Second Quarter 2021 Earnings Presentation JULY 22, 2021 Exhibit 99.2

1 Forward-Looking Statements Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend,” "target,“ “outlook,” “guidance,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Measures: This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation.

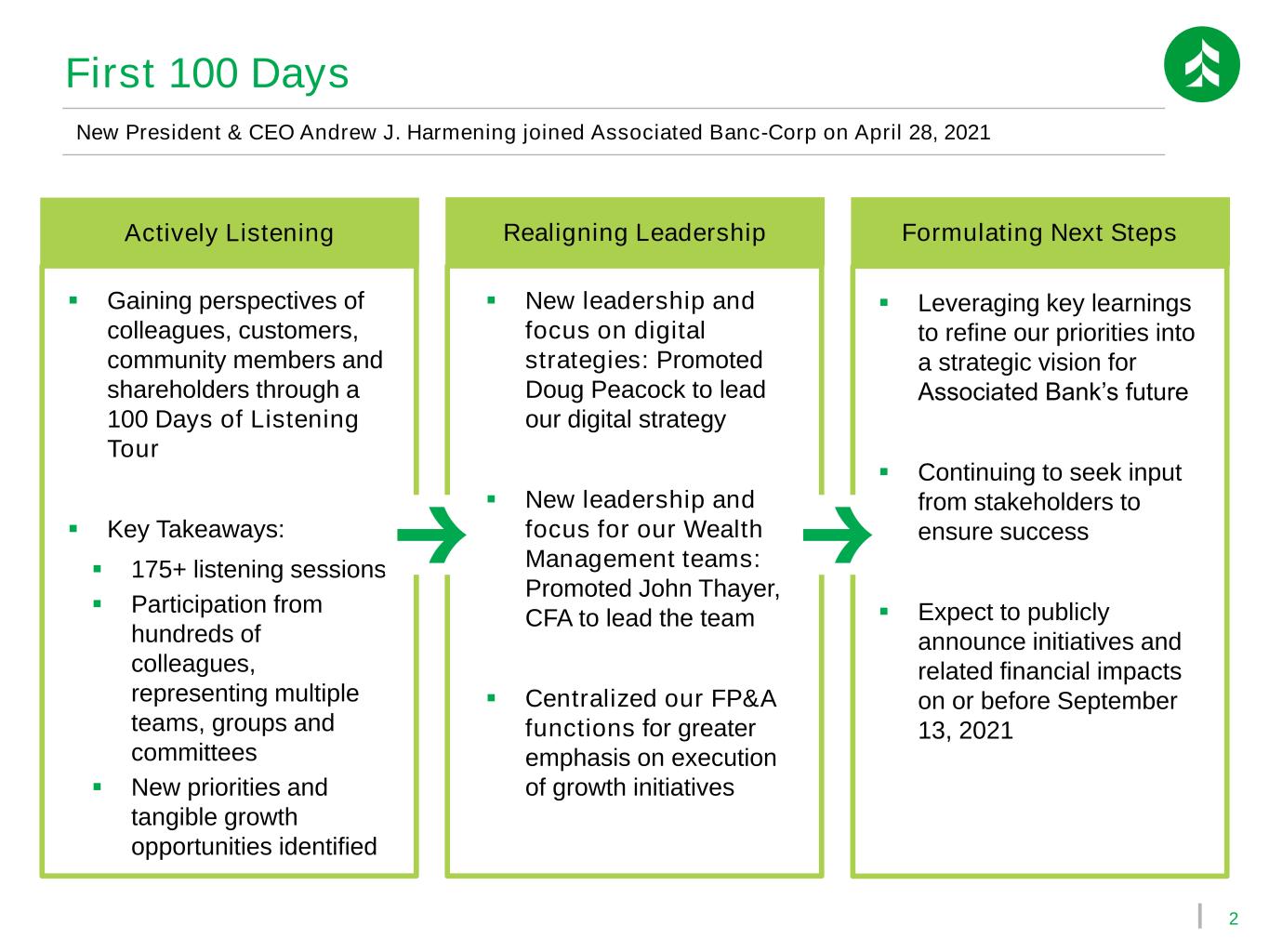

2 ▪ Leveraging key learnings to refine our priorities into a strategic vision for Associated Bank’s future ▪ Continuing to seek input from stakeholders to ensure success ▪ Expect to publicly announce initiatives and related financial impacts on or before September 13, 2021 ▪ New leadership and focus on digital strategies: Promoted Doug Peacock to lead our digital strategy ▪ New leadership and focus for our Wealth Management teams: Promoted John Thayer, CFA to lead the team ▪ Centralized our FP&A functions for greater emphasis on execution of growth initiatives ▪ Gaining perspectives of colleagues, customers, community members and shareholders through a 100 Days of Listening Tour ▪ Key Takeaways: ▪ 175+ listening sessions ▪ Participation from hundreds of colleagues, representing multiple teams, groups and committees ▪ New priorities and tangible growth opportunities identified First 100 Days New President & CEO Andrew J. Harmening joined Associated Banc-Corp on April 28, 2021 Actively Listening Realigning Leadership Formulating Next Steps

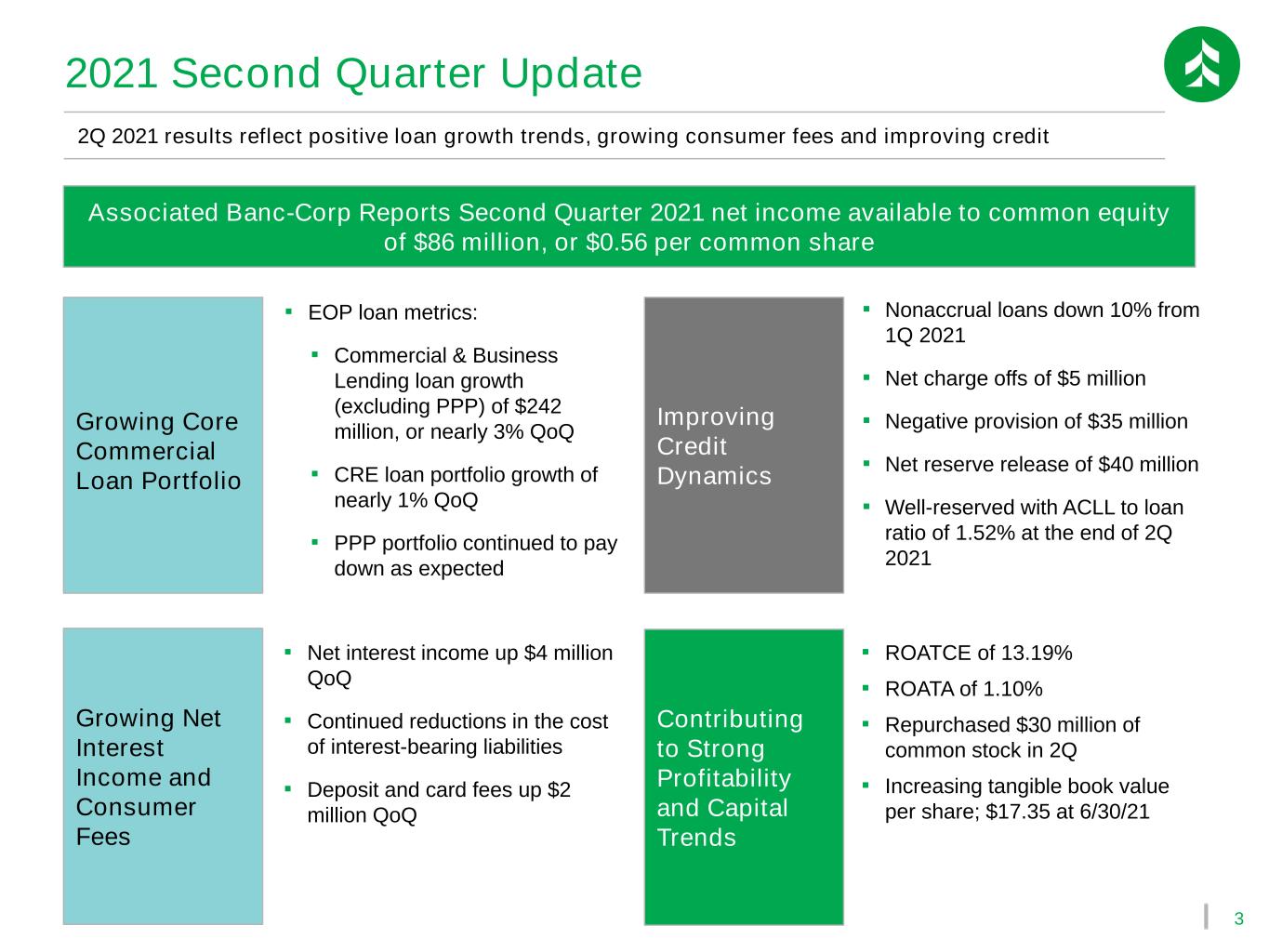

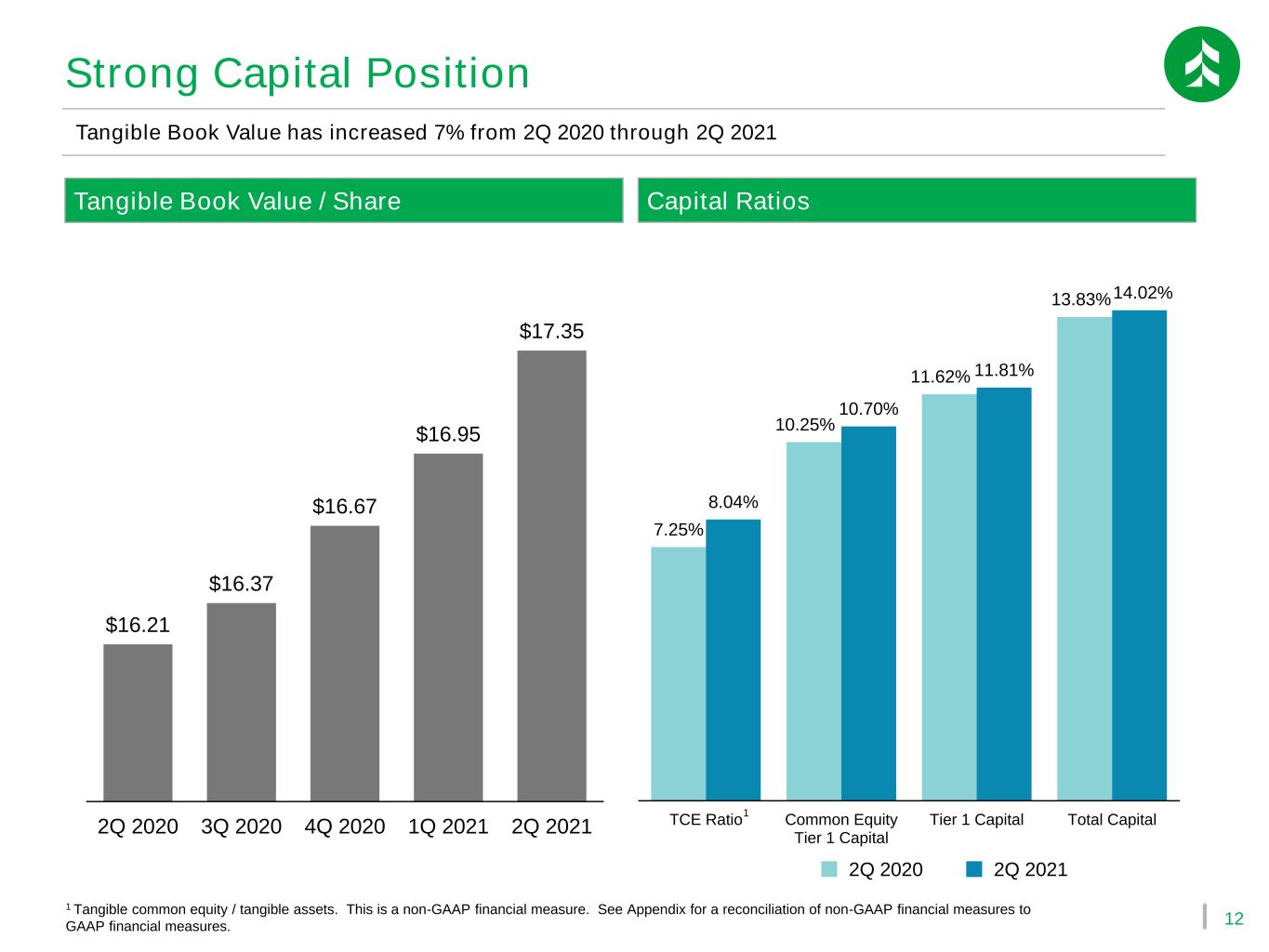

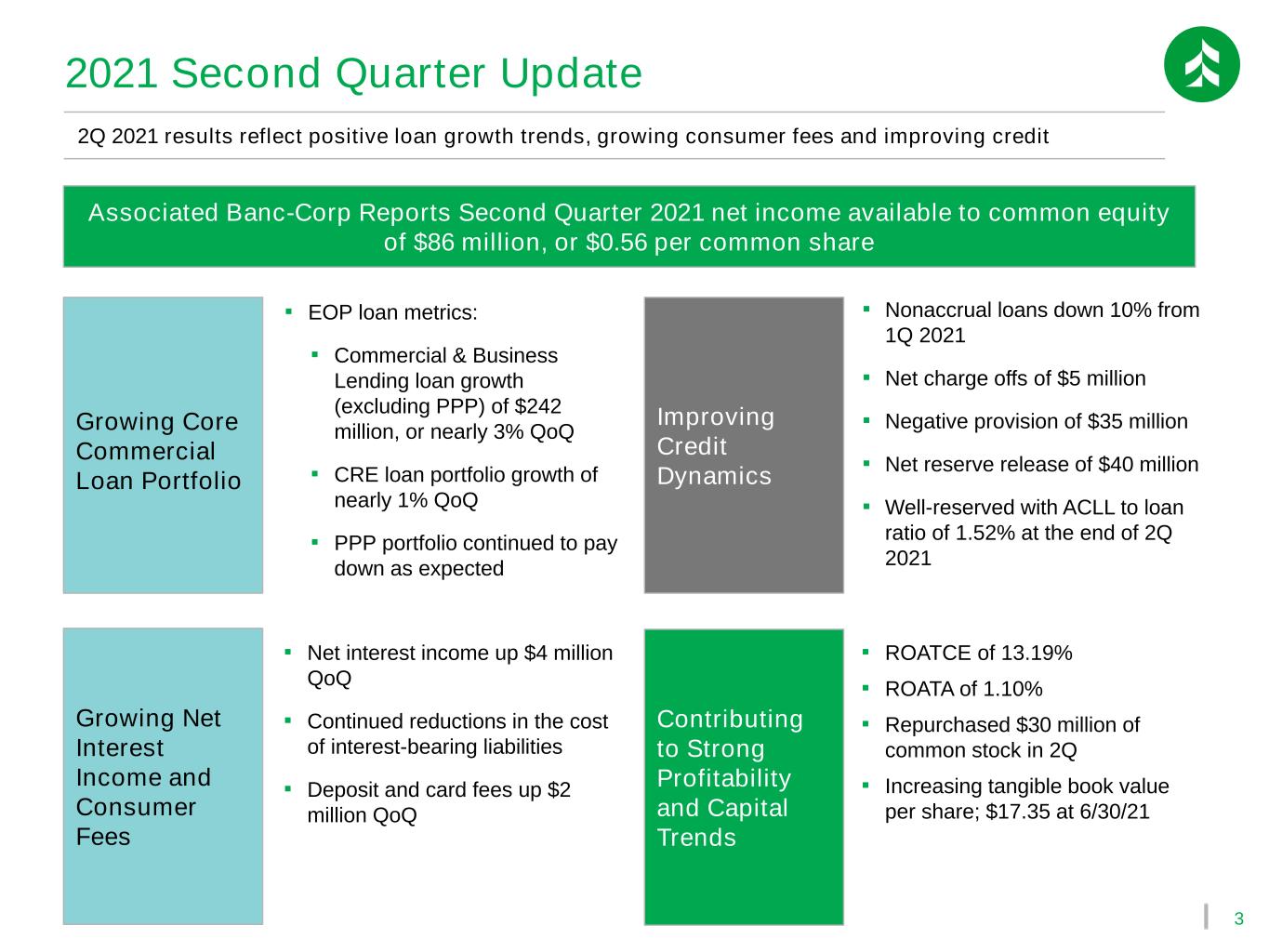

3 Growing Core Commercial Loan Portfolio ▪ EOP loan metrics: ▪ Commercial & Business Lending loan growth (excluding PPP) of $242 million, or nearly 3% QoQ ▪ CRE loan portfolio growth of nearly 1% QoQ ▪ PPP portfolio continued to pay down as expected Contributing to Strong Profitability and Capital Trends ▪ ROATCE of 13.19% ▪ ROATA of 1.10% ▪ Repurchased $30 million of common stock in 2Q ▪ Increasing tangible book value per share; $17.35 at 6/30/21 Improving Credit Dynamics ▪ Nonaccrual loans down 10% from 1Q 2021 ▪ Net charge offs of $5 million ▪ Negative provision of $35 million ▪ Net reserve release of $40 million ▪ Well-reserved with ACLL to loan ratio of 1.52% at the end of 2Q 2021 ▪ Net interest income up $4 million QoQ ▪ Continued reductions in the cost of interest-bearing liabilities ▪ Deposit and card fees up $2 million QoQ 2Q 2021 results reflect positive loan growth trends, growing consumer fees and improving credit Associated Banc-Corp Reports Second Quarter 2021 net income available to common equity of $86 million, or $0.56 per common share 2021 Second Quarter Update Growing Net Interest Income and Consumer Fees

