Exhibit 99.2 THIRD QUARTER 2019 EARNINGS PRESENTATION October 24, 2019

DISCLAIMER Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target," “outlook” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. These forward-looking statements include: management plans relating to the proposed acquisition of First Staunton Bancshares, Inc. (“proposed transaction”); the expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction; the ability to obtain any required regulatory approvals; any statements of the plans and objectives of management for future operations, products or services; any statements of expectation or belief; projections related to certain financial results or other benefits of the proposed transaction; and any statements of assumptions underlying any of the foregoing. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings, and such factors are incorporated herein by reference. Additional factors which may cause actual results of the proposed transaction to differ materially from those contained in forward-looking statements are the possibility that expected benefits of the proposed transaction may not materialize in the timeframe expected or at all, or may be more costly to achieve; the proposed transaction may not be timely completed, if at all; that required regulatory approvals are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of shareholders, customers, employees or other constituents to the proposed transaction; and diversion of management time on acquisition-related matters. Non-GAAP Measures This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation. 2

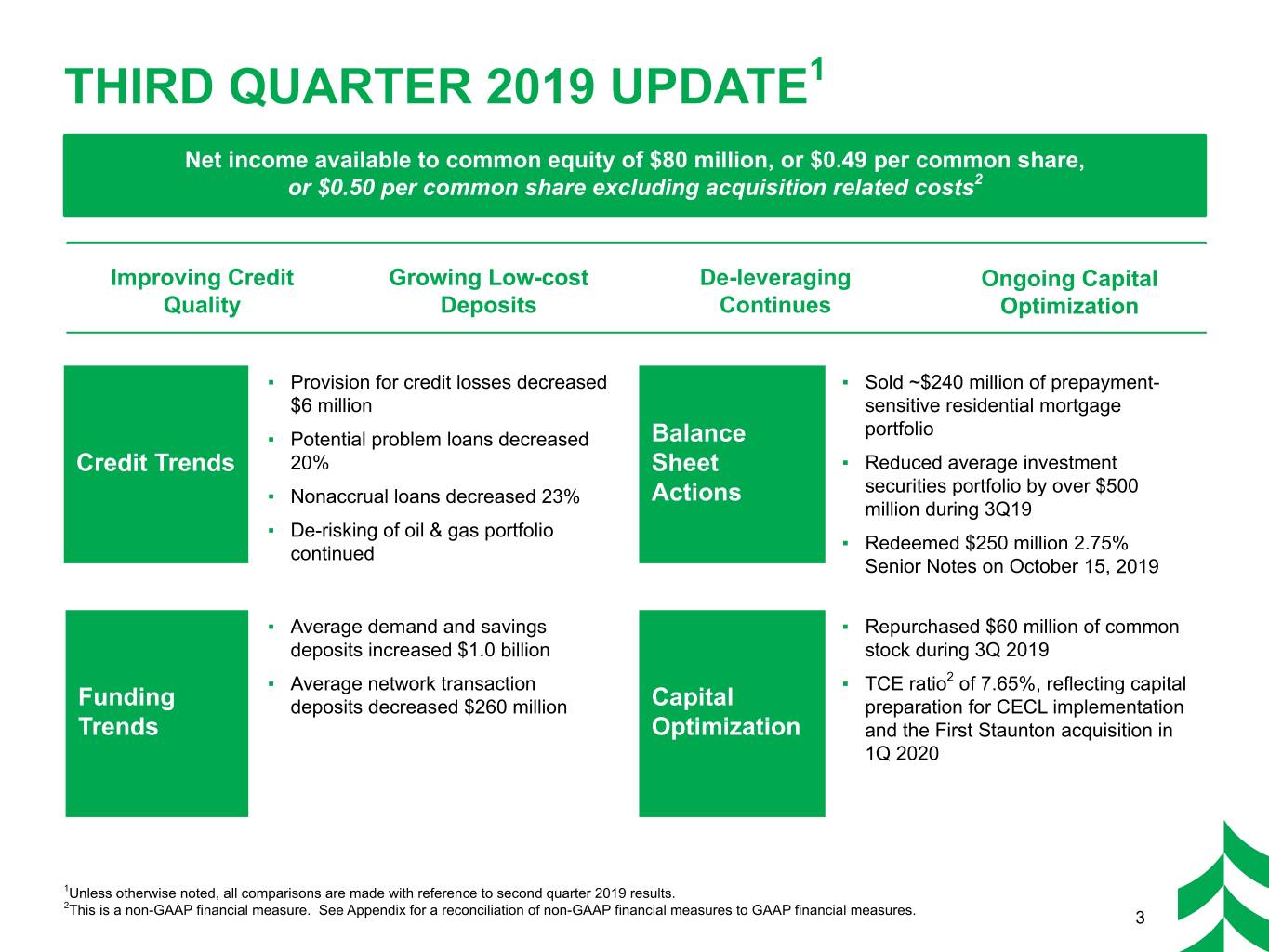

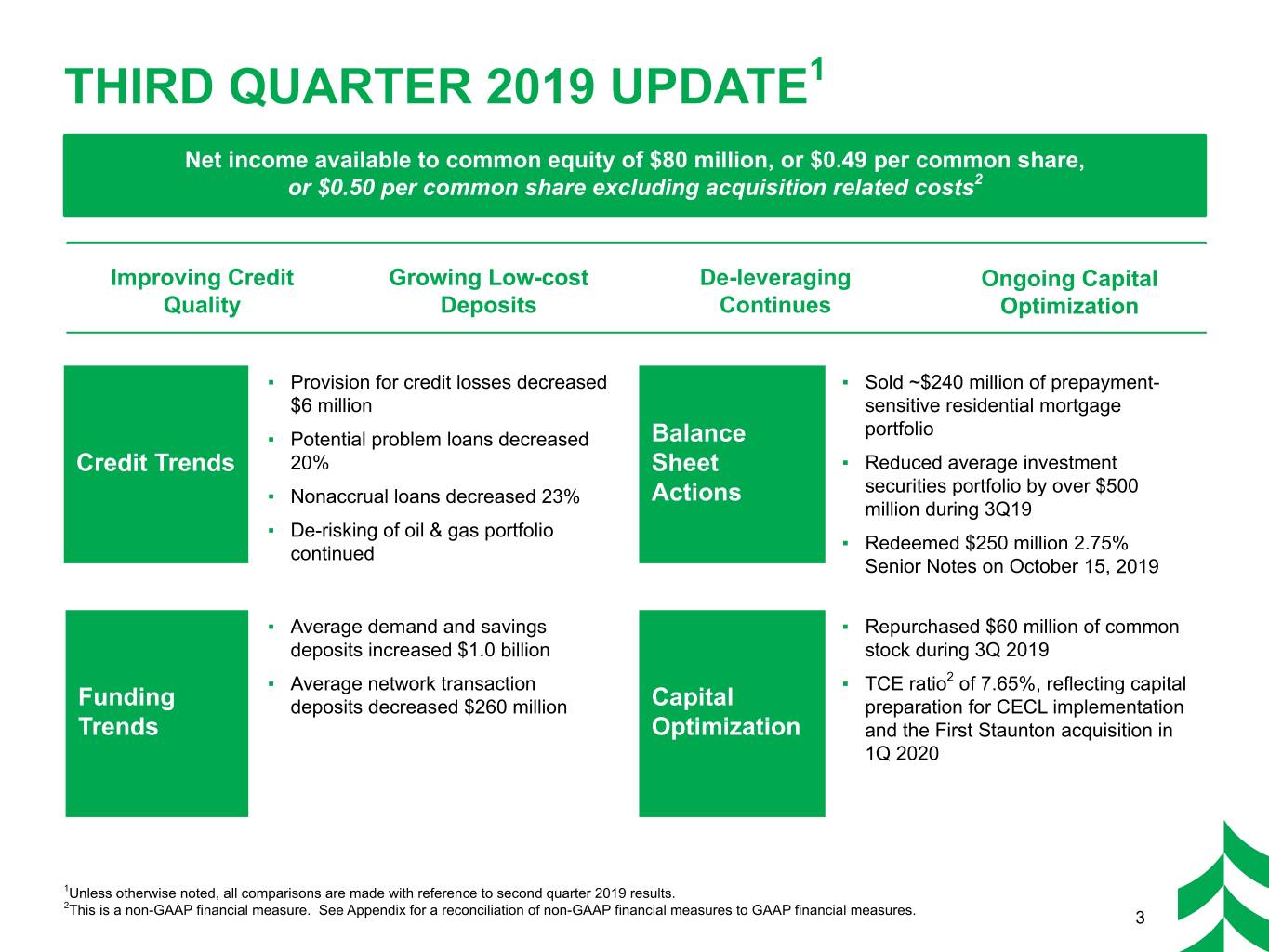

THIRD QUARTER 2019 UPDATE1 Net income available to common equity of $80 million, or $0.49 per common share, or $0.50 per common share excluding acquisition related costs2 Improving Credit Growing Low-cost De-leveraging Ongoing Capital Quality Deposits Continues Optimization ▪ Provision for credit losses decreased ▪ Sold ~$240 million of prepayment- $6 million sensitive residential mortgage portfolio ▪ Potential problem loans decreased Balance Credit Trends 20% Sheet ▪ Reduced average investment securities portfolio by over $500 ▪ Nonaccrual loans decreased 23% Actions million during 3Q19 ▪ De-risking of oil & gas portfolio ▪ Redeemed $250 million 2.75% continued Senior Notes on October 15, 2019 ▪ Average demand and savings ▪ Repurchased $60 million of common deposits increased $1.0 billion stock during 3Q 2019 ▪ Average network transaction ▪ TCE ratio2 of 7.65%, reflecting capital Funding deposits decreased $260 million Capital preparation for CECL implementation Trends Optimization and the First Staunton acquisition in 1Q 2020 1Unless otherwise noted, all comparisons are made with reference to second quarter 2019 results. 2 This is a non-GAAP financial measure. See Appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 3

