Exhibit 99.1

Perini

Annual Meeting

September 5, 2008

Significant Achievements

Perini

Financial Results For the Six Months Ended June 30, 2008

Revenues of $2.6 billion

Backlog of $8.0 billion (includes $1.2B McCarran Airport contract signed July 15, 2008)

Net Worth of $428.1 million

Income before taxes of $84.9 million

Cash and cash equivalents of $416.7 million

Award of new contracts and expansion of existing projects ($3.7 billion) in 2007 and ($1.9 billion) for the Six Months Ended June 30, 2008

Merger with Tutor-Saliba Corporation

Recognition

Perini Building Company 3 #1 Commercial General Contractor in Nevada, In Business

Perini Building Company 3 Top Contractor, Nevada, Southwest Contractor

James A. Cummings wins Platinum Level Safety Award, Associated Builders & Contractors (FL)

Rudolph and Sletten 3 #1 Top Project in California, California Construction

Perini Corporation #1 in Boston Globe’s Top 100 Companies in Massachusetts 2007 & 2008

Launch of construction program in Dubai and UAE

Revenues and profits at Rudolph and Sletten and James A. Cummings have doubled since acquisition by Perini—successful transition to gaming projects by R&S

?Strong outlook for balance of 2008 and 2009-2010

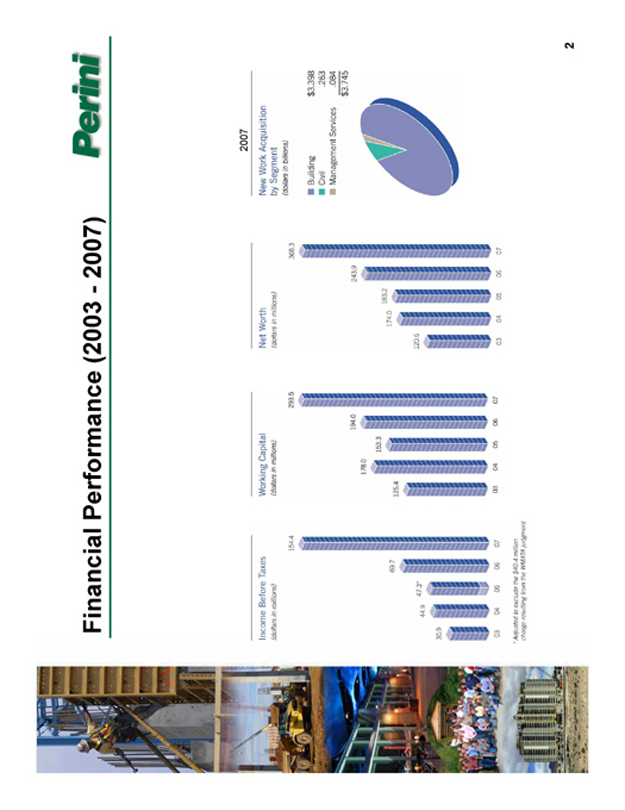

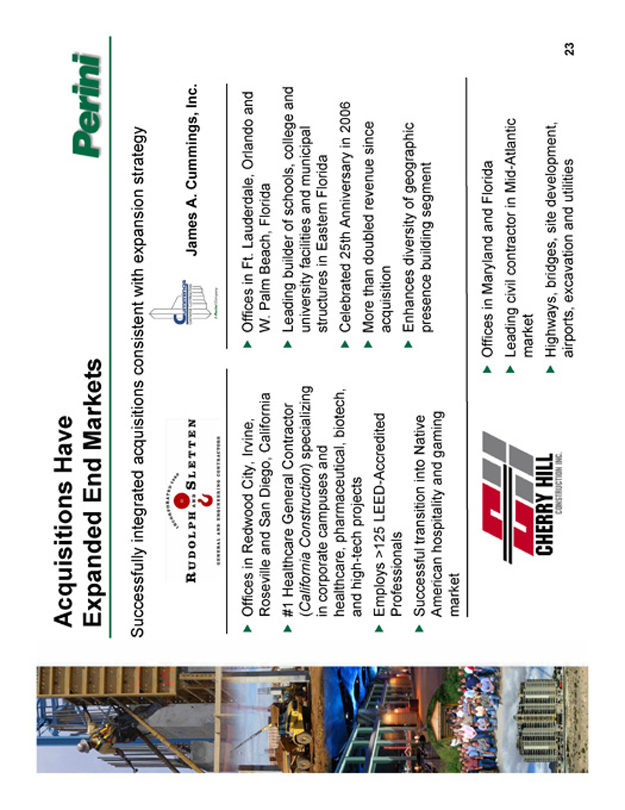

Financial Performance (2003—2007)

Perini

Income Before Taxes

(dollars in millions)

154.4

69.7

47.3

44.9

30.9

03

04

05

06

07

Working Capital

(dollars in millions)

293.5

194.0

153.3

178.0

125.4

03

04

05

06

07

Net Worth

(dollars in millions)

368.3

243.9

183.2

174.0

120.6

03

04

05

06

07

2007

New Work Acquisition by Segment

(dollars in billions)

Building $3.398

Civil .263

Management Services.084

$3.745

Adjusted to exclude the $40.4 million

Charge resulting from the WMATE judgment

2

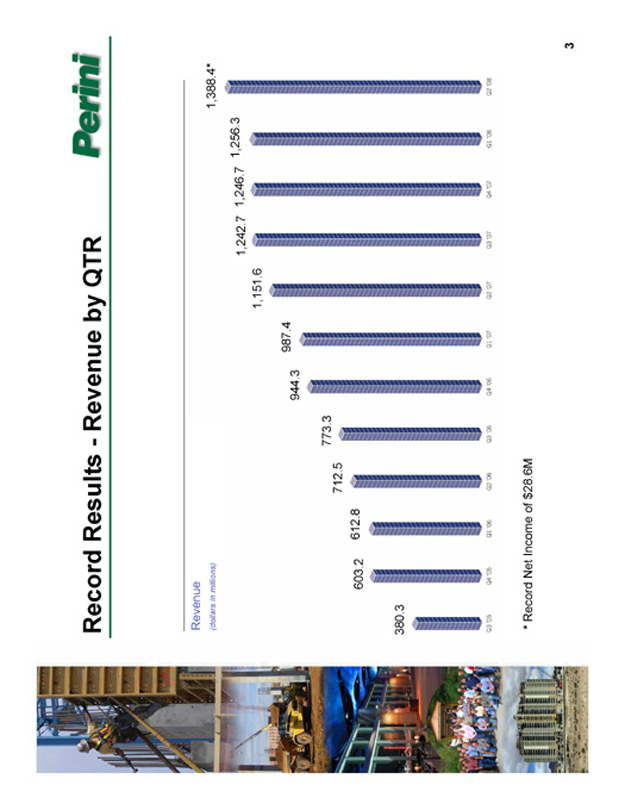

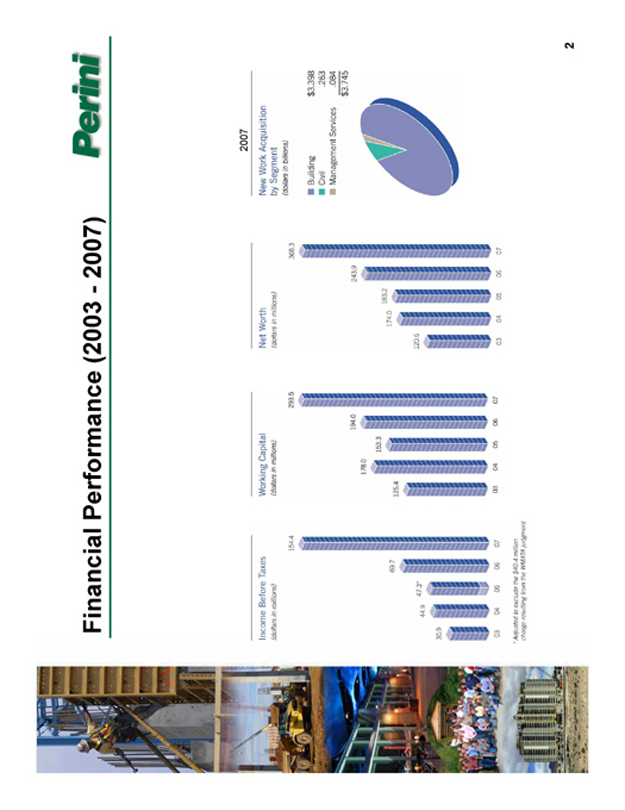

Record Results—Revenue by QTR

Perini

Revenue

(dollars in millions)

380.3

603.2

612.8

712.5

773.3

944.3

987.4

1,151.6

1,242.7

1,246.7

1,256.3

1,388.4*

Q3’05

Q3’05

Q1’06

Q2’06

Q3’06

Q4’06

Q1’07

Q2’07

Q3’07

Q4’07

Q1’08

Q2’08

* Record Net Income of $28.6M

3

The Combined Perini Tutor-Saliba

Perini

The premier publicly traded civil and commercial construction services firm in the U.S.

