Leveraging our Four Pillar Strategy: The Acquisition of Spartech October 24, 2012 Filed by PolyOne Corporation Commission File No. 1-16091 Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Spartech Corporation Commission File No. 1-5911 |

Forward – Looking Statements Page 2 • In this presentation, statements that are not reported financial results or other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, statements in this press release regarding the proposed acquisition of Spartech are forward-looking statements. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. They are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. They use words such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance and/or sales. • Factors that could cause actual results to differ materially from those implied by these forward-looking statements include, but are not limited to: The time required to consummate the proposed acquisition; the satisfaction or waiver of conditions in the merger agreement; any material adverse changes in the business of Spartech; the ability to obtain required regulatory, shareholder or other third-party approvals and consents and otherwise consummate the proposed acquisition; our ability to achieve the strategic and other objectives relating to the proposed acquisition, including any expected synergies; our ability to successfully integrate Spartech and achieve the expected results of the acquisition, including, without limitation, the acquisition being accretive; Disruptions, uncertainty or volatility in the credit markets that could adversely impact the availability of credit already arranged and the availability and cost of credit in the future; The financial condition of our customers, including the ability of customers (especially those that may be highly leveraged and those with inadequate liquidity) to maintain their credit availability; The speed and extent of an economic recovery, including the recovery of the housing market; Our ability to achieve new business gains; The amount and timing of repurchases, if any, of PolyOne common shares and our ability to pay regular quarterly cash dividends and the amounts and timing of any future dividends; The effect on foreign operations of currency fluctuations, tariffs, and other political, economic and regulatory risks; Changes in polymer consumption growth rates in the markets where we conduct business; Changes in global industry capacity or in the rate at which anticipated changes in industry capacity come online; Fluctuations in raw material prices, quality and supply and in energy prices and supply; Production outages or material costs associated with scheduled or unscheduled maintenance programs; Unanticipated developments that could occur with respect to contingencies such as litigation and environmental matters; An inability to achieve or delays in achieving or achievement of less than the anticipated financial benefit from initiatives related to working capital reductions, cost reductions, employee productivity goals, and an inability to raise or sustain prices for products or services; An inability to maintain appropriate relations with unions and employees; and Other factors affecting our business beyond our control, including, without limitation, changes in the general economy, changes in interest rates and changes in the rate of inflation. • The above list of factors is not exhaustive. • We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any further disclosures we make on related subjects in our reports on Form 10-Q, 8-K and 10-K that we provide to the Securities and Exchange Commission. |

• This presentation includes the use of both GAAP (generally accepted accounting principles) and non-GAAP financial measures. The non-GAAP financial measures include: adjusted EPS, earnings before interest, tax, depreciation and amortization (EBITDA), adjusted EBITDA, net debt, Specialty platform operating income, adjusted operating income, return on invested capital, net debt/ EBITDA, and the exclusion of corporate charges in certain calculations. In certain cases throughout this presentation, we have presented GAAP and non-GAAP financial measures adjusted to reflect full-year 2011 Pro forma results, including ColorMatrix. • PolyOne’s chief operating decision makers use these financial measures to monitor and evaluate the ongoing performance of the Company and each business segment and to allocate resources. In addition, operating income before special items is a component of various PolyOne annual and long-term employee incentive plans. • A reconciliation of each non-GAAP financial measure with the most directly comparable GAAP financial measure is attached to this presentation which is posted on our website at www.polyone.com. Use of Non GAAP Measures Page 3 |

Additional Information Additional Information • In connection with the proposed transaction, a registration statement on Form S-4 will be filed with the SEC. SPARTECH CORPORATION STOCKHOLDERS ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final proxy statement/prospectus will be mailed to stockholders of Spartech Corporation. Investors and security holders will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, from PolyOne at its website, www.polyone.com, or 33587 Walker Road, Avon Lake, Ohio 44012, Attention: Corporate Secretary, or from Spartech Corporation at its website, www.spartech.com, or 120 S. Central Avenue, Suite 1700, Clayton, Missouri 63105, Attention: Corporate Secretary. Participants in Solicitation • PolyOne and Spartech Corporation and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information concerning PolyOne’s participants is set forth in the proxy statement, dated March 23, 2012, for PolyOne’s 2012 Annual Meeting of Stockholders as filed with the SEC on Schedule 14A and PolyOne’s current reports on Form 8-K, as filed with the SEC on May 11, 2012 and September 25, 2012. Information concerning Spartech Corporation’s participants is set forth in the proxy statement, dated January 24, 2012, for Spartech Corporation’s 2012 Annual Meeting of Stockholders as filed with the SEC on Schedule 14A and Spartech Corporation’s current report on Form 8-K, as filed with the SEC on March 16, 2012. Additional information regarding the interests of participants of PolyOne and Spartech Corporation in the solicitation of proxies in respect of the proposed merger will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Page 4 |

