PAGE 1 OF 6 POLICY NUMBER: CP-102 DATE: NOVEMBER 12, 2024 SUBJECT: INSIDER TRADING PROCEDURES ISSUED BY: LEGAL DEPARTMENT SUPERSEDES PROCEDURES DATED: JUNE 14, 2024 DISTRIBUTION: COMPANY INSIDERS APPROVED BY: BOARD OF DIRECTORS A. SCOPE AND PURPOSE Tutor Perini Corporation (including its subsidiaries, the “Company”) has adopted: (i) an Insider Trading Policy (the “Insider Trading Policy”) applicable to all its directors, officers and employees, as well as contractors and consultants who have access to the Company’s material nonpublic information, and (ii) these Insider Trading Procedures (these “Procedures”) governing securities trading by the Company’s directors, executive officers, and certain other designated employees, contractors and consultants, who in the ordinary course of the performance of their duties have access to material nonpublic information regarding the Company (“Insiders”). These Procedures have been adopted to help Insiders comply with insider trading laws and regulations. These Procedures regulate trades in the Company’s securities by: ▪ Insiders; ▪ family members of any Insider who reside with such Insider, anyone else who lives in an Insider’s household (other than household employees) and any family members of any Insider who do not live in such Insider’s household but whose transactions in Company securities are subject to the Insider’s influence or who consult with the Insider before they trade in Company securities (collectively referred to as “Family Members”); and ▪ entities controlled or managed by an Insider or an Insider’s Family Members, and trusts for which an Insider or his or her Family Members are the trustee or beneficiary (“Control Entities”). Insiders are responsible for ensuring compliance with these Procedures and the Insider Trading Policy by their Family Members and Control Entities. Unless the context otherwise requires, References to “Insiders” in these Procedures refer collectively to Insiders and their Family Members and Control Entities. These Procedures apply to any and all transactions in the Company’s securities, including the Company’s common stock, options to purchase common stock, or any other type of securities that the Company may issue, as well as derivative securities that are not issued by the Company, such as exchange-traded put or call options or swaps relating to Company’s securities. B. COMPLIANCE WITH THE INSIDER TRADING POLICY No Insider may trade in any of the Company’s securities if such Insider is in possession of material nonpublic information about the Company, unless the trade has been effected in compliance with a pre-approved Rule 10b5-1 Plan (as discussed below). This prohibition applies even if such Insider receives pre-clearance, and the transaction would occur during a trading window. Exhibit 19.2

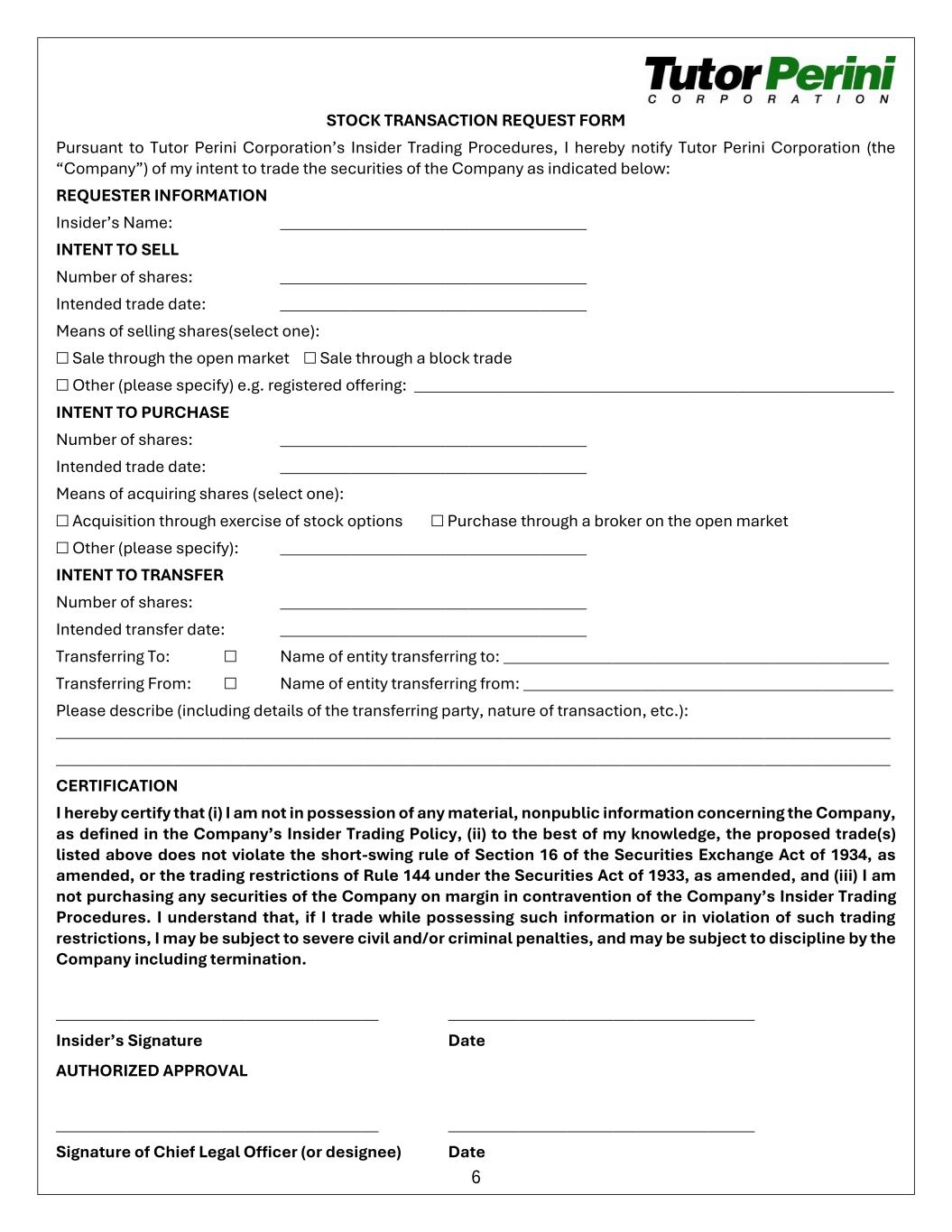

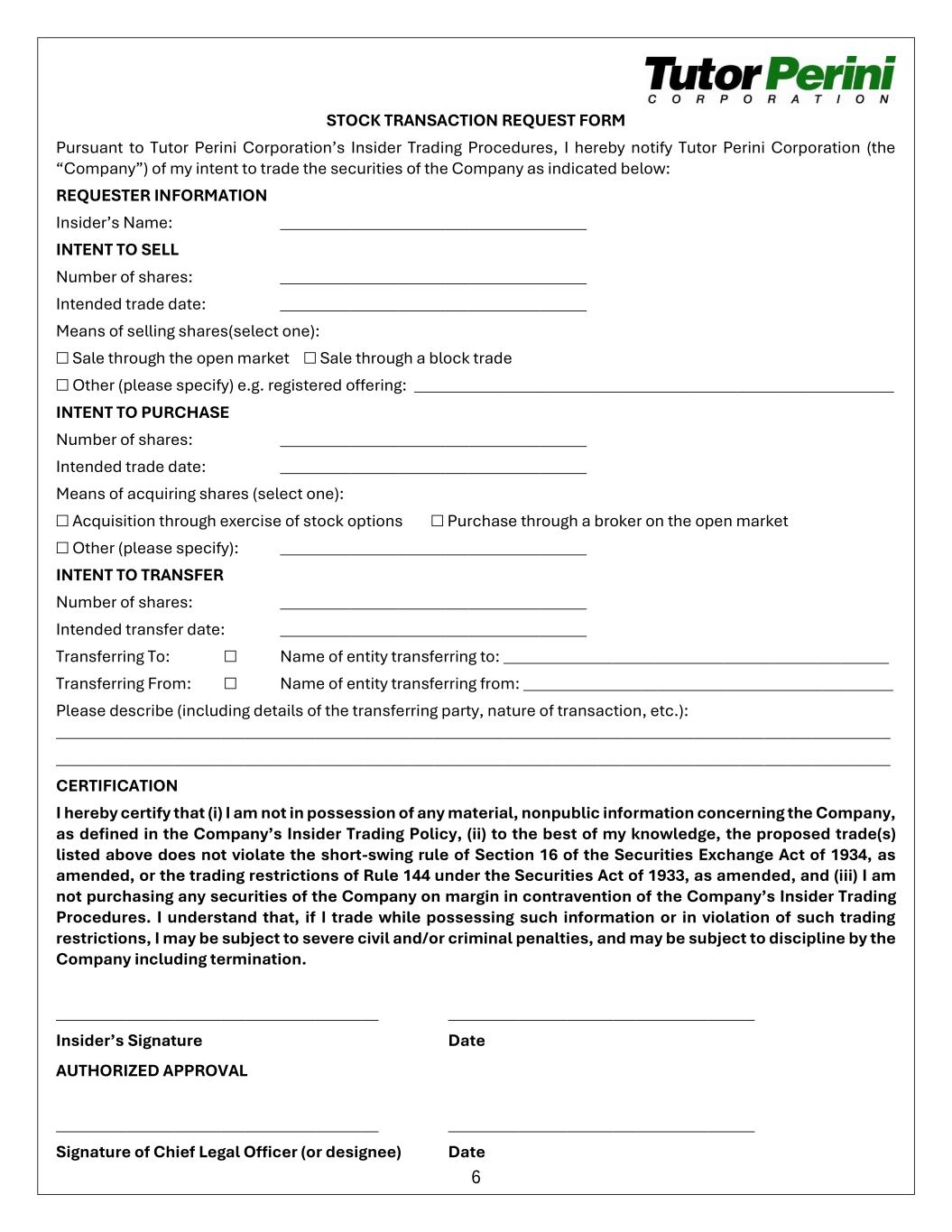

2 C. SPECIAL TRADING RESTRICTIONS AND PROCEDURES The following special trading restrictions apply to Insiders: 1. No Trading During Blackout Periods. Insiders may not purchase, sell, gift or otherwise transfer the Company’s securities during the four quarterly blackout periods except under limited exceptions, and then only after obtaining pre-clearance from the Chief Legal Officer (“CLO”) or his or her designee in accordance with the procedures set forth in Section C.2. a. Quarterly Blackout Periods. Unless otherwise advised, the four blackout periods begin close