Exhibit 99.1 Associated Banc-Corp Investor Presentation 2019 Brookfield Office (Milwaukee MSA) – Opened October 2017 SECOND QUARTER

FORWARD-LOOKING STATEMENTS Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” “target,” “outlook” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. 1

OUR FRANCHISE First Quarter 2019 Highlights and Accomplishments of assets of loans $34 billion $23 billion . Largest bank headquartered in Wisconsin2 $4 billion of equity $26 billion of deposits . Approximately 4,700 employees, servicing 1.3 million customer accounts in 8 states and 1Q 2019 Average Loans by Business Segment over 110 communities1 Corporate and 53% Commercial Specialty . #1 Mortgage Lender in Wisconsin3 Community, Consumer, 45% and Business . Top 50 U.S. insurance brokerage firm4 2% Other Affinity Programs 41% of active personal checking accounts are affinity related5 1As of March 31, 2019. 2Based on assets, as of March 31, 2019. 3The Wisconsin’s #1 Mortgage Lender designation is based on information gathered from the Home Mortgage Disclosure Act data compiled annually by the Bureau of Consumer Financial Protection. The results of the data were obtained through the Bureau of Consumer Financial Protection Mortgage Database (HMDA), June 2018. 2 4Business Insurance magazine, July 2018. Rankings based on 2017 brokerage revenue gathered by U.S. based clients. 5Affinity debit cards as a percentage of active personal checking accounts, as of March 31, 2019.

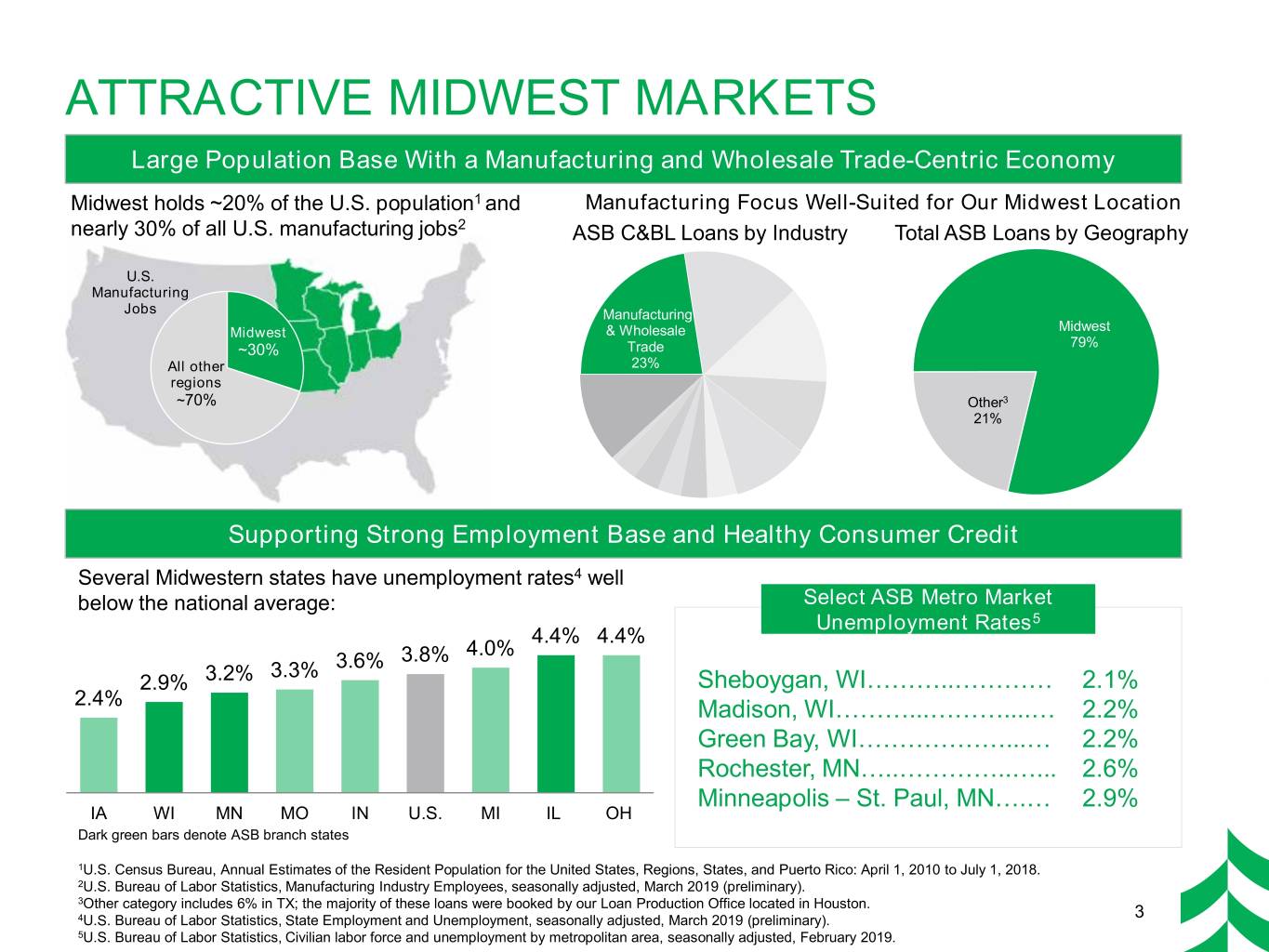

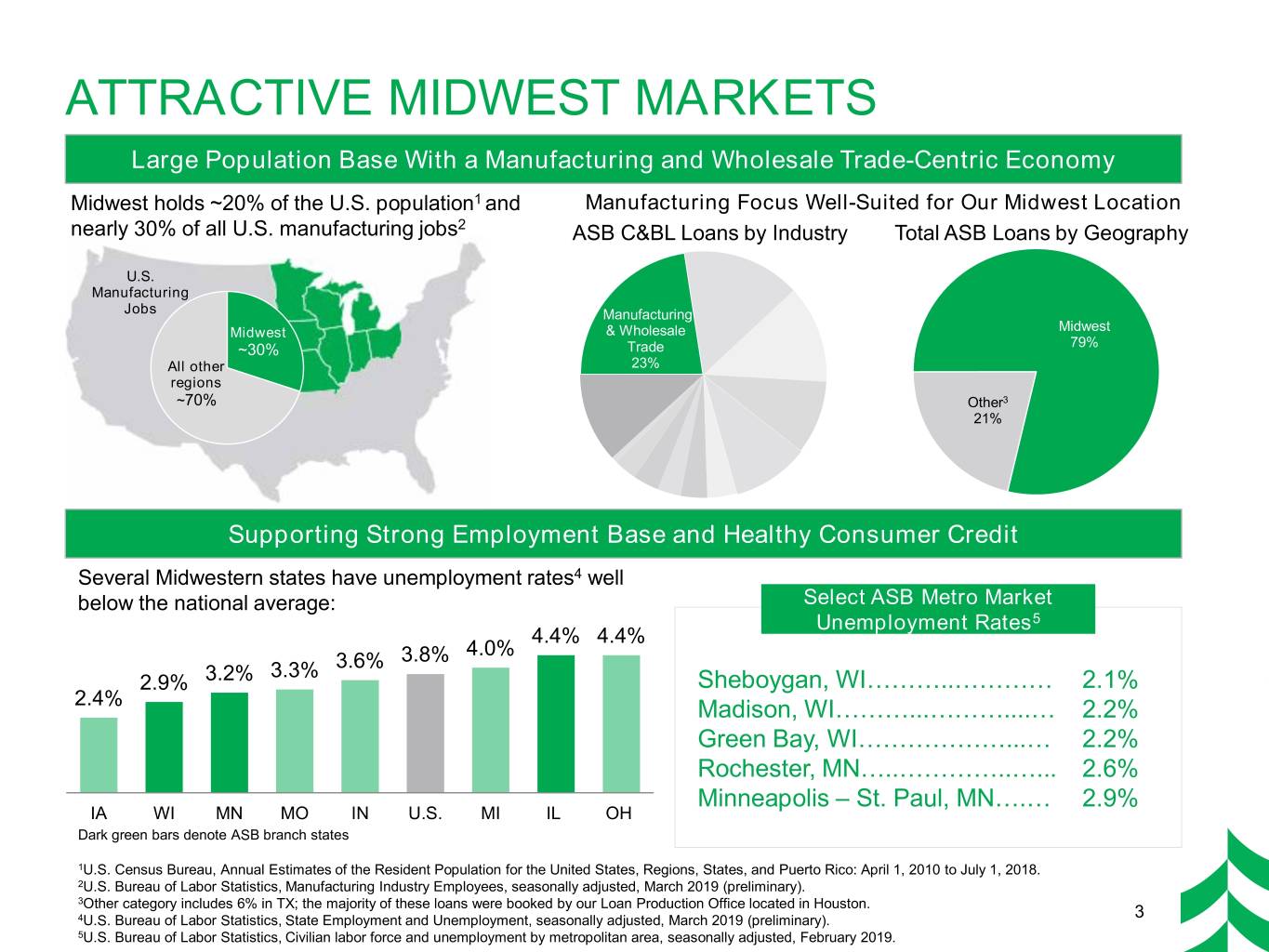

ATTRACTIVE MIDWEST MARKETS Large Population Base With a Manufacturing and Wholesale Trade-Centric Economy Midwest holds ~20% of the U.S. population1 and Manufacturing Focus Well-Suited for Our Midwest Location nearly 30% of all U.S. manufacturing jobs2 ASB C&BL Loans by Industry Total ASB Loans by Geography U.S. Manufacturing Jobs Manufacturing Midwest Midwest & Wholesale 79% ~30% Trade All other 23% regions ~70% Other3 21% Supporting Strong Employment Base and Healthy Consumer Credit Several Midwestern states have unemployment rates4 well below the national average: Select ASB Metro Market Unemployment Rates5 4.4% 4.4% 3.8% 4.0% 3.3% 3.6% 2.9% 3.2% Sheboygan, WI………..………… 2.1% 2.4% Madison, WI………...………....… 2.2% Green Bay, WI………………...… 2.2% Rochester, MN…..…………..…... 2.6% Minneapolis – St. Paul, MN….… 2.9% IA WI MN MO IN U.S. MI IL OH Dark green bars denote ASB branch states 1U.S. Census Bureau, Annual Estimates of the Resident Population for the United States, Regions, States, and Puerto Rico: April 1, 2010 to July 1, 2018. 2U.S. Bureau of Labor Statistics, Manufacturing Industry Employees, seasonally adjusted, March 2019 (preliminary). 3Other category includes 6% in TX; the majority of these loans were booked by our Loan Production Office located in Houston. 4U.S. Bureau of Labor Statistics, State Employment and Unemployment, seasonally adjusted, March 2019 (preliminary). 3 5U.S. Bureau of Labor Statistics, Civilian labor force and unemployment by metropolitan area, seasonally adjusted, February 2019.