Spartech – Compelling Strategic Rationale • Spartech expands PolyOne’s specialty portfolio with adjacent technologies in attractive end markets Bolt-on acquisition with opportunity for global expansion, as only 6% of Spartech’s revenues are outside of North America • PolyOne has a proven management team with a track record of transformational success • Preliminary annual synergies estimated at $65 million Significant opportunity to expand profitability by leveraging PolyOne’s four pillar strategy • Substantial potential share price appreciation for all shareholders Accretive to EPS in first full year post-acquisition / $0.50 once synergies realized Page 5 |

Custom Sheet & Rollstock 52% Packaging Technologies 21% Color & Specialty Compounds 27% Packaging 27% Transportation 22% Construction 18% Sign & Advertising 9% Recreation & Leisure 8% Appliance & Electronics 6% Other 10% Spartech at a Glance 3Q12 LTM Revenue: $1,156 million • #1 North America market position in sheet, rigid barrier packaging and specialty cast acrylics • Operates as a producer of plastic products, custom extruded sheet and rollstock products, and packaging principally in the United States • Approximately 2,500 employees • 30 plants in four countries: US (25), Canada (3), Mexico (1), France (1) Business Description Sales by Segment Sales By End Market Sales By Geography Page 6 United States 80% Asia & Other 1% Europe 5% Mexico 7% Canada 7% |

Spartech Segment Overview Custom Sheet & Rollstock #1 in Sheet #1 in Cast Acrylics North American Market Position • Plastic Sheet • Custom Rollstock • Calendered Film • Laminates • Cell Cast Acrylic • Monolayer Rollstock • Barrier Rollstock • Thermoformed Containers • Graphics Arts • Compounds • Color Concentrates • Black, White • Roofing Formulations • Contract Manufacturing Products Cell Cast Acrylic in Aerospace Graphic Arts Packaging with Barrier Technology Energy efficient TPO Roofing Compounds Drip Irrigation Specialty Security Glazing Page 7 #1 in Rigid Barrier Packaging Leader in energy efficient TPO Roofing Packaging Technologies Color & Specialty Compounds |

