Filed by United Bancorp Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: United Bancorp Inc.

Commission File No. 000-16640

Old National Bancorp To Partner With United Bancorp, Inc. A Winning Combination January 8, 2014

Lynell Walton Investor Relations Old National Bancorp

3 Additional Information for Shareholders of United Bancorp, Inc. Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Old National Bancorp will file with the Securities and Exchange Commission (SEC) a Registration Statement on Form S - 4 that will include a Proxy Statement of United Bancorp, Inc. (“United” or “UBMI”) and a Prospectus of Old National Bancorp (“Old National” or “ONB”), as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Old National and United, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Old National at www.oldnational.com under the tab “Investor Relations” and then under the heading “Financial Information” or from United by accessing United’s website at www.ubat.com under the heading “About Us” and then under the tab “Investor Relations” and then under the tab “SEC Filings.” Old National and United and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of United in connection with the proposed merger. Information about the directors and executive officers of Old National is set forth in the proxy statement for Old National’s 2013 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 15, 2013. Information about the directors and executive officers of United is set forth in the proxy statement for United’s 2013 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 25, 2013. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

4 Additional Information for Shareholders of Tower Financial Corporation Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Old National Bancorp has filed with the Securities and Exchange Commission (SEC) a Registration Statement on Form S - 4 that includes a Proxy Statement of Tower Financial Corporation and a Prospectus of Old National Bancorp, as well as other relevant documents concerning the proposed transaction. The SEC declared the Form S - 4 Registration Statement effective on December 19, 2013. Shareholders of Tower Financial Corporation are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain important information. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Old National Bancorp and Tower Financial Corporation, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Old National Bancorp at www.oldnational.com under the tab “Investor Relations” and then under the heading “Financial Information” or from Tower Financial Corporation by accessing Tower Financial Corporation’s website at www.towerbank.net under the tab “Investor Relations” and then under the heading “SEC Filings.” Old National Bancorp and Tower Financial Corporation and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Tower Financial Corporation in connection with the proposed merger. Information about the directors and executive officers of Old National Bancorp is set forth in the proxy statement for Old National’s 2013 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 15, 2013. Information about the directors and executive officers of Tower Financial Corporation is set forth in the proxy statement for Tower Financial Corporation’s 2013 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 28, 2013. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger. Free copies of this document may be obtained as described in the preceding paragraph.

5 Disclosures Forward - Looking Statement This presentation contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, descriptions of Old National’s financial condition, results of opera tio ns, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefit and other ef fects of the proposed mergers. Forward - looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward - looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: market, economic, operational, liquidity, credit and interest rate risks associat ed with Old National's business; competition; government legislation and policies (including the impact of the Dodd - Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of Old National to execute its business plan, including the pr oposed acquisitions of Tower Financial Corporation and United Bancorp, Inc.; changes in the economy which could materially impact cr edi t quality trends and the ability to generate loans and gather deposits; failure or circumvention of Old National’s internal con tro ls; failure or disruption of our information systems; failure to adhere to or significant changes in accounting, tax or regulator y p ractices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; other matters discussed in t his presentation and other factors identified in Old National’s Annual Report on Form 10 - K and other periodic filings with the Secur ities and Exchange Commission. These forward - looking statements are made only as of the date of this presentation, and Old National undertakes no obligation to release revisions to these forward - looking statements to reflect events or conditions after the date of this presentation. Non - GAAP Financial Measures These slides contain non - GAAP financial measures. For purposes of Regulation G, a non - GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amount s, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measur e calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, Old National Bancorp has provided reconciliations within the slides, as necessary, of the non - GAAP financial measure to the most directly comparable GAAP financial measure.