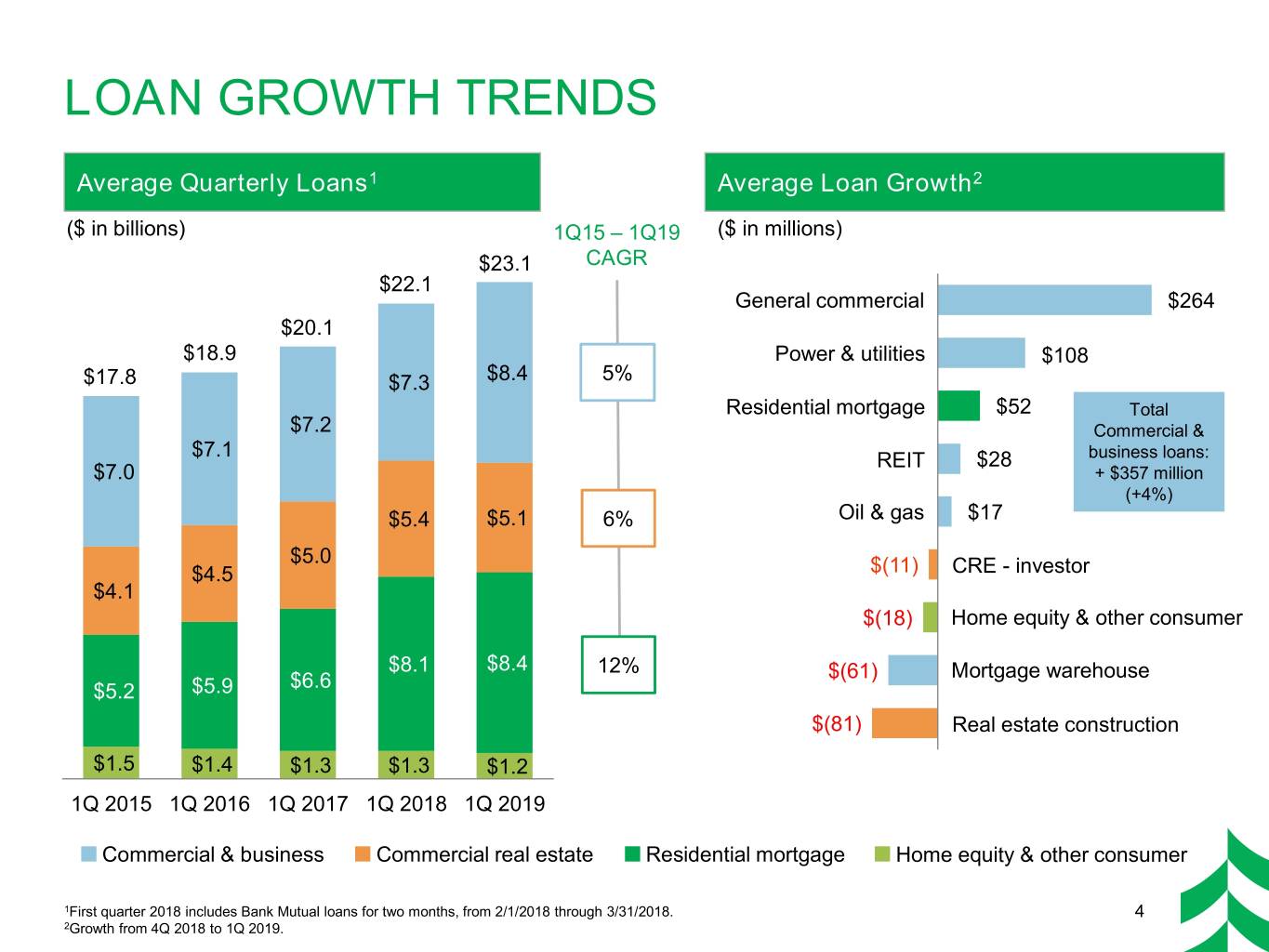

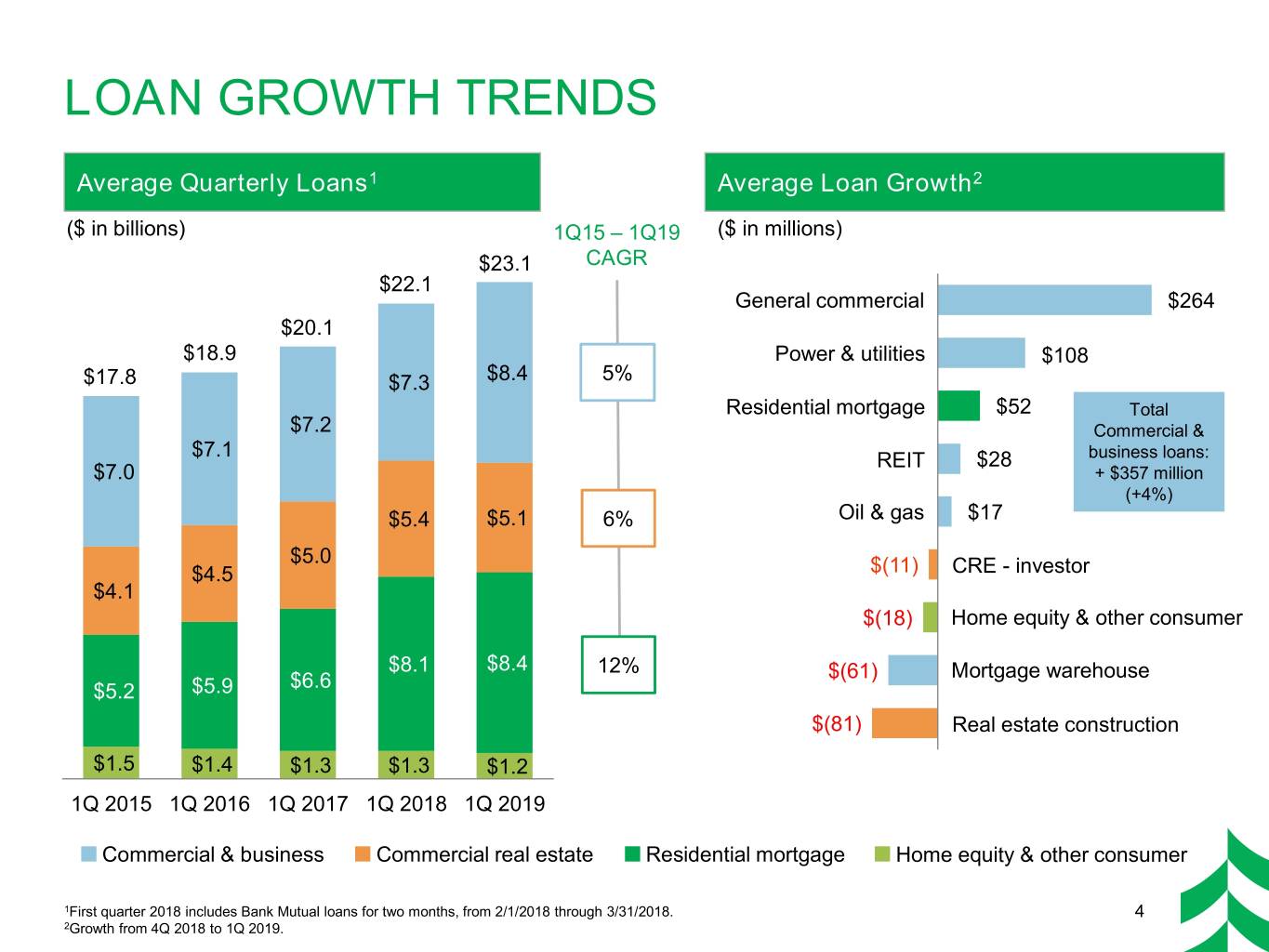

LOAN GROWTH TRENDS Average Quarterly Loans1 Average Loan Growth2 ($ in billions) 1Q15 – 1Q19 ($ in millions) $23.1 CAGR $22.1 General commercial $264 $20.1 $18.9 Power & utilities $108 $17.8 $7.3 $8.4 5% Residential mortgage $52 Total $7.2 Commercial & $7.1 REIT $28 business loans: $7.0 + $357 million (+4%) $5.4 $5.1 6% Oil & gas $17 $5.0 $4.5 $(11) CRE - investor $4.1 $(18) Home equity & other consumer $8.1 $8.4 12% $6.6 $(61) Mortgage warehouse $5.2 $5.9 $(81) Real estate construction $1.5 $1.4 $1.3 $1.3 $1.2 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 Commercial & business Commercial real estate Residential mortgage Home equity & other consumer 1First quarter 2018 includes Bank Mutual loans for two months, from 2/1/2018 through 3/31/2018. 4 2Growth from 4Q 2018 to 1Q 2019.

DEPOSIT GROWTH TRENDS Average Quarterly Deposits1 Quarter-end Loan to Deposit Ratio ($ in billions) 1Q15 – 1Q19 98% $24.6 CAGR 96% $23.7 94% 94% $21.5 $5.0 4% 95% $20.6 $5.1 $19.1 $5.0 91% $5.0 90% $4.3 $4.7 12% 89% $4.5 1Q 2Q 3Q 4Q $3.8 $3.0 $2.2 Historical Quarter-end Range 2014-2019 2019 $3.0 $2.4 Historical Quarter-end Range 2014-2018 $3.4 $3.6 $2.9 Low Cost Deposit Mix2 $7.4 $7.2 Checking and Savings represent nearly 50% $5.9 $6.3 $6.0 $2.1 $1.7 30% $1.3 $1.4 $1.5 $2.7 $3.1 20% 19% $1.6 $1.6 $1.6 9% 9% 13% 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 Time deposits Money market Interest-bearing demand Savings Network transaction dep Noninterest-bearing demand 5 1First quarter 2018 includes Bank Mutual deposits for two months, from 2/1/2018 through 3/31/2018. 2Percentages based on first quarter 2019 average balances.

