Drexel-Hamilton Road Show September 9, 2014 Christopher Oddleifson – Chief Executive Officer Robert Cozzone – Chief Financial Officer and Treasurer Exhibit 99.1

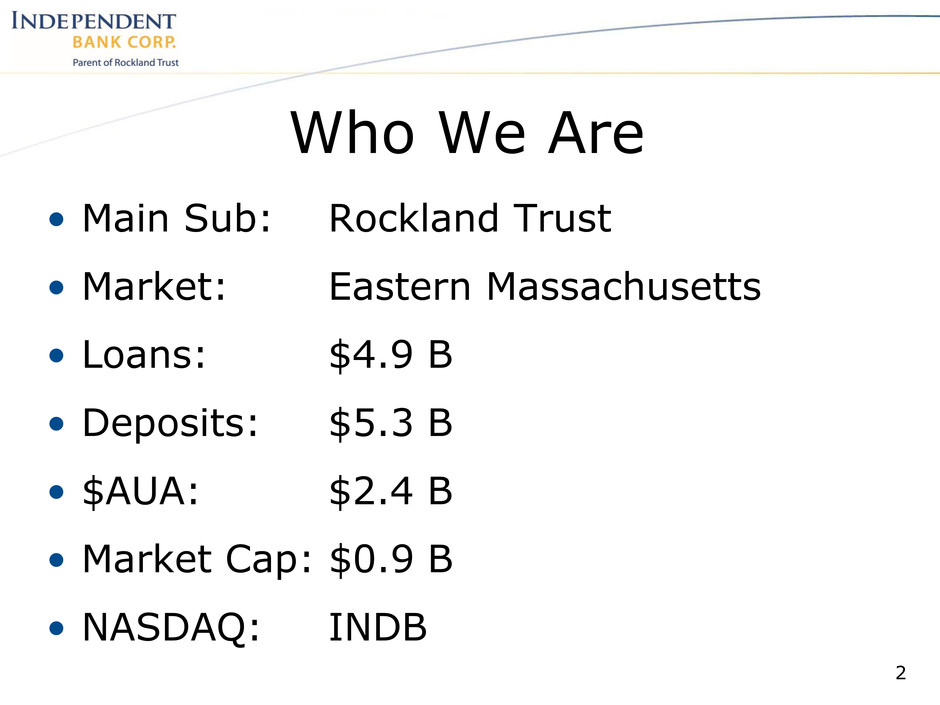

• Main Sub: Rockland Trust • Market: Eastern Massachusetts • Loans: $4.9 B • Deposits: $5.3 B • $AUA: $2.4 B • Market Cap: $0.9 B • NASDAQ: INDB Who We Are 2

• Track record of consistent, solid performance • Expanding/strengthening footprint and share • Well-positioned competitively • Growing fee revenue sources • Disciplined risk management culture • Strong capital/TBV steadily rising • Raising the bar on operational excellence Key Messages 3

• Record operating EPS performance ($2.39) in 2013 • Excellent commercial loan and core deposit growth • Very successful customer acquisition campaigns • Deposit households up 5% (MA growth <1%) • Growing franchise value via accretive acquisitions • Opened first office in downtown Boston • Multiple 3rd party recognition of excellence INDB Recent Accomplishments 4

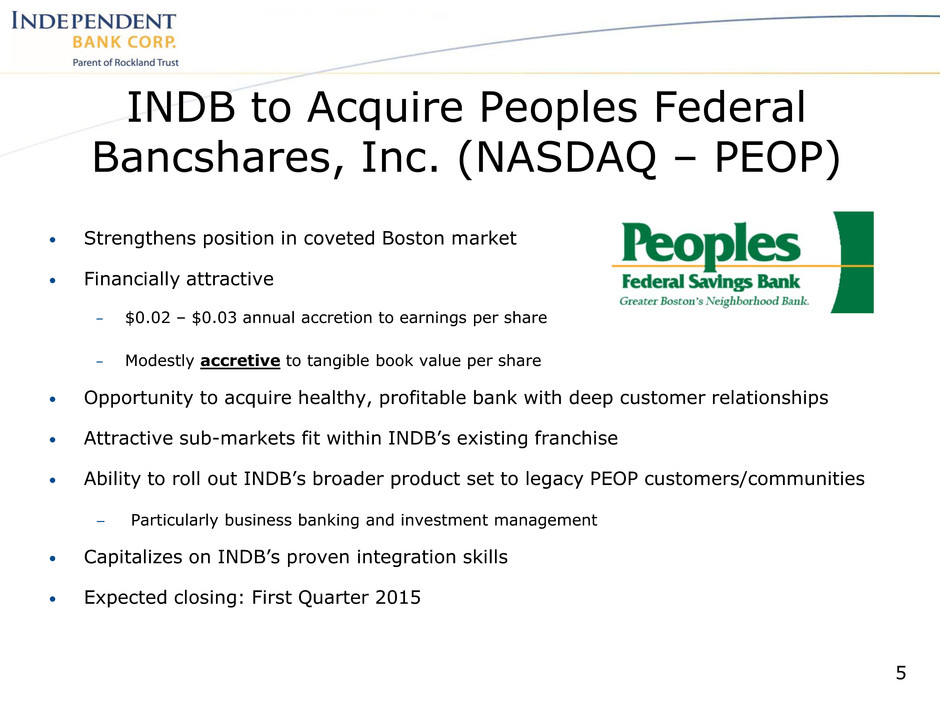

• Strengthens position in coveted Boston market • Financially attractive – $0.02 – $0.03 annual accretion to earnings per share – Modestly accretive to tangible book value per share • Opportunity to acquire healthy, profitable bank with deep customer relationships • Attractive sub-markets fit within INDB’s existing franchise • Ability to roll out INDB’s broader product set to legacy PEOP customers/communities − Particularly business banking and investment management • Capitalizes on INDB’s proven integration skills • Expected closing: First Quarter 2015 INDB to Acquire Peoples Federal Bancshares, Inc. (NASDAQ – PEOP) 5

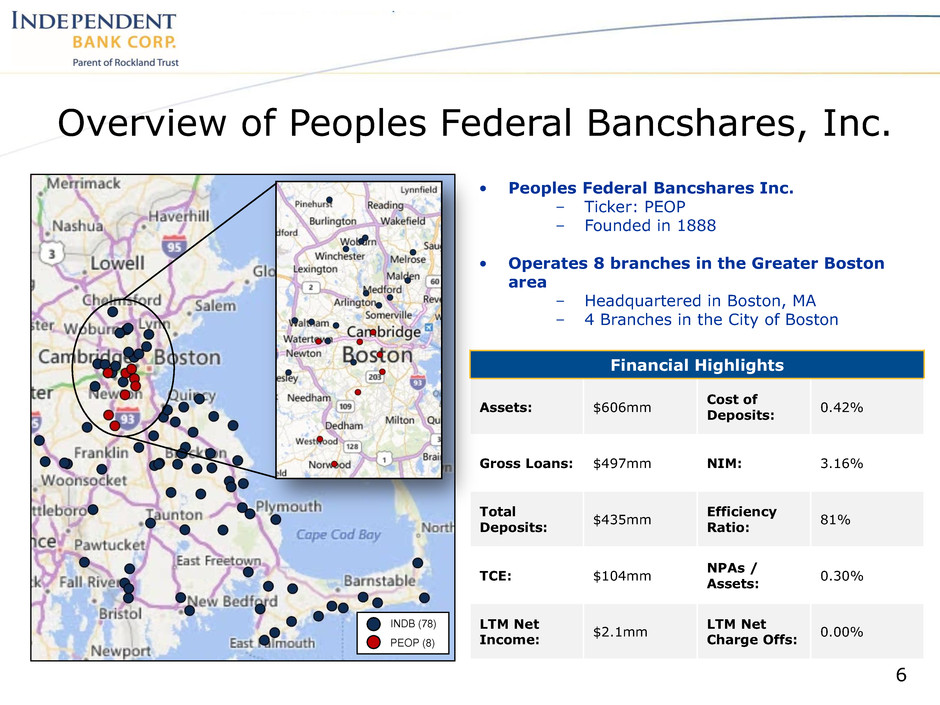

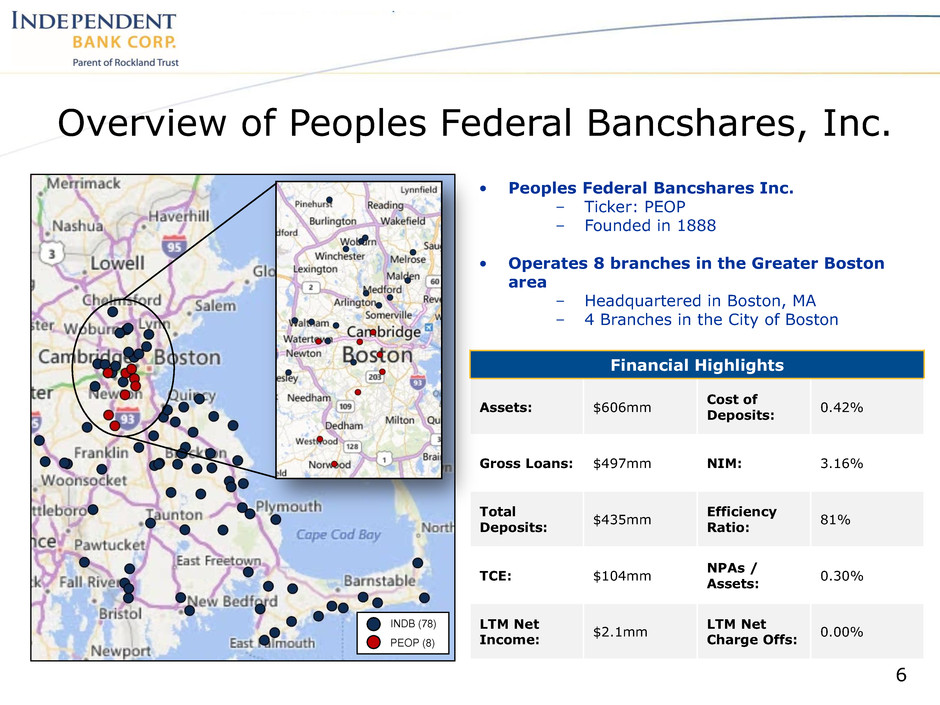

Overview of Peoples Federal Bancshares, Inc. • Peoples Federal Bancshares Inc. – Ticker: PEOP – Founded in 1888 • Operates 8 branches in the Greater Boston area – Headquartered in Boston, MA – 4 Branches in the City of Boston Financial Highlights Assets: $606mm Cost of Deposits: 0.42% Gross Loans: $497mm NIM: 3.16% Total Deposits: $435mm Efficiency Ratio: 81% TCE: $104mm NPAs / Assets: 0.30% LTM Net Income: $2.1mm LTM Net Charge Offs: 0.00% 6 INDB (78) PEOP (8)

