UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

DELAWARE GROUP ADVISER® FUNDS

DELAWARE GROUP CASH RESERVE

DELAWARE GROUP EQUITY FUNDS I

DELAWARE GROUP EQUITY FUNDS II

DELAWARE GROUP EQUITY FUNDS IV

DELAWARE GROUP EQUITY FUNDS V

DELAWARE GROUP FOUNDATION FUNDS

DELAWARE GROUP GLOBAL & INTERNATIONAL FUNDS

DELAWARE GROUP GOVERNMENT FUND

DELAWARE GROUP INCOME FUNDS

DELAWARE GROUP LIMITED-TERM GOVERNMENT FUNDS

DELAWARE GROUP STATE TAX-FREE INCOME TRUST

DELAWARE GROUP TAX FREE FUND

DELAWARE POOLED® TRUST

DELAWARE VIP® TRUST

VOYAGEUR INSURED FUNDS

VOYAGEUR INTERMEDIATE TAX FREE FUNDS

VOYAGEUR MUTUAL FUNDS

VOYAGEUR MUTUAL FUNDS II

VOYAGEUR MUTUAL FUNDS III

VOYAGEUR TAX FREE FUNDS

(Names of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

DELAWARE GROUP® ADVISER FUNDS

DELAWARE GROUP CASH RESERVE

DELAWARE GROUP EQUITY FUNDS I

DELAWARE GROUP EQUITY FUNDS II

DELAWARE GROUP EQUITY FUNDS IV

DELAWARE GROUP EQUITY FUNDS V

DELAWARE GROUP FOUNDATION FUNDS

DELAWARE GROUP GLOBAL & INTERNATIONAL FUNDS

DELAWARE GROUP GOVERNMENT FUND

DELAWARE GROUP INCOME FUNDS

DELAWARE GROUP LIMITED-TERM GOVERNMENT FUNDS

DELAWARE GROUP STATE TAX-FREE INCOME TRUST

DELAWARE GROUP TAX FREE FUND

DELAWARE POOLED® TRUST

DELAWARE VIP® TRUST

VOYAGEUR INSURED FUNDS

VOYAGEUR INTERMEDIATE TAX FREE FUNDS

VOYAGEUR MUTUAL FUNDS

VOYAGEUR MUTUAL FUNDS II

VOYAGEUR MUTUAL FUNDS III

VOYAGEUR TAX FREE FUNDS

100 Independence

610 Market Street

Philadelphia, PA 19106-2354

October 22, 2021

Dear Shareholder:

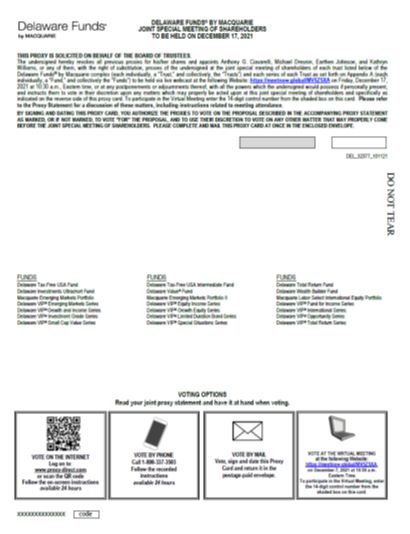

A joint special meeting of the shareholders of each trust listed above in the Delaware Funds® by Macquarie complex (each individually, a “Trust,” and collectively, the “Trusts”) and each series of each Trust as set forth on Appendix A (each individually, a “Fund,” and collectively the “Funds”) will be held via webcast on December 17, 2021 at 10:30 am, ET (the “Meeting”). You are receiving this letter because you were a shareholder of record of at least one Fund as of October 4, 2021 (the “Record Date”).

The Meeting is being held to approve to the election of thirteen (13) trustees to the Board of Trustees of each Trust.

The Board of Trustees of each Trust has approved, and unanimously recommends that you vote FOR, all trustee nominees.

Detailed information about the proposal is contained in the enclosed materials. Please review and consider the enclosed materials carefully, and then please take a moment to vote.

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the Meeting only if you were a shareholder of a Fund as of the close of business on the Record Date, or if you hold a valid proxy for the Meeting. Shareholders will be able to attend and participate in the Special Meeting online, vote electronically and submit questions prior to and during the meeting by visiting https://meetnow.global/MV5Z5XA on the meeting date and time described in the accompanying proxy statement. To participate in the Special Meeting, you will need to log on using the control number from your proxy card or Meeting notice. The control number can be found in the shaded box. There is no physical location for the Meeting.

Whether or not you plan to attend the virtual Meeting, your vote is needed.

Attendance at the Meeting will be limited to shareholders of the Fund as of the close of business on Record Date. You are entitled to notice of, and to vote at, the Meeting and any adjournment of the Meeting, even if you no longer hold shares of the Fund. Your vote is important no matter how many shares you own. It is important that your vote be received no later than the time of the Meeting.

Voting is quick and easy. Everything you need is enclosed. You may vote by completing and returning your proxy card/voting instruction form in the enclosed postage-paid return envelope, by calling the toll-free telephone number listed on the enclosed proxy card/voting instruction form, or by visiting the Internet website listed on the enclosed proxy card/voting instruction form. You may receive more than one set of proxy materials if you hold shares in more than one account. Please be sure to vote each proxy card/voting instruction form you receive. If we do not hear from you, our proxy solicitor, Computershare, may contact you. This will ensure that your vote is counted even if you cannot or do not wish to attend the Meeting. If you have any questions about the proposal or how to vote, you may call Computershare at 866-963-6125 and a representative will assist you.

Your vote is important to us. Thank you for your response and for your investment.

| Sincerely, |

Shawn K. Lytle |

| President of the Trusts |

DELAWARE GROUP® ADVISER FUNDS

DELAWARE GROUP CASH RESERVE

DELAWARE GROUP EQUITY FUNDS I

DELAWARE GROUP EQUITY FUNDS II

DELAWARE GROUP EQUITY FUNDS IV

DELAWARE GROUP EQUITY FUNDS V

DELAWARE GROUP FOUNDATION FUNDS

DELAWARE GROUP GLOBAL & INTERNATIONAL FUNDS

DELAWARE GROUP GOVERNMENT FUND

DELAWARE GROUP INCOME FUNDS

DELAWARE GROUP LIMITED-TERM GOVERNMENT FUNDS

DELAWARE GROUP STATE TAX-FREE INCOME TRUST

DELAWARE GROUP TAX FREE FUND

DELAWARE POOLED® TRUST

DELAWARE VIP® TRUST

VOYAGEUR INSURED FUNDS

VOYAGEUR INTERMEDIATE TAX FREE FUNDS

VOYAGEUR MUTUAL FUNDS

VOYAGEUR MUTUAL FUNDS II

VOYAGEUR MUTUAL FUNDS III

VOYAGEUR TAX FREE FUNDS

100 Independence

610 Market Street

Philadelphia, PA 19106-2354

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS |

NOTICE IS HEREBY GIVEN that a joint special meeting of the shareholders of each trust listed above of the Delaware Funds by Macquarie complex (each individually, a “Trust,” and collectively, the “Trusts”) and each series of each Trust as set forth on Appendix A (each individually, a “Fund,” and collectively the “Funds”) will be held via webcast on December 17, 2021 at 10:30 am ET (the “Meeting”). At the Meeting, shareholders will be asked to consider and vote upon the following proposal (the “Proposal”) and to act upon any other business which may properly come before the Meeting or any adjournment or postponement thereof:

Shareholders Entitled to Vote | ||||

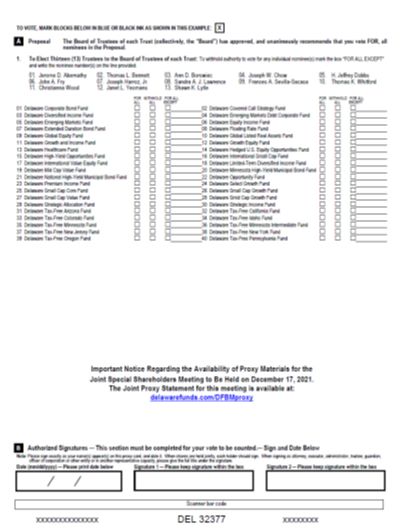

Proposal: | To Elect Thirteen (13) Trustees to the Board of Trustees of each Trust | All shareholders of each Trust, voting separately |

The Board of Trustees of each Trust (collectively, the “Board”) has approved, and unanimously recommends that you vote FOR, all nominees in the Proposal.