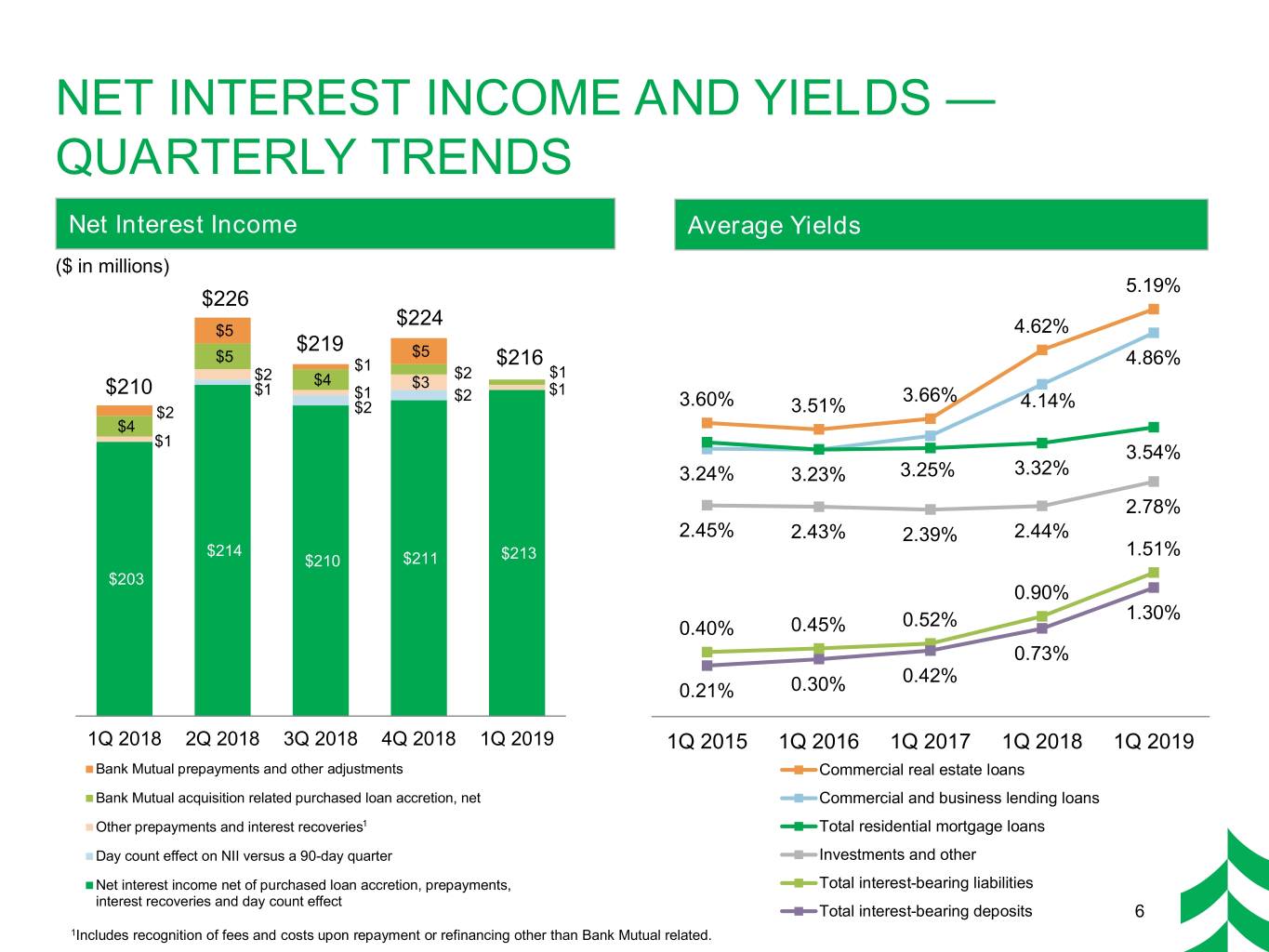

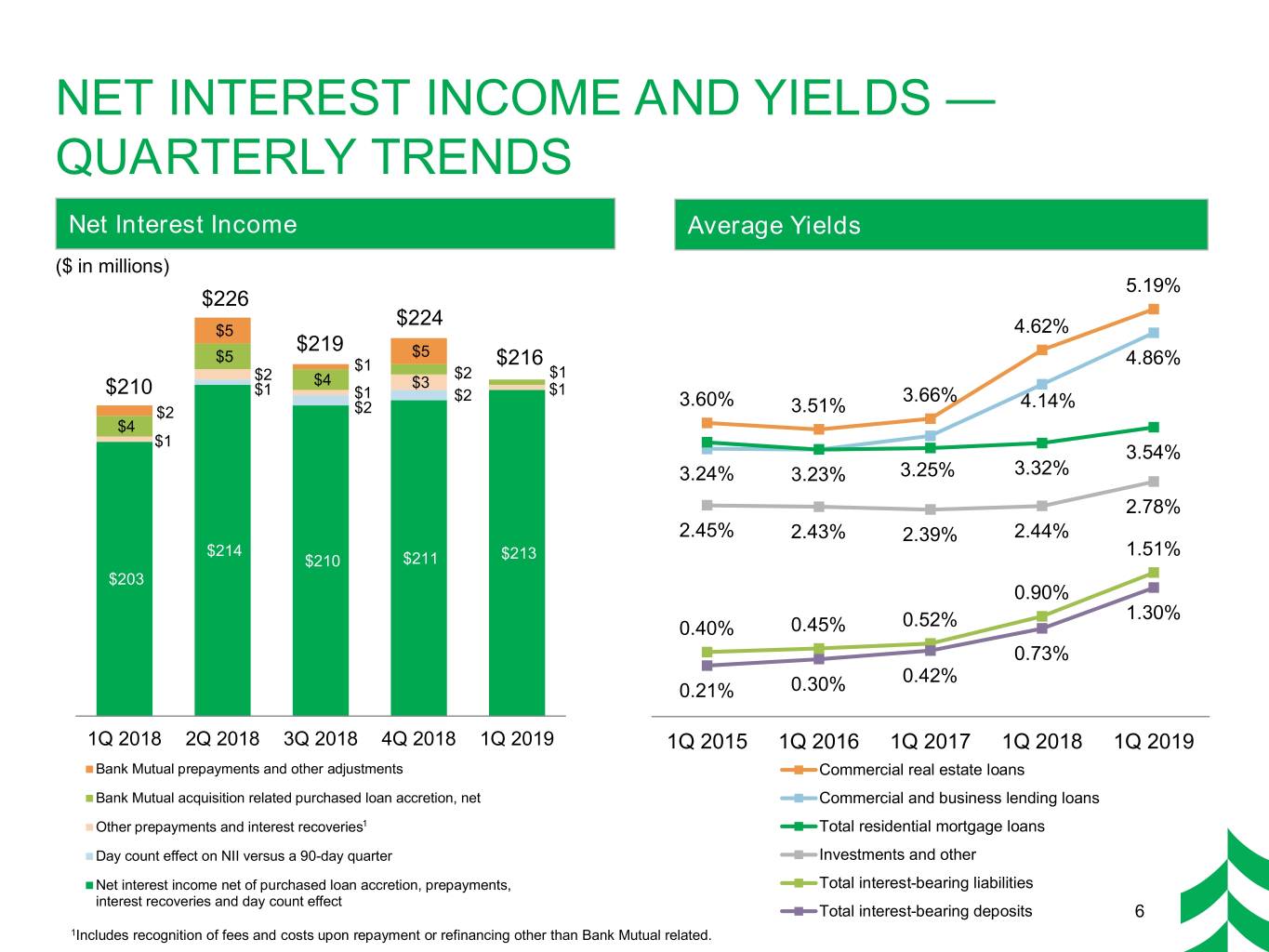

NET INTEREST INCOME AND YIELDS — QUARTERLY TRENDS Net Interest Income Average Yields ($ in millions) 5.19% $226 $224 $5 4.62% $219 $5 $5 $1 $216 4.86% $2 $4 $2 $1 $210 $1 $3 $1 $1 $2 3.60% 3.66% 4.14% $2 $2 3.51% $4 $1 3.54% 3.24% 3.23% 3.25% 3.32% 2.78% 2.45% 2.43% 2.39% 2.44% $214 1.51% $210 $211 $213 $203 0.90% 1.30% 0.40% 0.45% 0.52% 0.73% 0.42% 0.21% 0.30% 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 Bank Mutual prepayments and other adjustments Commercial real estate loans Bank Mutual acquisition related purchased loan accretion, net Commercial and business lending loans Other prepayments and interest recoveries1 Total residential mortgage loans Day count effect on NII versus a 90-day quarter Investments and other Net interest income net of purchased loan accretion, prepayments, Total interest-bearing liabilities interest recoveries and day count effect Total interest-bearing deposits 6 1Includes recognition of fees and costs upon repayment or refinancing other than Bank Mutual related.

