Associated Banc-Corp (ASB) 8-KResults of Operations and Financial Condition

Filed: 17 Jul 14, 12:00am

ASSOCIATED BANC-CORP 2Q 2014 EARNINGS PRESENTATION JULY 17, 2014 Exhibit 99.2 |

FORWARD-LOOKING STATEMENTS Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or similar expressions. Forward- looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are incorporated herein by reference. 1 |

2014 SECOND QUARTER HIGHLIGHTS 2 Loan Growth drives Solid Earnings • Average loans of $16.6 billion were up $482 million, or 3% from the first quarter Total average commercial loans grew $398 million from the first quarter Credit card portfolio purchased on June 30, 2014 for $108 million • Net interest income of $169 million was up $4 million, or 2% from the first quarter Interest on Commercial loans was up $3 million, or 3% from the first quarter • Net interest margin of 3.08% compared to 3.12% in the first quarter • Quarterly dividend of $0.09 / common share, or 32% of second quarter earnings • Repurchased 1.7 million shares of common stock during the second quarter July 1st – repurchased additional 1.6 million shares in accelerated program • Capital ratios remain strong and above Basel III targets • Noninterest income of $72 million was down $1 million compared to the first quarter Core fee-based revenues grew $3 million from the first quarter • Noninterest expense of $168 million was flat compared to the first quarter Efficiency ratio improved from the first quarter to 68% • Net income available to common shareholders of $45 million or $0.28 per share • Pretax income of $68 million was up $2 million, or 3% from the first quarter • Return on Tier 1 Common Equity of 9.6% Net Interest Income & Net Interest Margin Noninterest Income & Expenses Capital Balance Sheet Net Income & ROT1CE |

