| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies; |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined); |

| (4) | Proposed maximum aggregate value of transaction; |

| (5) | Total Fee Paid. |

SPARTECH CORPORATION

120 S. Central Avenue, Suite 1700

Clayton, Missouri 63105-1705

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 8, 2006

DEAR FELLOW SHAREHOLDER:

I cordially invite you to attend the 2006 Annual Meeting of Shareholders of Spartech Corporation to be held at 10:00 a.m. on Wednesday, March 8, 2006, at the Saint Louis Club, 7701 Forsyth Blvd., 16th Floor, Clayton, Missouri 63105, for the following purposes:

1. | To elect three Class A directors to serve three-year terms. |

2. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2006 fiscal year. |

3. | To approve the Company’s Executive Bonus Plan. |

4. | To approve six separate amendments to the Company’s Restated Certificate of Incorporation. |

5. | To transact such other business as may properly come before the meeting. |

The matters to be acted on at the Annual Meeting are described in detail in the accompanying Proxy Statement. Please read it carefully.

The Board of Directors has fixed the close of business on January 9, 2006 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting and at any and all adjournments thereof.

I look forward to seeing you at the meeting, so please mark your calendar for the second Wednesday in March. However, if you are unable to attend, you can ensure that your shares are represented at the meeting by promptly completing your proxy and returning it in the enclosed envelope.

| Sincerely, | |

| George A. Abd | |

| St. Louis, Missouri | President and |

| January 27, 2006 | Chief Executive Officer |

SPARTECH CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MARCH 8, 2006

To Our Shareholders:

The enclosed proxy is solicited by Spartech Corporation on behalf of its Board of Directors for use at the Company’s 2006 Annual Meeting of Shareholders. All expenses for the preparation and mailing of this Proxy Statement and form of proxy will be paid by the Company. In addition to solicitations by mail, a number of regular employees of the Company may solicit proxies in person or by telephone. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable costs incurred by them in transmitting proxy materials to the beneficial owners of the Company’s common stock.

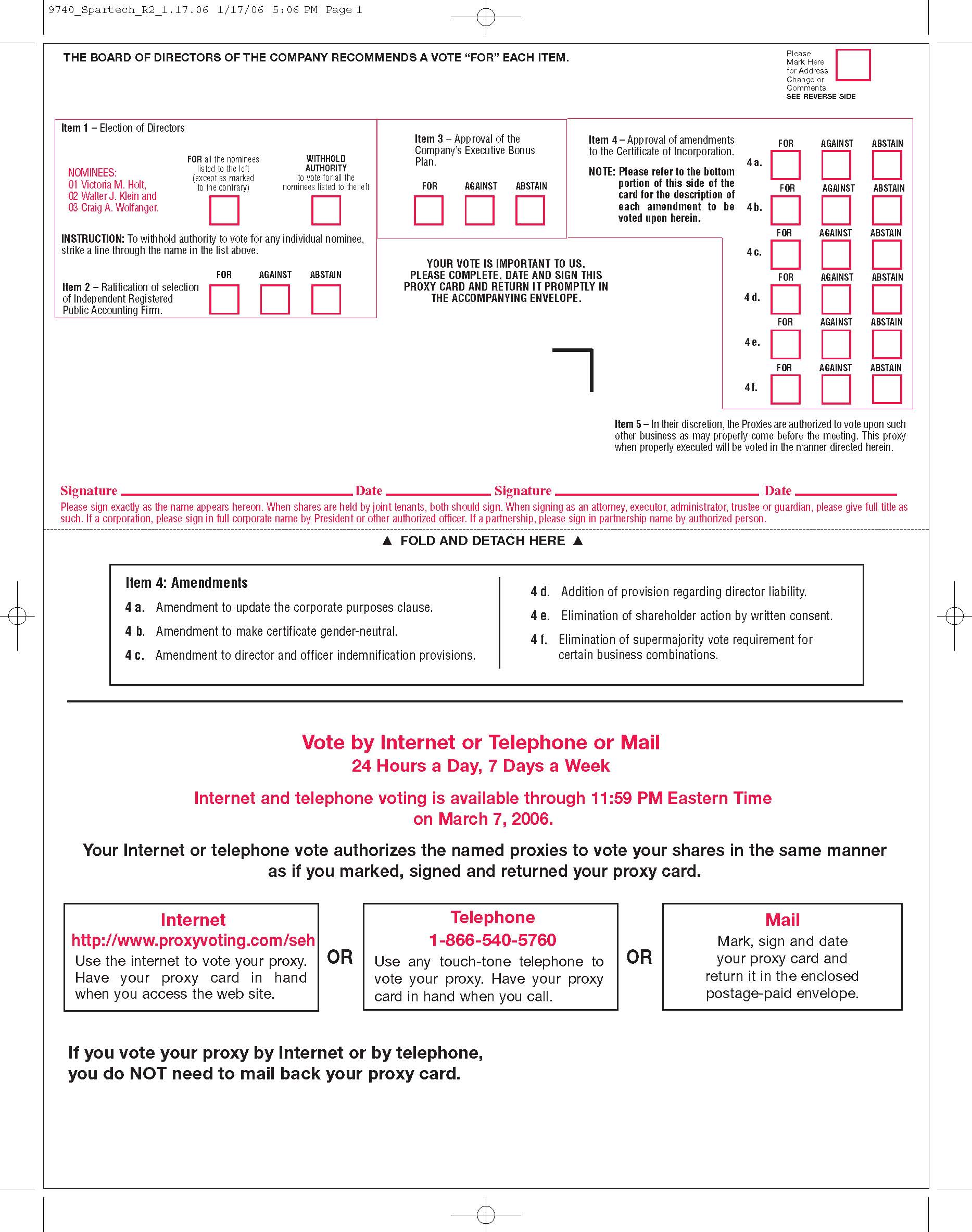

The persons named in the accompanying proxy were selected by the Board of Directors of the Company. They have advised the Company of their intentions, if no contrary instructions are given, to vote the shares represented by all properly executed and unrevoked proxies received by them for the Board of Directors’ nominees for director, for proposals 2 through 4, as set forth in the Notice of Annual Meeting of Shareholders, including each of the six separate amendments in proposal 4, and on any other matter which may come before the Annual Meeting in accordance with their best judgment.

This Proxy Statement and the proxy solicited hereby are being first sent or delivered to shareholders of the Company on or about January 27, 2006. Any shareholder giving a proxy has the right to revoke it by notifying the Secretary of the Company of such revocation, in writing, at any time before its exercise. Execution or revocation of a proxy will not in any way affect the shareholder’s right to attend the Annual Meeting and vote in person.

A copy of Spartech’s Annual Report to Shareholders for the fiscal year ended October 29, 2005 accompanies this Proxy Statement.

OUTSTANDING SHARES AND VOTING PROCEDURES

The outstanding voting securities of the Company on January 9, 2006 consisted of 32,047,520 shares of Common Stock, $0.75 par value per share, entitled to one vote per share. Only shareholders of record at the close of business on January 9, 2006 are entitled to receive notice of and to vote at the Annual Meeting and at any and all adjournments thereof.

A majority of the outstanding shares of common stock must be represented at the Annual Meeting in person or by proxy to constitute a quorum for the transaction of business. Abstentions and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum.

With respect to Proposal 1, the election of directors, a plurality of the votes cast in person or by proxy at the Annual Meeting is required, which means that the three nominees who receive the largest number of votes cast are elected as directors. Abstentions and broker non-votes will have no effect on the election.

Proposals 2 and 3, to ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm and approve the Executive Bonus Plan, each require the affirmative vote of a majority of the votes cast in person or by proxy at the Annual Meeting. Abstentions will be counted in the tabulations of the votes cast, and will therefore have the same effect as negative votes; however broker non-votes will not be counted for the purpose of determining whether the proposals have been approved.

2

The six parts of Proposal 4, to amend the Restated Certificate of Incorporation, require different votes depending on the Article to be amended. The particular vote required for each is set out in the section describing each amendment. Abstentions and broker non-votes will have the same effect as negative votes on each of these proposals.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors currently consists of ten directors, divided into three classes. All directors hold office for a term of three years. The Class A directors elected at this Annual Meeting will hold office until the Annual Meeting of Shareholders in 2009, the Class B directors will continue in office until the Annual Meeting of Shareholders in 2007, and the Class C directors will continue in office until the Annual Meeting of Shareholders in 2008, and, in each case, until their successors are duly elected and qualified.

The Board of Directors has nominated Victoria M. Holt, Walter J. Klein and Craig A. Wolfanger, present directors of the Company, to be reelected Class A directors of the Company. Mr. Scherrer, who has been a director since 2000, will not stand for reelection.

The Board of Directors recommends that shareholders vote FOR the Board of Directors’ slate of nominees (Item 1 on the Proxy Card).