Highly complementary business models

Accelerates Perini s growth profile

Enhances leadership positions in key growth markets

Increases size, scale and diversity

Maintains existing strong financial position

Presents attractive synergy opportunities

4

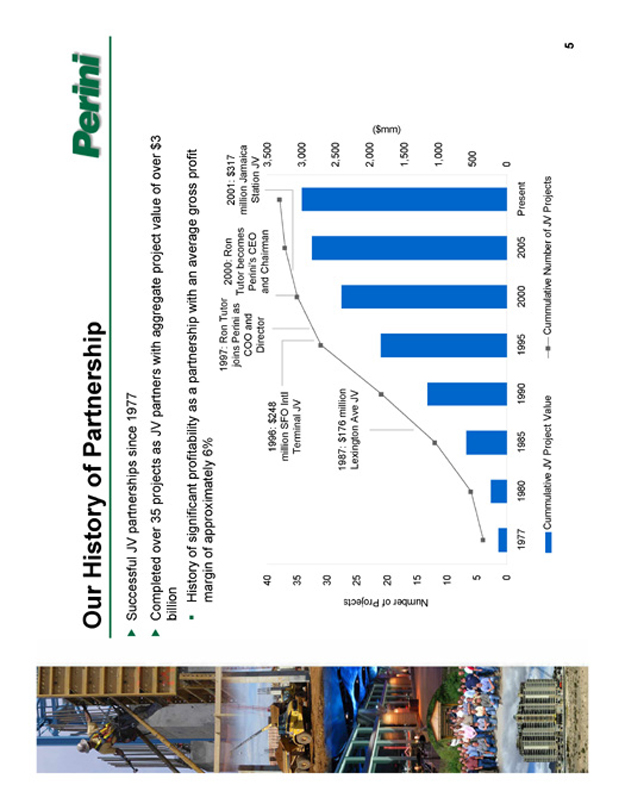

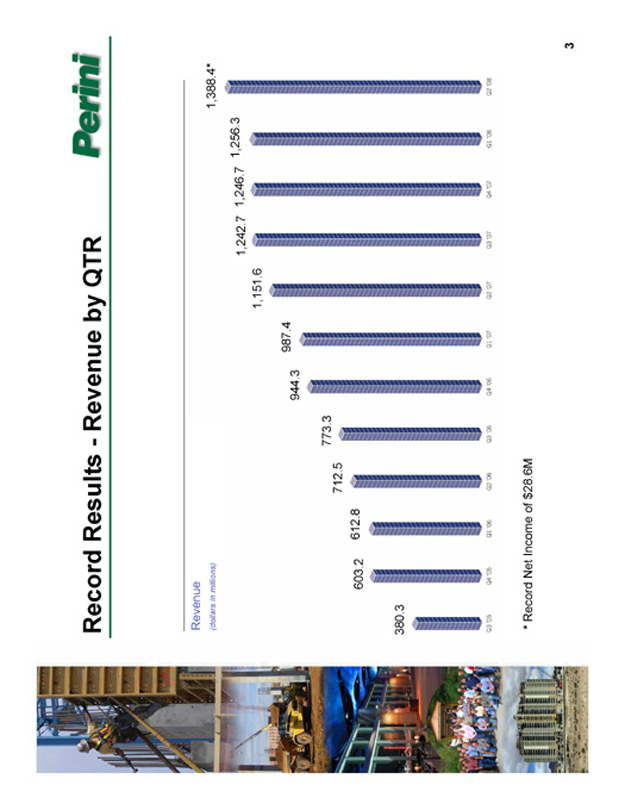

Our History of Partnership

Perini

Successful JV partnerships since 1977

Completed over 35 projects as JV partners with aggregate project value of over $3 billion

History of significant profitability as a partnership with an average gross profit margin of approximately 6%

1987: $176 million Lexington Ave JV

1996: $248 million SFO Intl Terminal JV

1997: Ron Tutor joins Perini as COO and Director

2000: Ron Tutor becomes Perini’s CEO and Chairman

2001: $317 million Jamaica Station JV

3,500

3,000

2,500

2,000 ( $ mm) 1,500

1,000 500 0

40 35 30 25 20 15

10 5 0

Number of Projects

1977 1980 1985 1990 1995 2000 2005 Present

Cummulative JV Project Value

Cummulative Number of JV Projects

5

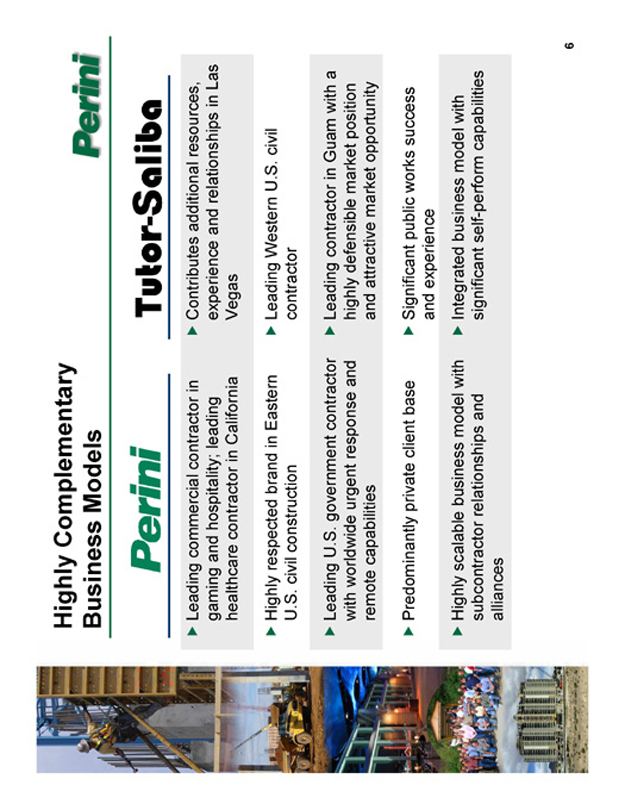

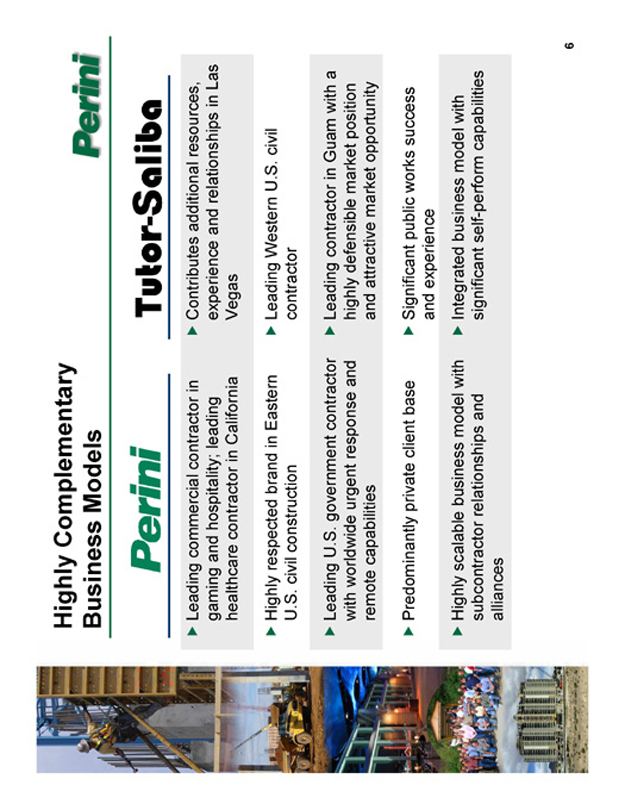

Highly Complementary Business Models

Perini

Perini

Tutor-Saliba

Leading commercial contractor in gaming and hospitality; leading healthcare contractor in California

Highly respected brand in Eastern U.S. civil construction

Leading U.S. government contractor with worldwide urgent response and remote capabilities

Predominantly private client base

Highly scalable business model with subcontractor relationships and alliances

Contributes additional resources, experience and relationships in Las Vegas

Leading Western U.S. civil contractor

Leading contractor in Guam with a highly defensible market position and attractive market opportunity

