Exhibit 99.1 Independent Bank Corp. Announces Acquisition of Blue Hills Bancorp September 21, 2018 (1)

Forward-Looking Statement Information set forth in this communication, including financial estimates and statements as to the expected timing, completion and effects of the proposed merger, constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the rules, regulations and releases of the Securities and Exchange Commission (the “SEC”). Such forward-looking statements include, but are not limited to, statements about the expected benefits of the merger, including the anticipated impact on Independent Bank Corp.’s (“Independent”) earnings, profitability, expenses, tangible book value, the acquisition’s expected internal rate of return, any other future financial and operating results, Rockland Trust Company’s (“Rockland Trust”) plans to expand its presence in Norfolk, Suffolk and Nantucket Counties and Rockland Trust’s other plans, objectives, expectations and intentions. Any statements that are not statements of historical fact, including statements containing such words as “will,” “could,” “plans,” “intends,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “anticipate,” “estimated,” or similar expressions, should also be considered forward-looking statements, although not all forward-looking statements contain these identifying words. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based upon assumptions and the current beliefs and expectations of the management of Independent and Blue Hills Bancorp, Inc. (“Blue Hills”). These forward-looking statements are subject to known and unknown risks and uncertainties, and actual results might differ materially from those discussed in, or implied by, the forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to, the following: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (2) the risk that Independent’s or Blue Hills’ stockholders may not adopt the merger agreement; (3) the risk that the necessary regulatory approvals may not be obtained, may be delayed, or may be obtained subject to conditions that are not anticipated; (4) delays in closing the merger or other risks that any of the closing conditions to the merger may not be satisfied in a timely manner or at all; (5) the inability to realize expected cost savings and synergies from the merger in the amounts or in the timeframe anticipated; (6) the diversion of management’s time from existing business operations due to time spent related to the merger or integration efforts; (7) the inability to successfully integrate Blue Hills Bank or that the integration will be more difficult, time-consuming, or costly than expected; (8) unexpected material adverse changes in Independent’s or Blue Hills’ operations or earnings, the real estate markets in which they operate, the local economy, or the local business environment; (9) potential litigation in connection with the merger; (10) higher than expected transaction or other costs and expenses; and (11) higher than expected attrition of Blue Hills’ customers or key employees. There are important additional factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including the factors described in Independent’s and Blue Hills’ Annual Reports on Form 10-K for the year ended December 31, 2017, which were filed with the SEC on February 27, 2018 and on March 7, 2018, respectively. Except as required by law, Independent and Blue Hills disclaim any intent or obligation to update publicly any forward-looking statements, whether in response to new information, future events, inaccurate assumptions, or otherwise. Any public statements or disclosures by Independent or Blue Hills following this communication, that modifies or impacts any of the forward-looking statements contained in this communication will be deemed to modify or supersede such statements in this communication. In addition to the information set forth in this (2) communication, you should carefully consider the Risk Factors in the joint proxy statement/prospectus when it becomes available. Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results.

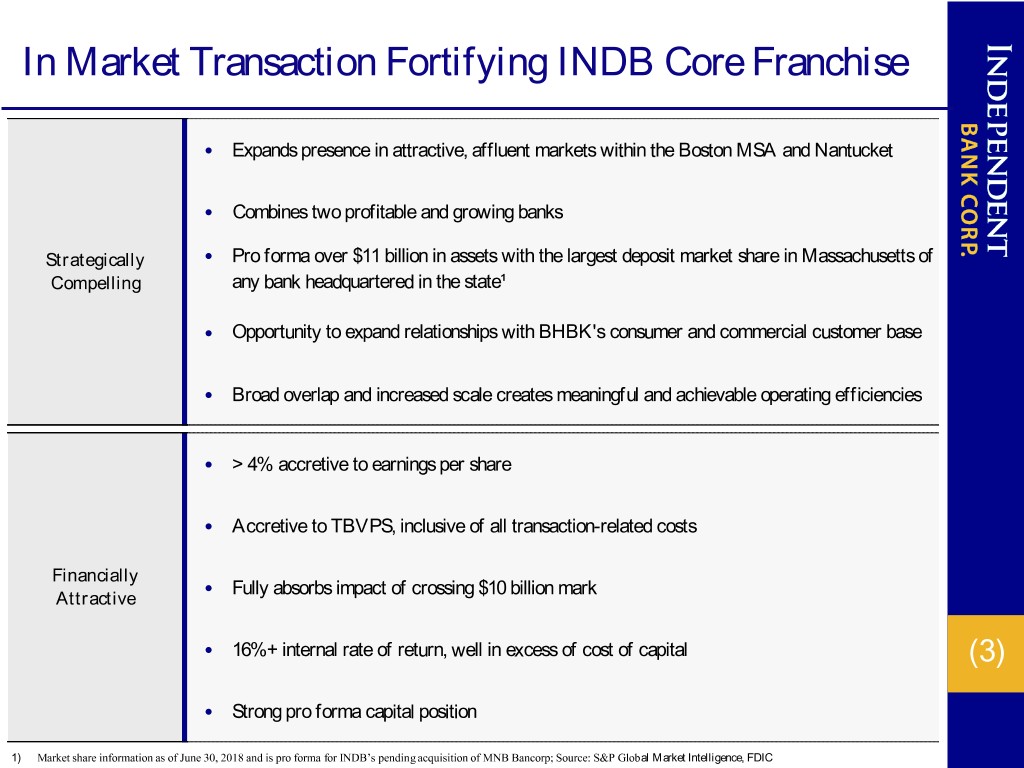

In Market Transaction Fortifying INDB Core Franchise • Expands presence in attractive, affluent markets within the Boston MSA and Nantucket • Combines two profitable and growing banks Strategically • Pro forma over $11 billion in assets with the largest deposit market share in Massachusetts of Compelling any bank headquartered in the state¹ • Opportunity to expand relationships with BHBK's consumer and commercial customer base • Broad overlap and increased scale creates meaningful and achievable operating efficiencies • > 4% accretive to earnings per share • Accretive to TBVPS, inclusive of all transaction-related costs Financially • Fully absorbs impact of crossing $10 billion mark Attractive • 16%+ internal rate of return, well in excess of cost of capital (3) • Strong pro forma capital position 1) Market share information as of June 30, 2018 and is pro forma for INDB’s pending acquisition of MNB Bancorp; Source: S&P Global Market Intelligence, FDIC

