Exhibit (a)(1)(A)

OFFER TO EXCHANGE

PHH CORPORATION

Offer to Exchange Any and All 6.00% Convertible Senior Notes Due 2017

CUSIP No. 693320 AQ6

for cash and shares of Common Stock of PHH Corporation

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 11:59 P.M., NEW YORK CITY TIME, ON MONDAY, JUNE 15, 2015, UNLESS THE OFFER IS EXTENDED BY US (SUCH DATE, AS THE OFFER MAY BE EXTENDED, THE “EXPIRATION DATE”). TENDERS MAY NOT BE WITHDRAWN AFTER THE NOTES HAVE BEEN ACCEPTED FOR EXCHANGE.

The Offer

Upon the terms and subject to the conditions set forth in this offer to exchange (as supplemented or amended, the “Offer to Exchange”) and the related letter of transmittal (as supplemented or amended, the “Letter of Transmittal”), PHH Corporation (“PHH” or the “Company,” “we,” “us” or “our”) is offering to exchange (the “Offer”) any and all of its 6.00% Convertible Senior Notes Due 2017 (the “Notes”) for consideration per each $1,000 principal amount of validly tendered and accepted Notes of $1,125.00 in cash, plus accrued and unpaid interest from June 15, 2015 to, but excluding, the Settlement Date (as defined herein), and a number of shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), which we refer to as the “Exchange Ratio” (together, the “Offer Consideration”). The Exchange Ratio will be equal to the sum of the Daily Settlement Amounts (as defined herein) for each VWAP Trading Day (as defined herein) during the Observation Period (as defined herein). The Exchange Ratio will be rounded to the nearest fourth decimal place.

The Exchange Ratio will be fixed and announced by 4:30 p.m., New York City time, on the Expiration Date (currently expected to be June 15, 2015). Details regarding the Exchange Ratio will also be available by that time at www.gbsc-usa.com/PHH and from the Information Agent (as defined herein). The press release announcing the Exchange Ratio will also be filed as an exhibit to an amendment to the Schedule TO that we have filed with the Securities and Exchange Commission (the “SEC”) relating to this Offer to Exchange.

Throughout the Offer, an indicative Offer Consideration payable for the Notes pursuant to the Offer (including the Exchange Ratio) based on the Daily Settlement Amounts on the VWAP Trading Days that have passed since the commencement of the Offer, will be available at www.gbsc-usa.com/PHH and from the Information Agent, which may be contacted at its toll-free telephone number set forth on the back cover page of this Offer to Exchange.

Fractional shares will not be issued in this Offer. If a tendering holder is entitled to receive a fractional share (calculated on an aggregate basis for each tendering holder), we will calculate and pay to such tendering holder a cash adjustment in respect of such fraction (calculated to the nearest 1/100 of a share) in an amount equal to the same fraction of the Daily VWAP (as defined herein) per share of our Common Stock on the Expiration Date.

Pursuant to the terms of the indenture relating to the Notes, a person in whose name a Note is registered at the close of business on June 1, 2015, being the record date with respect to the interest payable on the Notes on June 15, 2015 under the indenture, will be paid such interest, notwithstanding any tender of the Notes in the Offer. For information on the interest payment terms under the indenture, see “Description of Notes—Interest.”

The Offer will expire at 11:59 p.m., New York City time (the “Expiration Time”) on the Expiration Date, unless the Offer is extended or earlier terminated by us. Notes must be validly tendered for exchange in the Offer (and not validly withdrawn) on or prior to the Expiration Time on the Expiration Date to be eligible to receive the Offer Consideration. Notes tendered for exchange in the Offer may be withdrawn at any time

prior to the Expiration Time on the Expiration Date. Upon the terms and subject to the conditions of the Offer, all Notes validly tendered in the Offer and not validly withdrawn prior to the Expiration Time on the Expiration Date will be accepted for exchange in the Offer. You should carefully review the procedures for tendering Notes beginning on page 40 of this Offer to Exchange.

As of May 5, 2015, $245.0 million aggregate principal amount of the Notes was outstanding and 49,683,504 shares of our Common Stock were issued and outstanding. Our Common Stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “PHH.” The Notes are not listed on any securities exchange. On May 5, 2015, the last reported sales price of our Common Stock on the NYSE was $24.70 per share. We expect shares of our Common Stock issued pursuant to the Offer will be listed on the NYSE.

The Offer is being made on the terms and subject to the conditions set forth in this Offer to Exchange and the Letter of Transmittal. The Notes are represented by a global certificate registered in the name of The Depository Trust Company (“DTC”). As a result, all holders of Notes electing to tender pursuant to this Offer to Exchange must do so pursuant to DTC’s book entry procedures.

If you do not tender your Notes in exchange for the Offer Consideration prior to the Expiration Time on the Expiration Date, you will continue to hold your Notes and such Notes will continue to accrue interest in accordance with the terms thereof. Holders of Notes that are not validly tendered or that are validly withdrawn or that are not accepted by PHH can convert their Notes into Common Stock in accordance with the terms of the Notes.

The closing of the Offer is conditioned upon the satisfaction or waiver by PHH of certain conditions. See “Description of the Offer—Conditions to the Offer.” The settlement date (expected to be on or about June 18, 2015) in respect of any Notes that are validly tendered, that are not validly withdrawn and are accepted for exchange by PHH will occur promptly following the Expiration Date (the “Settlement Date”).

The Notes were offered and sold under a prospectus, dated January 10, 2012, pursuant to the Company’s shelf registration statement on Form S-3 (Registration No. 333-177723). The issuance of Common Stock upon exchange of the Notes pursuant to the Offer is intended to be exempt from registration pursuant to Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”). The shares of Common Stock received by a tendering holder of Notes in connection with the Offer will be freely tradable under U.S. securities laws, unless such tendering holder of Notes is considered an “affiliate” of ours, as that term is defined in the Securities Act (namely, a person controlling, controlled by, or under common control with, the Company).

You should carefully consider the risk factors beginning on page 25 of this Offer to Exchange, the section entitled “Cautionary Statement Regarding Forward-Looking Statements” on page 21 of this Offer to Exchange and the risk factors described in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any risk factors discussed from time to time in our other SEC filings and reports, incorporated by reference herein, before you decide whether or not to participate in the Offer and, through participation in the Offer, make an investment in our Common Stock.

You must make your own decision whether to tender any Notes pursuant to this Offer to Exchange. None of PHH, PHH’s Board of Directors or executive officers, the Financial Advisor (as defined herein), the Exchange Agent or the Information Agent or any agent or other person makes any recommendation as to whether holders should tender the Notes for exchange pursuant to this Offer to Exchange.

Neither the Offer nor the Common Stock portion of the Offer Consideration has been approved or disapproved by the SEC or any state securities commission, nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Offer to Exchange. Any representation to the contrary is unlawful and may be a criminal offense in the United States.

The Exchange Agent and the Information Agent for the Offer is Global Bondholder Services Corporation.

May 6, 2015

TABLE OF CONTENTS

| Page |

| |

SUMMARY OF THE OFFER | 1 |

QUESTIONS AND ANSWERS ABOUT THE OFFER | 7 |

NOTICE TO INVESTORS | 15 |

OUR COMPANY | 17 |

PURPOSE OF THE OFFER | 19 |

USE OF SECURITIES ACQUIRED | 20 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 21 |

INCORPORATION BY REFERENCE; ADDITIONAL INFORMATION | 24 |

RISK FACTORS | 25 |

PRICE RANGE OF COMMON STOCK AND PHH’S DIVIDEND POLICY | 31 |

CAPITALIZATION | 32 |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA | 33 |

RATIO OF EARNINGS TO FIXED CHARGES | 34 |

DESCRIPTION OF THE OFFER | 35 |

COMPARISON OF RIGHTS OF HOLDERS OF NOTES AND HOLDERS OF COMMON STOCK | 46 |

DESCRIPTION OF PHH CAPITAL STOCK | 48 |

DESCRIPTION OF NOTES | 51 |

INTERESTS OF DIRECTORS AND OFFICERS | 76 |

FINANCIAL ADVISOR, EXCHANGE AGENT AND INFORMATION AGENT | 77 |

U.S. FEDERAL INCOME TAX CONSEQUENCES | 78 |

i

SUMMARY OF THE OFFER

This summary highlights some of the information contained, or incorporated by reference, in this Offer to Exchange to help you understand the Offer. It does not contain all of the information that may be important to you. You should carefully read this Offer to Exchange, including the information incorporated by reference into this Offer to Exchange, to understand fully the terms of the Offer, as well as the other considerations that may be important to you in making your investment decision. You should pay special attention to the “Risk Factors” beginning on page 25, the section entitled “Cautionary Statement Regarding Forward-Looking Statements” on page 21 and the risk factors described in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any risk factors discussed from time to time in our other SEC filings and reports, incorporated by reference herein.

