January 23, 2025 Fourth Quarter 2024 Earnings Presentation Associated Banc-Corp Exhibit 99.2

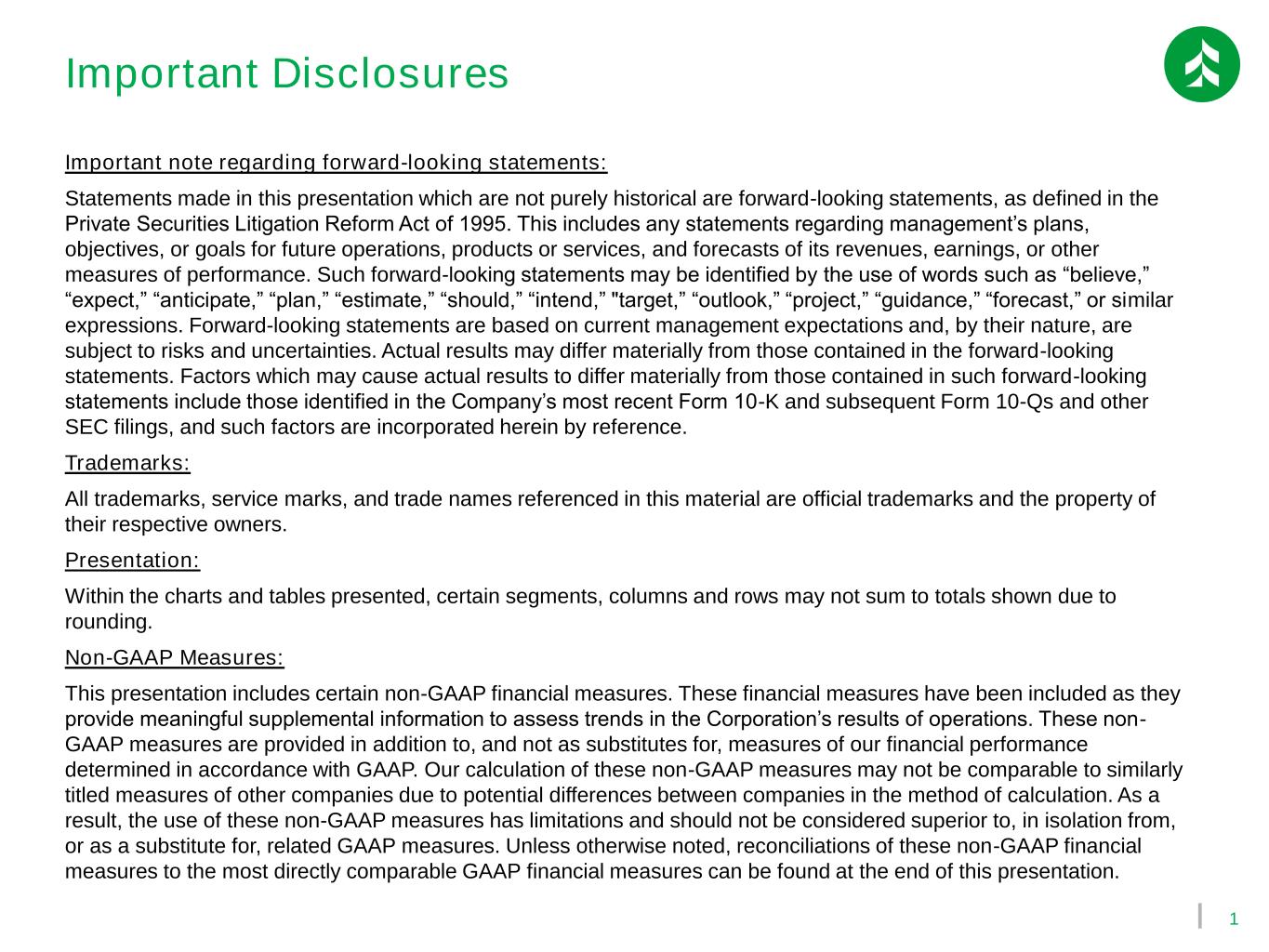

1 Important Disclosures Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “intend,” "target,” “outlook,” “project,” “guidance,” “forecast,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Measures: This presentation includes certain non-GAAP financial measures. These financial measures have been included as they provide meaningful supplemental information to assess trends in the Corporation’s results of operations. These non- GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Unless otherwise noted, reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation.

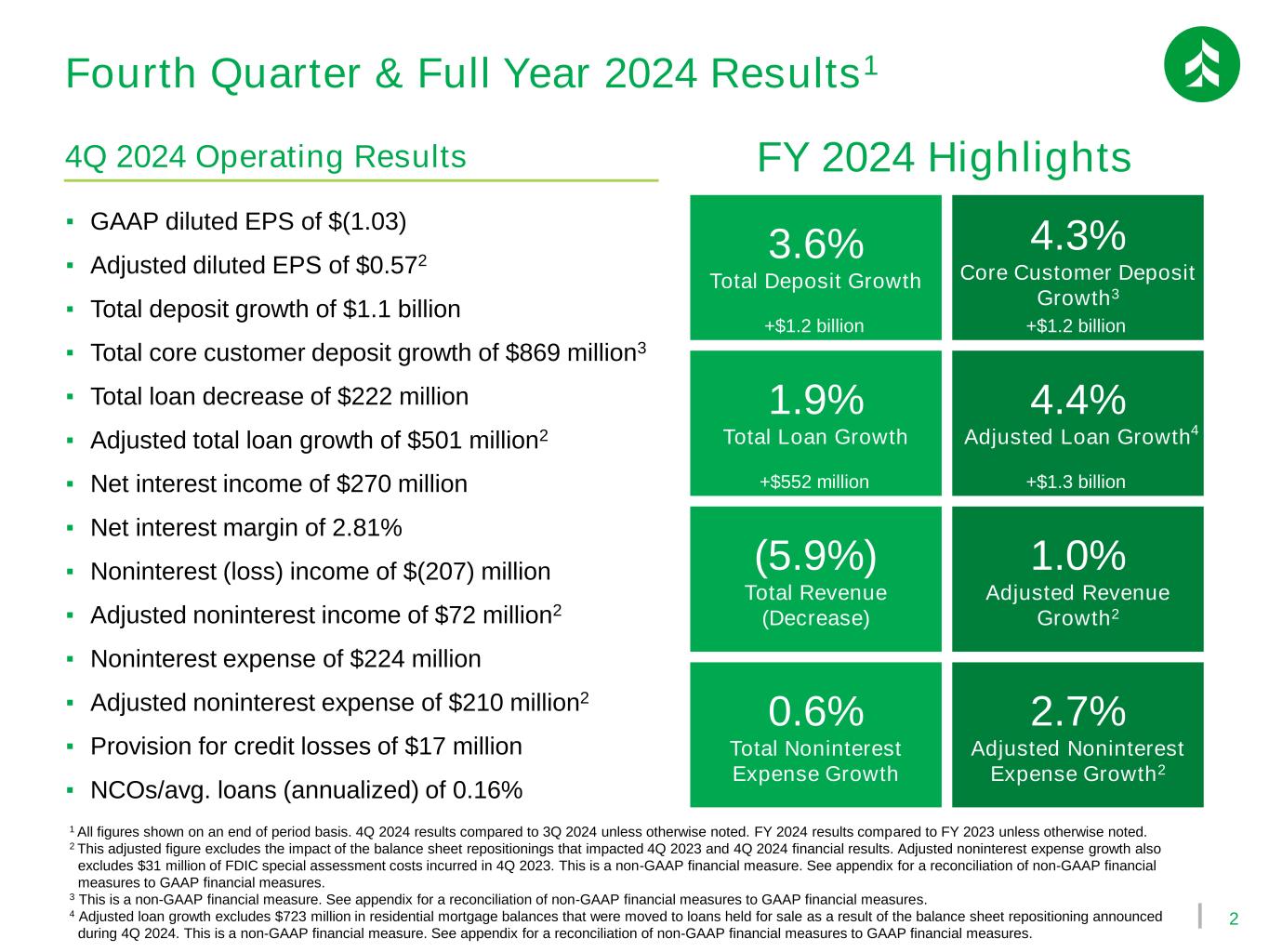

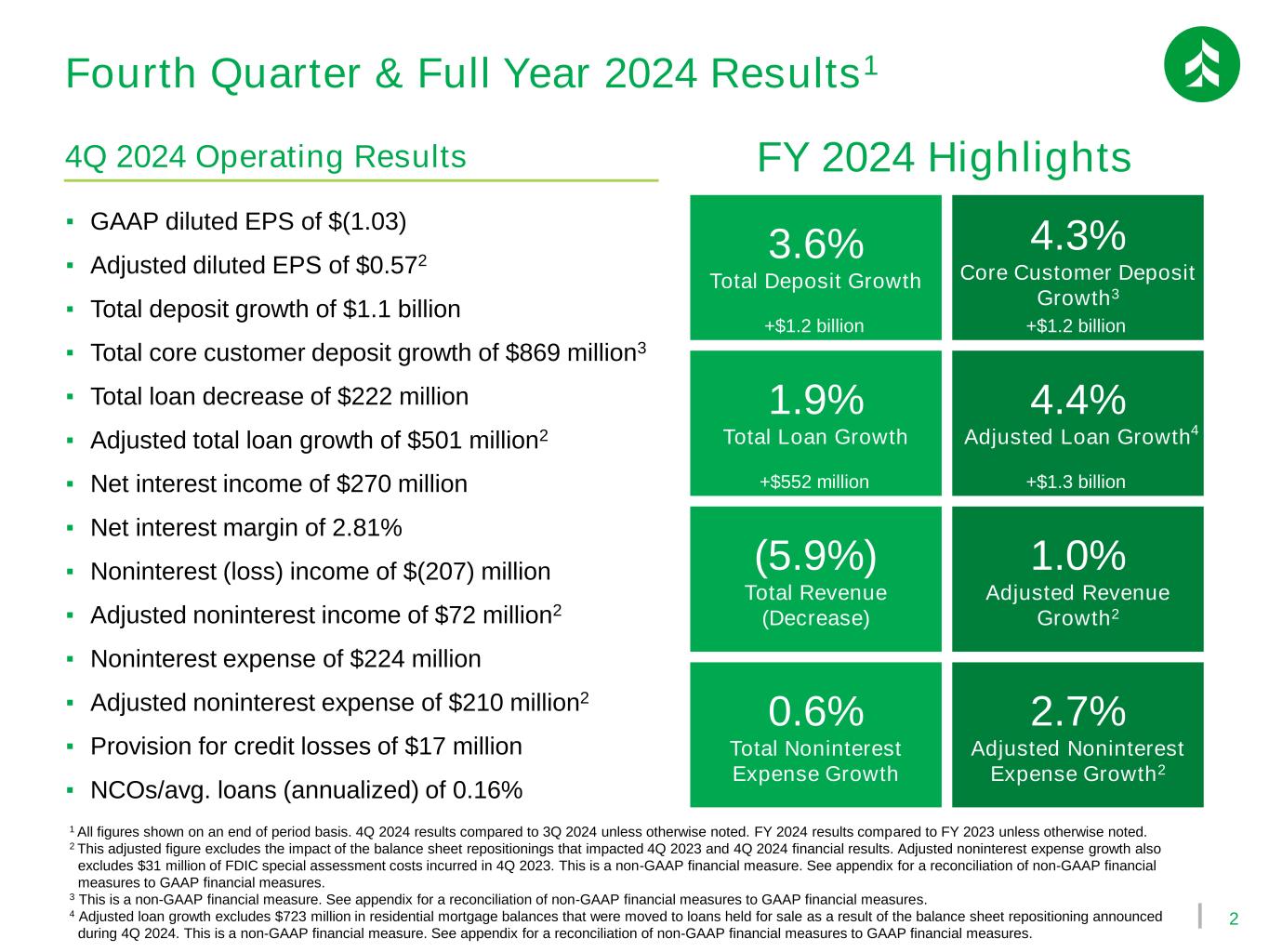

2 Fourth Quarter & Full Year 2024 Results1 1 All figures shown on an end of period basis. 4Q 2024 results compared to 3Q 2024 unless otherwise noted. FY 2024 results compared to FY 2023 unless otherwise noted. 2 This adjusted figure excludes the impact of the balance sheet repositionings that impacted 4Q 2023 and 4Q 2024 financial results. Adjusted noninterest expense growth also excludes $31 million of FDIC special assessment costs incurred in 4Q 2023. This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 3 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 4 Adjusted loan growth excludes $723 million in residential mortgage balances that were moved to loans held for sale as a result of the balance sheet repositioning announced during 4Q 2024. This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. ▪ GAAP diluted EPS of $(1.03) ▪ Adjusted diluted EPS of $0.572 ▪ Total deposit growth of $1.1 billion ▪ Total core customer deposit growth of $869 million3 ▪ Total loan decrease of $222 million ▪ Adjusted total loan growth of $501 million2 ▪ Net interest income of $270 million ▪ Net interest margin of 2.81% ▪ Noninterest (loss) income of $(207) million ▪ Adjusted noninterest income of $72 million2 ▪ Noninterest expense of $224 million ▪ Adjusted noninterest expense of $210 million2 ▪ Provision for credit losses of $17 million ▪ NCOs/avg. loans (annualized) of 0.16% 4Q 2024 Operating Results 3.6% Total Deposit Growth 4.3% Core Customer Deposit Growth3 1.9% Total Loan Growth 4.4% Adjusted Loan Growth (5.9%) Total Revenue (Decrease) 1.0% Adjusted Revenue Growth2 0.6% Total Noninterest Expense Growth 2.7% Adjusted Noninterest Expense Growth2 FY 2024 Highlights 4 +$1.2 billion +$1.2 billion +$552 million +$1.3 billion

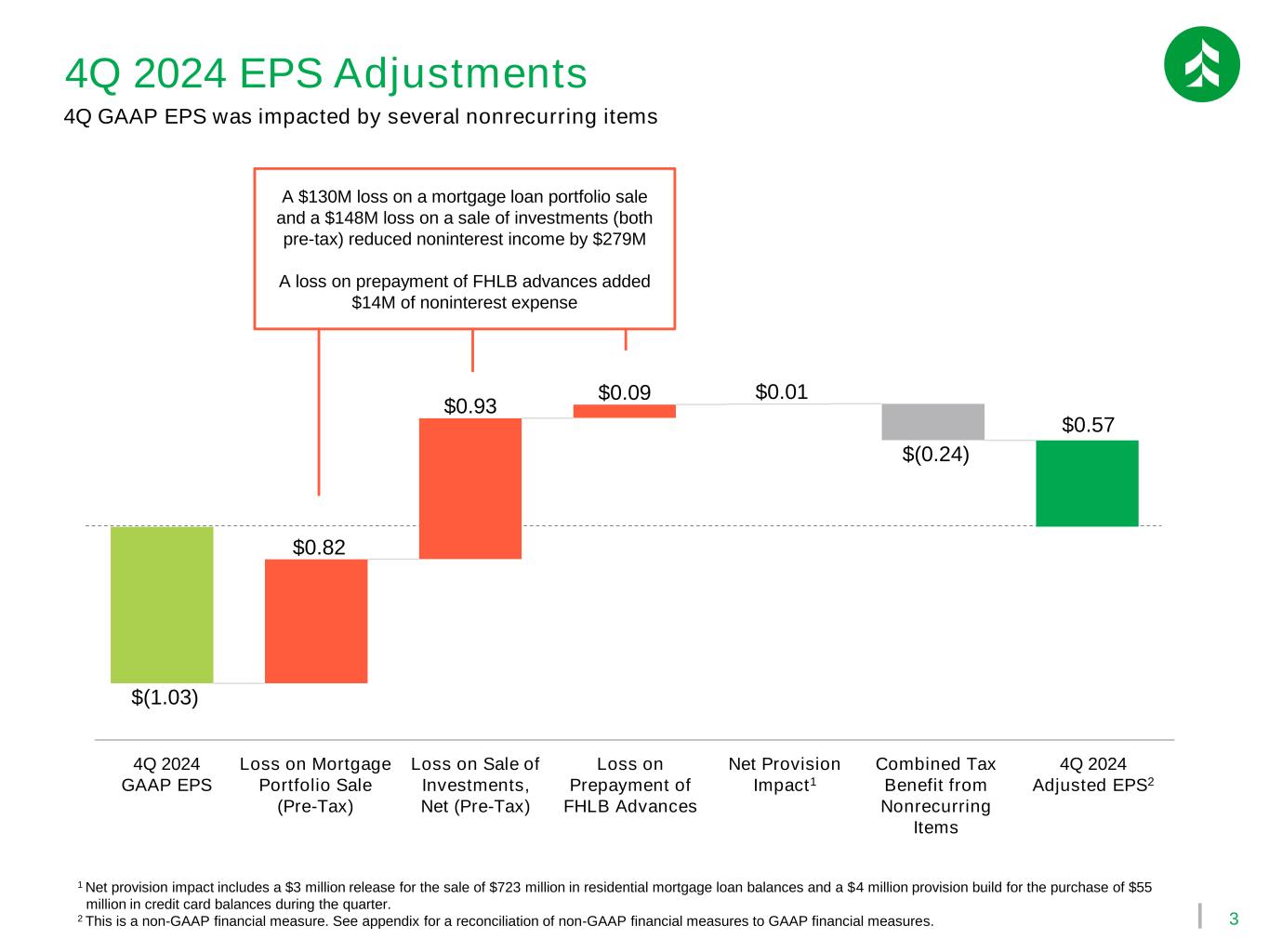

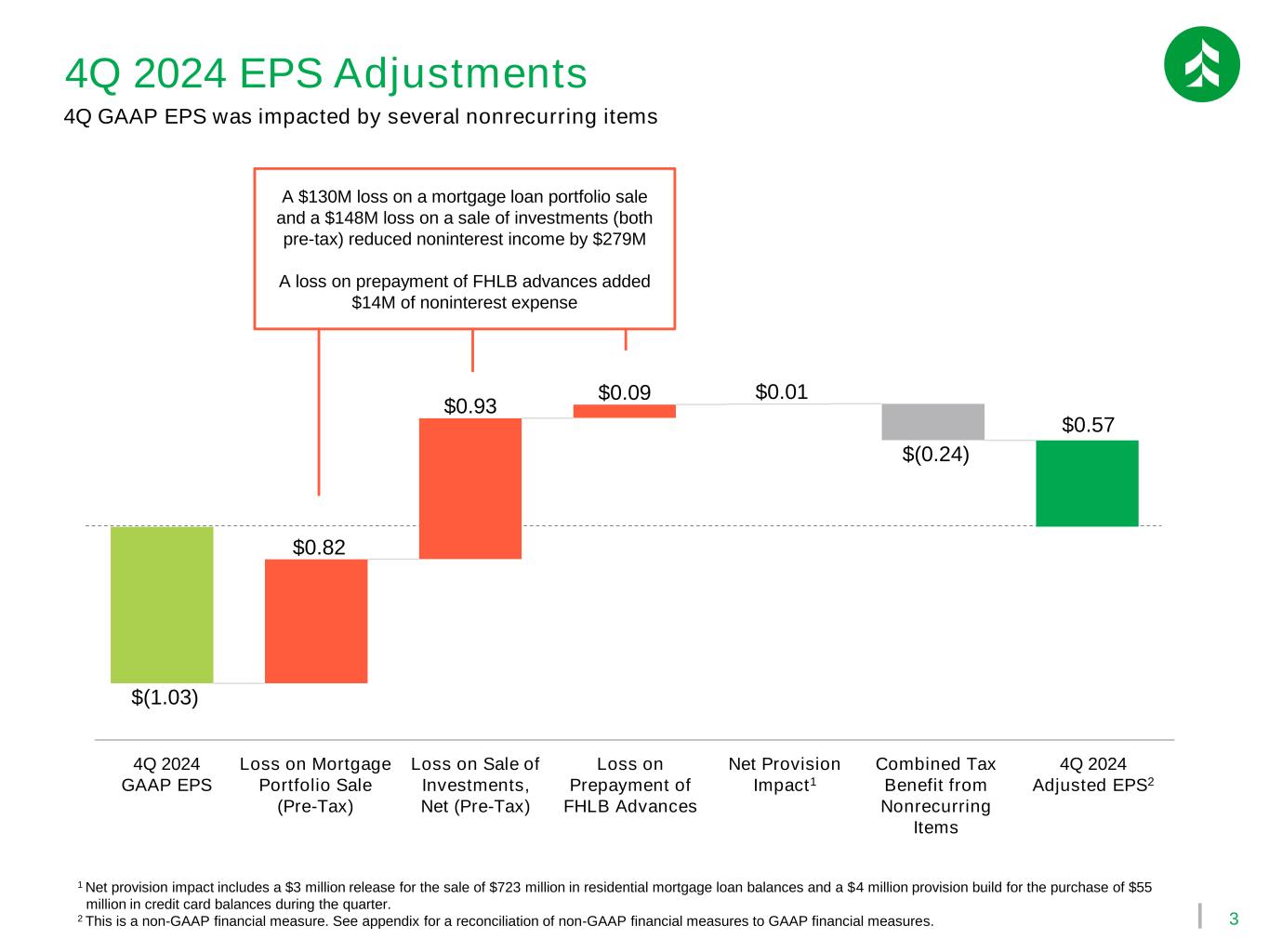

3 $0.82 $(1.03) $0.93 $0.09 $0.01 $(0.24) 4Q 2024 EPS Adjustments 1 Net provision impact includes a $3 million release for the sale of $723 million in residential mortgage loan balances and a $4 million provision build for the purchase of $55 million in credit card balances during the quarter. 2 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 4Q 2024 GAAP EPS Loss on Sale of Investments, Net (Pre-Tax) Loss on Mortgage Portfolio Sale (Pre-Tax) Loss on Prepayment of FHLB Advances 4Q 2024 Adjusted EPS2 Combined Tax Benefit from Nonrecurring Items A $130M loss on a mortgage loan portfolio sale and a $148M loss on a sale of investments (both pre-tax) reduced noninterest income by $279M A loss on prepayment of FHLB advances added $14M of noninterest expense $0.57 4Q GAAP EPS was impacted by several nonrecurring items Net Provision Impact1