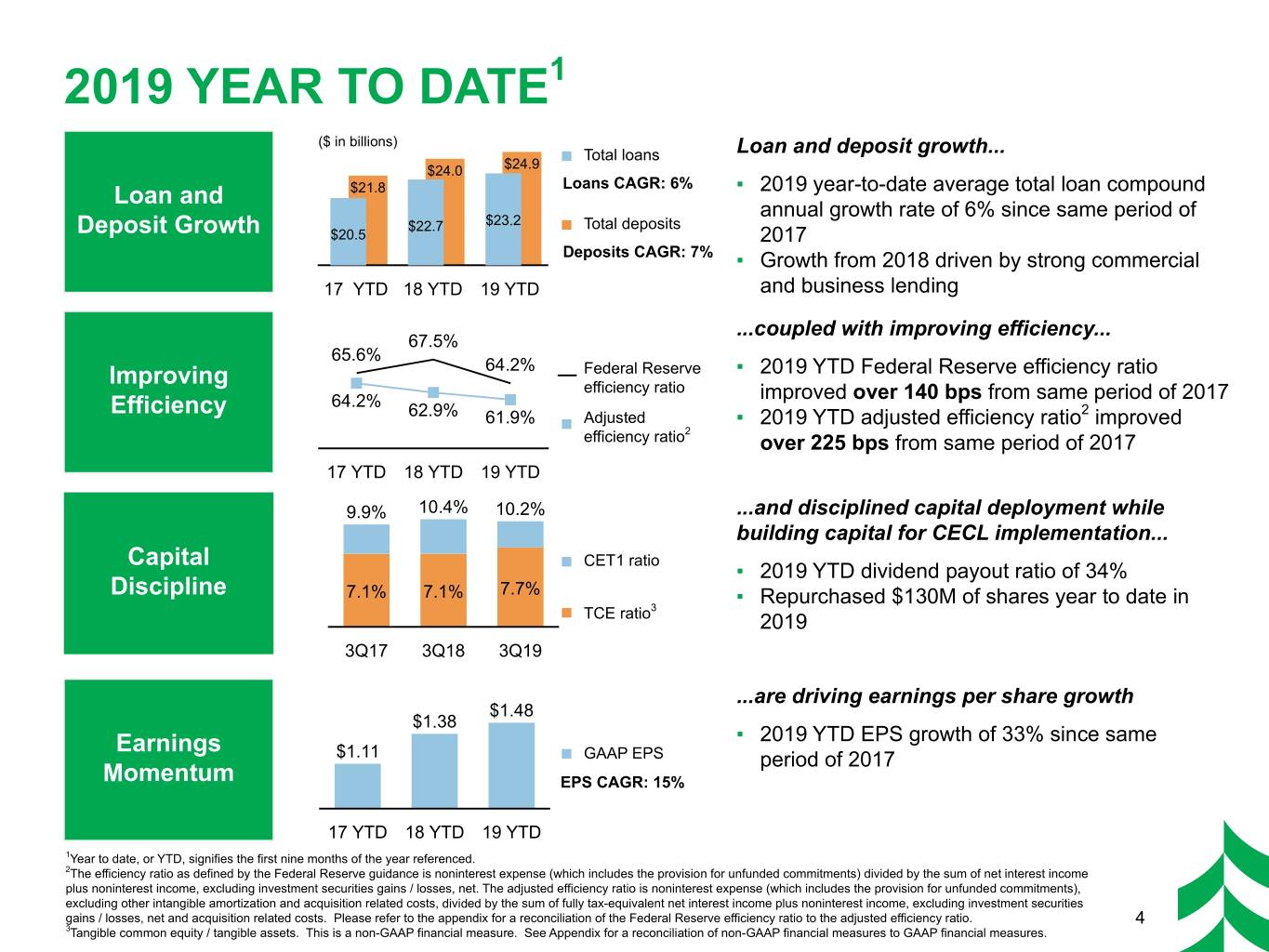

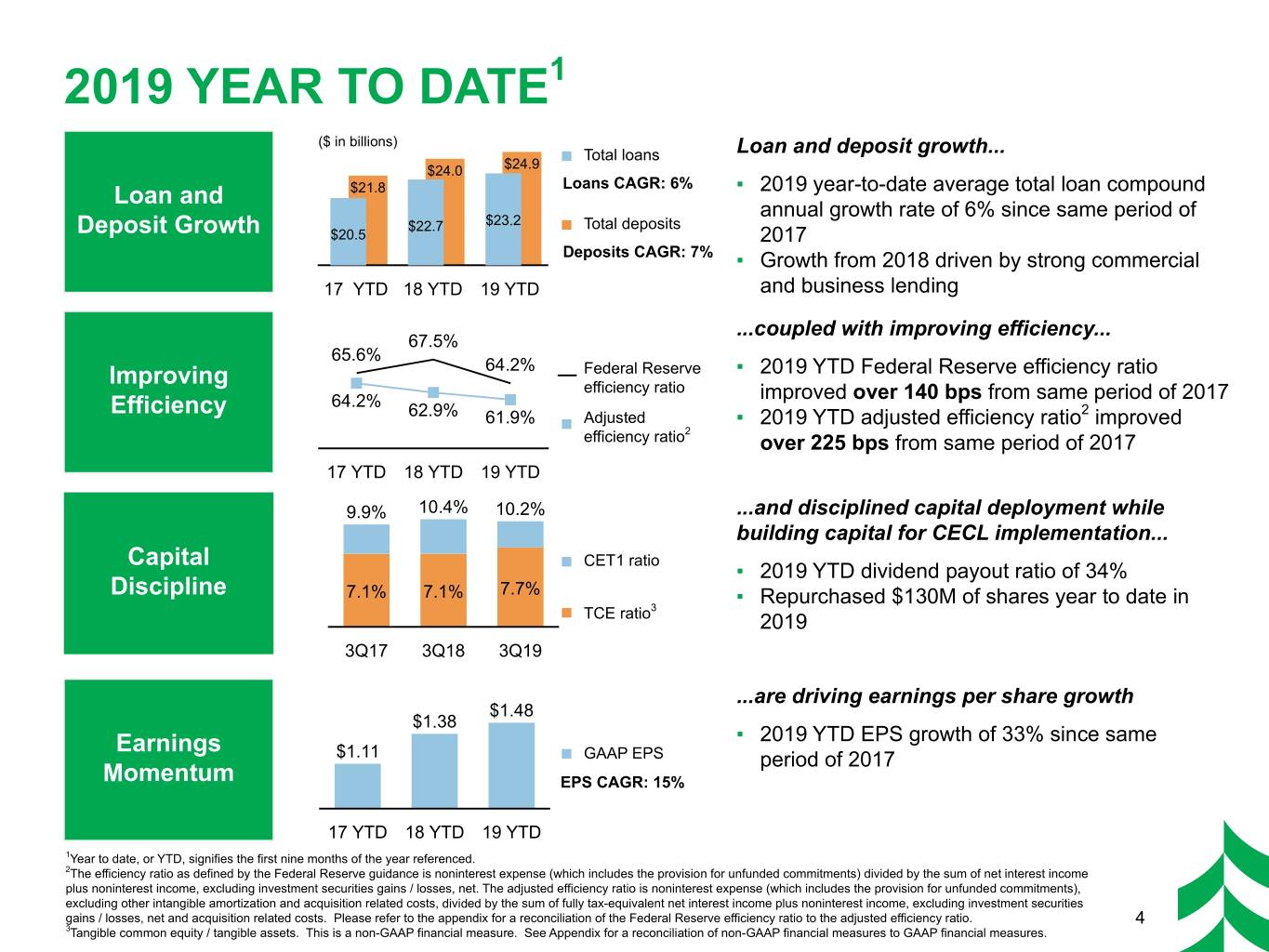

2019 YEAR TO DATE1 ($ in billions) Total loans Loan and deposit growth... $24.0 $24.9 ▪ Loans CAGR: 6% Loan and $21.8 ▪ 2019 year-to-date average total loan compound annual growth rate of 6% since same period of $22.7 $23.2 Total deposits Deposit Growth $20.5 ▪ 2017 Deposits CAGR: 7% ▪ Growth from 2018 driven by strong commercial 17 YTD 18 YTD 19 YTD and business lending ...coupled with improving efficiency... 67.5% 65.6% 64.2% Federal Reserve ▪ 2019 YTD Federal Reserve efficiency ratio Improving efficiency ratio 64.2% improved over 140 bps from same period of 2017 Efficiency 2 62.9% 61.9% Adjusted ▪ 2019 YTD adjusted efficiency ratio improved 2 ▪ efficiency ratio over 225 bps from same period of 2017 17 YTD 18 YTD 19 YTD 9.9% 10.4% 10.2% ...and disciplined capital deployment while building capital for CECL implementation... Capital CET1 ratio ▪ ▪ 2019 YTD dividend payout ratio of 34% Discipline 7.1% 7.1% 7.7% ▪ Repurchased $130M of shares year to date in 3 ▪ TCE ratio 2019 3Q17 3Q18 3Q19 ...are driving earnings per share growth $1.48 $1.38 Earnings ▪ 2019 YTD EPS growth of 33% since same $1.11 ▪ GAAP EPS period of 2017 Momentum EPS CAGR: 15% 17 YTD 18 YTD 19 YTD 1Year to date, or YTD, signifies the first nine months of the year referenced. 2The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and acquisition related costs. Please refer to the appendix for a reconciliation of the Federal Reserve efficiency ratio to the adjusted efficiency ratio. 4 3Tangible common equity / tangible assets. This is a non-GAAP financial measure. See Appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures.

