Exhibit 99.1

Associated Banc-Corp Investor Presentation

February 2012

Forward-Looking Statements

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. These statements may be identified by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or similar expressions. Outcomes related to such statements are subject to numerous risk factors and uncertainties including those listed in the company’s most recent Form 10-K and any subsequent Form 10-Q.

1

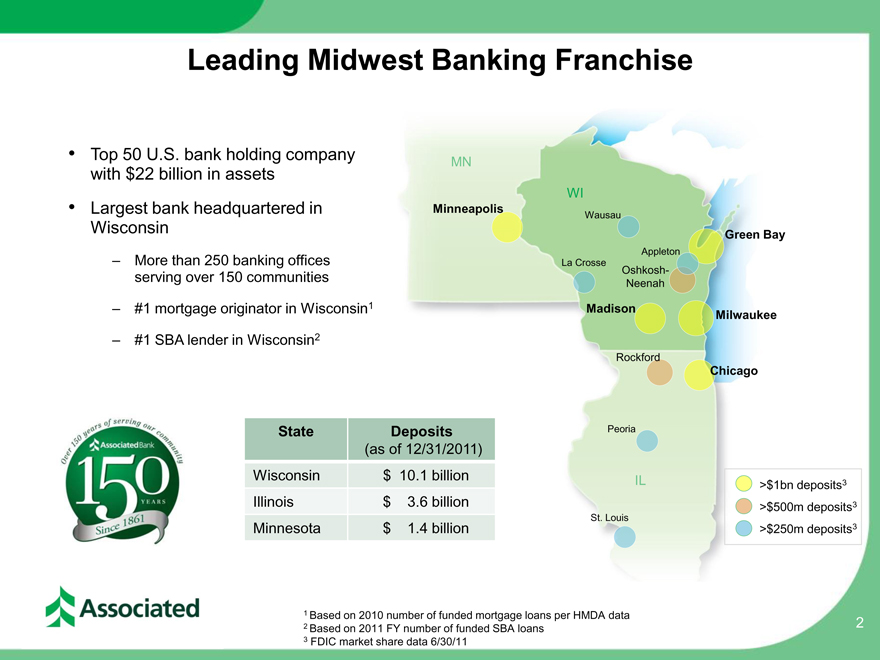

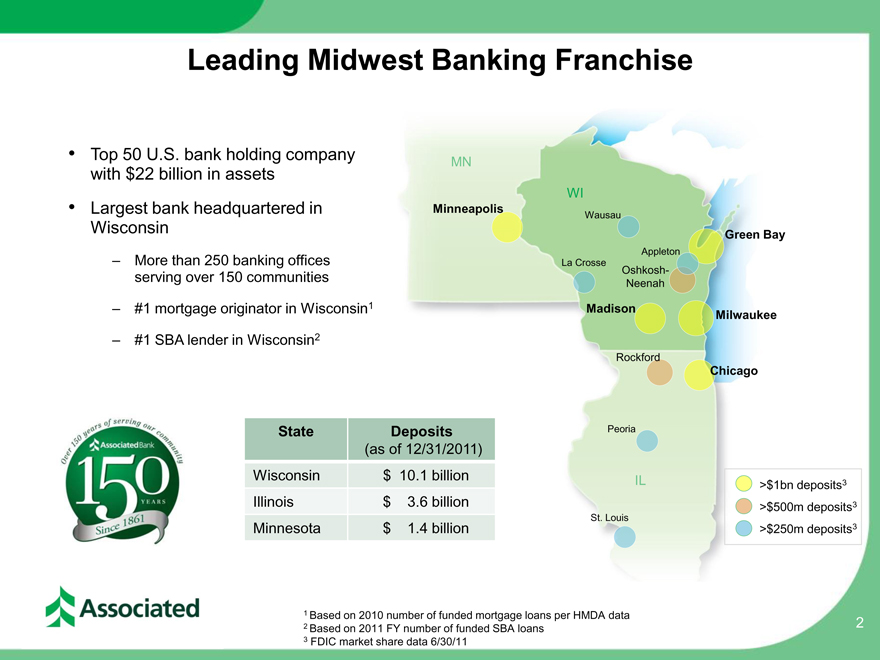

Leading Midwest Banking Franchise

Top 50 U.S. bank holding company with $22 billion in assets

Largest bank headquartered in Wisconsin

– More than 250 banking offices serving over 150 communities

– #1 mortgage originator in Wisconsin1

– #1 SBA lender in Wisconsin2

State Deposits

(as of 12/31/2011)

Wisconsin $ 10.1 billion

Illinois $ 3.6 billion

Minnesota $ 1.4 billion

MN

WI

Minneapolis

Wausau

Green Bay

Appleton La Crosse Oshkosh-Neenah

Madison

Milwaukee

Rockford

Chicago

Peoria

IL

St. Louis

>$1bn deposits3

>$500m deposits3

>$250m deposits3

1 Based on 2010 number of funded mortgage loans per HMDA data

2 Based on 2011 FY number of funded SBA loans

3 FDIC market share data 6/30/11

2

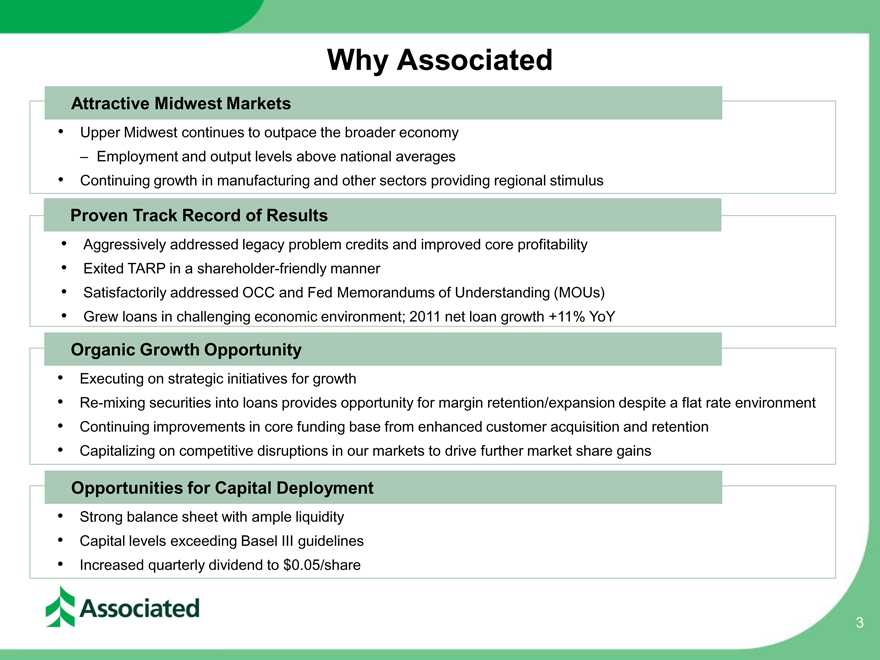

Why Associated

Attractive Midwest Markets

• Upper Midwest continues to outpace the broader economy

– Employment and output levels above national averages

• Continuing growth in manufacturing and other sectors providing regional stimulus

Proven Track Record of Results

• Aggressively addressed legacy problem credits and improved core profitability

• Exited TARP in a shareholder-friendly manner

• Satisfactorily addressed OCC and Fed Memorandums of Understanding (MOUs)

• Grew loans in challenging economic environment; 2011 net loan growth +11% YoY

Organic Growth Opportunity

• Executing on strategic initiatives for growth

• Re-mixing securities into loans provides opportunity for margin retention/expansion despite a flat rate environment

• Continuing improvements in core funding base from enhanced customer acquisition and retention

• Capitalizing on competitive disruptions in our markets to drive further market share gains

