Exhibit 99.1

May 7, 2012

Christopher Oddleifson

President & Chief Executive Officer

Denis K. Sheahan Chief Financial Officer

Who We Are

• Main Sub: Rockland Trust

• Market: Eastern Massachusetts

• Loans: $3.9 B

• Deposits: $3.9 B

• $AUA: $2.0 B

• Equity: $0.5 M

• NASDAQ: INDB

Key Messages

• Business lines generating robust volumes

• Solid, high-quality earnings performances

• Steadily expanding market presence

• Aggressively promoting brand and new products

• Investing for growth in high priority businesses

• Disciplined risk management culture

• Strong tangible and regulatory capital

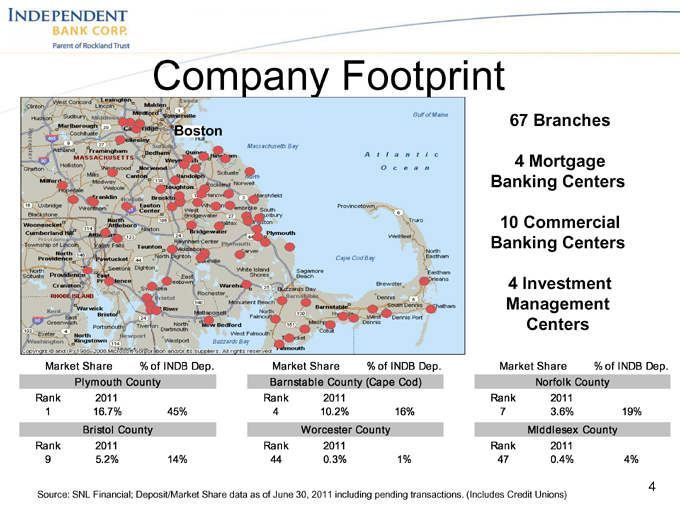

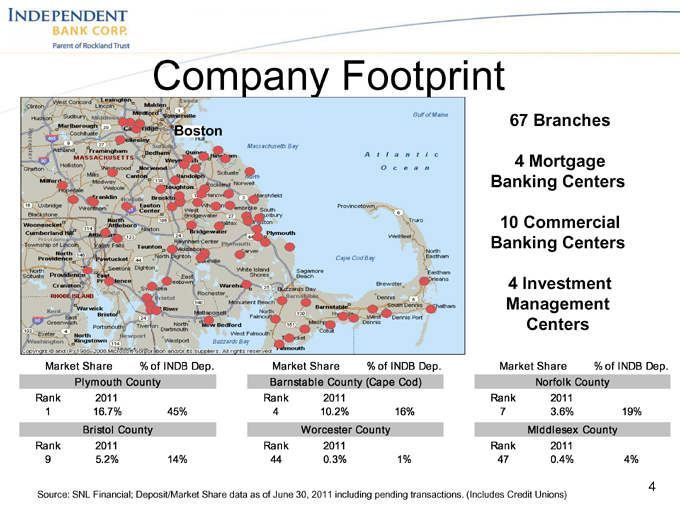

Company Footprint

67 Branches

4 | Mortgage Banking Centers |

10 Commercial Banking Centers

4 | Investment Management Centers |

Market Share

% of INDB Dep.

Market Share

% of INDB Dep.

Market Share

% of INDB Dep.

Plymouth County

Barnstable County (Cape Cod)

Norfolk County

Rank

2011

Rank

2011

Rank

2011

1

16.7%

45%

4

10.2%

16%

7

3.6%

19%

Bristol County

Worcester County

MIddlesex County

Rank

2011

Rank

2011

Rank

2011

9

5.2%

14%

44

0.3%

1%

47

0.4%

4%

2011 Accomplishments

• Operating E.P.S. up 12% in 2011 (+ 33% in 2010)

