- PDCE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

PDC Energy (PDCE) DEF 14ADefinitive proxy

Filed: 12 Apr 23, 4:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| |

Filed by the Registrant ☒ | |

| |

Filed by a Party other than the Registrant ☐ | |

| |

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

| | |

PDC ENERGY, INC. | ||

(Name of Registrant as Specified In Its Charter) | ||

| ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| ||

Payment of Filing Fee (Check all boxes that apply): | ||

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| | |

PDC ENERGY, INC.

1099 18th Street, Suite 1500

Denver, Colorado 80202

(303) 860-5800

April 12, 2023

Dear Stockholder of PDC Energy, Inc.:

You are cordially invited to attend the 2023 Annual Stockholders’ Meeting of PDC Energy, Inc. to be held via virtual web conference at www.virtualshareholdermeeting.com/PDCE2023 on May 24, 2023, at 1:00 p.m. Mountain Time (the “Annual Meeting”).

The accompanying Notice of Annual Meeting and Proxy Statement provide information concerning the matters to be considered at the Annual Meeting. The Annual Meeting will cover only the business contained in the Proxy Statement.

We hope you will join us at the Annual Meeting online. Your vote is important this year regardless of the number of shares you own. We value your opinion and encourage you to participate by voting your proxy card. Whether or not you plan to virtually attend, it is important that your shares be represented at the Annual Meeting. You may vote your shares by using the telephone or Internet voting options described in the attached Notice of Annual Meeting and proxy card. If you receive a proxy card by mail, you may cast your vote by completing, signing and returning it promptly. This will ensure that your shares are represented at the Annual Meeting even if you are unable to virtually attend.

| |

| Sincerely, |

|

|

| Barton R. Brookman |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

Wednesday, May 24, 2023

April 12, 2023

To the stockholders of PDC Energy, Inc.:

The 2023 Annual Meeting of PDC Energy, Inc. (the “Company”) will be held via the Internet through a virtual web conference at www.virtualshareholdermeeting.com/PDCE2023 on May 24, 2023, at 1:00 p.m. Mountain Time. You will be able to attend the Annual Meeting online by visiting the website above, and, prior to the Annual meeting, you may submit questions to be answered at the Annual Meeting. You will also be able to vote your shares electronically at the Annual Meeting. The Annual Meeting will be held online only, and will be held for the following purposes:

| ● | To elect the seven Directors nominated by the Board and identified in the accompanying proxy statement, each for a term of one year (Proposal No. 1); |

| ● | To approve, on an advisory basis, the compensation of the Company’s Named Executive Officers (Proposal No. 2); |

| ● | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal No. 3); |

| ● | To conduct an advisory vote on the frequency (every one, two or three years) of future advisory votes on the compensation of the Company’s Named Executive Officers (Proposal No. 4); and |

| ● | To transact any other business that may properly come before the meeting and at any and all adjournments or postponements thereof. |

The Board has fixed the close of business on March 29, 2023, as the record date for determining the stockholders having the right to receive notice of, to virtually attend and to vote at the Annual Meeting or any adjournment or postponement thereof. A list of these stockholders will be open for examination by any stockholder for any purpose germane to the Annual Meeting for a period of 10 days prior to the Annual Meeting at our principal executive offices at 1099 18th Street, Suite 1500, Denver, CO 80202, and electronically during the Annual Meeting at www.virtualshareholdermeeting.com/PDCE2023 when you enter your control number. The presence virtually or by proxy of the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote is required to constitute a quorum.

If you are a record holder of shares, or an owner who owns shares in “street name” and obtains a “legal” proxy from your broker, bank, trustee or nominee, you may attend the Annual Meeting and vote your shares or revoke your prior voting instructions.

Regardless of the number of shares of our common stock that you own, your vote at this Annual Meeting will be very important. Thank you for your continued support, interest and investment in the Company.

| |

| By Order of the Board of Directors, |

|

|

| |

| Nicole L. Martinet |

PDC ENERGY, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To be held on May 24, 2023

The accompanying proxy is being solicited by the Board of Directors (“Board”) of PDC Energy, Inc. (“PDC,” the “Company,” “we,” “us” or “our”) to be voted at the annual meeting of the stockholders of the Company (the “Annual Meeting”) to be held on May 24, 2023, at 1:00 p.m. Mountain Time and at any and all adjournments or postponements of the Annual Meeting, for the purposes set forth in this Proxy Statement and the accompanying Notice of Annual Meeting. On or about April 12, 2023, we began mailing proxy materials to stockholders. For information on how to vote your shares, see the instructions included on the proxy card or instruction form described under “Information About Voting and the Meeting” herein.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITYOF PROXY MATERIALS

FOR THE ANNUAL MEETING TO BE HELD ON MAY 24, 2023

The Notice of Annual Meeting, the Proxy Statement for the 2023 Annual Meeting, and the 2022 Annual Report, which is the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are available at www.proxyvote.com.

Virtual Meeting Admission

Stockholders of record as of March 29, 2023, will be able to participate in the Annual Meeting by visiting our Annual Meeting website at www.virtualshareholdermeeting.com/PDCE2023. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

The Annual Meeting will begin promptly at 1:00 p.m. Mountain Time on Wednesday, May 24, 2023. Online check-in will begin at 12:45 p.m. Mountain Time, and you should allow approximately 15 minutes for the online check-in procedures.

Voting

Whether or not you plan to virtually attend the Annual Meeting and regardless of the number of shares that you own, please cast your vote, at your earliest convenience, as instructed in the proxy card. Your vote is very important. Your vote before the Annual Meeting will ensure representation of your shares at the Annual Meeting even if you are unable to virtually attend. You may submit your vote by the Internet, telephone, mail or during the virtual Annual Meeting. Voting over the Internet or by telephone is fast and convenient, and your vote is immediately confirmed and tabulated. By using the Internet or telephone, you help us reduce postage, printing and proxy tabulation costs. We encourage all holders of record to vote in accordance with the instructions on the proxy card and/or voting instruction form prior to the Annual Meeting even if they plan on virtually attending the Annual Meeting. Submitting a vote before the Annual Meeting will not preclude you from voting your shares at the Annual Meeting should you decide to virtually attend.

TABLE OF CONTENTS

| |

| |

1 | |

2 | |

2 | |

3 | |

Name, Principal Occupation for Past Five Years and Other Directorships | 4 |

11 | |

11 | |

11 | |

12 | |

Director Stock Ownership Requirements and Prohibition on Certain Transactions | 12 |

12 | |

13 | |

13 | |

14 | |

14 | |

14 | |

15 | |

16 | |

16 | |

17 | |

17 | |

17 | |

17 | |

18 | |

23 | |

24 | |

24 | |

24 | |

25 | |

25 | |

25 | |

25 | |

Policies and Procedures with Respect to Transactions with Related Parties | 26 |

26 | |

26 | |

26 | |

26 | |

27 | |

27 | |

28 | |

29 | |

32 | |

33 | |

33 | |

36 | |

37 | |

40 | |

45 | |

48 | |

49 |

ACRONYMS AND ABBREVIATIONS USED IN THIS PROXY

The following acronyms and abbreviations used in this Proxy Statement have the meanings set forth below:

“Adjusted FCF” means adjusted free cash flow for the relevant year.

“CD&A” means Compensation Discussion & Analysis

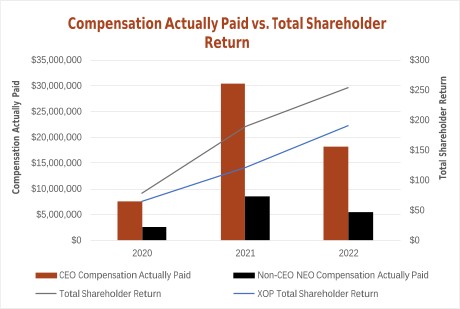

“CEO CAP” means compensation actually paid to the Company’s CEO for the relevant year.

“CEO” means Chief Executive Officer.

“CFO” means Chief Financial Officer.

“CRED” means Coloradoans for Responsible Energy Development.

“CROCI” means cash return on capital invested.

“CSR” means corporate social responsibility.

“DE&I” means diversity, equity, and inclusion.

“DJ Basin” means the Denver-Julesburg Basin.

“EHS” means environmental, health and safety.

“ESG&N Committee” meant the Company’s Environmental, Social, Governance and Nominating Committee.

“ESG” means environmental, social and governance.

“FCF” means adjusted free cash flow.

“G&A” means general and administrative expense.

“GAAP” means generally accepted accounting principles in the United States.

“GHG” means greenhouse gas.

