- ASB Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Associated Banc-Corp (ASB) DEF 14ADefinitive proxy

Filed: 15 Mar 19, 6:05am

Use these links to rapidly review the document

TABLE OF CONTENTS

COMPENSATION DISCUSSION AND ANALYSIS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| ASSOCIATED BANC-CORP | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

2019 Proxy Statement

Notice of Annual Meeting of Shareholders

To Be Held on April 30, 2019

March 15, 2019

To Our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Associated Banc-Corp scheduled for 11:00 a.m. (CDT) on Tuesday, April 30, 2019, at the KI Convention Center, 333 Main Street, Green Bay, Wisconsin. We will present an economic/investment update beginning at 10:00 a.m., with Associated's investment professionals providing an update on the equity market and interest rate environment.

On or about March 15, 2019, we began mailing a Notice of Internet Availability of Proxy Materials (Notice) to our shareholders informing them that our Proxy Statement, the 2018 Summary Annual Report to Shareholders and our 2018 Form 10-K, along with voting instructions, are available online. As more fully described in the Notice, shareholders may choose to access our proxy materials on the Internet or may request paper copies. This allows us to conserve natural resources and reduces the cost of printing and distributing the proxy materials, while providing our shareholders with access to the proxy materials in a fast, easily accessible and efficient manner.

The matters expected to be acted upon at the meeting are described in detail in the attached Notice of Annual Meeting of Shareholders and Proxy Statement.

Your Board of Directors and management look forward to personally greeting those shareholders who are able to attend. We always appreciate your input and interest in Associated Banc-Corp.

Sincerely,

![]()

William R. Hutchinson

Chairman of the Board

Philip B. Flynn

President and CEO

433 Main Street

Green Bay, Wisconsin 54301

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Tuesday, April 30, 2019

11:00 a.m.

KI Convention Center, 333 Main Street, Green Bay, Wisconsin

You may vote if you were a shareholder of record on March 4, 2019.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 30, 2019:

Associated Banc-Corp's Proxy Statement, 2018 Summary Annual Report to Shareholders and 2018 Form 10-K are available online at http://materials.proxyvote.com/045487.

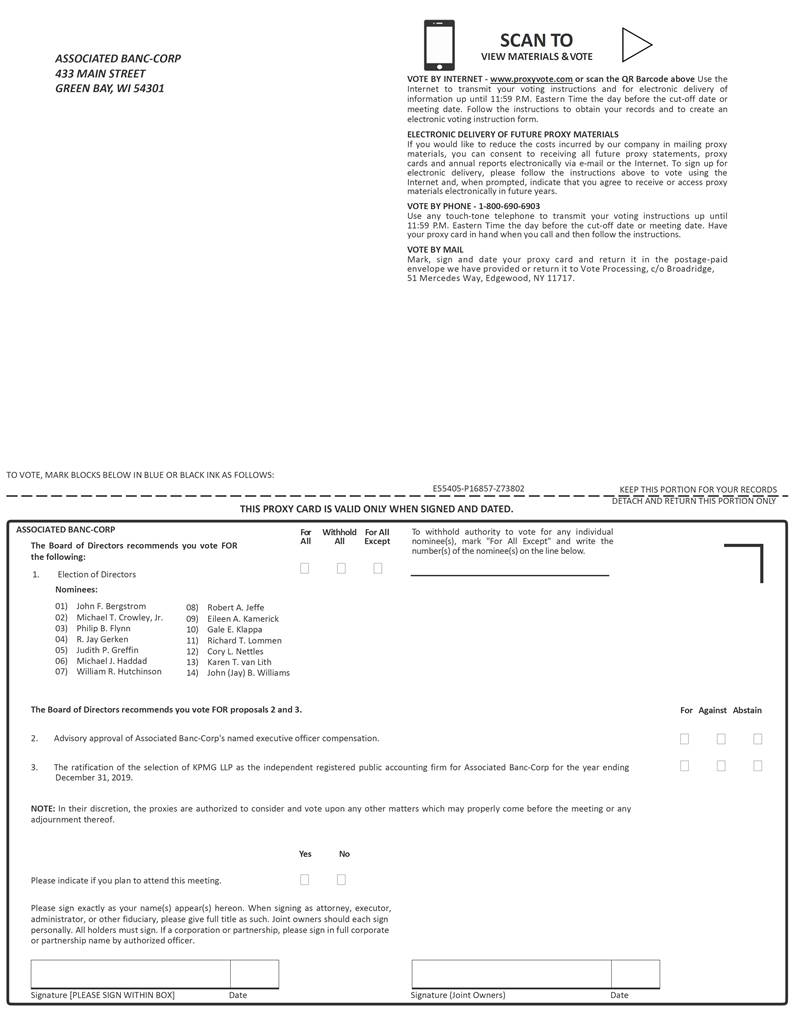

YOU CAN VOTE BY INTERNET - www.proxyvote.com.

YOU CAN ALSO VOTE BY TELEPHONE AT 1-800-690-6903.

IF YOU DO NOT VOTE BY USING THE INTERNET OR THE TELEPHONE, YOU ARE URGED TO SIGN, DATE, AND PROMPTLY RETURN YOUR PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND IN ORDER THAT THE PRESENCE OF A QUORUM AT THE MEETING MAY BE ASSURED. THE PROMPT RETURN OF YOUR SIGNED PROXY OR YOUR PROMPT VOTE BY USING THE INTERNET OR THE TELEPHONE, REGARDLESS OF THE NUMBER OF SHARES YOU HOLD, WILL AID ASSOCIATED BANC-CORP IN REDUCING THE EXPENSE OF ADDITIONAL PROXY SOLICITATION. THE GIVING OF YOUR PROXY DOES NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

Randall J. Erickson

Executive Vice President,

General Counsel &

Corporate Secretary

Green Bay, Wisconsin

March 15, 2019

GENERAL INFORMATION | 1 | |

PROPOSAL 1: ELECTION OF DIRECTORS | 3 | |

NOMINEES FOR ELECTION TO OUR BOARD | 3 | |

DIRECTOR QUALIFICATIONS | 10 | |

RECOMMENDATION OF THE BOARD OF DIRECTORS | 10 | |

AFFIRMATIVE DETERMINATIONS REGARDING DIRECTOR INDEPENDENCE | 10 | |

INFORMATION ABOUT THE BOARD OF DIRECTORS | 11 | |

BOARD COMMITTEES AND MEETING ATTENDANCE | 11 | |

SEPARATION OF BOARD CHAIRMAN AND CEO | 12 | |

BOARD DIVERSITY | 13 | |

DIRECTOR NOMINEE RECOMMENDATIONS | 13 | |

COMMUNICATIONS BETWEEN SHAREHOLDERS, INTERESTED PARTIES AND THE BOARD | 14 | |

COMPENSATION AND BENEFITS COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 14 | |

STOCK OWNERSHIP | 15 | |

SECURITY OWNERSHIP OF BENEFICIAL OWNERS | 15 | |

STOCK OWNERSHIP GUIDELINES FOR EXECUTIVE OFFICERS AND DIRECTORS | 16 | |

SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT | 16 | |

COMMON STOCK | 17 | |

RESTRICTED STOCK UNITS | 17 | |

DEPOSITARY SHARES OF PREFERRED STOCK | 18 | |

OWNERSHIP IN DIRECTORS' DEFERRED COMPENSATION PLAN | 19 | |

PROPOSAL 2: ADVISORY APPROVAL OF ASSOCIATED BANC-CORP'S NAMED EXECUTIVE OFFICER COMPENSATION | 20 | |

RECOMMENDATION OF THE BOARD OF DIRECTORS | 20 | |

COMPENSATION DISCUSSION AND ANALYSIS | 21 | |

COMPENSATION AND BENEFITS COMMITTEE REPORT | 39 | |

DIRECTOR COMPENSATION | 47 | |

DIRECTORS' DEFERRED COMPENSATION PLAN | 47 | |

DIRECTOR COMPENSATION IN 2018 | 48 | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 49 | |

RELATED PARTY TRANSACTIONS | 49 | |

RELATED PARTY TRANSACTION POLICIES AND PROCEDURES | 50 | |

PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 51 | |

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 51 | |

RECOMMENDATION OF THE BOARD OF DIRECTORS | 51 | |

REPORT OF THE AUDIT COMMITTEE | 52 | |

OTHER MATTERS THAT MAY COME BEFORE THE MEETING | 53 | |

SHAREHOLDER PROPOSALS | 53 |

PROXY STATEMENT

PURPOSE |

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of Associated Banc-Corp ("Associated") to be voted at the Annual Meeting of Shareholders at 11:00 a.m. (CDT) on Tuesday, April 30, 2019, (the "Annual Meeting") at the KI Convention Center, 333 Main Street, Green Bay, Wisconsin, and at any and all adjournments of the Annual Meeting.

