|

Statement Regarding Basis for Approval of Investment Advisory Contract (Unaudited) |

The Investment Company Act of 1940 (the “1940 Act”) requires that the full board of the Shelton Funds (the “Board”) and a majority of the Independent Trustees annually approve the continuation of:

•the Investment Advisory Agreement dated January 1, 2007, as amended, between the Shelton Funds, on behalf of the funds listed below, and CCM Partners d/b/a Shelton Capital Management (“SCM” or “Shelton Capital”) (the “Shelton Advisory Agreement (Main)”);

•Green California Tax Free Income Fund;

•Nasdaq-100 Index Fund;

•S&P 500 Index Fund;

•S&P MidCap Index Fund;

•S&P SmallCap Index Fund;

•Shelton Equity Income Fund;

•U.S. Government Securities Fund; and

•The United States Treasury Trust;

and

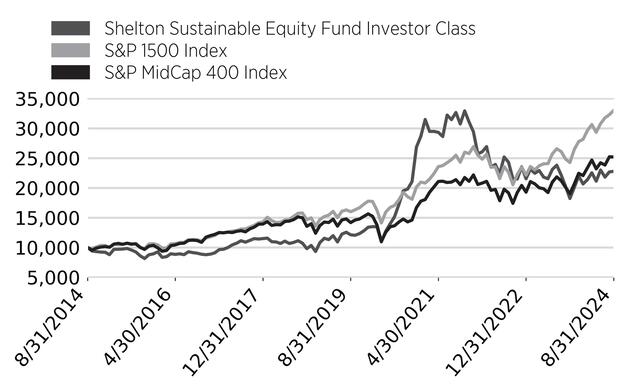

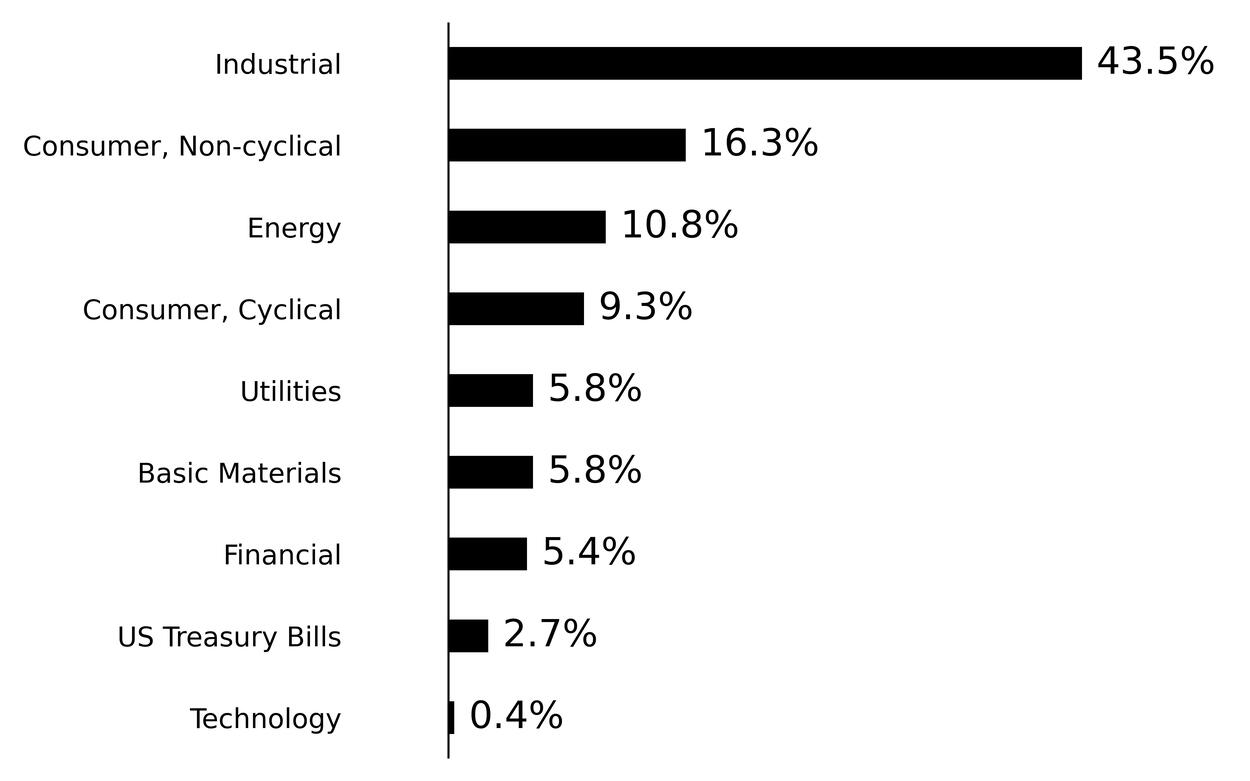

•the Investment Advisory Agreement, effective as of March 8, 2013, between Shelton Funds, on behalf of the Shelton Sustainable Equity Fund, and SCM (the “Sustainable Equity Fund Advisory Agreement,” and together with the Shelton Advisory Agreement (Main), the “Advisory Agreements”).