“LOE” means lease operating expense.

“NEOs” means the Company’s Named Executive Officers.

“Non-CEO NEO CAP” means the average compensation actually paid to the Company’s non-CEO NEOs for the relevant year.

“NYSE” means the New York Stock Exchange.

“OGDP” means oil and gas development plan.

“OGMP 2.0” means Oil and Gas Methane Partnership.

“P&R” means plug and reclaim.

“PAC” means political action committee.

“PCAOB” means the Public Company Accounting Oversight Board (United States).

“PDC” means PDC Energy, Inc.

“PSU” means performance share unit.

“PVAR” means preventable vehicle accident rate.

“PwC” means PricewaterhouseCoopers LLP.

“RSU” means restricted stock unit.

“S&P 400 Index” means Standard & Poor’s Mid-Cap 400 index.

“SASB” means Sustainability Accounting Standards Board.

“SEC” means the United States Securities and Exchange Commission.

“SMT” means the Company’s Senior Management Team.

“SVP” means senior vice president.

“TCFD” means Taskforce on Climate-Related Financial Disclosure.

“TRIR” means total recordable injury rate.

“TSR” means total shareholder return.

“U.S.” means the United States of America.

“VOC” means volatile organic compounds.

“XOP” means State Street Global Advisors’ SDPR Oil & Gas Exploration & Production ETF.

PDC ENERGY, INC. - PROXY STATEMENT

PROXY STATEMENT SUMMARY

This Proxy Statement Summary highlights information contained elsewhere in this document.

Please read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

|

|

|

TIME AND DATE | PLACE | RECORD DATE |

1:00 p.m. Mountain Time On Wednesday, May 24, 2023 | Virtually at www.virtualshareholdermeeting.com/ | March 29, 2023 |

VOTING

Stockholders as of the record date are entitled to vote. To vote via the Internet, by telephone, mail or virtually at the Annual Meeting, please refer to the instructions on your proxy card in the postage paid envelope provided.

Voting Matters

| | | | BOARD |

1 |

| PROPOSAL 1 Election of Seven Directors Elect seven Directors nominated by the Board, each for a term of one year. |

| FOR |

| | | | |

2 | | PROPOSAL 2 Approve Executive Officer Compensation To approve, on an advisory basis, the compensation of the Company’s Named Executive Officers. | | FOR |

| | | | |

3 | | PROPOSAL 3 Ratify the Appointment of PricewaterhouseCoopers LLP To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. | | FOR |

| | | | |

4 | | PROPOSAL 4 Approve Frequency of Future Compensation Votes To approve, on an advisory basis, the frequency (every one, two or three years) of future advisory votes on the compensation of the Company’s Named Executive Officers. | | Every One |

| PDC ENERGY | 1 |

PDC ENERGY, INC. - PROXY STATEMENT

PROPOSAL NO. 1—ELECTION OF Seven DIRECTORS

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE seven DIRECTORS NOMINATED BY THE BOARD. PROPERLY SUBMITTED PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY A CONTRARY VOTE.

You are asked to consider seven nominees for election to the Board. Each nominee would serve for a one-year term until the 2024 annual meeting of the stockholders of the Company and until his or her successor is duly elected and qualified.

The appointed proxies will vote your shares in accordance with your instructions on the proxy card and for the election of all of the Director nominees unless you withhold your authority to vote for one or more of them. The Board does not contemplate that any of the Director nominees will become unavailable for any reason; however, if any Director nominee is unable to stand for election, the Board may reduce the size of the Board or select a substitute. Your proxy cannot be voted for a person who is not named in this Proxy Statement as a candidate for Director or for a greater number of persons than the number of Director nominees named. The Directors will be elected by an affirmative vote of a plurality of the outstanding common shares. “Withhold votes” and broker non-votes will have no effect on the election of Directors.

BOARD OF DIRECTORS

As of the Annual Meeting, the composition of the Board is expected to be as follows:

| | | |

|

| YEAR THE |

|

| | DIRECTOR JOINED | |

DIRECTORS | | THE BOARD | |

Barton R. Brookman |

| 2015 |

|

Pamela R. Butcher | | 2022 | |

Mark E. Ellis |

| 2017 |

|

Paul J. Korus | | 2020 | |

Lynn A. Peterson | | 2020 | |

Carlos A. Sabater | | 2021 | |

Diana L. Sands | | 2021 | |

All of the Director nominees will be standing for election to serve a one-year term (the Company does not have a staggered Board; all of the Company’s Directors serve one-year terms and stand for election on an annual basis). The Board, based on the recommendation of the Environmental, Social, Governance and Nominating Committee (the “ESG&N Committee”), has recommended Mr. Brookman, Ms. Butcher, Mr. Ellis, Mr. Korus, Mr. Peterson, Mr. Sabater and Ms. Sands for re-election. All of the Director nominees are current members of the Board.

PDC ENERGY, INC. - PROXY STATEMENT

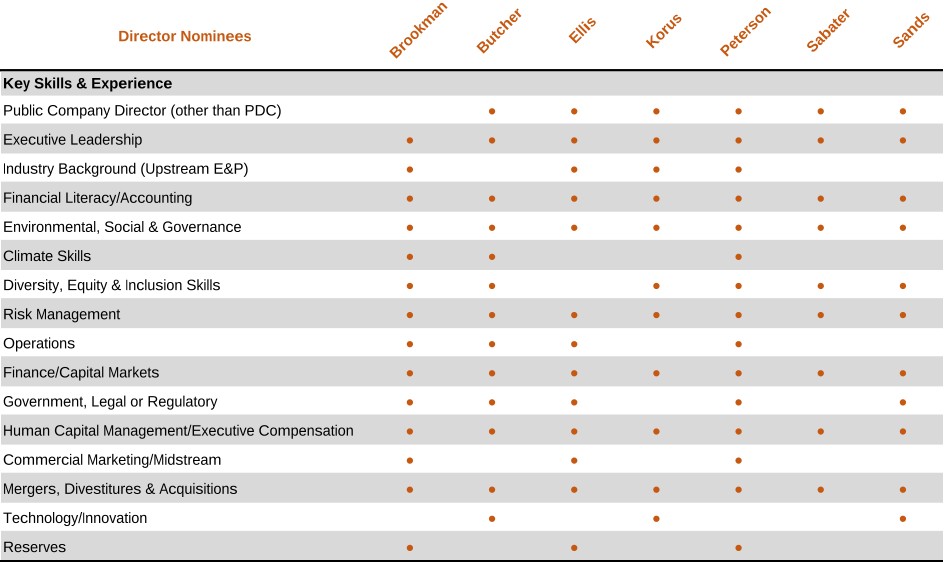

Summary of Director Nominee Qualifications and Diversity

Our Director nominees have a broad diversity of experience and a wide variety of qualifications, skills, and diverse characteristics that strengthen their ability to carry out their oversight role on behalf of our stockholders. The following matrices highlight key skills, qualifications, and diverse characteristics our Director nominees bring to the Board. More details on each Director nominee’s qualifications, skills and expertise are included in the Director nominee biographies on the following pages.

Director Skills Matrix

Director Diversity Matrix

| ||||

Total Number of Directors | 7 | |||

Female | Male | Non-Binary | Did Not Disclose | |

Part I: Gender Identity | ||||

Directors | 2 | 5 | 0 | 0 |

Part II: Demographic Background | ||||

African American or Black | 0 | 0 | 0 | 0 |

Alaskan Native or Native American | 0 | 0 | 0 | 0 |

Asian | 1 | 0 | 0 | 0 |

Hispanic or Latinx | 0 | 1 | 0 | 0 |

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

White | 1 | 4 | 0 | 0 |

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

LGBTQ+ | 0 | |||

Did Not Disclose Demographic Background | 0 | |||

PDC ENERGY, INC. - PROXY STATEMENT

NAME, PRINCIPAL OCCUPATION FOR PAST FIVE YEARS AND OTHER DIRECTORSHIPS

BARTON R. BROOKMAN DIRECTOR President and Age: 60 Committees: • None |

| Background Mr. Brookman, the Company’s President and Chief Executive Officer (“CEO”), joined the Board in January 2015, simultaneously with his appointment as the Company’s CEO. Mr. Brookman joined the Company in July 2005 as Senior Vice President—Exploration and Production; he was appointed to the position of Executive Vice President and Chief Operating Officer in June 2013 and then served as President and Chief Operating Officer from June 2014 through December 2014. Prior to joining PDC, Mr. Brookman worked for Patina Oil and Gas and its predecessor Snyder Oil from 1988 until 2005 in a series of operational and technical positions of increasing responsibility, ending his service at Patina as Vice President of Operations. Education B.S. in Petroleum Engineering from the Colorado School of Mines M.S. in Finance from the University of Colorado Experience The Board has concluded that in addition to his role as CEO of the Company, Mr. Brookman is qualified to serve as a Director due to, among other things, his many years of oil and gas industry executive management experience, his active involvement in industry groups and his knowledge of current developments and best practices in the industry. Skills | |

| | ● Executive Leadership ● Industry Background (Upstream E&P) ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Climate Skills ● Diversity, Equity & Inclusion Skills ● Risk Management | ● Operations ● Finance/Capital Markets ● Government, Legal or Regulatory ● Human Capital Management/Executive Compensation ● Commercial Marketing/Midstream ● Mergers, Divestitures & Acquisitions ● Reserves |