The cost of solicitation of proxies will be borne by Associated. In addition to solicitation by mail, some of Associated's directors, officers, and employees may, without extra compensation, solicit proxies by

telephone or personal interview. Associated has retained D.F. King & Co., Inc. to solicit proxies for the Annual Meeting from brokers, bank nominees and other institutional holders. Associated has agreed to pay D.F. King & Co., Inc. up to $9,000 plus its out-of-pocket expenses for these services. Arrangements will be made with brokerage houses, custodians, nominees, and other fiduciaries to send proxy materials to their principals, and they will be reimbursed by Associated for postage and clerical expenses.

INTERNET AVAILABILITY OF PROXY MATERIALS |

Securities and Exchange Commission ("SEC") rules allow us to make our Proxy Statement and other annual meeting materials available to you on the Internet. On or about March 15, 2019, we began mailing a Notice of Internet Availability of Proxy Materials (the "Notice"), to our shareholders advising them that this Proxy Statement, the 2018 Summary Annual Report to Shareholders and our 2018 Annual Report on Form 10-K (the "2018 Form 10-K"), along with voting instructions, may be accessed over the Internet at http://materials.proxyvote.com/045487. You may then access these materials and vote your shares over the Internet, or request that a printed copy of the proxy materials be sent to you. If you want

to receive a paper or e-mail copy of these materials, you must make the request over the Internet at www.proxyvote.com, by calling toll free 1-800-579-1639, or by sending an e-mail to sendmaterial@proxyvote.com. There is no charge to you for requesting a paper or e-mail copy to sendmaterial@proxyvote.com. If you would like to receive a paper or e-mail copy of the proxy materials, please make your request on or before April 16, 2019, in order to facilitate timely delivery. If you previously elected to receive our proxy materials electronically, these materials will continue to be sent via e-mail unless you change your election.

WHO CAN VOTE |

The Board has fixed the close of business on March 4, 2019, as the record date (the "Record Date") for the determination of shareholders entitled to receive notice of, and to vote at, the Annual Meeting. Each share of Associated's common stock, par value $0.01

("Common Stock"), is entitled to one vote on each matter to be voted on at the Annual Meeting. No other class of securities will be entitled to vote at the Annual Meeting.

QUORUM AND SHARES OUTSTANDING |

The presence, in person or by proxy, of the majority of the outstanding shares entitled to vote at the Annual Meeting is required to constitute a quorum for the transaction of business at the Annual Meeting. The securities of Associated entitled to be voted at the

meeting consist of shares of its Common Stock, of which 164,748,953 shares were issued and outstanding at the close of business on the Record Date.

1

REQUIRED VOTES |

The number of affirmative votes required to approve each of the proposals to be considered at the Annual Meeting is as follows:

Proposal 1 – Election of Directors

The 14 nominees receiving the largest number of affirmative votes cast at the Annual Meeting will be elected as directors. Under Associated's Corporate Governance Guidelines, any nominee in an uncontested election who receives a greater number of votes "withheld" from his or her election than votes "FOR" such election is required to tender his or her

resignation following certification of the shareholder vote. The Corporate Governance Committee is required to make a recommendation to the Board with respect to any such letter of resignation, and the Board is required to take action with respect to this recommendation and to disclose its decision and decision-making process.

Other Proposals

The affirmative vote of a majority of the votes cast is required to approve each of the other proposals.

ABSTENTIONS AND BROKER NON-VOTES |

Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum but as unvoted for purposes of determining the approval of any matter submitted to shareholders for a vote. If a broker indicates on the proxy that it does not have discretionary authority as

to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter but will be considered as present and entitled to vote for purposes of determining the presence of a quorum for the meeting.

HOW YOU CAN VOTE |

Shareholders are urged to vote as promptly as possible by Internet or telephone, or by signing, dating, and returning the proxy card in the envelope provided. If no specification is made, the shares will be voted "FOR" the election of the Board's nominees for director, "FOR" the advisory approval of Associated's named executive officer ("NEO") compensation and "FOR" the ratification of the selection of KPMG LLP as Associated's independent registered public accounting firm for 2019.

VOTE BY INTERNET – www.proxyvote.com. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on April 29, 2019. Have your Notice or proxy card, if you have requested paper copies of the proxy materials, in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. You will be required to enter the unique control number imprinted on your Notice or proxy card in order to

vote online. The Internet voting procedures are designed to authenticate shareholders' identities, to allow shareholders to provide their voting instructions, and to confirm that shareholders' instructions have been recorded properly. You should be aware that there might be costs associated with electronic access, such as usage charges from Internet access providers and telephone companies.If you vote by Internet, please do not mail your proxy card.

VOTE BY TELEPHONE – 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on April 29, 2019. Have your Notice or proxy card, if you have requested paper copies of the proxy materials, in hand when you call and then follow the instructions.If you vote by telephone, please do not mail your proxy card.

IN PERSON – You may also vote in person at the Annual Meeting.

REVOCATION OF PROXY |

Proxies may be revoked at any time prior to the time they are exercised by filing with the Corporate Secretary of Associated a written revocation or a duly executed proxy bearing a later date. Proxies may not be revoked via the Internet or by telephone.

The Corporate Secretary of Associated is Randall J. Erickson, 433 Main Street, Green Bay, Wisconsin 54301.

2

PROPOSAL 1:

ELECTION OF DIRECTORS

Directors elected at the Annual Meeting will serve for one-year terms expiring at the 2020 Annual Meeting and, with respect to each director, until his or her successor is duly elected and qualified. The term of each current director listed under "Nominees for Election to Our Board" expires at the Annual Meeting.

Unless otherwise directed, all proxies will be voted "FOR" the election of each of the individuals nominated to serve as directors. The biographical information below for each nominee includes the specific experience, qualifications, attributes or skills that led to the Corporate Governance Committee's conclusion that such nominee should serve as a director. The 14 nominees receiving the largest number of affirmative votes cast at the Annual Meeting will be elected as directors. Under Associated's Corporate Governance Guidelines, any nominee in an uncontested election who receives a greater number of votes "withheld" from his or her election than votes "FOR" such election is required to tender his or her resignation following certification of the shareholder vote. The Corporate Governance Committee is required to make a recommendation to the Board with respect to any such letter of resignation, and the Board is required to take action with respect to this recommendation and to disclose its decision and decision-making process.

Each nominee has consented to serve as a director, if elected, and as of the date of this Proxy Statement, Associated has no reason to believe that any of the nominees will be unable to serve. Correspondence may be directed to nominees at Associated's executive offices.

Mr. Haddad was recommended to the Corporate Governance Committee by two of the Company's independent directors and Mr. Flynn.

The information presented below is as of March 4, 2019.

NOMINEES FOR ELECTION TO OUR BOARD |

Philip B. Flynn |

| Mr. Flynn joined Associated Banc-Corp as President and Chief Executive Officer in December 2009. Mr. Flynn has more than 30 years of financial services industry experience. Prior to joining Associated, Mr. Flynn held the position of Vice Chairman and Chief Operating Officer of Union Bank in California. During his nearly 30-year career at Union Bank, he held a broad range of other executive positions, including chief credit officer and head of commercial banking, specialized lending and wholesale banking activities. Mr. Flynn serves as a director or trustee of the Medical College of Wisconsin, the Milwaukee Art Museum, St. Norbert College, Wisconsin Manufacturers & Commerce, and the Green Bay Packers, Inc. Mr. Flynn's qualifications to serve as a director and Chair of the Corporate Development Committee include his extensive experience in the banking industry and his significant executive management experience at a large financial institution. |

3

John F. Bergstrom |

| Mr. Bergstrom is Chairman and Chief Executive Officer of Bergstrom Corporation of Neenah, Wisconsin, one of the top 50 largest automobile dealer groups in the United States. Mr. Bergstrom also serves as a director of Kimberly-Clark Corporation (NYSE:KMG), WEC Energy Group (NYSE:WEC), Advance Auto Parts (NYSE:APP), and is a director emeritus of Green Bay Packers, Inc. Mr. Bergstrom's qualifications to serve as a director of Associated and member of the Compensation and Benefits Committee and the Corporate Governance Committee include his more than 30 years of leadership experience as a chief executive officer and over 50 years of combined experience as a director of various public companies. Mr. Bergstrom provides the board with a deep understanding of consumer sales and of Wisconsin's business environment. Mr. Bergstrom has completed the National Association of Corporate Directors ("NACD") corporate training program for Compensation Committee members and is now designated as a Master Fellow for Compensation Committee, governance and best practices. He was also designated as one of the top 100 corporate directors in America for 2017. |

