2011 ANNUAL REPORT

Associated Banc-Corp

— C O R P O R A T E P R O F I L E —

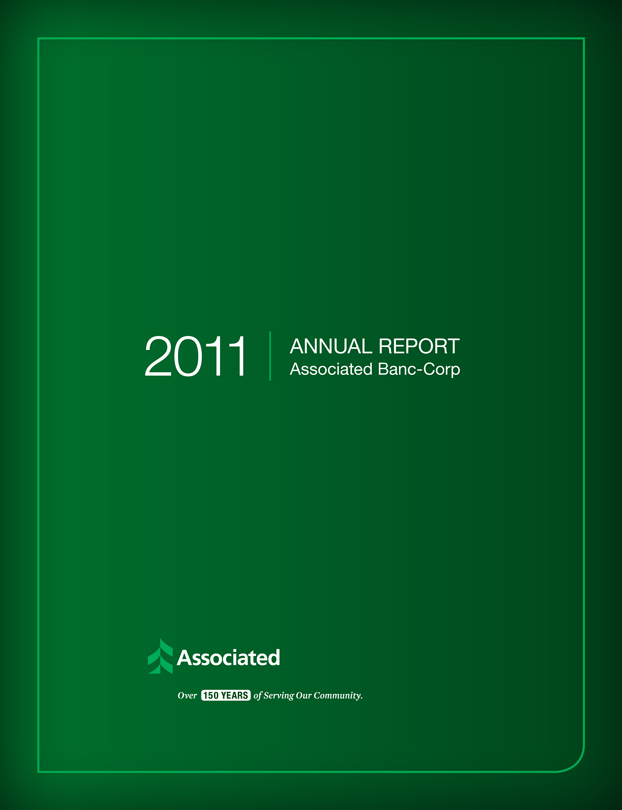

About Associated Net income available to common

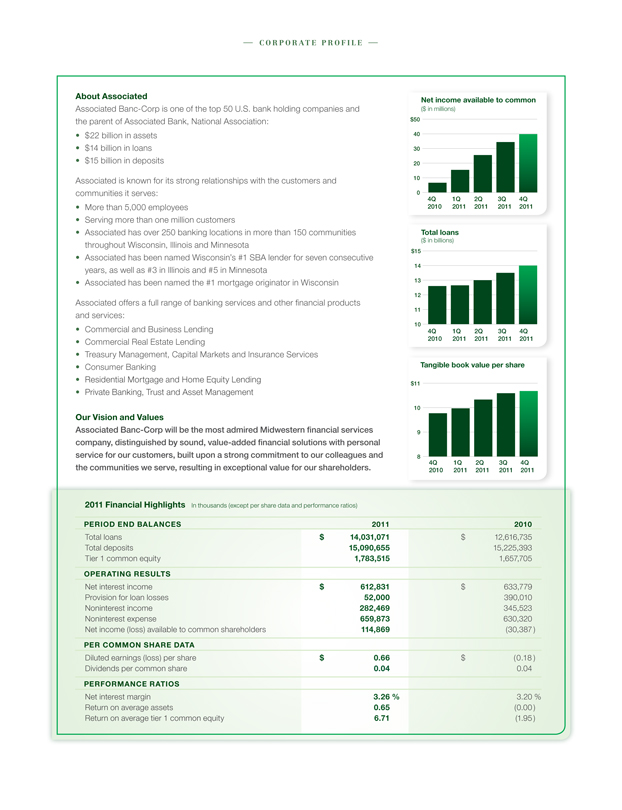

Associated Banc-Corp is one of the top 50 U.S. bank holding companies and ($ in millions) the parent of Associated Bank, National Association: $50 • $22 billion in assets 40 • $14 billion in loans 30 • $15 billion in deposits 20 Associated is known for its strong relationships with the customers and 10 communities it serves: 0 4Q 1Q 2Q 3Q 4Q • More than 5,000 employees 2010 2011 2011 2011 2011 • Serving more than one million customers • Associated has over 250 banking locations in more than 150 communities Total loans

($ in billions)

throughout Wisconsin, Illinois and Minnesota $15 • Associated has been named Wisconsin’s #1 SBA lender for seven consecutive years, as well as #3 in Illinois and #5 in Minnesota 14 • Associated has been named the #1 mortgage originator in Wisconsin 13 Associated offers a full range of banking services and other financial products 12

11

and services:

