- PFE Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Pfizer (PFE) DEF 14ADefinitive proxy

Filed: 14 Mar 02, 12:00am

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934, as amended (Amendment No. __)

Filed by the Registrant /X/

Filed by a party other than the Registrant / /

Check the appropriate box:

/ / Preliminary Proxy Statement

/ / Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

/X/ Definitive Proxy Statement

/ / Definitive Additional Materials

/ / Soliciting Material underss. 240.14a-12

PFIZER INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/X/ No fee required

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| / / | Fee paid previously with preliminary materials. |

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of Annual Meeting

of Shareholders and

Proxy Statement

March 14, 2002

HOW TO VOTE

Your vote is important. Most shareholders have a choice of voting on the Internet, by telephone or by mail, using a traditional proxy card. Please refer to the proxy card or other voting instructions included with these proxy materials for information on the voting methods available to you.If you vote by telephone or on the Internet, you do not need to return your proxy card.

ANNUAL MEETING ADMISSION

Either an admission ticket or proof of ownership of Pfizer stock, as well as a form of personal identification, must be presented in order to be admitted to the Annual Meeting. If you are a shareholder of record, your admission ticket is attached to your proxy card. If your shares are held in the name of a bank, broker or other holder of record, you must bring a brokerage statement or other proof of ownership with you to the Meeting, or you may request an admission ticket in advance. (See “Annual Meeting Admission” for further details.)

REDUCE MAILING COSTS

Eligible shareholders who have more than one account in their name or the same address as other shareholders may authorize us to discontinue mailings of multiple Annual Reports and Proxy Statements. Most shareholders also can view future Annual Reports and Proxy Statements on the Internet rather than receiving paper copies in the mail. See this Proxy Statement and your proxy card for more information.

| PFIZER INC. | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | |

| TIME

| 10:00 a.m. on Thursday, April 25, 2002 |

| PLACE | Birchwood Manor |

| 111 North Jefferson Road | |

| Whippany, New Jersey 07981 | |

| WEBCAST | Our Annual Meeting also will be webcast on |

| our web site at www.pfizer.comat 10:00 a.m. | |

| on April 25, 2002. Information included on | |

| our web site, other than our Proxy Statement | |

| and form of proxy, is not a part of the proxy | |

| soliciting material. | |

| ITEMS OF BUSINESS | (1) To elect six members of the Board of |

| Directors for three-year terms. | |

| (2) To approve KPMG LLP as our independent | |

| auditors for the 2002 fiscal year. | |

| (3) To transact such other business as may | |

| properly come before the Meeting and | |

| any adjournment or postponement. | |

| RECORD DATE | You can vote if you are a shareholder of |

| record on February 28, 2002. | |

| ANNUAL REPORT | Our 2001 Annual Report, which is not a part |

| of the proxy soliciting material, is enclosed. | |

| PROXY VOTING | It is important that your shares be |

| represented and voted at the Meeting. You | |

| can vote your shares by completing and | |

| returning the proxy card sent to you. Most | |

| shareholders also can vote their shares on | |

| the Internet or by telephone. If Internet or | |

| telephone voting is available to you, voting | |

| instructions are printed on your proxy card. | |

| You can revoke a proxy at any time prior to | |

| its exercise at the Meeting by following the | |

| instructions in the accompanying Proxy | |

| Statement. | |

C. L. Clemente | |

| March 14, 2002 | Secretary |

We are pleased to announce that this year, instead of distributing gift bags containing product samples to shareholders attending the Annual Meeting, a donation will be made by the Company to Employment Horizons, an organization that provides employment, training and job placement services to persons with disabilities and other disadvantages.

TABLE OF CONTENTS | |||

Page | |||

| PROXY STATEMENT | 1 | ||

| Annual Meeting Admission | 1 | ||

| Webcast of the Annual Meeting | 1 | ||

| Shareholders Entitled to Vote | 1 | ||

| Revocation of Proxies | 1 | ||

| Vote by Telephone | 2 | ||

| Vote on the Internet | 2 | ||

| Vote by Mail | 2 | ||

| Voting at the Annual Meeting | 2 | ||

| Consolidation of Your Vote | 3 | ||

| Householding Information | 3 | ||

| List of Shareholders | 3 | ||

| Required Vote | 3 | ||

| Voting on Other Matters | 4 | ||

| Electronic Delivery of Proxy Materials and Annual Report | 4 | ||

| Cost of Proxy Solicitation | 4 | ||

| Shareholder Account Maintenance | 4 | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | 5 | ||

| GOVERNANCE OF THE COMPANY | 6 | ||

| Our Corporate Governance Principles | 6 | ||

| Board and Committee Membership | 9 | ||

| The Audit Committee | 9 | ||

| The Corporate Governance Committee | 10 | ||

| The Executive Compensation Committee | 11 | ||

| The Executive Committee | 11 | ||

| Compensation of Non-Employee Directors | 12 | ||

| Fees and Benefit Plans for Non-Employee Directors | 12 | ||

| Related Party Transactions | 13 | ||

| Indemnification | 13 | ||

| Securities Ownership of Officers and Directors | 14 | ||

| ITEM 1—ELECTION OF DIRECTORS | 15 | ||

| Nominees for Directors Whose Terms Expire in 2005 | 16 | ||

| Directors Whose Terms Expire in 2004 | 18 | ||

| Directors Whose Terms Expire in 2003 | 20 | ||

| Named Executive Officers Who Are Not Directors | 21 | ||

| ITEM 2—APPROVAL OF AUDITORS | 23 | ||

| Audit and Non-Audit Fees | 23 | ||

| Audit Committee Report | 23 | ||

| EXECUTIVE COMPENSATION | 25 | ||

| Summary Compensation Table | 25 | ||

| Total Options Exercised in 2001 and Year-End Values | 27 | ||

| Option Grants in 2001 | 27 | ||

| Long-Term Incentive Plan Awards in 2001 | 28 | ||

| Page | ||

| EXECUTIVE COMPENSATION COMMITTEE REPORT | 29 | |

| Overview of Compensation Philosophy and Program | 29 | |

| Evaluation of Executive Performance in 2001 | 29 | |

| Total Compensation | 30 | |

| Salaries | 30 | |

| Executive Annual Incentive Awards | 30 | |

| Mr. Steere’s Compensation | 30 | |

| Long-Term Incentive Compensation | 30 | |

| Stock Ownership Program | 31 | |

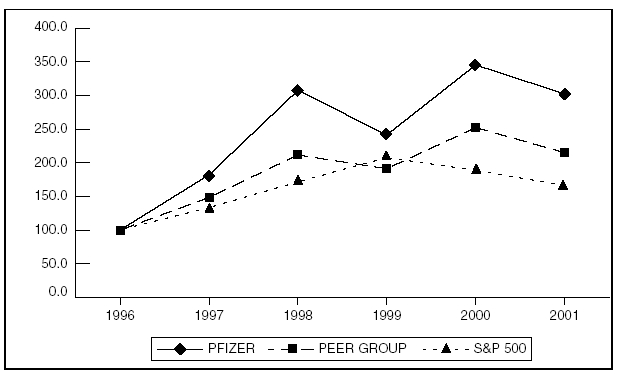

| PERFORMANCE GRAPH | 32 | |

| EMPLOYEE BENEFIT AND LONG-TERM COMPENSATION PLANS | 33 | |

| Retirement Annuity Plan | 33 | |

| Pension Plan Table | 33 | |

| 2001 Performance-Contingent Share Award Plan | 34 | |

| Executive Annual Incentive Plan | 34 | |

| 2001 Stock and Incentive Plan | 34 | |

| Warner-Lambert Company 1996 Stock Plan | 34 | |

| Pfizer Savings Plan | 35 | |

| EMPLOYMENT, CONSULTING AND SEVERANCE AGREEMENTS | 36 | |

| Employment Agreement | 36 | |

| Consulting Agreement | 36 | |

| Severance Agreements | 37 | |

| REQUIREMENTS, INCLUDING DEADLINES, FOR SUBMISSION OF PROXY PROPOSALS, | ||

| NOMINATION OF DIRECTORS AND OTHER BUSINESS OF SHAREHOLDERS | 38 | |

| ANNEX 1—Charter, Audit Committee | i | |

| ANNEX 2—Charter, Corporate Governance Committee | iii | |

| ANNEX 3—Charter, Executive Compensation Committee | iv | |

| DIRECTIONS TO BIRCHWOOD MANOR |

| Pfizer Inc. | |

| 235 East 42nd Street | |

| New York, New York 10017 |

PROXY STATEMENT

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Pfizer Inc. (“Pfizer,” the “Company,” “we,” or “us”), a Delaware corporation, of proxies to be voted at our 2002 Annual Meeting of Shareholders and at any adjournment or postponement.