Significant public works success and experience

Integrated business model with significant self-perform capabilities

6

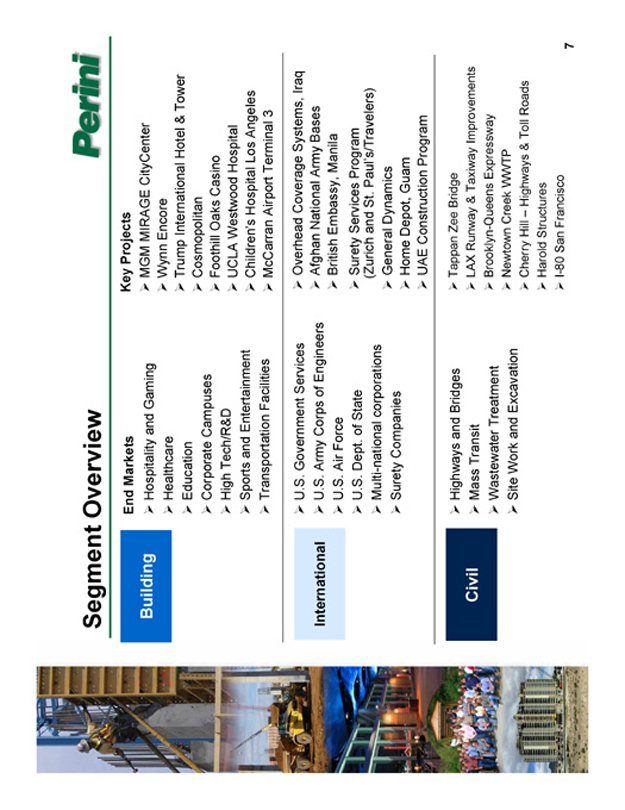

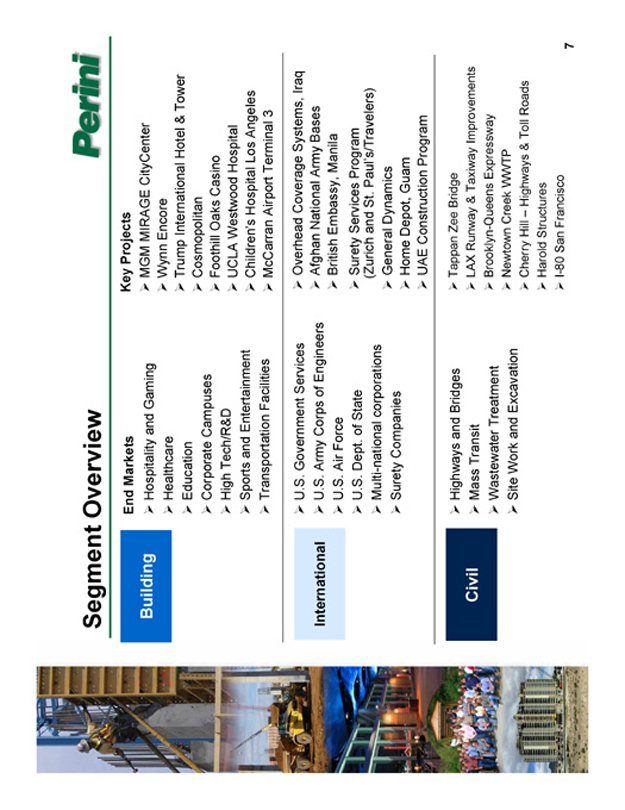

Segment Overview

Perini Building

End Markets

Hospitality and Gaming Healthcare Education Corporate Campuses High Tech/R&D

Sports and Entertainment Transportation Facilities

Key Projects

MGM MIRAGE CityCenter Wynn Encore

Trump International Hotel & Tower Cosmopolitan Foothill Oaks Casino UCLA Westwood Hospital Children’s Hospital Los Angeles McCarran Airport Terminal 3

International

U.S. Government Services U.S. Army Corps of Engineers

U.S. Air Force

U.S. Dept. of State Multi-national corporations Surety Companies

Overhead Coverage Systems, Iraq

Afghan National Army Bases

British Embassy, Manila

Surety Services Program (Zurich and St. Paul’s/Travelers)

General Dynamics

Home Depot, Guam

UAE Construction Program

Civil

Highways and Bridges Mass Transit Wastewater Treatment Site Work and Excavation

Tappan Zee Bridge

LAX Runway & Taxiway Improvements Brooklyn-Queens Expressway Newtown Creek WWTP

Cherry Hill Highways & Toll Roads Harold Structures I-80 San Francisco

7

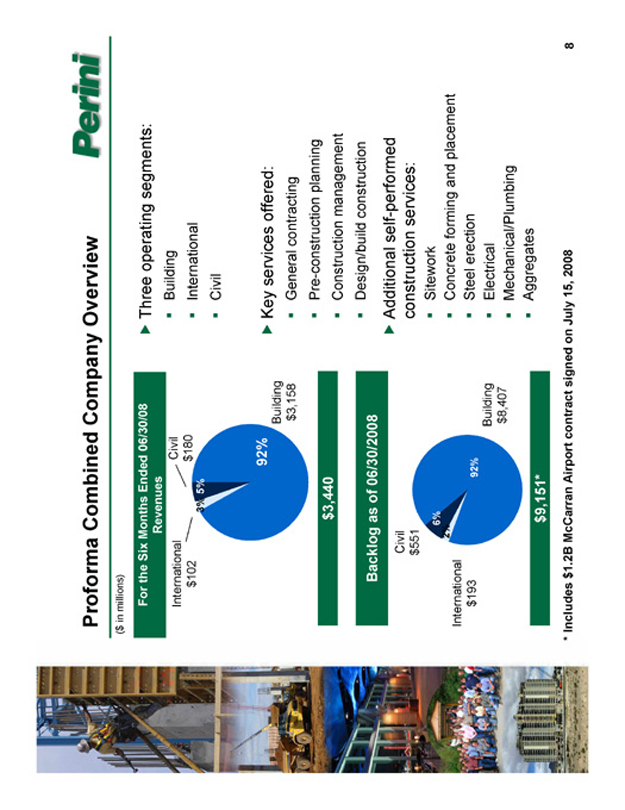

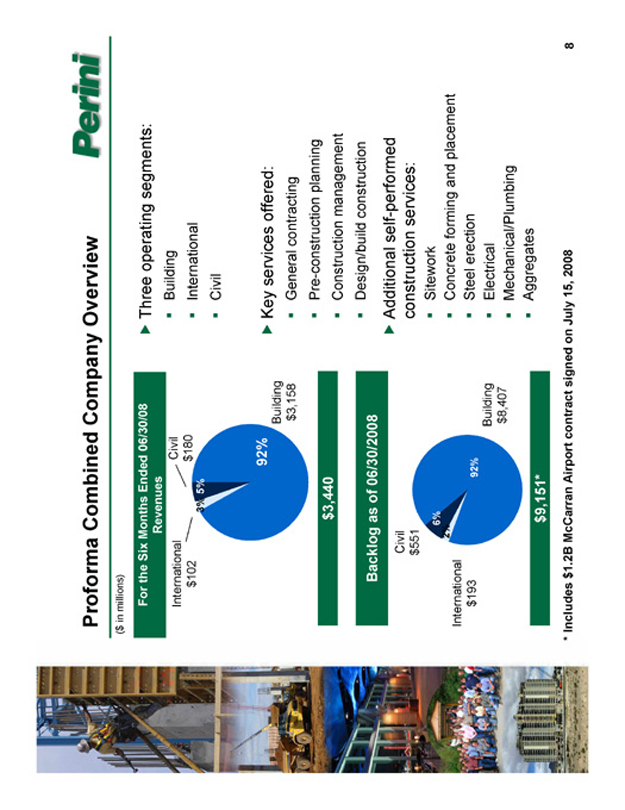

Proforma Combined Company Overview

Perini ($ in millions)

For the Six Months Ended 06/30/08 Revenues

International Civil $102 $180

3% 5%

92%

Building $3,158

$3,440

Backlog as of 06/30/2008

Civil $551

6% 2%

International $193

92%

Building $8,407

$9,151

Includes $1.2B McCarran Airport contract signed on July 15, 2008

Three operating segments:

Building

International

Civil

Key services offered:

General contracting

Pre-construction planning

Construction management

Design/build construction

Additional self-performed construction services:

Sitework

Concrete forming and placement

Steel erection

Electrical

Mechanical/Plumbing

Aggregates

8

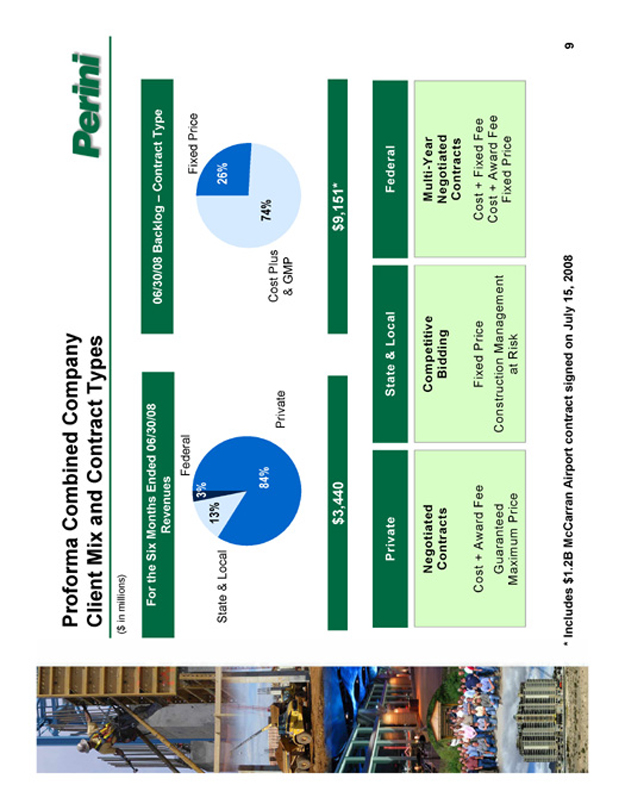

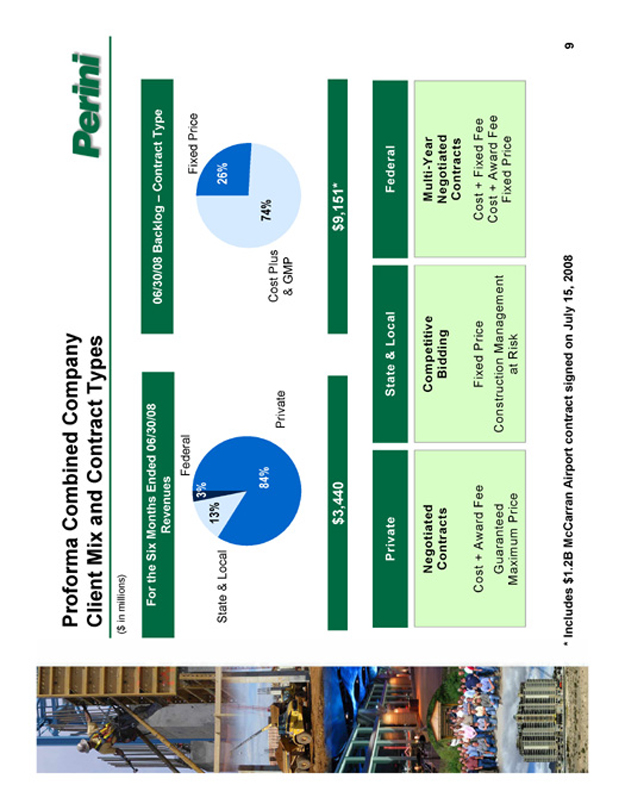

Proforma Combined Company Client Mix and Contract Types

Perini ($ in millions)