The Proposal is discussed in greater detail in the enclosed joint proxy statement. Please read the joint proxy statement carefully for information concerning the Proposal. The enclosed materials contain the Notice of Meeting of Shareholders, joint proxy statement and proxy card(s)/voting instruction form(s). A proxy card/voting instruction form is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to your Fund(s). If you complete, sign and return the proxy card/voting instruction form, we will vote it as you indicated. If you simply sign, date and return the enclosed proxy card/voting instruction form, but do not specify a vote, your proxy will be voted FOR the Proposal and FOR each trustee nominee.

Shareholders of record of the Fund at the close of business on October 4, 2021 (the “Record Date”) are entitled to receive notice of, and to vote at, the Meeting and any adjournments, postponements or delays thereof. It is important that your shares be voted at the Meeting. You may vote by telephone, Internet or by completing the enclosed proxy card(s)/voting instruction form(s) and returning it in the accompanying envelope as promptly as possible. You may also vote by attending the Meeting via webcast.

REGARDLESS OF WHETHER YOU PLAN TO PARTICIPATE IN THE MEETING VIA WEBCAST, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD/VOTING INSTRUCTION FORM IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD/VOTING INSTRUCTION FORM.

If you attend the Meeting via webcast and wish to vote at that time, you will be able to do so and your vote at the Meeting will revoke any proxy you may have submitted. Merely attending the Meeting via webcast, however, will not revoke a previously given proxy.

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the Meeting only if you were a shareholder of a Fund as of the close of business on the Record Date, or if you hold a valid proxy for the Meeting. Shareholders will be able to attend and participate in the Special Meeting online, vote electronically and submit questions prior to and during the meeting by visiting https://meetnow.global/MV5Z5XA on the meeting date and time described in the accompanying proxy statement. To participate in the Special Meeting, you will need to log on using the control number from your proxy card or Meeting notice. The control number can be found in the shaded box. There is no physical location for the Meeting.

YOUR VOTE IS EXTREMELY IMPORTANT. NO MATTER HOW MANY SHARES YOU OWN, PLEASE SEND IN THE PROXY CARD/VOTING INSTRUCTION FORM, OR VOTE BY TELEPHONE OR THE INTERNET TODAY.

Important Notice Regarding the Internet Availability of Proxy Materials for the Meeting. This Notice and the joint proxy statement and prospectus are available on the internet at delawarefunds.com/DFBMproxy. On this webpage, you will be able to access the Notice, the joint proxy statement and prospectus, any accompanying materials and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

By Order of the Boards of Trustees |

| Shawn K. Lytle |

President of the Trusts October 22, 2021 |

JOINT PROXY STATEMENT

For

DELAWARE GROUP® ADVISER FUNDS

DELAWARE GROUP CASH RESERVE

DELAWARE GROUP EQUITY FUNDS I

DELAWARE GROUP EQUITY FUNDS II

DELAWARE GROUP EQUITY FUNDS IV

DELAWARE GROUP EQUITY FUNDS V

DELAWARE GROUP FOUNDATION FUNDS

DELAWARE GROUP GLOBAL & INTERNATIONAL FUNDS

DELAWARE GROUP GOVERNMENT FUND

DELAWARE GROUP INCOME FUNDS

DELAWARE GROUP LIMITED-TERM GOVERNMENT FUNDS

DELAWARE GROUP STATE TAX-FREE INCOME TRUST

DELAWARE GROUP TAX FREE FUND

DELAWARE POOLED® TRUST

DELAWARE VIP® TRUST

VOYAGEUR INSURED FUNDS

VOYAGEUR INTERMEDIATE TAX FREE FUNDS

VOYAGEUR MUTUAL FUNDS

VOYAGEUR MUTUAL FUNDS II

VOYAGEUR MUTUAL FUNDS III

VOYAGEUR TAX FREE FUNDS

100 Independence

610 Market Street

Philadelphia, PA 19106-2354

Dated: October 22, 2021

JOINT PROXY STATEMENT FOR THE JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 17, 2021 |

This joint proxy statement (“Joint Proxy Statement”) is being furnished to you in connection with the solicitation of proxies by the Boards of Trustees (each a “Board,” and collectively, the “Board” or the “Boards”) of the each of the trusts listed above (each individually, a “Trust,” and collectively, the “Trusts”) on behalf of each series of each Trust as set forth on Appendix A (each individually, a “Fund,” and collectively the “Funds”) to be held via webcast on December 17, 2021 at 10:30 am ET (the “Meeting”).

The Joint Proxy Statement provides you with information you should review before voting on the matters listed in the Notice of the Joint Special Meeting of Shareholders. Much of the information in this Joint Proxy Statement is required under rules of the U.S. Securities and Exchange Commission (“SEC”). If there is anything you do not understand, please contact Computershares at 866-963-6125. This Joint Proxy Statement, the Notice of the Joint Special Meeting of Shareholders and related proxy card(s)/voting instruction form(s) will be mailed to shareholders of the Funds beginning on or about October 25, 2021.

Proposal/Shareholders Entitled to Vote

1

The Meeting is being called to ask shareholders to consider and vote on the following proposal (the “Proposal”), which is described more fully below:

Shareholders Entitled to Vote | ||||

Proposal: | To Elect Thirteen (13) Trustees to the Board of Trustees of each Trust | All shareholders of each Trust, voting separately |

The Board has unanimously approved, and recommends that you vote FOR, all nominees.

Shareholders of record of the Fund as of the close of business on October 4, 2021 (the “Record Date”) are entitled to attend and to vote at the Meeting. As of the Record Date, the number of shares of each Fund outstanding and entitled to vote at the Meeting is set forth on Appendix B.

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meeting will be conducted exclusively via webcast. Instructions on how to vote whether you expect to attend the Meeting or not are provided under the section “VOTING PROCEDURES—How do I vote?” section of this Joint Proxy Statement.

TO ASSURE THE PRESENCE OF A QUORUM AT THE MEETING, PLEASE PROMPTLY EXECUTE AND RETURN THE ENCLOSED PROXY CARD(S)/VOTING INSTRUCTION FORM(S). A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. ALTERNATIVELY, YOU MAY VOTE THROUGH THE INTERNET AT THE WEBSITE ADDRESS PRINTED ON THE ENCLOSED PROXY CARD/VOTING INSTRUCTION FORM.

2

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE PROPOSAL

Below is a brief overview of the matter to be voted on at the Meeting. Your vote is important, no matter how large or small your holdings may be. Please read the full text of this Joint Proxy Statement, which contains additional information about the Proposal, and keep it for future reference.

PROPOSAL: TO ELECT THIRTEEN (13) TRUSTEES TO THE BOARD OF TRUSTEES OF EACH TRUST

Why am I being asked to elect new Trustees?

Currently, the Board of Trustees of each Trust has ten members, nine of whom are Independent Trustees (as defined below). The Board has determined to increase the size of the Board of each Trust to thirteen members, to be comprised of the ten existing trustees of each Trust and three nominees who served as trustees of the Ivy Funds complex prior to the acquisition of the parent company of the Ivy Funds’ investment adviser, Waddell & Reed Financial, Inc., by Macquarie Asset Management, the asset management division of Macquarie Group (“Macquarie”) and an affiliate of the Funds’ investment adviser, Delaware Management Company (“DMC”). In order to satisfy the board composition requirements of the Investment Company Act of 1940, as amended (the “1940 Act”), the Funds’ shareholders must approve the selection of the trustee nominees. Among other things, the Board considered the background and experience of each trustee nominee, including each trustee nominee’s experience with the Delaware Funds by Macquarie or the Ivy Funds, and determined that each trustee nominee would provide valuable continuity and enhance the Board’s oversight of the Funds. Information about the trustee nominees, including age, principal occupations during the past five years, and other information, such as the trustee nominees’ experience, qualifications, attributes, or skills, is set forth in this Joint Proxy Statement.