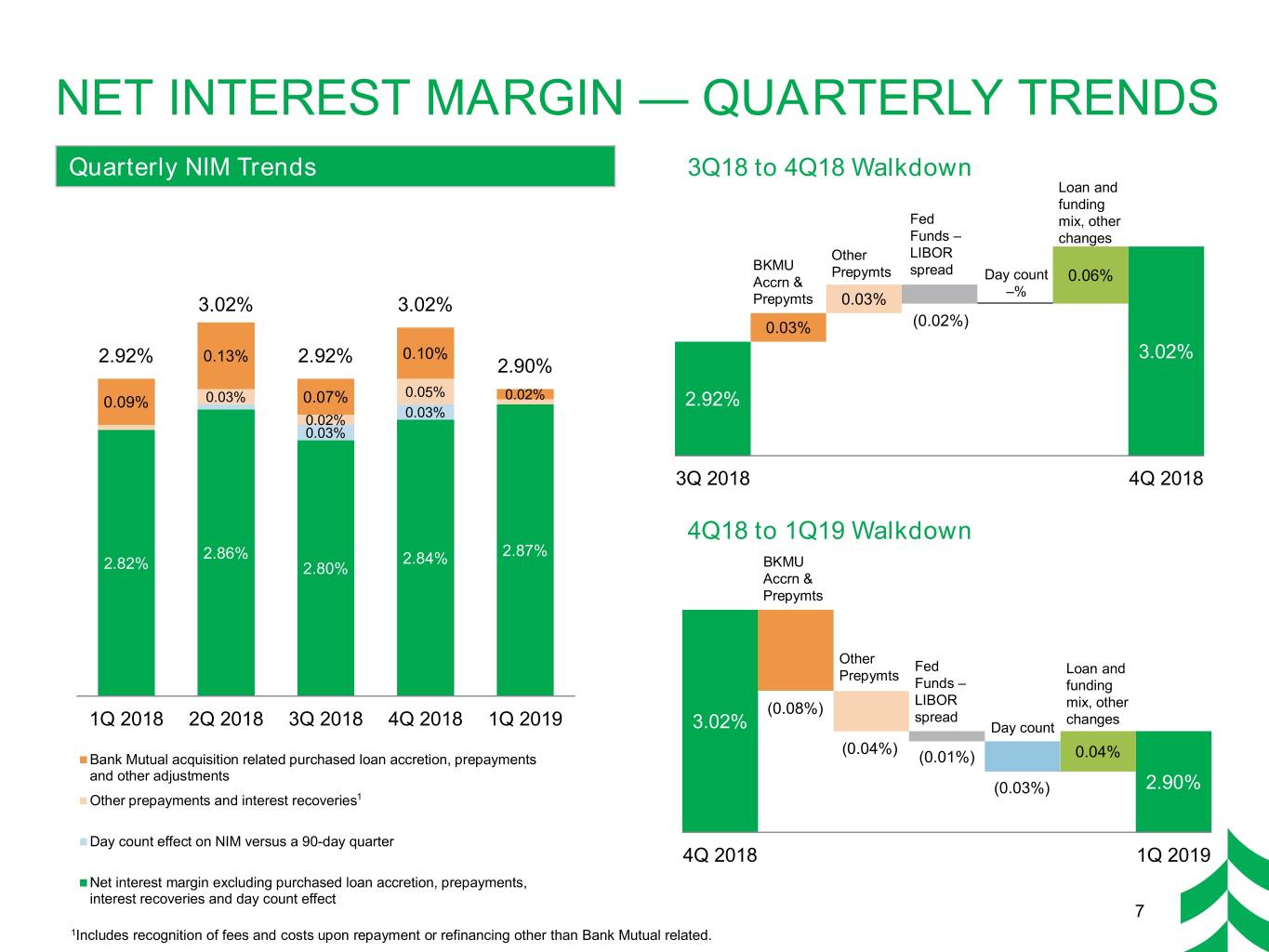

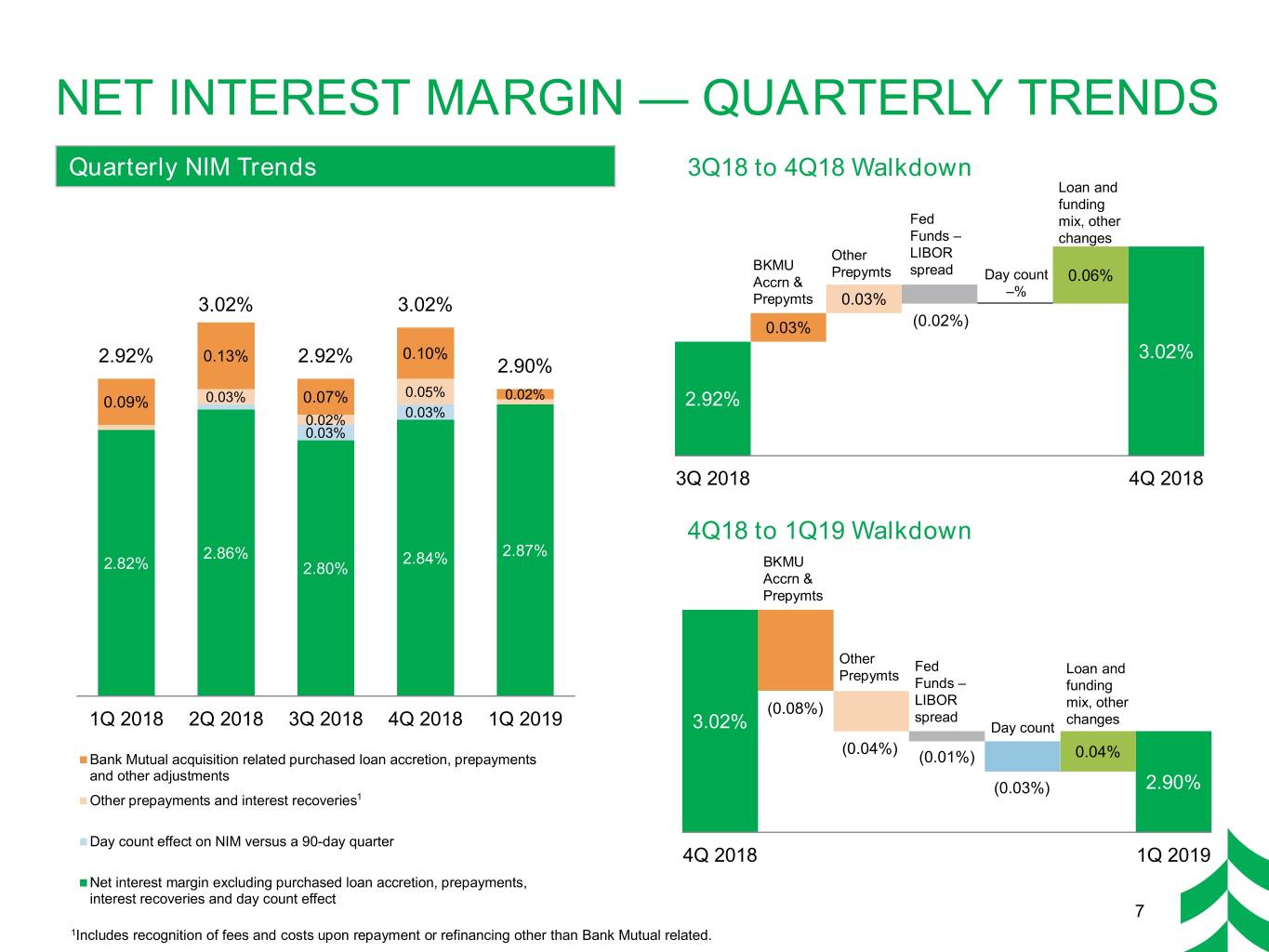

NET INTEREST MARGIN — QUARTERLY TRENDS Quarterly NIM Trends 3Q18 to 4Q18 Walkdown Loan and funding Fed mix, other Funds – changes Other LIBOR BKMU Prepymts spread Day count Accrn & 0.06% –% 3.02% 3.02% Prepymts 0.03% 0.03% (0.02%) 2.92% 0.13% 2.92% 0.10% 3.02% 2.90% 0.05% 0.09% 0.03% 0.07% 0.02% 2.92% 0.03% 0.02% 0.03% 3Q 2018 4Q 2018 4Q18 to 1Q19 Walkdown 2.86% 2.84% 2.87% 2.82% 2.80% BKMU Accrn & Prepymts Other Fed Loan and Prepymts Funds – funding LIBOR (0.08%) mix, other spread changes 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 3.02% Day count (0.04%) Bank Mutual acquisition related purchased loan accretion, prepayments (0.01%) 0.04% and other adjustments (0.03%) 2.90% Other prepayments and interest recoveries1 Day count effect on NIM versus a 90-day quarter 4Q 2018 1Q 2019 Net interest margin excluding purchased loan accretion, prepayments, interest recoveries and day count effect 7 1Includes recognition of fees and costs upon repayment or refinancing other than Bank Mutual related.