For the Six Months Ended 06/30/08 Revenues

Federal

3% 13%

State & Local

84%

Private

Fixed Price

26%

74%

Cost Plus & GMP

$3,440 $9,151*

Private

Negotiated Contracts

Cost + Award Fee Guaranteed Maximum Price

State & Local

Competitive Bidding

Fixed Price

Construction Management at Risk

Federal

Multi-Year Negotiated Contracts

Cost + Fixed Fee Cost + Award Fee Fixed Price

Includes $1.2B McCarran Airport contract signed on July 15, 2008

9

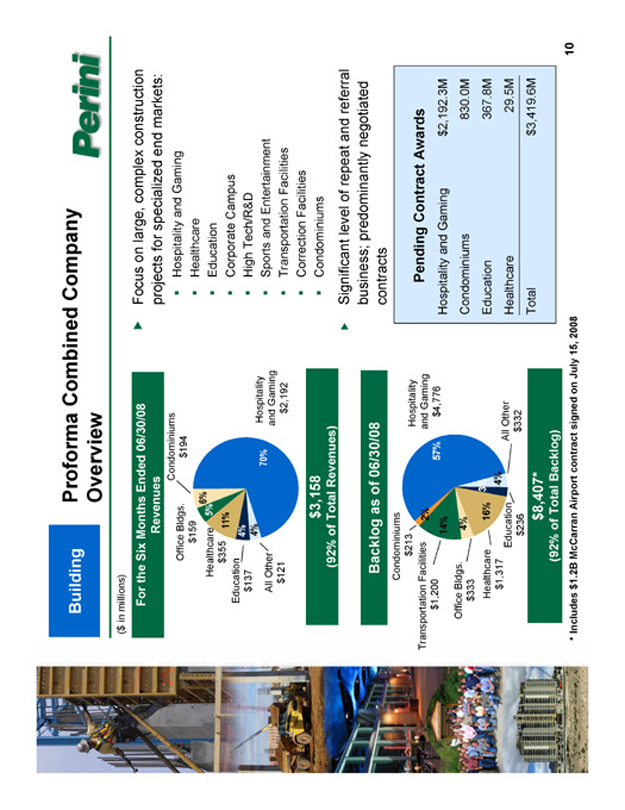

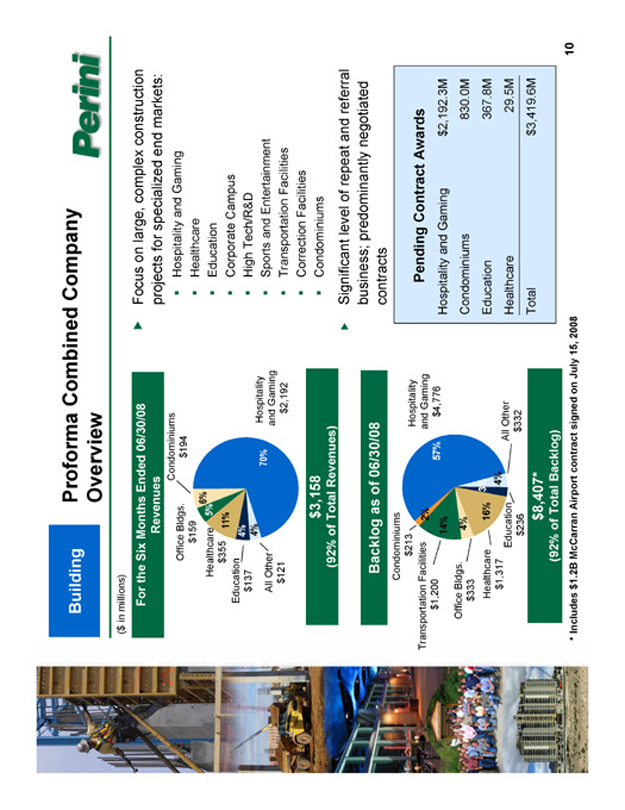

Building Proforma Combined Company Overview

Per ($ in millions)

For the Six Months Ended 06/30/08 Revenues

Condominiums Office Bldgs. $194 $159

6%

Healthcare 5% $355 11% Education

4% $137

4%

70% Hospitality All Other and Gaming $121 $2,192

$3,158

(92% of Total Revenues)

Backlog as of 06/30/08

Condominiums $213

Transportation Facilities $1,200

Hospitality Gaming $4,776

Office Bldgs. $333

Healthcare $1,317

Education $236

All Other $332

$8,407*

(92% of Total Backlog)

2%

14%

4%

16%

3%

4%

57%

* Includes $1.2B McCarran Airport contract signed on July 15, 2008

Focus on large, complex construction projects for specialized end markets:

Hospitality and Gaming

Healthcare

Education

Corporate Campus

High Tech/R&D

Sports and Entertainment

Transportation Facilities

Correction Facilities

Condominiums

Significant level of repeat and referral business; predominantly negotiated contracts

Pending Contract Awards

Hospitality and Gaming $2,192.3M Condominiums 830.0M Education 367.8M Healthcare 29.5M Total $3,419.6M

10

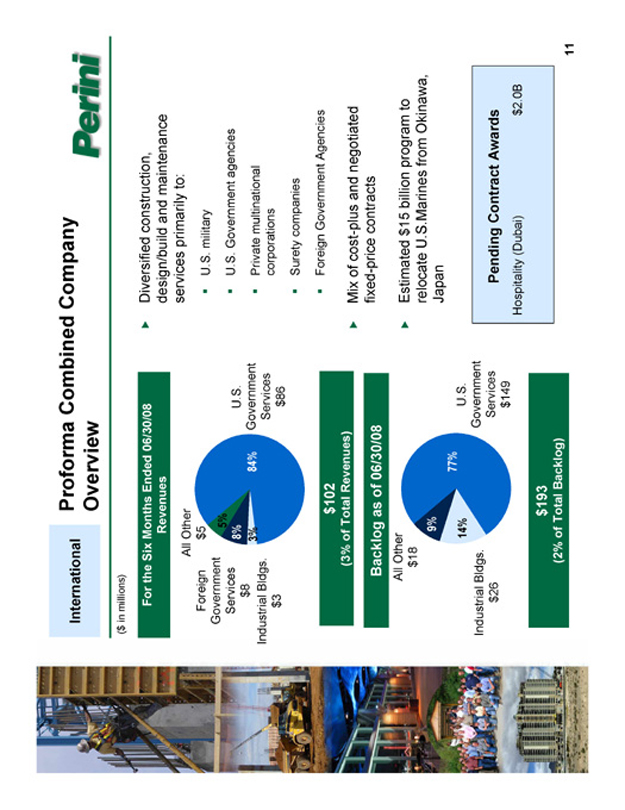

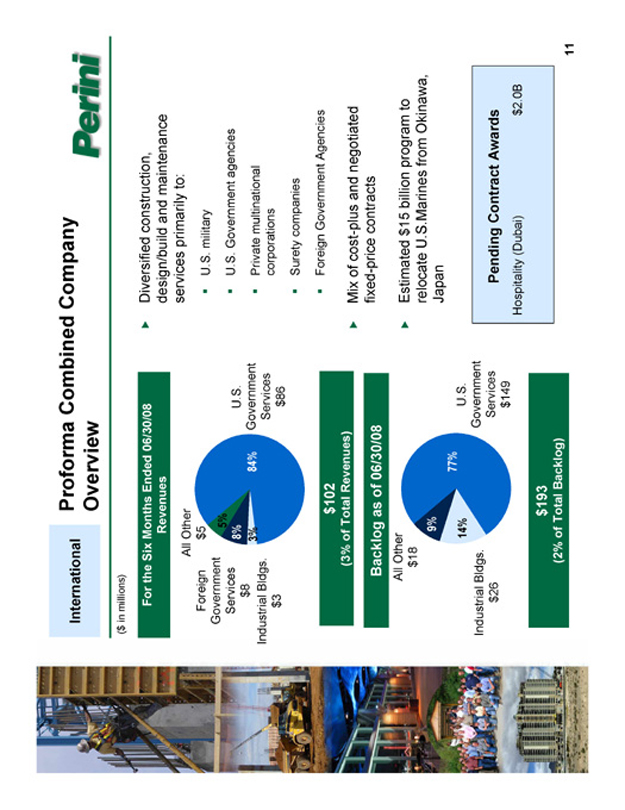

Proforma Combined Company

International

Overview

Perini

($ in millions)

