Exhibit 99.1

Associated

Associated Banc-Corp Investor Presentation

Second Quarter 2013

Forward-Looking Statements

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”,

“outlook”, or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference.

1

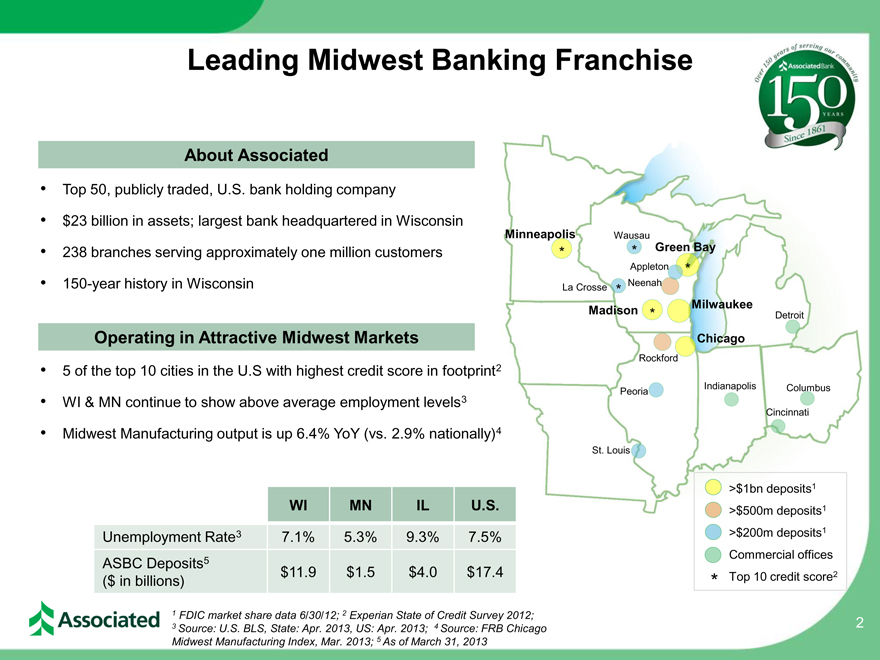

Leading Midwest Banking Franchise

About Associated

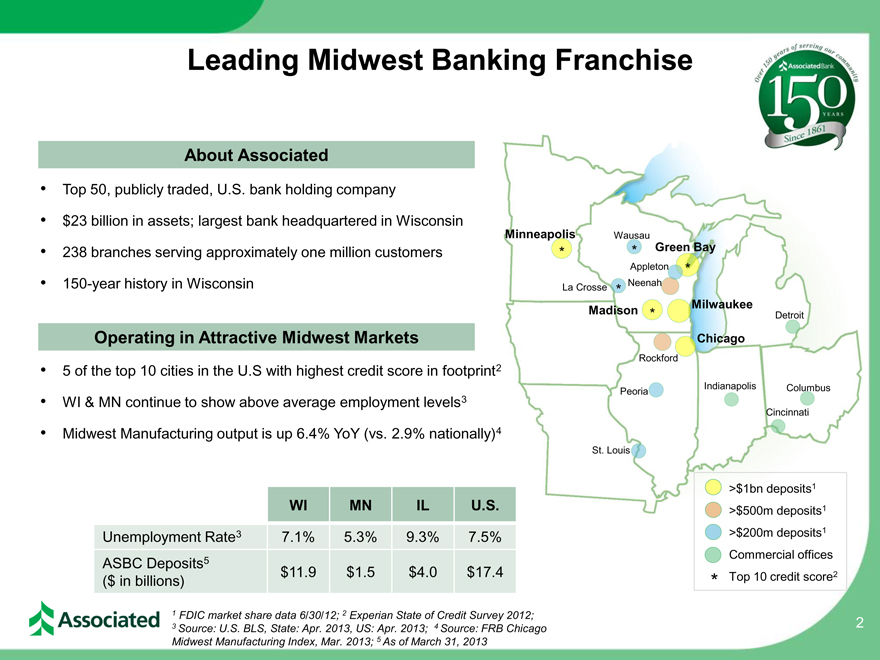

• Top 50, publicly traded, U.S. bank holding company

• $23 billion in assets; largest bank headquartered in Wisconsin

Minneapolis Wausau

• 238 branches serving approximately one million customers * * Green Bay

Appleton *

• 150-year history in Wisconsin Neenah

La Crosse *

Milwaukee

Madison * Detroit

Operating in Attractive Midwest Markets Chicago

Rockford

• 5 of the top 10 cities in the U.S with highest credit score in footprint

Indianapolis Columbus

WI & MN continue to show above employment levels3 Peoria

• average Cincinnati

• Midwest Manufacturing output is up 6.4% YoY (vs. 2.9% nationally)4

St. Louis

>$1bn deposits1

WI MN IL U.S.

>$500m deposits1

Unemployment Rate3 7.1% 5.3% 9.3% 7.5% >$200m deposits1

Commercial offices

ASBC Deposits5 $11.9 $1.5 $4.0 $17.4

($ in billions) * Top 10 credit score2

1 FDIC market share data 6/30/12; 2 Experian State of Credit Survey 2012;

3 Source: U.S. BLS, State: Apr. 2013, US: Apr. 2013; 4 Source: FRB Chicago 2 Midwest Manufacturing Index, Mar. 2013; 5 As of March 31, 2013

