report on Form 10-K, we expressed an unqualified opinion on those consolidated financial statements.

In our opinion, the information set forth in the condensed consolidated financial statements presented on pages 20 and 21 is fairly stated, in all material respects, in relation to the consolidated financial statements from which it has been derived.

BKD, LLP

Indianapolis, Indiana

February 25, 2009

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 19

CONDENSED CONSOLIDATED BALANCE SHEETS

UNITED BANCORP, INC. AND SUBSIDIARIES

| DECEMBER 31, | ||||

In thousands of dollars | 2008 |

| 2007 | ||

ASSETS |

|

|

| ||

Cash and cash equivalents | $ | 18,472 |

| $ | 29,126 |

Securities available for sale |

| 85,093 |

|

| 85,898 |

Loans held for sale |

| 4,988 |

|

| 5,770 |

|

|

|

|

|

|

Portfolio loans |

| 697,019 |

|

| 644,530 |

Less allowance for loan losses |

| 18,312 |

|

| 12,306 |

Net loans |

| 678,707 |

|

| 632,224 |

|

|

|

|

|

|

Premises and equipment, net |

| 13,205 |

|

| 13,160 |

Bank-owned life insurance |

| 12,447 |

|

| 11,961 |

Accrued interest receivable and other assets |

| 19,481 |

|

| 17,548 |

Total Assets | $ | 832,393 |

| $ | 795,687 |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

Deposits |

|

|

|

|

|

Noninterest bearing deposits | $ | 89,487 |

| $ | 77,878 |

Interest bearing deposits |

| 620,062 |

|

| 593,659 |

Total deposits |

| 709,549 |

|

| 671,537 |

|

|

|

|

|

|

Other borrowings |

| 50,036 |

|

| 44,611 |

Accrued interest payable and other liabilities |

| 3,357 |

|

| 6,572 |

Total Liabilities |

| 762,942 |

|

| 722,720 |

|

|

|

|

|

|

TOTAL SHAREHOLDERS' EQUITY |

| 69,451 |

|

| 72,967 |

Total Liabilities and Shareholders' Equity | $ | 832,393 |

| $ | 795,687 |

CONDENSEDCONSOLIDATEDSTATEMENT OFOPERATIONS

UNITED BANCORP, INC. AND SUBSIDIARIES

| FOR THE YEARS ENDEDDECEMBER31, | |||||||

In thousands of dollars | 2008 |

| 2007 |

| 2006 | |||

|

|

|

|

|

|

|

|

|

Interest income | $ | 47,041 |

| $ | 51,634 |

| $ | 47,056 |

Interest expense |

| 17,297 |

|

| 21,873 |

|

| 17,802 |

Net interest income |

| 29,744 |

|

| 29,761 |

|

| 29,254 |

Provision for loan losses |

| 14,607 |

|

| 8,637 |

|

| 2,123 |

Net interest income after provision for loan losses |

| 15,137 |

|

| 21,124 |

|

| 27,131 |

Noninterest income |

| 13,510 |

|

| 13,652 |

|

| 12,175 |

Noninterest expense |

| 29,963 |

|

| 27,559 |

|

| 26,914 |

Income (loss) before federal income tax |

| (1,316 | ) |

| 7,217 |

|

| 12,392 |

Federal income tax |

| (1,280 | ) |

| 1,635 |

|

| 3,420 |

Net income (loss) | $ | (36 | ) | $ | 5,582 |

| $ | 8,972 |

20 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

CONDENSEDCONSOLIDATEDSTATEMENT OFCHANGES INSHAREHOLDERS'EQUITY

UNITED BANCORP, INC. AND SUBSIDIARIES

|

|

|

|

| Accumulated |

|

|

| ||||

Balance, January 1, 2008 | $ | 67,860 |

| $ | 4,814 |

| $ | 293 |

| $ | 72,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss, 2008 |

|

|

|

| (36 | ) |

|

|

|

| (36 | ) |

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

Net change in unrealized gains on securities |

|

|

|

|

|

|

|

|

|

|

|

|

available for sale, net of reclass adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

for realized gains and related taxes |

|

|

|

|

|

|

| 625 |

|

| 625 |

|

Total comprehensive income |

|

|

|

|

|

|

|

|

|

| 589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared, $0.70 per share |

