Use these links to rapidly review the document

Table of Contents

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| CH2M HILL Companies, Ltd. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

April 24, 2017

Dear Stockholder,

You are cordially invited to attend the annual meeting of stockholders of CH2M HILL Companies, Ltd., which will take place on Monday, June 5, 2017, at our World Headquarters, 9191 South Jamaica Street, Englewood, Colorado, 80112, USA.

Details of the business to be conducted at the meeting are in the formal notice of the annual meeting of stockholders and the proxy statement that accompany this letter.

Your vote is important. Whether or not you plan to attend the annual meeting, it is important that your shares be represented and voted at the meeting. I urge you to promptly vote and authorize your proxy instructions electronically through the Internet, by telephone or by signing, dating and returning the proxy card enclosed with the proxy statement. Voting through the Internet or by phone will eliminate the need to return your proxy card.

On behalf of the Board of Directors, I would like to express our appreciation to our employees for their hard work and dedication to making CH2M the best place to work and one of the most respected companies in the industry.

Sincerely,

Jacqueline C. Hinman

Chairman, President and Chief Executive Officer

Table of Contents

| | |

| | |

9191 South Jamaica Street

Englewood, CO 80112

|

Notice of 2017 Annual

Meeting of Stockholders

To be held June 5, 2017

| | |

June 5, 2017

10:00 a.m., Mountain Daylight Time

CH2M World Headquarters

9191 South Jamaica Street

Englewood, Colorado, 80112 | | |

April 24, 2017

To our Stockholders:

NOTICE IS HEREBY GIVEN that the 2017 annual meeting of stockholders of CH2M HILL Companies, Ltd., a Delaware corporation, will be held at our World Headquarters, 9191 South Jamaica Street, Englewood, Colorado, 80112, USA on Monday, June 5, 2017, at 10:00 a.m., Mountain Daylight Time, for the following purposes:

| | | |

| | 1. | | To elect three directors from the nominees named in the attached proxy statement to serve for a three-year term. |

|

2. |

|

To approve an amendment to our Certificate of Incorporation to allow a retired employee to serve as an employee director on our Board of Directors. |

|

3. |

|

To consider an advisory vote on executive compensation. |

|

4. |

|

To consider an advisory vote on the frequency of the vote on executive compensation. |

|

5. |

|

To approve the material terms of executive incentive compensation. |

|

6. |

|

To ratify the appointment of KPMG LLP as the independent registered public accounting firm of CH2M for the fiscal year ending December 29, 2017. |

|

7. |

|

To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

These items of business are more fully described in the proxy statement accompanying this notice, which is available atwww.edocumentview.com/ch2m. Only stockholders of record owning shares of CH2M's common stock at the close of business on April 10, 2017, will be entitled to vote at this meeting or at any postponements or adjournments thereof. You may vote your shares via the Internet, by telephone or by proxy card.

BY ORDER OF THE BOARD OF DIRECTORS

Thomas M. McCoy

Executive Vice President, General Counsel

and Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials

for the 2017 Annual Meeting of Stockholders to be held on June 5, 2017:

The Notice of Meeting, Proxy Statement and Annual Report are available free of charge at: www.edocumentview.com/ch2m

Table of Contents

Table of Contents

| | |

2017 Proxy Statement Summary | | 1 |

| | | |

Proposal 1 — Election of Directors | | 2 |

| | | |

Corporate Governance | | 11 |

| | | |

Committee Membership | | 15 |

| | | |

Certain Relationships and Related Transactions | | 18 |

| | | |

Security Ownership of Certain Stockholders | | 19 |

| | | |

Executive Compensation | | 22 |

| | | |

Compensation Committee Report | | 43 |

| | | |

Director Compensation | | 50 |

| | | |

Proposal 2 — Approval of Charter Amendment to Permit a Retired Employee to Serve as an Employee Director | | 51 |

| | | |

Proposal 3 — Advisory Vote on Executive Compensation | | 53 |

| | | |

Proposal 4 — Advisory Vote on Frequency of Advisory Vote on Executive Compensation | | 54 |

| | | |

Proposal 5 — Approval of Material Terms of Executive Incentive Compensation | | 55 |

| | | |

Audit Committee Report | | 58 |

| | | |

Independent Registered Public Accounting Firm | | 59 |

| | | |

Proposal 6 — Ratification of the Appointment of the Independent Registered Public Accounting Firm | | 60 |

| | | |

Other Business | | 61 |

| | | |

Additional Information | | 62 |

| | | |

General Information | | 63 |

| | | |

Table of Contents

CH2M HILL Companies, Ltd.

This proxy statement and the accompanying materials are being furnished to you by our Board of Directors on or about April 24, 2017 in connection with the solicitation of your proxy to be voted at the 2017 Annual Meeting of Stockholders of CH2M to be held on Monday, June 5, 2017, at 10:00 a.m., Mountain Daylight Time, at our World Headquarters, 9191 South Jamaica Street, Englewood, Colorado, 80112, USA.

2017 Proxy Statement Summary

We are providing below highlights of certain information in this proxy statement. As it is only a summary, please refer to the complete proxy statement and 2016 Annual Report before you vote.

2017 Annual Meeting of Stockholders

| | |

| Date and Time: | | Monday, June 5, 2017, at 10:00 a.m., Mountain Daylight Time |

Record Date: |

|

April 10, 2017 |

Place: |

|

CH2M World Headquarters

9191 South Jamaica Street

Englewood, Colorado, 80112 |

| | | |

Proposals and Board Recommendations

| | | | |

| | | | | |

| Proposal | | Board

Recommendation

|

| | | | | |

1. |

|

Election of three nominees to our Board of Directors (page 2) |

|

FOR each Director Nominee |

2. |

|

Approval of the amendment to our Certificate of Incorporation to allow a retired employee to serve as an employee director on our Board of Directors (page 51) |

|

FOR |

3. |

|

Approval of the advisory vote on executive compensation (page 53) |

|

FOR |

4. |

|

Approval of the frequency of an advisory vote on executive compensation (page 54) |

|

Three Years |

5. |

|

Approval of the material terms of executive incentive compensation (page 55) |

|

FOR |

6. |

|

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 29, 2017 (page 60) |

|

FOR |

CH2M 2017 Proxy Statement 1

Table of Contents

Proposal 1. Election of Directors

Our Certificate of Incorporation and bylaws provide that our Board of Directors shall consist of no more than thirteen directors and not less than seven directors, provided that the majority of the Board consists of employee directors. The size of the Board may be changed from time-to-time by a resolution of the Board of Directors. There are currently thirteen members on our Board with six outside independent directors and seven employee directors.

Director Nominations

According to our bylaws and our Governance Principles, director candidates are nominated by the Board of Directors based on recommendations of the Governance and Corporate Citizenship Committee of the Board. The Governance and Corporate Citizenship Committee has the ability to consider nominees recommended by stockholders and nominees recommended from other sources and does not distinguish between nominees recommended by our stockholders. The procedures to be followed by stockholders in submitting such recommendations are available in our bylaws.

The Governance and Corporate Citizenship Committee's recommendations for employee director candidates take into account the recommendations of the Chairman and Chief Executive Officer whose recommendations are developed based on nominations from employees. The Governance and Corporate Citizenship Committee considers the Chairman and the Chief Executive Officer's recommendations, its own assessment of the needs of the company and the overall employee and independent mix of the Board in making recommendations to the Board. The Governance and Corporate Citizenship Committee recommended to the Board that each of W. Blakely Jeffcoat and Janet Walstrom be nominated for election as employee directors as part of the 2017 nomination slate and that Charles O. Holliday, Jr. be nominated for election as an independent director as part of the 2017 nomination slate.

The director candidates will each serve a three-year term expiring in 2020 or until their earlier retirement, death, resignation or removal. In the event that any of the nominees should become unavailable to stand for election at the annual meeting, the proxy holders will vote for either (1) such other person, if any, as may be designated by our Board of Directors, in the place of any nominee who is unable to serve or (2) the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. Our Board of Directors expects all of the nominees named below to be available for election. Incumbent directors will hold office until the annual meeting in the year their term expires and until their successors, if any, are elected and qualified, subject to the director's earlier death, retirement or removal.

