Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| CH2M HILL Companies, Ltd. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

CH2M HILL Companies, Ltd.

March 26, 2012

Dear Stockholder,

You are cordially invited to attend the annual meeting of stockholders of CH2M HILL Companies, Ltd., which will take place on Monday, May 7, 2012, at our world headquarters in Englewood, Colorado, U.S.A.

Details of the business to be conducted at the meeting are in the formal notice of the annual meeting of stockholders and the proxy statement that accompany this letter.

Your vote is important. Whether or not you plan to attend the annual meeting, it is important that your shares be represented and voted at the meeting. I urge you to promptly vote and authorize your proxy instructions electronically through the internet, by telephone or, by signing, dating and returning the proxy card enclosed with the proxy statement. Voting through the internet or by phone will eliminate the need to return your proxy card.

On behalf of the Board of Directors, I would like to express our appreciation to our employee shareholders for the hard work and dedication to making CH2M HILL the best place to work and one of the most respected companies in the industry.

| | |

| | | Sincerely, |

|

|

|

|

|

Lee A. McIntire

Chairman and Chief Executive Officer |

Table of Contents

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

CH2M HILL Companies, Ltd.

9191 South Jamaica Street

Englewood, CO 80112

1:00 p.m., May 7, 2012

CH2M HILL World Headquarters

9191 South Jamaica Street

Englewood, CO 80112

March 26, 2012

To our Stockholders:

The 2012 annual meeting of stockholders of CH2M HILL Companies, Ltd., a Delaware corporation, will be held at CH2M HILL world headquarters, 9191 South Jamaica Street, Englewood, Colorado, U.S.A., on Monday, May 7, 2012, at 1:00 p.m., Mountain Daylight Time, for the following purposes:

- 1.

- To elect seven directors from the nominees named in the attached Proxy Statement to serve for a two year term.

- 2.

- To approve the CH2M HILL Amended and Restated 2009 Stock Option Plan.

- 3.

- To approve material terms of executive incentive compensation.

- 4.

- To ratify the appointment of KPMG LLP as the independent auditors of CH2M HILL for the year ending December 31, 2012.

- 5.

- To transact any other business that may properly come before the meeting at the time and place scheduled or, should the meeting be adjourned, at such time and place as it may be resumed.

Only stockholders of record owning shares of CH2M HILL's common stock at the close of business on March 14, 2012 will be entitled to vote at this meeting or at any postponements or adjournments thereof. You may vote your shares via the internet, by telephone or by proxy card. The Proxy Statement and 2011 Annual Report to Stockholders are available athttp://bnymellon/mobular.net/bnymellon/ch2m.

| | |

| | | BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

| | | Margaret B. McLean

Senior Vice President, Corporate Secretary and

Chief Legal Officer |

Table of Contents

TABLE OF CONTENTS

| | |

Proxy Statement | | 1 |

General Information | | 1 |

Proposal No. 1—Election of Directors | | 3 |

Corporate Governance | | 12 |

Security Ownership | | 19 |

Executive Compensation | | 22 |

Director Compensation | | 38 |

Proposal No. 2—Approval of Amended and Restated 2009 Stock Option Plan | | 39 |

Proposal No. 3—Approval of Material Terms of Executive Incentive Compensation | | 45 |

Audit Committee Report | | 48 |

Independent Auditors | | 49 |

Proposal No. 4—Ratification of Appointment of Independent Auditors | | 49 |

Proposal No. 5—Other Business | | 50 |

Additional Information | | 50 |

Appendix A—CH2M HILL Companies, Ltd. Amended and Restated 2009 Stock Option Plan | | 51 |

Table of Contents

PROXY STATEMENT

2012 ANNUAL MEETING OF STOCKHOLDERS

CH2M HILL Companies, Ltd.

9191 South Jamaica Street

Englewood, Colorado 80112

March 26, 2012

CH2M HILL Companies, Ltd.

GENERAL INFORMATION

This proxy statement is being furnished to you by our Board of Directors in connection with the solicitation of your proxy to be voted at the 2012 Annual Meeting of Stockholders of CH2M HILL to be held on Monday, May 7, 2012, at 1:00 p.m., Mountain Daylight Time, at 9191 South Jamaica Street, Englewood, CO 80112. This proxy statement and the accompanying materials are being delivered electronically or mailed to stockholders on or about March 26, 2012.

What is the purpose of the Annual Meeting?

At our annual meeting, stockholders will have the opportunity to vote on the matters included in this proxy statement. We will also report on CH2M HILL's financial results and respond to questions from stockholders.

Who can attend the meeting?

All stockholders of record as of March 14, 2012 or their duly appointed proxies may attend the meeting.

Who is entitled to vote?

You are entitled to vote if our records show that you held your shares of CH2M HILL common stock at the close of business on March 14, 2012. This date is known as the "record date" for determining who receives notice of the meeting and who is entitled to vote. Each outstanding share entitles its holder to cast one vote on each matter upon which to be voted.

What constitutes a quorum?

A majority of the shares entitled to vote, present in person or represented by proxy, constitutes a quorum at the Annual Meeting. As of the record date, 31,639,482 shares of CH2M HILL's common stock were outstanding. Proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum.

How do I vote?

If you are a holder of record of CH2M HILL shares of common stock as of March 14, 2012, you can vote in one of four ways:

- 1.

- Vote by Internet—follow the instructions on the Internet atwww.proxyvoting.com/ch2m.

- 2.

- Vote by phone—call 1 (866) 540-5760 (in the U.S.) or 201-680-6599 (outside the U.S.).

- 3.

- Vote by proxy card—if you have requested and received a paper copy of the proxy materials, you can mark, sign, date and return the paper proxy card enclosed with the proxy materials in accordance with the instructions set forth on the proxy paper card;please note that if you vote through the Internet or by phone, you do not need to return your proxy card.

- 4.

- Vote in person—if you attend the meeting, you may deliver your completed proxy card in person or vote in person by completing the ballot form that will be provided.

1

Table of Contents

Can I change my vote or revoke my proxy?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Corporate Secretary of CH2M HILL at 9191 South Jamaica Street, Englewood, CO 80112 either a notice of revocation or a duly executed proxy bearing a later date as long as it is received by May 7, 2012 at 1:00 p.m., Mountain Daylight Time. Your proxy also will be revoked if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

How do I vote my 401(k) Plan shares?

If you participate in the CH2M HILL Retirement and Tax-Deferred Savings Plan, you have the right, if you choose, to instruct the trustee of the Plan how to vote the shares of common stock credited to your Plan account as well as a pro-rata portion of common stock credited to the accounts of other Plan participants and beneficiaries for which no instructions are received. Your instructions to the trustee of the Plan should be made by voting as discussed in "How Do I Vote?" above. The trustee of the Plan will vote your shares in accordance with your duly executed instructionswhich must be received by the trustee no later than 5:00 p.m., Mountain Daylight Time, on April 30, 2012. If you do not send instructions regarding the voting of common stock credited to your Plan account, such shares shall be voted pro rata according to the voting instruction of other Plan participants. You may also revoke previously given instructions by filing with the trustee of the Plan no later than 5:00 p.m., Mountain Daylight Time, on April 30, 2012, either written notice of revocation or a properly completed and signed voting instruction bearing a date later than the date of the prior instructions.

How will my proxy be voted?

The persons named as proxy holder on the proxy card will vote in accordance with your instructions or, if none are provided, in accordance with the recommendations of the Board of Directors as discussed in this proxy statement. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes and abstentions.

How many votes are required for each proposal?

Proposal 1: Election of Directors.

Vote Required: Majority of votes cast. The votes that stockholders cast "for" the director nominee must exceed the votes cast "against" the nominee to elect the nominee as a director.

Proposal 2: Stock Option Plan.

Vote Required: Majority of votes cast. The votes that stockholders cast "for" must exceed the votes that stockholders cast "against" to approve the Amended and Restated 2009 Stock Option Plan.

Proposal 3: Material Terms of Executive Incentive Compensation.

Vote Required: Majority of votes cast. The votes that stockholders cast "for" must exceed the votes that stockholders cast "against" to approve the material terms of executive incentive compensation for tax deductibility purposes.