Opportunities for Capital Deployment

• Strong balance sheet with ample liquidity

• Capital levels exceeding Basel III guidelines

• Increased quarterly dividend to $0.05/share

3

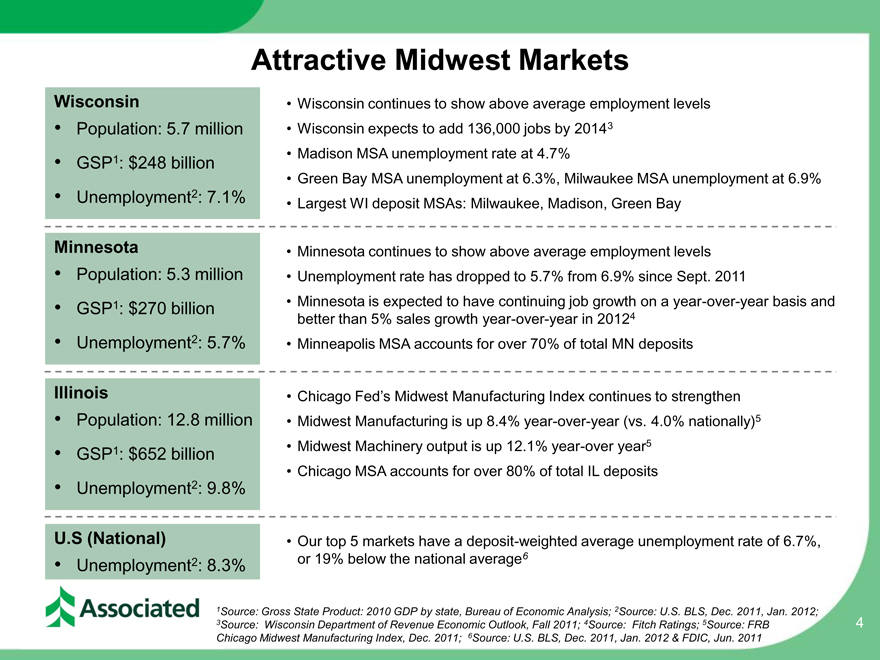

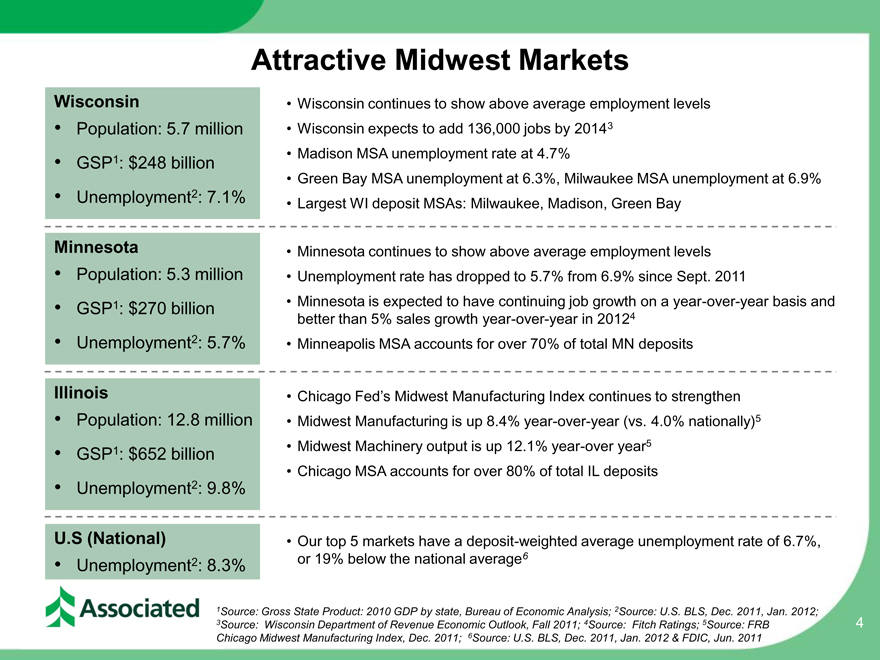

Attractive Midwest Markets

Wisconsin •Wisconsin continues to show above average employment levels

• Population: 5.7 million •Wisconsin expects to add 136,000 jobs by 20143

• GSP1: $248 billion •Madison MSA unemployment rate at 4.7%

•Green Bay MSA unemployment at 6.3%, Milwaukee MSA unemployment at 6.9%

• Unemployment2: 7.1% •Largest WI deposit MSAs: Milwaukee, Madison, Green Bay

Minnesota •Minnesota continues to show above average employment levels

• Population: 5.3 million •Unemployment rate has dropped to 5.7% from 6.9% since Sept. 2011

• GSP1: $270 billion •Minnesota is expected to have continuing job growth on a year-over-year basis and

better than 5% sales growth year-over-year in 20124

• Unemployment2: 5.7% •Minneapolis MSA accounts for over 70% of total MN deposits

Illinois •Chicago Fed’s Midwest Manufacturing Index continues to strengthen

• Population: 12.8 million •Midwest Manufacturing is up 8.4% year-over-year (vs. 4.0% nationally)5

• GSP1: $652 billion •Midwest Machinery output is up 12.1% year-over year5

•Chicago MSA accounts for over 80% of total IL deposits

• Unemployment2: 9.8%

U.S (National) •Our top 5 markets have a deposit-weighted average unemployment rate of 6.7%,

• Unemployment2: 8.3% or 19% below the national average6

1Source: Gross State Product: 2010 GDP by state, Bureau of Economic Analysis; 2Source: U.S. BLS, Dec. 2011, Jan. 2012; 3Source: Wisconsin Department of Revenue Economic Outlook, Fall 2011; 4Source: Fitch Ratings; 5Source: FRB

Chicago Midwest Manufacturing Index, Dec. 2011; 6Source: U.S. BLS, Dec. 2011, Jan. 2012 & FDIC, Jun. 2011