VOTING PROCEDURES

Why did you send me this booklet?

You are receiving this booklet because you were a shareholder of one or more Funds as of the close of business on October 4, 2021 (the “Record Date”). This booklet includes the Joint Proxy Statement. It provides you with information you should review before providing voting instructions on the matters listed above. The words “you” and “shareholder” are used in this Joint Proxy Statement to refer to the person or entity that has voting rights or is being asked to provide voting instructions in connection with the shares.

Who is asking for my vote?

The Board has sent a Joint Proxy Statement to you and all other shareholders of record who have a beneficial interest in a Fund as of the Record Date. The Board is soliciting your vote for the Proposal discussed herein.

Who is eligible to vote?

Shareholders holding an investment in shares of any of the Funds as of the close of business on the Record Date are eligible to vote. Shareholders of the Funds on the Record Date will be entitled to one vote for each share (and a proportional fractional vote for each fraction of a share held.) No shares have cumulative voting rights in the election of Trustees.

Delaware VIP Trust (“Delaware VIP”) sells its shares only to the separate accounts of certain select insurance companies (“Participating Insurance Companies”) to fund certain variable life insurance policies and variable annuity contracts (“Policies”). These shares are currently sold only to variable life insurance separate accounts and variable annuity separate accounts (hereinafter collectively referred to as the “Variable Accounts”) as a funding vehicle for the Policies offered by the Variable Accounts of Participating Insurance Companies. Each of the Variable Accounts has a sub-account (“Sub-Account”), the assets of which are invested in shares of Delaware VIP Funds.

Owners of the Policies issued by each Participating Insurance Company (“Policyowners”) who select a portfolio for investment through a Variable Account have a beneficial interest in a Delaware VIP Fund, but do not invest directly in or hold shares of a Delaware VIP Fund. The Participating Insurance Company that uses a Delaware VIP Fund as an investment option is, in most cases, the actual shareholder of the Delaware VIP Fund and, as the legal owner of the Delaware VIP Fund’s shares, has voting power with respect to the shares. Each Participating Insurance company is

3

the legal owner of all Delaware VIP Fund shares held by the Variable Accounts of that Participating Insurance Company. In accordance with its view of applicable law, each Participating Insurance Company is soliciting voting instructions from its Policyowners with respect to all matters to be acted upon at the Meeting. The Policyowners permitted to give instructions for the Delaware VIP Fund and the number of Fund shares for which instructions may be given will be determined as of the Record Date for the Meeting. The numbers of votes which a Policyowner has the right to instruct will be calculated separately for each Variable Account. That number will be determined by applying the Policyowner’s percentage interest, if any, in the Sub-Account holding shares of the Fund to the total number of votes attributable to that Sub-Account. All Delaware VIP Fund shares held by the Variable Accounts of a Participating Insurance Company will be voted in accordance with voting instructions received from its Policyowners. Each Participating Insurance Company will vote Delaware VIP Fund shares attributable to its Policies as to which no timely instructions are received, and any Delaware VIP Fund shares held by that Participating Insurance Company as to which Policyowners have no beneficial interest, in proportion to the voting instructions, including abstentions, which are received with respect to its Policies participating in the Delaware VIP Fund. The effect of such proportional voting is that a small number of Policyowners may determine the outcome of the vote.

For purposes of this Joint Proxy Statement, the terms “shareholder,” “you,” and “your” may refer to Policyowners and to Variable Accounts and Participating Insurance Companies, as direct owners of shares of the Delaware VIP Funds, and any other direct shareholders of the Funds, unless the context otherwise requires.

How do I vote?

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the Meeting only if you were a shareholder of a Fund as of the close of business on the Record Date, or if you hold a valid proxy for the Meeting. Shareholders will be able to attend and participate in the Meeting online, vote electronically and submit questions prior to and during the meeting by visiting https://meetnow.global/MV5Z5XA on the meeting date and time described in the accompanying proxy statement. To participate in the Special Meeting, you will need to log on using the control number from your proxy card or meeting notice. The control number can be found in the shaded box. There is no physical location for the Special Meeting.

If you do not expect to be present at the Meeting via webcast and wish to vote your shares, please vote your proxy in accordance with the instructions included on the enclosed proxy card(s)/voting instruction form(s). If your proxy is properly returned, shares represented by it will be voted at the Meeting in accordance with your instructions for the Proposal. If your proxy is properly executed and returned and no choice is specified on the proxy card(s)/voting instruction form(s) with respect to the Proposal, the proxy will be voted FOR the approval of each trustee nominee and in accordance with the judgment of the person appointed as proxy upon any other matter that may properly come before the Meeting. Shareholders who execute proxies may revoke or change their proxy at any time prior to the time it is voted by delivering a written notice of revocation, by delivering a subsequently dated proxy by mail or the Internet or by attending the Meeting via webcast and voting at the Meeting. If you revoke a previous proxy, your vote will not be counted unless you attend the Meeting via webcast and vote or legally appoint another proxy to vote on your behalf.

If you are a registered shareholder, you do not need to register to attend the Meeting virtually on the Internet. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Meeting virtually on the Internet.

To register to attend the Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare. You must contact the bank or broker who holds your shares to obtain your legal proxy. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., ET, 3 business days prior to the Meeting date.

Requests for registration should be directed to us by emailing an image of your legal proxy, to shareholdermeetings@computershare.com.

The virtual meeting platform is fully supported across MS Edge, Firefox, Chrome and Safari browsers and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is no longer supported. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the

4

start time. A link on the meeting page will provide further assistance should you need it or you may call 888-724-2416 or 781-575-2748.

How can I obtain more information about the Funds?

Copies of each Trust’s Annual Report for the most recently completed fiscal year previously have been mailed or made available to shareholders. This Joint Proxy Statement should be read in conjunction with each Annual Report. You can obtain copies of the Annual Reports, without charge, by writing to the respective Trust or to Delaware Distributors, L.P. at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, or by calling 800-523-1918. You should receive the reports within three business days of your request. Copies of these reports are also available free of charge at www.delawarefunds.com.

5

PROPOSAL 1

TO ELECT THIRTEEN (13) TRUSTEES TO THE BOARD OF TRUSTEES OF EACH TRUST

Introduction

Currently, the Board of Trustees of each Trust has ten members, nine of whom are Independent Trustees (as defined below). The Board has determined to increase the size of the Board of each Trust to thirteen members, to be comprised of the ten existing trustees of each Trust and three nominees who served as trustees of the Ivy Funds complex prior to the acquisition of the parent company of the Ivy Funds’ investment adviser, Waddell & Reed Financial, Inc., by Macquarie Asset Management, the asset management division of Macquarie Group (“Macquarie”) and an affiliate of the Funds’ investment adviser, Delaware Management Company (“DMC”).. In order to satisfy the board composition requirements of the Investment Company Act of 1940, as amended (the “1940 Act”), the Funds’ shareholders must approve the selection of the trustee nominees. Among other things, the Board considered the background and experience of each trustee nominee, including each trustee’s experience with the Delaware Funds by Macquarie and the Ivy Funds, and determined that each trustee nominee would provide valuable continuity and enhance the Board’s oversight of the Funds.

At the Meeting, shareholders of each Trust will be asked to elect the following nominees to serve as Trustees on the Board of each Trust: Jerome D. Abernathy, Thomas L. Bennett, Ann D. Borowiec, Joseph W. Chow, H. Jeffrey Dobbs, John A. Fry, Joseph Harroz, Jr., Sandra A. J. Lawrence, Frances A. Sevilla-Sacasa, Thomas K. Whitford, Christianna Wood, Janet L. Yeomans, and Shawn K. Lytle (the “Trustee Nominees”).