4 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

55 Audit | | Reporting to Boeing’s CEO and the audit committee, Ms. Sands oversaw a diverse team including corporate audit, ethics and investigations, compliance risk management, security, and internal services. During her 20-year career at Boeing, Ms. Sands served in several financial and governance roles with increasing responsibility, including Director of Corporate Treasury, Vice President Investor Relations, Financial Planning & Analysis, and Corporate Controller. Prior to Boeing, Ms. Sands served in finance roles at General Motors Corporation and Ameritech Communications, Inc., among others. Ms. Sands currently serves on the boards of SP Plus Corporation and National Philanthropic Trust, and is Chair for Start Early, a non-profit champion for quality early learning. Business Administration from University of Michigan and an M.B.A. from the Kellogg School of Management at Northwestern University. | |

Pamela R. Butcher DIRECTOR Age: 65 Committees: • Compensation • Environmental, Social, Governance and Nominating | | Background Ms. Butcher joined the Board in February of 2022. She serves as an independent director on the Boards of Pilot Chemical Corp. and J.M. Huber Corporation, serving also on J.M. Huber Corporation’s Corporate Governance and Nominating and Compensation Committee and the Human Capital Committees of J.M. Huber Corporation and Pilot Chemical Corp. Ms. Butcher previously served as a director of Trecora Resources from November 2016 until its acquisition by Balmoral Funds, LLC in June 2022, and as a director of Gruden Topco Holdings, LP/Quality Distribution, Inc. From 2010 to 2021, she served as President and COO, then CEO and President, of Pilot Chemical Corp., delivering significant revenue and profit growth along with five accretive acquisitions. Prior to joining Pilot, she worked 29 years for The Dow Chemical Company (now Dow Inc.) where she held a variety of executive leadership positions including Business Vice President of Specialty Chemicals, Vice President of Corporate Marketing and Sales and Vice President and General Manager of Adhesives and Sealants. She was a distinguished recipient of Dow's Genesis Award for people excellence, which is Dow's highest recognition for people leadership. Previously, she also served on the board of trustees for the Chemical Educational Foundation, as a member of the US Bank Advisory Group and on the Boards of the American Cleaning Institute, the Ohio Manufacturers' Association and numerous community organizations. Education Bachelor’s in Agronomy from Purdue University Master of Science from Purdue University Experience The Board has concluded that Ms. Butcher is qualified to serve as a Director because of, among other things, her extensive public and private company executive, leadership, and board experience. Skills | |

| | ● Public Company Director (other than PDC) ● Executive Leadership ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Climate Skills ● Diversity, Equity & Inclusion Skills ● Risk Management | ● Operations ● Finance/Capital Markets ● Government, Legal or Regulatory ● Human Capital Management/Executive Compensation ● Mergers, Divestitures & Acquisitions ● Technology/Innovation |

| | |

| PDC ENERGY | 5 |

PDC ENERGY, INC. - PROXY STATEMENT

MARK E. ELLIS DIRECTOR (Non-Executive Chairman) Age: 66 Committees: • Compensation |

| Background Mr. Ellis joined the Board in August 2017 and was appointed Non-Executive Chairman of the Board in February 2020. He served as a director and President and Chief Executive Officer of Linn Energy, Inc., the reorganized successor to Linn Energy, LLC (“LINN”), which filed for bankruptcy in the federal bankruptcy court, Southern District of Texas, in May 2016. From January 2010 until his retirement from LINN in August 2018, Mr. Ellis was the President and Chief Executive Officer and a director of LINN. From 2012 until August 2018, Mr. Ellis also served as Chairman of LINN’s board of directors. Prior to joining LINN in 2006, Mr. Ellis served in varying roles of increasing responsibility for Burlington Resources and ConocoPhillips. Education B.S. in Petroleum Engineering from Texas A&M University Experience The Board has concluded that Mr. Ellis is qualified to serve as a Director because his service as the chief executive officer and director of another public energy company provides extensive oil and gas industry knowledge and executive management experience. Skills | |

| | ● Public Company Director (other than PDC) ● Executive Leadership ● Industry Background (Upstream E&P) ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Risk Management ● Operations | ● Finance/Capital Markets ● Government, Legal or Regulatory ● Human Capital Management/Executive Compensation ● Commercial Marketing/Midstream ● Mergers, Divestitures & Acquisitions ● Reserves |

6 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

55 Audit | | Reporting to Boeing’s CEO and the audit committee, Ms. Sands oversaw a diverse team including corporate audit, ethics and investigations, compliance risk management, security, and internal services. During her 20-year career at Boeing, Ms. Sands served in several financial and governance roles with increasing responsibility, including Director of Corporate Treasury, Vice President Investor Relations, Financial Planning & Analysis, and Corporate Controller. Prior to Boeing, Ms. Sands served in finance roles at General Motors Corporation and Ameritech Communications, Inc., among others. Ms. Sands currently serves on the boards of SP Plus Corporation and National Philanthropic Trust, and is Chair for Start Early, a non-profit champion for quality early learning. Business Administration from University of Michigan and an M.B.A. from the Kellogg School of Management at Northwestern University. | |

PAUL J. KORUS DIRECTOR Age: 66 Committees: • Audit (Chair) • Environmental, Social, Governance and Nominating | | Background Mr. Korus joined the Board in January 2020 in connection with the closing of the Company’s merger with SRC Energy Inc. (“SRC”). He has served as a Director of Chord Energy Corporation (“Chord”) since July 2022. Prior to that, Mr. Korus served as a director of Whiting Petroleum Corporation until its merger with Oasis Petroleum, Inc. in July 2022, forming Chord. He also formerly served as a director of Crestwood Equity Partners LP from July to September 2022, a director of SRC from June 2016 until January 2020, a director of Antero Midstream Partners LP from January until March 2019, and a director of Antero Resources Corporation from December 2018 to June 2021. Mr. Korus was previously the Senior Vice President and Chief Financial Officer of Cimarex Energy Co. from September 2002 until his retirement in 2015, and held the same positions with its predecessor, Key Production Company, from 1999 through 2002. His previous experience also includes approximately five years as an oil and gas research analyst at an investment banking firm. He began his oil and gas career in 1982 with APA Corporation where he held positions in corporate planning, information technology and investor relations. Mr. Korus is a former CPA and is a member of the University of North Dakota Accounting Hall of Fame. From 2011 to 2019, Mr. Korus served on the UND College of Business and Public Administration Alumni Advisory Council and was its chairperson from 2017 to 2019. He is also a member of UND’s Strategic Planning and Campaign Committees. Education B.S. in Economics from the University of North Dakota M.S. in Accounting from the University of North Dakota Experience The Board has concluded that Mr. Korus is qualified to serve as a Director because of his service as an officer and director of other public energy companies, providing for extensive oil and gas industry executive and board experience. He also brings strong financial and accounting expertise based on his experience as a former chief financial officer of a public company. Skills | |

| | ● Public Company Director (other than PDC) ● Executive Leadership ● Industry Background (Upstream E&P) ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Diversity, Equity & Inclusion Skills | ● Risk Management ● Finance/Capital Markets ● Human Capital Management/Executive Compensation ● Mergers, Divestitures & Acquisitions ● Technology/Innovation |

| | |

| PDC ENERGY | 7 |

PDC ENERGY, INC. - PROXY STATEMENT

55 Audit | | Reporting to Boeing’s CEO and the audit committee, Ms. Sands oversaw a diverse team including corporate audit, ethics and investigations, compliance risk management, security, and internal services. During her 20-year career at Boeing, Ms. Sands served in several financial and governance roles with increasing responsibility, including Director of Corporate Treasury, Vice President Investor Relations, Financial Planning & Analysis, and Corporate Controller. Prior to Boeing, Ms. Sands served in finance roles at General Motors Corporation and Ameritech Communications, Inc., among others. Ms. Sands currently serves on the boards of SP Plus Corporation and National Philanthropic Trust, and is Chair for Start Early, a non-profit champion for quality early learning. Business Administration from University of Michigan and an M.B.A. from the Kellogg School of Management at Northwestern University. | |