4

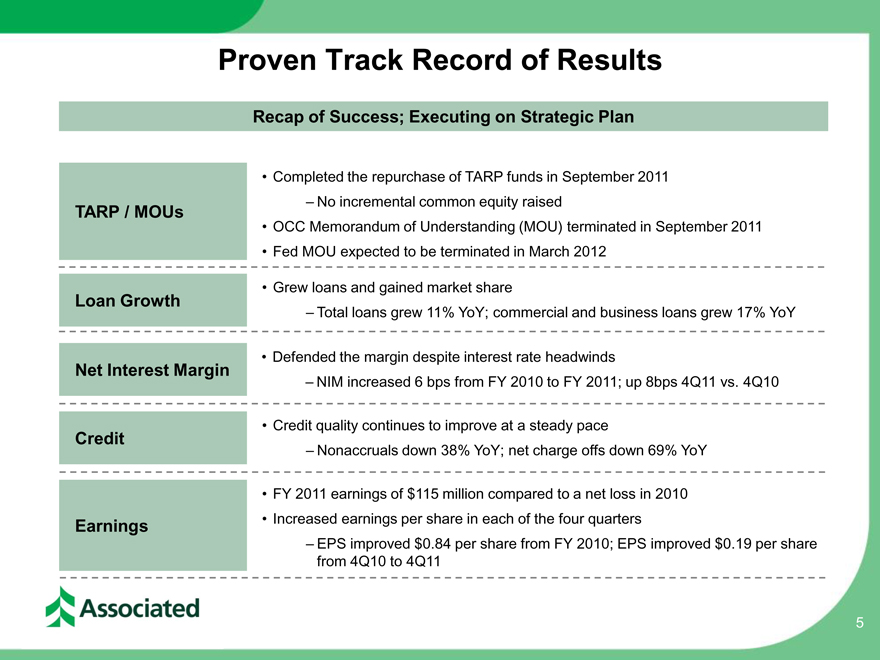

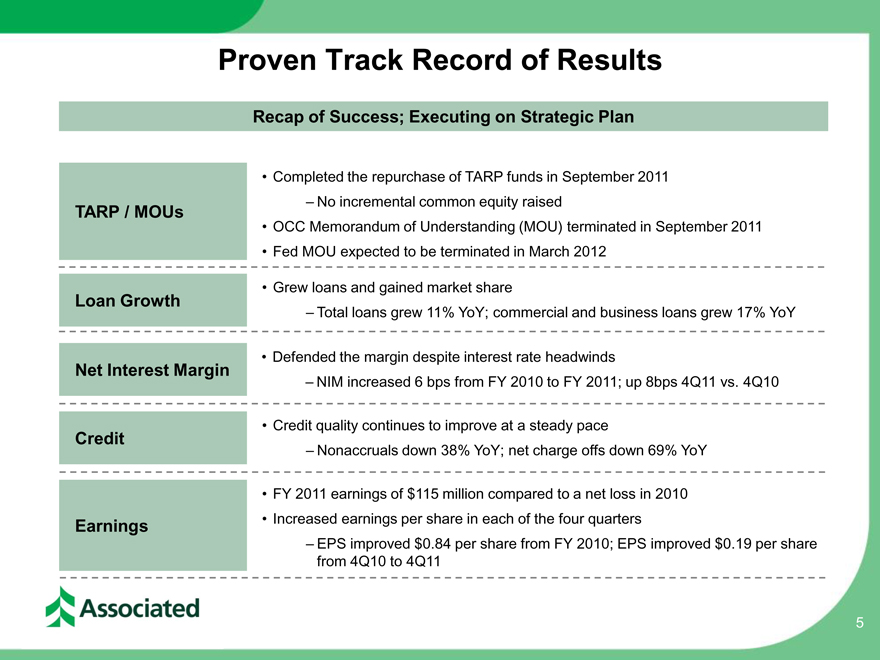

Proven Track Record of Results

Recap of Success; Executing on Strategic Plan

•Completed the repurchase of TARP funds in September 2011

TARP / MOUs –No incremental common equity raised

•OCC Memorandum of Understanding (MOU) terminated in September 2011

•Fed MOU expected to be terminated in March 2012

•Grew loans and gained market share

Loan Growth

–Total loans grew 11% YoY; commercial and business loans grew 17% YoY

•Defended the margin despite interest rate headwinds

Net Interest Margin

–NIM increased 6 bps from FY 2010 to FY 2011; up 8bps 4Q11 vs. 4Q10

•Credit quality continues to improve at a steady pace

Credit

–Nonaccruals down 38% YoY; net charge offs down 69% YoY

•FY 2011 earnings of $115 million compared to a net loss in 2010

Earnings •Increased earnings per share in each of the four quarters

–EPS improved $0.84 per share from FY 2010; EPS improved $0.19 per share

from 4Q10 to 4Q11

5

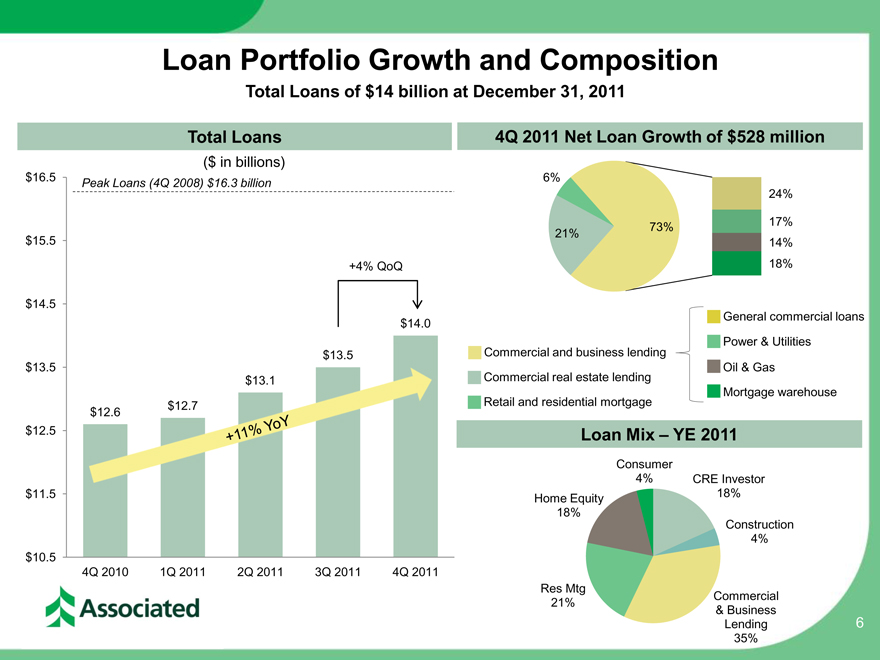

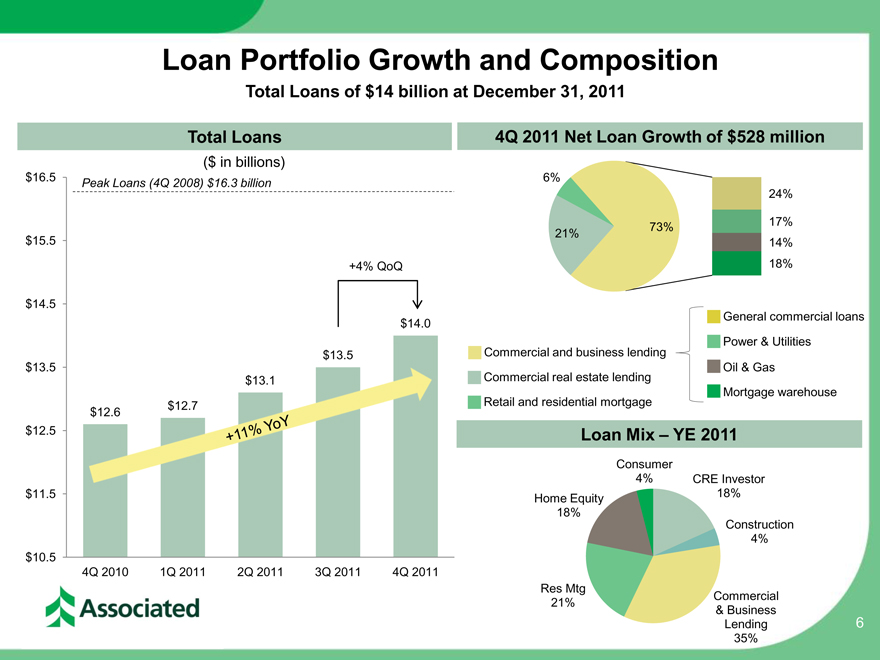

Loan Portfolio Growth and Composition

Total Loans of $14 billion at December 31, 2011

Total Loans

$16.5 Peak Loans (4Q 2008) $16.3 billion

$15.5

+4% QoQ

$14.5

$14.0

$13.5

$13.5

$13.1

$12.6 $12.7

$12.5

$11.5

$10.5

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

+11% YOY

4Q 2011 Net Loan Growth of $528 million

6%

24%

73% 17%

21%

14%

18%

Commercial and business lending Commercial real estate lending Retail and residential mortgage

General commercial loans Power & Utilities Oil & Gas Mortgage warehouse

Loan Mix – YE 2011

Consumer

4% CRE Investor

Home Equity 18%

18%

Construction

4%

Res Mtg

21% Commercial

& Business

Lending

35%

6

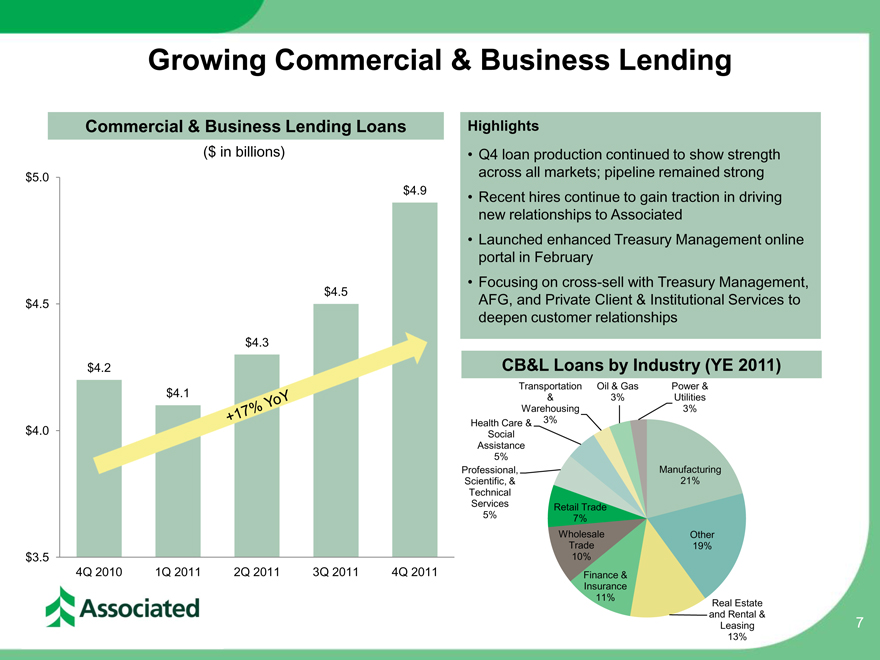

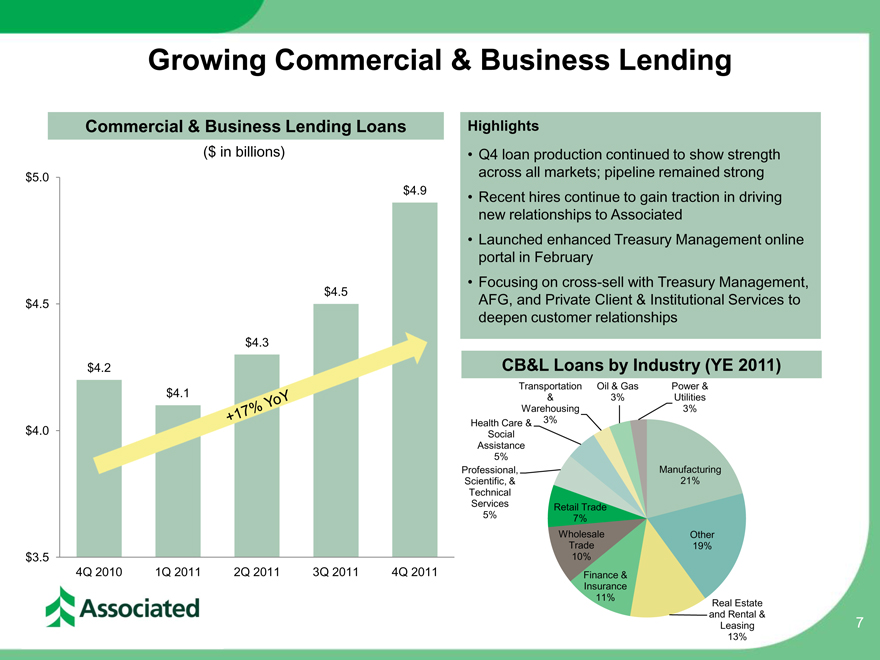

Growing Commercial & Business Lending

Commercial & Business Lending Loans

($ in billions)

