UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Pre-Effective Amendment No. 1 to

FORM S‑3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Registration No. 333-281814

PRUCO LIFE INSURANCE COMPANY

IN RESPECT OF

| | |

| PRUCO LIFE INSURANCE COMPANY |

| (Exact name of registrant as specified in its charter) |

| | |

| Arizona |

| (State or other jurisdiction of incorporation or organization) |

| | |

| 6311 |

| (Primary Standard Industrial Classification Code Number) |

| | |

| 22-1944557 |

| (I.R.S. Employer Identification Number) |

| | |

|

| c/o Pruco Life Insurance Company |

| 213 Washington Street |

| Newark, New Jersey 07102 |

| (800) 778-2255 |

| (Address, including zip code, and telephone number, including area code, or registrant's principal executive offices) |

| | |

|

| Pruco Life Insurance Company |

| C/O CT Corporation System |

| 3800 North Central Avenue, Suite 460 |

| Phoenix, Arizona 85012 |

| (602) 248-1145 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

|

| Copies to: |

| Christopher J. Madin |

| Vice President and Corporate Counsel |

| Pruco Life Insurance Company |

| 280 Trumbull Street |

| Hartford, Connecticut 06103 |

|

| | |

| January 17, 2025 |

| (Approximate date of commencement of proposed sale to the public) |

| | | | | | | | | | | | | | |

| If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: | ☐ |

| If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: | ☑ |

| If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | ☐ |

| If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. | ☐ |

| If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. | ☐ |

| If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. | ☐ |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☑ | Smaller reporting company | ☐ | |

| | Emerging growth company | ☐ | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. | ☐ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

January 17, 2025

Index Strategies

For

Prudential FlexGuard® Life IVUL

Issued by

PRUCO LIFE INSURANCE COMPANY

213 WASHINGTON STREET

NEWARK, NEW JERSEY 07102

TELEPHONE: 800-778-2255

This prospectus describes index-linked investment options (“Index Strategies”) available with Prudential FlexGuard® Life IVUL (“FlexGuardSM Life”), a flexible premium variable and index-linked life universal insurance contract, (“Contract”). The Contract is issued by Pruco Life Insurance Company (“Pruco Life,” “we,” “our,” or “us”).

Generally, you (the “Contract Owner”) may choose to allocate your Contract's premiums and its earnings to (i) the Fixed Rate Option, (ii) one or more Variable Investment Options, and (iii) one or more Index Strategies. A description of the Fixed Rate Option, which pays a guaranteed interest rate, and a complete list of the available Variable Investment Options are included in the Contract’s prospectus. The Index Strategies are described herein.

We offer five types of Index Strategies which contain a total of eight investment options. The Index Strategies provide for participation in the performance of an associated, underlying index (“Index” or “Indices"), which excludes dividends. Each Index Strategy limits participation in both positive and negative performance of the return of the underlying Index. A more detailed description of the Index Strategies can be found within this prospectus.

You may allocate your premiums and transfer your Contract Fund amounts to the Index Strategies, subject to certain restrictions described herein. We hold the assets for the Index Strategies in a non-insulated, non-unitized separate account we have established to support our obligations with respect to the Index Strategies.

The Index Strategies (type/option) described in this prospectus are:

| | | | | | | | | | | | | | |

Capped With Floor

Index Strategy | Capped With Buffer

Index Strategy | Enhanced Cap Rate

With Spread and Buffer

Index Strategy | Step Rate Plus

With Buffer

Index Strategy | Dual Directional

With Buffer

Index Strategy |

1 Year S&P 500® Cap Rate 0% Floor •Minimum Cap: 2% •Minimum Floor: 0% •Minimum Participation Rate: 100%

| 1 Year S&P 500® Cap Rate 10% Buffer •Minimum Cap: 5% •Minimum Buffer: 10% •Minimum Participation Rate: 100% 1 Year S&P 500® Cap Rate 15% Buffer •Minimum Cap: 4% •Minimum Buffer: 15% •Minimum Participation Rate: 100% | 1 Year S&P 500® Enhanced Cap Rate 10% Buffer •Minimum Cap: 5% •Minimum Buffer: 10% •Minimum Participation Rate: 100% •Maximum Spread: 2% 1 Year S&P 500® Enhanced Cap Rate 15% Buffer •Minimum Cap: 4% •Minimum Buffer: 15% •Minimum Participation Rate: 100% •Maximum Spread: 2% | 1 Year S&P 500® Step Rate Plus 10% Buffer •Minimum Buffer: 10% •Minimum Participation Rate: 60% •Minimum Step Rate: 1% | 1 Year S&P 500® Dual Directional 10% Buffer •Minimum Cap: 1% •Minimum Buffer: 10% •Minimum Participation Rate: 100% 1 Year S&P 500® Dual Directional 15% Buffer •Minimum Cap: 1% •Minimum Buffer: 15% •Minimum Participation Rate: 100% |

Negative investment returns do not impact investments allocated to the 0% Floor option. Negative investment returns may result in a loss of up to 90% of amounts invested in 10% Buffer option Segments, and up to 85% of amounts invested in 15% Buffer option Segments.

Not all Index Strategies or options contained in this prospectus may be available under your version of the Contract. See your FlexGuardSM Life prospectus’ appendix for a listing of Index Strategies currently available with your Contract.

We may add new Index Strategies in the future. For any Index Strategies that are offered under this Contract, Participation Rates will be at least 50%, Cap Rates (if applicable) will be at least 1%, Spreads (if applicable) will be no greater than 10%, Step Rates (if applicable) will be at least 1%, Buffers (if applicable) will be at least 5%, and Floors (if applicable) will be at least 0%. We may add Index Strategies that do not offer a Buffer or any downside protection. Further, we may remove Index Strategies, including all

strategies that provide a Buffer or any downside protection. As a result, future Index Segments might not offer downside protection. At least one Index Strategy option will always be available. This means that we might eliminate all Index Strategies but one, and an investor would be limited to investing in one Index Strategy with terms that they may not find acceptable, or other investment options where the performance is not based on the performance of an index and do not offer protection from investment loss. If you are not satisfied with the investment options in your Contract, you may surrender it at any time. A surrender will result in a surrender charge in the first fifteen Contract Years and result in a decrease to your Cash Surrender Value. Further, if the total of your surrender proceeds and any withdrawals exceeds the total premiums paid, any excess amount will typically be taxed as ordinary income. You may also receive an additional amount upon surrender if you purchased the Enhanced Cash Value Rider. If you were to surrender your Contract and purchase another contract, the new contract would be subject to a new surrender charge period and would offer different investment options and have different fees, benefits, and risks.

The maximum amount that can be allocated annually to the Variable Investment Options from the Index Strategies is 25% of the maturity value of each Index Strategy Segment.

PLEASE READ THE PROSPECTUSES

This prospectus sets forth information about the Index Strategies and associated information related to the Contract that you should know before purchasing. Please read this prospectus for more detail about the Index Strategies. Keep it for future reference. This prospectus must be read along with the prospectus for your Contract. You must also read your Contract, which includes any optional riders you elected. Certain terms used in this prospectus may be defined in the prospectus for your Contract. Those terms have the same meaning when used in this prospectus. The prospectus describing your Contract can be found online at www.Prudential.com/eProspectus.

Clients seeking information regarding their particular investment needs should contact a financial professional. Index-linked and variable life insurance contracts are complex insurance and investment vehicles. You should work with a financial professional to decide whether the Contract and features are appropriate for you based on a thorough analysis of your particular needs, financial objectives, investment goals, time horizons and risk tolerance.

The Contract is not a short-term investment and may not be appropriate if you need ready access to cash. The Contract is designed to provide benefits on a long-term basis. Consequently, you should not use the Contract as a short-term investment or savings vehicle.

There is a risk of substantial loss of your principal. The risk of loss may be greater in the case of a withdrawal from a Segment with a Buffer on any date other than a Segment start date or maturity date. If you take a withdrawal (including withdrawals taken to pay Contract charges and expenses, Death Benefit payments, loans, transfers, and surrenders) prior to a Segment’s maturity, we will use an Interim Value to determine the fair market value of the Segment at the time of the transaction. The Interim Value is designed to represent the fair value of the Segment on the Valuation Day, taking into account the potential gain or loss of the Index at Segment maturity. The Interim Value reflects the change in fair value due to economic factors of the investment instruments (including derivatives) supporting the Segment. The Interim Value may result in a loss even if the Index Value at the time the Interim Value is calculated is higher than the Index Value on the Segment start date. Because the downside protection provided by a Buffer normally does not apply to the Interim Value, it is theoretically possible that you could lose most of your investment, potentially up to 100% of your investment, in extreme scenarios such as an unprecedented complete market collapse. Surrender charges, withdrawal fees and taxes may also apply to a withdrawal prior to a Segment’s maturity. See Valuing Your Investment And Interim Value Of Index Strategy Segments and RISK FACTORS on Page 5 for more information. The Contract permits monthly charges to be deducted from the Index Strategies prior to the end of a Segment if amounts in the Variable Investment Options, Fixed Rate Option, and Fixed Holding Account are insufficient to cover monthly deductions, and such ongoing deductions could have adverse effects on values under the Contract. Investors should carefully consider whether to retain enough value in the Variable Investment Options and fixed options to cover their monthly deductions, and should consult with a financial professional about the appropriateness of the Index Strategies for them.

The Index Strategies investment options may not be available through all selling broker-dealers in the future. This prospectus does not constitute an offering in any jurisdiction in which such offering may not lawfully be made. This prospectus discloses all material terms of the Contract’s Index Strategies, including any state or intermediary variations.

We are obligated to pay all amounts promised to Contract Owners under the Contract. The obligations to Contract Owners and beneficiaries arising under the Contracts are our general corporate obligations. Guarantees and benefits within the Contract are subject to our creditworthiness and claims paying ability.

OTHER CONTRACTS

We offer a variety of fixed and variable life insurance contracts. They offer features and have fees and charges that are different from those offered by this prospectus. Not every contract or feature is offered through every selling firm or in every state. Upon request, your financial professional can show you information regarding other Pruco Life contracts that your financial professional sells. You can also contact us to find out more about the availability of any of the Pruco Life contracts.

AVAILABLE INFORMATION

Additional information about us and this offering is available in the registration statement and the exhibits thereto, as well as in documents incorporated by reference into this prospectus (which means they are legally part of this prospectus). You may review and obtain copies of these materials at no cost to you by contacting us. They may also be obtained through the Securities and Exchange Commission’s (“SEC”) website (www.SEC.gov), which the SEC maintains for us and other registrants that file electronically with the SEC. Please see How to Reach Us in ADDITIONAL INFORMATION later in this prospectus for our Service Office address.

THE CONTRACT IS NOT A DEPOSIT OR OBLIGATION OF, OR ISSUED, GUARANTEED OR ENDORSED BY, ANY BANK, AND IS NOT INSURED OR GUARANTEED BY THE U.S. GOVERNMENT, THE FEDERAL DEPOSIT INSURANCE CORPORATION (FDIC), THE FEDERAL RESERVE BOARD OR ANY OTHER AGENCY.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

PRUDENTIAL, PRUDENTIAL FINANCIAL, PRUCO LIFE AND THE ROCK LOGO ARE SERVICE MARKS OF THE PRUDENTIAL INSURANCE COMPANY OF AMERICA AND ITS AFFILIATES. OTHER PROPRIETARY PRUDENTIAL MARKS MAY BE DESIGNATED AS SUCH THROUGH USE OF THE SM OR ® SYMBOLS.

FOR FURTHER INFORMATION CALL 800-778-2255 OR GO TO OUR WEBSITE AT WWW.PRUDENTIAL.COM/EPROSPECTUS.

TABLE OF CONTENTS

(This page is intentionally left blank.)