LYNN A. PETERSON(1) DIRECTOR Age: 70 Committees: • None | | Background Mr. Peterson joined the Board in January 2020 in connection with the closing of the Company’s merger with SRC. Mr. Peterson was appointed Executive Chair of Chord in July 2022 upon the closing of the merger between Whiting Petroleum Corporation (“Whiting”) and Oasis Petroleum Inc. Mr. Peterson has been a member of the board of directors of Denbury Resources Inc. since May 2017. He was Chief Executive Officer of Whiting from October 2020 until July 2022. He was the Chairman of the Board, Chief Executive Officer and President of SRC from May 2015 until January 2020. He was a co-founder of Kodiak Oil & Gas Corporation (“Kodiak”), and served on Kodiak’s board from 2001-2014 and as its President and Chief Executive Officer from 2002-2014. Mr. Peterson has over 40 years of industry experience. Education B.S. in Accounting from University of Northern Colorado Experience The Board has concluded that Mr. Peterson is qualified to serve as a Director because of his extensive oil and gas industry and leadership experience. Mr. Peterson’s experience as a chief executive officer and service as director of other public energy companies provide valuable understanding of management processes and strategy of oil and gas companies. Skills | |

| | ● Public Company Director (other than PDC) ● Executive Leadership ● Industry Background (Upstream E&P) ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Climate Skills ● Diversity, Equity & Inclusion Skills ● Risk Management | ● Operations ● Finance/Capital Markets ● Government, Legal or Regulatory ● Human Capital Management/Executive Compensation ● Commercial Marketing/Midstream ● Mergers, Divestitures & Acquisitions ● Reserves |

(1)Director Overboarding. Mr. Peterson currently serves as Executive Chair of Chord Energy (NASDAQ: CHRD), and also as an outside director on each of the Boards of PDC and Denbury Resources Inc. (NYSE: DEN), for a total of three total public company boards. PDC routinely evaluates any potential conflicts of interests of our Board members, including employment and other directorships, and has determined that no conflicts exist with respect to Mr. Peterson’s positions with PDC, Chord and Denbury. Mr. Peterson is also in compliance with PDC’s internal over-boarding policy (no more than two public company boards beyond PDC). While Mr. Peterson serves as Executive Chair of Chord, he is not involved in the day-to-day aspects of the business, and instead provides a high level oversight role to the CEO and management team as needed. For PDC, Mr. Peterson is a highly engaged and committed Board member and actively participates in all PDC Board matters and brings valuable experience to the Board.

8 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

| | ● ● ● ● ● ● ● | ● ● ● ● ● ● |

CARLOS A. SABATER DIRECTOR Age: 64 Committees: • Audit | | Background Mr. Sabater joined the Board in May 2021. He is an accomplished global business executive and certified public accountant with nearly 40 years of leadership, corporate governance, accounting and financial reporting experience. Mr. Sabater also serves on the boards of KBR, Inc., where he is a member of the Audit Committee and Nominating and Corporate Governance Committee, and Pool Corporation, where he is a member of the Audit and Compensation Committees. During his extensive career at Deloitte Touche Tohmatsu Limited (“Deloitte”), he served in various senior leadership and operational roles, including CEO for both the U.S. and global audit practices and was the managing partner for all of Deloitte’s businesses across North and South America. Mr. Sabater led various risk, governance, audit, finance, compensation and global committees during his service as an elected board member for the Deloitte firms in the U.S., Mexico, Central and Latin America, the Caribbean and Bermuda. Mr. Sabater was born in Cuba, having immigrated to the U.S. as a child, and is fluent in Spanish. Education B.B.A. in Accounting and Finance from Florida International University Experience The Board has concluded that Mr. Sabater is qualified to serve as a Director because of, among other things, his extensive leadership, executive and board service and experience in audit, finance, risk and governance matters for public companies. Skills | |

| | ● Public Company Director (other than PDC) ● Executive Leadership ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Diversity, Equity & Inclusion Skills | ● Risk Management ● Finance/Capital Markets ● Human Capital Management/Executive Compensation ● Mergers, Divestitures & Acquisitions |

| | |

| PDC ENERGY | 9 |

PDC ENERGY, INC. - PROXY STATEMENT

55 | | Reporting to Boeing’s CEO and the audit committee, Ms. Sands oversaw a diverse team including corporate audit, ethics and investigations, compliance risk management, security, and internal services. During her 20-year career at Boeing, Ms. Sands served in several financial and governance roles with increasing responsibility, including Director of Corporate Treasury, Vice President Investor Relations, Financial Planning & Analysis, and Corporate Controller. Prior to Boeing, Ms. Sands served in finance roles at General Motors Corporation and Ameritech Communications, Inc., among others. Ms. Sands currently serves on the boards of SP Plus Corporation and National Philanthropic Trust, and is Chair for Start Early, a non-profit champion for quality early learning. Business Administration from University of Michigan and an M.B.A. from the Kellogg School of Management at Northwestern University. | |

DIANA L. SANDS DIRECTOR Age: 57 Committees: • Audit |

| Background Ms. Sands joined the Board in February 2021. She brings over 30 years of business experience across multiple industries and disciplines. Ms. Sands currently serves on the boards of SP Plus Corporation and VMO Aircraft Leasing. She retired in 2020 from the Boeing Company (“Boeing”) as Executive Officer and Senior Vice President, Office of Internal Governance and Administration, a role she held beginning in 2016. Reporting to Boeing’s CEO and the audit committee, Ms. Sands oversaw a diverse team including corporate audit, ethics and investigations, compliance risk management, security, and internal services. During her nearly 20-year career at Boeing, Ms. Sands served in several financial and governance roles with increasing responsibility, including Director of Corporate Treasury, Vice President Investor Relations, Financial Planning & Analysis, and Corporate Controller. Prior to Boeing, she served in finance roles at General Motors Corporation and Ameritech Communications, Inc., among others. Ms. Sands is dedicated to philanthropic efforts and currently serves on the board of National Philanthropic Trust, and is Chair of Start Early, a non-profit champion for quality early learning. Education Bachelor of Business Administration from University of Michigan M.B.A. from the Kellogg School of Management at Northwestern University Experience The Board has concluded that Ms. Sands is qualified to serve as a Director because, among other things, she has extensive executive finance and governance experience in large public companies, allowing her to contribute broad financial, audit and compliance expertise to the Board. Skills | |

| | ● Public Company Director (other than PDC) ● Executive Leadership ● Financial Literacy/Accounting ● Environmental, Social & Governance ● Diversity, Equity & Inclusion Skills ● Risk Management | ● Finance/Capital Markets ● Government, Legal or Regulatory ● Human Capital Management/Executive Compensation ● Mergers, Divestitures & Acquisitions ● Technology/Innovation |

10 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

DIRECTOR COMPENSATION

We compensate Directors with a combination of cash and equity-based incentives to attract and retain qualified candidates to serve on our Board and to align Directors’ interests with those of our stockholders. In determining how to compensate our Directors, we consider the significant amount of time they spend fulfilling their duties, as well as the competitive market for skilled directors. Cash retainers are paid quarterly. No compensation is paid to our CEO for his service on the Board.

Compensation for our non-employee Directors (“Non-Employee Directors”) is reviewed annually by the Compensation Committee and is approved by the Board. The Compensation Committee uses its independent compensation consultant to conduct this annual review, which includes board and committee retainers, meeting fees and equity-based awards using the same peer group used to determine executive compensation. See “Compensation Policies and Practices” and “Role of Independent Compensation Consultant” in the Compensation Discussion and Analysis section of this Proxy Statement. Based on its review for 2022, the Compensation Committee generally recommended minimal changes from the 2021 structure, maintaining the equity and cash compensation amounts for Directors but removing the Audit Committee member retainer fee (previously $10,000). This change fosters consistency across committees, as non-chair members of other committees did not receive a separate retainer fee.