$5.0

$4.9

$4.5

$4.5

$4.3

$4.2

$4.1

$4.0

$3.5

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

+17% YOY

Highlights

•Q4 loan production continued to show strength across all markets; pipeline remained strong •Recent hires continue to gain traction in driving new relationships to Associated •Launched enhanced Treasury Management online portal in February •Focusing on cross-sell with Treasury Management, AFG, and Private Client & Institutional Services to deepen customer relationships

CB&L Loans by Industry (YE 2011)

Transportation Oil & Gas Power &

3% Utilities

Warehousing 3%

Health Care & 3%

Social

Assistance

5%

Professional, Manufacturing

Scientific, & 21%

Technical

Services Retail Trade

5% 7%

Wholesale Other

Trade 19%

10%

Finance &

Insurance

11% Real Estate

and Rental &

Leasing

13%

7

Growing Commercial Real Estate Lending

Commercial Real Estate Lending Loans

($ in billions)

$5.0

$4.5

+ 9% YoY

$4.0

$3.5

$3.1

$3.0

$3.0 $2.9 $2.9 $2.9

$2.5

$2.5 $2.6

$2.3 $2.4 $2.4

$2.0

$1.5

$1.0

$0.5

$0.0

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

Construction

Investor commercial real estate

Highlights

•Growing multi-family lending portfolio •Net growth over $200 million in 2011 •Continuing strong growth across the footprint •~90% of CRE loans are in core three-state footprint

CRE Loans by Collateral (YE 2011)

Single

Hotel/Motel family/condo

4% 1%

Other

7% Office/Mixed

Use

Industrial 22%

8%

Retail

17% Multi-family

22%

Construction

19%

8

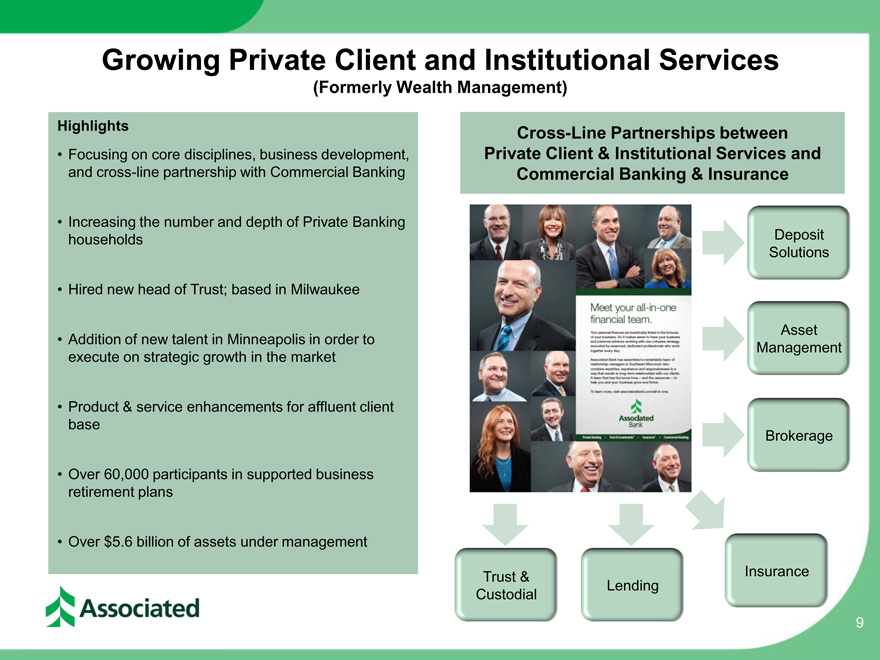

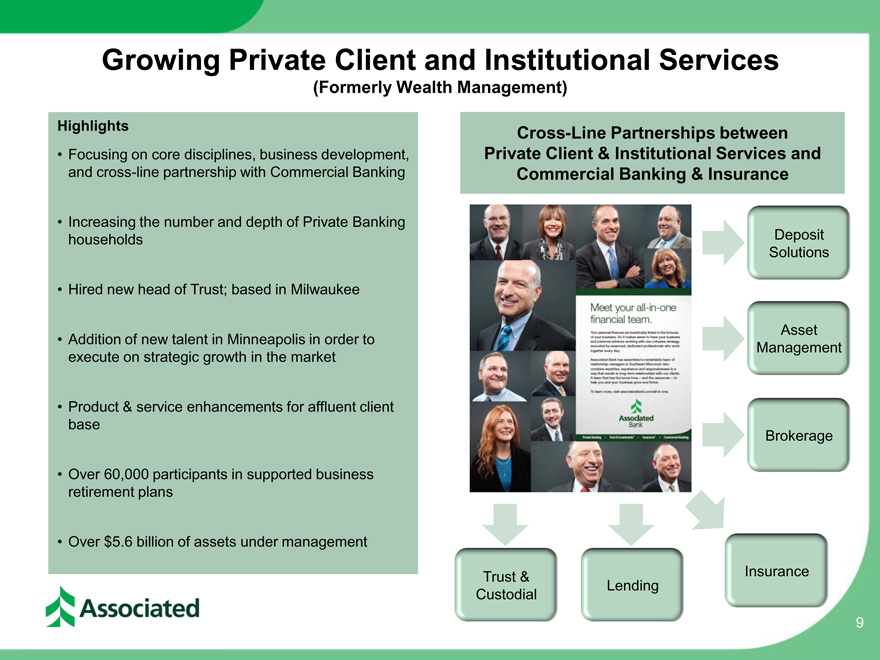

Growing Private Client and Institutional Services

(Formerly Wealth Management)

Highlights

•Focusing on core disciplines, business development, and cross-line partnership with Commercial Banking

•Increasing the number and depth of Private Banking households

•Hired new head of Trust; based in Milwaukee

•Addition of new talent in Minneapolis in order to execute on strategic growth in the market

•Product & service enhancements for affluent client base

•Over 60,000 participants in supported business retirement plans

•Over $5.6 billion of assets under management

Cross-Line Partnerships between Private Client & Institutional Services and Commercial Banking & Insurance