SUMMARY OF INDEX STRATEGIES

The Index Strategies are investment options to which you may choose to allocate all or part of your net premiums or Contract Fund, subject to restrictions when enrolled in the Segment Maturity Allocation Program and when used in combination with certain riders. See Segment Maturity Allocation Program and Riders later in this prospectus for more detail. The Index Strategies provide limited exposure to potential market growth opportunities with a certain level of protection in down market cycles. The Index Strategies receive an amount called “Index Interest,” which is based in part on the performance of an external index (“Index”), subject to minimums and maximums. Index Interest can be positive or negative, which means it is possible to lose value and prior earnings when investing in the Index Strategies. We currently offer Index Strategies based on the S&P 500® Index Price Return, which is the S&P 500® Index excluding dividends. The S&P 500® Index is comprised of 500 stocks considered representative of the overall market. Although the Index Strategies provide Index Interest linked to an Index, money placed in the Index Strategies is not a direct investment in a particular Index (you cannot invest directly in an Index). You are not purchasing or investing in any of the stocks that make up the Index and therefore have no rights of ownership such as the right to earn dividends, receive distributions, or the right to vote. Since the S&P 500® Index Price Return does not include dividends, a direct investment in the securities comprising the Index may result in a higher rate of return. Life insurance contracts provide other benefits such as a Death Benefit and the downside protection options offered by this Contract.

Amounts in the Index Strategies become part of your Contract Fund. The Index Strategies are comprised of one or more Index Strategy Segments (“Segments”). When you allocate net premiums or transfer amounts from your Contract Fund to the Index Strategies, we place those funds temporarily into accounts called the Fixed Holding Accounts. Then, on each Monthly Transfer Date, we transfer the entire balance of the Fixed Holding Accounts into the corresponding Index Strategies. Each time we transfer the value of a Fixed Holding Account to an Index Strategy, we create a new Segment. Each Segment matures one year from the date it was created. We reserve the right to create Segments with maturity dates based on different durations. At Segment maturity we determine the change in Index Value and apply the Segment's predetermined Buffer, Spread, Step Rate, Participation Rate, Index Growth Floor, and Index Growth Cap, as applicable, to an Index Strategy, to ultimately calculate the Segment’s Index Interest and final Segment maturity value. The maximum amount that can be allocated annually to the Variable Investment Options from the Index Strategies is 25% of the maturity value of each Index Strategy Segment. For more information on the components and calculations of the Index Strategies, see DESCRIPTION OF THE INDEX STRATEGIES. We currently offer the following types of Index Strategies: Capped With Floor, Capped With Buffer, Enhanced Cap Rate With Spread and Buffer, Step Rate Plus With Buffer, and Dual Directional With Buffer. How the Index Strategies Work

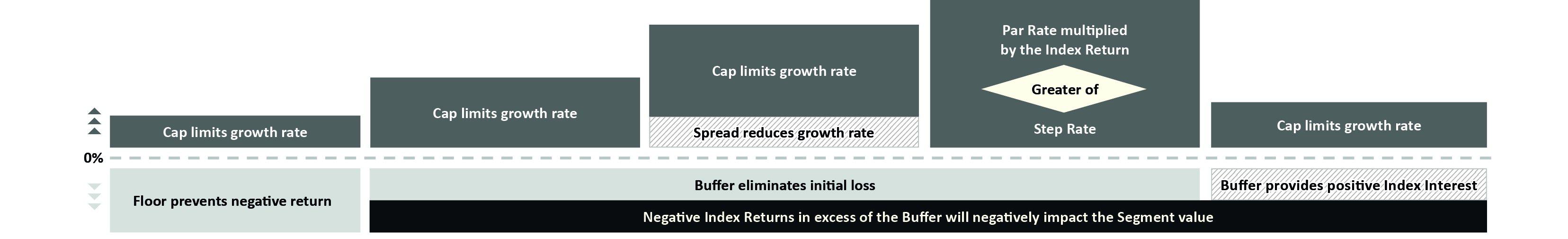

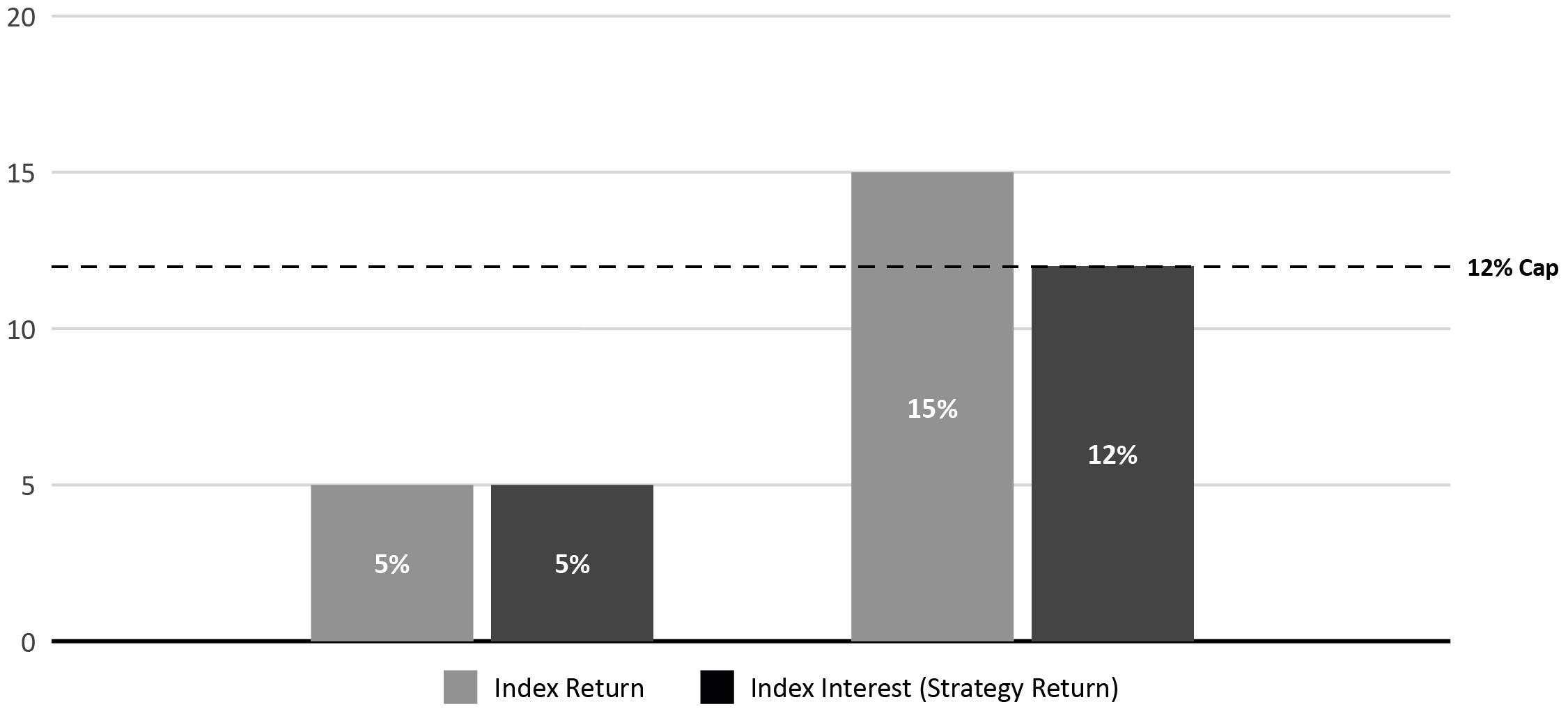

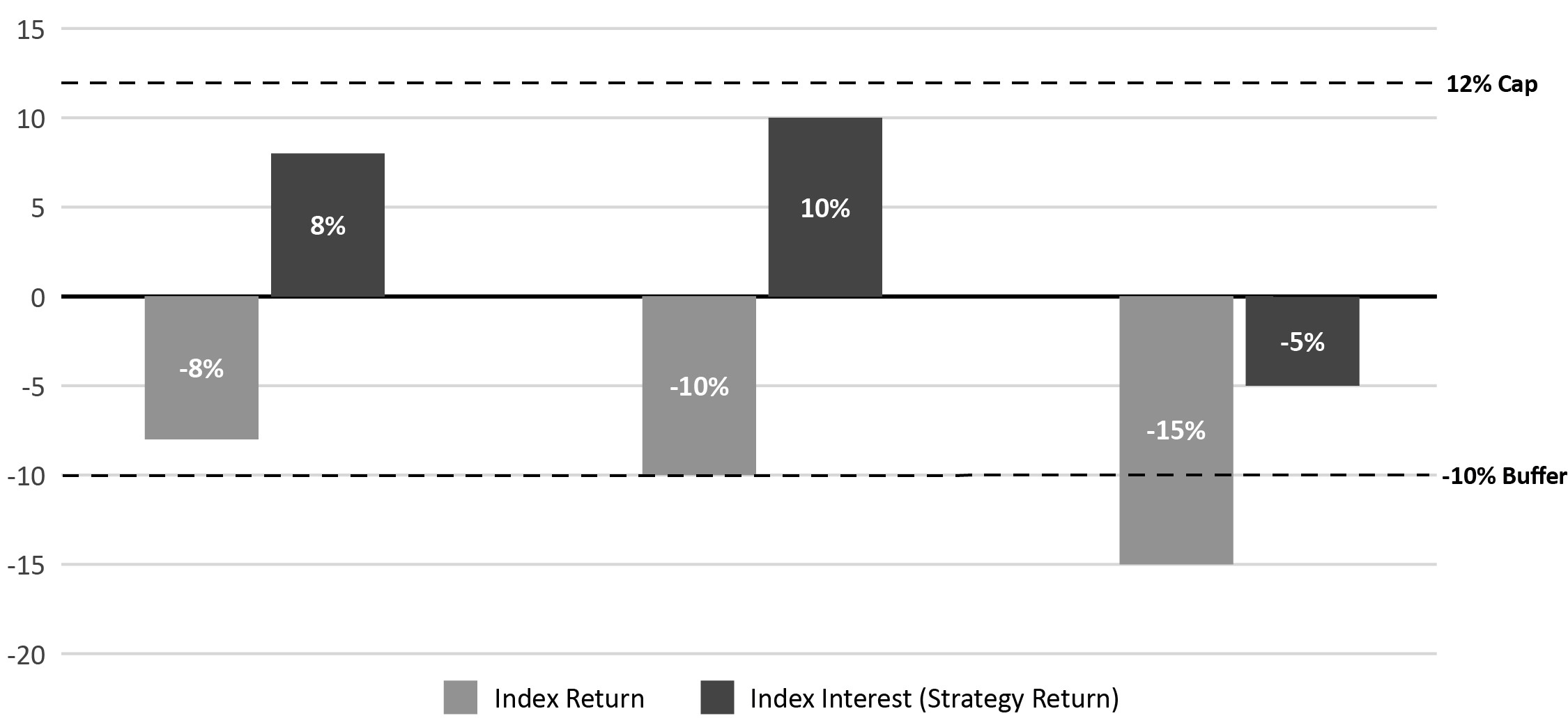

The following chart provides a comparative and summarized overview of the Index Strategies. A complete description of each Index Strategy with numeric examples is provided in the section DESCRIPTION OF THE INDEX STRATEGIES.