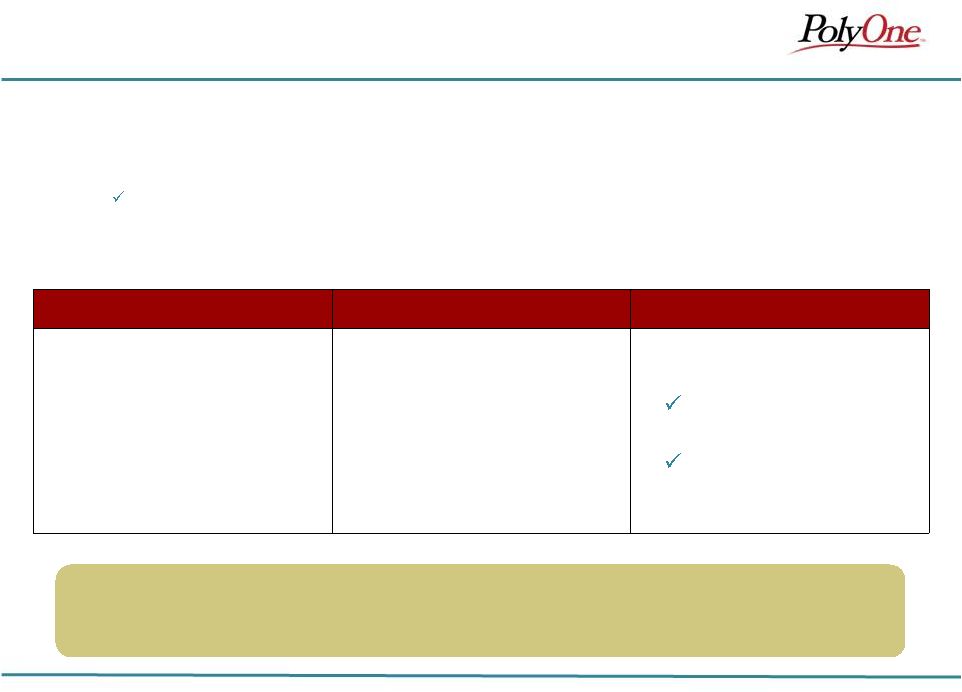

Acquisition Aligned with Four-Pillar Strategy Page 8 Specialization Commercial Excellence Operational Excellence • Market leading positions in roughly 60% of its business • Adds adjacent technology and designed solutions across several attractive market segments and applications • Leadership in rigid barrier packaging provides opportunity to capitalize on PolyOne barrier additive technology • Mix shift: from Volume to Value • Establish Lean Six Sigma as way of life • Plant rationalization aligned with the voice of the customer • Elimination of redundant corporate overhead • Raw material savings • Expanded solutions across key markets including packaging, aerospace, healthcare, transportation and consumer • Accelerate sales force efficiency and effectiveness • Substantial cross-selling potential exists Color & additives Distribution • Mix shift: from Volume to Value Globalization • Opportunity to capitalize on PolyOne’s global footprint • Leverage relationships with multi-national OEMs to drive expansion of Spartech products |

Healthcare / Medical • Medical device packaging • Medical test strips Aerospace and Security • Cast acrylic canopies • Flame retardant / fire-rated • Bullet resistant barriers • Aircraft cabin windows Examples of Spartech Specialty Products • Beverage Pods • Single-serve dairy (yogurt, cottage cheese) • Shelf-stable foods • 1-Seal Technology End Markets Examples of Spartech Specialty Applications Consumer Packaging Page 9 |

The PolyOne Transformation “Doing What We Do Best” |

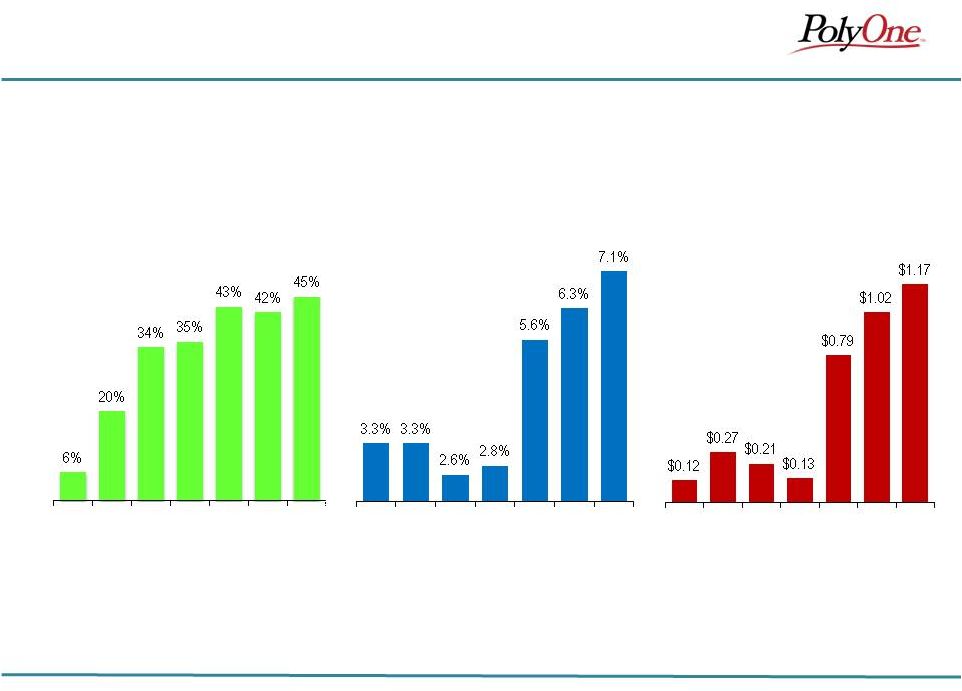

CAGR = 43.2% Specialty Operating Income Mix CAGR = 46.2% Accelerating Growth PolyOne Adjusted Operating Income % of Sales Adjusted EPS $13M $46M $87M $111M $31M $46M $89M Page 11 OI CAGR = 15.7% '06 '07 '08 '09 '10 '11 3Q '12 LTM '06 '07 '08 '09 '10 '11 3Q '12 LTM '06 '07 '08 '09 '10 '11 3Q '12 LTM |