You are invited to attend our Annual Meeting of Shareholders on April 25, 2002, beginning at 10:00 a.m. The Meeting will be held at Birchwood Manor, 111 North Jefferson Road, Whippany, New Jersey 07981. See the inside back cover of this Proxy Statement for directions.

Shareholders will be admitted to the Annual Meeting beginning at 9:00 a.m. If you wish to attend, please plan to arrive early since seating will be limited.

Birchwood Manor is accessible to disabled persons and, upon request, we will provide wireless headsets for hearing amplification. Sign interpretation also will be offered upon request. Please mail your request to the address noted below under “Annual Meeting Admission.”

This Proxy Statement, form of proxy and voting instructions are being mailed starting March 14, 2002.

Annual Meeting Admission

An admission ticket, which is required for entry into the Annual Meeting, is attached to your proxy card if you hold shares directly in your name as a shareholder of record. If you plan to attend the Annual Meeting, please vote your proxy but keep the admission ticket and bring it to the Annual Meeting.

If your shares are held in the name of a bank, broker or other holder of record and you plan to attend the Meeting, you must present proof of your ownership of Pfizer stock, such asa bank or brokerage account statement, to be admitted to the Meeting. If you would rather have an admission ticket, you can obtain one in advance by mailing a written request, along with proof of your ownership of Pfizer stock, to:

Pfizer Shareholder Services

235 East 42nd Street, 7th Floor

New York, NY 10017

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Meeting.

Webcast of the Annual Meeting

Our Annual Meeting also will be webcast on April 25, 2002. You are invited to visit www.pfizer.com at 10:00 a.m. on April 25, 2002 to view the webcast of the Meeting.

Shareholders Entitled to Vote

Holders of Pfizer common stock at the close of business on February 28, 2002, are entitled to receive this notice and to vote their shares at the Annual Meeting. As of that date, there were 6,266,249,535 shares of common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the Meeting.

Revocation of Proxies

You can revoke your proxy at any time before it is exercised by:

1

HOW TO VOTE

Your vote is important. You can save us the expense of a second mailing by voting promptly. Shareholders of record can vote by telephone, on the Internet or by mail as described below. If you are a beneficial owner, please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see which options are available to you.

The Internet and telephone voting procedures are designed to authenticate shareholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet you do not need to return your proxy card. Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 11:59 p.m. on April 24, 2002.

Vote by Telephone

You can vote by calling the toll-free telephone number on your proxy card. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded.If you are located outside the U.S. and Canada, see your proxy card for additional instructions.

Vote on the Internet

You also can choose to vote on the Internet. The web site for Internet voting iswww.eproxyvote.com/pfe. As with telephone voting, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you also can request electronic delivery of future proxy materials.

Vote by Mail

If you choose to vote by mail, simply mark your proxy, date and sign it, and return it to EquiServe Trust Company, N.A. in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card to Pfizer Inc., c/o EquiServe Trust Company N.A., P.O. Box 8923, Edison, New Jersey 08818-8923.

Voting at the Annual Meeting

The method by which you vote will not limit your right to vote at the Annual Meeting if you decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Meeting.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting. If you sign and return your proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors.

2

Consolidation of Your Vote

You will receive only one proxy card for all the shares you hold:

if you are a Pfizer employee,

If you are a U.S. Pfizer employee who currently has outstanding stock options, you are entitled to give voting instructions on a portion of the shares held in the Pfizer Inc. Employee Benefit Trust (the Trust).Your proxy card will serve as a voting instruction card for the trustee.

If you do not vote your shares or specify your voting instructions on your proxy card, the administrators of the Pfizer Savings Plan and of the Warner-Lambert Plans or the trustee of the Trust will vote your shares in the same proportion as the shares for which voting instructions have been received.To allow sufficient time for voting by the trustee of the Trust and the administrators of the Plans, your voting instructions must be received by April 22, 2002.

If you hold Pfizer shares through any other Company plan, you will receive voting instructions from that plan’s administrator.

Householding Information

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our Annual Report and Proxy Statement unless one or more of these shareholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

Shareholders who participate in householding will continue to receive separateproxy cards. Also, householding will not in any way affect dividend check mailings.

If you and other shareholders of record with whom you share an address currently receive multiple copies of Annual Reports and/or Proxy Statements, or if you hold stock in more than one account and in either case, you wish to receive only a single copy of the Annual Report or Proxy Statement for your household, please contact our transfer agent (in writing: EquiServe Trust Company, N.A., P.O. Box 2500, Jersey City, New Jersey, 07303-2500; by telephone: 1-800-733-9393) with the names in which all accounts are registered.

If you participate in householding and wish to receive a separate copy of the 2001 Annual Report or this Proxy Statement, or if you wish to receive separate copies of future Annual Reports and/or Proxy Statements, please contact EquiServe at the above address or phone number. We will deliver the requested documents to you promptly upon your request.

Beneficial shareholders can request information about householding from their banks, brokers or other holders of record.

List of Shareholders

The names of shareholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Meeting, between the hours of 8:45 a.m. and 4:30 p.m., at our principal executive offices at 235 East 42nd Street, New York, New York, by contacting the Secretary of the Company.

Required Vote

The presence of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

3

A plurality of the votes cast is required for the election of Directors. This means that the Director nominee with the most votes for a particular slot is elected for that slot. Only votes “for” or “against” affect the outcome.Abstentions are not counted for purposes of the election of Directors.

Under the Company’s By-laws, the affirmative vote of a majority of the votes cast “for” and “against” is required to approve the appointment of KPMG LLP as our independent auditors. Abstentions are not counted as votes “for” or “against” this proposal.

Under New York Stock Exchange rules, if you are a beneficial owner and your broker holds your shares in its name, the broker is permitted to vote your shares on the election of Directors and the approval of KPMG LLP as our independent auditors even if the broker does not receive voting instructions from you.

Voting on Other Matters

If other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. At the date this Proxy Statement went to press, we did not know of any other matters to be raised at the Annual Meeting.

Electronic Delivery of Proxy Materials and Annual Report

The notice of Annual Meeting and Proxy Statement and the 2001 Annual Report are available on our web site atwww.pfizer.com. Instead of receiving paper copies of the Annual Report and Proxy Statement in the mail, shareholders can elect to receive an e-mail which will provide an electronic link to these documents. Opting to receive your proxy materials online will save us the cost of producing and mailing documents to your home or business, and also will give you an electronic link to the proxy voting site.

Shareholders of Record:If you vote on the Internet atwww.eproxyvote.com/pfe,simply follow the prompts for enrolling in the electronic proxy delivery service. You also may enroll in the electronic proxy delivery service at any time in the future by going directly towww.econsent.com/pfeand following the Vote By Net instructions.

Beneficial Shareholders:If you hold your shares in a brokerage account, you also may have the opportunity to receive copies of the Annual Report and Proxy Statement electronically. Please check the information provided in the proxy materials mailed to you by your bank or broker regarding the availability of this service.

Cost of Proxy Solicitation

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by Directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. We have hired Morrow & Co. to distribute and solicit proxies. We will pay Morrow & Co. a fee of $25,000, plus reasonable expenses, for these services.

Shareholder Account Maintenance

Our Transfer Agent is EquiServe Trust Company, N.A. All communications concerning accounts of shareholders of record, including address changes, name changes, inquiries as to requirements to transfer shares of common stock and similar issues can be handled by calling the Pfizer Shareholder Services' toll-free number, 1-800-733-9393, or contacting EquiServe through their web site atwww.equiserve.com.

In addition, you can access your account through EquiServe’s web site. You can view your current balance, access your account history, sell shares or request a certificate for shares held in the Pfizer Shareholder Investment Program and obtain current and historical stock prices. To access your account on the Internet, visitwww.equiserve.comand enter your issue number, account number and password. These can be found on your account statement or dividend check stub.