6 Old National Bancorp to Partner With United Bancorp, Inc. Expansion in Michigan is a key part of ONB’s strategy. ▪ ONB can leverage UBMI’s expertise in small business administration lending throughout ONB’s footprint. ▪ UBMI’s talented mortgage servicing operation can be expanded across ONB’s footprint. ONB UBMI United (OTCQB: UBMI) offers 18 branches and $806 million of deposits in the Southeastern Michigan area, doubling ONB’s presence in Michigan. Includes branches from pending TOFC transaction

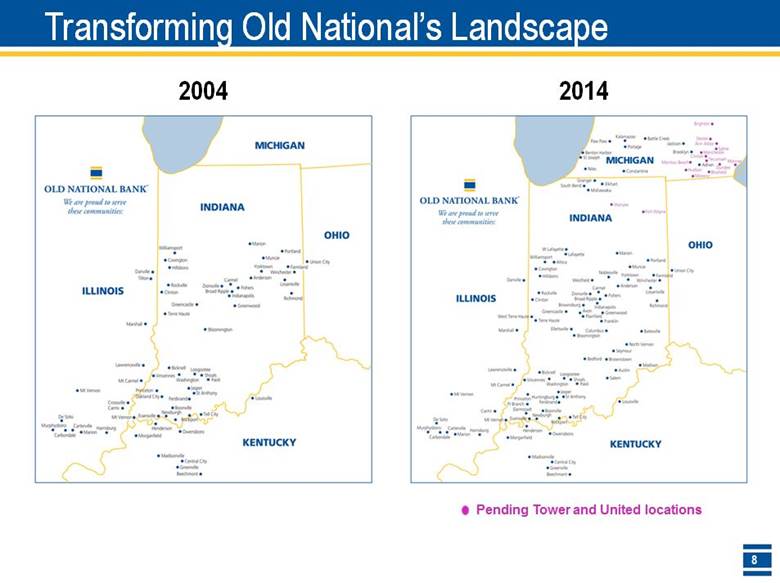

7 Returned to community bank model 2004 2005 Sold non - strategic market – Clarksville, TN – 5 branches 2006 Sold non - strategic market – O’Fallon, IL – 1 branch 2007 2008 2009 2010 2011 2012 2013 Acquired St. Joseph Capital – Entry into Northern IN market February, 2007 Acquired 65 Charter One branches throughout Indiana March, 2009 Acquired Monroe Bancorp – Enhanced Bloomington, IN presence January, 2011 Acquired IN Community – Entry into Columbus, IN September, 2012 FDIC - assisted acquisition of Integra Bank July, 2011 Sold non - strategic market – Chicago - area - 4 branches Consolidation of 21 branches Acquired 24 MI / IN branches July, 2013 Consolidation of 2 branches Consolidation of 8 branches Consolidation of 1 branch Consolidation of 10 branches Consolidation of 12 branches Consolidation of 44 branches Consolidation of 5 branches Sold 12 branches Consolidation of 22 branches Purchased 175 + 25 pending 22 Sold 125 Consolidations Pending acquisition of Tower Financial – Enhancing Ft. Wayne, IN presence Transforming Old National’s Landscape Pending acquisition of United Bancorp – Entry into Ann Arbor, MI 2014

8 2004 2014 8 Transforming Old National’s Landscape Pending Tower and United locations

9 - New markets since 2004 Per SNL Financial 2014 map includes pending Tower locations Market MSA Population Adding Markets with Greater Populations 2004 Bloomington, IN 162,131 Kalamazoo, MI 328,709 South Bend, IN 319,575 Indianapolis, IN 1,913,665 >50k <50k Counties with Populations Columbus, IN 77,943 Ft. Wayne, IN 421,029 Lafayette, IN 205,437 Louisville, KY 1,247,256 Ann Arbor, MI 348,690 2014