4 ▪ +$1.5B in net new Mass Affluent deposits since Dec. 2022 launch ▪ Launched customer-favorite enhancements including Grace Zone, Early Pay & Credit Monitor in 2023-2024 ▪ Steady cadence of digital upgrades planned for 2025 Advancing our Growth Strategy1 (1-3)% 0% 1% 2-3% 2016-2022 2023 2024 2025 (est.) Customer Checking Household Growth 39 42 42 51 2021 2022 2023 2024 Net Promoter Score2 94 115 ~120 9/30/2023 12/31/2024 3/31/2025 (est.) Commercial & Business RM FTE 1 All updates as of or for the years ended December 31st unless otherwise noted. 2 Annual net promoter score as measured by a customer’s likelihood to recommend Associated Bank to family & friends per our internal Consumer Relationship Survey. Growth initiatives & an infusion of talent in key areas have provided tailwinds for our company into 2025 Upgraded Customer Experience Rebalanced Consumer Lending Approach Repositioned Balance Sheet Filled Several Key Leadership Roles Expanding our Commercial Presence ▪ Onboarded four new executive leaders in 2024 ▪ Added three new directors in 2024 ▪ Reduced mortgage loan concentration from 36% (2018) to 24% (2024) ▪ +$2.8B in prime/super prime Auto Finance balances since 3Q21 ▪ Sold $0.8B of securities and $1.0B of mortgage loans in 2023 ▪ Sold $1.3B of securities and $0.7B of mortgage loans in 2024 ▪ Purchased $55M in existing customer credit card balances in Dec. 2024 ▪ Launched new deposit vertical in 4Q 2024 ▪ On track to add 26 commercial & business RMs by 1Q 2025 (vs. 9/30/2023)

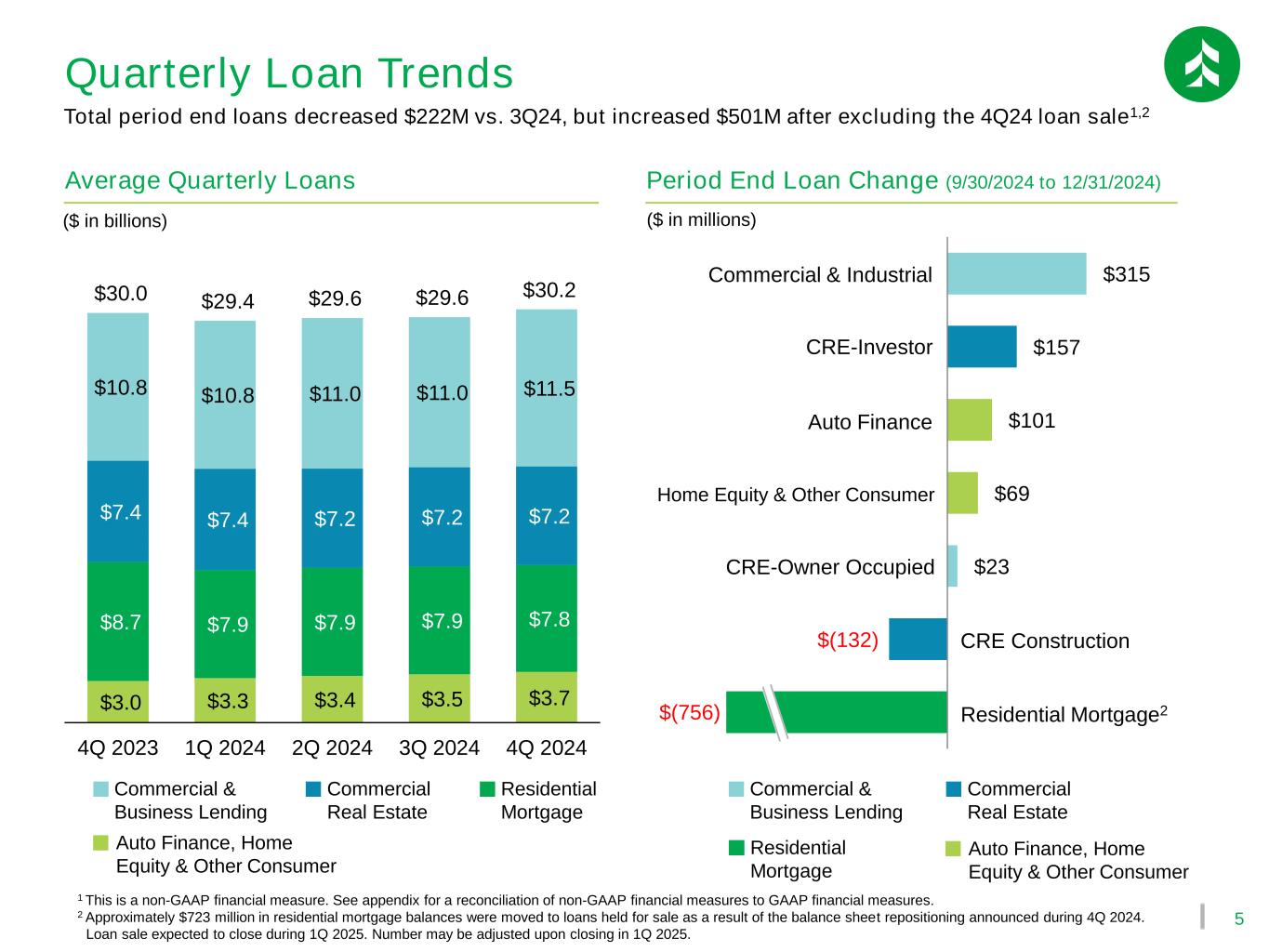

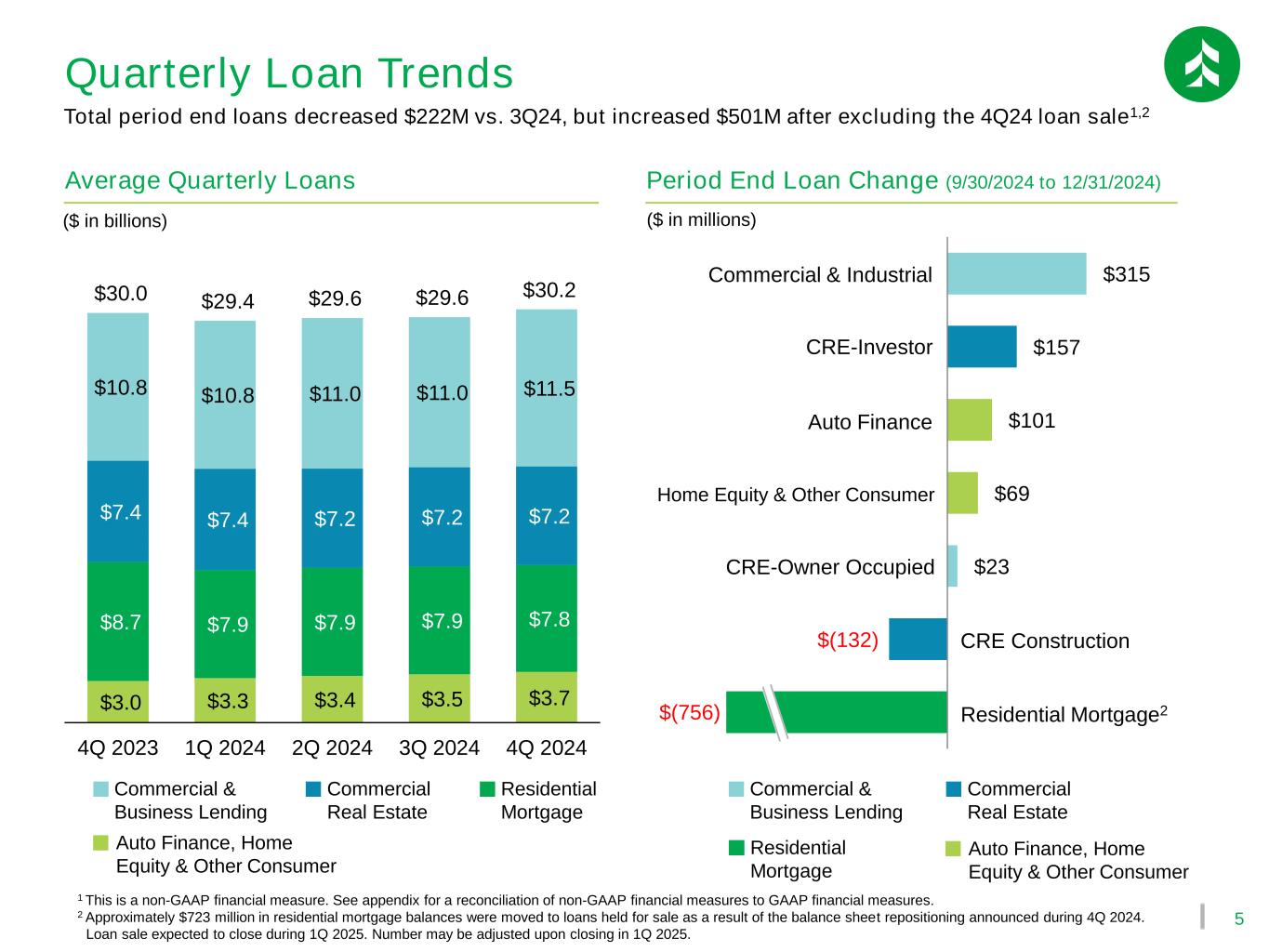

5 Commercial & Business Lending Commercial Real Estate Residential Mortgage $3.0 $3.3 $3.4 $3.5 $3.7 $8.7 $7.9 $7.9 $7.9 $7.8 $7.4 $7.4 $7.2 $7.2 $7.2 $10.8 $10.8 $11.0 $11.0 $11.5 $30.0 $29.4 $29.6 $29.6 $30.2 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 ($ in billions) Commercial & Business Lending Commercial Real Estate Residential Mortgage Auto Finance, Home Equity & Other Consumer Average Quarterly Loans ($ in millions) $(132) $23 $69 $101 $157 $315 CRE-Investor Commercial & Industrial Period End Loan Change (9/30/2024 to 12/31/2024) Residential Mortgage2 Auto Finance Home Equity & Other Consumer CRE Construction CRE-Owner Occupied Quarterly Loan Trends Total period end loans decreased $222M vs. 3Q24, but increased $501M after excluding the 4Q24 loan sale1,2 Auto Finance, Home Equity & Other Consumer $(756) 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 2 Approximately $723 million in residential mortgage balances were moved to loans held for sale as a result of the balance sheet repositioning announced during 4Q 2024. Loan sale expected to close during 1Q 2025. Number may be adjusted upon closing in 1Q 2025.

6 Annual Loan Trends (Period end balances) Emerging C&I Loan Growth Total period end loans increased $552 million vs. year-end 2023, with C&I loans up $842 million 1 Approximately $723 million in residential mortgage balances were moved to loans held for sale as a result of the balance sheet repositioning announced during 4Q 2024. Loan sale expected to close during 1Q 2025. Number may be adjusted upon closing in 1Q 2025. 1H 2024 +$239 million 2H 2024 +$603 million FY 2025 Outlook +$1.2 billion $1.0 $1.0 $2.3 $3.2 $3.8 $7.9 $7.6 $8.5 $7.9 $7.0 $6.2 $6.2 $7.2 $7.4 $7.2 $9.4 $9.4 $10.8 $10.8 $11.7 $24.5 $24.2 $28.8 $29.2 $29.8 2020 2021 2022 2023 2024 ($ in billions) Commercial & Business Lending Commercial Real Estate Residential Mortgage1 Auto Finance, Home Equity & Other Consumer Period End Annual Loans 32% 24% Commercial & Industrial Loans

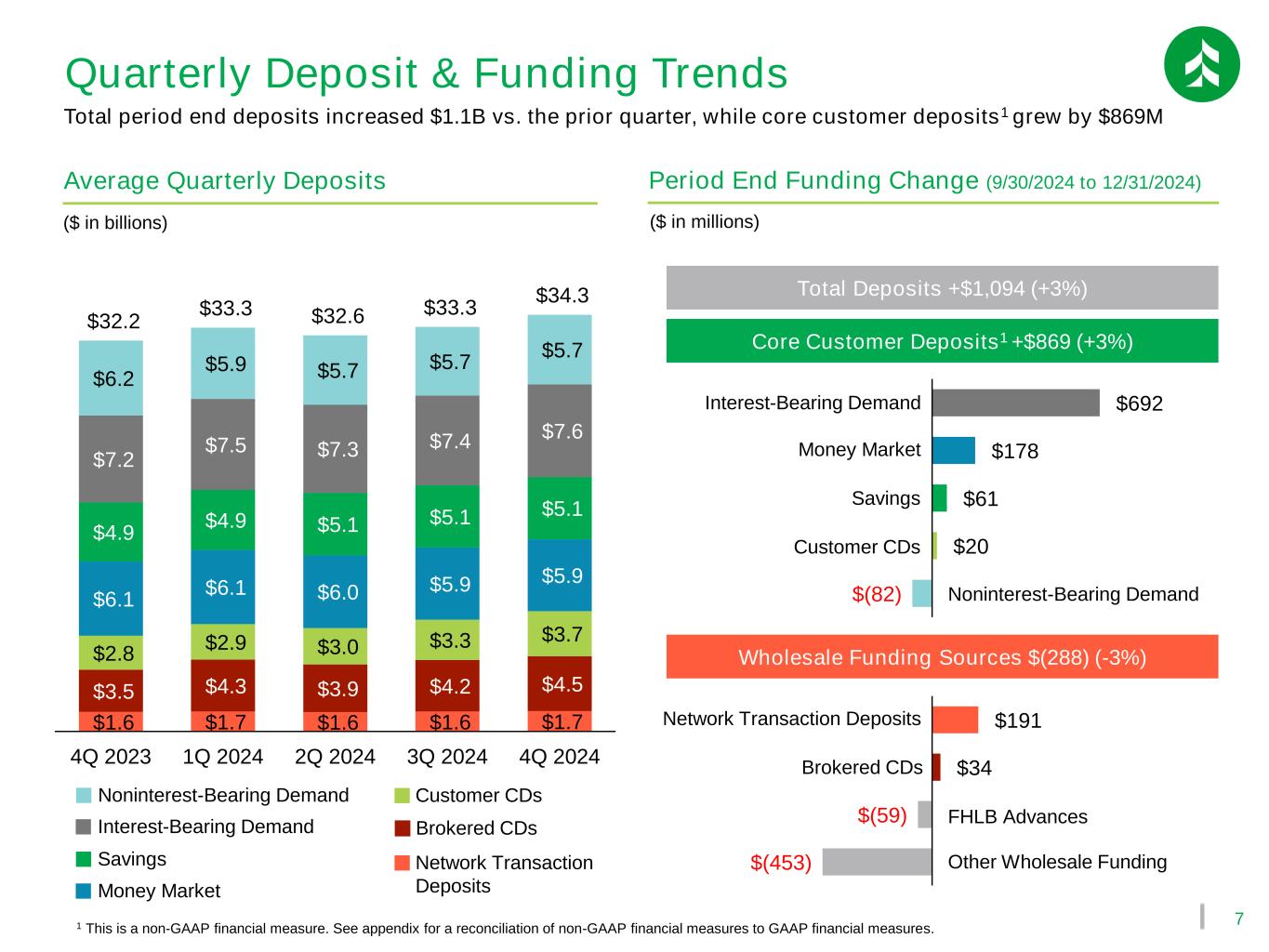

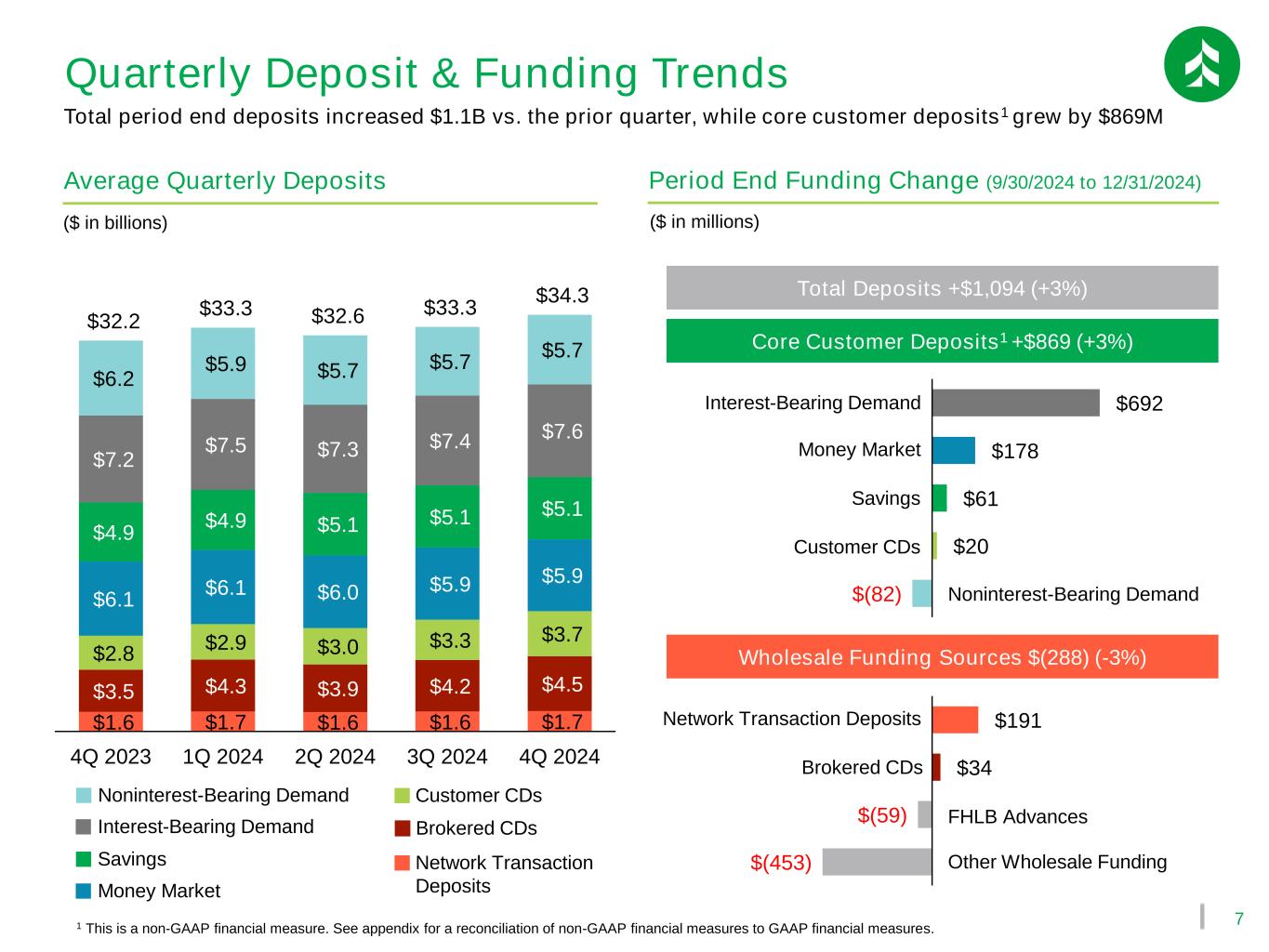

7 $1.6 $1.7 $1.6 $1.6 $1.7 $3.5 $4.3 $3.9 $4.2 $4.5 $2.8 $2.9 $3.0 $3.3 $3.7 $6.1 $6.1 $6.0 $5.9 $5.9 $4.9 $4.9 $5.1 $5.1 $5.1 $7.2 $7.5 $7.3 $7.4 $7.6 $6.2 $5.9 $5.7 $5.7 $5.7 $32.2 $33.3 $32.6 $33.3 $34.3 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Average Quarterly Deposits ($ in billions) Period End Funding Change (9/30/2024 to 12/31/2024) ($ in millions) Customer CDs Savings Money Market Network Transaction Deposits Noninterest-Bearing Demand Interest-Bearing Demand Brokered CDs 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. $(82) $20 $61 $178 $692 Noninterest-Bearing Demand Money Market $(453) $(59) $34 $191 Brokered CDs Network Transaction Deposits Other Wholesale Funding Core Customer Deposits1 +$869 (+3%) Wholesale Funding Sources $(288) (-3%) Total Deposits +$1,094 (+3%) Interest-Bearing Demand Quarterly Deposit & Funding Trends Savings Total period end deposits increased $1.1B vs. the prior quarter, while core customer deposits1 grew by $869M Customer CDs FHLB Advances