4

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our Directors and executive officers to file reports of holdings and transactions in Pfizer shares with the SEC and the New York Stock Exchange. Based on our records and other information, we believe that in 2001 our Directors and executive officers met all applicable SEC filing requirements, except as described below:

| • | In October 2000, Craig Saxton, a Vice President who retired in April 2001, gifted shares of Pfizer stock. He reported this gift on a late Form 4 in March 2001. |

| • | In February 2001, our Director William R. Howell learned that in the previous month his portfolio manager sold 2,300 shares of Pfizer stock from his account. Mr. Howell had no knowledge of this sale until he received his statement from the portfolio manager and discovered the transaction. Mr. Howell immediately notified the portfolio manager of this error. The portfolio manager then repurchased 2,300 Pfizer shares and returned them to Mr. Howell’s account. |

| Because Mr. Howell’s portfolio manager sold, and then purchased, shares of Pfizer stock within a six-month period, Mr. Howell became subject to the statutory Section 16(b) insider liability for short-swing profits. | |

| Consequently, we requested and received a check from Mr. Howell in the amount of $2,307.96, representing disgorgement of the short-swing profits on the sale and purchase of the 2,300 Pfizer shares. A late Form 4 was filed reporting the sale and an additional Form 4 was filed on a timely basis reporting the purchase. A footnote on this Form confirmed that Mr. Howell paid Pfizer $2,307.96, representing disgorgement of the short-swing profits. |

5

GOVERNANCE OF THE COMPANY

Our Corporate Governance Principles

Role and Composition of the Board of Directors

1. The Board of Directors, which is elected by the shareholders, is the ultimate decision-making body of the Company except with respect to those matters reserved to the shareholders. It selects the senior management team, which is charged with the conduct of the Company’s business. Having selected the senior management team, the Board acts as an advisor and counselor to senior management and ultimately monitors its performance.

2. The Board also plans for succession to the position of Chairman of the Board and Chief Executive Officer as well as certain other senior management positions. To assist the Board, the Chairman and CEO annually provides the Board with an assessment of senior managers and of their potential to succeed him or her. He or she also provides the Board with an assessment of persons considered potential successors to certain senior management positions.

3. It is the policy of the Company that the positions of Chairman of the Board and Chief Executive Officer be held by the same person, except in unusual circumstances. This combination has served the Company well over a great many years. The function of the Board in monitoring the performance of the senior management of the Company is fulfilled by the presence of outside Directors of stature who have a substantive knowledge of the business.

4. It is the policy of the Company that the Board consist of a majority of outside Directors and that the number of Directors not exceed a number that can function efficiently as a body. The Corporate Governance Committee, in consultation with the Chairman and CEO, considers and makes recommendations to the Board concerning the appropriate size and needs of the Board. The Corporate Governance Committee considers candidates to fill new positions created by expansion and vacancies that occur by resignation, by retirement or for any other reason. When a Director’s principal occupation or business association changes substantially during his or her tenure as a Director, that Director shall tender his or her resignation for consideration by the Corporate Governance Committee. The Corporate Governance Committee will recommend to the Board the action, if any, to be taken with respect to the resignation. Candidates are selected for their character, judgment, business experience and acumen. Scientific expertise, prior government service and familiarity with national and international issues affecting business are among the relevant criteria. Final approval of a candidate is determined by the full Board. The Corporate Governance Committee annually reviews the compensation of Directors. All Directors are expected to own stock in the Company in an amount that is appropriate for them.

5. It is the general policy of the Company that all major decisions be considered by the Board as a whole. As a consequence, the committee structure of the Board is limited to those committees considered to be basic to or required for the operation of a publicly owned company. Currently these committees are the Executive Committee, Audit Committee, Executive Compensation Committee and Corporate Governance Committee. The members and chairs of these committees are recommended to the Board by the Corporate Governance Committee in consultation with the Chairman and CEO. The Audit Committee, Executive Compensation Committee and Corporate Governance Committee are made up of only outside Directors. The membership of these three committees is rotated from time to time.

6

6. In furtherance of its policy of having major decisions made by the Board as a whole, the Company has a full indoctrination process for new Board members that includes extensive materials, meetings with key management and visits to Company facilities.

7. It is the policy of the Company that the chairs of the Audit, Executive Compensation and Corporate Governance committees of the Board each act as the chair at meetings or executive sessions of the outside Directors at which the principal items to be considered are within the scope of the authority of his or her committee. Experience has indicated that this practice, which has been in place on an informal basis, provides for leadership at all of the meetings or executive sessions of outside Directors without the need to designate a lead Director.

8. The Executive Compensation Committee is responsible for setting annual and long-term performance goals for the Chairman and CEO and for evaluating his or her performance against such goals. The Committee meets annually with the Chairman and CEO to receive his or her recommendations concerning such goals. Both the goals and the evaluation are then submitted for consideration by the outside Directors of the Board at a meeting or executive session of that group. The Committee then meets with the Chairman and CEO to evaluate his or her performance against such goals. The Executive Compensation Committee also is responsible for setting annual and long-term performance goals and compensation for the direct reports to the Chairman and CEO. These decisions are approved or ratified by action of the outside Directors of the Board at a meeting or executive session of that group.

9. The Chairman and CEO is responsible for establishing effective communications with the Company’s stakeholder groups, i.e., shareholders, customers, company associates, communities, suppliers, creditors, governments and corporate partners. It is the policy of the Company that management speaks for the Company. This policy does not preclude outside Directors from meeting with shareholders, but it is suggested that any such meetings be held with management present.

Functioning of the Board

1. The Chairman of the Board and Chief Executive Officer sets the agenda for Board meetings with the understanding that certain items pertinent to the advisory and monitoring functions of the Board be brought to it periodically by the Chairman and CEO for review and/or decision. For example, the annual corporate budget is reviewed by the Board. Agenda items that fall within the scope of responsibilities of a Board committee are reviewed with the chair of that committee. Any member of the Board may request that an item be included on the agenda.

2. Board materials related to agenda items are provided to Board members sufficiently in advance of Board meetings where necessary to allow the Directors to prepare for discussion of the items at the meeting.

3. At the invitation of the Board, members of senior management recommended by the Chairman and CEO attend Board meetings or portions thereof for the purpose of participating in discussions. Generally, presentations of matters to be considered by the Board are made by the manager responsible for that area of the Company’s operations. In addition, Board members have free access to all other members of management and employees of the Company.

4. Executive sessions or meetings of outside Directors without management present are held at least once each year to review the report of the outside auditors, the criteria upon which the performance of the Chairman and CEO and other senior managers is based, the performance of the Chairman and CEO against such criteria, and the compensation of the Chairman and CEO and other senior managers. Additional executive sessions or meetings of outside Directors may be held from time to time as required. Executive sessions or meetings are held from time to time with the Chairman and CEO for a general discussion of relevant subjects.

7

Functioning of Committees

1. The Audit, Executive Compensation and Corporate Governance committees consist of only outside Directors.

2. The frequency, length and agenda of meetings of each of the committees are determined by the chair of the committee. Sufficient time to consider the agenda items is provided. Materials related to agenda items are provided to the committee members sufficiently in advance of the meeting where necessary to allow the members to prepare for discussion of the items at the meeting.

3. The responsibilities of each of the committees are determined by the Board from time to time.

Periodic Review

These principles are reviewed by the Board from time to time.

8

Board and Committee Membership

Our business, property and affairs are managed under the direction of our Board of Directors. Members of our Board are kept informed of our business through discussions with our Chairman and Chief Executive Officer and other officers, by reviewing materials provided to them, by visiting our offices and plants and by participating in meetings of the Board and its committees.

During 2001, the Board of Directors met 9 times and had four committees. Those committees consisted of an Audit Committee, a Corporate Governance Committee, an Executive Compensation Committee, and an Executive Committee. All of our Directors attended at least 88 percent or more of the regularly scheduled and special meetings of the Board and Board committees on which they served in 2001, and the average attendance of Directors at all meetings during the year was 96 percent.