of business on the 11th calendar day before the end of the then quarter and end on the second business day after the Company’s issuance of a press release (or other method of broad public dissemination) announcing its quarterly or annual earnings. b. Additional Blackout Periods. From time to time, the CLO may determine that an additional blackout period is appropriate. Persons subject to an additional blackout period must not purchase, sell, gift or otherwise transfer the Company’s securities, except as otherwise permitted by these Procedures, and must not disclose that an additional blackout period is in effect. c. Exceptions. Insiders may be allowed to trade outside of a trading window only in the following special circumstances: i. Pursuant to a pre-approved Rule 10b5-1 Plan as described in Section D.1, or ii. In accordance with any waiver described in Section F. 2. All Trades Must be Pre-Cleared by the CLO. An Insider may not purchase, sell, gift or otherwise transfer Company securities unless the transaction has been approved in advance by the CLO or his or her designee in accordance with the following procedures: a. Stock Transaction Request Form. The Insider must notify the CLO or his or her designee of the amount and nature of the proposed trade(s) using the Stock Transaction Request form attached to these Insider Trading Procedures. The Stock Transaction Request form should, if practicable, be received by the CLO at least two (2) business days prior to the intended trade date. b. Certification. The Insider must certify to the CLO in writing prior to the proposed trade(s) that: i. the Insider is not in possession of material nonpublic information concerning the Company; and ii. to the Insider’s best knowledge, the proposed trade(s) does not violate the short-swing rule of Section 16 or the trading restrictions of Rule 144 of the Securities Act of 1933, as amended; and iii. the Insider is not purchasing any of the Company’s securities on margin in contravention of these Procedures. c. Additional Information. Insiders shall provide to the CLO or his or her designee any documentation reasonably requested by her or him in furtherance of the foregoing procedures. Any failure to provide such requested information will be grounds for denial of approval by the CLO or his or her designee. d. No Obligation to Approve Trades. The existence of the foregoing approval procedures does not in any way obligate either the CLO or his or her designee to approve any trade requested by Insiders. The CLO or his or her designee may refuse any trading request at

3 his or her sole reasonable discretion. Pre-clearance should not be understood to represent legal advice by the company that a proposed transaction complies with the law. None of the Company, the CLO, or the Company’s other employees will have any liability for any delay in reviewing, or refusal of, a request for pre-clearance. e. Completion of Trades. After receiving written clearance to trade signed by either the CLO or his or her designee, an Insider should complete the proposed trade within seven (7) business days. Even after clearance has been obtained, a proposed trade may not be executed if the Insider acquires material nonpublic information concerning the Company before completing the trade. If a trade is not completed within the period described above, the trade must be approved again before it may be executed. 