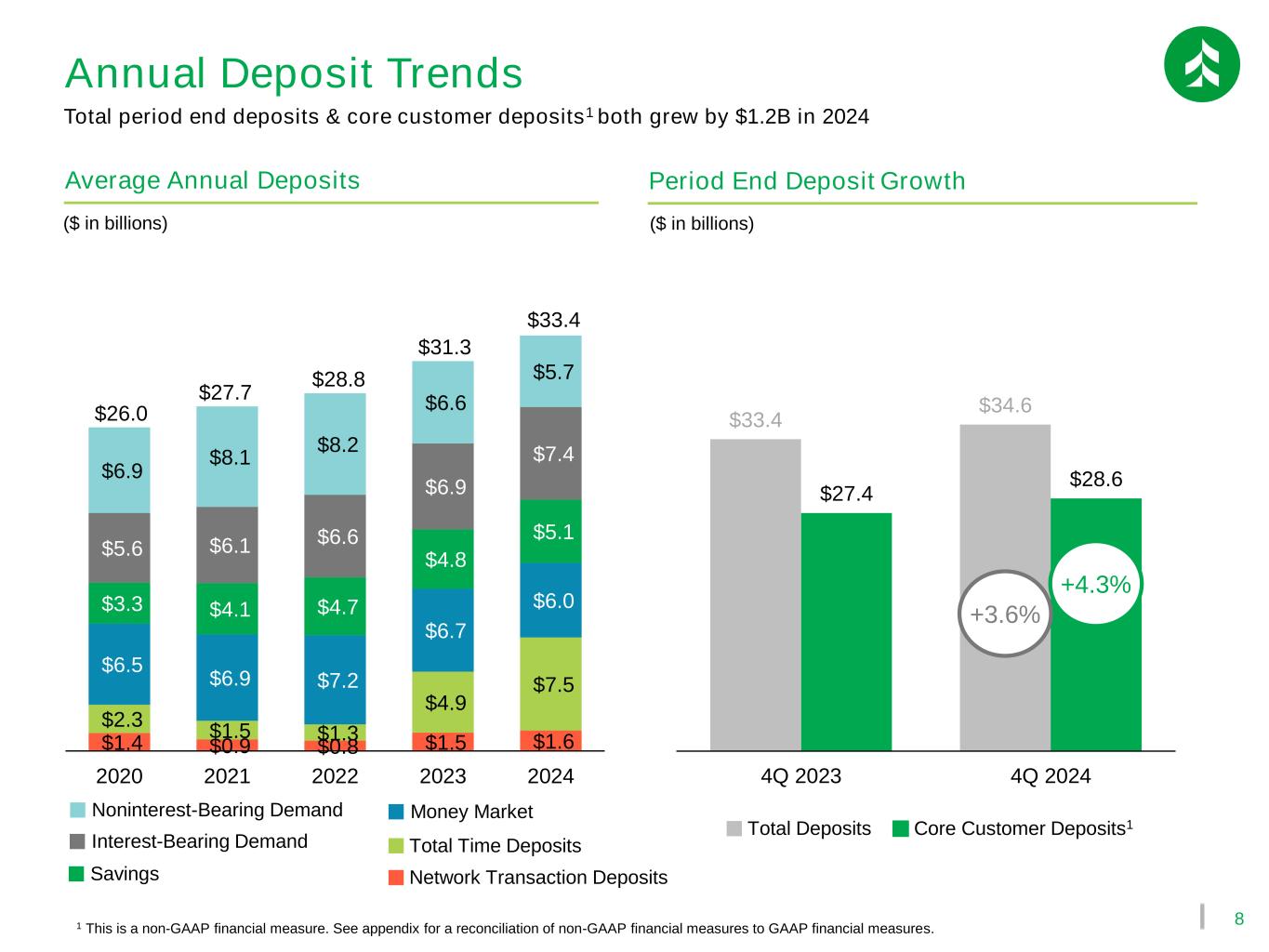

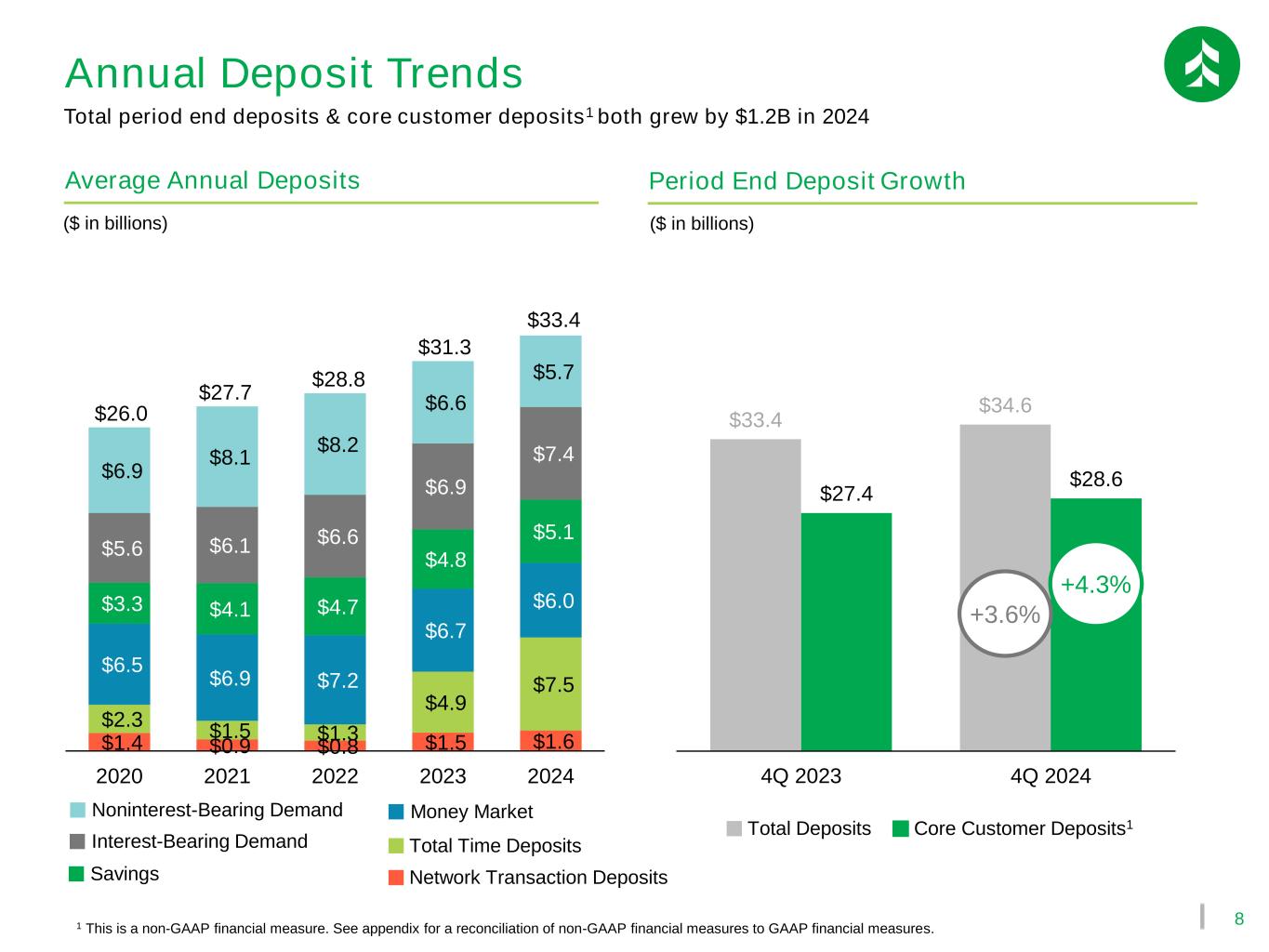

8 $1.4 $0.9 $0.8 $1.5 $1.6 $2.3 $1.5 $1.3 $4.9 $7.5 $6.5 $6.9 $7.2 $6.7 $6.0 $3.3 $4.1 $4.7 $4.8 $5.1 $5.6 $6.1 $6.6 $6.9 $7.4 $6.9 $8.1 $8.2 $6.6 $5.7 $26.0 $27.7 $28.8 $31.3 $33.4 2020 2021 2022 2023 2024 Annual Deposit Trends Total Time Deposits Savings Money Market Network Transaction Deposits Noninterest-Bearing Demand Interest-Bearing Demand ($ in billions) Average Annual Deposits Period End Deposit Growth ($ in billions) $33.4 $34.6 $27.4 $28.6 4Q 2023 4Q 2024 Core Customer Deposits1Total Deposits Total period end deposits & core customer deposits1 both grew by $1.2B in 2024 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. +3.6% +4.3%

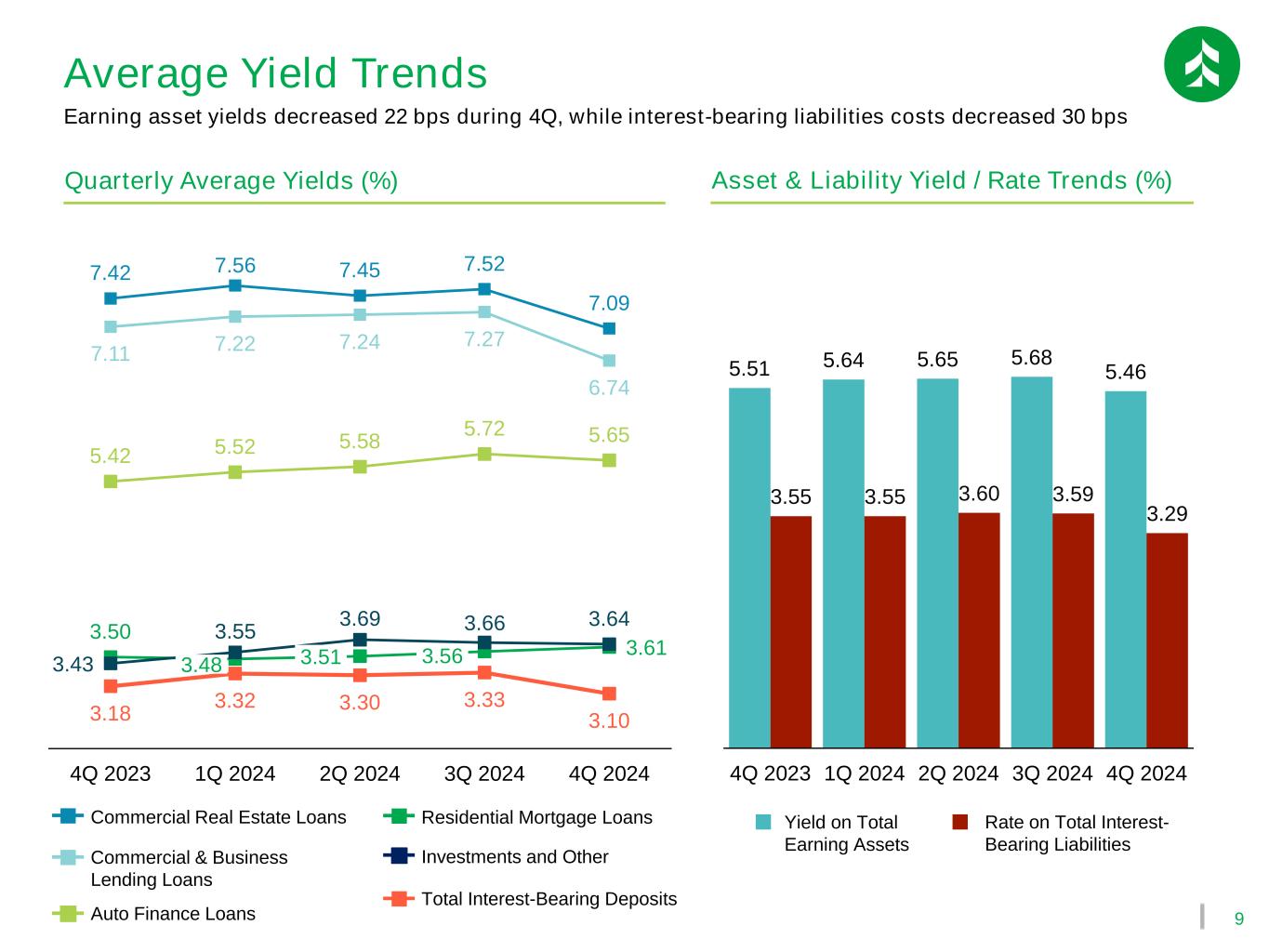

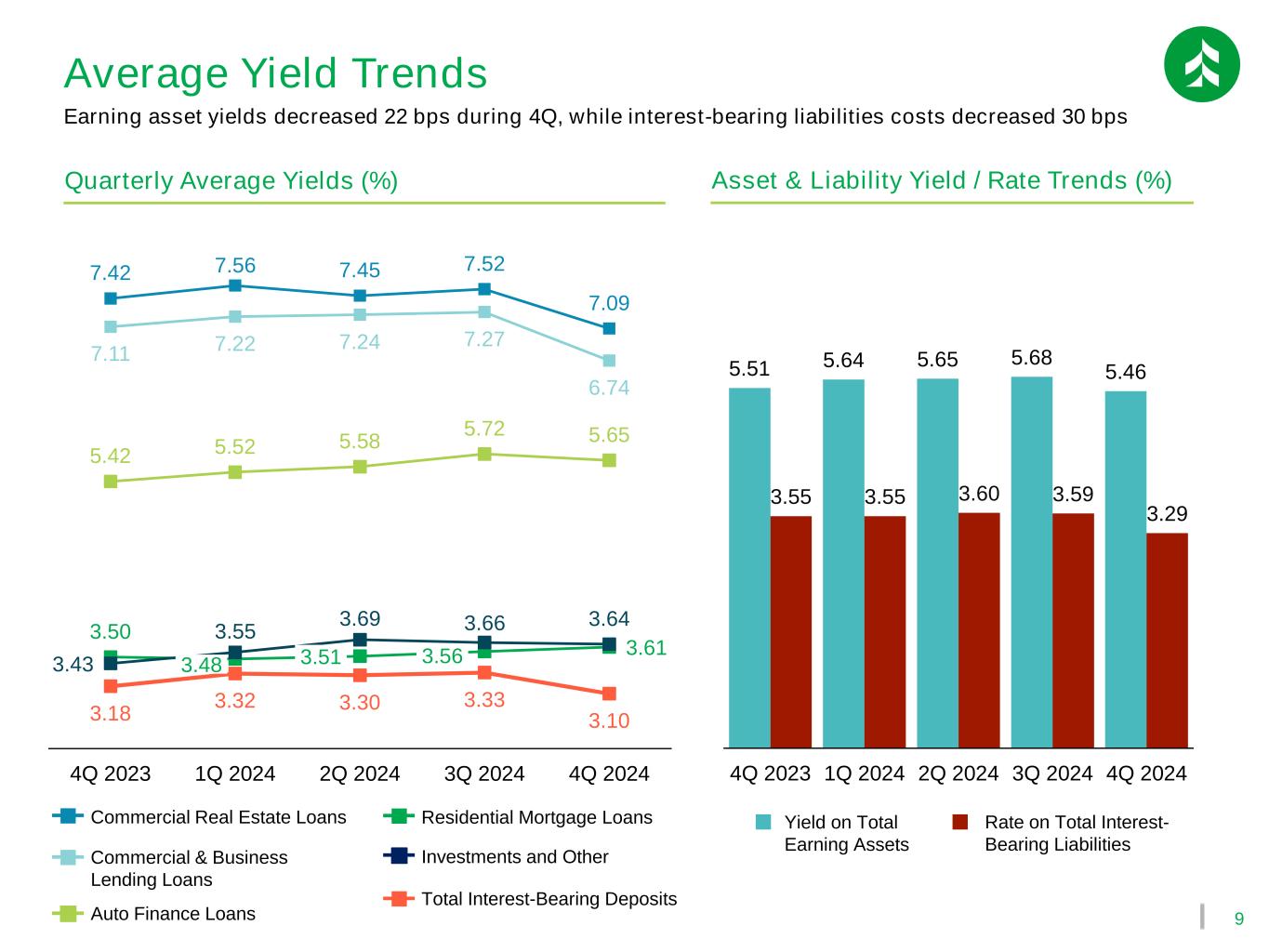

9 Quarterly Average Yields (%) Average Yield Trends 7.42 7.56 7.45 7.52 7.09 7.11 7.22 7.24 7.27 6.74 5.42 5.52 5.58 5.72 5.65 3.50 3.48 3.51 3.56 3.61 3.43 3.55 3.69 3.66 3.64 3.18 3.32 3.30 3.33 3.10 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Residential Mortgage Loans Commercial & Business Lending Loans Commercial Real Estate Loans Total Interest-Bearing Deposits Auto Finance Loans Asset & Liability Yield / Rate Trends (%) Rate on Total Interest- Bearing Liabilities Yield on Total Earning Assets 5.51 5.64 5.65 5.68 5.46 3.55 3.55 3.60 3.59 3.29 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Investments and Other Earning asset yields decreased 22 bps during 4Q, while interest-bearing liabilities costs decreased 30 bps

10 Net Interest Income & Net Interest Margin Trends Net Interest Income & Net Interest Margin $253 $258 $257 $263 $270 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 2.78%2.75%2.79% 2.69% 2.81% Quarterly Net Interest Income Quarterly Net Interest Margin ($ in millions) 2.81% 2.81% 0.17% 2.98% 4Q 2024 Actual 4Q 2024 Pro Forma 4Q 2024 Pro Forma Net Interest Margin1 1 Pro forma net interest margin reflects the impact of the balance sheet repositioning announced in December 2024 and the credit card balance acquisition completed in December 2024 as if both transactions were completed on October 1, 2024. + Our 4Q 2024 balance sheet repositioning & credit card balance acquisition would have added an incremental ~17 bps to our 4Q NIM if the transactions were completed on 10/1/2024. We expect the repositioning to be completed in 1Q 2025 with the full financial impact realized beginning in 2Q 2025. NII increased by $8 million and NIM expanded by 3 bps during 4Q

11 ▪ Added $2.8 billion of fixed-rate prime/super prime Auto Finance balances since 3Q 2021 ▪ Gradually built receive fixed swaps portfolio to protect against downside rate risk, with notional balances of ~$2.70 billion as of 12/31/2024 ▪ Emphasized shorter-term durations on contractual funding sources to maintain repricing flexibility in a falling rate environment Interest Rate Risk Management1 Balance Sheet Actions Since 2021 Contractual Funding Obligations ≤ 1 Yr. 1-3 Yrs. 3+ Yrs. Total Time Deposits $7.9 $0.1 $0.0 $8.0 Short-Term Funding $0.5 - - $0.5 FHLB Advances $1.6 $0.0 $0.2 $1.9 Other Long-Term Funding $0.3 $0.0 $0.6 $0.8 Total $10.3 $0.1 $0.8 $11.1 ($ in billions) 1 All updates as of or for the period ended December 31, 2024 unless otherwise noted. 2 In both the down 100 and down 200 for 4Q 2021, scenario rates are floored at zero. We’ve taken proactive steps to reduce our asset sensitivity & protect NII in a falling rate environment Estimated NII Sensitivity Profile (%) 10.6 7.8 3.8 2.0 5.0 3.9 1.9 1.0 -6.8 -3.4 -1.3 -0.5 -6.8 -6.7 -2.6 -1.3 4Q 2021 4Q 2022 4Q 2023 4Q 2024 Up 200 bps Up 100 bps Down 100 bps Down 200 bps (12-Month Ramp, Dynamic Forecast) 2

12 Cash & Investment Securities Portfolio 18.9% 18.8% 19.1% 19.2% 19.8% 2.3% 2.1% 2.3% 2.3% 2.4% 21.1% 20.9% 21.4% 21.5% 22.2% 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Securities Period End Securities + Cash / Total Assets Cash $3.6 $3.7 $3.9 $4.2 $4.6 $3.9 $3.8 $3.8 $3.8 $3.7 $0.3 $0.2 $0.2 $0.2 $0.2 $7.7 $7.8 $7.9 $8.1 $8.5 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Held to MaturityAvailable for Sale ($ in billions) Period End Securities Book Composition Other Securities CET1 Including AOCI1 (%) CET1 Ratio Incl. AOCICET1 Ratio 9.39 9.43 9.68 9.72 10.00 8.87 8.79 9.01 9.38 9.78 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. We are targeting securities + cash / total assets of 22% to 24% in 2025