| | | | | | | | | | | | | | |

| | | | |

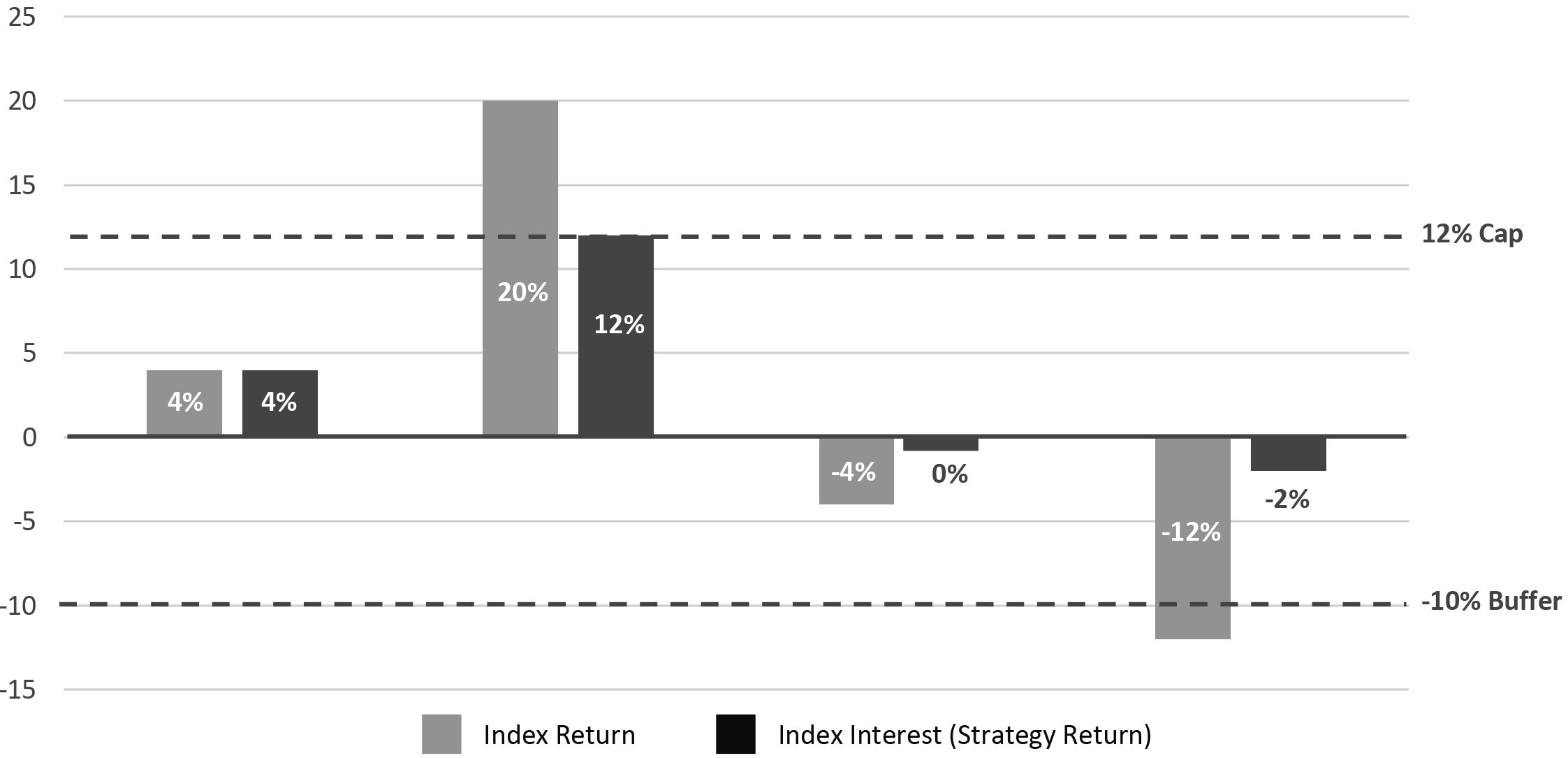

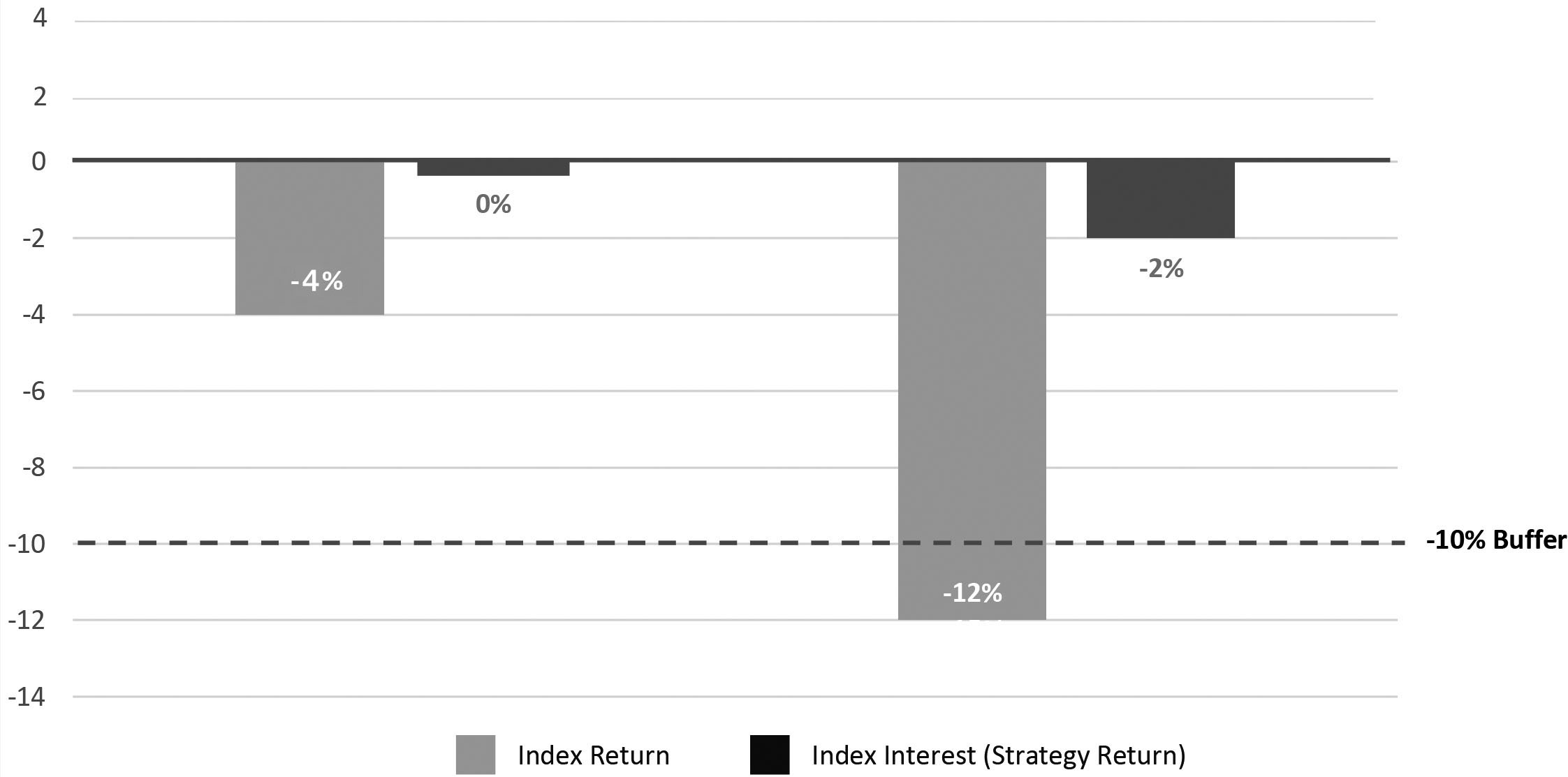

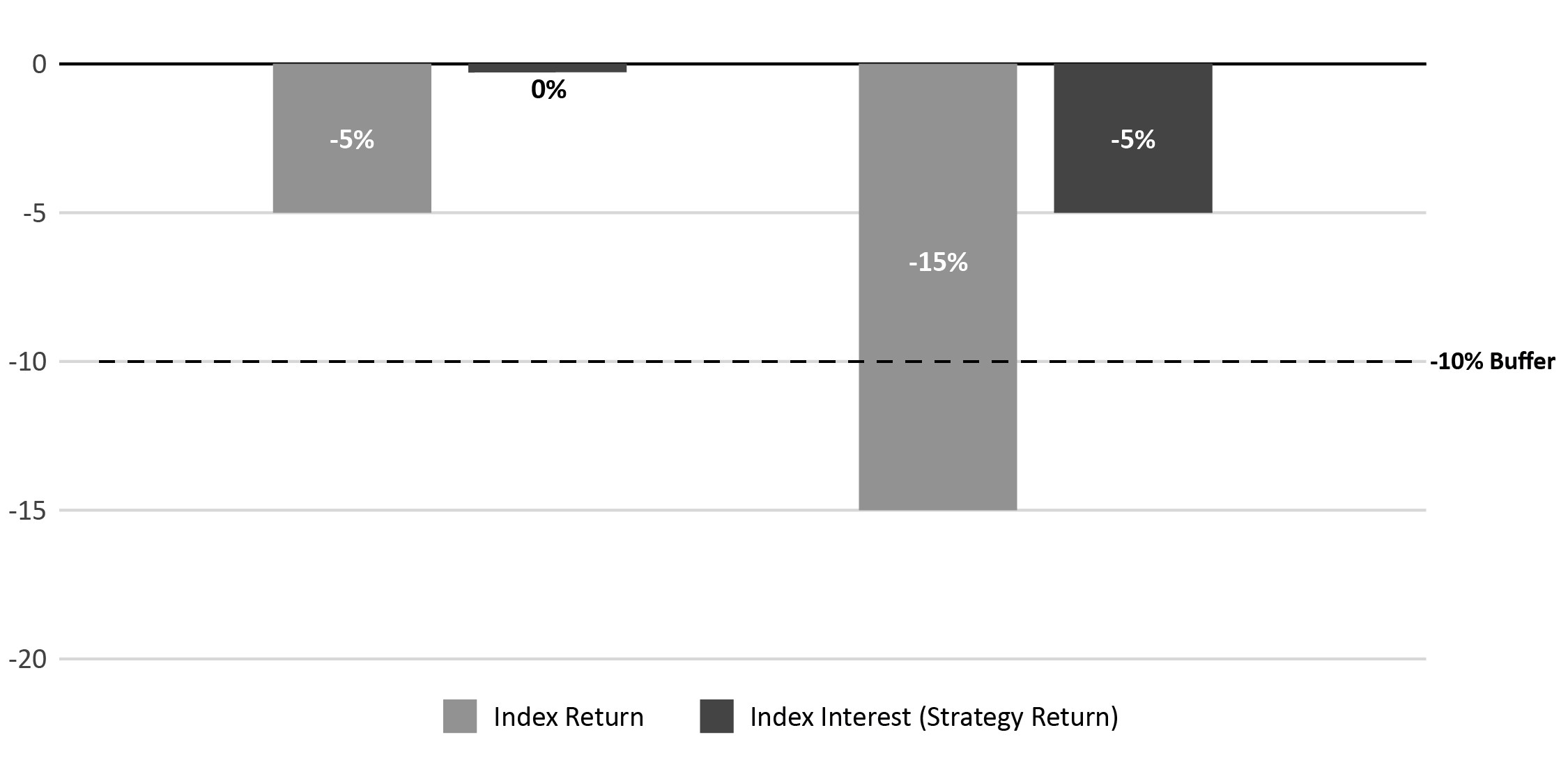

Provides a percentage of Index Interest up to a Cap (subject to a guaranteed minimum) and down to a Floor. •If the Index Return is positive, the Index Return is multiplied by the Participation Rate. ◦If the result is greater than or equal to the Cap Rate, then the percentage of Index Interest is equal to the Cap. ◦If the result is less than the Cap, the percentage of Index Interest is equal to the result. •If the Index Return is zero or negative, the percentage of Index Interest is 0% due to the 0% Floor. Offers downside protection, but limited upside potential. Guaranteed minimums: 1 Year S&P 500® Cap Rate 0% Floor ◦Minimum Cap: 2% ◦Minimum Floor: 0% ◦Minimum Participation Rate: 100% | Provides a percentage of Index Interest up to a Cap (subject to a guaranteed minimum) and down to any negative return in excess of a Buffer. •If the Index Return is positive, the Index Return is multiplied by the Participation Rate. ◦If the result is greater than or equal to the Cap Rate, then the percentage of Index Interest is equal to the Cap. ◦If the result is less than the Cap, the percentage of Index Interest is equal to the result. •If the Index Return is zero, the Index Interest is 0%. •If the Index Return is negative, and: ◦equal to or less than the Buffer, the percentage of Index Interest is 0%. ◦greater than the Buffer, the percentage of negative Index Interest is the amount by which the negative Index Return exceeds the Buffer. Offers a level of downside protection, but limits upside potential. Guaranteed minimums: 1 Year S&P 500® Cap Rate 10% Buffer ◦Minimum Cap: 5% ◦Minimum Buffer: 10% ◦Minimum Participation Rate: 100% 1 Year S&P 500® Cap Rate 15% Buffer* ◦Minimum Cap: 4% ◦Minimum Buffer: 15% ◦Minimum Participation Rate: 100%