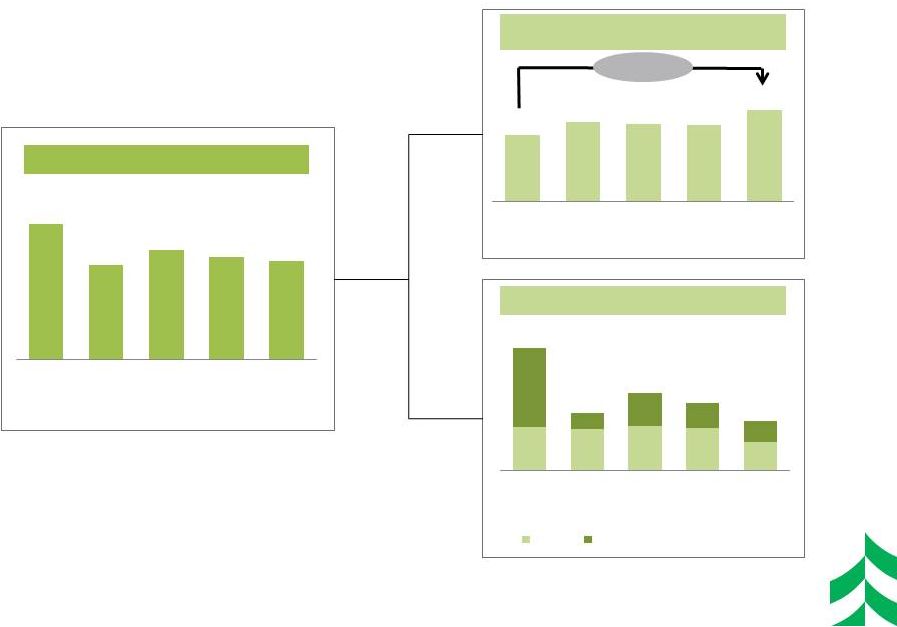

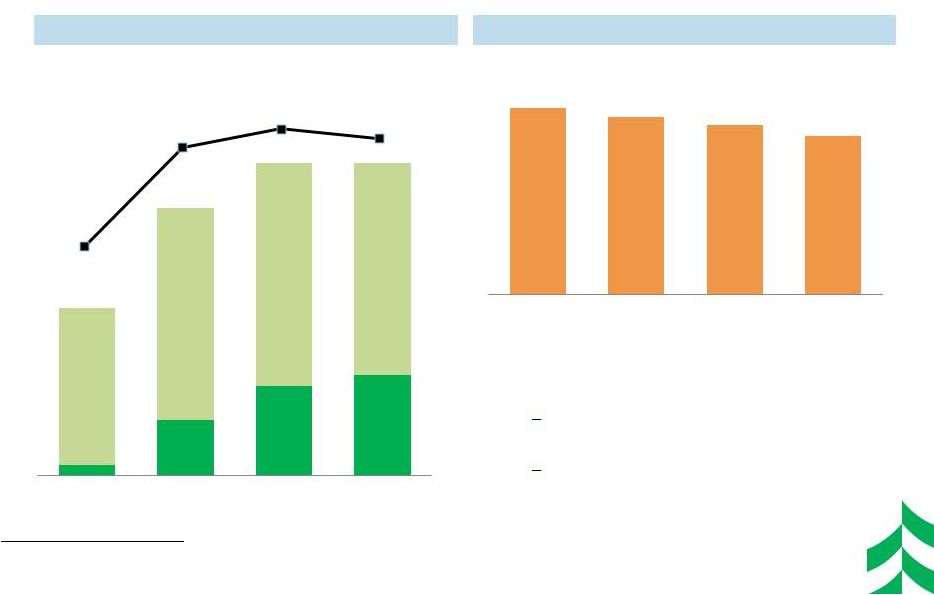

LOAN PORTFOLIO COMPOSITION 3 2Q 2014 Average Net Loan Change (+$482 mln) Loan Mix – 2Q 2014 (Average) ($ in millions) Home Equity & Installment Commercial Real Estate Residential Mortgage Power & Utilities Oil & Gas Mortgage Warehouse General Commercial Loans Average Quarterly Loans ($ in billions) $16.6 +4% % Chg +78% +2% +14% (3%) $15.7 +2% $16.2 $14.6 $13.0 Total Commercial & Business Lending +6% +8% $4.2 $5.0 $5.9 $6.1 $6.5 $2.9 $3.3 $3.7 $3.9 $4.0 $2.7 $3.3 $3.7 $3.9 $4.1 $3.2 $3.0 $2.5 $2.2 $2.1 2Q 2011 2Q 2012 2Q 2013 1Q 2014 2Q 2014 Commercial & Business Commercial Real Estate Residential Mortgage Home Equity & Installment ($67) $48 $60 $74 $97 $119 $151 CRE Investor 18% Construction 6% Commercial & Business Lending 39% Res Mtg 25% Home Equity 10% Installment 2% |

COMMERCIAL LINE UTILIZATION TRENDS 4 Line utilization increased in Commercial & Business Lending Change from 1Q 14 Commercial Real Estate (including construction) - 260 bps Commercial & Business Lending + 290 bps 50.0% 51.1% 48.6% 46.9% 48.8% 51.7% 56.5% 60.4% 61.1% 63.1% 64.2% 61.6% 45.0% 50.0% 55.0% 60.0% 65.0% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Commercial & Business Lending Commercial Real Estate |

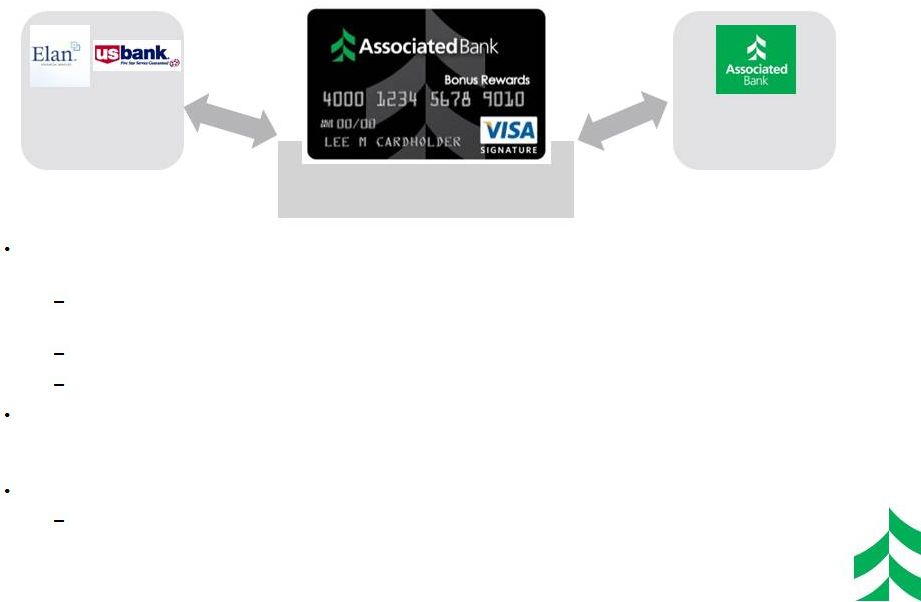

160,000 “Associated Bank” branded card accounts CREDIT CARD PORTFOLIO PURCHASE 5 Summary Details: ASBC and US Bank will both participate on a pro-rata basis in all revenues, credit losses, and growth going forward. Elan will continue to administer, service, and manage the portfolio for a fixed, per account fee. The purchase premium will be amortized over 5 years. 55% participation 45% participation ASBC acquired a 45% participation interest ($99 million) in a credit card portfolio of customers who currently hold “Associated Bank” branded credit card accounts for $108 million. ASBC will forego referral fees it has been receiving from Elan/US Bank for new accounts but expects that the net yield on the portfolio (net of losses and premium amortization) will offset this foregone fee revenue. Transaction is expected to result in less card based fee income but more net interest income. Bottom line impact should not be material in 2014, but will build value over time and contribute to earnings growth as the portfolio grows. |