For the Six Months Ended 06/30/08 Revenues

All Other $5

Foreign Government Services. $8

Industrial Bldgs. $3

U.S

Government Services $86

5%

8%

3% 84%

$102

(3% of Total Revenues)

Backlog as of 06/30/08

All Other $18

U.S. Government Services $149

Industrial Bldgs. $26

9%

14%

77%

$193

(2% of Total Backlog)

Diversified construction, design/build and maintenance services primarily to:

U.S. military

U.S. Government agencies

Private multinational corporations

Surety companies

Foreign Government Agencies

Mix of cost-plus and negotiated fixed-price contracts

Estimated $15 billion program to relocate U.S.Marines from Okinawa, Japan

Pending Contract Awards

Hospitality (Dubai) $2.0B

11

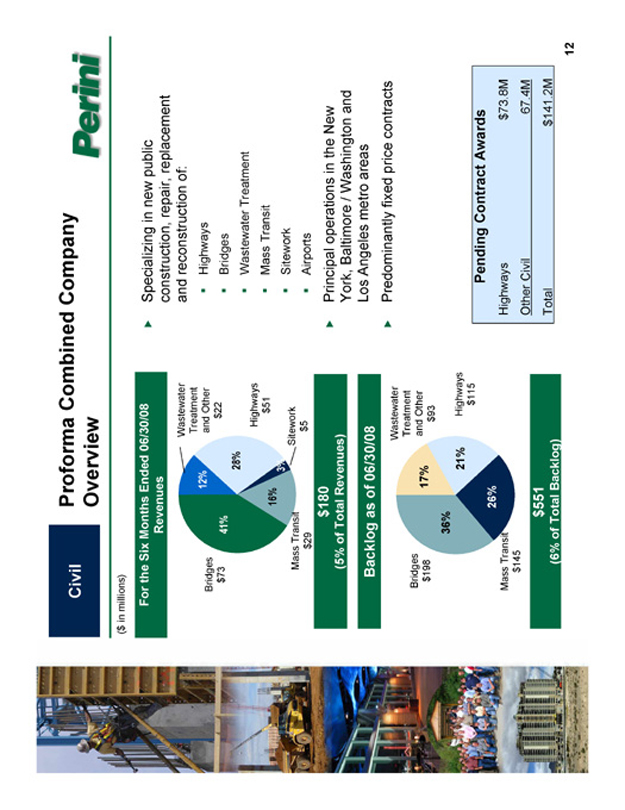

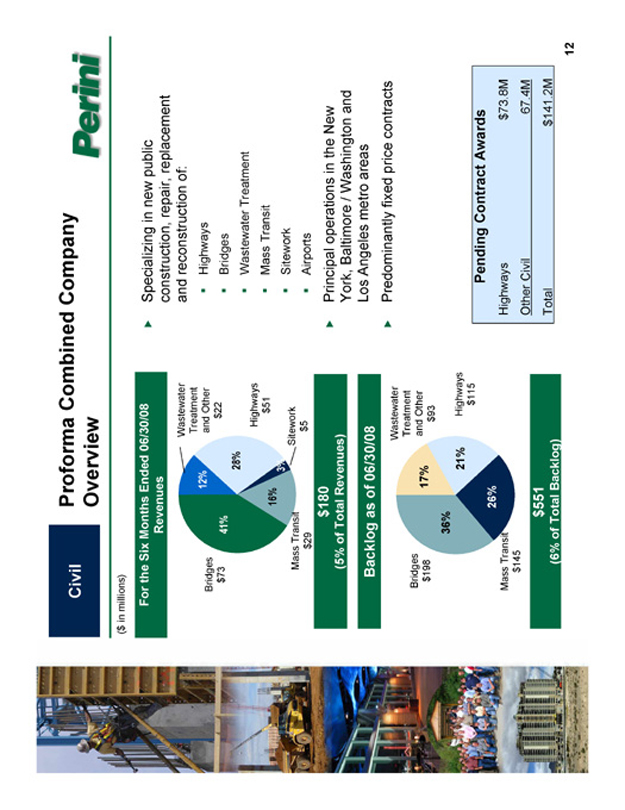

Proforma Combined Company

Civil

Overview

Perini ($ in millions)

For the Six Months Ended 06/30/08 Revenues

Bridges $73

Wastewater Treatment and Other $22

Highways $51

Sitework $5

Mass Transit $29

12%

28%

41%

16%

3%

$180

(5% of Total Revenues)

Backlog as of 06/30/08

Bridges $198

Wastewater Treatment and Other $93

Highways $115

Mass Transit $145

17%

36%

21%

26%

$551

(6% of Total Backlog)

Specializing in new public construction, repair, replacement and reconstruction of:

Highways

Bridges

Wastewater Treatment

Mass Transit

Sitework

Airports

Principal operations in the New York, Baltimore / Washington and Los Angeles metro areas

Predominantly fixed price contracts

Pending Contract Awards

Highways $73.8M Other Civil 67.4M Total $141.2M

12

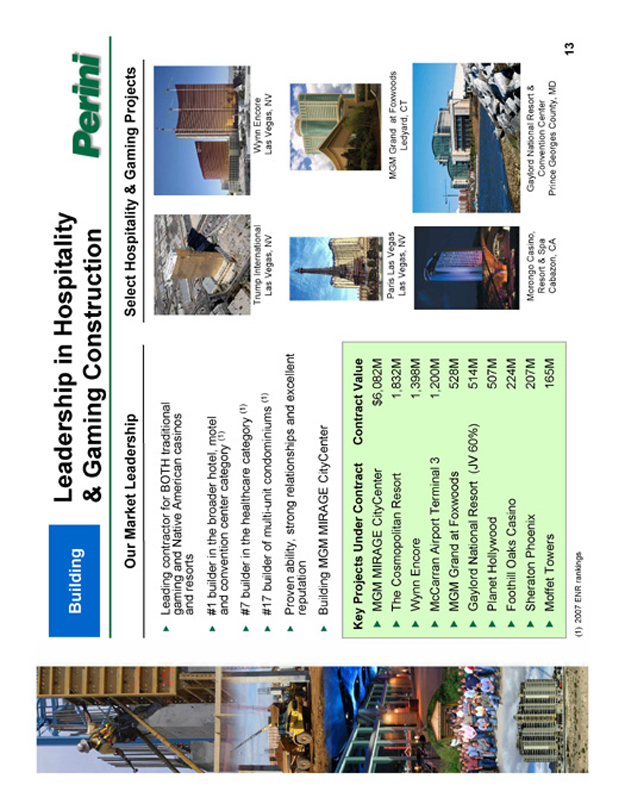

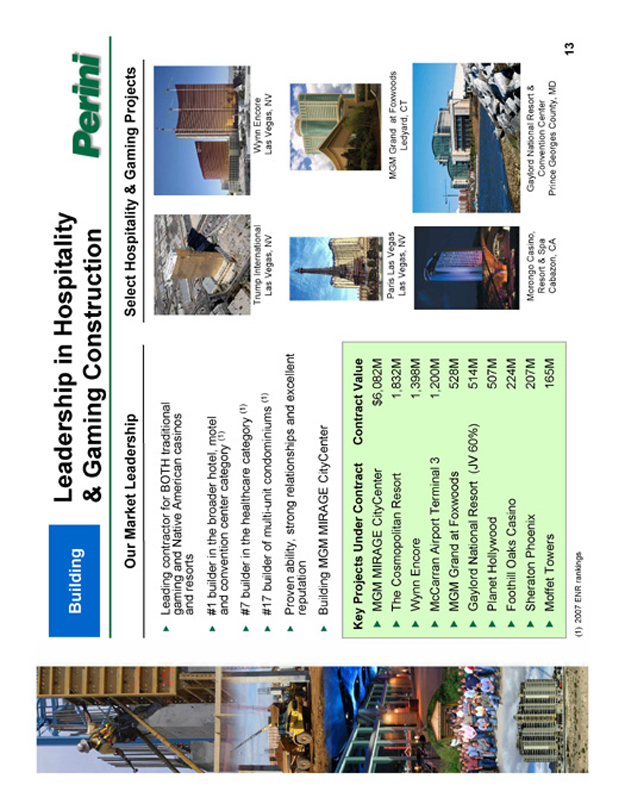

Leadership in Hospitality

Building

& Gaming Construction

Perini

Our Market Leadership

Leading contractor for BOTH traditional gaming and Native American casinos and resorts

#1 builder in the broader hotel, motel and convention center category (1)

#7 builder in the healthcare category (1)

#17 builder of multi-unit condominiums (1)

Proven ability, strong relationships and excellent reputation

Building MGM MIRAGE CityCenter

Key Projects Under Contract Contract Value

MGM MIRAGE CityCenter $6,082M

The Cosmopolitan Resort 1,832M

Wynn Encore 1,398M

McCarran Airport Terminal 3 1,200M

MGM Grand at Foxwoods 528M

Gaylord National Resort (JV 60%) 514M

Planet Hollywood 507M

Foothill Oaks Casino 224M

Sheraton Phoenix 207M

Moffet Towers 165M

(1) 2007 ENR rankings

Select Hospitality & Gaming Projects

Trump International Las Vegas, NV

Wynn Encore

Las Vegas, NV

Paris Las Vegas Las Vegas, NV

MGM Grand at Foxwoods Ledyard, CT

Morongo Casino, Resort & Spa Cabazon, CA

Gaylord National Resort & Convention Center Prince Georges County, MD

13

Strong Position in Other

Building

Attractive Niche Markets

Perini

Our Competitive Position

Healthcare Facilities

Perini selectively competes for new healthcare facilities construction

Rudolph and Sletten #1 Healthcare Builder in California (CA Builder)

Education Facilities

Perini became a leading contractor of schools and municipal buildings in Florida with the acquisition of James A. Cummings, Inc.