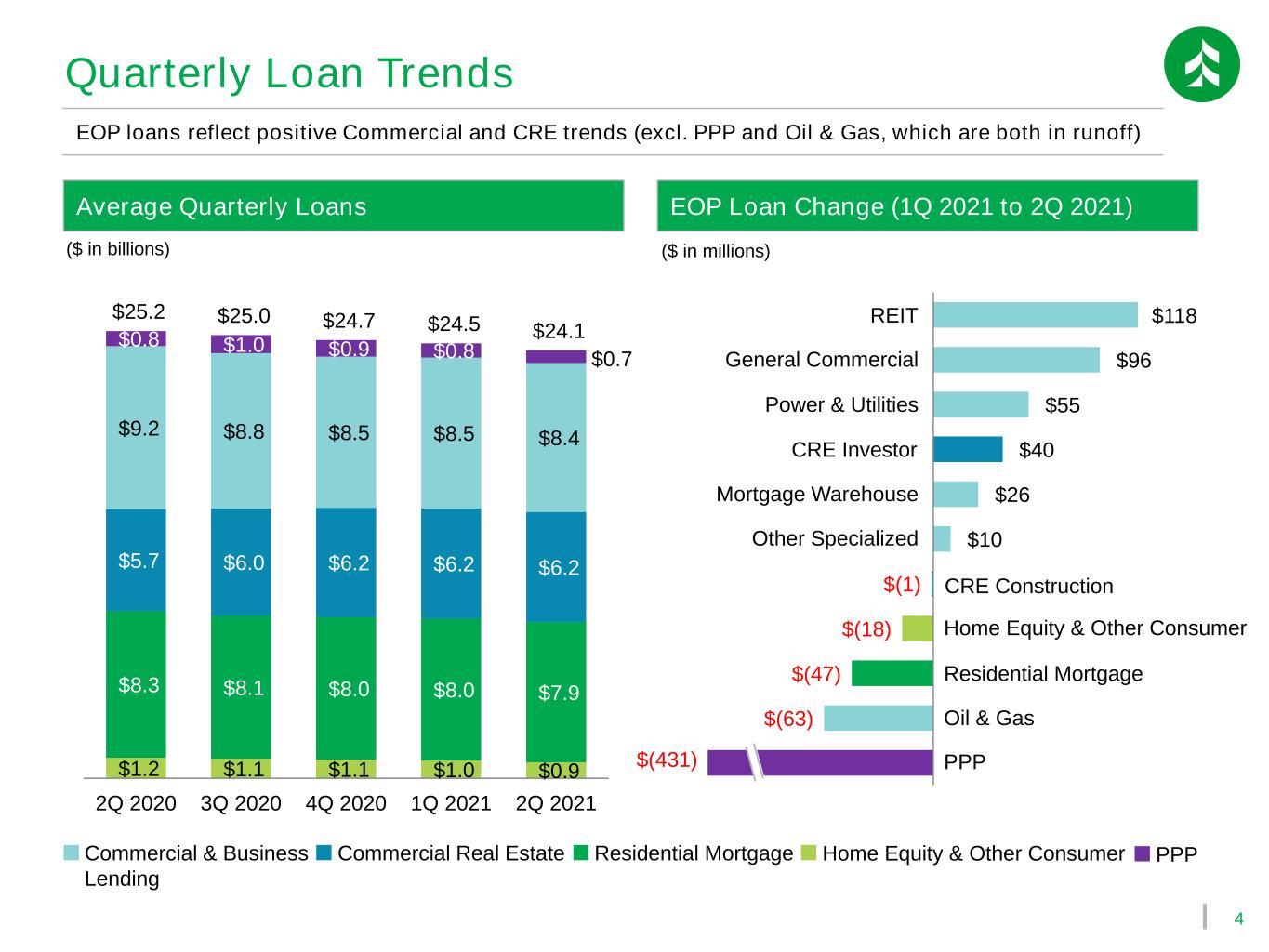

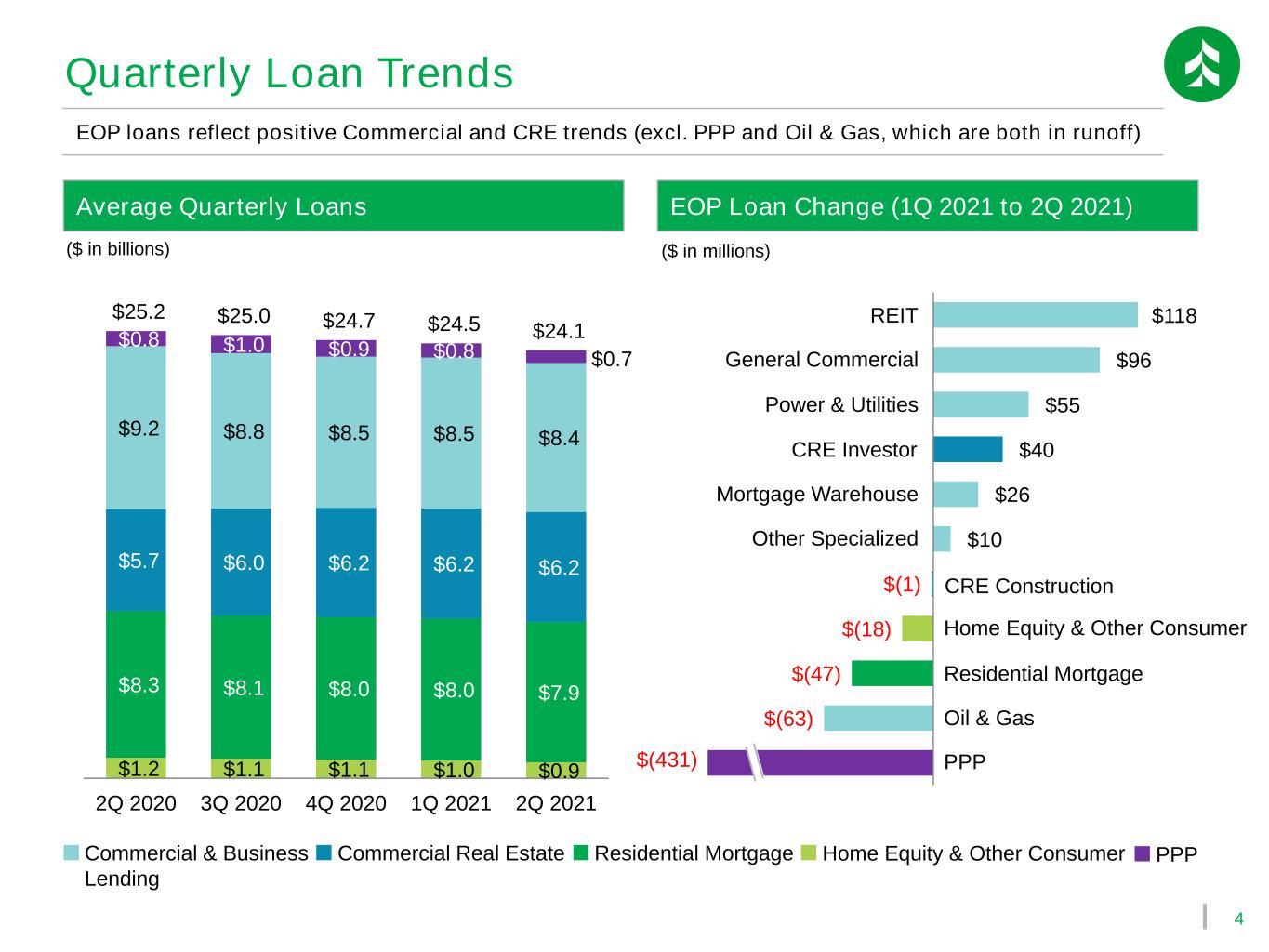

4 $1.2 $1.1 $1.1 $1.0 $0.9 $8.3 $8.1 $8.0 $8.0 $7.9 $5.7 $6.0 $6.2 $6.2 $6.2 $9.2 $8.8 $8.5 $8.5 $8.4 $0.8 $1.0 $0.9 $0.8 $0.7 $25.2 $25.0 $24.7 $24.5 $24.1 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 $(63) $(47) $(18) $(1) $10 $26 $40 $55 $96 $118 Quarterly Loan Trends CRE Investor Residential Mortgage Home Equity & Other Consumer General Commercial REIT Power & Utilities ($ in millions) Oil & Gas EOP loans reflect positive Commercial and CRE trends (excl. PPP and Oil & Gas, which are both in runoff) CRE Construction Average Quarterly Loans ($ in billions) EOP Loan Change (1Q 2021 to 2Q 2021) Commercial & Business Lending Commercial Real Estate Residential Mortgage Home Equity & Other Consumer PPP Mortgage Warehouse PPP$(431) Other Specialized

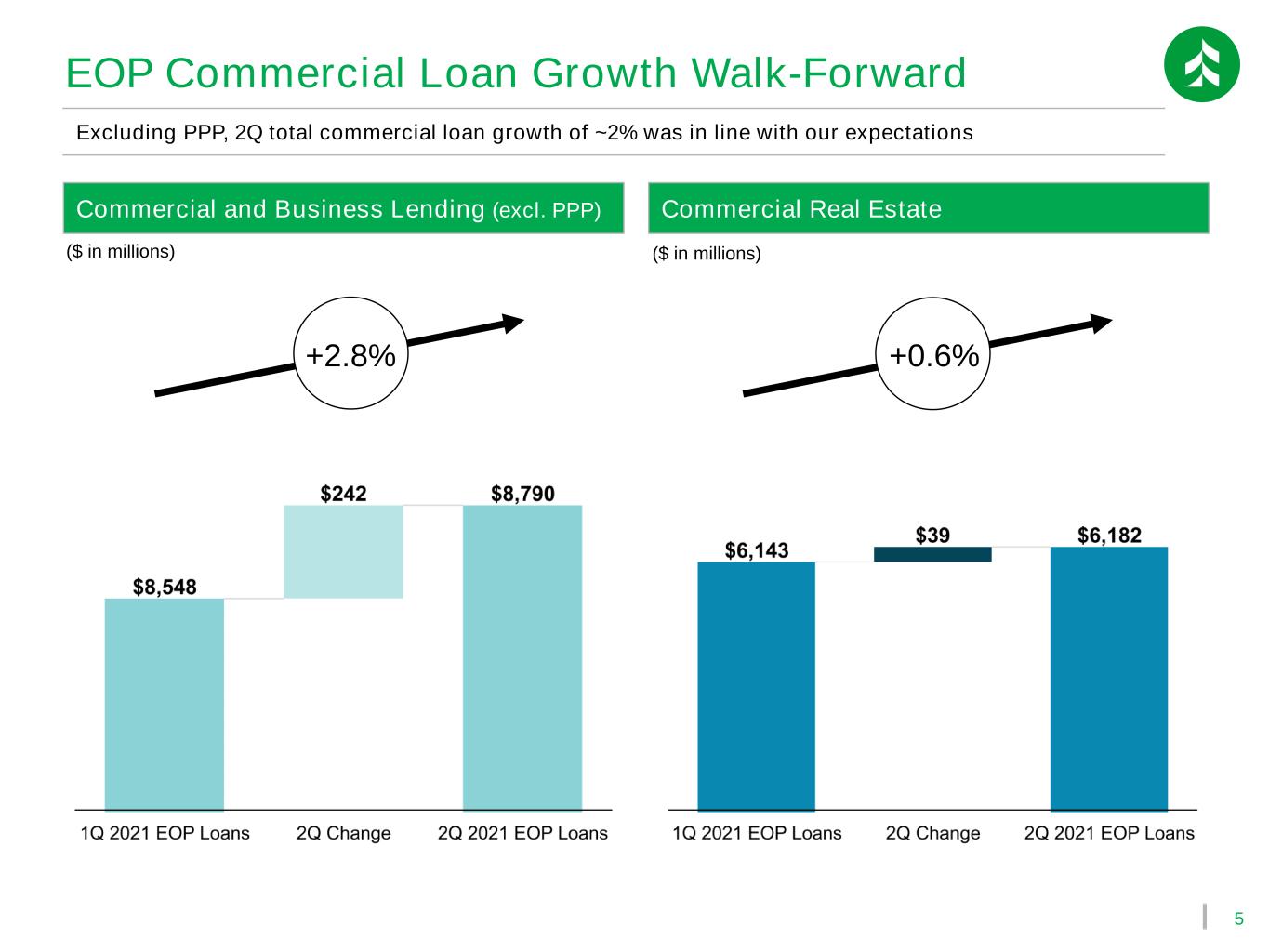

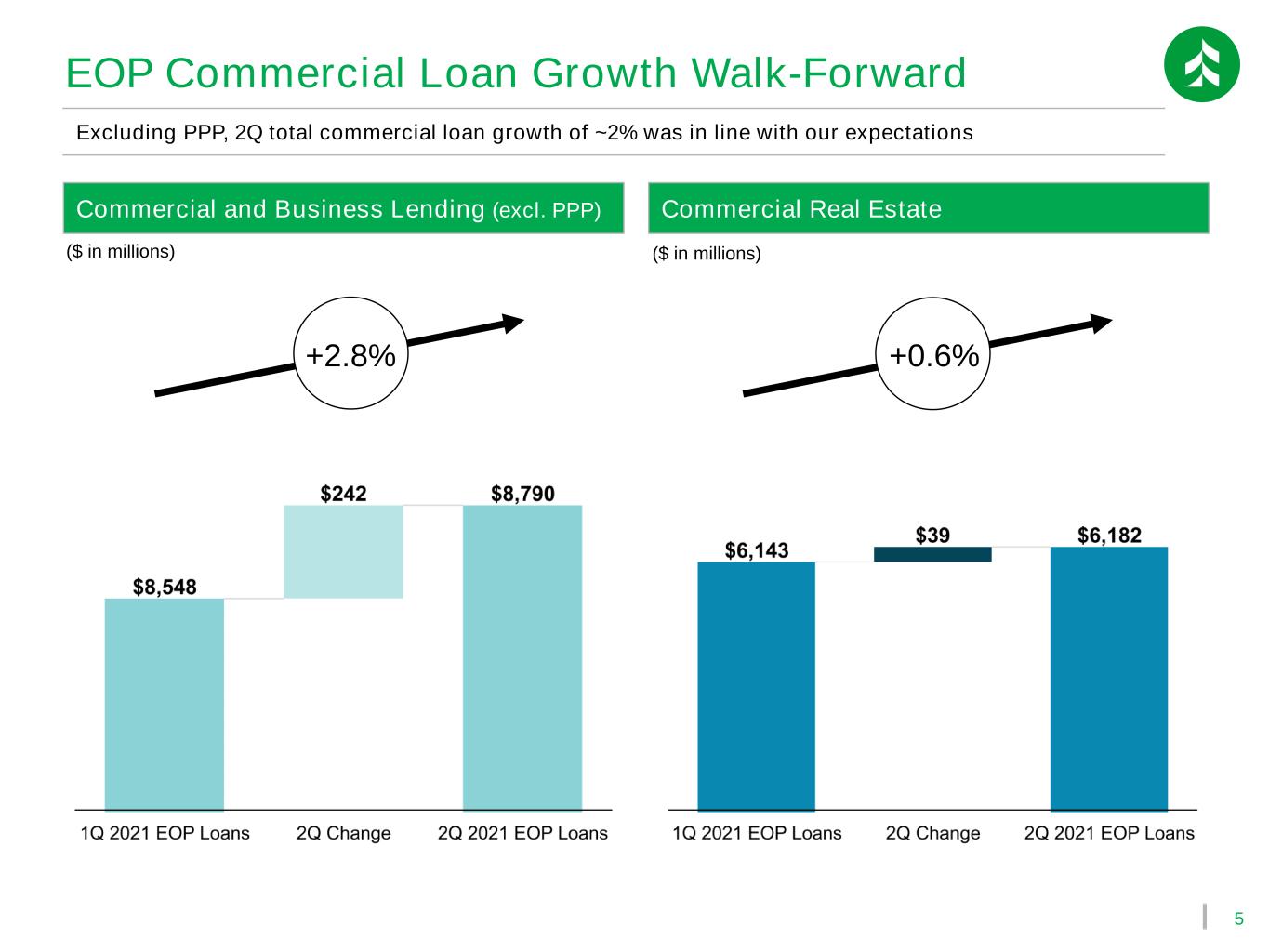

5 EOP Commercial Loan Growth Walk-Forward ($ in millions) Excluding PPP, 2Q total commercial loan growth of ~2% was in line with our expectations Commercial and Business Lending (excl. PPP) ($ in millions) Commercial Real Estate +2.8% +0.6%