Old PolyOne Transformation *Operating Income excludes corporate charges and special items ** Pro forma for the acquisition of ColorMatrix and divestiture of SunBelt Specialty OI $5M $46M $89M $117M Target Mix Shift Highlights Specialty Transformation PolyOne 2015 Target Page 12 34% 42% 50% 65-75% 0% 20% 40% 60% 80% 100% 2005 2008 2011 2011** 2015 JV's PP&S Distribution Specialty 2% |

Proof of Performance PolyOne *ROIC is defined as TTM adjusted OI divided by the sum of average debt and equity over a 5 quarter period Page 13 2007 2012 Target YTD 9/30/12 “Where we were” “What we said” “Where we are” 1) Operating Income % Specialty 3.2% 10% - 12% 9.7% PP&S 6.1% 8% - 10% 9.3% Distribution 3.0% 4% - 5% 6.3% 2) Specialty Platform % of Operating Income 20% >50% 46% 3) Specialty Vitality Index 21% 35% - 40% 46% 4) ROIC* (pre-tax) 11% >15% 17% 5) Sales outside the US 37% >40% 39% |

Page 14 PolyOne Spartech Opportunity Proof of Performance Spartech Opportunity 2006 YTD 9/30/12 Today Intermediate Goal “Where we were” “Where we are” “Where Spartech is” “Where we can go” Specialty Operating Margin 1.5% 9.7% 1.8% 8.0% – 10.0 |

Achievable Synergies • Near-term and preliminary annualized synergies estimated at $65 million Achieved over a 3-year period • One-time cash cost to achieve synergies is estimated at ~$60 million Page 15 Commercial Operations Administration • Value based selling to drive margin expansion • Cross-selling • Leverage relationships to drive specialty growth and differentiation • Align manufacturing network with voice of customer • Sourcing savings • Lean Six Sigma to drive further operational gain • Elimination of redundant overhead Duplicate public company costs Corporate governance Synergy plan doubles the pace of transformation executed at PolyOne since 2006 – doing what we have proven we can do |

Financial Highlights • Purchase Price of $8.00 per share, 33.34% cash and 66.66% stock consideration Plan to complete repurchase of stock issued in the transaction within 12-18 months after closing • Each Spartech share exchanged for $2.67 in cash and 0.3167 shares of PolyOne stock • $393 million total enterprise value, including approximately $142 million of Spartech net debt • 7.4x LTM EBITDA • 3.3x LTM EBITDA including run-rate synergies Transaction Overview Pro Forma Financial Impact Page 16 • Expected to be accretive to EPS in year 1 following acquisition • Preliminary annual synergies estimated to be $65 million • Expected EPS accretion of approximately $0.50 once full value of synergies are realized |

Financing and Share Repurchase Plan Page 17 • Committed financing in place to support transaction New long-term debt of $250 million • Expanded revolver that will allow us to incorporate Spartech assets Undrawn at closing • At closing, between the undrawn revolver and balance sheet cash, we anticipate having liquidity of approximately $500 million that can be used for: Operating needs Restructuring costs Expanded share repurchases Bolt-on acquisition opportunities • Pro forma net debt / EBITDA of 2.1x • Board authorization to repurchase 20 million shares • After closing, PolyOne expects to opportunistically repurchase shares issued in the transaction • In addition, as previously announced, PolyOne also intends to continue to opportunistically repurchase approximately 2 million shares per year to offset employee issuances and reduce outstanding shares • Expect to complete repurchases within 12-18 months post-closing funded through free cash flow, balance sheet cash and revolver capacity At Closing Post-Closing Share Buyback |

• Expected to close in Q1, 2013 • Spartech stockholder approval • Receipt of necessary regulatory approvals • Completion of standard and customary closing conditions No financing contingency Clear Path to Completion Page 18 |

Summary and Key Takeaways • Strategy remains unchanged Be the world’s premier provider of specialized polymer materials, services and solutions • Spartech expands PolyOne’s breadth of specialty offerings with adjacent technologies in attractive end markets • PolyOne transformation continues with greater upside potential Preliminary annual synergies estimated to be $65 million • Substantial share price appreciation potential for all shareholders Accretive to EPS in first full year post-acquisition / $0.50 once preliminary estimate of synergies achieved Page 19 |