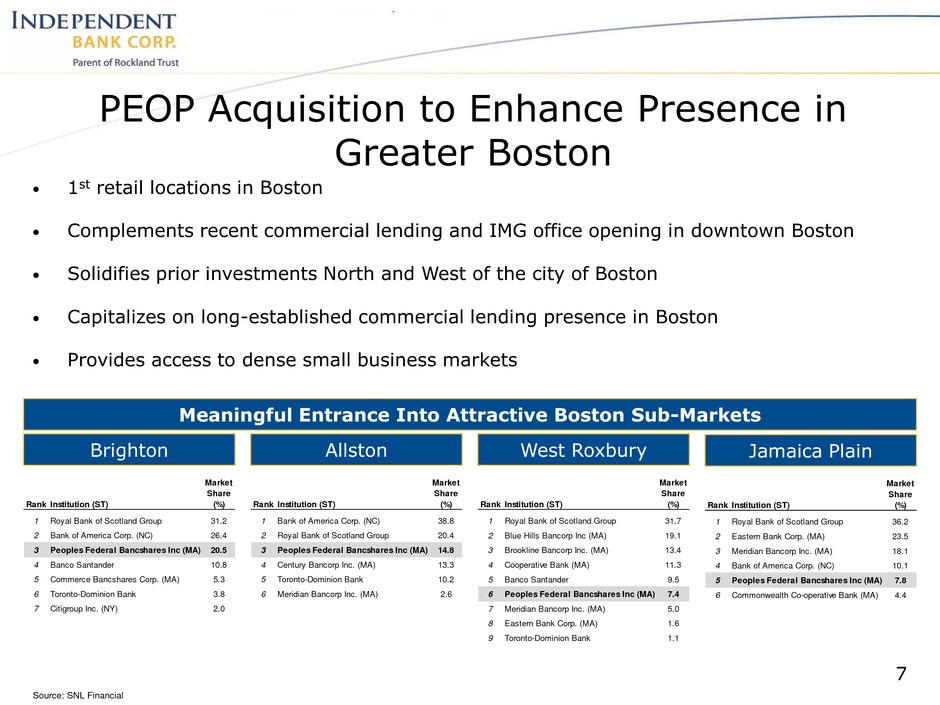

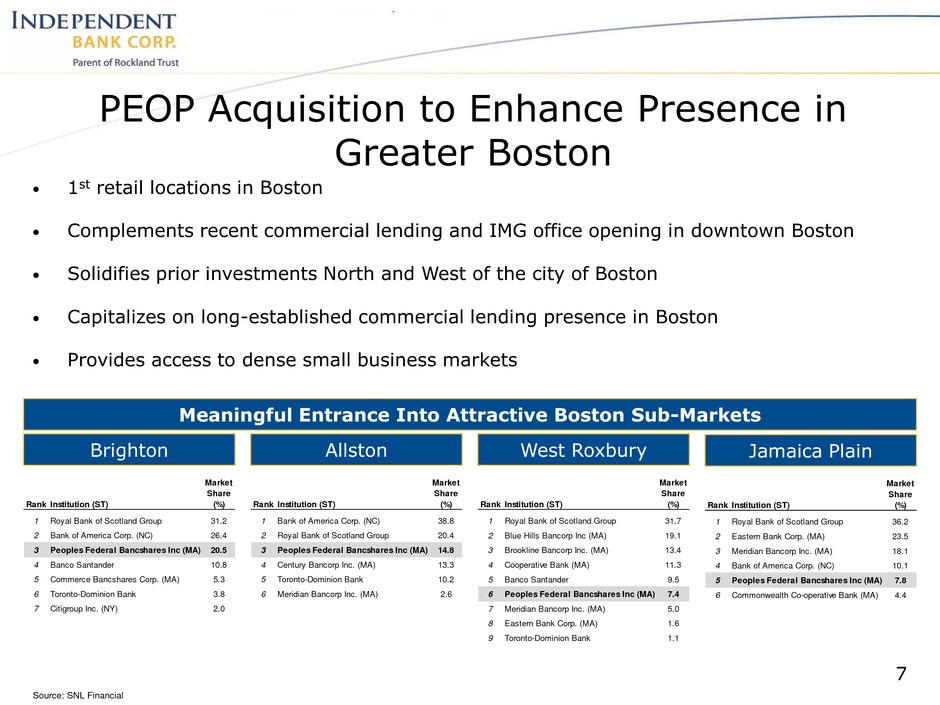

• 1st retail locations in Boston • Complements recent commercial lending and IMG office opening in downtown Boston • Solidifies prior investments North and West of the city of Boston • Capitalizes on long-established commercial lending presence in Boston • Provides access to dense small business markets 7 PEOP Acquisition to Enhance Presence in Greater Boston Meaningful Entrance Into Attractive Boston Sub-Markets Brighton Jamaica Plain West Roxbury Allston Rank Institution (ST) Market Share (%) 1 Royal Bank of Scotland Group 31.2 2 Bank of America Corp. (NC) 26.4 3 Peoples Federal Bancshares Inc (MA) 20.5 4 Banco Santander 10.8 5 Commerce Bancshares Corp. (MA) 5.3 6 Toronto-Dominion Bank 3.8 7 Citigroup Inc. (NY) 2.0 Rank Institution (ST) Market Share (%) 1 Royal Bank of Scotland Group 36.2 2 Eastern Bank Corp. (MA) 23.5 3 Meridian Bancorp Inc. (MA) 18.1 4 Bank of America Corp. (NC) 10.1 5 Peoples Federal Bancshares Inc (MA) 7.8 6 Commonwealth Co-operative Bank (MA) 4.4 Rank Institution (ST) Market Share (%) 1 Royal Bank of Scotland Group 31.7 2 Blue Hills Bancorp Inc (MA) 19.1 3 Brookline Bancorp Inc. (MA) 13.4 4 Cooperative Bank (MA) 11.3 5 Banco Santander 9.5 6 Peoples Federal Bancshares Inc (MA) 7.4 7 Meridian Bancorp Inc. (MA) 5.0 8 Eastern Bank Corp. (MA) 1.6 9 Toronto-Dominion Bank 1.1 Rank Institution (ST) Market Share (%) 1 Bank of America Corp. (NC) 38.8 2 Royal Bank of S otland Group 20.4 3 Peoples Federal Bancshares Inc (MA) 14.8 4 Century Bancorp Inc. (MA) 13.3 5 Toronto-Dominion Bank 10.2 6 Meridian Bancorp Inc. (MA) 2.6 Source: SNL Financial