Select Projects

UCLA Westwood Hospital Los Angeles, CA

Children’s Hospital New Patient Tower & Parking Los Angeles, CA

Florida Int’l. University Research Center Miami, FL

Molecular Foundry Berkeley, CA

14

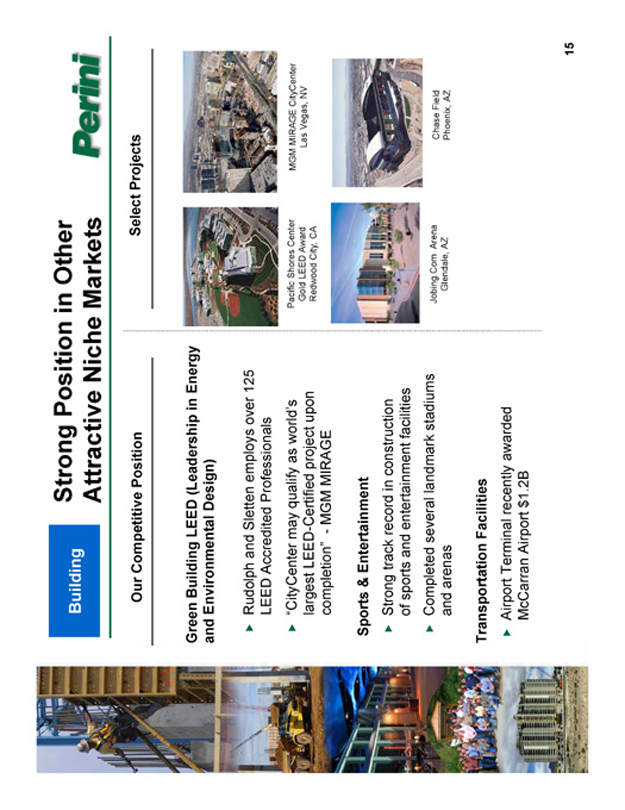

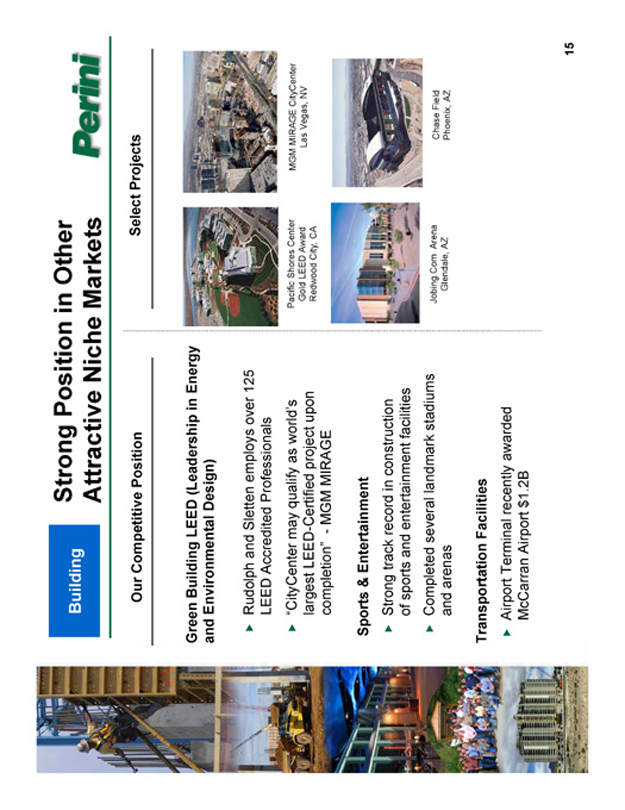

Perini

Strong Position in Other

Building

Attractive Niche Markets

Our Competitive Position Select Projects

Green Building LEED (Leadership in Energy and Environmental Design)

Rudolph and Sletten employs over 125 LEED Accredited Professionals

“CityCenter may qualify as world’s largest LEED-Certified project upon completion” - MGM MIRAGE

Sports & Entertainment

Strong track record in construction of sports and entertainment facilities

Completed several landmark stadiums and arenas

Transportation Facilities

Airport Terminal recently awarded McCarran Airport $1.2B

Pacific Shores Center MGM MIRAGE CityCenter Gold LEED Award Las Vegas, NV

Redwood City, CA

Jobing.Com Arena Chase Field Glendale, AZ Phoenix, AZ

15

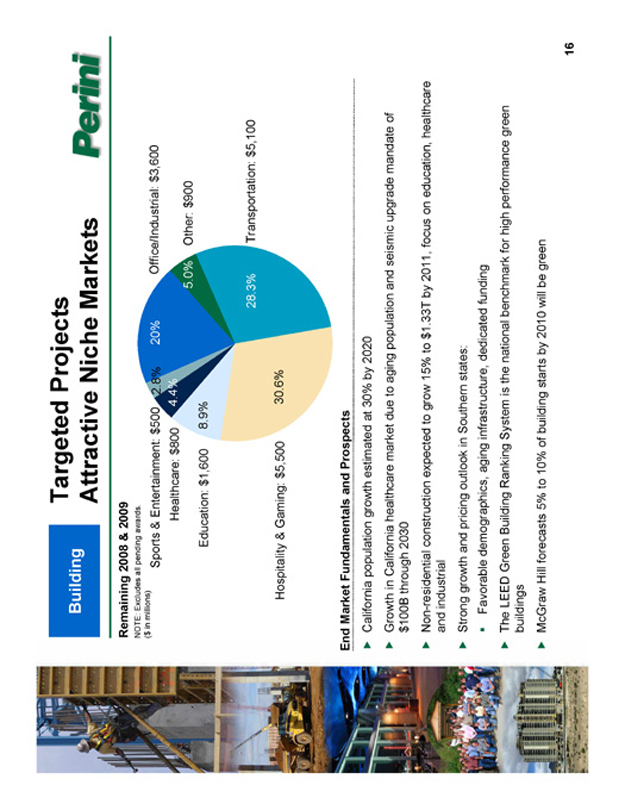

Perini

Targeted Projects

Building

Attractive Niche Markets

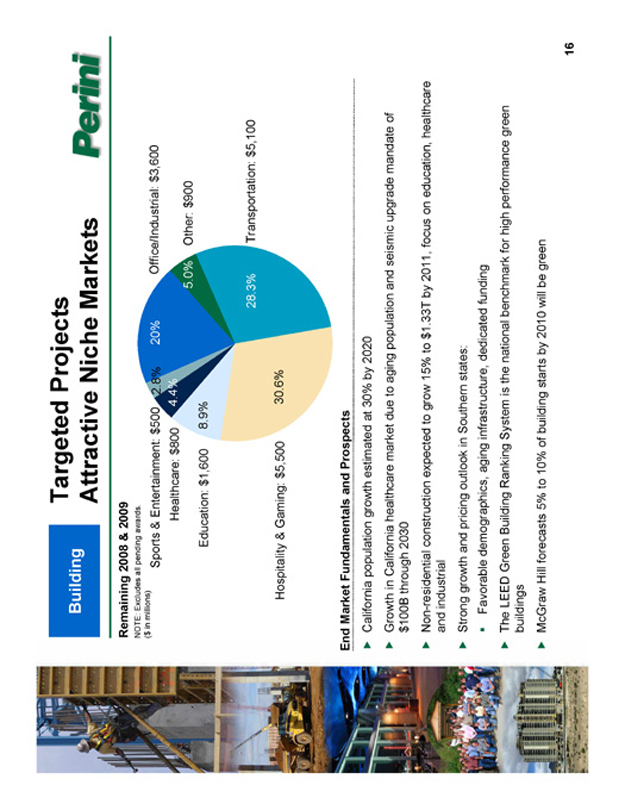

Remaining 2008 & 2009

NOTE: Excludes all pending awards. ($ in millions)

Sports & Entertainment: $500 2.8% 20% Office/Industrial: $3,600 Healthcare: $800 4.4% 5.0% Other: $900 Education: $1,600 8.9%

28.3% Transportation: $5,100

Hospitality & Gaming: $5,500 30.6%

End Market Fundamentals and Prospects

California population growth estimated at 30% by 2020

Growth in California healthcare market due to aging population and seismic upgrade mandate of $100B through 2030

Non-residential construction expected to grow 15% to $1.33T by 2011, focus on education, healthcare and industrial

Strong growth and pricing outlook in Southern states:

Favorable demographics, aging infrastructure, dedicated funding

The LEED Green Building Ranking System is the national benchmark for high performance green buildings