Unless stated otherwise, the discussion in this Offer to Exchange of our business includes the business of PHH Corporation and its subsidiaries. Unless otherwise indicated or the context otherwise requires, the terms “PHH,” “the Company,” “we,” “us” and “our” refer to PHH Corporation and its subsidiaries on a consolidated basis.

Offeror | | PHH Corporation |

| | |

Securities Subject to the Offer | | 6.00% Convertible Senior Notes due 2017 of PHH, of which $245.0 million aggregate principal amount was outstanding as of May 5, 2015. |

| | |

The Offer | | We are offering to exchange any and all outstanding Notes for the Offer Consideration per each $1,000 principal amount of Notes validly tendered and accepted of $1,125.00 in cash, plus accrued and unpaid interest from June 15, 2015 to, but excluding, the Settlement Date, and a number of shares of our Common Stock equal to the Exchange Ratio, upon the terms and subject to the conditions set forth in this Offer to Exchange and the accompanying Letter of Transmittal. |

| | |

| | The Exchange Ratio will be equal to the sum of the Daily Settlement Amounts for each VWAP Trading Day during the Observation Period. The Exchange Ratio will be rounded to the nearest fourth decimal place. |

| | |

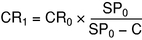

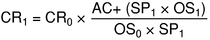

| | The “Daily Settlement Amount” means, for any VWAP Trading Day: · 1/25 multiplied by · (i) 78.2014 shares of our Common Stock multiplied by the Daily VWAP for such VWAP Trading Day, minus (ii) 1,000, divided by · the Daily VWAP for such VWAP Trading Day. The “Daily VWAP” means, for any VWAP Trading Day, the per share volume-weighted average price as displayed under the heading “Bloomberg VWAP” on Bloomberg page PHH US <equity> AQR (or any equivalent successor page) in respect of the period from the scheduled open of trading on the NYSE to the scheduled close of trading on the NYSE on such VWAP Trading Day or, if such volume-weighted average price is unavailable, the market value of one share of our Common Stock on such VWAP Trading Day using a volume-weighted method as determined by a nationally recognized independent investment banking firm retained for this purpose by us; provided that, in the event that such price or market value is lower than $21.00, the Daily VWAP shall be |

| | $21.00; and, provided further, that, in the event that such price or market value is higher than $28.00, the Daily VWAP shall be $28.00. The Daily VWAP will be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours. The “Observation Period” means the 25 consecutive VWAP Trading Days beginning on the 24th VWAP Trading Day preceding the Expiration Date and ending on the Expiration Date. “VWAP Trading Day” means a day during which (i) trading in our Common Stock generally occurs on the NYSE and (ii) there is no “VWAP market disruption event” (as defined in “Description of Notes—Conversion Rights—Payment upon Conversion”). Holders may obtain information on the Daily VWAP with respect to our Common Stock and indicative Exchange Ratios throughout the Offer by calling the Information Agent at the toll-free number set forth on the back cover page of this Offer to Exchange. Throughout the Offer, an indicative Offer Consideration payable for the Notes pursuant to the Offer (including the Exchange Ratio) based on the Daily Settlement Amounts on the VWAP Trading Days that have passed since the commencement of the Offer, will be available at www.gbsc-usa.com/PHH and from the Information Agent, which may be contacted at its toll-free telephone number set forth on the back cover page of this Offer to Exchange. See “Description of the Offer—Terms of the Offer” and “Description of the Offer—Exchange Ratio.” |

| | |

Accrued and Unpaid Interest | | As part of the Offer Consideration for validly tendered and accepted Notes, holders will receive accrued and unpaid interest from June 15, 2015 to, but excluding, the Settlement Date. No additional payments of interest will be made with respect to any Notes that are validly tendered and not validly withdrawn and are accepted by us. Pursuant to the terms of the indenture relating to the Notes, a person in whose name Notes are registered at the close of business on June 1, 2015, being the record date with respect to the interest payable on the Notes on June 15, 2015 under the indenture, will be paid such interest, notwithstanding any tender of such Notes in the Offer. For information on the interest payment terms under the indenture, see “Description of Notes—Interest.” |

| | |

Fractional Shares | | Fractional shares will not be issued in this Offer. If, under the terms of this Offer to Exchange, a tendering holder is entitled to receive a fractional share (calculated on an aggregate basis for each tendering holder), we will calculate and pay to such tendering holder a cash adjustment in respect of such fraction (calculated to the nearest 1/100 of a share) in an amount equal to the same fraction of the Daily VWAP per share of our Common Stock on the Expiration Date. |

| | |

Holders Eligible to Participate in the Offer | | All holders of the Notes are eligible to participate in the Offer. |

| | |

Market Value of the Notes | | The Notes are not listed on any securities exchange. We cannot provide you with any information regarding any trading market or market value for the Notes. We urge you to obtain current market price information for the |

2

| | Notes before deciding whether to participate in the Offer. |

| | |

Common Stock Trading | | Our Common Stock is listed on the NYSE under the symbol “PHH.” On May 5, 2015, the last reported sales price of our Common Stock on the NYSE was $24.70 per share. |

| | |

| | We expect shares of our Common Stock issued pursuant to the Offer will be listed on the NYSE. |

| | |

Expiration Date | | The Offer will expire at 11:59 p.m., New York City time (the “Expiration Time”), on Monday, June 15, 2015, unless extended by us (such date, as the same may be extended, the “Expiration Date”). We, in our sole discretion, may extend the Expiration Date for any purpose, including in order to permit the satisfaction or waiver of any or all conditions to the Offer. If we decide to extend the Expiration Date, we will announce any extension by press release or other public announcement no later than 9:00 a.m., New York City time, on the first business day following the previously scheduled Expiration Date. See “Description of the Offer—Expiration Date” and “Description of the Offer—Extension, Termination or Amendment.” |

| | |

Withdrawal | | You may withdraw previously tendered Notes at any time before the Expiration Time on the Expiration Date. In addition, you may withdraw any tendered Notes if we have not accepted them for exchange within 40 business days from the commencement of the Offer on May 6, 2015. |

| | |

| | Since the Exchange Ratio will be calculated and announced by us prior to 4:30 p.m., New York City time, on the Expiration Date, which we currently expect to be June 15, 2015, and the Offer will not expire earlier than 11:59 p.m., New York City time, on the Expiration Date, you will have approximately 7.5 hours following the determination of the Exchange Ratio to tender your Notes in the Offer or to withdraw your previously tendered Notes. See “Description of the Offer—Exchange Ratio” and “Description of the Offer—Withdrawal of Tenders.” |

| | |

| | To withdraw previously tendered Notes, you are required to submit a notice of withdrawal to the Exchange Agent, in accordance with the procedures described herein and in the Letter of Transmittal. See “Description of the Offer—Withdrawal of Tenders.” |

| | |

| | To withdraw previously tendered Notes after 5:00 p.m., New York City time, but on or prior to the Expiration Time, on the Expiration Date, DTC participants may follow the procedures for withdrawing Notes after such time described under “Description of the Offer—Withdrawal of Tenders.” |

| | |

Settlement Date | | The Settlement Date (expected to be June 18, 2015) of the Offer will be promptly following the Expiration Date. See “Description of the Offer—Acceptance of Notes for Exchange and Delivery of Offer Consideration.” |

| | |

Purpose of the Offer | | The purpose of the Offer is to reduce our outstanding indebtedness and interest expense. We are commencing the Offer at this time because, among other reasons, the premium at which the Notes have traded above par has declined materially and because the Notes represent our unsecured debt with the highest effective interest rate. We also believe the Offer can mitigate dilution that could result from the conversion of the tendered |

