UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4395

Smith Barney Muni Funds

(Exact name of registrant as specified in charter)

125 Broad Street, New York, NY 10004

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Smith Barney Fund Management LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: March 31

Date of reporting period: March 31, 2005

| ITEM 1. | REPORT TO STOCKHOLDERS. |

| The Annual Report to Stockholders is filed herewith. |

| |

| |

| |

| |

| |

| | SMITH BARNEY

MUNI FUNDS | |

| | CALIFORNIA MONEY

MARKET PORTFOLIO | |

| |

| ANNUAL REPORT | MARCH 31, 2005 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |  | | Smith Barney

Mutual Funds | |

| |

| | Your Serious Money. Professionally Managed.® | |

| |

| Your Serious Money. Professionally Managed.® is a registered service mark of Citigroup Global Markets Inc. |

| |

| | NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE | |

| |

| |

| | | |

Dear Shareholder, Despite rising interest rates, continued high oil prices, geopolitical concerns and uncertainties surrounding the U.S. Presidential election, the U.S. economy continued to expand during the period. Given the strength of the economy and surging energy prices, the Federal Reserve Board (“Fed”)i raised the fed funds target rateii seven times during the fiscal year in an attempt to ward off inflation. Since bond prices decline when interest rates rise, this is generally troublesome for longer-term fixed-income securities. However, this market environment can be a positive for short-term instruments such as money market securities. Rising rates result in higher levels of income offered by new short-term securities. Throughout the one-year period, money market yields rose as these securities closely tracked the rising fed funds target rate. | | |

| | R. JAY GERKEN, CFA

Chairman, President and

Chief Executive Officer |

| | | |

Please read on for a more detailed look at prevailing economic and market conditions during the Fund’s fiscal year and to learn how those conditions have affected fund performance. Information About Your Fund As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Fund’s Adviser and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the Adviser and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations. |

1 Smith Barney Muni Funds | 2005 Annual Report

|

Important information concerning the Fund and its Adviser with regard to recent regulatory developments is contained in the “Additional Information” note in the Notes to the Financial Statements included in this report. As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals. Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer May 3, 2005 |

2 Smith Barney Muni Funds | 2005 Annual Report

|

| | | | | |

Performance Review As of March 31, 2005, the seven-day current yield for Class A shares of the Smith Barney Muni Funds — California Money Market Portfolio was 1.52% and its seven-day effective yield, which reflects compounding, was 1.53%.1 | |  | |  |

| | | JOSEPH P. DEANE

Vice President and

Investment Officer

| | JULIE P. CALLAHAN,CFA

Vice President and

Investment Officer |

| | | | | |

SMITH BARNEY MUNI FUNDS — CALIFORNIA MONEY MARKET PORTFOLIO

YIELDS AS OF MARCH 31, 2005

(unaudited) |

| |

| | | Seven-Day

Current Yield1 | | Seven-Day

Effective Yield1 | |

|---|

| | Class A Share | 1.52% | | 1.53% | |

| | Class Y Share | 1.65% | | 1.66% | |

| | | | | | |

| | The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. | |

| | | | | | |

| | Yields will fluctuate and may reflect reimbursements and/or fee waivers, without which the performance would have been lower. | |

| | | | | | |

| |

An investment is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund. Certain investors may be subject to the federal Alternative Minimum Tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser. |

| |

| 1 | The seven-day effective yield is calculated similarly to the seven-day current yield but, when annualized, the income earned by an investment in the fund is assumed to be reinvested. The effective yield typically will be slightly higher than the current yield because of the compounding effect of the assumed reinvestment. |

3 Smith Barney Muni Funds | 2005 Annual Report

|

Market Review The U.S. economy was surprisingly resilient during the one year period ended March 31, 2005. Following a 3.3% gain in the second quarter of 2004, gross domestic product (“GDP”)iii growth was a robust 4.0% in the third quarter and 3.8% in the fourth quarter. On April 28, after the reporting period ended, first quarter 2005 GDP growth estimate came in at 3.1%. Given the overall strength of the economy, the Fed moved to raise interest rates to head off inflation. As expected, the Fed increased its target for the federal funds rate by 0.25% to 1.25% on June 30, 2004 — the first rate hike in four years. The Fed again raised rates in 0.25% increments during its next six meetings, bringing the target for the federal funds rate from 1.00% to 2.75% by the end of March. The Fed raised its target rate by an additional 0.25% to 3.00% at its May meeting, after the Fund’s reporting period. For much of the reporting period, the fixed-income market confounded many investors as short-term interest rates rose in concert with the Fed rate tightening, while longer-term rates, surprisingly, remained fairly steady. However, this changed late in the period, coinciding with the Fed’s official statement accompanying its March rate hike. While the Fed continued to say it expected to raise rates at a “measured” pace, it made several adjustments to its statement, which some investors interpreted to mean larger rate hikes could be possible in the future. This subsequently caused longer-term interest rates to rise sharply. Municipal money market yields rose during the fiscal year as a whole. This trend began in the second quarter of 2004, in anticipation of the first Fed rate increase. Monetary policy was viewed as being accommodative and the Fed was seen as needing to shift to a less stimulative stance. Investment Approach During the period, the Fund included a significant amount of municipal obligations backed by school districts and revenue bonds. Revenue bonds are issued to finance public works such as tunnels, sewer systems and bridges, and the issuers’ finances are supported directly by the operations of these systems. The Fund maintained a diversified mix of securities that included commercial paper, fixed-income notes and variable-rate demand notes. Given the current rate environment and expectations that interest rates will continue to rise, we are maintaining a cautious maturity stance in the municipal money market portfolio. While no one can say with any certainty where interest rates will head, as of the period’s close, we felt this strategy was prudent considering the close proximity of yields on shorter- and longer-term money market instruments given the recent economic environment. |

4 Smith Barney Muni Funds | 2005 Annual Report

|

Thank you for your investment in the Smith Barney Muni Funds — California Money Market Portfolio. As ever, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals. Sincerely, |

| |

| |  |

Joseph P. Deane

Vice President and

Chief Executive Officer | | Julie P. Callahan, CFA

Vice President and

Investment Officer |

| | | |

May 3, 2005 The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole. RISKS: Certain investors may be subject to the federal Alternative Minimum Tax (AMT), and state and local taxes may apply. Capital gains, if any, are fully taxable. An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. |

| |

| i | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| ii | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iii | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

5 Smith Barney Muni Funds | 2005 Annual Report

|

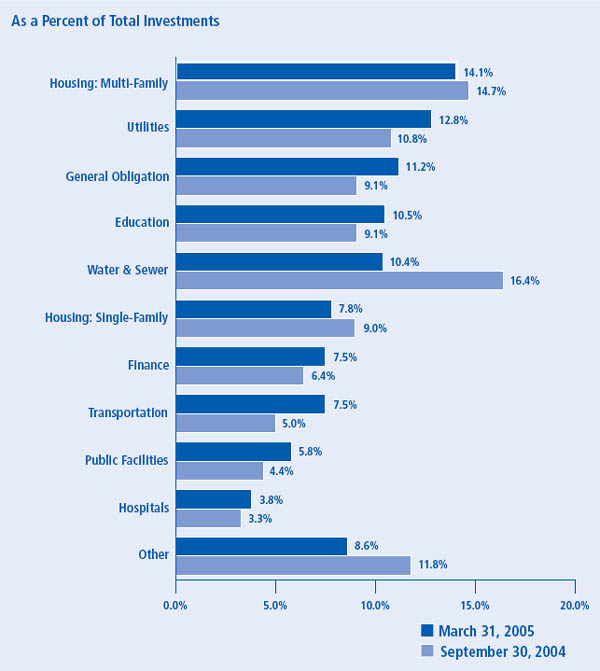

Fund at a Glance (unaudited) |

6 Smith Barney Muni Funds | 2005 Annual Report

|

Fund Expenses (unaudited) |

| |

Example As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. This example is based on an investment of $1,000 invested on October 1, 2004 and held for the six months ended March 31, 2005. Actual Expenses The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”. |

| |

Based on Actual Total Return(1) |

| | | | | |

|---|

| | | | Actual

Total Return(2)

| | Beginning

Account

Value

| | Ending

Account

Value

| | Annualized

Expense

Ratio | | Expenses

Paid During

the Period(3)

| |

|

| Class A | | | | 0.59 | % | | $ | 1,000.00 | | $ | 1,005.90 | | | 0.59 | % | | $ | 2.95 | | |

|

| Class Y | | | | 0.64 | | | | 1,000.00 | | | 1,006.40 | | | 0.47 | | | | 2.35 | | |

|

| | |

| (1) | For the six months ended March 31, 2005. |

| (2) | Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | Expenses (net of voluntary fee waiver) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

7 Smith Barney Muni Funds | 2005 Annual Report

|

Fund Expenses (unaudited) (continued) |

| |

Hypothetical Example for Comparison Purposes The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charge (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher. |

| |

Based on Hypothetical Total Return(1) |

| | | | | |

|---|

| | | | Hypothetical

Annualized

Total Return | | Beginning

Account

Value

| | Ending

Account

Value

| | Annualized

Expense

Ratio | | Expenses

Paid During

the Period(2) | |

|

| Class A | | | | 5.00 | % | | $ | 1,000.00 | | $ | 1,021.99 | | | 0.59 | % | | $ | 2.97 | | |

|

| Class Y | | | | 5.00 | | | | 1,000.00 | | | 1,022.59 | | | 0.47 | | | | 2.37 | | |

|

| | |

| (1) | For the six months ended March 31, 2005. |

| (2) | Expenses (net of voluntary fee waiver) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