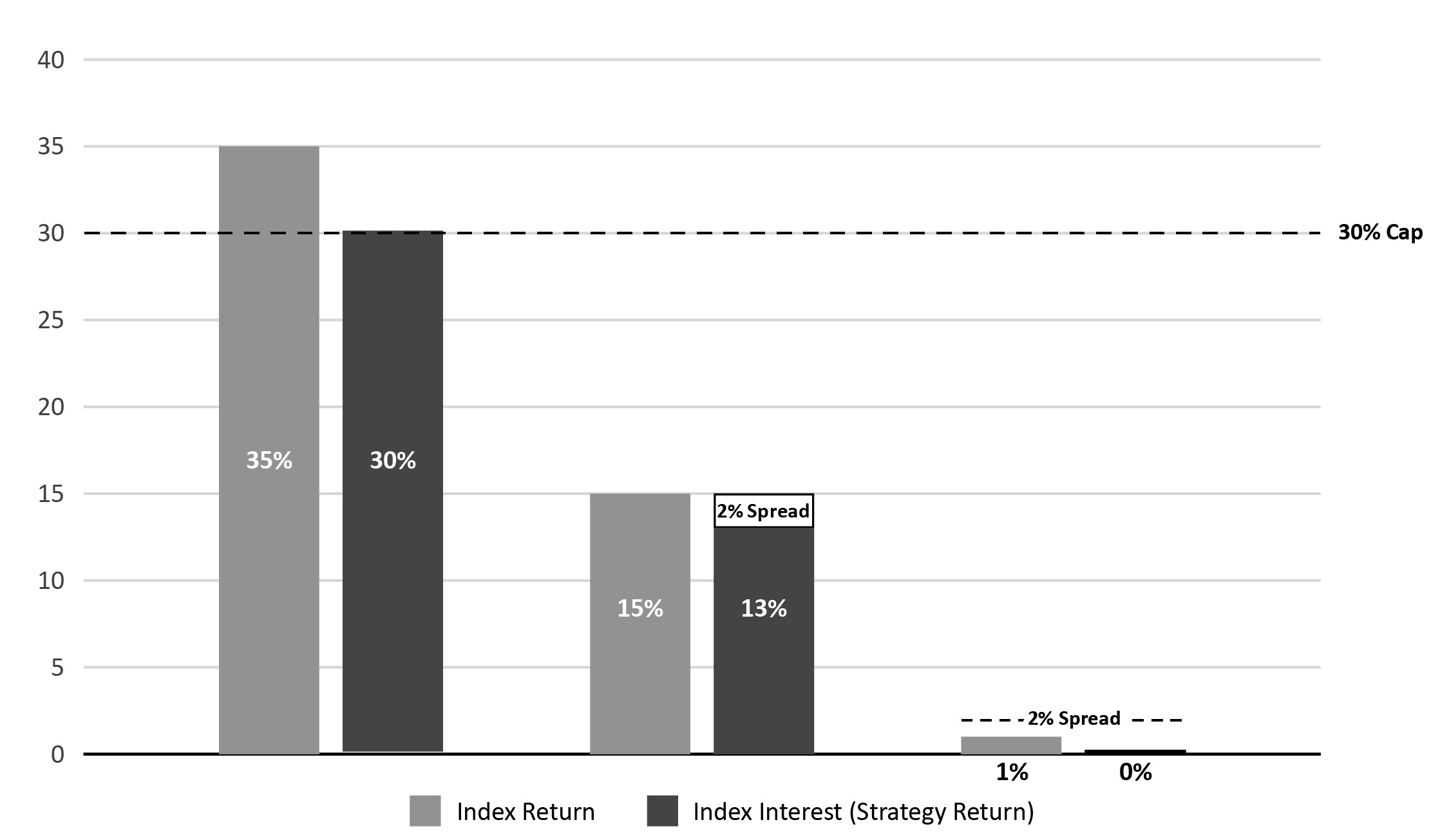

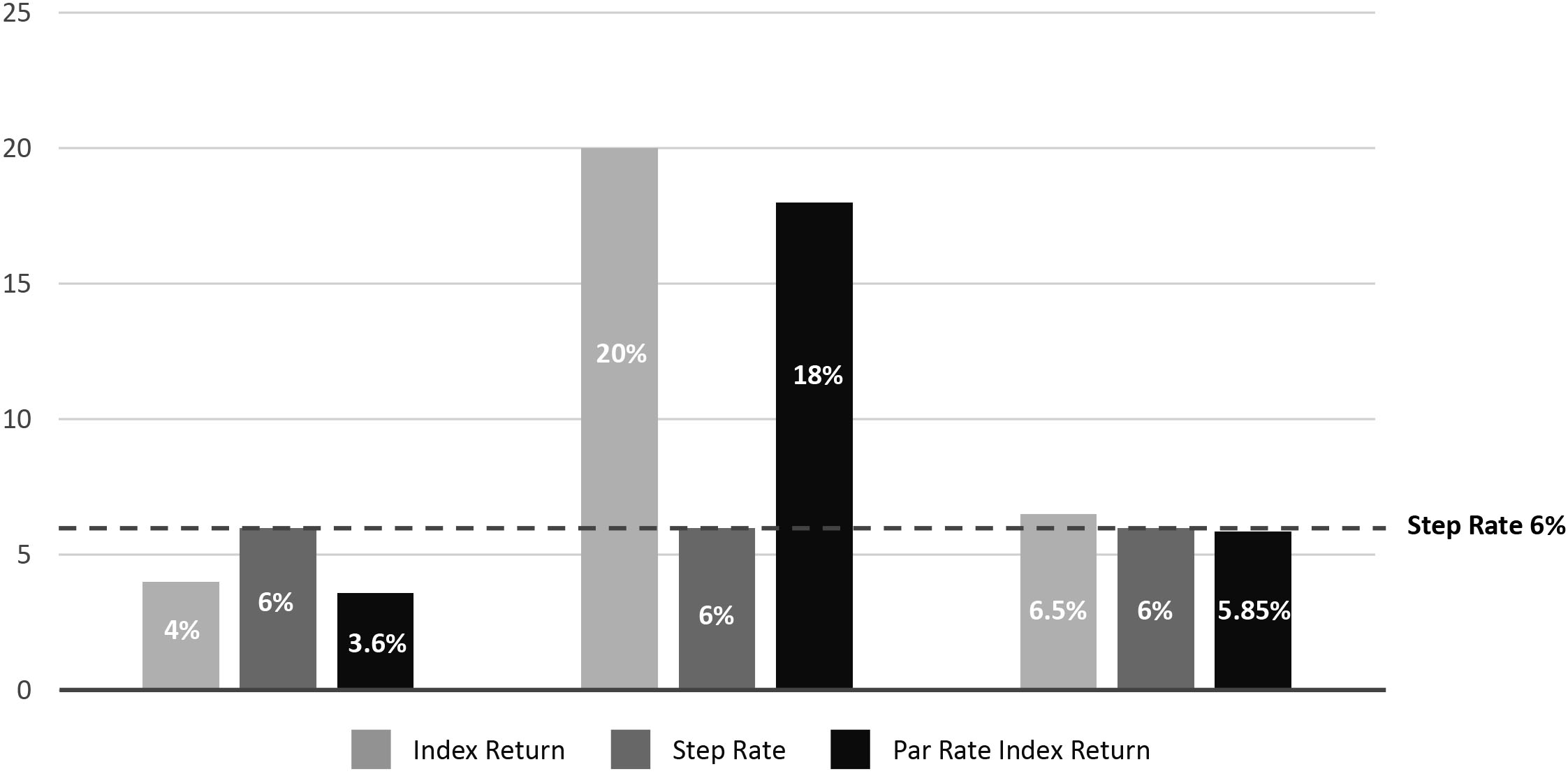

| Provides a percentage of Index Interest up to a Cap (subject to a guaranteed minimum) and down to any negative return in excess of a Buffer. •If the Index Return is positive, the Index Return is multiplied by the Participation Rate. ◦If the result is greater than or equal to the Cap Rate plus the Spread, the Index Interest is equal to the Cap Rate. ◦If the result is greater than the Spread, but less than the Cap Rate plus the Spread, the Index Interest is equal to the result minus the Spread. ◦If the result is greater than or equal to zero and equal to or less than the Spread, the percentage of Index Interest is 0%. •If the Index Return is negative, and: ◦equal to or less than the Buffer, the percentage of Index Interest is 0%. ◦greater than the Buffer, the percentage of negative Index Interest is the amount by which the negative Index Return exceeds the Buffer. Offers higher level of upside potential, after the deduction of a Spread, along with downside protection. Guaranteed minimums/maximums: 1 Year S&P 500® Enhanced Cap Rate 10% Buffer* ◦Minimum Cap: 5% ◦Minimum Buffer: 10% ◦Minimum Participation Rate: 100% ◦Maximum Spread: 2% 1 Year S&P 500® Enhanced Cap Rate 15% Buffer* ◦Minimum Cap: 4% ◦Minimum Buffer: 15% ◦Minimum Participation Rate: 100% ◦Maximum Spread: 2% | Provides a percentage of Index Interest up to the greater of 1) the Index Return multiplied by a Participation Rate and 2) a Step Rate (both subject to a guaranteed minimum) and down to any negative return in excess of a Buffer. •If the Index Return is zero or positive, the percentage of Index Interest is equal to the greater of (a) the Index Return multiplied by the Participation Rate and (b) the Step Rate. •If the Index Return is negative, and: ◦equal to or less than the Buffer, percentage of Index Interest is 0%. ◦greater than the Buffer, the percentage of negative Index Interest is the amount by which the negative Index Return exceeds the Buffer. Offers an upside potential with no maximum, as well as a level of downside protection. Guaranteed minimums: 1 Year S&P 500® Step Rate Plus 10% Buffer ◦Minimum Buffer: 10% ◦Minimum Participation Rate: 60% ◦Minimum Step Rate: 1%