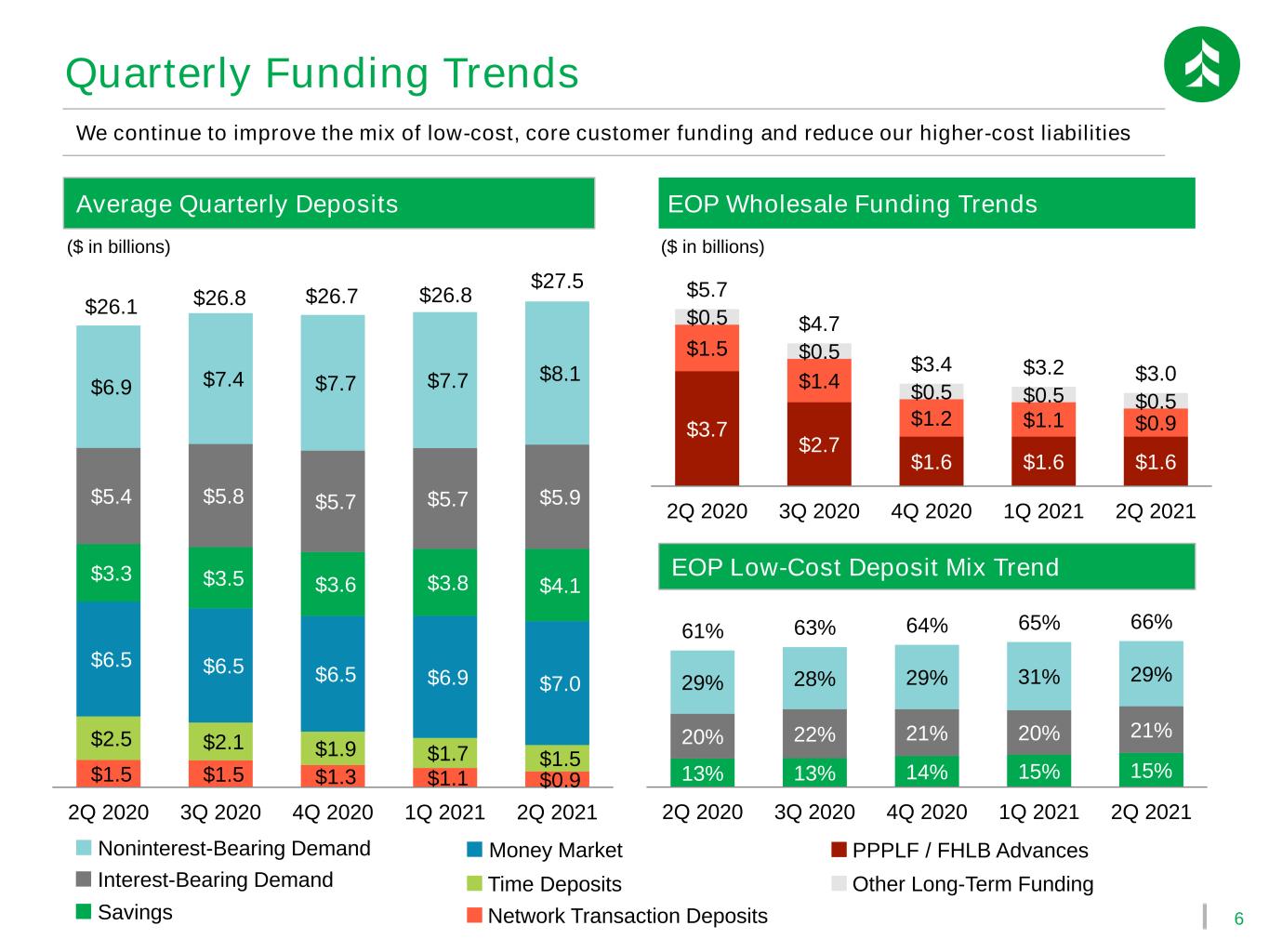

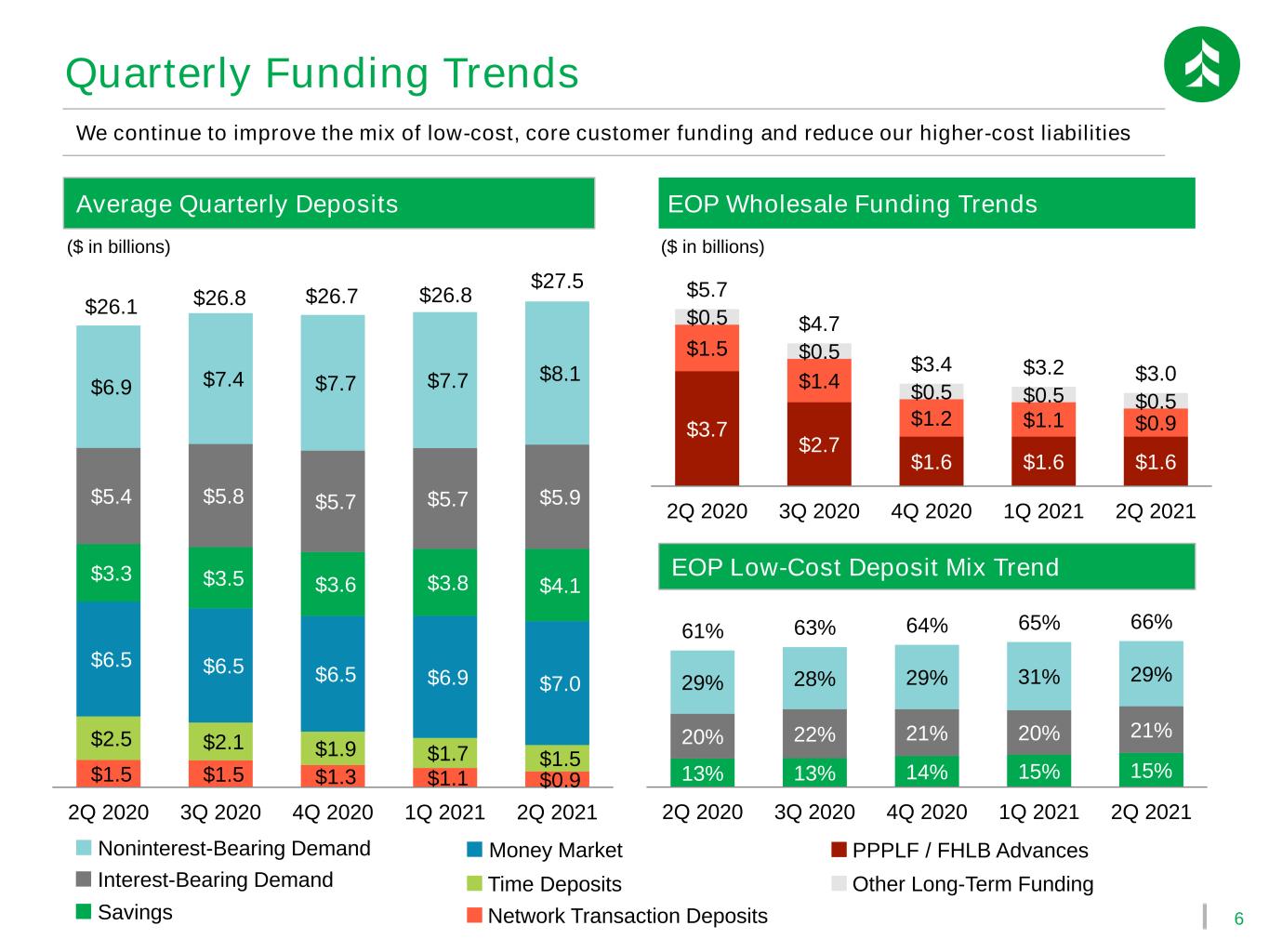

6 $1.5 $1.5 $1.3 $1.1 $0.9 $2.5 $2.1 $1.9 $1.7 $1.5 $6.5 $6.5 $6.5 $6.9 $7.0 $3.3 $3.5 $3.6 $3.8 $4.1 $5.4 $5.8 $5.7 $5.7 $5.9 $6.9 $7.4 $7.7 $7.7 $8.1 $26.1 $26.8 $26.7 $26.8 $27.5 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Quarterly Funding Trends ($ in billions) Average Quarterly Deposits Time Deposits Savings Money Market EOP Wholesale Funding Trends Network Transaction Deposits We continue to improve the mix of low-cost, core customer funding and reduce our higher-cost liabilities Noninterest-Bearing Demand Interest-Bearing Demand ($ in billions) EOP Low-Cost Deposit Mix Trend 13% 13% 14% 15% 15% 20% 22% 21% 20% 21% 29% 28% 29% 31% 29% 61% 63% 64% 65% 66% 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 PPPLF / FHLB Advances Other Long-Term Funding $3.7 $2.7 $1.6 $1.6 $1.6 $1.5 $1.4 $1.2 $1.1 $0.9 $0.5 $0.5 $0.5 $0.5 $0.5 $5.7 $4.7 $3.4 $3.2 $3.0 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021

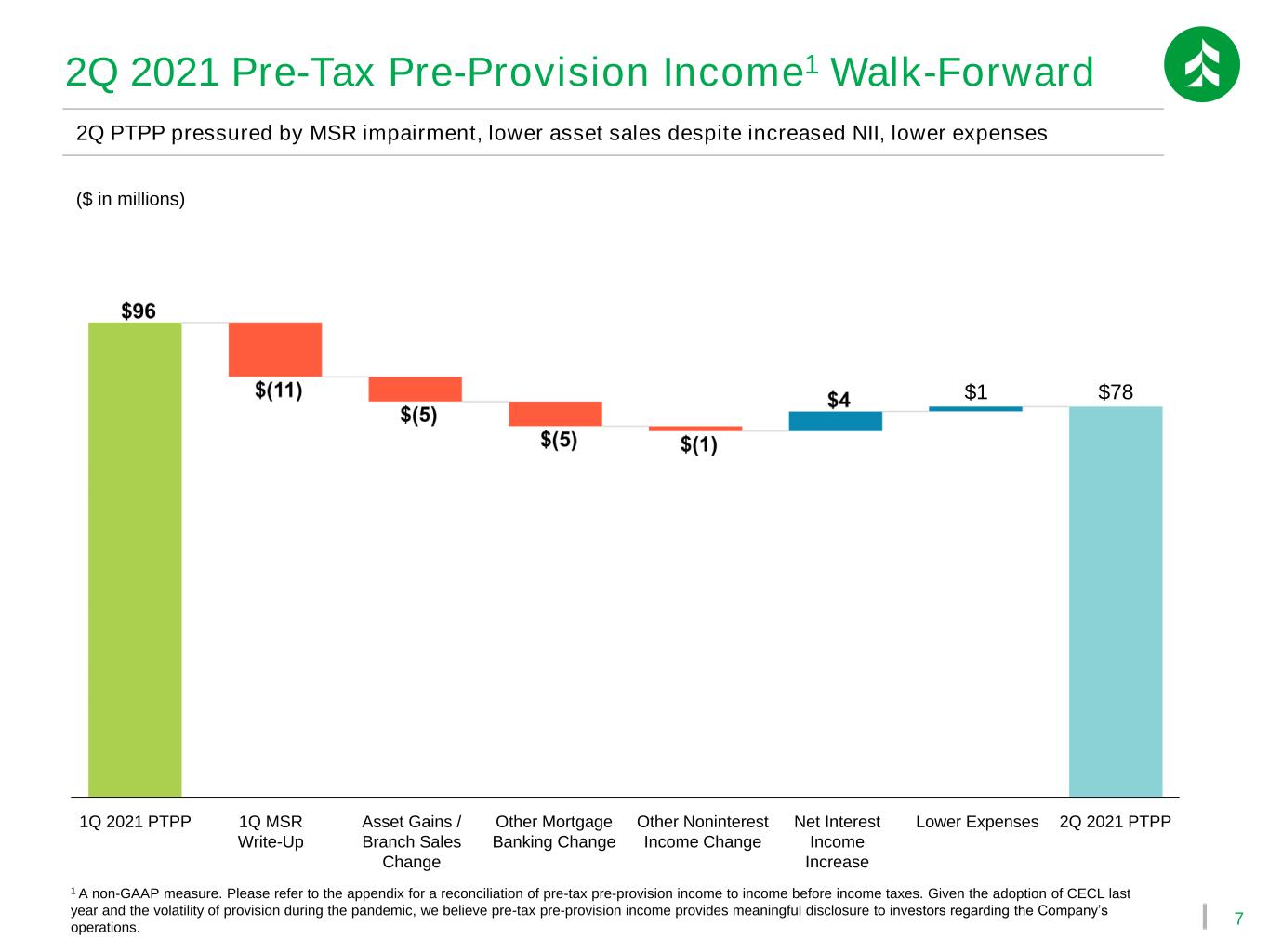

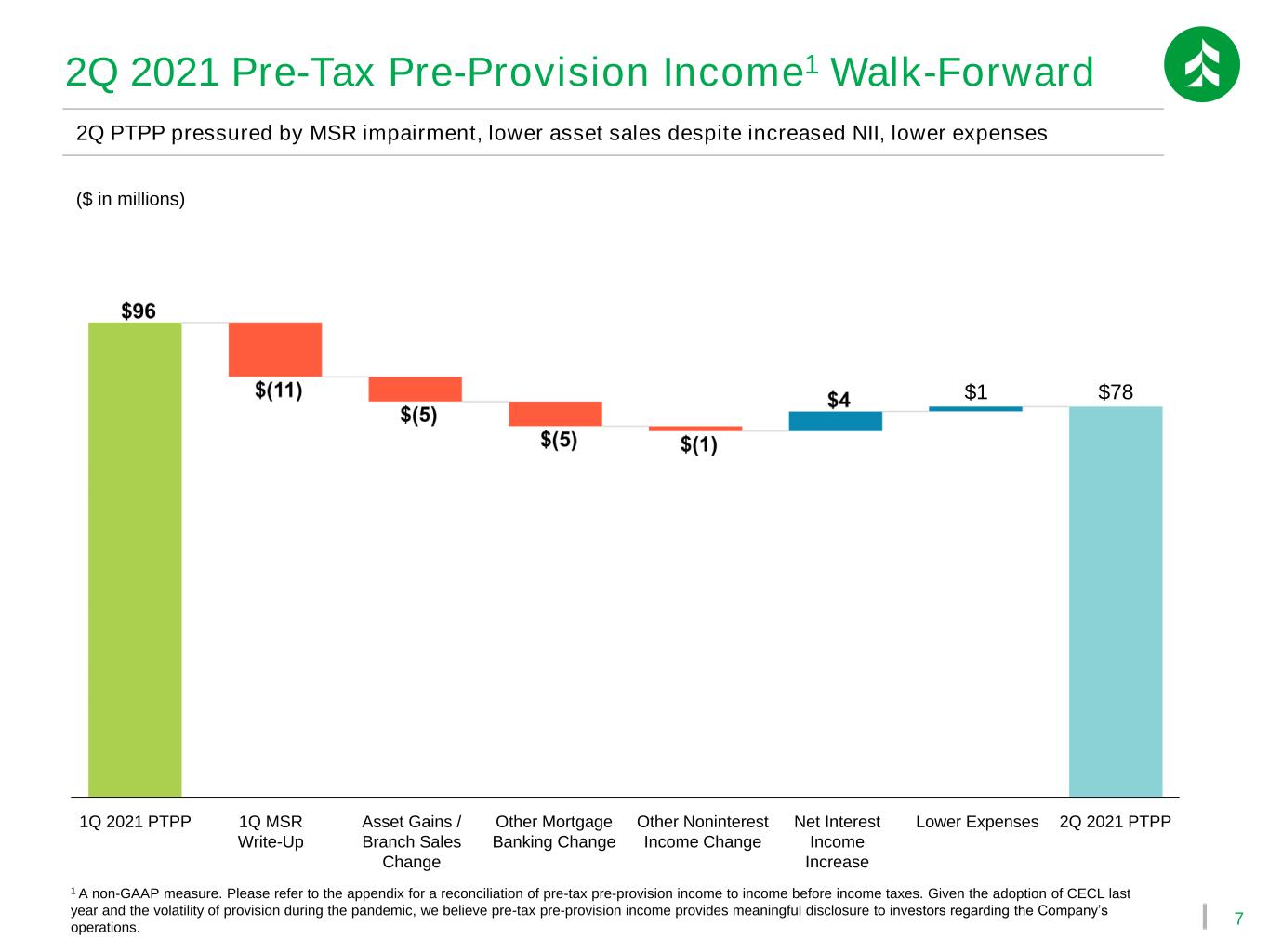

7 2Q 2021 Pre-Tax Pre-Provision Income1 Walk-Forward 2Q PTPP pressured by MSR impairment, lower asset sales despite increased NII, lower expenses 1Q 2021 PTPP Other Noninterest Income Change Asset Gains / Branch Sales Change 1Q MSR Write-Up Lower ExpensesNet Interest Income Increase 2Q 2021 PTPP $1 ($ in millions) $78 1 A non-GAAP measure. Please refer to the appendix for a reconciliation of pre-tax pre-provision income to income before income taxes. Given the adoption of CECL last year and the volatility of provision during the pandemic, we believe pre-tax pre-provision income provides meaningful disclosure to investors regarding the Company’s operations. Other Mortgage Banking Change

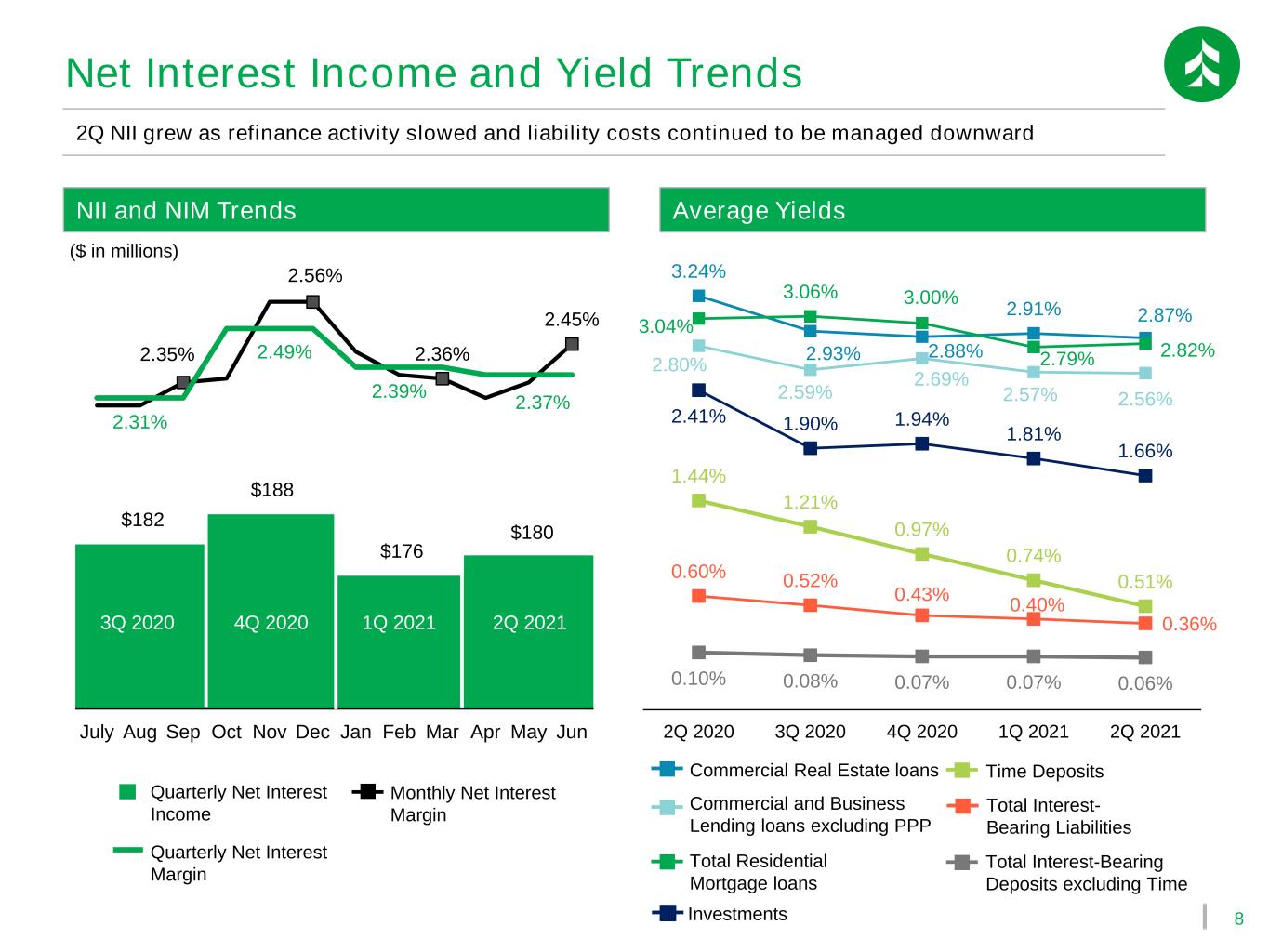

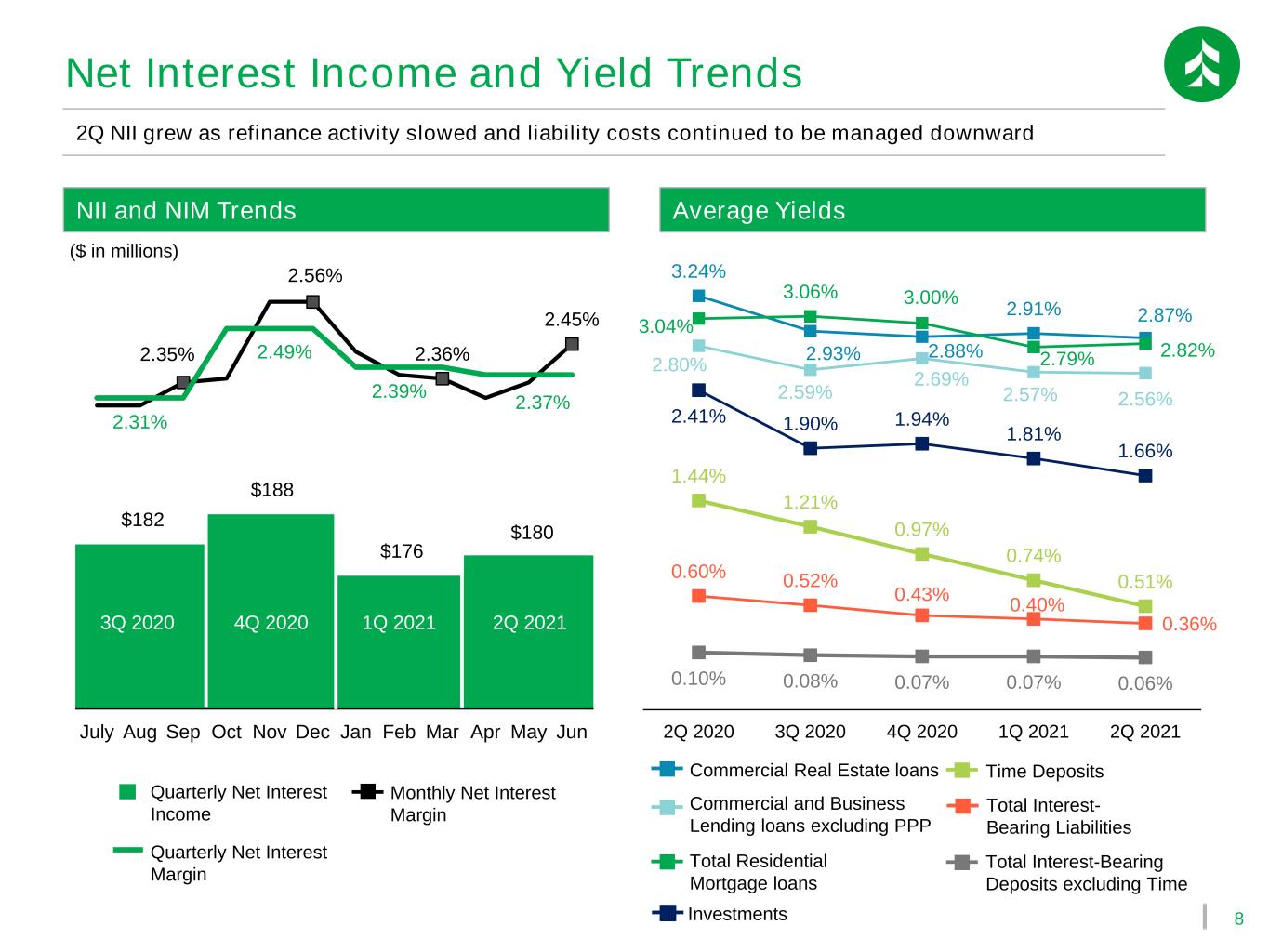

8 Net Interest Income and Yield Trends NII and NIM Trends 3.24% 2.93% 2.88% 2.91% 2.87% 2.80% 2.59% 2.69% 2.57% 2.56% 3.04% 3.06% 3.00% 2.79% 2.82% 2.41% 1.90% 1.94% 1.81% 1.66% 0.60% 0.52% 0.43% 0.40% 0.36% 0.10% 0.08% 0.07% 0.07% 0.06% 1.44% 1.21% 0.97% 0.74% 0.51% 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 $182 $188 $176 $180 2.35% 2.56% 2.36% 2.45% 2.31% 2.49% 2.39% 2.37% July Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Average Yields ($ in millions) 2Q NII grew as refinance activity slowed and liability costs continued to be managed downward Total Residential Mortgage loans Commercial and Business Lending loans excluding PPP Commercial Real Estate loans Total Interest- Bearing Liabilities Time Deposits Quarterly Net Interest Income Monthly Net Interest Margin Total Interest-Bearing Deposits excluding Time 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Investments Quarterly Net Interest Margin