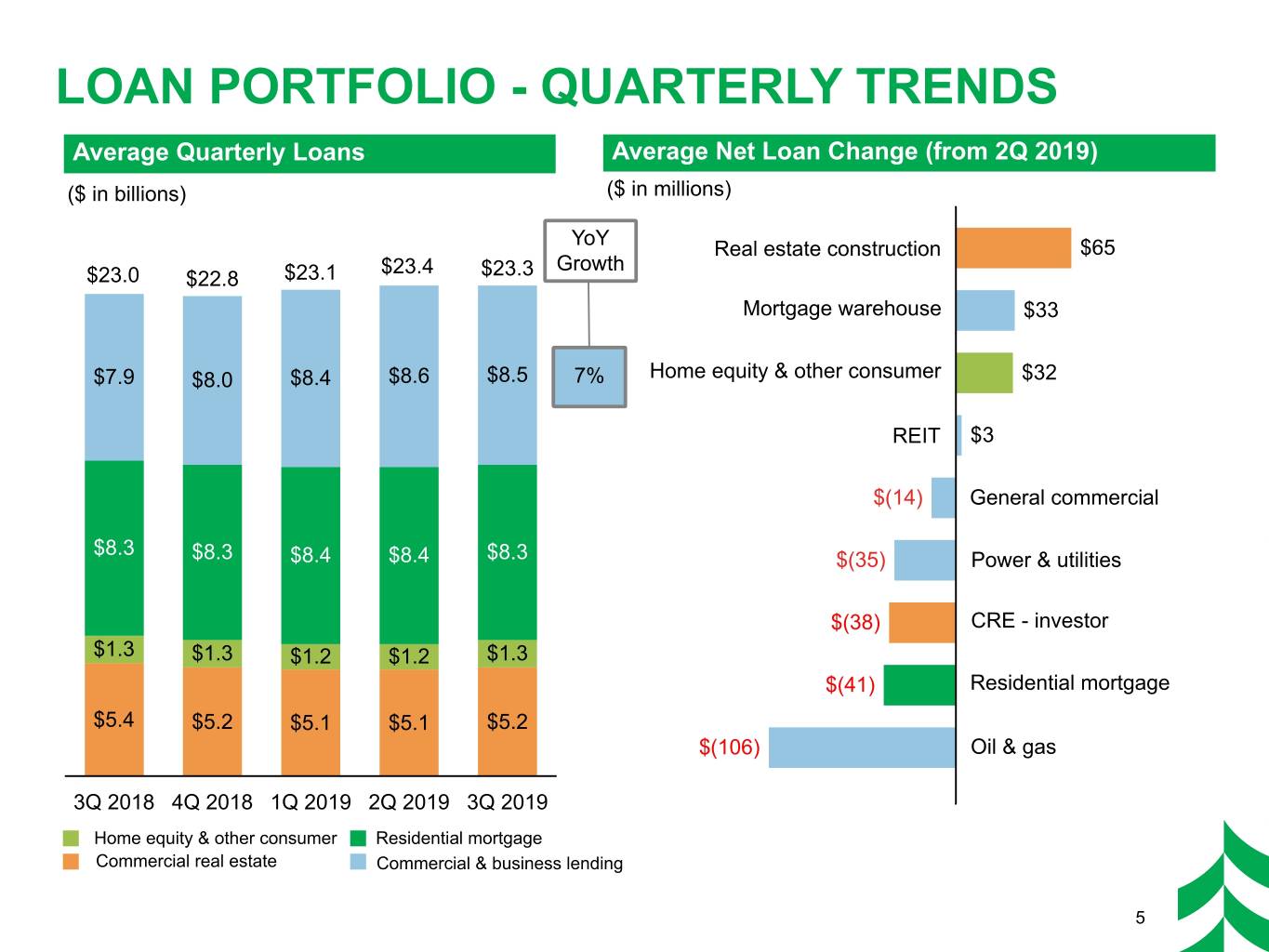

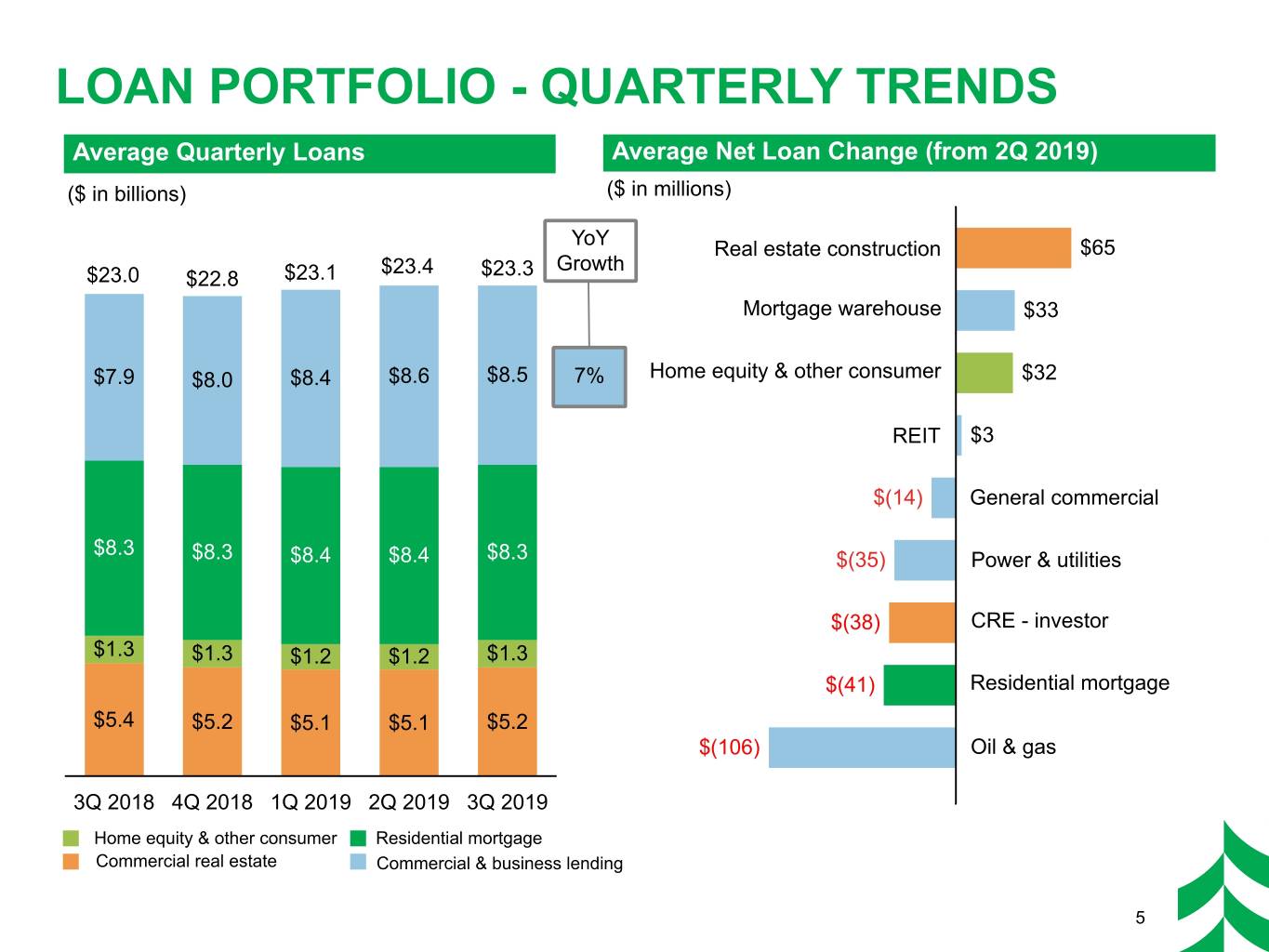

LOAN PORTFOLIO - QUARTERLY TRENDS Average Quarterly Loans Average Net Loan Change (from 2Q 2019) ($ in billions) ($ in millions) YoY Real estate construction $65 $23.4 Growth $23.0 $22.8 $23.1 $23.3 Mortgage warehouse $33 $7.9 $8.0 $8.4 $8.6 $8.5 7% Home equity & other consumer $32 REIT $3 $(14) General commercial $8.3 $8.3 $8.4 $8.4 $8.3 $(35) Power & utilities $(38) CRE - investor $1.3 $1.3 $1.2 $1.2 $1.3 $(41) Residential mortgage $5.4 $5.2 $5.1 $5.1 $5.2 $(106) Oil & gas 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Home equity & other consumer Residential mortgage Commercial real estate Commercial & business lending 5

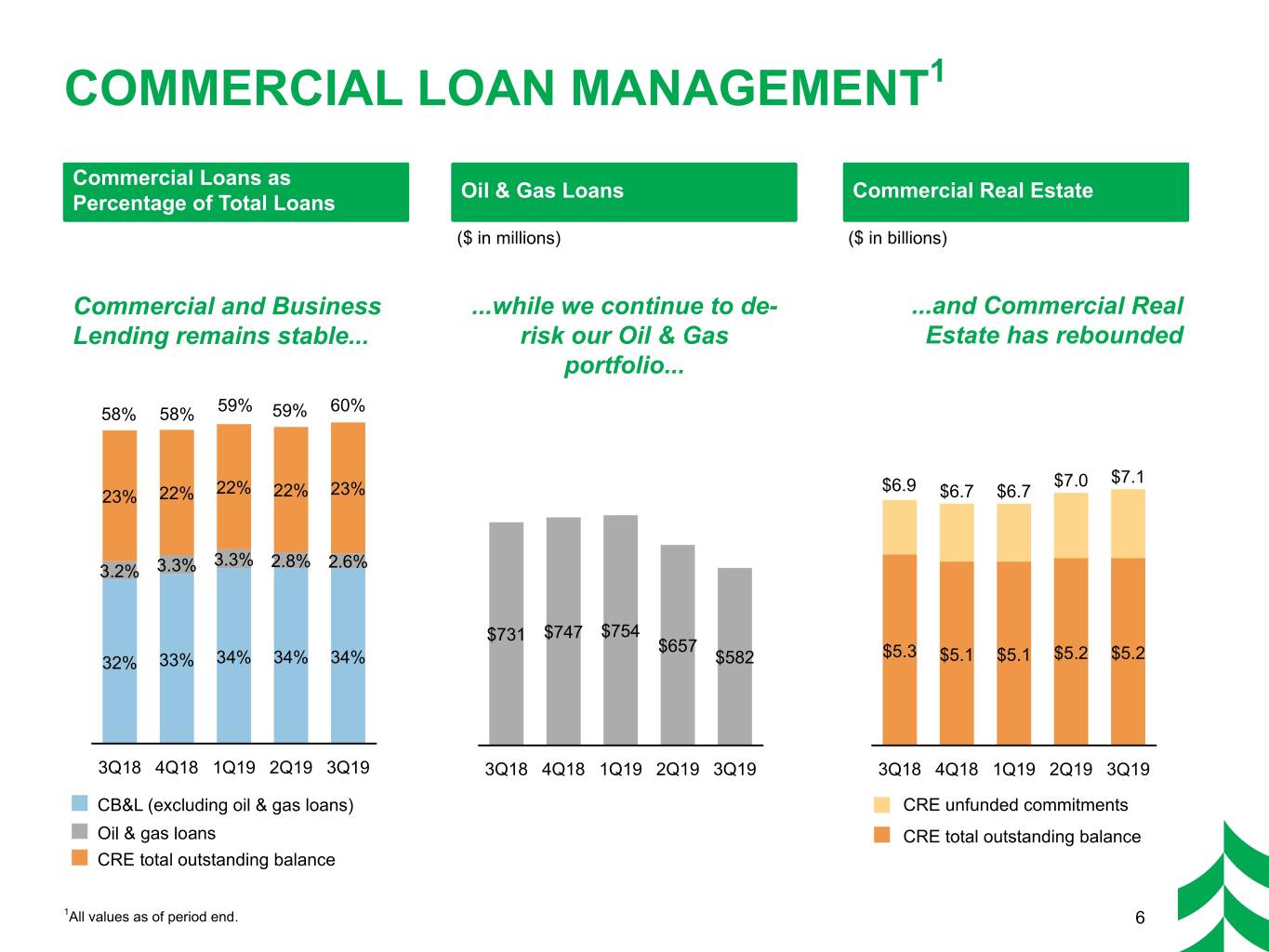

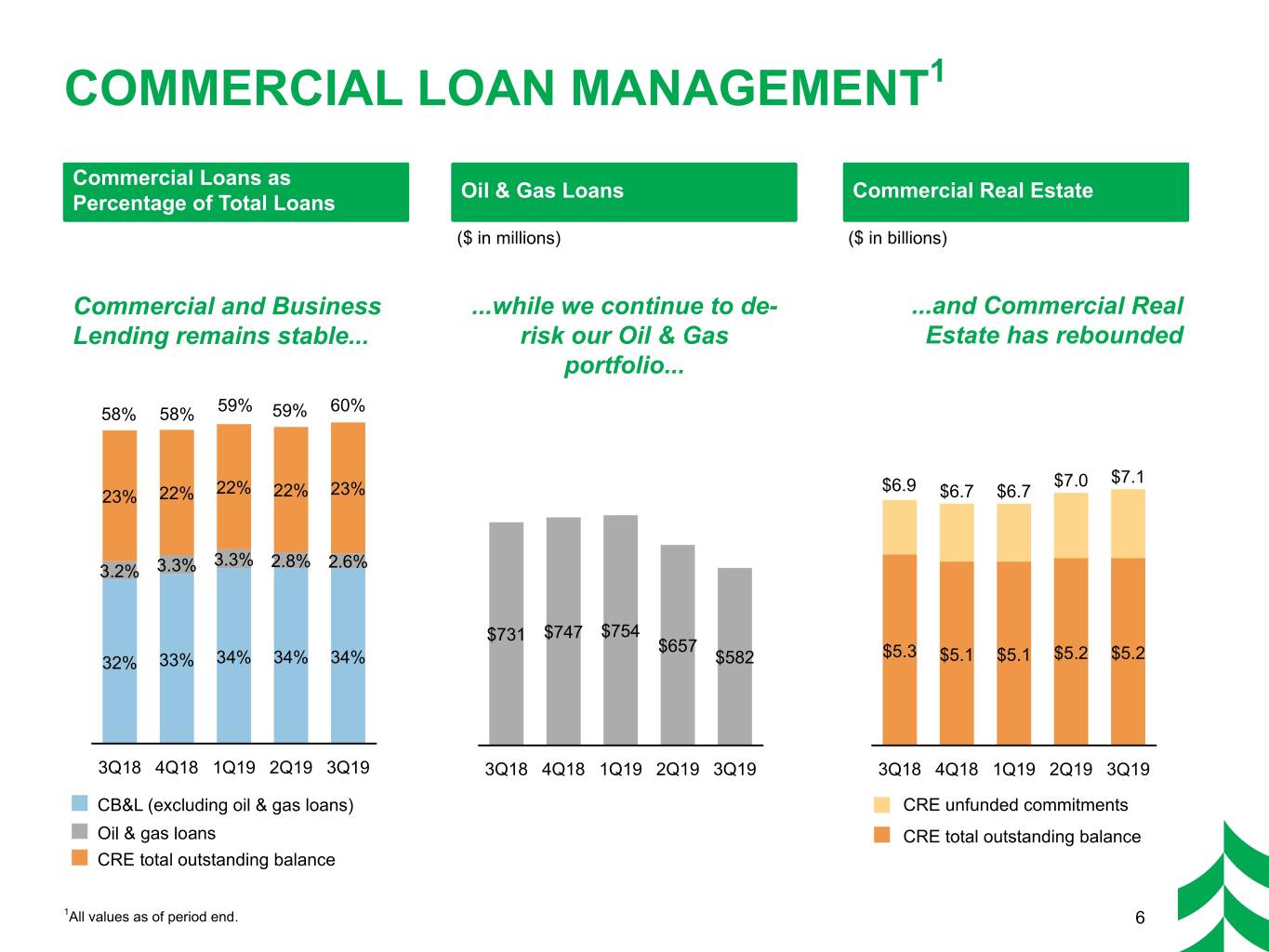

COMMERCIAL LOAN MANAGEMENT1 Commercial Loans as Oil & Gas Loans Commercial Real Estate Percentage of Total Loans ($ in millions) ($ in billions) Commercial and Business ...while we continue to de- ...and Commercial Real Lending remains stable... risk our Oil & Gas Estate has rebounded portfolio... 58% 58% 59% 59% 60% $7.1 22% $6.9 $7.0 23% 22% 22% 23% $6.7 $6.7 3.3% 2.8% 2.6% 3.2% 3.3% $731 $747 $754 $657 $5.3 $5.2 $5.2 32% 33% 34% 34% 34% $582 $5.1 $5.1 3Q18 4Q18 1Q19 2Q19 3Q19 3Q18 4Q18 1Q19 2Q19 3Q19 3Q18 4Q18 1Q19 2Q19 3Q19 CB&L (excluding oil & gas loans) CRE unfunded commitments Oil & gas loans CRE total outstanding balance CRE total outstanding balance 1All values as of period end. 6