Listed below are the members of the Company’s Board of Directors, including the nominees for election to the Board, with certain information about each of them including their principal occupations for the last five years:

| Name, Age | Principal Occupation and Other Directorships | Spartech Director Since | ||

| George A. Abd, 42 | Mr. Abd became President and Chief Executive Officer and a Director of the Company on May 6, 2005. He was Vice President – Compounding from March 1998 to August 2000, Executive Vice President – Color and Specialty Compounds from August 2000 to March 2004, and Executive Vice President – Color and Specialty Compounds and Engineered Products from March 2004 to May 2005. His term as director expires at the 2007 annual meeting. | 2005 | ||

| Ralph B. Andy, 61 | Mr. Andy has been the Chairman and Chief Executive Officer of Pennatronics Corp., a provider of contract electronic manufacturing services, since 2000. His term as director expires at the 2008 annual meeting. | 1998 | ||

| Lloyd E. Campbell, 48 | Mr. Campbell is the Managing Director and Head of the Global Private Placement Group at Rothschild, Inc. as well as a member of that firm’s Investment Banking Committee. Prior to joining Rothschild in June 2001, Mr. Campbell was a Managing Director and the Head of the Private Finance Group at Credit Suisse First Boston. Mr. Campbell also serves on the board of directors of Alderwoods Group and the board of trustees of Georgetown University. In addition, he is the Chairman and Founder of Pride First Corporation, a non-profit organization dedicated to improving the scholastic achievement of young people in New York City. His term as director expires at the 2008 annual meeting. | 2002 | ||

| Victoria M. Holt, 48 | Ms. Holt is Senior Vice President, Glass and Fiber Glass, for PPG Industries, Inc. Prior to joining PPG in January 2003, she was Vice | 2005 |

3

| Name, Age | Principal Occupation and Other Directorships | Spartech Director Since | ||

| President of Performance Films for Solutia, Inc. Ms. Holt began her career at Solutia’s predecessor, Monsanto Company, where she held various sales, marketing, and global general management positions. The Board of Directors elected Ms. Holt as a director in September 2005 when the Board was expanded from nine to ten members. She currently stands for reelection. | ||||

| Walter J. Klein, 59 | Mr. Klein is a CPA and from 1992 until April 2002 was Vice President, Finance for Stepan Company, a specialty chemicals company listed on the New York Stock Exchange. He brings more than 20 years of industrial and financial expertise to the Board. He currently stands for reelection. | 2003 | ||

| Pamela F. Lenehan, 53 | Ms. Lenehan has been President of Ridge Hill Consulting, LLC, a strategy and financial consulting firm, since June 2002. From September 2001 until June 2002, she was self-employed as a private investor. From March 2000 until September 2001, Ms. Lenehan was Vice President and Chief Financial Officer of Convergent Networks, Inc., a manufacturer of switching equipment. She also serves on the board of directors of Avid Technology and The Center for Women & Enterprise, a non-profit organization. Her term as director expires at the 2007 Annual Meeting. | 2004 | ||

| Randy C. Martin, 43 | Mr. Martin is Executive Vice President, Corporate Development and Chief Financial Officer of the Company. He is a CPA, and became Corporate Controller of the Company in 1995, Vice President and Chief Financial Officer in 1996, and an Executive Vice President in September 2000. His term as director expires at the 2007 Annual Meeting. | 2001 | ||

| Jackson W. Robinson, 63 | Mr. Robinson became Chairman of the Board on May 6, 2005. He is also the President and Chief Investment Officer of Winslow Management Company, LLC in Boston, having held that position since 1983. Mr. Robinson is also a director of Jupiter Global Green Investment Trust PLC and Jupiter European Opportunities Trust PLC, and a Trustee of Suffield Academy. His term as director expires at the 2008 annual meeting. | 1993 | ||

| Richard B. Scherrer, 58 | Mr. Scherrer is a partner of Armstrong Teasdale LLP and has been Managing Partner of that firm since January 1998. He is a Fellow in the International Society of Barristers and is listed in The Best Lawyers In America publication. His term as director expires at the 2006 Annual Meeting and he is not standing for reelection. | 2000 | ||

| Craig A. Wolfanger, 47 | Mr. Wolfanger is President and Senior Managing Director of Raptor LLC, an investment banking firm. Prior to joining Raptor in March 2005, he was an investment banker with Kidder, Peabody & Co. Incorporated, Alex. Brown & Sons Incorporated and Parker/Hunter Incorporated. He currently stands for reelection. | 2001 |

4

CERTAIN BUSINESS RELATIONSHIPS AND TRANSACTIONS

Mr. Scherrer is the Managing Partner of Armstrong Teasdale LLP, which the Company retained as its principal outside law firm during fiscal 2005 and expects to retain through fiscal 2006.

BOARD OF DIRECTORS

The listing standards of the New York Stock Exchange include a set of Corporate Governance Standards applicable to NYSE listed companies. Among other things, the NYSE Corporate Governance Standards require a majority of the Board and all members of the Audit, Compensation and Governance Committees to be “independent” as defined by the NYSE. Pursuant to the NYSE Corporate Governance Standards, the Board has adopted a set of Corporate Governance Guidelines setting forth certain internal governance policies and rules as well as a Director Independence Policy implementing the NYSE director independence requirements. The Corporate Governance Guidelines and Director Independence Policy are set forth in the Investor Relations/Corporate Governance section of the Company’s website at www.spartech.com, and a print ed copy will be provided to any shareholder on request.

The Board has determined that all of the Company’s directors other than Messrs. Abd, Martin and Scherrer meet all applicable independence standards and therefore qualify as “independent” directors.

The Board of Directors held eleven regular meetings during fiscal 2005. Every incumbent director attended at least 75% of the aggregate number of formal meetings of the Board and the committees on which the director served which were held while he or she was a director. Because the Company schedules its spring meeting of the Board of Directors in conjunction with the Annual Meeting of Shareholders, the Company’s directors are expected to and normally do attend each Annual Meeting. The 2005 Annual Meeting was attended by all nine directors then serving.

Pursuant to the NYSE Corporate Governance Standards, the Board holds regularly scheduled executive sessions without management, and at least annually schedules an executive session with only independent directors. Mr. Robinson, as Chairman of the Board, presides over these meetings.

COMMITTEES

The Board of Directors has three standing committees, Audit, Compensation and Governance. The Board has determined that all members of each of these committees are “independent” under the NYSE Corporate Governance Standards and the Company’s Director Independence Policy.

Each committee has a written Charter setting forth its duties, responsibilities and authority as assigned by the full Board. Each Charter is posted in the Investor Relations/Corporate Governance section of the Company’s website, www.spartech.com, and a printed copy will be provided to any shareholder on request.

Audit Committee

The Audit Committee consists of Mr. Campbell, Mr. Klein (Chairman), Ms. Lenehan and Mr. Wolfanger. It met eight times during fiscal 2005. The Audit Committee’s principal responsibilities are to appoint the independent accountants to audit the Company’s financial statements and perform other services related to the audit, to review the scope and results of the audit with the independent accountants, to review with management and the independent accountants the Company’s interim and year-end operating results, to oversee the external reporting by the Company, to consider the adequacy of the internal accounting and auditing procedures of the Company, to evaluate the independence of the internal and external auditors, and to approve and review any non-audit services to be performed by the independent accountants. The Board

5

has determined that the Audit Committee’s Chairman, Mr. Klein, qualifies as an “audit committee financial expert” under the NYSE Corporate Governance Standards.

Compensation Committee

The Compensation Committee consists of Mr. Andy (Chairman), Ms. Holt, Ms. Lenehan and Mr. Klein. It met ten times during fiscal 2005. The Compensation Committee’s principal responsibilities are to establish, and at least annually review, the compensation package for the Chief Executive Officer, to review and approve the compensation packages for all other executive officers, to review the financial terms of any other employment arrangement providing for compensation of more than $200,000 per year, and to approve the annual awards under the Company’s 2004 Equity Compensation Plan.

Governance Committee

The Governance Committee consists of Mr. Andy, Mr. Campbell (Chairman), Ms. Holt and Mr. Wolfanger. It met five times during fiscal 2005. The Governance Committee’s principal responsibilities are to ensure that the Company is governed in an appropriate manner, to ensure that the membership of the Board continues to have a high degree of quality and independence by performing the functions generally carried on by a nominating committee, to review and make recommendations to the Board as to the appropriate amount and form of compensation for non-employee directors, and to ensure that any future change of control of the Company would occur, if at all, only on terms fair to the Company’s shareholders.

CODE OF ETHICS

The Company has adopted a Code of Ethics for its Chief Executive Officer and Senior Financial Officers. It has posted the Code of Ethics on its website and intends to satisfy the disclosure requirement under Item 5.05 of Form 8-K by posting such information on its website. The Company also has adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees. Both Codes are posted in the Investor Relations/Corporate Governance section of the Company’s website, www.spartech.com, and a printed copy will be provided to any shareholder on request.