9 Net Interest Income Walk-Forward Declining mortgage refinance activity, accelerated PPP recognition and lower deposit costs boosted 2Q NII Declining refinance activity contributed to slower prepayment rates on mortgages and mortgage-backed securities, driving mortgage margins higher and investment income higher QoQ PPP income recognition accelerated relative to 1Q 2021 1Q 2021 NII Mortgage Refinance Activity Accelerated PPP Pay Downs Lower Deposit Costs 2Q 2021 NII ($ in millions) Continued downward momentum in overall deposit costs (particularly time deposits) QoQ

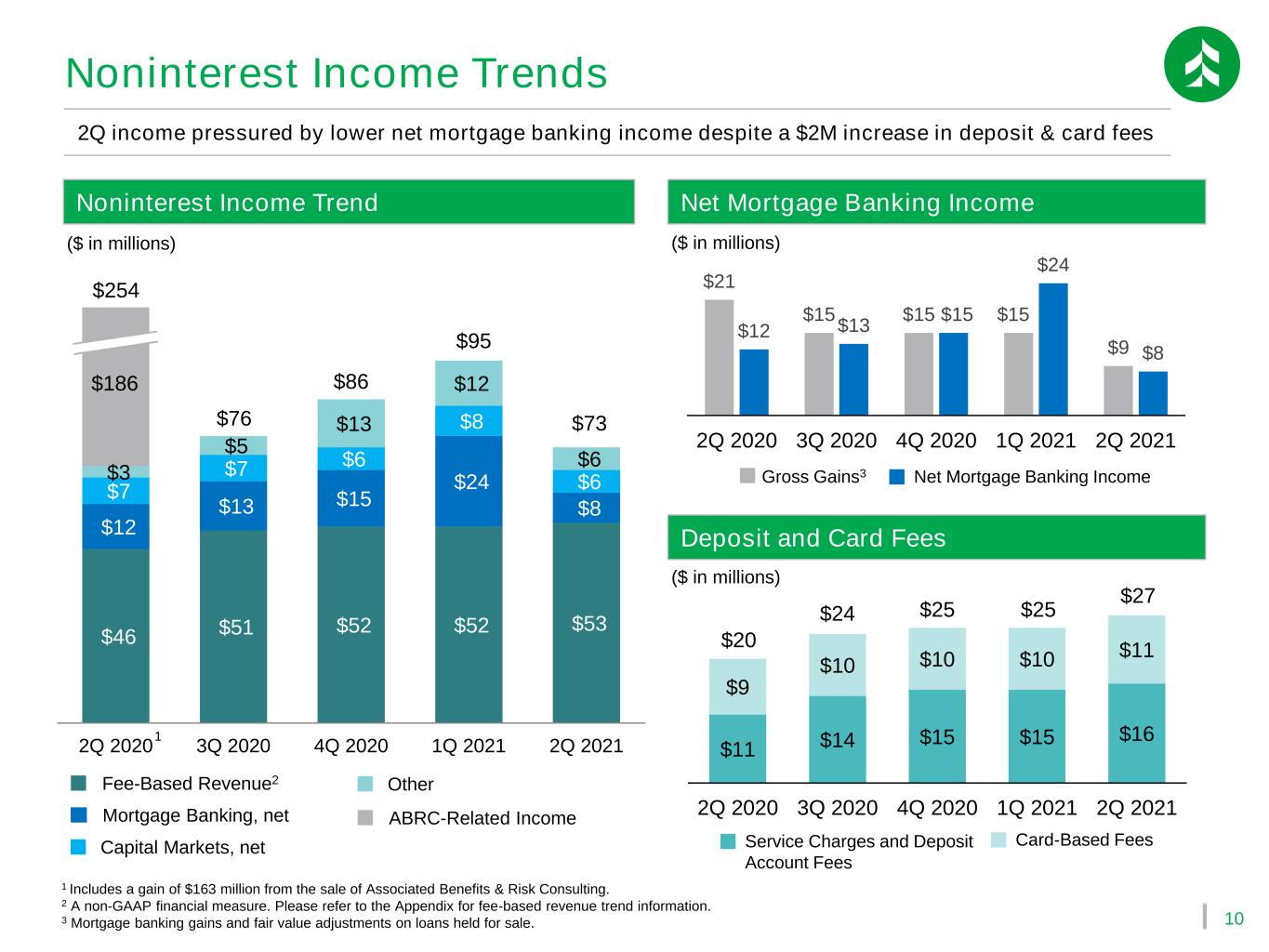

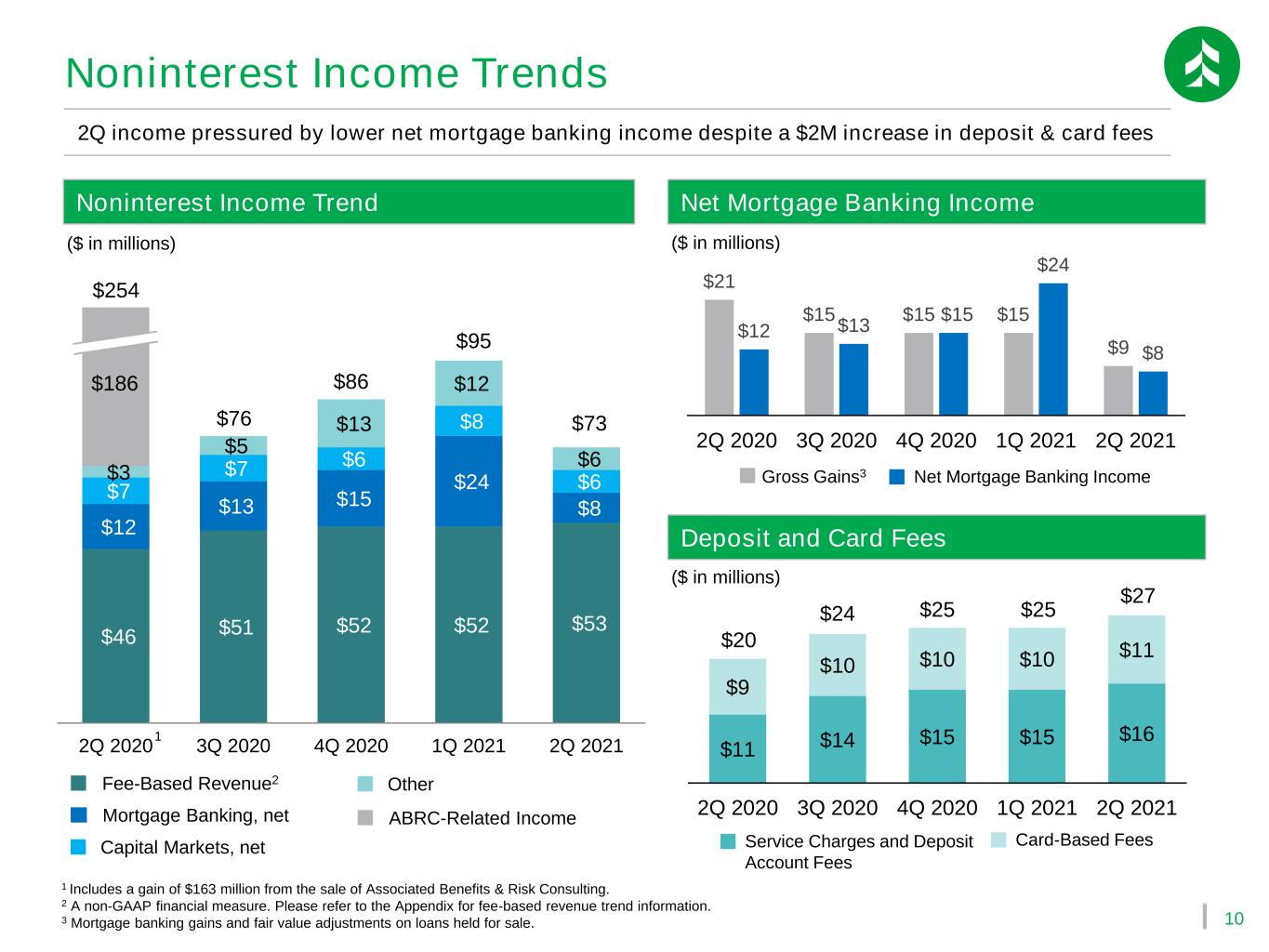

10 $21 $15 $15 $15 $9 $12 $13 $15 $24 $8 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 $46 $51 $52 $52 $53 $12 $13 $15 $24 $8 $7 $7 $6 $8 $6 $3 $5 $13 $12 $6 $73 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 $254 $186 $76 $86 $95 Noninterest Income Trends Net Mortgage Banking IncomeNoninterest Income Trend ($ in millions) ($ in millions) ($ in millions) Deposit and Card Fees 2Q income pressured by lower net mortgage banking income despite a $2M increase in deposit & card fees Fee-Based Revenue2 Capital Markets, net Mortgage Banking, net Other Net Mortgage Banking IncomeGross Gains3 $11 $14 $15 $15 $16 $9 $10 $10 $10 $11 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 1 1 Includes a gain of $163 million from the sale of Associated Benefits & Risk Consulting. 2 A non-GAAP financial measure. Please refer to the Appendix for fee-based revenue trend information. 3 Mortgage banking gains and fair value adjustments on loans held for sale. ABRC-Related Income Card-Based FeesService Charges and Deposit Account Fees $20 $24 $25 $25 $27

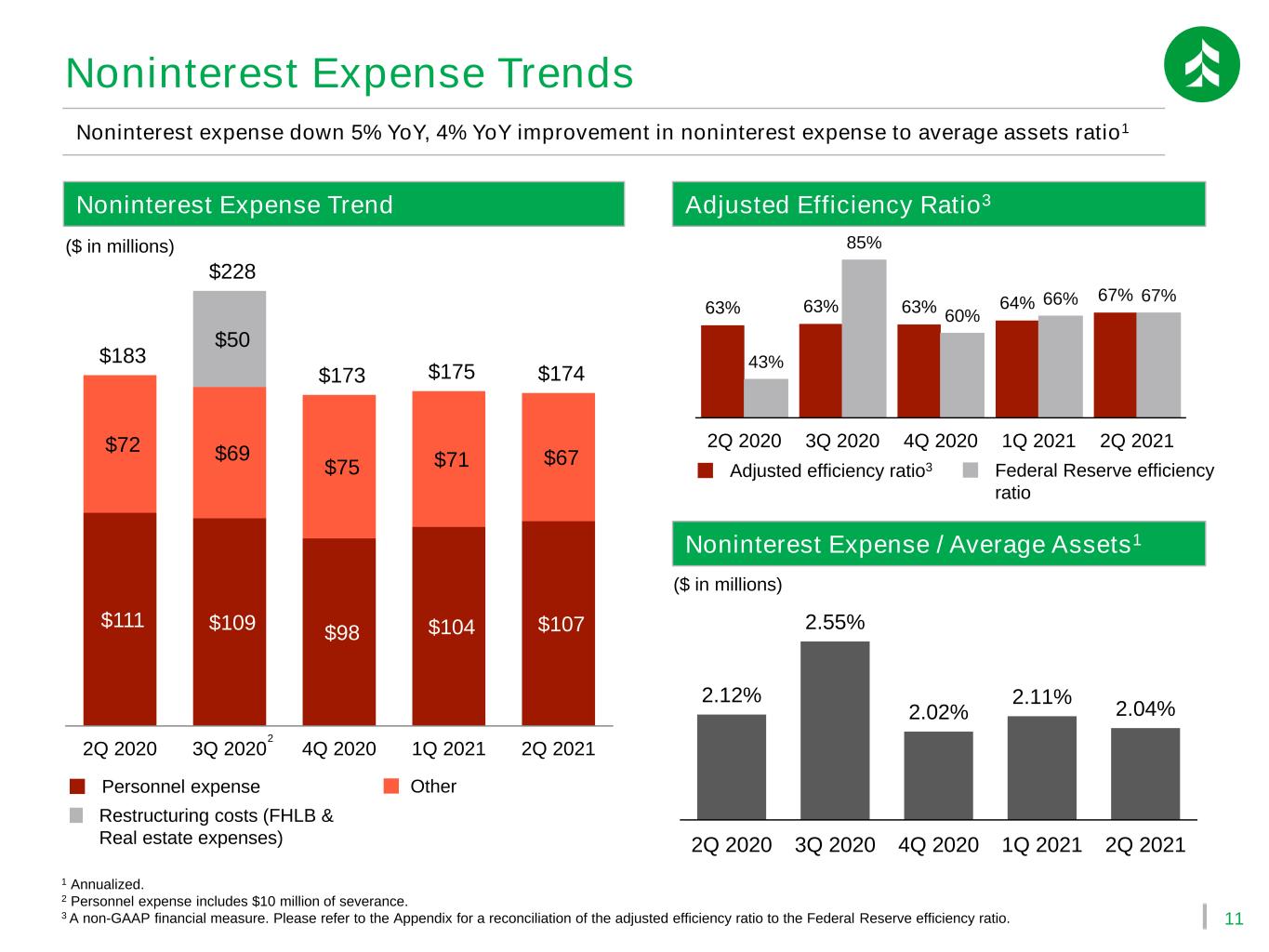

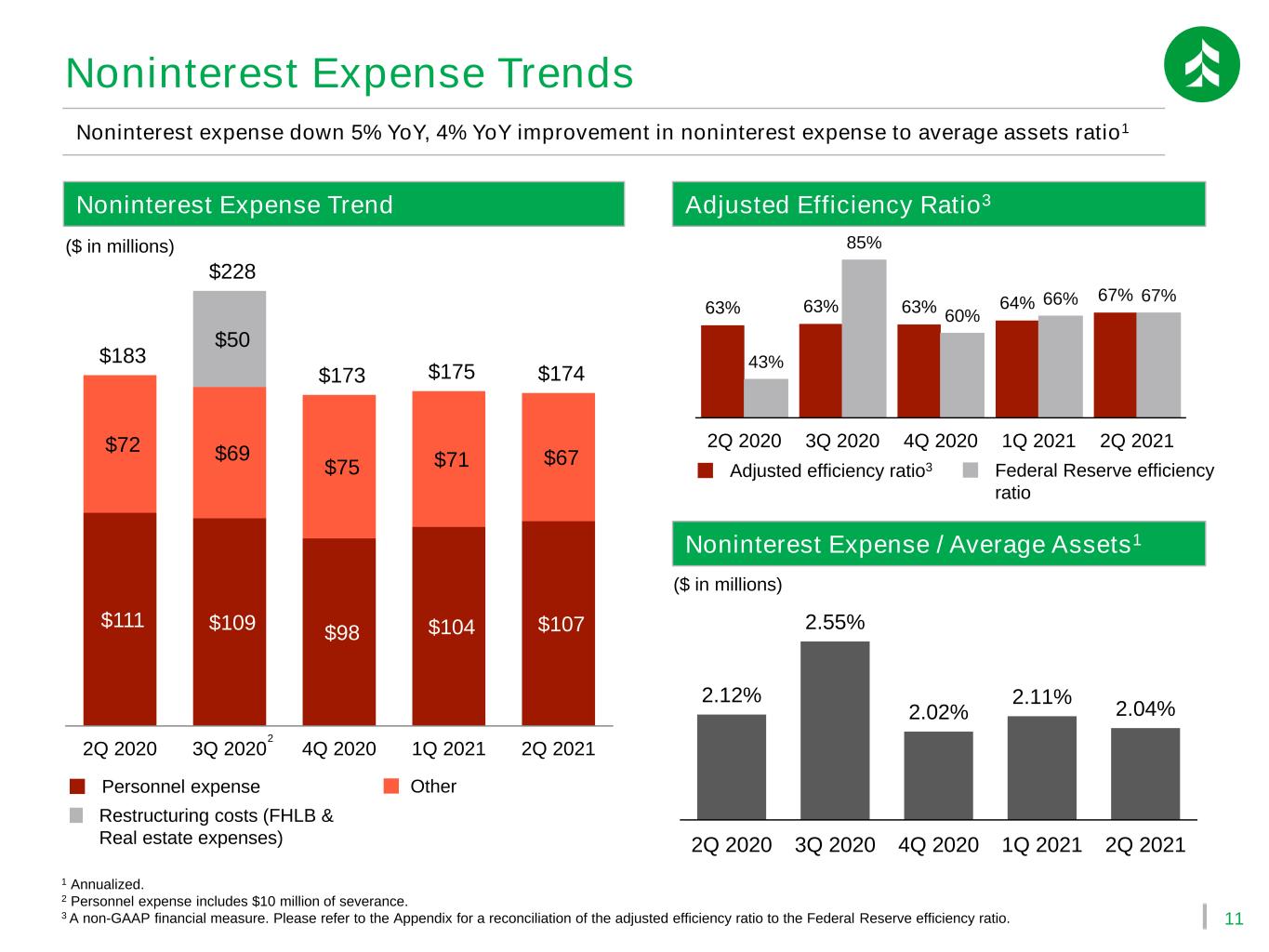

11 $111 $109 $98 $104 $107 $72 $69 $75 $71 $67 $50 $183 $228 $173 $175 $174 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Noninterest Expense Trends Adjusted Efficiency Ratio3Noninterest Expense Trend 1 Annualized. 2 Personnel expense includes $10 million of severance. 3 A non-GAAP financial measure. Please refer to the Appendix for a reconciliation of the adjusted efficiency ratio to the Federal Reserve efficiency ratio. ($ in millions) Noninterest expense down 5% YoY, 4% YoY improvement in noninterest expense to average assets ratio1 Personnel expense Other Restructuring costs (FHLB & Real estate expenses) 2 Federal Reserve efficiency ratio 63% 63% 63% 64% 67% 43% 85% 60% 66% 67% 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Adjusted efficiency ratio3 Noninterest Expense / Average Assets1 ($ in millions) 2.12% 2.55% 2.02% 2.11% 2.04% 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021