Michael T. Crowley, Jr. |

| Mr. Crowley held the position of Chairman of Bank Mutual Corporation from 2000 to 2018, serving as CEO of the subsidiary bank from 1985 to 2013, and President from 1983 to 2010. Mr. Crowley's extensive experience in the financial community includes serving as Chairman for the Federal Home Loan Bank System Stockholder Study Committee, the State of Wisconsin Savings Bank Review Board, and the State of Wisconsin Savings and Loan Review Board. He also served as Vice Chairman for Federal Home Loan Bank of Chicago, a member of the Federal Reserve Board of Governors Thrift Institutions Advisory Council, President of the Wisconsin Banker's Association, and a director of The Wisconsin Partnership for Housing Development, Inc. Mr. Crowley's qualifications to serve as a director of Associated and member of the Enterprise Risk Committee and Trust Committee include his executive management experience at a large financial institution, his significant experience in the banking industry, as well as his leadership experience as Chairman of Bank Mutual Corporation. |

4

R. Jay Gerken |

| Mr. Gerken is a director of 19 mutual funds with approximately $39 billion in assets associated with Sanford C. Bernstein Fund, Inc. and the Bernstein Fund, Inc. which are mutual fund complexes. Mr. Gerken served as the President and Chief Executive Officer of Legg Mason Partners Fund Advisor, LLC from 2005 until June 2013. During that period, he was also the President and a director of the Legg Mason and Western Asset mutual fund complexes with combined assets in excess of $100 billion. Previously, Mr. Gerken served in a similar capacity at Citigroup Asset Management Mutual Funds from 2002 to 2005. Mr. Gerken's qualifications to serve as a director of Associated, Chairman of the Audit Committee and member of the Enterprise Risk Committee include his extensive investment and financial experience, as well as his executive leadership roles at several large mutual funds. Mr. Gerken is certified as a National Association of Corporate Directors Board Leadership Fellow. As a Chartered Financial Analyst with experience as a portfolio manager and in overseeing the preparation of financial statements, Mr. Gerken also meets the requirements of an audit committee financial expert. |

Judith P. Greffin |

| Ms. Greffin served as Executive Vice President and Chief Investment Officer at the Allstate Corporation (NYSE: ALL), the nation's largest publicly held personal lines insurer, from 2008 to 2016. Prior to this position, Ms. Greffin held several other key positions at Allstate from 1990 to 2008. Ms. Greffin currently serves on the board of Church Mutual Insurance Company, which insures over 100,000 religious institutions, the Northwestern Memorial Foundation, the investment committee of Northwestern Memorial Healthcare, the investment committee of the Field Museum of Natural History and is also a member of the Miami University, Ohio Business Advisory Council and the Economic Club of Chicago. Ms. Greffin's qualifications to serve as a director of Associated and member of the Enterprise Risk Committee and the Trust Committee include her extensive investment, strategy and risk mitigation background as well as her executive leadership experience at a large publicly traded company. Ms. Greffin is also a Chartered Financial Analyst. |

Michael J. Haddad |

| Mr. Haddad has been President and Chief Executive Officer and a member of the Board of Directors of Schreiber Foods, Inc., an employee-owned, international dairy company headquartered in Green Bay, Wisconsin, since January 1, 2009. He served as President and Chief Operating Officer of Schreiber Foods, Inc. from 2006 to 2008, having served in a number of positions of increasing responsibility with the company since 1995. Mr. Haddad is also a member of the Board of Trustees of St. Norbert College, the Board of Directors of Bellin Health Systems and the Board of Directors of the Green Bay Packers. Mr. Haddad's qualifications to serve as a director of Associated include his extensive experience as a CEO and board member of a large global food company with annual revenues over $5 billion, and his long-standing familiarity with the markets in which Associated is headquartered and serves. |

5

William R. Hutchinson |

| Mr. Hutchinson is Chairman of the Board. He has served as President of W. R. Hutchinson & Associates, Inc., an energy industry consulting company, since April 2001. Previously, he was Group Vice President, Mergers & Acquisitions, of BP Amoco p.l.c. from January 1999 to April 2001 and held the positions of Vice President – Financial Operations, Treasurer, Controller, and Vice President – Mergers, Acquisitions & Negotiations of Amoco Corporation, Chicago, Illinois, from 1981 until 1999. Mr. Hutchinson also serves as an independent director and Chairman of the Audit Committees of approximately 23 closed-end mutual funds in the Legg Mason mutual fund complex. Mr. Hutchinson's qualifications to serve as Chairman of the Board of Directors of Associated and member of the Corporate Development Committee include executive level responsibility for the financial operations of a large publicly traded company and significant mergers and acquisitions experience. Although Mr. Hutchinson is not currently serving on Associated's Audit Committee, he meets the requirements of an audit committee financial expert. |

Robert A. Jeffe |

| Mr. Jeffe is Chairman of OAG Analytics, Inc., which has a web-based software platform that provides, through machine learning, optimization advice for drilling and field development for energy exploration and production companies. Mr. Jeffe served as Co-Chairman and Co-Founder of Hawkwood Energy, a private oil and gas company based in Denver and focused on onshore exploration and production in the U.S. from February 2012 until June 2017. Mr. Jeffe was Chairman of the Corporate Advisory Group of Deutsche Bank from November 2004 until February 2011. Previously, Mr. Jeffe served as Senior Vice President of Corporate Business Development for General Electric Company from December 2001 to November 2004, and as a member of GE Capital's board of directors from January 2002 to June 2004. Mr. Jeffe has more than 34 years of investment banking experience and prior to working at Deutsche Bank, he was with Morgan Stanley, Credit Suisse and Smith Barney (now Citigroup) serving at all three firms as Managing Director, Head of the Global Energy and Natural Resources Group, and a member of the Investment Banking Management Committee and Global Leadership Group. At Morgan Stanley, Mr. Jeffe also was Co-Head of Global Corporate Finance. Mr. Jeffe's qualifications to serve as a director of Associated and member of the Audit Committee, the Corporate Development Committee and the Enterprise Risk Committee include his extensive investment banking and corporate finance experience, as well as his leadership roles at several large financial institutions and energy companies and his Board positions at these energy firms. Mr. Jeffe also meets the requirements of an audit committee financial expert. |

6

Eileen A. Kamerick |

| Ms. Kamerick is an adjunct professor at leading law schools and consults on corporate governance and financial strategy matters. Previously, from March 2014 until January 2015, she was Senior Advisor to the Chief Executive Officer and Executive Vice President and Chief Financial Officer of ConnectWise, Inc., an international software and services company. From October 2012 until July 2013, Ms. Kamerick was Chief Financial Officer of Press Ganey Associates, a leading health care analytics and strategic advisory firm. She previously served as the Managing Director and Chief Financial Officer of Houlihan Lokey, an international investment bank, from May 2010 to October 2012. Ms. Kamerick has also served as Chief Financial Officer at several leading companies, including Heidrick & Struggles International, Inc., Leo Burnett, and BP Amoco Americas. She also currently serves on the board of directors of Hochschild Mining, plc (LON:HOC), serves as an independent director of 23 closed-end mutual funds in the Legg Mason mutual fund complex, and serves as independent trustee for the 24 AIG and Anchor Trust Funds. She previously served on the Board of Directors of Westell Technologies, Inc. (NASDAQ: WSTL). She has formal training in law, finance, and accounting. Ms. Kamerick's qualifications to serve as a director of Associated, Chair of the Corporate Governance Committee and member of the Compensation and Benefits Committee and the Corporate Development Committee include her executive-level responsibilities for the financial operations of both public and private companies, her board positions on public companies, and her experience as a frequent law school lecturer on corporate governance and corporate finance. She is also a National Association of Corporate Directors Board Leadership Fellow. Although Ms. Kamerick is not currently serving on Associated's Audit Committee, she meets the requirements of an audit committee financial expert. |

7

Gale E. Klappa |

| Mr. Klappa is the Executive Chairman of WEC Energy Group (NYSE: WEC) of Milwaukee, Wisconsin, one of the nation's premier energy companies. Mr. Klappa was Chairman and Chief Executive Officer of WEC Energy Group from October 2017 until February 2019, and served as non-executive Chairman from May 2016 until October 2017. Mr. Klappa served as Chairman and Chief Executive Officer of WEC Energy Group from June 2015 until May 2016. Mr. Klappa had served as Chairman and Chief Executive Officer of Wisconsin Energy and We Energies from May 2004 until June 2015. Previously, Mr. Klappa was Executive Vice President, Chief Financial Officer and Treasurer of Southern Company (NYSE: SO) in Atlanta, Georgia and also held the positions of Chief Strategic Officer, North American Group President of Southern Energy Inc., Senior Vice President of Marketing for Georgia Power Company, a subsidiary of Southern Company and President and Chief Executive Officer of South Western Electricity, Southern Company's electric distribution utility in the United Kingdom. Mr. Klappa also serves as a director of Badger Meter Inc. (NYSE: BMI) and is co-chair of the Milwaukee 7, a regional economic development initiative. He is also the Vice-Chairman of the Metropolitan Milwaukee Association of Commerce and serves on the School of Business Advisory Council for the University of Wisconsin-Milwaukee. Mr. Klappa also served on the board of directors of Joy Global Inc. from 2006 until the company was acquired in 2017. Mr. Klappa's qualifications to serve as a director of Associated and as a member of the Audit Committee and Compensation and Benefits Committee include his 40 years of management experience in large publicly traded companies, including over 25 years at a senior executive level, and his recognized leadership in the economic development of southeastern Wisconsin. Mr. Klappa also meets the requirements of an audit committee financial expert. |