2

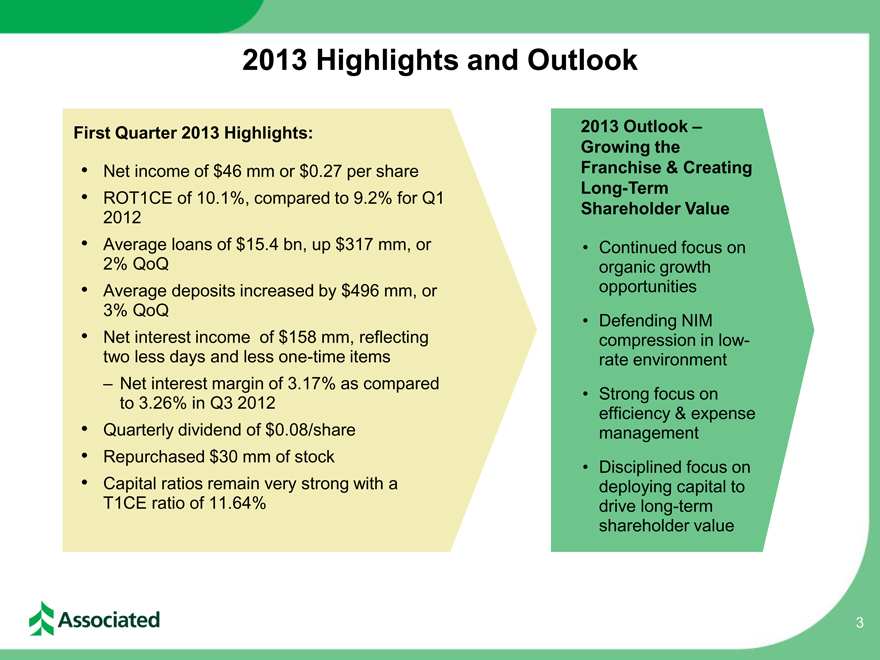

2013 Highlights and Outlook

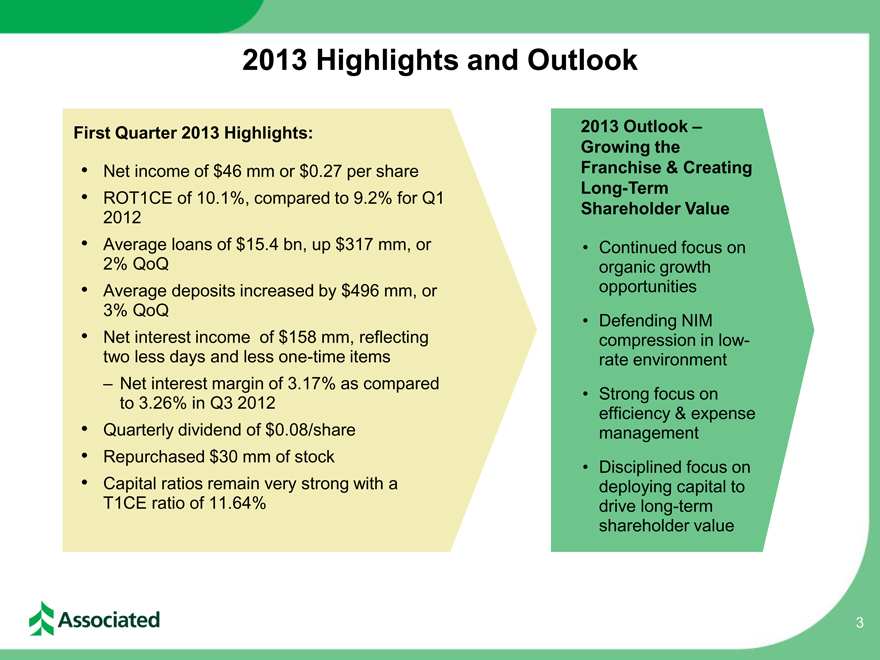

First Quarter 2013 Highlights: 2013 Outlook –

Growing the

• Net income of $46 mm or $0.27 per share Franchise & Creating

• ROT1CE of 10.1%, compared to 9.2% for Q1 Long-Term

2012 Shareholder Value

• Average loans of $15.4 bn, up $317 mm, or • Continued focus on

2% QoQ organic growth

• Average deposits increased by $496 mm, or opportunities

3% QoQ • Defending NIM

• Net interest income of $158 mm, reflecting compression in low-

two less days and less one-time items rate environment

– Net interest margin of 3.17% as compared

to 3.26% in Q3 2012 • Strong focus on

efficiency & expense

• Quarterly dividend of $0.08/share management

• Repurchased $30 mm of stock • Disciplined focus on

• Capital ratios remain very strong with a deploying capital to

T1CE ratio of 11.64% drive long-term

shareholder value

3

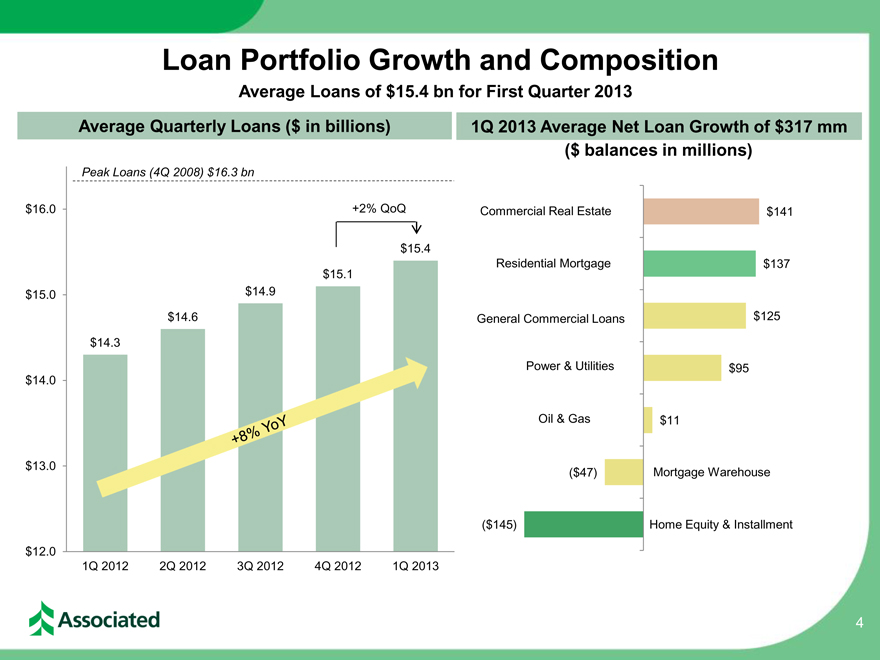

Loan Portfolio Growth and Composition

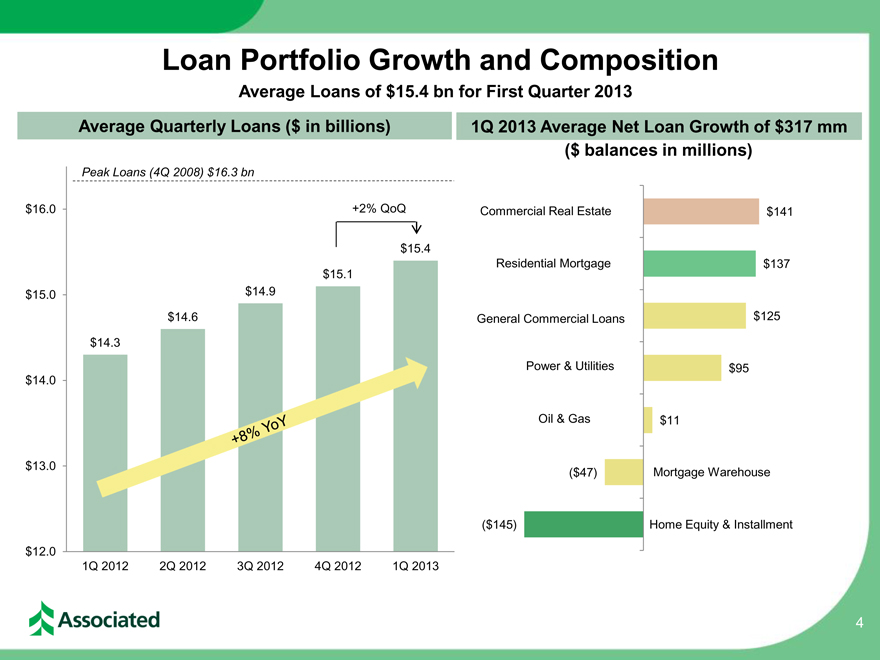

Average Loans of $15.4 bn for First Quarter 2013

Average Quarterly Loans ($ in billions) 1Q 2013 Average Net Loan Growth of $317 mm

($ balances in millions)