8 Smith Barney Muni Funds | 2005 Annual Report

|

| | | | |

|---|

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Education — 10.6% | | | |

| $ | 14,800,000 | | VMIG 1* | | ABAG Finance Authority for Nonprofit Corp. | | | |

| | | | | | Valley Christian Schools 2.28% VRDO | $ | 14,800,000 | |

| | | | | | Alameda Contra Costa Schools Finance Authority | | | |

| | | | | | Capital Improvements Financing Project COP: | | | |

| | 4,780,000 | | A-1+ | | Series D 2.30% VRDO | | 4,780,000 | |

| | 1,540,000 | | A-1+ | | Series E 2.30% VRDO | | 1,540,000 | |

| | 13,690,000 | | A-1+ | | Series L 2.30% VRDO | | 13,690,000 | |

| | 2,160,000 | | VMIG 1* | | Alvord USD Finance Corp. COP 2.33% VRDO | | 2,160,000 | |

| | 2,900,000 | | VMIG 1* | | California EFA St. Mary’s College of California Series B | | | |

| | | | | | 2.28% VRDO | | 2,900,000 | |

| | 62,140,000 | | SP-1+ | | California Schools Cash Reserve Program Series A | | | |

| | | | | | 3.00% due 7/6/05 | | 62,362,291 | |

| | 35,212,000 | | A-1+ | | California State University Series A 2.04% due 5/9/05 TECP | | 35,212,000 | |

| | 4,150,000 | | VMIG 1* | | California Statewide Communities Development Authority | | | |

| | | | | | Revenue Concordia University Project Series A | | | |

| | | | | | 2.31% VRDO | | 4,150,000 | |

| | 2,270,000 | | A-1 | | Carlsbad USD School Facility Bridge Funding Program | | | |

| | | | | | FSA-Insured 2.23% VRDO | | 2,270,000 | |

| | 15,000,000 | | A-1+ | | Hesperia USD COP Interim School Funding Program | | | |

| | | | | | FSA-Insured 2.27% VRDO | | 15,000,000 | |

| | 1,000,000 | | VMIG 1* | | Irvine USD Community Facilities District 03 2.28% VRDO | | 1,000,000 | |

| | 9,485,000 | | VMIG 1* | | Long Beach USD Capital Improvement Project | | | |

| | | | | | AMBAC-Insured 2.28% VRDO | | 9,485,000 | |

| | 1,000,000 | | A-1 | | Paramount USD School Facility Bridge Funding Program | | | |

| | | | | | 2.23% VRDO | | 1,000,000 | |

| | 2,600,000 | | A-1 | | Riverside USD COP School Facility Bridge Refinancing | | | |

| | | | | | Program FSA-Insured 2.23% VRDO | | 2,600,000 | |

| | 3,195,000 | | A-1 | | San Gabriel USD COP School Facilities Funding Program | | | |

| | | | | | FSA-Insured 2.23% VRDO | | 3,195,000 | |

| | 20,000,000 | | A-1+ | | San Mateo USD School Facility Bridge Funding FSA-Insured | | | |

| | | | | | 2.23% VRDO | | 20,000,000 | |

| | 5,980,000 | | VMIG 1* | | Santa Ana USD COP 2.24% VRDO | | 5,980,000 | |

| | 19,400,000 | | VMIG 1* | | Santa Maria Joint UHSD COP Series A 2.28% VRDO | | 19,400,000 | |

| | 1,930,000 | | A-1 | | Southern Kern USD COP Building Program Series A | | | |

| | | | | | FSA-Insured 2.23% VRDO | | 1,930,000 | |

| | | | | | University of California Board of Regents Series A TECP: | | | |

| | 30,000,000 | | A-1+ | | 1.80% due 4/1/05 | | 30,000,000 | |

| | 10,400,000 | | A-1+ | | 1.95% due 4/4/05 | | 10,400,000 | |

| | 10,000,000 | | A-1+ | | 2.02% due 6/7/05 | | 10,000,000 | |

| | 6,150,000 | | VMIG 1* | | Val Verde USD COP Series A 2.28% VRDO | | 6,150,000 | |

| | 2,400,000 | | A-1 | | William S. Hart UHSD COP School Facility Bridge Funding | | | |

| | | | | | Program FSA-Insured 2.23% VRDO | | 2,400,000 | |

|

| | | | | | | 282,404,291 | |

|

See Notes to Financial Statements. 9 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

| | | | |

|---|

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Finance — 7.5% | | | |

| $ | 1,060,000 | | SP-1+ | | California Community College Finance Authority Series A | | | |

| | | | | | FSA-Insured 3.00% due 6/30/05 | $ | 1,062,411 | |

| | 23,800,000 | | A-1+ | | California Infrastructure & Economic Development Bank | | | |

| | | | | | ISO Series A AMBAC-Insured 2.28% VRDO | | 23,800,000 | |

| | | | | | California State Economic Recovery Bonds: | | | |

| | 15,000,000 | | A-1+ | | Series C-10 2.27% VRDO | | 15,000,000 | |

| | 1,960,000 | | A-1+ | | Series C-15 FSA-Insured 2.29% VRDO | | 1,960,000 | |

| | | | | | XLCA-Insured: | | | |

| | 49,600,000 | | A-1+ | | Series C-14 2.23% VRDO | | 49,600,000 | |

| | 23,000,000 | | A-1+ | | Series C-17 2.28% VRDO | | 23,000,000 | |

| | 10,525,000 | | A-1+ | | Series C-18 2.23% VRDO | | 10,525,000 | |

| | | | | | Los Angeles Capital Asset Lease Corp. TECP: | | | |

| | 19,300,000 | | A-1+ | | 1.93% due 4/6/05 | | 19,300,000 | |

| | 17,500,000 | | A-1+ | | 2.06% due 5/3/05 | | 17,500,000 | |

| | 9,800,000 | | A-1+ | | 2.02% due 6/1/05 | | 9,800,000 | |

| | 2,765,000 | | VMIG 1* | | Puerto Rico PFC Series 522X MBIA-Insured PART | | | |

| | | | | | 2.30% VRDO | | 2,765,000 | |

| | 17,565,000 | | A-1+ | | Santa Clara Finance Authority Lease Project B | | | |

| | | | | | 2.24% VRDO | | 17,565,000 | |

| | 9,640,000 | | A-1 | | Vallejo Capital Improvements Project 2.33% VRDO | | 9,640,000 | |

|

| | | | | | | | 201,517,411 | |

|

| General Obligation — 11.2% | | | |

| | | | | | California State GO: | | | |

| | | | | | MSTC PART: | | | |

| | 3,700,000 | | A-1+ | | Series SGA 7 FSA-Insured 2.26% VRDO | | 3,700,000 | |

| | 1,400,000 | | A-1+ | | Series SGA 119 FGIC-Insured 2.30% VRDO | | 1,400,000 | |

| | 25,000,000 | | A-1+ | | Series C-2 2.23% VRDO | | 25,000,000 | |

| | 11,000,000 | | A-1+ | | Series C-4 2.28% VRDO | | 11,000,000 | |

| | 58,495,000 | | SP-1 | | California State RAN Series A 3.00% due 6/30/05 | | 58,649,886 | |

| | 7,000,000 | | SP-1+ | | Contra Costa County Board of Education | | | |

| | | | | | TRAN 3.00% due 6/30/05 | | 7,023,088 | |

| | | | | | Los Angeles County GO: | | | |

| | 9,285,000 | | A-1 | | MSTC Series 9004 FGIC-Insured PART 2.27% VRDO | | 9,285,000 | |

| | 15,375,000 | | SP-1+ | | TRAN Series A 3.00% due 6/30/05 | | 15,411,547 | |

| | | | | | Los Angeles USD PART FGIC-Insured: | | | |

| | 1,100,000 | | A-1 | | MSTC Series 2001-135 2.30% VRDO | | 1,100,000 | |

| | 3,600,000 | | A-1+ | | Putters Series 261Z 2.31% VRDO | | 3,600,000 | |

| | 12,470,000 | | VMIG 1* | | Palo Alto USD MERLOT Series R FGIC-Insured | | | |

| | | | | | PART 2.32% VRDO | | 12,470,000 | |

See Notes to Financial Statements. 10 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

| | | | |

|---|

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| General Obligation — 11.2% (continued) | | | |

| | | | | | Puerto Rico Government Development Bank TECP: | | | |

| $ | 10,761,000 | | A-1 | | 2.10% due 4/7/05 | $ | 10,761,000 | |

| | 15,864,000 | | A-1 | | 1.95% due 5/12/05 | | 15,864,000 | |

| | 10,000,000 | | A-1 | | 1.95% due 5/13/05 | | 10,000,000 | |

| | 21,030,000 | | A-1 | | 2.05% due 5/19/05 | | 21,030,000 | |

| | 6,823,000 | | A-1 | | 2.00% due 5/23/05 | | 6,823,000 | |

| | 13,171,000 | | A-1 | | 2.08% due 6/9/05 | | 13,171,000 | |

| | 50,000,000 | | SP-1+ | | Sacramento County TRAN Series A 3.00% due 7/11/05 | | 50,157,602 | |

| | 22,565,000 | | A-1+ | | San Diego USD MSTC SGA-120 MBIA-Insured | | | |

| | | | | | PART 2.26% VRDO | | 22,565,000 | |

|

| | | | | | | | 299,011,123 | |

|

| Hospitals — 3.8% | | | |

| | 5,000,000 | | A-1+ | | Antelope Valley Healthcare District Series A 2.28% VRDO | | 5,000,000 | |