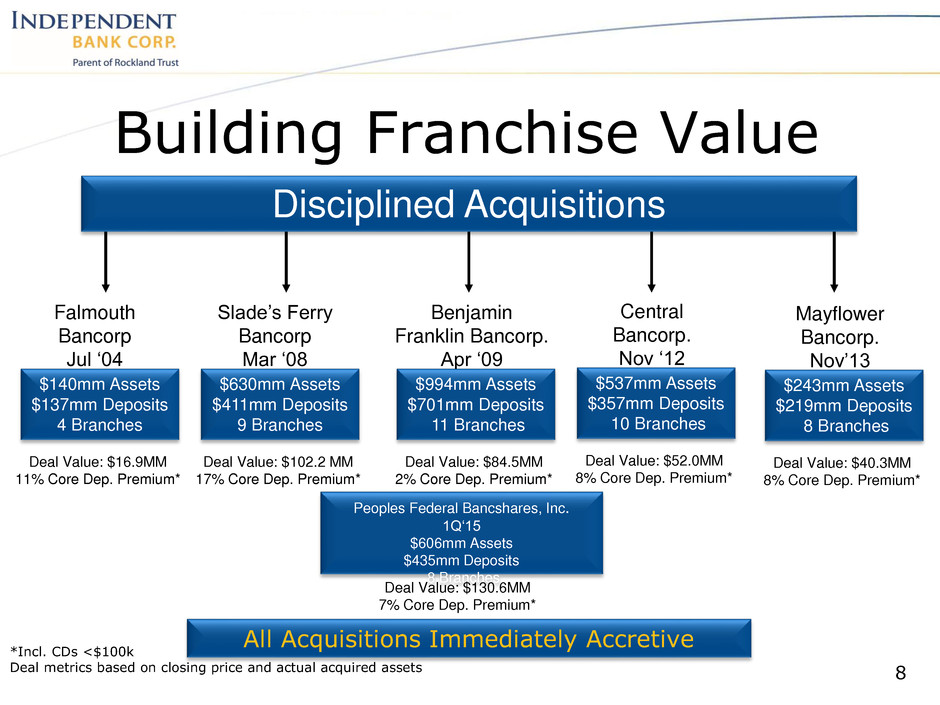

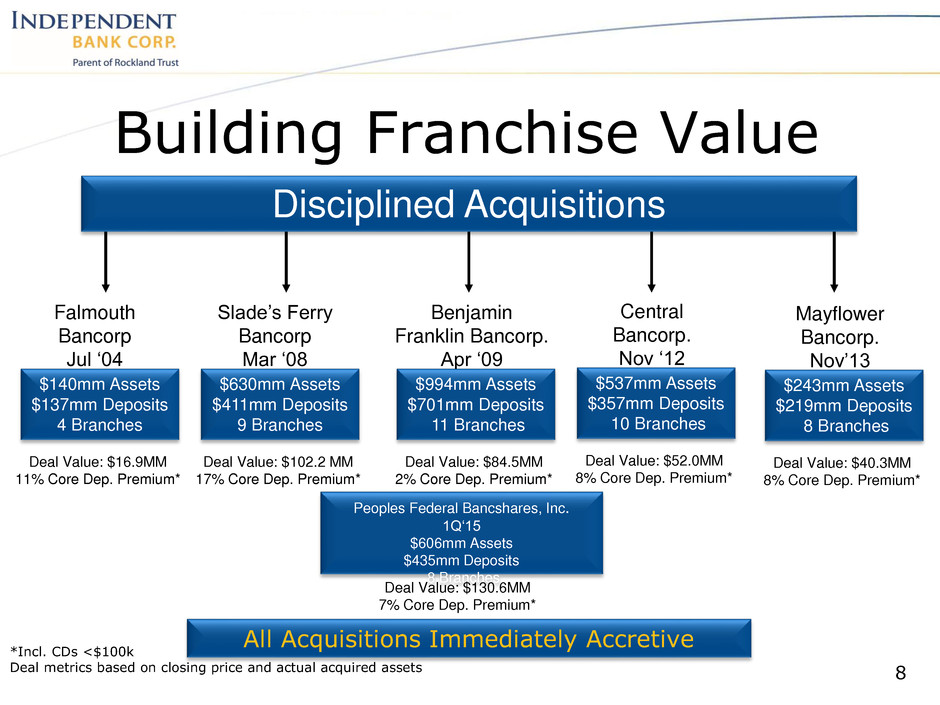

Building Franchise Value 8 All Acquisitions Immediately Accretive Deal Value: $16.9MM 11% Core Dep. Premium* Falmouth Bancorp Jul ‘04 $140mm Assets $137mm Deposits 4 Branches Deal Value: $102.2 MM 17% Core Dep. Premium* Slade’s Ferry Bancorp Mar ‘08 $630mm Assets $411mm Deposits 9 Branches Deal Value: $84.5MM 2% Core Dep. Premium* Benjamin Franklin Bancorp. Apr ‘09 $994mm Assets $701mm Deposits 11 Branches Deal Value: $52.0MM 8% Core Dep. Premium* Central Bancorp. Nov ‘12 $537mm Assets $357mm Deposits 10 Branches Disciplined Acquisitions *Incl. CDs <$100k Deal metrics based on closing price and actual acquired assets Deal Value: $40.3MM 8% Core Dep. Premium* Mayflower Bancorp. Nov’13 $243mm Assets $219mm Deposits 8 Branches Peoples Federal Bancshares, Inc. 1Q‘15 $606mm Assets $435mm Deposits 8 Branches Deal Value: $130.6MM 7% Core Dep. Premium*

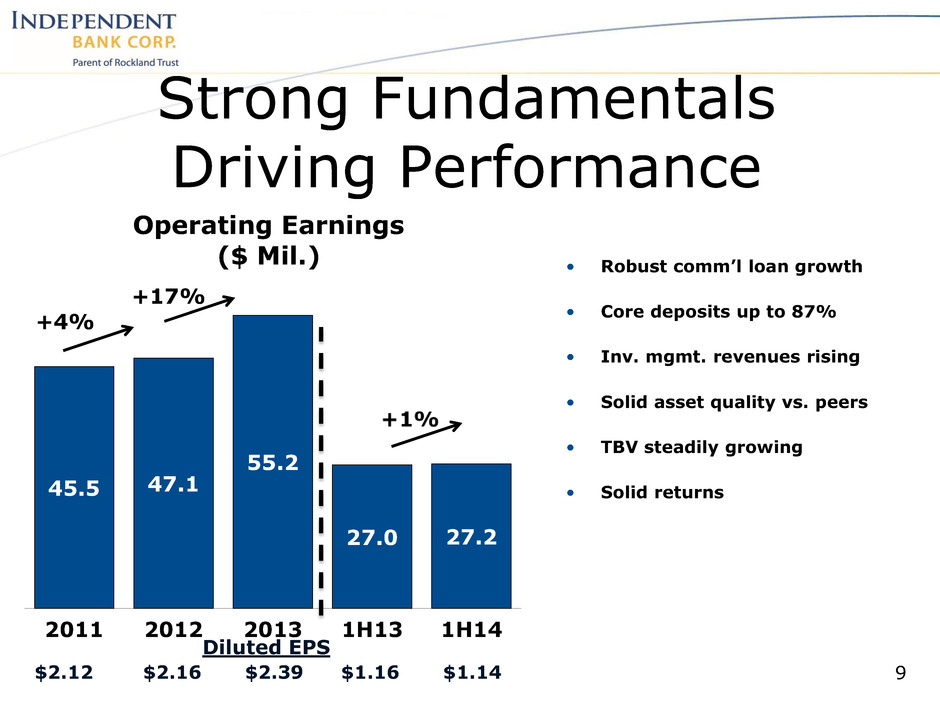

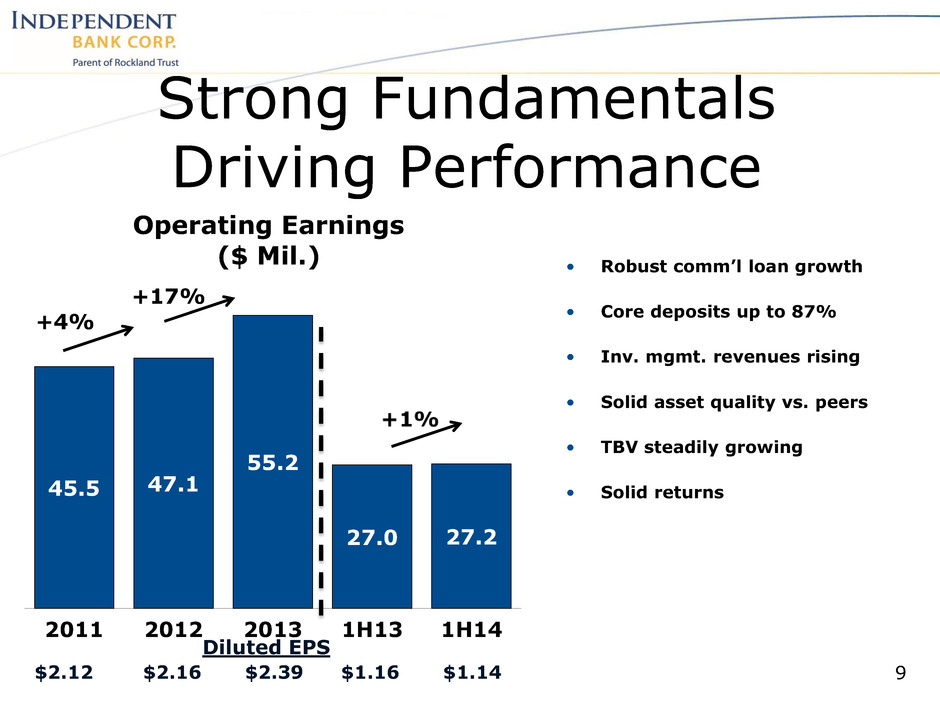

Strong Fundamentals Driving Performance 9 45.5 47.1 55.2 27.0 27.2 2011 2012 2013 1H13 1H14 Operating Earnings ($ Mil.) +17% Diluted EPS $2.12 $2.16 $2.39 $1.16 $1.14 +4% • Robust comm’l loan growth • Core deposits up to 87% • Inv. mgmt. revenues rising • Solid asset quality vs. peers • TBV steadily growing • Solid returns