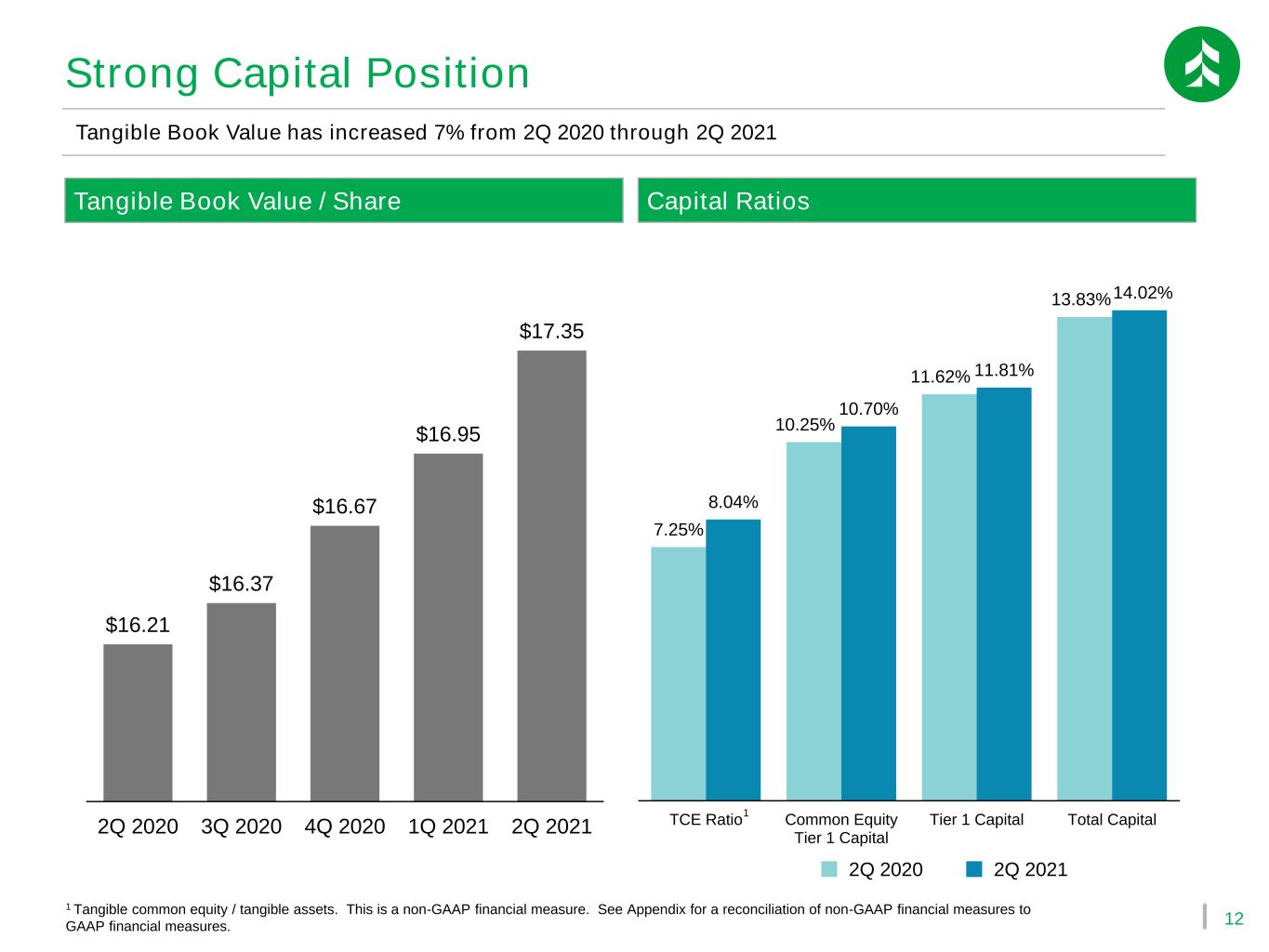

12 7.25% 10.25% 11.62% 13.83% 8.04% 10.70% 11.81% 14.02% TCE Ratio Common Equity Tier 1 Capital Tier 1 Capital Total Capital 1 Tangible common equity / tangible assets. This is a non-GAAP financial measure. See Appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. Capital Ratios 2Q 2020 Tangible Book Value has increased 7% from 2Q 2020 through 2Q 2021 2Q 2021 Strong Capital Position Tangible Book Value / Share $16.21 $16.37 $16.67 $16.95 $17.35 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 1

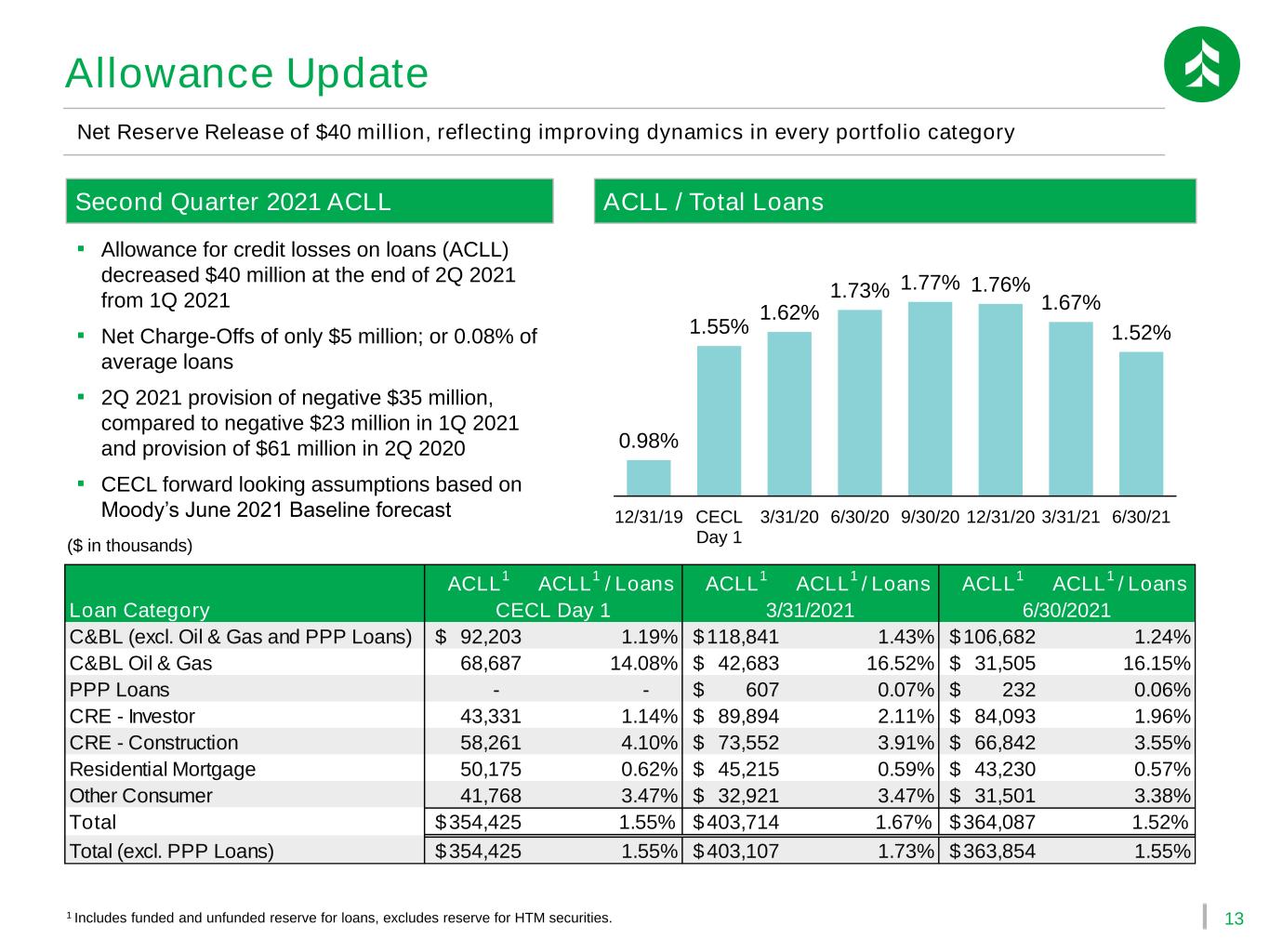

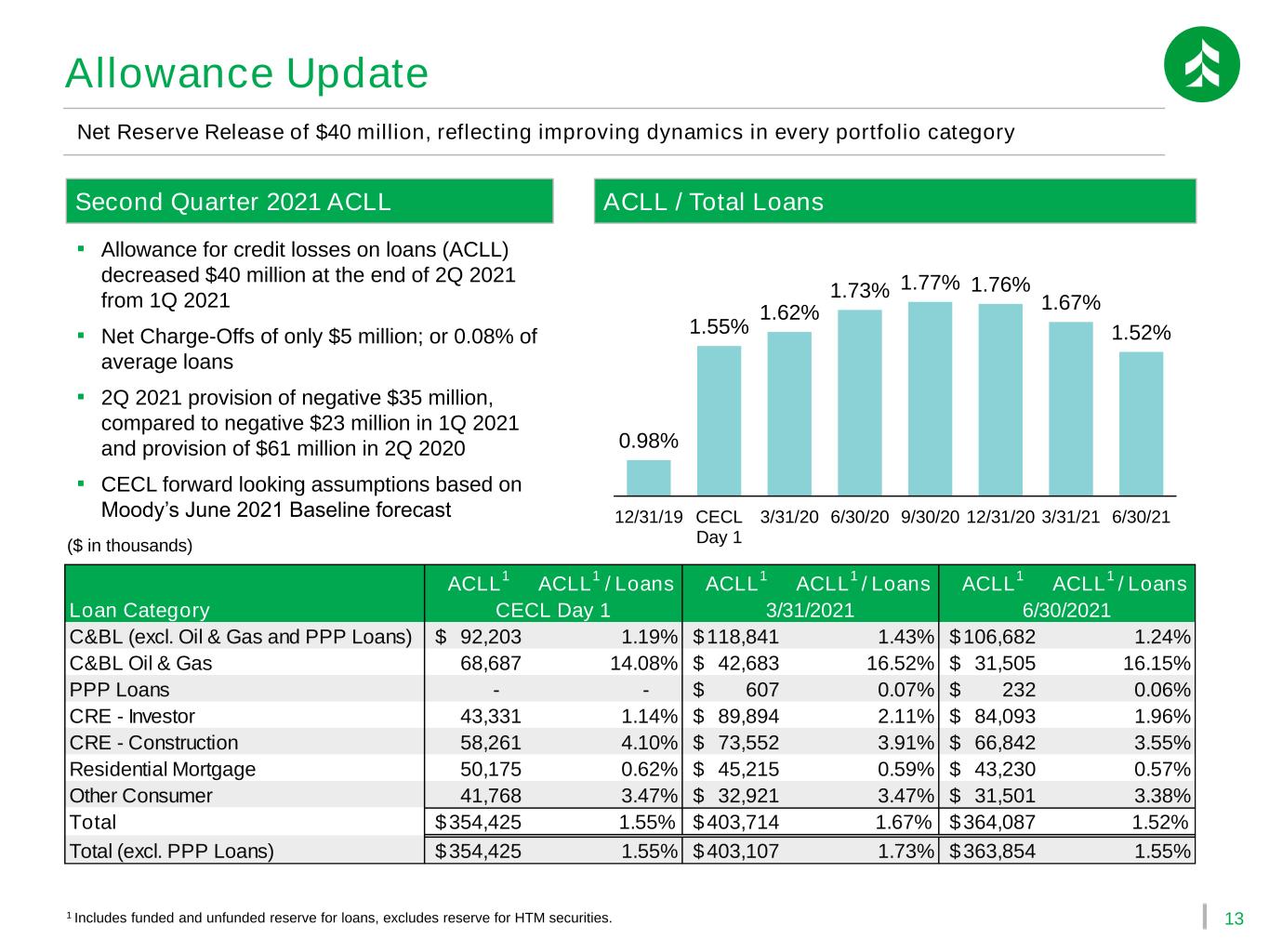

13 Second Quarter 2021 ACLL ▪ Allowance for credit losses on loans (ACLL) decreased $40 million at the end of 2Q 2021 from 1Q 2021 ▪ Net Charge-Offs of only $5 million; or 0.08% of average loans ▪ 2Q 2021 provision of negative $35 million, compared to negative $23 million in 1Q 2021 and provision of $61 million in 2Q 2020 ▪ CECL forward looking assumptions based on Moody’s June 2021 Baseline forecast 1 Includes funded and unfunded reserve for loans, excludes reserve for HTM securities. ($ in thousands) ACLL / Total Loans Net Reserve Release of $40 million, reflecting improving dynamics in every portfolio category Allowance Update 0.98% 1.55% 1.62% 1.73% 1.77% 1.76% 1.67% 1.52% 12/31/19 CECL Day 1 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 6/30/21 ACLL 1 ACLL 1 / Loans ACLL 1 ACLL 1 / Loans ACLL 1 ACLL 1 / Loans Loan Category C&BL (excl. Oil & Gas and PPP Loans) 92,203$ 1.19% 118,841$ 1.43% 106,682$ 1.24% C&BL Oil & Gas 68,687 14.08% 42,683$ 16.52% 31,505$ 16.15% PPP Loans - - 607$ 0.07% 232$ 0.06% CRE - Investor 43,331 1.14% 89,894$ 2.11% 84,093$ 1.96% CRE - Construction 58,261 4.10% 73,552$ 3.91% 66,842$ 3.55% Residential Mortgage 50,175 0.62% 45,215$ 0.59% 43,230$ 0.57% Other Consumer 41,768 3.47% 32,921$ 3.47% 31,501$ 3.38% Total 354,425$ 1.55% 403,714$ 1.67% 364,087$ 1.52% Total (excl. PPP Loans) 354,425$ 1.55% 403,107$ 1.73% 363,854$ 1.55% CECL Day 1 3/31/2021 6/30/2021