| | | | | | California Health Facilities Finance Authority: | | | |

| | 4,600,000 | | A-1+ | | Catholic Healthcare Series B MBIA-Insured 2.26% VRDO | | 4,600,000 | |

| | 15,075,532 | | A-1+ | | Sisters of Charity Health Systems 2.28% VRDO | | 15,075,532 | |

| | 15,740,000 | | A-1+ | | Southern California Presbyterian Homes MBIA-Insured | | | |

| | | | | | 2.28% VRDO | | 15,740,000 | |

| | | | | | California Statewide Communities Development Authority | | | |

| | | | | | Revenue: | | | |

| | 1,625,000 | | A-1+ | | House Ear Institute 2.29% VRDO | | 1,625,000 | |

| | | | | | Kaiser Permanente Health Systems TECP: | | | |

| | 16,800,000 | | A-1 | | 1.95% due 4/7/05 | | 16,800,000 | |

| | 14,000,000 | | A-1 | | 2.10% due 7/14/05 | | 14,000,000 | |

| | 5,000,000 | | VMIG 1* | | MERLOT Series E FSA-Insured PART 2.32% VRDO | | 5,000,000 | |

| | 6,650,000 | | A | | Long Beach Health Facilities Revenue Memorial Health | | | |

| | | | | | Services Series 91 2.25% VRDO | | 6,650,000 | |

| | 16,800,000 | | A-1+ | | Torrance Hospital Authority Little Co. of Mary Hospital |

| | | | | | 2.28% VRDO | | 16,800,000 | |

|

| | | | | | | | 101,290,532 | |

|

| Housing: Multi-Family — 14.1% | | | |

| | 6,180,000 | | A-1+ | | Anaheim Housing Authority MFH Park Vista Apartments | | | |

| | | | | | FHLMC 2.35% VRDO AMT | | 6,180,000 | |

| | | | | | California HFA MFH: | | | |

| | | | | | FNMA: | | | |

| | 3,000,000 | | A-1+ | | Series C 2.35% VRDO AMT | | 3,000,000 | |

| | 4,965,000 | | A-1+ | | Series E 2.32% VRDO AMT | | 4,965,000 | |

| | 1,100,000 | | A-1+ | | Series F 2.30% VRDO | | 1,100,000 | |

| | 2,745,000 | | A-1+ | | Series G 2.32% VRDO AMT | | 2,745,000 | |

| | 10,000,000 | | A-1+ | | Series C 2.35% VRDO AMT | | 10,000,000 | |

| | 1,781,000 | | VMIG 1* | | California State Department of Veterans Affairs Clipper | | | |

| | | | | | Tax Exempt Trust Series 98-9 AMBAC-Insured PART | | | |

| | | | | | 2.38% VRDO AMT | | 1,781,000 | |

See Notes to Financial Statements. 11 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

| | | | |

|---|

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Housing: Multi-Family — 14.1% (continued) | | | |

| | | | | | California Statewide Communities Development | | | |

| | | | | | Authority Revenue MFH FNMA: | | | |

| $ | 3,415,000 | | A-1+ | | Breezewood Apartments Series F-1 2.34% VRDO AMT | $ | 3,415,000 | |

| | 5,665,000 | | A-1+ | | Oakmont of Danville-Sunrise Project 2.34% VRDO AMT | | 5,665,000 | |

| | 6,955,000 | | A-1+ | | Corona MFH Housing Country Hills Project Series B | | | |

| | | | | | FHLMC 2.26% VRDO | | 6,955,000 | |

| | 5,000,000 | | A-1+ | | Covina RDA MFH Shadowhills Apartments Series-A FNMA | | | |

| | | | | | 2.26% VRDO | | 5,000,000 | |

| | 9,500,000 | | A-1+ | | Escondido MFH Via Roble Apartments Series A FNMA | | | |

| | | | | | 2.34% VRDO AMT | | 9,500,000 | |

| | 1,350,000 | | VMIG 1* | | Hayward MFH Tennyson Gardens Apartments Series A | | | |

| | | | | | 2.31% VRDO AMT | | 1,350,000 | |

| | 1,750,000 | | A-1+ | | Livermore MFH Diablo Vista Apartments FNMA | | | |

| | | | | | 2.33% VRDO | | 1,750,000 | |

| | | | | | Los Angeles Community RDA MFH Security: | | | |

| | 4,900,000 | | A-1+ | | Building Project Series A FNMA 2.28% VRDO AMT | | 4,900,000 | |

| | 10,311,000 | | VMIG 1* | | Promenade Towers Project FHLMC 2.29% VRDO | | 10,311,000 | |

| | | | | | Los Angeles County Housing Authority MFH: | | | |

| | 3,000,000 | | VMIG 1* | | Canyon Country Villas Project Series H FHLMC | | | |

| | | | | | 2.28% VRDO | | 3,000,000 | |

| | 20,000,000 | | VMIG 1* | | Channel Gateway Apartments Series B FHLMC | | | |

| | | | | | 2.33% VRDO AMT | | 20,000,000 | |

| | 8,250,000 | | A-1+ | | Malibu Meadows II-C FNMA 2.30% VRDO | | 8,250,000 | |

| | 4,300,000 | | A-1+ | | Sand Canyon Series F FHLMC 2.28% VRDO | | 4,300,000 | |

| | 5,994,000 | | VMIG 1* | | Studio Colony Series C 2.27% VRDO | | 5,994,000 | |

| | 20,500,000 | | A-1+ | | Milpitas MFH Crossing at Montague Series A | | | |

| | | | | | FNMA 2.34% VRDO AMT | | 20,500,000 | |

| | | | | | Orange County Apartment Development: | | | |

| | | | | | FHLMC: | | | |

| | 13,200,000 | | VMIG 1* | | Capistrano Pointe Series A 2.30% VRDO | | 13,200,000 | |

| | 16,500,000 | | VMIG 1* | | Foothill Oaks Apartments 2.34% VRDO AMT | | 16,500,000 | |

| | | | | | FNMA: | | | |

| | 5,275,000 | | A-1+ | | Alicia Apartments Series A 2.38% VRDO AMT | | 5,275,000 | |

| | 23,500,000 | | A-1+ | | Ladera Apartments Series 2-B 2.34% VRDO AMT | | 23,500,000 | |

| | | | | | WLCO LF Partners Issue G: | | | |

| | 14,400,000 | | A-1+ | | Series 2 2.30% VRDO | | 14,400,000 | |

| | 7,100,000 | | A-1+ | | Series 3 2.30% VRDO | | 7,100,000 | |

| | 13,100,000 | | A-1+ | | Orange County Housing Authority Oasis Martinique | | | |

| | | | | | Project FNMA 2.27% VRDO | | 13,100,000 | |

| | 9,500,000 | | A-1+ | | Pasadena Community Development Commission MFH | | | |

| | | | | | Holly Street Apartments Series A FNMA | | | |

| | | | | | 2.28% VRDO AMT | | 9,500,000 | |

| | 15,780,000 | | VMIG 1* | | Richmond RDA MFH Summit Hilltop Series A FNMA | | | |

| | | | | | 2.30% VRDO | | 15,780,000 | |

See Notes to Financial Statements. 12 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

| | | | |

|---|

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Housing: Multi-Family — 14.1% (continued) | | | |

| $ | 5,800,000 | | A-1+ | | Rohnert Park MFH Crossbrook Apartments Series A | | | |

| | | | | | FNMA 2.30% VRDO | $ | 5,800,000 | |

| | | | | | Sacramento County Housing Authority MFH FNMA: | | | |

| | 6,000,000 | | A-1+ | | Ashford Series D 2.30% VRDO | | 6,000,000 | |

| | 4,100,000 | | A-1+ | | Bent Tree Apartments Series A 2.26% VRDO | | 4,100,000 | |

| | 6,000,000 | | A-1+ | | River Apartments 2.30% VRDO | | 6,000,000 | |

| | 5,000,000 | | A-1+ | | Stone Creek Apartments 2.30% VRDO | | 5,000,000 | |

| | 7,900,000 | | A-1+ | | Stonebridge Apartments Series D 2.23% VRDO | | 7,900,000 | |

| | | | | | San Francisco City & County RDA MFH: | | | |

| | | | | | Fillmore Center: | | | |

| | 10,600,000 | | A-1+ | | Series A-1 2.29% VRDO | | 10,600,000 | |

| | 9,600,000 | | A-1+ | | Series A-2 2.29% VRDO | | 9,600,000 | |

| | 5,750,000 | | A-1+ | | Series B-2 2.30% VRDO AMT | | 5,750,000 | |

| | | | | | San Jose MFH: | | | |

| | 7,000,000 | | A-1+ | | Cinnabar Commons Series C 2.28% VRDO AMT | | 7,000,000 | |

| | 9,580,000 | | VMIG 1* | | Fairway Glen Series A FNMA 2.29% VRDO | | 9,580,000 | |

| | 4,900,000 | | VMIG 1* | | Foxchase Series B FNMA 2.29% VRDO | | 4,900,000 | |

| | 16,050,000 | | VMIG 1* | | Kimberly Woods Apartments Series A FHLMC | | | |

| | | | | | 2.30% VRDO | | 16,050,000 | |

| | 3,400,000 | | A-1+ | | San Leandro MFH Parkside Series A FNMA 2.23% VRDO | | 3,400,000 | |

| | 7,200,000 | | A-1+ | | Santa Cruz County Housing Authority MFH Paloma | | | |