At a meeting held on March 7-8, 2024, the Board, including a majority of the Independent Trustees, considered and approved the continuation of each Advisory Agreement for the maximum period allowed under the 1940 Act.

Prior to the Meeting, the Independent Trustees requested information from SCM and third-party sources. This information, together with other information provided by SCM, and the information provided to the Independent Trustees throughout the course of the year, formed the primary (but not exclusive) basis for the Board’s determinations, as summarized below. In addition to the information identified above, other material factors and conclusions that formed the basis for the Board’s subsequent approval are described below.

Information Received

Materials Received. During the course of each year, the Independent Trustees receive a wide variety of materials relating to the services provided by Shelton Capital, including reports on each applicable Fund’s investment results; portfolio composition; third party fund rankings; investment strategy; portfolio trading practices; shareholder services; compliance; and other information relating to the nature, extent and quality of services provided by Shelton Capital to the Funds. In addition, the Board requests and reviews supplementary information that includes materials regarding each Fund’s investment results, advisory fee and expense comparisons, the costs of operating the Funds and financial and profitability information regarding Shelton Capital, descriptions of various functions such as compliance monitoring and portfolio trading practices, and information about the personnel providing investment management services to each Fund.

Review Process. The Board received assistance and advice regarding legal and industry standards from independent legal counsel to the Independent Trustees and fund counsel. The Board discussed the renewal of the Shelton Funds Advisory Agreements with Shelton Capital representatives, and in a private session with independent legal counsel at which representatives of Shelton Capital were not present. In deciding to approve the renewal of the Shelton Funds Advisory Agreements, the Independent Trustees considered the total mix of information requested by and made available to them and did not identify any single issue or particular information that, in isolation, was the controlling factor. This summary describes the most important, but not all, of the factors considered by the Board.

Nature, Extent and Quality of Services

SCM, its personnel and its resources. The Board considered the depth and quality of Shelton Capital’s investment management process; the experience, capability and integrity of its senior management and other personnel; operating performance; and the overall financial strength and stability of its organization. The Board also considered that Shelton Capital made available to its investment professionals a variety of resources relating to investment management, compliance, trading, performance and portfolio accounting. The Board further considered Shelton Capital’s continuing need to attract and retain qualified personnel and determined that Shelton Capital was adequately managing matters related to the Funds.

Other Services. The Board considered, in connection with the performance of its investment management services to the Funds: Shelton Capital’s policies, procedures and systems to ensure compliance with applicable laws and regulations and its commitment to these programs; Shelton Capital’s efforts to keep the Trustees informed; and its attention to matters that may involve conflicts of interest with the Funds. The Board also considered the nature, extent, quality and cost of certain non-investment related administrative services provided by Shelton Capital to the Funds under the administration servicing agreements.

The Board concluded that Shelton Capital had the quality and depth of personnel and investment methods necessary to performing its duties under the Shelton Funds Advisory Agreements, and that the nature, extent and overall quality of such services provided by Shelton Capital were satisfactory and reliable.

Investment Performance

The Board considered each Fund’s investment results in comparison to its stated investment objectives. The Trustees also reviewed performance rankings for each Fund as provided by an independent third-party service provider. In assessing performance of the Index Funds, the Trustees took into consideration the fact that Fund performance is expected to mirror the appropriate benchmarks as closely as possible given certain practical constraints imposed by the 1940 Act, the Fund’s investment restrictions, the Fund’s size, and similar factors. The Trustees also considered supplemental peer category performance information provided by the Adviser. Among the factors considered in this regard, were the following for the periods ended December 31, 2023:

•For the Green California Tax-Free Income Fund, it was noted that the Fund was in the second to lowest performing quartile over the 3-year period and the lowest performing quartile over the 1-year, 5-year, and 10-year periods.

•For the Nasdaq-100 Index Fund, it was noted that the performance of the Fund was in the highest performing quartile relative to its peer category over the 1-year, 3-year, 5-year and 10-year periods.