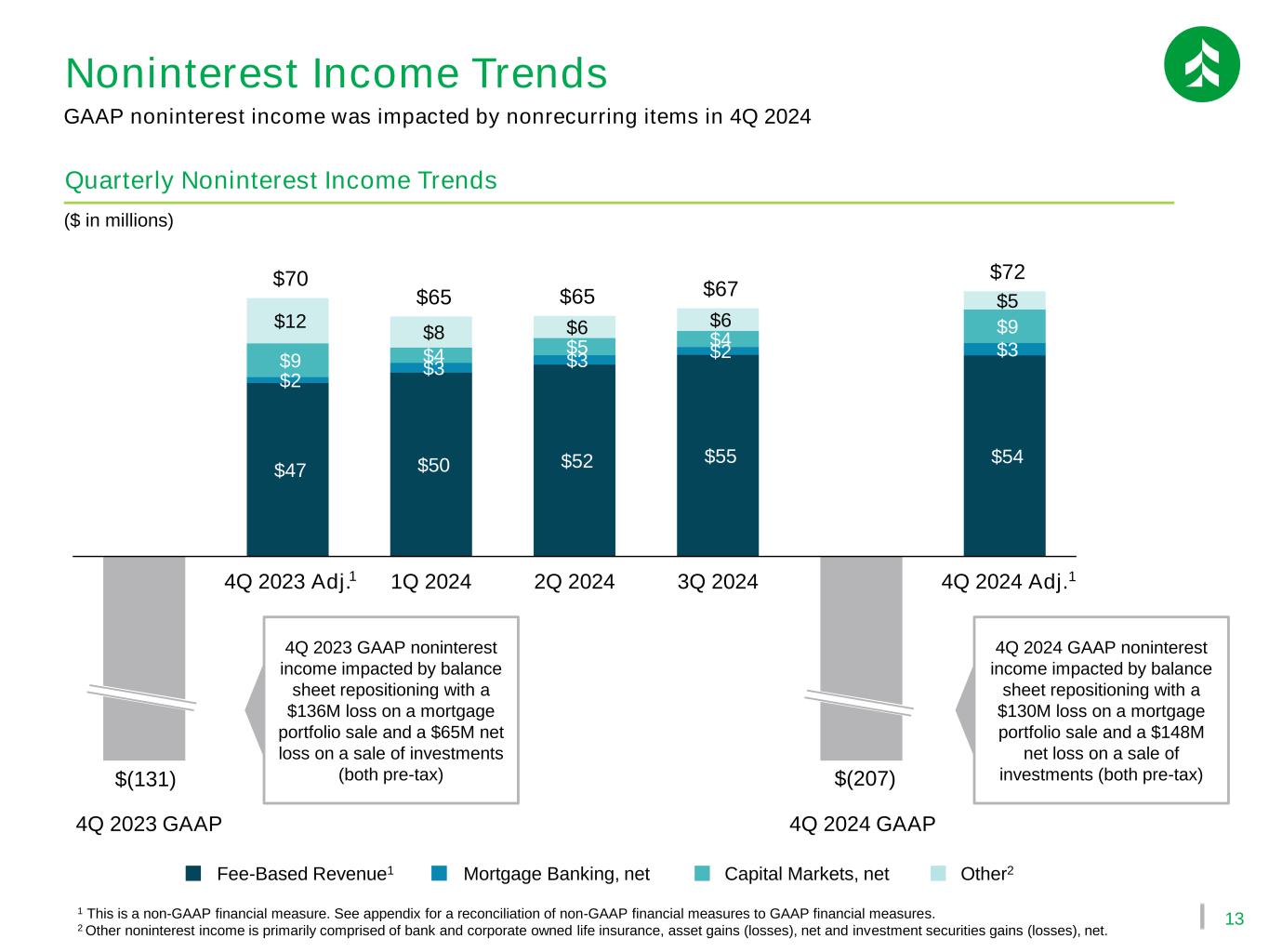

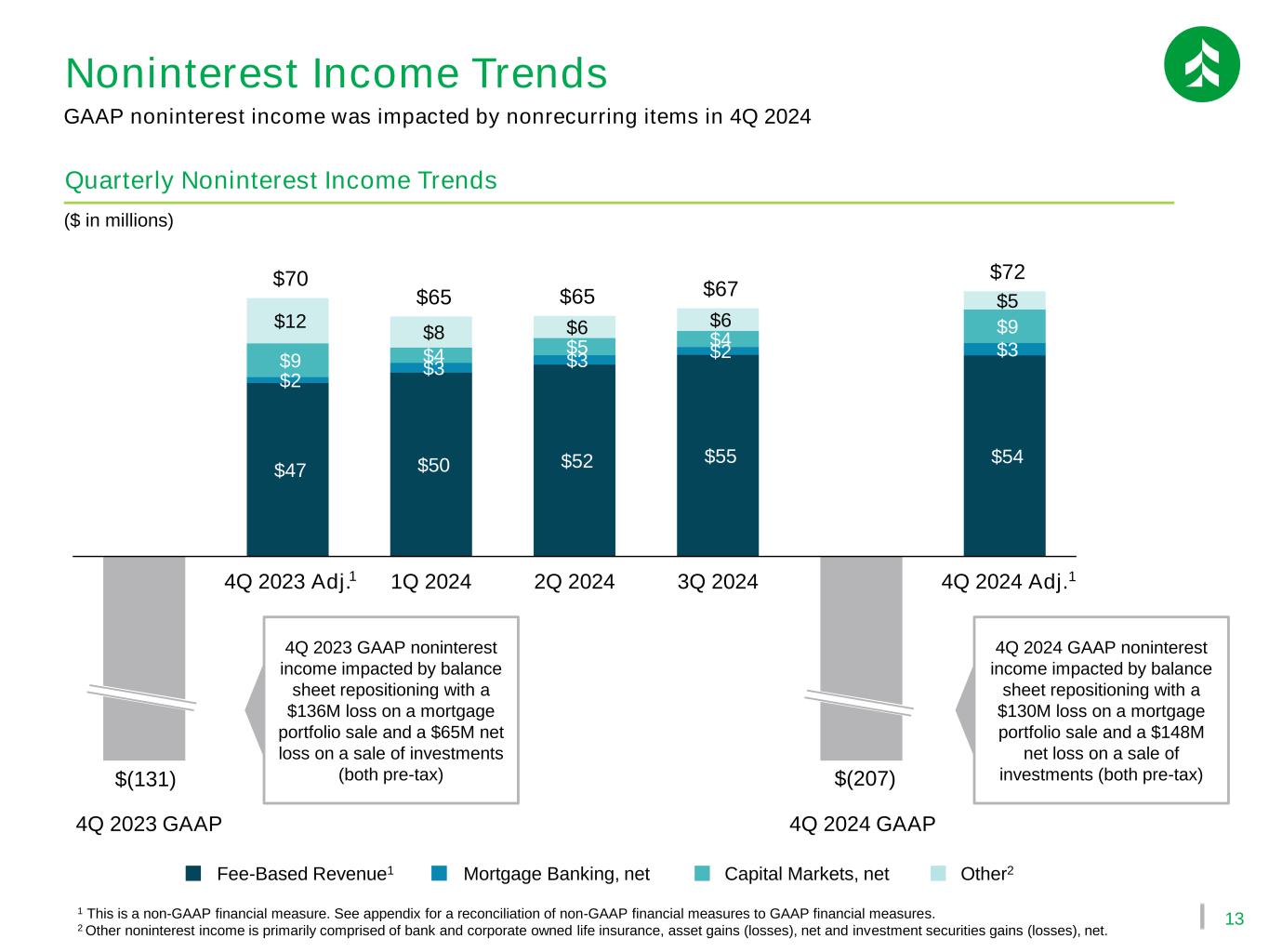

13 $47 $50 $52 $55 $54 $2 $3 $3 $2 $3 $9 $4 $5 $4 $9 $12 $8 $6 $6 $5 $70 $65 $65 $67 $72 4Q 2023 Adj. 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Adj. Noninterest Income Trends ($ in millions) 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 2 Other noninterest income is primarily comprised of bank and corporate owned life insurance, asset gains (losses), net and investment securities gains (losses), net. Quarterly Noninterest Income Trends Fee-Based Revenue1 Capital Markets, net Mortgage Banking, net Other2 4Q 2023 GAAP noninterest income impacted by balance sheet repositioning with a $136M loss on a mortgage portfolio sale and a $65M net loss on a sale of investments (both pre-tax) 1 4Q 2023 GAAP $(131) GAAP noninterest income was impacted by nonrecurring items in 4Q 2024 4Q 2024 GAAP $(207) 4Q 2024 GAAP noninterest income impacted by balance sheet repositioning with a $130M loss on a mortgage portfolio sale and a $148M net loss on a sale of investments (both pre-tax) 1

14 $121 $119 $122 $121 $126 $28 $26 $27 $27 $27 $60 $44 $47 $52 $57 $31 $8 $14 $239 $198 $196 $201 $224 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Efficiency Ratio (%)Noninterest Expense Trends Noninterest Expense Trends 1 Based on updated estimates of the FDIC special assessment received from the FDIC over the course of 2024, we recognized a $2 million decrease of FDIC special assessment expense in 2Q 2024, a further $1 million decrease in 3Q 2024, and a further $0.5 million decrease in 4Q 2024. 2 Other expenses are primarily comprised of occupancy, business development & advertising, equipment, legal & professional, and FDIC assessment costs. 3 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. ($ in millions) Adjusted Efficiency Ratio3Federal Reserve Efficiency Ratio 61.0 61.5 61.5 107.4 64.1 57.2 60.9 60.4 61.1 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Personnel Expense Other2 Technology Expense FDIC Special Assessment 132.0 Noninterest Expense / Average Assets (%) 2.00 1.98 2023 YTD 2024 YTD 11 4Q noninterest expense included a $14 million loss on prepayment of FHLB advances Loss on Prepayment of FHLB 1

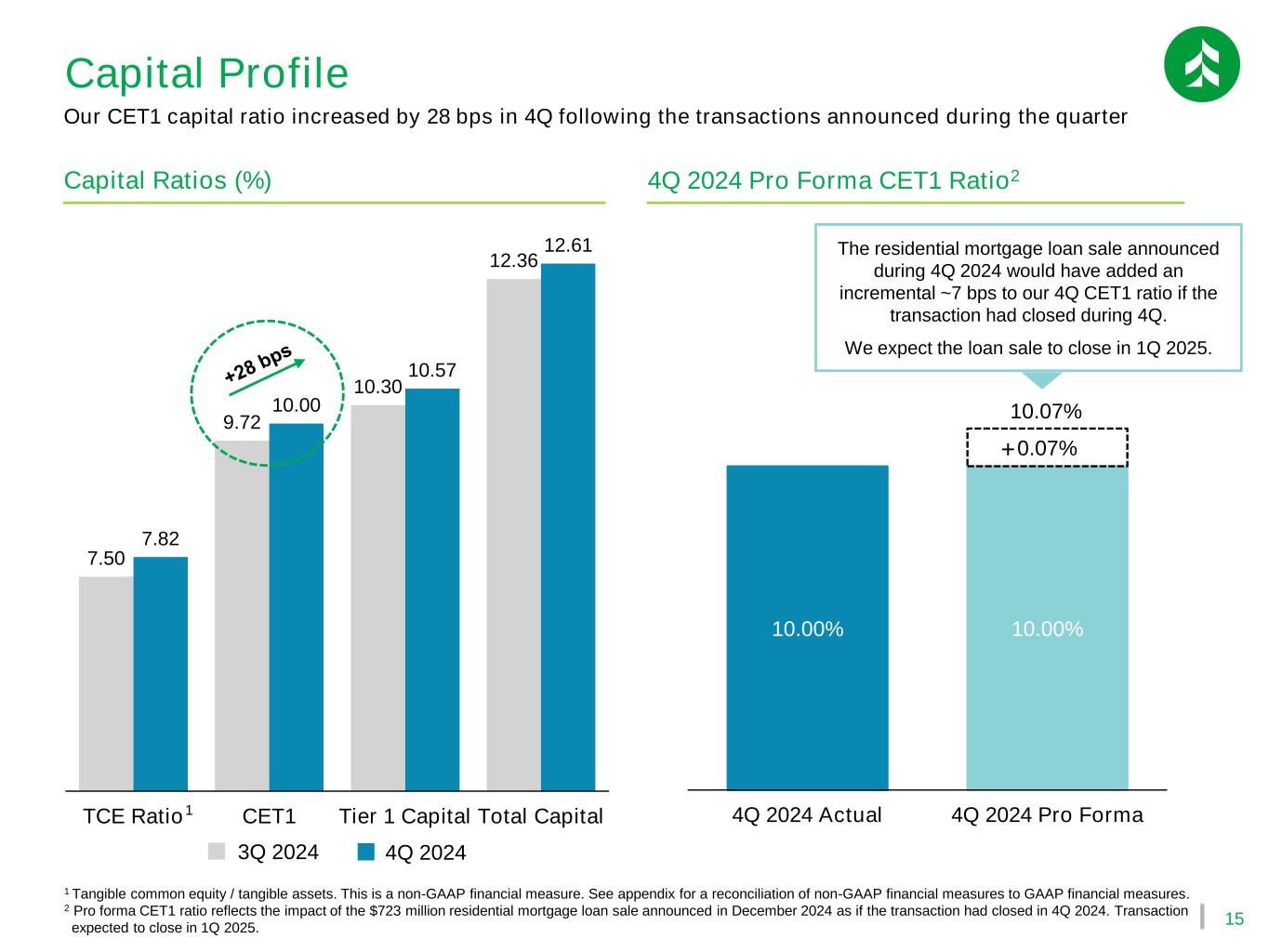

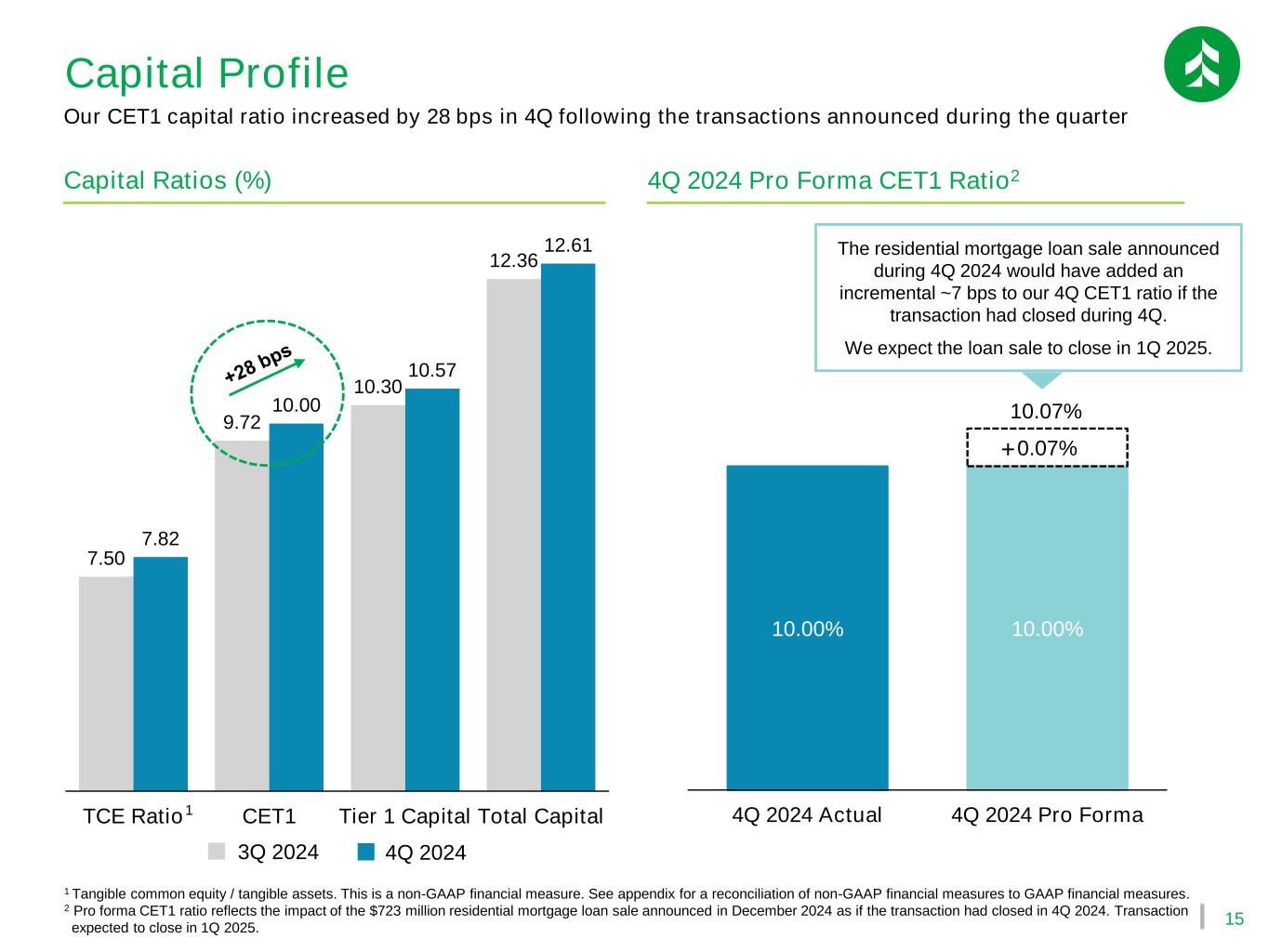

15 Capital Ratios (%) 7.50 9.72 10.30 12.36 7.82 10.00 10.57 12.61 TCE Ratio CET1 Tier 1 Capital Total Capital 1 Tangible common equity / tangible assets. This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 2 Pro forma CET1 ratio reflects the impact of the $723 million residential mortgage loan sale announced in December 2024 as if the transaction had closed in 4Q 2024. Transaction expected to close in 1Q 2025. Capital Profile 1 4Q 2024 Pro Forma CET1 Ratio2 3Q 2024 4Q 2024 Our CET1 capital ratio increased by 28 bps in 4Q following the transactions announced during the quarter 10.00% 10.00% 0.07% 10.07% 4Q 2024 Actual 4Q 2024 Pro Forma The residential mortgage loan sale announced during 4Q 2024 would have added an incremental ~7 bps to our 4Q CET1 ratio if the transaction had closed during 4Q. We expect the loan sale to close in 1Q 2025. +