10

• Commercial and Business Lending 4Q 1Q 2Q 3Q 4Q • Commercial Real Estate Lending 2010 2011 2011 2011 2011 • Treasury Management, Capital Markets and Insurance Services

• Consumer Banking Tangible book value per share

• Residential Mortgage and Home Equity Lending

$11

• Private Banking, Trust and Asset Management

10

Our Vision and Values

Associated Banc-Corp will be the most admired Midwestern financial services 9 company, distinguished by sound, value-added financial solutions with personal service for our customers, built upon a strong commitment to our colleagues and 8

4Q 1Q 2Q 3Q 4Q

the communities we serve, resulting in exceptional value for our shareholders. 2010 2011 2011 2011 2011

2011 Financial Highlights In thousands (except per share data and performance ratios)

PERIOD END BALANCES 2011 2010 Total loans $ 14,031,071 $ 12,616,735 Total deposits 15,090,655 15,225,393 Tier 1 common equity 1,783,515 1,657,705

OPERATING RESULTS

Net interest income $ 612,831 $ 633,779 Provision for loan losses 52,000 390,010 Noninterest income 282,469 345,523 Noninterest expense 659,873 630,320 Net income (loss) available to common shareholders 114,869 (30,387)

PER COMMON S HARE DATA

Diluted earnings (loss) per share $ 0.66 $ (0.18) Dividends per common share 0.04 0.04

PERFORMANCE RATIOS

Net interest margin 3.26 % 3.20 % Return on average assets 0.65 (0.00) Return on average tier 1 common equity 6.71 (1.95)