The table below provides membership and meeting information for each of the Board committees.

| Corporate | Executive | |||

| Name | Audit | Governance | Compensation | Executive |

| Dr. Brown | X | |||

| Mr. Burns | X* | X | ||

| Mr. Burt | X* | |||

| Mr. Cornwell | X | |||

| Mr. Gray | X | |||

| Ms. Horner | X* | X | ||

| Mr. Howell | X | |||

| Dr. Ikenberry | X | X | ||

| Mr. Kamen | X | |||

| Mr. Lorch | X | |||

| Mr. Mandl | X | |||

| Dr. McKinnell | X* | |||

| Dr. Mead | X | |||

| Mr. Raines | X | |||

| Dr. Simmons | X | |||

| Mr. Steere | X** | |||

| Dr. Vallès | X | |||

| 2001 Meetings | 6 | 4 | 8 | 0 |

| * | Chair |

| ** | Mr. Steere served as our Chief Executive Officer until December 31, 2000, and as our Chairman until April 30, 2001. Because he is a former executive of the Company, he does not participate in the nomination process for Board candidates. |

The Audit Committee

Under the terms of its Charter, the Audit Committee meets at least six times a year and is responsible for recommending the annual appointment of the public accounting firm to be our outside auditors, subject to approval by the Board and the shareholders. In addition, the Committee:

9

A copy of the Audit Committee Charter is attached as Annex 1 to this Proxy Statement.

The Board of Directors has determined that all of the members of the Committee are“independent,” as defined by the rules of the New York Stock Exchange.

The Corporate Governance Committee

Under the terms of its Charter, the Corporate Governance Committee is responsible for considering and making recommendations to the Board concerning the appropriate size, function and needs of the Board. This responsibility includes:

The Committee’s additional functions are:

The Committee also:

10

A copy of the Corporate Governance Committee Charter is attached as Annex 2 to this Proxy Statement.

The Executive Compensation Committee

Under the terms of its Charter, the Executive Compensation Committee is responsible for establishing annual and long-term performance goals for our elected officers. This responsibility includes establishing the compensation and evaluating the performance of the Chairman and CEO and other elected officers. In addition, the Committee:

A copy of the Executive Compensation Committee Charter is attached as Annex 3 to this Proxy Statement.

The Executive Committee

The Executive Committee performs the duties and exercises the powers delegated to it by the Board of Directors.

11

Compensation of Non-Employee Directors

2001 Cash Retainer and Meeting Fees

| Annual | Board and | |||||||||||

| Board/Committee | Business | Committee | ||||||||||

| Director | Retainer | MeetingFees | MeetingFees | Total | ||||||||

| Dr. Brown | $ | 30,000 | $ | 13,500 | $ | 6,000 | $ | 49,500 | ||||

| Mr. Burns | 32,000 | 15,000 | 12,000 | 59,000 | ||||||||

| Mr. Burt | 31,000 | 16,500 | 9,000 | 56,500 | ||||||||

| Mr. Cornwell | 30,000 | 13,500 | 9,000 | 52,500 | ||||||||

| Mr. Gray | 30,000 | 15,000 | 6,000 | 51,000 | ||||||||

| Ms. Horner | 32,000 | 15,000 | 6,000 | 53,000 | ||||||||

| Mr. Howell | 30,000 | 15,000 | 7,500 | 52,500 | ||||||||

| Dr. Ikenberry | 30,000 | 15,000 | 6,000 | 51,000 | ||||||||

| Mr. Kamen | 30,000 | 15,000 | 6,000 | 51,000 | ||||||||

| Mr. Lorch | 30,000 | 13,500 | 13,500 | 57,000 | ||||||||

| Mr. Mandl | 30,000 | 13,500 | 10,500 | 54,000 | ||||||||

| Dr. Mead | 30,000 | 15,000 | 9,000 | 54,000 | ||||||||

| Mr. Raines | 30,000 | 15,000 | 10,500 | 55,500 | ||||||||

| Dr. Simmons | 30,000 | 15,000 | 9,000 | 54,000 | ||||||||

| Mr. Steere | 15,000 | 6,000 | 3,000 | 24,000 | ||||||||

| Dr. Vallès | 30,000 | 15,000 | 9,000 | 54,000 | ||||||||

Fees and Benefit Plans for Non-Employee Directors

Annual Cash Retainer Fees.Non-employee Directors receive an annual cash retainer fee of $26,000 per year. Non-employee Directors who serve on one or more Board committees (other than the Executive Committee) receive an additional annual fee of $4,000. In addition, the Chair of a Board committee receives an additional $2,000 per year, per committee.

Meeting Fees.Non-employee Directors also receive a fee of $1,500 for attending each Board meeting, committee meeting, the Annual Meeting of Shareholders, each day of a visit to a plant or office of ours or our subsidiaries, and for attending any other business meeting to which the Director is invited as a representative of the Company.

Unit Awards and Deferred Compensation.Under the Pfizer Inc. Nonfunded Deferred Compensation and Unit Award Plan for Non-Employee Directors (the Unit Award Plan), a non-employee Director is granted an initial award of 3,600 units when he or she becomes a Director. Afterwards, each non-employee Director is granted an annual award of 3,600 units (Annual Unit Award) on the day of our Annual Meeting, provided the Director continues to serve as a Directorfollowing the Meeting. The awards under the Unit Award Plan are made in addition to the Directors’ annual cash retainers and meeting attendance fees. Such units are not payable until the recipient ceases to be a Director.

On the day of the 2001 Annual Meeting of Shareholders, all of our non-employee Directors who continued as Directors were awarded 3,600 units under the Unit Award Plan.

Non-employee Directors may defer all or a part of their annual cash retainers and meeting fees under the Unit Award Plan until they cease to be Directors. At a Director’s election, the fees held in the Director’s account may be credited either with interest at the rate of return of the Intermediate Treasury Index Fund of the Pfizer Savings Plan, or with units. The units are calculated by dividing the amount of the fee by the closing price of our common stock on the last business day before the date that the fee would be paid. The number of units in a Director’s account is increased by the value of any distributions on the common stock. When an individual ceases to be a Director, the amount held in the Director’s account is paid in cash. The amount paid is determined by multiplying the number of units in the account by the closing price of the common stock on the last business day before the payment date.

12

Retainer Unit Awards.Under the Pfizer Inc. Annual Retainer Unit Award Plan, each year, on the day of the Annual Meeting, every non-employee Director who continues to serve as a Director following the Meeting receives the equivalent of the value of his or her annual retainer fee in units. These awards are in addition to the Annual Unit Awards, the Directors’ annual cash retainers and meeting attendance fees. The number of units awarded to the non-employee Director is based upon the five-day average of the closing trading price of our common stock on the New York Stock Exchange for the first five trading days after April 1 of each year (rounded up to the nearest unit). On the day of the 2001 Annual Meeting, all of our non-employee Directors who continued as Directors were awarded 652 units under this Plan.

Trusts.In certain circumstances, we fund trusts established to secure our obligations to make payments to our Directors under the above benefit plans, programs or agreements in advance of the date that payment is due.

Related Party Transactions

From time to time in 2001, we asked Dr. Brown to provide consulting services in connection with our business. He received a total of $10,000 for those services. We anticipate that Dr. Brown will continue to provide similar services to us in the future as he and we may agree upon from time to time.

We paid Mr. Steere $50,000 in 2001 under the terms of our consulting agreement with him. This agreement is described in this Proxy Statement under the heading “Employment, Consulting and Severance Agreements.”

We imputed income in the amount of $965 to Dr. Brown for personal use of Company transportation.

We imputed income in the following amounts in connection with our payment of premiums for continued coverage under Warner-Lambert’s life and AD&D insurance policies for certain of the former Warner-Lambert Directors who joined our Board after our merger with Warner-Lambert: $1,572 to Mr. Howell, $840 to Mr. Lorch and $564 to Mr. Mandl.

We have business arrangements with organizations with which certain of our Directors are affiliated. However, none of these arrangements is material to either us or any of those organizations.

Indemnification

We indemnify our Directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to the Company. This is required under our By-laws, and we have also signed agreements with each of those individuals contractually obligating us to provide this indemnification to them.