Peak Loans (4Q 2008) $16.3 bn

$16.0 +2% QoQ Commercial Real Estate $141

$15.4

Residential Mortgage $137

$15.1

$15.0 $14.9

$ 14.6 General Commercial Loans $125

$ 14.3

Power & Utilities $95

$14.0

Oil & Gas $11

$13.0 ($47) Mortgage Warehouse

($145) Home Equity & Installment

$12.0

1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013

4

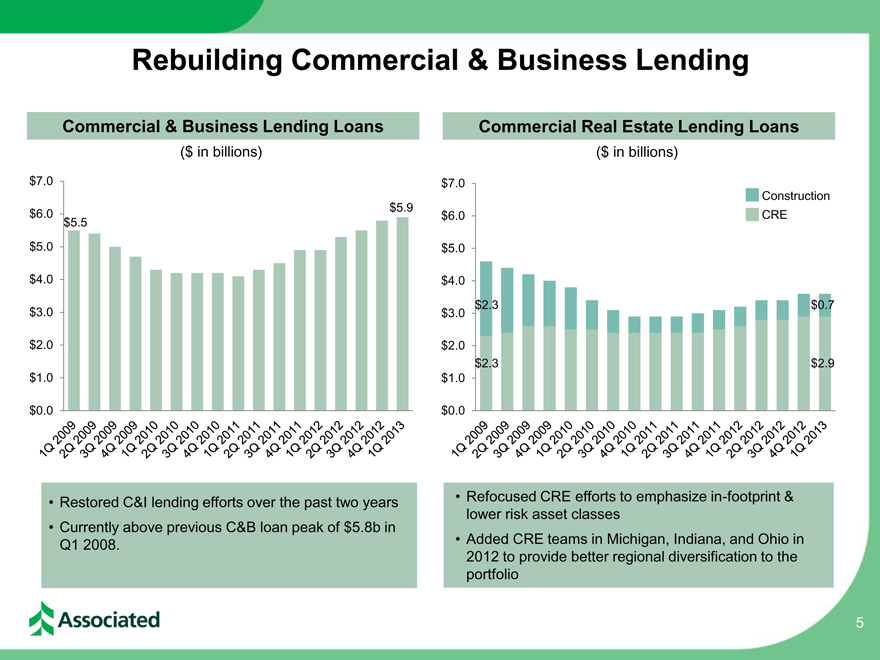

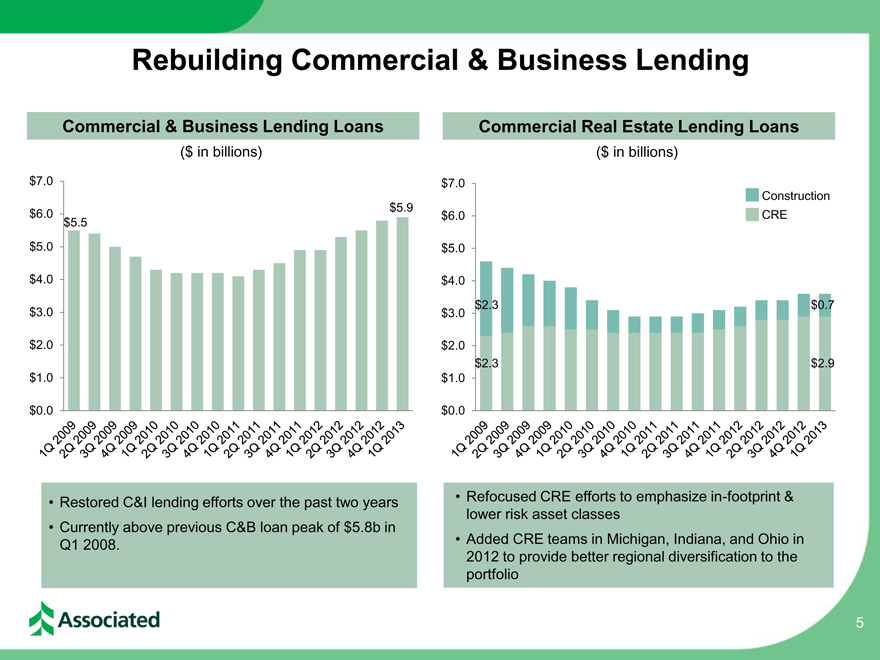

Rebuilding Commercial & Business Lending

Commercial & Business Lending Loans Commercial Real Estate Lending Loans

($ in billions) ($ in billions)

$7.0 $7.0

Construction

$5.9

$6.0 $6.0 CRE

$5.5

$5.0 $5.0

$4.0 $4.0

$3.0 $3.0 $ 2.3 $0.7

$2.0 $2.0

$ 2.3 $2.9

$1.0 $1.0

$0.0 $0.0

• Restored C&I lending efforts over the past two years • Refocused CRE efforts to emphasize in-footprint &

lower risk asset classes

• Currently above previous C&B loan peak of $5.8b in

Q1 2008. • Added CRE teams in Michigan, Indiana, and Ohio in

2012 to provide better regional diversification to the

portfolio

1Q 2009 2Q 2009 3Q 2009 1Q 2009

1Q 2010 2Q 2010 3Q 2010 1Q 2010

1Q 2011 2Q 2011 3Q 2011 1Q 2011

1Q 2012 2Q 2012 3Q 2012 1Q 2012

1Q 2013

1Q 2009 2Q 2009 3Q 2009 1Q 2009

1Q 2010 2Q 2010 3Q 2010 1Q 2010

1Q 2011 2Q 2011 3Q 2011 1Q 2011

1Q 2012 2Q 2012 3Q 2012 1Q 2012

1Q 2013

5

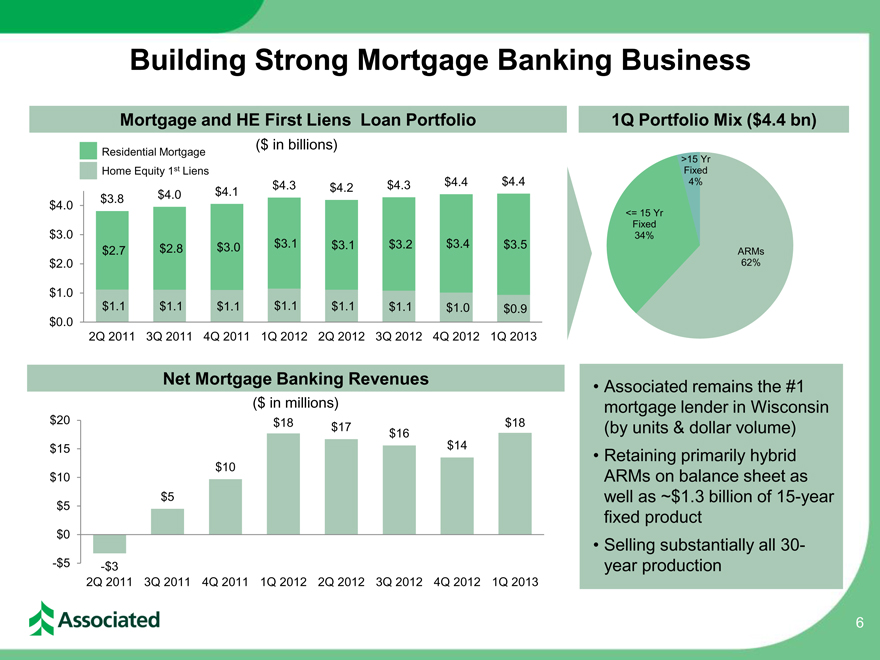

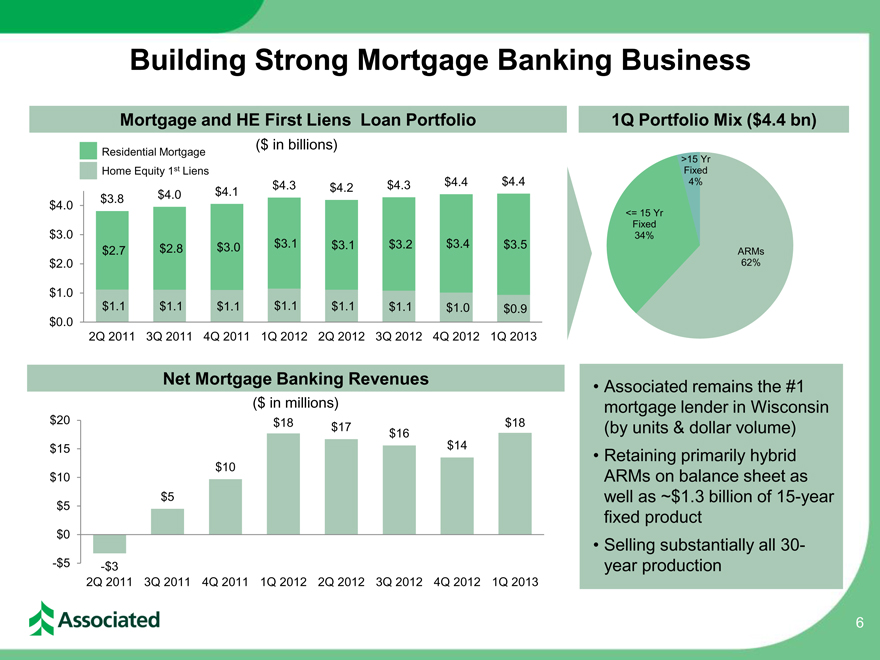

Building Strong Mortgage Banking Business

Mortgage and HE First Liens Loan Portfolio 1Q Portfolio Mix ($4.4 bn)

Residential Mortgage ($ in billions)

>15 Yr

Home Equity 1st Liens Fixed

$4.0 $4.1 $4.3 $4.2 $4.3 $4.4 $4.4 4%

$4.0 $3.8

<= 15 Yr

Fixed

$3.0 34%

$3.1

$2.7 $2.8 $3.0 $3.1 $3.2 $3.4 $3.5 ARMs

$2.0 62%

$1.0

$1.1 $1.1 $1.1 $1.1 $1.1 $1.1 $1.0 $0.9

$0.0

2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013

Net Mortgage Banking Revenues • Associated remains the #1

($ in millions) mortgage lender in Wisconsin

$20 $18 $17 $18 (by units & dollar volume)