The Board currently consists of ten Trustees: Jerome D. Abernathy, Thomas L. Bennett, Ann D. Borowiec, Joseph W. Chow, John A. Fry, Frances A. Sevilla-Sacasa, Thomas K. Whitford, Christianna Wood, Janet L. Yeomans, and Shawn K. Lytle (the “Current Trustees”).

If each Trustee Nominee is approved, the Board of each Trust would consist of thirteen Trustees. Of the ten Current Trustees, Thomas L. Bennett, Ann D. Borowiec, Joseph W. Chow, John A. Fry, Frances A. Sevilla-Sacasa, Thomas K. Whitford and Janet L. Yeomans have previously been elected to the Board by Fund shareholders. In addition to the Trustee Nominees who are Current Trustees, it is proposed that three additional Trustee Nominees — Joseph Harroz, Jr., Sandra A. J. Lawrence, and H. Jeffrey Dobbs — be added to the Board if elected by Fund shareholders. Except for Mr. Lytle, none of the Trustee Nominees are an “interested person” of the Trusts (as such term is defined in the 1940 Act) (the “Independent Trustees”). Should Mr. Lytle be elected to the Board of each Trust by that Trust’s shareholders, he would be considered an “interested” Trustee because of his position with Macquarie (the “Interested Trustee”).

At a meeting held on August 11-12, 2021, the Board, at the recommendation of the Trusts’ Nominating and Corporate Governance Committee, which is comprised solely of Independent Trustees, nominated each Trustee Nominee for election to the Board of each Trust.

Information about the Trustee Nominees

The persons named in the accompanying form of proxy intend to vote at the Meeting (unless directed not to vote) FOR the election of each Trustee Nominee set forth below. All Trustee Nominees have indicated that they will serve on the Board, and the Board has no reason to believe that any of them will become unavailable to continue to serve as Trustees. If a Trustee Nominee is unavailable to serve for any reason, the persons named as proxies will vote for such other Trustee Nominees nominated by the Independent Trustees. Under the Declarations of Trust and By-laws, a Trustee may serve as a Trustee until he or she dies, resigns or is removed from office.

Independent Trustee Nominees

The twelve Independent Trustee Nominees, their term of office and length of time served (as applicable), their principal business occupations during the past five years, the number of portfolios overseen by the Trustee Nominees

6

(or the number of portfolios they will oversee should they be elected by shareholders, as applicable) and other directorships, if any, held by the Trustee Nominees are shown below.

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD OR TO BE HELD WITH THE TRUSTS | TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN OR TO BE OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS |

Interested Trustee | |||||

Shawn K. Lytle1 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1970 | President, Chief Executive Officer, and Trustee | President and Chief Executive Officer since August 2015 Trustee since September 2015 | Global Head of Macquarie Investment Management (January 2019-Present); Head of Americas of Macquarie Group (December 2017-Present); Deputy Global Head of Macquarie Investment Management (2017-2019); Head of Macquarie Investment Management Americas (2015-2017) | 150 | None |

| Independent Trustees | |||||

Jerome D. Abernathy 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1959 | Trustee | Since January 2019 | Managing Member, Stonebrook Capital Management, LLC (financial technology: macro factors and databases) (January 1993–Present) | 150 | None |

Thomas L. Bennett 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1947 | Chair and Trustee | Trustee since March 2005 Chair since March 2015 | Private Investor (March 2004–Present) | 150 | None |

Ann D. Borowiec 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1958 | Trustee | Since March 2015 | Private Investor (2013-Present) Chief Executive Officer, Private Wealth Management (2011–2013) and Market Manager, New Jersey Private Bank (2005–2011)—J.P.Morgan Chase & Co. | 150 | Director—Banco Santander International (October 2016–December 2019) Director—Santander Bank, N.A. (December 2016– December 2019) |

Joseph W. Chow 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1953 | Trustee | Since January 2013 | Private Investor (April 2011–Present) | 150 | Director and Audit Committee Member—Hercules Technology Growth Capital, Inc. (July 2004–July 2014) |

| H. Jeffrey Dobbs 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1955 | Trustee Nominee | N/A | Private Investor (2015-Present) Global Sector Chairman, Industrial Manufacturing—KPMG LLP (2010-2015) | 150 | Trustee—Ivy Funds, InvestEd and Ivy VIP Funds (2019-2021) Director—Valparaiso University (2012-Present) Director—TechAccel LLC (2015-Present) (Tech R&D) |

7

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD OR TO BE HELD WITH THE TRUSTS | TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN OR TO BE OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS |

Board Member—Kansas City Repertory Theatre (2015-Present) Board Member—PatientsVoices, Inc. (technology) (2018-Present) Kansas City Campus for Animal Care (2018-Present) | |||||

John A. Fry 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1960 | Trustee | Since January 2001 | President—Drexel University (August 2010–Present) President—Franklin & Marshall College (July 2002–June 2010) | 150 | Director; Compensation Committee and Governance Committee Member—Community Health Systems (May 2004–Present) Director and Audit Committee Member— vTv Therapeutics Inc. (2017–Present) Director and Audit Committee Member—FS Credit Real Estate Income Trust, Inc. (2018–Present) Director and Audit Committee Member—Federal Reserve Bank of Philadelphia (January 2020–Present) |

| Joseph Harroz, Jr. 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1967 | Trustee Nominee | N/A | President (2020-Present), Interim President (2019-2020), Vice President (2010-2019) and Dean (2010-2019)—College of Law, University of Oklahoma Managing Member—Harroz Investments, LLC, (commercial enterprises) (1998-2019) Managing Member—St. Clair, LLC (commercial enterprises) (2019-Present) | 150 | Trustee—Ivy Funds, InvestEd and Ivy VIP Funds (1998-2021) Director and Shareholder—Valliance Bank (2007-Present) Director—Foundation Healthcare (formerly Graymark HealthCare) (2008-2017) Trustee—the Mewbourne Family Support Organization (non-profit) (2006-Present) (non-profit) Independent Director—LSQ Manager, Inc. (real estate) (2007-2016) Director—Oklahoma Foundation for Excellence (non-profit) (2008-Present) Independent Chairman and Trustee—WRA Funds (Independent Chairman: 2015-2018; Trustee: 1998-2018) |

8

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD OR TO BE HELD WITH THE TRUSTS | TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN OR TO BE OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS |

Sandra A. J. Lawrence 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1957 | Trustee Nominee | N/A | Private Investor (2019-Present) Formerly, Chief Administrative Officer—Children’s Mercy Hospitals and Clinics (2016-2019); and CFO—Children’s Mercy Hospitals and Clinics (2005-2016) | 150 | Trustee—Ivy Funds, InvestEd and Ivy VIP Funds (2019-2021) Director, Hall Family Foundation (1993-Present) Director, Westar Energy (utility) (2004-2018) Trustee, Nelson-Atkins Museum of Art (non-profit) (2007-2020) Director, Turn the Page KC (non-profit) (2012-2016) Director, Kansas Metropolitan Business and Healthcare Coalition (non-profit) (2017-2019) Director, National Association of Corporate Directors (non-profit) (2017-Present) Director, American Shared Hospital Services (medical device) (2017-Present) Director, Evergy, Inc., Kansas City Power & Light Company, KCP&L Greater Missouri Operations Company, Westar Energy, Inc. and Kansas Gas and Electric Company (related utility companies) (2018-Present) Director, Stowers (research) (2018); CoChair, Women Corporate, Directors (director education) (2018-2020) |