COMPENSATION OF DIRECTORS

The Company pays each non-management director an annual fee of $40,000. Mr. Robinson receives an additional $100,000 annual fee as Chairman of the Board, Mr. Klein receives an additional $15,000 annual fee as Chair of the Audit Committee, Mr. Andy receives an additional $10,000 annual fee as Chair of the Compensation Committee, Mr. Campbell receives an additional $10,000 annual fee as Chair of the Governance Committee, and Ms. Lenehan receives an additional $10,000 annual fee as Chair of the Board’s Strategic Planning Committee, a limited-term Board committee. Each non-management director also receives $1,200 for each Board and Committee Meeting attended, and the Company reimburses each director for the expenses incurred in attending each meeting.

Prior to 2004, it was the policy of the Company to grant non-management directors options to purchase common stock of the Company periodically during their terms as directors, as additional compensation. However, no options were granted to directors during fiscal 2004 pending the results of a study by the Governance Committee’s compensation consultant. Upon the recommendation of the compensation consultant, the Board determined to replace grants of stock options to its non-management directors with annual awards of restricted stock units having a value of $30,000 per director based on the market value of the Company’s common stock on the date of grant. Holders of restricted stock units also receive additional units having a value equal to the dividends payable on an equal number of shares of common stock. Restricted stock units are non-forfeitable but are non-transferable and non-redeemable until one year after

6

the end of the director’s service on the Board. At that time, they will be automatically exchanged for shares of the Company’s common stock. In June 2004 the Board awarded 1,266 restricted stock units to each non-management director for 2003, and in December 2004 the Board awarded 1,153 restricted stock units to each non-management director for 2004. In December 2005 the Board awarded 1,416 restricted stock units to each non-management director for 2005, and Mr. Robinson received an additional 1,416 restricted stock units as Chairman of the Board.

DIRECTOR NOMINATIONS

The Governance Committee of the Board of Directors is responsible under its Charter for identifying and selecting qualified candidates for election to the Board prior to each annual meeting of the shareholders as well as to fill any vacancies on the Board. In addition, shareholders who wish to recommend a candidate for election to the Board may submit such recommendation to the Chairman of the Board of the Company at the address set out under “Communication With Directors” below. Any recommendation must include name, contact information, background, experience and other pertinent information on the proposed candidate and must be received in writing by November 24, 2006 for consideration by the Governance Committee for the 2007 Annual Meeting.

Although the Governance Committee is willing to consider candidates recommended by shareholders, it has not adopted a formal policy with regard to the consideration of any director candidates recommended by security holders. The Committee believes that a formal policy is not necessary or appropriate both because of the small size of the Board and because the Company has historically afforded representation on its Board to major shareholders on a case by case basis. For the past several years, the Company has not received any recommendations by shareholders for nominations to the Board.

The Director Independence Policy requires that a person elected to the Board must qualify as an independent director if there are two or more non-independent directors already serving on the Board. The Governance Committee does not have any other specific minimum qualifications that must be met by a candidate for election to the Board of Directors in order to be considered for nomination by the Committee. In identifying and evaluating nominees for director, the Committee considers each candidate’s qualities, experience, background and skills, as well as any other factors which the candidate may be able to bring to the Board. The process is the same whether the candidate is recommended by a shareholder, another director, management or otherwise. Since June 2004, the Governance Committee has retained the consulting firm of Spencer Stuart to assist it in identifying candidates for possible election to the Board. Ms. Holt was identified by Spencer Stua rt and was elected to the Board of Directors in September 2005.

We would like to recognize and thank Richard Scherer for his dedicated service as a Board member since 2000. His insight and experience in formulating Board strategy and his legal expertise and advice has been invaluable.

COMMUNICATION WITH DIRECTORS

The Company has established procedures for shareholders or other interested parties to communicate directly with the Board of Directors. Such parties can contact the Board by mail at: Spartech Board of Directors, Attention: Jackson W. Robinson, Chairman of the Board, Ninety Nine High Street, 12th Floor, Boston, MA 02110. All communications made by this means will be received directly by the Chairman of the Board.

With the unanimous approval of its independent directors, the Company has arranged for a third-party company, The Network, to provide an Ethics Hotline for employees, security holders and other interested parties to communicate concerns involving internal controls, accounting or auditing matters directly to the

7

Audit Committee. The Company’s Ethics Hotline phone number is 800-886-2144 (U.S. and Canada) or 770-582-5285 (International). The Ethics Hotline can also be used to communicate other concerns to the Company’s management. Concerns can be reported anonymously, if the caller chooses.

COMPENSATION COMMITTEE REPORT

ON EXECUTIVE COMPENSATION

Committee Composition and Responsibilities

The Compensation Committee of the Board of Directors currently consists of four directors, all of whom are independent as defined by the Securities and Exchange Commission and the New York Stock Exchange. Pursuant to its Charter, the Compensation Committee is solely responsible for establishing the compensation of the Company’s Chief Executive Officer and for determining the various components of the Chief Executive Officer’s compensation. It is also responsible for reviewing and approving the compensation of the other executive officers and for reviewing the financial terms of any other employment arrangement providing for compensation of more than $200,000 per year.

The Committee also establishes goals for incentive compensation and determines whether those goals have been achieved, makes recommendations to the Board as to long-term compensation plans, oversees and administers the Company’s Deferred Compensation Plan for senior executives, and approves the annual awards to employees under the Company’s 2004 Equity Compensation Plan.

General Compensation Philosophy

The Committee’s objective is to establish compensation levels that are fair and equitable to both senior management and the Company, considering each employee’s overall responsibilities, professional qualifications, business experience and technical expertise, and the resultant combined value of the employee to the Company’s long-term performance and growth. The Committee believes that both incentive and long-term compensation are important elements of the Company’s management compensation program, in each case with an increased emphasis on performance-based compensation. The Committee believes that by providing fair and equitable compensation levels, the Company will be able to continue to attract and retain qualified individuals who are dedicated to the long-term performance and growth of the Company.

Factors Considered

The Compensation Committee at least annually reviews the compensation established for each employee for whom it is responsible and reviews and approves adjustments recommended by the Chief Executive Officer to reflect individual performance evaluations and responsibilities, operating results of the Company and its operating units, and current economic conditions.

The Committee retains Mercer Human Resources Consulting as its compensation consultant. At the Committee’s request, Mercer conducted a comprehensive study of the compensation of the Company’s Chief Executive Officer and senior management, and advised the Committee on appropriate levels and components of compensation. Following the change in the Company’s Chief Executive Officer in May 2005, the Committee decided to re-set the performance-oriented goals for 2005 executive compensation to be based on Company debt paydown, second half earnings targets, and achieving an unqualified Sarbanes-Oxley Section 404 audit report.

8

Elements of Executive Officer and Senior Management Compensation

Cash Compensation. The cash compensation of the Company’s senior management consists of base salary and an annual bonus, as determined by the Chief Executive Officer and approved by the Committee. For fiscal 2005, the annual bonus was based on achieving the performance-based goals outlined in the preceding paragraph.

Beginning with fiscal 2006, the Compensation Committee has adopted the Company’s 2006 Executive Bonus Plan for determining the annual bonuses of its executive officers according to objective, performance-based criteria. The principal provisions of the Bonus Plan and the specific criteria and targets for 2006 are described under Proposal 3: To Approve the Company’s Executive Bonus Plan, below. The Company simultaneously adopted a similar bonus plan for management personnel other than its executive officers.

In addition to any bonus payable under the Bonus Plan, the Committee has determined that up to one-fifth of Mr. Abd’s target bonus for 2006 will be awarded based on strategic factors determined by the Committee in its discretion. This portion of Mr. Abd’s bonus will not qualify as “performance-based compensation” for purposes of Section 162(m) of the Internal Revenue Code.

Long-Term Compensation. In addition to receiving cash compensation, senior management has generally received annual awards of stock options under the Company’s 2004 Equity Compensation Plan, which the Company’s shareholders approved in March 2004. All awards to the Company’s executive officers are approved by the Compensation Committee. Because public company accounting standards now require the Company to record an expense for financial statement purposes upon the issuance and vesting of stock options, and to emphasize the relationship between pay and performance, the Committee is considering changing the type of the Company’s equity compensation awards beginning in fiscal 2006.

Deferred Compensation. The Company also maintains a nonqualified Deferred Compensation Plan for senior management who are selected to participate in the Plan by the Board or the Chief Executive Officer. Under this Plan, each February, the Company contributes cash to each participant’s account equal to 10% of the participant’s annual cash compensation from the Company (with certain adjustments) for the preceding calendar year, subject to a maximum annual contribution of $30,000 per participant. The participant’s account balance is invested on behalf of the participant, and vests over a seven-year period, after which future contributions by the Company will vest over a four-year period. Upon termination of the participant’s employment, other than for cause, the participant is entitled to receive the vested balance in hi s or her account. The American Jobs Creation Act of 2004, enacted by Congress in late 2004, imposes strict new requirements on deferred compensation arrangements such as the Deferred Compensation Plan. Based on preliminary guidance issued by the Treasury Department, the Committee believes that the Plan is in compliance with the Act.