| | | | | | Apartments Series A 2.30% VRDO | | 7,200,000 | |

| | 7,800,000 | | VMIG 1* | | Simi Valley MFH Shadowridge Apartments FHLMC | | | |

| | | | | | 2.35% VRDO | | 7,800,000 | |

| | 1,000,000 | | A-1 | | Stockon MFH Mariners Pointe Association Series A | | | |

| | | | | | 2.30% VRDO | | 1,000,000 | |

|

| | | | | | | | 376,696,000 | |

|

| Housing: Single-Family — 7.8% | | | |

| | | | | | California Cities Home Ownership Authority Lease | | | |

| | | | | | Purchase Program: | | | |

| | 35,800,000 | | A-1+ | | Series A 2.34% VRDO | | 35,800,000 | |

| | 5,650,000 | | A-1+ | | Series B 2.34% VRDO | | 5,650,000 | |

| | | | | | California HFA SFH Home Mortgage: | | | |

| | 15,000,000 | | A-1+ | | Series B 2.375% due 7/1/05 AMT | | 15,000,000 | |

| | 20,265,000 | | A-1+ | | Series D FSA-Insured 2.30% VRDO AMT | | 20,265,000 | |

| | 5,000,000 | | A-1+ | | Series K 2.32% VRDO AMT | | 5,000,000 | |

| | 2,260,000 | | A-1+ | | Series Q 2.32% VRDO AMT | | 2,260,000 | |

| | 19,300,000 | | A-1 | | Series U MBIA-Insured 2.30% VRDO AMT | | 19,300,000 | |

| | | | | | California State Department of Veterans Affairs Home | | | |

| | | | | | Purchase Revenue: | | | |

| | 25,000,000 | | VMIG 1* | | Series A 2.23% VRDO | | 25,000,000 | |

| | 3,680,000 | | A-1 | | MSTC Series 1998-47 AMBAC-Insured PART | | | |

| | | | | | 2.26% VRDO AMT (b) | | 3,680,000 | |

See Notes to Financial Statements. 13 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

| | | | |

|---|

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Housing: Single-Family — 7.8% (continued) | | | |

| $ | 17,175,000 | | A-1+ | | Riverside-San Bernardino HFA Lease Pass-Through | | | |

| | | | | | Obligation Series A 2.29% VRDO | $ | 17,175,000 | |

| | 56,445,000 | | A-1+ | | San Diego HFA 2.34% VRDO | | 56,445,000 | |

| | 2,500,000 | | A-1+ | | Upland Apartment Development Mountain Springs | | | |

| | | | | | Series 1998A FNMA 2.30% VRDO | | 2,500,000 | |

|

| | | | | | | | 208,075,000 | |

|

| Industrial Development — 1.9% | | | |

| | | | | | California Infrastructure & Economic Development Bank: | | | |

| | 4,000,000 | | F-1+** | | IDR River Ranch 2.33% VRDO AMT | | 4,000,000 | |

| | 900,000 | | A-1+ | | ISO Series B MBIA-Insured 2.28% VRDO | | 900,000 | |

| | 2,400,000 | | A-1+ | | Roller Bearing of America 2.55% VRDO AMT | | 2,400,000 | |

| | | | | | California Statewide Communities Development Authority: | | | |

| | 2,400,000 | | A-1+ | | A&B Die Casting Corp. Series A 2.35% VRDO AMT | | 2,400,000 | |

| | 4,000,000 | | A-1+ | | Aegis Assisted Living Properties Series Y FNMA | | | |

| | | | | | 2.34% VRDO AMT | | 4,000,000 | |

| | 33,630,000 | | AA | | Puerto Rico Industrial Tourist Educational Medical & | | | |

| | | | | | Environmental Control Authority Abbott Laboratories | | | |

| | | | | | Project 2.55% due 3/1/06 | | 33,630,000 | |

| | | | | | Riverside County IDA: | | | |

| | 3,000,000 | | A-1+ | | Aluminum Body Corp. Project 2.33% VRDO AMT | | 3,000,000 | |

| | 1,900,000 | | NR† | | Rockwin Corp. Series II 2.35% VRDO AMT | | 1,900,000 | |

|

| | | | | | | | 52,230,000 | |

|

| Life Care Systems — 0.2% | | | |

| | 6,070,000 | | VMIG 1* | | ABAG Finance Authority for Nonprofit Corp. Pathways | | | |

| | | | | | Home Health Hospice 2.28% VRDO | | 6,070,000 | |

|

| Miscellaneous — 3.2% | | | |

| | 7,000,000 | | A-1+ | | ABAG Finance Authority for Nonprofit Corp. | | | |

| | | | | | Lease Pass-Through Obligation Series A 2.34% VRDO | | 7,000,000 | |

| | | | | | California Infrastructure & Economic Development Bank: | | | |

| | 10,000,000 | | A-1+ | | Academy of Motion Pictures AMBAC-Insured | | | |

| | | | | | 2.30% VRDO | | 10,000,000 | |

| | 10,000,000 | | A-1+ | | Buck Institute for Age Research 2.24% VRDO | | 10,000,000 | |

| | | | | | California Statewide Communities Development | | | |

| | | | | | Authority Revenue: | | | |

| | 1,555,000 | | VMIG 1* | | Nonprofit’s Insurance Alliance 2.27% VRDO | | 1,555,000 | |

| | 2,900,000 | | VMIG 1* | | North Peninsula Jewish Community Center | | | |

| | | | | | 2.28% VRDO | | 2,900,000 | |

| | 30,000,000 | | SP-1+ | | TRAN Series A-1 3.00% due 6/30/05 | | 30,102,660 | |

| | 6,000,000 | | VMIG 1* | | Irvine Improvement Board Assessment District 85-7 | | | |

| | | | | | FSA-Insured 2.28% VRDO | | 6,000,000 | |

| | 3,000,000 | | VMIG 1* | | Oakland MERLOT Series M AMBAC-Insured PART | | | |

| | | | | | 2.32% VRDO | | 3,000,000 | |

See Notes to Financial Statements. 14 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Miscellaneous — 3.2% (continued) | | | |

| $ | 600,000 | | A-1 | | Orange County Improvement District 88-1 2.28% VRDO | $ | 600,000 | |

| | 5,580,000 | | VMIG 1* | | Pasadena COP Rose Bowl Improvement Project Series 96 | | | |

| | | | | | 2.30% VRDO | | 5,580,000 | |

| | 7,200,000 | | VMIG 1* | | San Bernardino County COP Capital Improvement Project | | | |

| | | | | | 2.23% VRDO | | 7,200,000 | |

| | 2,310,000 | | A-1 | | Westminster COP Civic Center Refunding Program Series B | | | |

| | | | | | AMBAC-Insured 2.27% VRDO | | 2,310,000 | |

|

| | | | | | | | 86,247,660 | |

|

| | | | |

| Pollution Control — 0.4% | | | |

| | | | | | California PCFA PCR: | | | |

| | 7,800,000 | | A-1+ | | Santa Clara Valley Disposal Co. Series A | | | |

| | | | | | 2.28% VRDO AMT | | 7,800,000 | |

| | 2,900,000 | | A-1+ | | Wadham Energy Series B 2.25% VRDO AMT | | 2,900,000 | |

|

| | | | | | | | 10,700,000 | |

|

| | | | |

| Public Facilities — 5.8% | | | |

| | 4,600,000 | | VMIG 1* | | Escondido Community Development Commission COP | | | |

| | | | | | 2.33% VRDO AMT | | 4,600,000 | |

| | 3,400,000 | | VMIG 1* | | Kern County COP Kern Public Facilities Project Series D | | | |

| | | | | | 2.23% VRDO | | 3,400,000 | |

| | | | | | Oakland Alameda County Coliseum Project: | | | |

| | 5,813,000 | | A-1+ | �� | Series C-1 2.27% VRDO | | 5,813,000 | |

| | 37,400,000 | | A-1+ | | Series C-2 2.24% VRDO | | 37,400,000 | |

| | 18,410,000 | | A-1+ | | Oakland COP Capital Equipment Project 2.28% VRDO | | 18,410,000 | |

| | 2,200,000 | | A-1 | | Redwood City PFA COP City Hall Project 2.27% VRDO | | 2,200,000 | |

| | 1,400,000 | | VMIG 1* | | Riverside County Community Facilities District Special Tax | | | |

| | | | | | No. 89-1 2.27% VRDO | | 1,400,000 | |

| | 4,300,000 | | A-1+ | | Sacramento County COP Administration Center & | | | |

| | | | | | Courthouse Project 2.27% VRDO | | 4,300,000 | |

| | 16,940,000 | | A-1 | | Sacramento Finance Authority Lease Revenue MSTC | | | |

| | | | | | Series 2025 AMBAC-Insured PART 2.27% VRDO (b) | | 16,940,000 | |

| | 9,865,000 | | A-1 | | San Francisco Building Authority Civic Center MSTC 9006 | | | |

| | | | | | AMBAC-Insured PART 2.27% VRDO AMT (b) | | 9,865,000 | |

| | 21,850,000 | | A-1+ | | San Francisco Finance Lease Revenue Moscone Center | | | |

| | | | | | Project AMBAC-Insured 2.28% VRDO | | 21,850,000 | |

| | 11,090,000 | | A-1 | | South Orange County PFA MSTC Series 2030 FSA-Insured | | | |

| | | | | | PART 2.27% VRDO (b) | | 11,090,000 | |

| | 13,400,000 | | F-1+** | | Stanislaus County Capital Improvements Financing | | | |

| | | | | | Authority Central Valley Center For the Arts | | | |

| | | | | | 2.28% VRDO | | 13,400,000 | |

| | 5,000,000 | | A-1+ | | Temecula PFA Community Facilities District Harveston | | | |