• Excellent commercial loan and core deposit growth

• Expanded breadth and depth of commercial franchise

• New household acquisition grew by 51%

• Investment Management growth: Rev. ? 15%, $AUA ? 5%

• All capital ratios and TBV rose in 2011

• Fitch upgrade of long-term issuer rating

• Top Place to Work (3rd year) designation

• Momentum continuing into 2012

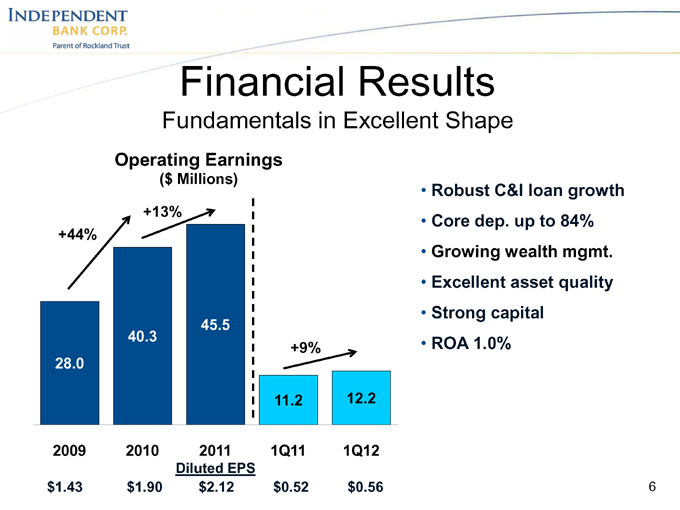

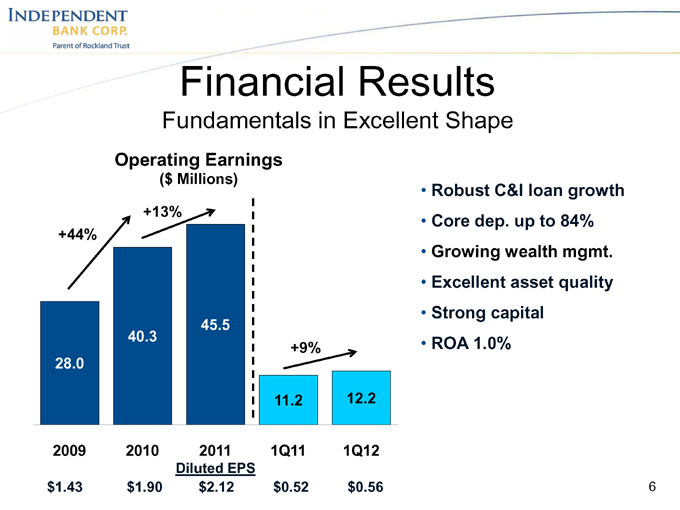

Financial Results

Fundamentals in Excellent Shape

• Robust C&I loan growth

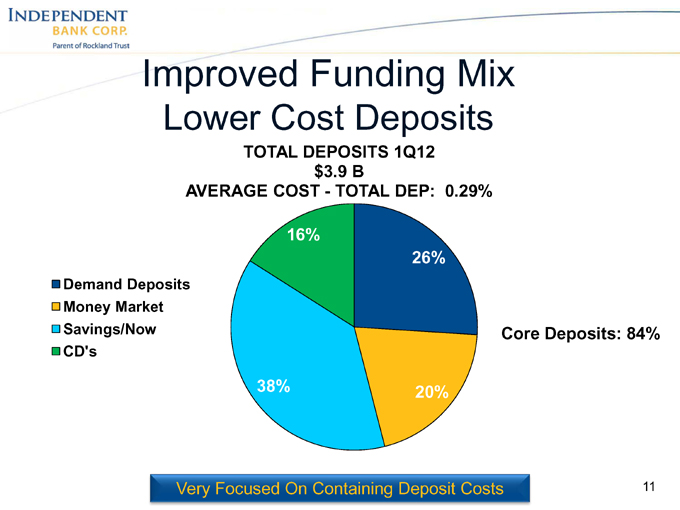

• Core dep. up to 84%

• Growing wealth mgmt.

• Excellent asset quality

• Strong capital

• ROA 1.0%

Diluted EPS

$1.43

$1.90

$2.12

$0.52

$0.56

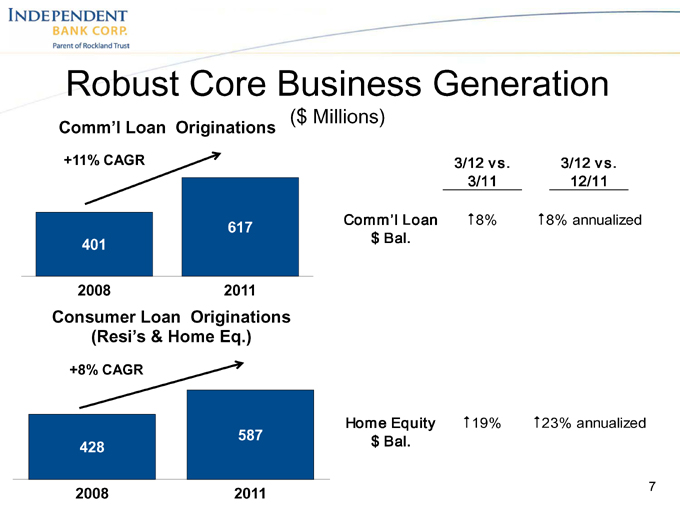

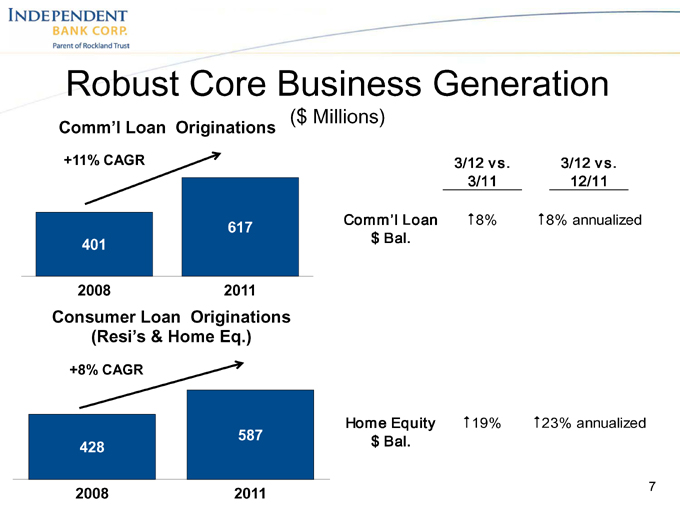

Robust Core Business Generation

($ Millions)

Comm’l Loan Originations

Consumer Loan Originations (Resi’s & Home Eq.)