3

| | Notes, particularly if we experience an increase in stock price from the continued successful execution of our re-engineering and growth actions. Although a successful Offer may result in unsecured debt levels below our targets, we believe the transaction is accretive to shareholders and provides a reasonable return on invested cash given current and projected liquidity needs. Following the Offer, as soon as we are legally permitted to do so, we intend to commence a $250 million open market share repurchase program, with the goal of completing the repurchases by March 31, 2016. Any open market share repurchases will be subject to market and business conditions, the trading price of our Common Stock and the nature of other investment opportunities. |

| | |

Conditions to the Offer | | The Offer is not conditioned on any minimum principal amount of the Notes being tendered in the Offer. Consummation of the Offer is conditioned upon the satisfaction or waiver of certain conditions, described in “Description of the Offer—Conditions to the Offer.” If any condition is not satisfied or waived, PHH may, in its sole discretion, terminate the Offer. |

| | |

Amendment and Termination | | We have the right to terminate or withdraw, in our sole discretion, the Offer at any time if the conditions to the Offer are not met by the Expiration Time on the Expiration Date. We reserve the right, subject to applicable law, (i) to waive any and all of the conditions of the Offer on or prior to the Expiration Time on the Expiration Date and (ii) to amend the terms of the Offer. In the event that the Offer is terminated, withdrawn or otherwise not consummated on or prior to the Expiration Time on the Expiration Date, no consideration will be paid or become payable to holders who have properly tendered their Notes pursuant to the Offer. In any such event, the Notes previously tendered pursuant to the Offer will be promptly returned to the tendering holders. See “Description of the Offer—Extension, Termination or Amendment.” |

| | |

How to Tender Notes | | The outstanding Notes are represented by a global certificate registered in the name of DTC. As a result, all holders of Notes electing to tender their Notes must do so pursuant to DTC’s book entry procedures. If you are a DTC participant, you may electronically transmit your acceptance through DTC���s Automated Tender Offer Program (the “ATOP”). See “Description of the Offer—Procedures for Tendering Notes.” If you wish to tender your Notes and your Notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact that registered holder promptly and instruct him, her or it to tender your Notes on your behalf. To tender Notes after 5:00 p.m., New York City time, but on or prior to the Expiration Time, on the Expiration Date, DTC participants may follow the procedures for tendering Notes after such time described under “Description of the Offer—Procedures for Tendering Notes.” IF YOU HOLD YOUR NOTES THROUGH A BROKER, DEALER, COMMERCIAL BANK, TRUST COMPANY OR OTHER NOMINEE, YOU SHOULD KEEP IN MIND THAT SUCH ENTITY MAY REQUIRE YOU TO TAKE ACTION WITH RESPECT TO THE OFFER A NUMBER OF DAYS BEFORE THE EXPIRATION DATE IN ORDER FOR SUCH ENTITY TO TENDER SECURITIES ON YOUR BEHALF ON OR PRIOR TO THE EXPIRATION TIME ON THE |

4

| | EXPIRATION DATE. ACCORDINGLY, IF YOU WISH TO PARTICIPATE IN THE OFFER, YOU SHOULD CONTACT YOUR BROKER, DEALER, COMMERCIAL BANK, TRUST COMPANY OR OTHER NOMINEE AS SOON AS POSSIBLE IN ORDER TO DETERMINE THE TIMES BY WHICH YOU MUST TAKE ACTION IN ORDER TO PARTICIPATE IN THE OFFER. See “Description of the Offer—Procedures for Tendering Notes.” For further information on how to tender Notes, contact the Exchange Agent at the telephone numbers set forth on the back cover page of this Offer to Exchange or consult your broker, dealer, custodian bank, depository trust company or other nominee through whom you hold Notes with questions and requests for assistance. |

| | |

Risks of Failure to Tender | | Notes not exchanged in the Offer will remain outstanding after the consummation of the Offer. If the Offer is consummated, the trading market, if any, for the remaining Notes may be less liquid and more sporadic, potentially resulting in a market price for the Notes that is lower or more volatile than that which had previously prevailed. For further description of the risks of failing to exchange your Notes, see “Risk Factors—Risks to Holder of Non-Tendered Notes.” |

| | |

Risk Factors | | Your decision to participate in the Offer, and to exchange the Notes for the Offer Consideration, including shares of our Common Stock, will involve risk. You should be aware of, and carefully consider, the risk factors set forth in “Risk Factors” beginning on page 25, the section entitled “Cautionary Statement Regarding Forward-Looking Statements” on page 21 and the risk factors described in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any risk factors discussed from time to time in our other SEC filings and reports, incorporated by reference herein, before deciding whether to participate in the Offer and, through participation in the Offer, make an investment in our Common Stock. |

| | |

United States Federal Income Tax Consequences | | For a summary of the principal U.S. federal income tax consequences of the Offer, see “U.S. Federal Income Tax Consequences.” You should consult your own tax advisor for a full understanding of the tax consequences of participating in the Offer. |

| | |

Exchange Agent and Information Agent | | Global Bondholder Services Corporation is the Exchange Agent (“Exchange Agent”) and the Information Agent (“Information Agent”) for the Offer. Its address and telephone numbers are listed on the back cover page of this Offer to Exchange. See “Financial Advisor, Exchange Agent and Information Agent.” |

| | |

Financial Advisor | | We have retained Citigroup Global Markets Inc. as our exclusive financial advisor (the “Financial Advisor”) in connection with the Offer. We are paying the Financial Advisor customary fees for its services and have agreed to indemnify it for certain liabilities. The Financial Advisor’s compensation is in no way contingent on the results or the success of the Offer. The Financial Advisor has not been retained to, and will not, solicit acceptances of the Offer or make any recommendations with respect thereto. See “Financial Advisor, Exchange Agent and Information Agent.” |

| | |

Expenses; Source of Funds | | We will pay all of our fees and expenses in connection with the Offer. We intend to fund the cash portion of the Offer Consideration from cash on |

5

| | hand. A holder of Notes is responsible for paying all of its own fees and expenses, including the fees and expenses of such holder’s advisors. We will pay transfer taxes, if any, applicable to the exchange of Notes pursuant to the Offer, except as set forth in the Letter of Transmittal. |

| | |

Further Information | | If you have questions regarding the procedures for tendering your Notes pursuant to this Offer to Exchange or require assistance in tendering your Notes, please contact the Exchange Agent. If you would like additional copies of this Offer to Exchange, PHH’s annual, quarterly, and current reports or other information that is incorporated by reference in this Offer to Exchange, please contact either the Information Agent or PHH’s Investor Relations Department. The contact information for PHH’s Investor Relations Department is set forth below: PHH Corporation

3000 Leadenhall Road

Mt. Laurel, New Jersey 08054

Attention: Investor Relations

(856) 917-7118 The contact information for the Information Agent and the Exchange Agent is set forth on the back cover page of this Offer to Exchange. You may also contact your broker, dealer, custodian bank, depository trust company or other nominee through whom you hold Notes with questions and requests for assistance. |

6

QUESTIONS AND ANSWERS ABOUT THE OFFER

These answers to questions that you may have as a holder of the Notes provide an overview of certain material information regarding the Offer that is included elsewhere or incorporated by reference in this Offer to Exchange. To fully understand the Offer and the other considerations that may be important to your decision about whether to participate in the Offer, you should carefully read this Offer to Exchange in its entirety, including the section entitled “Risk Factors,” as well as the information incorporated by reference in this Offer to Exchange. For further information regarding PHH, see the section of this Offer to Exchange entitled “Incorporation By Reference; Additional Information.”