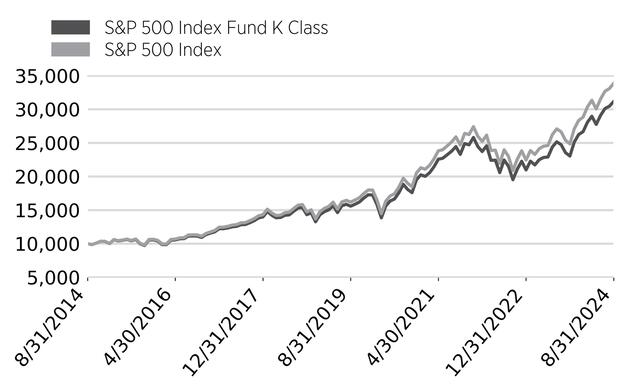

•For the S&P 500 Index Fund, it was noted that the performance of the Fund relative to its peer category was in the highest performing quartile over the 10-year period, and the second highest performing quartile over the 1-year, 3-year, and 5-year.

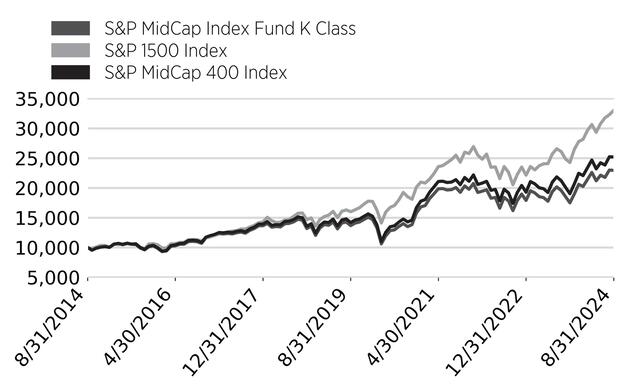

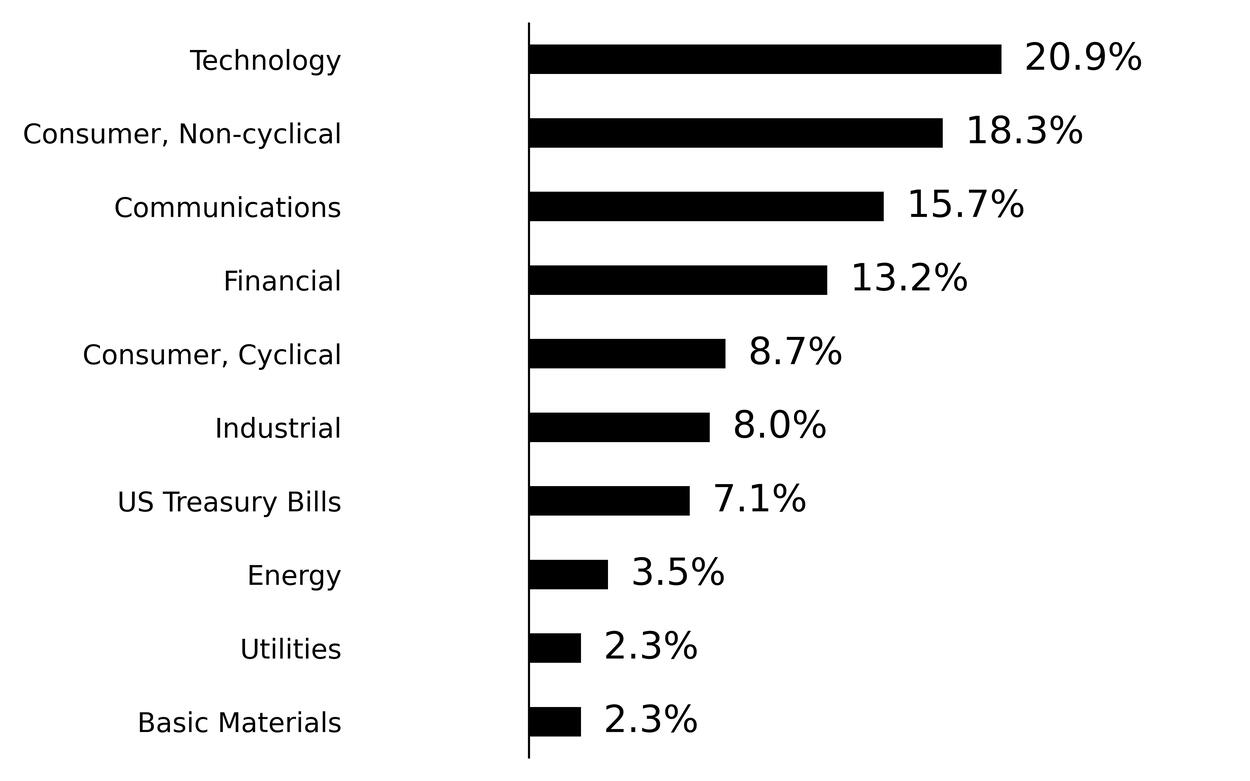

•For the S&P MidCap Index Fund, it was noted that the performance of the Fund relative to its peer category was in the second highest performing quartile over the 3-year and 10-year periods, and the second lowest performing quartile for the 1-year and 5-year periods.