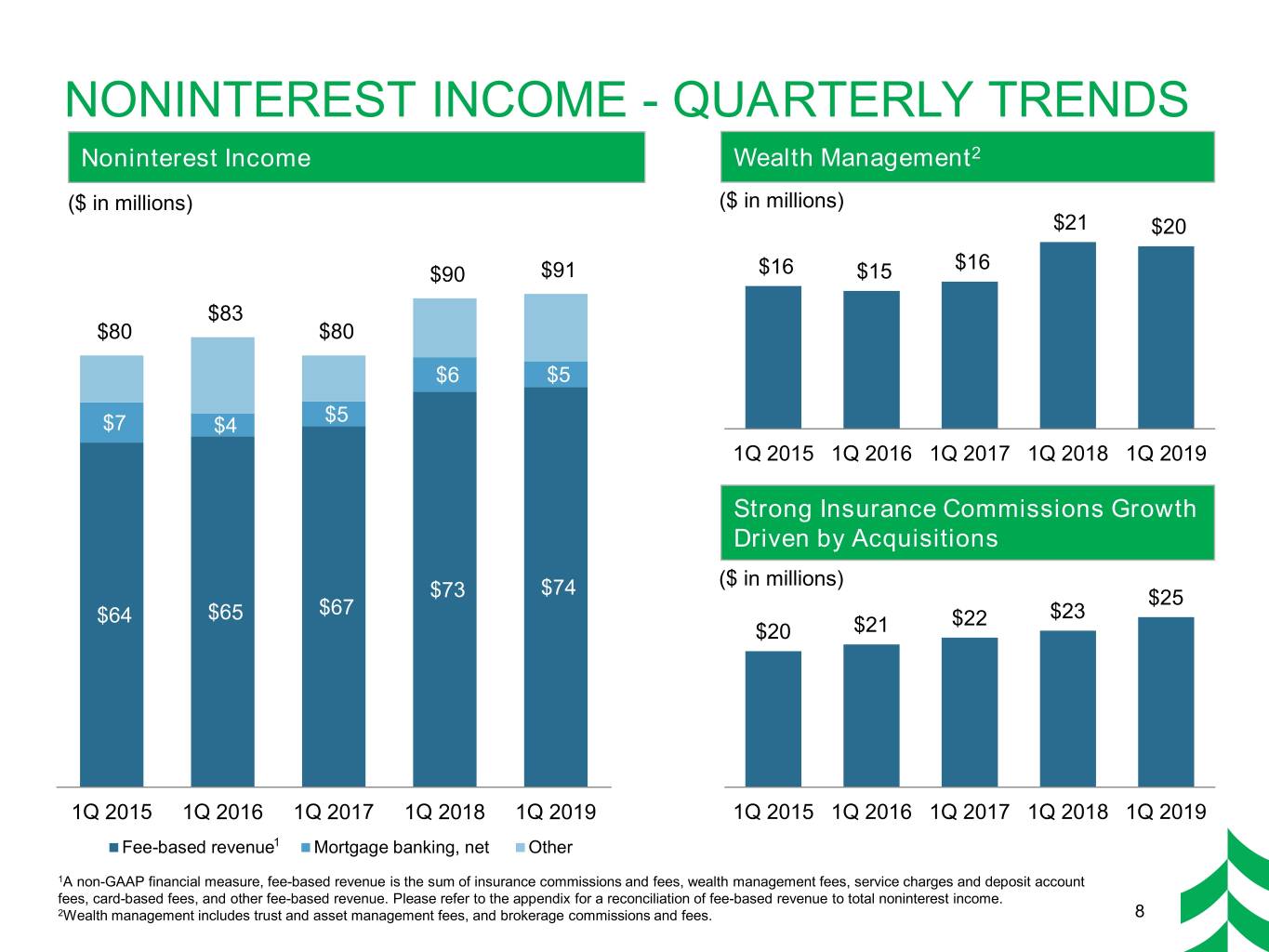

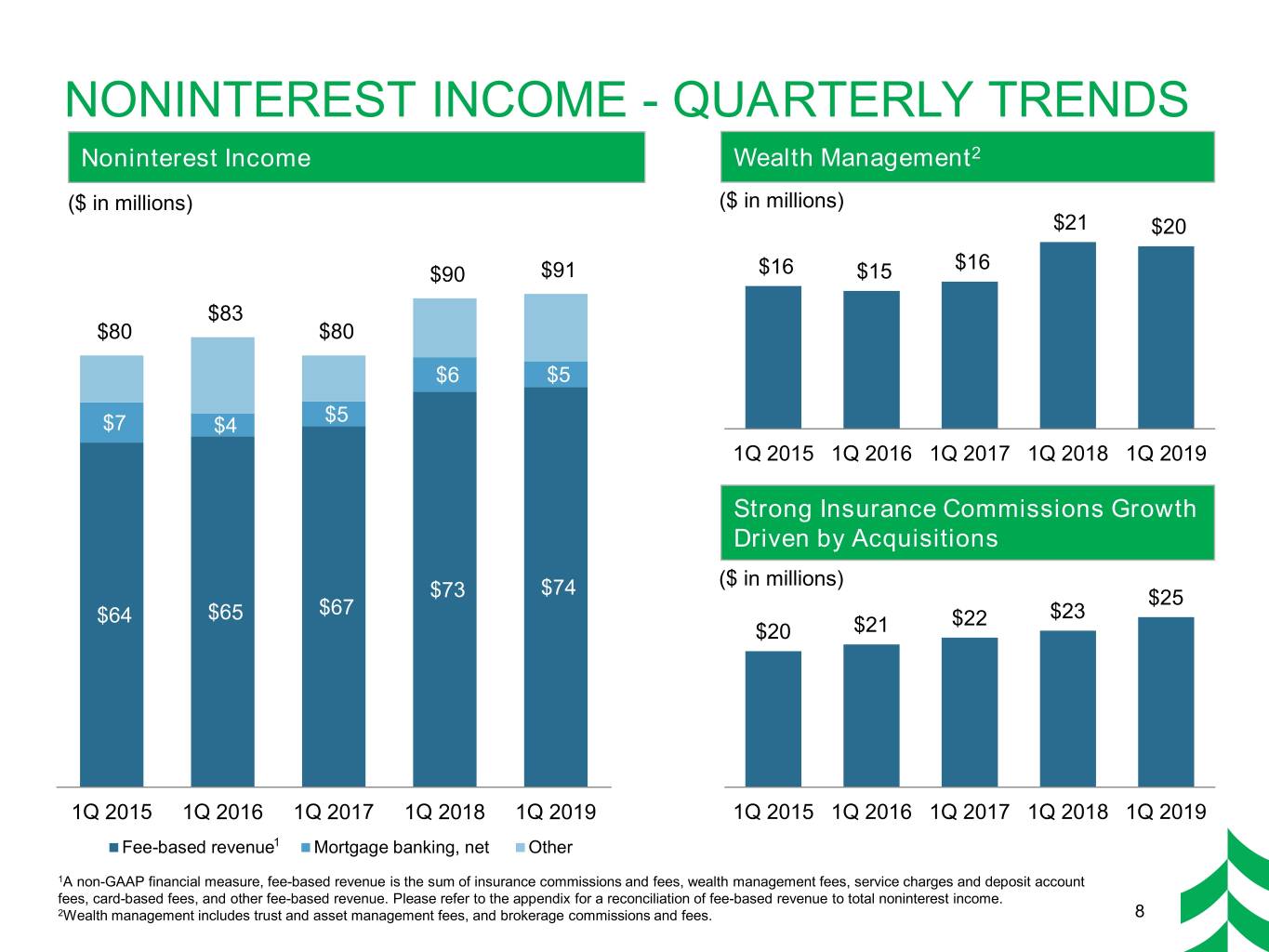

NONINTEREST INCOME - QUARTERLY TRENDS 2 ($Noninterest IN MILLIONS Income) Wealth Management ($ in millions) ($ in millions) $21 $20 $16 $90 $91 $16 $15 $83 $80 $80 $6 $5 $5 $7 $4 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 Strong Insurance Commissions Growth Driven by Acquisitions ($ in millions) $73 $74 $67 $25 $64 $65 $22 $23 $20 $21 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 Fee-based revenue1 Mortgage banking, net Other 1A non-GAAP financial measure, fee-based revenue is the sum of insurance commissions and fees, wealth management fees, service charges and deposit account fees, card-based fees, and other fee-based revenue. Please refer to the appendix for a reconciliation of fee-based revenue to total noninterest income. 2Wealth management includes trust and asset management fees, and brokerage commissions and fees. 8

OVERALL EXPENSE EFFICIENCY AUTOMATION AND CONSOLIDATIONS ARE DRIVING BETTER EFFICIENCY OVER TIME Efficiency Enhanced Automation Branch Consolidations Operational Efficiencies Drivers Noninterest Expense Efficiency Ratio2 Branches and FTEs ($ in millions) $213 4,792 $211 70% 71% 4,707 69% $7 $204 4,637 4,659 4,660 $21 $2 66% 1 69% 271 $193 $192 67% 63% 65% 63% 62% $204 $202 237 236 236 233 $192 $194 $191 1Q18 2Q18 3Q18 4Q18 1Q19 1Q15 1Q16 1Q17 1Q18 1Q19 1Q18 2Q18 3Q18 4Q18 1Q19 Acquisition related costs Federal Reserve efficiency ratio Period-end Branches All other noninterest expenses Adjusted efficiency ratio Average FTEs 1Includes $1 million of acquisition related cost recovery. 2The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio, which is a non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and acquisition related costs. 9 Refer to the appendix for a reconciliation of the Federal Reserve efficiency ratio to the adjusted efficiency ratio.

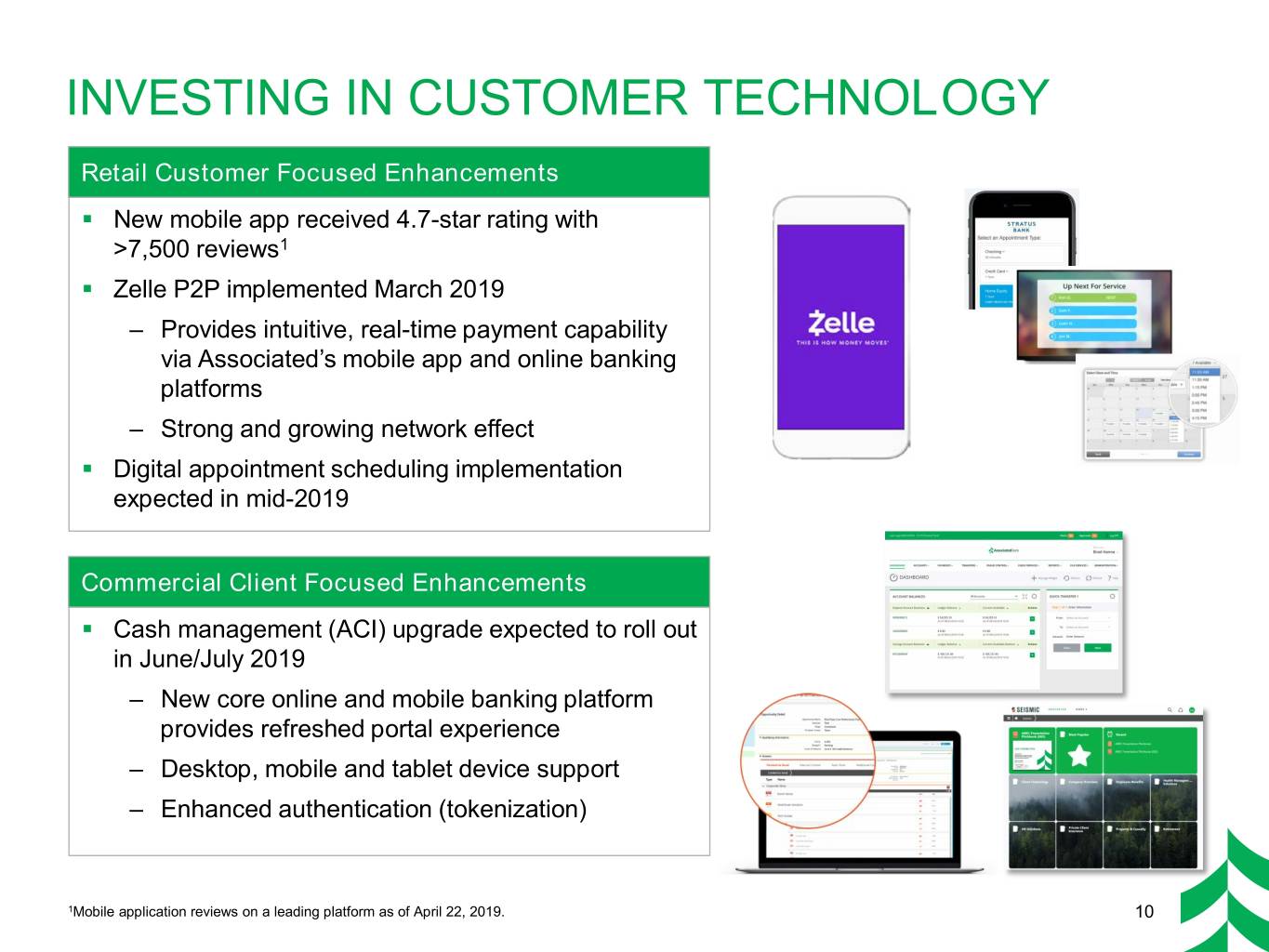

INVESTING IN CUSTOMER TECHNOLOGY Retail Customer Focused Enhancements . New mobile app received 4.7-star rating with >7,500 reviews1 . Zelle P2P implemented March 2019 – Provides intuitive, real-time payment capability via Associated’s mobile app and online banking platforms – Strong and growing network effect . Digital appointment scheduling implementation expected in mid-2019 Commercial Client Focused Enhancements . Cash management (ACI) upgrade expected to roll out in June/July 2019 – New core online and mobile banking platform provides refreshed portal experience – Desktop, mobile and tablet device support – Enhanced authentication (tokenization) 1Mobile application reviews on a leading platform as of April 22, 2019. 10