Frances A. Sevilla-Sacasa 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1956 | Trustee | Since September 2011 | Private Investor (January2017–Present) Chief Executive Officer— Banco Itaú International (April 2012–December 2016) Executive Advisor to Dean (August 2011–March2012) and Interim Dean (January 2011–July 2011)— | 150 | Trust Manager and Audit Committee Chair—Camden Property Trust (August 2011–Present) Director; Audit and Compensation Committee—Callon Petroleum Company (December 2019–Present) Director; Audit Committee |

9

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD OR TO BE HELD WITH THE TRUSTS | TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN OR TO BE OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS |

University of Miami School of Business Administration President—U.S. Trust Bank of America Private Wealth Management (Private Banking) (July 2007–December 2008) | Member—Carrizo Oil & Gas, Inc.(March 2018–December 2019) | ||||

Thomas K. Whitford 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1956 | Trustee | Since January 2013 | Private Investor (2013-Present) Vice Chairman (2010–April 2013)—PNC Financial Services Group | 150 | Director—HSBC North America Holdings Inc. (December 2013–Present) Director—HSBC USA Inc. (July 2014–Present) Director—HSBC Bank USA, National Association (July 2014–March 2017) Director—HSBC Finance Corporation (December 2013–April 2018) |

Christianna Wood 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1959 | Trustee | Since January 2019 | Chief Executive Officer and President—Gore Creek Capital, Ltd. (August 2009–Present) | 150 | Director; Finance Committee and Audit Committee Member— H&R Block Corporation (July 2008–Present) Director; Investments Committee, Capital and Finance Committee and Audit Committee Member—Grange Insurance (2013–Present) Trustee; Chair of Nominating and Governance Committee and Member of Audit Committee—The Merger Fund (2013–2021), The Merger Fund VL (2013–2021), WCM Alternatives: Event-Driven Fund (2013–2021), and WCM Alternatives: Credit Event Fund (December 2017–2021) Director; Chair of Governance Committee and Audit Committee Member—International Securities Exchange (2010–2016) |

Janet L. Yeomans 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 | Trustee | Since April 1999 | Private Investor (2012-Present) Vice President and Treasurer | 150 | Director; Personnel and Compensation Committee Chair; Member of Nominating, Investments, and Audit Committees for various periods |

10

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD OR TO BE HELD WITH THE TRUSTS | TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS | NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN OR TO BE OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS |

1948 | (January 2006–July 2012), Vice President—Mergers & Acquisitions (January 2003–January 2006), and Vice President and Treasurer (July 1995–January 2003)—3M Company | throughout directorship—Okabena Company (2009–2017) |

| 1. | Shawn K. Lytle is considered to be an “Interested Trustee” because he is an executive officer of DMC. |

Trustee Qualifications

The Nominating and Corporate Governance Committee of the Board of the Trusts is responsible for identifying, evaluating and recommending candidates to the Board. The Committee reviews the background and the educational, business and professional experience of candidates and the candidates’ expected contributions to the Board. Although the Board has not adopted a formal diversity policy, the Board nevertheless believes that the different perspectives, viewpoints, professional experience, education, and individual qualities of each director contribute to the Board’s diversity of experiences and bring a variety of complementary skills. It is the Trustees’ belief that this allows the Board, as a whole, to oversee the business of the Trusts in a manner consistent with the best interests of the Trusts’ shareholders.

The Board has determined that each Trustee Nominee is qualified to serve on the Board because of his or her specific attributes, including prior experience, background and skills. The Board considered that the Trustee Nominees’ familiarity and experience with the Funds, as members of the Board, of DMC and its affiliates, as members of the Delaware Funds by Macquarie board or the Ivy Funds board, would result in the Board having a breadth of knowledge that would enhance its ability to oversee the Funds.

The following is a summary of various qualifications, experiences and skills of each Trustee Nominee that that led to the Board’s conclusion that the Trustee Nominee should serve as a Trustee on the Board.

Independent Trustee Nominees

Jerome D. Abernathy – Mr. Abernathy has over 30 years of experience in the investment management industry. In selecting him to serve on the Board, the Independent Trustees of the Trust noted and valued his extensive experience as a chief investment officer, director of research, trader, and analytical proprietary trading researcher. Mr. Abernathy received a B.S. in electrical engineering from Howard University and a Ph.D. in electrical engineering and computer science from Massachusetts Institute of Technology.

Thomas L. Bennett – Mr. Bennett has over 30 years of experience in the investment management industry, particularly with fixed income portfolio management and credit analysis. He has served in senior management for a number of money management firms. Mr. Bennett has also served as a board member of another investment company, an educational institution, nonprofit organizations, and for-profit companies. He has an M.B.A. from the University of Cincinnati. Mr. Bennet has been nominated to serve as Chair of the Board.

Ann D. Borowiec – Ms. Borowiec has over 25 years of experience in the banking and wealth management industry. Ms. Borowiec also serves as a board member on several nonprofit organizations. In nominating her to the Board in 2015, the Independent Trustees of the Trust found that her experience as a Chief Executive Officer in the private wealth management business at a leading global asset manager and private bank, including the restructuring of business lines and defining client recruitment strategies, complemented the skills of existing board members. Her experience would also provide additional oversight skill in the area of fund distribution. Ms. Borowiec holds a B.B.A. from Texas Christian University and an M.B.A. from Harvard University.

11

Joseph W. Chow – Mr. Chow has over 30 years of experience in the banking and financial services industry. In nominating him to the Board, the Independent Trustees of the Trust found that his extensive experience in business strategy in non-US markets complemented the skills of existing Board members and also reflected the increasing importance of global financial markets in investment management. The Independent Trustees also found that Mr. Chow’s management responsibilities as a former Executive Vice President of a leading global asset servicing and investment management firm as well as his experience as Chief Risk and Corporate Administration Officer would add helpful oversight skills to the Board’s expertise. Mr. Chow holds a B.A. degree from Brandeis University and M.C.P. and M.S. in Management degree from Massachusetts Institute of Technology.

H. Jeffrey Dobbs – Mr. Dobbs has more than 35 years of experience in the automotive, industrial manufacturing, financial services and consumer sectors. He also has served as a partner in a public accounting firm. Mr. Dobbs holds a degree in accounting from Valparaiso University. The Board concluded that Mr. Dobbs is suitable to act as Trustee because of his extensive work in the global professional services industry and as a trustee of the Ivy Funds complex member, as well as his educational background.

John A. Fry – Mr. Fry has over 30 years of experience in higher education. He has served in senior management for three major institutions of higher learning including serving as president of a leading research university. Mr. Fry has also served as a board member of many nonprofit organizations and several for-profit companies. Mr. Fry has extensive experience in overseeing areas such as finance, investments, risk-management, internal audit, and information technology. He holds a B.A. degree in American Civilization from Lafayette College and an M.B.A. from New York University.

Joseph Harroz, Jr. – Mr. Harroz serves as the President of a state university, and also serves as a Director of a bank. He also has served as President and Director of a publicly traded company, as Interim President and General Counsel to a state university system and as Dean of the College of Law of that state university. Mr. Harroz holds a B.A. degree from the University of Oklahoma and a J.D. from Georgetown University Law Center. Mr. Harroz has multiple years of service as a trustee of the Ivy Funds complex. The Board concluded that Mr. Harroz is suitable to serve as Trustee because of his educational background, his work experience and the length of his service as a trustee of the Ivy Funds complex.

Sandra A. J. Lawrence – Ms. Lawrence has been a member and chair of the boards of several closely-held corporations and charitable organizations. She also has more than 14 years of experience serving on boards of public companies and has served as a chief financial officer and on investment committees. Ms. Lawrence holds an A.B. from Vassar College, as well as master’s degrees from the Massachusetts Institute of Technology and Harvard Business School. The Board concluded that Ms. Lawrence is suitable to serve as Trustee because of her work experience, financial background, academic background, service as trustee of the Ivy Funds complex, and service on corporate and charitable boards.