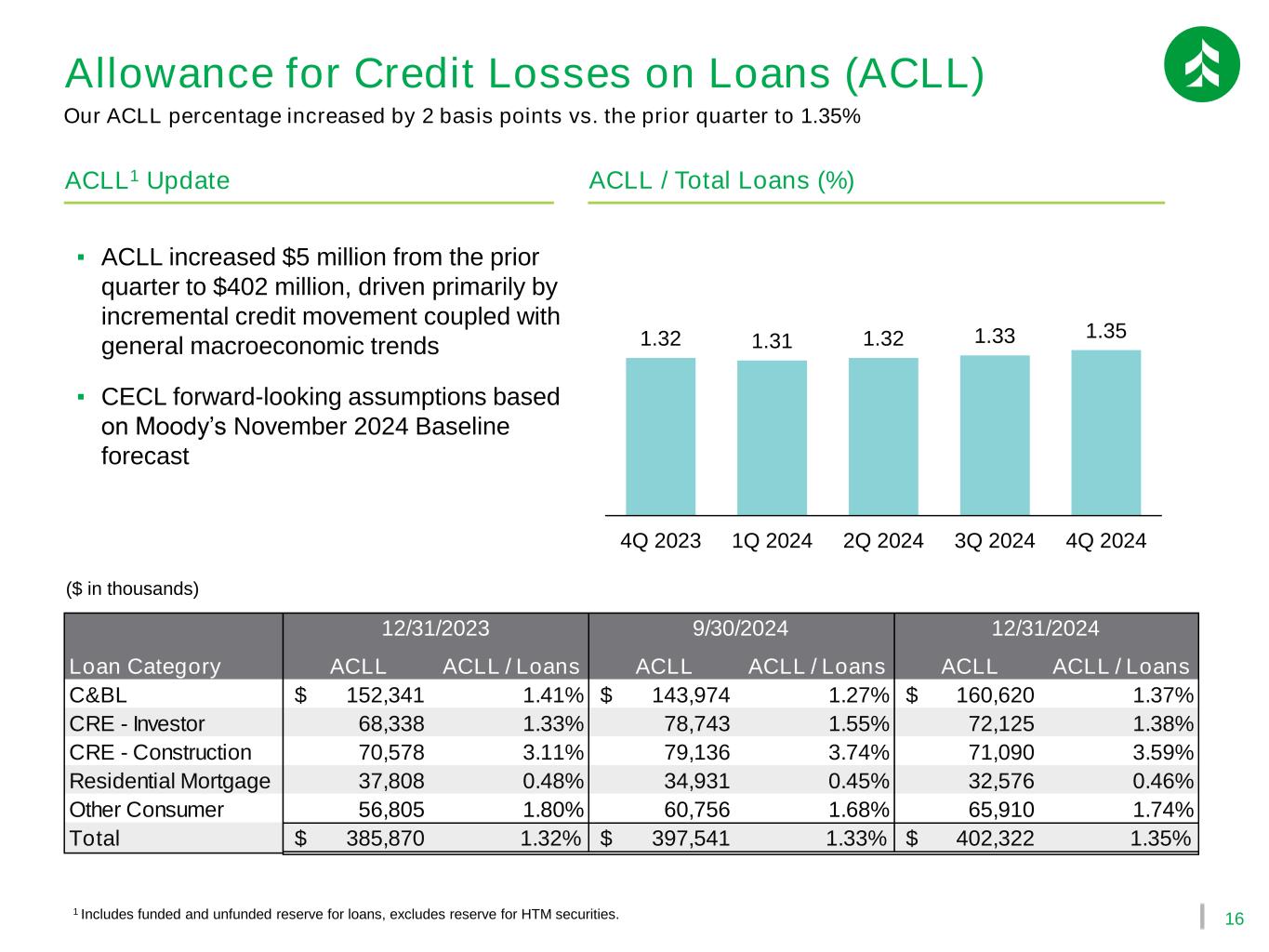

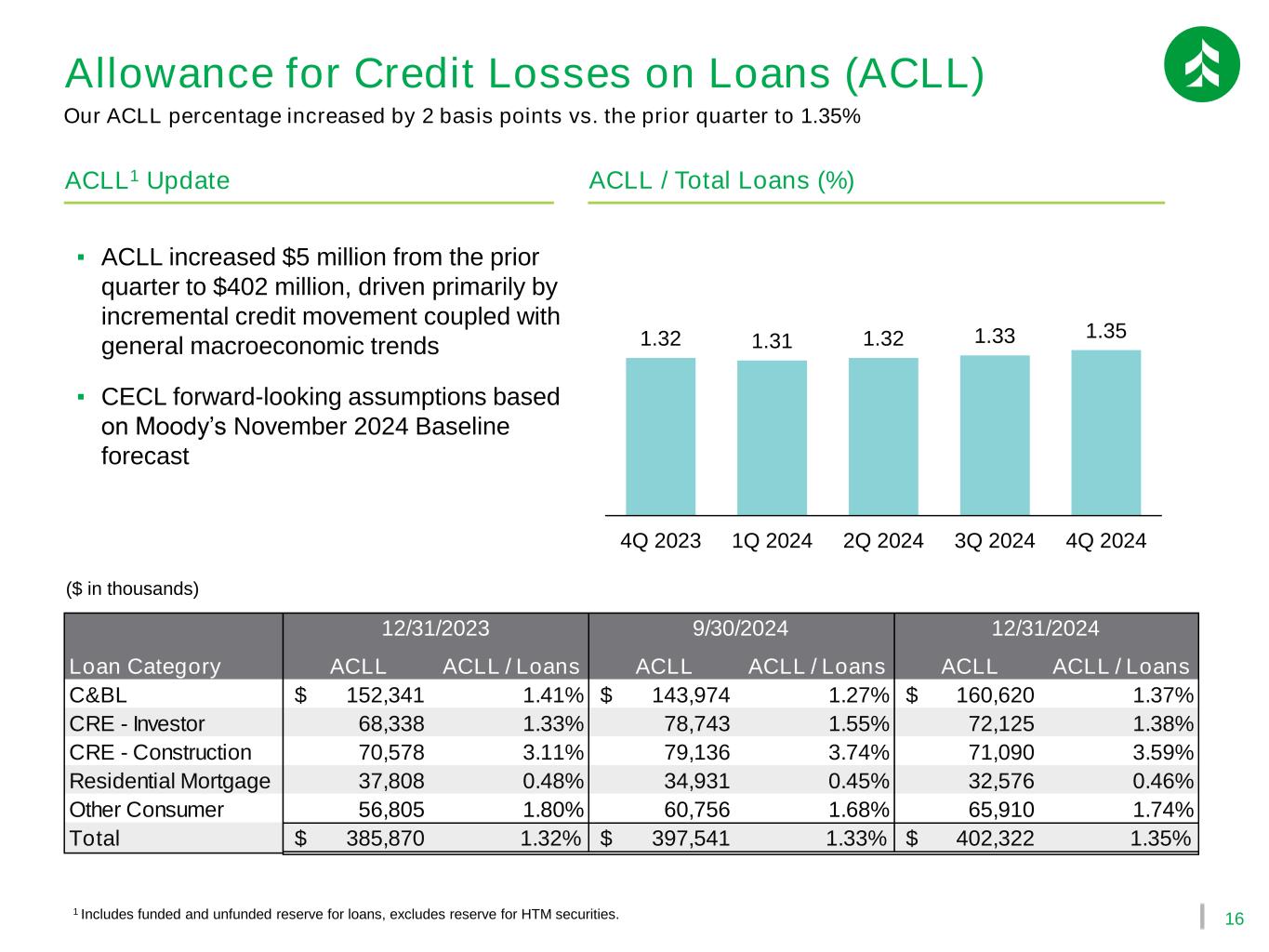

16 ACLL / Total Loans (%)ACLL1 Update ▪ ACLL increased $5 million from the prior quarter to $402 million, driven primarily by incremental credit movement coupled with general macroeconomic trends ▪ CECL forward-looking assumptions based on Moody’s November 2024 Baseline forecast 1 Includes funded and unfunded reserve for loans, excludes reserve for HTM securities. ($ in thousands) Allowance for Credit Losses on Loans (ACLL) 1.32 1.31 1.32 1.33 1.35 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Our ACLL percentage increased by 2 basis points vs. the prior quarter to 1.35% Loan Category ACLL ACLL / Loans ACLL ACLL / Loans ACLL ACLL / Loans C&BL 152,341$ 1.41% 143,974$ 1.27% 160,620$ 1.37% CRE - Investor 68,338 1.33% 78,743 1.55% 72,125 1.38% CRE - Construction 70,578 3.11% 79,136 3.74% 71,090 3.59% Residential Mortgage 37,808 0.48% 34,931 0.45% 32,576 0.46% Other Consumer 56,805 1.80% 60,756 1.68% 65,910 1.74% Total 385,870$ 1.32% 397,541$ 1.33% 402,322$ 1.35% 9/30/2024 12/31/202412/31/2023

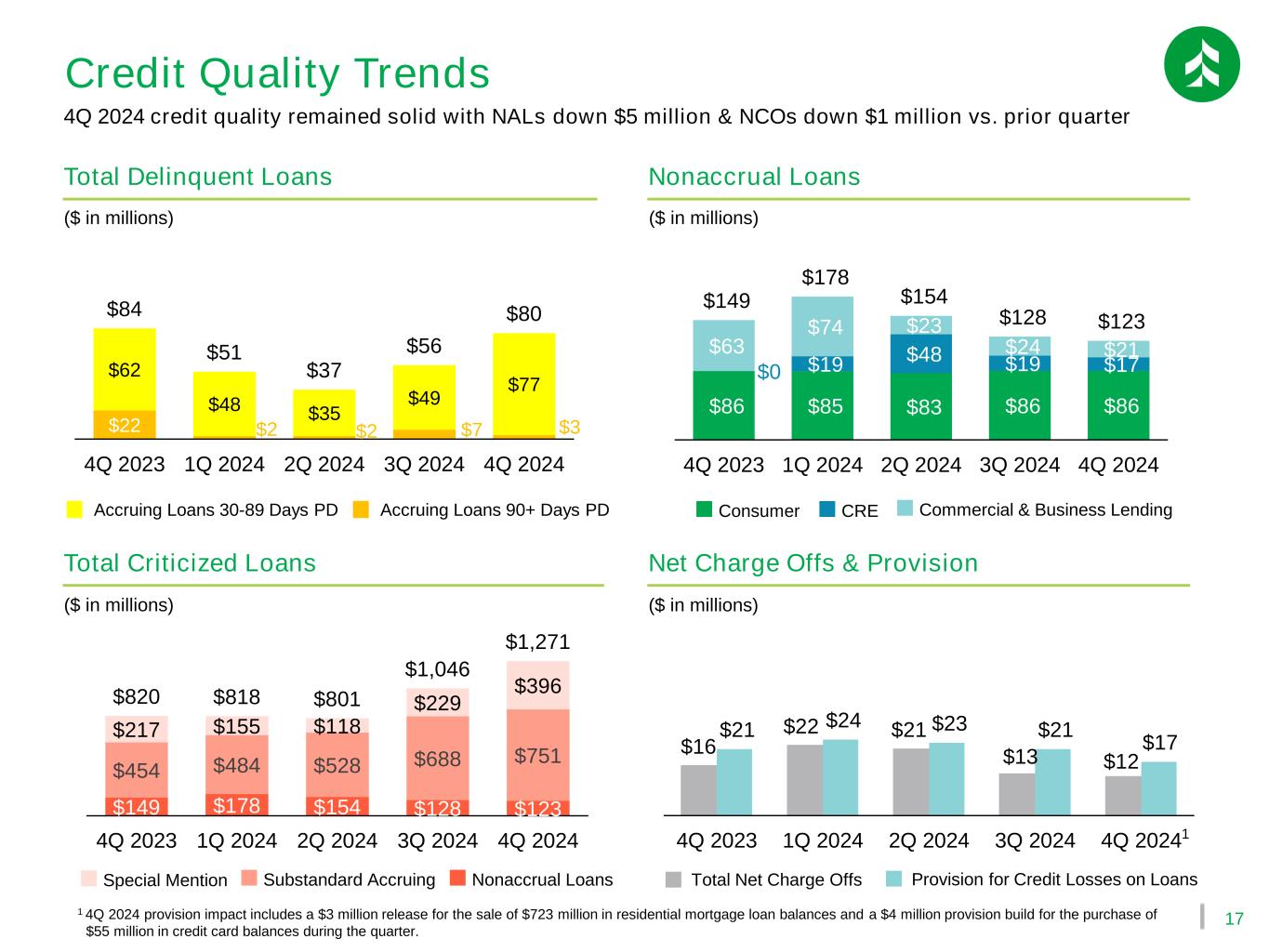

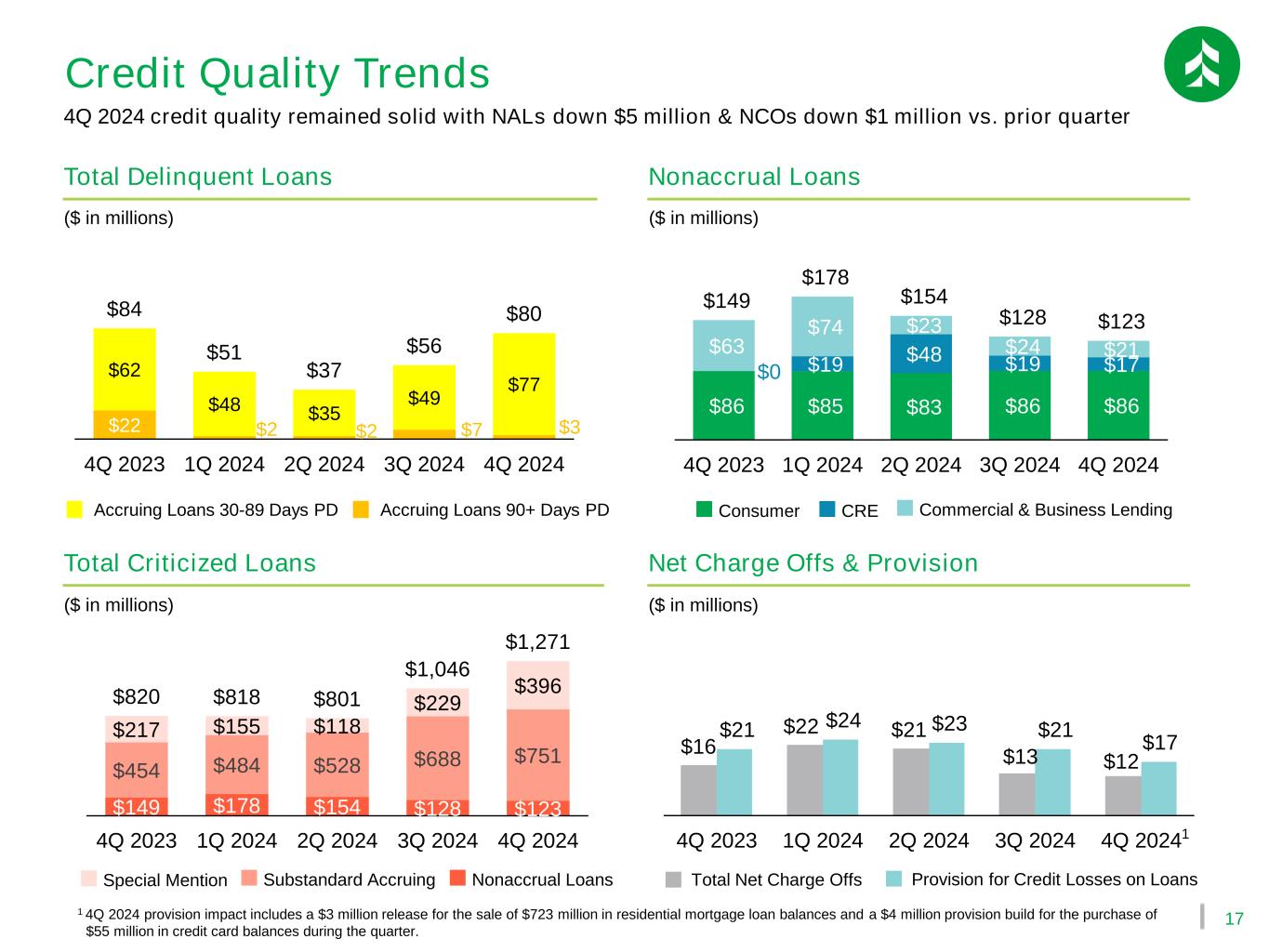

17 Net Charge Offs & Provision Total Delinquent Loans Credit Quality Trends $22 $2 $2 $7 $3 $62 $48 $35 $49 $77 $84 $51 $37 $56 $80 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 ($ in millions) Accruing Loans 30-89 Days PD $16 $22 $21 $13 $12 $21 $24 $23 $21 $17 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Total Net Charge Offs Provision for Credit Losses on Loans Accruing Loans 90+ Days PD Total Criticized Loans $149 $178 $154 $128 $123 $454 $484 $528 $688 $751 $217 $155 $118 $229 $396 $820 $818 $801 $1,046 $1,271 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 ($ in millions) ($ in millions) Nonaccrual Loans $86 $85 $83 $86 $86 $0 $19 $48 $19 $17 $63 $74 $23 $24 $21 $149 $178 $154 $128 $123 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 ($ in millions) CREConsumer Commercial & Business Lending Substandard AccruingSpecial Mention Nonaccrual Loans 4Q 2024 credit quality remained solid with NALs down $5 million & NCOs down $1 million vs. prior quarter 1 4Q 2024 provision impact includes a $3 million release for the sale of $723 million in residential mortgage loan balances and a $4 million provision build for the purchase of $55 million in credit card balances during the quarter. 1

18 1 Projections are on an end of period basis as of and for the year ended 12/31/2025 as compared to 2024 results as of 12/31/2024 unless otherwise noted. 2 Core customer deposits is a non-GAAP financial measure which excludes network transaction deposits and brokered CDs from total deposits. We have not provided a reconciliation of the projection for core customer deposits to the projection for total deposits due to the low visibility and unpredictability of the components of total deposits necessary for such reconciliation. 3 Adjusted 2024 figures have been provided for noninterest income and noninterest expense to exclude the impact of nonrecurring items incurred as a result of a balance sheet repositioning that the Corporation announced in the fourth quarter of 2024. These figures are non-GAAP financial measures. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. 4 Projections are on an end of period basis as of and for the year ended 12/31/2025 as compared to adjusted 2024 results as of 12/31/2024 unless otherwise noted. GAAP FY 2024 Result Adjusted FY 2024 Result3 FY 2025 Guidance4 Noninterest Income $(9)M $269M Up 0% to 1% Noninterest Expense $818M $804M Up 3% to 4% FY 2025 Guidance1 Total Loan Growth Up 5% to 6% Total Deposit Growth Up 1% to 2% Core Customer Deposit Growth2 Up 4% to 5% Net Interest Income Up 12% to 13% Effective Tax Rate 19% to 21% CET1 Capital Ratio 10% to 10.5% FY 2025 Outlook

Appendix

20 1 Approximately $723 million in residential mortgage balances were moved to loans held for sale as a result of the balance sheet repositioning announced during 4Q 2024. Loan sale expected to close during 1Q 2025. Number may be adjusted upon closing in 1Q 2025. 2 Net of tax and the net provision impact of the residential mortgage loan sale and credit card balance purchase. Net provision impact includes a $3 million release for the sale of $723 million in residential mortgage loan balances and a $4 million provision build for the purchase of $55 million in credit card balances during the quarter. Balance Sheet Repositioning Summary Estimated 12/4/2024 Actions Taken as of 12/31/2024 Remaining in 1Q 2025 Total Loans Sold1 $0.2B in ARMs & $0.5B in fixed-rate mortgages Wtd. avg. yield ~2.99% $723M in residential mortgage balances moved to loans held for sale Loan sale on track to close in January 2025 Securities Sold $1.3B in AFS securities Wtd. avg. yield 1.87% Sold $1.295B in AFS securities Wtd. avg. yield 1.87% Securities sale completed 4Q 2024 One-Time Loss (After-Tax)2 $253M Reported $256M after-tax loss for loan sale, securities sale, credit card balance purchase & loss on prepayment of FHLB FAS91 impact to be finalized upon closing of loan sale Use of Proceeds Reinvest into $1.5B of GNMA securities Wtd. avg. yield ~5.08% ~4 yr. duration Repay $0.6B of FHLB advances Wtd. avg. cost ~5.90% Reinvested into $1.486B of GNMA securities Wtd. avg. yield ~5.08% 4.15 yr. duration Purchased $55M in existing customer credit card balances Paid down $600M of FHLB advances at 6.17% and temporarily borrowed $600M at a spread reduction of 1.43% $600M of FHLB advances to be repaid upon closing of loan sale We are on track to finalize our balance sheet repositioning in 1Q 2025 Securities reinvestment completed Credit card balance purchase completed

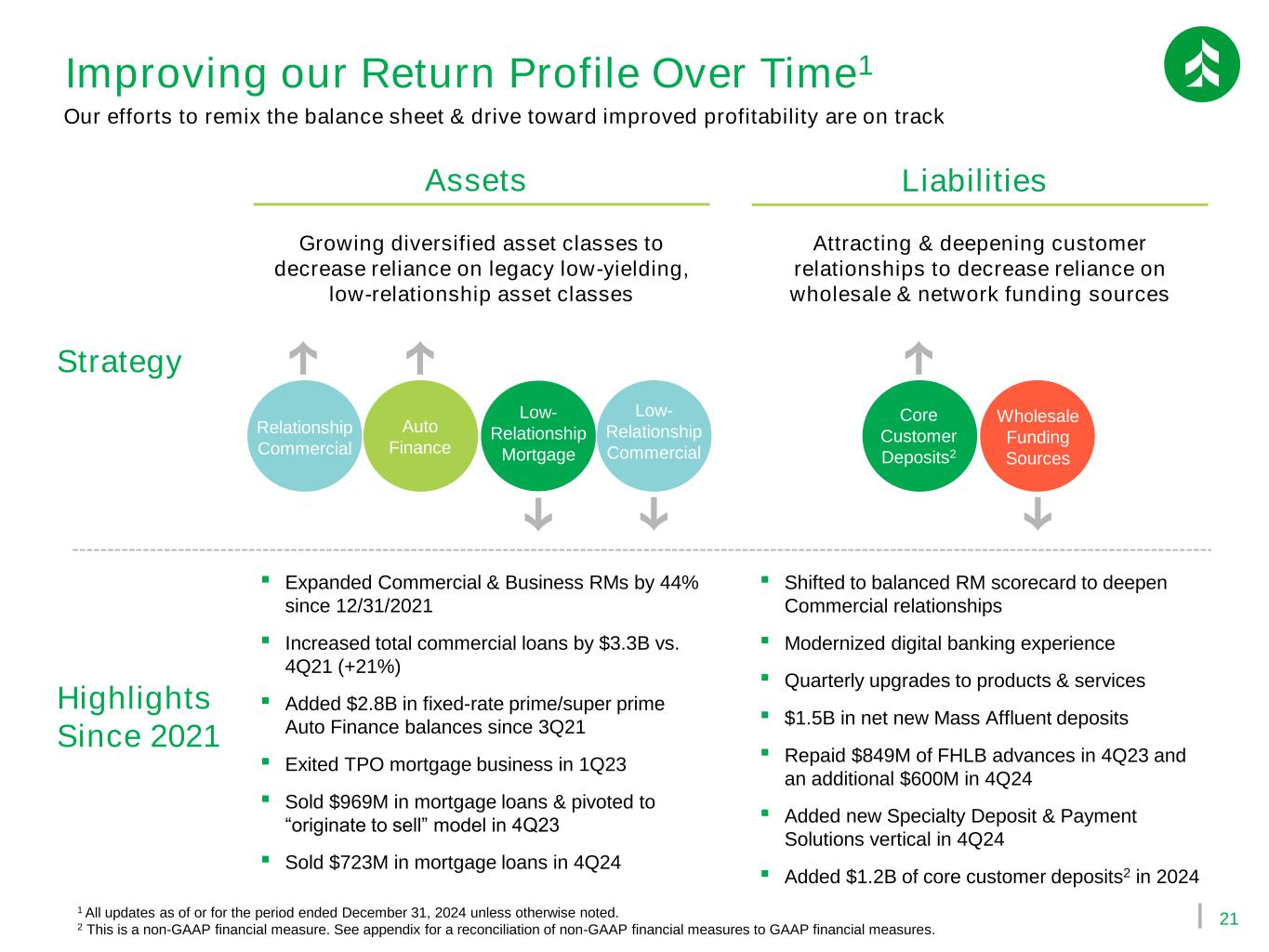

21 Improving our Return Profile Over Time1 Strategy Highlights Since 2021 Growing diversified asset classes to decrease reliance on legacy low-yielding, low-relationship asset classes ▪ Expanded Commercial & Business RMs by 44% since 12/31/2021 ▪ Increased total commercial loans by $3.3B vs. 4Q21 (+21%) ▪ Added $2.8B in fixed-rate prime/super prime Auto Finance balances since 3Q21 ▪ Exited TPO mortgage business in 1Q23 ▪ Sold $969M in mortgage loans & pivoted to “originate to sell” model in 4Q23 ▪ Sold $723M in mortgage loans in 4Q24 ▪ Shifted to balanced RM scorecard to deepen Commercial relationships ▪ Modernized digital banking experience ▪ Quarterly upgrades to products & services ▪ $1.5B in net new Mass Affluent deposits ▪ Repaid $849M of FHLB advances in 4Q23 and an additional $600M in 4Q24 ▪ Added new Specialty Deposit & Payment Solutions vertical in 4Q24 ▪ Added $1.2B of core customer deposits2 in 2024 LiabilitiesAssets Auto Finance Relationship Commercial Low- Relationship Mortgage Low- Relationship Commercial Wholesale Funding Sources Core Customer Deposits2 Attracting & deepening customer relationships to decrease reliance on wholesale & network funding sources 1 All updates as of or for the period ended December 31, 2024 unless otherwise noted. 2 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. Our efforts to remix the balance sheet & drive toward improved profitability are on track

22 Stable, Granular Deposit Portfolio 23% 23% 22% 22% 23% 77% 77% 78% 78% 77% $33.5 $33.7 $32.8 $33.8 $34.9 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Period End Deposit Trends (Associated Bank, N.A.) ($ in billions) Total of Insured & Collateralized Deposits Total of Uninsured & Uncollateralized Deposits As of 12/31/2024, ASB’s total liquidity sources covered 162% of uninsured, uncollateralized deposits Liquidity Sources 9/30/2024 12/31/2024 Federal Reserve Balance $405.8 $451.3 FHLB Chicago Capacity $6,164.5 $7,097.4 Fed Discount Window Capacity $2,981.2 $2,778.3 Funding Available Within One Business Day1 $9,551.5 $10,327.0 Fed Funds Lines $1,401.0 $1,164.0 Brokered Deposits Capacity2 $520.8 $418.2 Unsecured Debt Capacity3 $1,000.0 $1,000.0 Total Liquidity $12,473.3 $12,909.2 162% of uninsured, uncollateralized deposits 1 Estimated based on normal course of operations with the indicated institution. 2 Availability based on internal policy limitations. The Corporation includes outstanding deposits that have received a primary purpose exemption in the brokered deposit classification as they have similar funding characteristics and risk as brokered deposits. 3 Estimated availability based on the Corporation’s current internal funding considerations.