| | | | | | Series A 2.27% VRDO | | 5,000,000 | |

|

| | | | | | | | 155,668,000 | |

|

| | | |

| | | |

See Notes to Financial Statements. 15 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Solid Waste — 2.6% | | | | | |

| | | | | | California PCFA: | | | |

| $ | 3,855,000 | | F-1+** | | Alameda County Industrial Project Series A | | | |

| | | | | | 2.36% VRDO AMT | $ | 3,855,000 | |

| | 4,010,000 | | F-1+** | | Athens Disposal Inc. Project Series A 2.36% VRDO AMT | | 4,010,000 | |

| | 4,820,000 | | F-1+** | | Athens Services Project 2.36% VRDO AMT | | 4,820,000 | |

| | 1,520,000 | | F-1+** | | BLT Enterprises Series 99A 2.36% VRDO AMT | | 1,520,000 | |

| | 4,335,000 | | F-1+** | | Blue Line Transfer Project 2.36% VRDO AMT | | 4,335,000 | |

| | 2,430,000 | | F-1+** | | Blue Line Transfer Project A 2.36% VRDO AMT | | 2,430,000 | |

| | 12,845,000 | | F-1+** | | Edco Disposal Corp. 2.36% VRDO AMT | | 12,845,000 | |

| | 1,975,000 | | F-1+** | | Garaventa Enterprises Inc. 2.36% VRDO AMT | | 1,975,000 | |

| | 8,735,000 | | A-1+ | | Norcal Waste Systems Inc. 2.36% VRDO AMT | | 8,735,000 | |

| | 2,000,000 | | A-1+ | | Norcal Waste Systems Inc. Project A 2.36% VRDO AMT | | 2,000,000 | |

| | 1,070,000 | | A-1+ | | PCR Santa Clara Valley Disposal Co. Series A | | | |

| | | | | | 2.33% VRDO AMT | | 1,070,000 | |

| | 305,000 | | F-1+** | | Sonoma Compost Co. Project Series A 2.36% | | | |

| | | | | | VRDO AMT | | 305,000 | |

| | 1,300,000 | | F-1+** | | South County Sanitary Services Series 1999A | | | |

| | | | | | 2.36% VRDO AMT | | 1,300,000 | |

| | 2,995,000 | | F-1+** | | Willits Project Series A 2.36% VRDO AMT | | 2,995,000 | |

| | 16,770,000 | | A-1+ | | Stanislaus Waste-to-Energy Financing Agency Solid Waste | | | |

| | | | | | Facilities Ogden Martin Corp. MBIA-Insured | | | |

| | | | | | 2.27% VRDO | | 16,770,000 | |

|

| | | | | | | | 68,965,000 | |

|

| | | | |

| TaxAllocation —0.3% | | | |

| | 8,585,000 | | A-1+ | | Westminster RDA TAR Project 1 AMBAC-Insured | | | |

| | | | | | 2.27% VRDO | | 8,585,000 | |

|

| | | | |

| Transportation—7.5%�� | | | |

| | 40,000,000 | | A-1+ | | Bay Area Toll Authority Toll Bridge Revenue San Francisco | |

| | | | | | Bay Area AMBAC-Insured Series C 2.27% VRDO | | 40,000,000 | |

| | | | | | Los Angeles County MTA Sales Tax Revenue: | | | |

| | 2,875,000 | | VMIG 1* | | Series 837 AMBAC-Insured PART 2.30% VRDO | | 2,875,000 | |

| | 14,995,000 | | A-1+ | | Series A MBIA-Insured 2.23% VRDO | | 14,995,000 | |

| | 14,024,000 | | A-1 | | Sub-Series 2 1.95% due 4/8/05 TECP | | 14,024,000 | |

| | 11,375,000 | | A-1 | | Los Angeles Harbor Department Series B 2.10% due 6/2/05 | | | |

| | | | | | TECP AMT | | 11,375,000 | |

| | 19,675,000 | | VMIG 1* | | Port of Oakland Munitops Series 2000-5 FGIC-Insured | | | |

| | | | | | PART 2.34% VRDO AMT (b) | | 19,675,000 | |

| | 17,500,000 | | A-1+ | | Port of Oakland Series E 2.01% due 6/2/05 TECP | | 17,500,000 | |

| | 4,660,000 | | NR† | | Puerto Rico Commonwealth Highway & Transportation | | | |

| | | | | | Authority FSA-Insured 2.28% VRDO | | 4,660,000 | |

| | 41,340,000 | | VMIG 1* | | San Francisco City & County Airport Commission Munitops | | | |

| | | | | | Series 2000-9 FGIC-Insured PART 2.35% VRDO AMT | | 41,340,000 | |

| | | |

| | | |

| | | |

See Notes to Financial Statements. 16 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Transportation — 7.5% (continued) | | | |

| $ | 6,100,000 | | A-1+ | | San Gabriel Valley Council of Government Alameda | | | |

| | | | | | Corridor East Construction Project 2.02% | | | |

| | | | | | due 5/2/05 TECP | $ | 6,100,000 | |

| | | | | | San Joaquin Transportation Authority TECP: | | | |

| | 4,000,000 | | A-1+ | | 2.10% due 6/1/05 | | 4,000,000 | |

| | 24,800,000 | | A-1+ | | 2.02% due 6/6/05 | | 24,800,000 | |

|

| | | | | | | | 201,344,000 | |

|

| | | | |

| Utilities— 12.9% | | | | | |

| | | | | | California Infrastructure & EDB ISO MBIA-Insured: | | | |

| | 38,100,000 | | A-1+ | | Series A 2.28% VRDO | | 38,100,000 | |

| | 7,200,000 | | A-1+ | | Series C 2.25% VRDO | | 7,200,000 | |

| | | | | | California State Department of Water Resources Power | | | |

| | | | | | Supply Revenue: | | | |

| | 42,315,000 | | A-1+ | | Series C-2 2.28% VRDO | | 42,315,000 | |

| | 22,600,000 | | A-1+ | | Series C-11 2.23% VRDO | | 22,600,000 | |

| | 2,250,000 | | A-1+ | | Series C-12 2.23% VRDO | | 2,250,000 | |

| | 11,630,000 | | A-1+ | | Series C-14 2.23% VRDO | | 11,630,000 | |

| | | | | | Los Angeles Department of Water & Power: | | | |

| | 9,200,000 | | A-1+ | | Series B-1 2.28% VRDO | | 9,200,000 | |

| | 30,500,000 | | A-1+ | | Series B-5 2.28% VRDO | | 30,500,000 | |

| | 18,200,000 | | A-1+ | | Series B-7 2.28% VRDO | | 18,200,000 | |

| | 21,200,000 | | A-1+ | | Sub-Series A-5 2.23% VRDO | | 21,200,000 | |

| | | | | | MSR Public Power Agency San Juan Project: | | | |

| | 9,350,000 | | A-1+ | | Series B AMBAC-Insured 2.23% VRDO | | 9,350,000 | |

| | 30,600,000 | | A-1+ | | Series E MBIA-Insured 2.23% VRDO | | 30,600,000 | |

| | 7,200,000 | | A-1+ | | Northern California Power Agency Hydroelectric No. 1 | | | |

| | | | | | MBIA-Insured 2.23% VRDO | | 7,200,000 | |

| | 1,500,000 | | A-1+ | | Puerto Rico Electric Power Authority Series SGA-43 | | | |

| | | | | | MBIA-Insured PART 2.23% VRDO | | 1,500,000 | |

| | 23,145,000 | | A-1+ | | Roseville Electric System Revenue COP FSA-Insured | | | |

| | | | | | 2.23% VRDO | | 23,145,000 | |

| | 11,835,000 | | VMIG 1* | | Sacramento MUD Munitops Series 03-17 MBIA-Insured | | | |

| | | | | | PART 2.31% VRDO | | 11,835,000 | |

| | 8,000,000 | | A-1+ | | San Francisco Public Utilities Commission | | | |

| | | | | | 2.00% due 5/5/05 TECP | | 8,000,000 | |

| | | | | | Southern California Public Power Authority Transmission | | | |

| | | | | | Project FSA-Insured: | | | |

| | 25,150,000 | | A-1+ | | Series A 2.23% VRDO | | 25,150,000 | |

| | 23,725,000 | | A-1+ | | Series B 2.23% VRDO | | 23,725,000 | |

|

| | | | | | | | 343,700,000 | |

|

| | | |

| | | |

See Notes to Financial Statements. 17 Smith Barney Muni Funds | 2005 Annual Report

|

Schedule of Investments (continued) | | March 31, 2005 |

FACE

AMOUNT | | RATING(a) | | SECURITY | | VALUE | |

|

| Water & Sewer — 10.4% | | | |

| $ | 8,115,000 | | A-1+ | | Dublin San Ramon Services District Sewer Revenue COP | | | |

| | | | | | MBIA-Insured 2.24% VRDO | $ | 8,115,000 | |

| | 7,475,000 | | A-1+ | | Eastern Municipal Water District Water & Sewer Revenue | | | |

| | | | | | Series B FGIC-Insured 2.23% VRDO | | 7,475,000 | |

| | 36,200,000 | | VMIG 1* | | Elsinore Valley Municipal Water District COP Series A | | | |

| | | | | | FGIC-Insured 2.23% VRDO | | 36,200,000 | |

| | 2,650,000 | | A-1+ | | Fresno Sewer Revenue Series A FGIC-Insured | | | |

| | | | | | 2.23% VRDO | | 2,650,000 | |

| | 15,945,000 | | VMIG 1* | | Los Angeles County Sanitation District Finance Authority | | | |