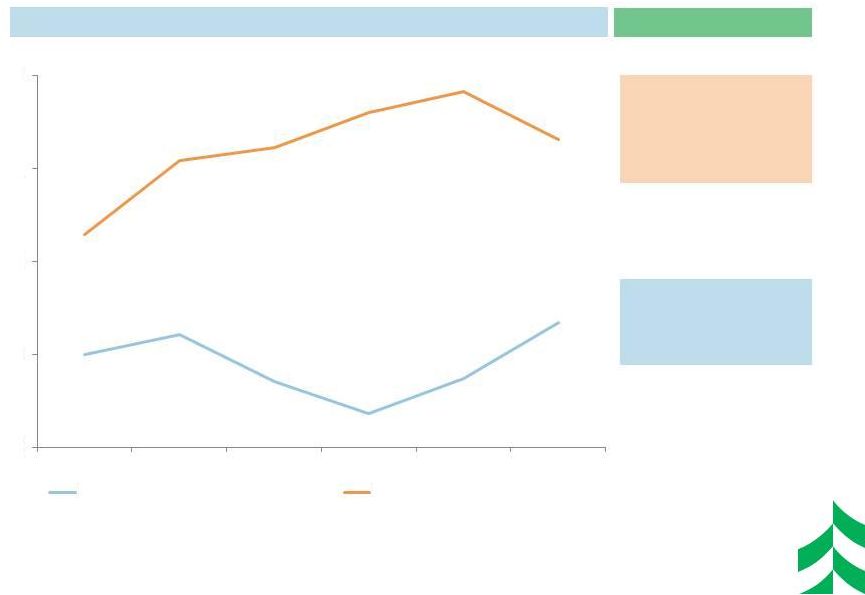

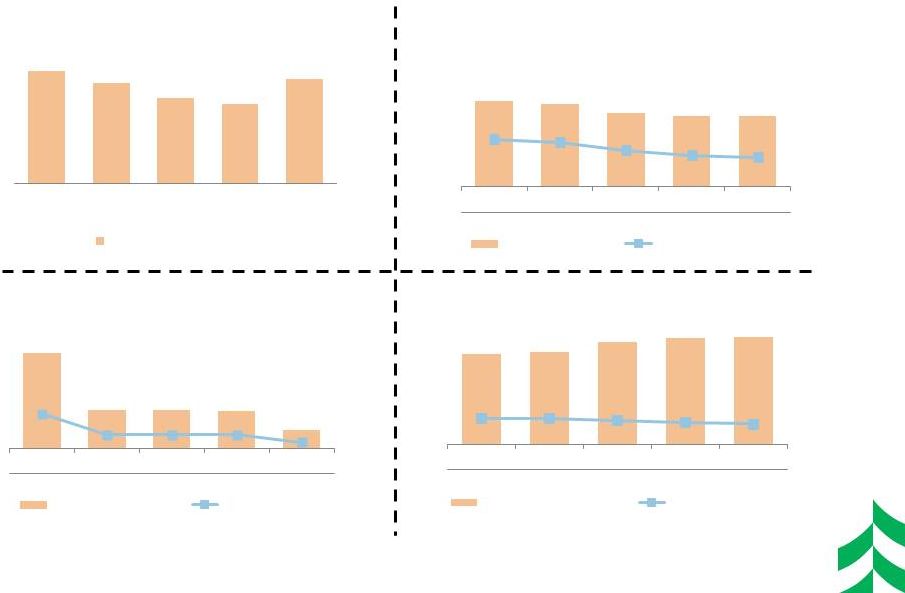

GROWING NET INTEREST INCOME WHILE MARGIN COMPRESSES 6 Yield on Interest-earning Assets Cost of Interest-bearing Liabilities Net Interest Income & Net Interest Margin ($ in millions) $160 $161 $167 $165 Net Interest Margin $169 $1 <$1 <$1 0.41% 0.35% 0.31% 0.38% 0.29% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 $159 $159 $163 $164 $168 $1 $4 Net Interest Income Net of Interest Recoveries Interest Recoveries 0.24% 0.23% 0.22% 0.19% 0.19% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Interest Bearing Deposit Costs Other Funding Costs 3.47% 3.42% 3.50% 3.36% 3.31% 3.16% 3.13% 3.23% 3.12% 3.08% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 |