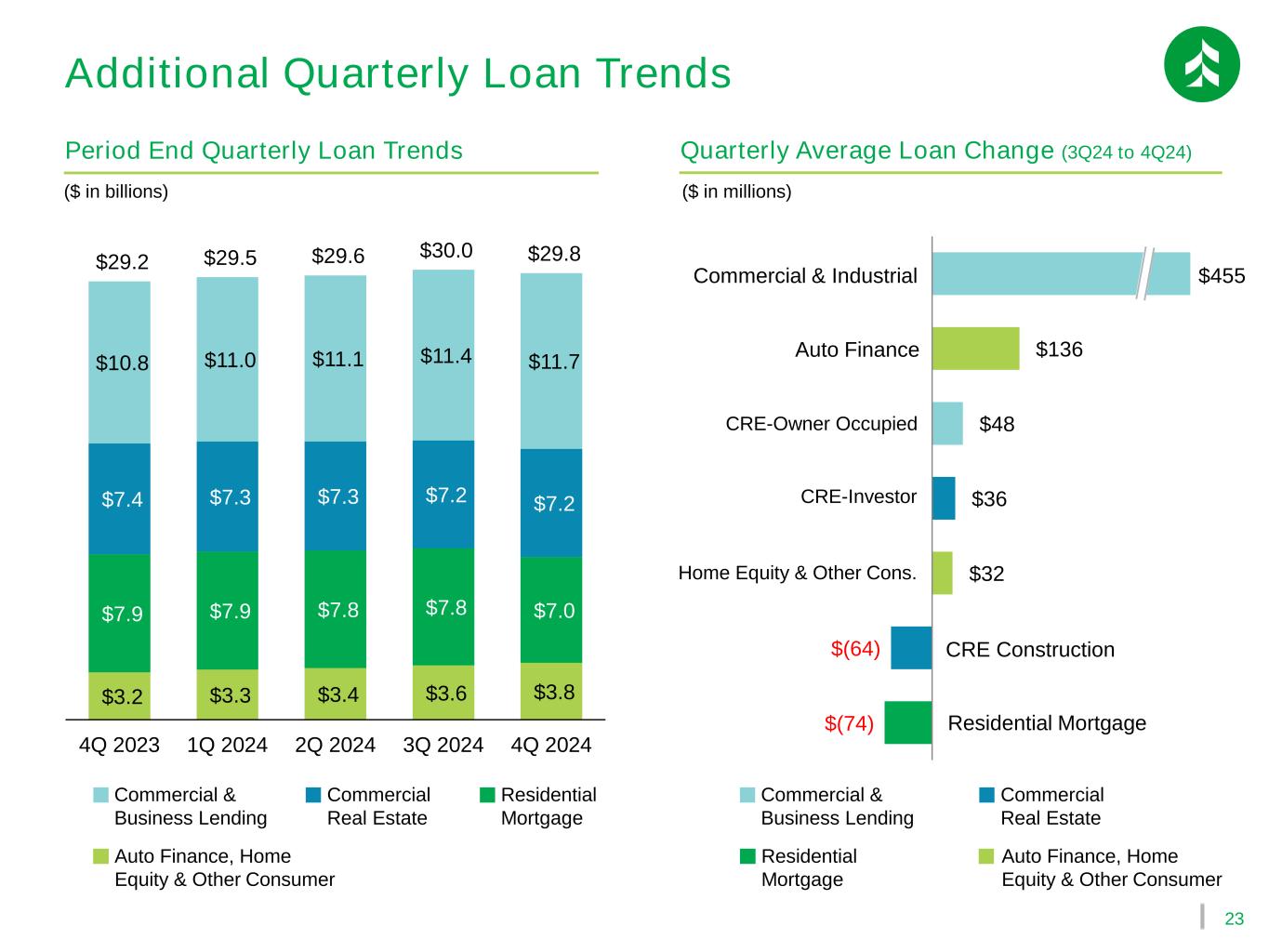

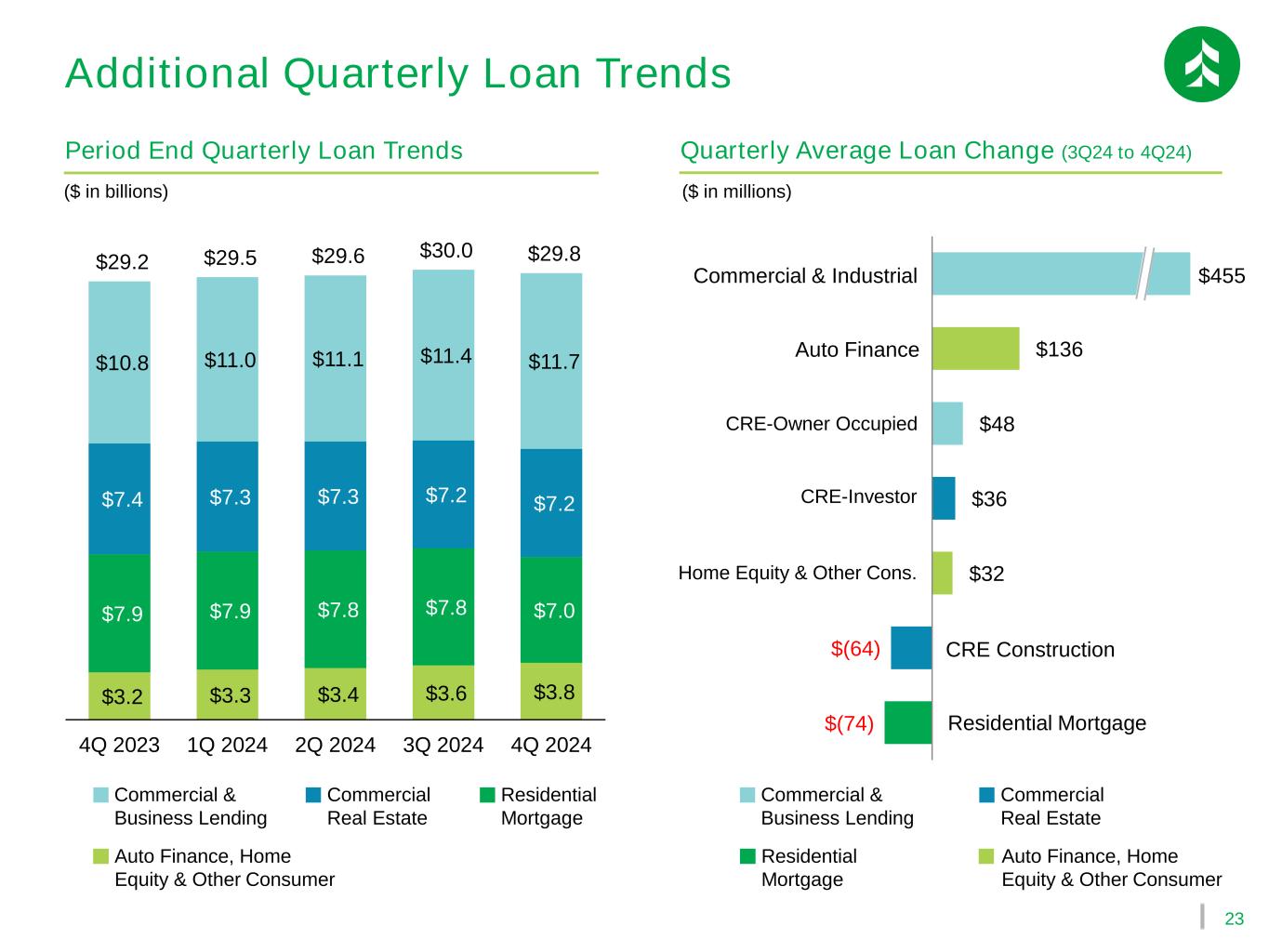

23 $3.2 $3.3 $3.4 $3.6 $3.8 $7.9 $7.9 $7.8 $7.8 $7.0 $7.4 $7.3 $7.3 $7.2 $7.2 $10.8 $11.0 $11.1 $11.4 $11.7 $29.2 $29.5 $29.6 $30.0 $29.8 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 ($ in billions) Commercial & Business Lending Commercial Real Estate Residential Mortgage Auto Finance, Home Equity & Other Consumer ($ in millions) Quarterly Average Loan Change (3Q24 to 4Q24)Period End Quarterly Loan Trends $(74) $(64) $32 $36 $48 $136 Commercial & Industrial CRE Construction CRE-Owner Occupied Auto Finance Residential Mortgage Additional Quarterly Loan Trends Commercial & Business Lending Commercial Real Estate Residential Mortgage Auto Finance, Home Equity & Other Consumer $455 Home Equity & Other Cons. CRE-Investor

24 Additional Annual Loan Trends Commercial & Business Lending Commercial Real Estate Residential Mortgage ($ in millions) $(877) $(155) $(36) $31 $84 $570 $633 Commercial & Industrial Quarterly Average Loan Change (4Q23 to 4Q24) Auto Finance, Home Equity & Other Consumer Auto Finance Residential Mortgage CRE-Owner Occupied Home Equity & Other Cons. CRE Construction CRE-Investor $1.1 $0.9 $1.7 $2.7 $3.4 $8.2 $7.8 $8.1 $8.7 $7.9 $5.8 $6.2 $6.6 $7.3 $7.3 $9.4 $9.1 $9.9 $10.8 $11.1 $24.5 $24.1 $26.2 $29.5 $29.7 2020 2021 2022 2023 2024 ($ in billions) Commercial & Business Lending Commercial Real Estate Residential Mortgage Auto Finance, Home Equity & Other Consumer Average Annual Loans 33% 27%

25 $1.6 $1.8 $1.5 $1.6 $1.8 $4.4 $3.9 $4.1 $4.2 $4.3 $2.9 $2.9 $3.1 $3.7 $3.7 $6.0 $6.2 $5.9 $5.8 $6.0 $4.8 $5.1 $5.2 $5.1 $5.1 $7.6 $7.5 $7.2 $7.3 $8.0 $6.1 $6.3 $5.8 $5.9 $5.8 $33.4 $33.7 $32.7 $33.6 $34.6 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Period End Quarterly Deposits ($ in billions) Average Funding Change (3Q 2024 to 4Q 2024) ($ in millions) Customer CDs Savings Money Market Network Transaction Deposits Noninterest-Bearing Demand Interest-Bearing Demand Brokered CDs $(18) $7 $86 $229 $399 Money Market Interest-Bearing Demand $(295) $(226) $46 $267 Brokered CDs FHLB Advances Core Customer Deposits1 +$703 (+3%) Wholesale Funding Sources $(208) (-2%) Total Deposits +$1,017 (+3%) Customer CDs Network Transaction Deposits Additional Quarterly Deposit & Funding Trends Noninterest-Bearing Demand Savings Other Wholesale Funding 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures.

26 $1.2 $0.8 $1.0 $1.6 $1.8 $1.8 $1.3 $1.9 $7.3 $8.0 $6.7 $6.9 $7.5 $6.0 $6.0 $3.7 $4.4 $4.6 $4.8 $5.1 $5.5 $6.5 $6.8 $7.6 $8.0 $7.7 $8.5 $7.8 $6.1 $5.8 $26.5 $28.5 $29.6 $33.4 $34.6 2020 2021 2022 2023 2024 Additional Annual Deposit Trends Total Time Deposits Savings Money Market Network Transaction Deposits Noninterest-Bearing Demand Interest-Bearing Demand ($ in billions) Period End Annual Deposits Quarterly Average Deposit Growth ($ in billions) $32.2 $34.3 $27.1 $28.1 4Q 2023 4Q 2024 Core Customer Deposits1Total Deposits 1 This is a non-GAAP financial measure. See appendix for a reconciliation of non-GAAP financial measures to GAAP financial measures. +6.7% +3.8%

27 Multi-Family 43% Retail 8% Office 13% Industrial 23% Other 14% Consumer 36% Com'l & Business Lending 39% CRE 24% Wisconsin 19% Illinois 15% Minnesota 10% Other Midwest2 21% Texas 9% Other 27% 1 All updates as of or for the period ended December 31, 2024 unless otherwise noted. 2 Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. 3 Accruing loans 30-89 days past due + accruing loans 90+ days past due. 4 Calculated on an annualized basis. Negative values indicate a net recovery. 5 Calculated based on the 10-year Treasury rate plus 300 basis points/25-year amortization. 6 Class A determined by third-party vendor partner mapping of portfolio. High-Quality Commercial Real Estate Portfolio1 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 Portfolio LTV 58% 59% 59% 58% 57% Delinquencies/Loans3 0.52% 0.28% 0.01% 0.22% 0.50% NALs/Loans 0.00% 0.26% 0.67% 0.26% 0.23% ACLL/Loans 1.88% 1.87% 1.98% 2.20% 1.99% NCOs/Avg. Loans4 (0.01%) 0.00% 0.25% 0.00% 0.37% CRE Credit Quality CRE Loan Portfolio Granularity % of Total Loans Largest Single CRE Borrower 0.19% Top 10 Largest CRE Borrowers 1.38% Largest CRE Property Type (Multi-Fam) 10.34% CRE Office Loans 3.08% CRE by Geography CRE by Property Type Total Loans by Segment CRE Office Highlights WAvg. Debt Service Coverage Ratio5 1.19x 2025 Remaining Maturities $420 million Central Business District vs. Suburban ~77% Suburban Property Class Mix ~56% Class A6 ASB has built a diversified CRE portfolio by partnering with well-known developers in stable Midwest markets