$16

$15 $14 • Retaining primarily hybrid

$10

$10 ARMs on balance sheet as

$5 $5 well as ~$1.3 billion of 15-year

fixed product

$0

• Selling substantially all 30-

-$5 -$3 year production

2Q 2011 3Q 2011 4Q 2011 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013

6

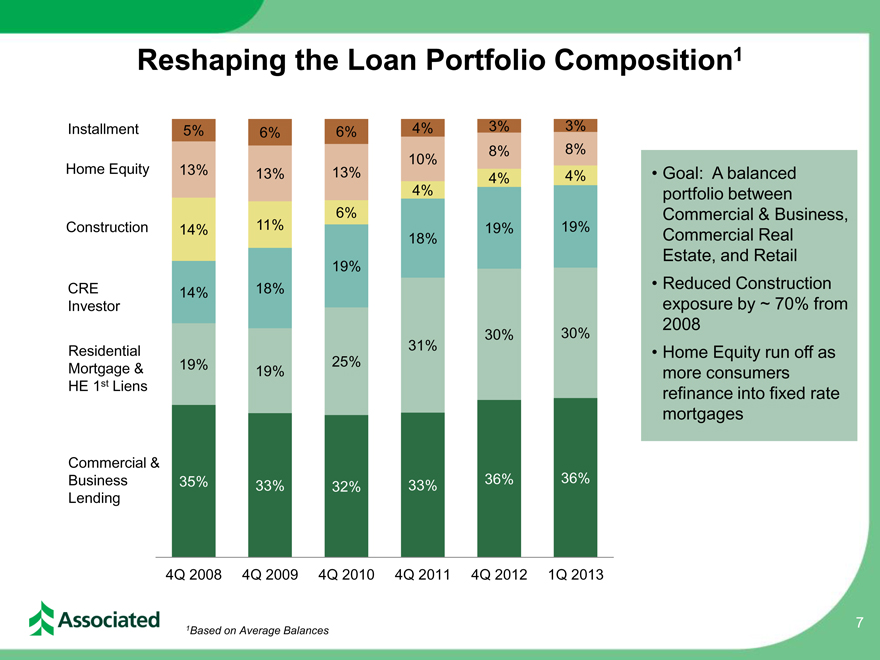

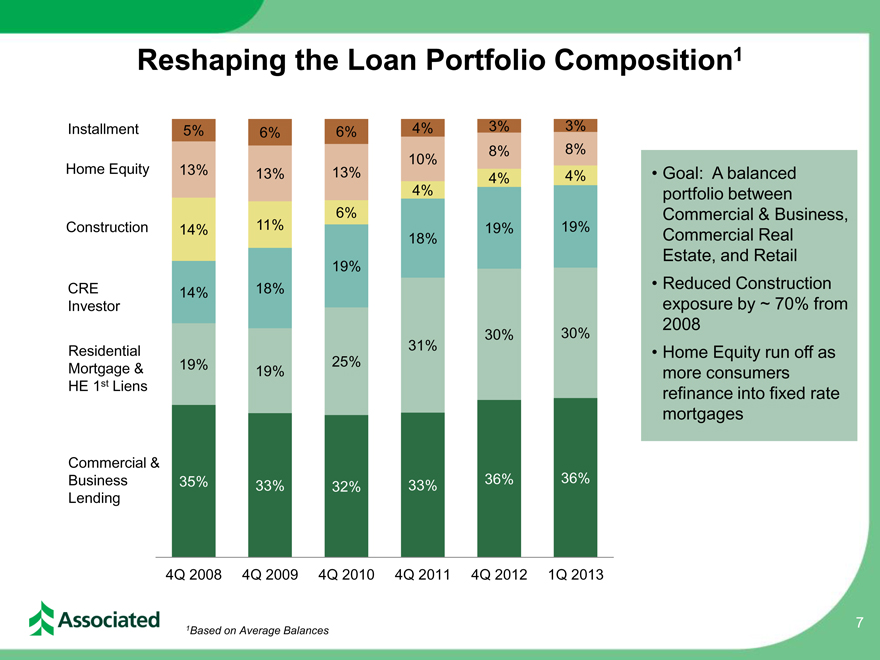

Reshaping the Loan Portfolio Composition1

Installment 5% 6% 6% 4% 3% 3%

10% 8% 8%

Home Equity 13% 13% 13% 4% 4% • Goal: A balanced

4% portfolio between

6% Commercial & Business,

Construction 14% 11% 18% 19% 19% Commercial Real

Estate, and Retail

19%

CRE 14% 18% • Reduced Construction

Investor exposure by ~ 70% from

30% 30% 2008

Residential 31% • Home Equity run off as

Mortgage & 19% 19% 25% more consumers

HE 1st Liens refinance into fixed rate

mortgages

Commercial &

Business 35% 33% 32% 33% 36% 36%

Lending

4Q 2008 4Q 2009 4Q 2010 4Q 2011 4Q 2012 1Q 2013

1Based on Average Balances 7

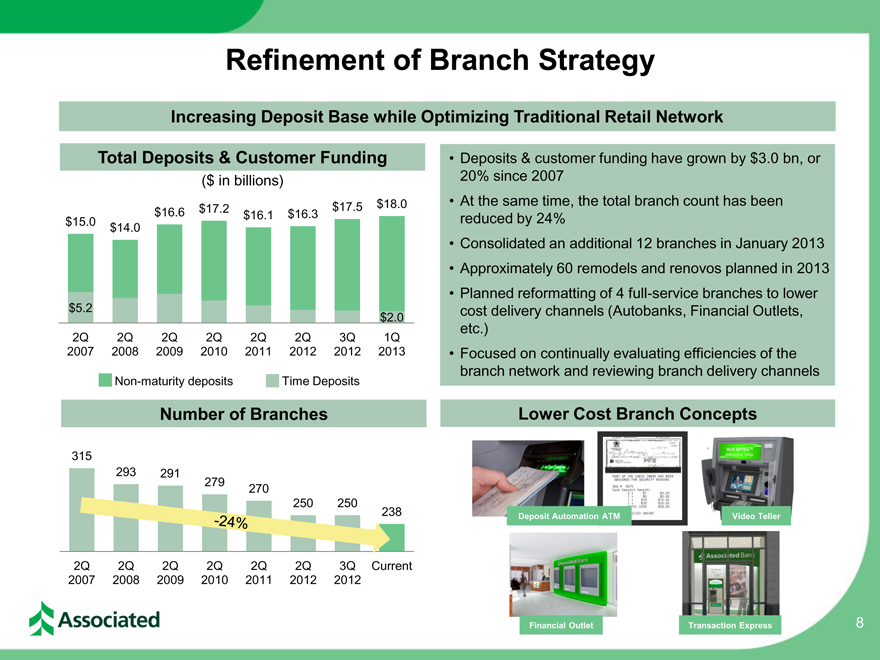

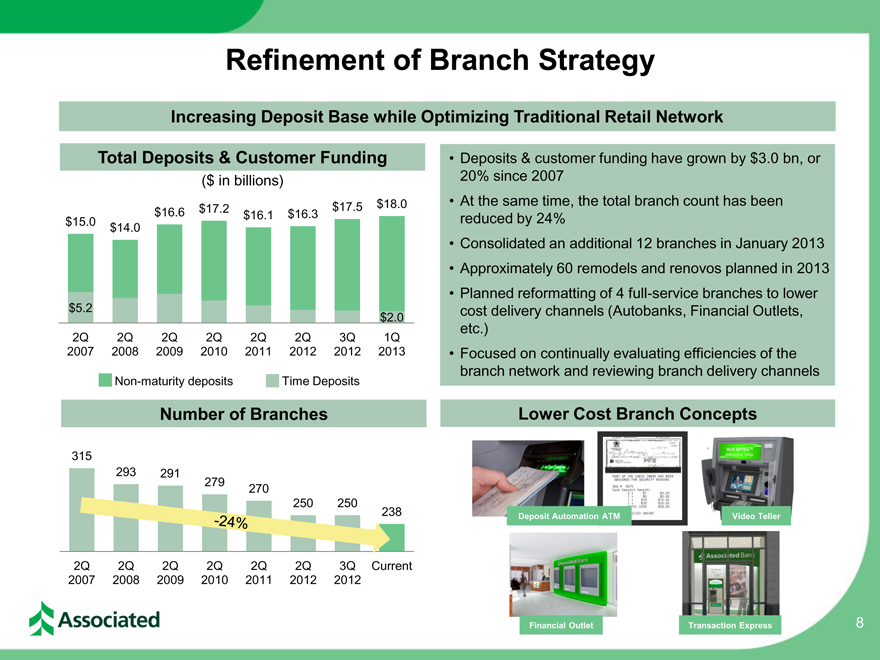

Refinement of Branch Strategy

Increasing Deposit Base while Optimizing Traditional Retail Network

Total Deposits & Customer Funding • Deposits & customer funding have grown by $3.0 bn, or

($ in billions) 20% since 2007

$16.6 $17.2 $17.5 $18.0 • At the same time, the total branch count has been

$15.0 $16.1 $16.3 reduced by 24%

$14.0

• Consolidated an additional 12 branches in January 2013

• Approximately 60 remodels and renovos planned in 2013

• Planned reformatting of 4 full-service branches to lower

$5.2 cost delivery channels (Autobanks, Financial Outlets,

$2.0

etc.)