3. Post-Trade Reporting by Section 16 Persons. After receiving written pre-clearance to trade, Directors and “officers” as defined in Rule 16a-1 of the Section 16 of the Securities Exchange Act of 1934, as amended (“Section 16 Persons”) are required to report to the CLO or his or her designee any trade (including transactions pursuant to a Rule 10b5-1 Plan) in the Company’s securities by them or their Family Members or Covered Entities as follows: a. Each report must be delivered to the CLO or his or her designee no later than the end of the day on which the transaction occurs. b. Each report should include the date of the transaction, quantity of shares and price per share for each individual trade made, and the broker through which the transaction was effected. This reporting requirement may be satisfied by sending (or having the broker send) duplicate confirmations of all trades made that day. c. Compliance with this provision by Section 16 Persons is imperative given the requirement they must report changes in beneficial ownership of the Company’s securities within two (2) business days in accordance with the Exchange Act. The sanctions for noncompliance with this reporting deadline include mandatory disclosure in the Company’s proxy statement for the next annual meeting of stockholders, as well as possible civil or criminal sanctions for chronic or egregious violators. 4. No Short Sales, Options Trading or Hedging. No Insider may at any time sell any securities of the Company that are not owned by such Insider at the time of the sale (a “short sale”). No Insider may buy, sell, or enter into puts, calls, zero-cost dollars, forward sales contracts, other derivative securities, or other hedging or monetization transactions of the Company at any time. 5. No Purchases on Margin. No Insider may hold Company securities in a margin account. 6. Pledging Limitation. No Insider may pledge more than 30% of the shares beneficially owned by the Insider. 7. Gifts are Subject to Same Restrictions as All Other Trades. No Insider may give or make any other transfer of Company securities without consideration (e.g., a gift or a transfer to a trust) during a blackout period and without pre-clearance. 8. Stock Ownership Guideline Compliance for Certain Insiders. Section 16 Persons must maintain certain equity ownership levels as detailed in the Company’s Stock Ownership Guidelines, as approved by the Company’s Compensation Committee. 9. Post-Termination Transactions. The trading prohibitions and restrictions set forth in these Insider Trading Procedures continue to apply to Insiders following their termination of service

4 to or employment with the Company until any material nonpublic information possessed by such Insider has become public or is no longer material. D. EXEMPTION FROM CERTAIN TRADING RESTRICTIONS: 1. Pre-Approved Rule 10b5-1 Plan Rule 10b5-1 of the Exchange Act provides an opportunity for Insiders to establish plans or arrangements to trade in Company securities outside the trading windows, even when in possession of material nonpublic information, provided that the transaction occurs pursuant to such plan adopted before such Insider became aware of such material nonpublic information (“Rule 10b5-1 Plan”). A Rule 10b5-1 Plan must: a. satisfy the conditions of Rule 10b5-1, and b. be pre-approved in advance by the CLO. Transactions effected pursuant to a pre-approved Rule 10b5-1 Plan will not be subject to the Company’s blackout periods or pre-clearance procedures as