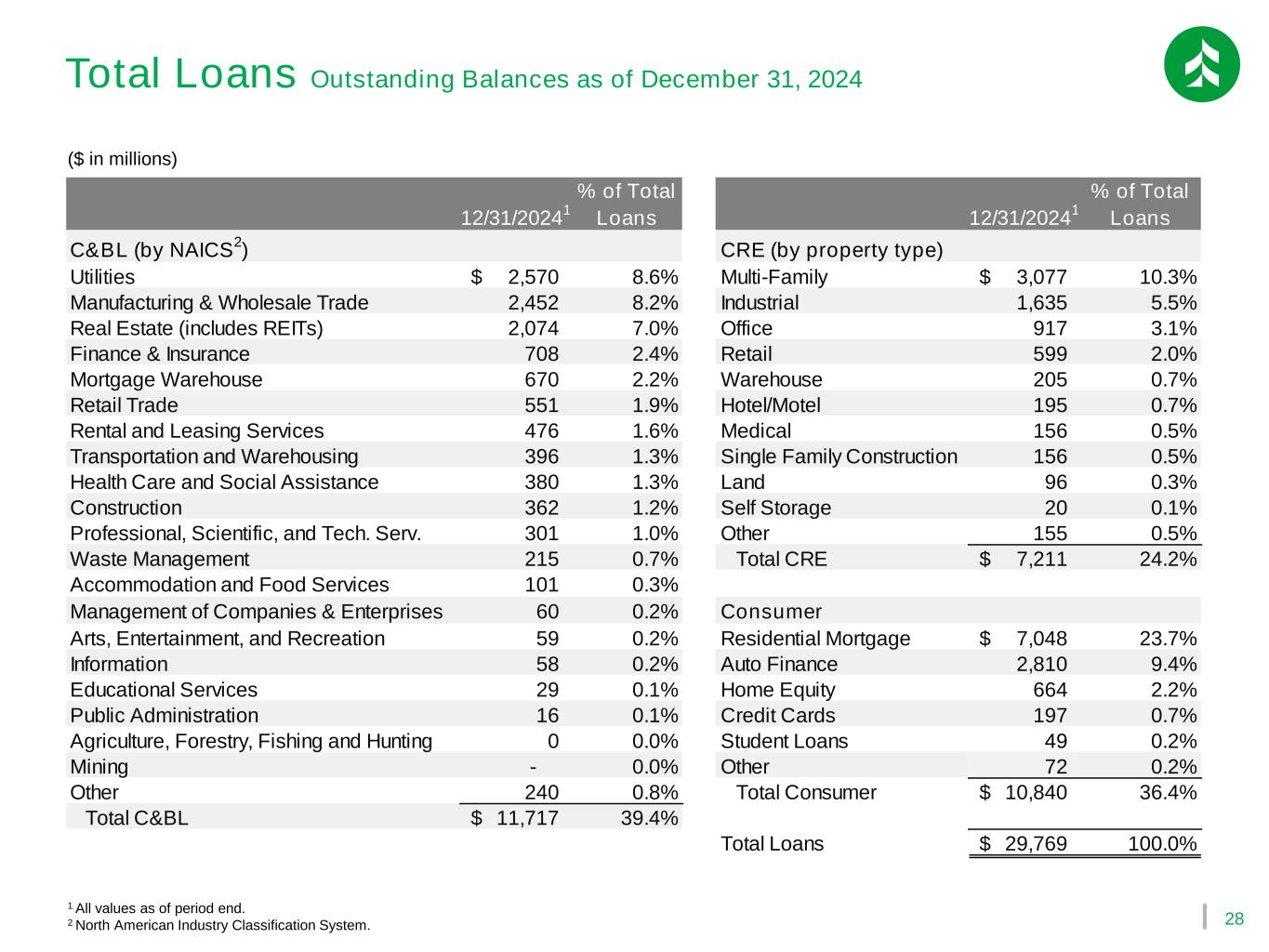

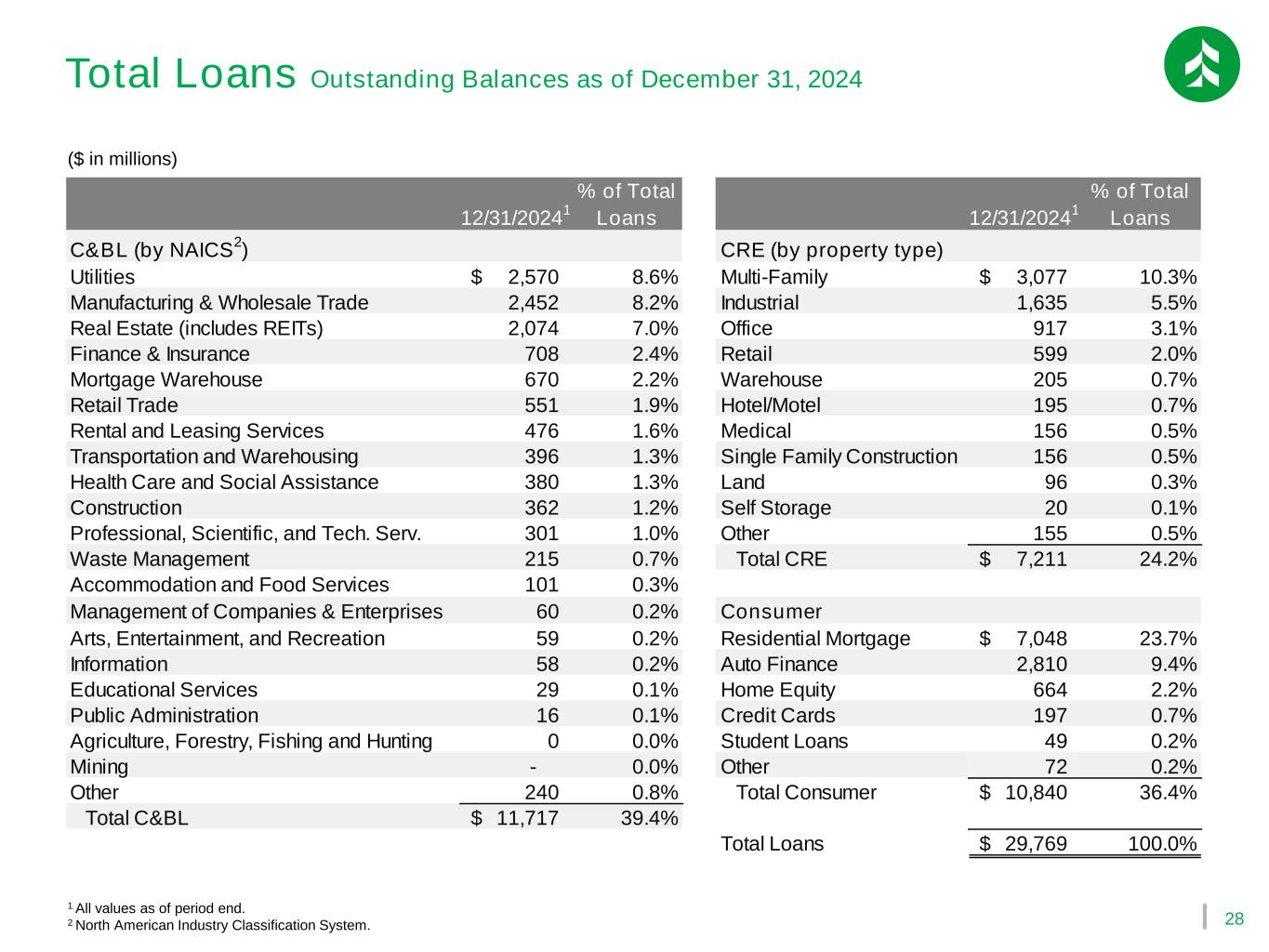

28 Total Loans Outstanding Balances as of December 31, 2024 ($ in millions) 1 All values as of period end. 2 North American Industry Classification System. 12/31/2024 1 % of Total Loans 12/31/2024 1 % of Total Loans C&BL (by NAICS 2 ) CRE (by property type) Utilities 2,570$ 8.6% Multi-Family 3,077$ 10.3% Manufacturing & Wholesale Trade 2,452 8.2% Industrial 1,635 5.5% Real Estate (includes REITs) 2,074 7.0% Office 917 3.1% Finance & Insurance 708 2.4% Retail 599 2.0% Mortgage Warehouse 670 2.2% Warehouse 205 0.7% Retail Trade 551 1.9% Hotel/Motel 195 0.7% Rental and Leasing Services 476 1.6% Medical 156 0.5% Transportation and Warehousing 396 1.3% Single Family Construction 156 0.5% Health Care and Social Assistance 380 1.3% Land 96 0.3% Construction 362 1.2% Self Storage 20 0.1% Professional, Scientific, and Tech. Serv. 301 1.0% Other 155 0.5% Waste Management 215 0.7% Total CRE 7,211$ 24.2% Accommodation and Food Services 101 0.3% Management of Companies & Enterprises 60 0.2% Consumer Arts, Entertainment, and Recreation 59 0.2% Residential Mortgage 7,048$ 23.7% Information 58 0.2% Auto Finance 2,810 9.4% Educational Services 29 0.1% Home Equity 664 2.2% Public Administration 16 0.1% Credit Cards 197 0.7% Agriculture, Forestry, Fishing and Hunting 0 0.0% Student Loans 49 0.2% Mining - 0.0% Other 72 0.2% Other 240 0.8% Total Consumer 10,840$ 36.4% Total C&BL 11,717$ 39.4% Total Loans 29,769$ 100.0%

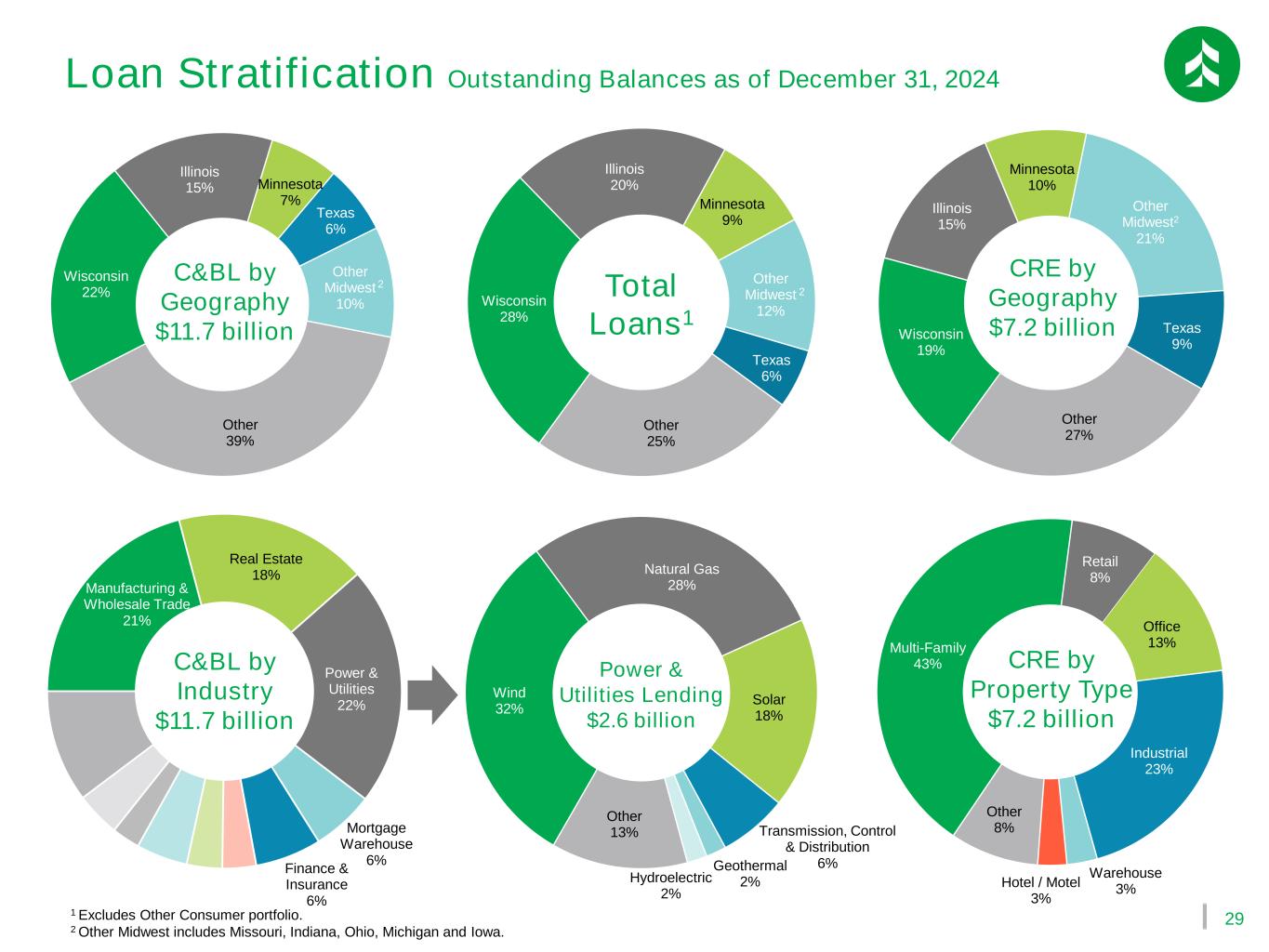

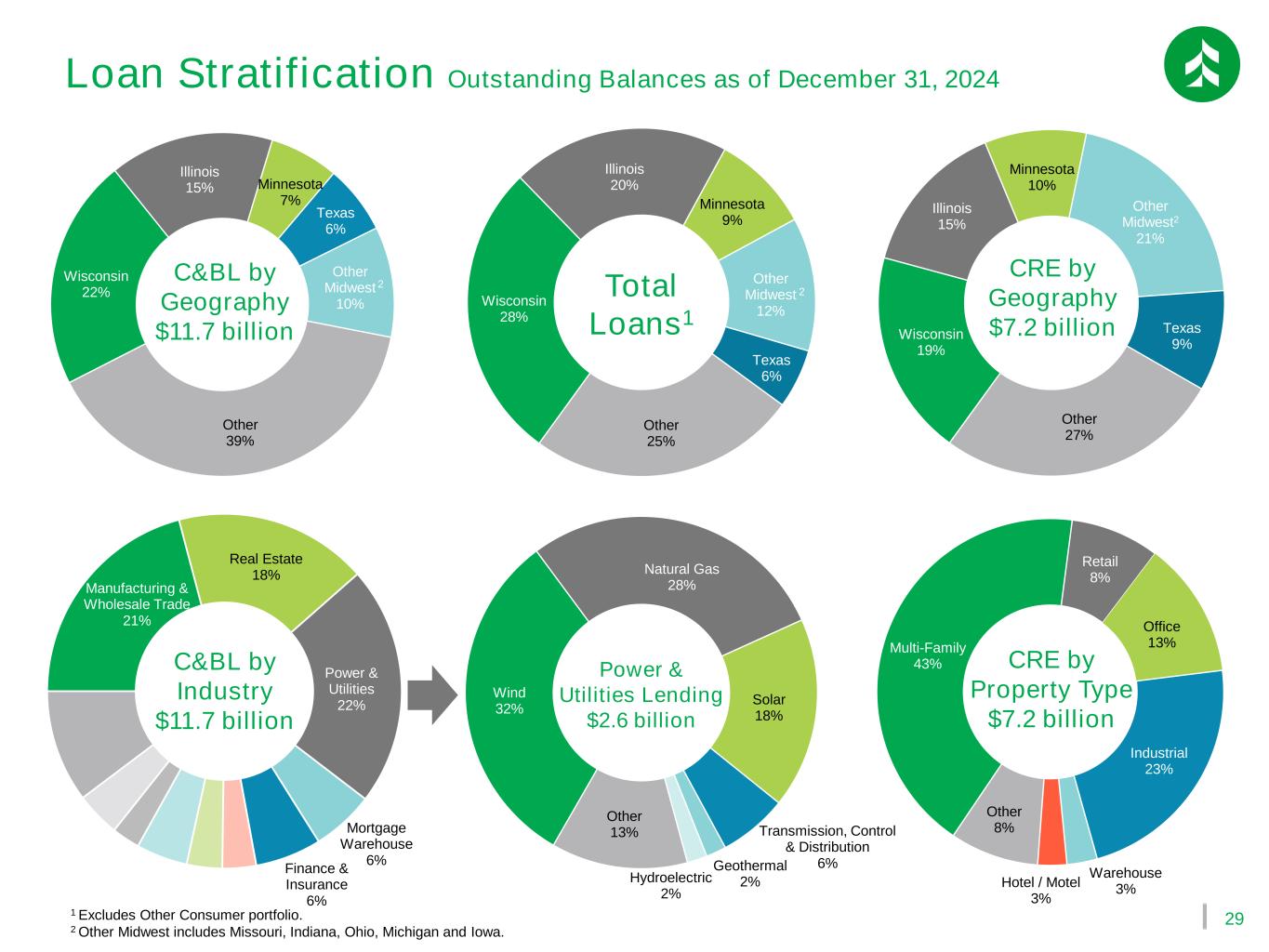

29 Multi-Family 43% Retail 8% Office 13% Industrial 23% Warehouse 3%Hotel / Motel 3% Other 8% Wisconsin 28% Illinois 20% Minnesota 9% Other Midwest 12% Texas 6% Other 25% Manufacturing & Wholesale Trade 21% Real Estate 18% Power & Utilities 22% Mortgage Warehouse 6% Finance & Insurance 6% 1 Excludes Other Consumer portfolio. 2 Other Midwest includes Missouri, Indiana, Ohio, Michigan and Iowa. Wind 32% Natural Gas 28% Solar 18% Transmission, Control & Distribution 6%Geothermal 2%Hydroelectric 2% Other 13% Wisconsin 22% Illinois 15% Minnesota 7% Texas 6% Other Midwest 10% Other 39% Wisconsin 19% Illinois 15% Minnesota 10% Other Midwest2 21% Texas 9% Other 27% 2 2 Loan Stratification Outstanding Balances as of December 31, 2024 C&BL by Geography $11.7 billion Power & Utilities Lending $2.6 billion C&BL by Industry $11.7 billion Total Loans1 CRE by Geography $7.2 billion CRE by Property Type $7.2 billion

30 Swaps Update Contractual swap balances as of 12/31/2024 $2.70 $2.85 $2.45 $2.45 $1.85 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 3.89% 3.82% 3.88% 3.89% 3.80% ($ in billions) Notional Balances Weighted Average Yield

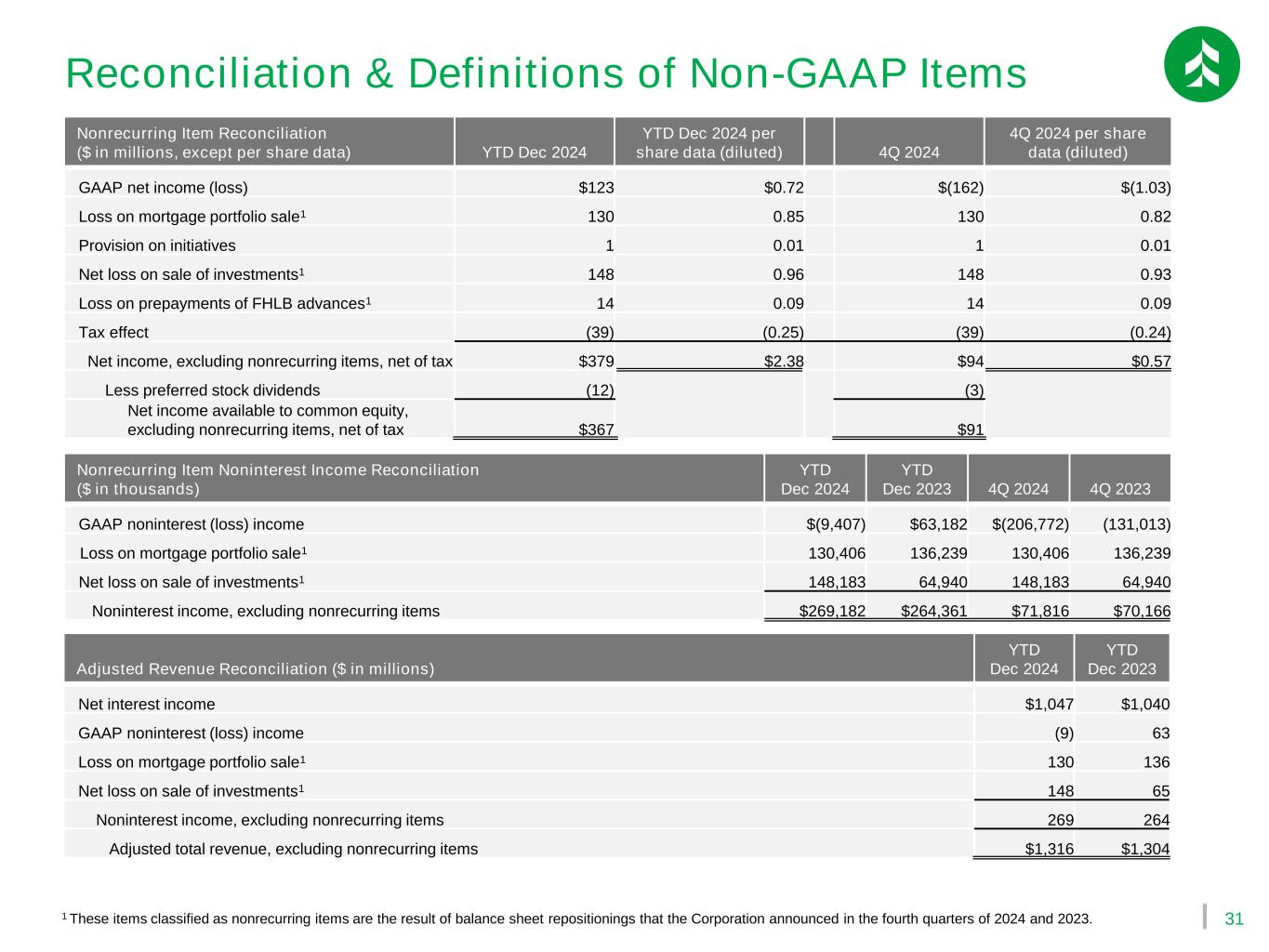

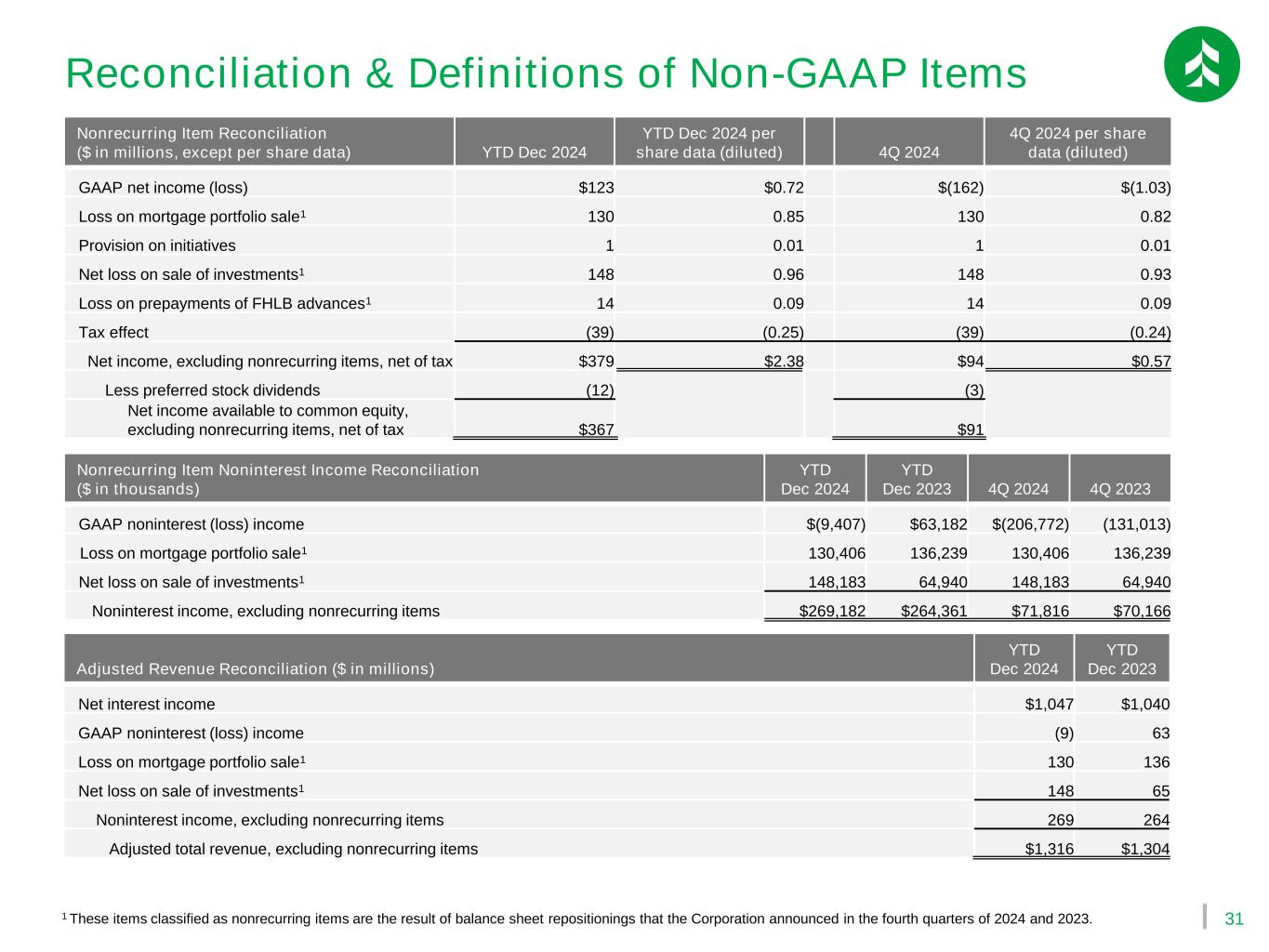

31 Reconciliation & Definitions of Non-GAAP Items 1 These items classified as nonrecurring items are the result of balance sheet repositionings that the Corporation announced in the fourth quarters of 2024 and 2023. Adjusted Revenue Reconciliation ($ in millions) YTD Dec 2024 YTD Dec 2023 Net interest income $1,047 $1,040 GAAP noninterest (loss) income (9) 63 Loss on mortgage portfolio sale1 130 136 Net loss on sale of investments1 148 65 Noninterest income, excluding nonrecurring items 269 264 Adjusted total revenue, excluding nonrecurring items $1,316 $1,304 Nonrecurring Item Reconciliation ($ in millions, except per share data) YTD Dec 2024 YTD Dec 2024 per share data (diluted) 4Q 2024 4Q 2024 per share data (diluted) GAAP net income (loss) $123 $0.72 $(162) $(1.03) Loss on mortgage portfolio sale1 130 0.85 130 0.82 Provision on initiatives 1 0.01 1 0.01 Net loss on sale of investments1 148 0.96 148 0.93 Loss on prepayments of FHLB advances1 14 0.09 14 0.09 Tax effect (39) (0.25) (39) (0.24) Net income, excluding nonrecurring items, net of tax $379 $2.38 $94 $0.57 Less preferred stock dividends (12) (3) Net income available to common equity, excluding nonrecurring items, net of tax $367 $91 Nonrecurring Item Noninterest Income Reconciliation ($ in thousands) YTD Dec 2024 YTD Dec 2023 4Q 2024 4Q 2023 GAAP noninterest (loss) income $(9,407) $63,182 $(206,772) (131,013) Loss on mortgage portfolio sale1 130,406 136,239 130,406 136,239 Net loss on sale of investments1 148,183 64,940 148,183 64,940 Noninterest income, excluding nonrecurring items $269,182 $264,361 $71,816 $70,166