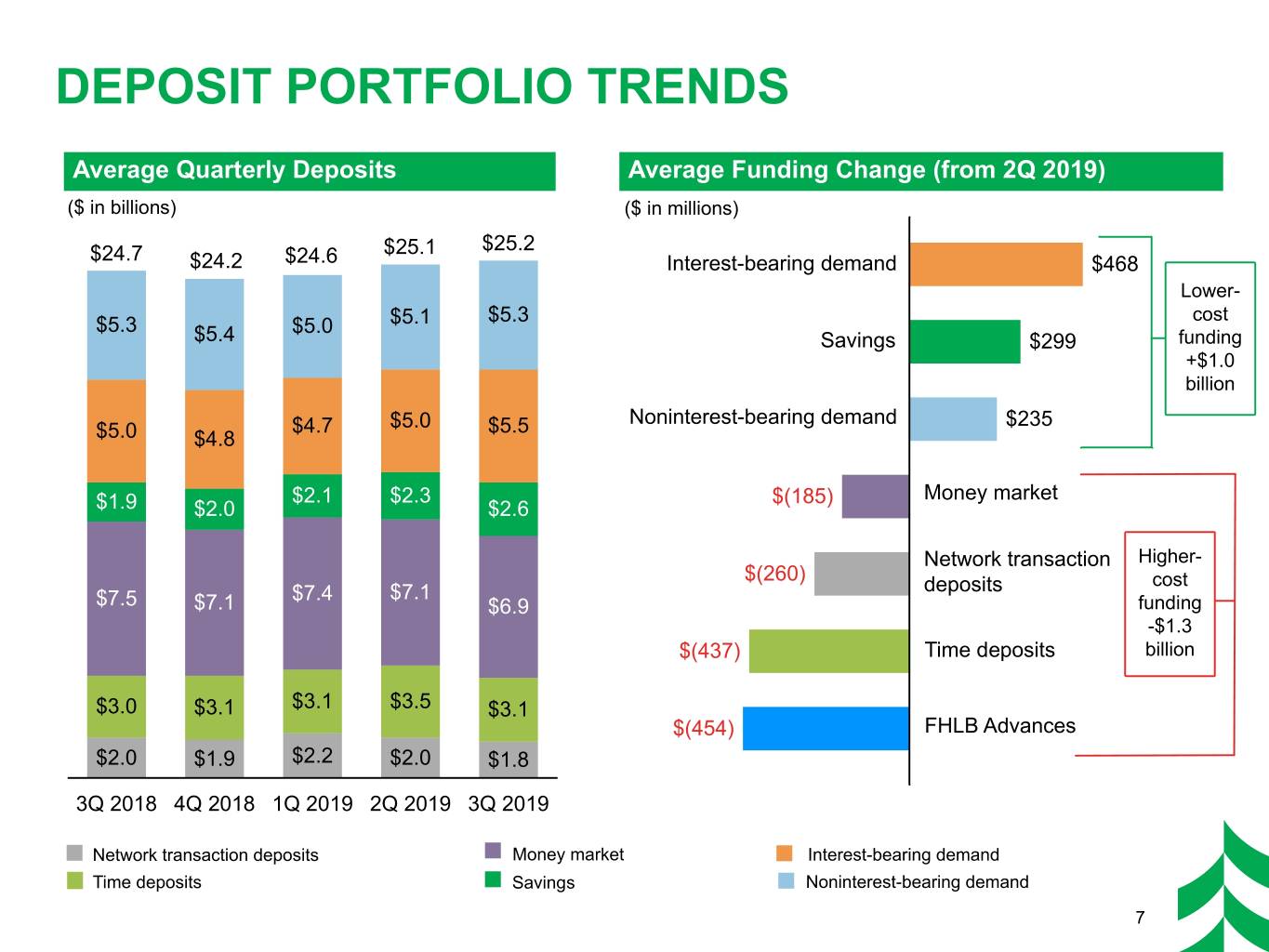

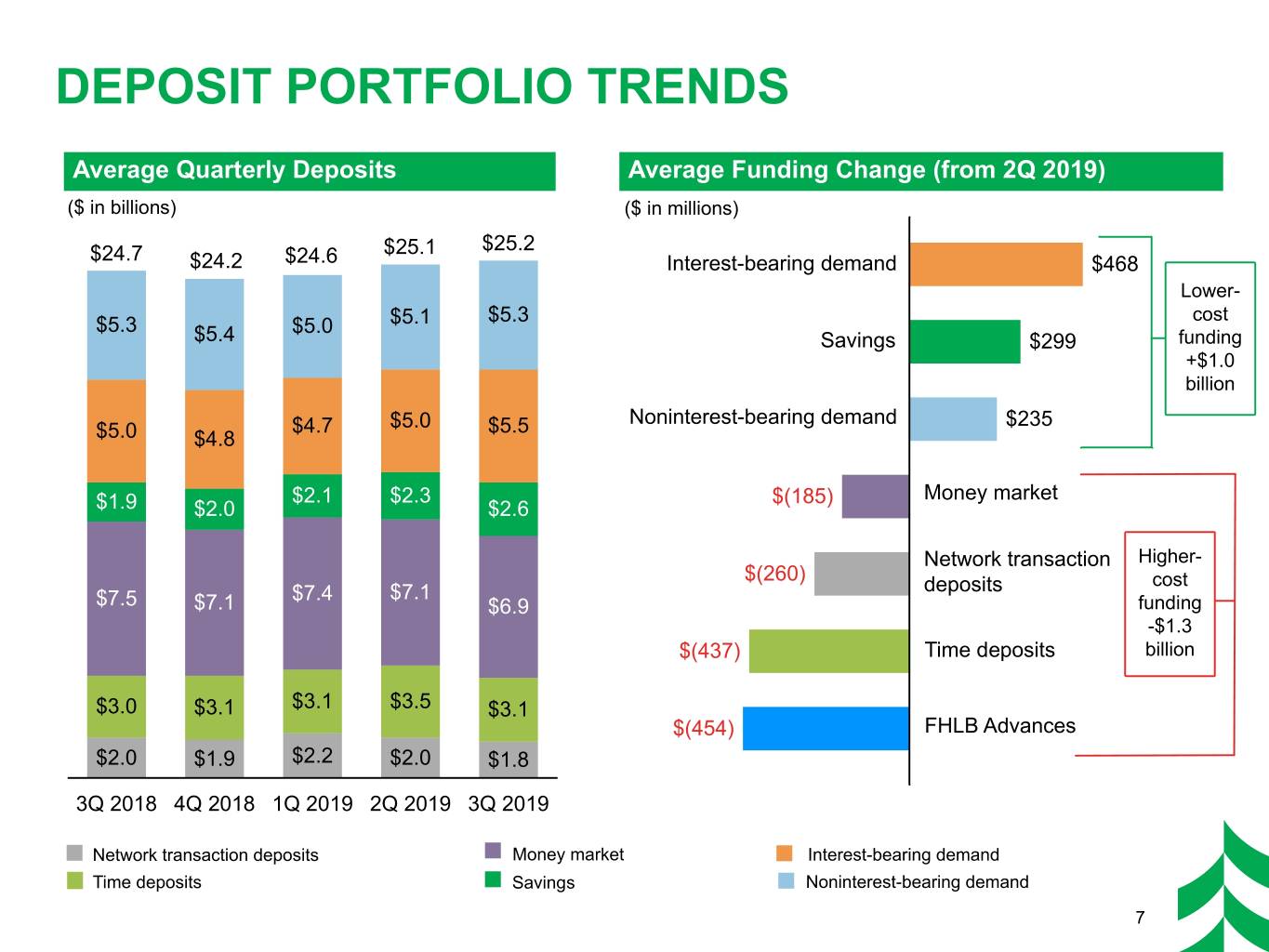

DEPOSIT PORTFOLIO TRENDS Average Quarterly Deposits Average Funding Change (from 2Q 2019) ($ in billions) ($ in millions) $25.1 $25.2 $24.7 $24.2 $24.6 Interest-bearing demand $468 Lower- $5.3 cost $5.3 $5.0 $5.1 $5.4 Savings $299 funding +$1.0 billion $4.7 $5.0 $5.5 Noninterest-bearing demand $235 $5.0 $4.8 $2.1 $2.3 $(185) Money market $1.9 $2.0 $2.6 Network transaction Higher- $(260) cost $7.4 $7.1 deposits $7.5 $7.1 $6.9 funding -$1.3 $(437) Time deposits billion $3.0 $3.1 $3.1 $3.5 $3.1 $(454) FHLB Advances $2.0 $1.9 $2.2 $2.0 $1.8 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Network transaction deposits Money market Interest-bearing demand Time deposits Savings Noninterest-bearing demand 7