Proposal 4: Ratification of Appointment of Independent Auditors.

Vote Required: Majority of votes cast. The votes cast "for" must exceed the votes that stock cast "against" to approve the ratification of KPMG LLP as CH2M HILL's independent auditors.

2

Table of Contents

How are abstentions treated?

A properly executed proxy marked "ABSTAIN" or "WITHHOLD" with respect to any matter will not be voted on that matter, although they will be counted for purposes of determining whether there is a quorum. All of the proposals will be determined by a majority of votes cast. Accordingly, since no minimum number of votes are required to pass the proposals, an abstention or "withhold" authority vote will have no effect on the outcome of such proposals.

How will proxies be solicited?

Proxies are being solicited through electronic delivery or by mail by the Board on behalf of CH2M HILL. The cost of solicitation of the proxies will be paid by CH2M HILL. CH2M HILL has no plans to retain any firms or otherwise incur any extraordinary expense in connection with the solicitation.

PROPOSAL 1. ELECTION OF DIRECTORS

Except where you withhold authority, your proxy will be voted at our Annual Meeting FOR the election of the nominees named below for a two year term and until his or her successor, if any, is duly elected and qualified. Incumbent directors will hold office until the Annual Meeting in the year their term expires and until their successors, if any, are elected and qualified, subject to the director's earlier death, retirement or removal.

Our articles of incorporation and bylaws provide that our Board of Directors shall consist of no more than thirteen directors and not less than seven directors, provided that the majority of the Board consists of employee directors. The size of the Board may be changed from time-to-time by the resolution of the Board of Directors. There are currently twelve members on our Board. Four directors are outside independent directors and eight directors are employees. At the February 2012 Board meeting, our Board determined the size of the 2012-2013 Board to be twelve Board members with the mix of outside and employee directors to be five and seven, respectively.

Director Nominations

According to our bylaws, director candidates are nominated by the CH2M HILL Board based on recommendations of the Governance Committee of the Board; provided that the Governance Committee's recommendations for employee director candidates are made on the recommendation of the Chief Executive Officer based on the nomination process conducted annually with input from CH2M HILL employees and the employee nominations committee. The Governance Committee of the Board takes the recommendations of the Chief Executive Officer into account when considering the employee director nominees it recommends for the Board's consideration, but the Governance Committee is not obligated to follow these recommendations as it must consider the needs of the company and the overall insider and outsider mix of the Board in its recommendations for the nomination slate. The Governance Committee recommended to the Board that Messrs. Brinded, Geist, Holliday and Williams and Ms. Nelson be nominated for election as outside directors and Messrs. Bailey and Smozjassy be nominated for election as employee directors as part of the 2012 nomination slate.

If elected, the director candidates will each serve two year terms expiring in 2014, and until their earlier retirement, death, resignation or removal. In the event that any of the nominees should become unavailable to stand for election at the Annual Meeting, the proxy holders will vote for either (1) such other person, if any, as may be designated by our Board of Directors, in the place of any nominee who is unable to serve or (2) the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. Our Board of Directors expects all of the nominees named below to be available for election.

3

Table of Contents

Director Qualifications

Each member appointed to the Board is qualified to serve as a director based on his or her experiences, attributes and skills. The principal employment and directorships held by the nominees for the past five years are set forth below. Specific experiences, attributes and skills that qualify each individual to serve as a director on the Board are also set forth below. In selecting the candidates, the Governance Committee and the Board considered the candidates' background and experience as well as diversity each would bring to our Board. We believe each director's professional experiences and attributes make him or her an asset to our Board and to the strategic direction of the company.

The following table lists our director nominees, as well as each of our continuing directors, and provides their respective ages and titles.

| | | | | | |

Name | | Age | | Title | | Director

Since |

|---|

Nominees whose term expires 2012 | | |

Robert W. Bailey | | 56 | | Director and President Water Business Group | | 2009 |

Jerry D. Geist (OD) | | 77 | | Director | | 1989 |

Charles O. Holliday, Jr. (OD) | | 64 | | Director | | 2009 |

Georgia R. Nelson (OD) | | 62 | | Director | | 2010 |

Barry L. Williams (OD) | | 67 | | Director | | 1995 |

New Nominees | | |

Malcolm Brinded (OD) | | 59 | | Outside Director nominee | | — |

Michael A. Szomjassy | | 61 | | Director nominee and President Environmental Services Business Group | | — |

Directors whose term expires 2013 | | |

Robert G. Card | | 59 | | Director and President Energy, Water & Facilities Division | | 2005 |

Michael A. Lucki | | 56 | | Director and Chief Financial Officer | | 2011 |

Lee A. McIntire | | 63 | | Director and Chairman & Chief Executive Officer | | 2009 |

Michael E. McKelvy | | 53 | | Director and President Government, Environment & Infrastructure Division | | 2010 |

Jacqueline C. Rast | | 50 | | Director and President International Division | | 2008 |

4

Table of Contents

| | |

|

Nominees for Election as Directors |

|

|

|

Robert W. Bailey has served as a director of CH2M HILL since 2009, and from 2005 to 2008.

Mr. Bailey joined CH2M HILL in 1984 and has been the President of CH2M HILL's Water Business Group since 2008. Between 2002 and 2007, he was the Regional Manager for the southeast U.S. region overseeing CH2M HILL's business portfolio in that geography. Prior to 2002, Mr. Bailey, a professional engineer, held a variety of positions with an expanding scope of responsibilities in CH2M HILL's Water Business Group.

Mr. Bailey is a Distinguished Alumni of the University of Illinois and a recognized leader in the global water community, having received the George Warren Fuller Award for Leadership in the Water Industry from the American Water Works Association. He also serves on the Water Security Advisory Council for the World Economic Forum.

Qualifications: Mr. Bailey is qualified to serve on our Board based on his extensive experience in the global water business, civil engineering and infrastructure industry in general. |

|

|

|

Malcolm Brinded has had a distinguished 37 year career with Royal Dutch Shell plc, a global oil and gas company, where he has worked in the United Kingdom, Brunei, the Netherlands, and Oman. Mr. Brinded has been a member of the Royal Dutch Shell plc's board of directors between 2002 and 2012. He is leaving Shell in April 2012. Mr. Brinded has been a member of the Network Rail Board in the UK as a Non-Executive Director since 2010.

Between 2009 and 2012, Mr. Brinded has been Royal Dutch Shell's Executive Director of the Upstream International business. Between 2004 and 2009, Mr. Brinded served as Executive Director in charge of Shell's Exploration and Production business unit, and prior to that he was a Managing Director responsible for Gas and Power, and IT. Between 1999 and 2002, Mr. Brinded was the Shell Country Chairman in the United Kingdom, as well as the Managing Director of Shell UK Exploration and Production business. Since 2009, he has served as the Chairman of the Shell Foundation.

Mr. Brinded graduated from Cambridge University with a degree in Engineering. He is a Fellow of the UK Institutions of Civil and Mechanical Engineers and the UK Royal Academy of Engineering. In 2002, Mr Brinded was awarded the CBE for services to the UK Oil and Gas Industry.

Qualifications: Mr. Brinded is qualified to serve on our Board based on his extensive experience as a public company director and executive officer, as well as his engineering background, and extensive work in the energy sector critical to our business. Mr. Brinded's leadership in sustainability and extensive experience in key international markets including Europe, the Middle East and Asia add to his stellar qualifications to serve on our Board. He also brings diversity to our Board as a non-U.S. national with extensive background of living and working outside of the U.S. |

|

5

Table of Contents

| | |

|

|

|

Jerry D. Geist has served as a director of CH2M HILL since 1989.

Mr. Geist has been Chairman of Santa Fe Center Enterprises, Inc. since 1990 and Chief Executive Officer of Howard International Utilities from 1994 through 2000. He was Chairman and Chief Executive Officer of Energy & Technology Company, Ltd. until 2003. Mr. Geist served as a Director of the Davis Family of Mutual Funds serving as Independent Lead Director until retiring as Director Emeritus on January 1, 2009. Mr. Geist had been the CH2M HILL Board's independent Lead Director from 2004 to 2011.