| | | | | | Series 826 FSA-Insured PART 2.30% VRDO | | 15,945,000 | |

| | | | | | Los Angeles Waste Water System: | | | |

| | 9,897,500 | | NR† | | Series 318 FGIC-Insured PART 2.30% VRDO | | 9,897,500 | |

| | 17,875,000 | | A-1+ | | Series A2 1.90% due 4/7/05 TECP | | 17,875,000 | |

| | 8,000,000 | | A-1+ | | Sub-Series A FGIC-Insured 2.15% due 12/15/05 | | 8,000,000 | |

| | 15,000,000 | | A-1+ | | Sub-Series B FGIC-Insured 2.15% due 12/15/05 | | 15,000,000 | |

| | 8,000,000 | | A-1+ | | Manteca Finance Authority Water Revenue MSTC SGA 147 | | | |

| | | | | | MBIA-Insured PART 2.26% VRDO | | 8,000,000 | |

| | | | | | Metropolitan Water District of Southern California: | | | |

| | 6,900,000 | | A-1 | | Series 01-113 MSTC FGIC-Insured PART 2.26% VRDO (b) | | 6,900,000 | |

| | 21,300,000 | | A-1+ | | Series A 2.28% VRDO | | 21,300,000 | |

| | 1,100,000 | | A-1+ | | Series B-1 2.23% VRDO | | 1,100,000 | |

| | 17,300,000 | | A-1+ | | Series B-2 2.23% VRDO | | 17,300,000 | |

| | 6,000,000 | | A-1+ | | Series B-2 2.23% VRDO | | 6,000,000 | |

| | 8,190,000 | | A-1+ | | Series C 2.24% VRDO | | 8,190,000 | |

| | 56,600,000 | | A-1+ | | Series C-2 2.23% VRDO | | 56,600,000 | |

| | | | | | San Diego County Water Authority: | | | |

| | 11,000,000 | | VMIG 1* | | Munitops Series 98-10 FGIC-Insured PART 2.30% VRDO | | 11,000,000 | |

| | 5,000,000 | | A-1+ | | Series 1 2.03% due 6/9/05 TECP | | 5,000,000 | |

| | 15,400,000 | | VMIG 1* | | South Placer Waste Water Authority Series B FGIC-Insured | | | |

| | | | | | 2.25% VRDO | | 15,400,000 | |

|

| | | | | | | | 277,947,500 | |

|

| | | | | | TOTAL INVESTMENTS — 100.2% | | | |

| | | | | | (Cost — $2,680,451,517***) | | 2,680,451,517 | |

| | | | | | Liabilities in Excess of Other Assets — (0.2%) | | (6,546,376 | ) |

|

| | | | | | TOTAL NET ASSETS — 100.0% | $ | 2,673,905,141 | |

|

| | | |

| (a) | All ratings are by Standard & Poor’s Ratings Service (“Standard & Poor’s”), except for those identified by an asterisk (*) which are rated by Moody’s Investor Service (”Moody’s”), and those identified by a double asterisk (**) are rated by Fitch Ratings (“Fitch”). |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to the guidelines approved by the Board of Trustees. |

| † | Security has not been rated by either Standard & Poor’s, Moody’s or Fitch. However, the Board of Trustees has determined this security to be considered a first tier quality issue due to enhancement features; such as insurance and/or irrevocable letters of credit. |

| *** | Aggregate cost for federal income tax purposes is substantially the same. |

| | |

| | See pages 19 and 20 for definitions of ratings and certain abbreviations. |

| |

See Notes to Financial Statements. 18 Smith Barney Muni Funds | 2005 Annual Report

|

| |

The definitions of the applicable rating symbols are set forth below: Standard & Poor’s Ratings Service (“Standard & Poor’s”) — Rating “AA” may be modified by the addition of a plus (+) or minus (-) sign to show relative standings within the major rating categories. |

| |

| AAA | — | Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong. |

| | | |

| AA | — | Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differ from the highest rated issue only in a small degree. |

| | | |

Moody’s Investors Service (“Moody’s”) — Numerical modifiers 1, 2 and 3 may be applied to each “Aa” rating, where 1 is the highest and 3 the lowest ranking within its generic category. |

| | | |

| Aaa | — | Bonds rated “Aaa” by Moody’s are judged to be of the best quality. They carry the smallest degree of investment risk and are generally referred to as “gilt edge.” Interest payments are protected by a large or by an exceptionally stable margin, and principal is secure. While the various protective elements are likely to change, such changes as can be visualized are most unlikely to impair the fundamentally strong position of such bonds. |

| | | |

| Aa | — | Bonds rated “Aa” are judged to be of high quality by all standards. Together with the “Aaa” group they comprise what are generally known as high grade bonds. They are rated lower than the best bonds because margins of protection may not be as large as in “Aaa” securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risks appear somewhat larger than in “Aaa” securities. |

| | | |

Short-Term Security Ratings (unaudited) |

| | | |

| SP-1 | — | Standard & Poor’s highest rating indicating very strong or strong capacity to pay principal and interest; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

| | | |

| SP-2 | — | Standard & Poor’s rating indicating satisfactory capacity to pay principal and interest, with some vulnerability to adverse financial and economic changes over the term of the notes. |

| | | |

| A-1 | — | Standard & Poor’s highest commercial paper and variable-rate demand obligation (“VRDO”) rating indicating that the degree of safety regarding timely payment is either overwhelming or very strong; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

| | | |

| VMIG 1 | — | Moody’s highest rating for issues having a demand feature — VRDO. |

| | | |

| MIG 1 | — | Moody’s highest rate for short-term municipal obligations. |

| | | |

| P-1 | — | Moody’s highest rating for commercial paper and for VRDO prior to the advent of the VMIG 1 rating |

| | | |

| F-1 | — | Fitch Ratings (“Fitch”) highest rating indicating that the degree of safety regarding timely payment is either overwhelming or very strong; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

| | | |

| NR | — | Indicates that the bond is not rated by Standard & Poor’s, Moody’s or Fitch. |

19 Smith Barney Muni Funds | 2005 Annual Report

|

Abbreviations* (unaudited) |

| ABAG | — | Association of Bay Area | | ISD | — | Independent School District |

| | | Governments | | ISO | — | Independent System Operator |

| ACA | — | American Capital Insurance | | LOC | — | Letter of Credit |

| AIG | — | American International | | MBIA | — | Municipal Bond Investors |

| | | Guaranty | | | | Assurance Corporation |

| AMBAC | — | Ambac Assurance Corporation | | MERLOT | — | Municipal Exempt Receipts |

| AMT | — | Alternative Minimum Tax | | | | Liquidity Optional Tender |

| BAN | — | Bond Anticipation Notes | | MFH | — | Multi-Family Housing |

| BIG | — | Bond Investors Guaranty | | MSTC | — | Municipal Securities Trust |

| CDA | — | Community Development | | | | Certificates |

| | | Authority | | MUD | — | Municipal Utilities District |

| CGIC | — | Capital Guaranty Insurance | | MVRICS | — | Municipal Variable Rate |

| | | Company | | | | Inverse Coupon Security |

| CHFCLI | — | California Health Facility | | PART | — | Partnership Structure |

| | | Construction Loan Insurance | | PCFA | — | Pollution Control Finance |

| CONNIE | — | College Construction Loan | | | | Authority |

| LEE | | Insurance Association | | PCR | — | Pollution Control Revenue |

| COP | — | Certificate of Participation | | PFA | — | Public Financing Authority |

| CSD | — | Central School District | | PFC | — | Public Finance Corporation |

| CTFS | — | Certificates | | PSFG | — | Permanent School Fund |

| DFA | — | Development Finance Agency | | | | Guaranty |

| EDA | — | Economic Development | | Q-SBLF | — | Qualified School Board Loan |

| | | Authority | | | | Fund |

| EFA | — | Educational Facilities Authority | | Radian | — | Radian Asset Assurance |

| ETM | — | Escrowed To Maturity | | RAN | — | Revenue Anticipation Notes |

| FGIC | — | Financial Guaranty Insurance | | RAW | — | Revenue Anticipation Warrants |

| | | Company | | RDA | — | Redevelopment Agency |

| FHA | — | Federal Housing Administration | | RIBS | — | Residual Interest Bonds |

| FHLMC | — | Federal Home Loan Mortgage | | RITES | — | Residual Interest Tax-Exempt |

| | | Corporation | | | | Securities |

| FLAIRS | — | Floating Adjustable Interest | | SFH | — | Single-Family Housing |

| | | Rate Securities | | SPA | — | Standby Bond Purchase |

| FNMA | — | Federal National Mortgage | | | | Agreements |

| | | Association | | SWAP | — | Swap Structure |

| FRTC | — | Floating Rate Trust Certificates | | SYCC | — | Structural Yield Curve |

| FSA | — | Financial Security Assurance | | | | Certificate |

| GIC | — | Guaranteed Investment | | TAN | — | Tax Anticipation Notes |

| | | Contract | | TCRS | — | Transferable Custodial Receipts |

| GNMA | — | Government National | | TECP | — | Tax Exempt Commercial Paper |

| | | Mortgage Association | | TFA | — | Transitional Finance Authority |

| GO | — | General Obligation | | TOB | — | Tender Option Bond Structure |

| HDC | — | Housing Development | | TRAN | — | Tax and Revenue Anticipation |

| | | Corporation | | | | Notes |

| HEFA | — | Health & Educational Facilities | | UFSD | — | Unified Free School District |