2Q 2Q 2Q 2Q 2Q 2Q 3Q 1Q

2007 2008 2009 2010 2011 2012 2012 2013 • Focused on continually evaluating efficiencies of the

branch network and reviewing branch delivery channels

Non-maturity deposits Time Deposits

Number of Branches Lower Cost Branch Concepts

315

293 291

279 270

Deposit Automation ATM Video Teller

2Q 2Q 2Q 2Q 2Q 2Q 3Q Current

2007 2008 2009 2010 2011 2012 2012

Financial Outlet Transaction Express 8

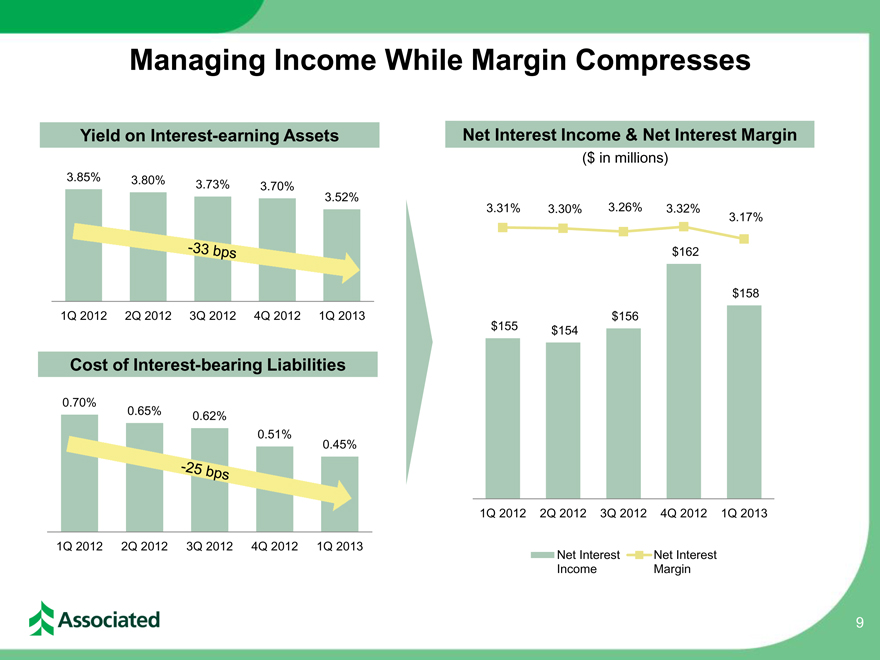

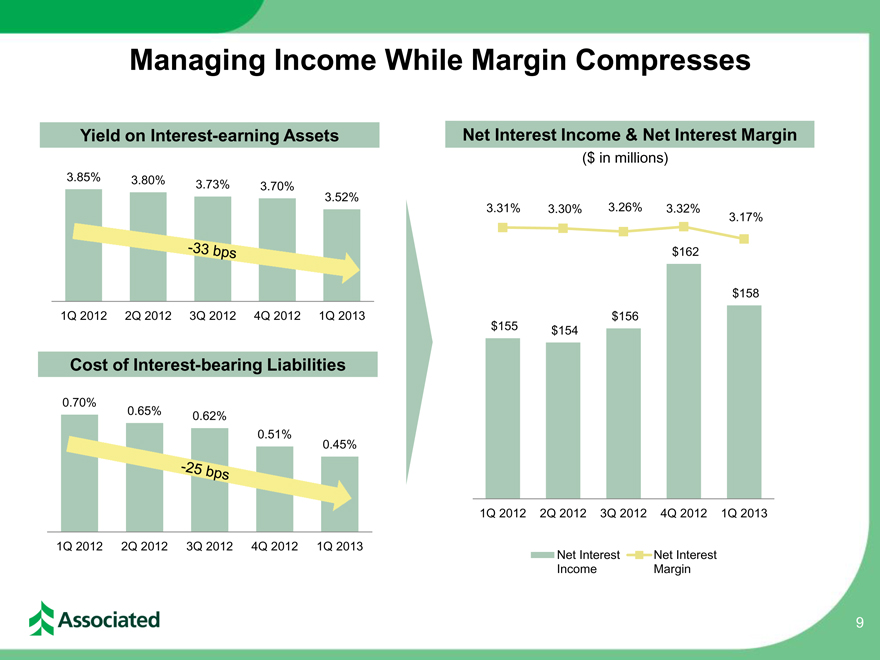

Managing Income While Margin Compresses

Yield on Interest-earning Assets Net Interest Income & Net Interest Margin

($ in millions)

4.00%

3.85% 3.80% 3.73% 3.70%

3.52% $168

3.31% 3.30% 3.26% 3.32% 3.17% 3.50%

$164

$162 3.00%

$160

$158 2.50%

1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 $156

$156 $155

$154 2.00%

Cost of Interest-bearing Liabilities $152

1.50%

0.70%

0.65% 0.62% 0.51% 0.45% $148 1.00%

$144 0.50%

$140 0.00%

1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013

1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013

Net Interest Net Interest

Income Margin

9

Capital Management Priorities

1) Funding Organic Growth

• Focus remains on funding organic loan growth across the footprint

• Supporting business growth initiatives and ongoing capital investments

2) Paying a Competitive Dividend

• Increased quarterly dividend to $0.08/share in fourth quarter

– 60% higher dividend than previous $0.05/share

3) Non-organic Growth Opportunities

• Continue to examine options for acquisitions while maintaining discipline in pricing of any transaction

• Branch consolidation transactions with cost take-out opportunities provide greater value in current environment

• Focused on transactions with lower tangible book value dilution and shorter-term earn back period

4) Buybacks and Redemptions

• Announced $125 mm share repurchase program to strategically return capital to shareholders

– Repurchased $60 mm under the program during Q4 2012 and Q1 2013

Repurchased $30 mm during May 2013

10

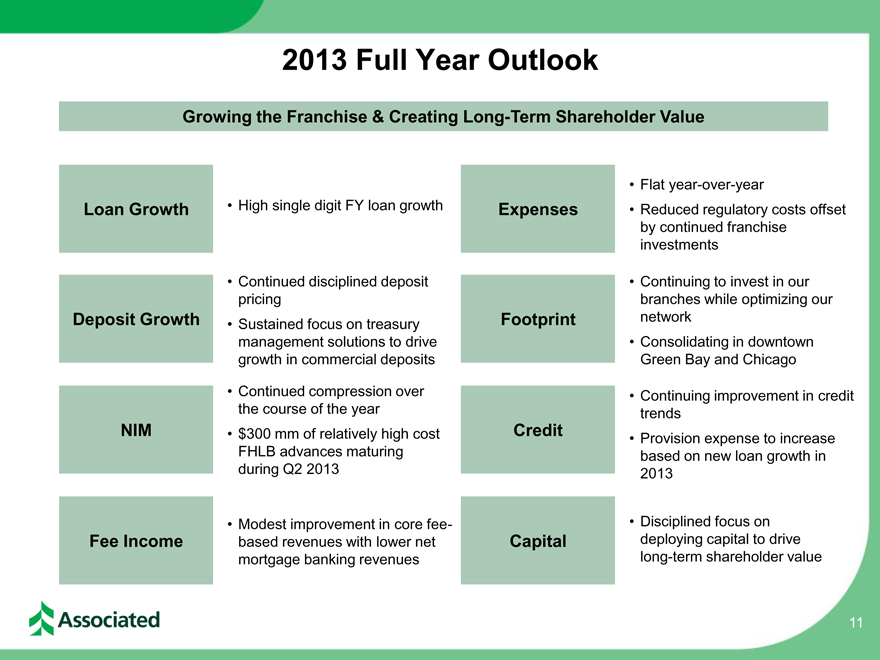

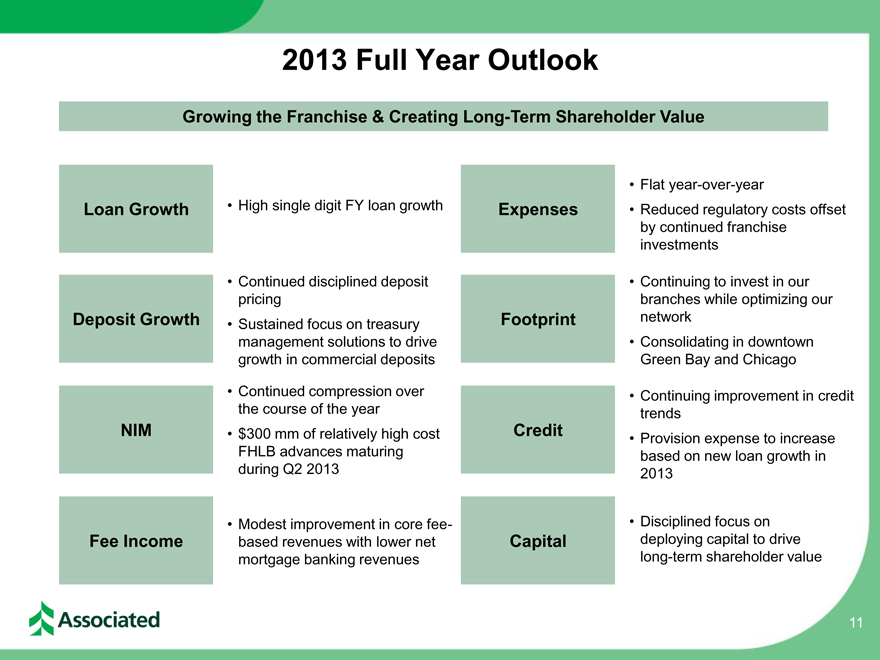

2013 Full Year Outlook

Growing the Franchise & Creating Long-Term Shareholder Value

• Flat year-over-year

Loan Growth • High single digit FY loan growth Expenses • Reduced regulatory costs offset