Mr. Geist has served as Chairman of the Edison Electric Institute and is currently the Chairman of the Board of Trustees of the University of New Mexico hospital.

Qualifications: Mr. Geist is qualified to serve on our Board based on his extensive public company experience as a director and as an executive, his experience as a member of our Board for over twenty years, and his considerable experience in the energy sector. |

|

|

|

Charles "Chad" O. Holliday, Jr. has served as a director of CH2M HILL since 2009.

Mr. Holliday was a member of the Board of Directors for E.I.��du Pont de Nemours and Company (DuPont) from 1997 through 2009 and served as its Chairman from 1999 through 2009. He is the Chairman of the Board of Directors of Bank of America and also a member of the Board of Directors for Deere & Company and Royal Dutch Shell plc. Mr. Holliday served as Chief Executive Officer of DuPont from February 1998 through January 2009. Mr. Holliday was named the CH2M HILL Board's independent Lead Director effective January 1, 2012.

Mr. Holiday is a member of the National Academy of Engineering, is the former Chairman of the U.S. Council on Competitiveness, and is a founding member of the International Business Council. He formerly served as the Chairman of the World Business Council for Sustainable Development and the Business Roundtable's Task Force for Environment, Technology and Economy. He is the Chair Emeritus of the Board of Directors of Catalyst. Mr. Holliday is the author of "Walking the Talk," a book that makes the business case for sustainable development and corporate responsibility.

Qualifications: Mr. Holliday is qualified to serve on our Board based on his extensive experience as a public company director on various Fortune 100 public company boards, as well as his engineering background and leadership in sustainability. |

|

6

Table of Contents

| | |

|

|

|

Georgia R. Nelson has served as a director of CH2M HILL since 2010.

Ms. Nelson spent more than 30 years in the power generation industry serving in various senior executive capacities for Edison International and its subsidiaries between 1971 and 2005, including President of Midwest Generation Edison Mission Energy (EME) and General Manager of EME Americas. In her role she was responsible for power plant construction and facilities management in the United States, Puerto Rico, United Kingdom, Turkey, Thailand, Indonesia, Australia and Italy. Ms. Nelson is a member of the Board of Directors of Cummins Inc., where she has been serving since 2004. Ms. Nelson served as a Director of Nicor, Inc. from 2005 until 2011. Ms. Nelson is also a Director of Ball Corporation, where she has been serving since 2006.

Ms. Nelson is a member of the Executive Committee of the National Coal Council, an industry advisory committee to the U.S. Department of Energy, which she chaired from May 2006 to May 2008.

Qualifications: Ms. Nelson is qualified to serve on our Board based on her public company experience as a member of several public company boards, and based on her experience in the power generation industry. |

|

|

|

Michael A. Szomjassy previously served on the Board of CH2M HILL between 2007 and 2010.

Mr. Szomjassy has been the President of CH2M HILL's Environmental Services Business Group since 2011. Between 2007 and 2010, Mr. Szomjassy served as the Deputy Program Director for the CLM Delivery Partner, a joint venture providing program management services to the Olympic Delivery Authority for the London 2012 Olympic and Paralympic Games. Between 2004 and 2007, Mr. Szomjassy served as Senior Vice President and Director of Operations of the Environmental Business Group. Prior to joining CH2M HILL in 2007, Mr. Szomjassy was President of Williams Environmental Services, Inc., Vice President of Insituform Technologies, Chief Operating Officer of Aqua Alliance, the U.S. arm of Vivendi's water business; and Executive Vice President of OHM Corp., at the time the largest environmental contractor in the U.S.

Qualifications: Mr. Szomjassy is qualified to serve on our Board based on his extensive experience in the environmental, water and other related engineering fields and his considerable international experience that can benefit our Board. |

|

7

Table of Contents

| | |

|

|

|

Barry L. Williams has served as a director of CH2M HILL since 1995.

Mr. Williams is the retired managing general partner of Williams Pacific Ventures, Inc., where he served since 1987. Between 2000 and 2001, Mr. Williams served as the President and CEO of American Management Association International. He has served as Senior Mediator for JAMS/Endispute from 1993 to 2002 and a visiting lecturer for the Haas Graduate School of Business, University of California from 1993 to 2000. Mr. Williams has acted as a general partner of WDG, a California limited partnership, from 1987 to 2002 and a general partner of Oakland Alameda Coliseum Joint Venture since 1998.

Mr. Williams also serves as a Director of PG&E Corp., Northwestern Mutual Life Insurance Company, Simpson Manufacturing Company, SLM Corporation and several not-for-profit organizations.

Qualifications: Mr. Williams is qualified to serve on our Board based on his significant financial experience, his public company experience as a member of several public company boards, and his extensive experience on our Board. |

|

The Board of Directors unanimously recommends that the stockholders vote FOR the appointment of each nominee to the Board of Directors. |

|

8

Table of Contents

| | |

|

Continuing Directors |

|

|

|

Robert G. Card has served as a director of CH2M HILL since 2005 and for several terms between 1992 and 2001.

Mr. Card has been an employee of CH2M HILL since 1974, except for a short departure between 2001 and 2004 when he served as an Under Secretary for the U.S. Department of Energy, and the President of The Card Group—a strategic advisory services firm for markets, policy and technology in energy and the environment. He currently serves as Senior Vice President of CH2M HILL and the President of the Energy, Water & Facilities Division. During his thirty eight year tenure with CH2M HILL, Mr. Card has served in many senior executive positions, including Chief Executive Officer of Kaiser-Hill Company between 1996 and 2001, Chairman and President and Chief Executive for International Operations from 2004 through 2006, deputy Program Director for CLM Delivery Partner Ltd, London 2012 Olympic and Paralympic Games program from 2006 through 2008, President and Chief Executive of CH2M HILL's Federal Client Group, the Government, Environment and Nuclear Division and the Facilities and Infrastructure Division.

Mr. Card also held positions as a Senior Advisor to the Center for Strategic and International Studies and as a Non-Resident Senior Fellow of The Brookings Institute.

Qualifications: Mr. Card is qualified to serve on our Board based on his extensive industry experience in and outside of the U.S. in various executive capacities, his U.S. government experience, and his project management experience. As one of CH2M HILL's largest individual stockholders, he is uniquely qualified for Board service.

Mr. Card's term expires in 2013. |

|

|

|

Michael A. Lucki has served as a director of CH2M HILL since 2011.

Mr. Lucki joined CH2M HILL in 2010 and currently serves as the Senior Vice President and Chief Financial Officer. He joined CH2M HILL from Ernst & Young LLP where he led the firm's Global Engineering and Construction (E&C) Industry Practice since 1994 and the firm's Global Infrastructure Practice since 2008.

Mr. Lucki is the Chair of the California State University, Los Angeles School of Business—Accounting Advisory Board and a Trustee of the California State University System Foundation Board. He is a member of the American Institute of Certified Public Accountants and a member of the California Society of Certified Public Accountants.

Qualifications: Mr. Lucki is qualified to serve on our Board based on his extensive engineering, construction and infrastructure industry experience, his mergers and acquisitions experience, and his experience in corporate finance and risk management.

Mr. Lucki's term expires in 2013. |

|

9

Table of Contents

| | |

|

|

|

Lee A. McIntire has served as a director of CH2M HILL since 2009.

Mr. McIntire joined CH2M HILL as the President and Chief Operating Officer in 2006. He became CH2M HILL's Chief Executive Officer in 2009, and CH2M HILL's Chairman of the Board on January 1, 2010. Before joining CH2M HILL, Mr. McIntire spent more than 15 years with Bechtel Group Inc., where he served as a partner and as President of several businesses and as a member of its Board of Directors between 1999 and 2004.

Between 2004 and 2006, Mr. McIntire was a Professor and Executive-in-Residence at the Graduate School of Management, University of California, Davis (UC Davis). Mr. McIntire is currently serving as a member of the board of BAE Systems plc.