Deposit

Solutions

Asset

Management

Brokerage

Trust & Insurance

Custodial Lending

9

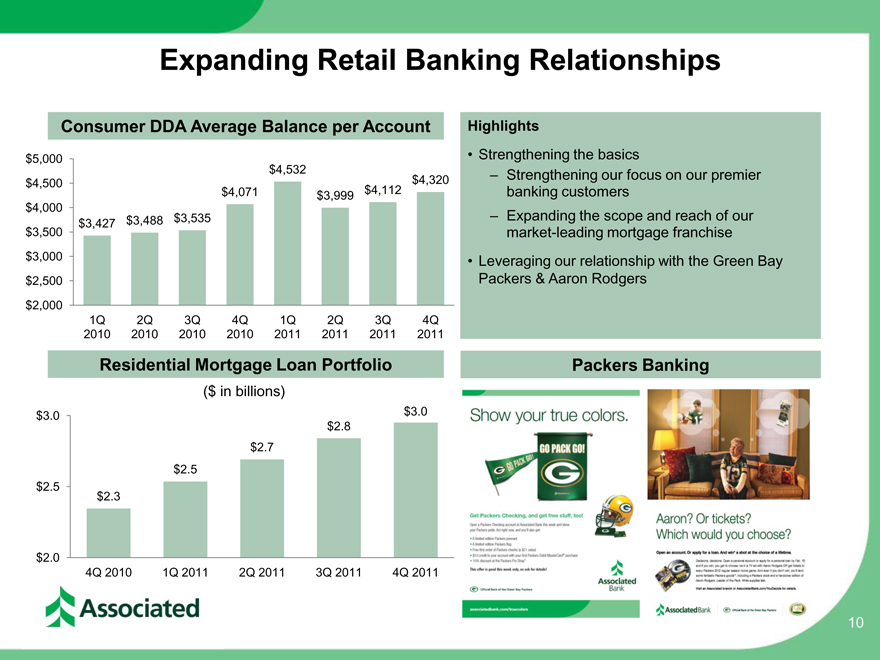

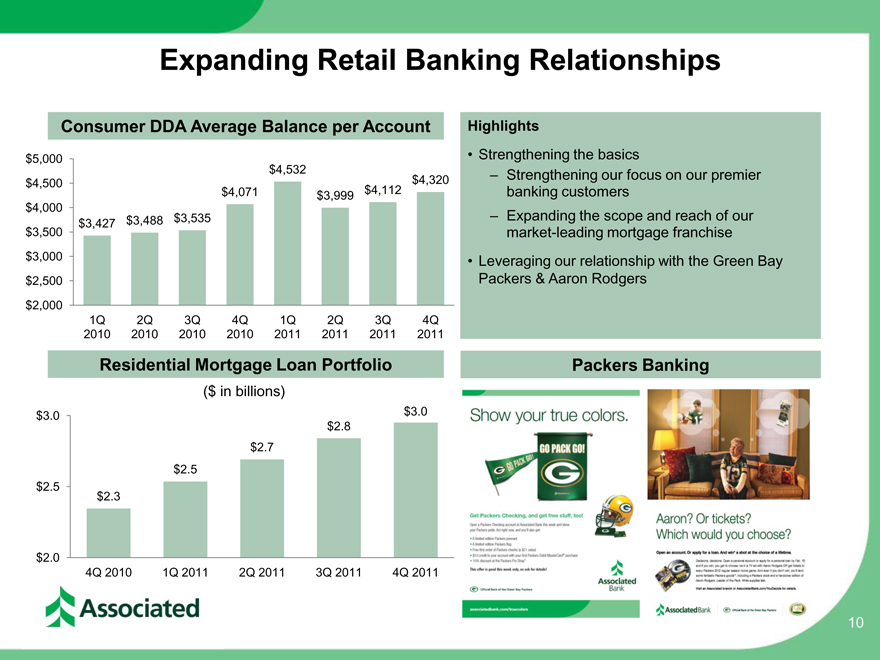

Expanding Retail Banking Relationships

Consumer DDA Average Balance per Account

$5,000

$4,532

$4,500 $4,320

$4,071 $3,999 $4,112

$4,000

$3,427 $3,488 $3,535

$3,500

$3,000

$2,500

$2,000

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q

2010 2010 2010 2010 2011 2011 2011 2011

Residential Mortgage Loan Portfolio

($ in billions)

$3.0 $3.0

$2.8

$2.7

$2.5

$2.5

$2.3

$2.0

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

Highlights

•Strengthening the basics

– Strengthening our focus on our premier banking customers

– Expanding the scope and reach of our market-leading mortgage franchise •Leveraging our relationship with the Green Bay Packers & Aaron Rodgers

Packers Banking

10

Footprint Update

Differentiating Associated in Branch Banking

Highlights

•Installation of

consistent signage

throughout the

footprint is largely

complete

•Completed the

remodel, relocation,

or new construction

Relocated office in Waukesha, WI Our first in-store location in the Milwaukee area; of over 30 branches

includes new in-store design elements in 2011

•Planned

consolidation of 21

branches in 1H2012

•Announced three

additional branch

sales in Jan. 2012;

these locations are

well outside of core

retail footprint

Relocated office in Manitowoc, WI; History wall in renovated office in Neenah, WI; •50 remodels

one of our three founding communities one of our three founding communities planned in 2012

11

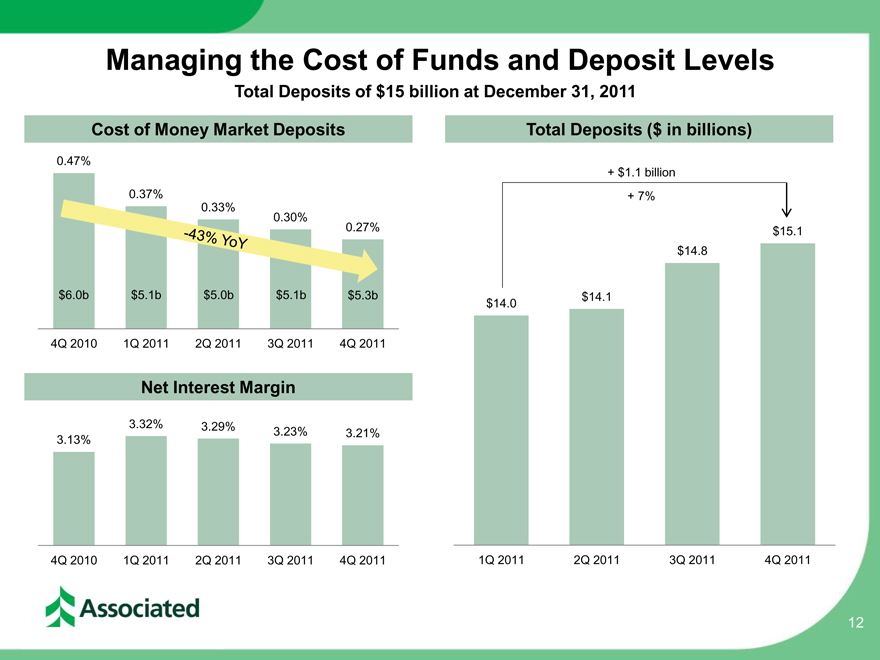

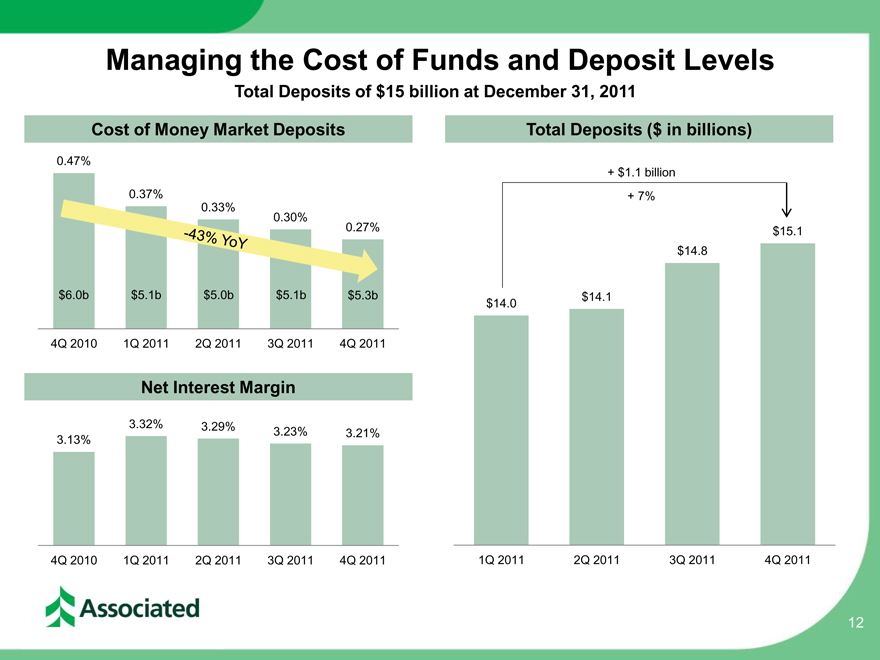

Managing the Cost of Funds and Deposit Levels

Total Deposits of $15 billion at December 31, 2011

Cost of Money Market Deposits

0.47%

0.37%

0.33%

0.30%

0.27%

$6.0b $5.1b $5.0b $5.1b $5.3b

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011 -43% YoY

Net Interest Margin

3.32% 3.29% 3.23% 3.21%

3.13%

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

Total Deposits ($ in billions)