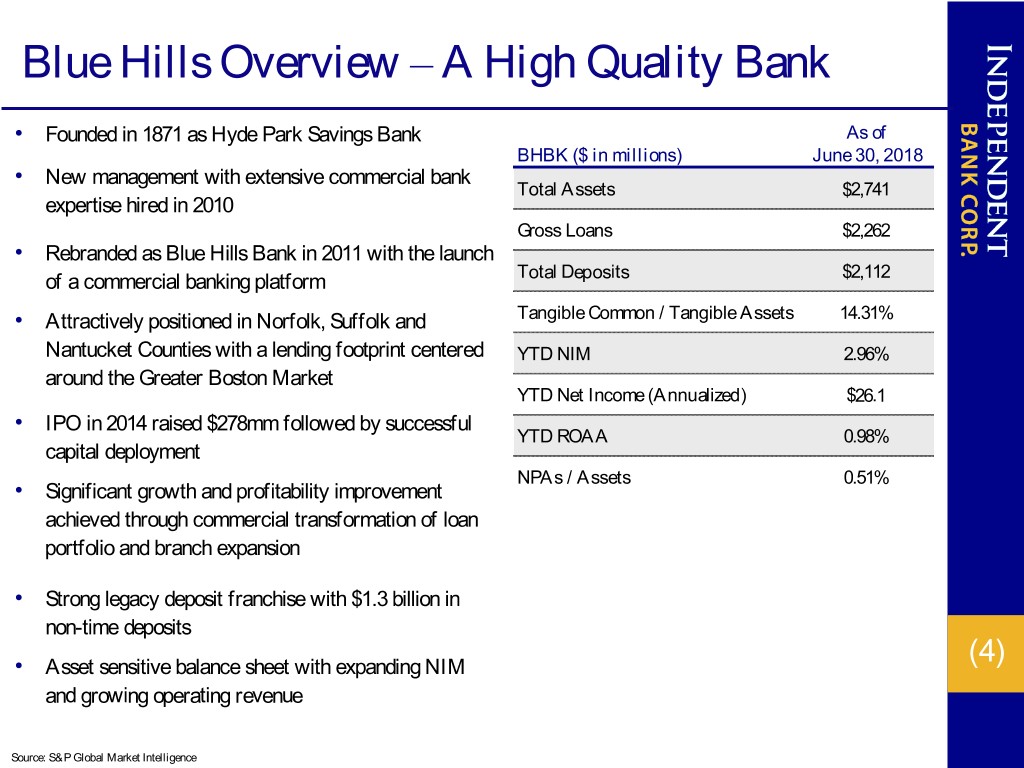

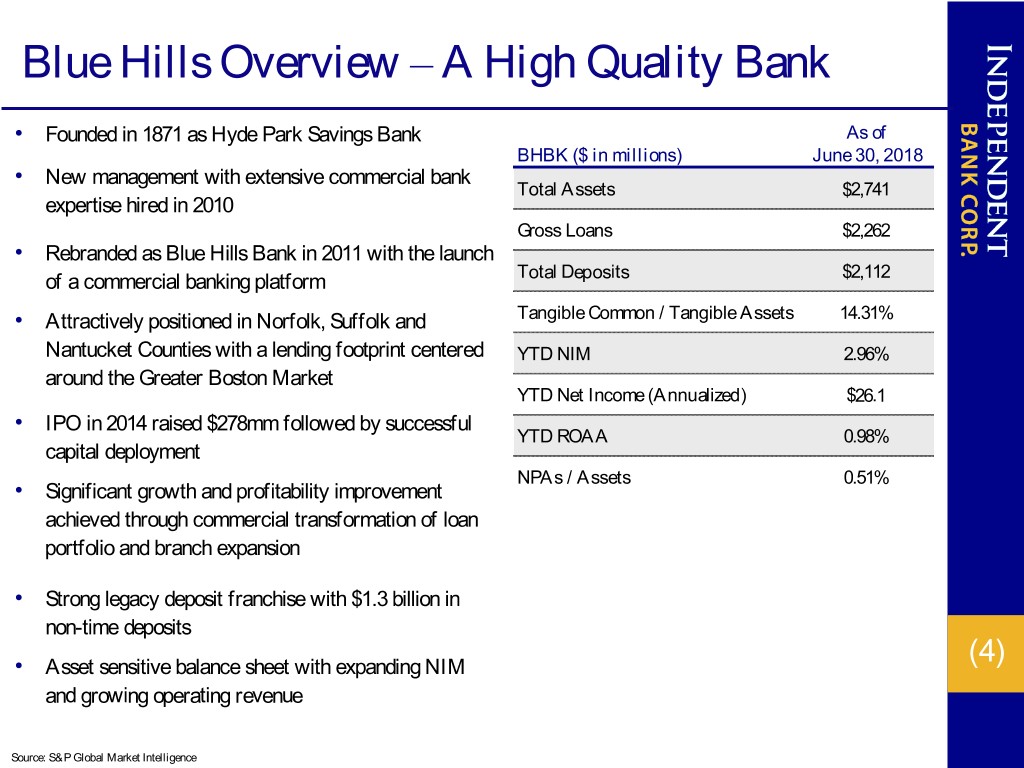

Blue Hills Overview – A High Quality Bank • Founded in 1871 as Hyde Park Savings Bank As of BHBK ($ in millions) June 30, 2018 • New management with extensive commercial bank Total Assets $2,741 expertise hired in 2010 Gross Loans $2,262 • Rebranded as Blue Hills Bank in 2011 with the launch of a commercial banking platform Total Deposits $2,112 • Attractively positioned in Norfolk, Suffolk and Tangible Common / Tangible Assets 14.31% Nantucket Counties with a lending footprint centered YTD NIM 2.96% around the Greater Boston Market YTD Net Income (Annualized) $26.1 • IPO in 2014 raised $278mm followed by successful YTD ROAA 0.98% capital deployment NPAs / Assets 0.51% • Significant growth and profitability improvement achieved through commercial transformation of loan portfolio and branch expansion • Strong legacy deposit franchise with $1.3 billion in non-time deposits • Asset sensitive balance sheet with expanding NIM (4) and growing operating revenue Source: S&P Global Market Intelligence

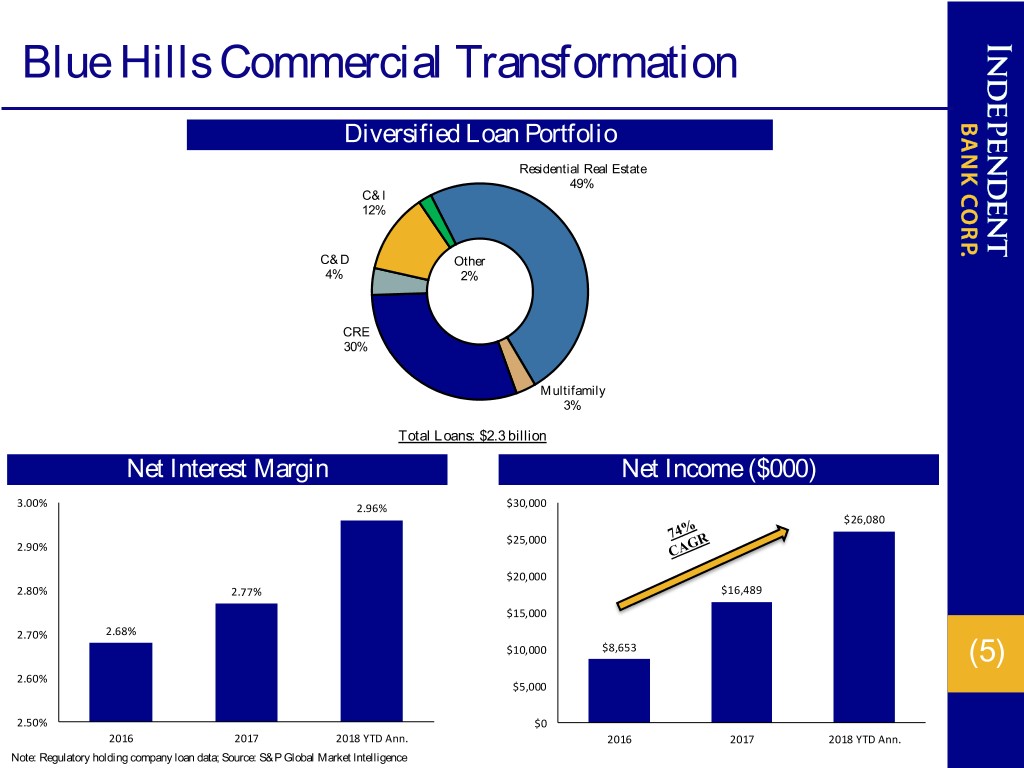

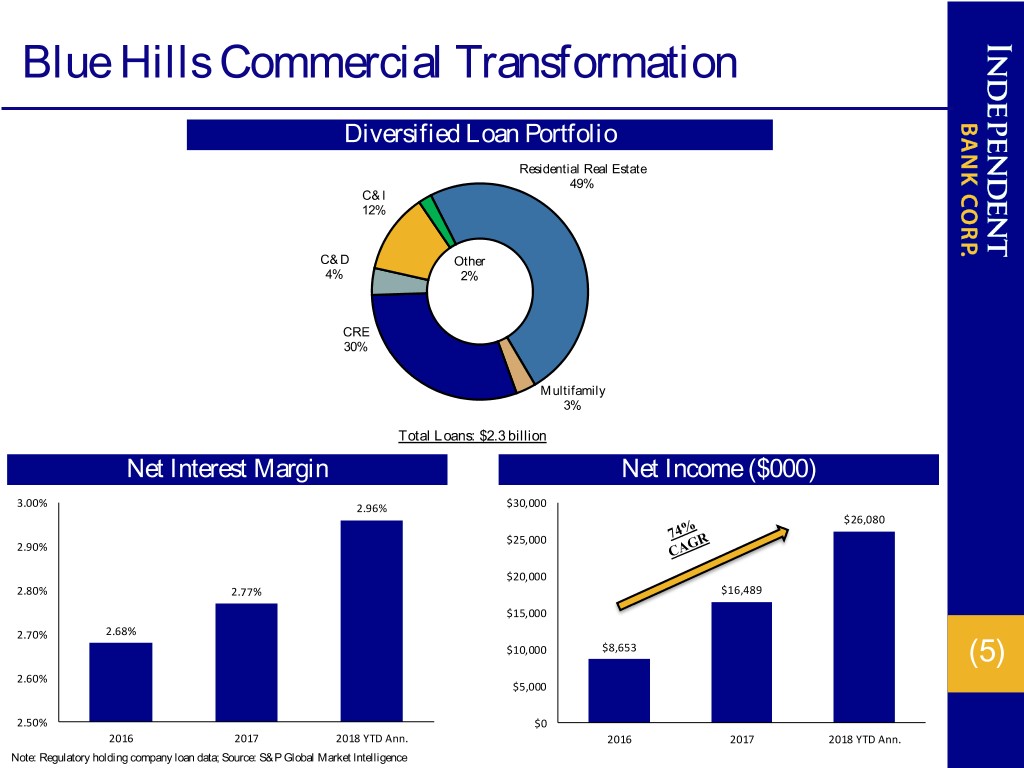

Blue Hills Commercial Transformation Diversified Loan Portfolio Residential Real Estate 49% C&I 12% C&D Other 4% 2% CRE 30% Multifamily 3% Total Loans: $2.3 billion Net Interest Margin Net Income ($000) 3.00% 2.96% $30,000 $26,080 $25,000 2.90% $20,000 2.80% 2.77% $16,489 $15,000 2.70% 2.68% $10,000 $8,653 (5) 2.60% $5,000 2.50% $0 2016 2017 2018 YTD Ann. 2016 2017 2018 YTD Ann. Note: Regulatory holding company loan data; Source: S&P Global Market Intelligence