Qualifications: Mr. McIntire is qualified to serve on our Board based on his extensive experience in the engineering and construction industry, and as part of CH2M HILL's leadership team.

Mr. McIntire's term expires in 2013. |

|

|

|

Michael E. McKelvy has served as a director of CH2M HILL since 2010.

Mr. McKelvy joined CH2M HILL in 2003 in connection with our acquisition of Lockwood Greene. He currently serves as a Senior Vice President and the President of the Government, Environment and Infrastructure Division of CH2M HILL. Mr. McKelvy has over thirty years of engineering and construction experience. Prior to his current role, Mr. McKelvy was the President and Group Chief Executive for the Industrial Client Group between 2006 and 2009 and President for the Manufacturing and Life Sciences Business Group since 2005. Between 1988 and 2003, he served in a variety of roles for Lockwood Greene such as the Geschäftsführer for Lockwood Greene GmbH in Germany and Director of southeast and southwest U.S. operations.

Between 2000 and 2003, Mr. McKelvy was a member of the Board of Directors for Green Diamond/Columbia Ventures in Columbia, SC and is a current board member for the Professional Services Corporation in D.C. He is a Registered Architect in 25 states and an active member of multiple professional societies and organizations.

Qualifications: Mr. McKelvy is qualified to serve on our Board based on his extensive engineering and construction industry experience, his experience with commercial and government business, and his experience outside of the U.S.

Mr. McKelvy's term expires in 2013. |

|

10

Table of Contents

| | |

|

|

|

Jacqueline C. Rast has served as a director of CH2M HILL since 2008.

Ms. Rast currently serves as a Senior Vice President and the President of the International Division of CH2M HILL and previously served as the President of the Facilities and Infrastructure Division from 2009 until 2011 and as Vice President, Major Programs Group and Executive Director for Mergers and Acquisitions between 2009 and 2010. Between 2007 and 2009, Ms. Rast led our Center for Project Excellence. She first joined CH2M HILL in 1988 in our Environmental business.

In 1998, Ms. Rast started her own management consulting firm, Talisman Partners, which she sold in 2001 to Earth Tech. Ms. Rast served as Senior Vice President, Facilities and Transportation business group for Earth Tech from 2001 to 2003; and was a member of Earth Tech's Design-Build Risk Review Committee. Ms. Rast returned to CH2M HILL in 2005.

Ms. Rast is a member of the Board of Directors of the Metro Denver Sports Commission and a member of the Board of Catalyst Europe.

Qualifications: Ms. Rast is qualified to serve on our Board based on her more than twenty years of industry experience, and her mergers and acquisitions and international experience.

Ms. Rast's term expires in 2013. |

|

11

Table of Contents

CORPORATE GOVERNANCE

Board of Directors

CH2M HILL is governed by our Board of Directors. Our Board held a total of fourteen meetings in 2011, four regularly scheduled and ten special meetings. All directors attended 75 percent or more of the aggregate Board and Committee meetings of which they are members. CH2M HILL does not have a policy regarding Board members attending the Annual Meeting of Stockholders. We had three Board members attend last year's Annual Meeting of Stockholders in person and five members via telephone.

Corporate Governance Principles

CH2M HILL is committed to best practices in corporate governance and maintains a business environment of uncompromising integrity. We continue to implement this commitment through, among other things, our Governance Principles, practices and compliance with the relevant provisions of the Sarbanes-Oxley Act of 2002, Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, and other laws and regulations that regulate our Company and our business. Our Board has formalized our standards of corporate governance that are reflected in our Governance Principles. Our Governance Principles, some of which are discussed below, are available on our website athttp://www.ch2m.com/corporate/about_us/governance.asp. Our governance policies are reviewed annually by the Governance Committee of our Board to determine whether they continue to advance the best interests of CH2M HILL and our stockholders, and whether they comply with the relevant laws that regulate our business.

Director Independence

CH2M HILL's common stock is not listed on a national securities exchange and, as a result, our directors are not subject to the independence requirements of the national stock exchanges. CH2M HILL believes, however, that outside directors should not have any material relationship with CH2M HILL. Our Board currently consists of twelve directors, four of whom are outside independent directors. Beginning in May 2012, the Board will consist of twelve directors, five of whom will be outside independent directors. The Board has adopted independence standards to assist the Board in determining director independence which are consistent with the independence tests under the corporate governance rules for listed companies of the New York Stock Exchange. Under our Board's standards, a director is not independent if:

- •

- The director is, or has been within the last three years, an employee of CH2M HILL, or any of the director's immediate family members is, or has been within the last three years, an executive officer of CH2M HILL.

- •

- The director, or any immediate family member of the director, has received, during any twelve month period within the last three years, more than $120,000 in direct compensation from CH2M HILL, other than director and committee fees, and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

- •

- (1) The director is a current partner or employee of a firm that is the internal or external auditor of the CH2M HILL; (2) the director has an immediate family member who is a current partner of such a firm; (3) the director has an immediate family member who is a current employee of such a the firm and who personally works on the CH2M HILL audit; or (4) the director, or any immediate family member of the director, was within the last three years a partner or employee of such a firm and personally worked on the Company's audit within that time.

12

Table of Contents

- •

- The director, or any immediate family member of the director, is, or has been within the last three years, employed as an executive officer of another company where any of CH2M HILL's executive officers at the same time serves or served on the other company's compensation committee.

- •

- The director is a current employee of, or any immediate family member of the director is a current executive officer, of a company that has made payments to, or received payments from, CH2M HILL for property or services in an amount which, in any of the last three fiscal years, exceeded two percent (2%) or $1,000,000, whichever is greater, of such other company's consolidated gross revenues.

Our outside independent directors include Jerry Geist, Charles "Chad" Holliday, Jr., Georgia Nelson, and Barry Williams. The Board has made a determination that all of these outside directors are "independent" pursuant to the independence standards. The Board has also determined that all the members of the Audit Committee and Compensation Committee are independent pursuant to these guidelines.

Board Leadership Structure

Under our Board's Governance Principles, our Board has the ability to change its leadership structure in the best interest of CH2M HILL at any given point in time. Our Board is led by a Chairman elected annually by the directors. Mr. McIntire has served as CH2M HILL's Chief Executive Officer since 2009 and the Chairman since 2010.

Our Board does not have a policy with respect to combining or separating the Chairman and Chief Executive Officer positions. Under the current Board leadership structure, the positions of Chairman and Chief Executive Officer are combined into one role because our Board believes that as an employee controlled company, CH2M HILL is best served by a Board where an employee Board member, as opposed to an independent outside Board member, serves as the chair of the Board. Our Board further believes that because all employee Board members report, directly or indirectly, to the Chief Executive Officer, a Board chaired by an employee shareholder who is not the Chief Executive Officer may create ambiguity of leadership in the board room. For these reasons and because Mr. McIntire is eminently qualified for the role, our Board believes that combining the roles of Chief Executive Officer and Chairman of the Board is appropriate at this time and is in the best interest of CH2M HILL.

Under our Board's Governance Principles, the outside directors of our Board designated one of the independent directors as Lead Director. The Lead Director presides at the meetings of outside directors, and facilitates communications between the outside independent directors and the Chairman, provides input to the Chairman on CH2M HILL's governance, performance issues, Board meeting structure and agendas and acts as a liaison to stockholders who wish to communicate with outside directors. Effective January 2012, Charles "Chad" Holliday, Jr. was elected as the Lead Director. Jerry Geist served as the Lead Director in 2011. The outside directors may retain or change this appointment after the nominees are elected by the stockholders at the Annual Meeting.

Board's Role in Risk Oversight

Our Board oversees and reviews CH2M HILL's risk management process directly and through its Audit and Risk Committees to ensure that the appropriate risks are timely considered and robust mitigation strategies are implemented. In addition, our Board routinely engages in the review of CH2M HILL's enterprise risk, as part of its oversight of CH2M HILL's strategy and capital planning activities. The Risk Committee of the Board is tasked with overseeing CH2M HILL's enterprise risk management systems and processes including the identification of major risks facing our industry and our Company and the impact of the risks on the business including portfolio and project risks. The Risk Committee

13

Table of Contents

provides periodic reports to our Board on the enterprise risk management program and offers review and guidance to our management on our approach and process to assess and analyze project and program related risks across the enterprise. The Audit Committee reviews policies regarding risk assessment and risk management, reviews financial and ethical risks and reviews major financial risk exposures and steps taken to monitor and control the exposures. The Audit Committee provides periodic reports to our Board on how CH2M HILL manages these risks.