Bob Jones President and CEO Old National Bancorp

11 ONB to Partner With UBMI Compelling Strategic Rationale • Strengthen ONB’s Michigan footprint by expanding into new, high - quality markets • Adds 18 full - service branches - $806 million in deposits and $643 million in loans 2 • Adds attractive fee business with $869 million in wealth management assets under management and $963 million in loan servicing with experienced residential mortgage and SBA lending teams Financially Attractive • Allows Old National to deploy excess capital in an attractive manner • Approximately 80% stock / 20% cash deal • Expected EPS accretion of approximately $.06 in 2015, excluding acquisition charges • Exceeds internal IRR hurdle • Expected operating efficiencies of approximately 32% Low Risk Opportunity • Comprehensive due diligence completed • Will cross the Durbin threshold • Retention of key management members • Complementary customer base and business mix • Positive relationship with United management and board Financial data as of September 30, 2013, per SNL Financial and Company documents Consideration of .70 shares 1 of ONB stock + $2.66 in cash for each share of UBMI stock Implied Transaction value of approximately $13.17 per UBMI share and $173.1 million in the aggregate, assuming ONB price of $15.02 (as of January 6, 2014) 1 The exchange ratio is subject to adjustment under certain circumstances as provided in the merger agreement. 2 Excludes loans held for sale

12 Using U.S. census data, SNL Financial 2013 market share data Promising Markets Ann Arbor, Michigan ▪ Highest median household income MSA in Michigan ▪ Fifth largest MSA in Michigan ▪ Unemployment rate of 6.0%, compared to the national rate of 7.3% ▪ Listed in Forbes’ 2013 “Best Places for Business and Careers” and was Livability.com’s 13th “Best Place to Live” ▪ $332 million of UBMI deposits and 4.82% market share in Washtenaw county Adrian, Michigan ▪ Includes UBMI’s Tecumseh headquarters, which has been used for 117+ years of their 120 - year history ▪ UBMI has dominant market share, at 39.95% with $396 million in deposits in Lenawee county Notable business operations in Ann Arbor Projected 2017 Median Household Income

13 ONB to Partner With UBMI – Highlights Transaction Financial Impact Marks Capital Closing • Consideration: .70 shares 1 of ONB stock + $2.66 in cash for each share of UBMI stock • Assumes 9.2 million shares of ONB common stock issued • Deal value = approximately $13.17 per UBMI share and $173.1 million in the aggregate, assuming ONB price of $15.02 (as of January 6, 2014) • Price / 2015 Estimated adjusted EPS (includes all synergies) of 9.7x • Price to tangible book of 208% • Expected to be immediately accretive to EPS in 2014, excluding acquisition charges of approximately $18.0 million • Expected EPS accretion of approximately $.06 in 2015 • Expected cost saves of approximately 32%, phased in 25% in 2014 and 100% thereafter • Approximate TBV dilution of 8% earned back in approximately 4 years using the incremental earnings method • Exceeds internal IRR hurdle • No revenue synergies assumed in model • Expected to create goodwill of approximately $121.8 million • No additional capital raise needed • Transaction anticipated to close late in 2Q14, subject to regulatory and UBMI shareholder approval and other customary closing conditions • Loan credit mark estimated at $55.4 million, or 8.6% of total gross loans • Loan interest rate mark estimated at $22.7 million 1 The exchange ratio is subject to adjustment under certain circumstances as provided in the merger agreement.