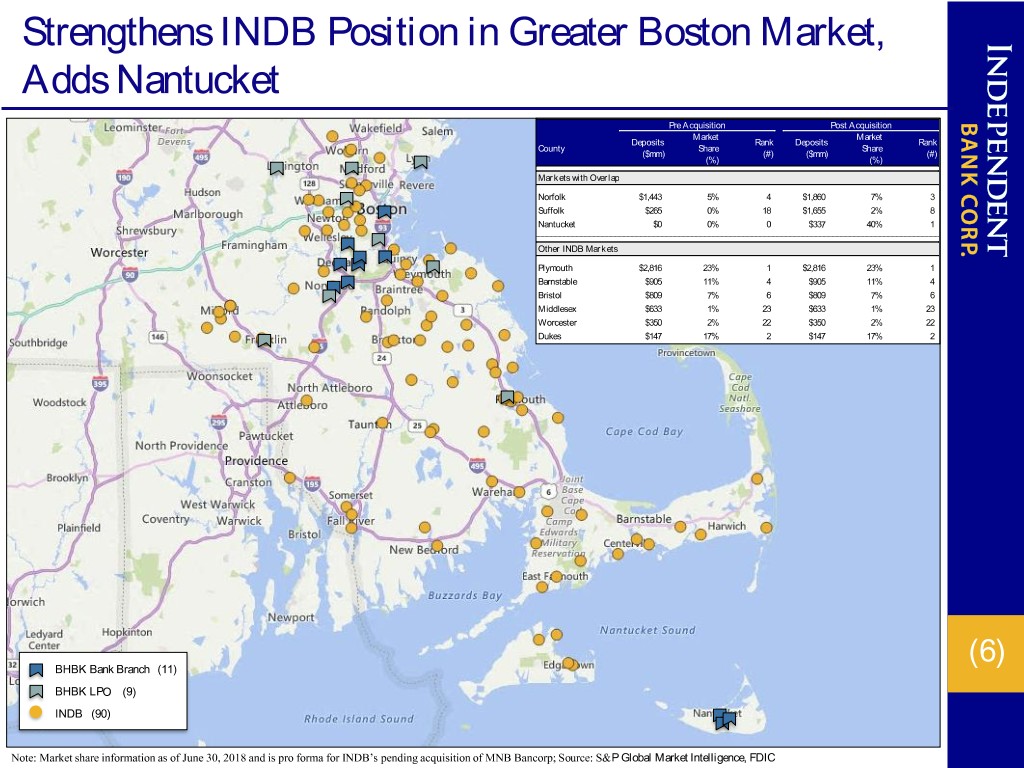

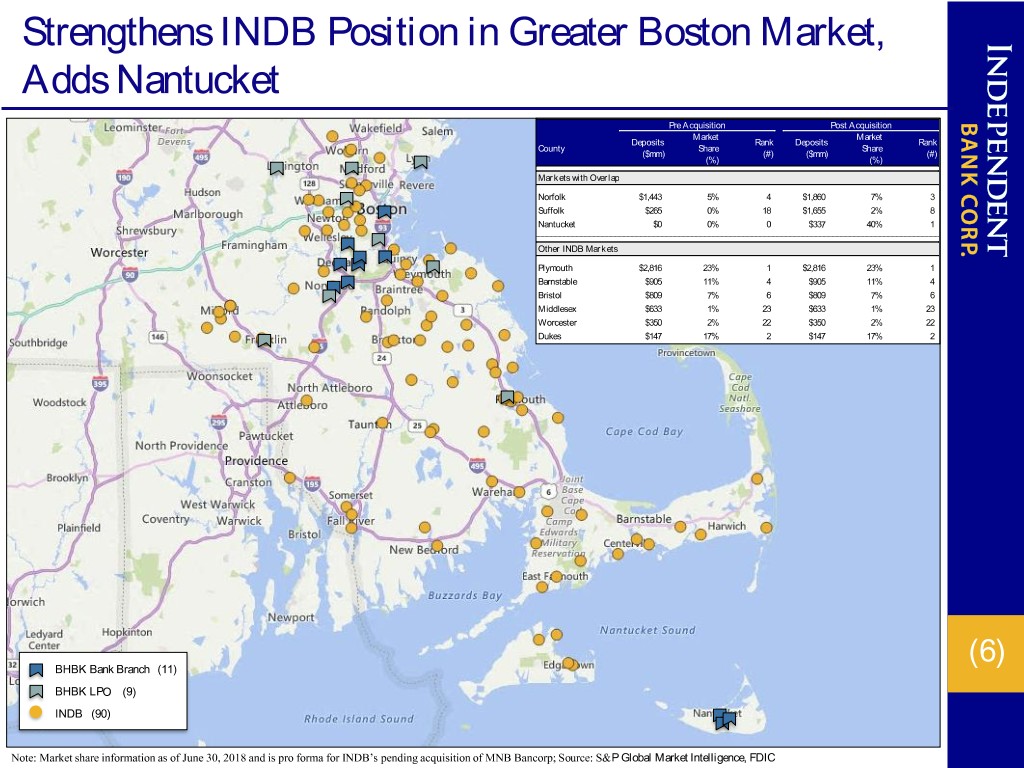

Strengthens INDB Position in Greater Boston Market, Adds Nantucket Pre Acquisition Post Acquisition Market Market Deposits Rank Deposits Rank County Share Share ($mm) (#) ($mm) (#) (%) (%) Markets with Overlap Norfolk $1,443 5% 4 $1,860 7% 3 Suffolk $265 0% 18 $1,655 2% 8 Nantucket $0 0% 0 $337 40% 1 Other INDB Markets Plymouth $2,816 23% 1 $2,816 23% 1 Barnstable $905 11% 4 $905 11% 4 Bristol $809 7% 6 $809 7% 6 Middlesex $633 1% 23 $633 1% 23 Worcester $350 2% 22 $350 2% 22 Dukes $147 17% 2 $147 17% 2 (6) BHBK Bank Branch (11) BHBK LPO (9) INDB (90) Note: Market share information as of June 30, 2018 and is pro forma for INDB’s pending acquisition of MNB Bancorp; Source: S&P Global Market Intelligence, FDIC