2 CH2M 2017 Proxy Statement

Table of Contents

Director Nominees and Continuing Directors

The following table lists our director nominees, as well as each of our continuing directors, and provides their respective ages and titles as of the date of the annual meeting. References to particular years refer to that calendar year.

| | | | | | | | | |

Name

| | Age

| | Title

| | Director

since

| |

|---|

| | | | | | | | | | |

| Directors whose term expires 2017 | | | | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Charles O. Holliday, Jr. (ID) | | | 69 | | Director | | | 2009 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| W. Blakely Jeffcoat | | | 68 | | Director and Senior Vice President, Enterprise Project Delivery | | | 2016 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Janet Walstrom | | | 57 | | Director and Senior Vice President, U.S. Civilian Agencies Operations | | | 2016 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Directors whose term expires 2018 | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Lisa Glatch | | | 54 | | Director and Executive Vice President, Growth and Sales | | | 2015 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Georgia R. Nelson (ID) | | | 67 | | Director | | | 2010 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Terry Ruhl | | | 50 | | Director and President, National Governments Client Sector | | | 2015 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Barry L. Williams (ID) | | | 72 | | Director | | | 1995 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Directors whose term expires 2019 | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Malcolm Brinded (ID) | | | 63 | | Director | | | 2012 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Jacqueline C. Hinman | | | 55 | | Chairman and Chief Executive Officer | | | 2008 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Scott Kleinman (ID) | | | 44 | | Director | | | 2015 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Gregory T. McIntyre | | | 58 | | Director and President, State & Local Governments Client Sector | | | 2013 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Antoine G. Munfakh (ID) | | | 34 | | Director | | | 2015 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

| Thomas L. Pennella | | | 58 | | Director and Senior Vice President | | | 2015 | |

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | |

ID = Independent Director

The Board and its Governance and Corporate Citizenship Committee believe the skills, qualities, attributes and experience of our directors provide CH2M with business acumen and a diverse range of perspectives to engage each other and management to address effectively CH2M's evolving needs and represent the best interests of stockholders.

CH2M 2017 Proxy Statement 3

Table of Contents

Nominees for Election as Directors

| | |

| |

|

|---|

| | | |

| | | |

|

|

Charles "Chad" O. Holliday, Jr. has served as a director of the Board of CH2M since 2009.

Mr. Holliday is the Chairman of the Board of Directors of Royal Dutch Shell plc. He also serves as a member of the Board of Directors of HCA Holdings, Inc. and previously served as a member of the Board of Directors of Deere & Company from 2007 to February 2016 and was the Chairman of the Board of Bank of America from 2009 to 2014. Mr. Holliday had a long career at E.I. du Ponte de Nemours and Company (DuPont), ultimately serving as Chairman and Chief Executive Officer from 1998 until 2009 when he retired from the company.

Mr. Holliday is a former Chairman of both the National Academy of Engineering and the U.S. Council on Competitiveness and is a founding member of the International Business Council. He formerly served as the Chairman of the World Business Council for Sustainable Development and the Business Roundtable's Task Force for Environment, Technology and Economy. Mr. Holliday is the author of "Walking the Talk," a book that makes the business case for sustainable development and corporate responsibility.

Qualifications: Mr. Holliday is qualified to serve on our Board based on his experience as a CEO, a public company director on various Fortune 100 public company boards, as well as his engineering background and leadership in sustainability.

|

| | | |

| | | |

| | | |

|

|

W. Blakely Jeffcoat has served as a director of the Board of CH2M since 2016.

Mr. Jeffcoat serves as a Senior Vice President and Enterprise Project Delivery Director of CH2M. He has been part of CH2M for almost 35 years and has held a number of client positions during that time. Some of those positions include project manager and principal-in-charge/client service manager for the Water Works and Sanitary Sewer Board for the City of Montgomery, Alabama; the Sewerage and Water Board of New Orleans; the Water and Wastewater System of Tuscaloosa, Alabama; the Puerto Rico Aqueduct and Sewerage Authority; the San Antonio Water System; the Merced Irrigation District; and the Columbus, GA Water Works.

He has served in numerous leadership positions within our company including regional manager, regional business group manager, regional project delivery manager, and WBG Americas operations manager.

Qualifications: Mr. Jeffcoat is qualified to serve on our Board based on his experience holding numerous leadership positions within our company and his extensive knowledge of our company.

|

| | | |

| | | |

| | | |

4 CH2M 2017 Proxy Statement

Table of Contents

| | |

| | | |

| | | |

|

|

Janet Walstrom has served as a director of the Board of CH2M since 2016.

Ms. Walstrom serves as a Senior Vice President of U.S. Civilian Agencies Operations, one of four major client portfolios within the National Governments client sector of CH2M. In this role, Ms. Walstrom serves as a key member of the National Governments' executive team charged with leading the sector to serve as the growth engine for CH2M, and in so doing enabling the firm to re-establish its position in the US Federal market. Previously, Ms. Walstrom served as the Enterprise Project Delivery Director of CH2M responsible for working collaboratively with the operating units to drive consistency, predictability and improved project performance across the company. This involved establishing and implementing an integrated commercial management program, including delivery systems, processes, tools, and status/reporting, as well as overseeing the performance management and career development of the company's project/program managers and managers of projects.

With more than 30 years of experience in the engineering and construction industry, Ms. Walstrom possesses a broad and diverse background from overall management of individual business unit profit and loss to program/project management associated with some of the world's most challenging programs. She was an integral member of the Kaiser-Hill leadership team responsible for successfully closing the Department of Energy's Rocky Flats Nuclear Weapons Complex in 2005. Ms. Walstrom also served in two different roles on the CLM Delivery Partner program leadership team responsible for planning and delivering the infrastructure and venues for the 2012 London Olympic and Paralympic Games. Ms. Walstrom has also served in a number of corporate leadership roles, including as Director of our former Operational Excellence function, founding Director of our Program Management Center of Excellence, and CH2M's Chief Learning Officer.

Qualifications: Ms. Walstrom is qualified to serve on our Board based on her more than 30 years of experience in the engineering and construction industry, successful involvement in major projects, and her experience holding numerous leadership positions.

|

| | | |

| | | |

| | |

| | The Board of Directors recommends that stockholders vote FOR the election of each nominee to the Board of Directors. |

CH2M 2017 Proxy Statement 5

Table of Contents

Continuing Directors

| | |

|

|

|

|---|

| | | |

|

|

Lisa Glatch has served as a director of CH2M since 2015.

Ms. Glatch has been CH2M's Executive Vice President of Growth & Sales since November 2016, and previously served as CH2M's Executive Vice President of Client Solutions & Sales since April 2014. Prior to joining CH2M, she served as an executive with Jacobs, an engineering, procurement and construction company, from April 2012 through March 2014, and most recently served as Senior Vice President of Global Sales. From 1986 to 2010, Ms. Glatch was with Fluor, an engineering, procurement and construction company, serving in various capacities including Senior Vice President of Energy and Chemicals from 2009 to 2010, and Senior Vice President of Government from 2003 to 2007.

Qualifications: Ms. Glatch is qualified to serve on our Board based on her more than thirty years of experience in the engineering, procurement and construction industry and her deep knowledge of the markets in which we operate. Ms. Glatch has worked for publicly traded companies and has demonstrated experience working with boards of directors for these companies. She also has served on the boards of community service and higher education organizations and provided staff support to the Risk Committee of the CH2M Board of Directors in 2014.

Ms. Glatch's term expires in 2018.

|

|

|

|

| | | |

|

|

Georgia R. Nelson has served as a director of the Board of CH2M since 2010.