Communications with the Board

Stockholders may communicate with our Board by writing to them in care of Margaret B. McLean, Senior Vice President, Corporate Secretary and Chief Legal and Ethics Officer, CH2M HILL, 9191 South Jamaica Street, Englewood, CO 80112 or to the Lead Director in care of the same address. All communications should indicate whether they are intended for the full Board, for outside independent directors only, or for any particular Board member. The inquiries will be directed to the appropriate Board member or members who will reply to stockholders directly.

Nominations of Directors

Our Governance Committee identifies and recommends for nomination individuals it believes are qualified to be inside and outside Board members and who are best suited to contribute to the Board's activities given CH2M HILL's needs and objectives. The Board seeks directors with diverse professional backgrounds and reputation for integrity who combine a broad spectrum of experience and expertise that is important to CH2M HILL's short and long term interests. Diversity of background has always been and shall continue to be an important objective in the selection of directors. A candidate for director should have experience in positions with a high degree of responsibility and be selected based upon contributions they can make to the Board and upon their willingness to devote adequate time and effort to Board responsibilities. In making this assessment, the Governance Committee considers the candidates' knowledge of our industry and markets, and our clients' industries and markets, the number of other boards on which the candidate serves, and the other business and professional commitments of the candidate. The candidate should also have the ability to exercise sound business judgment to act in what he or she reasonably believes to be in the best interest of CH2M HILL and our stockholders.

The Governance Committee of our Board makes recommendations to the full Board about outside director candidate nominees. In reviewing and selecting the outside director nominees for Board consideration, the Committee considers a variety of factors including outside director performance, any special expertise and how the expertise fits with the needs of CH2M HILL. Candidates for outside director positions must fulfill the Board's independence standards for outside directors as described above and included in the Governance Principles which are available on our website athttp://www.ch2m.com/corporate/about_us/governance.asp.

In selecting employee directors for consideration, the Governance Committee takes into account the recommendation of the Chief Executive Officer based on input he receives from our employee stockholders. The process for annual board nominations for employee director candidates commences with the Chief Executive Officer sending a detailed description of the nominating process and qualification requirements for Board membership to all employee stockholders. The Chief Executive Officer then convenes a special employee director nominating committee. The employee director nominating committee carefully reviews all nominations received by employee stockholders and recommends to the Chief Executive Officer a slate of candidates for employee director slots. The Chief Executive Officer thereafter shares these recommendations with the Governance Committee which makes its own recommendations to the full Board. The Governance Committee considers the Chief Executive Officer's recommendations in its deliberations, but is not bound by them and is not required to select only employee director nominees from among the Chief Executive Officer's recommendations. The Committee may include other employee director candidates in its recommendations to the full Board.

14

Table of Contents

The criteria for employee director nominees includes, among other things:

- •

- Personal characteristics of the highest caliber and proven leadership abilities,

- •

- Experience and capabilities similar to those required of senior corporate officers of a global company of our size, including at least 15 years experience in the engineering and construction related business,

- •

- Potential of bringing the diversity of background and experience to the Board's deliberations to broaden the Board's perspective and to reflect the diversity of our clients and stakeholders,

- •

- Knowledgeable about CH2M HILL and ideally has worked with a broad cross section of business units, technical and/or geographical issues and capable of representing the interests of the entire enterprise in policy and governance issues, and

- •

- Brings special skills to the Board mix based on issues facing the company during the relevant Board term.

Code of Ethics

We have adopted a code of ethics and business conduct for our executive and financial officers entitled "CH2M HILL Executive and Financial Officers' Code of Ethics." It applies to all of our senior executives and financial officers, including our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Chief Human Resources Officer, Chief Legal Officer, Treasurer, and Presidents of our operating divisions and business groups. The code is available on our website athttp://www.ch2m.com/corporate/about_us/business_ethics.asp. A hard copy is also available without charge to any stockholder upon request by writing to Margaret B. McLean, Senior Vice President, Corporate Secretary and Chief Legal and Ethics Officer, CH2M HILL, 9191 South Jamaica Street, Englewood, CO 80112. We will disclose any future changes of the Code of Ethics on our website.

We also have ethics policies that are applicable to all employees entitled "CH2M HILL Employee Ethics and Business Conduct Principles" that mandates rules of conduct to all CH2M HILL employees including all senior executives and financial officers. It is also available on our website by following the same links as described above and will be available in hard copy. We maintain a confidential telephone and web-based hotline, where employees can seek guidance or report potential violations of laws, CH2M HILL policies or rules of conduct.

Committees of the Board

In 2011, the Board of Directors had five committees: Audit, Compensation, Executive, Governance and Risk Committees. The Audit Committee had a subcommittee that focused on audit issues only and which consisted of outside independent directors only. This subcommittee was eliminated in September 2011 when the Audit Committee membership was reconfigured to consist of outside independent directors only. The Audit Subcommittee (and the Audit Committee after September 2011) and Compensation Committees are comprised solely of independent directors. Below is a chart showing current committee members and a summary of the functions performed by the committees during 2011.

15

Table of Contents

COMMITTEE MEMBERSHIP

| | | | | | | | | | | | |

| | Audit | | Audit Sub* | | Compensation | | Executive | | Governance | | Risk |

|---|

Manuel Aguirre | | | | | | | | | | | | |

Robert Bailey | | | | | | | | | | | | X |

Robert Card | | X* | | | | | | X | | X | | |

Jerry Geist (OD) | | X | | X | | C | | X | | X | | |

Charles Holliday, Jr. (OD) | | X | | X | | X | | X | | C | | |

Michael Lucki | | | | | | | | X | | | | |

Lee McIntire | | | | | | | | C | | | | |

Michael McKelvy | | X* | | | | | | X | | | | X |

Georgia Nelson (OD) | | X | | X | | X | | | | X | | C |

Jacqueline Rast | | X* | | | | | | | | X | | |

Nancy Tuor | | | | | | | | | | | | X |

Barry Williams (OD) | | C | | C | | X | | X | | | | X |

OD = Outside Director

C = Chairman

- *

- Through September 2011 only

Audit Committee

The Audit Committee met four times during 2011. The Committee's written charter is available on our website athttp://www.ch2m.com/corporate/about_us/leadership.asp. The Audit Committee is responsible for CH2M HILL's financial processes and internal control environment, including:

- •

- Reviewing legislative or other changing business environment conditions that could have a noticeable impact on CH2M HILL's financial controls and future operations,

- •

- Reviewing all individual capital expenditure items in excess of $15.0 million and monitoring capital expenditures relative to annual capital plans, and

- •

- Monitoring various financial measurements for CH2M HILL relative to established financial policies.

Audit Subcommittee

The Audit Committee previously established an Audit Subcommittee consisting entirely of outside independent directors. In 2011, the Audit Subcommittee met independently of the Audit Committee. Effective in September 2011, the Audit Committee eliminated the Audit Subcommittee and changed the composition of the Audit Committee to consist solely of independent outside directors.

The Audit Subcommittee met three times during 2011 and had a written charter. The Board of Directors determined that each member of the Audit Subcommittee is independent in accordance with the independence criteria established by the Board consistent with the independence definition under the corporate governance rules of the New York Stock Exchange, and complies with the requirements of the Sarbanes-Oxley Act of 2002. The Board designated Barry Williams as an "audit committee financial expert" as defined by the Securities and Exchange Commission regulations. The Subcommittee's responsibilities include, among other things:

- •

- Appointing CH2M HILL's independent auditors,

- •

- Reviewing and evaluating the work and performance of CH2M HILL's internal auditors and its independent auditors,

16

Table of Contents

- •

- Establishing procedures for (a) the receipt, retention, and treatment of complaints received by CH2M HILL regarding accounting, internal accounting controls, or auditing matters, and (b) the confidential, anonymous submission by employees of CH2M HILL of concerns regarding questionable accounting or auditing matters,

- •

- Conferring with CH2M HILL's independent auditors and its internal auditors and financial officers to monitor CH2M HILL's internal accounting methods and procedures and evaluating any recommended changes therefrom, and

- •

- Reviewing the financial statements with management and the independent auditors.