CASH COMPENSATION

Annual Board and Committee Retainers

Each Non-Employee Director receives an annual cash retainer for service on the Board, which covers attendance at all Board and committee meetings. In addition, Non-Employee Directors receive an additional cash retainer for service as committee chairs to compensate them for the extra responsibilities associated with their roles, but no compensation is awarded for serving as a committee member. The 2022 Board and committee cash retainers are reflected in the following table.

| | | | | | |

|

| | Member |

| | Chair |

| | | Retainer | | | Retainer |

| | | ($) |

| | ($) |

Board | | $ | 85,000 | | $ | 100,000 |

Audit Committee | | | — | |

| 20,000 |

Compensation Committee | | | — | |

| 15,000 |

ESG&N Committee | | | — | |

| 15,000 |

EQUITY COMPENSATION

On May 25, 2022, Mr. Ellis, the Non-Executive Chairman, was granted an equity award with an intended value of $215,000 in restricted stock units (“RSUs”) and the remaining Non-Employee Directors other than Ms. Butcher each received an equity award with an intended value of $180,000 in RSUs for their service on the Board. In May 2022, Ms. Butcher received a pro-rata grant with an intended value of $120,000 that, combined with her initial pro-rata grant in February 2022 with an intended value of $60,000, is intended to align her Director equity awards with the other non-Chairman Directors’ equity awards. The RSUs were granted under our 2010 Amended and Restated Long Term Equity Plan (the “2010 Equity Plan”), or the 2018 Long Term Equity Plan, as amended (the “2018 Equity Plan”), as applicable. The actual number of RSUs granted was determined based on the five-day average closing stock price ending the day prior to the date of grant. The RSUs vest on the one-year anniversary of the grant date (subject, generally, to the Director not resigning or being removed for cause prior to the vesting date).

| | |

| PDC ENERGY | 11 |

PDC ENERGY, INC. - PROXY STATEMENT

Compensation paid to the Non-Employee Directors for 2022 was as follows:

2022 DIRECTOR COMPENSATION

| | | | | | | | | |

|

| Fees |

| | |

| | | |

| | Earned | | | | | | | |

| | or Paid | | Stock | | | | ||

| | in Cash(1) | | Awards(2)(3) | | Total | |||

Name | | ($) | | ($) | | ($) | |||

Pamela R. Butcher | | $ | 77,917 | | $ | 188,054 | | $ | 265,971 |

Mark E. Ellis | |

| 191,016 | |

| 225,671 | |

| 416,687 |

Paul J. Korus | | | 108,984 | | | 188,921 | | | 297,905 |

David C. Parke(4) | |

| 55,000 | |

| — | |

| 55,000 |

Lynn A. Peterson | | | 85,000 | | | 188,921 | | | 273,921 |

Carlos A. Sabater | | | 98,008 | | | 188,921 | | | 286,929 |

Diana L. Sands | |

| 98,008 | |

| 188,921 | |

| 286,929 |

| (1) | Includes annual Board retainer, committee chair retainers and the retainer for the Non-Executive Chairman of the Board. |

| (2) | Represents RSUs granted to our Non-Employee Directors and each RSU award includes the right to receive dividend equivalent amounts. The amounts reported in this table reflect the grant date fair value of the RSUs computed in accordance with FASB ASC Topic 718 based solely on the stock price on the date of grant. Such amounts differ slightly from the intended award amounts described above. Cash payments made to our Directors in 2022 for dividend equivalent rights that accumulated and vested on the 2021 RSU awards totaled $33,481; additionally, Mr. Peterson received a cash payment of $109,325 for dividend equivalent rights that accumulated and vested on a 2020 PSU award in connection with the SRC merger. |

| (3) | At December 31, 2022, the aggregate number of unvested RSUs outstanding for each Non-Employee Director were as follows: Ms. Butcher – 2,787; Mr. Ellis – 3,187; Mr. Korus – 2,668; Mr. Peterson – 2,668; Mr. Sabater – 2,668; Ms. Sands – 2,668. |

| (4) | Mr. Parke did not stand for re-election at the Company’s 2022 Annual Meeting. Compensation includes cash for service during 2022 and payment of dividend equivalent rights upon vesting of an RSU award. |

DIRECTOR STOCK OWNERSHIP REQUIREMENTS AND PROHIBITION ON CERTAIN TRANSACTIONS

Under the Company’s Stock Ownership Guidelines, each Non-Employee Director is expected to hold shares of Company stock in an amount equal to at least five times his or her annual cash retainer ($425,000 for 2022). Compliance with ownership requirements is reviewed annually. Qualifying stock holdings include shares owned outright and unvested RSUs. Directors are expected to comply with the ownership guidelines within five years of their election to the Board. As of December 31, 2022, all of the Directors met or exceeded the ownership expectations under the guidelines, with the exception of Ms. Butcher who is still within her five-year compliance grace period. The Stock Ownership Guidelines can be reviewed on the Company’s website at www.pdce.com under “Corporate Governance.”

The Company’s Insider Trading Policy expressly prohibits Directors from short-term trading (purchasing and selling Company securities within a six-month period), short sales of Company securities, hedging or monetization transactions through financial instruments (such as prepaid variable forwards, equity swaps, collars and/or exchange funds), holding securities in margin accounts or pledging securities as collateral for loans, or engaging in other transactions that are intended to hedge against the economic risk of owning Company stock.

DIRECTOR QUALIFICATIONS AND SELECTION

The Board has adopted Director Nomination Procedures that describe the process the ESG&N Committee will use to evaluate nominees for election to the Board. The Director Nomination Procedures can be viewed

12 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

on the Company’s website at www.pdce.com under “Corporate Governance.” The ESG&N Committee evaluates each candidate based on his or her level and range of experience and knowledge (industry-specific and general), skills, education, reputation, integrity, professional stature and diversity in terms of race, gender and ethnicity, as well as other factors that may be relevant depending on the particular candidate.

Additional factors considered by the ESG&N Committee include the size and composition of the Board at the time, and the benefit to the Company of a broad mixture of skills, experience and perspectives on the Board. The Director nomination process also includes consideration of the diversity provided by each candidate, and diversity is considered as part of the overall assessment of the Board’s functioning and needs. The ESG&N Committee also considers tenure and prioritizes continuous Board refreshment initiatives in the Director nomination process. One or more of these factors may be given more weight in a particular case at a particular time, although no single factor is viewed as determinative. The ESG&N Committee has not specified any minimum qualifications that it believes must be met by any particular nominee.

The ESG&N Committee has historically identified potential Director nominees primarily through recommendations made by independent third-party search firms. For example, Ms. Butcher’s 2022 appointment to the Board resulted from the engagement of Russell Reynolds Associates. The ESG&N Committee also considers recommendations made by Non-Employee Directors, employees, stockholders and others. All recommendations, regardless of the source, are evaluated on the same basis against the criteria contained in the Director Nomination Procedures.

STANDING COMMITTEES OF THE BOARD

BOARD MEETINGS AND ATTENDANCE

The Board has a standing Audit Committee, Compensation Committee and ESG&N Committee. Actions taken by these committees are reported to the Board at its next meeting. During 2022, each Director attended at least 75% of all meetings of the Board and committees of which he or she was a member. As specified in the Corporate Governance Guidelines, Directors are strongly encouraged, but not required, to attend the Annual Meeting. All of the Directors virtually attended the 2022 Annual Meeting held on May 25, 2022.

The Non-Employee Directors generally meet in “executive session” in connection with each regularly scheduled Board meeting—i.e., without Mr. Brookman, the Company’s President and CEO, or other members of management present. The Non-Executive Chairman of the Board chairs these sessions; however, the other Non-Employee Directors may, in the event of the Non-Executive Chairman's absence, select another Director to preside over the executive session.

The following table identifies the members of each committee of the Board and the chair of each committee, and the number of meetings held in 2022.

| | |

| PDC ENERGY | 13 |

PDC ENERGY, INC. - PROXY STATEMENT

2022 BOARD AND COMMITTEE MEMBERSHIPS

| ||||

DIRECTORS | Board of | Audit | Compensation | Environmental, Social, Governance |

Barton R. Brookman |

| |||

Pamela R. Butcher(1) |

| |

|

|

Mark E. Ellis |

| |

| |

Paul J. Korus |

|

| |

|

David Parke(2) |

| | | |

Lynn A. Peterson |

| | | |

Carlos L. Sabater(3) |

|

|

| |

Diana A. Sands(4) |

|

| |

|

Number of Meetings Held | 11 | 9 | 7 | 6 |

| |

|

|

Chair | Member |

| (1) | On May 25, 2022, Ms. Butcher was appointed as a Member of the Compensation Committee (replacing Mr. Korus) and ESG&N Committee. |

| (2) | Mr. Parke did not stand for re-election at the Company’s 2022 Annual Meeting. As such, immediately prior to the May 25, 2022, Board Meeting, he stepped down as Chair of the Compensation Committee and from all other Committee assignments. |

| (3) | On May 25, 2022, Mr. Sabater was appointed as Chair of the Compensation Committee. |

| (4) | On May 25, 2022, Ms. Sands was appointed as Chair of the ESG&N Committee. |

AUDIT COMMITTEE

The Audit Committee is composed entirely of persons whom the Board has determined to be independent under NASDAQ Listing Rule 5605(a)(2), Section 301 of the Sarbanes-Oxley Act of 2002, Section 10A(m)(3) of the Exchange Act and the relevant provisions of the Audit Committee Charter. The Board has adopted the Audit Committee Charter, which was most recently amended and restated on September 15, 2021, and is posted on the Company’s website at www.pdce.com under “Corporate Governance.” The Board has determined that all members of the Audit Committee qualify as “financial experts” as defined by Securities and Exchange Commission (“SEC”) regulations. The Company’s website materials are not incorporated by reference into this Proxy Statement.