Richard T. Lommen |

| Mr. Lommen is Chairman of the Board of Courtesy Corporation, a McDonald's franchisee, located in La Crosse, Wisconsin. Prior to that, he served as President of Courtesy Corporation from 1968 to 2006. Mr. Lommen served as Vice Chairman of the Board of First Federal Capital Corp from April 2002 to October 2004, when it was acquired by Associated. Mr. Lommen's qualifications to serve as a director of Associated, Chairman of the Compensation and Benefits Committee and a member of the Trust Committee include his successful small business/franchise ownership, his experience in all aspects of franchise ownership, particularly management and instruction of retail employees, and marketing and sales to consumers and his service as Vice Chairman of First Federal Capital Corp. |

8

Cory L. Nettles |

| Mr. Nettles is the Founder and Managing Director of Generation Growth Capital, Inc., a private equity fund. He was Of Counsel at Quarles & Brady LLP from 2007 to 2016. He previously served as Secretary for the Wisconsin Department of Commerce from 2002 to 2004. Mr. Nettles serves on the boards of Weyco Group, Inc. (NASDAQ: WEYS), Robert W. Baird's Baird Funds, Inc. mutual fund complex, and several nonprofit organizations including the Medical College of Wisconsin, the Greater Milwaukee Foundation and the University of Wisconsin Foundation and Lawrence University. He previously served on the board of The Private Bank-Wisconsin. Mr. Nettles' qualifications to serve as a director of Associated and member of the Corporate Governance Committee, Corporate Development Committee and Enterprise Risk Committee include his strong business background and legal experience. |

Karen T. van Lith |

| Ms. van Lith is currently a consultant for companies requiring transformative leadership as they go through start-up, rapid growth, mergers and acquisitions or business model changes. From June 2011 until June 2012, she served as Chief Executive Officer and a director of MakeMusic, Inc., a company that develops and markets music education technology solutions and was publicly traded until April 2013. Ms. van Lith also serves as a director of E.A. Sween, a privately-held company doing business as Deli Express, since August 2012. Until June 2011, she ran an internet-marketing services company through Beckwith Crowe, LLC. Ms. van Lith was President and Chief Executive Officer of Gelco Information Network, a privately held provider of transaction and information processing systems to corporations and government agencies, based in Eden Prairie, Minnesota, until its sale to Concur Technologies in October 2007. She held various other positions of increasing authority with Gelco since 1999. Ms. van Lith served as a director of XRS Corporation, a publicly traded provider of fleet operations solutions to the transportation industry from 2010 to 2014. Ms. van Lith's qualifications to serve as a director of Associated, Chair of the Trust Committee and a member of the Compensation and Benefits Committee include her education in finance and accounting along with her past and present directorship experience in both public and private companies. Ms. van Lith provides the board with a strong understanding of accounting as well as experience in small business start-ups. She was a CPA, has practiced with an international public accounting firm and has served in various executive capacities. She also meets the requirements of an audit committee financial expert. |

9

John (Jay) B. Williams |

| Mr. Williams joined the Board of Directors in July 2011 following a 37-year career in banking. He is also past President and Chief Executive Officer of the Milwaukee Public Museum, Inc. Mr. Williams' banking career included experience with retail, commercial, private client, operations and technology along with mergers and acquisitions. He is Chairman of the Board of Church Mutual Insurance Company, which insures over 100,000 religious institutions, and on the Board of Directors of Northwestern Mutual Wealth Management, a subsidiary of Northwestern Mutual, the Medical College of Wisconsin, and the Milwaukee Public Museum. Mr. Williams' qualifications to serve as a director of Associated and Chair of the Enterprise Risk Committee and member of the Audit Committee include his vast experience in the banking industry, as well as his certification as a NACD Board Leadership Fellow. In addition, Mr. Williams has earned the CERT, Certificate in Cybersecurity Oversight. Mr. Williams also meets the requirements of an audit committee financial expert. |

DIRECTOR QUALIFICATIONS |

Directors are responsible for overseeing Associated's business consistent with their fiduciary duty to shareholders. This significant responsibility requires highly skilled individuals with various qualities, attributes and professional experience. The Board believes that there are certain general requirements for service on Associated's Board of Directors that are applicable to all directors, and that there are other skills and experience that should be represented on the Board as a whole but not necessarily by every director. The Board and the Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board's overall composition and Associated's current and future needs.

In its assessment of each nominee for director, including those recommended by shareholders, the Corporate Governance Committee considers the nominee's judgment, integrity, experience, independence, understanding of Associated's business or other related industries and such other factors that the Corporate Governance Committee determines are pertinent in light of the current needs of the Board. The Corporate Governance Committee also takes into account the ability of a director to devote the time and effort necessary to fulfill his or her responsibilities to Associated.

The Board and the Corporate Governance Committee require that each director be a person of high integrity with a proven record of success in his or her field. Each director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures and a commitment to sustainability and to dealing responsibly with social issues. In addition to the qualifications required of all directors, the Board conducts interviews of potential director candidates to assess intangible qualities including the individual's ability to ask difficult questions and, simultaneously, to work collegially.

The Board believes that the combination of qualifications, skills and experiences of each of the director nominees will contribute to an effective and well-functioning Board. The Board and the Corporate Governance Committee believe that, individually and as a whole, the directors possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to Associated's management.

RECOMMENDATION OF THE BOARD OF DIRECTORS |

The Board recommends that shareholders vote "FOR" the election of Mses. Greffin, Kamerick and van Lith and Messrs. Flynn, Bergstrom, Crowley, Gerken, Haddad, Hutchinson, Jeffe, Klappa, Lommen, Nettles and Williams to the Board of Directors.

AFFIRMATIVE DETERMINATIONS REGARDING DIRECTOR INDEPENDENCE |

Associated's Board has considered the independence of the nominees for election at the Annual Meeting and all individuals who served as directors during any portion of 2018, under the corporate governance rules of the NYSE. The Board has determined that all such directors are independent, or were independent at the time they served as directors, under the NYSE corporate governance rules, except for Mr. Flynn, President and CEO of Associated. Mr. Flynn is not independent because of his service as an executive officer of Associated and not because of any other transactions or relationships.

10

INFORMATION ABOUT THE BOARD OF DIRECTORS

BOARD COMMITTEES AND MEETING ATTENDANCE |

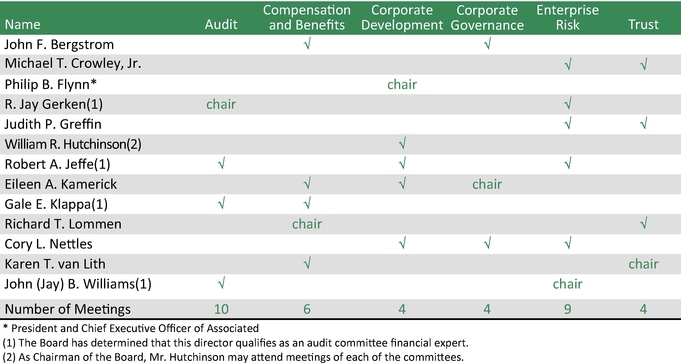

The Board held seven meetings during 2018. During 2018, each director who was a director for all of 2018 attended at least 75% of the Board meetings held, and each such director attended at least 75% of the meetings of each committee of which he or she was a member.

The Board convened an executive session of its non-management directors at all of its regular board meetings held in 2018. Executive sessions of Associated's non-management directors are presided over by the Chairman of the Board.

All of the directors serve on the Boards of two of Associated's operating subsidiaries, Associated Bank, National Association and Associated Trust Company, National Association. The Board believes that a single governing body to advise and determine strategy for the organization provides the Board with a comprehensive picture of the level and trends in operational and compliance risk exposure for the entire organization and ensures comprehensive oversight of regulatory matters.

The Board has adopted Corporate Governance Guidelines, including a Code of Business Conduct and

Ethics, which can be found on Associated's website at www.associatedbank.com, "Investor Relations," "Governance Documents." We will describe on our website any amendments to or waivers from our Code of Business Conduct and Ethics in accordance with all applicable laws and regulations.