+ $1.1 billion

+ 7%

$15.1

$14.8

$14.0 $14.1

1Q 2011 2Q 2011 3Q 2011 4Q 2011

12

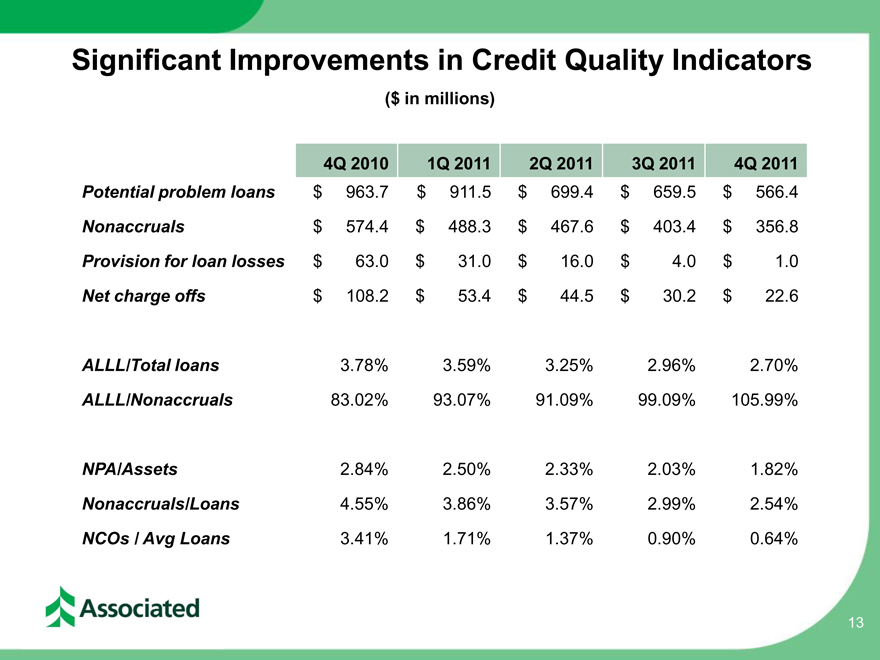

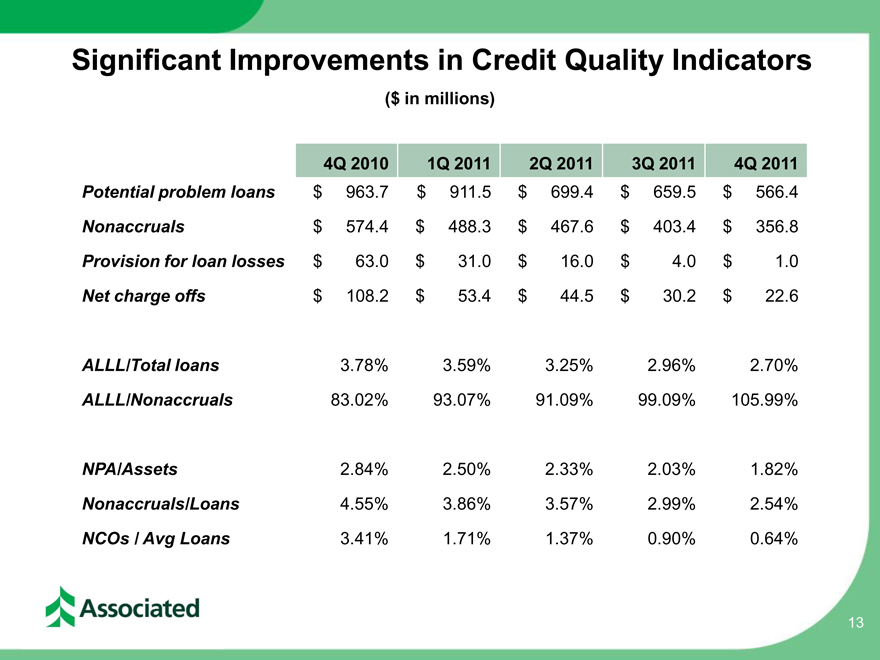

Significant Improvements in Credit Quality Indicators

($ in millions)

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

Potential problem loans $ 963.7 $ 911.5 $ 699.4 $ 659.5 $ 566.4

Nonaccruals $ 574.4 $ 488.3 $ 467.6 $ 403.4 $ 356.8

Provision for loan losses $ 63.0 $ 31.0 $ 16.0 $ 4.0 $ 1.0

Net charge offs $ 108.2 $ 53.4 $ 44.5 $ 30.2 $ 22.6

ALLL/Total loans 3.78% 3.59% 3.25% 2.96% 2.70%

ALLL/Nonaccruals 83.02% 93.07% 91.09% 99.09% 105.99%

NPA/Assets 2.84% 2.50% 2.33% 2.03% 1.82%

Nonaccruals/Loans 4.55% 3.86% 3.57% 2.99% 2.54%

NCOs / Avg Loans 3.41% 1.71% 1.37% 0.90% 0.64%

13

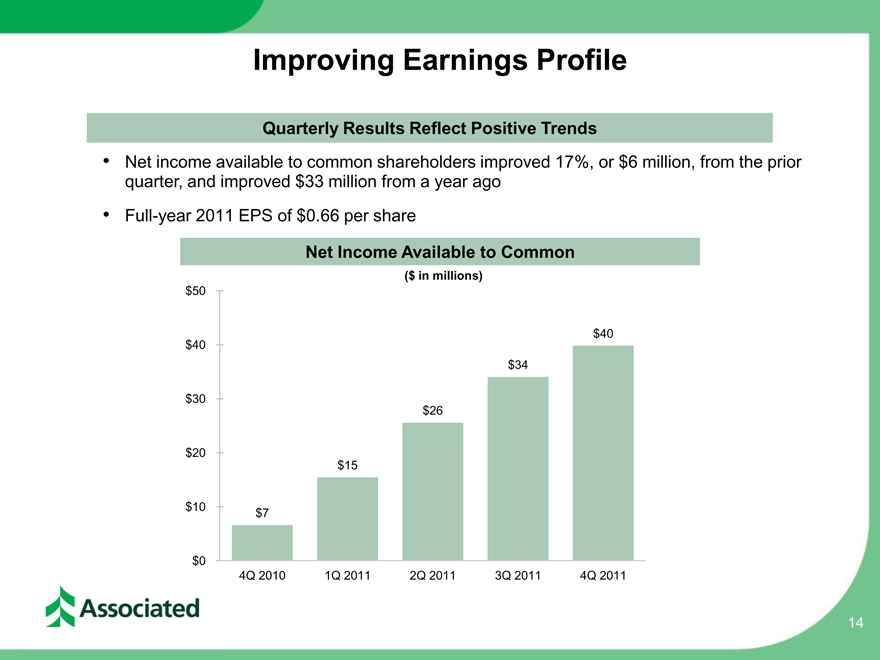

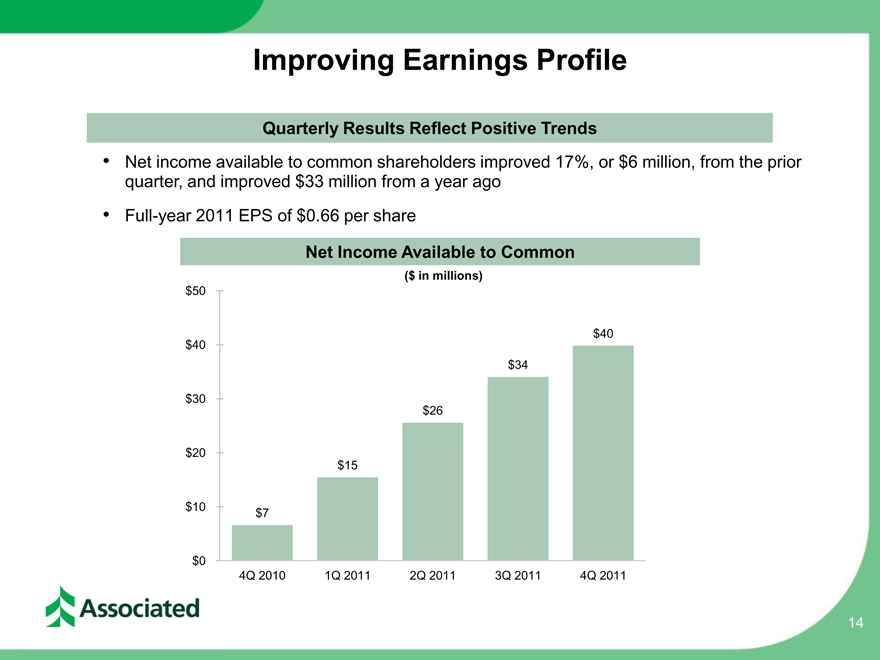

Improving Earnings Profile

Quarterly Results Reflect Positive Trends

•Net income available to common shareholders improved 17%, or $6 million, from the prior quarter, and improved $33 million from a year ago

•Full-year 2011 EPS of $0.66 per share

Net Income Available to Common

($ in millions)