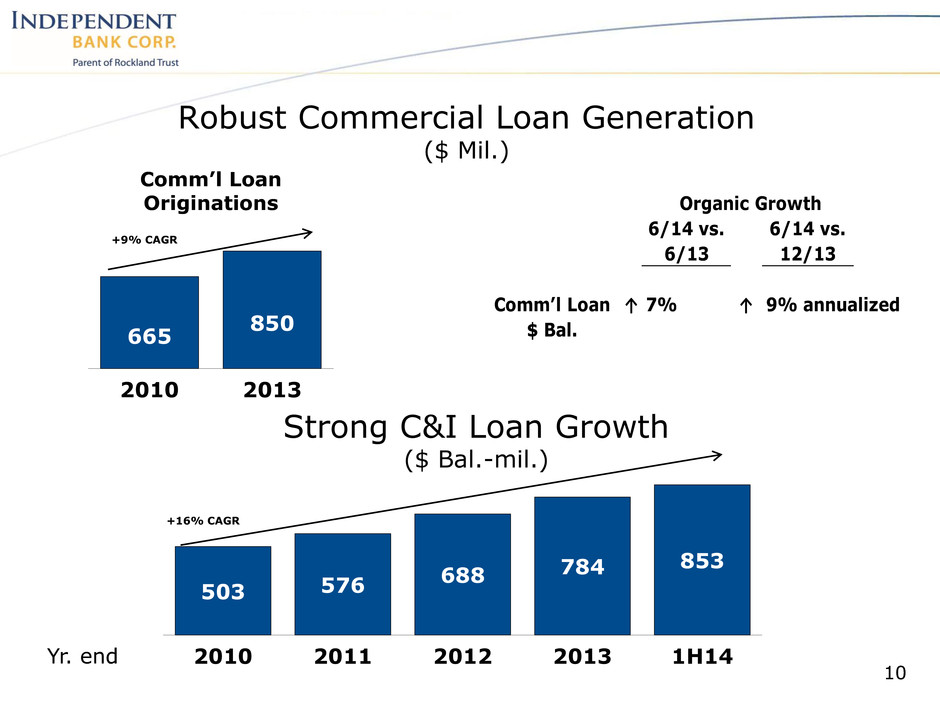

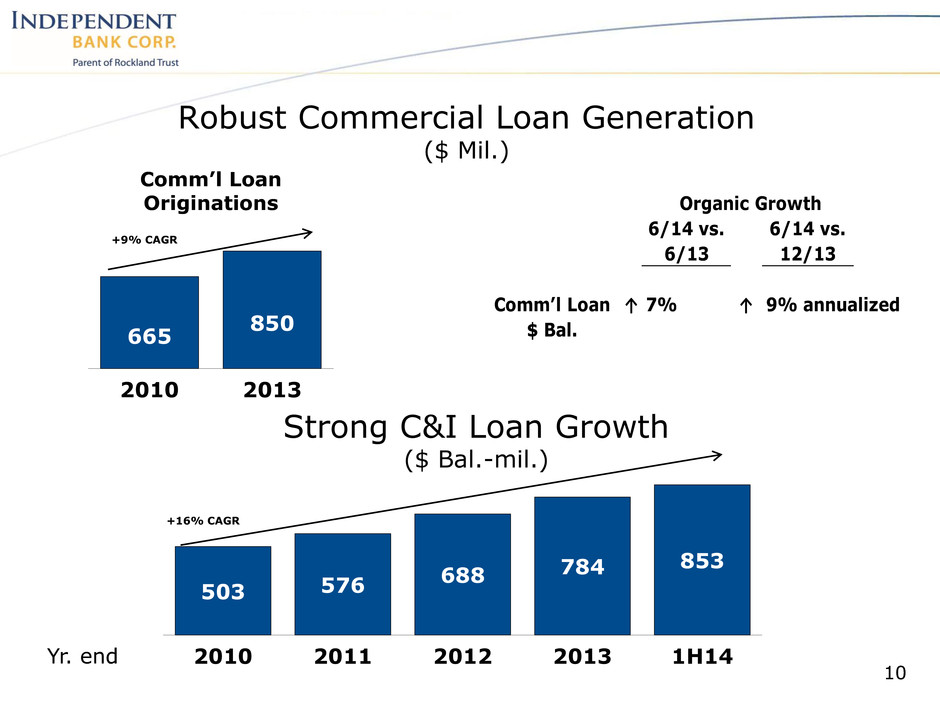

6/14 vs. 6/13 6/14 vs. 12/13 ↑ 7% ↑ 9% annualizedComm’l Loan $ Bal. Organic Growth 503 576 688 784 853 2010 2011 2012 2013 1H14 +16% CAGR Robust Commercial Loan Generation ($ Mil.) 10 665 850 2010 2013 Comm’l Loan Originations +9% CAGR Strong C&I Loan Growth ($ Bal.-mil.) Yr. end

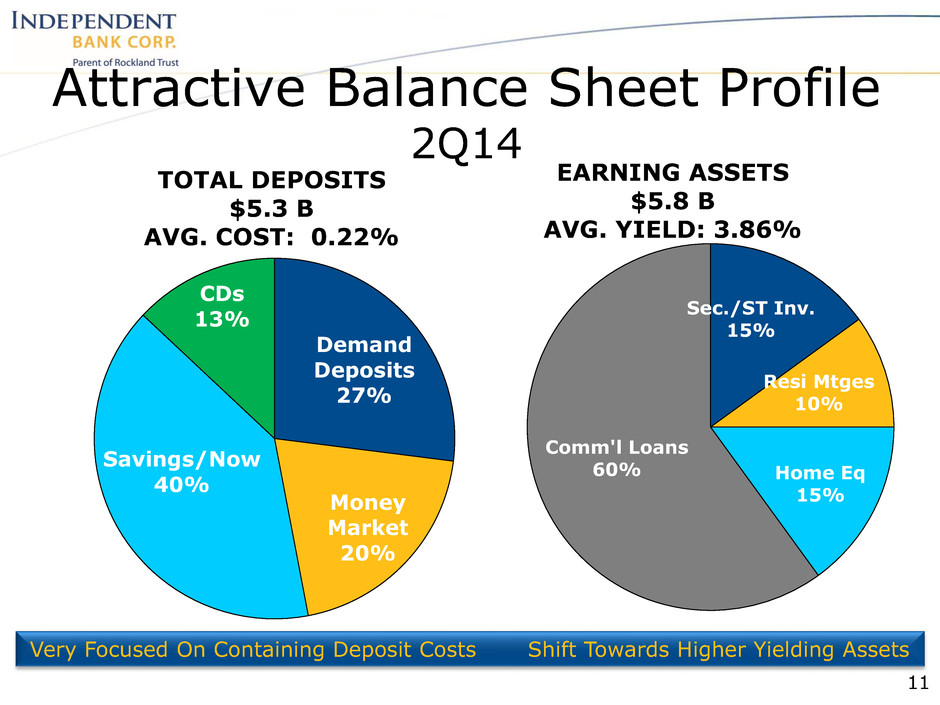

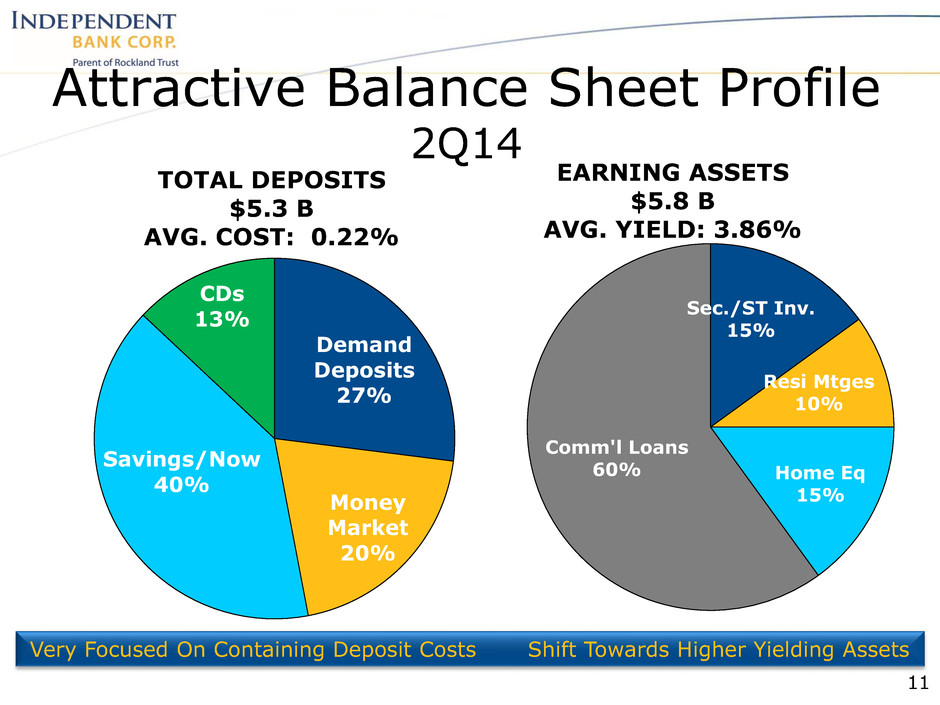

Attractive Balance Sheet Profile 2Q14 Sec./ST Inv. 15% Resi Mtges 10% Home Eq 15% Comm'l Loans 60% EARNING ASSETS $5.8 B AVG. YIELD: 3.86% Very Focused On Containing Deposit Costs Shift Towards Higher Yielding Assets Demand Deposits 27% Money Market 20% Savings/Now 40% CDs 13% TOTAL DEPOSITS $5.3 B AVG. COST: 0.22% 11