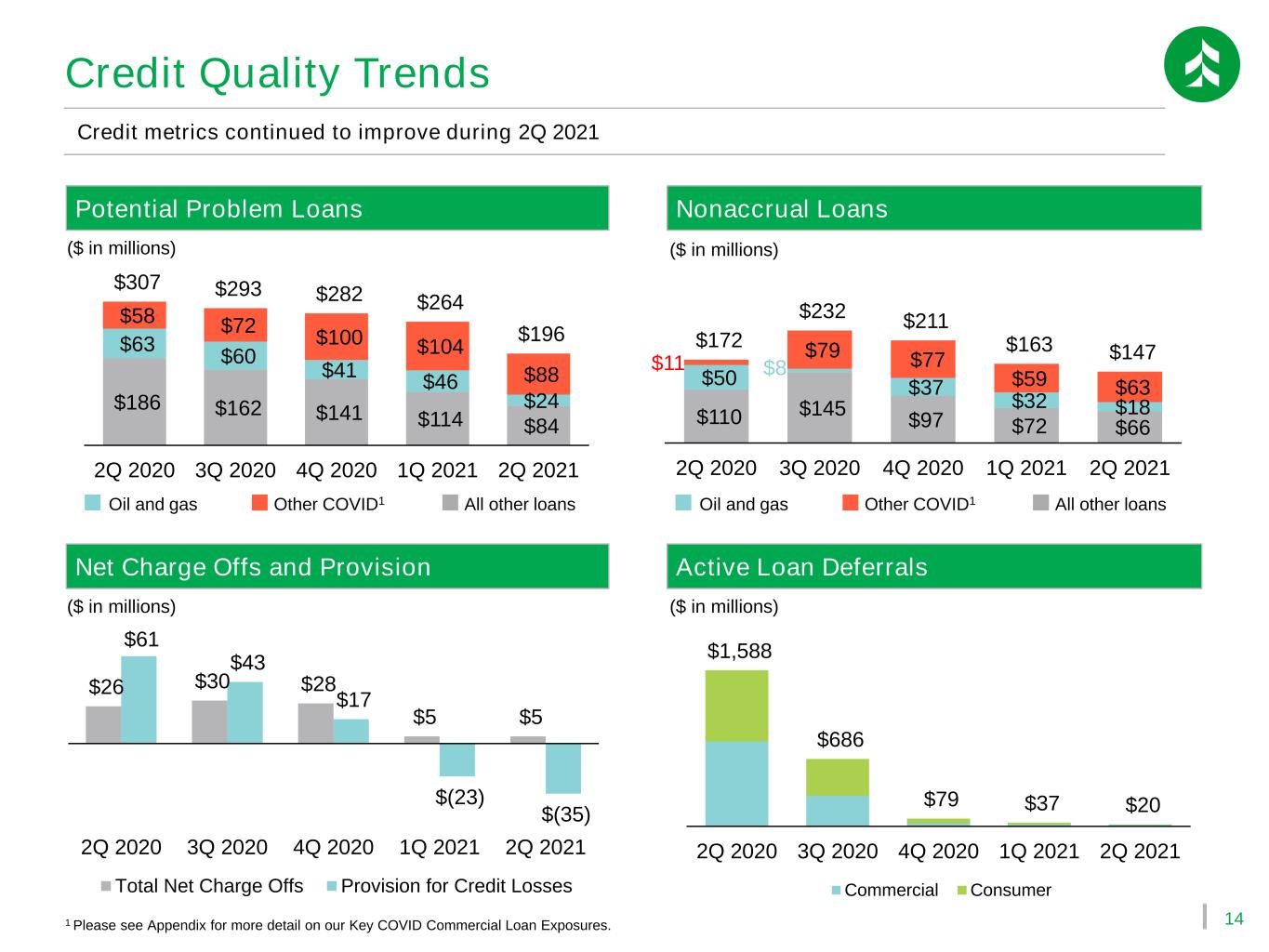

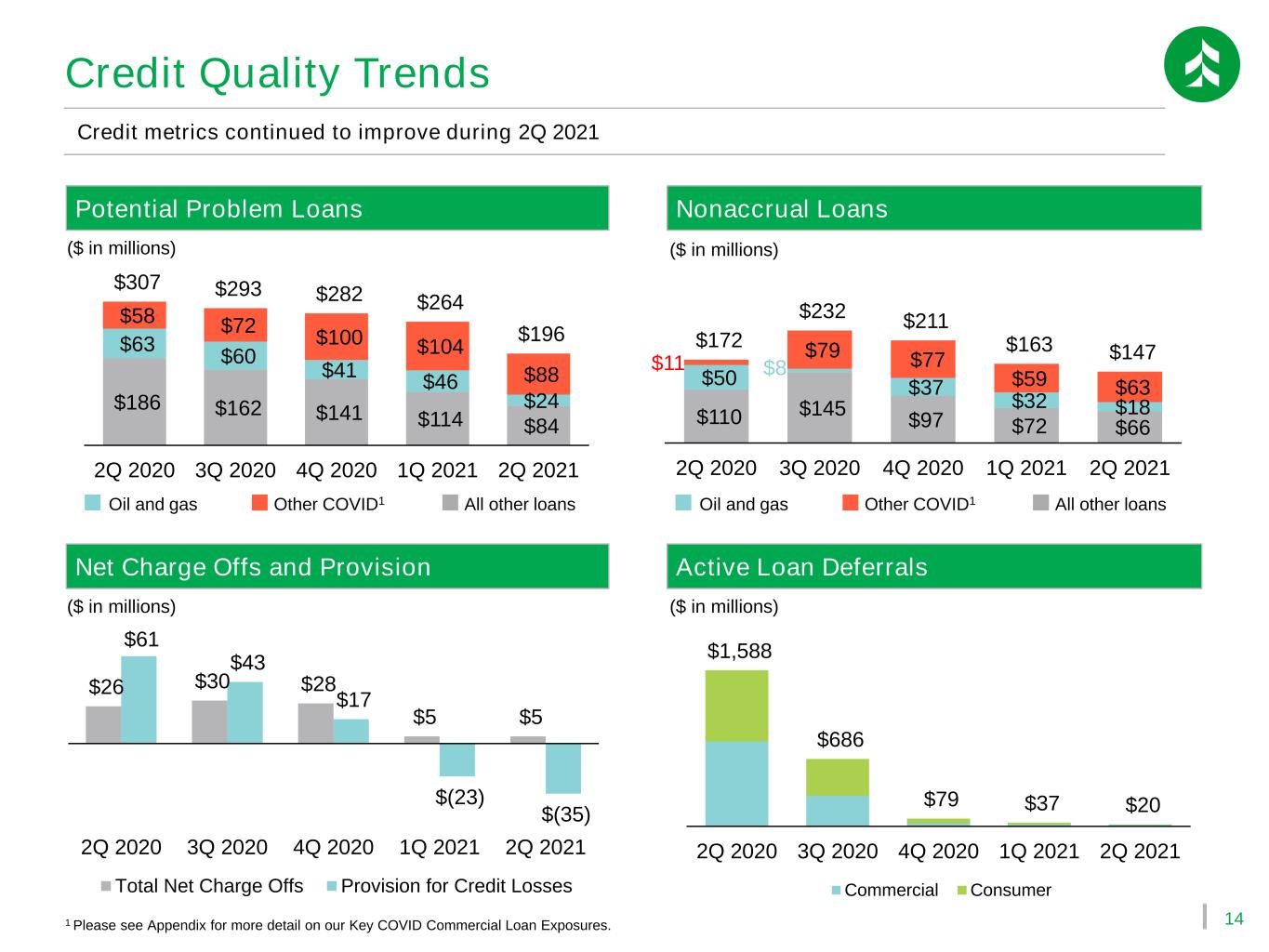

14 Credit Quality Trends $110 $145 $97 $72 $66 $50 $8 $37 $32 $18 $11 $79 $77 $59 $63 $172 $232 $211 $163 $147 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 $186 $162 $141 $114 $84 $63 $60 $41 $46 $24 $58 $72 $100 $104 $88 $307 $293 $282 $264 $196 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Credit metrics continued to improve during 2Q 2021 ($ in millions) ($ in millions) ($ in millions) 1 Please see Appendix for more detail on our Key COVID Commercial Loan Exposures. Potential Problem Loans Nonaccrual Loans Active Loan DeferralsNet Charge Offs and Provision Oil and gas All other loansOther COVID1 Oil and gas All other loansOther COVID1 $1,588 $686 $79 $37 $20 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Commercial Consumer ($ in millions) $26 $30 $28 $5 $5 $61 $43 $17 $(23) $(35) 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Total Net Charge Offs Provision for Credit Losses

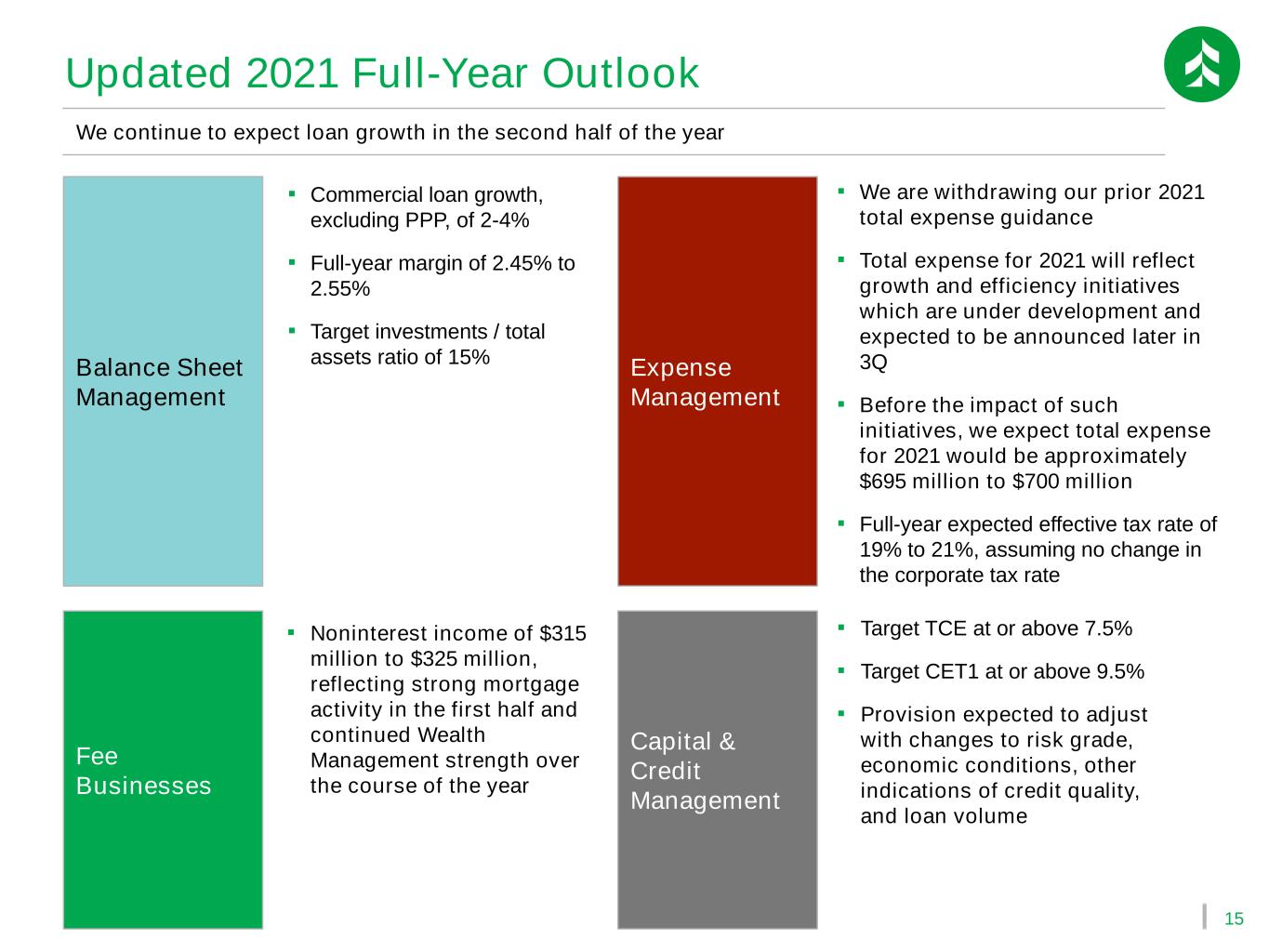

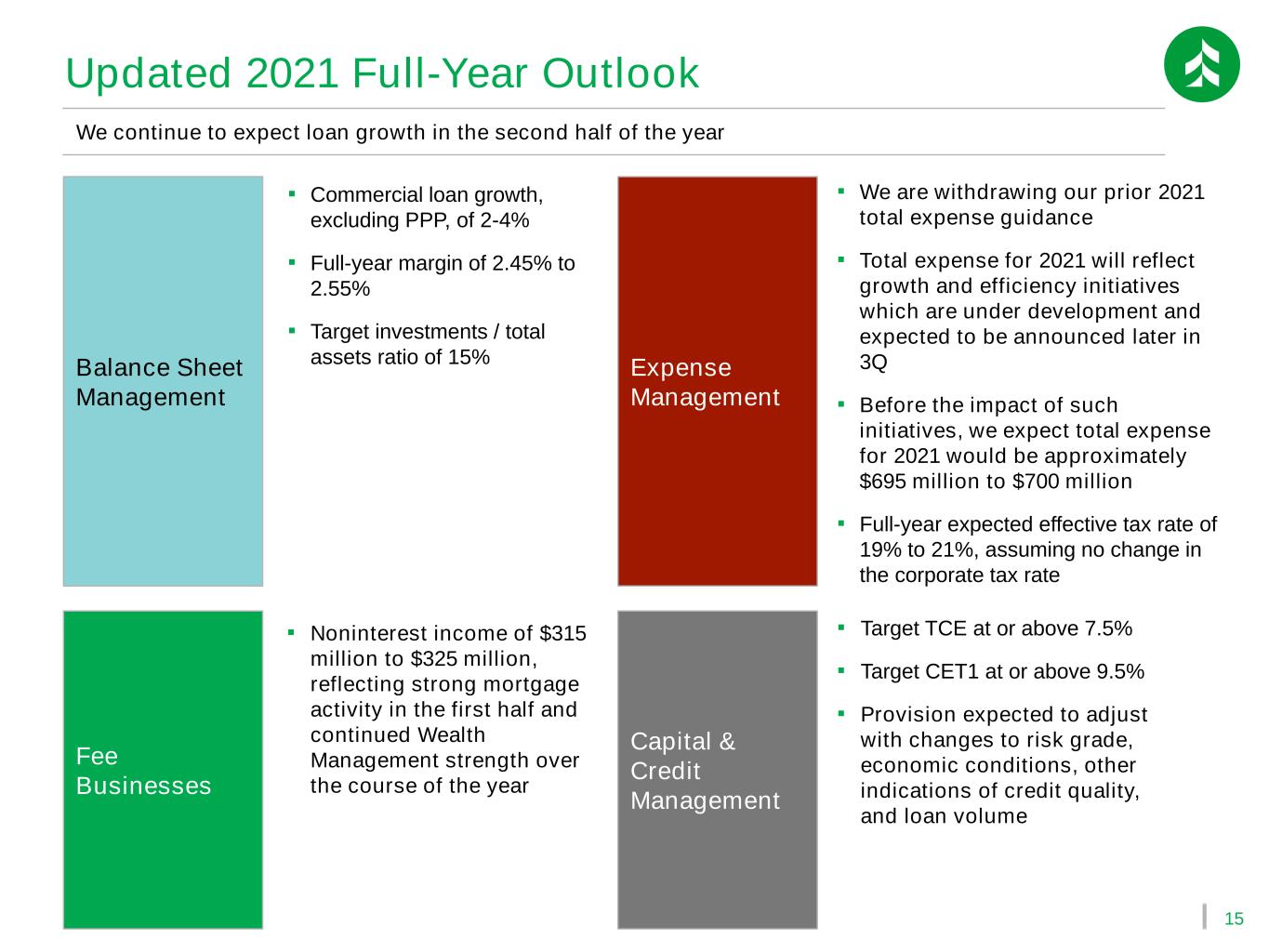

15 Balance Sheet Management ▪ Commercial loan growth, excluding PPP, of 2-4% ▪ Full-year margin of 2.45% to 2.55% ▪ Target investments / total assets ratio of 15% Fee Businesses ▪ Noninterest income of $315 million to $325 million, reflecting strong mortgage activity in the first half and continued Wealth Management strength over the course of the year Expense Management ▪ We are withdrawing our prior 2021 total expense guidance ▪ Total expense for 2021 will reflect growth and efficiency initiatives which are under development and expected to be announced later in 3Q ▪ Before the impact of such initiatives, we expect total expense for 2021 would be approximately $695 million to $700 million ▪ Full-year expected effective tax rate of 19% to 21%, assuming no change in the corporate tax rate Capital & Credit Management ▪ Target TCE at or above 7.5% ▪ Target CET1 at or above 9.5% ▪ Provision expected to adjust with changes to risk grade, economic conditions, other indications of credit quality, and loan volume We continue to expect loan growth in the second half of the year Updated 2021 Full-Year Outlook

Appendix

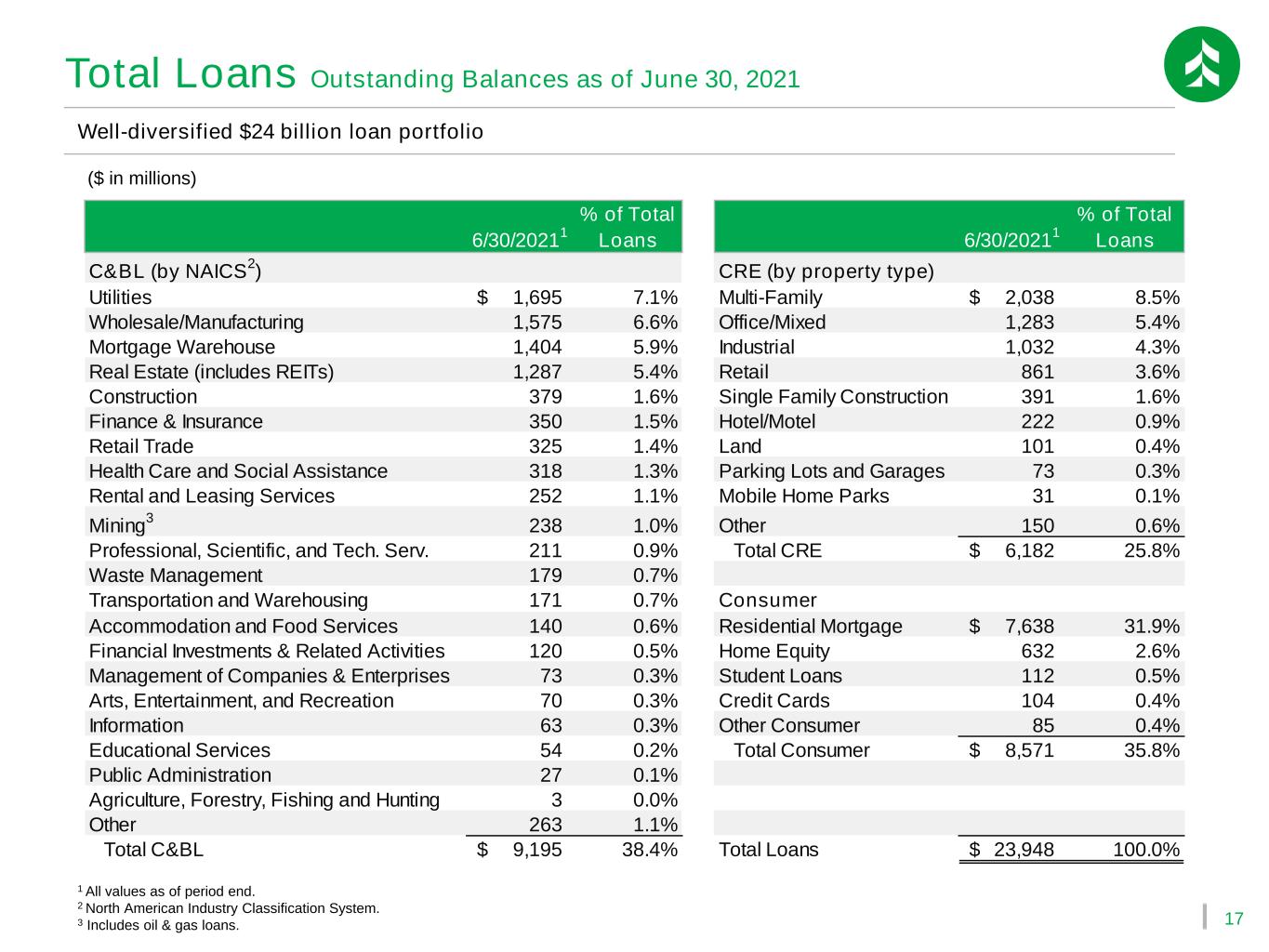

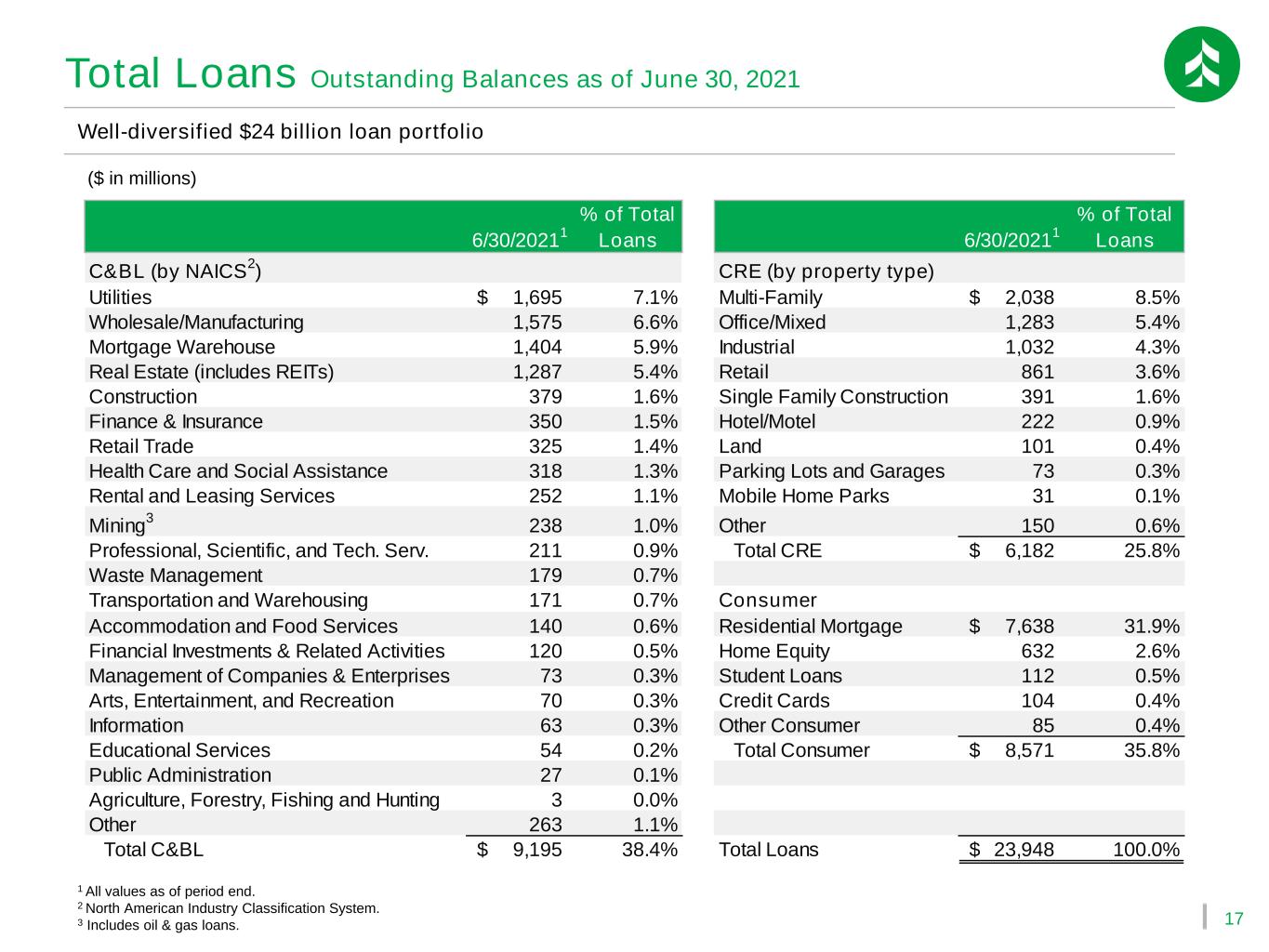

17 Total Loans Outstanding Balances as of June 30, 2021 Well-diversified $24 billion loan portfolio ($ in millions) 6/30/2021 1 % of Total Loans 6/30/2021 1 % of Total Loans C&BL (by NAICS 2 ) CRE (by property type) Utilities 1,695$ 7.1% Multi-Family 2,038$ 8.5% Wholesale/Manufacturing 1,575 6.6% Office/Mixed 1,283 5.4% Mortgage Warehouse 1,404 5.9% Industrial 1,032 4.3% Real Estate (includes REITs) 1,287 5.4% Retail 861 3.6% Construction 379 1.6% Single Family Construction 391 1.6% Finance & Insurance 350 1.5% Hotel/Motel 222 0.9% Retail Trade 325 1.4% Land 101 0.4% Health Care and Social Assistance 318 1.3% Parking Lots and Garages 73 0.3% Rental and Leasing Services 252 1.1% Mobile Home Parks 31 0.1% Mining 3 238 1.0% Other 150 0.6% Professional, Scientific, and Tech. Serv. 211 0.9% Total CRE 6,182$ 25.8% Waste Management 179 0.7% Transportation and Warehousing 171 0.7% Consumer Accommodation and Food Services 140 0.6% Residential Mortgage 7,638$ 31.9% Financial Investments & Related Activities 120 0.5% Home Equity 632 2.6% Management of Companies & Enterprises 73 0.3% Student Loans 112 0.5% Arts, Entertainment, and Recreation 70 0.3% Credit Cards 104 0.4% Information 63 0.3% Other Consumer 85 0.4% Educational Services 54 0.2% Total Consumer 8,571$ 35.8% Public Administration 27 0.1% Agriculture, Forestry, Fishing and Hunting 3 0.0% Other 263 1.1% Total C&BL 9,195$ 38.4% Total Loans 23,948$ 100.0% 1 All values as of period end. 2 North American Industry Classification System. 3 Includes oil & gas loans.