It is Associated's policy that all directors and nominees for election as directors at the Annual Meeting attend the Annual Meeting, except under extraordinary circumstances. All directors and nominees for director at the time of the 2018 Annual Meeting of Shareholders attended the meeting.

The Board has adopted written charters for all of its standing committees. The committee charters can be found on Associated's website at www.associatedbank.com, "Investor Relations," "Governance Documents." The following summarizes the responsibilities of the various committees.

The following table lists the members of each of the standing committees as of February 15, 2019 and the number of meetings held by each committee during 2018.

11

Audit Committee

The Audit Committee of the Board reviews the adequacy of internal accounting controls, reviews with Associated's independent registered public accounting firm its audit plan and the results of the audit engagement, reviews the scope and results of procedures for internal auditing, reviews and approves the general nature of audit services by the independent registered public accounting firm, and reviews quarterly and annual financial statements issued by Associated. The Audit Committee has the sole authority to appoint or replace the independent registered public accounting firm, subject to ratification by the shareholders at the Annual Meeting. Both the internal auditors and the independent registered accounting firm meet periodically with the Audit Committee and have access to the Audit Committee at any time. In addition, the Audit Committee oversees management's bank regulatory compliance.

Compensation and Benefits Committee

The functions of the Compensation and Benefits Committee of the Board include, among other duties directed by the Board, administration and oversight of Associated's executive compensation, employee benefit programs and director compensation. The Compensation and Benefits Committee sets the strategic direction of Associated's executive compensation policies and programs, and oversees managements' execution of and compliance with that strategic direction. The Compensation and Benefits Committee determines the compensation of Associated's Chief Executive Officer (the "CEO") and, with input from the CEO, establishes the compensation of Associated's other NEOs. The Compensation and Benefits Committee also has responsibility for ensuring that Associated's incentive compensation programs do not encourage unnecessary and excessive risk taking that would threaten the value of Associated or the integrity of its financial reporting. As permitted under its charter, the Compensation and Benefits Committee engages an independent compensation consultant to advise it on

the structure and amount of compensation of Associated's executive officers and Board of Directors, which is described in detail under "Executive Compensation – Compensation Discussion and Analysis," beginning on page 21.

Corporate Development Committee

The functions of the Corporate Development Committee of the Board include, among other duties directed by the Board, reviewing and recommending to the Board proposals for acquisition or expansion activities.

Corporate Governance Committee

The functions of the Corporate Governance Committee of the Board include corporate governance oversight, review and recommendation for Board approval of Board and committee charters. The Corporate Governance Committee also reviews the structure and composition of the Board, considers qualification requirements for continued Board service, and recruits new director candidates. The Corporate Governance Committee also advises the Board with respect to the Code of Business Conduct and Ethics.

Enterprise Risk Committee

The functions of the Enterprise Risk Committee of the Board include oversight of the enterprise-wide risk management framework of Associated, including the strategies, policies and practices established by management to identify, assess, measure and manage significant risks.

Trust Committee

The functions of the Trust Committee of the Board include the supervision of the trust and fiduciary activities of Associated Bank, National Association and Associated Trust Company, National Association to ensure the proper exercise of their trust/fiduciary powers.

SEPARATION OF BOARD CHAIRMAN AND CEO |

Associated's Corporate Governance Guidelines require the separation of the positions of Chairman of the Board and CEO. Currently, Mr. Hutchinson serves as Chairman of the Board and Mr. Flynn serves as CEO. These positions have been separated since Mr. Flynn joined Associated in December 2009, at which time the Board determined that Mr. Hutchinson, Associated's former Lead Director, serving as Chairman would enhance the effectiveness of the

Board. The Board also recognized that managing the Board in an increasingly complex economic and regulatory environment is a particularly time-intensive responsibility. Separating the roles allows Mr. Flynn to focus solely on his duties as the CEO. Separation of these roles also promotes risk management, enhances the independence of the Board from management and mitigates potential conflicts of interest between the Board and management.

12

BOARD DIVERSITY |

The Corporate Governance Committee considers attributes of diversity as outlined in the Corporate Governance Committee Charter when considering director nominees. While these attributes are considered on an ongoing basis, they are particularly considered in the recruitment and deliberation regarding prospective director nominees. The Corporate Governance Committee Charter outlines desired diversity characteristics for Board member experience and competencies. The Corporate Governance Committee believes that Associated's best interests are served by maintaining a diverse and active Board membership with members who are willing, able and well-situated to provide insight into current business conditions, opportunities and risks. The "outside" perspectives of the Board members are key factors in contributing to our success. The following diversity principles have been adopted:

The Corporate Governance Committee periodically assesses the effectiveness of these diversity principles. In light of the current Board's representation of diverse industry, background, communities within Associated's markets, professional expertise and racial and gender diversity, the Corporate Governance Committee believes that Associated has effectively implemented these principles.

DIRECTOR NOMINEE RECOMMENDATIONS |

The Corporate Governance Committee will consider any nominee recommended by a shareholder as described in this section under the same criteria as any other potential nominee. The Corporate Governance Committee believes that a nominee recommended for a position on the Board must have an appropriate mix of experience, diverse perspectives, and skills. Qualifications for nomination as a director can be found in the Corporate Governance Committee Charter. At a minimum, the core competencies should include accounting or finance experience, market familiarity, business or management experience, industry knowledge, customer-base experience or perspective, crisis response, leadership, and/or strategic planning.

A shareholder who wishes to recommend a person or persons for consideration as a nominee for election to the Board must send a written notice by mail, c/o Corporate Secretary, Associated Banc-Corp, 433 Main Street, Green Bay, Wisconsin 54301, that sets forth (1) the name, age, address (business and residence) and principal occupation or employment (present and

for the past five years) of each proposed nominee; (2) the number of shares of Associated beneficially owned (as defined by Section 13(d) of the Exchange Act) and any other ownership interest in the shares of Associated, whether economic or otherwise, including derivatives and hedges, by each proposed nominee; (3) any other information regarding such proposed nominee that would be required to be disclosed in a definitive proxy statement prepared in connection with an election of directors pursuant to Section 14(a) of the Exchange Act; and (4) the name and address (business and residential) of the shareholder making the recommendation; and (5) the number of shares of Associated beneficially owned (as defined by Section 13(d) of the Exchange Act) and any other ownership interest in the shares of Associated, whether economic or otherwise, including derivatives and hedges, by the shareholder making the recommendation. Associated may require any proposed nominee to furnish additional information as may be reasonably required to determine his or her qualifications to serve as a director of Associated.

13

COMMUNICATIONS BETWEEN SHAREHOLDERS, INTERESTED PARTIES AND THE BOARD |

Associated's Board provides a process for shareholders and other interested parties to send communications to the Board or any of the directors. Shareholders and other interested parties may send written communications to the Board or any of the individual directors by mail, c/o Corporate Secretary, Associated Banc-Corp, 433 Main Street, Green Bay, Wisconsin 54301. All communications will be compiled by Associated's Corporate Secretary and submitted to the Board or the individual director, as

applicable, on a regular basis unless such communications are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s). Examples of communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to Associated or Associated's business, or communications that relate to improper or irrelevant topics.

COMPENSATION AND BENEFITS COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

There are no Compensation and Benefits Committee interlocking relationships, as defined by the rules adopted by the SEC, and no Associated officer or

employee is a member of the Compensation and Benefits Committee.

14

SECURITY OWNERSHIP OF BENEFICIAL OWNERS |

The following table presents information regarding the beneficial ownership of Common Stock by each person who, to our knowledge, was the beneficial owner of 5% or more of our outstanding Common Stock on February 15, 2019.

The information below is from Schedule 13G and Schedule 13G/A filings reporting holdings as of December 31, 2018.

Name and Address | Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | ||

The Vanguard Group, Inc. | 15,394,732(3) | 9.35% | ||

BlackRock, Inc. | 15,228,128(4) | 9.24% | ||

Dimensional Fund Advisors LP | 10,724,871(5) | 6.51% | ||

| | | | | |

15

STOCK OWNERSHIP GUIDELINES FOR EXECUTIVE OFFICERS AND DIRECTORS |

Associated's Compensation and Benefits Committee believes that robust security ownership guidelines are an important means of ensuring that the interests of Associated's executive officers and directors are fully aligned with long-term shareholder value.

Associated's executive stock ownership guidelines, which apply to members of the Executive Committee (which is composed of colleagues that directly report to the Chief Executive Officer) and other key executives identified by the CEO, include:

Associated's director stock ownership guidelines require each independent member of the Board to own shares of Common Stock with a value equal to five times the value of the annual cash retainer payable to a director. Directors are required to attain such stock ownership goal no later than five years from the date on which they first were appointed to the Board. Balances in the Directors' Deferred Compensation Plan and RSUs count toward satisfying this requirement.