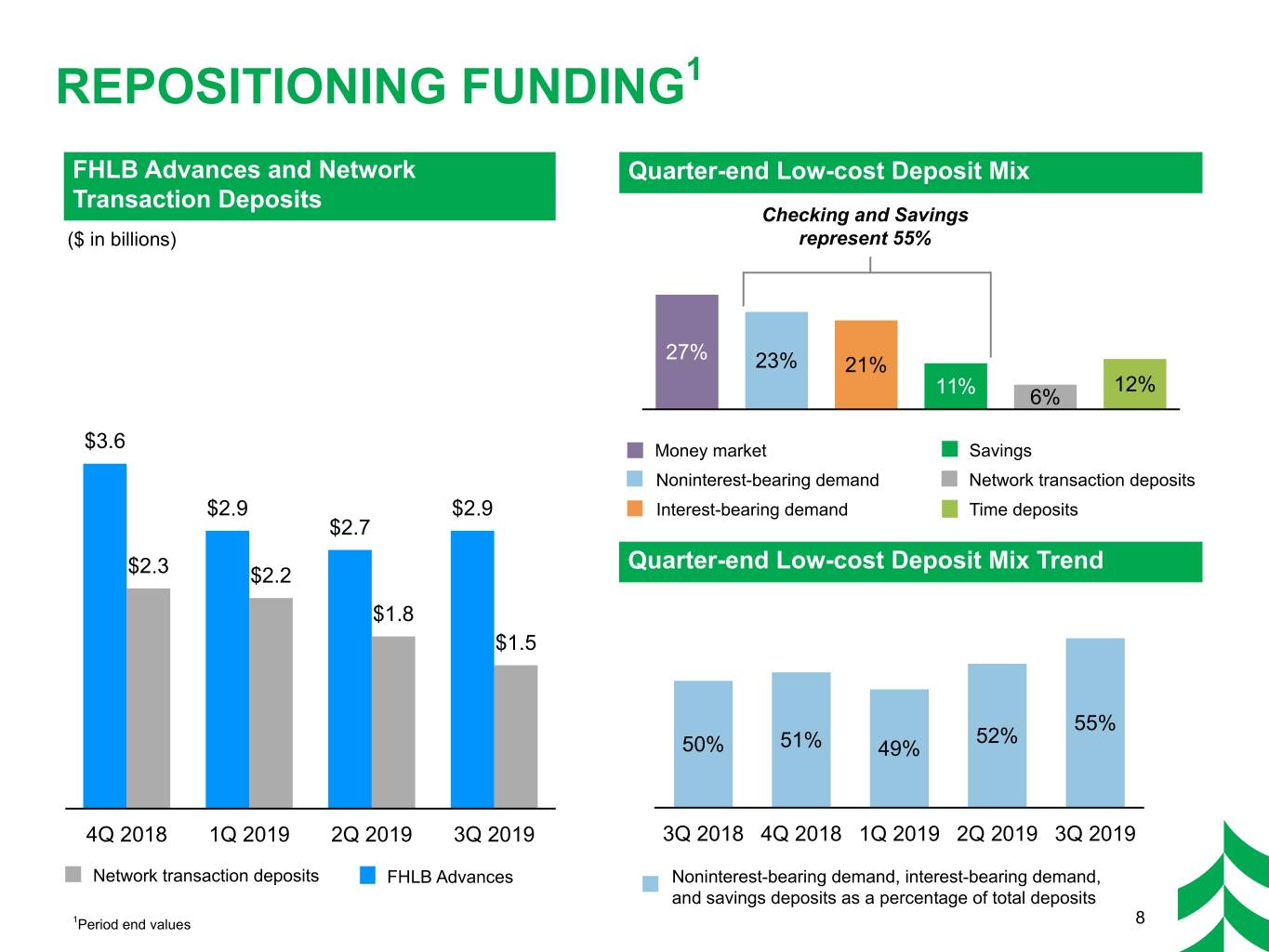

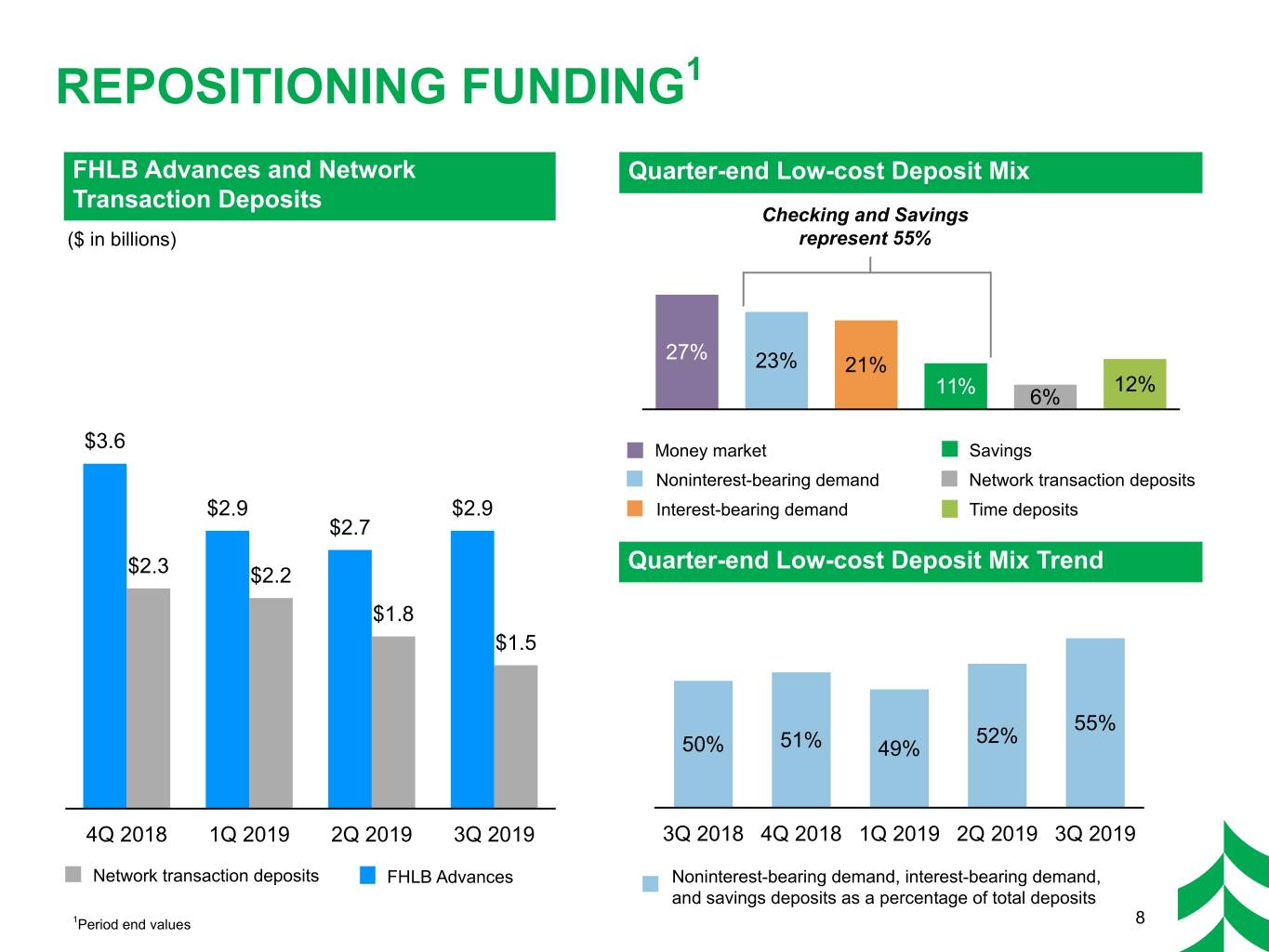

REPOSITIONING FUNDING1 FHLB Advances and Network Quarter-end Low-cost Deposit Mix Transaction Deposits Checking and Savings ($ in billions) represent 55% 27% 23% 21% 11% 12% 6% $3.6 Money market Savings Noninterest-bearing demand Network transaction deposits $2.9 $2.9 Interest-bearing demand Time deposits $2.7 Quarter-end Low-cost Deposit Mix Trend $2.3 $2.2 $1.8 $1.5 55% 52% 50% 51% 49% 4Q 2018 1Q 2019 2Q 2019 3Q 2019 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Network transaction deposits FHLB Advances Noninterest-bearing demand, interest-bearing demand, and savings deposits as a percentage of total deposits 1Period end values 8

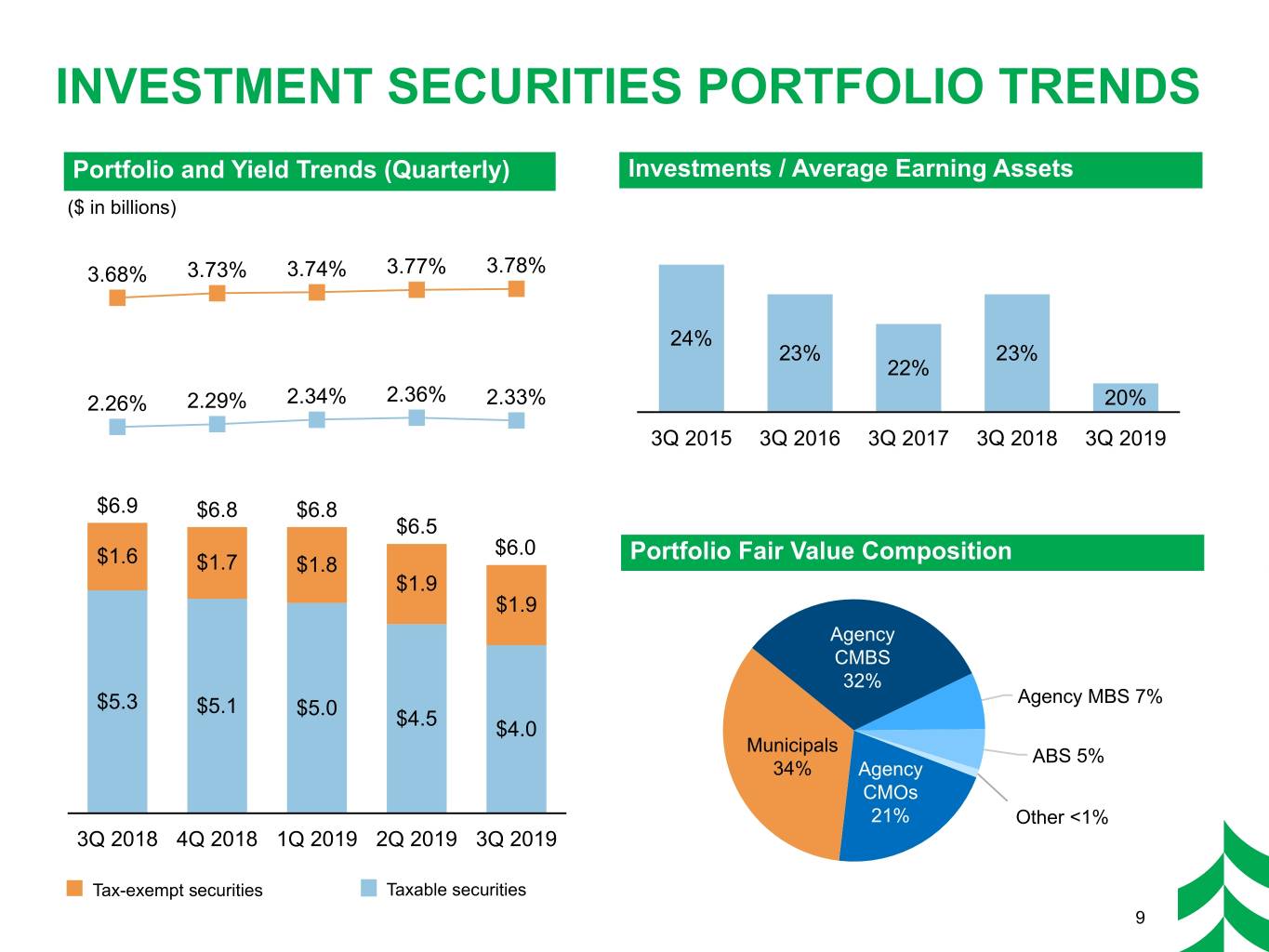

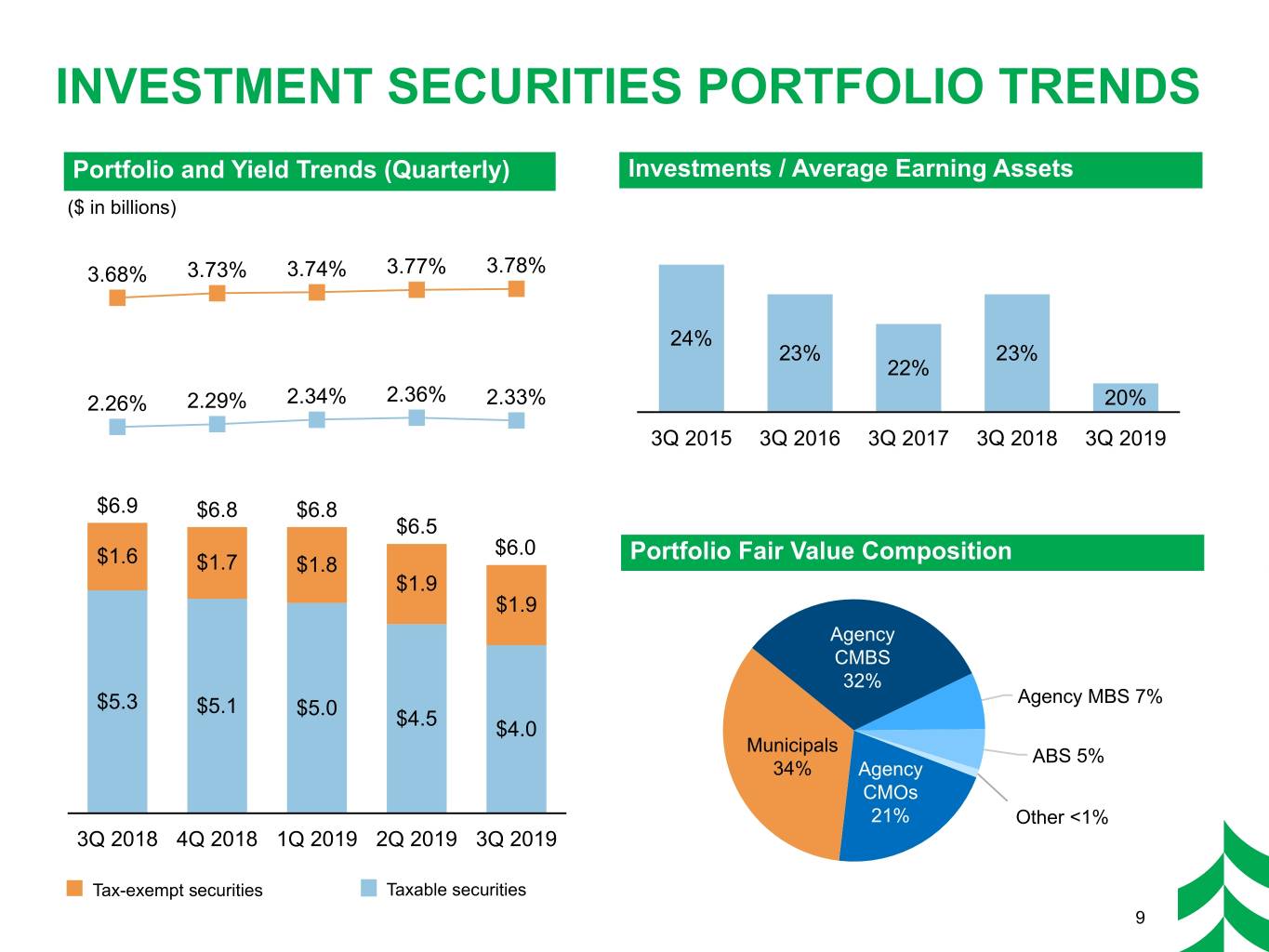

INVESTMENT SECURITIES PORTFOLIO TRENDS Portfolio and Yield Trends (Quarterly) Investments / Average Earning Assets ($ in billions) 3.68% 3.73% 3.74% 3.77% 3.78% 24% 23% 23% 22% 2.26% 2.29% 2.34% 2.36% 2.33% 20% 3Q 2015 3Q 2016 3Q 2017 3Q 2018 3Q 2019 $6.9 $6.8 $6.8 $6.5 $6.0 Portfolio Fair Value Composition $1.6 $1.7 $1.8 $1.9 $1.9 Agency CMBS 32% Agency MBS 7% $5.3 $5.1 $5.0 $4.5 $4.0 Municipals ABS 5% 34% Agency CMOs 21% Other <1% 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Tax-exempt securities Taxable securities 9