| | | Authority | | UHSD | — | Unified High School District |

| HFA | — | Housing Finance Authority | | USD | — | Unified School District |

| IBC | — | Insured Bond Certificates | | VA | — | Veterans Administration |

| IDA | — | Industrial Development | | VRDD | — | Variable Rate Daily Demand |

| | | Authority | | VRDO | — | Variable Rate Demand |

| IDB | — | Industrial Development Board | | | | Obligation |

| IDR | — | Industrial Development | | VRWE | — | Variable Rate Wednesday |

| | | Revenue | | | | Demand |

| IFA | — | Infrastructure Finance Agency | | XLCA | — | XL Capital Assurance |

| INFLOS | — | Inverse Floaters | | | | |

| |

|

| * Abbreviations may or may not appear in the schedule of investments. |

20 Smith Barney Muni Funds | 2005 Annual Report

|

Statement of Assets and Liabilities | | March 31, 2005 |

| | |

|---|

| ASSETS: | | | | |

| Investments, at amortized cost | | $ | 2,680,451,517 | |

| Cash | | | 349,753 | |

| Receivable for Fund shares sold | | | 50,059,744 | |

| Receivable for securities sold | | | 44,607,316 | |

| Interest receivable | | | 10,245,722 | |

| Prepaid expenses | | | 32,015 | |

| Other assets | | | 33,793 | |

|

| Total Assets | | | 2,785,779,860 | |

|

| LIABILITIES: | |

| Payable for Fund shares reacquired | | | 108,454,133 | |

| Dividends payable | | | 2,029,153 | |

| Management fee payable | | | 1,123,773 | |

| Distribution plan fees payable | | | 81,338 | |

| Transfer agency service fees payable | | | 68,519 | |

| Trustees’ fees payable | | | 34,208 | |

| Accrued expenses | | | 83,595 | |

|

| Total Liabilities | | | 111,874,719 | |

|

| Total Net Assets | | $ | 2,673,905,141 | |

|

| NET ASSETS: | |

| Par value of shares of beneficial interest (Note 5) | | $ | 2,673,825 | |

| Capital paid in excess of par value | | | 2,671,231,316 | |

|

| Total Net Assets | | $ | 2,673,905,141 | |

|

| Shares Outstanding: | |

| Class A | | | 2,636,628,318 | |

|

| Class Y | | | 37,196,192 | |

|

| Net Asset Value: | |

| Class A (and redemption price) | | $ | 1.00 | |

|

| Class Y (and redemption price) | | $ | 1.00 | |

|

See Notes to Financial Statements. 21 Smith Barney Muni Funds | 2005 Annual Report

|

| | For the Year Ended March 31, 2005 |

| | |

|---|

| INVESTMENT INCOME: | | | | |

| Interest | | $ | 35,919,831 | |

|

| EXPENSES: | |

| Management fee (Note 2) | | | 11,141,871 | |

| Distribution plan fees (Notes 2 and 3) | | | 2,392,273 | |

| Transfer agency service fees (Notes 2 and 3) | | | 446,009 | |

| Custody | | | 121,331 | |

| Shareholder communications (Note 3) | | | 50,710 | |

| Audit and legal | | | 48,874 | |

| Trustees’ fees | | | 20,664 | |

| Registration fees | | | 5,692 | |

| Other | | | 28,555 | |

|

| Total Expenses | | | 14,255,979 | |

| Less: Management fee waiver (Notes 2 and 7) | | | (153,658 | ) |

|

| Net Expenses | | | 14,102,321 | |

|

| Net Investment Income | | | 21,817,510 | |

|

| Net Realized Gain From Investment Transactions (Note 1) | | | 2,727 | |

|

| Increase in Net Assets From Operations | | $ | 21,820,237 | |

|

See Notes to Financial Statements. 22 Smith Barney Muni Funds | 2005 Annual Report

|

Statements of Changes in Net Assets | | For the Year Ended March 31, 2005 |

| | 2005 | | 2004 | |

|---|

|

| OPERATIONS: | | | | | | | |

| Net investment income | | $ | 21,817,510 | | $ | 10,597,259 | |

| Net realized gain | | | 2,727 | | | 993 | |

|

| Increase in Net Assets From Operations | | | 21,820,237 | | | 10,598,252 | |

|

| DISTRIBUTIONS TO SHAREHOLDERS | |

| FROM (NOTES 1 AND 4): | |

| Net investment income | | | (21,817,510 | ) | | (10,597,263 | ) |

| Net realized gain | | | (2,730 | ) | | — | |

|

| Decrease in Net Assets From | |

| Distributions to Shareholders | | | (21,820,240 | ) | | (10,597,263 | ) |

|

| FUND SHARE TRANSACTIONS (NOTE 5): | |

| Net proceeds from sale of shares | | | 11,324,527,674 | | | 8,720,404,004 | |

| Net asset value of shares issued for reinvestment | |

| of distributions | | | 19,889,650 | | | 10,444,598 | |

| Cost of shares reacquired | | | (11,115,072,682 | ) | | (8,674,429,374 | ) |

|

| Increase in Net Assets From Fund Share Transactions | | | 229,344,642 | | | 56,419,228 | |

|

| Increase in Net Assets | | | 229,344,639 | | | 56,420,217 | |

| | |

| NET ASSETS: | |

| Beginning of year | | | 2,444,560,502 | | | 2,388,140,285 | |

|

| End of year | | $ | 2,673,905,141 | | $ | 2,444,560,502 | |

|

See Notes to Financial Statements. 23 Smith Barney Muni Funds | 2005 Annual Report

|

For a share of beneficial interest outstanding throughout each year ended March 31: |

| Class A Shares | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

|---|

|

| Net Asset Value, Beginning of Year | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

|

| Income From Operations | |

| Net investment income | | | 0.009 | | | 0.004 | | | 0.008 | | | 0.016 | | | 0.030 | |

| Net realized gains | | | 0.000 | * | | — | | | — | | | — | | | — | |

|

| Total Income From Operations | | | 0.009 | | | 0.004 | | | 0.008 | | | 0.016 | | | 0.030 | |

|

| Less Distributions From: | |

| Net investment income | | | (0.009 | ) | | (0.004 | ) | | (0.008 | ) | | (0.016 | ) | | (0.030 | ) |

| Net realized gains | | | (0.000 | )* | | — | | | — | | | — | | | — | |

|

| Total Distributions | | | (0.009 | ) | | (0.004 | ) | | (0.008 | ) | | (0.016 | ) | | (0.030 | ) |

|

| Net Asset Value, End of Year | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

|

| Total Return(1) | | | 0.87 | % | | 0.44 | % | | 0.76 | % | | 1.66 | % | | 3.03 | % |

|

| Net Assets, End of Year (millions) | | $ | 2,637 | | $ | 2,398 | | $ | 2,388 | | $ | 2,618 | | $ | 3,355 | |

|

| Ratios to Average Net Assets: | |

| Expenses(2) | | | 0.58 | %(3) | | 0.58 | % | | 0.64 | % | | 0.63 | % | | 0.63 | % |

| Net investment income | | | 0.89 | | | 0.44 | | | 0.76 | | | 1.67 | | | 2.97 | |

|

| Class Y Shares | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

|---|

|

| Net Asset Value, Beginning of Year | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

|

| Income From Operations | |

| Net investment income | | | 0.010 | | | 0.006 | | | 0.010 | | | 0.018 | | | 0.031 | |

| Net realized gains | | | 0.000 | * | | — | | | — | | | — | | | — | |

|

| Total Income From Operations | | | 0.010 | | | 0.006 | | | 0.010 | | | 0.018 | | | 0.031 | |

|

| Less Distributions From: | |

| Net investment income | | | (0.010 | ) | | (0.006 | ) | | (0.010 | ) | | (0.018 | ) | | (0.031 | ) |

| Net realized gains | | | (0.000 | )* | | — | | | — | | | — | | | — | |

|

| Total Distributions | | | (0.010 | ) | | (0.006 | ) | | (0.010 | ) | | (0.018 | ) | | (0.031 | ) |

|

| Net Asset Value, End of Year | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | | $ | 1.00 | |

|

| Total Return(1) | | | 0.99 | % | | 0.62 | % | | 1.02 | % | | 1.78 | % | | 3.12 | % |

|

| Net Assets, End of Year (millions) | | $ | 37 | | $ | 47 | | $ | 0 | ** | $ | 0 | ** | $ | 0 | ** |

|

| Ratios to Average Net Assets: | |

| Expenses(4) | | | 0.46 | %(3) | | 0.45 | % | | 0.53 | % | | 0.54 | % | | 0.54 | % |

| Net investment income | | | 1.02 | | | 0.54 | | | 0.87 | | | 1.72 | | | 3.06 | |

|

| | | | | |

| (1) | Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (2) | As a result of a voluntary expense limitation, the ratio of expenses to average net assets will not exceed 0.80% for Class A shares. |

| (3) | The investment manager voluntarily waived a portion of its management fee for the year ended March 31, 2005. If such fees were not voluntarily waived, the actual expense ratios would have been 0.59% and 0.47% for Class A and Class Y, respectively. |

| (4) | As a result of a voluntary expense limitation, the ratio of expenses to average net assets will not exceed 0.70% for Class Y shares. |

| * | Amount represents less than $0.001 per share. |

| ** | Amount represents less than $0.5 million. |

| |

See Notes to Financial Statements. 24 Smith Barney Muni Funds | 2005 Annual Report

|

Notes to Financial Statements |

| |

1. Organization and Significant Accounting Policies The California Money Market Portfolio (“Fund”), a separate investment fund of the Smith Barney Muni Funds (“Trust”), a Massachusetts business trust, is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company. The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. (a) Investment Valuation. Money market instruments are valued at amortized cost, in accordance with Rule 2a-7 under the 1940 Act, which approximates market value. This method involves valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium. The Fund’s use of amortized cost is subject to its compliance with certain conditions as specified under Rule 2a-7 of the 1940 Act. (b) Security Transactions and Investment Income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. The cost of investments sold is determined by use of the specific identification method. (c) Distributions to Shareholders. Distributions on the shares of the Fund are declared each business day to shareholders of record, and are paid monthly. Distributions of net realized gains, if any, are taxable to shareholders, and are declared at least annually. Distributions are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP. (d) Class Accounting. Investment income, common expenses and realized/unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution, transfer agency services and shareholder communications fees relating to a specific class are charged directly to that class. |