13

Securities Ownership of Officers and Directors

The table below shows the number of shares of our common stock beneficially owned as of February 28, 2002 by each of our Directors and each Named Executive Officer listed in the Summary Compensation Table, as well as the number of shares beneficially owned by all of our Directors and executive officers as a group. Together these individuals beneficially own less than one percent (1%) of our common stock. The table also includes information about stock options, stock units, restricted stock and deferred performance-contingent share awards credited to the accounts of each Director and executive officer under various compensation and benefit plans.

There are currently no known beneficial owners of five percent (5%) or more of our common stock.

| Number of Shares or Units | ||||||

| Common | Stock-Equivalent | Options Exercisable | ||||

| BeneficialOwners | Stock | Units | Within 60 Days | |||

| Michael S. Brown | 1,200 | 26,950 | (2) | — | ||

| M. Anthony Burns | 20,400 | 33,222 | (2) | — | ||

| Robert N. Burt | 2,200 | 24,204 | (6) | — | ||

| C.L. Clemente | 858,670 | (1)(4)(5) | 110,557 | (3) | 798,710 | |

| W. Don Cornwell | 600 | (4) | 31,562 | (2) | — | |

| William H. Gray III | 876 | 48,092 | (6) | — | ||

| Constance J. Horner | 10,914 | 33,222 | (2) | — | ||

| William R. Howell | 6,350 | 38,285 | (6) | — | ||

| Stanley O. Ikenberry | 39,952 | (4) | 125,873 | (2) | — | |

| Harry P. Kamen | 2,520 | 39,460 | (2) | |||

| Karen L. Katen | 583,650 | (1) | 20,152 | (3) | 704,250 | |

| George A. Lorch | 1,650 | 20,032 | (6) | — | ||

| Alex J. Mandl | 2,000 | 42,871 | (6) | |||

| Henry A. McKinnell | 1,060,088 | (1)(5) | 47,537 | (3) | 1,621,158 | |

| Dana G. Mead | 9,000 | 28,291 | (2) | — | ||

| John F. Niblack | 927,261 | (1)(4) | 32,472 | (3) | 970,950 | |

| Franklin D. Raines | 1,500 | 21,563 | (2) | — | ||

| David L. Shedlarz | 502,526 | (1)(4) | 16,081 | (3) | 331,612 | |

| Ruth J. Simmons | 879 | 29,781 | (2) | — | ||

| William C. Steere, Jr | 2,176,916 | (1)(4)(7) | 179,369 | (2)(3) | 4,566,950 | |

| Jean-Paul Vallès | 755,915 | (4) | 77,966 | (2) | — | |

| All Directors and Executive Officers | ||||||

| as a group (24 persons) | 7,384,799 | 1,118,644 | (8) | 9,694,604 | ||

| (1) | As of February 28, 2002, this number includes shares credited under the Pfizer Savings Plan or deferred Performance—Contingent Share Awards granted under the 2001 Performance-Contingent Share Award Plan or its predecessor Program. These plans are described in this Proxy Statement under the heading “Employee Benefit and Long-Term Compensation Plans.” |

| (2) | As of February 28, 2002, these units are held under the Pfizer Inc. Nonfunded Deferred Compensation and Unit Award Plan for Non-Employee Directors and the Pfizer Inc. Annual Retainer Unit Award Plan. The value of a Director’s unit account is measured by the price of our common stock. The Plans are described in this Proxy Statement under the heading “Compensation of Non-Employee Directors—Fees and Benefit Plans for Non-Employee Directors.” |

| (3) | As of February, 28, 2002, these units are held under the Supplemental Savings Plan. The value of these units is measured by the price of our common stock. The Supplemental Savings Plan is described in this Proxy Statement under the heading “Employee Compensation and Long-Term Benefit Plans—Pfizer Savings Plan.” |

| (4) | These shares do not include the following number of shares held in the names of family members, as to which beneficial ownership is disclaimed: Mr. Clemente, 26,136 shares; Mr. Cornwell, 300 shares; Dr. Ikenberry, 8,300 shares; Dr. Niblack, 17,508 shares; Mr. Shedlarz, 2,097 shares; Mr. Steere, 4,936 shares; and Dr. Vallès, 142,320 shares. |

| (5) | As of February 28, 2002, this includes the following number of shares held in a Grantor Retained Annuity Trust: Dr.McKinnell, 47,380 shares; Mr. Clemente, 53,814 shares. |

| (6) | As of February 28, 2002, this number includes units held under the Pfizer Inc. Nonfunded Deferred Compensation and Unit Award Plan for Non-Employee Directors and the Pfizer Inc. Annual Retainer Unit Award Plan. The value of a Director’s unit account is measured by the price of our common stock. The Plans are described in this Proxy Statement under the heading ”Compensation of Non-Employee Directors—Fees and Benefit Plans for Non-Employee Directors.” This number also includes the following number of units resulting from the conversion into Pfizer units of previously deferred Warner-Lambert director compensation under the Warner-Lambert Company 1996 Stock Plan. That Plan is described in this Proxy Statement under the heading “Employee Benefit and Long-Term Compensation Plans—Warner-Lambert Company 1996 Stock Plan”: Mr. Burt, 16,243 units; Mr. Gray, 40,131 units; Mr. Howell, 28,265 units; Mr. Lorch, 10,562 units; and Mr. Mandl, 32,849 units. |

| (7) (8) | As of February 28, 2002, this includes 131,402 shares held in a Flint Trust for Mr. Steere. As of February 28, 2002, this number includes, for one of our executive officers, units held under the Pfizer Inc. Deferred Compensation Plan relating to deferred bonus payments made under the Executive Annual Incentive Plan. These Plans are described in this Proxy Statement under the heading “Employee Benefit and Long¯Term Compensation Plans¯Executive Annual Incentive Plan.” |

14

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, with each class consisting of six Directors whose terms expire at successive Annual Meetings. Six Directors will be elected at the Annual Meeting to serve for a three-year term expiring at our Annual Meeting in 2005.

The persons named in the enclosed proxy intend to vote the proxy for the election of each of the six nominees, unless you indicate on the proxy card that your vote should be withheld from any or all of the nominees.

The Board of Directors has proposed the following nominees for election as Directors with terms expiring in 2005 at the Annual Meeting:

Michael S. Brown, Constance J. Horner, George A. Lorch, Alex J. Mandl, Franklin D. Raines and Jean-Paul Vallès.

Each nominee elected as a Director will continue in office until his or her successor has been elected and qualified, or until his or her earlier death, resignation or retirement.

The Board of Directors unanimously recommends a vote FOR the election of these nominees as Directors.

We expect each nominee for election as a Director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board chooses to reduce the number of Directors serving on the Board.

The principal occupation and certain other information about the nominees and other Directors whose terms of office continue after the Annual Meeting are set forth on the following pages.

15

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

NOMINEES FOR DIRECTORS WHOSE TERMS EXPIRE IN 2005

Michael S. Brown 61

Distinguished Chair in Biomedical Sciences from 1989 and Regental Professor from 1985 at the University of Texas Southwestern Medical Center at Dallas. Co-recipient of the Nobel Prize in Physiology or Medicine in 1985 and the National Medal of Science in 1988. Member of the National Academy of Sciences. Director of Regeneron Pharmaceuticals, Inc. Our Director since 1996. Member of our Corporate Governance Committee.

Distinguished Chair in Biomedical Sciences from 1989 and Regental Professor from 1985 at the University of Texas Southwestern Medical Center at Dallas. Co-recipient of the Nobel Prize in Physiology or Medicine in 1985 and the National Medal of Science in 1988. Member of the National Academy of Sciences. Director of Regeneron Pharmaceuticals, Inc. Our Director since 1996. Member of our Corporate Governance Committee.

Constance J. Horner 60

Guest Scholar since 1993 at The Brookings Institution, an organization devoted to nonpartisan research, education and publication in economics, government and foreign policy and the social sciences. Commissioner of the U.S. Commission on Civil Rights from 1993 to 1998. Served at the White House as Assistant to President George H. Bush and as Director of Presidential Personnel from August 1991 to January 1993. Deputy Secretary, U.S. Department of Health and Human Services from 1989 to 1991. Director of the U. S. Office of Personnel Management from 1985 to 1989. Director of Foster Wheeler Ltd., Ingersoll-Rand Company Limited and Prudential Financial, Inc. Fellow, National Academy of Public Administration; Trustee, Annie E. Casey Foundation; Member of the Board of Trustees of the Prudential Foundation. Our Director since 1993. Chair of our Corporate Governance Committee and member of our Executive Committee.