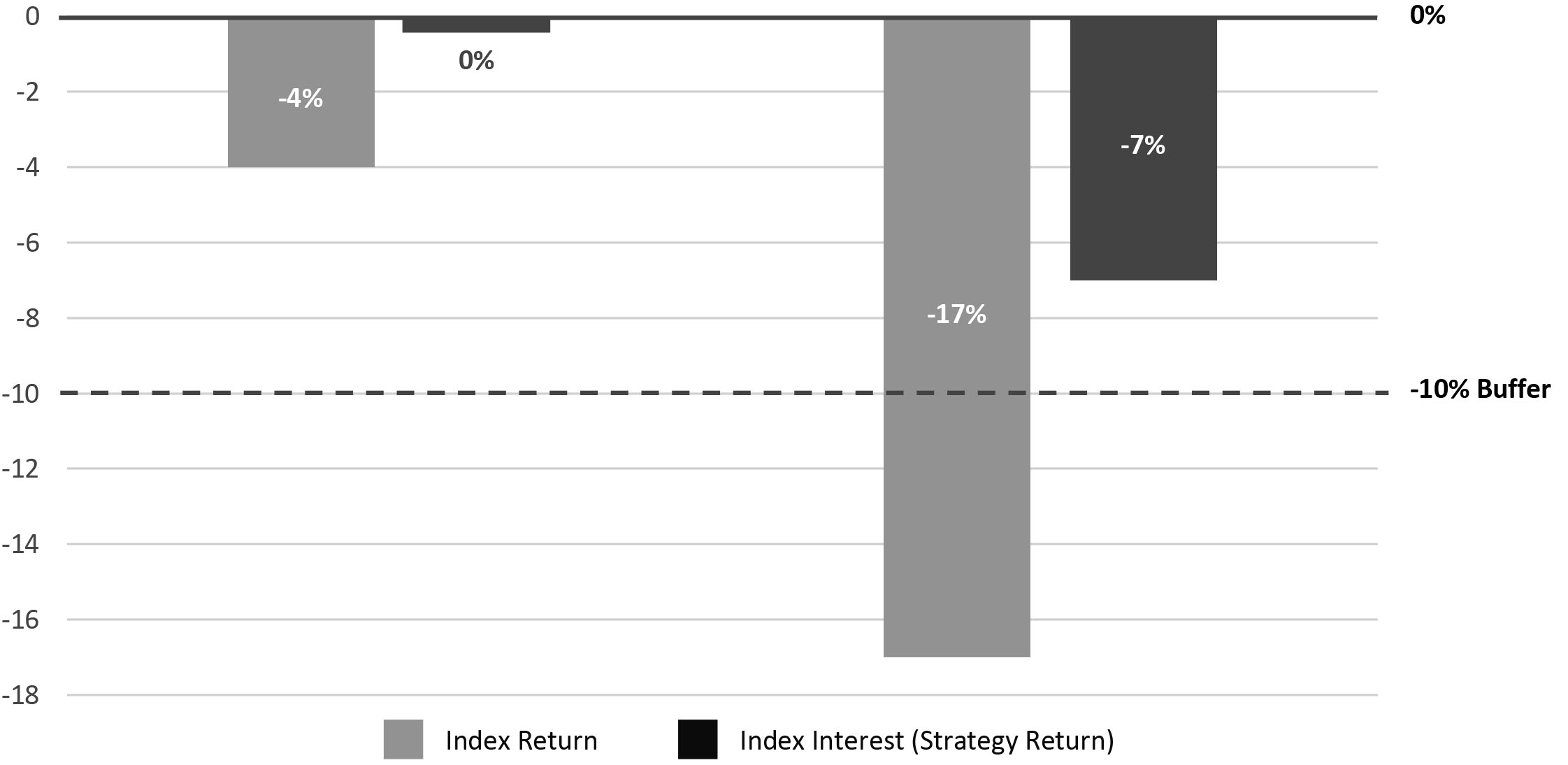

| Provides a percentage of Index Interest up to a Cap (subject to a guaranteed minimum) when the Index Return is positive and down to any negative return in excess of a Buffer when the Index Return is negative. •If the Index Return is positive, the Index Return is multiplied by the Participation Rate. ◦If the result is greater than or equal to the Cap Rate, then the percentage of Index Interest is equal to the Cap. ◦If the result is less than the Cap, the percentage of Index Interest is equal to the result. •If the Index Return is zero, the Index Interest is 0%. •If the Index Return is negative, and: ◦equal to or less than the Buffer, a positive percentage of Index Interest amount is applied. The percentage is equal to the absolute value of the result. ◦greater than the Buffer, the percentage of negative Index Interest is the amount by which the negative Index Return exceeds the Buffer. Offers a level of downside protection and upside potential even when Index Returns are negative. Guaranteed minimums: 1 Year S&P 500® Dual Directional 10% Buffer* ◦Minimum Cap: 1% ◦Minimum Buffer: 10% ◦Minimum Participation Rate: 100% 1 Year S&P 500® Dual Directional 15% Buffer* ◦Minimum Cap: 1% ◦Minimum Buffer: 15% ◦Minimum Participation Rate: 100%

|

| * This Investment Strategy option is only available for Contracts purchased on or after February 24, 2025. |

Examples:

The Cap Rate, when applicable, is the maximum of any positive interest we will credit when the Index Return is positive. For example, if the Index Return is 12% and the Cap Rate is 4%, we will credit 4% interest at the end of the Segment, meaning your Index Value will increase by that percent.

The Floor, when applicable, is the maximum amount your Segment Value may decline due to negative Index performance. For example, if the Index Return is -12% and the Floor is 0%, your Index Value will decline by 0% at the end of the Segment.

The Buffer, when applicable, is the level of protection from negative Index Returns. Any negative return that exceeds the Buffer level will result in a negative impact to your Segment Value. For example, if the Buffer level is 10% and the Index Return is -12%, your Index Value will decline by 2% (the amount of negative return in excess of the Buffer) at the end of the Segment.

The Participation Rate is a percentage that is multiplied by the positive Index Return to calculate the amount of Index Interest that will apply to a Segment (not to exceed the Cap, when applicable). For example, if the Index Return is 10% and the Participation Rate is 70%, the amount of interest calculated is 7% (10% x 70% = 7%).

The Spread, when applicable, is a percentage that reduces the value of positive Index Returns used in the calculation of Index Interest that will apply to a Segment. The Spread is subtracted from the Index Return. For example, if the Index Return is 10% and the Spread is 2%, the Index Return that would be used to calculate Index Interest is 8% (10% - 2% = 8%).

The Step Rate, when applicable, is the minimum rate that may be credited to a Segment when the Index Return is zero or positive. For example, if the Step Rate is 6% and the Index Return is 1%, the amount of Index Interest we will credit is 6%.

The features of an Index Strategy may change from one term to the next, new Index Strategies may be added, and existing Index Strategies may be terminated. We do not guarantee that the Company will always offer Index Strategies that provide downside protection.

If you choose to invest in Index Strategies, you must provide us with written allocation instructions in Good Order. You may change these instructions at any time, but we reserve the right to defer allocation instructions into Index Strategies received less than two business days prior to a Segment’s start date until the next available Segment start date for that Index Strategy. For currently available Index Strategies and associated rates, please refer to our website at www.Prudential.com/eProspectus. Any changes to Index Strategies’ availability or rates (other than upside limits) will be described in the prospectus. You will receive notice of new upside limit rates prior to a Segment start date. Our current administrative practice is to set upside limit rates monthly and make them available on our website by the fifth day of each month. The rate applicable to a Segment is the rate that is currently in force and shown on our website on the Segment start date. New rates may be different than rates previously applied to your Contract and from the current rates that we are offering for newly issued Contracts. We currently offer Index Strategies for one-year terms. The Contract currently offers Index Strategies with 10% and 15% Buffers, and different Buffers may be offered with new Index Strategy options. When we offer a new Index Strategy with a Buffer, the Buffer will never be less than 5%. Any loss beyond the Buffer level reduces the Contract Fund value allocated to the Index Strategy. This means it is possible for you to lose up to 95% of your investment in a Segment that is allocated to an Index Strategy with a 5% Buffer. Please see Types of Index Strategies for more information. If (1) you take a loan or withdrawal, (2) you transfer out of a Segment prior to maturity, (3) we process a Contract fee or charge, (4) surrender your Contract, or (5) we pay a death claim between a Segment start date and Segment maturity date of an Index Strategy with a Buffer, we will use an Interim Value to determine the fair market value of each Index Strategy Segment at the time of the transaction. The Interim Value is also used to determine how much the Index Strategy Segment Base will be reduced after a withdrawal, transfer or charge. If you withdraw, transfer a portion out of, or we process a charge from Contract Fund amounts allocated to an Index Strategy with a Buffer, the withdrawal, transfer, or charge will cause an immediate reduction to your Index Strategy Segment Base in a proportion equal to the reduction in the Segment’s Interim Value. A proportional reduction could be larger than the dollar amount of your withdrawal, transfer or charge. Reductions to your Index Strategy Segment Base will negatively impact your Interim Value for the remainder of the Segment and will result in lower Index Interest on the Segment maturity date. Once your Index Strategy Segment Base is reduced during a Segment, it will not increase for the remainder of the Segment.

The Interim Value is designed to represent the fair value of the Index Strategy with a Buffer on each Valuation Day, taking into account the potential gain or loss of the Index at the Segment maturity date. The Interim Value reflects the change in fair value due to economic factors of the investment instruments (including derivatives) supporting the Index Strategies with a Buffer. The Interim Value helps protect us from bearing the costs of potential investment losses and ensures that we will be able to meet our obligations under the Contact when amounts are removed from an Index Strategy before the Segment maturity date. The Interim Value may result in a loss even if the Index Value at the time the Interim Value is calculated is higher than the Index Value on the Segment start date of an Index Strategy with a Buffer because the amount withdrawn will not participate in the Index Return at Segment maturity. Because the downside protection provided by a Buffer normally does not apply to the Interim Value, it is theoretically possible that you could lose most of your investment, potentially up to 100% of your investment, in extreme scenarios such as an unprecedented complete market collapse. See Effect Of Interim Value and Valuing Your Investment And Interim Value of Index Strategies with a Buffer for more information. Each of these functions, components and calculations of the Index Strategies are described later in this prospectus. It is important that you understand how the Index Strategies function as well as the limitations and impacts on other Contract features and functions.

There is no additional charge for investing in an Index Strategy, however, Contract charges and expenses do apply. You should review the “Fee Table” and “Charges and Expenses” sections in the Contract’s prospectus for more information.

All guarantees are based on our claims paying ability and financial strength. Current and historical rates and performance for the Index Strategies can be found at www.Prudential.com/eProspectus.

Right To Cancel

Generally, you may return the Contract for a refund within 10 days after you receive it (or within any longer period of time required by state law). Please refer to your Contract’s prospectus for more information regarding your right to cancel (or “free look”) your Contract within a certain number of days. You may not allocate your Contract Fund to the Index Strategies prior to the end of your right to cancel period. Any amounts you have instructed us to allocate to the Index Strategies will be placed in a money market investment option until your right to cancel period has ended. At the end of your right to cancel period, any amounts you have instructed us to allocate to the Index Strategies will be placed in the Fixed Holding Accounts until the next Index Strategy Segment start date.

Right To Discontinue And Limit Amounts Allocated To The Index Strategies

We reserve the right to restrict or terminate future allocations to the Index Strategies at any time, however, at least one Index Strategy option will always be available. We may also temporarily suspend offering Index Strategy Segments at any time and for any reason including emergency conditions as determined by the Securities and Exchange Commission. We are not obligated to continue to offer Segments with any particular level of downside protection. We reserve the right to establish a maximum amount or a maximum percentage for any single Contract that can be allocated to the Index Strategies. We also reserve the right to impose a cut-off date for allocations into an Index Strategy Segment. This would require Contract Funds to be allocated to a Fixed Holding Account a certain number of days prior to an Index Strategy Segment start date.

If an Index is discontinued or changed in a manner that results in a material change in the formula or method of calculating the Index, we reserve the right to substitute it with an alternative Index and will notify you of any such substitution. Upon substitution of an Index, we will calculate your Index Return on the replaced Index up until the date of substitution and the substitute Index from the date of substitution to the Index Strategy maturity date. An Index substitution will not change your Index Strategy. A substitution of an Index between the Index Strategy start date and Index Strategy maturity date may impact the calculation of your Index Interest on the Index Strategy maturity date. When we notify you of any substitution of an Index, we will also inform you of the potential impacts to your Index Interest.

RISK FACTORS

Risk Of Loss – Index Strategies – You take the investment risk for amounts allocated to one or more Index Strategies since the Index Interest is based upon the performance of the reference Index, subject to any limitations imposed by the Index Strategy. When applicable, the Buffer is the level of protection from negative Index Return provided by the Index Strategy. Any negative Index Interest in excess of the Buffer reduces the Contract Fund allocated to the Index Strategy. You bear the risk of the negative Index Return in excess of the Buffer. Please note, the assessment of fees and charges can also result in a reduction of the Contract Fund allocated to any of the Index Strategy types. Negative investment returns do not impact investment allocations to the 0% Floor option. Negative investment returns may result in a loss of up to 90% of amounts invested in 10% Buffer option Segments, and up to 85% of amounts invested in 15% Buffer option Segments.

Risks Associated With the Indices – Because the S&P 500® Index is comprised of a collection of equity securities, in each case the value of the component securities is subject to market risk, or the risk that market ups and downs may cause the value of the component securities to go up or down, sometimes rapidly and unpredictably. Market ups and downs can result from disasters and other events, such as storms, earthquakes, fires, outbreaks of infectious diseases (such as COVID-19), utility failures, terrorist acts, political and social developments, and military and governmental actions. In addition, the value of equity securities may increase or decline for reasons directly related to the issuers of the securities. In addition, the value of equity securities may increase or decline for reasons directly related to the issuers of the securities. Equity markets are subject to the risk that the value of the securities may fall due to general market and economic conditions. Market ups and downs may exist with these indices, which means that the value of the indices can change dramatically over a short period of time in either direction. Indices are not funds and are not available for direct investment. Since the S&P 500® Index Price Return does not include dividends, a direct investment in the securities comprising the Index may result in a higher rate of return. Life insurance contracts provide other benefits such as a Death Benefit and the downside protection options offered by this Contract.