All Associated directors and NEOs are within the expected guidelines of the stock ownership requirements.

Under Associated's Insider Trading Policy, directors and executive officers are prohibited from engaging in hedging transactions with respect to Associated Common Stock and from pledging Associated Common Stock as collateral for loans, with the exception, for directors only, of pledges already in place when the prohibition on pledging was adopted in 2012. All of the NEOs are in compliance with this policy. Where applicable, shares pledged as collateral will not be counted for purposes of compliance with the stock ownership guidelines.

SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT |

Listed below is information as of February 15, 2019 concerning beneficial ownership of Common Stock, depositary shares and RSUs by each director and director nominee Michael J. Haddad, and each NEO, and by directors, the director nominee and executive

officers as a group. The information is based in part on information received from the respective persons and in part from the records of Associated. The RSUs and depositary shares are nonvoting.

16

COMMON STOCK |

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Shares Issuable Within 60 Days(2) | Percent of Class | |||

| Directors | ||||||

| Philip B. Flynn | 1,506,419 | 798,492 | * | |||

| John F. Bergstrom | 20,500 | — | * | |||

| Michael T. Crowley, Jr. | 955,672 | — | * | |||

| R. Jay Gerken | 2,000 | — | * | |||

| Judith P. Greffin | — | — | — | |||

| Michael J. Haddad | — | — | — | |||

| William R. Hutchinson | 52,301 | — | * | |||

| Robert A. Jeffe | — | — | — | |||

| Eileen A. Kamerick | — | — | — | |||

| Gale E. Klappa | — | — | — | |||

| Richard T. Lommen | 163,849 | — | * | |||

| Cory L. Nettles | — | — | — | |||

| Karen T. van Lith | 10,000 | — | * | |||

| John (Jay) B. Williams | 6,000 | — | * | |||

| Named Executive Officers | ||||||

| Christopher J. Del Moral-Niles | 207,452 | 115,971 | * | |||

| John A. Utz | 197,034 | 125,504 | * | |||

| Randall J. Erickson | 220,731 | 121,070 | * | |||

| David Stein | 260,192 | 160,641 | * | |||

| All Directors and Executive Officers as a group (28 persons) | 4,423,965 | 1,850,773 | 2.69% | |||

| | | | | | | |

RESTRICTED STOCK UNITS |

Beneficial Owner | Number of RSUs | |

Directors | ||

John F. Bergstrom | 38,250 | |

Michael T. Crowley, Jr. | 10,285 | |

R. Jay Gerken | 32,218 | |

Judith P. Greffin | 15,259 | |

Michael J. Haddad | — | |

William R. Hutchinson | 42,302 | |

Robert A. Jeffe | 38,250 | |

Eileen A. Kamerick | 38,250 | |

Gale E. Klappa | 21,362 | |

Richard T. Lommen | 38,250 | |

Cory L. Nettles | 37,253 | |

Karen T. van Lith | 38,250 | |

John (Jay) B. Williams | 38,250 | |

All Directors as a group | 388,179 | |

| | | |

17

Beneficial Owner | Number of RSUs | |

Named Executive Officers | ||

Philip B. Flynn | 173,181 | |

Christopher J. Del Moral-Niles | 40,933 | |

John A. Utz | 35,022 | |

Randall J. Erickson | 35,520 | |

David Stein | 26,914 | |

All Executive Officers as a group (15 persons) | 477,731 | |

| | | |

Each RSU represents the contingent right to receive one share of Common Stock. For the non-employee directors, the RSUs vest 100% on the fourth anniversary of the grant date. For executive officers, RSUs are subject to performance-based and/or time-based vesting criteria as set forth in the applicable RSU award agreement.

DEPOSITARY SHARES OF PREFERRED STOCK |

The following table provides information concerning beneficial ownership of depositary shares. Each depositary share represents a 1/40th ownership interest in a share of Associated's 6.125% Non-Cumulative Perpetual Preferred Stock, Series C (the "Series C Preferred Stock"), Associated's 5.375% Non-Cumulative Perpetual Preferred Stock, Series D (the "Series D Preferred Stock") or 5.875% Non-Cumulative Perpetual Preferred Stock, Series E (the "Series E Preferred Stock"), as indicated in the

table. Each of the Series C Preferred Stock, the Series D Preferred Stock and the Series E Preferred Stock has a liquidation preference of $1,000 per share (equivalent to $25 per depositary share). Holders of depositary shares are entitled to all proportional rights and preferences of the Series C Preferred Stock, the Series D Preferred Stock or the Series E Preferred Stock, as applicable (including dividend, voting, redemption and liquidation rights).

| Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||||||||||

| Series C Preferred Stock | Series D Preferred Stock | Series E Preferred Stock | Series C Preferred Stock | Series D Preferred Stock | Series E Preferred Stock | |||||||

| Directors | ||||||||||||

| Philip B. Flynn | 40,000 | — | 190,000 | 1.54% | — | 4.75% | ||||||

| John F. Bergstrom | — | 40,000 | 20,000 | — | 1.00% | * | ||||||

| Michael T. Crowley, Jr. | — | — | 8,000 | — | — | * | ||||||

| R. Jay Gerken | 4,000 | — | — | * | — | — | ||||||

| Judith P. Greffin | — | — | — | — | — | — | ||||||

| Michael J. Haddad | — | — | — | — | — | — | ||||||

| William R. Hutchinson | — | — | 4,000 | — | — | * | ||||||

| Robert A. Jeffe | — | 60,000 | — | — | 1.5% | — | ||||||

| Eileen A. Kamerick | — | — | — | — | — | — | ||||||

| Gale E. Klappa | — | 4,000 | 2,000 | — | * | * | ||||||

| Richard T. Lommen | — | — | 12,000 | — | — | * | ||||||

| Cory L. Nettles | — | — | — | — | — | — | ||||||

| Karen T. van Lith | — | — | — | — | — | — | ||||||

| John (Jay) B. Williams | — | — | — | — | — | — | ||||||

| | | | | | | | | | | | | |

| Named Executive Officers | ||||||||||||

| Christopher J. Del Moral-Niles | — | — | 2,000 | — | — | * | ||||||

| John A. Utz | — | — | — | — | — | — | ||||||

| Randall J. Erickson | — | — | — | — | — | — | ||||||

| David Stein | 1,000 | 2,000 | 4,000 | * | * | * | ||||||

| All Directors and Executive Officers as a group (28 persons) | 45,000 | 106,000 | 242,000 | 1.73% | 2.65% | 6.05% | ||||||

| | | | | | | | | | | | | |

18

OWNERSHIP IN DIRECTORS' DEFERRED COMPENSATION PLAN |

In addition to the beneficial ownership set forth in the Security Ownership of Directors and Management tables above, the non-employee directors have an account in the Directors' Deferred Compensation Plan with the balances in phantom stock as of February 15, 2019 set forth below. The dollar balances in these accounts are expressed daily in units of Common

Stock based on its daily closing price. These balances are included for purposes of the non-employee director holding requirements under the Director Stock Ownership Guidelines. The units are nonvoting. See "Director Compensation – Directors' Deferred Compensation Plan" on page 47.

Beneficial Owner | | Account Balance at February 15, 2019 | Equivalent Number of Shares of Common Stock(1) | ||

John F. Bergstrom | $ | 165,004 | 7,100 | ||

Michael T. Crowley, Jr. | — | — | |||

R. Jay Gerken | — | — | |||

Judith P. Greffin | — | — | |||

Michael J. Haddad | — | — | |||

William R. Hutchinson | 532,126 | 22,897 | |||

Robert A. Jeffe | 380,787 | 16,385 | |||

Eileen A. Kamerick | 542,933 | 23,362 | |||

Gale E. Klappa | — | — | |||

Richard T. Lommen | 1,825,665 | 78,557 | |||

Cory L. Nettles | — | — | |||

Karen T. van Lith | 494,710 | 21,287 | |||

John (Jay) B. Williams | 89,683 | 3,859 | |||

All Directors as a group | $ | 4,030,908 | 173,447 | ||

| | | | | | |

19

ADVISORY APPROVAL OF ASSOCIATED BANC-CORP'S NAMED EXECUTIVE OFFICER COMPENSATION

Associated's executive compensation program plays a key role in our ability to attract, retain and motivate the highest quality executive team. The principal objectives of Associated's executive compensation program are to align executive incentive compensation with long-term shareholder value creation, target executive compensation within competitive market ranges, and reward performance, without incenting unnecessary or excessive risk. As discussed in the Compensation Discussion and Analysis, which begins on page 21, the Compensation and Benefits Committee (the "Committee") has designed the program to incorporate a number of features and best practices that support these objectives, including, among others:

Shareholders are encouraged to carefully review the "Executive Compensation" section of this Proxy Statement in its entirety for a detailed discussion of Associated's executive compensation program.