Ms. Nelson has been the President and Chief Executive Officer of PTI Resources, LLC, an energy and environmental consulting firm, since 2005. Ms. Nelson spent more than thirty years in the power generation industry serving in various senior executive capacities for Edison International and its subsidiaries between 1971 and 2005, including President of Midwest Generation Edison Mission Energy (EME) and General Manager of EME Americas. In her role she was responsible for power plant construction and operations in the United States, Puerto Rico, the United Kingdom, Turkey, Thailand, Indonesia, Australia and Italy. Ms. Nelson is a member of the Board of Directors of Cummins Inc., where she has been serving since 2004. Ms. Nelson is also currently a director of Ball Corporation, TransAlta Corporation and Sims Metal Management.

Ms. Nelson is a member of the Executive Committee of the National Coal Council, an industry advisory committee to the U.S. Department of Energy, which she chaired from May 2006 to May 2008.

Qualifications: Ms. Nelson is qualified to serve on our Board based on her experience as a public company executive and director and based on her experience with international engineering projects and regulated industries. She also brings important diversity to our Board as a senior female executive with extensive global experience.

Ms. Nelson's term expires in 2018.

|

|

|

|

| | | |

|

|

|

6 CH2M 2017 Proxy Statement

Table of Contents

| | |

| | | |

|

|

Terry Ruhl has served as a director of the Board of CH2M since 2015.

Mr. Ruhl has been President of CH2M's National Governments Client Sector since November 2016, and previously served as Transportation Business Group President since July 2012. His tenure with CH2M spans twenty-four years. He previously served in the Transportation Business Group as Senior Vice President and Director of Consulting and International Operations from June 2009 to July 2012, the Global Market Sector Director from June 2008 to June 2009 and the Aviation Market Sector Director from August 2006 to June 2008.

Qualifications: Mr. Ruhl is qualified to serve on our Board based on his long tenure with CH2M and his extensive experience and skills in the engineering industry. In addition, he has served on industry boards, joint venture boards and provided staff support to CH2M's Governance and Corporate Citizenship Committee Board of Directors in 2014.

Mr. Ruhl's term expires in 2018.

|

|

|

|

| | | |

|

|

Barry L. Williams has served as a director of the Board of CH2M since 1995.

Mr. Williams is the retired managing general partner of Williams Pacific Ventures, Inc. (business investment and consulting), where he served from 1986 to 2014. Between 2000 and 2001, Mr. Williams served as the President and CEO of American Management Association International. He served as Senior Mediator for JAMS/Endispute from 1993 to 2002 and as a visiting lecturer for the Haas Graduate School of Business, University of California from 1993 to 2000. Mr. Williams has acted as a general partner of WDG, a California limited partnership, from 1987 to 2002 and a general partner of Oakland Alameda Coliseum Joint Venture from 1998 until 2014.

Mr. Williams also serves as a director of PG&E Corporation, Navient Corporation and several not-for-profit organizations, and Mr. Williams previously served as a director of SLM Corporation, Northwestern Mutual Life Insurance Company and Simpson Manufacturing Co.

Qualifications: Mr. Williams is qualified to serve on our Board based on his significant financial experience, his experience as a member of public company boards, and his more than twenty years of experience on our Board. He also brings important diversity to our Board.

Mr. Williams's term expires in 2018.

|

|

|

|

| | | |

CH2M 2017 Proxy Statement 7

Table of Contents

| | |

| | | |

| | | |

|

|

Malcolm Brinded has served as a director of the Board of CH2M since 2012.

Mr. Brinded had a thirty-seven year career with Shell, a global oil and gas company, where he worked in the United Kingdom, Brunei, the Netherlands and Oman. He served on Royal Dutch Shell plc's board of directors between 2002 and 2012, during which period he was Shell's Executive Director for global Exploration and Production from 2004 to 2009, and for its Upstream International business from 2009 to 2012.

Since 2009, Mr. Brinded has served as the Chairman of the Shell Foundation and has served as a Non-Executive Director of BHP Billiton since April 2014. Mr. Brinded also served as a Non-Executive Director of Network Rail in the U.K. from 2010 to 2016.

Mr. Brinded graduated from Cambridge University with a degree in engineering. He is a Fellow of the U.K. Institutions of Civil and Mechanical Engineers and the U.K. Royal Academy of Engineering, President — elect of the U.K. Energy Institute, and Chairman of EngineeringUK. In 2002, Mr. Brinded was awarded the Commander of the Order of the British Empire for services to the U.K. Oil and Gas Industry.

Qualifications: Mr. Brinded is qualified to serve on our Board based on his extensive experience as a public company director and executive officer, as well as his engineering background and his extensive work in the energy sector, which is critical to our business. Mr. Brinded's comprehensive experience in key international markets is uniquely valuable to our Board. He also brings diversity to our Board as a non-U.S. national with extensive background of living and working outside of the U.S.

Mr. Brinded's term expires in 2019.

|

|

|

|

| | | |

|

|

Jacqueline C. Hinman has served as a director of the Board of CH2M since 2008.

Ms. Hinman has served as the Chairman of the Board of Directors of CH2M since September 2014 and as the President and Chief Executive Officer of CH2M since January 1, 2014. She previously served as Senior Vice President and the President of the International Division of CH2M from 2011 until 2014, as the President of the Facilities and Infrastructure Division from 2009 until 2011 and as Vice President, Major Programs Group and Executive Director for Mergers and Acquisitions between 2009 and 2010. Between 2007 and 2009, Ms. Hinman led our Center for Project Excellence.

Ms. Hinman is a member of the Board of Catalyst.

Qualifications: Ms. Hinman is qualified to serve on our Board based on her role as the President and Chief Executive Officer of CH2M; based on her more than twenty years of industry experience; and her extensive infrastructure, environmental services, mergers and acquisitions and international experience. She also brings valuable diversity to our Board as a senior engineer and female executive in a predominantly male profession.

Ms. Hinman's term expires in 2019.

|

|

|

|

| | | |

|

|

|

8 CH2M 2017 Proxy Statement

Table of Contents

| | |

| | | |

|

|

Scott Kleinman has served as a director of the Board of CH2M since 2015.

Mr. Kleinman has been a Private Equity Lead Partner of Apollo Global Management, LLC since 2010. Mr. Kleinman is also a member of Apollo's Senior Management Committee. For the past decade, Mr. Kleinman has focused on Apollo's cyclical industrial businesses, including companies in the chemicals, forest products and industrial industries. Prior to joining Apollo in 1996, Mr. Kleinman was employed by Smith Barney Inc., in its Investment Banking Division. Mr. Kleinman received a B.A. and B.S. from the University of Pennsylvania and the Wharton School of Business, respectively, graduating magna cum laude, Phi Beta Kappa.

Mr. Kleinman also serves as a member of the boards of directors of Momentive Performance Materials Holdings LLC and Verso Corporation and previously served on the boards of directors of Realogy Holdings Corp., Hexion Inc., LyondellBasell Industries N.V. and Taminco Corporation.

Qualifications: Mr. Kleinman is qualified to serve as a member of the Board based on his position with Apollo, and his extensive finance and business experience.

Mr. Kleinman's term expires in 2019.

|

|

|

|

| | | |

|

|

Gregory T. McIntyre has served as a director of the Board of CH2M since 2013, and from 2001 through 2003.

Mr. McIntyre has been President of CH2M's State & Local Governments Client Sector since November 2016. In this role, he leads the firm's global business serving clients in cities, counties, states, local authorities and provinces in the areas of water, environment, transportation and social infrastructure. Mr. McIntyre previously served as Operations Director for all global business groups since October 2015, the President of the Water Business Group from January 2014, and the Managing Director of CH2M's International Infrastructure business in 2012. Prior to that role, Mr. McIntyre served as the Managing Director of Halcrow, acquired by CH2M in 2011, and a member of its board of directors, where he oversaw the integration of Halcrow's operations into CH2M. He was the Deputy Program Manager and CH2M Managing Director for CLM Delivery Partner, the delivery partner to the Olympic Delivery Authority for the London 2012 Olympics and Paralympic Games, between 2010 and 2011. Mr. McIntyre also served as the Global Operations Director for CH2M's water business between 2004 and 2010. Mr. McIntyre joined CH2M in 1981 and has been a long-term member of CH2M's senior executive team.