George A. Lorch 60

Chairman Emeritus of Armstrong Holdings, Inc., a company that manufactures flooring and ceiling materials, since August 2000. Chairman and Chief Executive Officer of Armstrong Holdings, Inc. from May 2000 to August 2000, and its Chairman, President and Chief Executive Officer from September 1993 to May 1994. President and Chief Executive Officer of Armstrong World Industries, Inc., from September 1993 to May 2000, and a Director from 1988 to December 2000. On December 6, 2000, Armstrong World Industries Inc. filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. Director of Household International, Inc. and The Williams Companies, Inc. Our Director since June 2000. Member of our Executive Compensation Committee.

Chairman Emeritus of Armstrong Holdings, Inc., a company that manufactures flooring and ceiling materials, since August 2000. Chairman and Chief Executive Officer of Armstrong Holdings, Inc. from May 2000 to August 2000, and its Chairman, President and Chief Executive Officer from September 1993 to May 1994. President and Chief Executive Officer of Armstrong World Industries, Inc., from September 1993 to May 2000, and a Director from 1988 to December 2000. On December 6, 2000, Armstrong World Industries Inc. filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. Director of Household International, Inc. and The Williams Companies, Inc. Our Director since June 2000. Member of our Executive Compensation Committee.

16

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

NOMINEES FOR DIRECTORS WHOSE TERMS EXPIRE IN 2005

(continued)

Alex J. Mandl 58

Principal of ASM Investments, a company focusing on early stage funding in the technology sector, since April 2001. Chairman and Chief Executive Officer of Teligent Inc. from 1996 to March 2001. On May 21, 2001, Teligent Inc. filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. AT&T’s President and Chief Operating Officer from 1994 to 1996, and its Executive Vice President and Chief Financial Officer from 1991 to 1993. Chairman of the Board and Chief Executive Officer of Sea-Land Services Inc. from 1988 to 1991. Director of Dell Computer Corporation. Our Director since June 2000. Member of our Executive Compensation Committee.

Principal of ASM Investments, a company focusing on early stage funding in the technology sector, since April 2001. Chairman and Chief Executive Officer of Teligent Inc. from 1996 to March 2001. On May 21, 2001, Teligent Inc. filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code. AT&T’s President and Chief Operating Officer from 1994 to 1996, and its Executive Vice President and Chief Financial Officer from 1991 to 1993. Chairman of the Board and Chief Executive Officer of Sea-Land Services Inc. from 1988 to 1991. Director of Dell Computer Corporation. Our Director since June 2000. Member of our Executive Compensation Committee.

Franklin D. Raines 53

Chairman and Chief Executive Officer of Fannie Mae, a company that provides a secondary market for residential mortgages through portfolio purchases, issuance of mortgage-backed securities, and other services, since January 1999. Director of the Office of Management and Budget for the Clinton administration from 1996 to 1998. Director of AOL Time Warner Inc. and PepsiCo, Inc. Chairman of the Corporate Governance Task Force of the Business Roundtable. A former Director of Pfizer from 1993 to 1996, Mr. Raines was re-elected to our Board in October 1998. Member of our Executive Compensation Committee.

Jean-Paul Vallès 65

Chairman Emeritus of Minerals Technologies Inc. (MTI), a resource and technology-based company that develops, produces and markets specialty mineral, mineral-based and synthetic mineral products, since October 2001. Chairman of MTI from August 1992 to October 2001, and Chief Executive Officer of MTI from August 1992 to December 2000. Formerly our Vice Chairman from March to October 1992. Director of the Board of Overseers, Leonard N. Stern School of Business, New York University. Our Director since 1980. Member of our Audit Committee.

17

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

DIRECTORS WHOSE TERMS EXPIRE IN 2004

Robert N. Burt 64

Retired Chairman and Chief Executive Officer of FMC Corporation, a company that manufactures chemicals and machinery, and FMC Technologies, Inc., a subsidiary of FMC Corporation. Mr. Burt was Chairman of the Board of FMC Corporation from 1991 to December 2001, its Chief Executive Officer from 1991 to August 2001 and a member of its Board of Directors since 1989. He was Chairman of the Board of FMC Technologies, Inc., from June 2001 to December 2001 and its Chief Executive Officer from June 2001 to August 2001. Director of Phelps Dodge Corporation. Also a Director of the Rehabilitation Institute of Chicago and Chicago Public Education Fund. Our Director since June 2000. Chair of our Audit Committee.

Retired Chairman and Chief Executive Officer of FMC Corporation, a company that manufactures chemicals and machinery, and FMC Technologies, Inc., a subsidiary of FMC Corporation. Mr. Burt was Chairman of the Board of FMC Corporation from 1991 to December 2001, its Chief Executive Officer from 1991 to August 2001 and a member of its Board of Directors since 1989. He was Chairman of the Board of FMC Technologies, Inc., from June 2001 to December 2001 and its Chief Executive Officer from June 2001 to August 2001. Director of Phelps Dodge Corporation. Also a Director of the Rehabilitation Institute of Chicago and Chicago Public Education Fund. Our Director since June 2000. Chair of our Audit Committee.

W. Don Cornwell 54

Chairman of the Board and Chief Executive Officer since 1988 of Granite Broadcasting Corporation, a group broadcasting company. Director of Avon Products, Inc. and CVS Corporation. Also, a Director of Hershey Trust Company, Milton Hershey School, Wallace-Reader’s Digest Funds and the Telecommunications Development Fund. Trustee of Big Brothers/Sisters of New York and Mt. Sinai University Medical Center. Our Director since February 1997. Member of our Audit Committee.

Henry A. McKinnell 59

Chairman of our Board since May 2001. Our Chief Executive Officer since January 2001. Our President from May 1999 to May 2001, and President, Pfizer Pharmaceuticals Group, the principal operating division of the Company, from January 1997 to April 2001. Chief Operating Officer from May 1999 to December 2000 and Executive Vice President from 1992 to 1999. Director of Moody’s Corporation and John Wiley & Sons, Inc. Dr. McKinnell is currently Chairman of the Pharmaceutical Research and Manufacturers of America (PhRMA). Member of the Board of Directors of the Business Roundtable (BRT), Vice Chairman of the BRT’s Corporate Governance Task Force and Chairman of its SEC subcommittee. Director of the Trilateral Commission and the Business Council, and Chairman of the Stanford University Graduate School of Business Advisory Council. Chairman Emeritus of the Business-Higher Education Forum, a Fellow of the New York Academy of Medicine, and a member of the Boards of Trustees of the New York City Public Library, the New York City Police Foundation and the Economic Club of New York. Our Director since June 1997. Chair of our Executive Committee and a member of the Pfizer Leadership Team.

18

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

DIRECTORS WHOSE TERMS EXPIRE IN 2004

(continued)

Dana G. Mead 66

Retired Chairman and Chief Executive Officer of Tenneco, Inc. Chairman and Chief Executive Officer of Tenneco, Inc. from 1994 to 1999. Chairman of two of the successor companies of the Tenneco conglomerate, Tenneco Automotive Inc. and Pactiv Corporation, global manufacturing companies with operations in automotive parts and packaging, from November 1999 to March 2000. Director of Zurich Financial Services and TaskPoint.com. Director of the Center for Creative Leadership and the Logistics Management Institute. Member of the Massachusetts Institute of Technology Corporation and a Lifetime Trustee of the Association of Graduates, U.S. Military Academy, West Point. Former Chairman of the Business Roundtable and of the National Association of Manufacturers. Our Director since January 1998. Member of our Executive Compensation Committee.

Ruth J. Simmons 56

President since July 1, 2001, of Brown University. President, from 1995 to 2001, of Smith College. Vice Provost of Princeton University from 1992 to 1995. Director of The Goldman Sachs Group, Inc. and Texas Instruments Incorporated. Trustee of the Carnegie Corporation of New York. Member of the National Academy of Arts and Sciences, the American Philosophical Society, and the Council on Foreign Relations. Our Director since January 1997. Member of our Audit Committee.