NONINTEREST INCOME TRENDS ($ IN MILLIONS) 7 Core Fee-based Revenue Other Noninterest Income Total Noninterest Income 1 – Core Fee-based Revenue = Trust service fees plus Service charges on deposit accounts plus Card-based and other nondeposit fees plus Insurance commissions plus Brokerage and annuity commissions. This is a non-GAAP measure. Please refer to press release tables for more information. 2 – Other Noninterest Income = Total Noninterest Income minus Core Fee-based Revenue. $29 $13 $19 $17 $12 $84 $71 $76 $74 $72 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 $55 $58 $57 $57 $60 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 +10% $10 $10 $10 $10 $7 $19 $4 $8 $6 $5 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Other Mortgage Banking Income (net) 1 2 |

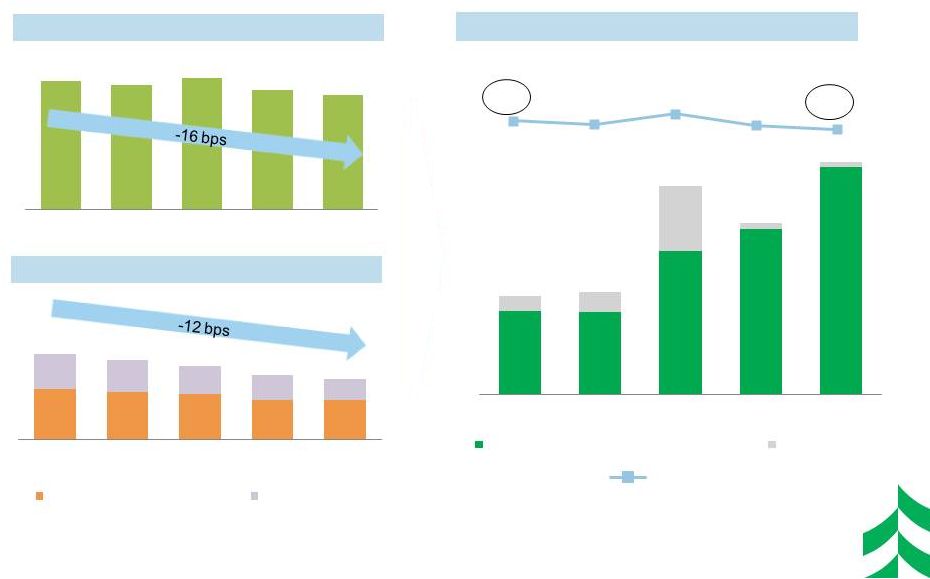

NONINTEREST EXPENSE TRENDS ($ IN MILLIONS) 8 Total Noninterest Expense Personnel Spend / FTE Trend Efficiency Ratio 67% 70% 73% 69% 68% Other Non-Personnel Spend Trend 1 – Efficiency ratio = Noninterest expense, excluding amortization of intangibles, divided by sum of taxable equivalent net interest income plus noninterest income, excluding investment securities gains, net, and asset gains, net. This is a non-GAAP financial measure. Please refer to the appendix for a reconciliation of this. 2 – FTE = Average Full Time Equivalent Employees 3 – Technology Spend = Data Processing and Equipment expenses 4 – Other Non-Personnel Spend = Total Noninterest Expense less Personnel and Technology spend 3 4 $69 $67 $78 $70 $70 $169 $165 $179 $168 $168 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 $100 $98 $101 $98 $98 4,790 4,699 4,584 4,517 4,431 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Personnel Spend FTE $19 $19 $19 $19 $21 $50 $49 $58 $51 $49 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Technology Spend Other Non-Personnel 1 2 |

CREDIT QUALITY INDICATORS ($ IN MILLIONS) 9 $310 $277 $235 $220 $288 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Potential Problem Loans $217 $208 $185 $178 $179 1.38% 1.33% 1.17% 1.08% 1.05% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Nonaccruals Nonaccruals / Loans $14 $5 $5 $5 $3 0.35% 0.14% 0.14% 0.14% 0.06% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Net Charge Offs NCOs / Avg Loans 127% 131% 145% 151% 152% 1.76% 1.74% 1.69% 1.63% 1.59% 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 ALLL/ Nonaccruals ALLL/ Total Loans |