Qualifications: Mr. McIntyre is qualified to serve on our Board based on his more than thirty years of experience with CH2M in senior roles, his extensive water and infrastructure industry experience, and his major programs and international experience, and because of his prior experience as a member of the Board.

Mr. McIntyre's term expires in 2019.

|

|

|

|

| | | |

|

|

|

CH2M 2017 Proxy Statement 9

Table of Contents

| | |

| | | |

|

|

Antoine G. Munfakh has served as a director of the Board of CH2M since 2015.

Mr. Munfakh is a Partner of Apollo Global Management, LLC, which he joined in 2008. Prior to his current role, Mr. Munfakh served as an associate for two years in the Business & Industrial Services group at the private equity firm Court Square Capital Partners. He also has served as an analyst in the Financial Sponsor Investment Banking group at J.P. Morgan, where he focused on mergers and acquisitions and financing services in support of private equity transactions. Mr. Munfakh graduated summa cum laude from Duke University with a B.S. in Economics, where he was elected to Phi Beta Kappa.

Mr. Munfakh also serves on the board of directors of Maxim Crane Works, McGraw-Hill Education, Inc., Apollo Education Group Inc., and Claire's Stores.

Qualifications: Mr. Munfakh is qualified to serve as a member of the Board based on his position with Apollo, and his extensive finance and business experience.

Mr. Munfakh's term expires in 2019.

|

|

|

|

| | | |

|

|

Thomas L. Pennella has served as a director of the Board of CH2M since 2015.

Mr. Pennella has been Senior Vice President since November 2016 and previously served as President of CH2M's Industrial & Urban Environments Business Group. Along with his role as Senior Vice President, he retains leadership responsibility overseeing the wind down of the firm's last remaining Power EPC project that terminated in early 2017. Mr. Pennella has more than 30 years of leadership and management experience addressing the complex business and technical needs of clients. From March 2014 to January 2015, Mr. Pennella served as Global Operations Director for CH2M's former Energy Business Group, with an emphasis on supporting the Power business. Prior to joining CH2M in 1984, Mr. Pennella worked in General Electric's Gas Turbine division as an international field engineer.

Qualifications: Mr. Pennella is qualified to serve as a member of the Board based on his extensive experience leading client-facing operations with advanced systems and technologies in various parts of the company's diverse business portfolio including industrial processes, power generation, water, environmental remediation, government facilities and sustainable urban environments in the U.S., Middle East, Europe and Australia.

Mr. Pennella's term expires in 2019.

|

|

|

|

| | | |

10 CH2M 2017 Proxy Statement

Table of Contents

Corporate Governance

Board of Directors

CH2M is governed by our Board of Directors. Our Board held a total of 16 meetings in fiscal year 2016, 14 regularly scheduled and two special meetings. All directors attended 75 percent or more of the aggregate meetings of the Board and Committees of which they are members with the exception of Scott Kleinman, who attended 63 percent of the Board meetings and does not serve on a committee. CH2M does not have a policy regarding Board members attending the Annual Meeting of Stockholders. We had nine Board members attend last year's Annual Meeting of Stockholders either in person or via telephone.

Corporate Governance Principles

| | | |

| | CH2M is committed to best practices in corporate governance and maintains a business environment of uncompromising integrity. | |  |

We continue to implement this commitment through, among other things, our Governance Principles, practices and compliance with the relevant provisions of the Sarbanes-Oxley Act of 2002, Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, and other laws and regulations that regulate CH2M and our business. Our Board has formalized our standards of corporate governance in our published Governance Principles. Our Governance Principles, some of which are discussed below, are available on our website athttp://ir.ch2m.com/corporate-governance. Our governance policies are reviewed annually by the Governance and Corporate Citizenship Committee of our Board to assure that they continue to advance the best interests of CH2M and our stockholders, and whether they comply with applicable laws and regulations.

Director Independence

There are currently thirteen members on our Board, six of whom are independent directors and seven of whom are employee directors. CH2M's common stock is not listed on a national securities exchange and, as a result, our directors are not subject to the independence requirements of a national stock exchange. In 2011, the Board adopted independence standards that are consistent with the independence tests under the corporate governance rules for listed companies of the New York Stock Exchange. The Governance and Corporate Citizenship Committee of the Board reviews our Board independence standards annually to confirm their appropriateness for the company. Under our Board's standards, a director is not independent if:

- •

- The director is, or has been within the last three years, an employee of CH2M, or any of the director's immediate family members is, or has been within the last three years, an executive officer of CH2M.

- •

- The director, or any immediate family member of the director, has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from CH2M, other than director and committee fees, and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service).

- •

- (1) The director is a current partner or employee of a firm that is the internal or external auditor of the CH2M; (2) the director has an immediate family member who is a current partner of such a firm; (3) the director has an immediate family member who is a current employee of such a firm and who personally works on the CH2M audit; or (4) the director, or any immediate family member of the director, was within the last three years a partner or employee of such a firm and personally worked on the CH2M audit within that time.

- •

- The director, or any immediate family member of the director, is, or has been within the last three years, employed as an executive officer of another company where any of CH2M's executive officers at the same time serves or served on the other company's compensation committee.

CH2M 2017 Proxy Statement 11

Table of Contents

- •

- The director is a current employee of, or any immediate family member of the director, is a current executive officer of a company that has made payments to, or received payments from, CH2M for property or services in an amount which, in any of the last three fiscal years, exceeded two percent (2%) of such other company's consolidated gross revenues or $1,000,000, whichever is greater.

Our outside independent directors are Malcolm Brinded, Charles Holliday, Jr., Scott Kleinman, Antoine Munfakh, Georgia Nelson and Barry Williams. The Board has made a determination that all these independent directors are "independent" under our independence standards. Because our Audit and Compensation Committees are comprised solely of our independent directors, all the members of those committees are independent pursuant to these guidelines.

Board Leadership Structure

Under our Board's Governance Principles, our Board has the ability to change its leadership structure in the best interest of CH2M at any point in time. Our Board is led by a Chairman elected annually by the directors. Ms. Hinman has served as Chairman of the Board of CH2M since September 2014.

Our Board does not have a policy with respect to combining or separating the Chairman and Chief Executive Officer positions. Under the current Board leadership structure, the positions of Chairman and Chief Executive Officer are combined into one role because our Board believes that as an employee-controlled company, CH2M is best served by a Board where an employee Board member serves as the chair of the Board. For this reason, and because Ms. Hinman is eminently qualified for the role, our Board believes that combining the roles of Chief Executive Officer and Chairman of the Board is appropriate at this time and is in the best interest of CH2M.

Under our Board's Governance Principles, the independent directors of our Board also designate one of the independent directors as Lead Director to provide independent leadership on the Board. The Lead Director initiates and presides at the meetings of independent directors, initiates meetings of all the Directors (including or excluding the Chairman and Chief Executive Officer), and presides at specific sessions of Board meetings as agreed with the Chairman and Chief Executive Officer. The Lead Director also facilitates communication between the independent directors and the Chairman and Chief Executive Officer, facilitates relationships among Board members and works with the Chairman and Chief Executive Officer in planning Board meeting schedules and agendas. In addition, the Lead Director serves as a sounding board to the Chairman and Chief Executive Officer on key issues facing CH2M, works with the Chair of the Compensation Committee on the performance and compensation of the Chairman and Chief Executive Officer and acts as a liaison to stockholders who wish to communicate with independent directors. Charles Holliday, Jr. has served as the Lead Director since 2012. The independent directors may retain or change this appointment after the stockholders elect the nominees for Board membership at the annual meeting.