Frances A. Sevilla-Sacasa – Ms. Sevilla-Sacasa has over 30 years of experience in banking and wealth management. In nominating her to the Board, the Independent Trustees of the Trust found that her extensive international wealth management experience, in particular, complemented the skills of existing Board members and also reflected the increasing importance of international investment management not only for dollar-denominated investors but also for investors outside the US. The Independent Trustees also found that Ms. Sevilla-Sacasa’s management responsibilities as the former President and Chief Executive Officer of a major trust and wealth management company would add a helpful oversight skill to the Board’s expertise, and her extensive nonprofit Board experience gave them confidence that she would make a meaningful, experienced contribution to the Board of Trustees. Finally, in electing Ms. Sevilla-Sacasa to the Board, the Independent Trustees valued her perceived dedication to client service as a result of her overall career experience. Ms. Sevilla-Sacasa holds B.A. and M.B.A. degrees from the University of Miami and Thunderbird School of Global Management, respectively.

Thomas K. Whitford – Mr. Whitford has over 25 years of experience in the banking and financial services industry, and served as Vice Chairman of a major banking, asset management, and residential mortgage banking institution. In nominating him to the Board, the Independent Trustees of the Trust found that Mr. Whitford’s senior management role in wealth management and experience in the mutual fund servicing business would provide valuable current management and financial industry insight, in particular, and complemented the skills of existing Board members.

12

The Independent Trustees also found that his senior management role in integrating company acquisitions, technology, and operations and his past role as Chief Risk Officer would add a helpful oversight skill to the Board’s expertise. Mr. Whitford holds a B.S. degree from the University of Massachusetts and an M.B.A. degree from The Wharton School of the University of Pennsylvania.

Christianna Wood – Ms. Wood has over 30 years of experience in the investment management industry. In selecting her to serve on the Board, the Independent Trustees of the Trust noted and valued her significant portfolio management, corporate governance and audit committee experience. Ms. Wood received a B.A. in economics from Vassar College and an M.B.A. in finance from New York University.

Janet L. Yeomans – Ms. Yeomans has over 28 years of business experience with a large global diversified manufacturing company, including service as Treasurer for this company. In this role, Ms. Yeomans had significant broad-based financial experience, including global financial risk-management, investments, and mergers and acquisitions. She served as a board member of a for-profit company and also is a current board member of a hospital and a public university system. She holds degrees in mathematics and physics from Connecticut College, an M.S. in mathematics from Illinois Institute of Technology, and an M.B.A. from the University of Chicago.

Interested Trustee Nominee

Shawn K. Lytle – Mr. Lytle has over 20 years of experience in the investment management industry. He has been the president of Macquarie Asset Management - Americas since June 2015, and he is responsible for all aspects of the firm’s business. Prior to that time, Mr. Lytle served in various executive management, investment management, and distribution positions at two major banking institutions. He holds a B.A. degree from The McDonough School of Business at Georgetown University. Mr. Lytle serves on the board of directors of the National Association of Securities Professionals (NASP), the Sustainability Accounting Standards Board, and he is a member of the board of governors for the Investment Company Institute (ICI). In November 2017, Mr. Lytle was named to the Black Enterprise list of “Most Powerful Executives in Corporate America.”

Board Structure and Related Matters

The Trusts are governed by the Board, which is responsible for the overall management of the Trusts and the Funds. Such responsibility includes general oversight and review of the Funds’ investment activities, in accordance with Federal law and the law of the State of Delaware, as well as the stated policies of the Funds. The Board has appointed officers of the Trusts and delegated to them the management of the day-to-day operations of the Funds, based on policies reviewed and approved by the Board, with general oversight by the Board.

Under the Declarations of Trust and By-laws, a Trustee may serve as a Trustee until he or she dies, resigns or is removed from office. The Trusts are not required to hold annual meetings of shareholders for the election or re-election of Trustees or for any other purpose, and do not intend to do so. Delaware law permits shareholders to remove Trustees under certain circumstances and requires the Trusts to assist in shareholder communications.

If shareholders elect the Trustee Nominees, the Board will be comprised of twelve Independent Trustees and one Interested Trustee. The Board believes that having a majority of Independent Trustees on the Board is appropriate and in the best interests of the Trusts’ shareholders. In addition, the Board’s chairman, Thomas L. Bennett, is an Independent Trustee. In that regard, Mr. Bennett’s responsibilities include: setting an agenda for each meeting of the Board; presiding at all meetings of the Board and of the Independent Trustees; and serving as a liaison with other Trustees, the Trusts’ officers and other management personnel, and counsel. The Independent Chair also performs such other duties as the Board may from time to time determine.

The Board generally holds four regularly scheduled meetings each year. The Board may hold special meetings, as needed, in person, by videoconference or by telephone, to address matters arising between regular meetings. The Independent Trustees also hold four regularly scheduled meetings each year, during a portion of which management is not present, as well as a special meeting in connection with the Board’s annual consideration of the Trusts’ management agreements, and may hold special meetings, as needed. The Board held 6 meetings (all of which were virtual because of the COVID-19 pandemic) during the 12-month period ended August 31, 2021. No Current Trustee attended less than 75% of the aggregate number of meetings of each Board and of each Committee on which the Current Trustee served during such period.

13

The Board has established a committee structure (described below) that includes four standing committees, the Audit Committee, the Nominating and Corporate Governance Committee, the Investments Committee, and the Committee of Independent Trustees, all of which are comprised solely of Independent Trustees. The Board periodically evaluates its structure and composition, as well as various aspects of its operations. The Board believes that its leadership structure, including its Independent Chair position and its committees, is appropriate for the Trusts in light of, among other factors, the asset size and nature of the Trusts, the number of Funds overseen by the Board, the arrangements for the conduct of the Trusts’ operations, the number of Trustees, and the Board’s responsibilities.

Committees of the Board

The Board has established the following standing committees: Audit Committee, Executive Committee, Investment Oversight Committee and Governance Committee. The respective duties and current memberships of the standing committees are set forth below. The Board may establish ad hoc committees from time to time and compensate Trustees for service on such committees.

Audit Committee. This committee monitors accounting and financial reporting policies, practices, and internal controls for the Trust. It also oversees the quality and objectivity of the Trust's financial statements and the independent audit thereof, and acts as a liaison between the Trust's independent registered public accounting firm and the full Board. The Trust's Audit Committee consists of the following Independent Trustees: Thomas K. Whitford, Chair; Jerome D. Abernathy; John A. Fry; and Christianna Wood. The Committee held 7 meetings (all of which were virtual because of the COVID-19 pandemic) during the 12-month period ended August 31, 2021.

Committee of Independent Trustees. This committee develops and recommends to the Board a set of corporate governance principles and oversees the evaluation of the Board, its committees, and its activities. The committee comprises all of the Trust's Independent Trustees. The Committee held 4 meetings (all of which were virtual because of the COVID-19 pandemic) during the 12-month period ended August 31, 2021.

Investment Committee. The primary purposes of the Investments Committee are to: (i) assist the Board at its request in its oversight of the investment advisory services provided to the Trust by DMC as well as any sub-advisors; (ii) review all proposed advisory and sub-advisory agreements for new funds or proposed amendments to existing agreements and to recommend what action the full Board and the Independent Trustees should take regarding the approval of all such proposed agreements; and (iii) review reports supplied by DMC regarding investment performance, portfolio risk and expenses and to suggest changes to such reports. The Investments Committee consists of the following Independent Trustees: Joseph W. Chow, Chair; Jerome D. Abernathy; and Christianna Wood. The Committee held 6 meetings (all of which were virtual because of the COVID-19 pandemic) during the 12-month period ended August 31, 2021.