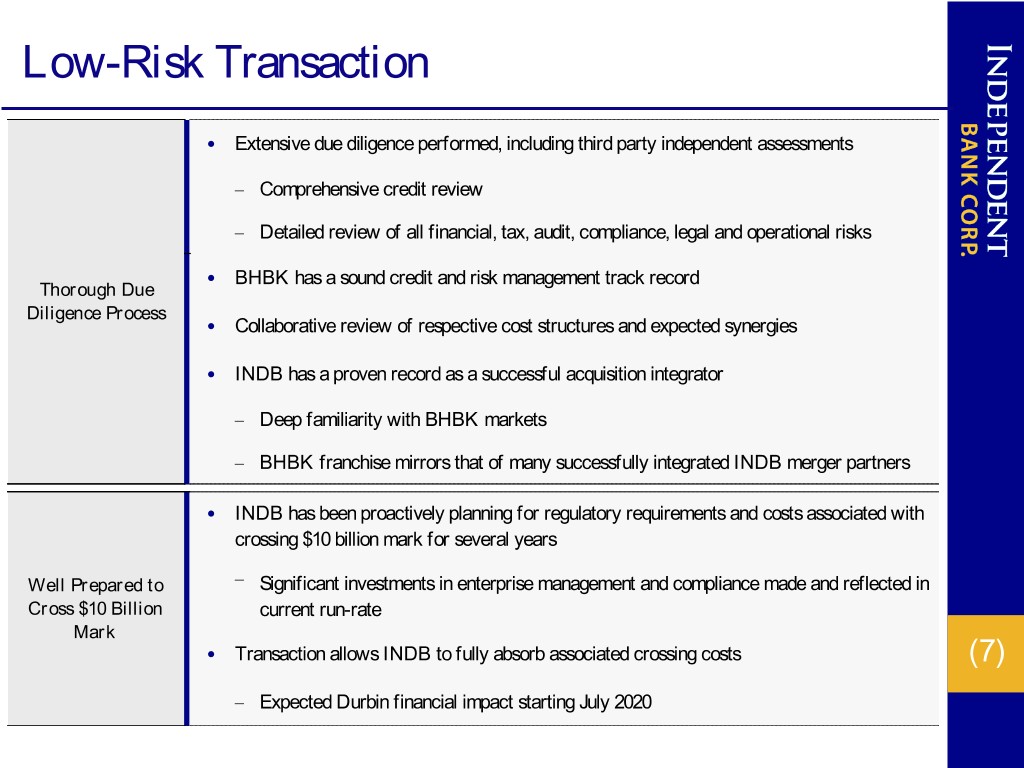

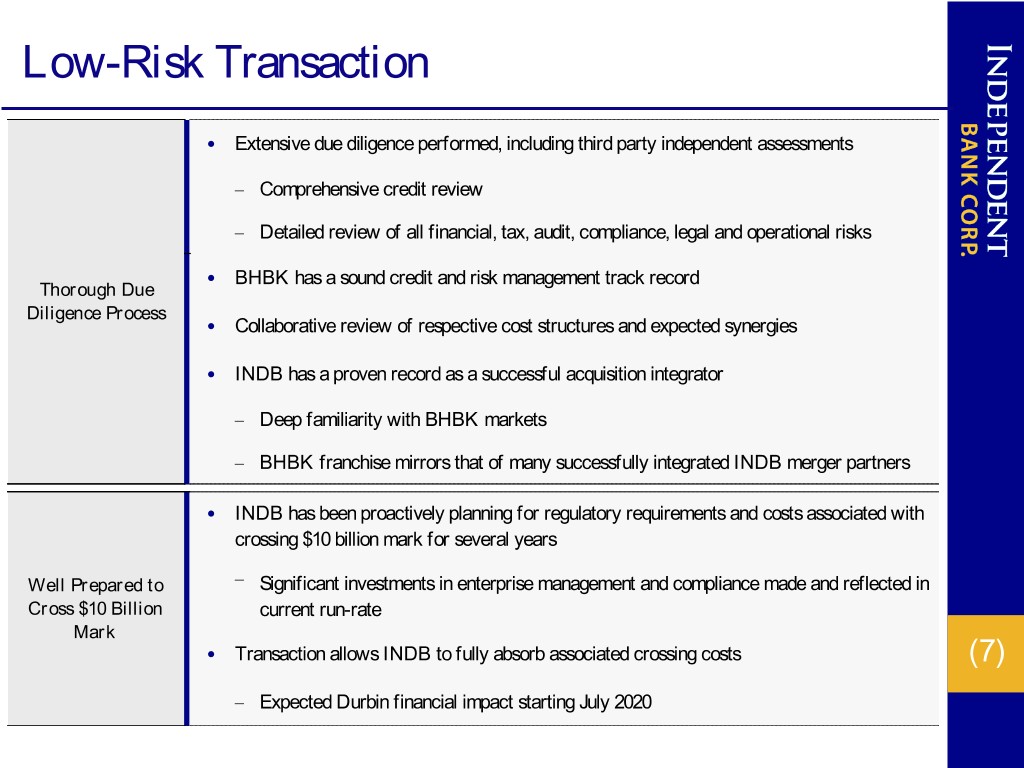

Low-Risk Transaction • Extensive due diligence performed, including third party independent assessments – Comprehensive credit review – Detailed review of all financial, tax, audit, compliance, legal and operational risks • BHBK has a sound credit and risk management track record Thorough Due Diligence Process • Collaborative review of respective cost structures and expected synergies • INDB has a proven record as a successful acquisition integrator – Deep familiarity with BHBK markets – BHBK franchise mirrors that of many successfully integrated INDB merger partners • INDB has been proactively planning for regulatory requirements and costs associated with crossing $10 billion mark for several years Well Prepared to – Significant investments in enterprise management and compliance made and reflected in Cross $10 Billion current run-rate Mark • Transaction allows INDB to fully absorb associated crossing costs (7) – Expected Durbin financial impact starting July 2020