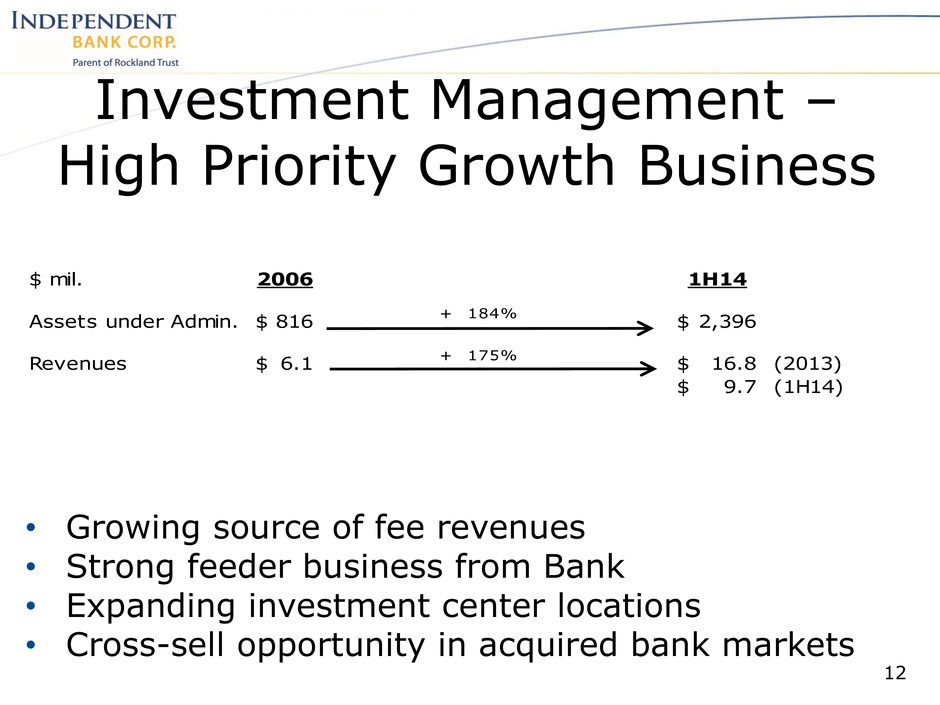

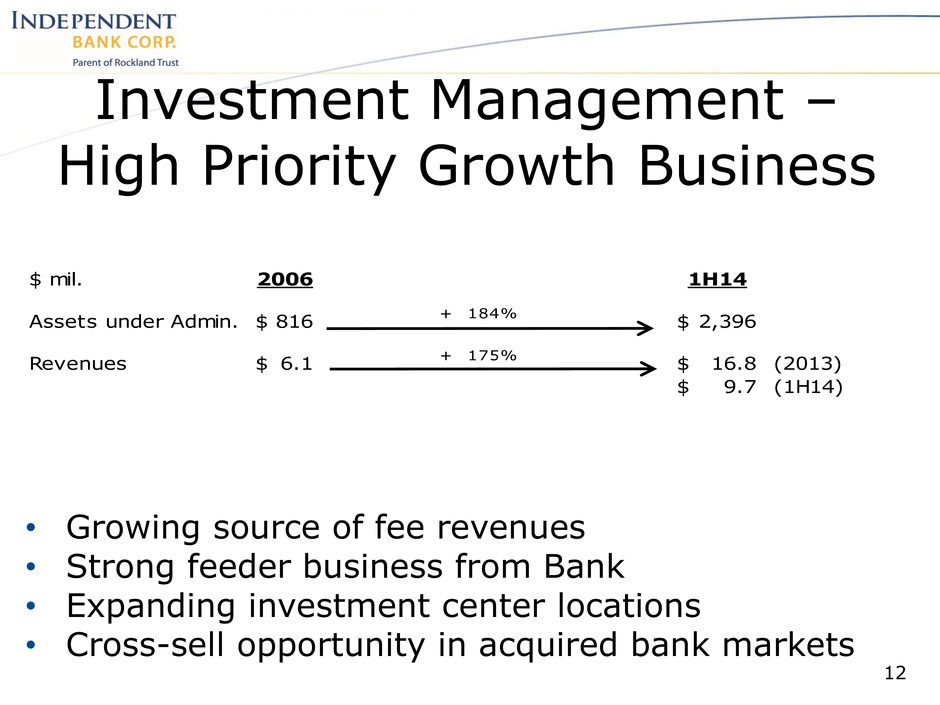

Investment Management – High Priority Growth Business 12 • Growing source of fee revenues • Strong feeder business from Bank • Expanding investment center locations • Cross-sell opportunity in acquired bank markets $ mil. 2006 1H14 Assets under Admin. 816$ + 184% 2,396$ Revenues 6.1$ + 175% 16.8$ (2013) 9.7 (1H 4)