Nominating and Corporate Governance Committee. This committee recommends Board nominees, fills Board vacancies that arise in between meetings of shareholders, and considers the qualifications and independence of Board members. The committee also monitors the performance of counsel for the Independent Trustees. The committee will consider shareholder recommendations for nomination to the Board only in the event that there is a vacancy on the Board. Shareholders who wish to submit recommendations for nominations to the Board to fill a vacancy must submit their recommendations in writing to the Nominating and Corporate Governance Committee, Attention: Secretary, c/o Delaware Funds by Macquarie at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354. Shareholders should include appropriate information on the background and qualifications of any persons recommended (e.g., a resume), as well as the candidate's contact information and a written consent from the candidate to serve if nominated and elected. Shareholder recommendations for nominations to the Board will be accepted on an ongoing basis and such recommendations will be kept on file for consideration when there is a vacancy on the Board. The committee consists of the following Independent Trustees: Frances A. Sevilla-Sacasa, Chair; Thomas L. Bennett (ex officio); Ann D. Borowiec; John A. Fry; and Janet L. Yeomans. The Board has adopted a written charter of the Nominating and Corporate Governance Committee, which is attached as Appendix C. The Committee held 5 meetings (all of which were virtual because of the COVID-19 pandemic) during the 12-month period ended August 31, 2021.

In reaching its determination that an individual should serve or continue to serve as a Trustee of the Trust, the committee considers, in light of the Trust's business and structure, the individual's experience, qualifications, attributes, and skills (the “Selection Factors”). No one Selection Factor is determinative, but some of the relevant

14

factors that have been considered include: (i) the Trustee's business and professional experience and accomplishments, including prior experience in the financial services industry or on other boards; (ii) the ability to work effectively and collegially with other people; and (iii) how the Trustee's background and attributes contribute to the overall mix of skills and experience on the Board as a whole.

Risk Oversight

Consistent with its responsibility for oversight of the Trusts and their Funds, the Board oversees the management of risks relating to the administration and operation of the Trusts and the Funds. The Board performs this risk management oversight directly and, as to certain matters, directly through its The Board performs a risk oversight function for the Trust consisting, among other things, of the following activities: (1) receiving and reviewing reports related to the performance and operations of the Trust; (2) reviewing, approving, or modifying as applicable, the compliance policies and procedures of the Trust; (3) meeting with portfolio management teams to review investment strategies, techniques and the processes used to manage related risks; (4) addressing security valuation risk in connection with its review of fair valuation decisions made by Fund management pursuant to Board-approved procedures; (5) meeting with representatives of key service providers, including DMC, the Funds’ distributor, the Funds' transfer agent, the custodian and the independent public accounting firm of the Trust, to review and discuss the activities of the Trust's series, and to provide direction with respect thereto; (6) engaging the services of the Trust's Chief Compliance Officer to test the compliance procedures of the Trust and its service providers; and (7) requiring management's periodic presentations on specified risk topics.

The Trustees perform this risk oversight function throughout the year in connection with each quarterly Board meeting. The Trustees routinely discuss certain risk-management topics with Fund management at the Board level and also through the standing committees of the Board. In addition to these recurring risk-management discussions, Fund management raises other specific risk-management issues relating to the Funds with the Trustees at Board and committee meetings. When discussing new product initiatives with the Board, Fund management also discusses risk — either the risks associated with the new proposals or the risks that the proposals are designed to mitigate. Fund management also provides periodic presentations to the Board to give the Trustees a general overview of how DMC and its affiliates identify and manage risks pertinent to the Trust.

The Audit Committee looks at specific risk-management issues on an ongoing basis. The Audit Committee is responsible for certain aspects of risk oversight relating to financial statements, the valuation of the Trust's assets, and certain compliance matters. In addition, the Audit Committee meets with DMC’s internal audit and risk-management personnel on a quarterly basis to review the reports on their examinations of functions and processes affecting the Trust.

The Board's other committees also play a role in assessing and managing risk. The Nominating and Corporate Governance Committee and the Committee of Independent Trustees play a role in managing governance risk by developing and recommending to the Board corporate governance principles and, in the case of the Committee of Independent Trustees, by overseeing the evaluation of the Board, its committees, and its activities. The Investments Committee plays a significant role in assessing and managing risk through its oversight of investment performance, investment process, investment risk controls, and fund expenses.

Because risk is inherent in the operation of any business endeavor, and particularly in connection with the making of financial investments, there can be no assurance that the Board's approach to risk oversight will be able to minimize or even mitigate any particular risk. The Funds are designed for investors that are prepared to accept investment risk, including the possibility that as yet unforeseen risks may emerge in the future.

Selection of Nominees

The Board’s Nominating and Corporate Governance Committee makes Independent Trustee candidate recommendations to the Board pursuant to its charter. The Committee evaluates a candidate’s qualification for Board membership and the independence of such candidate from DMC and other principal service providers.

15

The Committee evaluates candidates using certain criteria, considering, among other qualities, a high level of integrity, appropriate experience, a commitment to fulfill the fiduciary duties inherent in Board membership, and the extent to which potential candidates possess sufficiently diverse skill sets that would contribute to the Board’s overall effectiveness.

The Committee considers prospective candidates from any reasonable source, including from recommendations by shareholders of the Trusts. The Committee initially evaluates prospective candidates on the basis of preliminary information required of all preliminary candidates, considered in light of the criteria discussed above. Those prospective candidates that appear likely to be able to fill a significant need of the Board would be contacted by a Committee member to discuss the position; if there appeared to be sufficient interest, a meeting with one or more Committee members would be arranged. If the Committee, based on the results of these contacts, believed it had identified a viable candidate, it would air the matter with the full group of Independent Trustees for input.

Any request by management to meet with the prospective candidate would be given appropriate consideration. The Trusts have not paid a fee to third parties to assist in finding nominees.

Shareholders seeking to recommend one or more candidates to the Board should direct the names of such candidates they wish to be considered to the attention of the Trusts’ Nominating and Corporate Governance Committee, in care of the Trusts’ Secretary, at the address of the Trusts listed on the front page of this Joint Proxy Statement. Such candidates will be considered with any other trustee candidates on the basis of the same criteria described above used to consider and evaluate candidates recommended by other sources.

For candidates to serve as Independent Trustees, independence from DMC, its affiliates and other principal service providers is critical, as is an independent and questioning mindset. The Committee also considers whether the prospective candidates’ workloads would allow them to attend the vast majority of Board meetings, be available for service on Board committees, and devote the additional time and effort necessary to keep up with Board matters and the rapidly changing regulatory environment in which the Trusts operate. Different substantive areas may assume greater or lesser significance at particular times, in light of the Board’s present composition and the Governance Committee’s (or the Board’s) perceptions about future issues and needs.

Ownership of Fund Shares

Set forth in Appendix D is information regarding shares of the Funds beneficially owned by each Trustee Nominee as of the Record Date, as determined in accordance with Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, as amended, as well as the aggregate dollar range of shares owned by each Trustee Nominee of Funds within the Delaware Funds by Macquarie complex.

To the best of the Trusts’ knowledge, as of the Record Date, no person owned beneficially more than 5% of the outstanding shares of any class of any Fund’s securities, except as set out in Appendix E. As of that date, all of the Trustees and officers of the Trusts, as a group, beneficially owned less than 1% of the outstanding shares of each class of the Funds. In addition, no Trustee or nominee purchased or sold any securities of Macquarie or its affiliates during the past fiscal year.

Compensation

The fees paid to the Trustees are allocated among the Trusts based on their Funds’ relative asset size. Information relating to compensation paid to the Trustees for each Trust’s most recent fiscal year is set forth in Appendix F.

Required Vote

Shareholders of each Trust, including each Fund and class thereof, will vote on a trust-by-trust basis to elect Trustees to that Trust’s Board. For each Trust, the presence at the Meeting of one-third of the outstanding shares of such Trust shall be sufficient to constitute a quorum for that Trust. Trustees are elected by the affirmative vote of a plurality of shares present at the Meeting and entitled to vote, at which quorum is present. This means that the 13 candidates who

16

receive the largest number of votes will be elected as trustees. In the election of trustees, votes may be cast in favor of a candidate or withheld. If elected, the Trustee Nominees will serve as Trustees.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF EACH TRUST VOTE FOR THE ELECTION OF EACH TRUSTEE NOMINEE.