25 Smith Barney Muni Funds | 2005 Annual Report

|

Notes to Financial Statements (continued) |

| |

(e) Fund Concentration. Because the Fund invests primarily in obligations of issuers within California, it is subject to possible concentration risks associated with economic, political, or legal developments or industrial or regional matters specifically affecting California. (f) Federal and Other Taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains on investments, if any, to shareholders each year. Therefore, no federal income tax provision is required. (g) Reclassifications. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made: |

| | | Undistributed Net

Investment Income | | Undistributed

Realized Gains | | Paid-in-Capital | |

|---|

|

| | | $3 | | | $(993) | | | $990 | |

|

| |

These reclassifications are primarily due to distributions paid in connection with the redemptions of Fund shares and book/tax differences in the treatment of various items. 2. Investment Management Agreement and Other Transactions with Affiliates Smith Barney Fund Management LLC (“SBFM”), an indirect wholly-owned subsidiary of Citigroup Inc. (“Citigroup”), acts as investment manager to the Fund. The Fund pays SBFM a management fee calculated at an annual rate of 0.475% on the first $1 billion of the Fund’s average daily net assets; 0.450% on the next $1 billion; 0.425% on the next $3 billion; 0.400% on the next $5 billion and 0.375% on the Fund’s average daily net assets in excess of $10 billion. This fee is calculated daily and paid monthly. During the year ended March 31, 2005, the Fund’s Class A and Y shares had voluntary expense limitations in place of 0.80% and 0.70%, respectively. These expense limitations can be terminated at anytime by SBFM. During the year ended March 31, 2005, SBFM voluntarily waived a portion of its management fee in the amount of $153,658. |

26 Smith Barney Muni Funds | 2005 Annual Report

|

Notes to Financial Statements (continued) |

| |

Citicorp Trust Bank, fsb. (“CTB”), another subsidiary of Citigroup, acts as the Fund’s transfer agent. PFPC Inc. (“PFPC”) acts as the Fund’s sub-transfer agent. CTB receives account fees and asset-based fees that vary according to the size and type of account. PFPC is responsible for shareholder recordkeeping and financial processing for all shareholder accounts and is paid by CTB. For the year ended March 31, 2005, the Fund paid transfer agent fees of $350,582 to CTB. Citigroup Global Markets Inc. (“CGM”), another indirect wholly-owned subsidiary of Citigroup, acts as the Fund’s distributor. All officers and one Trustee of the Trust are employees of Citigroup or its affiliates and do not receive compensation from the Trust. 3. Class Specific Expenses Pursuant to a Rule 12b-1 Distribution Plan, the Fund pays a service fee with respect to Class A shares calculated at an annual rate of 0.10% of the average daily net assets of that class. For the year ended March 31, 2005, total Rule 12b-1 Distribution Plan fees, which are accrued daily and paid monthly, were $2,392,273. For the year ended March 31, 2005, total Transfer Agency Service expenses were as follows: |

| | Class A | | Class Y | |

|---|

|

| Transfer Agency Service Expenses | | | $ 445,904 | | | $ 105 | |

|

| For the year ended March 31, 2005, total Shareholder Communication expenses were as follows: |

| |

| | Class A | | Class Y | |

|---|

|

| Shareholder Communication Expenses | | | $ 49,828 | | | $ 882 | |

|

| |

| 4. Distributions Paid to Shareholders by Class |

| | Year Ended

March 31, 2005 | | Year Ended

March 31, 2004 | |

|---|

|

| Class A | | | | | | | |

| Net investment income | | $ | 21,275,793 | | $ | 10,514,312 | |

| Net realized gains | | | 2,642 | | | — | |

|

| Total | | $ | 21,278,435 | | $ | 10,514,312 | |

|

| Class Y | |

| Net investment income | | $ | 541,717 | | $ | 82,951 | |

| Net realized gains | | | 88 | | | — | |

|

| Total | | $ | 541,805 | | $ | 82,951 | |

|

27 Smith Barney Muni Funds | 2005 Annual Report

|

Notes to Financial Statements (continued) |

| |

5. Shares of Beneficial Interest At March 31, 2005, the Trust had an unlimited amount of shares of beneficial interest authorized with a par value of $0.001 per share. The Fund has the ability to issue multiple classes of shares. Each share of a class represents an identical interest in the Fund and has the same rights, except that each class bears certain expenses specifically related to the distribution of its shares. Transactions in shares of each class were as follows: |

| | Year Ended

March 31, 2005 | | Year Ended

March 31, 2004 | |

|---|

|

| Class A | | | | | | | |

| Shares sold | | | 11,138,409,174 | | | 8,640,554,636 | |

| Shares issued on reinvestment | | | 19,364,829 | | | 10,381,572 | |

| Shares reacquired | | | (10,918,773,385 | ) | | (8,641,366,497 | ) |

|

| Net Increase | | | 239,000,618 | | | 9,569,711 | |

|

| Class Y | |

| Shares sold | | | 186,118,500 | | | 79,849,368 | |

| Shares issued on reinvestment | | | 524,821 | | | 63,026 | |

| Shares reacquired | | | (196,299,297 | ) | | (33,062,877 | ) |

|

| Net Increase (Decrease) | | | (9,655,976 | ) | | 46,849,517 | |

|

| |

| 6. Income Tax Information and Distributions to Shareholders |

| |

| Subsequent to the fiscal year end, the Fund has made the following distributions: |

| Declaration Date | | Record Date | | Payable Date | | Class A | | Class Y | |

|---|

| Daily | | Daily | | April 8, 2005 | | $0.001133869 | | $0.001229829 | |

| Daily | | Daily | | May 13, 2005 | | $0.001939106 | | $0.002063355 | |

|

| |

| The tax character of distributions paid by the fund during the fiscal years ended March 31, were as follows: |

| | 2005 | | 2004 | |

|---|

|

| Distributions paid from: | | | | | | | |

| Tax Exempt Income | | $ | 21,817,513 | | $ | 10,597,263 | |

|

| Net Realized Gain | | | 2,727 | | | — | |

|

| Total Distributions Paid | | $ | 21,820,240 | | $ | 10,597,263 | |

|

| |

| As of March 31, 2005, there were no significant differences between the book and tax components of net assets. |

28 Smith Barney Muni Funds | 2005 Annual Report

|

Notes to Financial Statements (continued) |

| |

7. Additional Information Smith Barney Fund Management LLC (“SBFM”) and Citigroup Global Markets Inc. (“CGMI”) have submitted an Offer of Settlement of an administrative proceeding to the U.S. Securities and Exchange Commission (“SEC”) in connection with an investigation into the 1999 appointment of an affiliated transfer agent for the Smith Barney family of mutual funds (the “Funds”). SBFM and CGMI understand that the SEC has accepted the Offer of Settlement, but has not yet issued the administrative order. The SEC order will find that SBFM and CGMI willfully violated Section 206(1) of the Investment Advisers Act of 1940 (“Advisers Act”). Specifically, the order will find that SBFM and CGMI knowingly or recklessly failed to disclose to the boards of the Funds in 1999 when proposing a new transfer agent arrangement with an affiliated transfer agent that: First Data Investors Services Group (“First Data”), the Funds’ then-existing transfer agent, had offered to continue as transfer agent and do the same work for substantially less money than before; and that Citigroup Asset Management (“CAM”) had entered into a side letter with First Data under which CAM agreed to recommend the appointment of First Data as sub-transfer agent to the affiliated transfer agent in exchange, among other things, for a guarantee by First Data of specified amounts of asset management and investment banking fees to CAM and CGMI. The order also will find that SBFM and CGMI willfully violated Section 206(2) of the Advisers Act by virtue of the omissions discussed above and other misrepresentations and omissions in the materials provided to the Funds’ boards, including the failure to make clear that the affiliated transfer agent would earn a high profit for performing limited functions while First Data continued to perform almost all of the transfer agent functions, and the suggestion that the proposed arrangement was in the Funds’ best interests and that no viable alternatives existed. SBFM and CGMI do not admit or deny any wrongdoing or liability. The settlement will not establish wrongdoing or liability for purposes of any other proceeding. The SEC will censure SBFM and CGMI and order them to cease and desist from violations of Sections 206(1) and 206(2) of the Advisers Act. The order will require Citigroup to pay $208.1 million, including $109 million in disgorgement of profits, $19.1 million in interest, and a civil money penalty of $80 million. Approximately $24.4 million has already been paid to the Funds, primarily through fee waivers. The remaining $183.7 million, including the penalty, will be paid to the U.S. Treasury and then distributed pursuant to a plan to be prepared by Citigroup and |

29 Smith Barney Muni Funds | 2005 Annual Report

|

Notes to Financial Statements (continued) |

| |