Retirement Plan. The Company also offers a voluntary 401(k) plan for all eligible employees, including management, pursuant to which the Company matches 50% of participants’ contributions up to a maximum of 6% of their compensation. The Company has no defined benefit or defined contribution pension plan for management.

Compensation of Chief Executive Officer. In establishing the compensation for the Chief Executive Officer, the Committee consults independent published surveys as well as studies by Mercer, its compensation consultant. We endeavor to establish Mr. Abd’s total compensation at levels that are competitive with this position for other publicly-traded companies of comparable size to Spartech, subject to the achievement of annually specified strategic and financial performance objectives. For fiscal 2006, four-fifths of Mr. Abd’s targeted annual bonus will be determined under the 2006 Executive Bonus Plan, if it is

9

approved by the shareholders, and one-fifth will be determined on the basis of strategic factors determined by the Committee.

Compensation of Other Executive Officers. Pursuant to its Charter, the Committee reviews and approves the compensation of all other executive officers, and reviews all other compensation arrangements that involve annual compensation of $200,000 or more. For fiscal 2006, all bonuses of the other executive officers will be determined under the 2006 Executive Bonus Plan if it is approved by the shareholders.

Deductibility of Executive Compensation. Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, limits the Company’s tax deduction to $1 million per year (the “Compensation Cap”) for certain compensation paid in a given year to the Chief Executive Officer and the four other most highly compensated executives named in the annual Proxy Statement. However, the Code and regulations issued under the Code exclude from the Compensation Cap amounts based on attainment of pre-established, objective performance goals provided that certain requirements are met including shareholder approval. The Committee has structured the 2006 Executive Bonus Plan so that any bonuses awarded under it will qualify for this exclusion from the Compensation Cap, provided that the shareholders approve the Bonus Plan at the 2006 Annual Mee ting.

| Ralph B. Andy | Victoria M. Holt | Pamela F. Lenehan | Walter J. Klein |

| Chairman |

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes compensation earned by the Company’s Chief Executive Officer and the four other most highly compensated executive officers whose aggregate salary and bonus exceeded $100,000 for fiscal 2005.

| Annual Compensation | Long-Term Compensation | |||||||||||||||||||

| Name and Principal Position | Fiscal Year | Salary | Bonus | Other Annual Compensation(2) | Options Granted | All Other Compensation(1) | ||||||||||||||

| George A. Abd(3) | 2005 | $427,115 | $ | 350,000 | $ | 74,394 | 136,000 | $ | 11,145 | |||||||||||

| President and Chief | 2004 | $301,385 | $ | 240,000 | $ | 30,000 | 28,000 | $ | 7,096 | |||||||||||

| Executive Officer | 2003 | $281,260 | $ | 240,000 | $ | 15,000 | 30,000 | $ | 6,076 | |||||||||||

| Randy C. Martin | 2005 | $309,692 | $ | 160,000 | $ | — | 36,000 | $ | 7,371 | |||||||||||

| Executive Vice President, | 2004 | $304,334 | $ | 175,000 | $ | 30,000 | 30,000 | $ | 6,191 | |||||||||||

| Corporate Development | 2003 | $275,750 | $ | 175,000 | $ | 15,000 | 30,000 | $ | 5,200 | |||||||||||

| and Chief Financial Officer | ||||||||||||||||||||

| Steven J. Ploeger(4) | 2005 | $295,673 | $ | 145,000 | $ | 51,534 | 36,000 | $ | 5,596 | |||||||||||

| Executive Vice | 2004 | $249,279 | $ | 150,000 | $ | 30,000 | 9,000 | $ | 5,374 | |||||||||||

| President, Custom | 2003 | $203,991 | $ | 141,240 | $ | 15,000 | 7,500 | $ | 6,039 | |||||||||||

| Sheet and Rollstock | ||||||||||||||||||||

| and Engineered | ||||||||||||||||||||

| Products | ||||||||||||||||||||

| Jeffrey D. Fisher | 2005 | $232,788 | $ | 100,000 | $ | — | 18,000 | $ | 6,733 | |||||||||||

| Senior Vice President | 2004 | $223,005 | $ | 95,000 | $ | 28,926 | 15,000 | $ | 5,066 | |||||||||||

| and General Counsel | 2003 | $205,000 | $ | 85,000 | $ | 15,000 | 15,000 | $ | 4,931 | |||||||||||

| Michael G. Marcely(5) | 2005 | $169,350 | $ | 67,500 | $ | — | 10,000 | $ | 2,800 | |||||||||||

| Vice President and | 2004 | $145,853 | $ | 50,000 | $ | 17,213 | 5,000 | $ | 2,650 | |||||||||||

| Corporate Controller | 2003 | $111,634 | $ | 37,500 | $ | 31,081 | — | $ | 2,155 | |||||||||||

| Bradley B. Buechler(6) | 2005 | $439,531 | $ | — | $ | — | 120,000 | $ | 3,340,151 | (7) | ||||||||||

| Former Chairman, | 2004 | $794,821 | $ | 606,285 | $ | 122,575 | 100,000 | $ | 9,893 | |||||||||||

| President, and | 2003 | $727,212 | $ | 479,889 | $ | 198,393 | 100,000 | $ | 8,933 | |||||||||||

| Chief Executive Officer | ||||||||||||||||||||

| (1) | The amounts disclosed in this column for fiscal year 2005 include amounts contributed by the Company to the Spartech Corporation 401(k) Savings & Investment Plan on behalf of Mr. Abd, $7,000, Mr. Martin, $7,000, Mr. Ploeger, $5,596, Mr. Fisher, $6,733, Mr. Marcely, $2,800 and Mr. Buechler, $5,192. In addition, the Company paid premiums for term life insurance for the benefit of Mr. Abd, $4,145 and Mr. Martin, $371. |

| (2) | The amounts disclosed in this column for fiscal year 2005 include $74,394 of relocation assistance and income tax gross-up for Mr. Abd and $51,534 for Mr. Ploeger and for fiscal year 2003 include $31,081 of relocation assistance and income tax gross-up for Mr. Marcely. For fiscal year 2005 the Company did not make any contributions to non-qualified deferred compensation arrangements on behalf of the named executive officers as the plan was amended in December 2005 to change the annual funding date from December of each calendar year to the following February. |

| (3) | Mr. Abd became President and Chief Executive Officer on May 6, 2005. |

| (4) | Mr. Ploeger was given responsibility over Engineered Products effective May 6, 2005. |

| (5) | Mr. Marcely was elected as an executive officer in December 2004. |

| (6) | Mr. Buechler retired as Chairman, President and Chief Executive Officer effective May 6, 2005. |

| (7) | All other compensation for Mr. Buechler includes payments made pursuant to Mr. Buechler’s Retirement Agreement entered into on May 28, 2005 which replaced his Amended and Restated Employment Agreement dated November 1, 2002. The Retirement Agreement provided for a cash settlement based upon a multiple of Mr. Buechler’s former annual salary plus his previous deferred compensation arrangement totaling $2,711,174, a deferred retirement payment of $123,000 representing the pro-rated portion of the fiscal 2005 bonus he would have been entitled to under his Employment Agreement, the transfer of a life insurance policy owned and maintained by the Company as funding for the deferred compensation provided for Mr. Buechler under his Employment Agreement having a cash surrender value of $420,339, the transfer to him of his company car, including sales tax paid, valued at $52,526, the |

11

| payment of Mr. Buechler’s legal fees in connection with his retirement totaling $17,000 and the transfer to him of his office furniture valued at $10,920. |

The Company provides leased automobiles to certain senior management and sales personnel for their business and personal use, with the value of any personal use treated as additional compensation to them. Until June 2005, the Company’s former Chief Executive Officer periodically chartered the Company’s airplane for his personal use when it was not scheduled for Company business, and he reimbursed the Company in advance for such personal use based on a formula set out in Internal Revenue Service regulations. In June 2005, the Company terminated its aircraft lease and therefore, no longer leases an airplane.

Option Grants

The following table summarizes option grants made during fiscal 2005 to the executive officers named in the Summary Compensation Table.