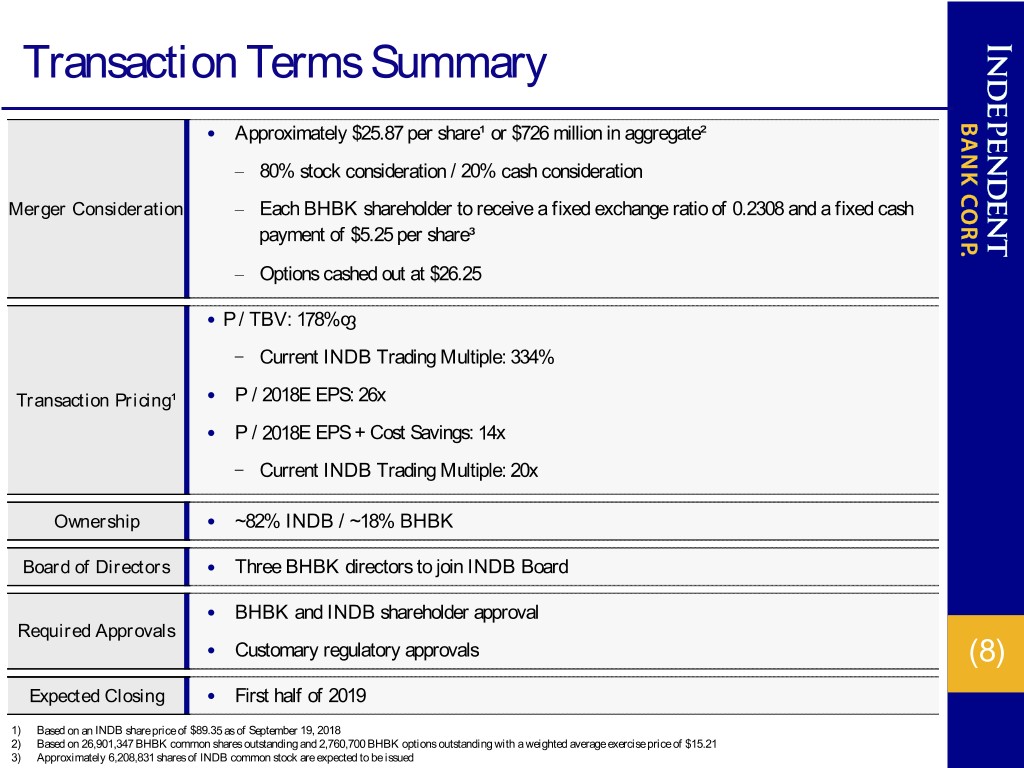

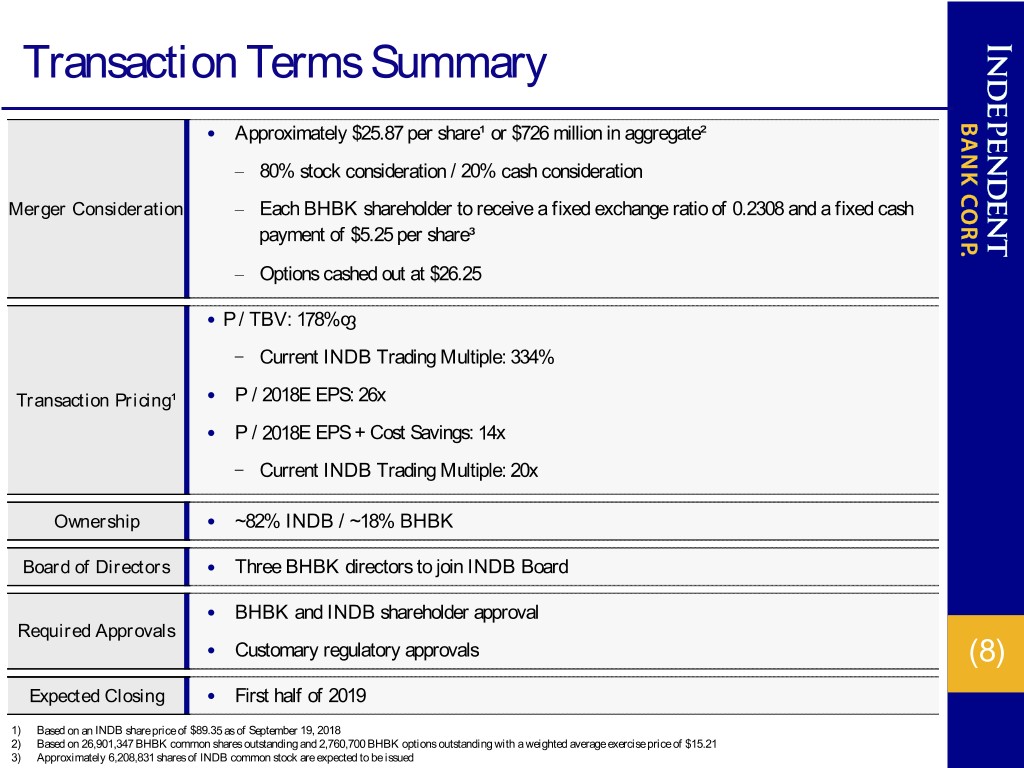

Transaction Terms Summary • Approximately $25.87 per share¹ or $726 million in aggregate² – 80% stock consideration / 20% cash consideration Merger Consideration – Each BHBK shareholder to receive a fixed exchange ratio of 0.2308 and a fixed cash payment of $5.25 per share³ – Options cashed out at $26.25 • P / TBV: 178% ‒ Current INDB Trading Multiple: 334% Transaction Pricing¹ • P / 2018E EPS: 26x • P / 2018E EPS + Cost Savings: 14x ‒ Current INDB Trading Multiple: 20x Ownership • ~82% INDB / ~18% BHBK Board of Directors • Three BHBK directors to join INDB Board • BHBK and INDB shareholder approval Required Approvals • Customary regulatory approvals (8) Expected Closing • First half of 2019 1) Based on an INDB share price of $89.35 as of September 19, 2018 2) Based on 26,901,347 BHBK common shares outstanding and 2,760,700 BHBK options outstanding with a weighted average exercise price of $15.21 3) Approximately 6,208,831 shares of INDB common stock are expected to be issued

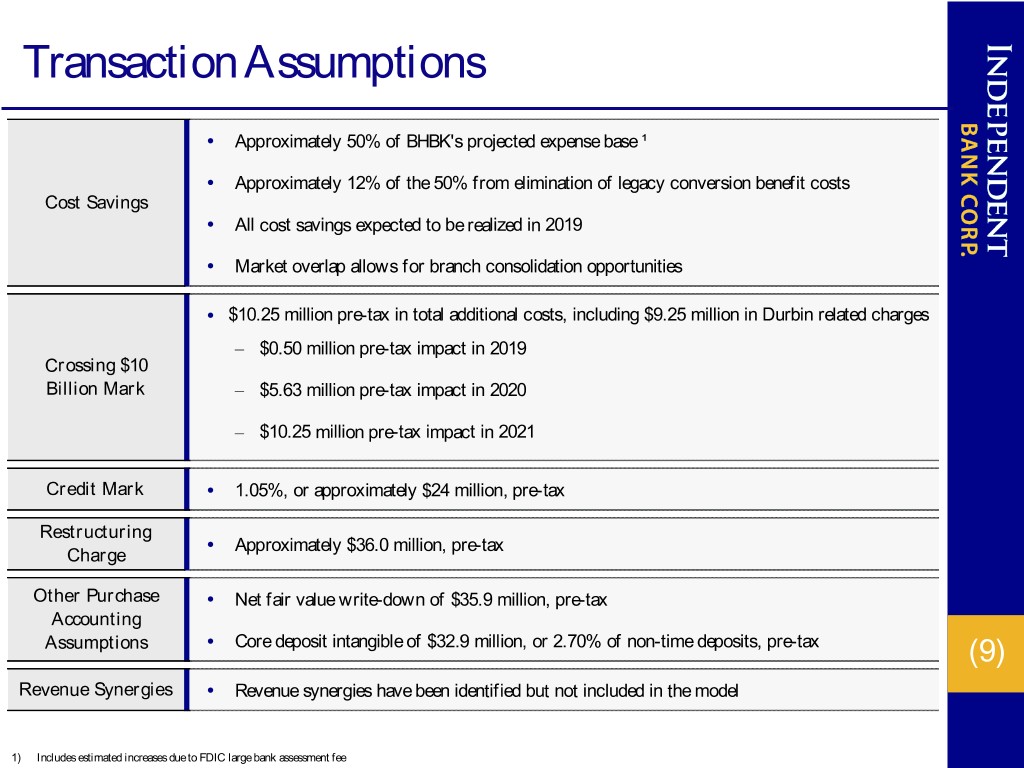

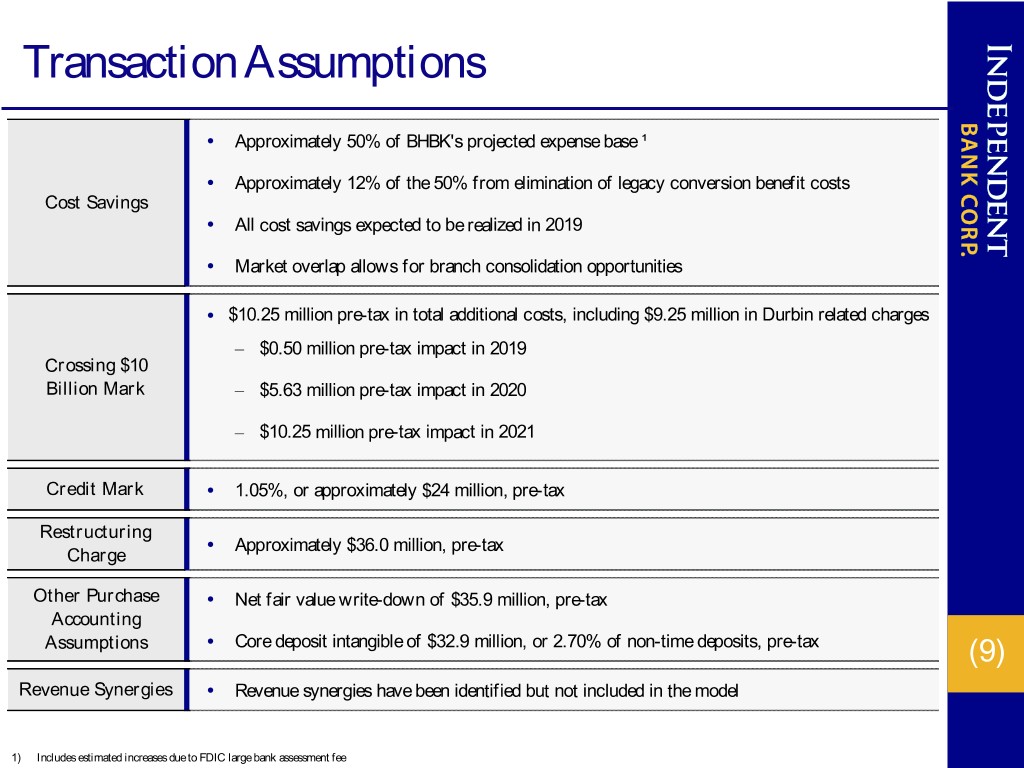

Transaction Assumptions • Approximately 50% of BHBK's projected expense base ¹ • Approximately 12% of the 50% from elimination of legacy conversion benefit costs Cost Savings • All cost savings expected to be realized in 2019 • Market overlap allows for branch consolidation opportunities • $10.25 million pre-tax in total additional costs, including $9.25 million in Durbin related charges – $0.50 million pre-tax impact in 2019 Crossing $10 Billion Mark – $5.63 million pre-tax impact in 2020 – $10.25 million pre-tax impact in 2021 Credit Mark • 1.05%, or approximately $24 million, pre-tax Restructuring • Approximately $36.0 million, pre-tax Charge Other Purchase • Net fair value write-down of $35.9 million, pre-tax Accounting Assumptions • Core deposit intangible of $32.9 million, or 2.70% of non-time deposits, pre-tax (9) Revenue Synergies • Revenue synergies have been identified but not included in the model 1) Includes estimated increases due to FDIC large bank assessment fee