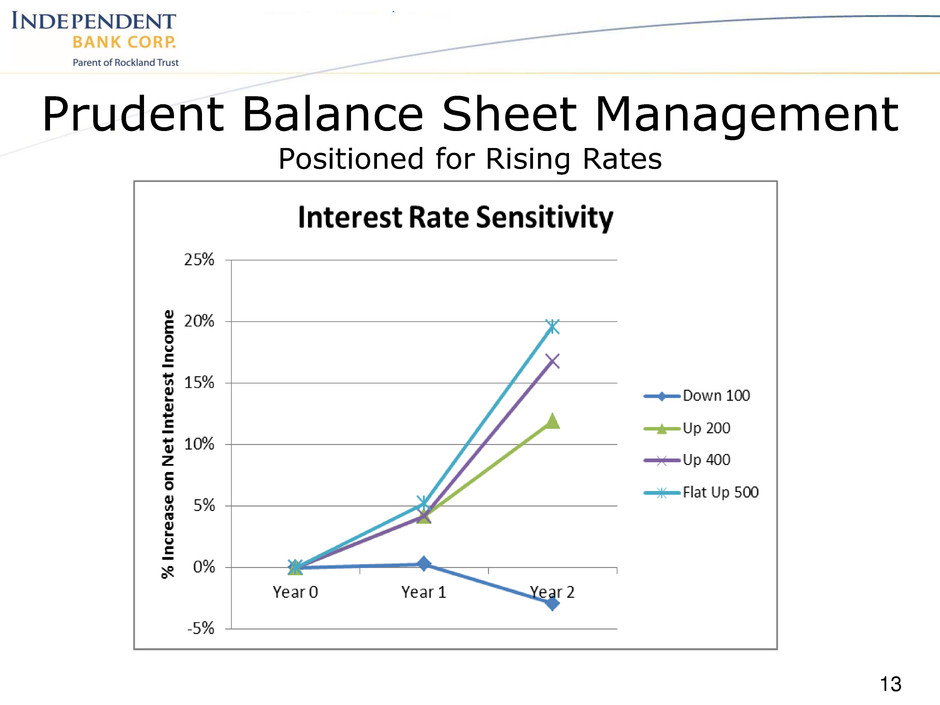

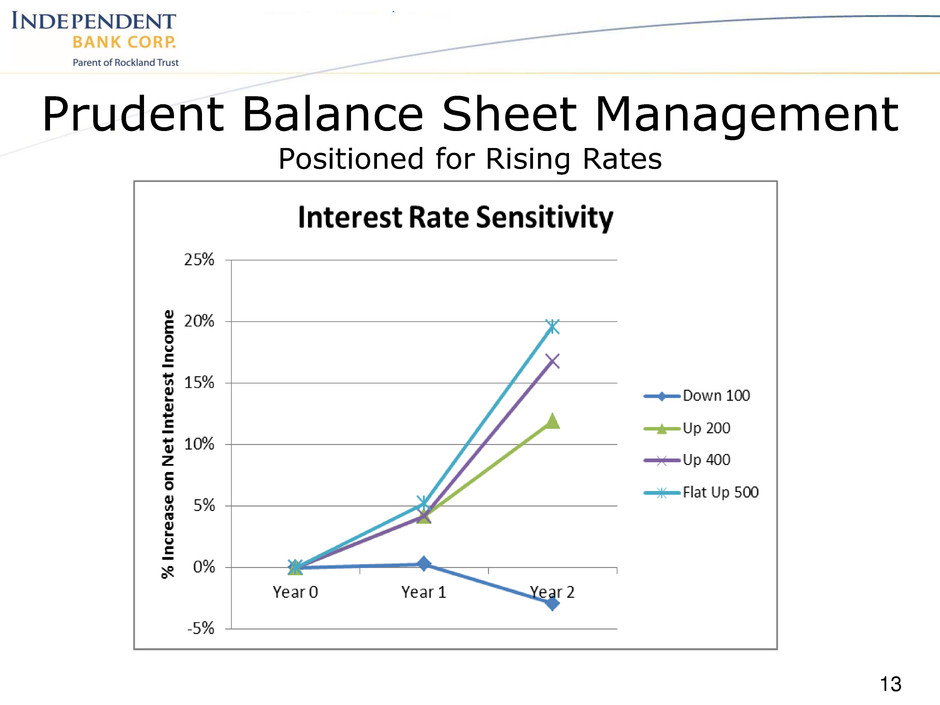

13 Prudent Balance Sheet Management Positioned for Rising Rates

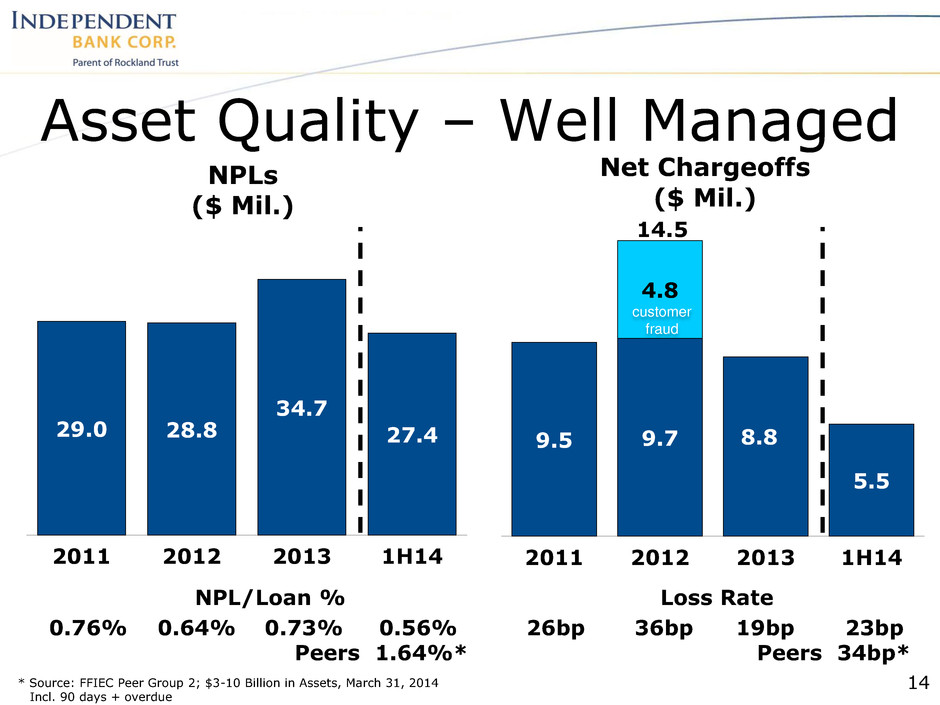

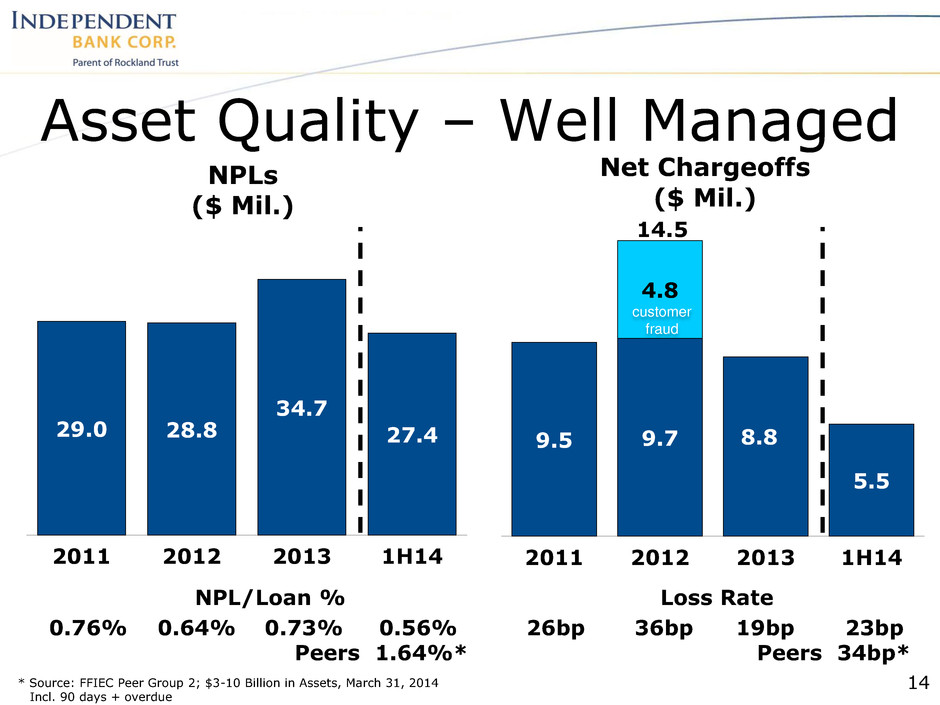

Asset Quality – Well Managed 29.0 28.8 34.7 27.4 2011 2012 2013 1H14 NPLs ($ Mil.) 9.5 9.7 8.8 5.5 4.8 2011 2012 2013 1H14 Net Chargeoffs ($ Mil.) customer fraud 14.5 customer fraud NPL/Loan % 0.76% 0.64% 0.73% 0.56% Peers 1.64%* Loss Rate 26bp 36bp 19bp 23bp Peers 34bp* * Source: FFIEC Peer Group 2; $3-10 Billion in Assets, March 31, 2014 Incl. 90 days + overdue 14

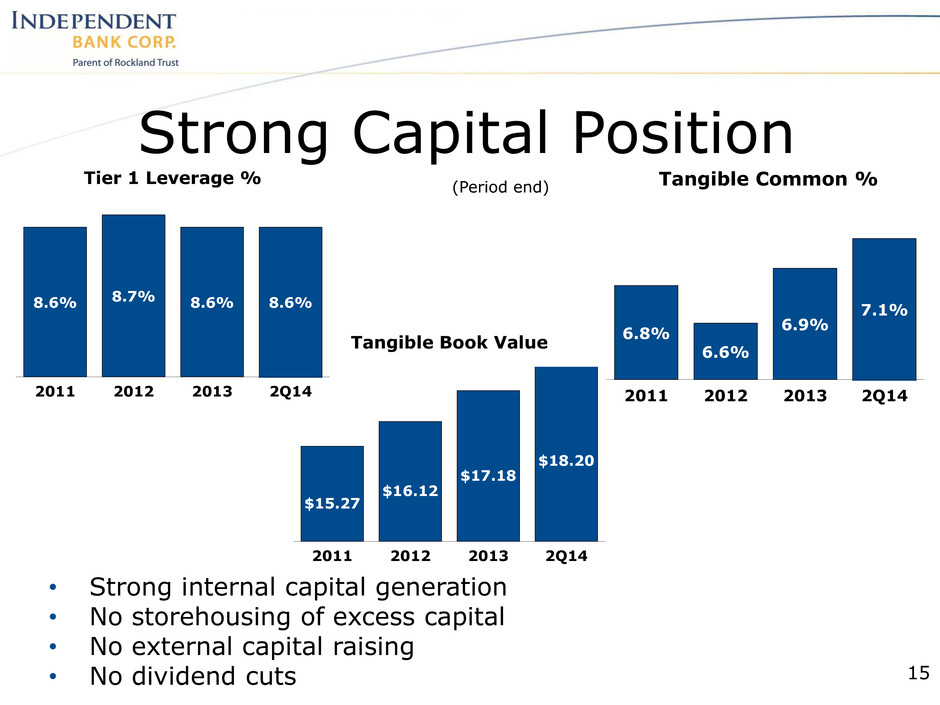

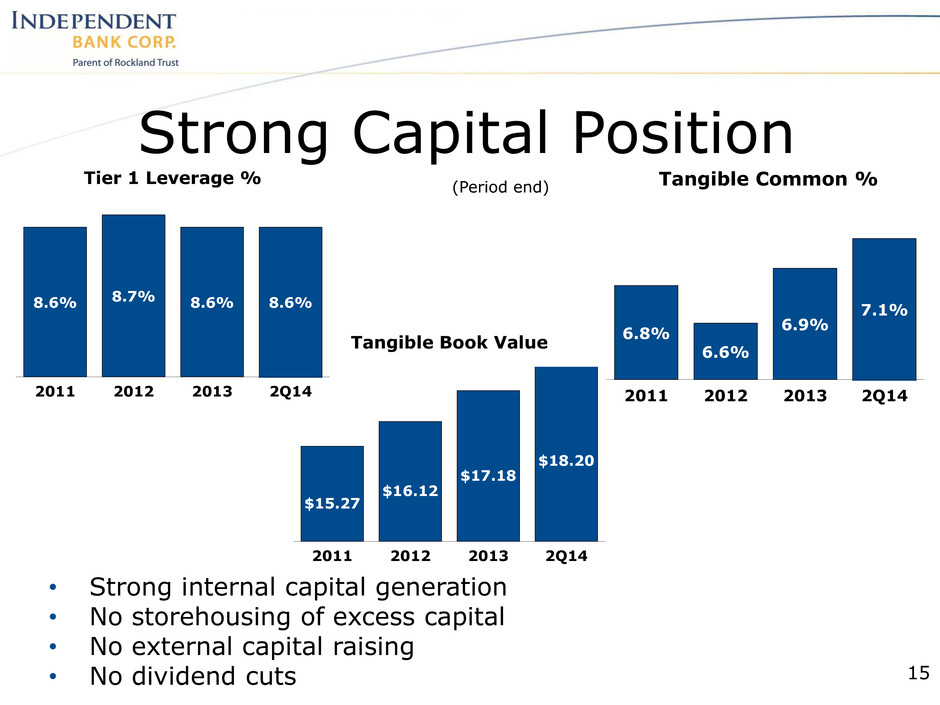

• Strong internal capital generation • No storehousing of excess capital • No external capital raising • No dividend cuts Strong Capital Position 15 8.6% 8.7% 8.6% 8.6% 2011 2012 2013 2Q14 Tier 1 Leverage % 6.8% 6.6% 6.9% 7.1% 2011 2012 2013 2Q14 Tangible Common % $15.27 $16.12 $17.18 $18.20 2011 2012 2013 2Q14 Tangible Book Value (Period end)