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(1) | |||||||||||||||||

| Name | Number of Securities Underlying Options Granted | % of Total Options Granted to Employees in Fiscal Year | Exercise Price | Expiration Date | 5% | 10% | ||||||||||||

| George A. Abd | 36,000 | (2) | 6.2 | % | $26.02 | 12/9/14 | $ | 589,098 | $ | 1,492,890 | ||||||||

| 100,000 | (3) | 17.3 | % | $17.01 | 6/8/15 | $ | 1,069,750 | $ | 2,710,956 | |||||||||

| Randy C. Martin | 36,000 | (2) | 6.2 | % | $26.02 | 12/9/14 | $ | 589,098 | $ | 1,492,890 | ||||||||

| Steven J. Ploeger | 36,000 | (2) | 6.2 | % | $26.02 | 12/9/14 | $ | 589,098 | $ | 1,492,890 | ||||||||

| Jeffrey D. Fisher | 18,000 | (2) | 3.1 | % | $26.02 | 12/9/14 | $ | 294,549 | $ | 746,445 | ||||||||

| Michael G. Marcely | 10,000 | (2) | 1.7 | % | $26.02 | 12/9/14 | $ | 163,638 | $ | 414,692 | ||||||||

| Bradley B. Buechler | 120,000 | (4) | 20.8 | % | $26.02 | 12/9/14 | $ | 1,963,661 | $ | 4,976,301 | ||||||||

| (1) | The rates of appreciation presented of 5% and 10% are set by the Securities and Exchange Commission, and therefore, are not intended to forecast future appreciation of the Company’s stock price. |

| (2) | All options were granted at market value and vest in four equal annual installments beginning December 10, 2005. |

| (3) | Mr. Abd was granted 100,000 options at the time of his appointment as President and Chief Executive Officer. This option was granted at market value and vests in four equal annual installments beginning June 9, 2006. |

| (4) | These options terminated upon Mr. Buechler’s retirement on May 6, 2005. |

12

Option Exercises and Outstanding Options

The following table summarizes all options exercised in fiscal 2005 and unexercised options at the end of fiscal 2005 for the executive officers named in the Summary Compensation Table.

| Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised “In-the-Money” Options at Fiscal Year End(2) | |||||||||||||||

| Name | Shares Acquired on Exercise | Value Realized(1) | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

| George A. Abd | 2,187 | $ | 14,828 | 76,437 | 178,250 | (3) | $ | 34,966 | $ | 171,400 | ||||||

| Randy C. Martin | — | — | 79,000 | 73,750 | (3) | $ | 194,216 | $ | 8,400 | |||||||

| Steven J. Ploeger | — | — | 38,575 | 48,275 | (3) | $ | 114,466 | $ | 8,400 | |||||||

| Jeffrey D. Fisher | — | — | 40,200 | 40,500 | (3) | $ | 83,916 | $ | 4,200 | |||||||

| Michael G. Marcely | — | — | 1,250 | 13,750 | (3) | $ | — | $ | — | |||||||

| Bradley B. Buechler | 132,500 | $ | 499,078 | 147,500 | — | $ | — | $ | — | |||||||

| (1) | The values represent the difference between the exercise price of the options and the price of the Company’s common stock on the date of exercise. |

| (2) | The values represent the difference between the exercise price of the options and the price of the Company’s common stock at fiscal year end. |

| (3) | These represent the unvested portion of options granted during fiscal 2002, 2003, 2004 and 2005 which vest in four equal annual installments beginning one year after date of grant. |

Retirement Agreement

Mr. Buechler

The Company entered into a Retirement Agreement and Release (“Retirement Agreement”), effective on May 6, 2005, with Bradley B. Buechler, its former Chairman, President and Chief Executive Officer. This Retirement Agreement replaced Mr. Buechler’s Amended and Restated Employment Agreement dated November 2, 2002 (“Employment Agreement”).

The Retirement Agreement includes various terms and conditions pertaining to Mr. Buechler’s retirement. The payments and benefits paid to Mr. Buechler under this Retirement Agreement included the following major provisions:

- A cash settlement paid June 3, 2005, based upon a multiple of Mr. Buechler’s former annual salary plus his previous deferred compensation arrangement, totaling $2,711,174.

- A bonus to be paid on the Company’s fiscal 2005 results pro-rated for Mr. Buechler’s employment through the effective date of the Retirement Agreement.

- An amendment to the vested terms of Mr. Buechler’s vested Stock Options to treat his resignation as a retirement before having reached the minimum retirement age of 60 specified in his option agreements.

Employment Agreements

Messrs. Abd, Ploeger and Fisher

The Company has a three-year employment agreement with Mr. Abd expiring February 28, 2006, a three-year employment agreement with Mr. Ploeger expiring April 30, 2007, and a three-year employment agreement with Mr. Fisher expiring November 30, 2006. The annual base compensation for these executives, subject to periodic review for cost of living and/or merit and other increases, is currently $600,000, $310,000

13

and $265,000 respectively. The agreements also provide for annual bonuses based upon individual performance and the overall results of the Company’s operations. In addition, the agreements require the Company to provide minimum term life insurance for the employees’ designated beneficiaries for the term of the agreements, in the amount of $500,000 for Mr. Abd, $250,000 for Mr. Ploeger and $250,000 for Mr. Fisher.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth certain information as of October 29, 2005 regarding the Company’s 1991 Incentive Stock Option Plan, 1991 Restricted Stock Option Plan, 2001 Stock Option Plan and 2004 Equity Compensation Plan:

| (a) | (b) | (c) | |

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under compensation plans (excluding securities reflected in column (a)) |

| Equity compensation plans approved by security holders | 2,193,000 | $21.21 | (1) |

| Equity compensation plans not approved by security holders | None | None | None |

| Total | 2,193,000 | $21.21 |

| (1) | The maximum amount of common stock for which options or other awards may be granted under the Company’s 2004 Equity Compensation Plan is 3,000,000 shares. The Plan prohibits the Company from repricing any options granted under the Plan. No options or other awards may be granted under the Plan after December 31, 2010. No further options may be granted under any other stock option plans of the Company. In the event of any stock split, reverse stock split or stock dividend in excess of 5%, or any other recapitalization, combination or exchange affecting the common stock generally, the number and kind of shares available for issuance under the Company’s stock option plans and any outstanding awards will be appropriately and automatically adjusted. |

AUDIT COMMITTEE REPORT

The Company’s management has the primary responsibility for its financial reporting process, including its systems of internal controls, for the financial statements resulting from that process, and for the public reporting process. The Company’s independent registered public accounting firm is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States and on management’s assessment of the effectiveness of the Company’s internal control over financial reporting. In addition, the independent registered public accounting firm is responsible for expressing an opinion on the effectiveness of the Company’s internal control over financial reporting.

Each member of the Audit Committee is an independent director as determined by our Board of Directors, based on the New York Stock Exchange listing rules and Spartech’s independence guidelines. Each member of the committee also satisfies the Securities and Exchange Commission’s additional independence requirement for members of audit committees. In addition, our Board of Directors has determined that Walter J. Klein is an “audit committee financial expert” as defined by SEC rules.

The Audit Committee, retains the independent registered public accounting firm and oversees the Company’s financial reporting process and the audit on behalf of the Board of Directors.

In fulfilling our oversight responsibilities for 2005, the Audit Committee:

- Retained Ernst & Young LLP to perform the fiscal 2005 audit.

- Reviewed and discussed with management the Company’s audited financial statements for the fiscal year ended October 29, 2005 as well as the quarterly unaudited financial statements.

14

- Reviewed and discussed with management the quality and the acceptability of the Company’s financial reporting and internal controls.

- Discussed with Ernst & Young LLP and the Company’s internal auditors the overall scope and plans for their respective audits as well as the results of their examinations and their evaluations of the Company’s internal controls.

- Reviewed with Ernst & Young LLP their judgments as to the quality and the acceptability of the Company’s financial reporting.

- Met with Ernst & Young LLP and the Company’s internal auditors, separately and together, with and without management present, to discuss the Company’s financial reporting processes and internal accounting controls.

- Reviewed significant audit findings by Ernst & Young LLP and by the Company’s auditors, together with management’s responses.

- Received from Ernst & Young LLP, the written disclosures and letter required by Standard No. 1 of the Independence Standards Board, and discussed with Ernst & Young LLP the auditors’ independence from management and the Company, including the impact of permitted non-audit-related services approved by the Committee to be performed by Ernst & Young LLP. The committee also concluded that Ernst & Young LLP’s provision of audit and non-audit services to Spartech and its affiliates is compatible with Ernst & Young’s independence.

- Discussed with Ernst & Young LLP and management such other matters as are required to be discussed with the Audit Committee under Statement on Auditing Standards No. 61 and other auditing standards generally accepted in the United States, the corporate governance standards of the New York Stock Exchange, and the Audit Committee’s Charter.

Based on the above reviews and discussions, we recommended to the Board of Directors that the audited financial statements for the fiscal year ended October 29, 2005 be included in the Company’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

| Walter J. Klein Chairman | Lloyd E. Campbell | Pamela F. Lenehan | Craig A. Wolfanger |

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

During fiscal 2004 and 2005, the Company’s principal auditor, Ernst & Young LLP, provided services in the following categories for the following fees:

| 2004 | 2005 | |||||||

| Audit Fees | $ | 569,560 | $ | 1,098,925 | ||||

| Audit-Related Fees | $ | 108,102 | $ | 17,296 | ||||

| Tax Fees | $ | — | $ | — | ||||

| All Other Fees | $ | — | $ | — | ||||

Audit Fees primarily related to work performed in connection with the audit of the Company’s annual financial statements, the effectiveness of the Company’s internal control over financial reporting and reviews of Securities and Exchange Commission Forms 10-Q and 10-K. The increase in 2005 Audit Fees compared

15

to 2004 relates to additional cost of compliance with audit requirements of the Sarbanes-Oxley Act that became effective for the first time in 2005. Audit-Related Fees for 2004 primarily related to work performed in connection with the filing of the Company’s shelf registration statement on Form S-3, the review of internal controls and the audit of employee benefit plans. For 2005, Audit-Related Fees related only to work performed in connection with the audit of employee benefit plans.