McGraw Hill forecasts 5% to 10% of building starts by 2010 will be green

16

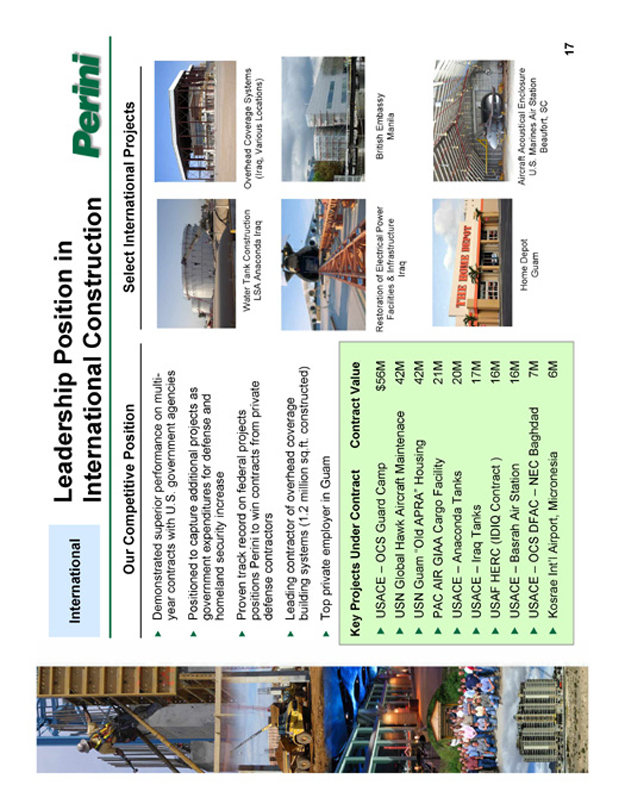

Perini

Leadership Position in

International

International Construction

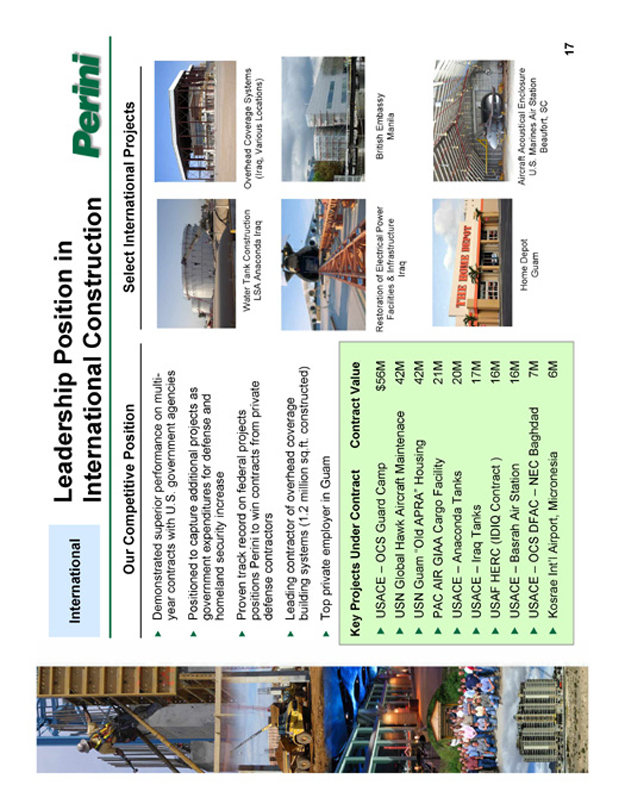

Our Competitive Position Select International Projects

Demonstrated superior performance on multi-year contracts with U.S. government agencies

Positioned to capture additional projects as government expenditures for defense and homeland security increase

Proven track record on federal projects positions Perini to win contracts from private defense contractors

Leading contractor of overhead coverage building systems (1.2 million sq.ft. constructed)

Top private employer in Guam

Key Projects Under Contract Contract Value

USACE ±OCS Guard Camp $56M

USN Global Hawk Aircraft Maintenace 42M

USN Guam 3 Old APRA Housing 42M

PAC AIR GIAA Cargo Facility 21M

USACE ±Anaconda Tanks 20M

USACE ±Iraq Tanks 17M

USAF HERC (IDIQ Contract ) 16M

USACE ±Basrah Air Station 16M

USACE ±OCS DFAC ±NEC Baghdad 7M

Kosrae Int’l Airport, Micronesia 6M

Water Tank Construction LSA Anaconda Iraq

Overhead Coverage Systems (Iraq, Various Locations)

Restoration of Electrical Power British Embassy Manila

Facilities & Infrastructure Iraq

Home Depot Aircraft Acoustical Enclosure U.S. Marines Air Station Beaufort, SC

Guam

17

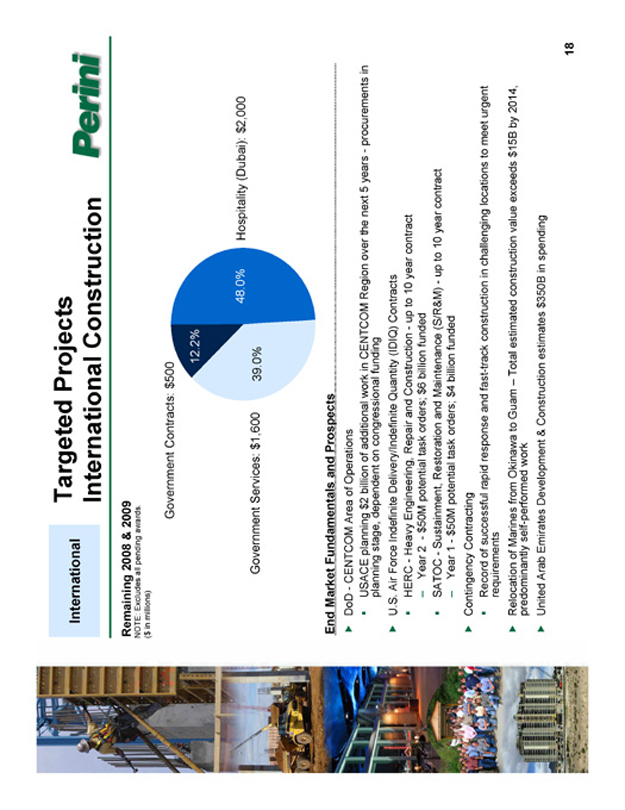

Perini

Targeted Projects

International

International Construction

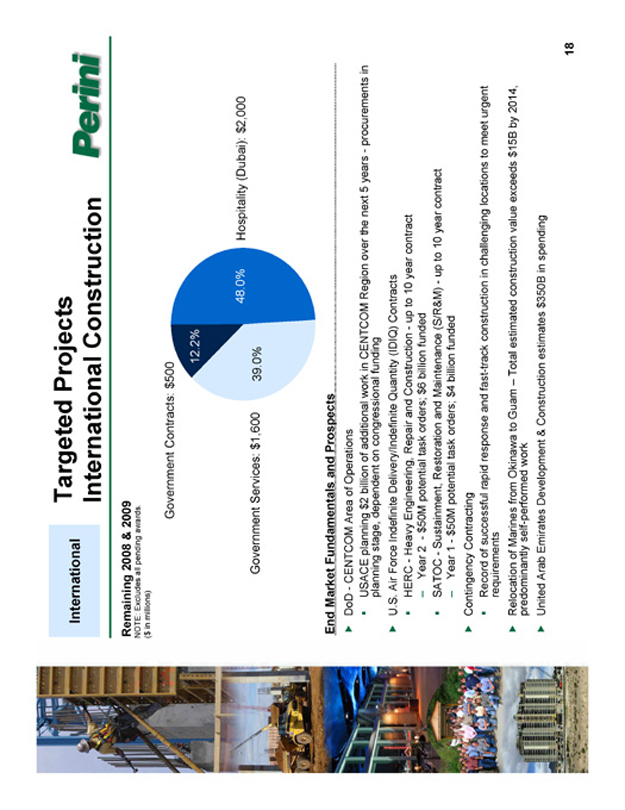

Remaining 2008 & 2009

NOTE: Excludes all pending awards. ($ in millions)

Government Contracts: $500

12.2%

48.0% Hospitality (Dubai): $2,000 Government Services: $1,600 39.0%

End Market Fundamentals and Prospects

DoD—CENTCOM Area of Operations

USACE planning $2 billion of additional work in CENTCOM Region over the next 5 years—procurements in planning stage, dependent on congressional funding

U.S. Air Force Indefinite Delivery/Indefinite Quantity (IDIQ) Contracts

HERC—Heavy Engineering, Repair and Construction—up to 10 year contract

Year 2—$50M potential task orders; $6 billion funded

SATOC—Sustainment, Restoration and Maintenance (S/R&M)—up to 10 year contract

Year 1—$50M potential task orders; $4 billion funded

Contingency Contracting

Record of successful rapid response and fast-track construction in challenging locations to meet urgent requirements

Relocation of Marines from Okinawa to Guam – Total estimated construction value exceeds $15B by 2014, predominantly self-performed work

United Arab Emirates Development & Construction estimates $350B in spending

18

Perini

Market Trends,

Civil

Position & Projects

Our Competitive Position Select Civil Projects

California, Northeast, Mid-Atlantic States & Florida

Among select group qualified for complex civil projects in dense urban areas

Proven record of performance

Strong financial position

Significant local resources

Established union relationships

Industry-leading access to surety bonding

#16 Builder in the U.S. bridge construction category (1)

Key Projects Under Contract Contract Value

I-80 San Francisco $262M

LAX Runway 186M

Tappan Zee Bridge Replacement 157M

Harold Structures New York 139M

I-95 @ I-895 Kenwood MD 87M

Peekskill Bridges New York 73M

Pier A West/Area 2 67M

CVN Maintenance Pier Replacement 61M

9th St. Bridge 44M

Joint Water Treatment Plant 32M

(1) 2007 ENR rankings

Highways

Brooklyn-Queens I-80

Expressway San Francisco, CA Queens, NY

Mass Transit

Metro North Commuter Jamaica Station Rail Line Rehab Project Intermodal Transportation New York Center Bridges Jamaica, NY