$50

$40

$40

$34

$30

$26

$20

$15

$10 $7

$0

4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

14

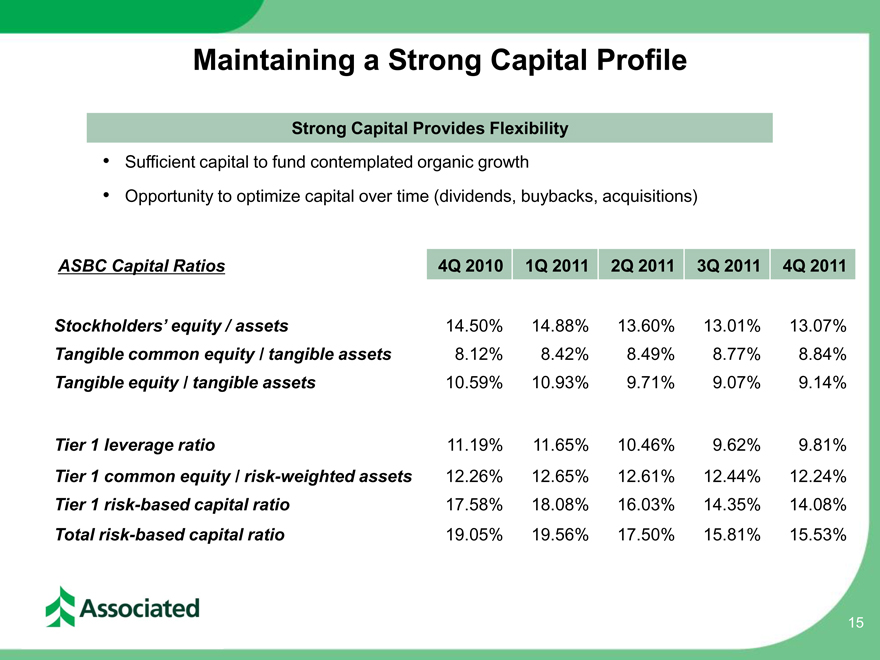

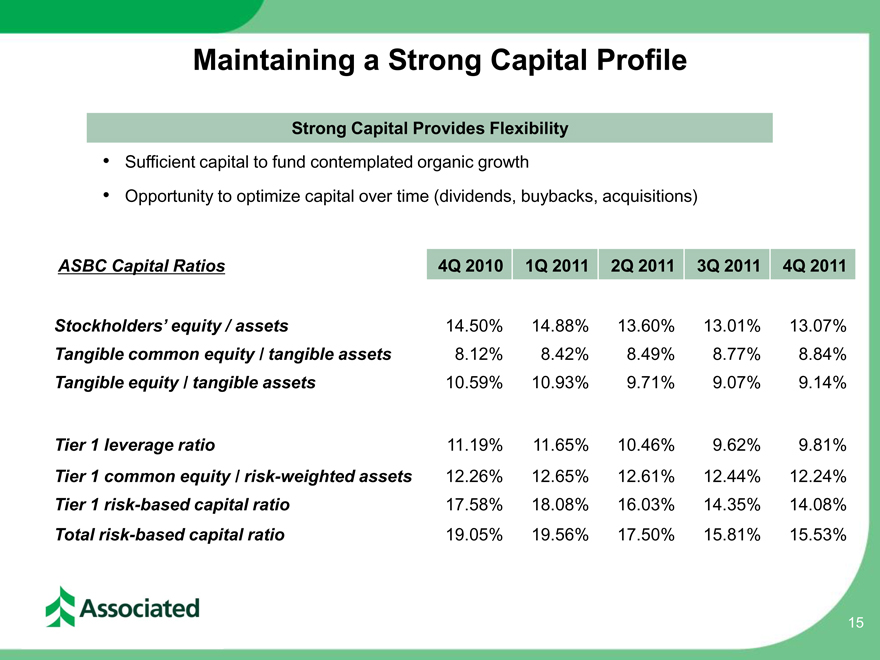

Maintaining a Strong Capital Profile

Strong Capital Provides Flexibility

•Sufficient capital to fund contemplated organic growth

•Opportunity to optimize capital over time (dividends, buybacks, acquisitions)

ASBC Capital Ratios 4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011

Stockholders’ equity/ assets 14. 50% 14.88% 13.60% 13.01% 13.07%

Tangible common equity / tangible assets 8.12% 8.42% 8.49% 8.77% 8.84%

Tangible equity / tangible assets 10.59% 10.93% 9.71% 9.07% 9.14%

Tier 1 leverage ratio 11.19% 11.65% 10.46% 9.62% 9.81%

Tier 1 common equity / risk-weighted assets 12.26% 12.65% 12.61% 12.44% 12.24%

Tier 1 risk-based capital ratio 17.58% 18.08% 16.03% 14.35% 14.08%

Total risk-based capital ratio 19.05% 19.56% 17.50% 15.81% 15.53%

15

2012 Outlook

Positioned for Growth; Creating Long-Term Shareholder Value

Loan Growth •~3% quarterly growth Expenses •Low single-digit YoY growth

•Continued run-off of high cost

CDs & disciplined deposit pricing •Net consolidation in branch

Deposit Growth Footprint network while remodeling and

•Sustained focus on treasury renovations continue

management solutions to drive

growth in commercial deposits

•Continuing improvement in

credit trends

NIM •Relatively stable Credit

•Very modest provision outlook

•Continuing to fund organic

•Modest improvement despite growth

Fee Income Capital

considerable headwinds •Increased quarterly dividend

to $0.05; payable on March 15

16

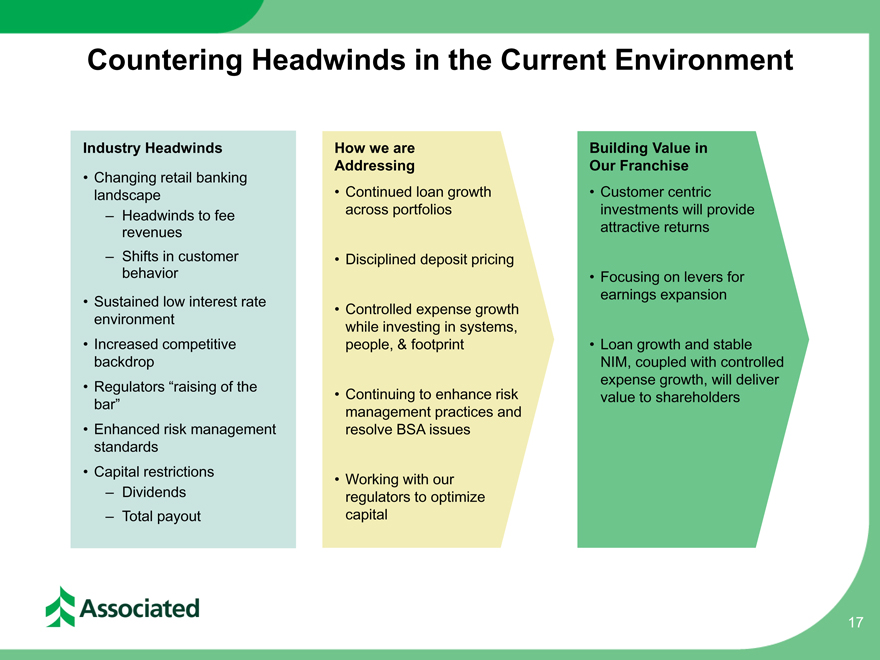

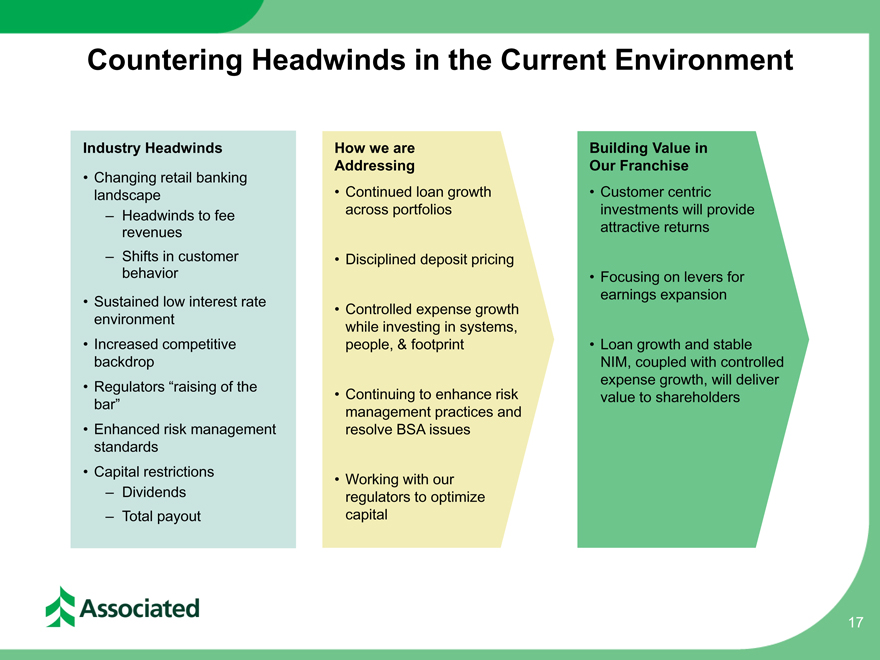

Countering Headwinds in the Current Environment

Industry Headwinds

Changing retail banking landscape

Headwinds to fee revenues

Shifts in customer behavior

Sustained low interest rate environment

Increased competitive backdrop

Regulators “raising of the bar”

Enhanced risk management standards

Capital restrictions

Dividends

Total payout

How we are

Addressing

Continued loan growth across portfolios

Disciplined deposit pricing

Controlled expense growth while investing in systems, people, & footprint

Continuing to enhance risk management practices and resolve BSA issues

Working with our regulators to optimize capital

Building Value in

Our Franchise

Customer centric investments will provide attractive returns

Focusing on levers for earnings expansion

Loan growth and stable NIM, coupled with controlled expense growth, will deliver value to shareholders

17

Associated Banc-Corp will be the most admired Midwestern financial services company, distinguished by sound, value-added financial solutions with personal service for our customers, built upon a strong commitment to our colleagues and the communities we serve, resulting in exceptional value for our shareholders.