Who is making the Offer?

PHH Corporation is making the Offer.

What securities are the subject of the Offer?

PHH is offering to exchange any and all of its 6.00% Convertible Senior Notes due 2017, of which $245.0 million aggregate principal amount was outstanding as of May 5, 2015. For more information on the Notes, see “Description of Notes.”

What will I receive pursuant to the Offer if I validly tender Notes for exchange and they are accepted by PHH?

A holder who validly tenders Notes that are not validly withdrawn and are accepted for exchange by PHH pursuant to the Offer will receive for each $1,000 principal amount of such Notes the Offer Consideration of $1,125.00 in cash, plus accrued and unpaid interest on such Notes from June 15, 2015 to, but excluding, the Settlement Date, and a number of shares of our Common Stock equal to the Exchange Ratio upon the terms and subject to the conditions set forth in this Offer to Exchange and the accompanying Letter of Transmittal.

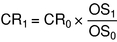

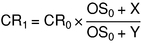

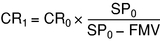

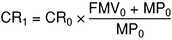

The Exchange Ratio will be calculated on the Expiration Date as the sum of the Daily Settlement Amounts for each VWAP Trading Day during the Observation Period. The Exchange Ratio will be rounded to the nearest fourth decimal place.

The “Daily Settlement Amount” means, for any VWAP Trading Day:

· 1/25 multiplied by

· (i) 78.2014 shares of our Common Stock multiplied by the Daily VWAP for such VWAP Trading Day, minus (ii) 1,000, divided by

· the Daily VWAP for such VWAP Trading Day.

The “Daily VWAP” means, for any VWAP Trading Day, the per share volume-weighted average price as displayed under the heading “Bloomberg VWAP” on Bloomberg page PHH US <equity> AQR (or any equivalent successor page) in respect of the period from the scheduled open of trading on the NYSE to the scheduled close of trading on the NYSE on such VWAP Trading Day or, if such volume-weighted average price is unavailable, the market value of one share of our Common Stock on such VWAP Trading Day using a volume-weighted method as determined by a nationally recognized independent investment banking firm retained for this purpose by us; provided that, in the event that such price or market value is lower than $21.00, the Daily VWAP shall be $21.00; and, provided further, that, in the event that such price or market value is higher than $28.00, the Daily VWAP shall be $28.00. The Daily VWAP will be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours.

The “Observation Period” means the 25 consecutive VWAP Trading Days beginning on the 24th VWAP Trading Day preceding the Expiration Date and ending on the Expiration Date.

7

“VWAP Trading Day” means a day during which (i) trading in our Common Stock generally occurs on the NYSE and (ii) there is no “VWAP market disruption event” (as defined in “Description of Notes—Conversion Rights—Payment Upon Conversion”).

Holders may obtain information on the Daily VWAP with respect to our Common Stock and indicative Exchange Ratios throughout the Offer by calling the Information Agent at the toll-free number set forth on the back cover page of this Offer to Exchange. Throughout the Offer, an indicative Offer Consideration payable for the Notes pursuant to the Offer (including the Exchange Ratio) based on the Daily Settlement Amounts on the VWAP Trading Days that have passed since the commencement of the Offer, will be available at www.gbsc-usa.com/PHH and from the Information Agent, which may be contacted at its toll-free telephone number set forth on the back cover page of this Offer to Exchange. See “Description of the Offer—Terms of the Offer” and “Description of the Offer—Exchange Ratio.”

What aggregate principal amount of Notes is being sought in the Offer?

We are offering to purchase any and all of our outstanding Notes. As of May 5, 2015, $245.0 million aggregate principal amount of Notes was outstanding.

What is the maximum aggregate amount of cash that the Company may pay to noteholders pursuant to the Offer?

The maximum aggregate amount of cash that the Company may pay to noteholders pursuant to the Offer will not exceed $275,625,000, in addition to any accrued and unpaid interest from June 15, 2015 to, but excluding, the Settlement Date, and any cash paid in lieu of fractional shares of Common Stock to which any holder of Notes would be entitled pursuant to the terms of the Offer.

Will fractional shares be issued in the Offer?

Fractional shares will not be issued in this Offer. If, under the terms of this Offer to Exchange, a tendering holder is entitled to receive a fractional share (calculated on an aggregate basis for each tendering holder), we will calculate and pay to such tendering holder a cash adjustment in respect of such fraction (calculated to the nearest 1/100 of a share) in an amount equal to the same fraction of the Daily VWAP per share of our Common Stock on the Expiration Date.

When will I know the Exchange Ratio for the Offer?

We will calculate and announce the Exchange Ratio prior to 4:30 p.m., New York City time, on the Expiration Date (currently expected to be June 15, 2015, unless the Expiration Date is extended). Details regarding the Exchange Ratio will also be available by that time at www.gbsc-usa.com/PHH and from the Information Agent at its toll-free number set forth on the back cover page of this Offer to Exchange. The press release announcing the Exchange Ratio will also be filed as an exhibit to an amendment to our Schedule TO that we have filed with the SEC relating to this Offer to Exchange.

Throughout the Offer, an indicative Offer Consideration payable for the Notes pursuant to the Offer (including the Exchange Ratio) based on the Daily Settlement Amounts on the VWAP Trading Days that have passed since the commencement of the Offer, will be available at www.gbsc-usa.com/PHH and from the Information Agent, which may be contacted at its toll-free telephone number set forth on the back cover page of this Offer to Exchange. See “Description of the Offer—Exchange Ratio.”

Will I have an opportunity to tender my Notes in the Offer, or withdraw previously tendered Notes, after the determination of the Exchange Ratio?

Yes. Since the Exchange Ratio will be calculated and announced by us by 4:30 p.m., New York City time, on the Expiration Date and the Offer will not expire earlier than 11:59 p.m., New York City time, on the Expiration Date, you will have approximately 7.5 hours following the determination of the Exchange Ratio to tender your

8

Notes in the Offer or to withdraw your previously tendered Notes. If the Expiration Date is extended, holders will have such additional time as may elapse between the 11:59 p.m., New York City time, on the previously scheduled Expiration Date and the new Expiration Date. See “Description of the Offer—Exchange Ratio” and “Description of the Offer—Withdrawal of Tenders.”

To tender or withdraw Notes after 5:00 p.m., New York City time, but on or prior to the Expiration Time, on the Expiration Date, DTC participants may follow the procedures for tendering Notes after such time described under “Description of the Offer—Procedures for Tendering Notes,” or the procedures for withdrawing Notes after such time described under “Description of the Offer—Withdrawal of Tenders,” as applicable.

If your Notes are held of record through a broker, dealer, commercial bank, trust company or other nominee and you wish to tender or withdraw your Notes after 5:00 pm, New York City time, on the Expiration Date, you must make arrangements with your nominee for such nominee to fax a voluntary offering instructions form (in the case of a tender) or a notice of withdrawal (in the case of a withdrawal) to the Exchange Agent at its number set forth on the back cover page of this Offer to Exchange on your behalf on or prior to the Expiration Time on the Expiration Date, in accordance with the procedures described under “Description of the Offer—Procedures for Tendering Notes” or “Description of the Offer—Withdrawal of Tenders,” as applicable.

Why is PHH making the Offer?

The purpose of the Offer is to reduce our outstanding indebtedness and interest expense. We are commencing the Offer at this time because, among other reasons, the premium at which the Notes have traded above par has declined materially and because the Notes represent our unsecured debt with the highest effective interest rate. We also believe the Offer can mitigate dilution that could result from the conversion of the tendered Notes, particularly if we experience an increase in stock price from the continued successful execution of our re-engineering and growth actions. Although a successful Offer may result in unsecured debt levels below our targets, we believe the transaction is accretive to shareholders and provides a reasonable return on invested cash given current and projected liquidity needs. Following the Offer, as soon as we are legally permitted to do so, we intend to commence a $250 million open market share repurchase program, with the goal of completing the repurchases by March 31, 2016. Any open market share repurchases will be subject to market and business conditions, the trading price of our Common Stock and the nature of other investment opportunities.