As required under the Exchange Act, this proposal seeks a shareholder advisory vote on the approval of compensation of our Named Executive Officers as disclosed pursuant to Item 402 of Regulation S-K through the following resolution:

"Resolved, that the shareholders approve the compensation of Associated's Named Executive Officers as disclosed pursuant to the compensation rules of the SEC in the Compensation Discussion and Analysis, the compensation tables and any related materials."

Because this is an advisory vote, it will not be binding upon the Board of Directors. However, the Compensation and Benefits Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

RECOMMENDATION OF THE BOARD OF DIRECTORS |

The Board recommends that shareholders vote "FOR" the advisory approval of Associated Banc-Corp's Named Executive Officer compensation, as disclosed pursuant to the compensation disclosure rules of the SEC (which disclosure includes the Compensation Discussion and Analysis, the compensation tables and any related material). If a majority of the votes cast are voted "FOR" this Proposal 2, it will pass. Unless otherwise directed, all proxies will be voted "FOR" Proposal 2.

20

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

CD&A DIRECTORY |

EXECUTIVE SUMMARY |

Associated's executive compensation program is overseen by the Compensation and Benefits Committee (referred to in this section as the "Committee") and is intended to provide a balanced program that rewards corporate, business area, and individual results that support Associated's mission, with a focus on performance-based compensation. The program's strong pay-for-performance alignment is an important part of Associated's continuing commitment to enhancing long-term shareholder value.

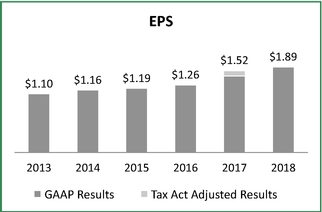

2018 Financial Performance

2018 was Associated's most profitable year in its entire history. Associated continues to maintain a healthy balance sheet with strong capital and liquidity levels. Associated is committed to making investments to expand services, develop new products and services, and drive new business. The completed acquisition of Bank Mutual Corporation in 2018 and the announcement in the fourth quarter of 2018 of the acquisition of the Wisconsin branch banking operations of The Huntington National Bank, a subsidiary of Huntington Bancshares Incorporated, further demonstrates Associated's commitment to profitable growth. In addition, during the first half of 2018, Associated acquired Anderson Insurance & Investment Agency, Inc. and Diversified Insurance Solutions.

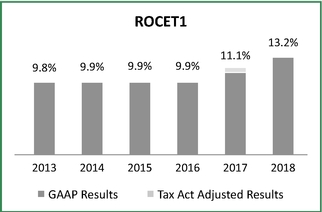

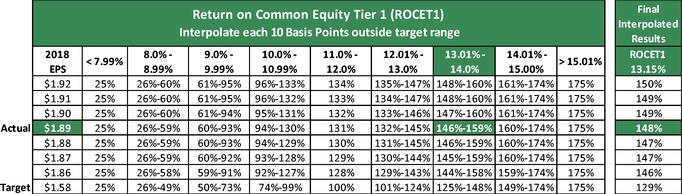

Reflecting another year of progress, Associated reported GAAP earnings per common share ("EPS") of $1.89 and Return on Common Equity Tier 1 ("ROCET1") of 13.15%, which reflects a year-over-year non-tax adjusted growth of 33% and 26% respectively.

Consistent with Associated's focus on delivering increased value and returning capital to its shareholders, dividends per common share increased 24% in 2018 to $0.62. In addition, in 2018 Associated repurchased over 9 million shares of Common Stock.

Associated continued to grow its balance sheet with average loans increasing 10% year-over-year to $22.7 billion. In addition, average deposits of $24.1 billion for 2018 increased 10% from 2017. These results reflect the continuing commitment of colleagues and executive officers throughout Associated to serving the needs of Associated's customers and enhancing long-term shareholder value.

Common Equity Tier 1, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of Associated's capital with the capital of other financial services companies. Management uses Common Equity Tier 1 along with other capital measures, to assess and monitor Associated's capital position. The Federal Reserve establishes regulatory capital requirements, including well-capitalized standards for Associated. Prior to 2015, the regulatory capital requirements effective for the Corporation followed the Capital Accord of the Basel Committee on Banking Supervision. Beginning January 1, 2015, the regulatory capital requirements effective for Associated follow Basel III, subject to certain transaction provisions. Common Equity Tier 1 prior to Basel III requirements was calculated as Tier 1 capital excluding qualifying perpetual preferred stock and qualifying trust preferred securities. See Table 26 in Part II, Item 7 of the 2018 Form 10-K for a reconciliation of Common Equity Tier 1.

21

|  |

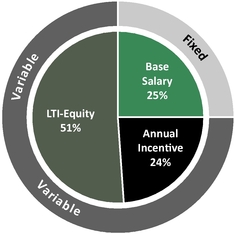

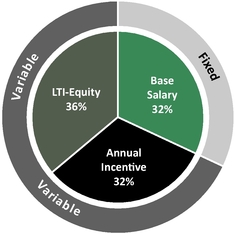

Key Elements of Associated's Executive Compensation Program

The key elements of our executive pay program (Salary, Annual Incentive, and Equity Awards) support the Committee's philosophy of providing a balanced program of short- and long-term compensation that targets market-competitive levels that attract and retain top talent.

| SALARY | INCENTIVE | EQUITY | ||

|  | |||

Base pay that is targeted at the midpoint of the market and adjusted to account for individual performance and tenure | A formulaic annual award that is based on the achievement of total Company performance and adjusted for individual performance | Equity represents the largest portion of executive pay with direct alignment to shareholder value and the value of our Common stock |

Key Executive Compensation Governance Practices

We believe our pay practices demonstrate our commitment to and alignment with stockholders' interests and our dedication to maintaining a compensation program supported by strong corporate governance. The Committee meets regularly and in addition to each member's own business knowledge of best practices, they receive guidance on best practices and market trends from the Committee's independent compensation consultant, Pay Governance LLC. Strong governance is exemplified by the detailed chart below which describes the practices that are included and excluded in our programs.

22

| We Do | We Don't | |||||||||

| Pay for performance by having a significant portion of executives' compensation tied to Company performance and weighted towards long-term. | X | Have excess perquisites and include only executive physicals, financial planning services and access to clubs for business purposes. | ||||||||

Utilize Long-Term Incentive pay that is delivered in equity and does not have a cash component. | X | Make tax gross-up payments in connection with excise tax or other tax liabilities except for relocation. | ||||||||

Use robust incentive plan governance that is reviewed by internal key experts, by the Committee, and by an independent third party as needed. | X | Pay dividend equivalents until the end of the performance period on unvested performance stock. Dividends are calculated based on the number of shares awarded. | ||||||||

Retain an independent compensation consultant selected by the Committee for Executive pay consultation. | X | Allow hedging or pledging of Company securities by executive officers or directors. | ||||||||

Require a double trigger for vesting of equity awards and severance payments upon a change of control. | X | Have employment agreements with our NEOs. | ||||||||

Clawback pay related to material restatement of financial statements. | ||||||||||

Hold an annual say-on-pay vote in order to elicit regular feedback from stockholders. | ||||||||||

Hold proactive shareholder engagement meetings to solicit feedback on our corporate governance and compensation practices. | ||||||||||

Require stock ownership for executives based on a salary multiple of stockand retention of a portion of shares after vesting. | ||||||||||

| | | | | | | | | | | |

Shareholder Outreach and Response to 2018 Advisory Vote on NEO Compensation

Associated's 2018 advisory shareholder vote on NEO compensation resulted in more than 79% of the votes cast in favor of the program. On an annual basis, the Company is in direct dialogue with between 50 and 100 institutional investors through regular attendance at industry conferences and investor events. This includes regular, private one-on-one dialogue with most of the Company's top 20 shareholders, which represents 52% of outstanding shares. In addition, management engages with investors through conference calls to discuss Company results, performance relative to industry trends, peer metrics, governance matters, and the Company's strategic direction. During 2018, key executive officers and senior leaders engaged in specific outreach with two significant shareholders and two shareholder advisory firms with respect to its compensation practices to gain an understanding of shareholder views on the Committee's decisions and to provide clarification on the use of common publicly reported metrics that align the performance plans with shareholder interests. The discussion focused on components of Associated's incentive compensation program and design choices by the Committee. These discussions and outcomes are described below.The Committee took comments into consideration and has made forward looking modifications, which are described below and discussed further on page 37 under Compensation Decisions for 2019.