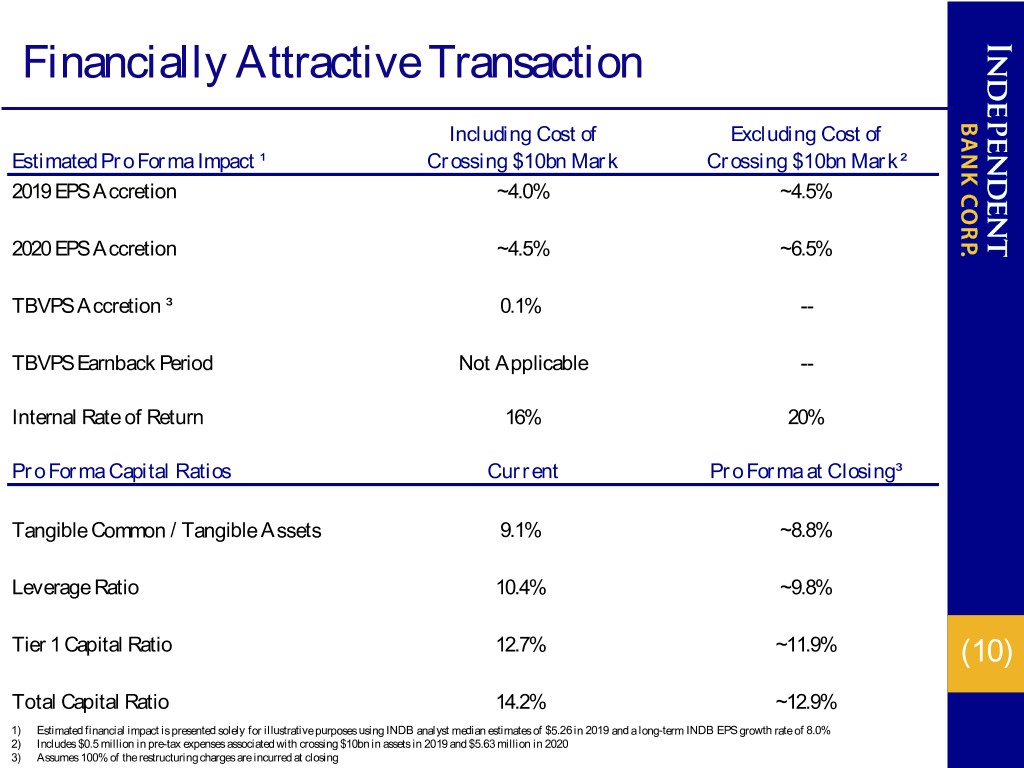

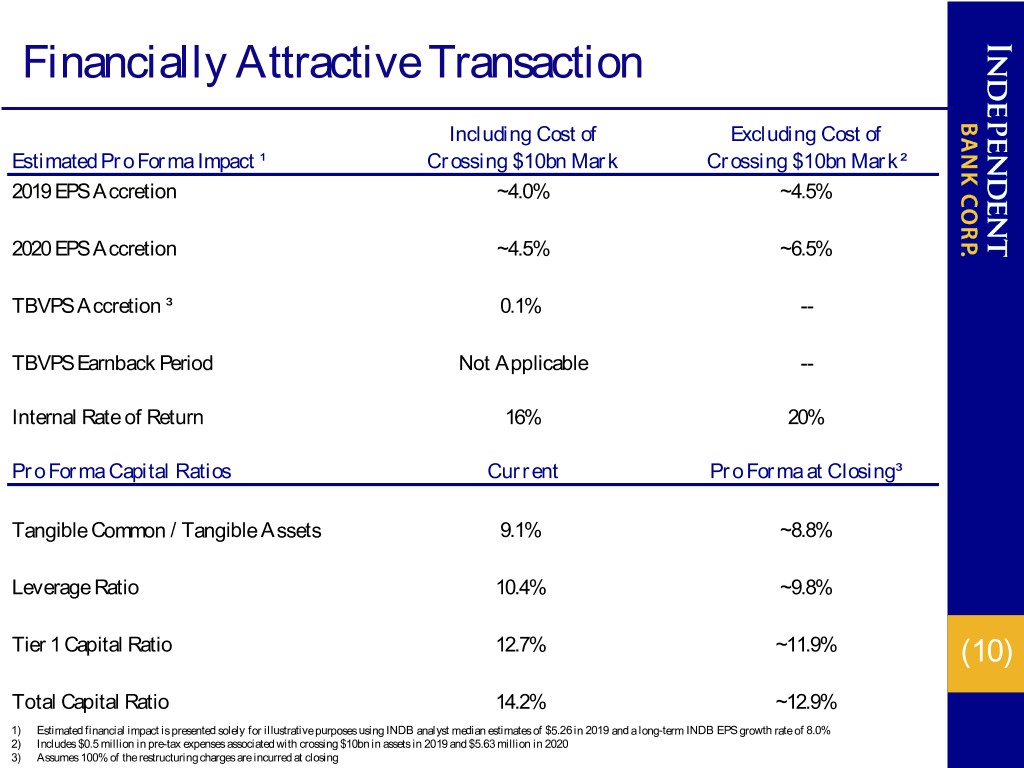

Financially Attractive Transaction Including Cost of Excluding Cost of Estimated Pro Forma Impact ¹ Crossing $10bn Mark Crossing $10bn Mark² 2019 EPS Accretion ~4.0% ~4.5% 2020 EPS Accretion ~4.5% ~6.5% TBVPS Accretion ³ 0.1% -- TBVPS Earnback Period Not Applicable -- Internal Rate of Return 16% 20% Pro Forma Capital Ratios Current Pro Forma at Closing³ Tangible Common / Tangible Assets 9.1% ~8.8% Leverage Ratio 10.4% ~9.8% Tier 1 Capital Ratio 12.7% ~11.9% (10) Total Capital Ratio 14.2% ~12.9% 1) Estimated financial impact is presented solely for illustrative purposes using INDB analyst median estimates of $5.26 in 2019 and a long-term INDB EPS growth rate of 8.0% 2) Includes $0.5 million in pre-tax expenses associated with crossing $10bn in assets in 2019 and $5.63 million in 2020 3) Assumes 100% of the restructuring charges are incurred at closing