Do I have a choice in whether to exchange my Notes?

Yes. Holders of Notes are not required to exchange their Notes pursuant to the Offer. All rights and obligations under the indenture pursuant to which Notes were issued will continue with respect to those Notes that remain outstanding after the Expiration Date. For example, payments of interest on such Notes will continue at the same rate and on the same schedule, and such Notes will continue to be convertible into shares of Common Stock upon the same terms, as prior to the Offer.

As at the date of this Offer to Exchange, the stock price condition (as defined in “Description of Notes—Conversion Rights—Conversion Based on Common Stock Price”), which allows holders of Notes to convert their Notes if the last reported sale price of our Common Stock for 20 or more trading days in a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter exceeds 130% of the applicable conversion price in effect for the Notes on each such trading day, was met with respect to the calendar quarter ending on March 31, 2015, of which PHH notified the holders of the Notes pursuant to the terms of the indenture relating to the Notes. Therefore, holders of the Notes are currently entitled to surrender their Notes for conversion pursuant to the terms of the indenture.

May I tender only a portion of the Notes that I hold?

Yes. You do not have to tender all of your Notes to participate in the Offer. You may choose to tender in the Offer all or any portion of the Notes that you hold.

9

Is PHH making a recommendation regarding whether I should tender my Notes pursuant to the Offer?

No. None of PHH, PHH’s Board of Directors or executive officers, the Financial Advisor, the Exchange Agent or the Information Agent or any agent or other person makes any recommendation as to whether holders should tender the Notes for exchange pursuant to the Offer. Accordingly, you must make your own determination as to whether to tender your Notes in the Offer and, if so, the principal amount of Notes to tender. Before making your decision, we urge you to carefully read this Offer to Exchange in its entirety, including the information set forth in the section of this Offer to Exchange entitled “Risk Factors” beginning on page 25, the section entitled “Cautionary Statement Regarding Forward-Looking Statements” on page 21 and the risk factors described in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any risk factors discussed from time to time in our other SEC filings and reports, incorporated by reference herein. We also urge you to consult your financial and tax advisors in making your own decisions as to what action, if any, to take in light of your own particular circumstances.

How does the Offer Consideration that I will receive if I validly tender Notes in the Offer compare to the amount of Common Stock that I would otherwise receive upon conversion of my Notes?

You have the option, subject to certain qualifications and the satisfaction of certain conditions and during the periods described under “Description of Notes—Conversion Rights,” to convert your Notes into cash and shares, if any, of our Common Stock at a conversion rate of 78.2014 shares of Common Stock per $1,000 principal amount of Notes. This is equivalent to a conversion price of approximately $12.79 per share of Common Stock. The conversion rate is subject to adjustment if certain events occur. As at the date of this Offer to Exchange, the stock price condition (as defined in “Description of Notes—Conversion Rights—Conversion Based on Common Stock Price”), which allows holders of Notes to convert their Notes if the last reported sale price of our Common Stock for 20 or more trading days in a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter exceeds 130% of the applicable conversion price in effect for the Notes on each such trading day, was met with respect to the calendar quarter ending on March 31, 2015, of which PHH notified the holders of the Notes pursuant to the terms of the indenture relating to the Notes. Therefore, holders of the Notes are currently entitled to surrender their Notes for conversion pursuant to the terms of the indenture.

A holder who validly tenders Notes in the Offer that are not validly withdrawn and are accepted for exchange by us will receive, for each $1,000 principal amount of validly tendered and accepted Notes, a number of shares of Common Stock equal to the Exchange Ratio, as well as $1,125.00 in cash, plus accrued and unpaid interest on such Notes from June 15, 2015 to, but excluding, the Settlement Date. The Exchange Ratio will be calculated on the Expiration Date as the sum of the Daily Settlement Amounts for each VWAP Trading Day during the Observation Period. The Exchange Ratio will be rounded to the nearest fourth decimal place.

See “Description of the Offer—Exchange Ratio” and “Description of Notes—Conversion Rights.”

Will I continue to receive interest payments on exchanged Notes?

No. As part of the Offer Consideration for validly tendered and accepted Notes, you will receive accrued and unpaid interest from June 15, 2015 to, but excluding, the Settlement Date. No additional payments of interest will be made with respect to any Notes that are validly tendered and not validly withdrawn and are accepted by us.

Pursuant to the terms of the indenture relating to the Notes, a person in whose name Notes are registered at the close of business on June 1, 2015, being the record date with respect to the interest payable on the Notes on June 15, 2015 under the indenture, will be paid such interest, notwithstanding any tender of such Notes in the Offer. For information on the interest payment terms under the indenture, see “Description of Notes—Interest.”

Which holders are eligible to participate in the Offer?

All holders of the Notes are eligible to participate in the Offer. See “Description of the Offer—Terms of the Offer.”

10

What is the current market value of the Notes?

The Notes are not listed on any securities exchange. We cannot provide you with any information regarding any trading market or market value for the Notes. We urge you to obtain current market price information for the Notes before deciding whether to participate in the Offer.

What is the current market value of the Common Stock?

Our Common Stock is listed on the NYSE under the symbol “PHH.” On May 5, 2015, the last reported sales price of our Common Stock on the NYSE was $24.70 per share. You should inform yourself regarding the market value of our Common Stock since May 5, 2015.

When does the Offer expire and how long do I have to decide?

The offer will expire at the Expiration Time on the Expiration Date, unless extended by us. We, in our sole discretion, may extend the Expiration Date for the Offer for any purpose, including in order to permit the satisfaction or waiver of any or all conditions to the Offer. See “—Will I have an opportunity to tender my Notes in the Offer, or withdraw previously tendered Notes, after the determination of the Exchange Ratio?”, “Description of the Offer—Expiration Date” and “Description of the Offer—Extension, Termination or Amendment.”

Under what circumstances may I withdraw previously tendered Notes?

You may withdraw previously tendered Notes at any time before the Expiration Time on the Expiration Date. In addition, you may withdraw any Notes that you tender that are not accepted by us for exchange within 40 business days from the commencement of the Offer on May 6, 2015. To withdraw previously tendered Notes, you are required to submit a notice of withdrawal to the Exchange Agent, in accordance with the procedures described herein and in the Letter of Transmittal. See “Description of the Offer—Withdrawal of Tenders.”

To withdraw previously tendered Notes after 5:00 p.m., New York City time, but on or prior to the Expiration Time, on the Expiration Date, DTC participants may follow the procedures for withdrawing Notes after such time described under “Description of the Offer—Withdrawal of Tenders.”

When will I receive my cash and shares of Common Stock if I participate in the Offer?

You will receive your cash and shares of Common Stock on the Settlement Date, which is expected to be June 18, 2015. See “Description of the Offer—Acceptance of Notes for Exchange and Delivery of Offer Consideration.”

Who will pay the fees and expenses in connection with the Offer? How will PHH fund the Offer?

We will pay all of our fees and expenses in connection with the Offer. We intend to fund the cash portion of the Offer Consideration from cash on hand. A holder of Notes is responsible for paying all of its own fees and expenses, including the fees and expenses of such holder’s advisors. We will pay transfer taxes, if any, applicable to the exchange of Notes pursuant to the Offer, except as set forth in the Letter of Transmittal.

What are the conditions to the Offer?

The Offer is not conditioned on any minimum principal amount of the Notes being tendered in the Offer. Consummation of the Offer is conditioned upon the satisfaction or waiver of the conditions described in the section of this Offer to Exchange entitled “Description of the Offer—Conditions to the Offer.” PHH may waive the conditions of the Offer. If any condition is not satisfied or waived, PHH may, in its sole discretion, terminate the Offer. See “Description of the Offer—Conditions to the Offer.”

11

Under what circumstances may the Offer be amended or terminated?