|

|

|

| (3,544 | ) |

|

|

|

| (3,544 | ) |

Purchase of common stock, 42,641 net shares |

| (831 | ) |

|

|

|

|

|

|

| (831 | ) |

Common stock transactions, 2,984 net shares |

| 137 |

|

|

|

|

|

|

|

| 137 |

|

Director and management deferred stock plans |

| 174 |

|

| (41 | ) |

|

|

|

| 133 |

|

Balance, December 31, 2008 | $ | 67,340 |

| $ | 1,193 |

| $ | 918 |

| $ | 69,451 |

|

PRICERANGE FORCOMMONSTOCK

The following table shows the high and low selling prices of common stock of the Company for each quarter of 2008 and 2007 as obtained from the Over the Counter Bulletin Board ("OTCBB"). These prices do not reflect private trades not involving brokers or dealers. The common stock of the Company is quoted over the counter as UBMI. Such over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent actual transactions. The Company had 1,251 shareholders of record as of December 31, 2008. The prices and dividends per share have been adjusted to reflect the 2007 stock dividends.

|

| 2008 |

| 2007 | ||||||||||||||||

|

|

|

| CASH |

|

|

| CASH | ||||||||||||

QTR. |

| HIGH |

| LOW |

| DECLARED |

| HIGH |

| LOW |

| DECLARED | ||||||||

1st |

| $ | 22.00 |

| $ | 17.55 |

| $ | 0.20 |

|

| $ | 23.50 |

| $ | 21.88 |

| $ | 0.19 |

|

2nd |

|

| 20.00 |

|

| 14.00 |

|

| 0.20 |

|

|

| 24.00 |

|

| 21.75 |

|

| 0.20 |

|

3rd |

|

| 14.98 |

|

| 9.20 |

|

| 0.20 |

|

|

| 22.50 |

|

| 20.20 |

|

| 0.20 |

|

4th |

|

| 12.99 |

|

| 7.55 |

|

| 0.10 |

|

|

| 22.00 |

|

| 17.00 |

|

| 0.20 |

|

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 21

BOOK VALUE PER SHARE AT DECEMBER 31 AVERAGE LOANS DIVIDENDS PER SHARE AVERAGE DEPOSITS EARNINGS (LOSS) PER SHARE AVERAGE TOTAL ASSETS 2004 2005 2006 2007 2008 $11.98 $12.92 $14.20 $14.33 $13.75 $471.1 $527.4 $574.7 $633.9 $673.3 $0.62 $0.68 $0.73 $0.79 $0.70 $522.3 $569.7 $608.3 $647.3 $676.8 $1.46 $1.58 $1.69 $1.06 -$0.01 $633.7 $689.5 $730.0 $777.2 $809.2

22 │ UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM

Stock Transfer Agent and Registrar

Please contact United Bancorp, Inc.'s transfer agent, at the website, phone number, or address listed below, with questions concerning stock certificates, dividend checks, transfer of ownership, or other matters pertaining to your stock account.

Investor RelationsRegistrar & Transfer Company

10 Commerce Dr.

Cranford, New Jersey 07016-3572

(800) 368-5948

www.rtco.com

Stock Symbol

United Bancorp, Inc. common stock is traded over the counter under the symbol UBMI. Orders to buy or sell the Company's stock may be placed with any broker.

Nature of Business

United Bancorp, Inc. is a financial holding company that is the parent company for United Bank & Trust and United Bank & Trust - Washtenaw. The subsidiary banks operate 17 banking offices in Lenawee, Washtenaw, and Monroe Counties, and United Bancorp, Inc. maintains an active Wealth Management Group that serves the Company's market area.

Annual Meeting

The annual meeting of the shareholders of United Bancorp, Inc. will be held Tuesday, April 28, 2009, at 4:30 p.m. at:

United Bank & Trust

Downing Center

209 E. Russell Rd.

Tecumseh, Michigan 49286

Form 10-K Report

A copy of the 2008 form 10-K Annual Report of United Bancorp, Inc., as filed with the Securities and Exchange Commission, will be furnished to any shareholder free of charge upon submission of written request to:

Randal J. Rabe

Executive Vice President and

Chief Financial Officer

United Bancorp, Inc.

P.O. Box 248

Tecumseh, Michigan 49286

In addition, you may visit the Securities and Exchange Commission website at www.sec.gov to obtain a copy.

UNITED BANCORP, INC. │ 2008 ANNUAL REPORT │ WWW.UBAT.COM │ 23

| © 2009 United Bancorp, Inc. |