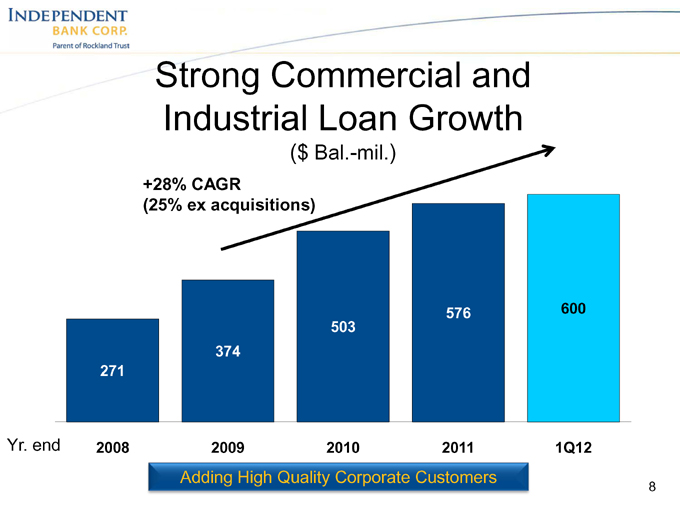

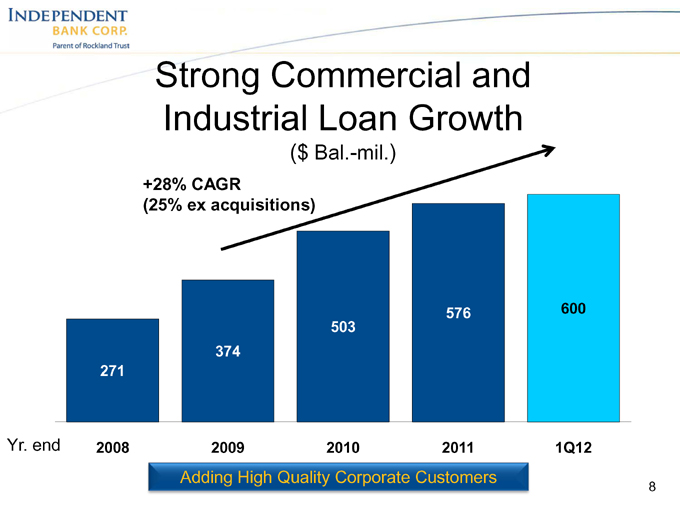

Strong Commercial and Industrial Loan Growth

Adding High Quality Corporate Customers

Commercial Banking Recent Growth Initiatives

• Hired experienced team of asset-based lenders

• Opened new commercial office in Providence

– Includes wealth mgmt. services

• Added senior C&I lender in Boston market

• Expanded retirement plan service outreach to small businesses

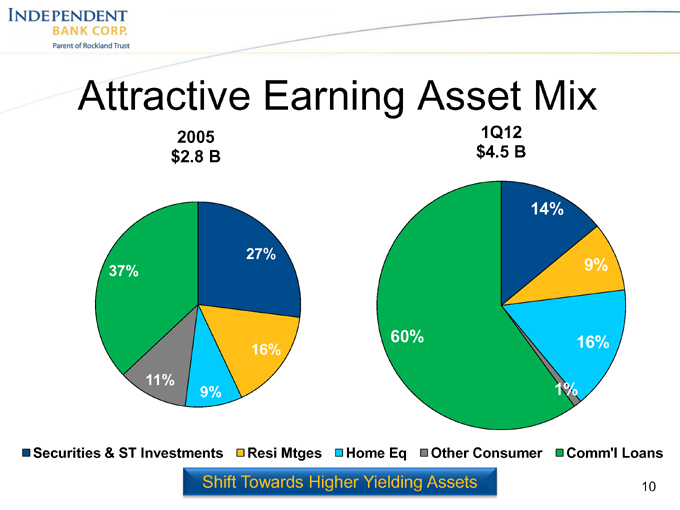

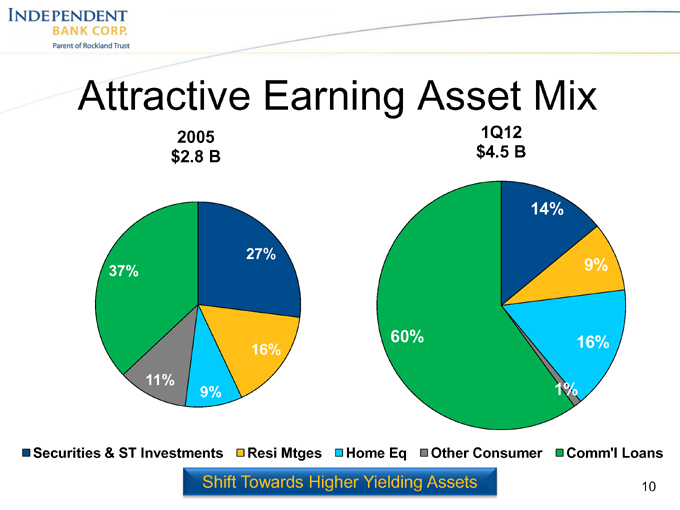

Attractive Earning Asset Mix

Securities & ST Investments Resi Mtges Home Eq Other Consumer Comm'l Loans

Shift Towards Higher Yielding Assets 10

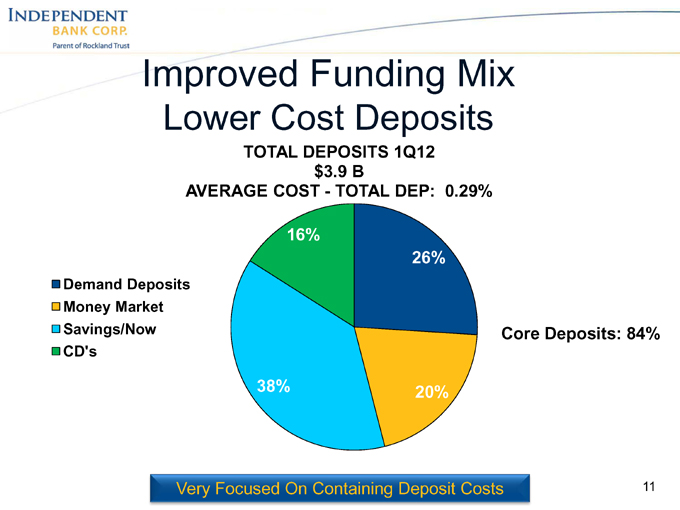