PHH has the right to terminate or withdraw, in its sole discretion, the Offer at any time if the conditions to the Offer are not met by the Expiration Time on the Expiration Date. PHH reserves the right, subject to applicable law, (i) to waive any and all of the conditions of the Offer on or prior to the Expiration Time on the Expiration Date and (ii) to amend the terms of the Offer. In the event that the Offer is terminated, withdrawn or otherwise not consummated on or prior to the Expiration Time on the Expiration Date, no consideration will be paid or become payable to holders who have properly tendered their Notes pursuant to the Offer. In any such event, the Notes previously tendered pursuant to the Offer will be promptly returned to the tendering holders. See “Description of the Offer—Extension, Termination or Amendment.”

How will I be notified if the Offer is extended or amended?

We will issue a press release or otherwise publicly announce any extension or amendment of the Offer. In the case of an extension, we will promptly make a public announcement by issuing a press release no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled Expiration Date.

How do I tender my Notes in response to the Offer?

The outstanding Notes are represented by a global certificate registered in the name of DTC. As a result, all holders of Notes electing to tender their Notes must do so pursuant to DTC’s book entry procedures. If you wish to tender your Notes and your Notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact that registered holder promptly and instruct him, her or it to tender your Notes on your behalf. If you are a DTC participant, you may electronically transmit your acceptance through ATOP. See “Description of the Offer—Procedures for Tendering Notes.” For further information on how to tender Notes, contact the Exchange Agent at the telephone numbers set forth on the back cover page of this Offer to Exchange or consult your broker, dealer, custodian bank, depository trust company or other nominee through whom you hold Notes with questions and requests for assistance.

May I tender my Notes by notice of guaranteed delivery?

No. There are no guaranteed delivery procedures applicable to the Offer and, accordingly, Notes may not be tendered by delivering a notice of guaranteed delivery. All tenders must be completed by the Expiration Time on the Expiration Date in order to be considered valid.

What risks should I consider in deciding whether or not to tender my Notes?

Your decision to participate in the Offer, and to exchange the Notes for the Offer Consideration, including shares of our Common Stock, will involve risk. You should be aware of, and carefully consider the risk factors set forth in “Risk Factors” beginning on page 25, the section entitled “Cautionary Statement Regarding Forward-Looking Statements” on page 21 and the risk factors described in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any risk factors discussed from time to time in our other SEC filings and reports, incorporated by reference herein, before deciding whether to participate in the Offer and, through participation in the Offer, make an investment in our Common Stock.

Notes not exchanged in the Offer will remain outstanding after the consummation of the Offer. If the Offer is consummated, the trading market, if any, for the remaining Notes may be less liquid and more sporadic, potentially resulting in a market price for the Notes that is lower or more volatile than that which had previously prevailed. For further description of the risks of failing to exchange your Notes, see “Risk Factors—Risks to Holders of Non-Tendered Notes.”

Will the Common Stock to be issued in the Offer be freely tradable?

Yes, as a general matter. The Common Stock you receive in the Offer will be freely tradable, unless you are considered an “affiliate” of ours, as that term is defined in the Securities Act (namely a person controlling,

12

controlled by or under common control with, the Company). Our Common Stock is listed on the NYSE under the symbol “PHH,” and we expect the shares of our Common Stock to be issued in the Offer to be approved for listing on the NYSE under the symbol “PHH” on or prior to the settlement of the Offer. For more information regarding the market for our Common Stock, see “Price Range of Common Stock and PHH’s Dividend Policy.”

What must I do to participate if my Notes are held of record by a broker, dealer, commercial bank, trust company or other nominee?

If you wish to tender your Notes and they are held of record by a broker, dealer, commercial bank, trust company or other nominee, you should contact such entity promptly and instruct it to tender Notes on your behalf. You are urged to instruct your broker, dealer, commercial bank, trust company or other nominee as soon as possible in order to allow adequate processing time for your instruction.

Should you have any questions as to the procedures for tendering your Notes, please call your broker, dealer, commercial bank, trust company or other nominee, or call the Exchange Agent at its telephone numbers set forth on the back cover page of this Offer to Exchange.

IF YOU HOLD YOUR NOTES THROUGH A BROKER, DEALER, COMMERCIAL BANK, TRUST COMPANY OR OTHER NOMINEE, YOU SHOULD KEEP IN MIND THAT SUCH ENTITY MAY REQUIRE YOU TO TAKE ACTION WITH RESPECT TO THE OFFER A NUMBER OF DAYS BEFORE THE EXPIRATION DATE IN ORDER FOR SUCH ENTITY TO TENDER SECURITIES ON YOUR BEHALF ON OR PRIOR TO THE EXPIRATION TIME ON THE EXPIRATION DATE. ACCORDINGLY, IF YOU WISH TO PARTICIPATE IN THE OFFER, YOU SHOULD CONTACT THEIR BROKER, DEALER, COMMERCIAL BANK, TRUST COMPANY OR OTHER NOMINEE AS SOON AS POSSIBLE IN ORDER TO DETERMINE THE TIMES BY WHICH YOU MUST TAKE ACTION IN ORDER TO PARTICIPATE IN THE OFFER.

Tenders not completed on or prior to the Expiration Time on the Expiration Date will be disregarded and of no effect.

Are the Company’s financial condition and results of operations relevant to the decision to tender Notes for exchange in the Offer?

We believe that the price of our Common Stock and the Notes are closely linked to our financial condition and results of operations. For information about our financial condition and results of operations, see the section of this Offer to Exchange entitled “Capitalization” and the information incorporated by reference in this Offer to Exchange.

What are the principal U.S. federal income tax consequences of my participating in the Offer?

For a summary of the principal U.S. federal income tax consequences of participating in the Offer, see “U.S. Federal Income Tax Consequences.” You should consult your own tax advisor for a full understanding of the tax consequences of participating in the Offer.

Who are the Information Agent and Exchange Agent and how may I contact them?

Global Bondholder Services Corporation is the Exchange Agent and the Information Agent for the Offer. Its address and telephone numbers are listed on the back cover page of this Offer to Exchange. See “Financial Advisor, Exchange Agent and Information Agent.”

Who is PHH’s Financial Advisor in connection with the Offer?

We have retained Citigroup Global Markets Inc. as our Financial Advisor in connection with the Offer. We are paying the Financial Advisor customary fees for its services and have agreed to indemnify it for certain liabilities. The Financial Advisor’s compensation is in no way contingent on the results or the success of the Offer.

13

The Financial Advisor has not been retained to, and will not, solicit acceptances of the Offer or make any recommendations with respect thereto. See “Financial Advisor, Exchange Agent and Information Agent.”

To whom may I direct questions regarding the Offer?

If you have questions regarding the procedures for tendering your Notes pursuant to this Offer to Exchange or require assistance in tendering your Notes, please contact the Exchange Agent. If you would like additional copies of this Offer to Exchange, PHH’s annual, quarterly, and current reports or other information that is incorporated by reference in this Offer to Exchange, please contact either the Information Agent or PHH’s Investor Relations Department. The contact information for PHH’s Investor Relations Department is set forth in the sections of this Offer to Exchange entitled “Summary of the Offer” and “Incorporation by Reference; Additional Information.” The contact information for the Information Agent and the Exchange Agent is set forth on the back cover page of this Offer to Exchange. You may also contact your broker, dealer, custodian bank, depository trust company or other nominee through whom you hold your Notes with questions and requests for assistance.

14

NOTICE TO INVESTORS

We are making the Offer to holders of Notes in reliance upon the exemption from the registration requirements of the Securities Act under Section 3(a)(9) of the Securities Act. We will not pay or give, directly or indirectly, any commission or other remuneration to any broker, dealer, salesman or other person for soliciting tenders of Notes. Our officers, directors and employees may solicit tenders from holders of our Notes and will answer inquiries concerning the Notes, but they will not be paid or given, directly or indirectly, additional compensation for soliciting tenders or answering any such inquiries.