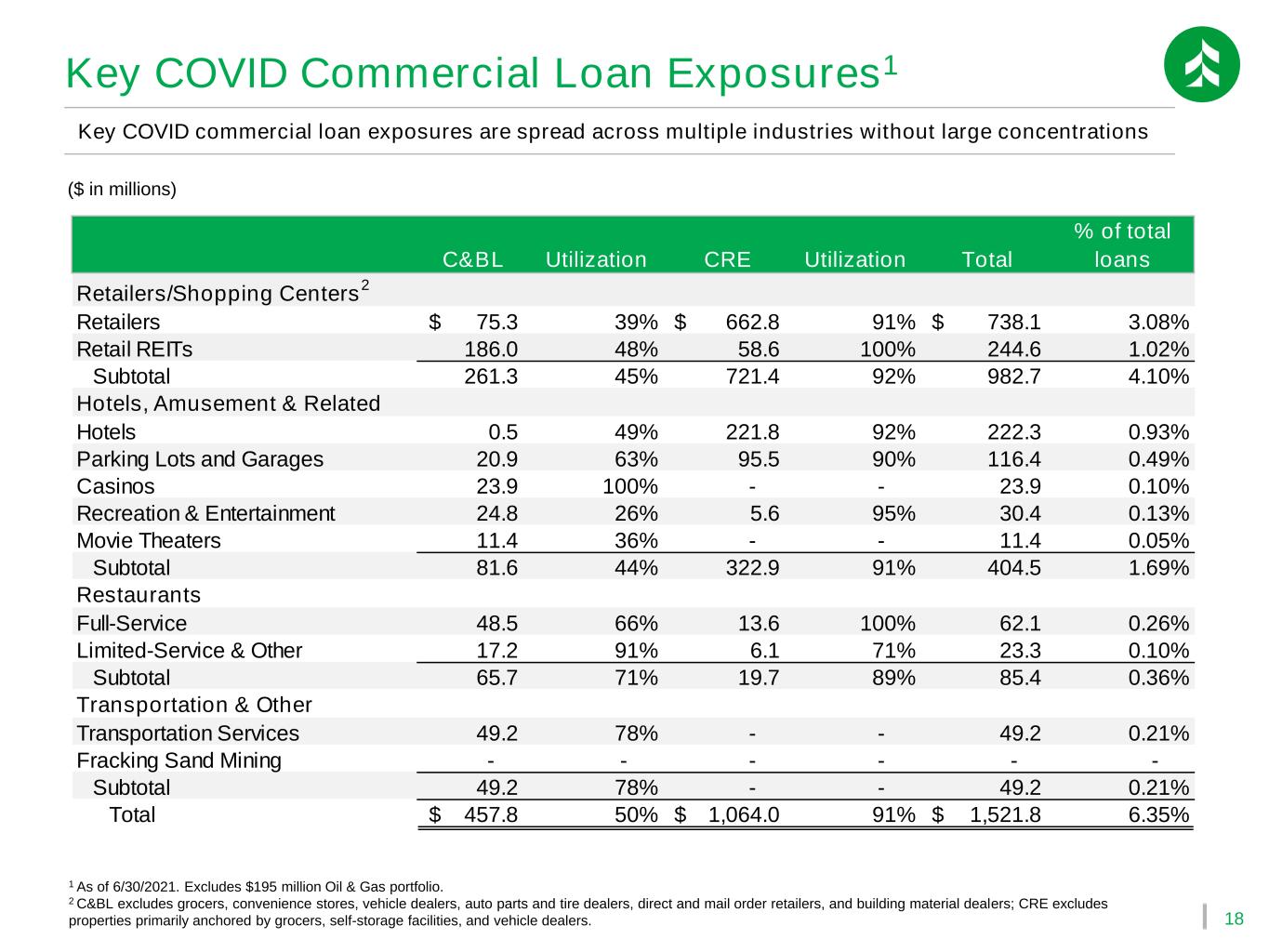

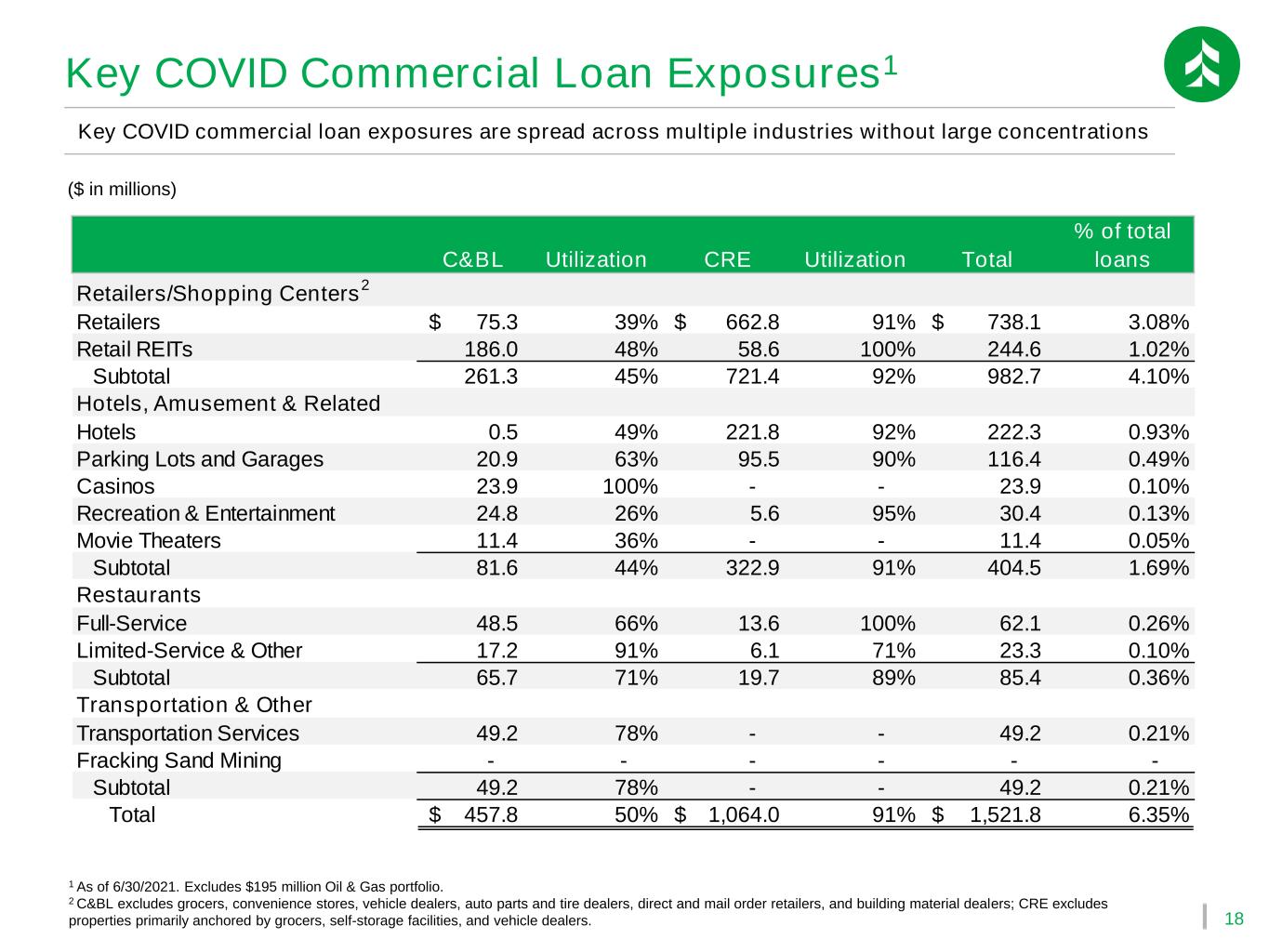

18 1 As of 6/30/2021. Excludes $195 million Oil & Gas portfolio. 2 C&BL excludes grocers, convenience stores, vehicle dealers, auto parts and tire dealers, direct and mail order retailers, and building material dealers; CRE excludes properties primarily anchored by grocers, self-storage facilities, and vehicle dealers. Key COVID commercial loan exposures are spread across multiple industries without large concentrations ($ in millions) Key COVID Commercial Loan Exposures1 C&BL Utilization CRE Utilization Total % of total loans Retailers/Shopping Centers 2 Retailers 75.3$ 39% 662.8$ 91% 738.1$ 3.08% Retail REITs 186.0 48% 58.6 100% 244.6 1.02% Subtotal 261.3 45% 721.4 92% 982.7 4.10% Hotels, Amusement & Related Hotels 0.5 49% 221.8 92% 222.3 0.93% Parking Lots and Garages 20.9 63% 95.5 90% 116.4 0.49% Casinos 23.9 100% - - 23.9 0.10% Recreation & Entertainment 24.8 26% 5.6 95% 30.4 0.13% Movie Theaters 11.4 36% - - 11.4 0.05% Subtotal 81.6 44% 322.9 91% 404.5 1.69% Restaurants Full-Service 48.5 66% 13.6 100% 62.1 0.26% Limited-Service & Other 17.2 91% 6.1 71% 23.3 0.10% Subtotal 65.7 71% 19.7 89% 85.4 0.36% Transportation & Other Transportation Services 49.2 78% - - 49.2 0.21% Fracking Sand Mining - - - - - - Subtotal 49.2 78% - - 49.2 0.21% Total 457.8$ 50% 1,064.0$ 91% 1,521.8$ 6.35%

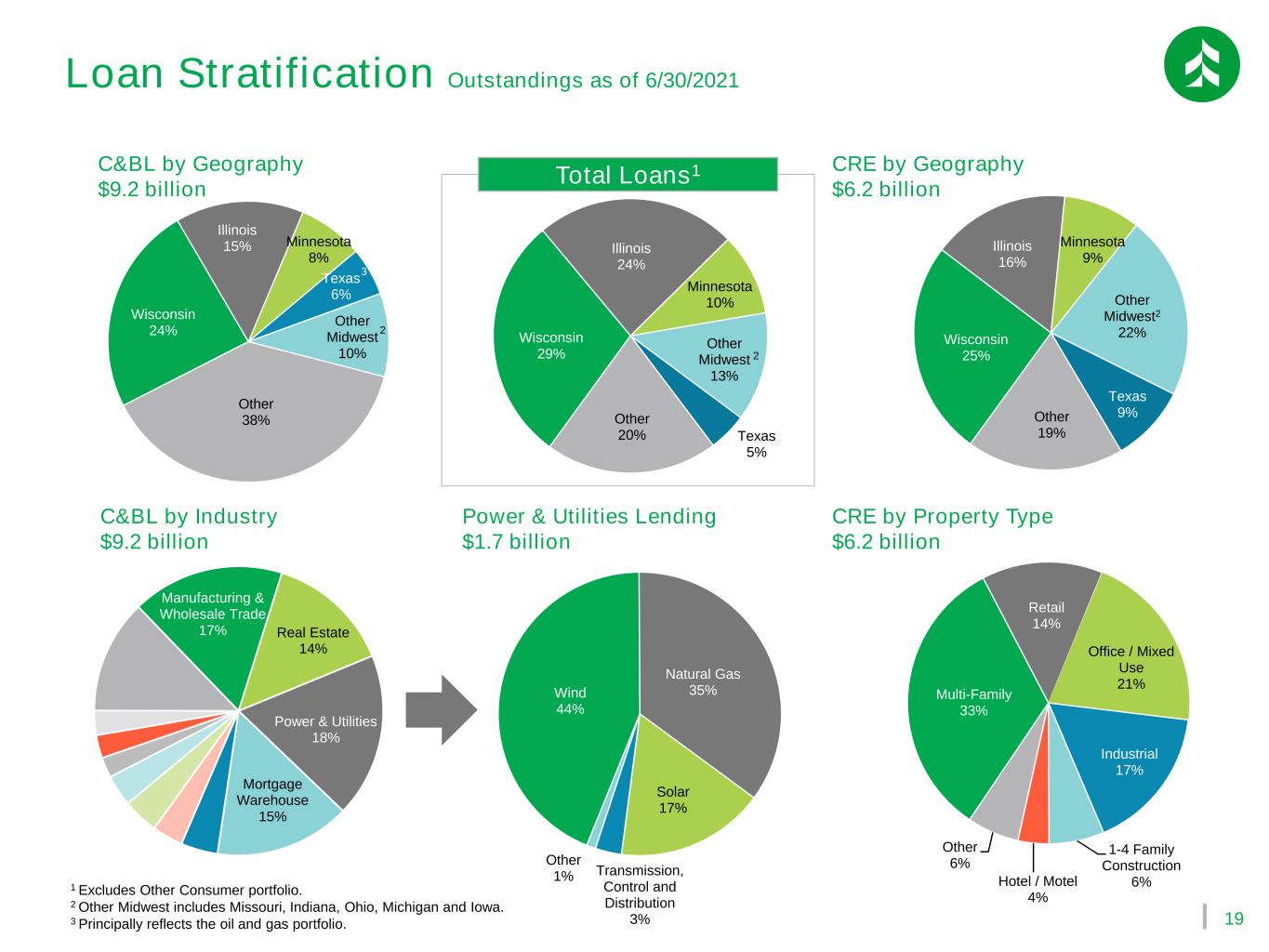

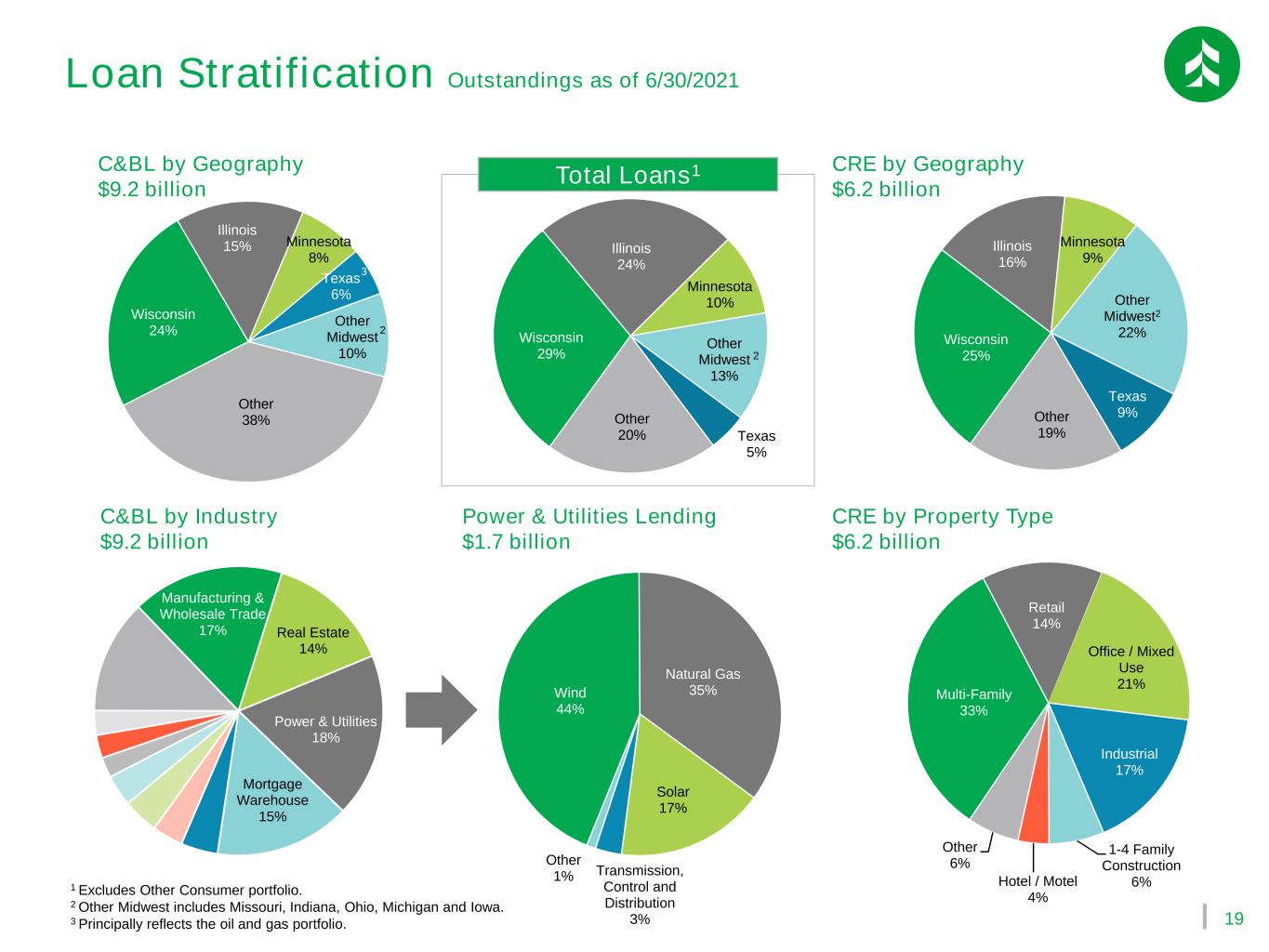

19 Manufacturing & Wholesale Trade 17% Real Estate 14% Power & Utilities 18% Mortgage Warehouse 15% 1 Excludes Other Consumer portfolio. 2 Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. 3 Principally reflects the oil and gas portfolio. C&BL by Geography $9.2 billion CRE by Geography $6.2 billion Multi-Family 33% Retail 14% Office / Mixed Use 21% Industrial 17% 1-4 Family Construction 6%Hotel / Motel 4% Other 6% Wind 44% Natural Gas 35% Solar 17% Transmission, Control and Distribution 3% Other 1% Wisconsin 24% Illinois 15% Minnesota 8% Texas 6% Other Midwest 10% Other 38% Wisconsin 25% Illinois 16% Minnesota 9% Other Midwest2 22% Texas 9%Other 19% Total Loans1 Wisconsin 29% Illinois 24% Minnesota 10% Other Midwest 13% Texas 5% Other 20% C&BL by Industry $9.2 billion Power & Utilities Lending $1.7 billion CRE by Property Type $6.2 billion 3 2 2 Loan Stratification Outstandings as of 6/30/2021