Improved Funding Mix Lower Cost Deposits

TOTAL DEPOSITS 1Q12 $3.9 B

AVERAGE COST—TOTAL DEP: 0.29%

Very Focused On Containing Deposit Costs

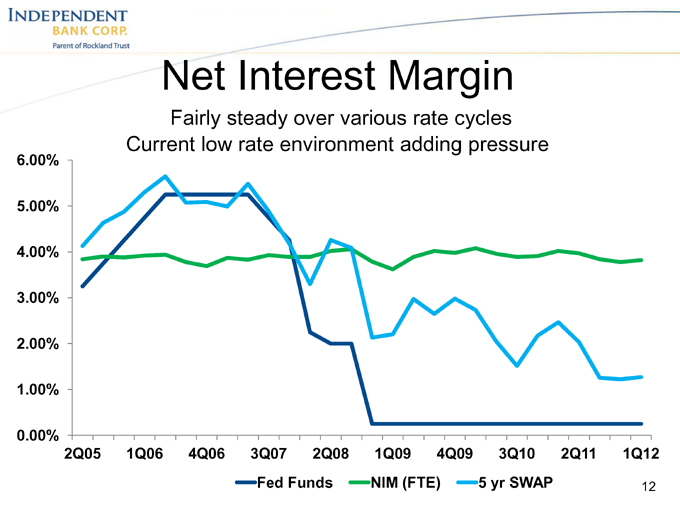

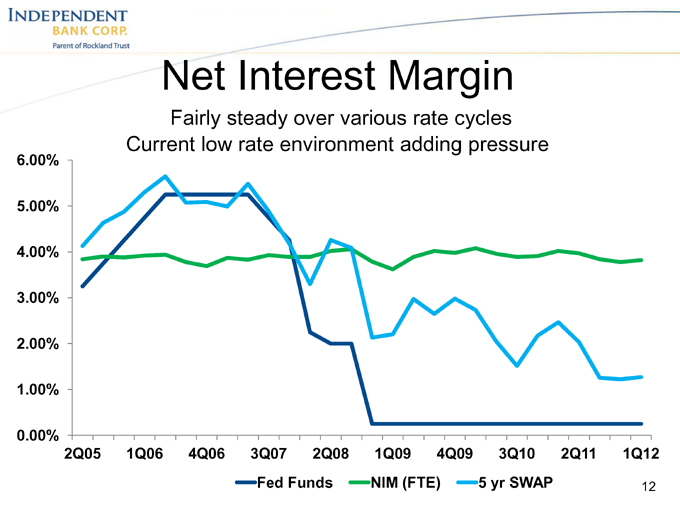

Net Interest Margin

Fairly steady over various rate cycles Current low rate environment adding pressure

Disciplined Credit Culture

• Longstanding underwriting conservatism

• Loan portfolio based within footprint

• In-depth knowledge of local markets

• No wholesale originations of any loan type

• Workout team in place for 20 years

• Expedited problem loan resolution

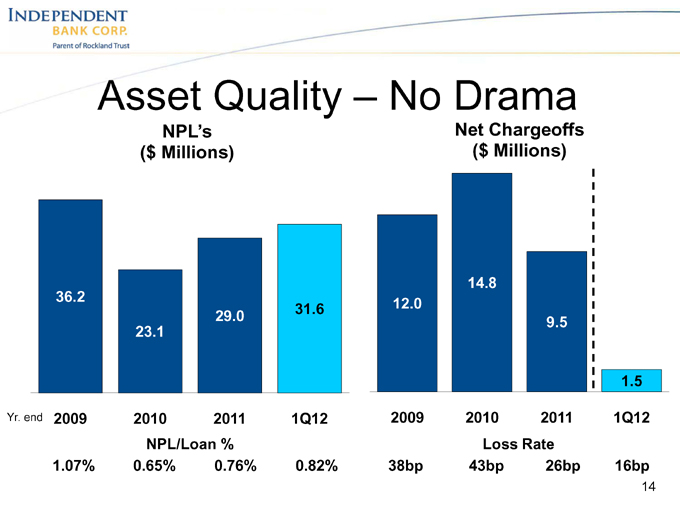

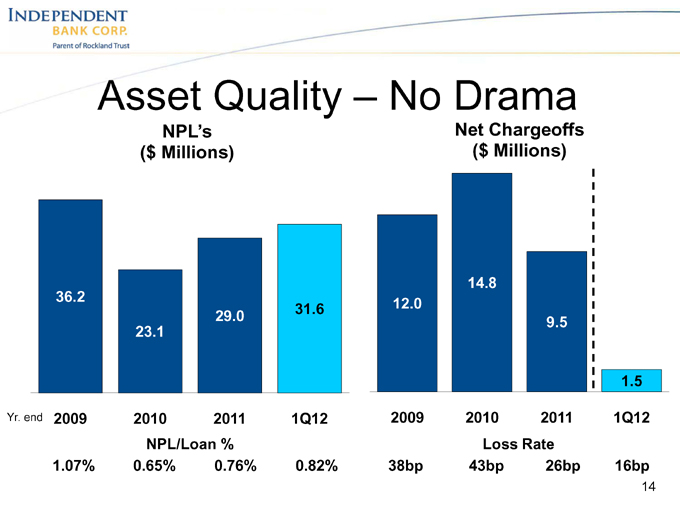

Asset Quality – No Drama

NPL’s Net Chargeoffs

($ Millions) ($ Millions)