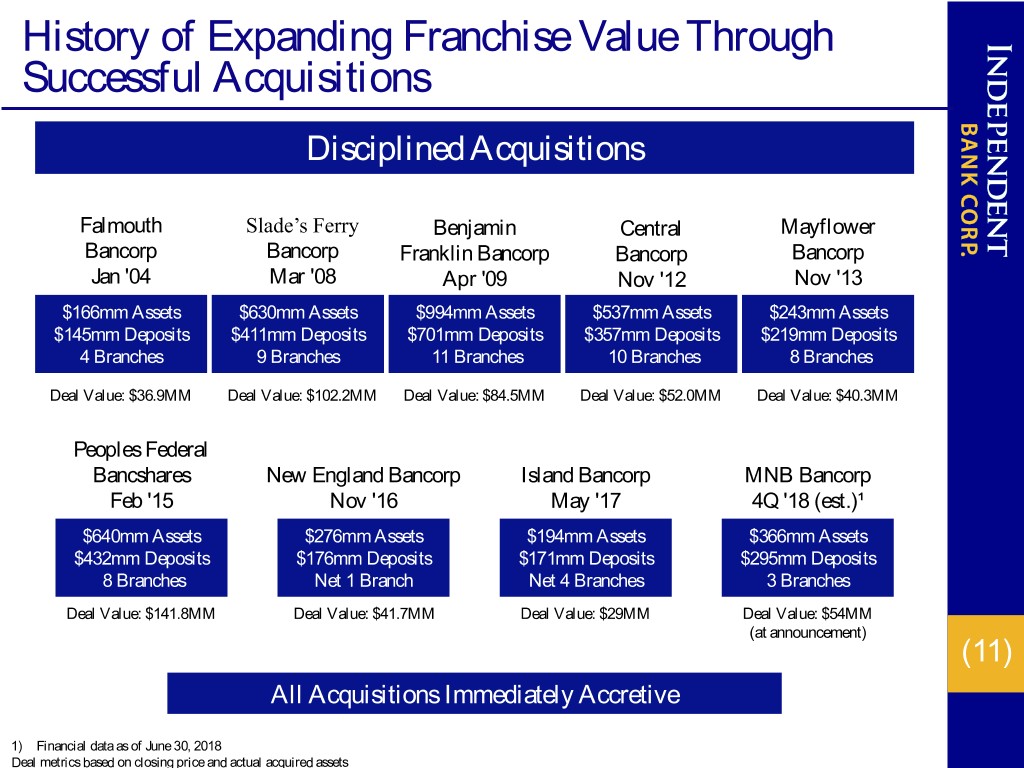

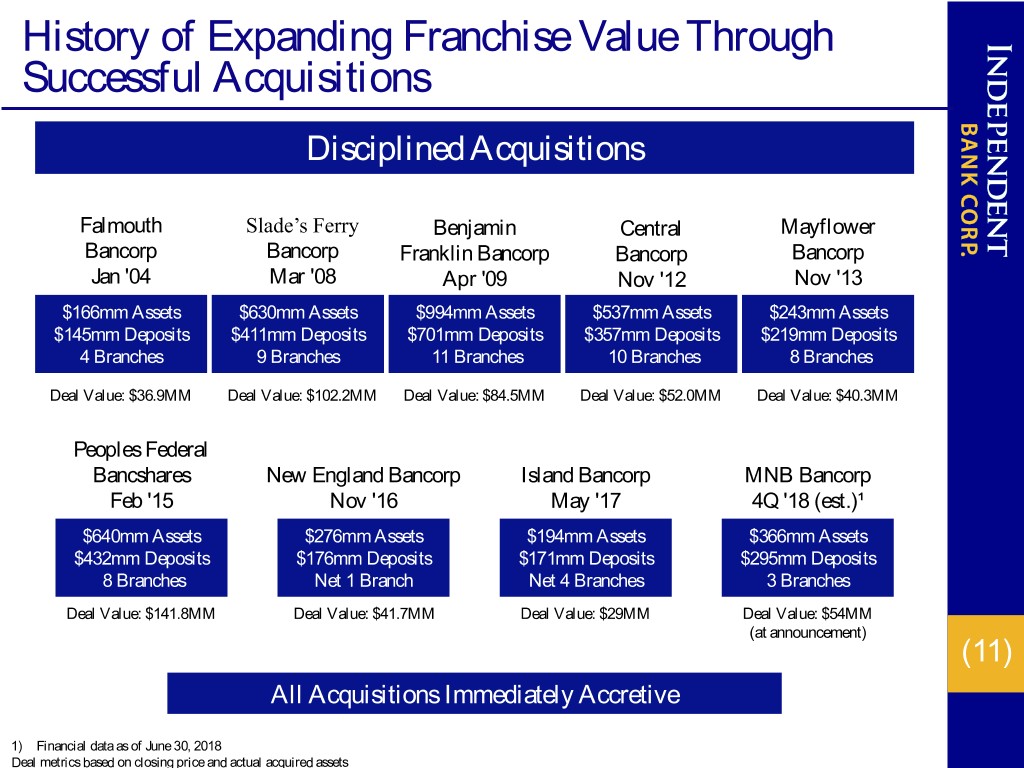

History of Expanding Franchise Value Through Successful Acquisitions Disciplined Acquisitions Falmouth Slade’s Ferry Benjamin Central Mayflower Bancorp Bancorp Franklin Bancorp Bancorp Bancorp Jan '04 Mar '08 Apr '09 Nov '12 Nov '13 $166mm Assets $630mm Assets $994mm Assets $537mm Assets $243mm Assets $145mm Deposits $411mm Deposits $701mm Deposits $357mm Deposits $219mm Deposits 4 Branches 9 Branches 11 Branches 10 Branches 8 Branches Deal Value: $36.9MM Deal Value: $102.2MM Deal Value: $84.5MM Deal Value: $52.0MM Deal Value: $40.3MM Peoples Federal Bancshares New England Bancorp Island Bancorp MNB Bancorp Feb '15 Nov '16 May '17 4Q '18 (est.)¹ $640mm Assets $276mm Assets $194mm Assets $366mm Assets $432mm Deposits $176mm Deposits $171mm Deposits $295mm Deposits 8 Branches Net 1 Branch Net 4 Branches 3 Branches Deal Value: $141.8MM Deal Value: $41.7MM Deal Value: $29MM Deal Value: $54MM (at announcement) (11) All Acquisitions Immediately Accretive 1) Financial data as of June 30, 2018 Deal metrics based on closing price and actual acquired assets

Compelling Transaction Rationale • Fortifies INDB position in familiar, attractive and coveted markets • Expands footprint into Nantucket • Combines two high quality franchises • Financially attractive • Provides benefit of additional scale • Low-risk transaction • Continues to build INDB franchise value (12)

Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger involving Independent and Blue Hills. In connection with the proposed merger, Independent intends to file with the SEC a Registration Statement on Form S-4 containing a joint proxy statement/prospectus. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Investors and security holders are advised to read the joint proxy statement/prospectus when it becomes available because it will contain important information. Investors and security holders may obtain a free copy of the registration statement (when available), including the joint proxy statement/prospectus and other documents filed by Independent and Blue Hills with the SEC at the SEC’s web site at www.sec.gov. These documents may be accessed and downloaded, free of charge, at Independent’s web site at www.RocklandTrust.com under the tab “Investor Relations” and then under the heading “SEC Filings” or by directing a request to Investor Relations, Independent Bank Corp., 288 Union Street, Rockland, Massachusetts 02370, telephone (781) 982-6737. You will also be able to obtain these documents free of charge at Blue Hills’ web site at www.bluehillsbancorp.com or by directing a request to Investors Relations, Blue Hills Bancorp, Inc., 500 River Ridge Drive, Suite 300, Norwood, Massachusetts 02062, telephone: (617) 361- 6900. This communication is not a solicitation of a proxy from any security holder of Independent or Blue Hills. However, Independent, Blue Hills, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from stockholders of Independent and Blue Hills in respect of the proposed merger. Information regarding the directors and executive officers of Independent may be found in its definitive proxy statement relating to its 2018 Annual Meeting of Shareholders, which was filed with the SEC on March 29, 2018, and its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 27, 2018, each of which can be obtained free of charge from Independent’s website. Information regarding the directors and executive officers of Blue Hills may be found in its definitive proxy statement relating to its 2018 Annual Meeting of Stockholders, which was filed with the SEC on April 11, 2018, and its Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on March 7, 2018, each of which can be obtained free of charge from Blue Hills’ website. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests in the merger will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. (13)

NASDAQ Ticker: INDB www.rocklandtrust.com Robert Cozzone – CFO & EVP Consumer and Business Banking Shareholder Relations: (781) 982-6737 Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time (14) to time.