William C. Steere, Jr 65

Chairman Emeritus of Pfizer Inc. since July 2001. Chairman of our Board from 1992 to April 2001 and our Chief Executive Officer from February 1991 to December 2000. Director of Dow Jones & Company, Inc., MetLife, Inc. and Minerals Technologies Inc. Director of the New York University Medical Center and the New York Botanical Garden. Member of the Board of Overseers of Memorial Sloan-Kettering Cancer Center. Our Director since 1987. Member of our Corporate Governance Committee.

19

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

DIRECTORS WHOSE TERMS EXPIRE IN 2003

M. Anthony Burns 59

Chairman of the Board since May 1985, Chief Executive Officer from January 1983 to November 2000, and President from December 1979 to June 1999 of Ryder System, Inc., a provider of transportation and logistics services. Director of The Black & Decker Corporation, J. C. Penney Company, Inc. and J. P. Morgan Chase & Co. Trustee of the University of Miami. Member of the Business Council. Our Director since 1988. Chair of our Executive Compensation Committee and a member of our Executive Committee.

William H. Gray III 60

President and Chief Executive Officer of The College Fund/UNCF, an educational assistance organization, since 1991. Mr. Gray served as a Congressman from the Second District of Pennsylvania from 1979 to 1991, and at various times during his tenure, served as Budget Committee Chair and House Majority Whip. Director of Dell Computer Corporation, Electronic Data Systems Corporation, J. P. Morgan Chase & Co., MBIA Inc., Prudential Financial, Inc., Rockwell International Corporation, Viacom Inc. and Visteon Corporation. Our Director since June 2000. Member of our Corporate Governance Committee.

William R. Howell 66

Chairman Emeritus of J. C. Penney Company, Inc., a provider of consumer merchandise and services through department stores, catalog departments and the Internet, since 1997. Chairman of the Board and Chief Executive Officer of J. C. Penney Company, Inc. from 1983 to 1997. Director of American Electric Power Company, Bankers Trust Corporation, Exxon Mobil Corporation, Halliburton Company, The Williams Companies, Inc. and Viseon, Inc. Chairman of the Board of Trustees of Southern Methodist University from 1996 to 2000. Our Director since June 2000. Member of our Audit Committee.

Stanley O. Ikenberry 67

President Emeritus, Regent Professor, Department of Educational Organization and Leadership, University of Illinois, since September 2001. President, November 1996 to June 2001, of the American Council on Education, an independent nonprofit association dedicated to ensuring high-quality education at colleges and universities throughout the United States. President from 1979 through July 1995 of the University of Illinois. Director of Utilicorp United Inc. President, Board of Overseers of Teachers’ Insurance & Annuity Association - College Retirement Equities Fund (TIAA-CREF). Director of the National Museum of Natural History, Smithsonian Institution. Our Director since 1982. Member of our Corporate Governance Committee and of our Executive Committee.

20

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

DIRECTORS WHOSE TERMS EXPIRE IN 2003

(continued)

Harry P. Kamen 68

Retired Chairman of the Board and Chief Executive Officer of Metropolitan Life Insurance Company (now known as MetLife, Inc.), a multi-service insurance provider. Chairman of the Board and Chief Executive Officer of MetLife, Inc. from 1993 through June 1998, and President from 1995 through November 1994. Director of BDirect Capital, Bethlehem Steel Corporation, and MetLife, Inc. Member of the Board of Governors of the National Association of Securities Dealers, Inc. Our Director since 1996. Member of our Corporate Governance Committee.

John F. Niblack 63

Our Vice Chairman since May 1999 and President of Pfizer Global Research and Development since June 2000. Our Executive Vice President from 1993 to May 1999. Responsible for our Global Research and Development Division and pharmaceutical Licensing and Development. Our Director since June 1997. Member of the Pfizer Leadership Team.

NAMED EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

C.L. Clemente 64

| Our Executive Vice President - Corporate Affairs since May 1999. Secretary and Corporate Counsel since 1992. Senior Vice President from 1992 to May 1999. He is a Director of IMS Health Incorporated, and Chairman of the United Way of New York City. Mr. Clemente, a member of the Pfizer Leadership Team, joined us in 1964. |

Karen L. Katen 53

| Our Executive Vice President and President of PfizerPharmaceuticals Group, the Company’s worldwide pharmaceutical organization, since April 2001. President of our U.S.Pharmaceuticals Group since 1995; Executive Vice President of the Global Pfizer Pharmaceuticals Group since 1997. She is a Director of General Motors Corporation and Harris Corporation and also serves on the International Council of J. P. Morgan Chase & Co. Ms. Katen, a member of the Pfizer Leadership Team, joined us in 1974. |

21

| Name and Age as of the | |

| April 25, 2002 Annual Meeting | Position, Principal Occupation, Business Experience and Directorships |

NAMED EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

(continued)

David L. Shedlarz 53

Our Executive Vice President since 1999 and our Chief Financial Officer since 1995. Mr. Shedlarz was appointed a Senior Vice President in January 1997 with additional worldwide responsibility for our former Medical Technology Group. He is a Director of Pitney Bowes Inc., a member of the J. P. Morgan Chase & Co. National Advisory Board, Co-Chair of the Principal Financial Officers Task Force at the Business Roundtable, and Director of the Board of Overseers, Leonard N. Stern School of Business, New York University. Mr. Shedlarz, a member of the Pfizer Leadership Team, joined us in 1976. |

22

ITEM 2—APPROVAL OF AUDITORS

The Board of Directors, upon the recommendation of its Audit Committee, has appointed KPMG LLP to serve as our independent auditors for 2002, subject to the approval of our shareholders.

Representatives of KPMG LLP will be present at the Annual Meeting to answer questions. They also will have the opportunity to make a statement if they desire to do so.

Audit and Non-Audit Fees

The following table presents fees for professional audit services rendered by KPMG LLP for the audit of the Company’s annual financial statements for the year ended December 31, 2001, and fees billed for other services rendered by KPMG LLP:

| Audit fees, excluding | ||||

| audit related services: | $8,375,000 | |||

| Financial information systems | ||||

| design and implementation: | 0 | |||

| All other fees: | ||||

| Audit related fees(1) | $ 1,915,000 | |||

| Tax Advisory Services(2) | 20,885,000 | |||

| Other non-audited services(3) | 2,684,000 | |||

| Total all other fees | $25,484,000 | |||

| (1) | Audit related fees consisted principally of assistance with matters related to the merger of Warner-Lambert Company, audits of employee benefits plans, review of registration statements, issuance of consents and letters to underwriters. |

| (2) | Tax advisory services were provided principally for assistance with matters related to the merger of various Pfizer and Warner-Lambert corporate entities throughout the world. This project was substantially complete at December 31, 2001 and, therefore, it is our current expectation that these fees will be substantially lower for 2002. |

| (3) | Other non-audit services consisted principally of project management assistance, development of a supplier catalog, and year-end closing support for subsidiaries. |

The Board of Directors unanimously recommends a vote FOR the approval of KPMG LLP as our independent auditors for 2002.

Audit Committee Report

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In this context, the Committee has met and held discussions with management and the independent auditors regarding the fair and complete presentation of the Company’s results. Management represented to the Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees).

In addition, the Committee has discussed with the independent auditors the auditors’ independence from the Company and its management, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees). The Committee also has considered whether the independent auditors’ provision of information technology and other non-audit services to the Company is compatible with the auditors’ independence. The Committee has concluded that the independent auditors are independent from the Company and its management.

The Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

23

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Securities and Exchange Commission. The Committee and the Board also haverecommended, subject to shareholder approval, the selection of the Company’s independent auditors.

| The Audit Committee: | |

| Mr. Burt (Chair) | |

| Mr. Cornwell | |

| Mr. Howell | |

| Dr. Simmons | |

| Dr. Vallès |

24

EXECUTIVE COMPENSATION | ||||||||||||||||

Summary Compensation Table | ||||||||||||||||

| Annual Compensation | Long-Term Compensation | |||||||||||||||

Awards | Payouts | |||||||||||||||

| OtherAnnualCompensation(2) ($) | RestrictedStock Awards(3) ($) | SecuritiesUnderlyingOptions (#) | ||||||||||||||

| LTIPPayouts(5)($) | All OtherCompensation(6) ($) | |||||||||||||||

| Name andPrincipal Position | Salary ($) | Bonus(1)($) | ||||||||||||||

| Year |

| |||||||||||||||

| Dr. McKinnell*Chairman and CEO | 2001 | 1,516,667 | 2,780,800 | 33,655 | 0 | 800,000 | 7,920,000 | 117,743 | ||||||||

| 2000 | 984,100 | 1,426,900 | 42,079 | 1,408,826 | 330,000 | 4,930,892 | 83,084 | |||||||||

| 1999 | 869,800 | 1,093,000 | 26,998 | 2,003,125 | 405,450 | (4) | 4,864,950 | 76,796 | ||||||||

| Dr. Niblack Vice Chairman | 2001 | 944,600 | 1,062,700 | 27,347 | 0 | 450,000 | 5,890,500 | 75,080 | ||||||||

| 2000 | 832,500 | 932,400 | 23,538 | 1,096,949 | 210,000 | 3,839,321 | 69,128 | |||||||||

| 1999 | 799,700 | 895,700 | 13,849 | 1,802,813 | 360,450 | (4) | 4,096,800 | 66,404 | ||||||||

| Ms. Katen*Executive V.P.;President-PfizerPharmaceuticalsGroup andPresident-U.S.Pharmaceuticals | 2001 | 854,625 | 1,043,400 | 28,043 | 0 | 330,000 | 4,108,500 | 63,397 | ||||||||

| 2000 | 698,800 | 730,300 | 11,638 | 688,282 | 165,000 | 2,408,986 | 53,772 | |||||||||

| 1999 | 625,800 | 645,500 | 9,774 | 130,906 | 225,450 | (4) | 2,389,800 | 45,304 | ||||||||

| Mr. ShedlarzExecutive V.P.and CFO | 2001 | 772,800 | 736,900 | 20,025 | 0 | 330,000 | 3,861,000 | 59,860 | ||||||||

| 2000 | 695,100 | 723,700 | 12,909 | 763,562 | 160,000 | 2,672,468 | 53,508 | |||||||||

| 1999 | 625,800 | 642,600 | 11,096 | 65,453 | 225,450 | (4) | 2,731,200 | 47,556 | ||||||||

| C.L. ClementeExecutive V.P.-Corporate Affairs;Secretary andCorporate Counsel | 2001 | 679,500 | 680,900 | 22,203 | 0 | 225,000 | 2,970,000 | 54,416 | ||||||||

| 2000 | 651,500 | 680,900 | 27,736 | 645,264 | 140,000 | 2,258,424 | 45,420 | |||||||||

| 1999 | 625,800 | 654,000 | 23,693 | 0 | 225,450 | (4) | 2,457,150 | 43,320 | ||||||||

| Mr. SteereFormer Chairman** | 2001 | 808,000 | 1,616,000 | 22,000 | 0 | 0 | 0 | 549,440 | ||||||||

| 2000 | 1,616,000 | 3,232,000 | 21,500 | 2,688,600 | 800,000 | 9,410,100 | 179,544 | |||||||||

| 1999 | 1,436,300 | 2,872,600 | 13,595 | 0 | 900,450 | (4) | 10,668,750 | 167,828 | ||||||||

| * | Dr. McKinnell and Ms. Katen received promotions to the positions indicated in the Table above during 2001. |

| ** | Mr. Steere served as Chairman of the Company until April 30, 2001. |

| (1) | The amounts shown in this column constitute the Annual Incentive Awards made to each officer based on the Board’s evaluation of each officer’s performance. These awards are discussed in further detail in the Executive Compensation Committee Report. |

| (2) | The amounts shown in this column represent tax payments made by us on behalf of each officer relating to his or her use of Company transportation and personal financial counseling. |

| (3) | The amounts shown in this column represent the dollar value of the Company’s common stock on the date of grant of the restricted stock. All grants of restricted stock are made under our 2001 Stock and Incentive Plan, or were made under its predecessor Plan. |

25

| On February 21, 2001, Dr. McKinnell received a grant of 31,440 shares of common stock, Dr. Niblack received a grant of 24,480 shares of common stock, Ms. Katen received a grant of 15,360 shares of common stock, Mr. Shedlarz received a grant of 17,040 shares of common stock; Mr. Clemente received a grant of 14,400 shares of common stock, and Mr. Steere received a grant of 60,000 shares of common stock. All of these restricted stock grants vested on February 21, 2002, except for Mr. Steere’s grant, which vested upon his retirement from the Company on July 1, 2001. On August 26, 1999, Dr. McKinnell received a grant of 50,000 shares of common stock and Dr. Niblack received a grant of 45,000 shares of common stock. Dr. McKinnell’s restricted stock grant vests on August 24, 2004 and Dr. Niblack’s restricted stock grant vests on August 26, 2002. On February 25, 1999, Ms. Katen received a grant of 1,000 shares of common stock (subsequently adjusted to 3,000 shares to reflect our June 1999 3-for-1 stock split), and, Mr. Shedlarz received a grant of 500 shares of common stock (subsequently adjusted to 1,500 shares to reflect our June 1999 3-for-1 stock split). These shares vested on February 25, 2002. Dividends are paid during the restricted period on all restricted shares. As of December 31, 2001, the aggregate number of shares of restricted stock held by the officers, and the dollar value of such shares was: Dr. McKinnell, 81,440 shares ($3,245,384); Dr. Niblack, 69,480 shares, ($2,768,778); Ms. Katen, 18,360 shares ($731,646); Mr. Shedlarz, 18,540 shares, ($738,819); Mr. Clemente, 14,400 shares, ($573,840); and Mr. Steere, 0 shares ($0). The dollar values are based on the closing price of our common stock on December 31, 2001. |

| (4) | Adjusted for our June 1999 3-for-1 stock split. |

| (5) | The 2001 payout represents the dollar market value of shares of our common stock on February 27, 2002 (the payment date) earned under the Company’s previous Performance-Contingent Share Award Program using the closing sales price of our common stock ($41.25) on the New York Stock Exchange on that date. The number of Performance-Contingent Shares awarded to each Named Executive Officer was as follows: Dr. McKinnell, 192,000 shares; Dr. Niblack, 142,800 shares; Ms. Katen, 99,600 shares; Mr. Shedlarz, 93,600 shares; Mr. Clemente, 72,000 shares; Mr. Steere, 0 shares and all Executive Officers and Directors as a group, 698,400 shares. |

| (6) | The amounts shown in this column represent Company matching funds under the Pfizer Savings Plan (a tax-qualified retirement savings plan) and related Supplemental Plan, which are discussed under the heading “Employee Benefit and Long-Term Compensation Plans.” |

| For Mr. Steere, the amount also includes a $323,200 payment for vacation accrued but not used. Under the Company’s policy, such payment is made after retirement. | |

26

Total Options Exercised in 2001 and Year-End Values

This table gives information for options exercised by each of the Named Executive Officers in 2001 and the value (stock price less exercise price) of the remaining options held by those executive officers at year-end, using the average ($40.145) of the high and low trading price of our common stock on December 31, 2001.

| Number of Securities | Value of Unexercised | |||||||||||

| Underlying Unexercised | In-The-Money Options | |||||||||||

| Options Held at 12/31/01 | at 12/31/01 | |||||||||||

| Shares | ||||||||||||

| Acquired | Value | |||||||||||

| On Exercise | Realized | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||

| Name | (#) | ($) | (#) | (#) | ($) | ($) | ||||||

| Dr. McKinnell | 310,104 | 11,390,540 | 1,473,708 | 1,541,450 | 29,307,744 | 4,371,990 | ||||||

| Dr. Niblack | 253,500 | 7,919,951 | 856,500 | 1,050,450 | 12,294,049 | 3,490,320 | ||||||

| Ms. Katen | 84,960 | 2,874,197 | 625,800 | 717,450 | 10,727,835 | 2,150,220 | ||||||

| Mr. Shedlarz | 145,200 | 4,046,646 | 254,162 | 722,450 | 882,779 | 2,216,395 | ||||||

| Mr. Clemente | 89,696 | 3,309,730 | 850,852 | 604,450 | 17,784,789 | 2,166,500 | ||||||

| Mr. Steere | 721,260 | 25,268,842 | 2,846,500 | 1,720,450 | 49,876,119 | 10,310,900 | ||||||

Option Grants in 2001