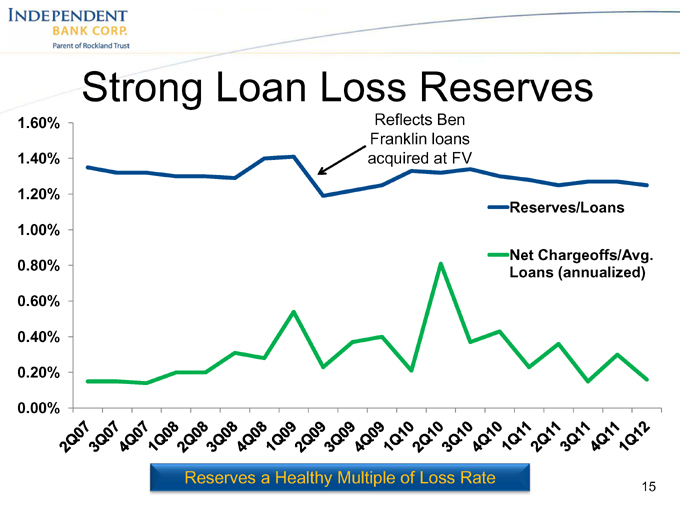

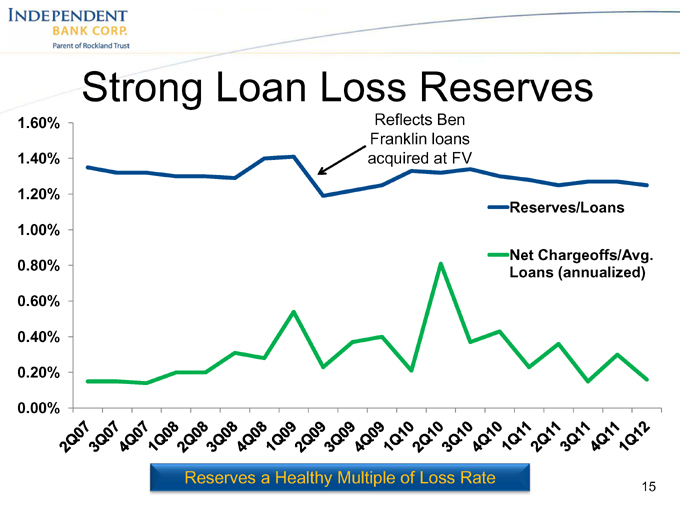

Strong Loan Loss Reserves

Reserves a Healthy Multiple of Loss Rate

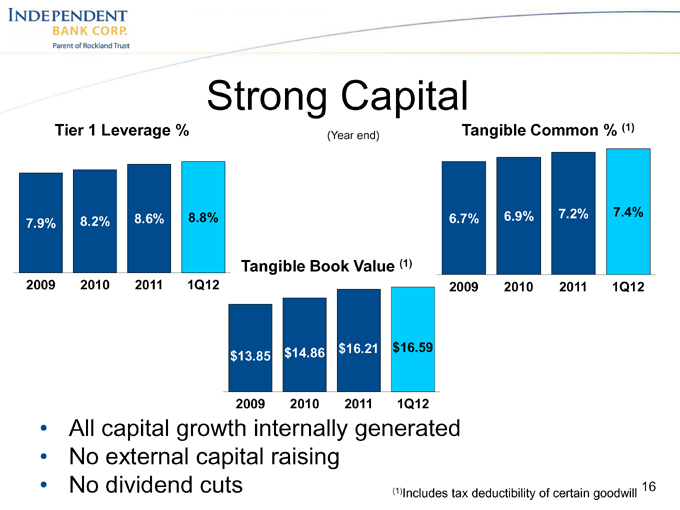

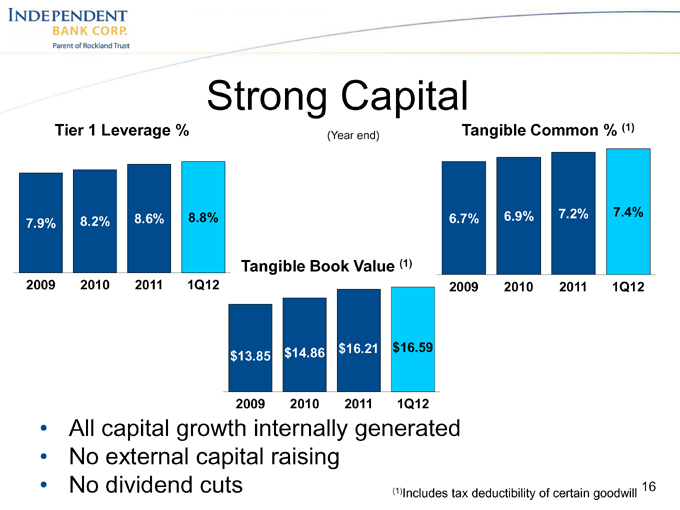

Strong Capital

Tier 1 Leverage %

(Year end)

Tangible Common % (1)

Tangible Book Value (1)