Effect Of Interim Value – To determine the Interim Value for a Segment with a Buffer, we apply a formula which does not reflect the actual performance of the applicable Index, but rather a determination of the value of hypothetical underlying investments at the time of the Interim Value calculation. This amount could be more or less than if you had held the Segment with a Buffer until the Segment maturity date. It also means that you could have a negative performance, even if the value of the Index has increased at the time of the calculation. All withdrawals from a Segment with a Buffer on any date other than a Segment start date or maturity date, including withdrawals taken to pay Contract charges and expenses, death benefit payments, transfers, loans, and surrenders paid before the Segment maturity date will be based on the Interim Value. Withdrawals before a Segment maturity date could have adverse impacts even if the value of the Index has increased at the time of the calculation because an early withdrawal will not allow you to participate in the Index Return for the Segment with a Buffer with your entire Index Strategy Segment Base. Because the downside protection provided by a Buffer normally does not apply to the Interim Value, it is theoretically possible that you could lose most of your investment, potentially up to 100% of your investment, in extreme scenarios such as an unprecedented complete market collapse. If you withdraw Contract Funds allocated to an Index Strategy, the withdrawal will cause an immediate reduction to your Index Strategy Segment Base in a proportion equal to the reduction in your Interim Value. A proportional reduction may be larger than the dollar amount of your withdrawal even if the value of the Index has increased. See Impact Of Withdrawals On Segment Value (next below) for additional information.

Impact Of Withdrawals On Segment Value – Withdrawals taken for any reason, including to pay Contract charges and expenses, death benefit payments, transfers, loans, and surrenders, can negatively impact your Segment value. (1) If a withdrawal is taken from Contract Funds allocated to a Segment with a Buffer, the withdrawal will cause an immediate reduction to your Index Strategy Segment Base in a proportion equal to the reduction in your Segment’s Interim Value. A proportional reduction could be larger than the dollar amount of your withdrawal. Reductions to your Index Strategy Segment Base will negatively impact your Interim Value for the remainder of the Segment(s) with a buffer and will result in the application of a lower Index Interest on the Segment with a Buffer at maturity. Once your Index Strategy Segment Base is reduced during any Segment with a Buffer, it will not increase for the remainder of the Segment with a Buffer. (2) If a withdrawal is taken from Contract Funds allocated to a floored (non-buffered) Segment it will cause an immediate reduction in your Index Segment Strategy Base and result in the application of lower Index Interest at maturity. Once your Index Strategy Segment Base is reduced during any floored Segment, it will not increase for the remainder of the floored Segment. In either instance, even if Index performance has been positive, the Index Return will be applied against a lower Index Segment Strategy Base resulting in lower (or zero) Index Interest.

Impact of Monthly Charges on Segment Value – The Contract permits monthly charges to be deducted from the Index Strategies prior to the end of a Segment if amounts in the Variable Investment Options, Fixed Rate Option, and Fixed Holding Account are insufficient to cover monthly deductions, and such ongoing deductions could have adverse effects on values under the Contract. Investors should carefully consider whether to retain enough value in the Variable Investment Options and fixed options to cover their monthly deductions, and should consult with a financial professional about the appropriateness of the Index Strategies for them.

Availability Of Index Strategies Will Vary Over Time – Before allocating to an Index Strategy Segment, you should determine the Index Strategies, Buffers, Spreads, Floors, Caps, Participation Rates and Step Rates available to you. We reserve the right to change Caps, Spreads, Participation Rates and/or Step Rates at any time prior to a Segment start date, subject to the applicable guaranteed

minimum rate. At least one Index Strategy option will always be available, which means the Company reserves the right to eliminate all but one Index Strategy. There is no guarantee that an Index Strategy will be available in the future. You should make sure the Index Strategies you select are appropriate for your investment goals. A change in Cap, Spread, Participation or Step Rate may limit the Index Interest you receive. We reserve the right to offer Index Strategies with different Buffers, which may impact the amount of negative Index Interest applied to your Contract Fund.

Availability Of Index Strategies With Downside Protection May Vary – We may add Index Strategies that do not offer a Buffer or any downside protection. Further, we may remove all Index Strategies that provide a Buffer or any downside protection. As a result, future Index Segments would also change and there might not be any Segments that offer downside protection. If we choose not to offer an Index Strategy with downside protection or eliminate existing Index Strategies, you will have the option of allocating your funds to at least one Index Strategy, one or more Variable Investment Options, or the Fixed Rate Option. If you are not satisfied with the investment options in your Contract, you may surrender it at any time. A surrender will result in a surrender charge in the first fifteen Contract Years. Further, if the total of your surrender proceeds and any withdrawals exceeds the total premiums paid, any excess amount will typically be taxed as ordinary income. You may also receive an additional amount upon surrender if you purchased the Enhanced Cash Value Rider.

Reallocation Of Index Strategies – On the Segment maturity date for an Index Strategy Segment, the amount allocated to that Segment will be reallocated based upon your instructions we received in Good Order, or if none has been received in Good Order, automatically renew into the next available Segment for the same Index Strategy option. If the same Index Strategy is no longer available, the amount will be transferred into the Fixed Rate Option, and the amount may be transferred among the Variable Investment Options, subject to applicable transfer restrictions, or into another available Index Strategy on the next Index Strategy Segment start date. You must provide instructions for reallocation, in Good Order, at least two business days prior to a designated Segment start date. Failure to provide timely instructions may result in amounts being transferred into the Fixed Holding Account (if the existing Index Strategy no longer is available), and could remain in the Fixed Holding Account until the next Index Strategy Segment start date. The maximum amount that can be allocated annually to the Variable Investment Options from the Index Strategies is 25% of the maturity value of each Index Strategy Segment. This means that it may take years to exit the Index Strategies. In order to exit sooner, you would need to either take a withdrawal and incur partial surrender charges and taxes, enroll in a Segment Maturity Allocation Program (which would also take several years to exit and which prohibits allocations to the Index Strategies during that time), or allocate to the Fixed Rate Option (which is similarly restricted from allocating more than 25% to the Variable Investment Options).

Limitation On Index Interest – Index Growth Cap – If you elect an Index Strategy with an Index Growth Cap, the Index Interest is limited by any applicable Cap, which means that your Index Interest could be lower than if you had invested directly in a fund based on the applicable Index. The Index Growth Cap does not guarantee any level of Index Return. The Index Growth Cap exists for the full term of the Index Strategy Segment. Index Growth Caps, upon renewal, may be higher or lower than the initial Index Growth Cap but will never be less than the Guaranteed Minimum Index Growth Cap. Renewal Index Growth Caps may differ from the Caps used for new life insurance contracts or for other life insurance contracts issued at different times.

Limitation On Index Interest – Participation Rate – If you elect an Index Strategy with a Participation Rate, your Index Interest may be limited if the applicable Participation Rate is less than 100%, which means that your Index Interest may be lower than if you had invested directly in a fund based on the applicable Index. If you elect an Index Strategy with an applicable Participation Rate equal to 100%, your percentage of Index Interest will be equal to the Index Return subject to the effect of any Cap, Step Rate, or Spread (if applicable). If the Participation Rate is greater than 100%, your percentage of Index Interest may exceed the Index Return. A Participation Rate only applies when the Index Return is positive. The Participation Rate does not guarantee any level of Index Return. Participation Rates apply for the full term of the Index Strategy Segment. Participation Rates are determined at our discretion.

Limitation On Index Interest – Spread – If you elect an Index Strategy with a Spread, when the Index Return is positive and greater than the Spread, the Index Return will be reduced by the Spread, and subject to the Cap Rate to arrive at the Index Interest. If the Index Return is positive but less than or equal to the Spread, your Index Interest would be zero. As a result, your Index Interest could be lower than if you had invested directly in a fund based on the applicable Index or allocated to another available Index Strategy that does not include a Spread. The Spread exists for the full term of the Index Strategy and will never be greater than the Guaranteed Maximum Spread.

Limitation On Index Interest – Step Rate - If you elect an Index Strategy with a Step Rate, the Participation Rate may be less than 100%. If the Index Return is zero or positive, the percentage of Index Interest is equal to the greater of (a) the Index Return multiplied by the Participation Rate and (b) the Step Rate, which could result in lower Index Interest than if you had invested directly in a fund based on the applicable Index.

Substitution Of An Index – We have the right to substitute a comparable Index prior to an Index Strategy Segment maturity date if any Index is discontinued or if the calculation of an Index is substantially changed (such as a material change in the formula or method of calculating the Index). We would attempt to choose a substitute Index that has a similar investment objective and risk profile to the replaced Index and would notify you of any such substitutions. Upon substitution of an Index, we will calculate your Index Return on the replaced Index up until the date of substitution and the substitute Index from the date of substitution to the Segment maturity date. Other than the reference Index, an Index substitution will not change the terms of your Index Strategy. The performance of the new Index may not be as good as the one that it substituted and as a result your Index Return may have been better if there had been no substitution. At least one Index Strategy will always be available on your Contract, but we reserve the right to close an Index strategy at any time. If this happens, no new transfers to that Index Strategy will be allowed and amounts expiring on Segment maturity dates will be moved by us to the fixed rate option, unless you submit separate maturing Segment allocation instructions, until no value remains in that Index Strategy. If an Index Strategy is withdrawn, replaced, or closed, we will notify you and any assignee of record.

Effect Of Certain Contract Riders – (1) If your Contract includes either the BenefitAccess Rider or Overloan Protection Rider, you may be required to reallocate your entire Contract Fund to the Fixed Rate Option. While the riders’ conditions are in effect, you will not have access to the Index Strategies or the Variable Investment Options, which could result in limiting the growth potential of your Contract Fund. (2) If you elect the Extended Plus No-Lapse Guarantee option of the Lapse Protection Rider, you will only be able to allocate your Contract Fund to the Index Strategies with Buffers for the first ten (10) Contract Years. You will not be able to allocate to the other investment options until your eleventh (11) Contract Year.

Potential Federal Tax Consequences – Your Contract is structured to meet the definition of life insurance under Section 7702 of the Internal Revenue Code. At issue, the Contract Owner chooses one of the following definition of life insurance tests: (1) Cash Value Accumulation Test or (2) Guideline Premium Test. We reserve the right to refuse to accept a premium payment that would, in our opinion, cause this Contract to fail to qualify as life insurance for federal tax purposes. Although we believe that the Contract should qualify as life insurance for tax purposes, there are some uncertainties, particularly because the Secretary of Treasury has not yet issued permanent regulations that bear on this question. Current tax law generally excludes Death Benefits from the gross income of the beneficiary of a life insurance contract. However, your Death Benefit could be subject to income tax in certain instances, such as if transferred in accordance with a reportable policy sale. Your Death Benefit may also be subject to estate tax. In addition, you generally are not subject to taxation on any increase in the Contract value until it is withdrawn. Generally, you are taxed on surrender proceeds and the proceeds of any withdrawals only if those amounts, when added to all previous distributions, exceed the total premiums paid. Amounts received upon surrender or withdrawal (including any outstanding Contract loans) in excess of premiums paid are treated as ordinary income.

Special rules govern the tax treatment of life insurance policies that meet the definition of a Modified Endowment Contract under Section 7702A of the Internal Revenue Code. The Contract could be classified as a Modified Endowment Contract if premiums in amounts that are too large are paid or a decrease in the Basic Insurance Amount is made (or a rider removed). Under current tax law, pre-death distributions, including loans and assignments, are taxed less favorably (on a gain first basis) under Modified Endowment Contracts. Death Benefit payments under Modified Endowment Contracts, however, like Death Benefit payments under other life insurance contracts, generally are excluded from the gross income of the beneficiary.

Disclosure contained herein is based on current tax law and not intended as tax advice. Tax laws and interpretations are subject to change at any time, which may impact your Contract. You should consult your own tax adviser for complete information and advice.

Issuing Company – No company other than Pruco Life has any legal responsibility to pay amounts that Pruco Life owes under the Contract. You should look to the financial strength of Pruco Life for its claims-paying ability. Amounts allocated to the Index Strategies are held in a non-registered, non-insulated separate account. These assets are subject to the claims of the creditors of Pruco Life and the benefits provided under the Index Strategies are subject to the claims paying ability of Pruco Life.