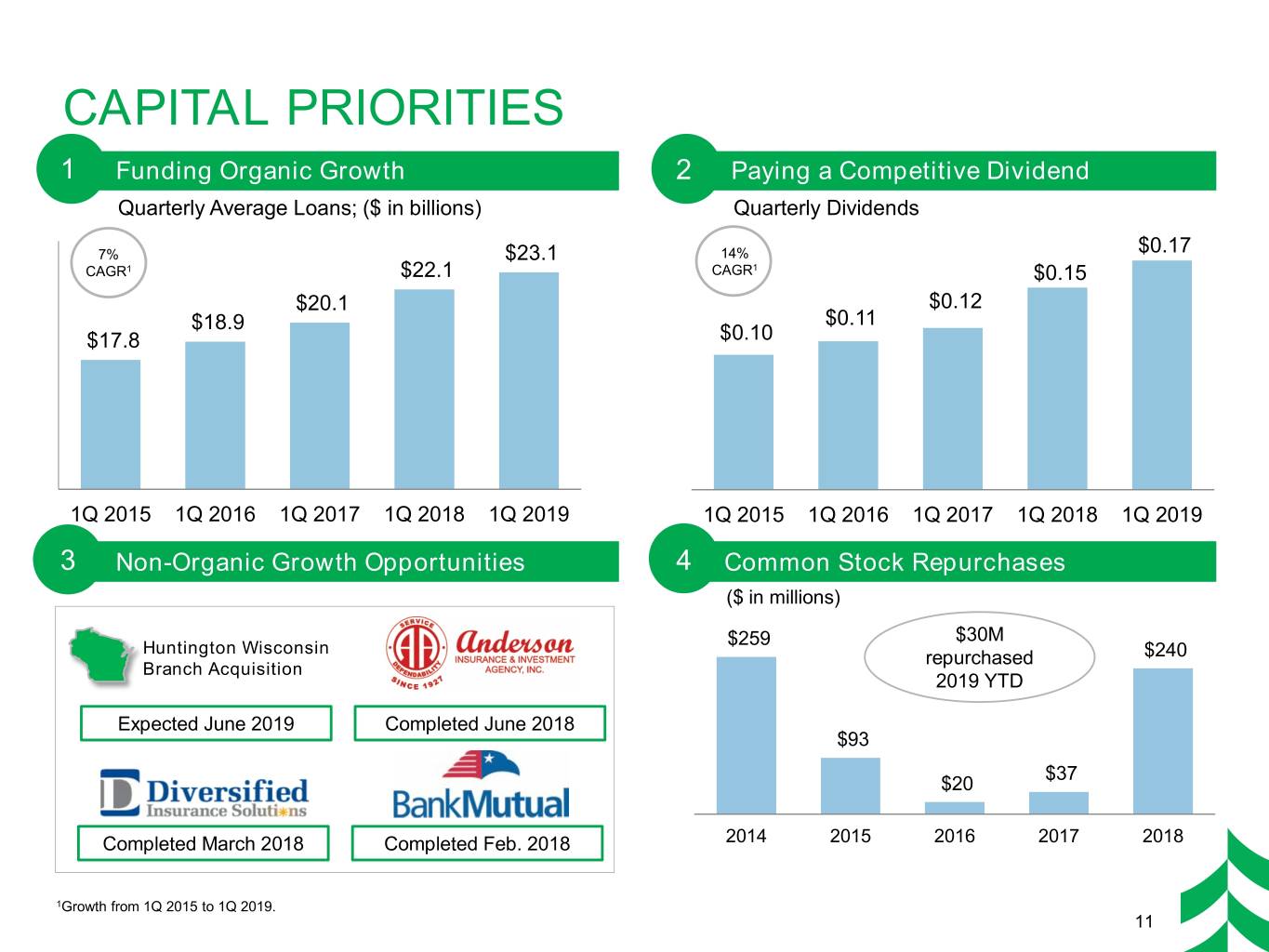

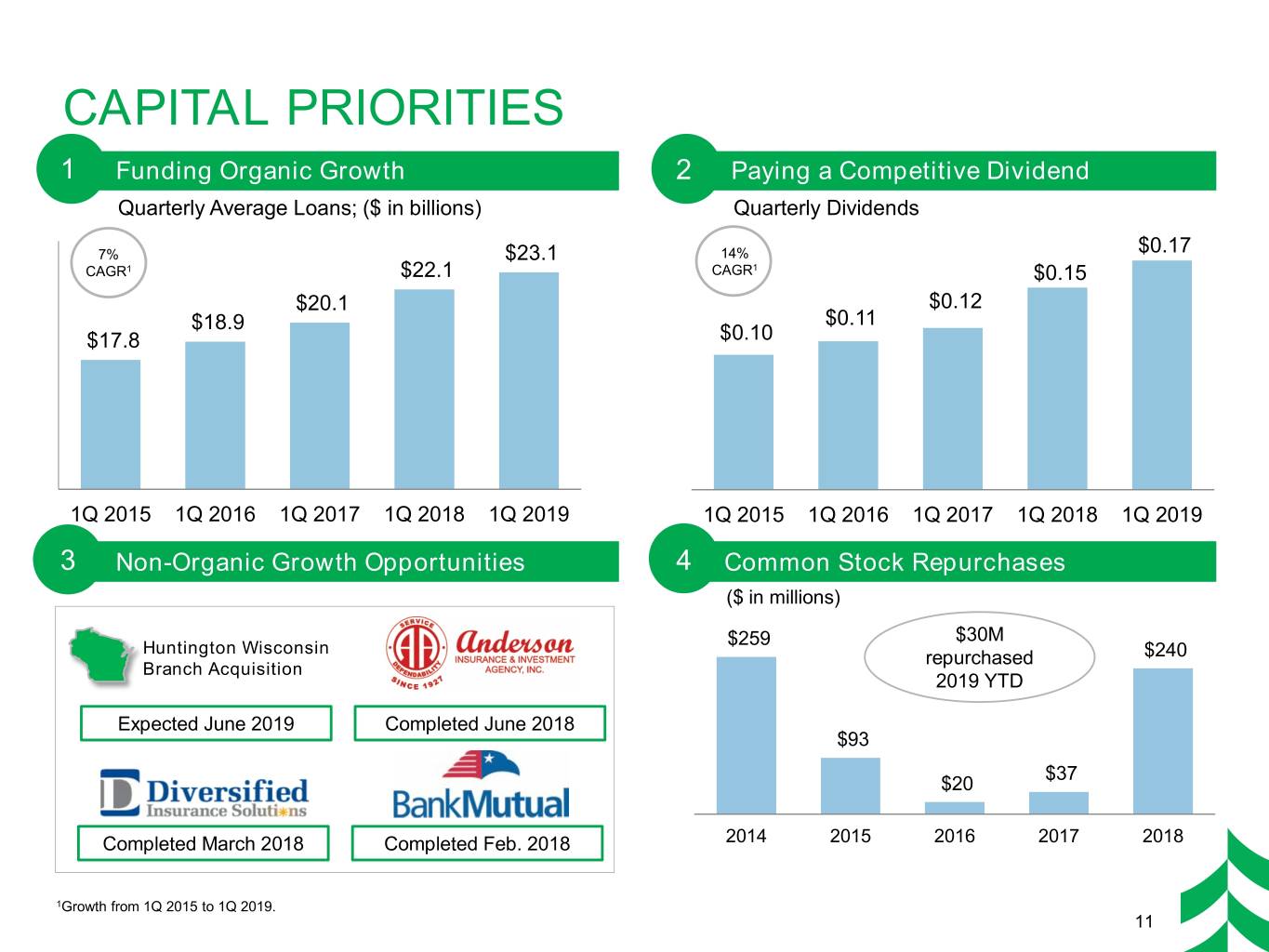

CAPITAL PRIORITIES 1 Funding Organic Growth 2 Paying a Competitive Dividend Quarterly Average Loans; ($ in billions) Quarterly Dividends 7% $23.1 14% $0.17 CAGR1 $22.1 CAGR1 $0.15 $20.1 $0.12 $18.9 $0.11 $17.8 $0.10 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 3 Non-Organic Growth Opportunities 4 Common Stock Repurchases ($ in millions) $259 $30M Huntington Wisconsin repurchased $240 Branch Acquisition 2019 YTD Expected June 2019 Completed June 2018 $93 $37 $20 Completed March 2018 Completed Feb. 2018 2014 2015 2016 2017 2018 1Growth from 1Q 2015 to 1Q 2019. 11

2019 OUTLOOK . This outlook reflects a stable to improving economy and no Fed Funds rate changes. We may adjust our outlook if, and when, we have more clarity on these factors. . We received regulatory approval for the acquisition of the Wisconsin branch banking operations of Huntington Bank and continue to expect this transaction will close in June 2019. ▪ 3% - 6% annual average loan ▪ Approximately $800 million growth for 2019 noninterest expense ▪ Maintain loan to deposit ratio ▪ Adjusted efficiency ratio1 Balance Sheet under 100% Expense expected to improve by ~100 bps Management ▪ Flat to slightly lower full-year Management ▪ Effective tax rate: 21% - 23% for 2019 NIM, based on no full-year 2019 additional Fed rate action ▪ Approximately $360 million - ▪ Provision expected to adjust with $375 million full-year noninterest changes to risk grade, other income indications of credit quality, and Capital & loan volume Fee ▪ Improving year over year fee- Credit Businesses based revenues ▪ Continue to follow stated Management corporate priorities for capital deployment 1The 2019 outlook includes the adjusted efficiency ratio which is a non-GAAP financial measure. This non-GAAP measure excludes acquisition related costs which by their nature are unpredictable and have low visibility. Estimates of these unpredictable and low visibility costs for 2019 which would be included in the GAAP efficiency measurement of the Federal Reserve Board are, therefore, unavailable. 12