• All capital growth internally generated

• No external capital raising

• No dividend cuts (1) 16

Includes tax deductibility of certain goodwill

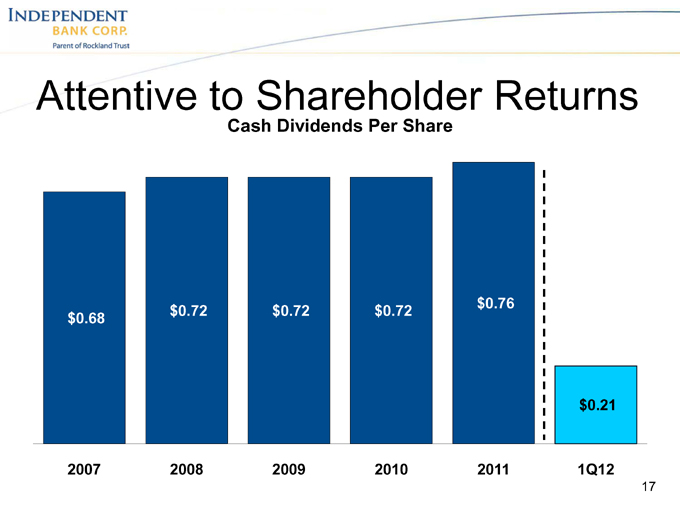

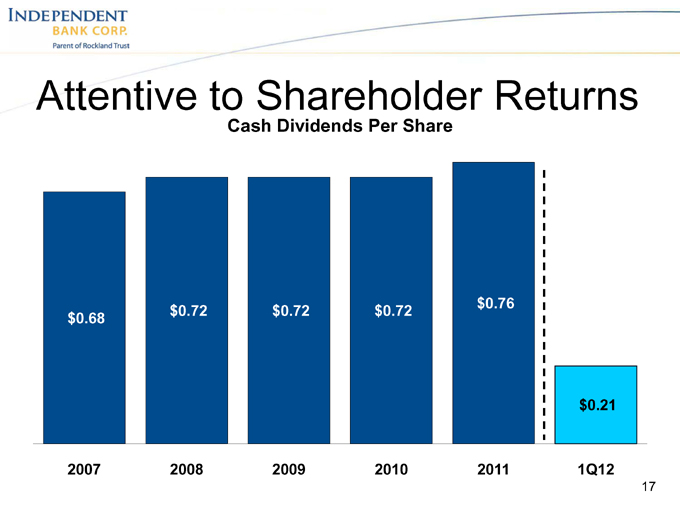

Attentive to Shareholder Returns

Cash Dividends Per Share

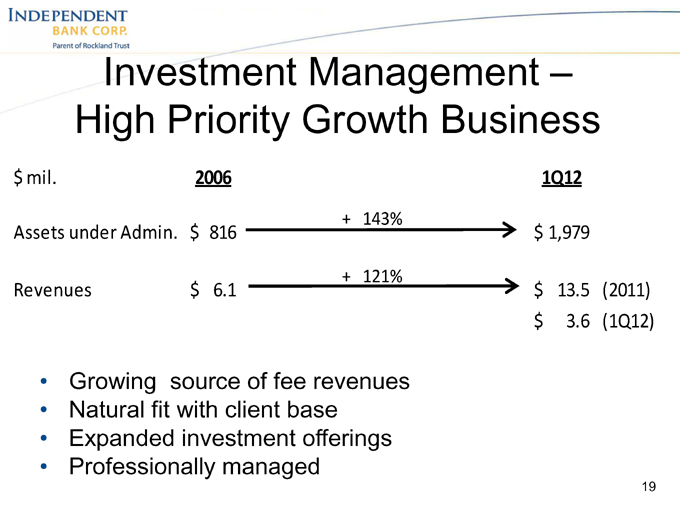

Investment Management – High Priority Growth Business

• Transformed business in 2004 – tripled in size since

• Strong feeder business from bank

• Proprietary and 3rd party fund offerings

• Strong intermediary network

• Expanding outreach and talent

PAGE 19 NOT PASTE

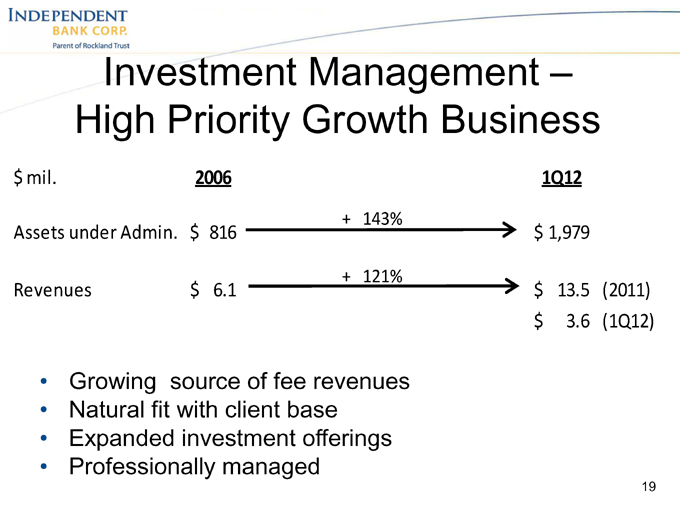

Investment Management –

High Priority Growth Business

• Growing source of fee revenues

• Natural fit with client base

• Expanded investment offerings

• Professionally managed

Sustaining Business Momentum

Business Line Focal Points

• Expand Market Presence • Grow C&I Client Base

• Expand Specialty Products, e.g. ABL

• Continue to Drive Household Growth • Expand Electronic Banking Platform • Optimize Branch Network

• Capitalize on Strong Market Demographics • Target COI Opportunity • Continue Strong Branch/Commercial Referrals