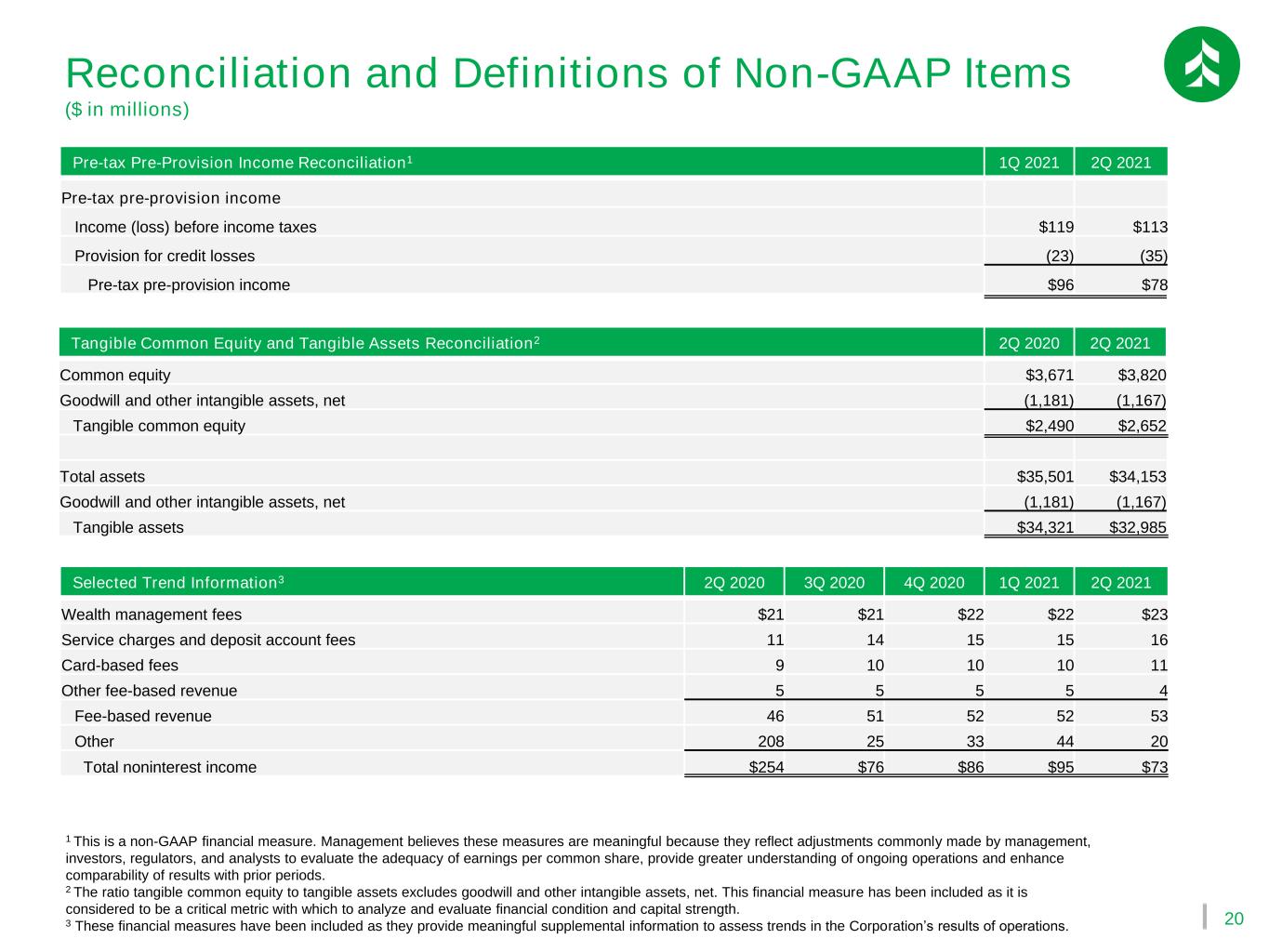

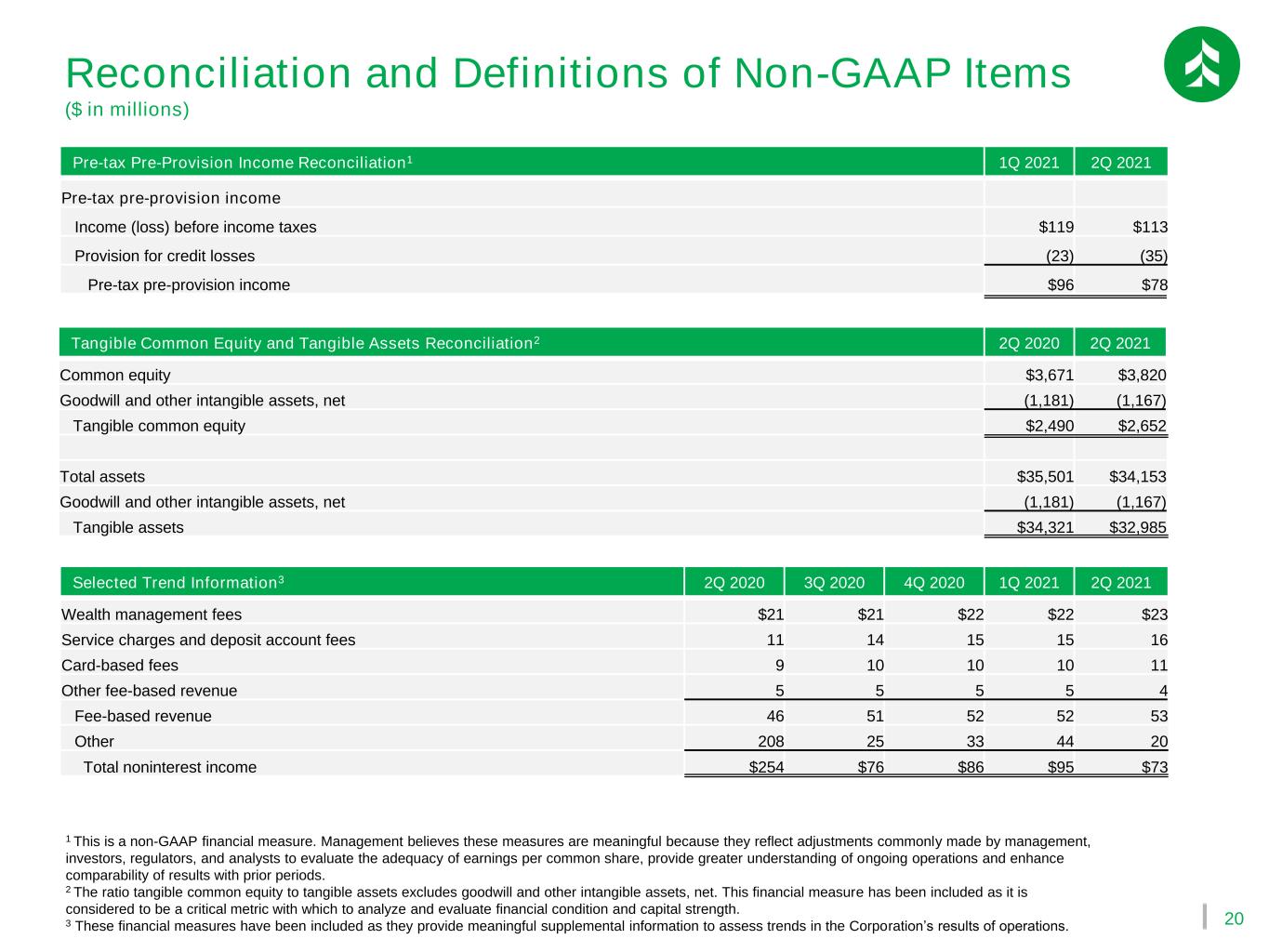

20 Reconciliation and Definitions of Non-GAAP Items ($ in millions) 1 This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. 2 The ratio tangible common equity to tangible assets excludes goodwill and other intangible assets, net. This financial measure has been included as it is considered to be a critical metric with which to analyze and evaluate financial condition and capital strength. 3 These financial measures have been included as they provide meaningful supplemental information to assess trends in the Corporation’s results of operations. Pre-tax Pre-Provision Income Reconciliation1 1Q 2021 2Q 2021 Pre-tax pre-provision income Income (loss) before income taxes $119 $113 Provision for credit losses (23) (35) Pre-tax pre-provision income $96 $78 Tangible Common Equity and Tangible Assets Reconciliation2 2Q 2020 2Q 2021 Common equity $3,671 $3,820 Goodwill and other intangible assets, net (1,181) (1,167) Tangible common equity $2,490 $2,652 Total assets $35,501 $34,153 Goodwill and other intangible assets, net (1,181) (1,167) Tangible assets $34,321 $32,985 Selected Trend Information3 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Wealth management fees $21 $21 $22 $22 $23 Service charges and deposit account fees 11 14 15 15 16 Card-based fees 9 10 10 10 11 Other fee-based revenue 5 5 5 5 4 Fee-based revenue 46 51 52 52 53 Other 208 25 33 44 20 Total noninterest income $254 $76 $86 $95 $73

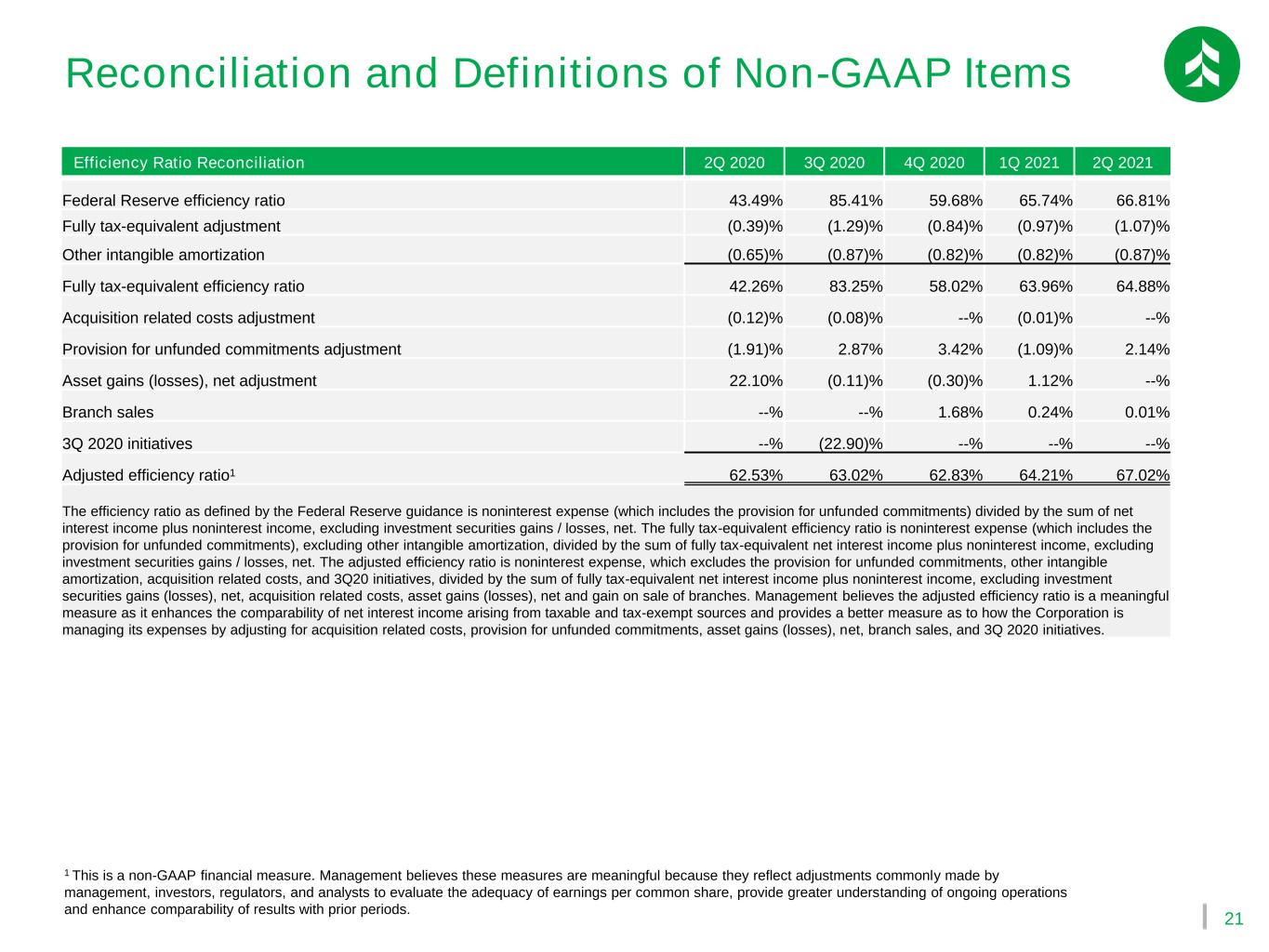

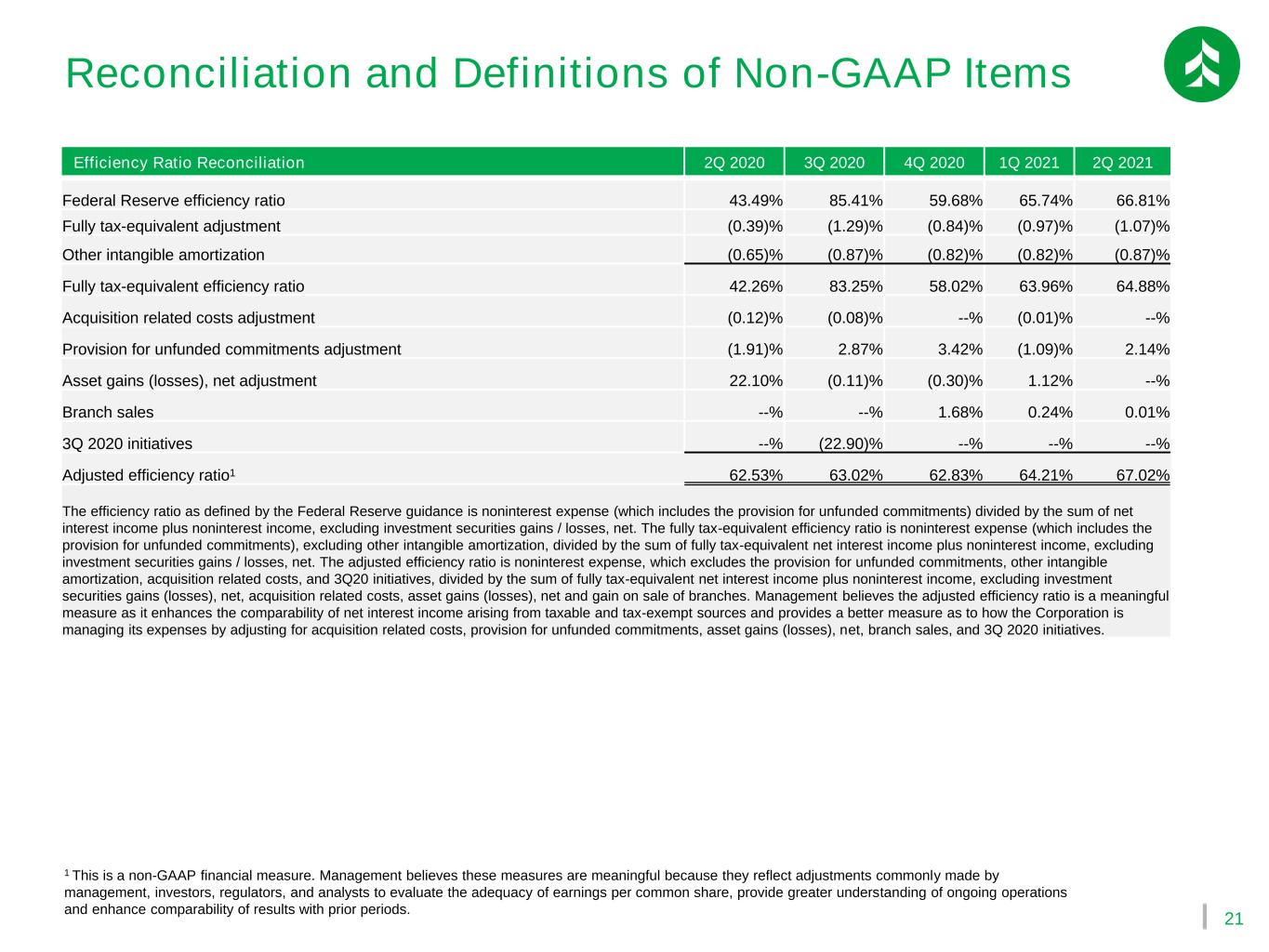

21 Reconciliation and Definitions of Non-GAAP Items 1 This is a non-GAAP financial measure. Management believes these measures are meaningful because they reflect adjustments commonly made by management, investors, regulators, and analysts to evaluate the adequacy of earnings per common share, provide greater understanding of ongoing operations and enhance comparability of results with prior periods. Efficiency Ratio Reconciliation 2Q 2020 3Q 2020 4Q 2020 1Q 2021 2Q 2021 Federal Reserve efficiency ratio 43.49% 85.41% 59.68% 65.74% 66.81% Fully tax-equivalent adjustment (0.39)% (1.29)% (0.84)% (0.97)% (1.07)% Other intangible amortization (0.65)% (0.87)% (0.82)% (0.82)% (0.87)% Fully tax-equivalent efficiency ratio 42.26% 83.25% 58.02% 63.96% 64.88% Acquisition related costs adjustment (0.12)% (0.08)% --% (0.01)% --% Provision for unfunded commitments adjustment (1.91)% 2.87% 3.42% (1.09)% 2.14% Asset gains (losses), net adjustment 22.10% (0.11)% (0.30)% 1.12% --% Branch sales --% --% 1.68% 0.24% 0.01% 3Q 2020 initiatives --% (22.90)% --% --% --% Adjusted efficiency ratio1 62.53% 63.02% 62.83% 64.21% 67.02% The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. The adjusted efficiency ratio is noninterest expense, which excludes the provision for unfunded commitments, other intangible amortization, acquisition related costs, and 3Q20 initiatives, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains (losses), net, acquisition related costs, asset gains (losses), net and gain on sale of branches. Management believes the adjusted efficiency ratio is a meaningful measure as it enhances the comparability of net interest income arising from taxable and tax-exempt sources and provides a better measure as to how the Corporation is managing its expenses by adjusting for acquisition related costs, provision for unfunded commitments, asset gains (losses), net, branch sales, and 3Q 2020 initiatives.