Environmental, Social, Governance and NOMINATING COMMITTEE

In September 2021, the Board formalized Environmental, Social and Governance (“ESG”) oversight and accountability at the Board level by establishing the ESG&N Committee and amending and restating the committee’s charter to, among other things, include oversight of ESG matters. Members of the ESG&N

14 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

Committee were selected primarily based on their previous Nominations & Governance Committee experience and also based on other relevant sustainability expertise and experience.

The ESG&N Committee receives quarterly updates on the Company’s ESG strategy, reporting, goals and initiatives from key internal ESG leadership, including the Company’s ESG executive sponsors – the General Counsel and SVP Operations – and members of PDC’s ESG Steering Committee. Committee members are asked for input and guidance on progress and path forward, leveraging their individual areas of expertise and experience. The ESG&N Committee is also significantly engaged in the Company’s ESG reporting process.

The Board has determined that all members of the ESG&N Committee are independent of the Company under NASDAQ Listing Rule 5605(a)(2). The Board has adopted an ESG&N Committee Charter, which was most recently amended and restated on September 15, 2021, and is posted on the Company’s website at www.pdce.com under “Corporate Governance.” The Company’s website materials are not incorporated by reference into this Proxy Statement.

COMPENSATION COMMITTEE

The Board has determined that all members of the Compensation Committee are independent of the Company under NASDAQ Listing Rules 5605(a)(2) and 5605(d)(2). The Board has adopted a Compensation Committee Charter, which was most recently amended and restated on December 7, 2022, and is posted on the Company’s website at www.pdce.com under “Corporate Governance.” The Company’s website materials are not incorporated by reference into this Proxy Statement.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has been an officer or employee of the Company, nor did any of them have any relationships requiring disclosure by the Company under Item 404 of Regulation S-K in 2022. During 2022, none of our executive officers served as a Director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity whose executive officers served on our Compensation Committee or the Board.

| | |

| PDC ENERGY | 15 |

PDC ENERGY, INC. - PROXY STATEMENT

Summary of Committee Responsibilities

AUDIT COMMITTEE |

| COMPENSATION COMMITTEE |

| Environmental, Social, Governance and NOMINATING COMMITTEE |

Responsibilities: ⦁ Monitors the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and legal compliance; ⦁ Monitors the independence of the independent registered public accounting firm; ⦁ Monitors and provides oversight with respect to Company enterprise risk and cybersecurity risks, and the Company’s processes, policies, and guidelines established to address such risks; and ⦁ Provides an avenue for communications among the independent registered public accounting firm, management and the Board. | Responsibilities: ⦁ Oversees the development of a compensation strategy for the Company’s Named Executive Officers; ⦁ Evaluates the performance of and establishes the compensation of the CEO; ⦁ Reviews and approves the elements of compensation for other senior executive officers of the Company; ⦁ Negotiates and approves the terms of employment and severance agreements with executive officers of the Company and approves all Company severance and change of control plans; ⦁ Reviews the Non-Employee Directors’ compensation and recommends to the Board any changes in such compensation; ⦁ Reviews and approves performance criteria and results for bonus and performance-based equity awards for senior executive officers and approves awards to those officers; ⦁ Recommends to the Board equity-based incentive plans necessary to implement the Company’s compensation strategy, approves equity grants under the plans and administers all equity-based incentive programs of the Company, which may include specific delegation to management to grant awards to non-executive officers; ⦁ Reviews and approves Company contributions to Company sponsored retirement plans; and ⦁ Recommend to the Board approval of creation or revision of any “clawback” policy allowing the Company to recoup compensation paid to employees when the Committee determines it is necessary or appropriate or as required by law or stock exchange rules. | Responsibilities: ⦁ Assists the Board by identifying and recruiting individuals qualified to become Board members and recommending nominees for election at the next annual meeting of stockholders or to fill any vacancies; ⦁ Recommends to the Board and oversees development of corporate governance and ethics policies applicable to the Company; ⦁ Oversees and makes recommendations with respect to the adequacy of the Company’s ESG policies and programs, compliance with ESG laws, and progress toward the Company’s achievement of ESG objectives, including diversity, equity, and inclusivity; ⦁ Leads the Board in its annual self-assessment of the Board’s and its committees’ performance and the Directors’ contributions; ⦁ Assists the Board in creating and maintaining an appropriate committee structure, and recommends to the Board the nominees for membership on, and Chair of, each committee, as well as the Non-Executive Chair position; and ⦁ Annually reviews succession plans for the Board, CEO and other senior executives, both for ordinary course and contingency planning succession circumstances; recommend to the Board any proposed updates. |

BOARD LEADERSHIP STRUCTURE

Although the Board has no specific policy with respect to the separation of the offices of Chairman and CEO, the Board believes that our current leadership structure, under which Mr. Brookman serves as President and CEO and Mr. Ellis serves as Non-Executive Chairman of the Board, is the appropriate structure for our Board at this time. Since June 2011, the roles of Chairman and CEO have been held by separate individuals. We currently believe that it continues to be beneficial to have an independent, separate Chairman who has the responsibility of leading the Board, allowing the CEO to focus on leading the Company. We believe our CEO and Chairman have an excellent working relationship, which, given the separation of their positions, provides

16 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

strong Board leadership while positioning our CEO as the leader of the Company in front of our employees and stockholders. The Board evaluates this separated structure at least annually.

STOCKHOLDER RECOMMENDATIONS

The ESG&N Committee will consider Director candidates recommended by stockholders of the Company on the same basis as those recommended by other sources. Any stockholder who wishes to recommend a prospective Director nominee should notify the ESG&N Committee by writing to the ESG&N Committee at the Company’s headquarters or by email to board@pdce.com. All recommendations will be reviewed by the ESG&N Committee. A submission recommending a nominee should include:

| ● | Sufficient biographical information to allow the ESG&N Committee to evaluate the potential nominee in light of the Director Nomination Procedures, including current employment and other public company directorships that may impact a nominee’s ability to meaningfully participate on PDC’s Board; |

| ● | An indication as to whether the proposed nominee will meet the requirements for independence under NASDAQ and SEC guidelines; |

| ● | Information concerning any relationships between the potential nominee and the stockholder recommending the potential nominee; and |

| ● | An indication of the willingness of the proposed nominee to serve if nominated and elected. |

STOCKHOLDER NOMINATIONS

Stockholders may nominate candidates for election to the Board. The Company’s Bylaws require that stockholders who wish to submit nominations for election to the Board at a meeting of stockholders follow certain procedures. See “Stockholder Nominations and Proposals—Advance Notice Procedures under the Company’s Bylaws” for a description of these procedures.