by continued franchise

investments

• Continued disciplined deposit • Continuing to invest in our

pricing branches while optimizing our

Deposit Growth • Sustained focus on treasury Footprint network

management solutions to drive • Consolidating in downtown

growth in commercial deposits Green Bay and Chicago

• Continued compression over • Continuing improvement in credit

the course of the year trends

NIM • $300 mm of relatively high cost Credit • Provision expense to increase

FHLB advances maturing based on new loan growth in

during Q2 2013 2013

• Modest improvement in core fee- • Disciplined focus on

Fee Income based revenues with lower net Capital deploying capital to drive

mortgage banking revenues long-term shareholder value

11

Why Associated

Net Income Available to Common & ROT1CE Reasons to Invest

Net Income • Leading Midwest Bank Operating in

Available to Return on Tier 1 Attractive Markets

Common Common Equity

($ in millions) • Core Organic Growth Opportunity

$50 12.50%

$45 $45 $46 • Disciplined Deposit Pricing & Stable Margin

$41 $42 • Committed to Efficiency Ratio Improvement

$40

$40 10.00% • Improving Credit Quality

10.1%

34 9.7% 9.6%

$ 9.2% 9.3% • Strong Capital Profile Above Basel III

9.0% Expectations & Opportunities for Capital

$30 7.50% Deployment

$26 7.8%

• Improving Earnings Profile

$20 6.1% 5.00%

$15

3.8%

$10 2.50%

Management Team Focused on Creating

$0 0.00% Long-Term Shareholder Value

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q

2011 2011 2011 2011 2012 2012 2012 2012 2013

12

Associated Banc-Corp will be the most admired Midwestern financial services company, distinguished by sound, value-added financial solutions with personal service for our customers, built upon a strong commitment to our colleagues and the communities we serve, resulting in exceptional value for our shareholders.

Appendix

14

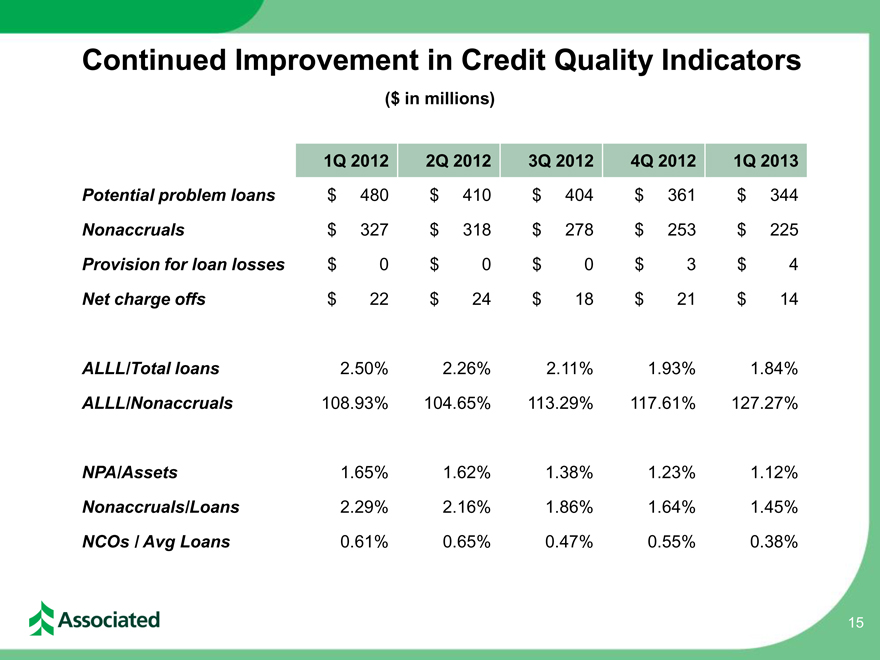

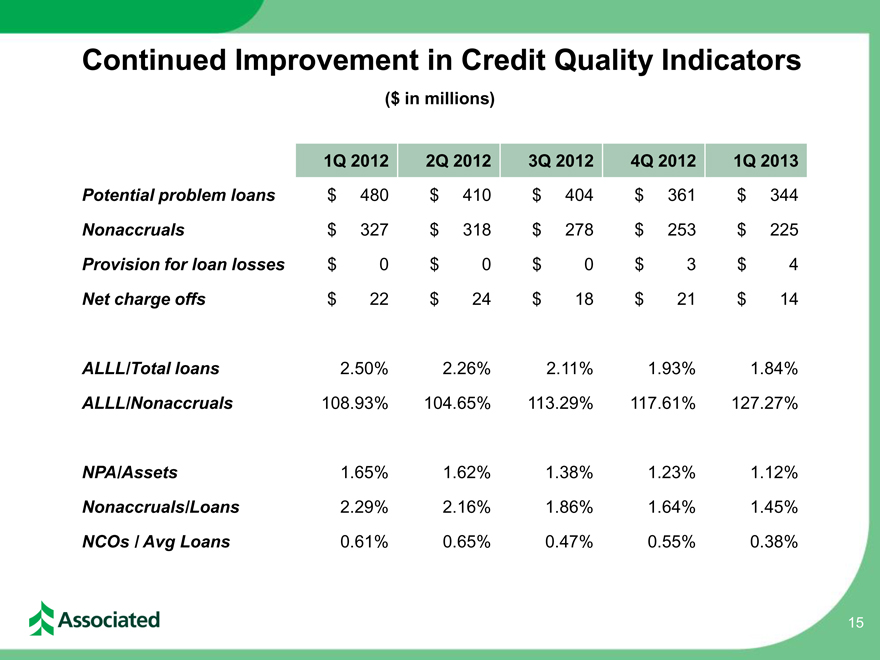

Continued Improvement in Credit Quality Indicators

($ in millions)