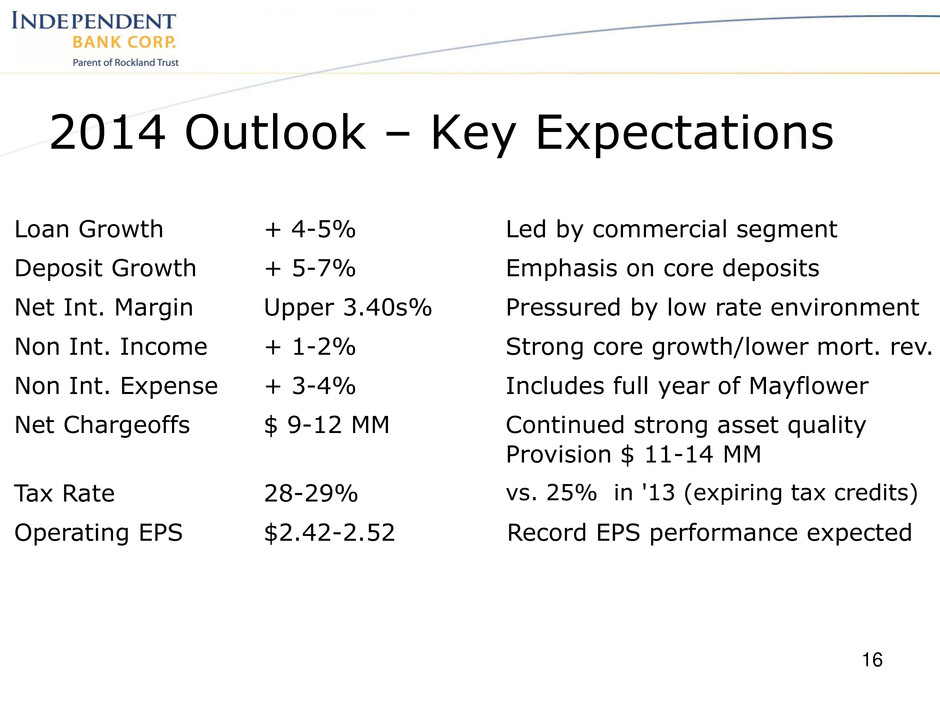

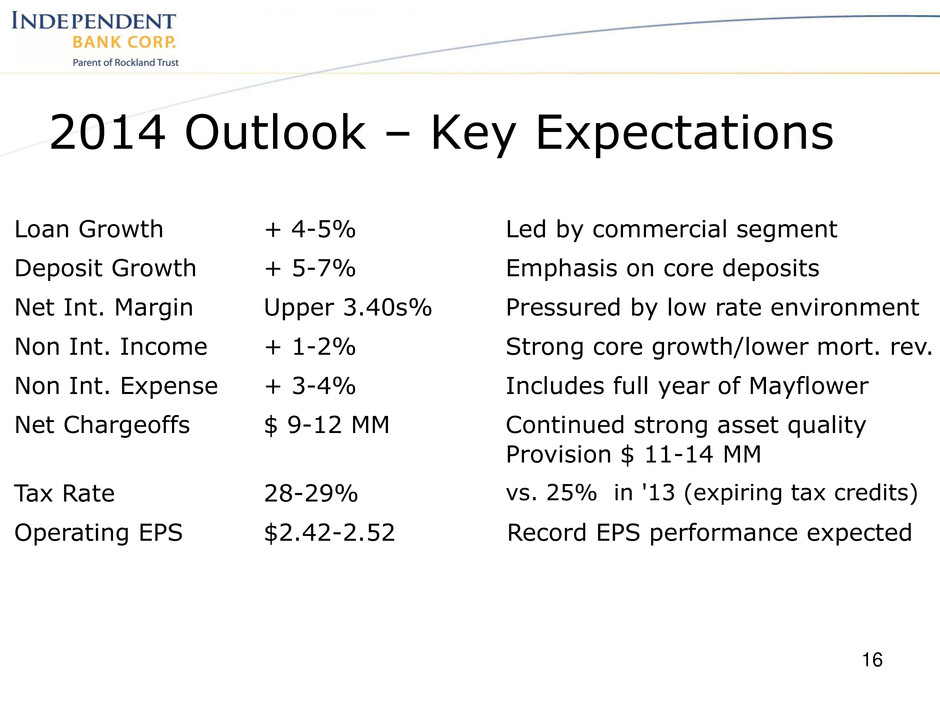

2014 Outlook – Key Expectations 16 Loan Growth + 4-5% Led by commercial segment Deposit Growth + 5-7% Emphasis on core deposits Net Int. Margin Upper 3.40s% Pressured by low rate environment Non Int. Income + 1-2% Strong core growth/lower mort. rev. Non Int. Expense + 3-4% Includes full year of Mayflower Net Chargeoffs $ 9-12 MM Continued strong asset quality Provision $ 11-14 MM Tax Rate 28-29% vs. 25% in '13 (expiring tax credits) Operating EPS $2.42-2.52 Record EPS performance expected

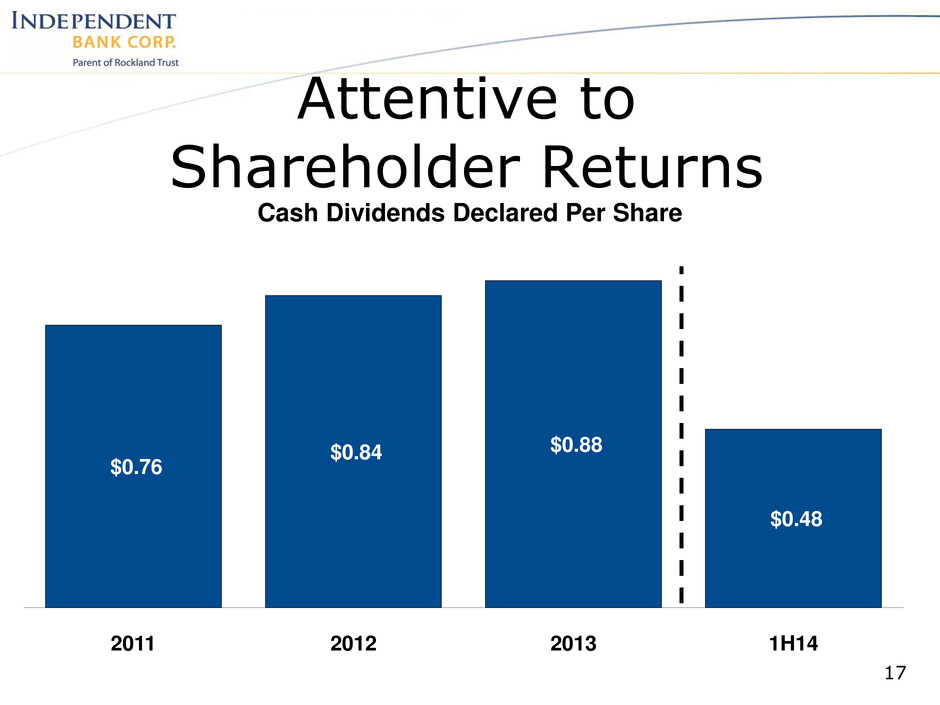

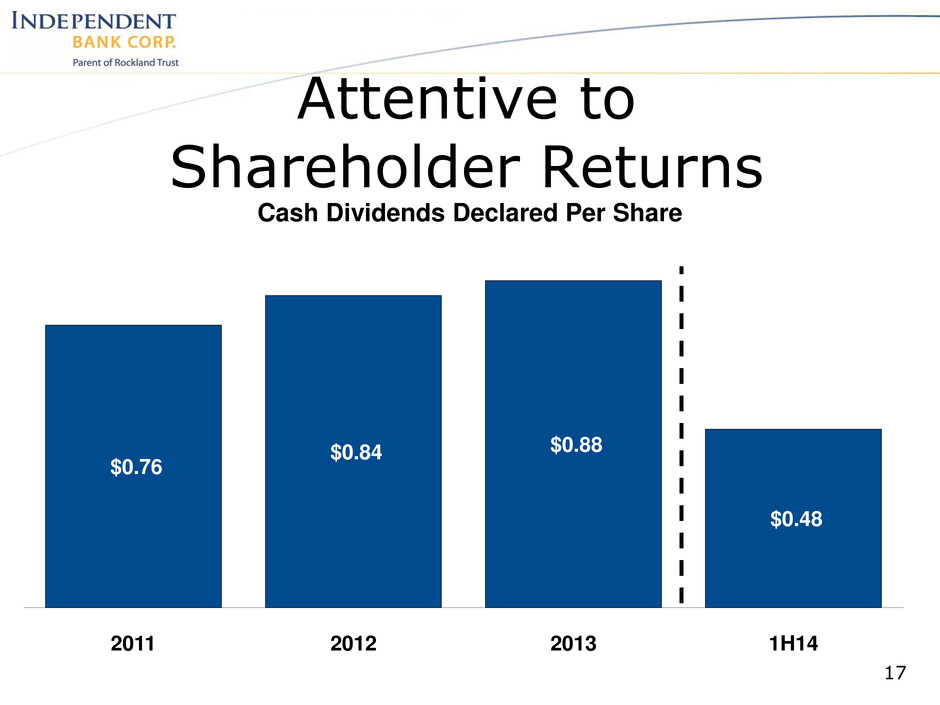

Attentive to Shareholder Returns 17 $0.76 $0.84 $0.88 $0.48 2011 2012 2013 1H14 Cash Dividends Declared Per Share