17

OTHER BUSINESS

The Board does not intend to present any other business at the Meeting. If, however, any other matters are properly brought before the Meeting, the persons named in the accompanying form of proxy card/voting instruction form will vote thereon in accordance with their judgment.

The Trusts generally are not required to hold annual meetings of shareholders, and the Trusts currently do not intend to hold such meetings unless certain specified shareholder actions are required to be taken under the 1940 Act or a Trust’s charter documents. Any shareholder who wishes to submit proposals to be considered at a special meeting of a Fund’s shareholders should send such proposals to the Secretary of the relevant Fund at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354. Any shareholder proposal intended to be presented at any future meeting of a Fund’s shareholders must be received by such Fund at its principal office a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in the proxy statement relating to such meeting. Moreover, inclusion of any such proposals is subject to limitations under the federal securities laws. Persons named as proxies for any subsequent shareholders’ meeting will vote in their discretion with respect to proposals submitted on an untimely basis.

Shareholders who wish to send communications to the Board or the specific members of the Board should submit the communication in writing to the attention of the Secretary of the relevant Fund, at the address in the preceding paragraph, identifying the correspondence as intended for the Board of the Fund or a specified member of the Board. The Secretary will maintain a copy of any such communication and will promptly forward it to the Board or the specified member of the Board, as appropriate.

INFORMATION ABOUT THE MEETING

Record Date

Shareholders of record of the Funds as of the close of business on the Record Date are entitled to vote at the Meeting. Shareholders of the Funds on the Record Date will be entitled to one vote for each share and a fractional vote for each fractional share that they own. No shares have cumulative voting rights in the election of Trustees. The number of shares that you may vote is the total of the number shown on the proxy card/voting instruction form accompanying this Joint Proxy Statement. Appendix B sets forth the number of shares issued and outstanding for each class of each Fund as of the Record Date.

Revocation of Proxies

Any shareholder giving a proxy has the power to revoke it by mail (addressed to the Secretary at the principal executive office of the Trusts at the address shown at the beginning of this Joint Proxy Statement) or webcast at the Meeting, by executing a superseding proxy or by submitting a notice of revocation to the relevant Fund. A superseding proxy may also be executed by voting via telephone or Internet. The superseding proxy need not be voted using the same method (mail, telephone, or Internet) as the original proxy vote.

All properly executed and unrevoked proxies received in time for the Meeting will be voted as instructed by shareholders. If you execute your proxy but give no voting instructions, your shares that are represented by proxies will be voted “FOR” each Trustee Nominee and, in the proxies’ discretion, “FOR” or “AGAINST” any other business that may properly come before the Meeting.

Quorum, Voting and Adjournment

For each Trust, the presence at the Meeting, via webcast or by proxy, of one-third of the outstanding shares of such Trust entitled to vote, as of the Record Date, shall be necessary and sufficient to constitute a quorum for the transaction of business for that Trust or Fund.

18

In the event that a quorum is not present at the Meeting, or if there are insufficient votes to approve the Proposal by the time of the Meeting, the proxies, or their substitutes, or the chairman of the Meeting may propose that the Meeting be adjourned one or more times to permit further solicitation. Any adjournment by the shareholders requires the affirmative vote of a majority of the total number of shares that are present via webcast or by proxy when the adjournment is being voted on. If a quorum is present, the proxies will vote in favor of any such adjournment all shares that they are entitled to vote in favor of the Proposal and the proxies will vote against any such adjournment any shares for which they are directed to vote against the Proposal. The proxies will not vote any shares for which they are directed to abstain from voting on the Proposal.

Effect of Abstentions and Broker Non-Votes. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and broker “non-votes” (i.e., shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will be treated as shares that are present for purposes of determining a quorum. For purposes of determining the approval of the Proposal, abstentions and broker non-votes do not count as votes cast with respect to the Proposal. Accordingly, abstentions and broker non-votes will have no effect on Proposal.

Discretionary Voting

Broker-dealers that hold a Trust’s shares in “street name” for the benefit of their customers will request the instructions of such customers on how to vote their shares on the election of a Trustee Nominee. The Trusts understand that, under the rules of the New York Stock Exchange (“NYSE”), such broker-dealer firms may for certain “routine” matters, without instructions from their customers and clients, grant discretionary authority to the proxies designated by the Board to vote if no instructions have been received prior to the date specified in the broker-dealer firm’s request for voting instructions. The election of a Trustee is a “routine” matter and beneficial owners who do not provide proxy instructions or who do not return a proxy card/voting instruction form may have their shares voted by broker-dealer firms in favor of the Proposal. Broker-dealers who are not members of the NYSE may be subject to other rules, which may or may not permit them to vote your shares without instruction. We urge you to provide instructions to your broker or nominee so that your votes may be counted.

Solicitation of Proxies

The initial solicitation of proxies will be made by mail. Additional solicitations may be made by telephone, e-mail, or other personal contact by the Trusts’ officers or employees or representatives of DMC or one of its affiliates or by a proxy soliciting firm retained by the Trusts. DMC has retained Computershare as proxy solicitor to assist in the solicitation of proxy votes primarily by contacting shareholders by telephone and facsimile. The proxy solicitor’s services include proxy consulting, mailing, tabulation and solicitation services. The cost of retaining such proxy solicitor, including printing and mailing costs, is estimated to be approximately $3,500,000-$5,000,000, to be borne by the Trusts. Costs will vary depending on the number of solicitations made. The Trusts’ officers, and those employees and representatives of DMC or its affiliates who assist in the proxy solicitation, will not receive any additional or special compensation for any such efforts. In addition, the Trusts will request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of their shares held of record by such persons.

OTHER INFORMATION

Service Providers

Investment Adviser. DMC, located at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, serves as the current investment adviser to the Funds. DMC is a series of Macquarie Investment Management Business Trust (a Delaware statutory trust), which is a subsidiary of Macquarie Management Holdings, Inc. (“MMHI”). MMHI is a subsidiary, and subject to the ultimate control, of Macquarie Group Limited (“Macquarie”). Macquarie is a Sydney, Australia-headquartered global provider of banking, financial, advisory, investment and funds management services.

19

Distributor. Delaware Distributors, L.P. (“DDLP”), located at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, serves as the national distributor of the Funds’ shares.

Custodian. The Bank of New York Mellon (“BNY Mellon”), located at One Wall Street, New York, New York 10286, serves as the custodian for the Funds.

Fund Accountants. BNY Mellon also provides fund accounting and financial administration services to the Funds. Those services include performing functions related to calculating the Funds’ net asset values (“NAVs”) and providing financial reporting information, regulatory compliance testing and other related accounting services. For these services, the Funds pay BNY Mellon an asset-based fee, subject to certain fee minimums plus certain out-of-pocket expenses and transactional charges.

Delaware Investments Fund Services Company (“DIFSC” or “Transfer Agent”), located at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, provides fund accounting and financial administration oversight services to the Funds. Those services include overseeing the Funds’ pricing process, the calculation and payment of fund expenses, and financial reporting in shareholder reports, registration statements and other regulatory filings. DIFSC also manages the process for the payment of dividends and distributions, dissemination of Fund NAVs and performance data, and shareholder servicing.

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP (“PwC”) was selected as the Funds’ independent registered public accounting firm to audit the accounts of the Funds for their most recently completed fiscal years. Representatives of PwC are not expected to attend the Meeting. The Funds do not know of any direct or indirect financial interest of PwC in the Trusts.

Appendix G shows the fees billed by PwC for audit and other services provided to the Trusts for the fiscal years indicated.

Shareholder Reports

Copies of each Trust’s Annual Report for the most recently completed fiscal year previously have been mailed or made available to shareholders. This Joint Proxy Statement should be read in conjunction with each Annual Report. You can obtain copies of the Annual Reports, without charge, by writing to the respective Trust or to DDLP at 100 Independence, 610 Market Street, Philadelphia, PA 19106-2354, or by calling 800-523-1918. You should receive the reports within three business days of your request. Copies of these reports are also available free of charge at www.delawarefunds.com.

Householding