Filed by United Bancorp Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: United Bancorp Inc.

Commission File No. 000-16640

Robert K. Chapman and Todd C. Clark January 8, 2014

Information for Investors Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Old National Bancorp will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S - 4 that will include a proxy statement to be used by United Bancorp to solicit the required approval of its shareholders in connection with the proposed merger and will constitute a prospectus of Old National Bancorp. Old National Bancorp and United Bancorp may also file other documents with the SEC concerning the proposed merger. INVESTORS AND SECURITY HOLDERS OF OLD NATIONAL BANCORP AND UNITED BANCORP ARE URGED TO READ THE PROXY STATEMENT AND PROSPECTUS REGARDING THE PROPOSED MERGER AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders may obtain a free copy of the proxy statement and prospectus and other documents containing important information about Old National Bancorp and United Bancorp, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Old National Bancorp will be available free of charge on Old National Bancorp’s website at www.oldnational.com under the tab “Investor Relations” and then under the heading “Financial Information” or from United by accessing United’s website at www.ubat.com under the tab “Investor Relations” and then under the heading “SEC Filings .” Participants in the Solicitation Old National Bancorp, United Bancorp and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of United Bancorp in connection with the proposed transaction. Information about the directors and executive officers of Old National Bancorp is set forth in its proxy statement for its 2013 annual meeting of shareholders, which was filed with the SEC on March 15, 2013. Information about the directors and executive officers of United Bancorp is set forth in its proxy statement for its 2013 annual meeting of shareholders, which was filed with the SEC on March 25, 2013. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and prospectus and other relevant materials to be filed with the SEC when they become available.

Forward - Looking Statements This presentation contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, descriptions of ONB’s and United’s financial condition, results of operations, asset and credit quality trends and profitability and statements about the expected timing, completion, financial benefits and other effects of the proposed merger. Forward - looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. These forward - looking statements express management’s current expectations or forecasts of future events and, by their nature, are subject to risks and uncertainties and there are a number of factors that could cause actual results to differ materially from those in such statements. Factors that might cause such a difference include, but are not limited to: expected cost savings, synergies and other financial benefits from the proposed merger might not be realized within the expected time frames and costs or difficulties relating to integration matters might be greater than expected; the requisite shareholder and regulatory approvals for the proposed merger might not be obtained; market, economic, operational, liquidity, credit and interest rate risks associated with ONB’s and United’s businesses, competition, government legislation and policies (including the impact of the Dodd - Frank Wall Street Reform and Consumer Protection Act and its related regulations); ability of ONB and United to execute their respective business plans (including ONB’s proposed acquisitions of United and Tower Financial Corporation); changes in the economy which could materially impact credit quality trends and the ability to generate loans and gather deposits; failure or circumvention of either ONB’s or United’s internal controls; failure or disruption of our information systems; significant changes in accounting, tax or regulatory practices or requirements; new legal obligations or liabilities or unfavorable resolutions of litigations; other matters discussed in this Current Report and other factors identified in ONB’s and United’s Annual Reports on Form 10 - K and other periodic filings with the Securities and Exchange Commission. These forward - looking statements are made only as of the date of this Current Report, and neither ONB nor United undertakes an obligation to release revisions to these forward - looking statements to reflect events or conditions after the date of this presentation.

Why a Partnership? • The UBMI Board fully analyzed two strategies – Partnership – Organic Growth • Goals of a Partnership Strategy – Shareholder Value – Cultural Fit – Strategic Fit • Could we accelerate our Strategic Plan by 3 - 5 years

Old National Bank is the largest financial services holding company headquartered in Indiana. $9.7 billion in total assets $ 5.2 billion in wealth management assets under management 169 financial centers throughout Indiana, Western Kentucky, South West Michigan and Southern Illinois $1.5 billion market capitalization Operates one of the largest independent insurance agencies headquartered in Indiana with $37 million in revenue 39 Investment representatives with $13 million in revenue

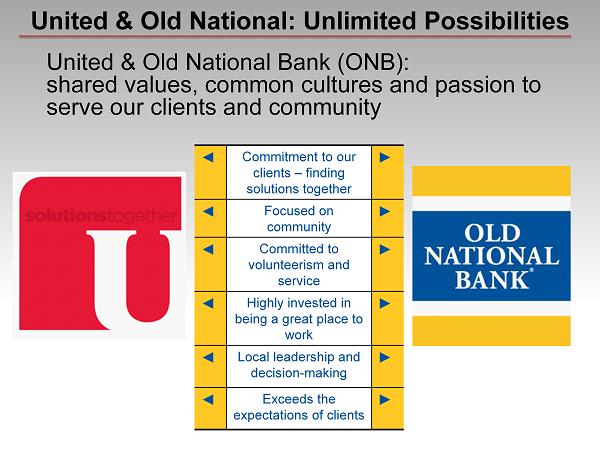

United & Old National: Unlimited Possibilities United & Old National Bank (ONB): shared values, common cultures and passion to serve our clients and community ◄ Commitment to our clients – finding solutions together ► ◄ Focused on community ► ◄ Committed to volunteerism and service ► ◄ Highly invested in being a great place to work ► ◄ Local leadership and decision - making ► ◄ Exceeds the expectations of clients ►