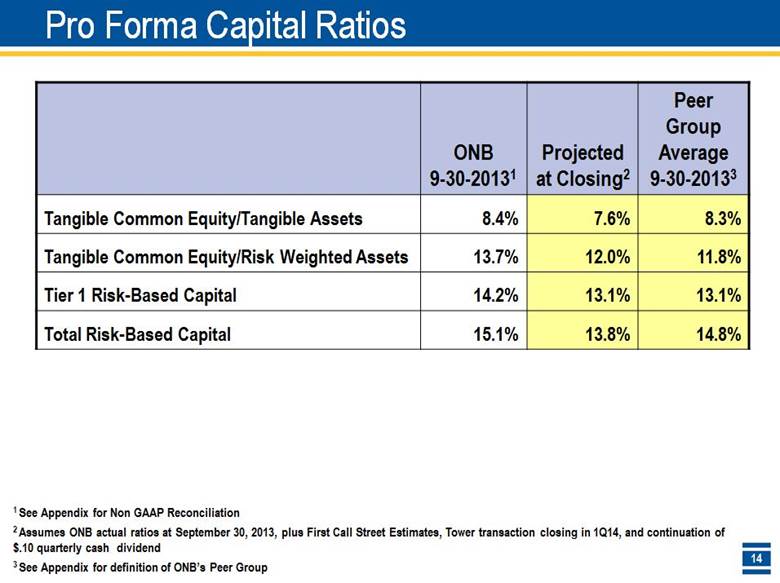

14 Pro Forma Capital Ratios ONB 9 - 30 - 2013 1 Projected at Closing 2 Peer Group Average 9 - 30 - 2013 3 Tangible Common Equity/Tangible Assets 8.4% 7.6% 8.3% Tangible Common Equity/Risk Weighted Assets 13.7% 12.0% 11.8% Tier 1 Risk - Based Capital 14.2% 13.1% 13.1% Total Risk - Based Capital 15.1% 13.8% 14.8% 1 See Appendix for Non GAAP Reconciliation 3 See Appendix for definition of ONB’s Peer Group 2 Assumes ONB actual ratios at September 30, 2013, plus First Call Street Estimates, Tower transaction closing in 1Q14, and con tin uation of $.10 quarterly cash dividend

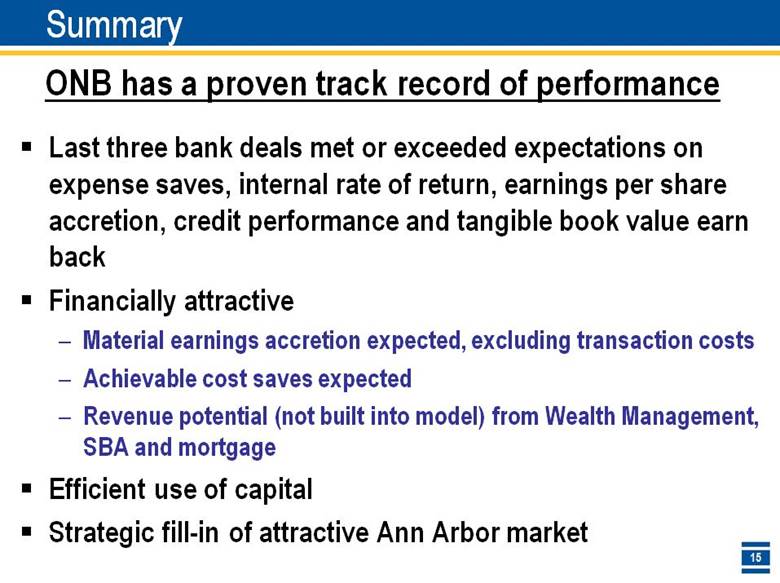

15 Summary ONB has a proven track record of performance ▪ Last three bank deals met or exceeded expectations on expense saves, internal rate of return, earnings per share accretion, credit performance and tangible book value earn back ▪ Financially attractive – Material earnings accretion expected, excluding transaction costs – Achievable cost saves expected – Revenue potential (not built into model) from Wealth Management, SBA and mortgage ▪ Efficient use of capital ▪ Strategic fill - in of attractive Ann Arbor market

Old National Bancorp Thank You Q&A

Old National Bancorp Appendix

18 Balance Sheet Mix – As of September 30, 2013 Old National United Pro Forma Loan Mix Deposit Mix Old National United Pro Forma Per SNL Financial/company documents