Business Continuity Risks – The Company is also subject to risks related to disasters and other events, such as storms, earthquakes, fires, outbreaks of infectious diseases (such as COVID-19), utility failures, terrorist acts, political and social developments, and military and governmental actions. These risks are often collectively referred to as “business continuity” risks. These events could adversely affect the Company and our ability to conduct business and process transactions. Although the Company has business continuity plans, it is possible that the plans may not operate as intended or required and that the Company may not be able to provide required services, process transactions, deliver documents or calculate values. It is also possible that service levels may decline as a result of such events.

Cyber Security Risks – With the increasing use of technology and computer systems in general and, in particular, the internet to conduct necessary business functions, we are susceptible to operational, information security and related risks. These risks, which are often collectively referred to as “cyber security” risks, may include deliberate or malicious attacks, as well as unintentional events and occurrences. These risks are heightened by our offering of products with certain features, including those with automatic asset transfer or re-allocation strategies, and by our employment of complex investment, trading and hedging programs. Cyber security is generally defined as the technology, operations and related protocol surrounding and protecting a user’s computer hardware, network, systems and applications and the data transmitted and stored therewith. These measures ensure the reliability of a user’s systems, as well as the security, availability, integrity, and confidentiality of data assets. Deliberate cyber-attacks can include, but are not limited to, gaining unauthorized access (including physical break-ins and attempts to fraudulently induce employees, customers, or other users of these systems to disclose sensitive information in order to gain access) to computer systems in order to misappropriate and/or disclose sensitive or confidential information; deleting, corrupting or modifying data; and causing operational disruptions. Cyber-attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites (in order to prevent access to computer networks). In addition to deliberate breaches engineered by external actors, cyber security risks can also result from the conduct of malicious, exploited or careless insiders, whose actions may result in the destruction, release or disclosure of confidential or proprietary information stored on an organization’s systems.

Ukraine-Russia Conflict Risk – The military invasion of Ukraine initiated by Russia in February 2022 and the resulting response by the United States and other countries have led to economic disruptions, as well as increased volatility and uncertainty in the financial markets. It is not possible to predict the ultimate duration and scope of the conflict, or the future impact on U.S. and global economies and financial markets. The performance of the Index(es) may be adversely affected.

DESCRIPTION OF THE INDEX STRATEGIES

Investing In the Index Strategies

Premium Allocations To the Index Strategies – Net premiums are allocated to your investment options pursuant to your premium allocation instructions, subject to restrictions when used in combination with certain riders or if you're enrolled in the Segment Maturity Allocation Program. See Segment Maturity Allocation Program below and Riders later in this prospectus for more detail.

You may allocate up to 100% of your net premiums to the Index Strategies. Net premium allocation instructions are also used for any other amounts placed into the Contract Fund, such as loan repayments, interest credits on outstanding loans, and any Enhanced Disability Benefit payment.

Fixed Holding Accounts – Net premiums and other amounts allocated to the Index Strategies, or funds requested to be transferred to the Index Strategies, will be temporarily placed in a Fixed Holding Account corresponding to an Index Strategy on the effective date of the payment or requested transfer, prior to being transferred to the Index Strategy Segment(s) on the Monthly Transfer Date. Additionally, any portion of a maturing Segment allocated to the Index Strategies will also be placed in a Fixed Holding Account on the applicable Segment maturity date, prior to reallocation to the next Segment or another investment option per your instructions. Net premiums may not be directly allocated to the Fixed Holding Account, as it is only intended to temporarily hold the funds that are being allocated, or requested to be transferred, to a corresponding Index Strategy. Transfers out of a Fixed Holding Account may be requested. For more information, see Transfers And Restrictions On Transfers. Funds may be deducted from a Fixed Holding Account to pay monthly charges, withdrawals, or loans. Amounts in the Fixed Holding Accounts are part of your Contract Fund. We guarantee that the part of the Contract Fund allocated to the Fixed Holding Accounts will accrue interest daily at an effective annual rate that we declare periodically, but not less than an effective annual rate of 1%. We are not obligated to credit interest at a rate higher than an effective annual rate of 1%, although we may do so.

Monthly Transfer Dates – Each month the current value of the Fixed Holding Accounts (including any interest earned) is transferred into new Segments for the Index Strategies you selected. This transfer occurs on the 15th day of each month and we may refer to it as the Segment start date. If the 15th of the month falls on a weekend or holiday, or any other time the New York Stock Exchange ("NYSE") is closed, the transfer to the Segments will process on the next business day, but we will use the last published Index Value preceding the start date. For example, October 15, 2022, falls on a Saturday, therefore, the transfer from the Fixed Holding Accounts to the Index Strategies would process on Monday, October 17, 2022, with a starting Index Value based on the closing Index Value from Friday, October 14, 2022.

We reserve the right to retain any funds in the Fixed Holding Accounts that were received into the Fixed Holding Accounts within two business days prior to a start date until the following start date. We will notify you in advance if we exercise this right.

Index Strategy Segments (“Segments”) – A new Index Strategy Segment may be created on each monthly Segment start date. Amounts transferred from the Fixed Holding Accounts are combined with any Designated Transfer amounts when creating new Segments. Segments may only be created on monthly start dates. At any given time, the value in the Index Strategies will be equal to the sum of the value in each Segment.

The Segment duration is the time-period allocated to each Index Strategy Segment. The term begins on the Segment start date and ends on the Segment maturity date. Segment durations are one (1) year.

Segment Maturity – Segments mature one year from the Segment start date on which they were created. If the 15th of the month falls on a weekend or holiday, or any other time the NYSE is closed, the Segment's maturity will be processed on the next business day, but we will use the last published Index Value preceding the Segment maturity date. Continuing with the example under Monthly Transfer Dates above, when the Index Interest is applied in October of 2023, it would be based on the closing Index Values from Friday, October 14, 2022, and Friday, October 13, 2023, since October 15, 2023, falls on a Sunday.

At Segment maturity, Index Interest may be applied. If your Contract lapses or terminates before the Segment maturity date, no Index Interest will be applied.

After the Contract is issued, you may submit maturing Segment allocation instructions that will direct the proceeds of maturing Segments to your chosen investment option(s), including the Fixed Rate Option, the Index Strategies, or Variable Investment Options, subject to the provisions of any optional Riders you have elected. The maximum amount that can be allocated annually to the Variable Investment Options from the Index Strategies is 25% of the maturity value of each Index Strategy Segment. This means that it may take years to exit the Index Strategies. In order to exit sooner, you would need to either take a withdrawal and incur partial surrender charges and taxes, enroll in a Segment Maturity Allocation Program (which would also take several years to exit and which prohibits allocations to the Index Strategies during that time), or allocate to the Fixed Rate Option (which is similarly restricted from allocating more than 25% to the Variable Investment Options).

If you elect the Extended Plus No-Lapse Guarantee option of the Lapse Protection Rider, your allocations are currently restricted to only the Index Strategies with a Buffer for the first ten (10) Contract Years. Allocation instructions must be in whole percentages totaling 100%. Your maturing Segment allocation instructions must be received in Good Order at our Service Office to become effective. By default, and unless maturing Segment allocation instructions are provided by you, 100% of a maturing Segment value will be allocated to the next available Segment of the same Index Strategy. Value from maturing Segments allocated to the Index Strategies will be temporarily placed into the corresponding Fixed Holding Account on the Segment maturity date and included in the current monthly transfer process to establish a new Segment.

We reserve the right to delay the election of, or changes to, maturing Segment allocation instructions that are received within two business days prior to a monthly start date. We will notify you in advance if we exercise this right.

Segment Maturity Allocation Program – If you intend to reallocate the entire balance of your Index Strategies to the Variable Investment Options, you must schedule consecutive annual reallocations by enrolling in the Segment Maturity Allocation Program

and following the instructions on our administrative form. The form can be requested by contacting your Pruco Life representative or our customer service office at 800-778-2255, Monday through Friday, 8:00 a.m. to 8:00 p.m., Eastern Time. While enrolled in this program, you will be prohibited from making any allocations to any Index Strategy and you will also be required to allocate the maximum allowable maturing Segment Value to the Variable Investment Options. If you have instructed us to make designated transfers, those instructions will terminate upon enrollment. It could take up to 35 months to complete the program. After this program, you may submit instructions to reallocate additional maturing Segment Values to the Variable Investment Option and you may provide new designated transfer instructions. If you have elected the Extended Plus No-Lapse Guarantee, you may not enroll in the Segment Maturity Allocation Program until the 11th Contract Year. Terms of this program are subject to change at our discretion.

Index – Each Index Strategy references an Index that determines the Index Return used to compute the Index Interest. When you allocate to an Index Strategy that is linked to the performance of an Index, you are not investing in the Index. We currently offer Index Strategies based on the S&P 500® Index Price Return, which is the S&P 500® Index excluding dividends. The S&P 500® Index is comprised of 500 stocks considered representative of the overall market. An Index is unmanaged and not available for direct investment. See Appendix B for important information about the Index. Index Value – The Index Value on any date is the published value of the S&P 500® Index, excluding any dividends that may be paid by the firms that comprise the Index, as of the close of business on that date. If there is no published closing value for the Index on a Segment start date or a Segment maturity date, we will use the most recently published closing value for the Index.

Index Strategy Segment Base – The Index Strategy Segment Base is used in determining the value of an Index Strategy Segment prior to the Segment maturity date and the Index Interest applied on the Segment maturity date.

For the Index Strategies without a Buffer, at any point in time prior to a Segment’s maturity date, the Index Strategy Segment Base is the initial amount transferred to the Segment on the start date, less amounts withdrawn and/or deducted (including loans).

For the Index Strategies with a Buffer, at any point in time prior to a Segment’s maturity date, the Index Strategy Segment Base is the initial amount transferred to the Segment on the start date, less amounts withdrawn and/or deducted (including loans) in the same proportion that the amounts reduced the Interim Value for that Segment.

If the Index Strategy Segment Base is less than zero, we will consider it to be zero.

Index Interest – Index Interest may be applied on each Segment maturity date using the Index Strategy Segment Base, the Index Value on the Segment maturity date, the Index Value on the Segment start date, the Participation Rate, the Index Growth Floor, the Index Growth Cap, the Buffer, the Spread, and the Step Rate. The method we use to compute interest is shown in the examples that follow for each Index Strategy. Index Interest can be positive or negative.