• Continue Aggressive H.E. Marketing

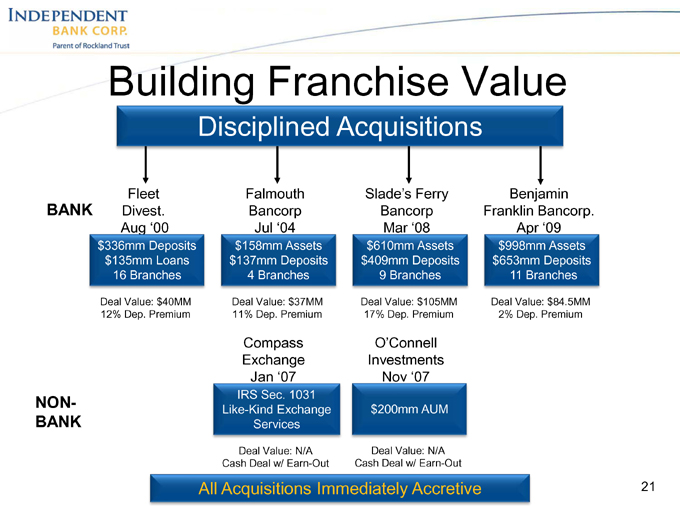

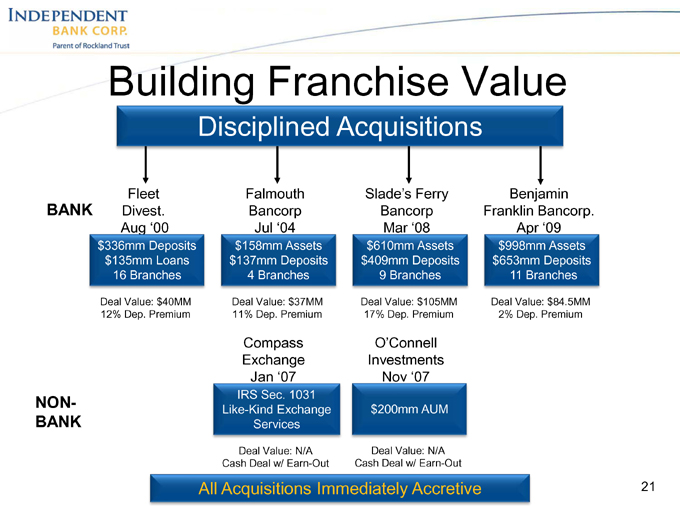

Building Franchise Value

Disciplined Acquisitions

Fleet

Falmouth

Slade’s Ferry

Benjamin

BANK

Divest.

Bancorp

Bancorp

Franklin Bancorp.

Aug ‘00

Jul ‘04

Mar ‘08

Apr ‘09

$336mm Deposits

$158mm Assets

$610mm Assets

$998mm Assets

$135mm Loans

$137mm Deposits

$409mm Deposits

$653mm Deposits

16 Branches

4 Branches

9 Branches

11 Branches

Deal Value: $40MM

Deal Value: $37MM

Deal Value: $105MM

Deal Value: $84.5MM

12% Dep. Premium

11% Dep. Premium

17% Dep. Premium

2% Dep. Premium

Compass

O’Connell

Exchange

Investments

Jan ‘07

Nov ‘07

NON-

IRS Sec. 1031

Like-Kind Exchange

$200mm AUM

BANK

Services

Deal Value: N/A

Deal Value: N/A

Cash Deal w/ Earn-Out

Cash Deal w/ Earn- Out

All Acquisitions Immediately Accretive

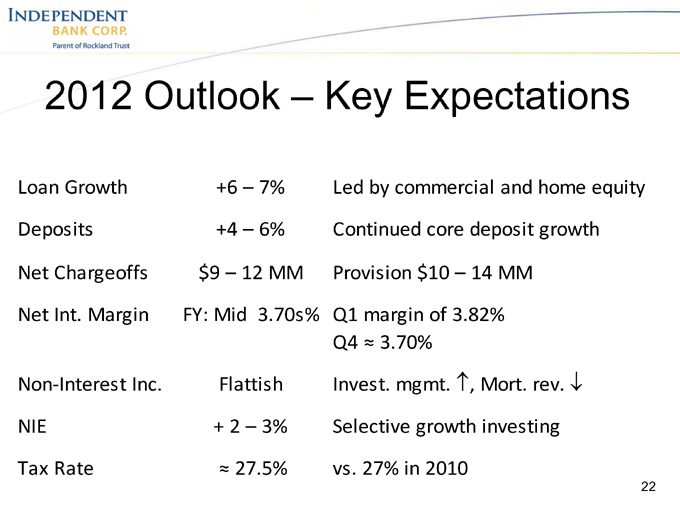

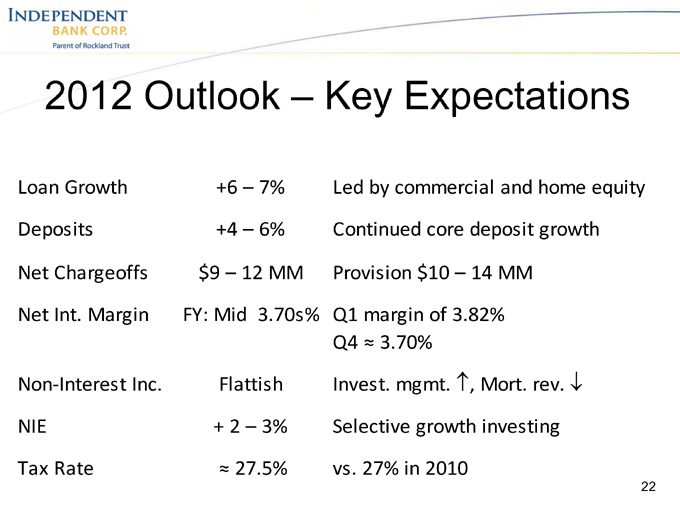

2012 Outlook – Key Expectations

Loan Growth +6 – 7% Led by commercial and home equity Deposits +4 – 6% Continued core deposit growth Net Chargeoffs $9 – 12 MM Provision $10 – 14 MM

Net Int. Margin FY: Mid 3.70s% Q1 margin of 3.82% Q4 3.70%

Non-Interest Inc. Flattish Invest. mgmt. ?, Mort. rev. ? NIE + 2 – 3% Selective growth investing Tax Rate 27.5%vs. 27% in 2010

INDB – Investment Merits

• High quality franchise in attractive markets

• Strong on-the-ground business volumes

• Operating platform that can be leveraged further

• Investing for growth in competitive strengths

• Balance sheet equipped to deal with uncertainty

• Grounded management team

• Aligned with shareholders – insider ownership 7%

• Positioned to grow, build, and acquire to drive long-term value creation

NASDAQ Ticker: INDB

www.rocklandtrust.com

Denis Sheahan—CFO Shareholder Relations: Jennifer Kingston (781) 878-6100

Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time.