Board's Role in Risk Oversight

Our Board oversees CH2M's risk management process through its Audit and Risk Committees to ensure that enterprise and major project risks are considered and managed in a timely manner. In addition, our Board routinely reviews CH2M's strategy and capital planning. The Risk Committee of the Board oversees CH2M's enterprise risk management systems and processes, including the identification of major project and portfolio risks and other risks facing our industry generally and our company specifically. The Risk Committee reports to our Board on the enterprise risk management program and offers review and guidance to our management on our approach and process to assess and analyze project- and program-related risks. The Audit Committee reviews risk assessment and management policies, reviews financial and compliance risks and risk management and reviews major financial risk exposures and plans to manage them. The Audit and Risk Committees typically report to our Board on their respective activities at every Board meeting.

Communications with the Board

Stockholders may communicate with our Board by writing to them in care of Thomas M. McCoy, Executive Vice President, General Counsel and Corporate Secretary, CH2M HILL Companies, Ltd., 9191 South Jamaica Street,

12 CH2M 2017 Proxy Statement

Table of Contents

Englewood, Colorado 80112 or to the Lead Director at 9191 South Jamaica Street, Englewood, CO 80112. All communications should indicate whether they are intended for the full Board, for outside independent directors only, or for any particular Board member. The inquiries will be directed to the appropriate Board member or members who will reply to stockholders directly.

Nominations of Directors

Our Governance and Corporate Citizenship Committee identifies and recommends for nomination individuals it believes are qualified to be employee and independent Board members and who are best suited to contribute to the Board's activities to serve CH2M's needs and objectives. The Board seeks directors with diverse professional backgrounds and reputations for integrity who combine a broad spectrum of experience and expertise that is important to CH2M's goals and strategy. Diversity of background has always been an important objective in the selection of directors. A candidate for director should have experience in positions with a high degree of responsibility and be selected based upon contributions they can make to the Board and upon their willingness to devote adequate time and effort to Board responsibilities. In making this assessment, the Governance and Corporate Citizenship Committee considers the candidates' knowledge of our industry and markets, and our clients' industries and markets, the number of other boards on which the candidate serves, strategic thinking and communication skills, and the other business and professional commitments of the candidate. The candidate should also have the ability to exercise sound independent business judgment to act in what he or she reasonably believes to be in the best interest of CH2M and our stockholders. Candidates for independent director positions must fulfill the Board's independence standards for independent directors as described above and included in the Governance Principles which are available on our website athttp://ir.ch2m.com/corporate-governance. There are no family relationships among any director, executive officer or any person nominated or chosen by us to become a director.

In selecting employee directors for consideration, the Governance and Corporate Citizenship Committee takes into account the recommendation of the Chairman of the Board and Chief Executive Officer based on input received from our employees. The process for annual board nominations for employee director candidates commences with the Chairman of the Board and the Chief Executive Officer sending a detailed description of the nominating process and qualification requirements for Board membership to all employees. The solicitation process and the resulting nominations are reviewed by the Governance and Corporate Citizenship Committee, which makes its own recommendations to the full Board. The Governance and Corporate Citizenship Committee of the Board reviews the recommendations from the Chairman of the Board and the Chief Executive Officer and recommends to the Board a slate of candidates for employee director slots. The Governance and Corporate Citizenship Committee considers the Chairman and the Chief Executive Officer's recommendations in its deliberations, but is not bound by them. Most recently, this process resulted in the appointment of W. Blakely Jeffcoat and Janet Walstrom to the Board during 2016.

The criteria for employee director nominees includes, among other things:

- •

- At least 15 years of professional experience in the engineering and construction industry, including responsibility at a senior officer level (such as leading a major business unit or geography, or global enterprise services/ corporate function);

- •

- Broad knowledge of CH2M's global business, organization and culture, through leadership experience gained in multiple business units and/or functions, and across multiple international geographies;

- •

- Experience with strategy and policy formulation, and a deep understanding of CH2M's strategy and competitive position;

- •

- A respected and networked leader in the engineering and construction industry, with strong contacts at the senior executive level in client and/or competitor organizations;

- •

- Proven business and financial acumen commensurate with that required to fulfill a director's fiduciary responsibilities with respect to financial and reporting requirements (including but not limited to company financial statements, SEC forms and filings, etc.);

CH2M 2017 Proxy Statement 13

Table of Contents

- •

- Previous corporate governance (Board of Directors or Advisory Board) experience in a for-profit or non-profit organization. In the absence of direct board experience, the individual should have successfully completed governance training and have experience advising or presenting to a board;

- •

- Demonstrated personal character of the highest caliber in integrity, trust, responsibility, respect, teamwork and maturity;

- •

- Demonstrated traits of an independent thinker, a diplomatic communicator and a patient listener;

- •

- Understanding of, and ability to serve, the interests of all CH2M stockholders, without conflict in relation to the employee director's job position, seniority, organizational alignment, or personal interests.

Code of Ethics

We have adopted a code of ethics and business conduct for our executive and financial officers entitled "CH2M HILL Executive and Financial Officers' Code of Ethics." It applies to all of our senior executives and financial officers, including our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, Chief Human Resources Officer, General Counsel, Treasurer and Presidents of our client sectors. The code is available on our website athttp://www.ch2m.com/corporate/about_us/business_ethics.asp. A hard copy also is available without charge to any stockholder upon request by writing to Thomas M. McCoy, Executive Vice President, General Counsel and Corporate Secretary, CH2M HILL Companies, Ltd. 9191 South Jamaica Street, Englewood, Colorado 80112. We will disclose any future changes to the Code of Ethics on our website.

We also have ethics policies that are applicable to all employees entitled "CH2M HILL Employee Ethics and Business Conduct Principles" that mandates rules of conduct to all CH2M employees including all senior executives and financial officers. It also is available on our website by following the same links as described above and will be available in hard copy upon request. We maintain a confidential telephone and web-based hotline, where employees can seek guidance or report potential violations of laws, CH2M policies or rules of conduct.

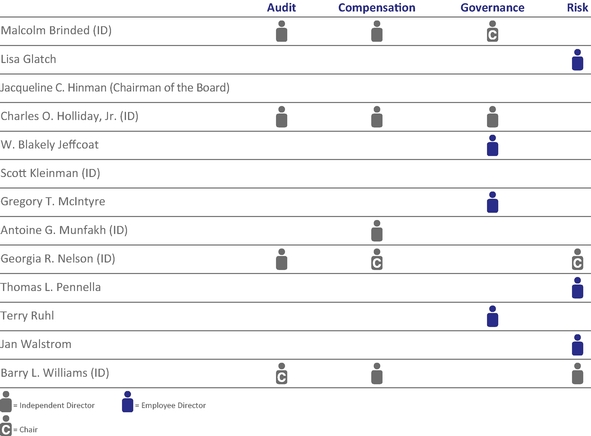

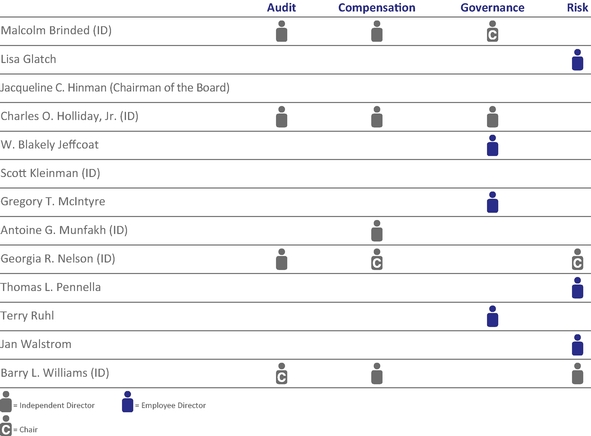

Committees of the Board

In fiscal 2016, the Board of Directors had four committees: Audit; Compensation; Governance and Corporate Citizenship; and Risk. The Audit and Compensation Committees are comprised solely of outside independent directors. Below is a chart showing current membership for each Board committee.

14 CH2M 2017 Proxy Statement

Table of Contents

Committee Membership

Audit Committee

The Audit Committee met 14 times during fiscal 2016. The Committee has a written charter, which is available on our website athttp://ir.ch2m.com/corporate-governance/.