Compensation Committee

The Compensation Committee met four times during 2011 and has a written charter. The charter is available on our website athttp://www.ch2m.com/corporate/about_us/leadership.asp. The Compensation Committee consists entirely of outside independent directors. Its responsibilities include, among other things:

- •

- Determining the senior executive compensation programs, including that of the Chief Executive Officer, and other senior executive officers of CH2M HILL,

- •

- Setting compensation for the Chief Executive Officer in light of the performance evaluation conducted by the Board,

- •

- Providing input to the Chief Executive Officer on compensation of our senior executives,

- •

- Overseeing the CH2M HILL equity based compensation and incentive plans, and

- •

- Managing the succession planning for the Chief Executive Officer.

Committee Role in Determining Director Compensation

The Committee is responsible for reviewing and recommending compensation for outside directors. It periodically assesses the structure of the compensation for outside directors in relation to director compensation of our peer group companies. The Committee has engaged outside compensation consultants from time-to-time to advise on executive and director compensation matters. These matters include, among other things, a review and market analysis of board of director pay and benefits.

Committee Role in Determining Executive Compensation

The role of the Compensation Committee in determining executive compensation and the use of compensation consultants is set forth in the Compensation Discussion and Analysis which follows.

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any member of the Board of Directors or the Compensation Committee and the board of directors or compensation committee of any other company.

Executive Committee

The Executive Committee met four times during 2011. The Committee does not have a written charter and serves at the pleasure of our Board based on expressly delegated authority. The Committee is authorized to exercise any powers, subject to certain limitations, of the Board in the management of the business and affairs of CH2M HILL, as delegated by our Board of Directors.

17

Table of Contents

Governance Committee

The Governance Committee met six times during 2011 and has a written charter. The charter is available on our website athttp://www.ch2m.com/corporate/about_us/leadership.asp. The Committee's responsibilities include, among other things:

- •

- Reviewing corporate governance,

- •

- Assessing and recommending to the full Board candidates for nomination of directors,

- •

- Overseeing Board succession planning,

- •

- Establishing and reviewing criteria for Board membership,

- •

- Overseeing the ethics and compliance functions,

- •

- Recommending Board committee assignments, and

- •

- Establishing Board performance objectives and overseeing annual Board evaluations.

Risk Committee

The Risk Committee met three times during 2011 and has a written charter. The charter is available on our website athttp://www.ch2m.com/corporate/about_us/leadership.asp. The Committee's responsibilities include, among other things:

- •

- Reviewing enterprise wide external risks,

- •

- Review of enterprise risks and lessons arising from our project portfolio,

- •

- Review of risks and opportunities related to availability of capital,

- •

- Review of project related risks, and

- •

- Risk evaluation and scenario planning for major disruptive events.

INFORMATION RELATED TO THE BOARD, NOMINEES AND EXECUTIVE OFFICERS

Review, Approval or Ratification of Transactions with Related Persons

In 2011, CH2M HILL had no related party transactions. Our written Related Party Policy provides that any transaction that exceeds $120,000 between CH2M HILL and any of our directors, executive officers or beneficial owners of at least 5% of our common stock is considered to be a "related party" transaction. The policy also provides that all related party transactions are required to be reviewed by the senior leadership team, including the Chief Executive Officer, Chief Financial Officer and the Chief Legal Officer. The Audit Committee is made aware of any related party transactions.

18

Table of Contents

SECURITY OWNERSHIP

Security Ownership of Certain Stockholders

The following table shows the number of shares of our common stock by any person or group known to us as of March 14, 2012, to be the beneficial owner of more than 5% of any our common stock.

| | | | | | | | | |

Name and Address of Stockholder | | Title of

Class | | Number of

Shares Held | | Percent

of Class | |

|---|

Trustees of the CH2M HILL Retirement and Tax-Deferred Savings Plan | | Common | | | 16,608,017 | (1) | | 52.49 | % |

9191 South Jamaica Street | | | | | | | | | |

Englewood, CO 80112 | | | | | | | | | |

Trustee of the CH2M HILL Amended and Restated Deferred Compensation Plan | | Common | | |

2,358,552 |

(2) | |

7.45 |

% |

9191 South Jamaica Street | | | | | | | | | |

Englewood, CO 80112 | | | | | | | | | |

- (1)

- Common shares are held of record by the Trustees for the accounts of participants in the Retirement and Tax-Deferred Savings Plan and will be voted in accordance with instructions received from participants. Shares as to which no instructions are received will be voted pro rata in accordance with the voting instructions submitted by all other plan participants.

- (2)

- Common shares are held of record by the Trustee for the accounts of participants in the CH2M HILL Companies, Ltd. Amended and Restated Deferred Compensation Plan and will be voted as directed by CH2M HILL as the owner of the assets of the trust.

19

Table of Contents

Security Ownership of Directors, Director Nominees and Executive Officers

The following table sets forth information as of March 14, 2012 as to the beneficial ownership of our equity securities by (a) each director and director nominee, (b) each executive officer listed in the summary compensation table and (c) all of our directors and executive officers as a group. None of the individuals listed below owns directly more than 1% of the outstanding shares of CH2M HILL. As a group, all directors, director nominees, and executive officers own 4.1% of the outstanding shares of CH2M HILL, including stock options exercisable within 60 days of March 14, 2012.

| | | | | | | | | | | | | |

Name of Beneficial Owner | | Common

Stock Held

Directly(1) | | Common

Stock Held

Indirectly(2) | | Stock Options

Exercisable

Within 60 Days | | Total

Beneficial

Ownership | |

|---|

Manuel Ernesto Aguirre | | | 4,836 | | | — | | | 3,170 | | | 8,006 | |

Robert W. Bailey | | | 56,735 | | | 30,940 | | | 8,576 | | | 96,251 | |

Malcolm Brinded | | | — | | | — | | | — | | | — | |

Robert G. Card | | | 216,457 | | | 6,687 | | | 28,027 | | | 251,171 | |

Jerry D. Geist | | | 21,021 | | | 48,375 | | | — | | | 69,396 | |

Charles O. Holliday, Jr. | | | 6,806 | | | — | | | — | | | 6,806 | |

Michael A. Lucki | | | 52,998 | | | 845 | | | 5,515 | | | 59,358 | |

Lee A. McIntire | | | 250,490 | | | 11,243 | | | 20,329 | | | 282,062 | |

Michael E. McKelvy | | | 44,401 | | | 6,085 | | | 16,942 | | | 67,428 | |

Georgia R. Nelson | | | 4,072 | | | — | | | — | | | 4,072 | |

Jacqueline C. Rast | | | 33,302 | | | 6,315 | | | 27,311 | | | 66,928 | |

Michael A. Szomjassy | | | 32,837 | | | 7,867 | | | 12,487 | | | 53,191 | |

Nancy R. Tuor | | | 37,894 | | | 46,921 | | | 23,701 | | | 108,516 | |

Barry L. Williams | | | 24,894 | | | — | | | — | | | 24,894 | |

All directors, director nominees and executive officers as a group (18 people) | | | 936,421 | | | 199,256 | | | 166,679 | | | 1,302,356 | |

- (1)

- Includes restricted stock held by directors and executive officers over which they maintain sole voting power but no investment power.