Appendix

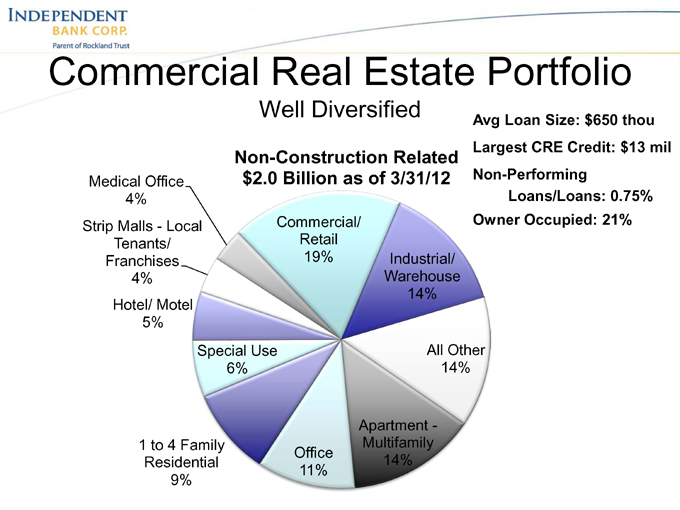

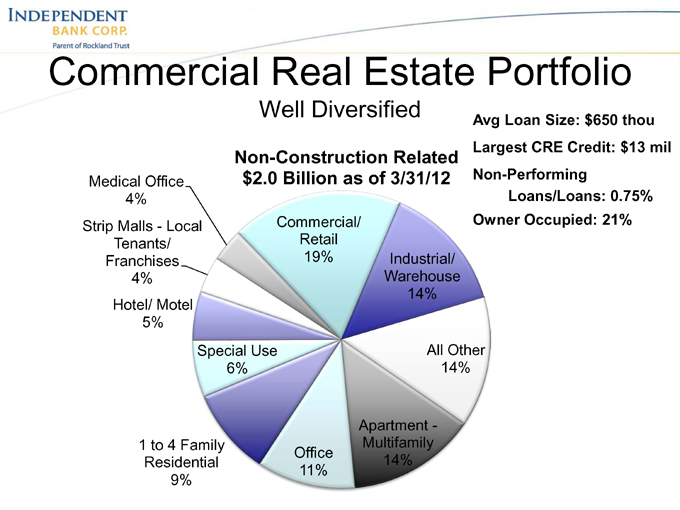

Commercial Real Estate Portfolio

Well Diversified

Avg Loan Size: $650 thou

Largest CRE Credit: $13 mil

Non-Construction Related $2.0 Billion as of 3/31/12 Non-Performing

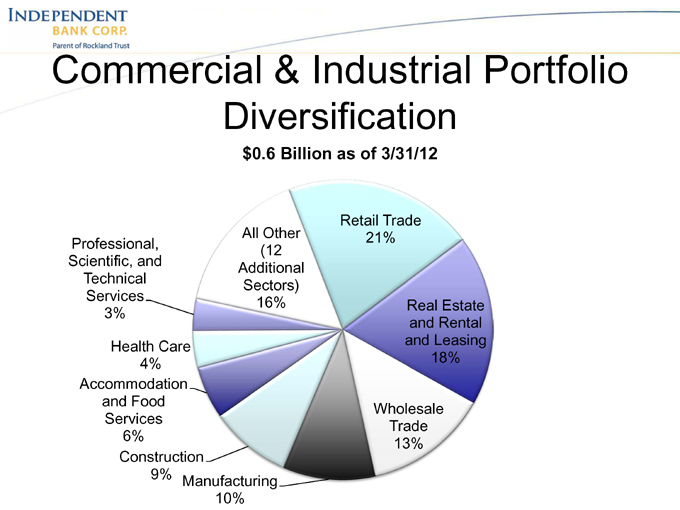

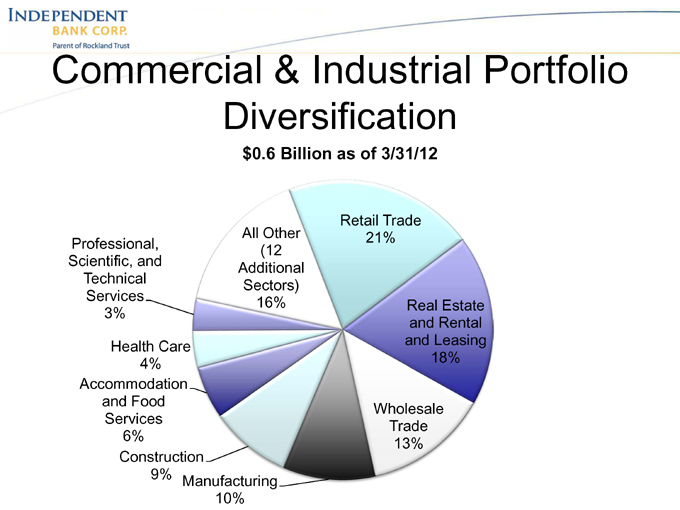

Commercial & Industrial Portfolio

Diversification

$0.6 Billion as of 3/31/12