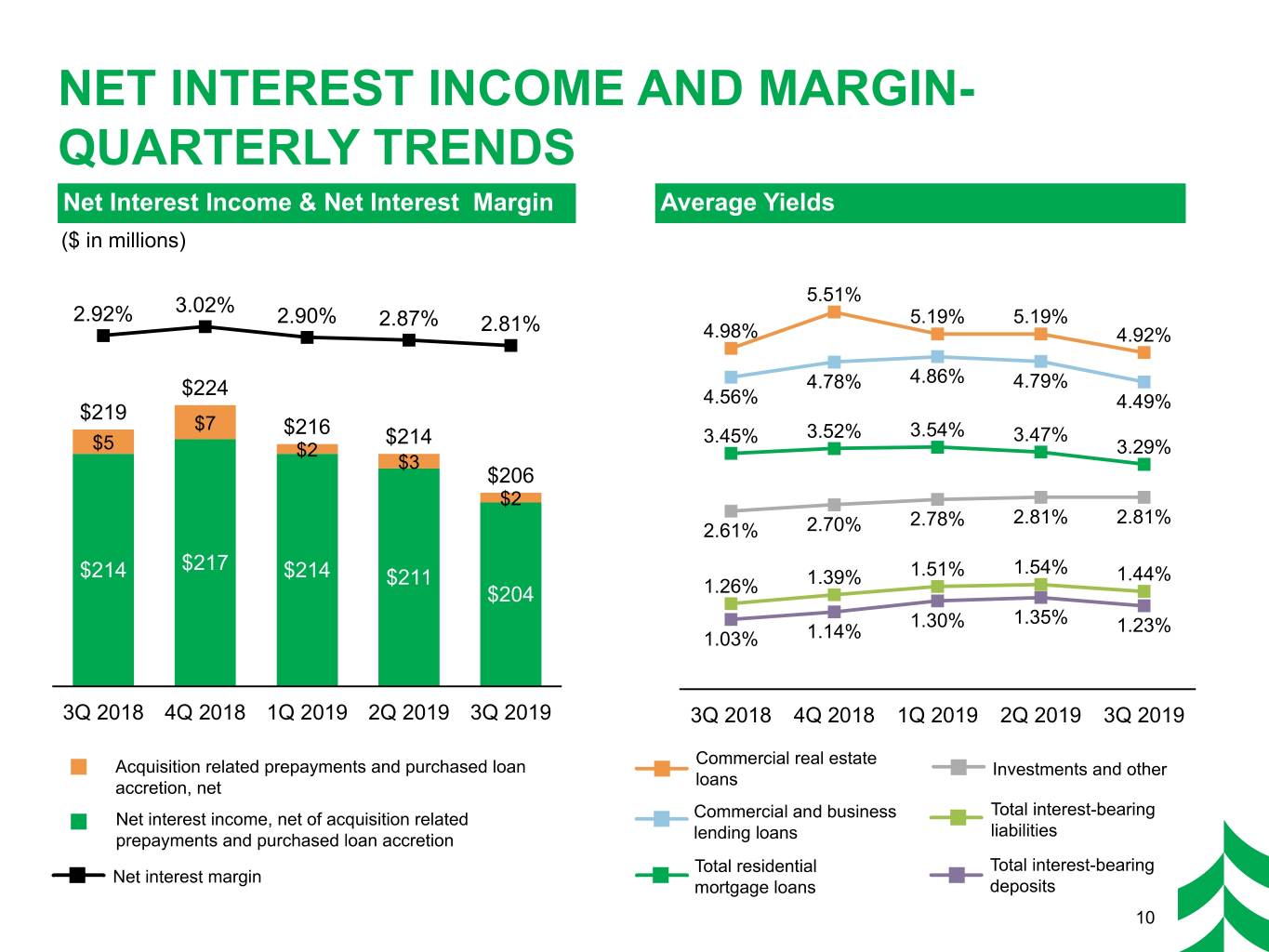

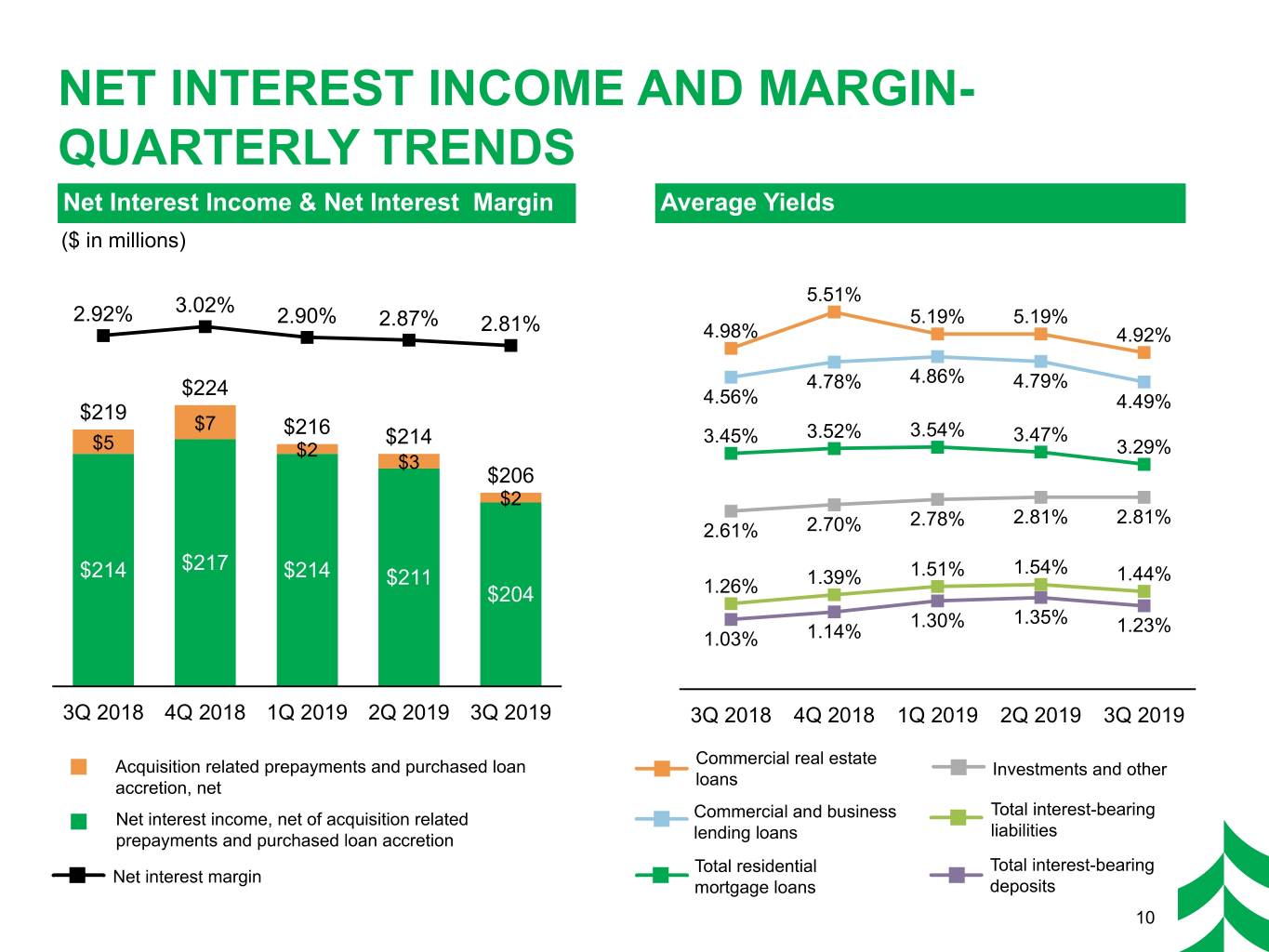

NET INTEREST INCOME AND MARGIN- QUARTERLY TRENDS Net Interest Income & Net Interest Margin Average Yields ($ in millions) 3.02% 5.51% 2.92% 2.90% 2.87% 2.81% 5.19% 5.19% 4.98% 4.92% 4.86% $224 4.78% 4.79% 4.56% 4.49% $219 $7 $216 $214 3.45% 3.52% 3.54% 3.47% $5 $2 3.29% $3 $206 $2 2.78% 2.81% 2.81% 2.61% 2.70% $217 1.54% $214 $214 $211 1.39% 1.51% 1.44% $204 1.26% 1.30% 1.35% 1.23% 1.03% 1.14% 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Commercial real estate Acquisition related prepayments and purchased loan Investments and other accretion, net loans Total interest-bearing Net interest income, net of acquisition related Commercial and business liabilities prepayments and purchased loan accretion lending loans Total residential Total interest-bearing Net interest margin mortgage loans deposits 10