- (2)

- Includes common stock held through the CH2M HILL Retirement and Tax-Deferred Savings Plan trust and the CH2M HILL Deferred Compensation Plan trust.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires our directors, executive officers and holders of more than 10% of our common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities. These executive officers, directors and beneficial owners are required by SEC regulation to furnish us with copies of all Section 16(a) forms filed by the reporting persons. Based on our records, we believe that all Section 16(a) reporting requirements related to CH2M HILL directors and executive officers were timely fulfilled during 2011, except for a Form 4 for each of Manuel Aguirre, Bob Bailey, Fred Brune, Bob Card, John Madia, Lee McIntire, Mike McKelvy, Margaret McLean, Jacque Rast, JoAnn Shea, Nancy Tuor and Bill Dehn which were not timely filed. The Form 4 was filed on April 4, 2011 and reported the award of stock for each individual under the CH2M HILL Long Term Incentive Plan and Annual Incentive Plan when the actual award of stock occurred on March 17, 2011 for the Annual Incentive Plan and March 25, 2011 for the Long Term Incentive Plan.

20

Table of Contents

Equity Compensation Plan Information

The following information is provided as of December 31, 2011 with respect to compensation plans pursuant to which CH2M HILL may grant equity awards to eligible persons. Please see Note 14 to the Consolidated Financial Statements, contained in CH2M HILL's Annual Report on Form 10-K for the year ended December 31, 2011 for descriptions of the equity compensation plans.

| | | | | | | | | | |

Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | | Weighted-average

exercise price of

outstanding options,

warrants and rights | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected

in column (a)) | |

|---|

| | (a)

| | (b)

| | (c)

| |

|---|

Equity compensation plans approved by security holders(1) | | | 2,913,658 | (3) | $ | 37.18 | | | 13,710,069 | (4) |

Equity compensation plans not approved by security holders(2) | | | 430,246 | (5) | $ | 57.01 | | | — | (6) |

| | | | | | | | |

Total | | | 3,343,904 | | $ | 39.73 | | | 13,710,069 | |

| | | | | | | | |

- (1)

- The equity compensation plans approved by stockholders include the CH2M HILL Companies, Ltd. 2009 Stock Option Plan and the CH2M HILL Companies, Ltd. Payroll Deduction Stock Purchase Plan as amended and restated effective January 1, 2004 (PDSPP).

- (2)

- The equity compensation plans not approved by stockholders include the CH2M HILL Companies, Ltd. Short Term Incentive Plan effective January 1, 2000 and the CH2M HILL Companies, Ltd. Long Term Incentive Plan effective January 1, 2005 as amended and restated on January 1, 2011.

- (3)

- Includes 2,913,658 of stock options outstanding. These options were granted prior to December 31, 2011.

- (4)

- Includes 1,410,033 shares reserved for future issuance under the Stock Option Plan and 12,300,036 shares available for purchase under the PDSPP.

- (5)

- Includes 430,246 shares issued under a long term incentive program paid or to be paid in 2012. These shares were earned in 2011.

- (6)

- Shares available for future issuance under the long term and short term incentive programs (excluding shares reflected in column (a)) are not determinable until the end of each year.

21

Table of Contents

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (CD&A) provides information about our compensation and benefit programs that were in place for our executive officers for 2011, and explains our compensation philosophy and objectives.

Executive Summary

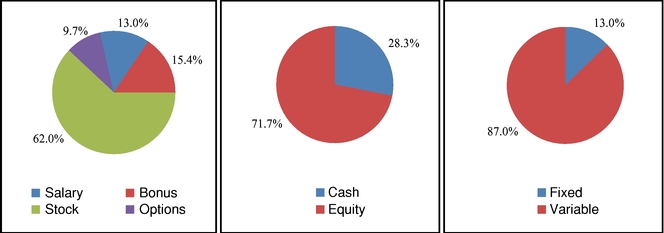

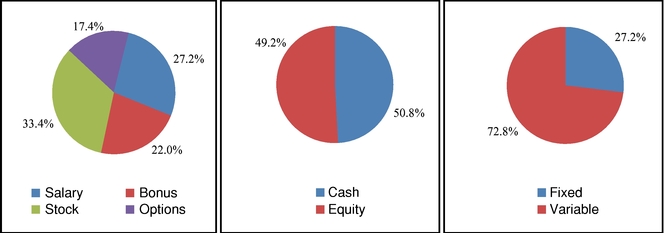

CH2M HILL has a pay-for-performance philosophy that seeks to link the interests of the named executive officers with achieving strategic and operational objectives as well as with those of our stockholders and that helps guide the Compensation Committee's decisions regarding executive compensation. As a result, approximately 80% of the compensation of our named executive officers is linked to CH2M HILL performance objectives, individual objectives and stock price performance.

The following elements comprise the total compensation awarded to our named executive officers: base salary, a cash-based annual incentive award, and equity-based long term incentives consisting of common stock, stock options and restricted stock as described below.

- •

- The long term incentive awards are used to reward stockholder value by aligning the interests of our executives and stockholders through CH2M HILL's performance objectives and goals. The awards also help retain executives over time and provide a means by which executives can meet their stock ownership guidelines.

- •

- We target all elements of our compensation program to provide compensation opportunity at the median of our peer companies. Actual payouts under these programs can be above or below the median based on CH2M HILL's performance and the executive's individual performance.

- •

- Our annual long term incentive award to our named executive officers is aligned directly to the annual goals and performance of CH2M HILL, in line with our "pay-for-performance" philosophy.

- •

- Our compensation programs are designed to attract, motivate, reward, and retain the most talented executives.

One of our main objectives is to make sure that CH2M HILL's compensation policies and practices for its employees, in general, and its executive officers, in particular, optimize CH2M HILL's performance without encouraging unreasonable risks or incentivizing behavior which may result in a material adverse effect on the Company. The design of our executive compensation programs, which combines short term and long term incentives, places considerable compensation at-risk and intentionally aligns executive officers' interests with the interests of the Company's stockholders.

The named executive officers who appear in the Summary Compensation Table are as follows:

- •

- Lee A. McIntire, President and Chief Executive Officer

- •

- Michael A. Lucki, Senior Vice President and Chief Financial Officer

- •

- Robert G. Card, Senior Vice President

- •

- Michael E. McKelvy, Senior Vice President

- •

- Jacqueline C. Rast, Senior Vice President

22

Table of Contents

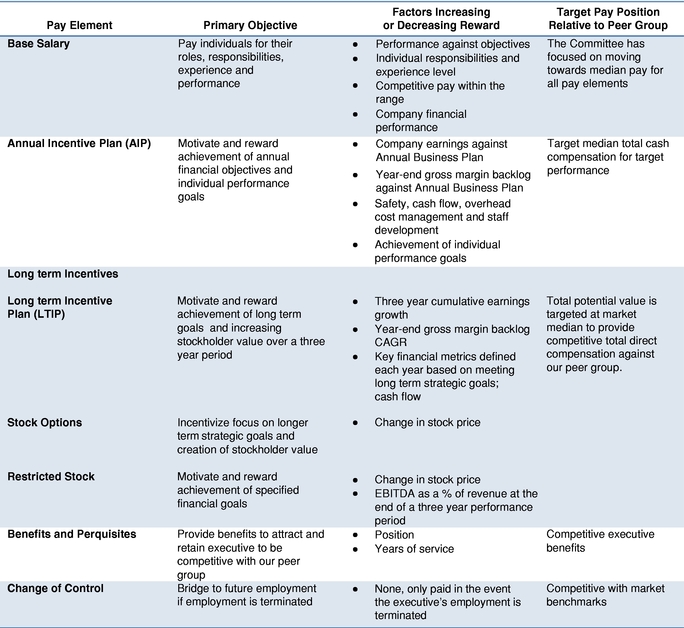

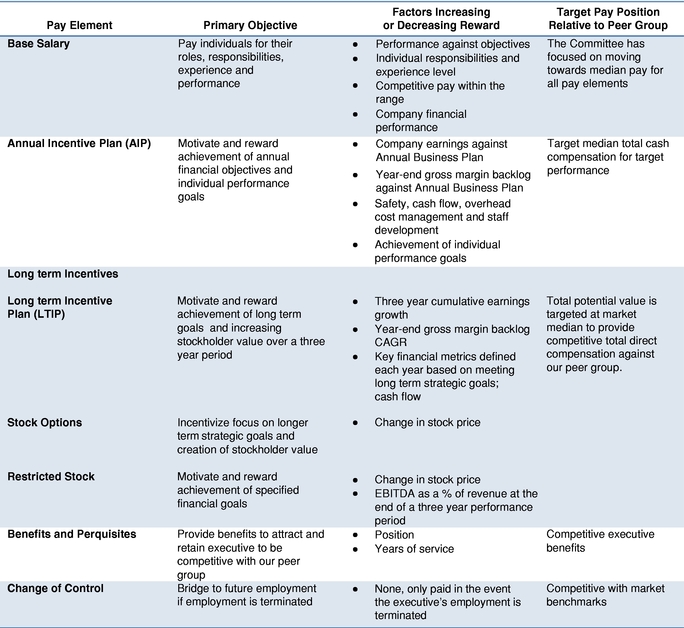

The following table summarizes the key elements of our executive compensation program.