23

Key Topics from Shareholder and Advisory Firm Discussions

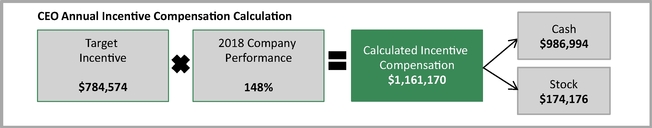

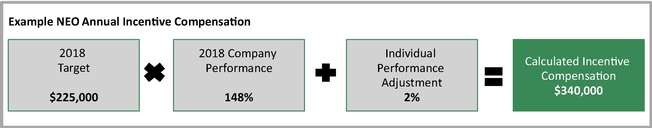

Topic #1: We have enhanced the disclosure around the formulas used by Associated to determine the CEO and NEO pay determination for the Annual Incentive Award to make it clearer.

Our disclosure more clearly depicts the formula mechanics used to calculate the CEO and NEO Annual Incentive Awards (see pages 28 to 31 for further detail). | |||

| Additionally, the Committee has chosen to further strengthen the formula by adding a cap to the amount of upward individual adjustment allowable. The CEO may apply a maximum upward adjustment, with the Committee's approval, of 20% to the individual executive bonus award. In 2018 the maximum upward adjustment of any NEO award was 3%. |

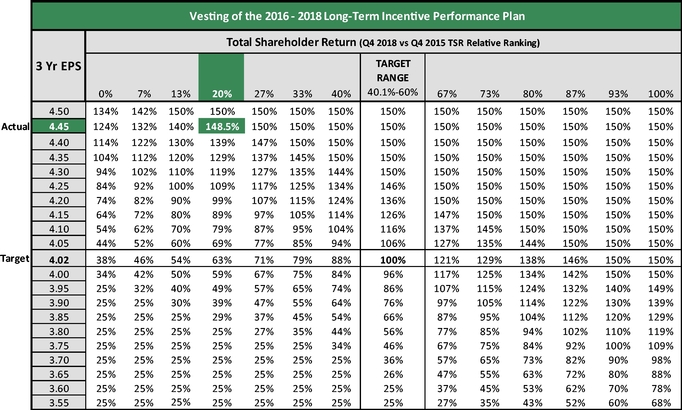

Topic #2: We have enhanced the description of the Long-Term Incentive Performance Plan, to provide a clearer description of the performance goals, including threshold, target and maximum.

Our current LTIPP design is based on an inter-dependent matrix for EPS and relative TSR that allows for continuous scaling of the metrics. The Committee has modified the LTIPP design for 2019 by moving to an additive model. This model will have the following features: |

| – | EPS and TSR will be individually weighted (50% each) | ||

| – | Relative TSR will have a threshold of 25% | ||

| – | EPS will have a threshold and maximum of 20% below or above target, respectively | ||

| – | Payout range will be from 0% to 150% (previous range was 25% to 150%) | ||

| – | Company performance achievement must reach the highest tier on each metric to achieve a maximum payout, therefore resulting in no offsetting of one metric by the other. |

Topic #3: Why does Associated use EPS in both the short- and long-term incentive plans?

The Committee believes that EPS is a strong indicator of value measurement for our shareholders. The continuity of using a short-term EPS and a cumulative long-term EPS ensures that our actions take into consideration the impact of short-term and long-term actions. |

Key Changes to Executive Compensation Programs in 2018

At the beginning of each fiscal year, the Committee evaluates the market competitiveness of compensation for each of our executive officers in order to guide target compensation decisions for the coming year. With the assistance of Pay Governance, the Committee reviews the compensation of our executive officers against that of the Company's compensation peer group, as well as the financial services industry in general. At the beginning of 2018, after reviewing the competitive pay data provided by Pay Governance, the Committee decided to make no material changes to the target compensation levels for our NEOs.

As described above, based on shareholder and shareholder advisory firm feedback on the annual short-term incentive plan, the Committee implemented a 20% upward cap and unlimited downward reduction to the individual executive performance calculation to bolster Associated's formulaic approach to the annual incentive plan calculations. The Committee believes that this addition will further minimize any discretionary aspect of the NEOs annual incentive determination and further align incentive compensation with the performance results of the Company.

24

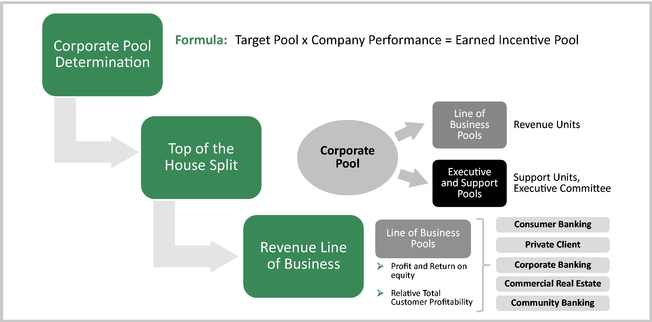

OVERVIEW OF COMPENSATION METHODOLOGY |

Philosophy and Objectives

Associated's executive compensation program is designed to provide each executive officer of Associated with a competitive total compensation package aligned with several objectives, including:

The Committee used the objectives listed above to drive the methodology for the design of the 2018 Executive Compensation Program with targeted total compensation for the NEOs and other executive officers to approximate median levels for executives with comparable responsibilities at financial institutions of comparable asset size. In addition to compensation levels, the Committee considers Associated's financial performance relative to its peers as part of the determination of total compensation opportunities. The Committee believes that peer comparison is important to the objectives of the program because Associated competes with a large number of financial institutions across the country for the services of qualified executive officers. Consideration was also given to individual factors based on performance evaluations. Where the Committee deems appropriate, total compensation opportunities may exceed the market median in order to attract currently employed, high-quality executives to join Associated and to retain experienced, high-performing executive officers. Conversely, Associated may target compensation below median market levels for newly promoted executives. The allocation of the various components of the NEOs' total compensation package is described below in the "Components of Total Executive Compensation for 2018" section beginning on page 27.

Peer Group

The Committee, with the input of Pay Governance, reviewed the 2017 peer group and made no changes to the peer group for 2018. The Committee noted that the comprehensive review process determined that Associated's asset scope remained aligned with the peer group median. The Committee also ensured that the peer group was comprehensive and included peers that were larger in asset size to allow for aspirational growth comparisons. The 2018 peer group consisted of bank holding companies that the Committee and Pay Governance believe are appropriate for comparison purposes in terms of size (based on total assets) and business composition and consisted of companies ranging in asset size from approximately $22.6 billion to approximately $71.6 billion that were engaged in lines of business similar to Associated. The median asset size of the companies in the peer group was approximately $32.0 billion, compared to Associated's assets of $30.5 billion, as of December 31, 2017. The peer group companies were:

BOK Financial Corporation | First Horizon National Corporation | Valley National Bancorp | |||||

Comerica Incorporated | People's United Financial | Webster Financial Corporation | |||||

Commerce Bancshares, Inc. | Prosperity Bancshares | Wintrust Financial Corporation | |||||

Cullen/Frost Bankers, Inc. | SVB Financial Group | Zions Bancorporation | |||||

East West Bancorp, Inc. | Synovus Financial Corp. | ||||||

First Citizens BancShares Inc. | TCF Financial Corporation | ||||||

25

While the peer group was a key point of comparison in the total compensation strategy, the Committee also took into account broader retail banking and financial services industry survey data as part of its compensation determinations to provide broader market context. Pay Governance analyzed compensation data from the Willis Towers Watson 2017 Executive Financial Services Survey of approximately 186 participants, including members of Associated's peer group. In analyzing the data, Pay Governance advised that the additional comparisons, beyond the peer group, provided a broader perspective from which to appropriately compare compensation, particularly for staff positions. When making compensation-related decisions, the Committee considered information that compared each executive officer's base salary and total compensation to the 25th, 50th and 75th percentiles of these market reference points.

Role of Independent Compensation Consultant

The Committee has engaged Pay Governance LLC since 2010 to advise on a variety of matters relating to the executive compensation program. Pay Governance reports directly to the Committee and provides no other services to Associated. The Committee has established procedures that it considers sufficient to ensure that the compensation consultant's advice to the Committee remains objective and is not influenced by Associated's management, including:

Pay Governance performed a competitive analysis of Associated's senior executive compensation levels and provided financial performance and other market data with respect to the peer group and a broader financial services survey group as a context for the Committee's assessment of competitive compensation levels, as further described below.

Role of Management

As part of the annual compensation review process, the CEO, the Chief Human Resources Officer, and the Deputy Chief Human Resources Officer interact with the Committee and Pay Governance, providing information about the current compensation structure, details regarding executive compensation, individual performance assessments, and descriptions of the job responsibilities of executive officers. The CEO typically makes recommendations to the Committee with respect to the compensation of NEOs, other than himself, and the Committee, determines CEO compensation in executive session without the CEO present.

Role of the Committee

The purpose of the Committee is to assist the Board of Directors in fulfilling its responsibility to oversee all of Associated's executive compensation. The Committee works closely with Pay Governance to make program decisions about, and set the framework for, Associated's executive compensation program. Among other things, the Committee's responsibilities include:

26