— CO m m u nI T I E s s E R v E d —

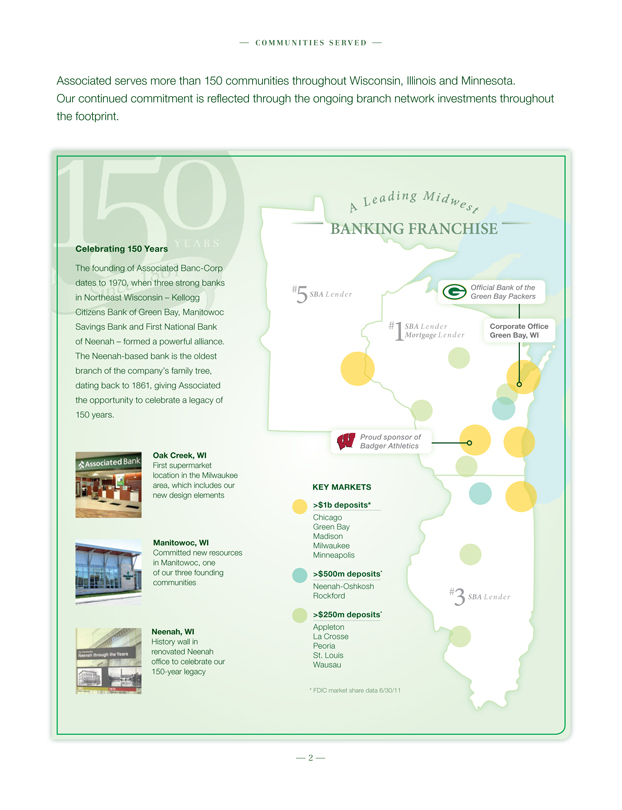

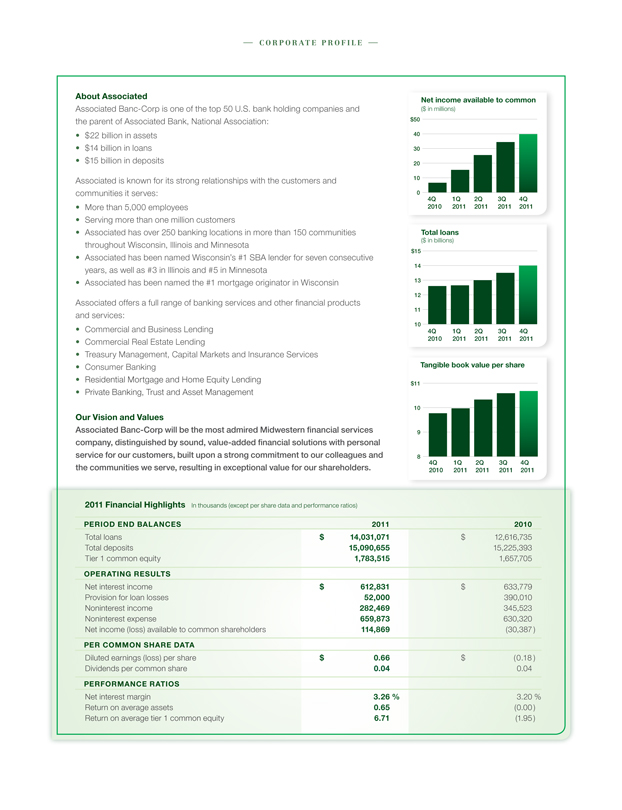

Associated serves more than 150 communities throughout Wisconsin, Illinois and Minnesota. Our continued commitment is reflected through the ongoing branch network investments throughout the footprint.

Celebrating 150 Years

The founding of Associated Banc-Corp dates to 1970, when three strong banks

# Official Bank of the in Northeast Wisconsin – Kellogg 5SBA L e nd e r Green Bay Packers Citizens Bank of Green Bay, Manitowoc Savings Bank and First National Bank # SBA L e nd e r Corporate Office

1Mortgage L e nd e r Green Bay, WI of Neenah – formed a powerful alliance.

The Neenah-based bank is the oldest branch of the company’s family tree, dating back to 1861, giving Associated the opportunity to celebrate a legacy of 150 years.

Proud sponsor of Badger Athletics

Oak Creek, WI

First supermarket location in the Milwaukee area, which includes our KEY MARKETS new design elements

>$1b deposits*

Chicago Green Bay Madison

Manitowoc, WI Milwaukee Committed new resources Minneapolis in Manitowoc, one of our three founding >$500m deposits* communities

Neenah-Oshkosh #

Rockford 3SBA L e nd e r

>$250m deposits*

Appleton

Neenah, WI

La Crosse History wall in Peoria renovated Neenah St. Louis office to celebrate our Wausau 150-year legacy

| | * | | FDIC market share data 6/30/11 |

— 2 —

— L E T T E R T O s H A R E H O L dE R s —

To our shareholders:

In 2011, the goals we set forth for Associated Banc-Corp were attained. Earnings increased each quarter. The credit quality of our loan portfolio continued to improve. Our loans outstanding increased substantially, with balanced growth across the major categories. Associated’s credit ratings improved and our capital levels remain very strong. We successfully repaid our TARP funds in September, without raising additional common equity. We dedicated ourselves to a renewed customer-centric focus. We celebrated 150 years of serving our communities this past year, and we reflect on this long history as we work to ensure continued growth in 2012 and beyond.

Delivering on Our Commitment to Shareholders

We set out in 2011 with a few specific goals, including:

• Returning the company to sustained and growing profitability – We achieved four consecutive quarters of growing profitability and delivered full-year net income available to common shareholders of $115 million.

• Repaying TARP funds in an efficient and shareholder-friendly manner and addressing open regulatory matters – In April and September, we repaid TARP funds without raising additional common equity and the OCC

Memorandum of Understanding (MOU) was terminated.

• Growing the loan portfolio throughout 2011 – We grew loans and gained market share throughout the year; total loans grew 11% year-over-year, and commercial and business loans grew 17% year-over-year.

As we look back, we are proud of having delivered on each of these commitments during 2011.

We also set out to grow our core businesses within our markets and to expand into new markets. We are pleased by our accomplishments on these fronts. We continued to enhance the customer experience by making investments in our people, our infrastructure and our facilities. Our performance this year was supported by strong loan growth across many of our portfolios, resulting from increases in both the number and depth of customer relationships. We also benefited from a strong credit recovery in all of our portfolios. This performance was achieved in spite of revenue headwinds, including the current low interest rate environment, as well as increased regulation from the implementation of the Dodd-Frank legislation.

Delivering on Our Strategy

Our Commercial Bank continues to be successful across all of our major markets. During the year, we added over 60 commercial lenders and grew commercial and business loans strongly over the prior year. In 2011, we promoted Donna Smith to lead the Commercial Banking group.

Commercial Deposit and Treasury Management, Specialized Industries and Commercial Financial Services have now all been aligned under the leadership of John Utz. John has a broad background in specialized commercial lending and treasury management and is leading the charge on our efforts to grow commercial deposits.