CORPORATE GOVERNANCE

GOVERNANCE HIGHLIGHTS

We believe that the Board has implemented a sound structure for the governance of the Company. Elements of this structure include:

| ● | Stockholder Engagement: On an annual basis, we conduct significant outreach to our stockholders to understand their views on various governance and other ESG matters. In 2022, we held in-person, telephonic or video meetings with stockholders representing approximately 50% of our outstanding common stock as of year-end 2022. Through this engagement, we aimed to understand our stockholders’ concerns and incorporate feedback, including perspectives around ESG, shareholder return frameworks, the Colorado regulatory environment, mergers and acquisitions activity and our operations. In response to stockholder feedback, the Board made a number of changes in 2021 and 2022 related to, among other things, Board refreshment, executive compensation and ESG initiatives. See below discussions on “Continuous Board Refreshment and Diversity”; “Environmental, Social and Governance”; “Investor Outreach and Engagement”; “Responsiveness to Stockholder Interests and Market Environment”; and “2023 Compensation Program and Board Changes” for further detail. |

| ● | Continuous Board Refreshment and Diversity: Five of the Company’s seven Director nominees have been added to the Board since 2020, including two in 2020, two in 2021, and one |

| | |

| PDC ENERGY | 17 |

PDC ENERGY, INC. - PROXY STATEMENT

| in 2022, demonstrating commitment to continued refreshment. Further, three Directors are either female and/or self-identify as underrepresented minorities. |

| ● | ESG Focus: We continue to prioritize our ESG strategic execution and transparency, as highlighted in our third annual Sustainability Report. A comprehensive overview of 2022 sustainability highlights and key 2023 initiatives can be found in the ESG section of this document. |

| ● | Independent Board Leadership: Non-Executive Chairman Mark E. Ellis has decades of executive experience in the oil and gas industry and provides strong leadership of the Board and oversight of management. |

| ● | Majority Independent Directors: Currently, six of our seven Director nominees are independent, and only independent Directors serve on our Board committees. |

| ● | Strong Independent Oversight: The majority of the Company’s Director nominees have significant operating, financial, strategic and other relevant experience in the oil and gas industry or as former executives at public companies. |

| ● | Share Ownership Requirement: Directors are required to hold a specified number of shares of our common stock with a transition period for new Directors. |

| ● | Majority Voting Policy: Except in the case of a contested election, any Director who receives more “withhold” votes than votes in favor must tender his or her resignation for consideration by the Board. |

| ● | Stockholder-called Special Meetings and Action by Consent: Stockholders that have 10% combined voting power have the right to call special stockholders’ meetings and stockholders can act by written consent. |

| ● | No Poison Pill: The Company does not have a poison pill. |

| ● | One Vote per Share: The Company does not have any super-voting shares. |

Environmental, Social and Governance

PDC is committed to an effective, accountable and measurable ESG strategy focused on driving a cleaner, safer, and more socially responsible company. Our strategy prioritizes sustainable outcomes that improve our core business, and is overseen by our ESG&N Committee and supported by our full Board. Internally, our ESG Steering Committee is responsible for building and executing our ESG vision, with engagement and approval from our Senior Management Team (“SMT”). As a result of our dedicated strategy and committed Board and SMT, we made significant progress in 2022 in each of the areas of E, S and G, as highlighted below:

Environmental

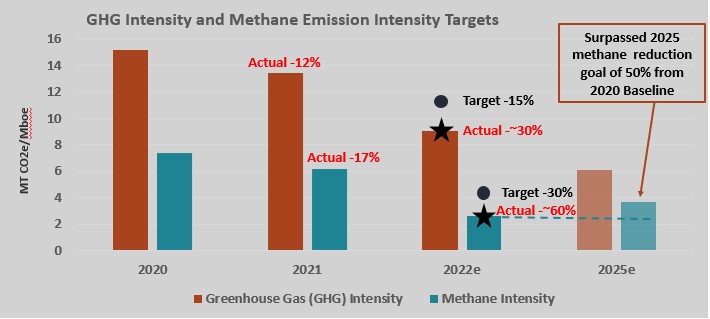

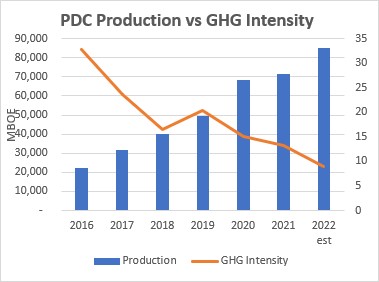

| ● | Continue to improve our greenhouse gas (“GHG”) and methane intensity, and surpassed our GHG and methane emission intensity reductions goals set last year, achieving approximately 30% and 60% reductions, respectively, compared to our original year over year targets of 15% and 30%, |

18 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

| respectively. We also surpassed our original methane intensity reduction goal of 50% by 2025, and are now reassessing our longer term goals. |

| ● | Demonstrated an overall reduction in gross Scope 1 emissions (MT CO2e) since 2021. Notable year-over-year achievements within our Scope 1 emissions profile include: |

| o | 49% approximate reduction in reported pneumatic emissions from 2021 due to improving data quality, adjusting our calculation methodology, and retrofitting pneumatics to instrument air; |

| o | 84% approximate reduction in emissions associated with well venting for liquids unloading due to operational changes in the DJ Basin; |

| o | 19% reduction of emissions from atmospheric storage tanks due to enhanced facility designs aimed at tank elimination; and |

| o | 37% reduction in emissions from associated venting and flaring due to operational changes in the Delaware Basin, essentially eliminating all routine flaring on a company-wide basis, and surpassing our 2025 zero routine faring goal. |

| | |

| PDC ENERGY | 19 |

PDC ENERGY, INC. - PROXY STATEMENT

| ● | Acquired Great Western Petroleum, LLC (“Great Western”), a Denver-based DJ Basin operator, closing the acquisition in May 2022 (the “Great Western Acquisition”), which was accretive to our emission reduction goals. |

| ● | Achieved approval of the Guanella Comprehensive Area Plan (“CAP”), a 22 well pad development in Weld County, Colorado, in December 2022 by the Colorado Oil and Gas Conservation Commission. The project is expected to create a net reduction in Volatile Organic Compounds (“VOC”) emissions over ten years through a robust plug and reclaim (“P&R”) program. PDC plans to P&R over 473 locations as part of the Guanella development, resulting in a minimum 58% reduction in VOC emissions. |

| ● | Plugged over 250 older, low-producing wells and decommissioned 98 associated facilities in Colorado in 2022. Sites associated with decommissioned wells and facilities are returned to their original grade and native plant growth through PDC’s land reclamation program. |

| ● | Partnered with the Butterfly Pavilion to study how restoration of well sites to native, pollinator-friendly landscapes benefits pollinator populations in Colorado. To date, PDC has begun this important work on two existing Colorado reclamation sites with more expected in the future. |

| ● | Continued its commitment to environmental transparency and disclosure through the following: |

| o | Assessed and published our climate-related risk and opportunities by utilizing the Taskforce on Climate-Related Financial Disclosure (“TCFD”), and identified a strategic focus that “PDC should seek to be a climate leader in our industry and geography while learning about and investing in emerging technologies.” |

| o | Responded to the CDP (previously Carbon Disclosure Project) Climate Change Questionnaire, providing detailed information on topics including emissions management, governance, and policy engagement, receiving a first time score of a “C”, which puts PDC ahead of its peers and aligns with the North America regional average. |

| o | In 2022, we joined and achieved a gold standard in the Oil and Gas Methane Partnership (“OGMP 2.0”), a comprehensive measurement-based reporting framework for the oil and gas industry that improves accuracy and transparency of methane emissions reporting in the oil and gas sector. |

| ● | To continue our commitment to accuracy in our reported emissions, we improved our process documentation and implemented enhanced reviews and internal controls. In 2022, PDC enlisted the services of an independent third-party to perform an assurance review of our emissions data reported for the 2021 reporting year. The third-party found the 2021 emissions report to be materially accurate. |

20 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

Social

| ● | Invested approximately $4 million in our communities through charitable donations, community programs, and scholarships, including supporting organizations that assisted those impacted by the Marshall Fire in Colorado and the war in Ukraine, as well as over $80,000 donated to various charities through our employee matching program. |

| ● | Over 7,000 volunteer hours were recorded by our employees in 2022, including throughout our keystone volunteer month-long volunteer program, Energizing Our Community Days. |

| ● | Established a formal Human Rights policy for all employees, contractors, and business partners that includes express commitments to: |

| o | Honesty, integrity, and respect for our people, environment, and communities; |

| o | Creating a positive impact in the communities where we live and work through engagement with all stakeholders, including employees, stockholders, landowners, and community members; and |

| o | Cultivating a diverse, inclusive, respectful, and safe work environment free from discrimination, harassment, and violence. |

| ● | Committed to adopting policies and practices that ensure equitable opportunities for all and building a culture that is welcoming and accessible for our current and future employees. For 2022, we leveraged our employee-led Diversity, Equity, and Inclusion (“DE&I”) Committee to identify DE&I priorities and initiatives for the organization, as well as hired a DE&I consultant to help develop a baseline assessment of where we stand today, define roles and responsibilities, and outline a roadmap for future DE&I efforts. |

| ● | Continued to prioritize diversity in our organization, with our Company’s officers (Vice Presidents and up) consisting of 27% women and 9% minorities, and the Company’s managers consisting of 28% women and 18% minorities, each as of December 31, 2022. |

| ● | Implemented new benefits policies, including: |

| o | An employee-managed professional development stipend to be used toward employee’s choice of learning and development initiatives in alignment with Company business strategies; and |

| o | A tiered education assistance program designed to encourage attainment of degrees with assistance from PDC with a focus on first-time college degrees. |