The Audit Committee approved in advance all services provided by Ernst & Young, LLP. The Audit Committee’s pre-approval policies and procedures are included within the Audit Committee Charter, which is posted in the Investor Relations/Corporate Governance section of the Company’s website, www.spartech.com.

SECURITY OWNERSHIP

The table set forth below identifies the aggregate shares of common stock beneficially owned by each director, by each executive officer, by the executive officers and directors as a group, and by each person known to the Company as of December 31, 2005 to be the beneficial owner of more than 5% of the 32,045,269 shares of common stock outstanding as of that date.

| Number of Common Shares Beneficially Owned(1) | Percentage of Common Shares Beneficially Owned | |||||||

| Directors and Executive Officers: | ||||||||

| Ralph B. Andy | 175,261 | (2) | * | |||||

| Randy C. Martin | 130,166 | (3) | * | |||||

| George A. Abd | 127,472 | (3) | * | |||||

| Bradley B. Buechler(4) | 110,034 | (3) | * | |||||

| Steven J. Ploeger | 72,637 | (3) | * | |||||

| Jeffrey D. Fisher | 60,523 | (3) | * | |||||

| Jackson W. Robinson | 60,000 | (3) | * | |||||

| Richard B. Scherrer | 44,350 | (3) | * | |||||

| Craig A. Wolfanger | 36,700 | (3) | * | |||||

| Lloyd E. Campbell | 25,000 | (3) | * | |||||

| Walter J. Klein | 20,500 | (3) | * | |||||

| Pamela F. Lenehan | 20,000 | * | ||||||

| Phillip M. Karig | 18,750 | (3) | * | |||||

| Michael G. Marcely | 7,946 | (3) | * | |||||

| Victoria M. Holt | 0 | * | ||||||

| Darrell W. Betz | 0 | * | ||||||

| All Directors and Executive Officers as a Group (16 persons) | 909,339 | (3) | 2.8 | % | ||||

| Other Beneficial Owners In Excess of 5% of the Common Shares Outstanding: | ||||||||

| Columbia Wanger Asset Management, L.P. | 3,628,500 | (5) | 11.3 | % | ||||

| 227 West Monroe Street, Suite 3000 | ||||||||

| Chicago, IL 60606 | ||||||||

| FMR Corp. | 3,260,007 | (6) | 10.2 | % | ||||

| Fidelity Management & Research Company | ||||||||

| 82 Devonshire Street | ||||||||

| Boston, MA 02109 | ||||||||

Notes To Security Ownership Table:

| * | Less than 1%. |

(1) | Includes shares issuable upon exercise of currently exercisable options as noted for the respective owners. |

16

(2) | Includes 25,000 shares issuable upon exercise of currently exercisable options, and 150,261 shares owned by RBA Partners, L.P. Mr. Andy is the sole shareholder of RBA Investments, Inc., which is a 0.1% general partner of RBA Partners, L.P. As such, Mr. Andy, through RBA Investments, Inc. has investment and voting power over the shares owned by RBA Partners, L.P. |

(3) | Includes shares issuable upon exercise of currently exercisable options, as follows: Mr. Martin, 109,250; Mr. Abd, 106,187; Mr. Buechler, 110,000; Mr. Ploeger, 53,475; Mr. Fisher, 55,950; Mr. Robinson, 35,000; Mr. Scherrer, 30,000; Mr. Wolfanger, 30,000; Mr. Campbell, 15,000; Mr. Klein, 15,000; Mr. Karig, 16,250; Mr. Marcely, 5,000 and all directors and executive officers as a group, 606,112. |

(4) | Mr. Buechler retired as an executive officer effective May 6, 2005. |

(5) | Based on information presented as of December 31, 2004 in Columbia Wanger Asset Management, L.P.’s (“WAM”) latest available Schedule 13G, WAM beneficially owned 3,628,500 shares of common stock. WAM has shared voting and investment power with WAM Acquisition GP, Inc. the general partner of WAM. |

(6) | Based on information presented as of December 31, 2004 in FMR Corp.’s latest available Schedule 13G, FMR Corp. beneficially owned 3,260,007 shares of common stock including 2,282,707 shares beneficially owned by Fidelity Management & Research Company as a result of its serving as investment adviser to various investment companies and other funds, 221,200 shares beneficially owned by Fidelity Management Trust Company as trustee or managing agent for various private investment accounts and other funds and 756,100 shares beneficially owned by Fidelity International Limited. FMR Corp. has sole voting power with respect to 977,300 shares and sole investment power with respect to all 3,260,007 shares. |

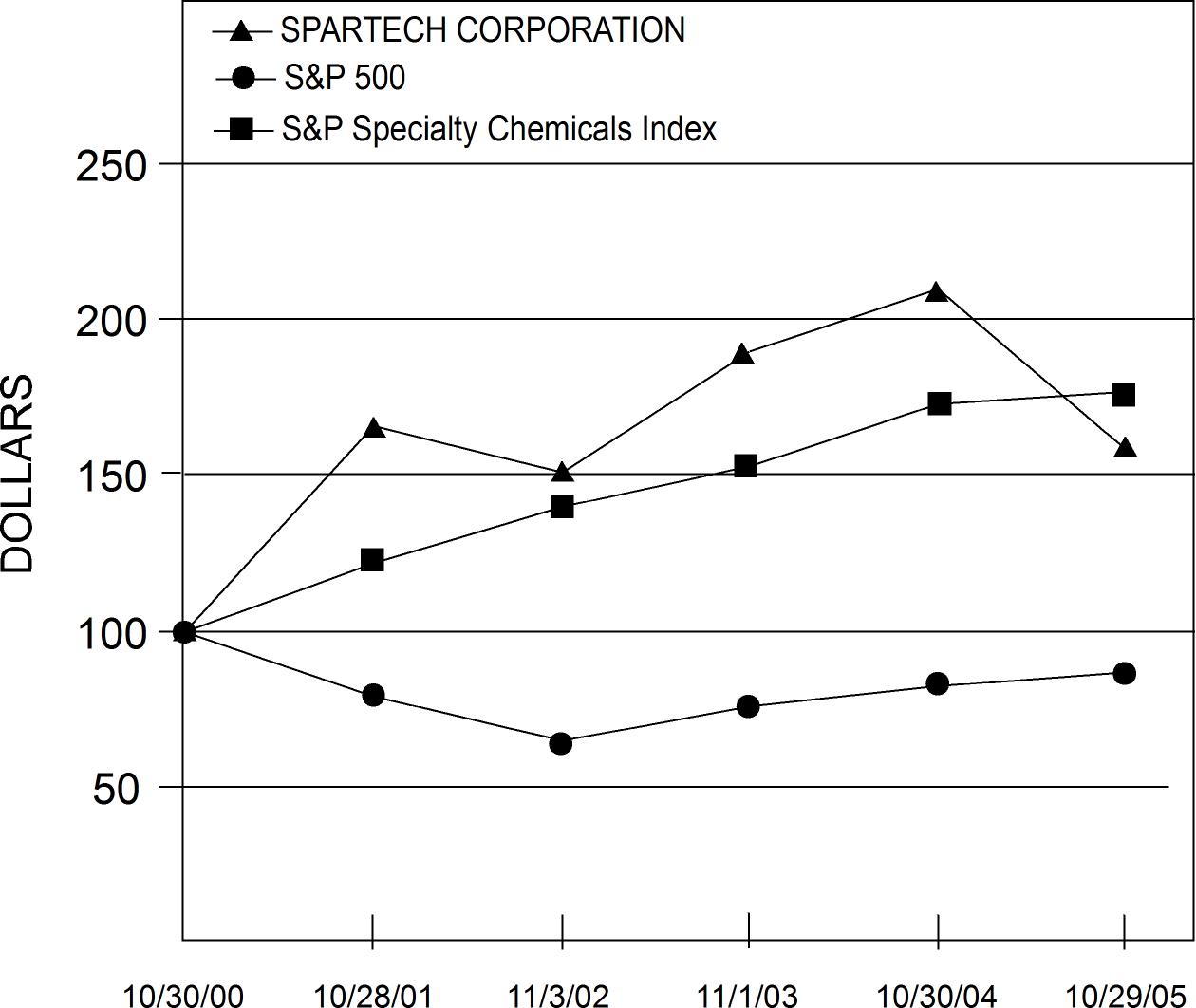

COMMON STOCK PERFORMANCE GRAPH

The following graph compares cumulative total Company shareholder return for the last five fiscal years with overall market performance, as measured by the cumulative return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Specialty Chemicals Index, assuming an initial investment of $100 at the beginning of the period and the reinvestment of all dividends.

| 10/30/00 | 10/28/01 | 11/3/02 | 11/1/03 | 10/30/04 | 10/29/05 | CAGR* | |||||||||||||||||||||

| SPARTECH STOCK PRICE | $ | 13.00 | $ | 21.05 | $ | 18.79 | $ | 23.18 | $ | 25.20 | $ | 18.64 | 9.6% | ||||||||||||||

| Assumed $100 Investment: | |||||||||||||||||||||||||||

| SPARTECH CORPORATION | $ | 100 | $ | 166 | $ | 151 | $ | 190 | $ | 210 | $ | 158 | 9.6% | ||||||||||||||

| S&P 500 | $ | 100 | $ | 79 | $ | 65 | $ | 76 | $ | 82 | $ | 87 | (2.8%) | ||||||||||||||

| S&P Specialty Chemicals Index | $ | 100 | $ | 122 | $ | 140 | $ | 153 | $ | 173 | $ | 177 | 12.1% | ||||||||||||||

*Compound annual growth rate.