described above, and Insiders are not required to complete a Stock Transaction Request form for such transactions. Any deviation from, or alteration to, the specifications of an approved Rule 10b5-1 Plan must be reported immediately to the CLO or his or her designee. Any modification, amendment or termination of an Insider’s prior Rule 10b5-1 Plan requires pre- approval by the CLO. Such modification or amendment must occur during a trading window and while such Insider is not aware of material nonpublic information. The CLO may impose such other conditions on the implementation and operation of a Rule 10b5-1 Plan as the Compliance Officer deems necessary or advisable. The CLO may refuse to approve a plan, arrangement or trading instruction as he or she deems appropriate including, without limitation, if he or she determines that such plan, arrangement or trading instruction does not satisfy the requirements of Rule 10b5-1. The CLO may consult with the Company’s legal counsel before approving a plan, arrangement or trading instruction. If the CLO does not approve an Insider’s plan, arrangement or trading instruction, such Insider must adhere to the pre-clearance procedures and trading windows set forth above until such time as a Rule 10b5-1 plan is approved. 2. Exercise Of Stock Options The black out period restrictions set forth Section C.1 do not apply to the exercise of an option to purchase the Company’s Securities with cash or through a “net exercise” where the underlying shares are withheld to pay the exercise price and/or tax withholding obligations. However, all stock option exercises and the Company’s securities acquired upon such exercises are subject to Section 16 reporting requirements and, therefore, Insiders must comply with the CLO pre- clearance and post-trade reporting requirements described in Sections C.2 and C.3 for any such transactions. The prohibitions and restrictions do apply, however, to the use of outstanding Company securities to constitute part or all of the exercise price of an option, any sale of stock as part of a broker- assisted cashless exercise of an option, or any other market sale for the purpose of generating the cash needed to pay the exercise price of an option. E. POTENTIAL PENALTIES FOR VIOLATIONS Violating these Procedures, the Insider Trading Policy or insider trading laws and regulations can undermine investor trust, harm the reputation and integrity of the Company, and result in dismissal from the Company or even serious criminal and civil charges against the individual and the

5 Company. The Company reserves the right to take disciplinary or other measure(s) it determines in its sole discretion to be appropriate in any particular situation, including disclosure of wrongdoing to governmental authorities. The penalties for insider trading violations can be severe. Persons violating insider trading or tipping rules may be required to disgorge the profit gained or the loss avoided by the trading; pay for losses suffered; pay civil penalties up to three times the profit made or loss avoided; pay a criminal penalty of up to $5 million; and serve a jail term of up to 20 years. The Company and the supervisors of the person violating the rules may also be required to pay major civil or criminal penalties. F. MODIFICATION AND WAIVERS The CLO has authority to interpret, amend and implement these Procedures. This authority includes interpreting or waiving the terms of these