NONE OF PHH, PHH’S BOARD OF DIRECTORS OR EXECUTIVE OFFICERS, THE EXCHANGE AGENT, THE INFORMATION AGENT, THE FINANCIAL ADVISOR OR ANY OF THEIR RESPECTIVE AFFILIATES MAKES ANY RECOMMENDATION AS TO WHETHER OR NOT HOLDERS OF NOTES SHOULD EXCHANGE NOTES FOR THE OFFER CONSIDERATION IN THE OFFER.

You should rely only on the information contained or incorporated by reference in this Offer to Exchange. The information contained in this Offer to Exchange is as of the date of this Offer to Exchange only and is subject to change, completion or amendment without notice. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information provided in this Offer to Exchange, including any information incorporated herein by reference, is accurate as of any date other than the date of this Offer to Exchange or the date of any such information incorporated herein by reference. Neither the delivery of this Offer to Exchange at any time, nor the Offer, exchange, sale or delivery of any security shall, under any circumstances, create any implication that there has been no change in the information contained or incorporated by reference in this Offer to Exchange or in our affairs since the date of this Offer to Exchange.

Pursuant to Rule 13e-4(c)(2) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), PHH has filed with the SEC an Issuer Tender Offer Statement on Schedule TO, which contains additional information with respect to the Offer. The Schedule TO, including exhibits and any amendments and supplements thereto, may be examined and copies may be obtained, at the same places and in the same manner as is set forth in “Incorporation by Reference; Additional Information.”

Neither the Offer nor the Common Stock portion of the Offer Consideration have been approved or disapproved by the SEC or any state securities commission, nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Offer to Exchange. Any representation to the contrary is unlawful and may be a criminal offense in the United States.

We are not aware of any jurisdiction in the United States in which the making of the Offer is not in compliance with applicable law. If we become aware of any such jurisdiction in the United States in which the making of the Offer would not be in compliance with applicable law, we will make a reasonable good faith effort to comply with any such law. If, after such reasonable good faith effort, we cannot comply with any such law, the Offer will not be made to (nor will tenders of Notes in connection with the Offer be accepted from or on behalf of) the holders of Notes residing in such jurisdiction.

This Offer to Exchange does not constitute an offer to participate in the Offer to any person in any jurisdiction where it is unlawful to make such an offer. The Offer is being made on the basis of this Offer to Exchange and is subject to the terms described herein. Holders should not construe anything in this Offer to Exchange as legal, business or tax advice. Each holder should consult its advisors as needed to make its investment decision and to determine whether it is legally permitted to participate in the Offer under applicable legal investment or similar laws or regulations.

Each holder must comply with all applicable laws and regulations in force in any jurisdiction in which it participates in the Offer or possesses or distributes this Offer to Exchange and must obtain any consent, approval or permission required by it for participation in the Offer under the laws and regulations in force in any jurisdiction to which it is subject, and neither we nor any of our respective representatives shall have any responsibility therefor.

15

We reserve the right, in our sole discretion and subject to applicable laws, to amend, modify or, if the conditions described in this Offer to Exchange are not met, withdraw the Offer at any time and to reject any tender, in whole or in part.

This Offer to Exchange contains summaries with respect to certain documents, but reference is made to the actual documents for complete information. All of those summaries are qualified in their entirety by this reference. Copies of documents referred to herein will be made available to holders upon request to PHH.

16

OUR COMPANY

We were incorporated in 1953 as a Maryland corporation. For periods between April 30, 1997 and February 1, 2005, we were a wholly owned subsidiary of Cendant Corporation (now known as Avis Budget Group, Inc.) and its predecessors that provided mortgage banking services, facilitated employee relocations and provided vehicle fleet management and fuel card services. On February 1, 2005, we began operating as an independent, publicly traded company pursuant to our spin-off from Cendant.

We are a leading non-bank mortgage originator and servicer of U.S. residential mortgage loans. Through our wholly-owned subsidiary, PHH Mortgage Corporation and its subsidiaries (collectively, “PHH Mortgage”), we provide outsourced mortgage banking services to a variety of clients, including financial institutions and real estate brokers throughout the U.S. and are focused on originating, selling and servicing residential mortgage loans. Our business activities are organized and presented in two operating segments: Mortgage Production and Mortgage Servicing. Our Mortgage Production segment originates, purchases and sells mortgage loans through PHH Mortgage. Our Mortgage Servicing segment services mortgage loans originated by PHH Mortgage, purchases mortgage servicing rights from others and acts as a subservicer for certain clients that own the underlying servicing rights. See our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, incorporated by reference herein, for additional information on our business.

Effective on July 1, 2014, we sold all of the issued and outstanding equity interests of our Fleet Management Services business and related fleet entities (collectively the “Fleet business”) to Element Financial Corporation, an Ontario corporation for a purchase price of $1.4 billion. The Fleet business was focused on providing commercial fleet management services to corporate clients and government agencies throughout the U.S. and Canada which included fleet leasing services and additional services and products for vehicle maintenance, accident management, driver safety training and fuel cards. Upon the completion of the sale described above, the Fleet business was no longer a reportable segment.

We are a Maryland corporation. Our headquarters are located at 3000 Leadenhall Road, Mt. Laurel, New Jersey 08054, and the telephone number at this location is (856) 917-1744. Information about the Company is available on our website at www.phh.com. The contents of our websites are not incorporated by reference herein and are not deemed to be part of this Offer to Exchange.

Recent Developments

On May 6, 2015, we announced our unaudited financial results for the first quarter of 2015. Below are selected highlights of our performance in the first quarter of 2015.

· Net income attributable to PHH was $21 million or $0.40 per basic share, which includes a $65 million pre-tax favorable market-related fair value adjustment to our mortgage servicing rights (“MSRs”), net of derivative gains related to MSRs.

· We realized $11 million of operating benefits in the first quarter of 2015 compared to the first quarter of 2014 from our re-engineering activities, representing 20% of our target annualized operating benefits. We invested $9 million of operating expenses and $1 million of capital expenses in our re-engineering efforts and evaluation of select growth opportunities during the first quarter of 2015.

· We signed renegotiated contracts with clients representing approximately 50% of our total private label closing volume for the year ended December 31, 2014.

· Mortgage applications were $15.2 billion, representing a 46% increase from $10.4 billion in the first quarter of 2014. Interest rate lock commitments expected to close were $2.1 billion, representing a 22% increase from $1.8 billion in the first quarter of 2014.

17

· Total closings were $9.4 billion, representing a 27% increase from $7.4 billion in the first quarter of 2014. Purchase closings were $3.8 billion, representing a 6% increase from $3.6 billion in the first quarter of 2014. Total loan margin was 315 basis points (“bps”), representing a 24 bps increase from 291 bps in the first quarter of 2014.

For more information on our financial results in the first quarter of 2015, see our first quarter 2015 earnings release dated May 6, 2015. These results have not been audited or reviewed by our registered independent public accountants. Accordingly, no opinion or any other form of assurance can be provided with respect to this information. The results of operations reported for interim periods are not necessarily indicative of the results of operations for the entire year or any subsequent interim period.

18

PURPOSE OF THE OFFER

The purpose of the Offer is to reduce our outstanding indebtedness and interest expense. We are commencing the Offer at this time because, among other reasons, the premium at which the Notes have traded above par has declined materially and because the Notes represent our unsecured debt with the highest effective interest rate. We also believe the Offer can mitigate dilution that could result from the conversion of the tendered Notes, particularly if we experience an increase in stock price from the continued successful execution of our re-engineering and growth actions. Although a successful Offer may result in unsecured debt levels below our targets, we believe the transaction is accretive to shareholders and provides a reasonable return on invested cash given current and projected liquidity needs. Following the Offer, as soon as we are legally permitted to do so, we intend to commence a $250 million open market share repurchase program, with the goal of completing the repurchases by March 31, 2016. Any open market share repurchases will be subject to market and business conditions, the trading price of our Common Stock and the nature of other investment opportunities.