17

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers and persons who own beneficially more than ten percent of a registered class of the Company’s equity securities to file with the Securities and Exchange Commission and the New York Stock Exchange initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Such officers, directors and greater than ten percent beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms filed by them.

To the Company’s knowledge, based solely on review of the copies of such reports furnished to the Company and written representations from its directors and executive officers that no other reports were required, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with on a timely basis during our 2005 fiscal year.

PROPOSAL 2: RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2006. The Audit Committee proposes that the shareholders ratify the selection at this Annual Meeting. Ernst & Young LLP has served as the Company’s independent auditors since fiscal 2002. The Company has had no disagreements with Ernst & Young LLP on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedures. In the event a majority of the votes cast at the Annual Meeting are not voted in favor of the selection, the Committee will reconsider its selection.

Ernst & Young LLP has advised the Company that its representatives will be present at the Annual Meeting, where they will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR Proposal 2 (Item 2 on the Proxy Card).

PROPOSAL 4: APPROVAL OF AMENDMENTS TO THE CERTIFICATE OF INCORPORATION

The Company’s Board of Directors has declared it to be advisable and in the best interests of the Company to amend its Certificate of Incorporation (the “Certificate”) in certain respects, and is recommending that the shareholders approve the specific amendments described in this section.

These amendments are being proposed as a result of a comprehensive review of the Certificate, which has not been amended since 1998 except to increase the authorized amount of common stock. The Certificate contains many provisions dating from 1968 and 1981 which have become outdated in view of subsequent changes in Delaware law or under current standard corporate practice. In addition, the Board believes that some of the provisions relating to anti-takeover defenses are no longer necessary or appropriate.

The proposed amendments are attached hereto as Appendix II. Each amendment is discussed separately below, and will be voted on separately by the shareholders.

Following shareholder approval, the amendments will become effective upon the filing of a Certificate of Amendment with the Secretary of State of Delaware. The Company intends to file the Certificate of Amendment promptly after the Annual Meeting.

18

The Board of Directors recommends that the shareholders vote FOR each of the amendments in Proposal 4.

AMENDMENT TO UPDATE THE CORPORATE PURPOSES CLAUSE

The statement of corporate purposes in Article Third has not been changed since the Company’s incorporation in 1968. It contains a two-page “laundry list” of corporate “purposes,” reflecting the now-obsolete corporate practice, formerly required by state law, of including specific corporate purposes in corporate charters. Since 1967 Delaware law has permitted a “general purposes” clause, and except in special circumstances it is now standard practice to form general business corporations with a general purposes clause in lieu of a detailed statement of purposes. The original drafters gave partial effect to this change by adding a form of “general purposes” clause at the end of the Article, which makes the “laundry list” of purposes completely superfluous.

The proposed amendment will conform the purposes clause to modern corporate practice, but it will have no other effect on the Company or its shareholders.

Approval of this amendment will require the affirmative vote of a majority of the issued and outstanding shares.

The Board of Directors recommends that the shareholders vote FOR the proposed amendment (Item 4A on the Proxy Card).

AMENDMENT TO MAKE CERTIFICATE GENDER-NEUTRAL

Modern corporate practice is to draft corporate documents to be gender-neutral. The Certificate is gender-neutral except for Articles SEVENTH and EIGHTH, which date back to 1968.

The proposed amendment makes minor, non-substantive changes in the text of Article SEVENTH to make this Article gender-neutral, but it will have no other effect on the Company or its shareholders. Article EIGHTH would also be gender-neutral following the amendments proposed in the next section.

Approval of this amendment will require the affirmative vote of a majority of the issued and outstanding shares.

The Board of Directors recommends that the shareholders vote FOR the proposed amendment (Item 4B on the Proxy Card).

AMENDMENT TO DIRECTOR AND OFFICER INDEMNIFICATION PROVISIONS

Article EIGHTH of the Certificate has not been changed since 1968. In its present form, it requires the Company to indemnify its directors and officers against certain liabilities incurred in the course of their services for the Company but limits the scope of indemnification to matters which are affirmatively found not to involve “negligence” on the part of the director or officer. Further, it provides that the corporation may indemnify directors and officers beyond the scope of the article, but only subject to the limitation to matters not involving negligence.

19

The current provision significantly restricts the right of the Company’s directors or officers to the indemnification which they would otherwise be permitted to receive under Delaware corporate law and the corporate laws of other states. When this provision was adopted almost forty years ago, it was consistent with the Delaware statute, which at that time contained a disqualification from the right to indemnification in cases of “negligence or misconduct.” In 1986, however, the Delaware statute was amended to be consistent with the Delaware case law which established “gross negligence” as the standard for liability for a violation of a director’s duty of care, but the Company’s charter was not amended to reflect the change in Delaware law. As a result, the Company’s directors and officers are now required to conform to a higher standard th an is now required by law in order to be entitled to the indemnification which is now commonplace in the corporate setting.

The Board of Directors believes that in order for the Company to be able to attract and retain skilled directors and officers, it must be able to assure them that they will be reimbursed for expenses which result from litigation which may arise out of their service for the Company. Although the Company provides director and officer liability insurance for its directors and officers, provides indemnification for its directors and officers by contract, and is required by Delaware law to indemnify a director or officer who has been successful in the defense of an action, the Board of Directors believes that the current restrictive provisions create uncertainty and doubt as to the Company’s authority to provide indemnification at a level which is now standard among corporations and which is expected by prospective officer candidates and prospective director nominees, and create uncertainty as to issues of potential conflicts and interpretation, all of which are negative factors in attempting to attract and retain qualified directors and officers.

None of the proposed provisions are intended to, and by law they cannot, override the limitations on indemnification provided under Delaware law. For example, under Delaware law and as included in the proposed amendment, a director or officer is entitled to indemnification only if he or she acted in good faith and in a manner he or she reasonably believed to be in (or at least not opposed to) the best interests of the Company, and if (with respect to any criminal proceeding), the director or officer had no reasonable cause to believe his or her conduct was unlawful.

In summary, the proposed amendment merely conforms the indemnification provisions of the Certificate to what is now permitted by law and standard practice among public companies, and will therefore assist the Company in attracting and retaining qualified directors and officers.

Approval of this amendment will require the affirmative vote of a majority of the issued and outstanding shares.

The Board of Directors recommends that the shareholders vote FOR the proposed amendment (Item 4C on the Proxy Card).

ADDITION OF PROVISION REGARDING DIRECTOR LIABILITY

The Board of Directors is also proposing to add a new section to Article EIGHTH, to provide that a director will not be personally liable to the Company or its shareholders for money damages for breach of the director’s duty of care. This would implement another provision of Delaware law, also enacted in 1986, specifically permitting Delaware corporations to include such a provision in their charters. Such a provision is now virtually universal among Delaware public corporations formed since 1986, but as with the preceding amendment, the Company’s charter has not been amended to reflect the change in Delaware law.

The proposed section would not limit a director’s liability for breach of the director’s duty of loyalty to the Company, for acts or omissions that are not in good faith or that involve intentional misconduct or a knowing

20

violation of law, for willful or negligent conduct in paying dividends or repurchasing stock out of funds which are not lawfully available for that purpose, or for any transaction from which the director derives an improper personal benefit.

As with the preceding amendment, the Board of Directors believes that in order for the Company to be able to attract and retain skilled directors, it must be able to provide them with terms of service comparable to those the director would have if he or she were serving another company. Since the proposed provision has become standard among Delaware public companies, the Board believes that it should be adopted by the Company in order to assist it in attracting and retaining qualified directors.

Approval of this amendment will require the affirmative vote of a majority of the issued and outstanding shares.

The Board of Directors recommends that the shareholders vote FOR the proposed amendment (Item 4D on the Proxy Card).

ELIMINATION OF SHAREHOLDER ACTION BY WRITTEN CONSENT

Under Delaware law, unless otherwise provided in the certificate of incorporation, the shareholders of a Delaware corporation may take any action required or permitted to be taken at any meeting of the shareholders without a meeting, without prior notice and without a vote, if written consents to the action are signed by shareholders having at least the minimum number of votes that would be required to approve the action at a meeting of all shareholders and delivered to the corporation.