Key Points Expansion in Michigan is a key part of ONB’s strategy. - Use the UBMI Platform and Management to execute the Michigan Growth Strategy. - ONB can leverage UBMI’s expertise in Small Business Administration and mortgage servicing throughout ONB’s footprint. ONB UBMI • We are Partners • Solutions By Working Together • People + Culture = Success

Unlimited Possibilities • Expansion in Michigan is key to ONB’s strategy • Strong growth opportunities can be created by leveraging Old National's lending limits and fee businesses with United’s strong client relationships • Old National can leverage United’s expertise in Structured Finance and Mortgage lending/ servicing throughout Old National’s footprint • Two strong teams coming together can create unlimited new opportunities

The Partnership Process • The Management Committee became involved in the process on December 2, 2013 • Extensive reverse due diligence was performed by UBMI • The UBMI Board decided to move forward with Old National Bank on December 19, 2013

What made UBMI attractive • Business Model/Diverse Revenue Stream • Executive & Co Worker Teams – Our ability to successfully manage through 2009 - 13 • Strategic Plan alignment • Markets and our connection to our Communities • Relationship Approach • Culture and Core Values

Business Model • We are United, a full - service financial services company, organized into four lines of business (Banking, Mortgage, Structured Finance and Wealth Management) • Our products and services are delivered in the Markets we serve • Our goal – Execute and Refine • This requires – Incredible Focus and we are forecasting heightened Execution Risk

Competing Priorities Dilutes Focus • Many new Products and Services to be developed • Process Efficiency Gains to: – Build Scalability – Reallocate Investment/Capital • We are 2 - 3 years away from truly being scalable and smaller acquisitions are not in our immediate future • 77% of Community Bank CEOs identified $1B as the minimal size to remain independent (KPMG October 2013 CB Survey) • Compliance and Regulatory Oversight continues to increase • Interest Rate Risk tool development and implementation • Investment in Information Security and System enhancements/upgrades

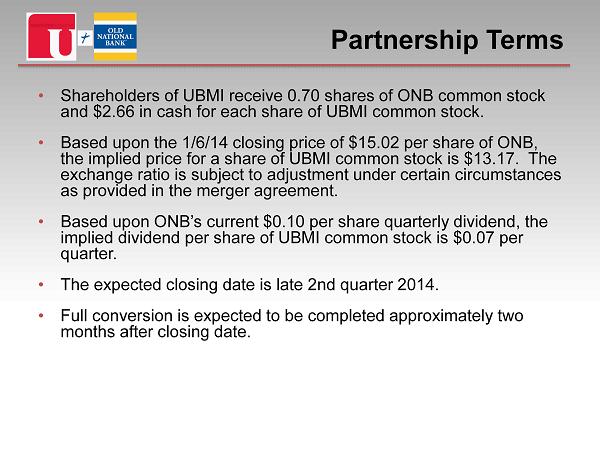

Partnership Terms • Shareholders of UBMI receive 0.70 shares of ONB common stock and $2.66 in cash for each share of UBMI common stock. • Based upon the 1/6/14 closing price of $15.02 per share of ONB, the implied price for a share of UBMI common stock is $13.17. The exchange ratio is subject to adjustment under certain circumstances as provided in the merger agreement. • Based upon ONB’s current $0.10 per share quarterly dividend, the implied dividend per share of UBMI common stock is $0.07 per quarter. • The expected closing date is late 2nd quarter 2014. • Full conversion is expected to be completed approximately two months after closing date.

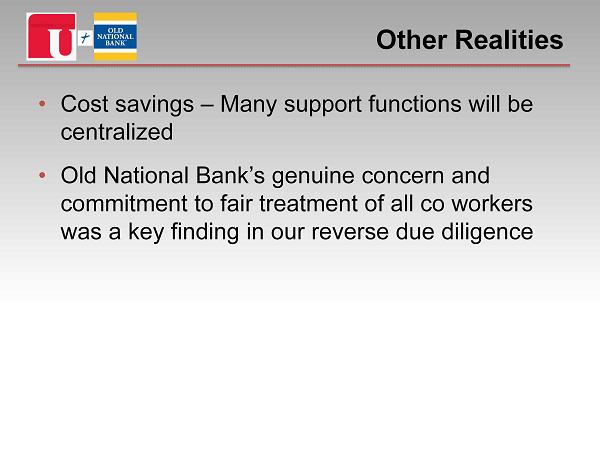

Other Realities • Cost savings – Many support functions will be centralized • Old National Bank’s genuine concern and commitment to fair treatment of all co workers was a key finding in our reverse due diligence