EPS, DIVIDENDS, AND CAPITAL DEPLOYMENT • Current capital levels are in excess of “well-capitalized” regulatory benchmarks Existing capital levels are already above Basel III capital levels $115 mm of remaining share repurchase authorization 10 Tier 1 Common Equity Ratio EPS and Dividends Paid & ROT1CE Earnings & Dividends per Common Share Return on Tier 1 Common Equity Definition of Tier 1 Common Equity: Tier 1 Common Equity (T1CE), a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of our capital with the capital of other financial services companies. Management uses Tier 1 common equity, along with other capital measures, to assess and monitor our capital position. Tier 1 Common Equity is Tier 1 capital excluding qualifying perpetual preferred stock and qualifying trust preferred securities. $0.15 $0.24 $0.28 $0.28 12.61% 12.04% 11.49% 10.72% 2Q 2011 2Q 2012 2Q 2013 2Q 2014 $0.01 $0.05 $0.08 $0.09 2Q 2011 2Q 2012 2Q 2013 2Q 2014 6.1% 9.3% 9.9% 9.6% |

2014 SECOND HALF OUTLOOK 11 Asset Growth Deposits / Funding Mix Margin Noninterest Income Noninterest Expense Capital Provision • Full year 2014 annual average loan growth of approximately 8% • Mid single digit average deposit and slightly higher other funding growth • NIM compression of a few basis points per quarter • Net interest income growth • Second half 2014 noninterest income in line with first half 2014 • Total 2014 expenses expected to be flat compared to 2013 with a continued focus on efficiency initiatives • Continue to follow stated corporate priorities for capital deployment • Provision based on expected loan growth and other factors |

APPENDIX 12 |

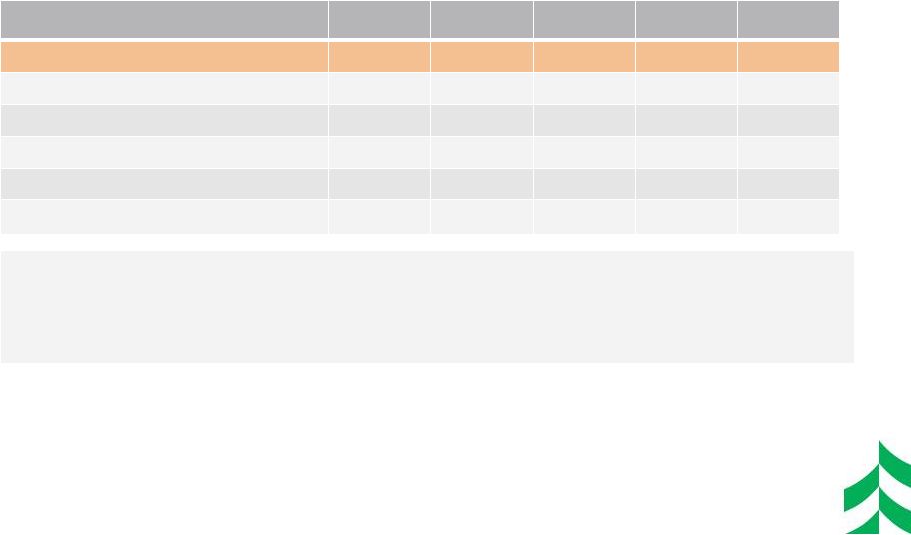

RECONCILIATION AND DEFINITIONS OF NON-GAAP ITEMS 13 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 Efficiency Ratio Reconciliation: Efficiency ratio (1) 69.01% 71.45% 73.70% 70.41% 69.70% Taxable equivalent adjustment (1.38) (1.50) (1.49) (1.35) (1.32) Asset gains (losses), net (0.01) 0.59 0.80 0.22 0.26 Other intangible amortization (0.41) (0.44) (0.42) (0.42) (0.41) Efficiency ratio, fully taxable equivalent (1) 67.21% 70.10% 72.59% 68.86% 68.23% (1) Efficiency ratio is defined by the Federal Reserve guidance as noninterest expense divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. Efficiency ratio, fully taxable equivalent, is noninterest expense, excluding other intangible amortization, divided by the sum of taxable equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net and asset gains / losses, net. This efficiency ratio is presented on a taxable equivalent basis, which adjusts net interest income for the tax-favored status of certain loans and investment securities. Management believes this measure to be the preferred industry measurement of net interest income as it enhances the comparability of net interest income arising from taxable and tax-exempt sources and it excludes certain specific revenue items (such as investment securities gains / losses, net and asset gains / losses, net). |