APPENDIX

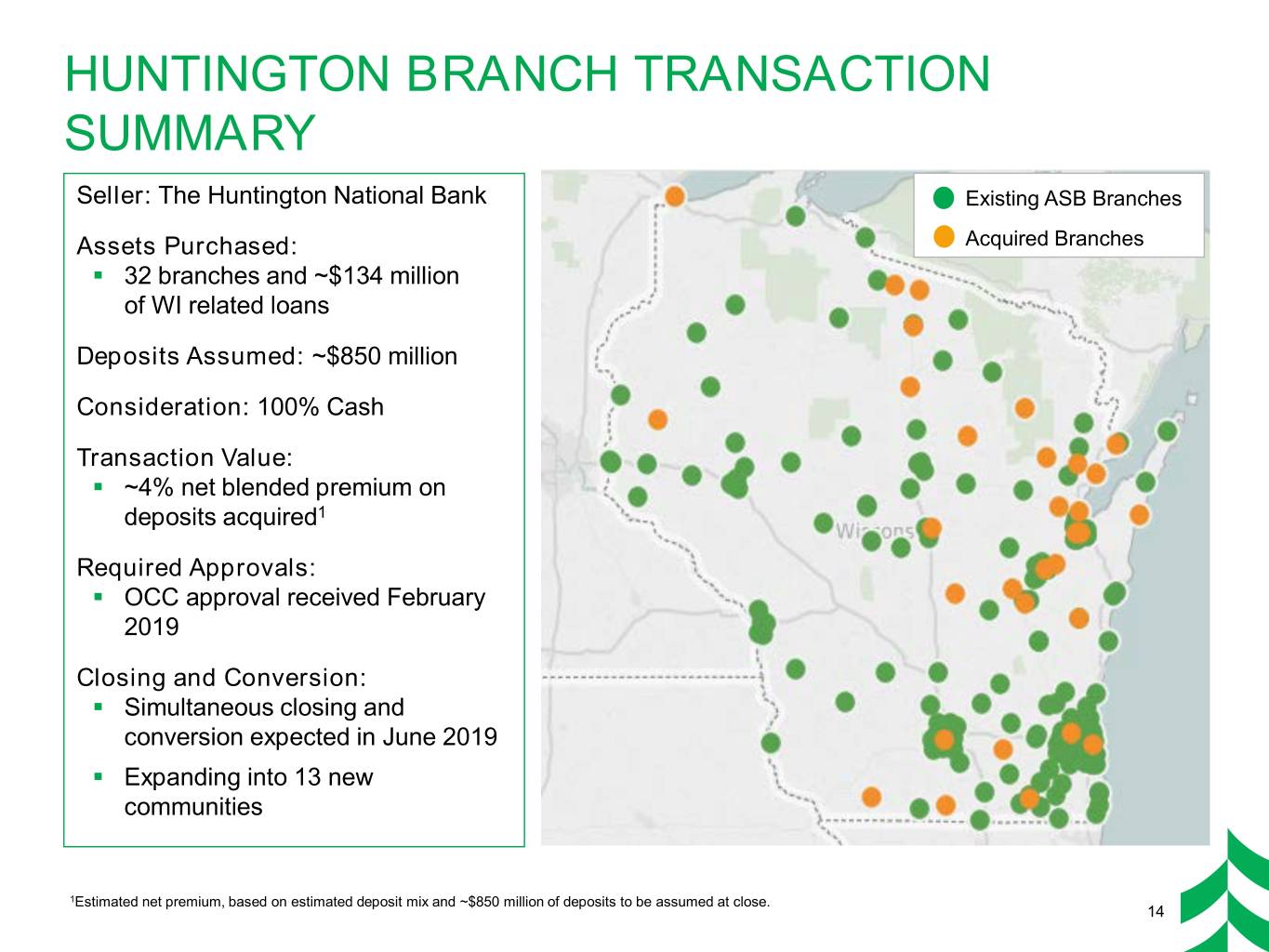

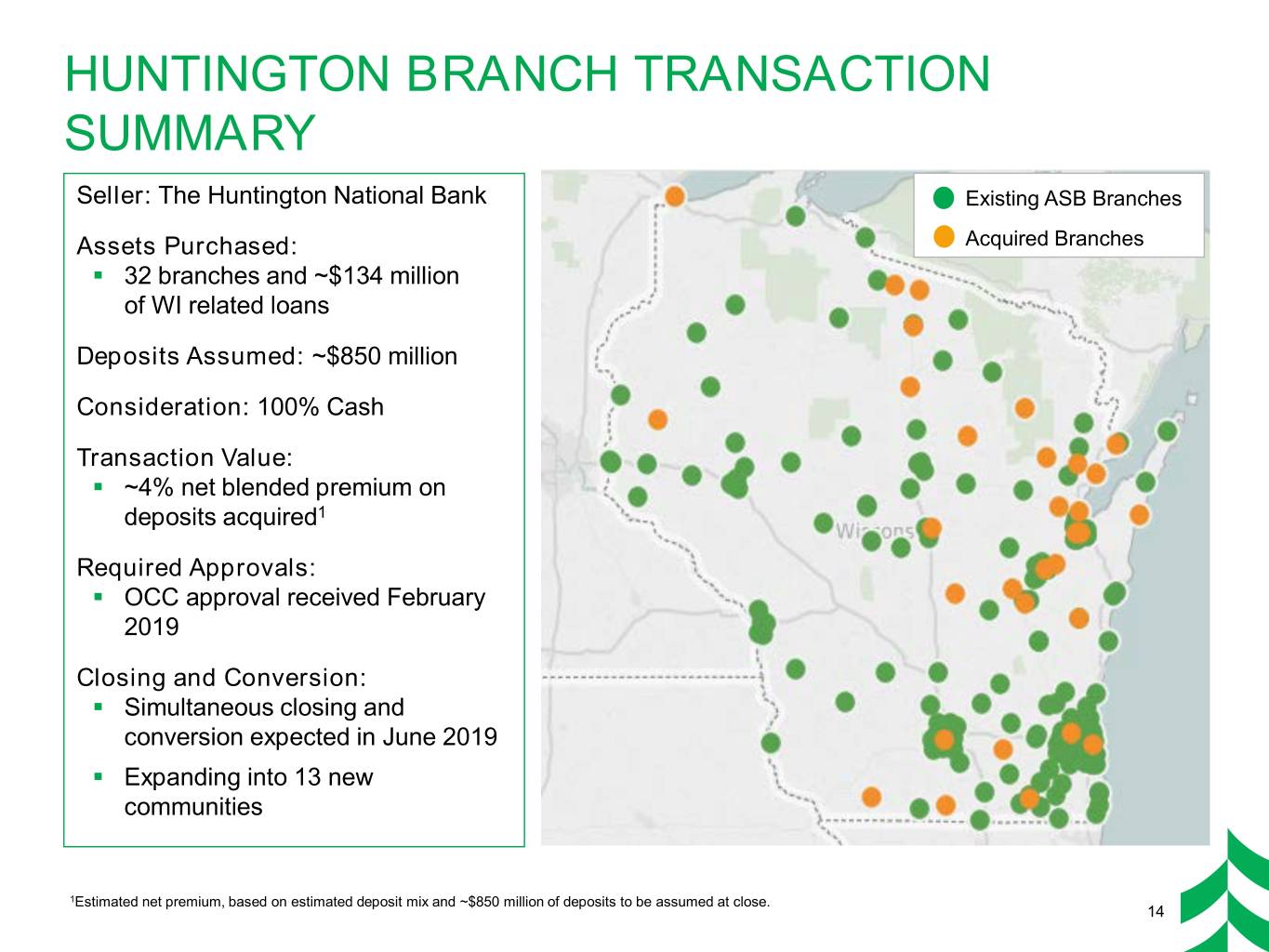

HUNTINGTON BRANCH TRANSACTION SUMMARY Seller: The Huntington National Bank Existing ASB Branches Acquired Branches Assets Purchased: . 32 branches and ~$134 million of WI related loans Deposits Assumed: ~$850 million Consideration: 100% Cash Transaction Value: . ~4% net blended premium on deposits acquired1 Required Approvals: . OCC approval received February 2019 Closing and Conversion: . Simultaneous closing and conversion expected in June 2019 . Expanding into 13 new communities 1Estimated net premium, based on estimated deposit mix and ~$850 million of deposits to be assumed at close. 14

CREDIT QUALITY – QUARTERLY TRENDS ($ IN MILLIONS) Potential Problem Loans Nonaccrual Loans $282 $242 $236 $250 $241 $209 $204 $154 $156 $128 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 Net Charge Offs Allowance for Loan Losses to Loans 1.1% 1.1% $12 1.0% 1.0% 1.0% $9 $8 $7 $0 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 1Q 2018 2Q 2018 3Q 2018 4Q 2018 1Q 2019 15

LOANS STRATIFICATION OUTSTANDINGS AS OF MARCH 31, 2019 C&BL by Geography Total Loans1 CRE by Geography $8.5 billion $5.1 billion Minnesota 6% Illinois Illinois Minnesota Texas3 14% 13% Illinois 12% 11% 24% Other Minnesota 2 10% Midwest Wisconsin Wisconsin Other 2 Wisconsin 11% 32% 30% Midwest 27% Other 23% Midwest2 13% Other 32% Other Other 14% Texas Texas 16% 6% 7% C&BL by Industry Oil and Gas Lending4 CRE by Property Type $8.5 billion $754 million $5.1 billion Power & South Texas Utilities & Eagle 16% Ford East Texas Retail Real Estate 19% 13% 16% North Louisiana Manufacturing & Arkansas Office / Mixed Wholesale Trade Permian 20% Multi-Family Use 23% Oil & Gas 23% 34% 20% 9% Rockies Finance & 14% Insurance Industrial 11% Bakken 13% 3% Marcellus Gulf Coast Utica Other 1-4 Family Appalachia 2% Mid- 5% Construction 8% 6% 1Excludes $0.4 billion Other consumer portfolio. Other Continent Hotel / Motel 2Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. Gulf Shallow (Onshore (primarily 4% 3Principally reflects the oil and gas portfolio. 3% Lower 48) OK & KS) 16 6% 4Chart based on commitments of ~$1.1 billion. 5%

HIGH QUALITY SECURITIES ($ IN BILLIONS) Portfolio Detail as of March 31, 2019 Strategic Portfolio Average Balance and Yield Trends Amortized Fair Duration Investment Type Cost Value (Yrs) $8 $6.89 $6.82 5.00% $7$8 $7 $6.08 $5.97 GNMA CMBS $1.78 $1.73 2.76 $6$7 $5.75 $6 4.00% GNMA MBS & CMOs 2.40 2.38 3.64 $5$6 $5 $4$5 Agency CMBS 0.02 0.02 10.05 $4 2.58% 2.72% $4 2.47% 2.41% 2.42% 3.00% Agency & Other MBS & CMOs $3$4 0.33 0.33 2.74 $3 $2$3 Municipals 1.92 1.96 6.81 $2 2.00% $1$2 $1 FFELP ABS 0.28 0.28 0.17 $1 $0 Other1 0.01 0.01 2.18 $- $0 1.00% 1Q 2015 1Q 2016 1Q 2017 1Q 2018 1Q 2019 Strategic Portfolio $6.74 $6.70 4.16 Membership Stock 0.22 0.22 Average Balance Average Yield Total Portfolio $6.96 $6.92 Strategic Portfolio Fair Value Composition Strategic Portfolio Risk Weighting Profile GNMA MBS Municipals 4% 29% 0% Risk-Weighted (Primarily GNMA Other MBS 63% GNMA securities) CMOs 31% 5% Other CMOs & All other securities and GNMA CMBS 1% adjustments CMBS 26% 37% (Primarily 20% ABS 4% Risk-Weighted) Other <1% 1Q 2019 17 1Includes Corporate, Treasury, and all other.