Procedures, to the extent consistent with its general purpose and applicable securities laws. The Chief Financial Officer will administer these Procedures as they apply to any trading activity by the CLO. G. QUESTIONS OR REPORTING OF VIOLATIONS You are encouraged to ask questions on the matters set forth in these Procedures. In addition, if you violate these Procedures, the Insider Trading Policy or any federal or state laws governing insider trading, or know of any such violation, you must report the violation immediately. Please direct all inquiries or reports to Kristiyan Assouri, Chief Legal Officer. Failure to observe these Procedures could lead to significant legal problems, and could have other serious consequences, including termination of employment.

6 STOCK TRANSACTION REQUEST FORM Pursuant to Tutor Perini Corporation’s Insider Trading Procedures, I hereby notify Tutor Perini Corporation (the “Company”) of my intent to trade the securities of the Company as indicated below: REQUESTER INFORMATION Insider’s Name: _______________________________________ INTENT TO SELL Number of shares: _______________________________________ Intended trade date: _______________________________________ Means of selling shares(select one): ☐ Sale through the open market ☐ Sale through a block trade ☐ Other (please specify) e.g. registered offering: _____________________________________________________________ INTENT TO PURCHASE Number of shares: _______________________________________ Intended trade date: _______________________________________ Means of acquiring shares (select one): ☐ Acquisition through exercise of stock options ☐ Purchase through a broker on the open market ☐ Other (please specify): _______________________________________ INTENT TO TRANSFER Number of shares: _______________________________________ Intended transfer date: _______________________________________ Transferring To: ☐ Name of entity transferring to: _________________________________________________ Transferring From: ☐ Name of entity transferring from: _______________________________________________ Please describe (including details of the transferring party, nature of transaction, etc.): __________________________________________________________________________________________________________ __________________________________________________________________________________________________________ CERTIFICATION I hereby certify that (i) I am not in possession of any material, nonpublic information concerning the Company, as defined in the Company’s Insider Trading Policy, (ii) to the best of my knowledge, the proposed trade(s) listed above does not violate the short-swing rule of Section 16 of the Securities Exchange Act of 1934, as amended, or the trading restrictions of Rule 144 under the Securities Act of 1933, as amended, and (iii) I am not purchasing any securities of the Company on margin in contravention of the Company’s Insider Trading Procedures. I understand that, if I trade while possessing such information or in violation of such trading restrictions, I may be subject to severe civil and/or criminal penalties, and may be subject to discipline by the Company including termination. _________________________________________ _______________________________________ Insider’s Signature Date AUTHORIZED APPROVAL _________________________________________ _______________________________________ Signature of Chief Legal Officer (or designee) Date