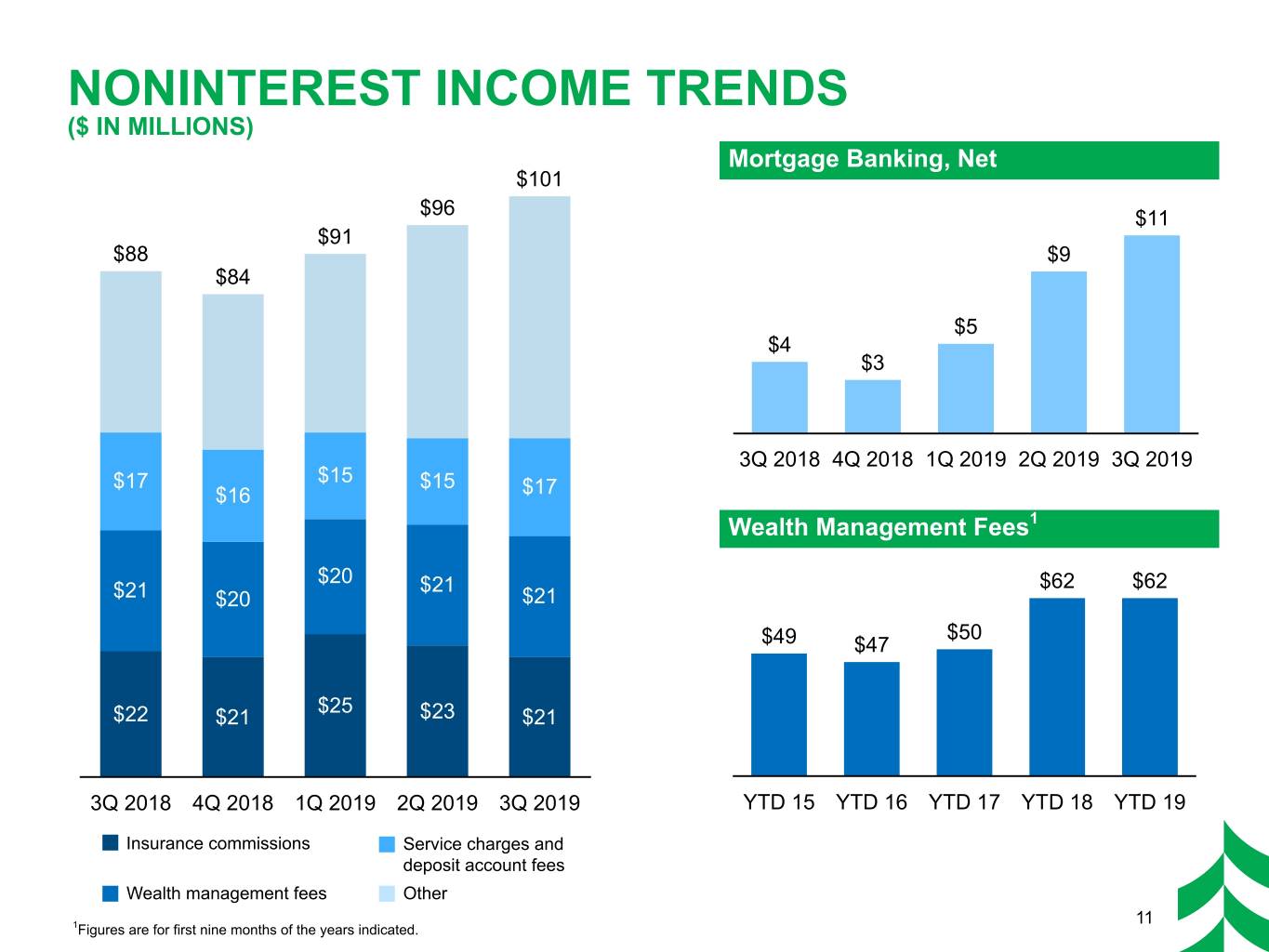

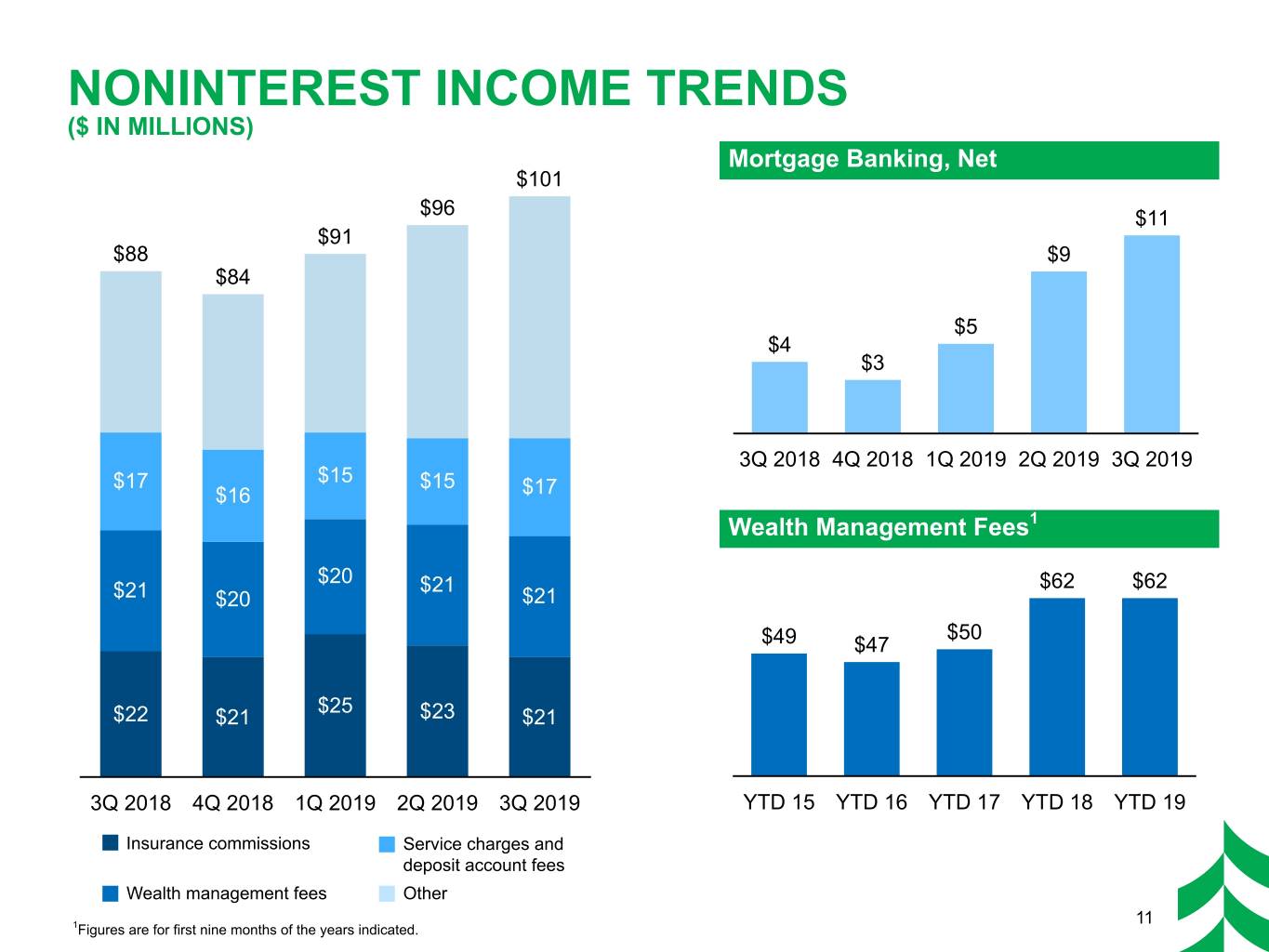

NONINTEREST INCOME TRENDS ($ IN MILLIONS) Mortgage Banking, Net $101 $96 $11 $91 $88 $9 $84 $5 $4 $3 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 $17 $15 $15 $16 $17 Wealth Management Fees1 $20 $21 $62 $62 $21 $20 $21 $50 $49 $47 $25 $22 $21 $23 $21 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 YTD 15 YTD 16 YTD 17 YTD 18 YTD 19 Insurance commissions Service charges and deposit account fees Wealth management fees Other 11 1Figures are for first nine months of the years indicated.

NONINTEREST EXPENSE TRENDS ($ IN MILLIONS) Efficiency Ratio2 69.8% $204 $201 67.5% 67.5% $2 $193 $198 $192 $4 $2 $1 68.1% 65.6% 64.2% 66.0% $78 $71 $76 64.2% $78 $71 62.9% 61.9% YTD 15 YTD 16 YTD 17 YTD 18 YTD 19 Federal Reserve efficiency ratio Adjusted efficiency ratio Restructuring Plan $124 $117 $120 $123 $123 ▪ Expect 4Q 2019 restructuring charges of ~$3 million ▪ Anticipate restructuring will result in flat to modestly lower noninterest expense in 2020, including First Staunton costs 3Q 2018 4Q 20181 1Q 2019 2Q 2019 3Q 2019 Personnel Other Acquisition related costs 1$1 million of acquisition related benefits were recognized in the fourth quarter of 2018. 2The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and acquisition related costs. Please refer to the appendix for a reconciliation of the Federal Reserve efficiency ratio to the adjusted efficiency ratio. 12