Tappan Zee Bridge Passaic River Bridge

New York, NY Newark, NJ 19

Perini

Targeted Projects

Civil

Civil Construction Market

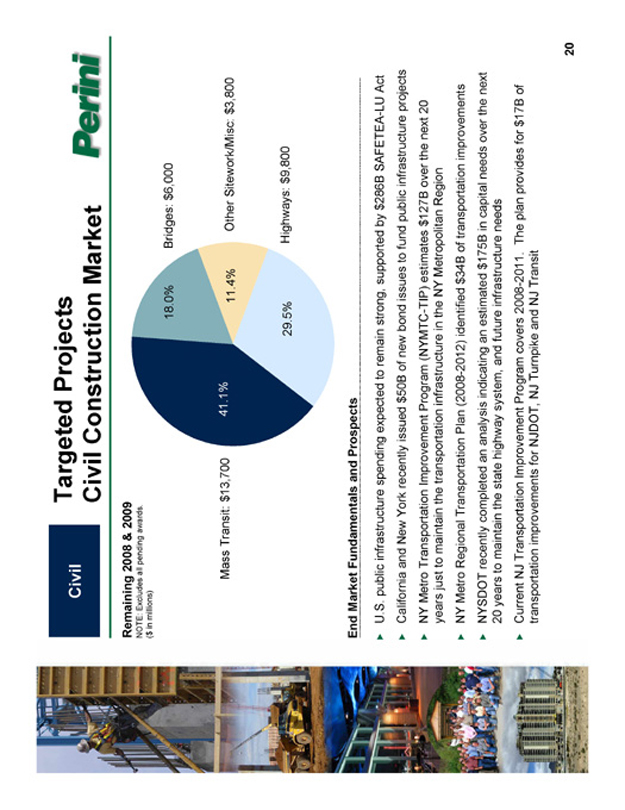

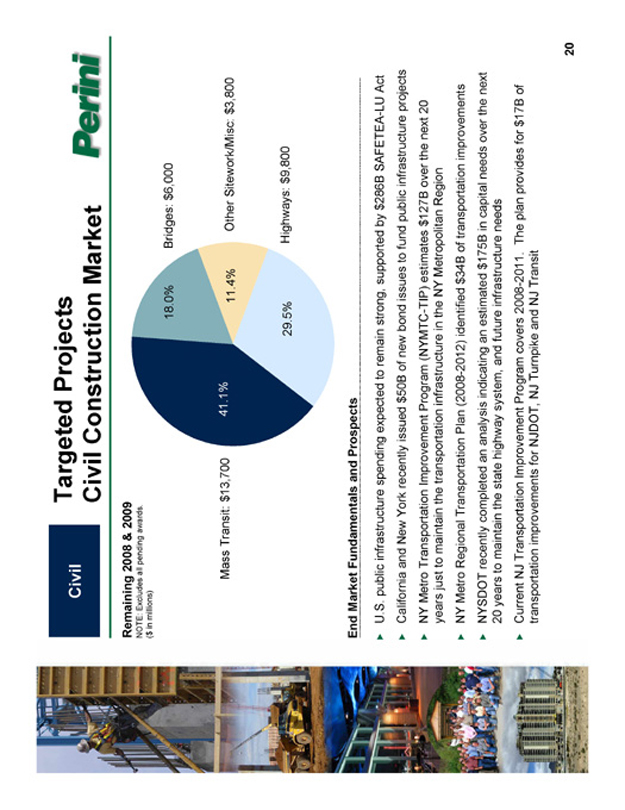

Remaining 2008 & 2009

NOTE: Excludes all pending awards. ($ in millions)

18.0% Bridges: $6,000

Mass Transit: $13,700 41.1%

11.4% Other Sitework/Misc: $3,800

29.5% Highways: $9,800

End Market Fundamentals and Prospects

U.S. public infrastructure spending expected to remain strong, supported by $286B SAFETEA-LU Act

California and New York recently issued $50B of new bond issues to fund public infrastructure projects

NY Metro Transportation Improvement Program (NYMTC-TIP) estimates $127B over the next 20 years just to maintain the transportation infrastructure in the NY Metropolitan Region

NY Metro Regional Transportation Plan (2008-2012) identified $34B of transportation improvements

NYSDOT recently completed an analysis indicating an estimated $175B in capital needs over the next 20 years to maintain the state highway system, and future infrastructure needs

Current NJ Transportation Improvement Program covers 2008-2011. The plan provides for $17B of transportation improvements for NJDOT, NJ Turnpike and NJ Transit

20

Perini

Business Strategy

Focus on Building Markets

Leverage leadership position and relationships to generate additional projects

Gain new contracts by emphasizing experience and proven ability to complete challenging projects

Leverage strong relationships with Native American tribes and traditional gaming clients

Expand Expertise to Additional Markets

Cross-utilize building construction expertise geographically and by project type (e.g. healthcare and education markets)

Continue to serve clients as they develop projects beyond core markets

Capitalize on the expertise of acquisitions to expand end markets

Become a significant contractor in U.A.E.

Pursue Federal Contracting Opportunities

Leverage extensive track record with the U.S. government to gain new contracts

Continue to pursue federal projects in domestic and overseas locations such as Guam

Continue to pursue multi-year urgent response and task order contracts

21

Perini

Business Strategy (cont’d)

Improve Civil Operating Performance

Build upon established position as a leading contractor in these regions

Capitalize on established credentials and proven expertise to win and complete civil projects

Leverage the Tutor-Saliba merger to extend already strong reputation in the region

Pursue Selected Strategic Acquisitions

Continue to pursue selected acquisitions to supplement internal growth

Enhance geographic presence and relationships

Expand expertise to new and additional markets

Continue to grow backlog and generate strong cash flow

22

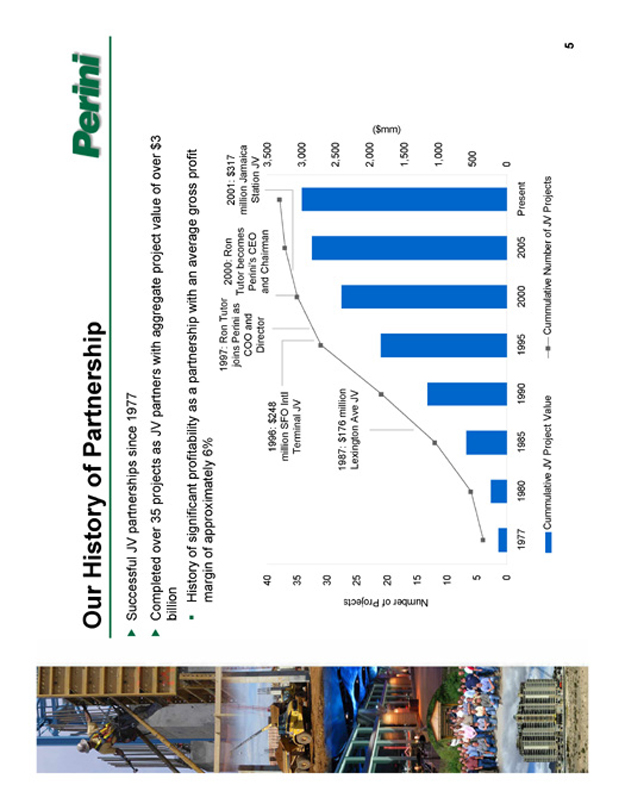

Perini

Acquisitions Have Expanded End Markets

Successfully integrated acquisitions consistent with expansion strategy

INCORPORATED 1960

RUDOLPH AND SLETTEN

GENERAL AND ENGINEERING CONTRACTORS

Offices in Redwood City, Irvine, Roseville and San Diego, California

#1 Healthcare General Contractor (California Construction) specializing in corporate campuses and healthcare, pharmaceutical, biotech, and high-tech projects

Employs >125 LEED-Accredited Professionals

Successful transition into Native American hospitality and gaming market

Cummings

General contractors

A Perini Company

James A. Cummings, Inc.

Offices in Ft. Lauderdale, Orlando and W. Palm Beach, Florida

Leading builder of schools, college and university facilities and municipal structures in Eastern Florida

Celebrated 25th Anniversary in 2006

More than doubled revenue since acquisition

Enhances diversity of geographic presence building segment

CHERRY HILL

CONSTRUCTION INC.

Offices in Maryland and Florida

Leading civil contractor in Mid-Atlantic market

Highways, bridges, site development, airports, excavation and utilities

Financial Outlook

23

Perini

Guidance for Full Year 2008

Revenues $5.5B—$5.9B

Earnings per share $3.50—$3.75

Guidance for Full Year 2009

Revenues $7.3B—$7.8B

Earnings per share $4.00—$4.20

Diluted Earnings Per Share Growth in 2010 between 10% to 20%

24

Perini

The Premier Publicly Traded Construction Services Firm in U.S.

$ 9.2B pro forma backlog, $5.6B of pending awards, and over $50B of targeted projects

Pre-eminent gaming and hospitality contractor

Leading and profitable civil construction services provider

Expanded international platform with compelling growth profile

Strong financial position and industry-leading access to surety bonding

Attractive growth opportunities

Focused, experienced management team with significant depth

25