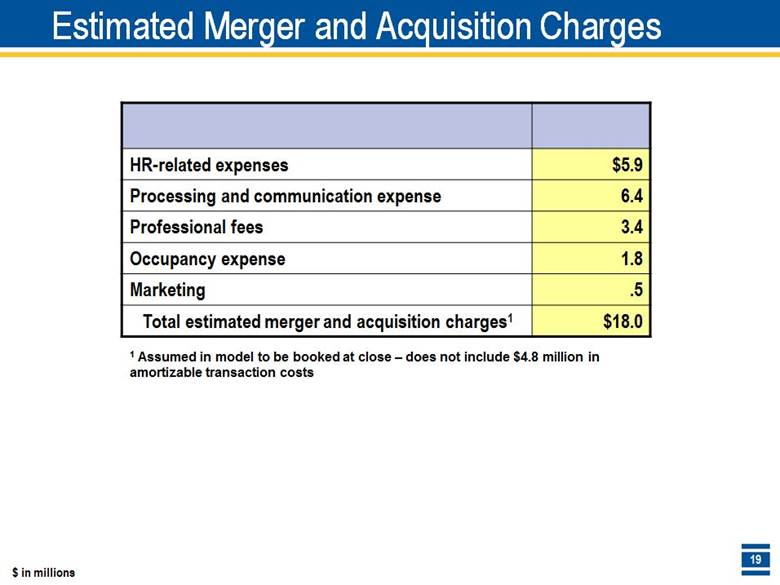

19 Estimated Merger and Acquisition Charges HR - related expenses $5.9 Processing and communication expense 6.4 Professional fees 3.4 Occupancy expense 1.8 Marketing .5 Total estimated merger and acquisition charges 1 $18.0 $ in millions 1 Assumed in model to be booked at close – does not include $4.8 million in amortizable transaction costs

20 Non - GAAP Reconciliations (end of period balances - $ in millions) ONB at 9 - 30 - 2013 Projected at Closing 1 Total Shareholders’ Equity $1,159.3 $1,395.7 Deduct: Goodwill and Intangible Assets (379.3) (607.9) Tangible Common Shareholders’ Equity $779.9 $787.8 Total Assets $9,652.1 $10,942.7 Add: Trust Overdrafts .1 0 Deduct: Goodwill and Intangible Assets (379.3) (607.9) Tangible Assets $9,272.8 $10,334.8 Tangible Common Equity to Tangible Assets 8.41% 7.6% (end of period balances - $ in millions) ONB at 9 - 30 - 2013 Projected at Closing 1 Total Shareholders’ Equity $1,159.3 $1,395.7 Deduct: Goodwill and Intangible Assets (379.3) (607.9) Tangible Common Shareholders’ Equity $779.9 $787.8 Risk Adjusted Assets $5,680.6 $6,554.9 Tangible Common Equity to Risk Weighted Assets 13.73% 12.0% 1 Assumes ONB actual ratios at September 30, 2013, plus First Call Street Estimates, Tower transaction closing in 1Q14, and con tin uation of $.10 quarterly cash dividend

21 ONB’s Peer Group 1st Source Corporation SRCE Heartland Financial USA, Inc. HTLF BancFirst Corporation BANF IBERIABANK Corporation IBKC BancorpSouth, Inc. BXS MB Financial, Inc. MBFI Bank of Hawaii Corporation BOH Park National Corporation PRK Chemical Financial Corporation CHFC Pinnacle Financial Partners, Inc. PNFP Commerce Bancshares, Inc. CBSH Prosperity Bancshares, Inc. PB Cullen/Frost Bankers, Inc. CFR Renasant Corp. RNST F.N.B. Corporation FNB S&T Bancorp, Inc. STBA First Commonwealth Financial Corporation FCF Susquehanna Bancshares, Inc. SUSQ First Financial Bancorp. FFBC Trustmark Corporation TRMK First Interstate BancSystem, Inc. FIBK UMB Financial Corporation UMBF First Merchants Corporation FRME United Bankshares, Inc. UBSI First Midwest Bancorp, Inc. FMBI Valley National Bancorp VLY FirstMerit Corporation FMER WesBanco, Inc. WSBC Fulton Financial FULT Wintrust Financial Corporation WTFC Glacier Bancorp, Inc. GBCI Like - size, publicly - traded financial services companies, generally in the Midwest, serving comparable demographics with comparable services as ONB

22 Old National Investor Relations Contact Additional information can be found on the Investor Relations web pages at www.oldnational.com Investor Inquiries: Lynell J. Walton, CPA SVP – Director of Investor Relations 812 - 464 - 1366 lynell.walton@oldnational.com