The Board of Directors determined that each member of the Audit Committee is independent in accordance with the independence criteria established by the Board, which are consistent with the independence definition under the corporate governance rules of the New York Stock Exchange and comply with the requirements of the Sarbanes-Oxley Act of 2002. The Board has designated Barry Williams as an "audit committee financial expert" as defined by Securities and Exchange Commission regulations. The Audit Committee is responsible for the oversight of CH2M's financial processes and internal control environment including, among other things:

- •

- Reviewing the financial statements with management and the independent registered public accounting firm;

- •

- Reviewing CH2M's process and compliance with the Sarbanes Oxley Act surrounding internal controls prior to filing quarterly Form 10-Qs and the annual Form 10-K;

- •

- Appointing CH2M's independent registered public accounting firm;

- •

- Reviewing and evaluating the work and performance of CH2M's internal auditors, its independent registered public accounting firm and the company's Chief Ethics and Compliance Officer;

CH2M 2017 Proxy Statement 15

Table of Contents

- •

- Establishing procedures for (a) the receipt, retention and treatment of complaints or concerns received by CH2M regarding accounting, internal accounting controls, or auditing matters, and (b) the confidential, anonymous submission by employees of CH2M of concerns regarding questionable accounting or auditing matters; and

- •

- Conferring with CH2M's independent registered public accounting firm and its internal auditors and financial officers to monitor CH2M's internal accounting methods and procedures and evaluating any recommended changes.

Compensation Committee

The Compensation Committee met six times during fiscal 2016. The Committee has a written charter, which is available on our website athttp://ir.ch2m.com/corporate-governance/. The Compensation Committee consists entirely of independent directors. Its responsibilities include, among other things:

- •

- Determining the senior executive compensation programs, including that of the Chief Executive Officer and other senior executive officers of CH2M;

- •

- Conducting an annual performance evaluation and setting compensation for the Chief Executive Officer;

- •

- Setting compensation for the other senior executives in light of their performance, after consultation with the Chief Executive Officer;

- •

- Overseeing the CH2M equity-based compensation and incentive plans; and

- •

- Managing the succession planning for the Chief Executive Officer and overseeing the succession planning for other executive officers.

The Compensation Committee has the ability to delegate its authority to a subcommittee or individual member as it deems appropriate. Additionally, the Compensation Committee also has the ability to authorize an officer of the Company to grant rights or options to employees (other than executive officers) in a manner that is in accordance with applicable law.

Committee Role in Determining Director Compensation

The Committee is responsible for reviewing and recommending compensation for independent directors. It periodically assesses the structure of the compensation for independent directors in relation to director compensation of our peer group companies. The Committee engages outside compensation consultants to advise on executive and director compensation matters. These matters include, among other things, a review and market analysis of board of director pay and benefits.

Committee Role in Determining Executive Compensation

The role of the Compensation Committee in determining executive compensation and the use of compensation consultants is set forth in the Compensation Discussion and Analysis that follows.

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any member of the Board of Directors or the Compensation Committee and the board of directors or compensation committee of any other company.

Governance and Corporate Citizenship Committee

The Governance and Corporate Citizenship Committee met four times during fiscal year 2016. The Committee has a written charter, which is available on our website athttp://ir.ch2m.com/corporate-governance/. The Committee's responsibilities include, among other things:

- •

- Directing corporate governance and continuing board education;

- •

- Assessing and recommending to the full Board candidates for nomination of directors;

- •

- Overseeing Board succession planning;

16 CH2M 2017 Proxy Statement

Table of Contents

- •

- Establishing and reviewing criteria for Board membership;

- •

- Recommending Board committee assignments;

- •

- Overseeing the company's health, safety and sustainability initiatives; and

- •

- Establishing Board performance objectives and conducting Board performance evaluations.

Risk Committee

The Risk Committee met four times during fiscal year 2016. The Committee has a written charter, which is available on our website athttp://ir.ch2m.com/corporate-governance/. The Committee's responsibilities include, among other things:

- •

- Reviewing and overseeing CH2M's processes and activities with respect to significant risks;

- •

- Reviewing CH2M's enterprise portfolio risks;

- •

- Reviewing CH2M's approach to project risk management and monitoring problem projects; and

- •

- Overseeing scenario planning for major disruptive events.

CH2M 2017 Proxy Statement 17

Table of Contents

Certain Relationships and Related Transactions

In fiscal year 2016, CH2M had no related party transactions, other than those disclosed below. Our written Related Party Policy provides that any transaction that exceeds $120,000 between CH2M and any of our directors, executive officers or beneficial owners of at least 5% of our common stock is considered to be a "related party" transaction. The policy also provides that all related party transactions are required to be reviewed by the senior leadership team, including the Chief Executive Officer, Chief Financial Officer and the General Counsel. The Audit Committee is made aware of any related party transactions.

Transaction with Apollo

On June 24, 2015, CH2M sold 3,214,400 shares of Series A Preferred Stock for a purchase price of $200.0 million to AP VIII CH2 Holdings, L.P. ("AP VIII CH2"), an entity owned by investment funds affiliated with Apollo Global Management, LLC ("Apollo"). The sale occurred in connection with the initial closing under a subscription agreement entered between CH2M and AP VIII CH2 on May 27, 2015. On April 11, 2016, CH2M sold an additional 1,607,200 shares of Series A Preferred Stock for an aggregate purchase price of approximately $100.0 million to Apollo in a private placement. Each share of Series A Preferred Stock is convertible into shares of our common stock, and the holders of the Series A Preferred Stock are entitled to vote with the holders of our common stock as a single class on an as-converted basis on all matters presented to CH2M stockholders.

Concurrently with the initial closing under the subscription agreement, CH2M and AP VIII CH2 entered into an Investor Rights Agreement, which among other things grants AP VIII CH2 customary registration rights, preemptive rights with respect to future issuances of CH2M securities and the right to cause CH2M to pursue an IPO or initiate a process to sell itself if CH2M has not, at its option, redeemed the Series A Preferred Stock, initiated an IPO process or completed a sale of itself prior to the fifth anniversary of the initial closing. Pursuant to the Investor Rights Agreement, for so long as AP VIII CH2 continues to hold a minimum required number of the shares of Series A Preferred Stock, AP VIII CH2 also will have the right to designate two directors to our Board of Directors, which designees are currently Scott Kleinman and Antoine G. Munfakh.

18 CH2M 2017 Proxy Statement

Table of Contents

Security Ownership of Certain Stockholders

The following table shows the number of shares of our common stock beneficially owned by any person or group known to us as of April 10, 2017, to be the beneficial owner of more than 5% of our common stock.

| | | | | | | |

Name and Address of Stockholder

| | Number of

Shares

| | Percent

of Class

| |

|---|

| | | | | | | | |

Trustees of the CH2M HILL Retirement and Tax-Deferred Savings Plan

9191 South Jamaica Street

Englewood, CO 80112 | | | 13,822,123 | 1 | | 55.81 | % |

| | | | | | | | |

AP VIII CH2 Holdings, L.P.

One Manhattanville Road, Suite 201

Purchase, NY 10577 | | | 5,195,878 | 2 | | 17.34 | % |

| | | | | | | | |

- 1

- Common shares are held of record by the Trustees for the accounts of participants in the Retirement and Tax-Deferred Savings Plan. The Trustees will vote uninstructed shares in accordance with the interests of plan participants and the plan as a whole. The Trustees will then vote plan participant instructed shares in accordance with such instructions, provided the Trustees determine they can do so in accordance with ERISA. In all events, the Trustees will comply with ERISA in voting shares.

- 2

- This share ownership information is based upon the records of CH2M on April 10, 2017. AP VIII CH2 Holdings, L.P., a Delaware limited partnership ("AP VIII CH2"), collectively with the entities listed below, has shared voting and dispositive power with respect to an aggregate of 5,195,878 shares of our common stock consisting of 4,821,600 shares of common stock issuable upon conversion of the shares of Preferred Stock held by AP VIII CH2 and 374,278 shares of common stock issuable with respect to dividends on the Preferred Stock that have accrued as of April 10, 2017 but have not been paid.