19

USE OF SECURITIES ACQUIRED

The Notes exchanged in connection with the Offer will be retired and cancelled. PHH will not receive any cash proceeds from the Offer.

20

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Offer to Exchange contains or incorporates by reference documents containing forward-looking statements regarding future events and the future results of the Company that are based on management’s current expectations, estimates, projections, and assumptions about the Company’s business. Generally, forward-looking statements are not based on historical facts but instead represent only our current beliefs regarding future events. All forward-looking statements are, by their nature, subject to risks, uncertainties and other factors. Such statements may be identified by words such as “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “may increase,” “may fluctuate” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could.” These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. In addition, such statements could be affected by general industry and market conditions. Forward-looking statements contained in this Offer to Exchange and documents incorporated by reference herein include, but are not limited to, statements concerning the following:

· the execution of our strategic priorities, including re-engineering our mortgage business, executing our growth strategies, executing our capital structure initiatives and our expectations regarding future operating benefits from the achievement of those priorities;

· other potential acquisitions, dispositions, partnerships, joint ventures and changes in product offerings to achieve disciplined growth in our franchise platforms and to optimize our mortgage business;

· our expectations of the impacts of regulatory changes on our businesses;

· future origination volumes and loan margins in the mortgage industry;

· our expectations regarding the impacts of the shift in our volume to a greater mix of subserviced loans, including the impacts on our earnings and potential benefits to our capital structure;

· our expectations around future losses from representation and warranty claims, and associated reserves and provisions;

· the impact of the adoption of recently issued accounting pronouncements on our financial statements; and

· our assessment of legal proceedings and associated reserves and provisions.

Actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors including, but not limited to, those discussed in “Risk Factors” beginning on page 25, and the risk factors described in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and any risk factors discussed from time to time in our other SEC filings and reports, incorporated by reference herein, including the factors described below:

· our ability to successfully re-engineer our mortgage business, re-negotiate our private label agreements, and implement changes to meet our operational and financial objectives;

· the effects of market volatility or macroeconomic changes on the availability and cost of our financing arrangements and the value of our assets;

· the effects of changes in current interest rates on our business and our financing costs;

· our decisions regarding the use of derivatives related to mortgage servicing rights, if any, and the resulting potential volatility of the results of operations of our business;

21

· the impact of changes in the U.S. financial condition and fiscal and monetary policies, or any actions taken or to be taken by the U.S. Department of the Treasury and the Board of Governors of the Federal Reserve System on the credit markets and the U.S. economy;

· the effects of any further declines in the volume of U.S. home sales and home prices, due to adverse economic changes or otherwise, on our business;

· the effects of any significant adverse changes in the underwriting criteria or existence or programs of government-sponsored entities, including Fannie Mae and Freddie Mac, including any changes caused by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other actions of the federal government;

· the ability to maintain our status as a government sponsored entity-approved seller and servicer, including the ability to continue to comply with the respective selling and servicing guides;

· the effects of changes in, or our failure to comply with, laws and regulations, including mortgage- and real estate-related laws and regulations, changes in the status of government sponsored-entities and changes in state, federal and foreign tax laws and accounting standards;

· the effects of any inquiries and investigations by attorneys general of certain states and the U.S. Department of Justice, the Bureau of Consumer Financial Protection, U.S. Department of Housing and Urban Development or other state or federal regulatory agencies related to our mortgage origination or servicing activities, any litigation related to our mortgage origination or servicing activities, or any related fines, penalties and increased costs;

· the ability to maintain our relationships with our existing clients, including our efforts to amend the terms of certain of our private label client agreements, and to establish relationships with new clients;

· the effects of competition in our business, including the impact of consolidation within the industry in which we operate and competitors with greater financial resources and broader product lines;

· the inability or unwillingness of any of the counterparties to our significant customer contracts or financing arrangements to perform their respective obligations under, or to renew on terms favorable to us, such contracts, or our ability to continue to comply with the terms of our significant customer contracts, including service level agreements;

· the impact of the failure to maintain our credit ratings, including the impact on our cost of capital and ability to incur new indebtedness or refinance our existing indebtedness, as well as on our current or potential customers’ assessment of our long-term stability;

· the ability to obtain alternative funding sources for our mortgage servicing rights, servicing advances or to obtain financing (including refinancing and extending existing indebtedness) on acceptable terms, if at all, to finance our operations or growth strategies, to operate within the limitations imposed by our financing arrangements and to maintain the amount of cash required to service our indebtedness and operate our business;

· any failure to comply with covenants or asset eligibility requirements under our financing arrangements;

· the effects of any failure in or breach of our technology infrastructure, or those of our outsource providers, or any failure to implement changes to our information systems in a manner sufficient to comply with applicable laws, regulations and our contractual obligations;

· the ability to attract and retain key employees; and

22

· any tender offers, exchange offers or other transactions similar to the Offer that we may undertake in the future, including share buy-backs.

Such forward-looking statements speak only as of the date of this Offer to Exchange or, in the case of any document incorporated by reference, the date of that document, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Offer to Exchange. If we update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect to other forward-looking statements.

23

INCORPORATION BY REFERENCE; ADDITIONAL INFORMATION

We are “incorporating by reference” certain information we file with the SEC into this Offer to Exchange, which means that we may disclose important information to you by referring you to those documents. Information that is incorporated by reference is an important part of this Offer to Exchange. We incorporate by reference into this Offer to Exchange the documents listed below, which were filed with the SEC, and such documents form an integral part of this Offer to Exchange.

· Annual Report on Form 10-K for the fiscal year ended December 31, 2014;

· Current Reports on Form 8-K filed with the SEC on February 17, 2015, March 3, 2015 and May 6, 2015; and

· Definitive Proxy Statement on Schedule 14A filed with the SEC on April 20, 2015.

On May 6, 2015, we issued a press release announcing our financial results for the three month period ended March 31, 2015, which was filed as Exhibit 99.1 to our Current Report on Form 8-K, filed on May 6, 2015. We will file our Quarterly Report on Form 10-Q for the three month period ended March 31, 2015 with the SEC promptly following the press release mentioned above, which shall be deemed to be incorporated in this Offer to Exchange by reference. All other documents filed by us under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act from the date of this Offer to Exchange and prior to the termination of the Offer shall also be deemed to be incorporated in this Offer to Exchange by reference.

Any statement contained in this Offer to Exchange or in a document (or part thereof) incorporated by reference in this Offer to Exchange shall be considered to be modified or superseded for purposes of this Offer to Exchange to the extent that a statement contained in this Offer to Exchange or in any other subsequently filed document (or part thereof) that is incorporated by reference in this Offer to Exchange modifies or supersedes that statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. Any statement so modified or superseded shall not be considered, except as so modified or superseded, to constitute part of this Offer to Exchange.

Copies of each of the documents incorporated by reference into this Offer to Exchange (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing) may be obtained at no cost by contacting the Information Agent, or PHH at the following addresses and telephone numbers:

Global Bondholder Services Corporation | PHH Corporation |

65 Broadway — Suite 404 | 3000 Leadenhall Road |

New York, New York 10006 | Mt. Laurel, New Jersey 08054 |

Attn: Corporate Actions | Attention: Investor Relations |

Bank and brokers call: (212) 430-3774 | (856) 917-7118 |

All other call toll-free: (866) 924-2200 | |

PHH is subject to the informational requirements of the Exchange Act and in accordance therewith files reports and information statements and other information with the SEC. You may read and copy any document PHH files with the SEC at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, DC 20549. You may also obtain copies of the same documents from the public reference room of the SEC in Washington by paying a fee. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website at www.sec.gov for further information on the public reference room. PHH’s filings are also electronically available from the SEC’s Electronic Document Gathering and Retrieval System, which is commonly known by the acronym “EDGAR,” and which may be accessed at www.sec.gov, as well as from commercial document retrieval services, and through our website at www.phh.com. The contents of our website are not incorporated by reference herein and are not deemed to be part of this Offer to Exchange.

24

RISK FACTORS