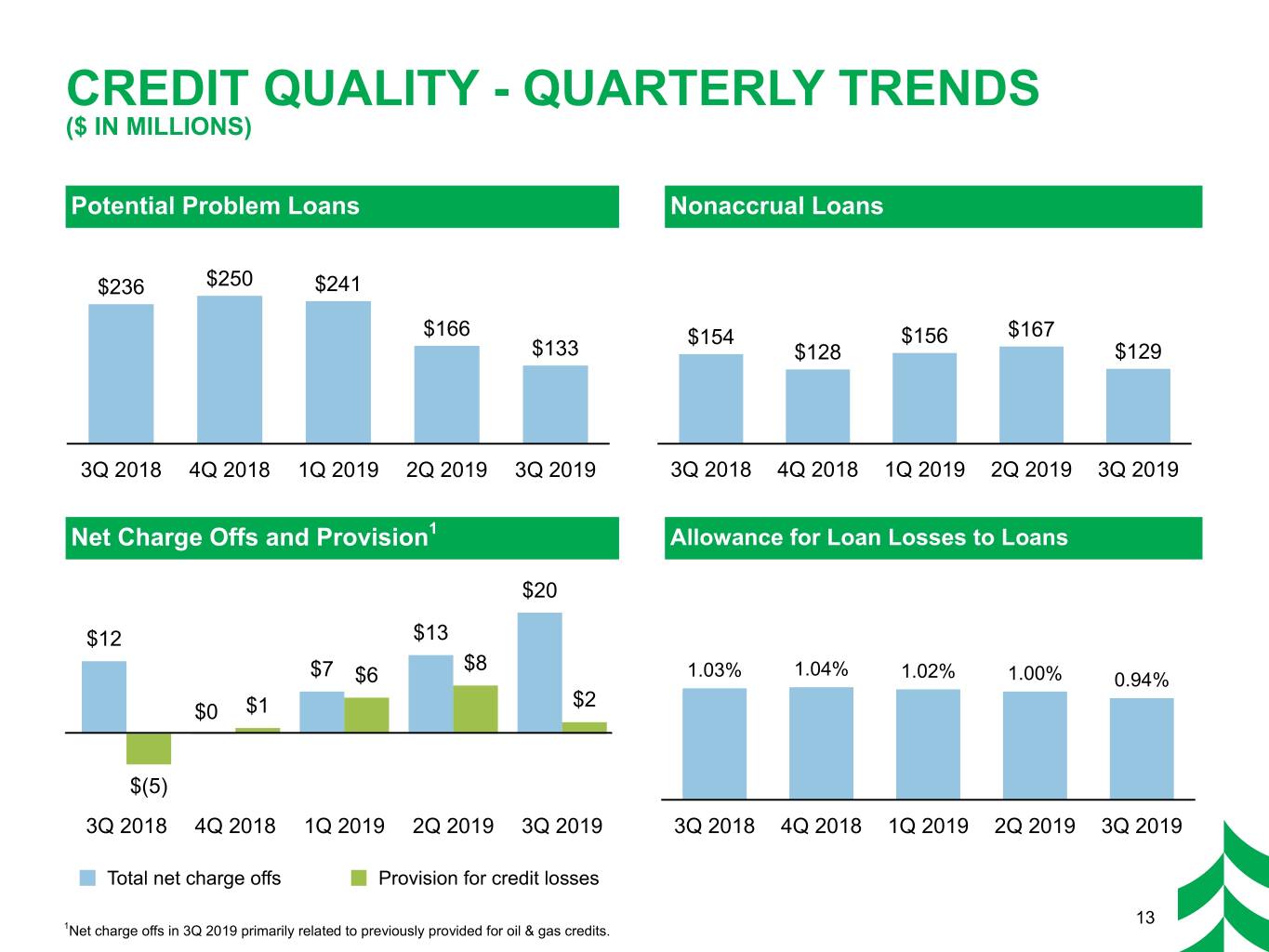

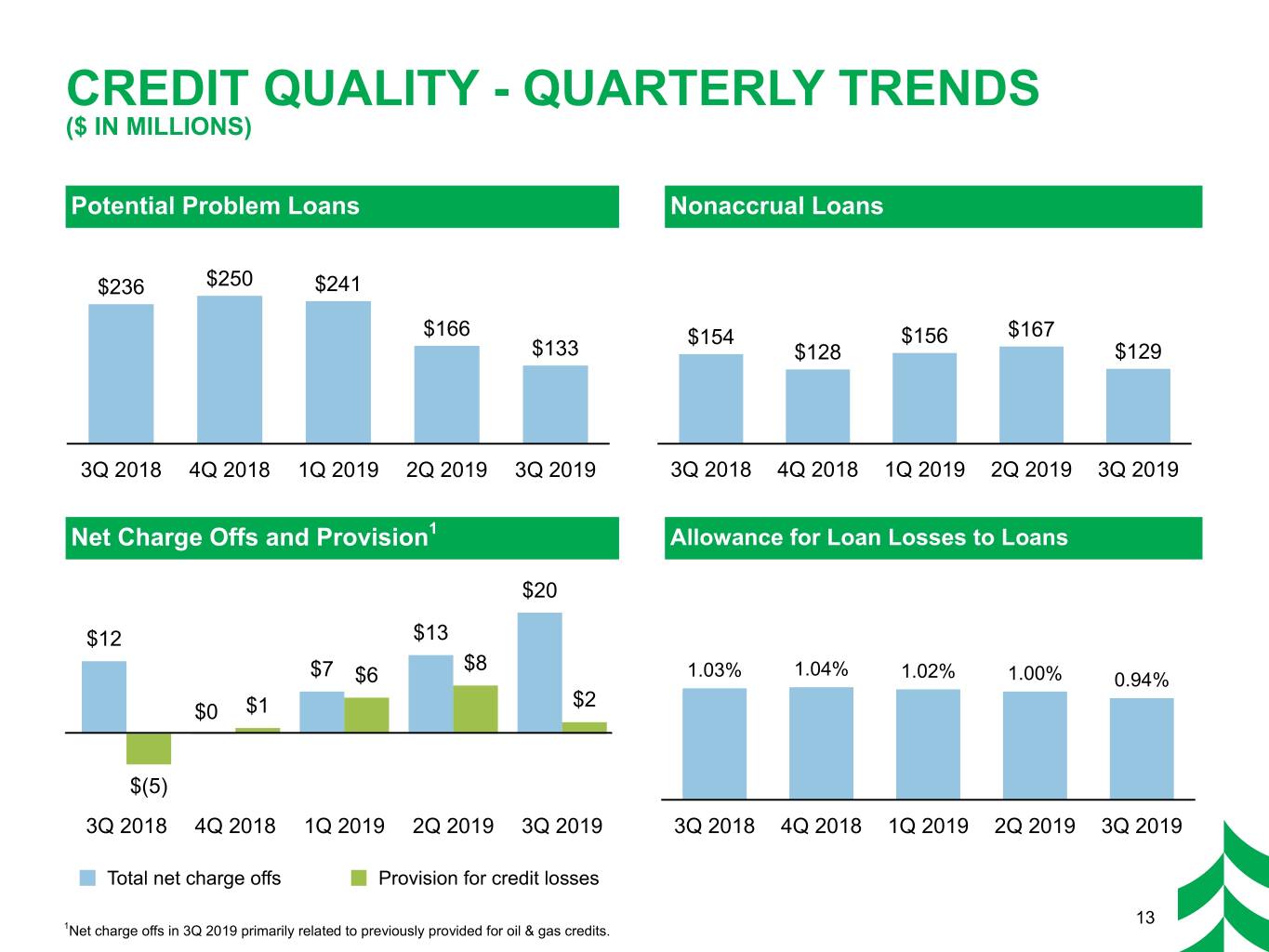

CREDIT QUALITY - QUARTERLY TRENDS ($ IN MILLIONS) Potential Problem Loans Nonaccrual Loans $236 $250 $241 $166 $154 $156 $167 $133 $128 $129 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Net Charge Offs and Provision1 Allowance for Loan Losses to Loans $20 $12 $13 $7 $8 1.03% 1.04% $6 1.02% 1.00% 0.94% $2 $0 $1 $(5) 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 3Q 2018 4Q 2018 1Q 2019 2Q 2019 3Q 2019 Total net charge offs Provision for credit losses 13 1Net charge offs in 3Q 2019 primarily related to previously provided for oil & gas credits.

APPENDIX

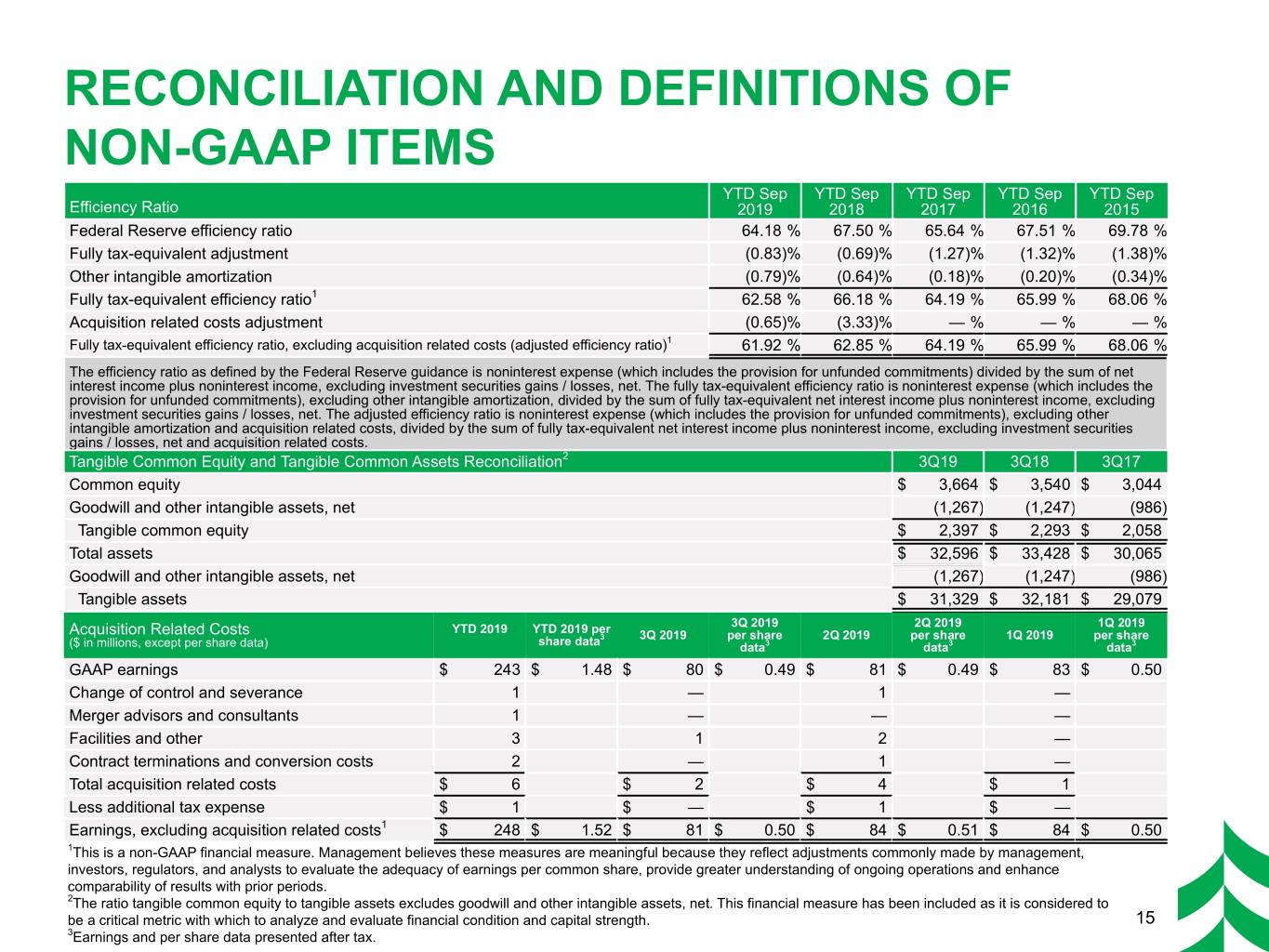

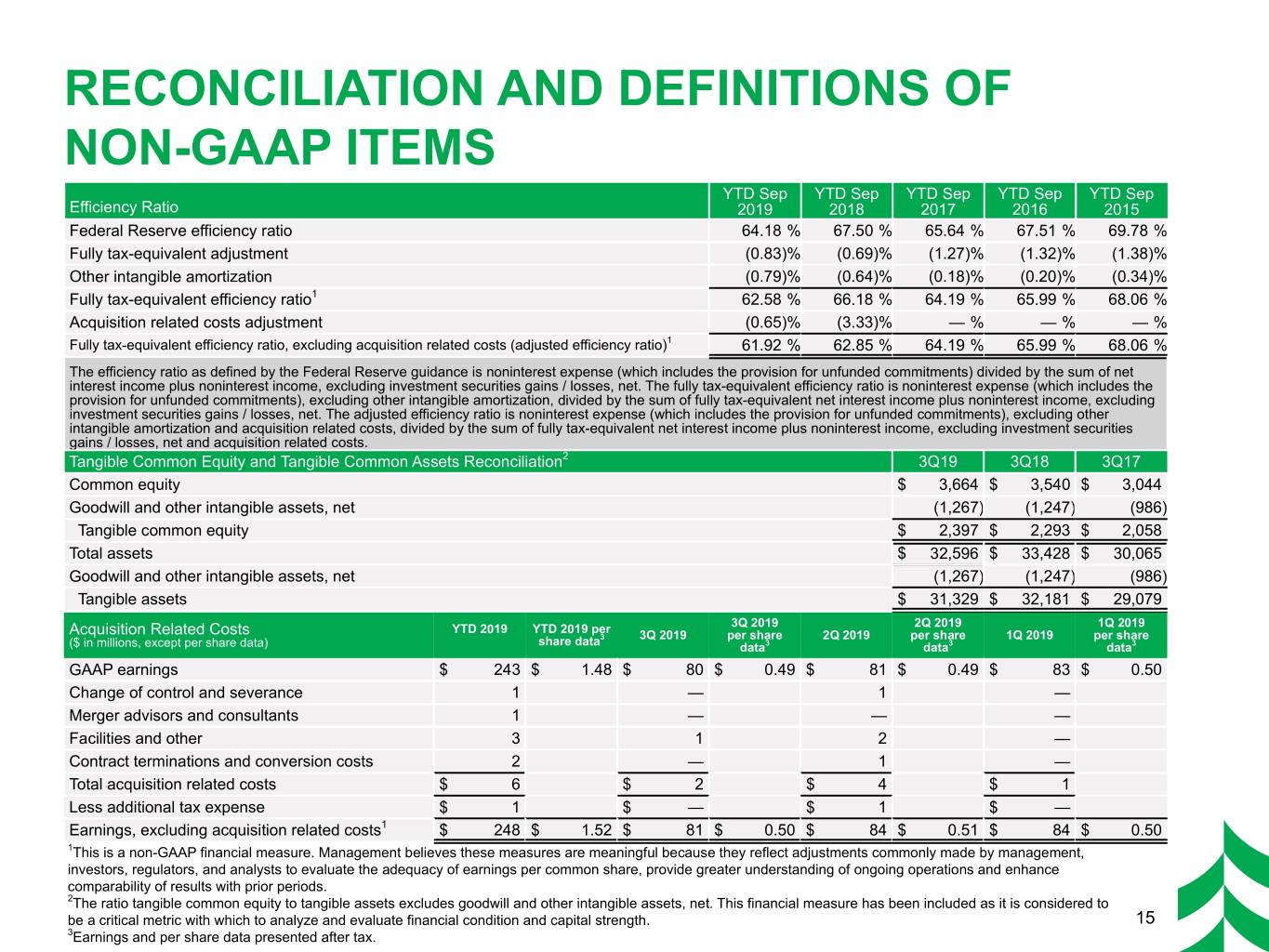

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS YTD Sep YTD Sep YTD Sep YTD Sep YTD Sep Efficiency Ratio 2019 2018 2017 2016 2015 Federal Reserve efficiency ratio 64.18 % 67.50 % 65.64 % 67.51 % 69.78 % Fully tax-equivalent adjustment (0.83)% (0.69)% (1.27)% (1.32)% (1.38)% Other intangible amortization (0.79)% (0.64)% (0.18)% (0.20)% (0.34)% Fully tax-equivalent efficiency ratio1 62.58 % 66.18 % 64.19 % 65.99 % 68.06 % Acquisition related costs adjustment (0.65)% (3.33)% — % — % — % Fully tax-equivalent efficiency ratio, excluding acquisition related costs (adjusted efficiency ratio)1 61.92 % 62.85 % 64.19 % 65.99 % 68.06 % The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization and acquisition related costs, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and acquisition related costs. Tangible Common Equity and Tangible Common Assets Reconciliation2 3Q19 3Q18 3Q17 Common equity $ 3,664 $ 3,540 $ 3,044 Goodwill and other intangible assets, net (1,267) (1,247) (986) Tangible common equity $ 2,397 $ 2,293 $ 2,058 Total assets $ 32,596 $ 33,428 $ 30,065 Goodwill and other intangible assets, net (1,267) (1,247) (986) Tangible assets $ 31,329 $ 32,181 $ 29,079 YTD 2019 YTD 2019 per 3Q 2019 2Q 2019 1Q 2019 Acquisition Related Costs 3 3Q 2019 per share 2Q 2019 per share 1Q 2019 per share ($ in millions, except per share data) share data data3 data3 data3 GAAP earnings $ 243 $ 1.48 $ 80 $ 0.49 $ 81 $ 0.49 $ 83 $ 0.50 Change of control and severance 1 — 1 — Merger advisors and consultants 1 — — — Facilities and other 3 1 2 — Contract terminations and conversion costs 2 — 1 — Total acquisition related costs $ 6 $ 2 $ 4 $ 1 Less additional tax expense $ 1 $ — $ 1 $ — Earnings, excluding acquisition related costs1 $ 248 $ 1.52 $ 81 $ 0.50 $ 84 $ 0.51 $ 84 $ 0.50 1This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. 2The ratio tangible common equity to tangible assets excludes goodwill and other intangible assets, net. This financial measure has been included as it is considered to be a critical metric with which to analyze and evaluate financial condition and capital strength. 15 3Earnings and per share data presented after tax.