Our Commercial Real Estate business, under the leadership of Breck Hanson, continues to provide us with numerous opportunities to work with seasoned and experienced developers. During the past year, we have expanded this business to new markets, including Cincinnati and Indianapolis, by bringing on board seasoned real estate lending teams with local experience. In 2012, we will further expand our Commercial Real Estate business into Michigan.

We have continued to invest in our Retail Bank under the leadership of David Stein. During 2011, we launched a multi-year project to improve customer experience in our branches, with more than 30 relocated, remodeled or new offices and new signage in most locations. Our plans for 2012 include remodeling another 50 branches, while at the same time consolidating more than 20 branches into other nearby locations. We have enhanced product offerings and elevated service levels for our Premier Banking clientele. In addition, we have made major

enhancements to our mobile banking and online banking platforms for all customers. We remain the number one mortgage lender and Small Business Administration lender in Wisconsin.

We continue to be pleased with the success of our Private Banking, Trust and Asset Management efforts. During the year, we strengthened this team with key hires in Milwaukee and more recently in Minneapolis. We appreciate and thank our recently retired Vice Chairman, Mark McMullen, for his many years of leadership in this area and are pleased that the group has continued to thrive with Tim Lau as its new leader.

During the course of the year, we also added key talent to our support teams. Arthur Heise joined the company as Chief Risk Officer to facilitate our work toward navigating the increased compliance and risk management demands of the industry. Patrick Derpinghaus joined the company and assumed the position of Chief Audit Executive, following the retirement of Art Olsen.

In July, we welcomed John (Jay) B. Williams to the Board. Jay currently serves as the President and CEO of the Milwaukee Public Museum, following a 37-year career in commercial banking in Wisconsin and Chicago, and brings a wealth of banking experience to our Board.

Delivering Value for Communities

Over the course of the year, our colleagues continued to show dedication to our local communities and combined to volunteer over 13,000 hours of service to nonprofit groups throughout

all of our markets. Additionally, this year we are proud to have raised over $1 million for United Way chapters through our annual workplace giving campaign.

Delivering Value for Customers

Early in 2010, we launched our Vision and Values statement that set the foundation for how we approach our business. We have recently launched our Customer Promise that builds on our Vision and Values by making a commitment to our customers of what they can expect from Associated in everyday interactions. We have included a copy of our Customer Promise on the following page of the annual report.

Delivering Value for Shareholders

We believe that by delivering for our customers and communities we can drive value for our shareholders over time. We are pleased to have delivered improving results for our shareholders over the course of this year and are proud to have recently announced an increase to our common dividend. Despite the challenging environment, we remain optimistic and are committed to building shareholder value through our long-term strategy for growth at Associated.

Thank you for your continued support of Associated Banc-Corp.

Commitment to Our Communities Minneapolis, MN

Preparing over 4,000 meals for students

The individual generosity of our colleagues is our most and families to be vibrant form of philanthropy. distributed through the Meals for Minds Program Volunteer activities have taken place at 13,742

V O L UN T E ER

HO UR S Madison, WI hundreds Volunteering at the O F N ON P R O F I T Second Harvest Foodbank OR GA N IZAT I ON S 798 of Southern Wisconsin; throughout our footprint. labeling boxes, boxing and CO L L E AG U E stacking over 6,000 cans

PA RT I C I PA N T S of vegetables

In 2011, colleagues donated more than 13,000 hours of time to community-based organizations. In addition, Associated and its Chicago, IL colleagues raised more than $1 million for United Way chapters through Associated colleagues honored as the top the company’s annual workplace giving campaign and volunteered fundraising team at the stair climb event for the more than 2,000 hours to United Way sponsored agencies through greater Chicago Cystic Associated’s “Days of Caring.” Fibrosis Foundation

Our vision of becoming the most admired Midwestern financial services company begins with delivering exceptional service to our customers and being actively involved in our communities.

Customer Promise As an Associated customer, your experience with us should be as pleasant as possible.

Early in 2010, we launched a

• You will be treated in a professional and friendly manner in every interaction. new Vision and Values Statement

• You will experience responsive service with consistently high quality. for Associated that sets the

• You will work with a knowledgeable and capable team. foundation for how we think about our business and our strategies. As part of our plan We are committed to meeting your needs. to focus our actions in order to

• We will guard and secure your personal and financial information at all times. align with our Vision and Values, • We will communicate clearly, so you can easily make informed decisions. we have recently created our • We will provide the professional advice and solutions you require.

Customer Promise:

And, should you encounter a problem, we will be fair and work hard to resolve it.