| | |

| PDC ENERGY | 21 |

PDC ENERGY, INC. - PROXY STATEMENT

Governance

| ● | The Code of Business Conduct and Ethics was updated to expand language around bribery and corruption and strictly prohibiting seeking, offering, accepting, or paying bribes to obtain or maintain business and/or competitive business advantages. |

| ● | Formalized ESG oversight and accountability at the Board level by establishing the ESG&N Committee. We continue to engage and educate our Board members regarding ESG matters, including comprehensive field training in September 2022, with a primary focus on emission reduction projects in the DJ Basin. |

| ● | ESG short-term incentive metrics for 2022 were enhanced for all employees, including: |

| o | Adopting quantitative goals in EHS performance for safety, spills, and GHG and methane emissions reductions; and |

| o | Adopting qualitative goals related to ESG including flaring reductions and DE&I initiatives. |

| ● | Female Board member, Pamela R. Butcher, joined the Board in 2022 following the addition of two diverse Board members in 2021. |

| o | Five of the Company’s seven Director nominees have been added to the Board since the beginning of 2020, demonstrating our commitment to continued refreshment and resulting in average Board tenure of approximately 3.6 years; and |

| o | Three Director nominees are either female and/or self-identify as underrepresented minorities. |

| ● | Increased disclosure and accessibility through additional comprehensive reports developed in 2022, including the TCFD Report, Corporate Social Responsibility (“CSR”) Report, Sustainability Accounting Standards Board (“SASB”) Reporting, Key Metrics & Disclosures, and CDP Climate Change Questionnaire as shown below: |

| ● | Established a Political Engagement Policy to guide Company efforts and increase transparency into PDC’s political involvement. The policy: |

| o | Governs the use of corporate funds or assets for public policy and political purposes; |

| o | States that all public policy and political engagement must comply with applicable legal restrictions including federal, state, and local rules and regulations; |

| o | Commits to annual, transparent reporting that discloses the Company’s public policy and political activity information not covered by government reporting requirements, including non-profit contributions; and |

| o | Outlines the standards for PDC’s political action committee (“PAC”). |

22 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

Ongoing Strategic Development

Moving forward, the Company will continue its thoughtful but ambitious approach to ESG. The Company is currently engaged in several key initiatives, including:

| ● | Climate-focused scenario planning and on-going strategic development in alignment with the recommendations of TCFD, and specifically engaging in an annual update and review that includes the SMT and Board; |

| ● | Deploying our first electric fleet for hydraulic fracturing operations in the DJ Basin in the first half of 2023; |

| ● | Continuing to enhance our GHG and methane reduction goals, setting approximate 20% and 40% GHG and methane reduction goals for 2023 compared to 2022, as incorporated into our 2023 short term incentive program; |

| ● | Reassessing our longer term GHG and methane reduction goals for 2025 and 2030, given the rapid achievement of our methane goal in 2022; |

| ● | Enhancing our DE&I focus through engagement of a third party expert to help develop a baseline assessment of where we stand today, define roles and responsibilities, and outline a roadmap for future DE&I efforts; and |

| ● | Continuing our significant charitable, scholarship and community outreach efforts, including through a Board approved 2023 budget of $5 million to support organizations that meet PDC’s guiding principles of Education, Equity, Essential and Environment. |

PDC’s sustainability efforts are marked by strategic planning, transparency, stakeholder engagement, materiality and – most importantly – steady progress on our material focus areas.

CORPORATE GOVERNANCE GUIDELINES

The Board has adopted Corporate Governance Guidelines that govern the structure and function of the Board and establish the Board’s policies on a number of corporate governance issues. Among other matters, the Corporate Governance Guidelines address:

| ● | Director selection, qualification and responsibilities; |

| ● | The holding and frequency of executive sessions of independent Directors, Board self-evaluation and senior executive performance reviews; |

| ● | Board committee structure and function; |

| ● | Succession planning; and |

| ● | Governance matters, standard of business conduct and Board committee responsibilities. |

The Corporate Governance Guidelines were most recently amended as of May 26, 2020, and can be viewed on the Company’s website at www.pdce.com under “Corporate Governance.” The Company’s website materials are not incorporated by reference into this Proxy Statement.

| | |

| PDC ENERGY | 23 |

PDC ENERGY, INC. - PROXY STATEMENT

Other Directorships

The Corporate Governance Guidelines also address Directors’ service on other public company boards. Recognizing the substantial time commitment required of public company directors, the Corporate Governance Guidelines state that Directors are expected to serve on other public company boards only to the extent that such services do not detract from the Directors’ ability to serve on PDC’s Board. In no case may PDC Directors serve on more than two public company boards (in addition to PDC’s Board). The ESG&N Committee reviews and oversees Directors’ service on other public company boards regularly and no less than annually.

The Company routinely evaluates its Directors’ service on other boards. All of PDC’s Directors comply with the overboarding policy under our Corporate Governance Guidelines. Still, certain investors and organizations may consider Mr. Peterson’s service as Executive Chair of Chord while serving on the boards of PDC and Denbury to constitute over-boarding. PDC, however, does not view those commitments as overboarding. As Executive Chair of Chord, Mr. Peterson is not involved in the day-to-day aspects of the business, and instead provides a high level oversight role to the CEO and management team as needed. Moreover, Mr. Peterson is a highly engaged and committed Board member and actively participates in all PDC Board matters and brings valuable experience to the Board.

UNCONTESTED ELECTIONS POLICY

The Corporate Governance Guidelines include an Uncontested Elections Policy (the “Policy”). Under the Policy, any nominee for Director in an uncontested election who receives a greater number of “withhold” votes than “for” votes will submit to the Board a letter of resignation for consideration by the ESG&N Committee. The ESG&N Committee will promptly consider the tendered resignation and will recommend to the Board whether or not to accept the tendered resignation or to take other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the “withhold” votes in a different way.

In making this recommendation, the ESG&N Committee will consider all factors deemed relevant by its members. These factors may include the underlying reasons for stockholders’ withholding of votes from such Director nominee (if ascertainable), the length of service and qualifications of the Director nominee whose resignation has been tendered, the Director’s contributions to the Company, whether the Company will remain in compliance with applicable laws, rules, regulations and governing documents if it accepts the resignation and, generally, whether or not accepting the resignation is in the best interests of the Company and its stockholders. In considering the ESG&N Committee’s recommendation, the Board will take into account the factors considered by the ESG&N Committee and such additional information and factors as the Board believes to be relevant.

CODE OF BUSINESS CONDUCT AND ETHICS

The Company has a Code of Business Conduct and Ethics (the “Code of Conduct”) that applies to all Directors, officers, employees, agents, consultants and representatives of the Company and is reviewed at least annually by the ESG&N Committee. The Company’s principal executive officer, principal financial officer and principal accounting officer are subject to additional specific provisions under the Code of Conduct. The Code of Conduct is acknowledged and reviewed annually by the Board, and was most recently amended and restated on December 7, 2022. It can be viewed on the Company’s website at www.pdce.com under “Corporate Governance.” The Company’s website materials are not incorporated by reference into this Proxy Statement.

In the event the Board approves an amendment to or a waiver of any provisions of the Code of Conduct, the Company will disclose the information on its website.

24 | PDC ENERGY |

PDC ENERGY, INC. - PROXY STATEMENT

FAMILY RELATIONSHIPS AND OTHER ARRANGEMENTS

There is no family relationship among any Directors or executive officers of the Company. There are no arrangements or understandings among any Directors or officers and any other person pursuant to which the person was selected as an officer or Director of the Company, except with respect to Paul J. Korus and Lynn A. Peterson who were appointed to the Board following the closing of the merger with SRC in January 2020 pursuant to the related merger agreement.

DIRECTOR INDEPENDENCE

In affirmatively determining whether a Director is “independent,” the Board analyzes and reviews NASDAQ listing standards, which set forth certain circumstances under which a director may not be considered independent. Mr. Brookman, the President and CEO of the Company, is not independent under such standards. Audit Committee and Compensation Committee members are subject to additional, more stringent independence requirements.

The Board has reviewed the business and charitable relationships between the Company and each Non-Employee Director to determine compliance with the NASDAQ listing standards and to evaluate whether there are any other facts or circumstances that might impair a Non-Employee Director’s independence. The Board has affirmatively determined that each of the Non-Employee Directors was independent under NASDAQ Listing Rule 5605, the Exchange Act, and our Board committee charter requirements at all times while serving as a Non-Employee Director.

THE BOARD’S ROLE IN RISK MANAGEMENT