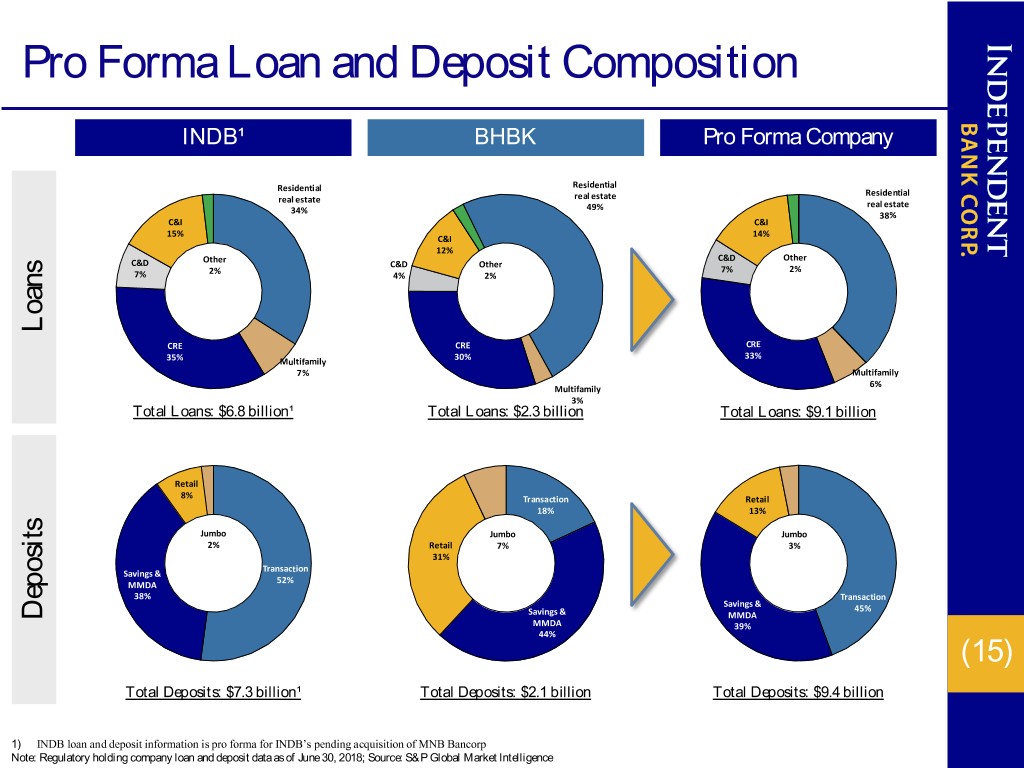

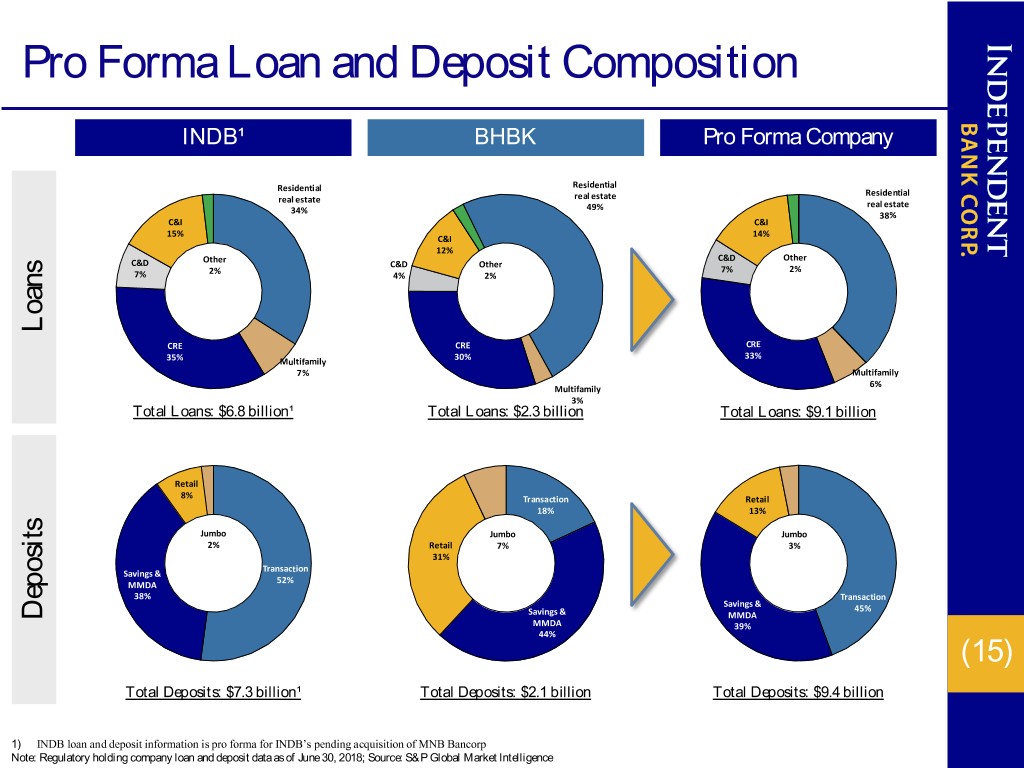

Pro Forma Loan and Deposit Composition INDB¹ BHBK Pro Forma Company Residential Residential Residential real estate real estate 49% real estate 34% 38% C&I C&I 15% 14% C&I 12% Other C&D Other C&D C&D Other 2% 7% 2% 7% 4% 2% Loans CRE CRE CRE 33% 35% Multifamily 30% 7% Multifamily 6% Multifamily 3% Total Loans: $6.8 billion¹ Total Loans: $2.3 billion Total Loans: $9.1 billion Retail 8% Transaction Retail 18% 13% Jumbo Jumbo Jumbo 2% Retail 7% 3% 31% Transaction Savings & 52% MMDA 38% Transaction Savings & Savings & 45% Deposits MMDA MMDA 39% 44% (15) Total Deposits: $7.3 billion¹ Total Deposits: $2.1 billion Total Deposits: $9.4 billion 1) INDB loan and deposit information is pro forma for INDB’s pending acquisition of MNB Bancorp Note: Regulatory holding company loan and deposit data as of June 30, 2018; Source: S&P Global Market Intelligence

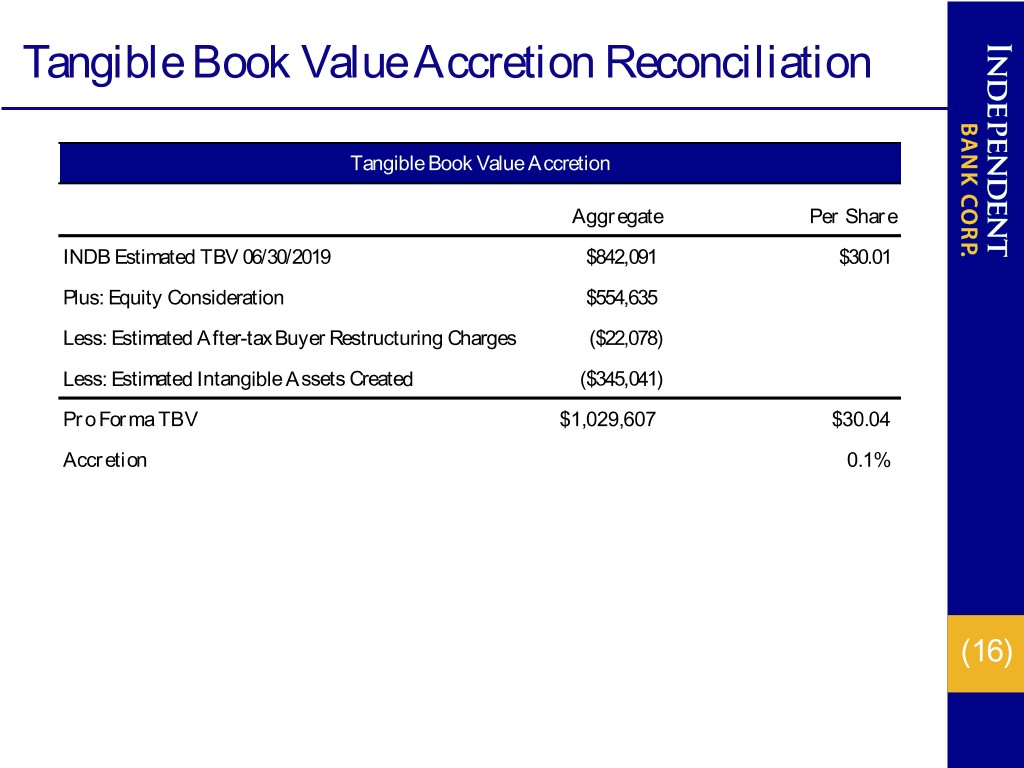

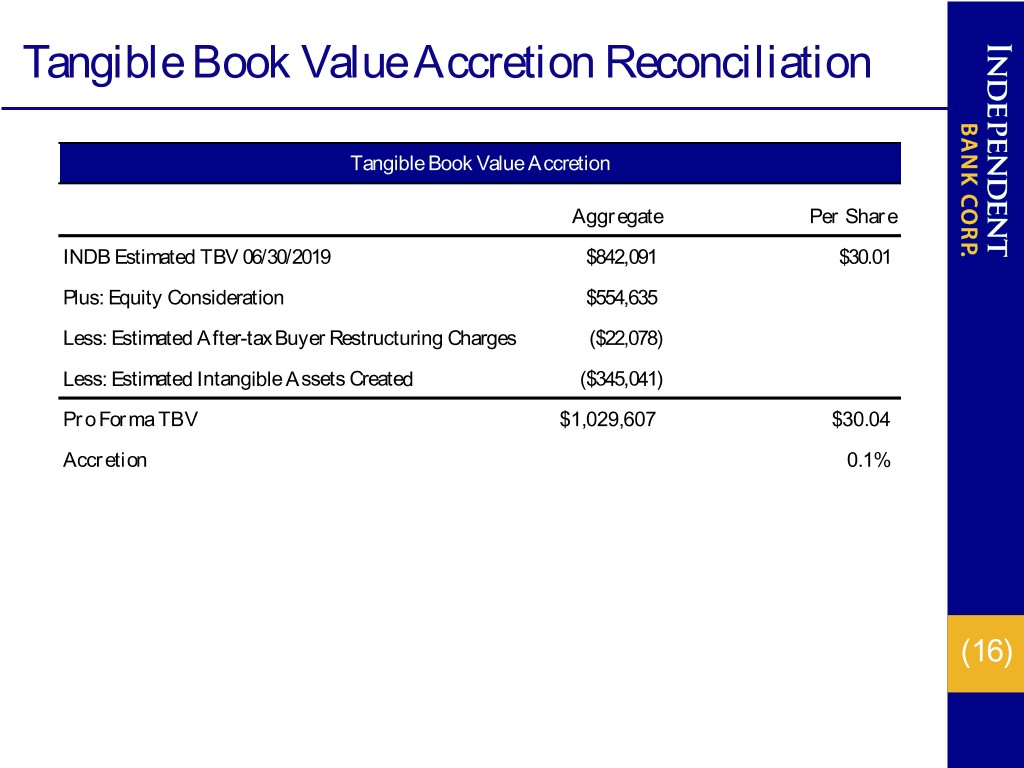

Tangible Book Value Accretion Reconciliation Tangible Book Value Accretion Aggregate Per Share INDB Estimated TBV 06/30/2019 $842,091 $30.01 Plus: Equity Consideration $554,635 Less: Estimated After-tax Buyer Restructuring Charges ($22,078) Less: Estimated Intangible Assets Created ($345,041) Pro Forma TBV $1,029,607 $30.04 Accretion 0.1% (16)