Compensation Philosophy and Objectives

Our compensation philosophy is based on two fundamental principles: competitive market compensation and pay-for-performance. Our compensation programs are designed to attract and retain the most qualified and talented executives and employees in our industry, and to provide incentives that appropriately motivate them to achieve and exceed our short term and long term performance goals, thereby enhancing stockholder value.

- •

- Competitive Market Compensation: We pay our executives and other employees compensation that is comparable to compensation paid by our industry peers, because the market for qualified executives and employees in our industry is highly competitive. We also evaluate competitive pay practices among general industry for companies of similar size, complexity and performance as certain executives and other senior positions may be drawn from this broader market.

23

Table of Contents

- •

- Pay-for-Performance: We align the interest of our executives and employees with the interest of our stockholders by paying for performance against agreed upon goals that tie with CH2M HILL's short and long term objectives and strategic plans. We place a substantial portion of our executive officers' compensation at-risk, where total compensation over time depends on each executive's performance against established goals and on the overall performance of the Company. Furthermore, a portion of all executives' compensation is provided in the form of CH2M HILL stock, stock options and restricted stock, which tie the total value of the compensation opportunity to CH2M HILL's overall performance.

We review our compensation philosophy and objectives annually in light of our performance against our goals and performance of our peer companies. This process takes into account market risks and opportunities as well as the economic environment. We revise our compensation objectives, as appropriate, to focus on our strategic goals and objectives.

Role of the Board of Directors in Establishing Compensation

Our Board of Directors delegated the responsibility for oversight of executive officers' compensation to its Compensation Committee. The Committee establishes total compensation for the Chief Executive Officer based on his performance, the Company's performance, and the input the Committee receives from its compensation consultants. The Committee also reviews the CEO's recommendations about compensation for other executive officers, establishes (based on market data provided by its compensation consultants) compensation for outside members of the Board of Directors, and considers and approves the equity-based incentive compensation plans that CH2M HILL uses to implement its compensation philosophy.

In 2011, the Committee reviewed Mr. McIntire's total compensation against market data provided by its compensation consultants, considered Mr. McIntire's performance for the year and CH2M HILL's performance overall, and set Mr. McIntire's compensation, as presented in the Summary Compensation Table.

The Compensation Committee reviews the competitiveness of CH2M HILL's executive compensation programs annually compared to that of executives in similar positions with companies we compete with in our industry and geographic markets. The competitive compensation comparison includes the peer group data, and published survey data for both our specific industry and general industry using companies of similar size and complexity.

The Compensation Committee reviews executive compensation in light of Section 162(m) of the Internal Revenue Code which establishes a limit on the deductibility of annual compensation that exceeds $1,000,000 for certain executive officers. It is the general intention of the Committee to meet the requirements for deductibility under Section 162(m) of the Internal Revenue Code; however, the Committee reserves the right, where merited by changing business conditions or an executive's individual performance, to authorize compensation payments which may not be fully deductible by CH2M HILL. The Committee reviews this policy on an ongoing basis.

Role of Stockholder Say-on-Pay Votes

CH2M HILL provided stockholders a non-binding advisory "say-on-pay" vote on its executive compensation at its 2011 annual meeting of stockholders. Stockholders expressed substantial support for the compensation of our executive officers, with approximately 90.5% of the votes cast for approval of the say-on-pay vote. The Compensation Committee evaluated the results of this advisory vote and also considered other factors in evaluating CH2M HILL's executive compensation policies and practices for 2011, including the relationship of the CH2M HILL compensation programs to the company's business objectives for the year, a review of peer group data and the evaluation of CH2M HILL's compensation programs by its compensation consultant. Based on these considerations, including the

24

Table of Contents

fact that an overwhelming majority of our stockholders approved the say on pay vote at the 2011 annual meeting, the Compensation Committee determined that our stockholders support our executive compensation policies and practices and therefore, the Committee did not implement changes to our compensation program. The Compensation Committee will continue to consider the outcome of future say-on-pay votes when making future executive compensation decisions.

Role of Management in Establishing Compensation

CH2M HILL's Chief Executive Officer reviews compensation data and analysis for his direct reports, including all executive officers based on the information provided to him by CH2M HILL's Human Resources compensation staff and the compensation consultants. He considers each component of executive compensation and determines how these components should be used to provide appropriate total compensation that motivates executive officers to optimize CH2M HILL's short term and long term operations and financial results in the best interest of CH2M HILL's stockholders. The CEO then provides an overview of performance and accomplishments for each executive officer and makes recommendations to the Compensation Committee about compensation levels and structure he deems appropriate.

Role of Compensation Consultants

The Compensation Committee has the authority to retain the services of outside compensation consultants to assist in the performance of its responsibilities. In 2011, the Compensation Committee retained the services of Sibson Consulting, the firm that has been providing executive and board of directors' compensation advice since 1998. At the request of the Committee, Sibson Consulting updated the annual compensation assessment for the CEO and other executive officers. The review provides a comprehensive assessment of the various components of our executive compensation programs against relevant market compensation data and our peer companies (as further discussed below), and provided the Committee with a recommended compensation range for our CEO and reference compensation ranges for our other executive officers. The Compensation Committee used this information to consider and set compensation for the CEO and to review the CEO's recommendations for other executive officers' compensation. As part of this process, Sibson Consulting also provided to the Committee compensation survey data for other key executives and managers at peer companies, which are used by the Company in considering compensation levels. Sibson Consulting previously worked with management to revise the restricted stock program for executives to include a performance measure in the 2011 restricted stock grants for Compensation Committee approval which were reflected in the 2010 compensation data. In 2011, Sibson Consulting was engaged to, among other things, analyze projected compensation opportunities against delivered results for the performance provisions relating to the restricted stock grants and to review metrics associated with the Long Term Incentive Plan. We paid Sibson Consulting approximately $155,000 for work performed in 2011.

In 2011, the Compensation Committee carefully considered Sibson Consulting's independence and all the services that Sibson provides to CH2M HILL's management, such as benchmarking surveys for senior management roles and consulting regarding overall incentive strategy. The Committee determined that Sibson's services to the Company did not impair its independence because of the value of compensation that Sibson derives from such services was not significant.

Benchmarking

The Compensation Committee uses market data as the primary tool in establishing compensation for the Chief Executive Officer and the Board of Directors, and in reviewing the CEO's recommendations for compensation of other executive officers. In establishing 2011 compensation, the Compensation Committee reviewed total compensation information of twelve peer companies as evaluated and recommended by the compensation consultant to the Committee. In considering which

25

Table of Contents

companies to include as its reference companies in this review, the Committee instructed Sibson to select companies that compete with CH2M HILL for executive talent in our industry and our geographic markets. Sibson provides an independent assessment of the peer group annually and recommends changes as appropriate, while recognizing the importance of year-over-year continuity. The Committee believes that the reference group of peer companies is appropriate for its compensation analysis. The full list of reference companies used in compensation considerations in 2011 is provided below.

Peer Companies

| | |

• Fluor Corporation | | • AECOM |

• KBR, Inc. | | • McDermott International, Inc. |

• Jacobs Engineering Group, Inc. | | • Foster Wheeler Ltd. |

• Emcor Group, Inc. | | • Chicago Bridge & Iron Co. |

• URS Corporation | | • Perini Corporation |

• Shaw Group, Inc. | | • Tetra Tech Inc. |