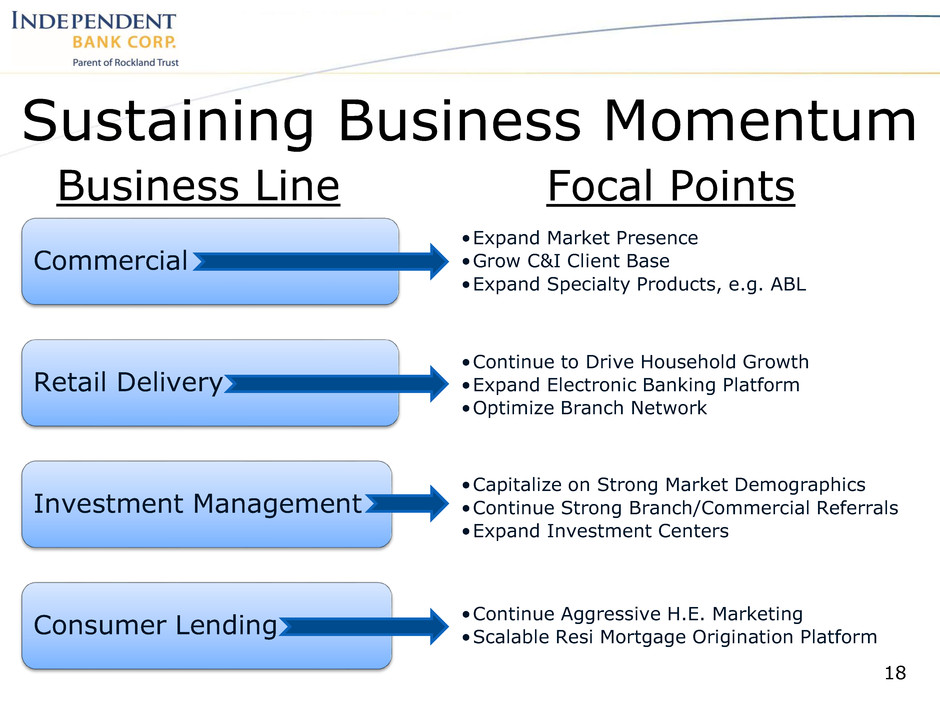

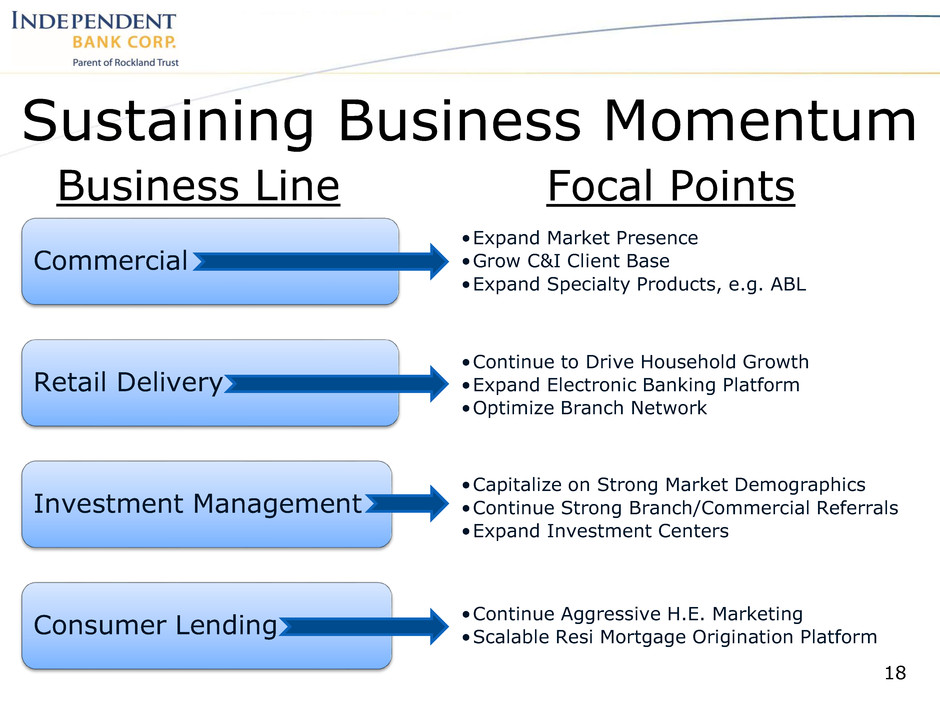

Sustaining Business Momentum 18 Business Line Focal Points •Expand Market Presence •Grow C&I Client Base •Expand Specialty Products, e.g. ABL Commercial •Continue to Drive Household Growth •Expand Electronic Banking Platform •Optimize Branch Network Retail Delivery •Capitalize on Strong Market Demographics •Continue Strong Branch/Commercial Referrals •Expand Investment Centers Investment Management •Continue Aggressive H.E. Marketing •Scalable Resi Mortgage Origination Platform Consumer Lending

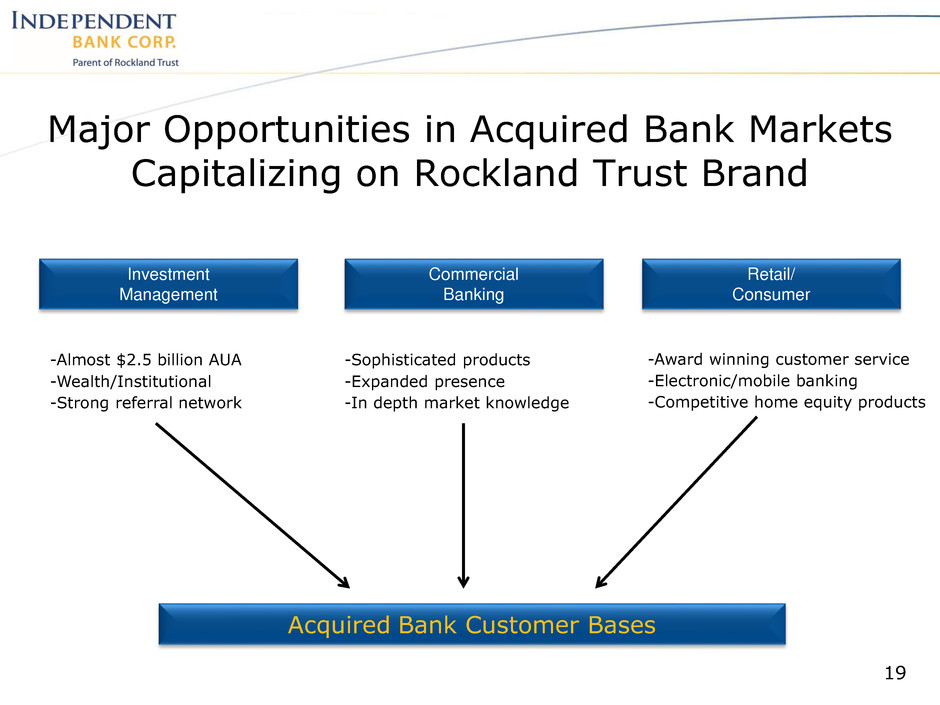

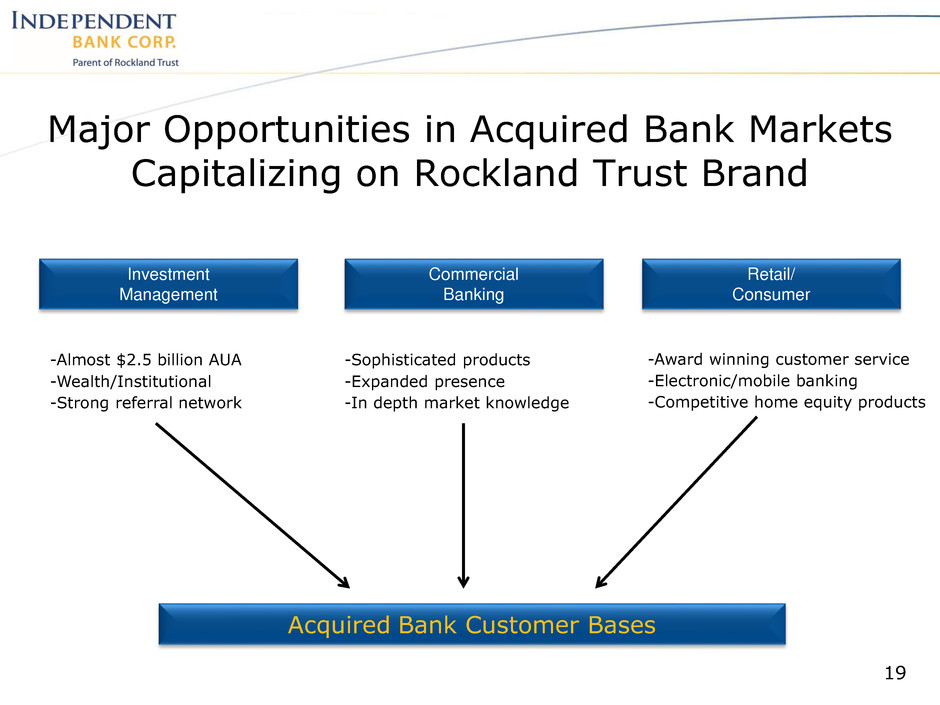

Investment Management Commercial Banking Retail/ Consumer -Almost $2.5 billion AUA -Wealth/Institutional -Strong referral network -Sophisticated products -Expanded presence -In depth market knowledge Acquired Bank Customer Bases -Award winning customer service -Electronic/mobile banking -Competitive home equity products Major Opportunities in Acquired Bank Markets Capitalizing on Rockland Trust Brand 19

20 Augmenting Organic Growth Adjacent Innovation Initiatives • Tax Credit Programs – New Markets Community Development – Affordable Housing Financing • Specialty Lending buildout e.g., Asset-Based • Mobile Banking enhancements • Attracting Senior Talent from within the Region Low-Risk Growth Opportunities

Business Intelligence/Knowledge Management • Further leverage analytics to drive business results • Grow and deepen quality customer relationships • Better align sales, marketing, and relationship management Process Improvement • Focused on cost and quality of delivery • Elevate the customer experience • Embed culture of continuous improvement Raising the Bar on Operational Excellence Key Initiatives 21

• High quality franchise in attractive markets • Strong organic business volumes • Operating platform that can be leveraged further • Capitalizing on in-market consolidation opportunities • Diligent stewards of shareholder capital • Grounded management team • Positioned to grow, build, and acquire to drive long- term value creation INDB – Investment Merits 22

NASDAQ Ticker: INDB www.rocklandtrust.com Robert Cozzone – CFO & Treasurer Shareholder Relations: (781) 878-6100 Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time.