— 5 —

Board of Directors

1 William R. Hutchinson 7 Eileen A. Kamerick

Chairman, Chief Financial Officer Associated Banc-Corp & Managing Director, President, W. R. Hutchinson Houlihan Lokey

& Associates, Inc. 8 Richard T. Lommen

1 2 3 4

2 John F. Bergstrom Chairman, Courtesy Corp. Chairman & Chief 9 J. Douglas Quick

Executive Officer, Chairman, Lakeside Bergstrom Corporation Foods, Inc.

3 Ruth M. Crowley 10 John C. Seramur

Principal, Innervisions Retired, former Management Chairman & Chief

5 6 7 8 4 Philip B. Flynn Executive Officer, President & Chief First Financial Corporation Executive Officer, 11 Karen T. van Lith

Associated Banc-Corp CEO & Director of

5 Ronald R. Harder MakeMusic, Inc. Retired, former President 12 John (Jay) B. Williams

& CEO, Jewelers Mutual President & Chief Insurance Co. Executive Officer,

9 10 11 12

6 Robert A. Jeffe Milwaukee Public Museum Former Chairman, Corporate Advisory Group, Deutsche Bank Securities Inc.

Executive Committee

1 Philip B. Flynn 9 Timothy J. Lau

President & Chief Head of Wealth Executive Officer Management

2 Oliver Buechse 10 Mark D. Quinlan

Chief Strategy Chief Information &

1 2 3 4

Officer Operations Officer

3 Christopher J. 11 Joseph B. Selner Del Moral-Niles Chief Financial Officer Deputy Chief Financial 12 Donna N. Smith Officer Head of Commercial

4 Patrick J. Derpinghaus Middle Market & Chief Audit Executive Regional Banking

5 6 7 8

5 Judith M. Docter 13 David L. Stein

Chief Human Resources Head of Retail Banking Officer 14 John A. Utz 6 Breck F. Hanson Head of Specialized Head of Commercial Industries & Commercial Real Estate Financial Services

7 Arthur G. Heise

9 10 11 12 Chief Risk Officer

8 Scott S. Hickey

Chief Credit Officer

13 14

— 6 —

Associated Banc-Corp Investor Relations

1200 Hansen Road Green Bay, WI 54304 920-491-7059

Additional information is available at Investor.AssociatedBank.com

Transfer Agent and Registrar Correspondence

Wells Fargo Bank, N.A. Shareowner Services 161 N. Concord Exchange St. Paul, MN 55075 800-468-9716 or 651-450-4064 www.shareowneronline.com

Shareowner Inquiries

800-468-9716 or 651-450-4064 24/7 automated system or representative from 7 a.m. – 7 p.m. CT, Monday through Friday

Stock Listing & Trading

Traded: NASDAQ

Stock Market Symbol: ASBC

Annual Meeting of Shareholders

11 a.m. Central Time Tuesday, April 24, 2012 St. Norbert College

Fort Howard Theater – Bemis Center 100 Grant Street, De Pere, WI 54115

Proxy materials for the 2012 Annual Meeting of Shareholders are available via the Internet under the U.S. Securities and Exchange Commission’s Notice and Access Rule. Shareholders as of the February 29, 2012, record date have been mailed a notice regarding the availability of proxy materials, which includes the Internet website address where the proxy materials can be viewed and shares voted. It also

includes instructions for requesting a paper copy of the proxy materials via telephone, Internet website or email.

Annual Report on Form 10-K

Shareholders and other interested persons may obtain a copy of Associated Banc-Corp’s 2011 Annual Report on Form 10-K at Investor.AssociatedBank.com or by calling or writing Associated Banc-Corp Investor Relations.

This report was printed on recycled paper and is recyclable.

Associated cares for our environment. Demonstration of our environmental stewardship includes eStatement and online bill payment promotions, reduced quantities of printed material, electronic newsletter enhancements, paperless paychecks and colleague rideshare programs.

Important Note Regarding Forward-Looking Statements: Statements made in this document that are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements of management’s plans, objectives or goals for future operations, products or services and forecasts of its revenues, earnings or other measures of performance. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. These statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,” “intend” or similar expressions. Outcomes related to such statements are subject to numerous risk factors and uncertainties including those listed in the company’s 2011 Annual Report on Form 10-K.

©2012 Associated Banc-Corp (3/12) 1017 MKTCC0002