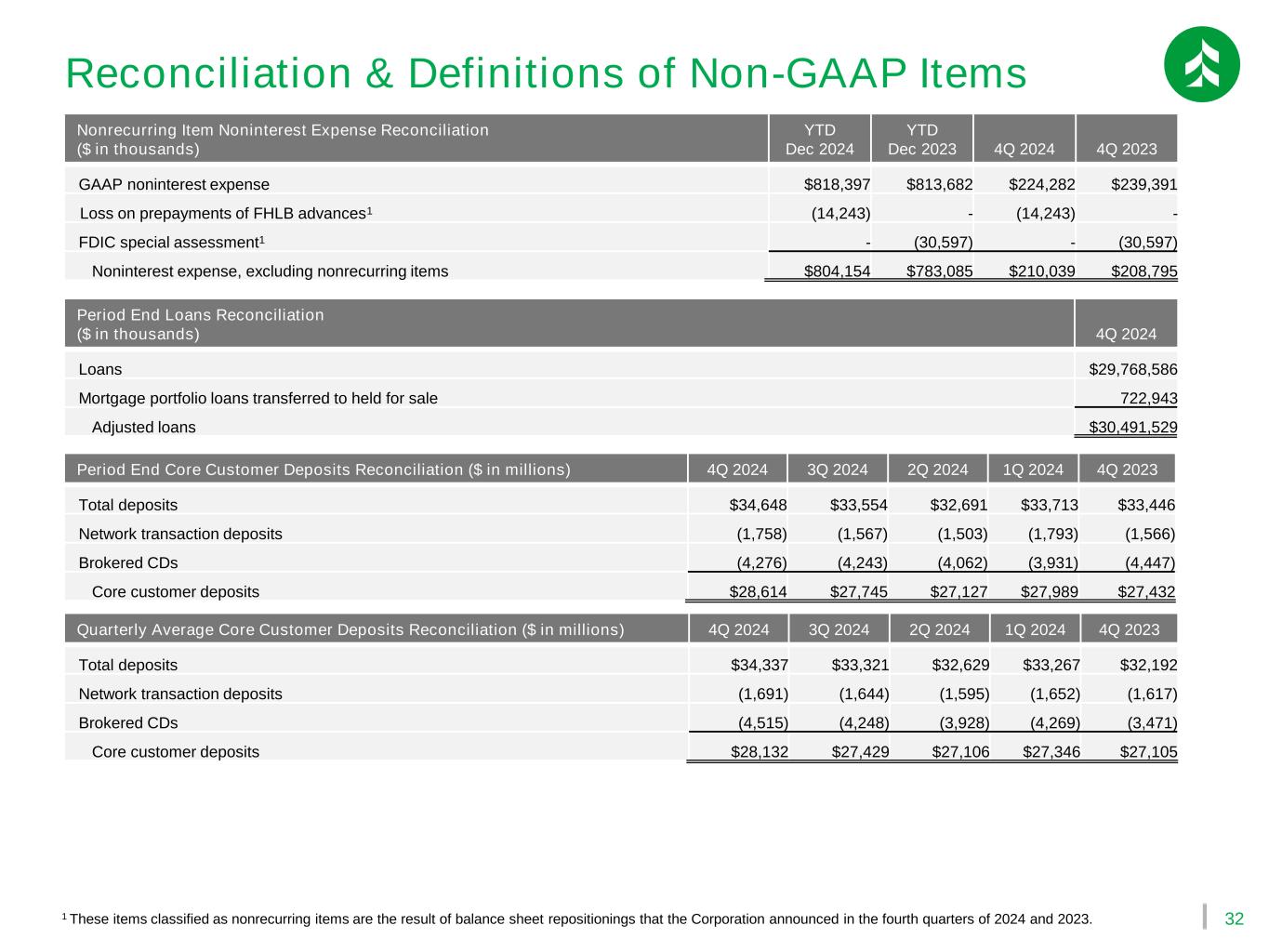

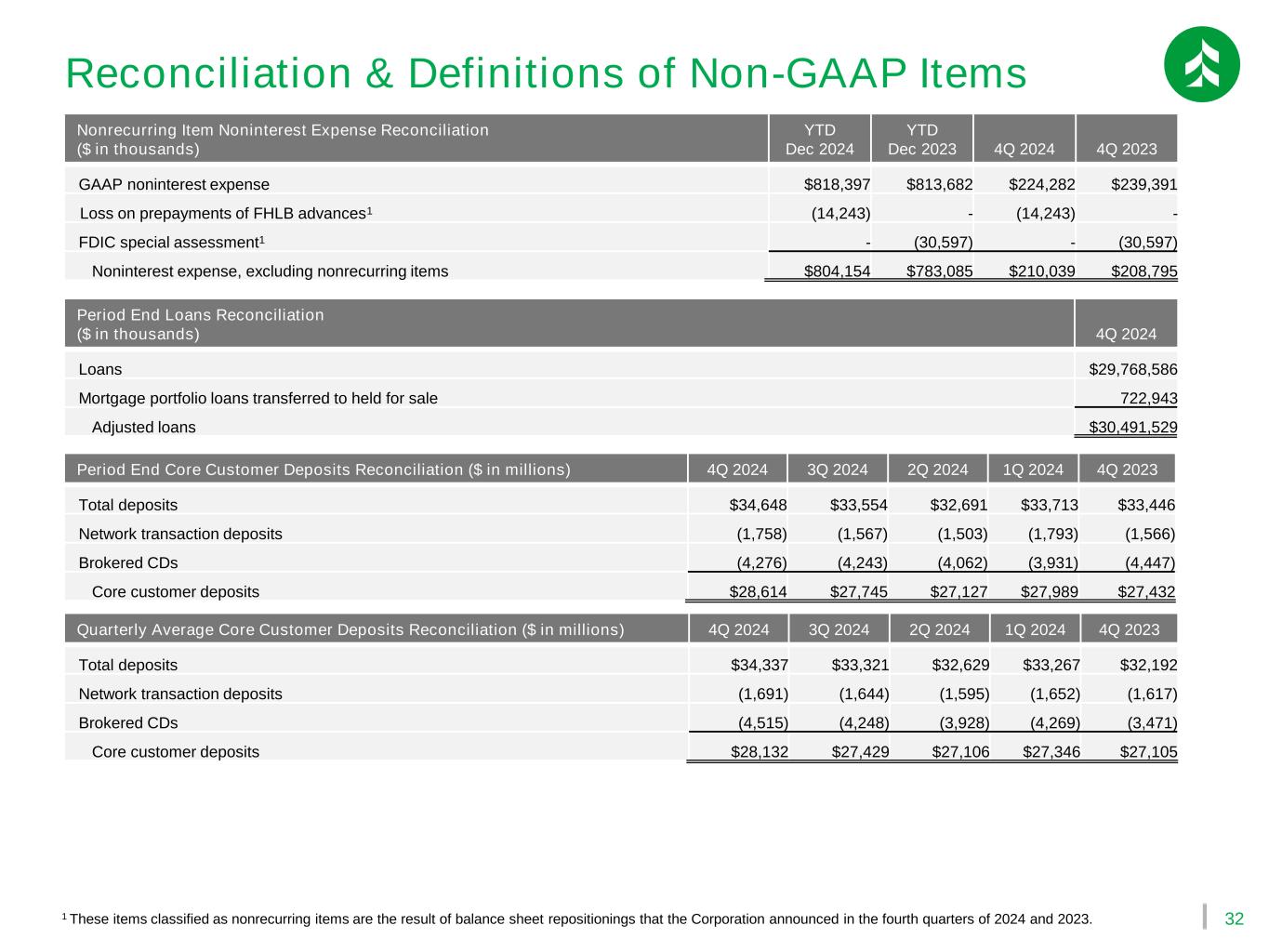

32 Period End Core Customer Deposits Reconciliation ($ in millions) 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 Total deposits $34,648 $33,554 $32,691 $33,713 $33,446 Network transaction deposits (1,758) (1,567) (1,503) (1,793) (1,566) Brokered CDs (4,276) (4,243) (4,062) (3,931) (4,447) Core customer deposits $28,614 $27,745 $27,127 $27,989 $27,432 Reconciliation & Definitions of Non-GAAP Items Period End Loans Reconciliation ($ in thousands) 4Q 2024 Loans $29,768,586 Mortgage portfolio loans transferred to held for sale 722,943 Adjusted loans $30,491,529 Nonrecurring Item Noninterest Expense Reconciliation ($ in thousands) YTD Dec 2024 YTD Dec 2023 4Q 2024 4Q 2023 GAAP noninterest expense $818,397 $813,682 $224,282 $239,391 Loss on prepayments of FHLB advances1 (14,243) - (14,243) - FDIC special assessment1 - (30,597) - (30,597) Noninterest expense, excluding nonrecurring items $804,154 $783,085 $210,039 $208,795 1 These items classified as nonrecurring items are the result of balance sheet repositionings that the Corporation announced in the fourth quarters of 2024 and 2023. Quarterly Average Core Customer Deposits Reconciliation ($ in millions) 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 Total deposits $34,337 $33,321 $32,629 $33,267 $32,192 Network transaction deposits (1,691) (1,644) (1,595) (1,652) (1,617) Brokered CDs (4,515) (4,248) (3,928) (4,269) (3,471) Core customer deposits $28,132 $27,429 $27,106 $27,346 $27,105

33 1 These financial measures have been included as they provide meaningful supplemental information to assess trends in the Corporation’s results of operations. 2 Other noninterest income is primarily comprised of capital markets, net, mortgage banking, net, bank and corporate owned life insurance, asset gains (losses), net and investment securities gains (losses), net. 4Q 2024 other noninterest income includes the loss on mortgage portfolio sale and net loss on sale of investments that are classified as nonrecurring items and are the result of a balance sheet repositioning that the Corporation announced in the fourth quarter of 2024. 4Q 2023 other noninterest income includes the loss on mortgage portfolio sale and net loss on sale of investments that are classified as nonrecurring items and are the result of a balance sheet repositioning that the Corporation announced in the fourth quarter of 2023. 3 The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the sum of net interest income plus noninterest income, excluding investment securities gains (losses), net. The fully tax-equivalent efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains (losses), net. The adjusted efficiency ratio is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, FDIC special assessment costs, and announced initiatives, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains (losses), net and announced initiatives. Management believes the adjusted efficiency ratio is a meaningful measure as it enhances the comparability of net interest income arising from taxable and tax-exempt sources and provides a better measure as to how the Corporation is managing its expenses by adjusting for nonrecurring costs like the FDIC special assessment and announced initiatives. Reconciliation & Definitions of Non-GAAP Items Common Equity Tier 1 Capital Ratio Reconciliation 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 Common equity Tier 1 capital ratio 10.00% 9.72% 9.68% 9.43% 9.39% Accumulated other comprehensive loss adjustment (0.22)% (0.34)% (0.67)% (0.64)% (0.52)% Common equity Tier 1 capital ratio including accumulated other comprehensive loss 9.78% 9.38% 9.01% 8.79% 8.87% Selected Trend Information1 ($ in millions) 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 Wealth management fees $24 $24 $23 $22 $21 Service charges and deposit account fees 13 14 12 12 11 Card-based fees 12 12 12 11 12 Other fee-based revenue 5 5 5 4 4 Fee-based revenue 54 55 52 50 47 Other2 (261) 13 13 15 (178) Total noninterest income $(207) $67 $65 $65 $(131) Efficiency Ratio Reconciliation3 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 Federal Reserve efficiency ratio 107.36% 61.46% 61.51% 61.03% 132.01% Fully tax-equivalent adjustment (1.83)% (0.69)% (0.71)% (0.71)% (3.29)% Other intangible amortization (1.04)% (0.67)% (0.68)% (0.69)% (1.21)% Fully tax-equivalent efficiency ratio 104.50% 60.11% 60.12% 59.63% 127.54% FDIC special assessment 0.14% 0.30% 0.73% (2.38)% (9.50)% Announced initiatives (43.53)% - - - (53.92)% Adjusted efficiency ratio 61.11% 60.42% 60.85% 57.25% 64.12%

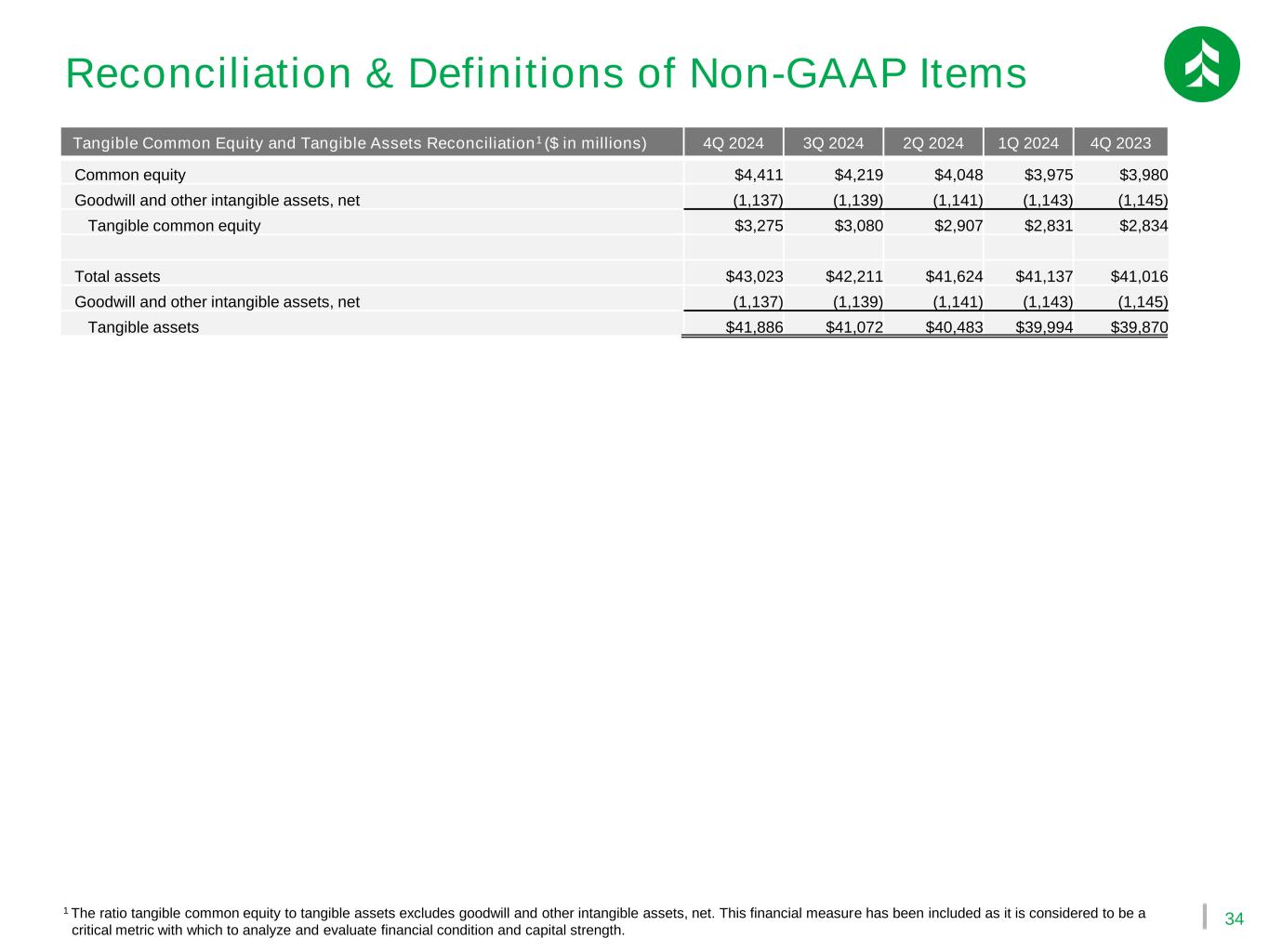

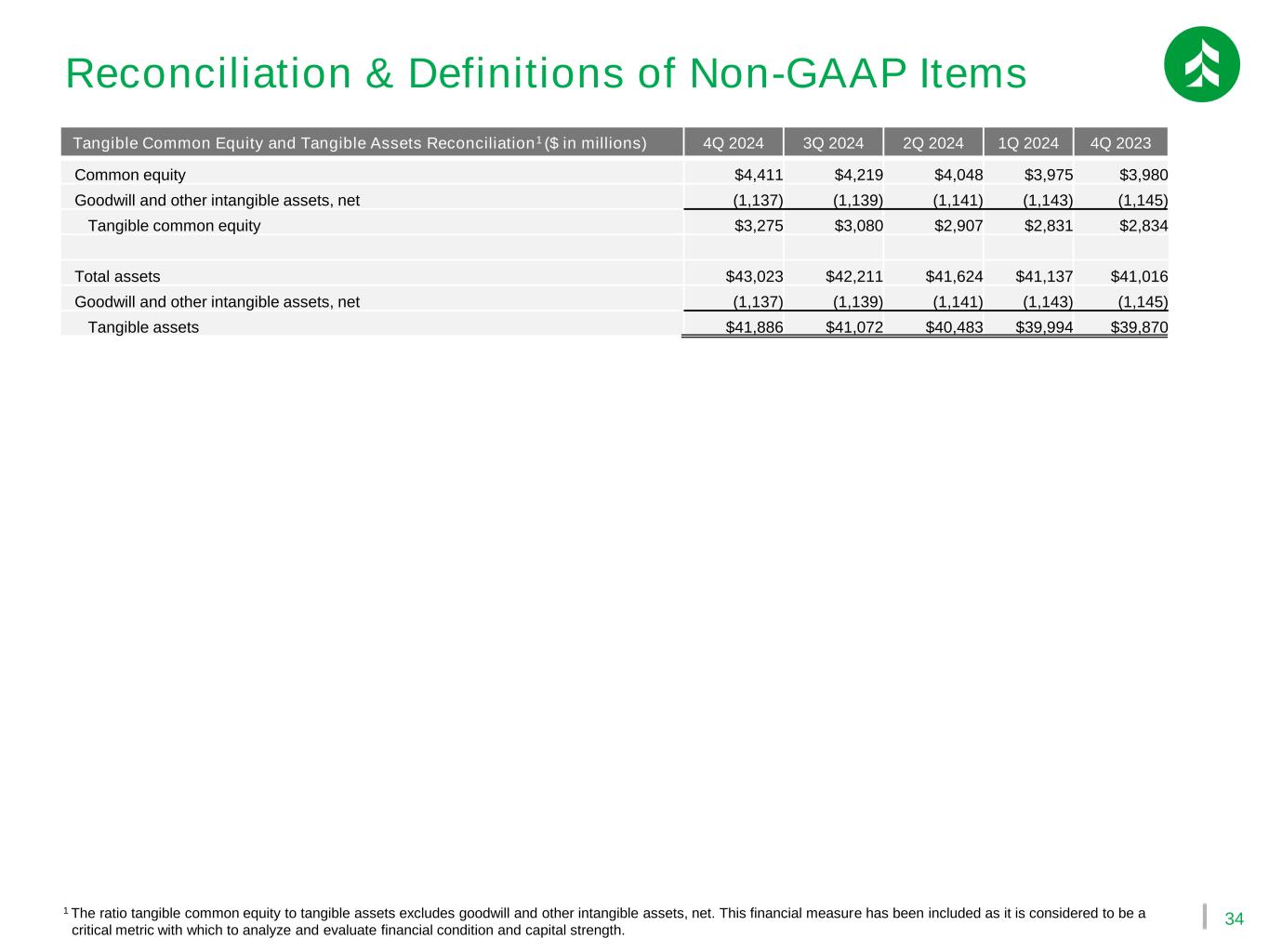

34 Reconciliation & Definitions of Non-GAAP Items Tangible Common Equity and Tangible Assets Reconciliation1 ($ in millions) 4Q 2024 3Q 2024 2Q 2024 1Q 2024 4Q 2023 Common equity $4,411 $4,219 $4,048 $3,975 $3,980 Goodwill and other intangible assets, net (1,137) (1,139) (1,141) (1,143) (1,145) Tangible common equity $3,275 $3,080 $2,907 $2,831 $2,834 Total assets $43,023 $42,211 $41,624 $41,137 $41,016 Goodwill and other intangible assets, net (1,137) (1,139) (1,141) (1,143) (1,145) Tangible assets $41,886 $41,072 $40,483 $39,994 $39,870 1 The ratio tangible common equity to tangible assets excludes goodwill and other intangible assets, net. This financial measure has been included as it is considered to be a critical metric with which to analyze and evaluate financial condition and capital strength.