Although the Company may have certain defenses against such an action, this provision would theoretically make it possible for a shareholder group to accumulate a sufficient number of shares to take action, such as to amend the Corporation’s Certificate, without any prior notice to the Company or its other shareholders.

The Board of Directors believes that such “action by written consent” is not appropriate for a public company, and should be prohibited by amending the Certificate to add to Article TWELFTH the proposed language prohibiting the shareholders from acting by written consent.

Approval of this amendment (and any subsequent amendment of the new language) is governed by Article SIXTEENTH of the Certificate, which provides that any amendment of Articles TWELFTH through SIXTEENTH requires for approval:

- The affirmative vote of the holders of at least 80% of the issued and outstanding common stock, plus

- The affirmative vote of the holders of at least a majority of the outstanding shares of common stock which are not beneficially owned, directly or indirectly, by any corporation, person or other entity which is the beneficial owner, directly or indirectly, of 10% or more of the issued and outstanding common stock.

As stated elsewhere in this Proxy Statement, the Company believes that there are two entities, FMR Corp. and Liberty Wanger Asset Management, L.P., which own beneficially 10% or more of the issued and outstanding common stock and whose shares would therefore be excluded from the second part of the above vote calculation.

The Board of Directors recommends that the shareholders vote FOR the proposed amendment (Item 4E on the Proxy Card).

21

ELIMINATION OF SUPERMAJORITY VOTE REQUIREMENT FOR CERTAIN BUSINESS COMBINATIONS

Article THIRTEENTH, added to the Certificate in 1981, is a fairly standard but complex “anti-takeover” provision which requires a “supermajority” vote of shareholders to approve a business combination or certain other sale or purchase transactions with a holder of 10% or more of the issued and outstanding common stock. The vote required is (a) the affirmative vote of 80% of all shares plus (b) the affirmative vote of the holders of at least a majority of the outstanding shares of common stock which are not beneficially owned, directly or indirectly, by the 10% shareholder. However, the Article provides that a supermajority vote is not required if the transaction has been approved by the Board (1) before the other party becomes a 10% shareholder, or (2) before the transaction is consummated either by unanimous written consent of the directors or by the vote of dir ectors constituting both a majority of the directors and 80% of the directors voting, at a meeting of the directors at which at least 80% of the directors are present.

The purpose of this type of provision is to make it more difficult for a hostile bidder to gain control of a corporation without first negotiating with the board of directors. However, the Company’s Board of Directors believes that the provision is of limited value given the high standards to which directors are held in a takeover situation, and is unnecessary in view of the existence of the Company’s Shareholder Rights Plan adopted in 2001. The proposed amendment would delete Article THIRTEENTH and remove the reference to that Article in Article SIXTEENTH.

As with the preceding proposal, approval of this amendment is governed by Article SIXTEENTH of the Certificate, which provides that any amendment of Articles TWELFTH through SIXTEENTH requires for approval:

- The affirmative vote of the holders of at least 80% of the issued and outstanding common stock, plus

- The affirmative vote of the holders of at least a majority of the outstanding shares of common stock which are not beneficially owned, directly or indirectly, by any corporation, person or other entity which is the beneficial owner, directly or indirectly, of 10% or more of the issued and outstanding common stock.

As stated elsewhere in this Proxy Statement, the Company believes that there are two entities, FMR Corp. and Liberty Wanger Asset Management, L.P., which own beneficially 10% or more of the issued and outstanding common stock and whose shares would therefore be excluded from the second part of the above vote calculation.

The Board of Directors recommends that the shareholders vote FOR the proposed amendment (Item 4F on the Proxy Card).

PROPOSAL 3: APPROVAL OF THE COMPANY’S EXECUTIVE BONUS PLAN

The Board of Directors has directed the submission to the shareholders of a proposal to approve the Spartech Corporation 2006 Executive Bonus Plan (the “Bonus Plan”), which was adopted by the Compensation Committee of the Board on December 19, 2005, and related performance goals. A copy of the Bonus Plan is attached hereto as Appendix I.

The Bonus Plan, which will be in effect for 2006 and subsequent years, is the vehicle by which the Committee intends to determine the annual cash bonuses for the Company’s executive officers for 2006 and subsequent years. The Company has adopted a similar performance-based bonus plan for its non-executive management. Under the Bonus Plan, executive bonuses will be based on pre-established, objective criteria and performance goals which are directly related to the Company’s operating or financial results. The Bonus

22

Plan replaces the Company’s prior policy, in effect through 2005, by which (a) the bonus for the Chief Executive Officer was determined by contract under a formula based solely on the Company’s adjusted pre-tax net income, and (b) bonuses for the other executive officers were determined by the Chief Executive Officer, subject to approval by the Compensation Committee, based on subjective evaluations of individual performance and responsibilities and a subjective assessment of the annual performance of the Company.

The purpose of the Bonus Plan is to use performance-based compensation to attract, motivate and reward eligible employees. The Compensation Committee approved the Bonus Plan based on its belief that a performance-based compensation system was more consistent with the Company’s business and financial objectives and best corporate practices than the prior, subjective plan. In addition, the Bonus Plan is designed to ensure that subject to shareholder approval, compensation payable under the Bonus Plan will qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code (the “Code”) and thereby help to ensure that the Company is able to continue fully deducting its executive bonuses for federal income tax purposes.

Summary Description of the Bonus Plan

The following is a description of the major provisions of the Bonus Plan:

Administration by Independent Committee. The Bonus Plan must be administered by a committee comprised solely of two or more independent directors of the Company. The Compensation Committee (“Committee”) meets these qualifications and will administer the Bonus Plan.

Performance Periods. The Bonus Plan authorizes the Committee to establish periods (“Performance Periods”) over which the Company’s performance will be measured to determine whether and in what amounts to pay bonuses to participants. Each Performance Period must be established in writing prior to the expiration of any prescribed time period for the pre-establishment of performance goals under Section 162(m) of the Code.

Eligibility and Participation. All executive officers of the Company, including the Chief Executive Officer, are eligible to participate in the Bonus Plan; currently, seven individuals meet this requirement. For each Performance Period, the Committee must designate one or more eligible employees as participants in the Bonus Plan and will also designate those Participants who are or may become “covered employees” (as defined in Section 162(m) of the Code) for the applicable Performance Period.

Performance Goals. For each Performance Period, the Committee must establish one or more objective, pre-established minimum performance goals, and adopt objective formulas or standards for computing the amounts of bonuses payable under the Bonus Plan based on actual results compared to the Performance Goals. All Performance Goals must be based upon one or more objective performance criteria, such as (but not necessarily limited to) sales, operating earnings, pretax income, earnings per share, return on equity, working capital or specific elements thereof, return on capital employed, cash flow, market share, stock price, total shareholder return, costs, productivity and economic value added. Performance Goals may be Company-wide or may be specific to a business unit. The Performance Goals and target bonuses may be different, or may be weighted differently, for different Participants or clas ses of Participants.

Amounts of Bonuses. For each Performance Period, the Committee must also establish one or more formulas or standards for determining the amounts of bonuses which may be paid to the designated participants. After the close of each Performance Period, the Committee must determine and certify in writing the achievement of the applicable Performance Goals and the amount of any Bonuses payable to the Participants for such Performance Period under the applicable formulas or standards. The Committee has the discretion to reduce, but not to increase, the amounts payable to participants below the formula or

23

standard amount to reflect individual performance and/or unanticipated factors. Any increase in a participant’s bonus above the formula or standard amount may only be granted outside the Bonus Plan.

Amendment and Termination. The Board may amend the Bonus Plan from time to time. However, no amendment to the Bonus Plan may be made without shareholder approval unless the Committee determines that shareholder approval of the amendment is not required in order for bonuses paid to covered employees to constitute qualified performance-based compensation under Section 162(m) of the Code.

Acceleration Events. Upon a Change in Control of the Company (as defined in the Bonus Plan), all bonuses would become immediately payable in cash, with any uncompleted Performance Period deemed ended and appropriate adjustments made to minimum performance goals and formulas to reflect the shortening of such Performance Period. Thereafter, the Committee would not be permitted to exercise its discretion to reduce the amounts of bonuses payable to any participant and could make no amendments adverse to any participant without that participant’s consent.

Federal Income Tax Consequences. Each participant in the Bonus Plan will realize ordinary income equal to the amount of any bonuses received in the year of payment, and, with the possible exception of bonuses paid upon a Change in Control, the Company will receive a deduction for the amount constituting ordinary income to all participants in the Bonus Plan.

The 2006 Performance Period

On December 19, 2005, the Committee:

- Established the Company’s 2006 fiscal year as the 2006 Performance Period under the Bonus Plan;

- Designated the seven executive officers of the Company as participants in the Bonus Plan and designated Messrs. Abd, Martin and Ploeger as potential covered employees;

- Established a target bonus for Mr. Abd for the 2006 Performance Period equal to 80% of his base salary, four-fifths of which will be determined according to the Performance Goals set under the Bonus Plan and one-fifth of which will be determined based on subjective factors determined by the Compensation Committee;