- Pursuant to a Schedule 13D/A filed with the Securities and Exchange Commission on February 24, 2017, such shares are owned by (i) AP VIII CH2, (ii) CH2 Holdings GP, LLC, a Delaware limited liability company ("CH2 Holdings GP"), (iii) Apollo Investment Fund VIII, L.P., a Delaware limited partnership ("AIF VIII"), (iv) Apollo Management VIII, L.P., a Delaware limited partnership ("Management VIII"), (v) AIF VIII Management, LLC, a Delaware limited liability company ("AIF VIII LLC"), (vi) Apollo Management, L.P., a Delaware limited partnership ("Apollo Management"), (vii) Apollo Management GP, LLC, a Delaware limited liability company ("Apollo Management GP"), (viii) Apollo Management Holdings, L.P., a Delaware limited partnership ("Management Holdings"), and (ix) Apollo Management Holdings GP, LLC, a Delaware limited liability company). The principal address of each of AP VIII CH2, CH2 Holdings GP and AIF VIII is One Manhattanville Road, Suite 201, Purchase, New York 10577. The principal address of each of Management VIII, AIF VIII LLC, Apollo Management, Apollo Management GP, Management Holdings and Management Holdings GP is 9 West 57th Street, 43rd Floor, New York, New York 10019.

Security Ownership of Directors, Director Nominees and Executive Officers

The following table sets forth information as of April 10, 2017, as to the beneficial ownership of our equity securities by (a) each director and director nominee of CH2M, (b) each "named executive officer" of CH2M and (c) all our current directors and executive officers as a group. None of the individuals listed below beneficially owned more than 1% of the outstanding shares of CH2M. As a group, all of our current directors and executive officers beneficially

CH2M 2017 Proxy Statement 19

Table of Contents

owned approximately 2.6% of the outstanding shares of CH2M, including stock options exercisable within 60 days of April 10, 2017.

| | | | | | | | | | | | | |

Name of Beneficial Owner

| | Common

Stock Held

Directly1

| | Common

Stock

Held

Indirectly2

| | Stock Options

Exercisable

Within 60 Days

| | Total

Beneficial

Ownership

| |

|---|

| | | | | | | | | | | | | | |

| Malcolm Brinded | | | 17,307 | | | 0 | | | 0 | | | 17,307 | |

| | | | | | | | | | | | | | |

| Lisa Glatch | | | 9,221 | | | 540 | | | 22,972 | | | 32,733 | |

| | | | | | | | | | | | | | |

| Jacqueline C. Hinman | | | 61,642 | | | 11,170 | | | 63,612 | | | 136,424 | |

| | | | | | | | | | | | | | |

| Charles O. Holliday, Jr. | | | 16,432 | | | 0 | | | 0 | | | 16,432 | |

| | | | | | | | | | | | | | |

| W. Blakely Jeffcoat | | | 16,638 | | | 36,398 | | | 0 | | | 53,036 | |

| | | | | | | | | | | | | | |

| Scott Kleinman | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

| Gary L. McArthur | | | 8,648 | | | 536 | | | 49,068 | | | 58,252 | |

| | | | | | | | | | | | | | |

| Thomas M. McCoy | | | 4,122 | | | 454 | | | 20,628 | | | 25,204 | |

| | | | | | | | | | | | | | |

| Gregory T. McIntyre | | | 42,831 | | | 66,706 | | | 14,240 | | | 123,777 | |

| | | | | | | | | | | | | | |

| Antoine G. Munfakh | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | | | | | | | | | | |

| Georgia R. Nelson | | | 12,893 | | | 0 | | | 0 | | | 12,893 | |

| | | | | | | | | | | | | | |

| Thomas L. Pennella | | | 15,373 | | | 8,685 | | | 5,342 | | | 29,400 | |

| | | | | | | | | | | | | | |

| Terry A. Ruhl | | | 11,351 | | | 5,043 | | | 8,094 | | | 24,488 | |

| | | | | | | | | | | | | | |

| Matthew Sutton | | | 4,177 | | | 177 | | | 3,386 | | | 7,740 | |

| | | | | | | | | | | | | | |

| Janet Walstrom | | | 34,944 | | | 5,205 | | | 3,875 | | | 44,024 | |

| | | | | | | | | | | | | | |

| Barry L. Williams | | | 33,716 | | | 0 | | | 0 | | | 33,716 | |

| | | | | | | | | | | | | | |

| All current directors and executive officers as a group (19 people) | | | 302,877 | | | 144,262 | | | 200,624 | | | 647,763 | |

| | | | | | | | | | | | | | |

- 1

- Includes restricted stock held by directors and executive officers over which they maintain sole voting power but no investment power.

- 2

- Includes common stock held through the CH2M HILL Retirement and Tax-Deferred Savings Plan trust and the CH2M HILL Deferred Compensation Plan trust.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") requires our directors, executive officers and holders of more than 10% of our common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities. These executive officers, directors and beneficial owners are required by SEC regulation to furnish us with copies of all Section 16(a) forms filed by the reporting persons. Based on our records, we believe that all Section 16(a) reporting requirements related to CH2M directors, executive officers and holders of more than 10% of our common stock were timely fulfilled during fiscal year 2016.

20 CH2M 2017 Proxy Statement

Table of Contents

Equity Compensation Plan Information

The following information is provided as of December 30, 2016, with respect to compensation plans pursuant to which CH2M may grant equity awards to eligible persons. Please see Note 15 to the Consolidated Financial Statements, contained in CH2M's Annual Report on Form 10-K for the fiscal year ended December 30, 2016, for descriptions of the equity compensation plans.

| | | | | | | | | | |

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under equity compensation

plans (excluding

securities reflected

in column (a))

| |

|---|

| | |

|---|

| | (a)

| | (b)

| | (c)

| |

|---|

| Equity compensation plans approved by security holders1 | | | 2,397,074 | 3 | $ | 58.90 | | | 12,203,385 | 4 |

| | | | | | | | | | | |

| Equity compensation plans not approved by security holders2 | | | 271 | 5 | $ | 46.83 | | | — | 6 |

| | | | | | | | | | | |

| Total | | | 2,397,345 | | $ | 58.90 | | | 12,203,385 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- 1

- The equity compensation plans approved by stockholders include the CH2M HILL Companies, Ltd. Amended and Restated 2009 Stock Option Plan and the CH2M HILL Companies, Ltd. Payroll Deduction Stock Purchase Plan as amended and restated effective January 1, 2004 (PDSPP).

- 2

- The equity compensation plans not approved by stockholders include the CH2M HILL Companies, Ltd. Amended and Restated Short-Term Incentive Plan effective January 1, 2012 and the CH2M HILL Companies, Ltd. Amended and Restated Long Term Incentive Plan effective January 1, 2011.

- 3

- Consists of 2,397,074 outstanding stock options. These stock options were granted prior to December 30, 2016.

- 4

- Includes 1,810,235 shares reserved for future issuance under the 2009 Stock Option Plan and 10,393,150 shares available for purchase under the PDSPP.

- 5

- Includes 271 shares issued under the Short-Term Incentive Plan and the Long Term Incentive Plan paid or to be paid in 2017. These shares were earned in 2016.

- 6

- Shares available for future issuance under the Long Term and Short-Term Incentive Plans (excluding shares reflected in column (a)) are not determinable until the end of each year.

CH2M 2017 Proxy Statement 21

Table of Contents

Executive Compensation

Compensation Discussion and Analysis

In this section we provide an overview of our executive compensation philosophy and objectives, as well as detailed information about the compensation and benefit programs for our CEO and other Named Executive Officers (NEOs) in 2016. Our 2016 NEOs are as follows:

- •

- Jacqueline C. Hinman, Chief Executive Officer, President and Chairman of the Board of Directors.