1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013

Potential problem loans $ 480 $ 410 $ 404 $ 361 $ 344

Nonaccruals $ 327 $ 318 $ 278 $ 253 $ 225

Provision for loan losses $ 0 $ 0 $ 0 $ 3 $ 4

Net charge offs $ 22 $ 24 $ 18 $ 21 $ 14

ALLL/Total loans 2.50% 2.26% 2.11% 1.93% 1.84%

ALLL/Nonaccruals 108.93% 104.65% 113.29% 117.61% 127.27%

NPA/Assets 1.65% 1.62% 1.38% 1.23% 1.12%

Nonaccruals/Loans 2.29% 2.16% 1.86% 1.64% 1.45%

NCOs / Avg Loans 0.61% 0.65% 0.47% 0.55% 0.38%

15

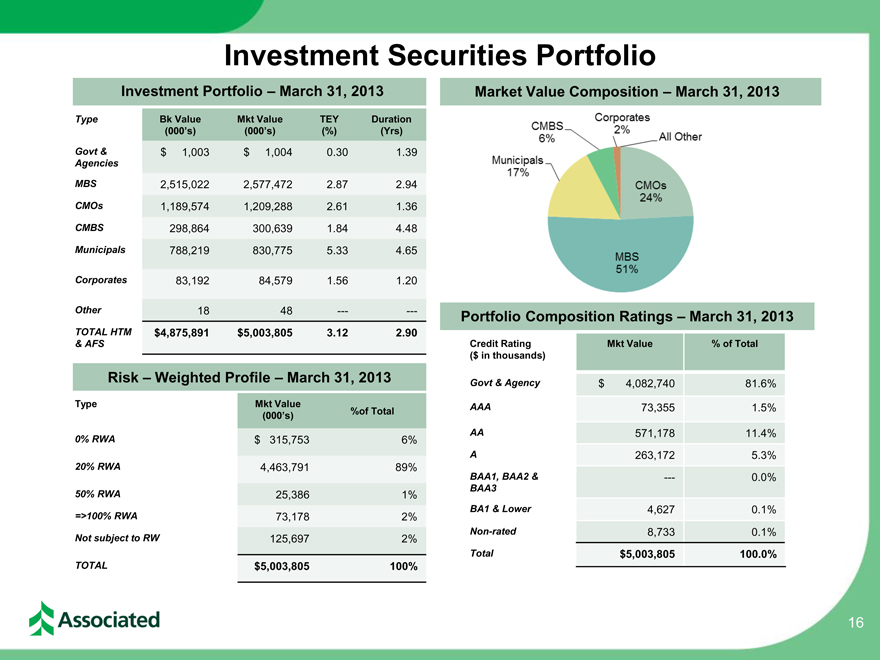

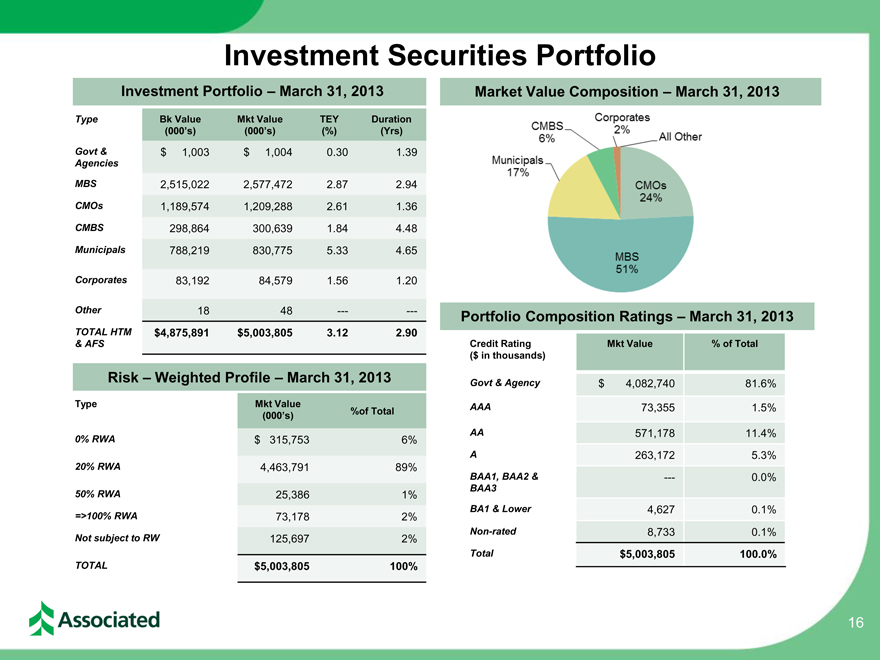

Investment Securities Portfolio

Investment Portfolio – March 31, 2013 Market Value Composition – March 31, 2013

Municipals 17% CMBS 6% Corporates 2% All Other CMOs 24% MBS 51%

Type Bk Value Mkt Value TEY Duration

(000’s) (000’s) (%) (Yrs)

Govt & $ 1,003 $ 1,004 0.30 1.39

Agencies

MBS 2,515,022 2,577,472 2.87 2.94

CMOs 1,189,574 1,209,288 2.61 1.36

CMBS 298,864 300,639 1.84 4.48

Municipals 788,219 830,775 5.33 4.65

Corporates 83,192 84,579 1.56 1.20

Other 18 48 —- —- Portfolio Composition Ratings – March 31, 2013

TOTAL HTM $4,875,891 $5,003,805 3.12 2.90

& AFS Credit Rating Mkt Value % of Total

($ in thousands)

Risk – Weighted Profile – March 31, 2013 Govt & Agency $ 4,082,740 81.6%

Type Mkt Value %of Total AAA 73,355 1.5%

(000’s)

0% RWA $ 315,753 6% AA 571,178 11.4%

A 263,172 5.3%

20% RWA 4,463,791 89%

BAA1, BAA2 & —- 0.0%

50% RWA 25,386 1% BAA3

=>100% RWA 73,178 2% BA1 & Lower 4,627 0.1%

Not subject to RW 125,697 2% Non-rated 8,733 0.1%

Total $5,003,805 100.0%

TOTAL $5,003,805 100%

16

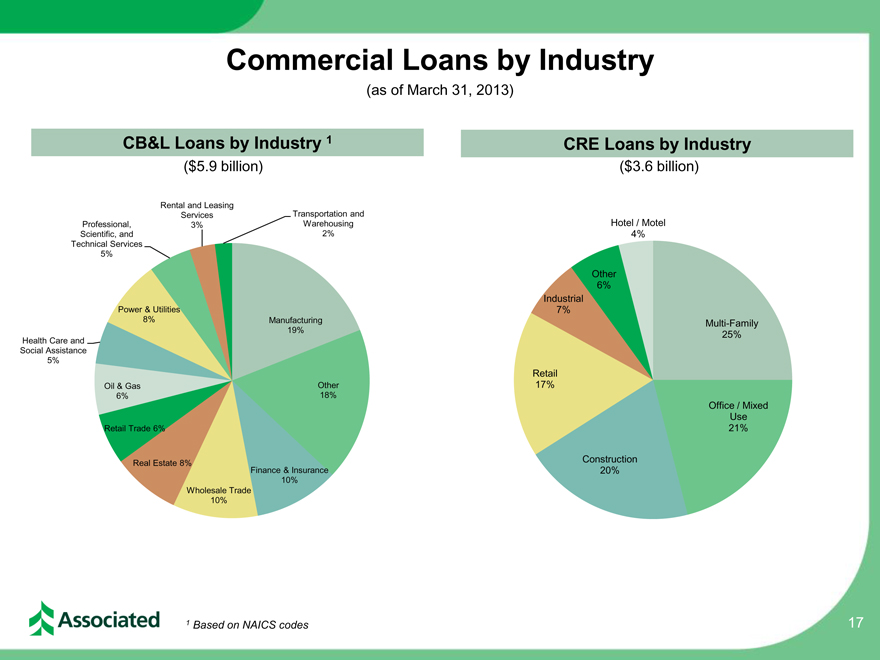

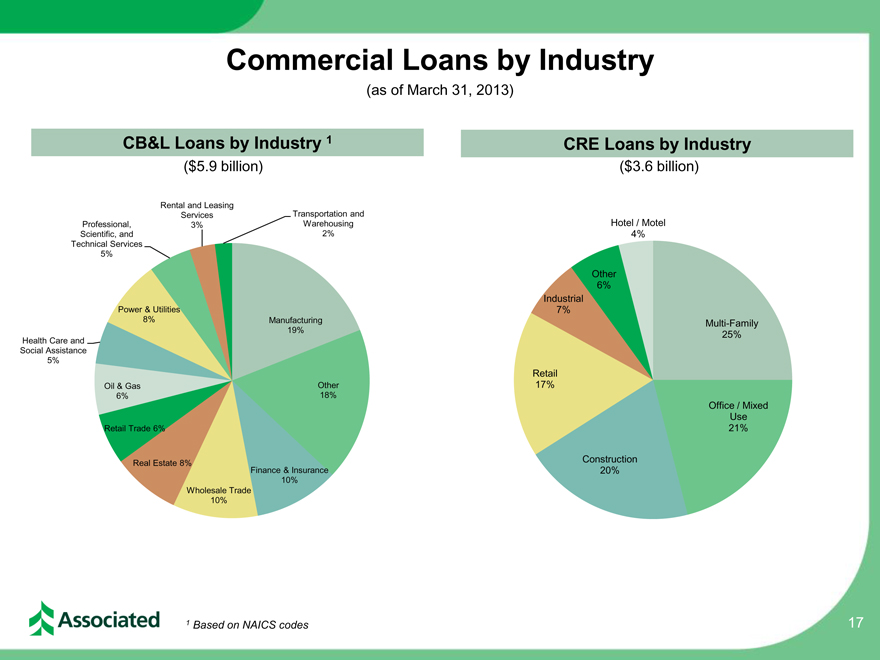

Commercial Loans by Industry

(as of March 31, 2013)

CB&L Loans by Industry 1 CRE Loans by Industry

($5.9 billion) ($3.6 billion)