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS Efficiency Ratio 1Q15 1Q16 1Q17 1Q18 1Q19 Federal Reserve efficiency ratio 70.26% 69.01% 66.39% 70.76% 63.32% Fully tax-equivalent adjustment (1.42)% (1.37)% (1.30)% (0.66)% (0.77)% Other intangible amortization (0.32)% (0.20)% (0.20)% (0.51)% (0.73)% Fully tax-equivalent efficiency ratio1 68.53% 67.44% 64.89% 69.60% 61.83% Acquisition related costs adjustment —% —% —% (6.80)% (0.20)% Fully tax-equivalent efficiency ratio, excluding acquisition related costs (adjusted efficiency ratio)1 68.53% 67.44% 64.89% 62.80% 61.63% The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax- equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and acquisition related costs. Fee-based Revenue ($ millions)1 1Q15 1Q16 1Q17 1Q18 1Q19 Insurance commissions and fees $20 $21 $22 $23 $25 Wealth management fees 16 15 16 21 20 Service charges and deposit account fees 16 16 16 16 15 Card-based fees and other fee-based revenue 12 12 12 13 13 Fee-based revenue $64 $65 $67 $73 $74 Other 16 18 13 17 17 Total noninterest income $80 $83 $80 $90 $91 1This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. 18

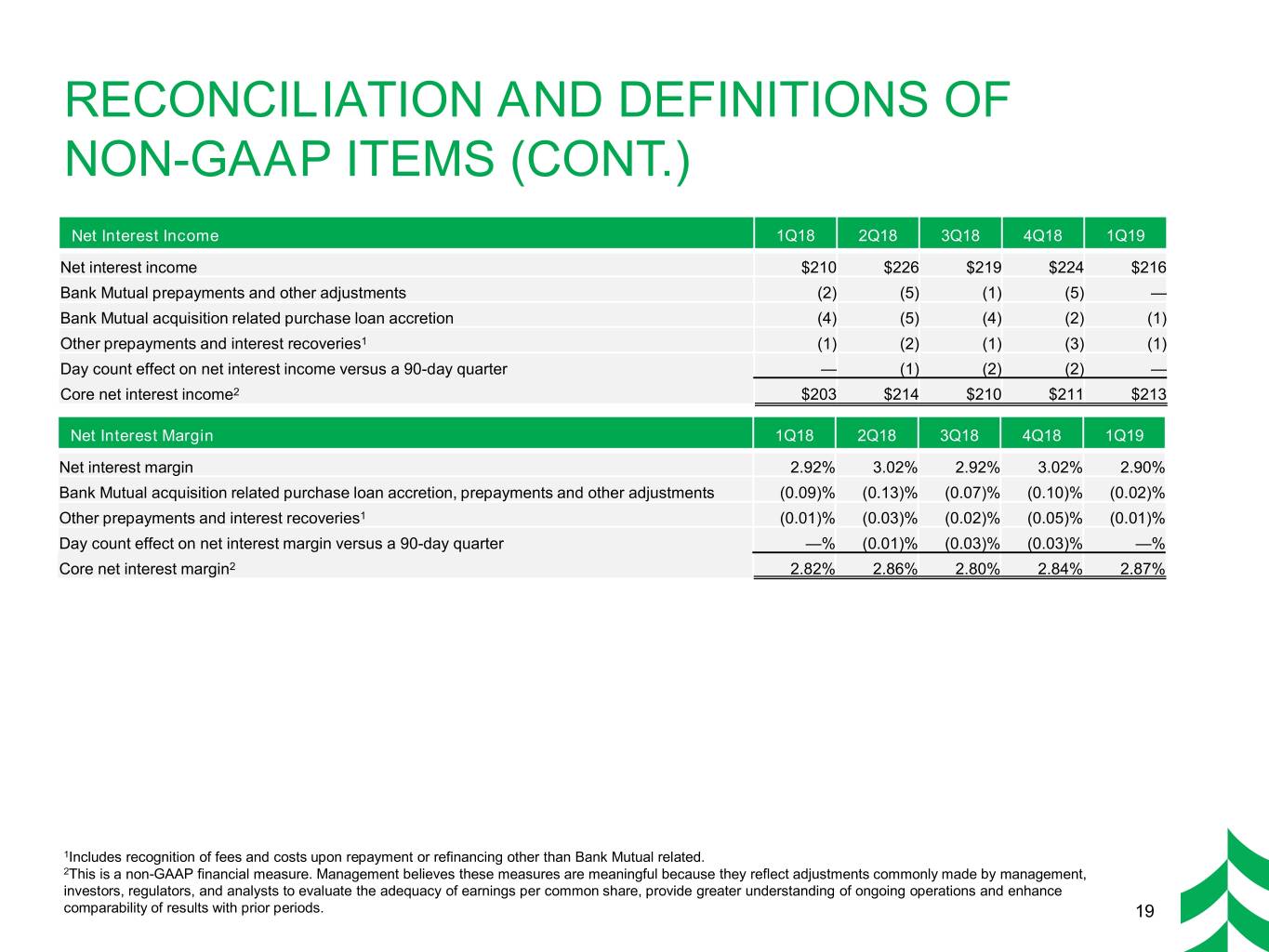

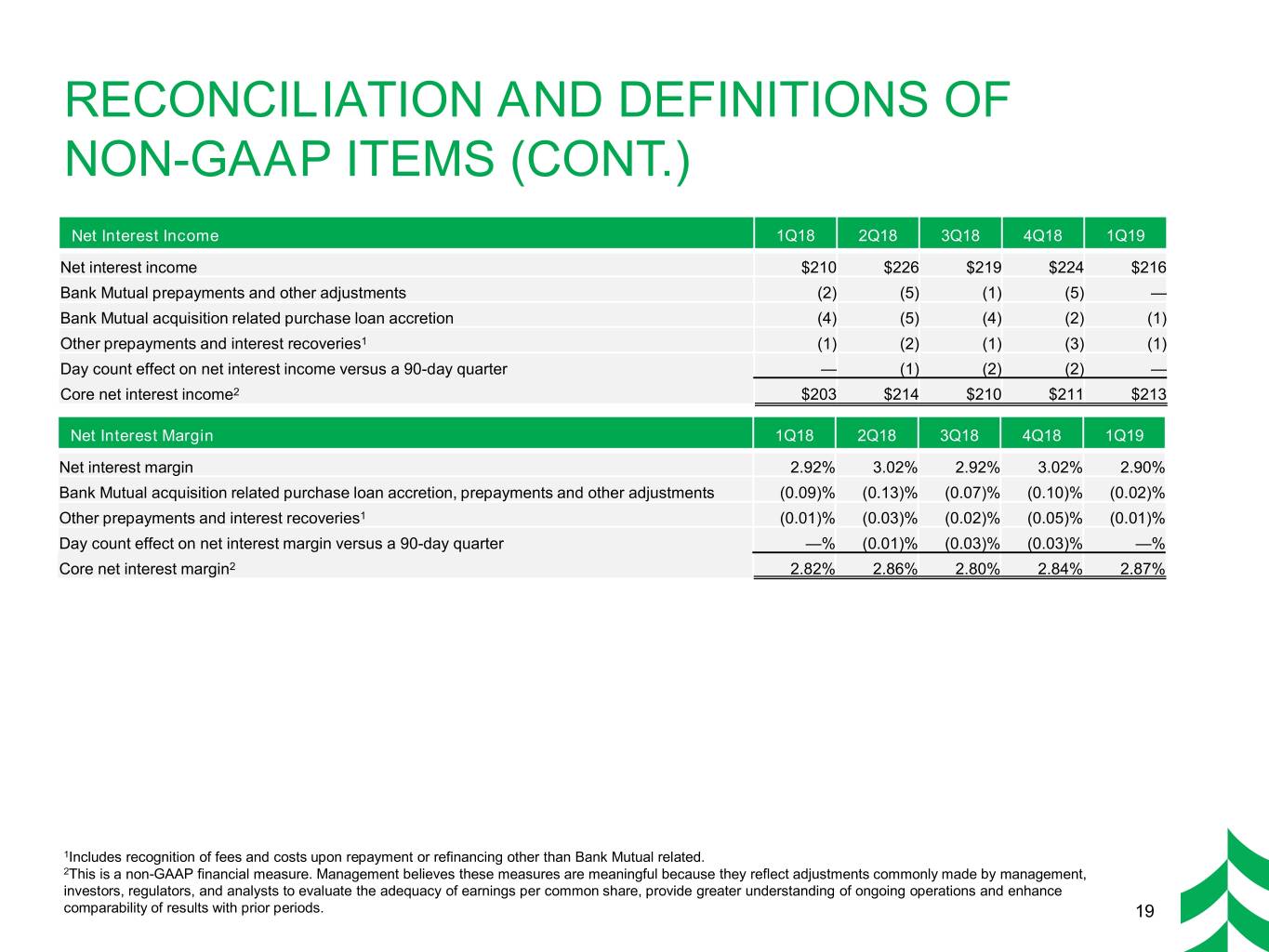

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS (CONT.) Net Interest Income 1Q18 2Q18 3Q18 4Q18 1Q19 Net interest income $210 $226 $219 $224 $216 Bank Mutual prepayments and other adjustments (2) (5) (1) (5) — Bank Mutual acquisition related purchase loan accretion (4) (5) (4) (2) (1) Other prepayments and interest recoveries1 (1) (2) (1) (3) (1) Day count effect on net interest income versus a 90-day quarter — (1) (2) (2) — Core net interest income2 $203 $214 $210 $211 $213 Net Interest Margin 1Q18 2Q18 3Q18 4Q18 1Q19 Net interest margin 2.92% 3.02% 2.92% 3.02% 2.90% Bank Mutual acquisition related purchase loan accretion, prepayments and other adjustments (0.09)% (0.13)% (0.07)% (0.10)% (0.02)% Other prepayments and interest recoveries1 (0.01)% (0.03)% (0.02)% (0.05)% (0.01)% Day count effect on net interest margin versus a 90-day quarter —% (0.01)% (0.03)% (0.03)% —% Core net interest margin2 2.82% 2.86% 2.80% 2.84% 2.87% 1Includes recognition of fees and costs upon repayment or refinancing other than Bank Mutual related. 2This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. 19