Appendix

19

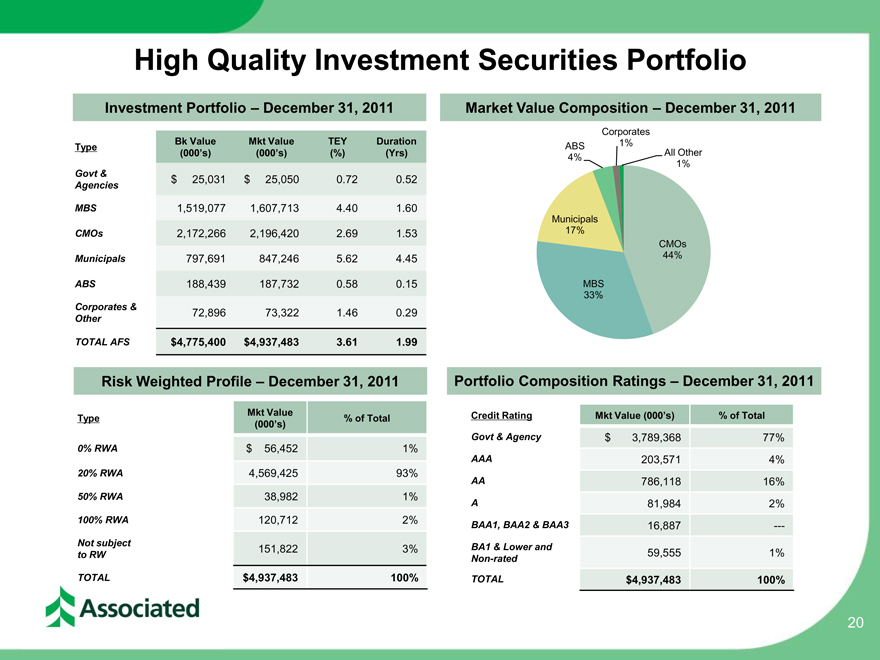

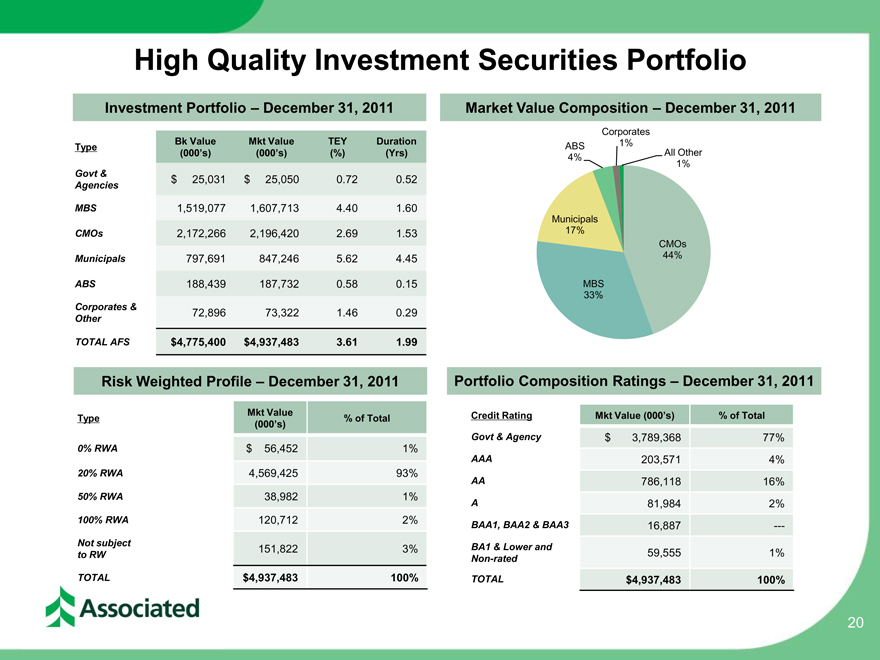

High Quality Investment Securities Portfolio

Investment Portfolio –December 31, 2011

Type Bk Value Mkt Value TEY Duration

(000’s) (000’s) (%)(Yrs)

Govt & $ 25,031 $ 25,050 0.72 0.52

Agencies

MBS 1,519,077 1,607,713 4.40 1.60

CMOs 2,172,266 2,196,420 2.69 1.53

Municipals 797,691 847,246 5.62 4.45

ABS 188,439 187,732 0.58 0.15

Corporates & 72,896 73,322 1.46 0.29

Other

TOTAL AFS $4,775,400 $4,937,483 3.61 1.99

Risk Weighted Profile –December 31, 2011

Mkt Value

Type% of Total

(000’s)

0% RWA $ 56,452 1%

20% RWA 4,569,425 93%

50% RWA 38,982 1%

100% RWA 120,712 2%

Not subject 151,822 3%

to RW

TOTAL $4,937,483 100%

Market Value Composition –December 31, 2011

Corporates

ABS 1%

4% All Other

1%

Municipals

17%

CMOs

44%

MBS

33%

Portfolio Composition Ratings –December 31, 2011

Credit Rating Mkt Value (000’s)% of Total

Govt & Agency $ 3,789,368 77%

AAA 203,571 4%

AA 786,118 16%

A 81,984 2%

BAA1, BAA2 & BAA3 16,887 -—

BA1 & Lower and 59,555 1%

Non-rated

TOTAL $4,937,483 100%

20

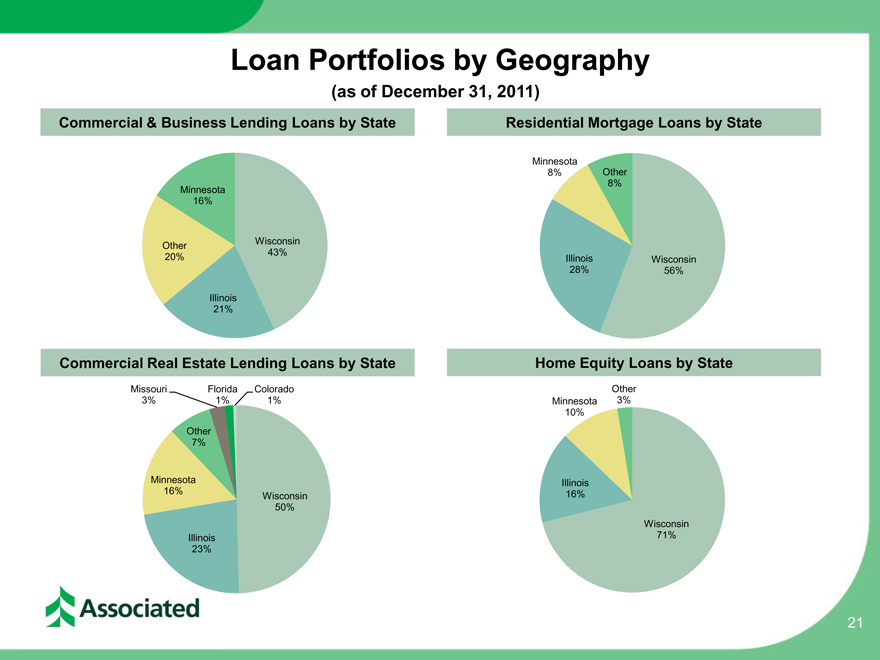

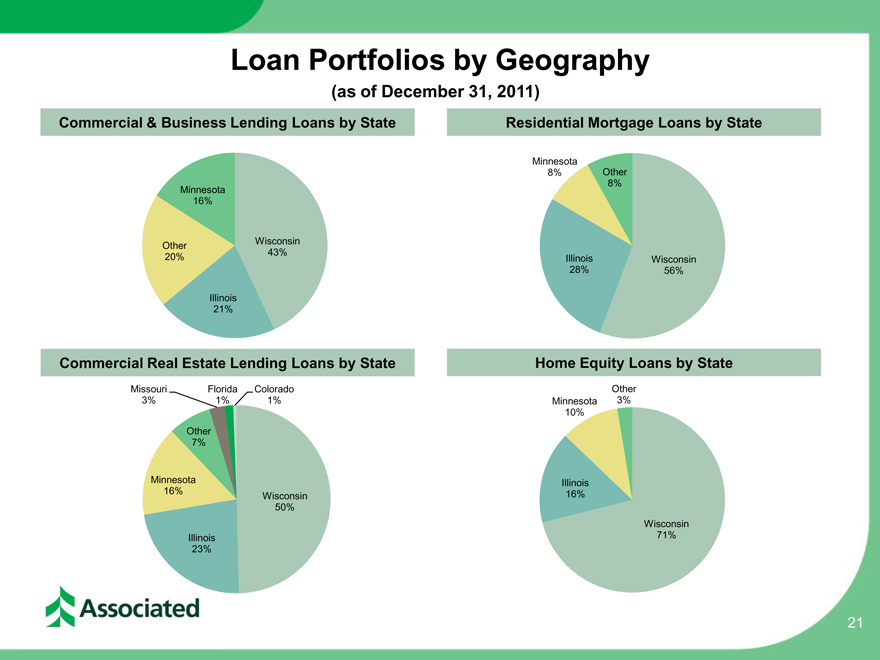

Loan Portfolios by Geography

(as of December 31, 2011)

Commercial & Business Lending Loans by State

Minnesota

16%

Other Wisconsin

20% 43%

Illinois

21%

Commercial Real Estate Lending Loans by State

Missouri Florida Colorado

3% 1% 1%

Other

7%

Minnesota

16% Wisconsin

50%

Illinois

23%

Residential Mortgage Loans by State

Minnesota

8% Other

8%

Illinois Wisconsin

28% 56%

Home Equity Loans by State

Other

Minnesota 3%

10%

Illinois

16%

Wisconsin

71%

21