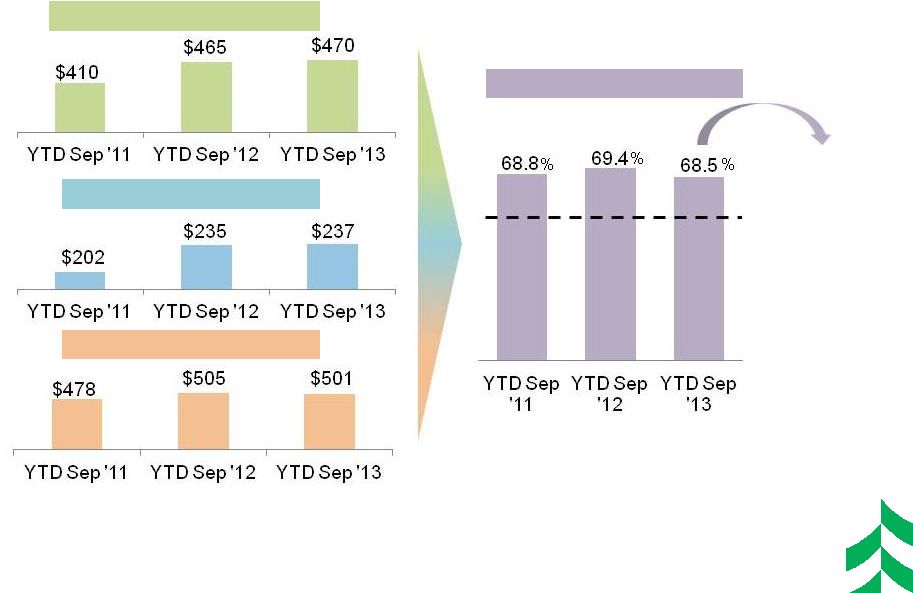

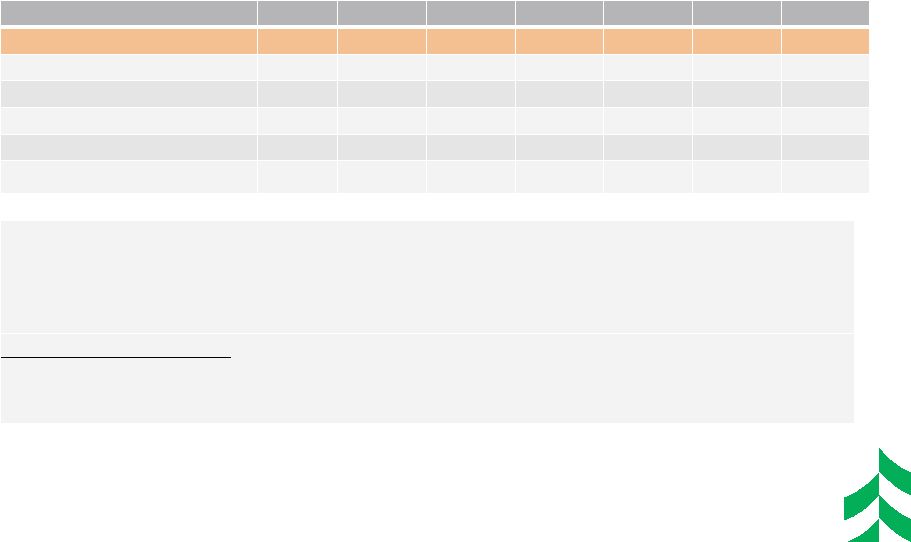

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS 29 YTD 2013 YTD 2012 3Q 2013 2Q 2013 1Q 2013 4Q 2012 3Q 2012 Efficiency Ratio Reconciliation: Efficiency ratio (1) 70.11% 72.65% 71.10% 69.54% 69.74% 73.71% 72.81% Taxable equivalent adjustment (1.44) (1.62) (1.49) (1.39) (1.46) (1.57) (1.61) Asset gains (losses), net 0.26 (1.16) 0.58 (0.01) 0.24 (0.06) (0.98) Other intangible amortization (0.42) (0.44) (0.44) (0.41) (0.42) (0.43) (0.43) Efficiency ratio, fully taxable equivalent (1) 68.51% 69.43% 69.75% 67.73% 68.10% 71.65% 69.79% (1) Efficiency ratio is defined by the Federal Reserve guidance as noninterest expense divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. Efficiency ratio, fully taxable equivalent, is noninterest expense, excluding other intangible amortization, divided by the sum of taxable equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and asset gains / losses, net. This efficiency ratio is presented on a taxable equivalent basis, which adjusts net interest income for the tax-favored status of certain loans and investment securities. Management believes this measure to be the preferred industry measurement of net interest income as it enhances the comparability of net interest income arising from taxable and tax-exempt sources and it excludes certain specific revenue items (such as investment securities gains / losses, net and asset gains / losses, net). Definition of Tier 1 Common Equity : Tier 1 Common Equity (T1CE), a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of our capital with the capital of other financial services companies. Management uses Tier 1 common equity, along with other capital measures, to assess and monitor our capital position. Tier 1 Common Equity is Tier 1 capital excluding qualifying perpetual preferred stock and qualifying trust preferred securities. |