Rental and Leasing

Services Transportation and

Professional, 3% Warehousing Hotel / Motel

Scientific, and 2% 4%

Technical Services

5%

Other

6%

Industrial

Power & Utilities 7%

8% Manufacturing Multi-Family

19% 25%

Health Care and

Social Assistance

5%

Retail

Oil & Gas Other 17%

6% 18%

Office / Mixed

Use

Retail Trade 6% 21%

Real Estate 8% Construction

Finance & Insurance 20%

10%

Wholesale Trade

10%

1 Based on NAICS codes 17

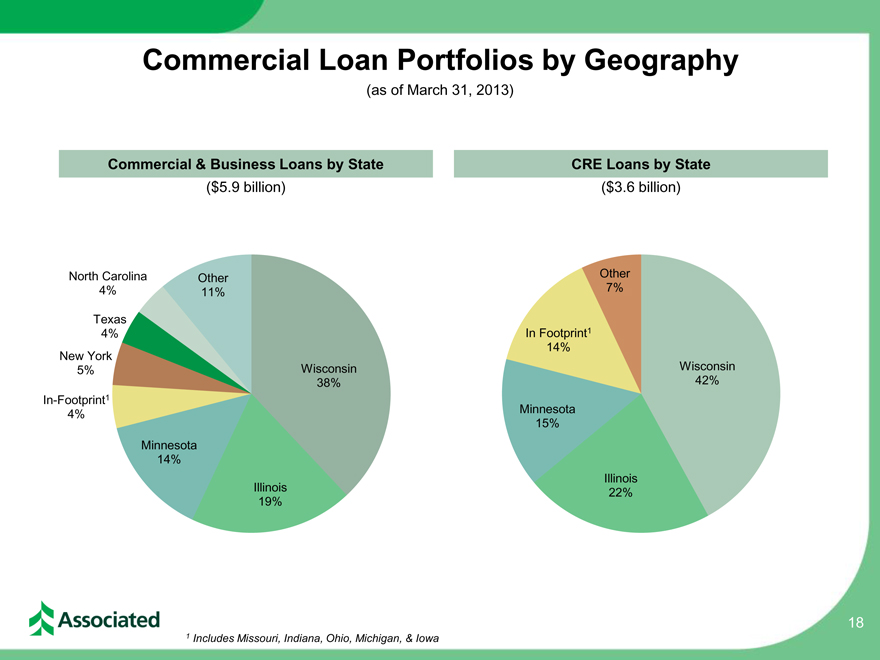

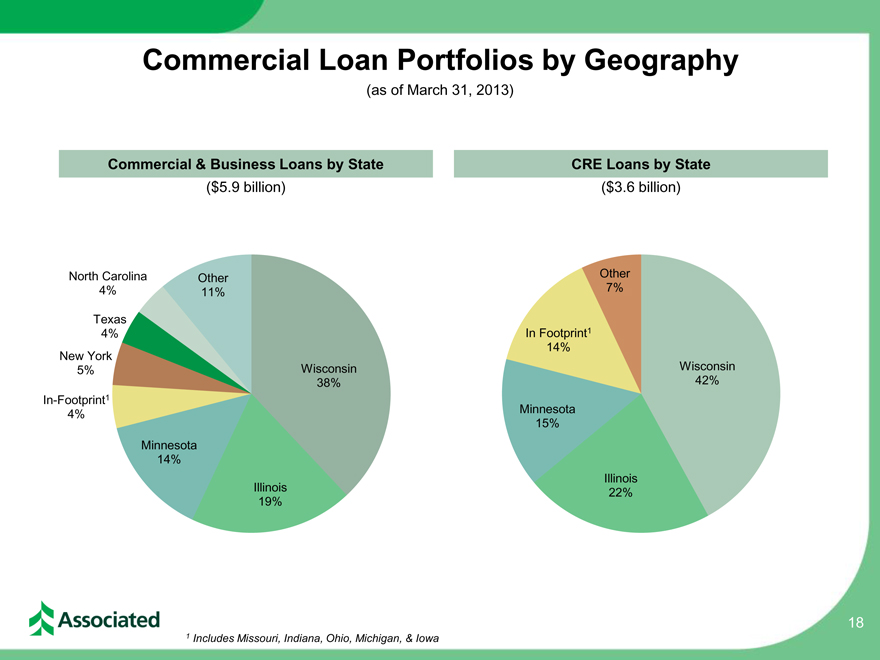

Commercial Loan Portfolios by Geography

(as of March 31, 2013)

Commercial & Business Loans by State CRE Loans by State

($5.9 billion) ($3.6 billion)

North Carolina Other Other

4% 11% 7%

Texas

4% In Footprint1

14%

New York

5% Wisconsin Wisconsin

38% 42%

In-Footprint1

4% Minnesota

15%

Minnesota

14%

Illinois

Illinois 22%

19%

18

1 Includes Missouri, Indiana, Ohio, Michigan, & Iowa

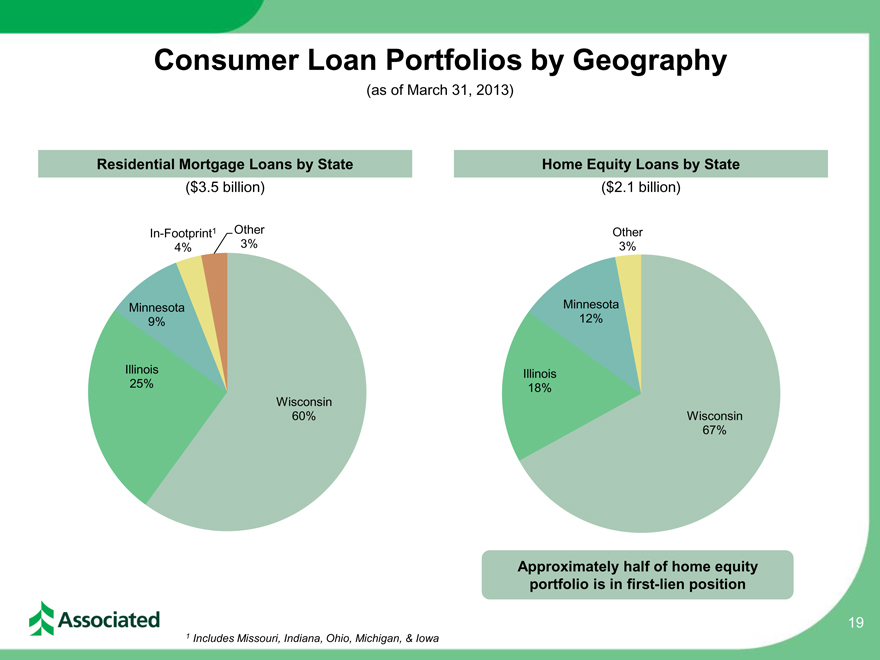

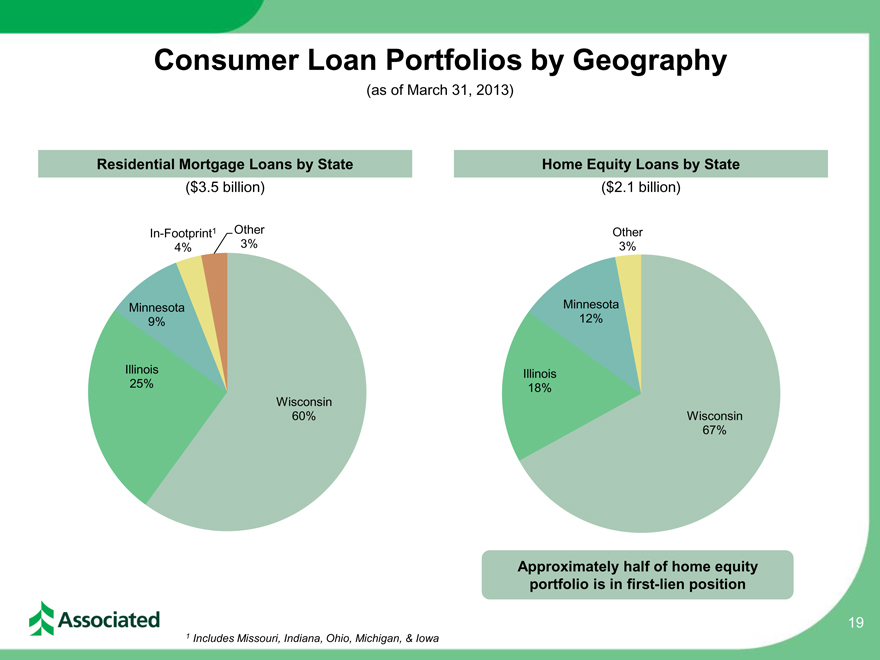

Consumer Loan Portfolios by Geography

(as of March 31, 2013)

Residential Mortgage Loans by State Home Equity Loans by State

($3.5 billion) ($2.1 billion)

In-Footprint1 Other Other

4% 3% 3%

Minnesota Minnesota

9% 12%

Illinois Illinois

25% 18%

Wisconsin

60% Wisconsin

67%

Approximately half of home equity

portfolio is in first-lien position

19

1 Includes Missouri, Indiana, Ohio, Michigan, & Iowa