Participation Rate – The Participation Rate is used in determining Index Interest for each Index Strategy Segment. Index Interest is limited to the Participation Rate multiplied by the Index Return, minus the Spread (if applicable). We will determine the Participation Rate for each Segment in advance. Once a Segment is created, its Participation Rate will not change. The Participation Rate applicable for any future Index Strategy Segment may change at our discretion. The Participation Rate for each Segment will not be lower than the guaranteed minimum Participation Rate for the Index Strategy. For more information, see Types Of Index Strategies. Index Growth Floor (“Floor”) – Certain Index Strategies apply an Index Growth Floor, which is used in determining Index Interest for each Segment. Losses resulting from negative Index Returns are prevented by the Index Growth Floor. We will determine the Floor for each Segment in advance. Once a Segment is created, its Floor will not change. The Floor applicable for any future Segments may change at our discretion. The Floor for each Segment will not be lower than the guaranteed minimum Index Growth Floor for the Index Strategy. The Floor is not a guarantee against loss, as the deduction of Contract charges and fees could reduce the overall cash value of the Index Strategy Segment. For more information, see Types Of Index Strategies. Index Growth Cap (“Cap”) – Certain Index Strategies apply an Index Growth Cap, which is used in determining Index Interest for each Segment. Gains resulting from positive Index Returns are limited by the Index Growth Cap. We will determine the Cap for each Segment in advance. Once a Segment is created, its Cap will not change. The Cap applicable for any future Segment may change at our discretion. The Cap for each Segment will not be lower than the guaranteed minimum Index Growth Cap for the Index Strategy. For more information, see Types Of Index Strategies. Buffer – Certain Index Strategies apply a Buffer, which is used in determining Index Interest for each Segment. Losses resulting from negative Index Returns are limited by the Buffer. Any negative Index Return in excess of the Buffer reduces the value of the Contract Fund. We will determine the Buffer for each Segment in advance. Once a Segment is created, its Buffer will not change. The Buffer applicable for any future Index Strategy may change at our discretion. The Buffer for each Segment will not be lower than the guaranteed minimum Buffer for the Index Strategy. The guaranteed minimum Buffer that may be offered for a new Index Strategy is 5%. For more information, see Types Of Index Strategies. Step Rate – Certain Index Strategies apply a Step Rate, which is used in determining Index Interest for each Segment. If the Index Return is zero or positive, we will credit interest in an amount at least equal to the Step Rate. We will determine the Step Rate for each Segment in advance. Once a Segment is created, its Step Rate will not change. The Step Rate applicable for any future Segment may change at our discretion. The Step Rate for each Segment will not be lower than the guaranteed minimum Step Rate for the Index Strategy. For more information, see Types Of Index Strategies. Spread – Certain Index Strategies apply a Spread, which is used in determining Index Interest for each Segment. Gains resulting from positive Index Returns are reduced by the Spread. We will determine the Spread for each Segment in advance. Once a Segment is created, its Spread will not change. The Spread applicable for any future Segment may change at our discretion. The Spread for

each Segment will not be greater than the guaranteed maximum Spread for the Index Strategy. For more information, see Types Of Index Strategies. Designated Transfers – To facilitate large premium payments intended for the Index Strategies, you may establish reoccurring, monthly transfers, called Designated Transfers, to the Index Strategies. This will allow for multiple Segments for each Index Strategy to be created, over time, from one (or more) premium payment. When you create a Designated Transfer, we move the dollar amount specified from the Fixed Rate Option to the elected Index Strategies on the Monthly Transfer Date. The amount of the Designated Transfer is combined with any amounts transferred from the corresponding Fixed Holding Accounts to form new Segments. You may choose to limit the number of monthly Designated Transfers to a set number of occurrences. Designated Transfers must be specified in dollar amounts (not percentages) and can be directed to one or more of the available Index Strategies. Designated Transfers may not originate from any of the Variable Investment Options. There is no minimum Designated Transfer dollar amount or number of occurrences.

If on any Monthly Transfer Date, the value in the Fixed Rate Option is less than the specified amount, we will transfer the full value of Fixed Rate Option to the designated Index Strategy(ies). Months where only a partial transfer or no transfer takes place because the Fixed Rate Option has insufficient value, or no value, will count against the number of months elapsed in your instructions. Your Designated Transfer instructions stay in effect until cancelled by you, are stopped by us due to certain situations described under Loans and Riders, you enroll in the Segment Maturity Allocation Program, or the requested number of monthly occurrences have been processed. If the Fixed Rate Option value is zero and the Designated Transfer instructions have not been cancelled, stopped, or expired, Designated Transfers will automatically resume when the Fixed Rate Option value is replenished. You may change the amount of the Designated Transfer at any time and your new instructions will take effect on the next Monthly Transfer Date. Your request to change or cancel your Designated Transfer instructions must be received in Good Order at our Service Office to become effective. We reserve the right to postpone the effective date for one month of any request to add or change a Designated Transfer if the request is received within two business days of a monthly start date. We will notify you in advance if we exercise this right.

Types Of Index Strategies

The Contract offers multiple Index Strategies which provide Index Interest based on the performance of an underlying Index. Index Interest is the amount you receive on an Index Strategy Segment maturity date based on the Index Strategy Segment Base and the performance limitations imposed by the Index Strategy. The Index Interest may be positive or negative, which means you can lose Contract Fund value and prior earnings. You may allocate all or a portion of your premium payments or Contract Fund into one or more Index Strategies. The Index Strategies are not invested in any underlying Index. We do not guarantee any Index Interest will be applied to the Index Strategy Segments. There is a risk of loss of your investment with Buffered strategies because the Segment will participate in the negative Index Return in excess of the level of protection provided by the Buffers. There is also a risk of loss with the Capped with Floor Index Strategy if the Index Return is less than the Contract fees and charges assessed during the Segment.

We currently offer the following Index Strategies: Capped With Floor, Capped With Buffer, Enhanced Cap Rate With Spread And Buffer, Step Rate Plus with Buffer, and Dual Directional With Buffer. These Index Strategies are explained below. As a result of economic market conditions, or utilization of the Index Strategies, we reserve the right to add and remove Index Strategies at any time. Additions or removals would be effective with any newly issued contracts or upon reallocation for any existing Contract Owner. Index Strategy removals would not impact existing Contract Owners currently allocated to that Index Strategy prior to the maturity date(s) of any open Segment(s). Index Strategy reallocation instructions must be made via a form provided by us.

If you are allocating to an Index Strategy with an additional Premium Payment, please note that we reserve the right to limit, suspend or reject any additional Premium Payment at any time, but would do so only on a non-discriminatory basis.

Note Regarding Examples – The examples set forth below, as well as other examples found throughout this prospectus, are intended to illustrate how various features of the Contract work. These examples should not be considered a representation of past or future performance of any Index Strategies. Actual performance may be greater or less than those shown in the examples. Similarly, the percentage of Index Interest in the examples are not an estimate or guarantee of future Index performance. The Caps, Participation Rates, Step Rates, Buffers, Floor, and Spread for the Index Strategies shown in the following examples are for illustrative purposes only and may not reflect actual declared rates. In addition, values may be rounded for display purposes only.

Capped With Floor Index Strategy

■1 year S&P 500® Cap Rate 0% Floor option

The Capped With Floor Index Strategy offers potential for Index Interest up to an Index Growth Cap (“Cap”) and protects your Contract from losses through an Index Growth Floor (“Floor”). The Floor is 0% in all scenarios, which means that you will never lose your investment due to negative Index Returns.

The Index Growth Floor is the minimum rate of interest that will be applied to a given Segment and is used in determining the Index Interest for each Segment at maturity. When calculating the Index Interest, the Index Growth Floor is applied after the Participation Rate and before the Index Growth Cap.

The guaranteed minimum Index Growth Floor rate for the Capped with Floor Index Strategy is 0%. At Segment maturity, the Index Growth Floor will be applied when determining the Index Interest.

Although the floor provides protection against loss due to negative Index Returns, the deduction of Contract charges and fees could reduce the overall cash value of the Index Strategy.

The Index Growth Cap (“Cap”) is the maximum rate that may be credited to a Capped with Floor Index Strategy Segment. A different Cap may be declared for different Segments. The Capped with Floor Index Strategy is available in 1-year Segments.

If the Index Return multiplied by the Participation Rate is positive and equal to or greater than the Cap, then the percentage of Index Interest is equal to the Cap. If the Index Return multiplied by the Participation Rate is positive, but less than the Cap, the percentage of Index Interest is equal to the Index Return multiplied by the Participation Rate.

If the Index Return is equal to or less than the Floor, the percentage of Index Interest is equal to the Floor.

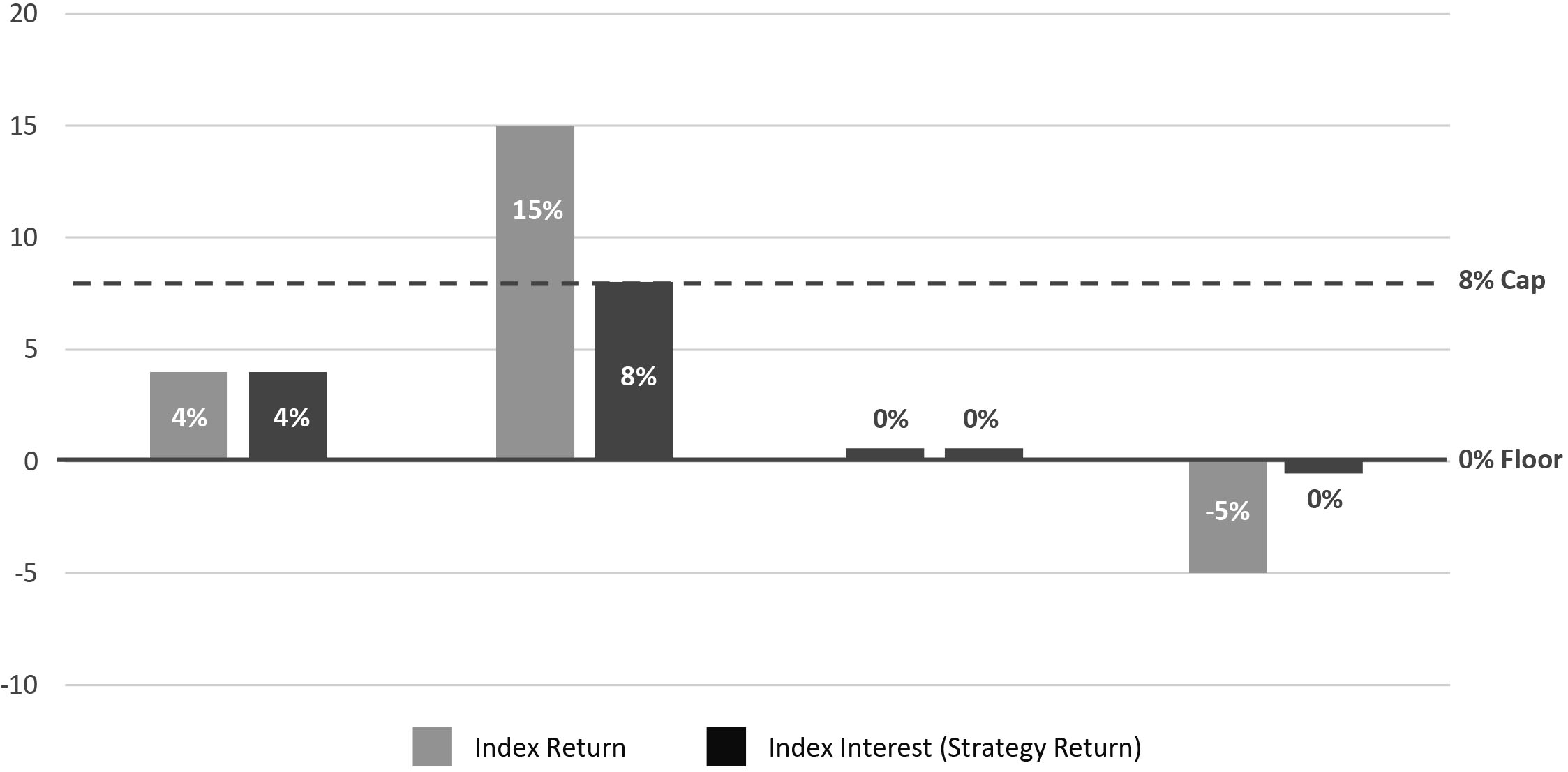

Hypothetical Example: how the Capped With Floor Index Strategy works

| | | | | | | | | | | |

| Assumptions: Cap (8%); Floor (0%); Participation Rate (100%) |

Scenario 1: Positive Index Return of 4% is less than the Cap. Your percentage of Index Interest is 4%. | Scenario2: Positive Index Return of 15% exceeds the Cap. Your percentage of Index Interest is 8% which is equal to the Cap. | Scenario 3: Flat Index Return of 0% is equal to the Floor. Your percentage of Index Interest is 0%. | Scenario 4: Negative Index Return of -5% is below the Floor. Due to the 0% floor, you are protected from loss and your percentage of Index Interest is 0%. |

|

In the preceding hypothetical example the strategy's upside potential equals 100% of the Index Return up to an assumed Index Growth Cap of 8%. Downside protection is provided by the Floor where index losses below the Floor are protected.

The Cap, Participation Rate and Floor apply to a Segment for the duration of the Segment. We will declare new rates for each subsequent Segment.

Subsequent Caps may be higher or lower than previously declared Caps but will never be less than the guaranteed minimum Index Growth Cap. Subsequent Caps may differ from the Caps used for new contracts or for other contracts issued at different times. We will determine new Caps on a basis that does not discriminate unfairly within any class of contracts. The guaranteed minimum Index Growth Cap equals 2.00% for a one-year Segment.