- •

- Gary L. McArthur, Executive Vice President and Chief Financial Officer.

- •

- Thomas M. McCoy, Executive Vice President, General Counsel and Corporate Secretary.

- •

- Gregory T. McIntyre, Executive Vice President and State and Local Client Sector President.

- •

- Matthew Sutton, Executive Vice President and Private Client Sector President.

Mr. Sutton joined CH2M on March 14, 2016 and is an NEO due to his new-hire incentives. In order to recruit Mr. Sutton to CH2M and offset incentive compensation that he forfeited with his prior employer, CH2M provided Mr. Sutton with a one-time $300,000 cash employment incentive to be paid over two years, a one-time stock option grant of 8,000 options, and a one-time restricted stock award of 10,313.835 shares to be granted in three separate installments over three years. Accordingly, in 2016, Mr. Sutton received a $150,000 cash employment incentive, 8,000 stock options, and 3,437.945 shares of restricted stock with a grant-date value of $209,405 and a one-year cliff vesting schedule. These awards are disclosed in theSummary Compensation Table at the end of this narrative.

Executive Summary

CH2M leads the professional services industry in providing sustainable solutions for complex development challenges. We combine world-renowned thought leadership and services in engineering, design, technology, sciences and project management to deliver iconic infrastructure and innovative developments for public-and private-sector clients around the world. CH2M's business is differentiated by the values and culture embedded in the firm. These values are exemplified by our people and delivered when we connect uncommon client-centricity and inclusive stakeholder collaboration to achieve greater social, environmental and economic outcomes in the work that we perform, for sustainable value creation.

2016 Company Performance Highlights

With flat revenue of $5.24 billion in 2016, we continued efforts in our client-centric strategy to position CH2M for profitable, organic growth. While we managed reasonably well through the effects of the prolonged oil and gas slump that weighed on our industry, we also had to absorb additional charges for two fixed-price legacy projects — a contract to design and construct roadway improvements on a tollway in the southwestern United States and a Power Engineer-Procure-Construct (EPC) joint venture to engineer, procure, construct and start-up a combined cycle power plant to supply power to a large liquefied natural gas facility in Australia. Those charges, which together amounted to $275 million, offset progress we made to expand revenue and margin in our core, continuing business. We finished the year with $15 million in net income.

In October 2016, we launched plans to realign our organization to a new client-centric operating model, establishing a simplified structure and governance aligned to three client sectors: National governments; State and local governments; and the Private sector. This new operating model also prompted a number of management changes, and positions us to derive greater revenue from a more attractive, profitable mix of services that differentiate our firm.

22 CH2M 2017 Proxy Statement

Table of Contents

A few months since, we're on-track to realize annual savings of approximately $100 million. In the fourth quarter of 2016, we achieved a $30 million reduction in selling, general and administrative (SG&A) costs, and a 73-percent improvement in operating income. Also in the fourth quarter, the consortium of companies serving the fixed-price Power EPC project terminated that contract based on the client's refusal to fulfill its obligations. We expect a lengthy, multiyear arbitration process to follow, and therefore do not foresee any further material effect on the firm in the near term. Finally, we expect to complete the fixed-price tollway project this year.

All of these developments — a unique new operating model; our growing, higher-margin portfolio of core business; and the wind down of our two fixed-price projects — position CH2M for improved performance in 2017.

Compensation Philosophy

Our executive compensation programs are designed to attract and retain our senior executives, and motivate them to achieve CH2M's short- and long-term operational and financial goals in the best long-term interest of CH2M's stockholders.

Our compensation philosophy is based on two fundamental principles: competitive market compensation and pay-for-performance:

- •

- Competitive Market Compensation. CH2M pays its executives and other employees compensation that compares to compensation paid by industry peers because the market for qualified executives and employees in our industry is highly competitive. We also evaluate competitive pay practices among general industry companies of similar size, complexity and performance because certain executives may be drawn from this broader market. We target all elements of our compensation programs to provide compensation opportunity at the median of our peer companies and/or general industry. Actual payouts under these programs can be above or below the median based on CH2M's performance and each executive's individual performance.

- •

- Pay-for-Performance. We align the interests of our executives and employees with the interests of our stockholders by paying for performance against agreed upon goals that tie with CH2M's short- and long-term objectives and strategic plans. We place a substantial portion of our executive officers' compensation at-risk, whereby total compensation over time depends on each executive's performance against established goals and on the overall performance of the company. Furthermore, a significant portion of all executives' compensation is provided in the form of CH2M stock, stock options, and restricted stock, which tie the total value of the compensation opportunity to CH2M's overall stock performance. Approximately 77 percent of the 2016 target compensation for our NEOs was linked to CH2M financial performance, individual performance, and stock price performance.

The long-term incentive awards granted to our executive officers are aligned to the strategic goals and long-term financial performance of CH2M, in line with our pay-for-performance philosophy. These long-term incentives also help retain executives over time and provide a means by which executives can meet our stock ownership guidelines.

One of our main objectives is to make sure that CH2M's compensation policies and practices for its employees and its executive officers optimize CH2M's performance without encouraging unreasonable risks or incentivizing behavior which may result in a material adverse effect on the company.

We review our compensation philosophy and objectives annually, bearing in mind our performance against company goals and the performance of our peer companies. This process takes into account market risks and opportunities as well as the economic environment. We revise our compensation practices, as appropriate, to focus on our strategic goals and objectives, and our requirements in recruiting and retaining leadership talent.

Pay for Performance

Based on the competitive market analysis performed by Sibson Consulting, our compensation consultant in 2015, and reviewed by the Compensation Committee in December 2015, the 2016 total target compensation for our Named Executive Officers ranged from 85% to 112% of market median, respectively, consistent with differences in experience,

CH2M 2017 Proxy Statement 23

Table of Contents

overall qualifications and performance. The analysis performed by Sibson was validated by Farient Advisors, our compensation consultant as of March 2016 (seeIndependent Compensation Consultant section below for more detail).

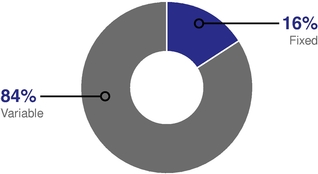

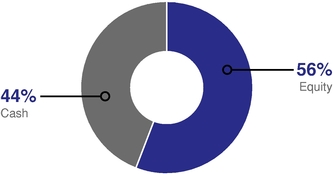

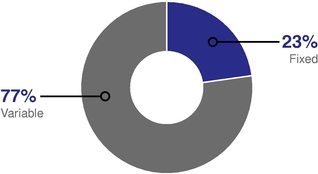

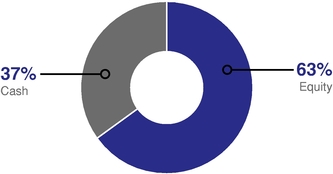

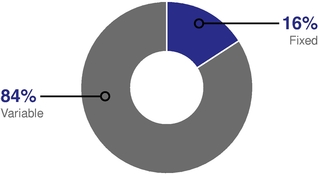

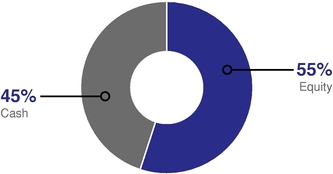

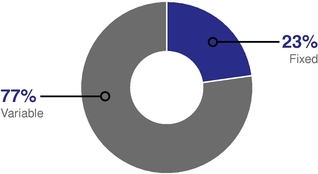

The charts below illustrate how the total target compensation for our NEOs includes a substantial portion of variable (performance-based, and therefore "at risk") compensation. "Fixed" compensation refers to base salary and "variable" compensation refers to performance-based pay, which is the aggregate of performance-based restricted stock, common stock under the Long Term Incentive Plan ("LTIP"), stock options, and Annual Incentive Plan ("AIP") cash awards. "Cash" compensation refers to base salary and AIP awards, and "equity" compensation refers to performance-based restricted stock, common stock awarded under the LTIP, and stock options.