- PFE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-C Filing

Pfizer (PFE) SC TO-CInformation about tender offer

Filed: 17 Jun 19, 5:16pm

Acquisition of Array BioPharma June 17, 2019 Exhibit 99.1

Forward-Looking Statements and Non-GAAP Financial Information Our discussions during this conference call will include forward-looking statements about, among other things, Pfizer, Array BioPharma and Pfizer’s planned acquisition of Array BioPharma, including its potential benefits, anticipated royalties, earnings dilution and accretion, and growth, Pfizer’s and Array BioPharma’s plans, objectives, expectations and intentions, the financial condition, results of operations and business of Pfizer and Array BioPharma, the BRAFTOVI/MEKTOVI combination and Array BioPharma’s other pipeline and portfolio assets, the anticipated timing of closing of the proposed acquisition and expected plans for financing the proposed acquisition, that are subject to substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information regarding these factors can be found in the press release dated June 17, 2019 announcing the planned acquisition, Pfizer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and in Pfizer’s subsequent reports on Form 10-Q, including in the sections thereof captioned “Risk Factors” and “Forward-Looking Information and Factors That May Affect Future Results”, as well as in its subsequent reports on Form 8-K, all of which are filed with the U.S. Securities and Exchange Commission (“the SEC”) and available at www.sec.gov and www.pfizer.com. The forward-looking statements in this presentation speak only as of the original date of this presentation and we undertake no obligation to update or revise any of these statements. Also, the discussions during this conference call may include certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP). Any non-U.S. GAAP financial measures presented should not be viewed as substitutes for financial measures required by U.S. GAAP, have no standardized meaning prescribed by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies Pfizer calculates projections regarding the expected dilutive and accretive impact of the potential acquisition based on internal forecasts of Adjusted Diluted Earnings Per Share (Adjusted Diluted EPS), which forecasts are non-GAAP financial measures derived by excluding certain amounts that would be included in GAAP calculations. These dilution/accretion projections should not be considered a substitute for GAAP measures. The determinations of the amounts that are excluded from the dilution/accretion calculations are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Pfizer is unable to present quantitative reconciliations because management cannot reasonably predict with reasonable certainty all of the necessary components of the comparable GAAP measure (such as the ultimate outcome of pending litigation, unusual or significant gains and losses, acquisition-related expenses, net gains or losses on investments in equity securities and potential future asset impairments) without unreasonable effort. These items are uncertain, depend on various factors, and could have a material impact on GAAP Reported results for the guidance relevant period. Pfizer has excluded from the dilution/accretion calculations the impact of purchase accounting adjustments, acquisition-related costs, discontinued operations and certain significant items. Such items can have a substantial impact on GAAP measures of financial performance. For more information on the Adjusted Diluted EPS measure see Pfizer’s 2018 Financial Report, which was filed as exhibit 13 to Pfizer’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and Pfizer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2019.

Important Information About the Tender Offer The tender offer referenced in this communication has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell securities, nor is it a substitute for the tender offer materials that Pfizer and its acquisition subsidiary will file with the SEC. The solicitation and offer to buy Array BioPharma stock will only be made pursuant to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, Pfizer and its acquisition subsidiary will file a tender offer statement on Schedule TO and thereafter Array BioPharma will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 WILL CONTAIN IMPORTANT INFORMATION. ARRAY BIOPHARMA STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF ARRAY BIOPHARMA SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES. The Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all holders of Array BioPharma stock at no expense to them. The tender offer materials and the Solicitation/Recommendation Statement will be made available for free at the SEC's website at www.sec.gov. Additional copies may be obtained for free by contacting Pfizer or Array BioPharma. Copies of the documents filed with the SEC by Array BioPharma will be available free of charge on Array BioPharma’s internet website at http://investor.Array BioPharma.com/sec-filings or by contacting Array BioPharma’s Investor Relations Department at (303) 381-6600. Copies of the documents filed with the SEC by Pfizer will be available free of charge on Pfizer’s internet website at https://investors.pfizer.com/financials/sec-filings/default.aspx or by contacting Pfizer’s Investor Relations Department at (212) 733-2323. In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Pfizer and Array BioPharma each file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports or other information filed by Pfizer or Array BioPharma at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Pfizer’s and Array BioPharma’s filings with the SEC are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Acquisition Aligns with Pfizer’s Strategic Priorities Potential to deliver breakthrough medicines and enhance long-term growth prospects Deploy capital to efficiently create meaningful shareholder value Bias towards “bolt-on” deals with potential for mid to long-term value creation and revenue and earnings growth Strengthen individual businesses with capabilities and flagship medicines to enhance leadership positions in priority areas

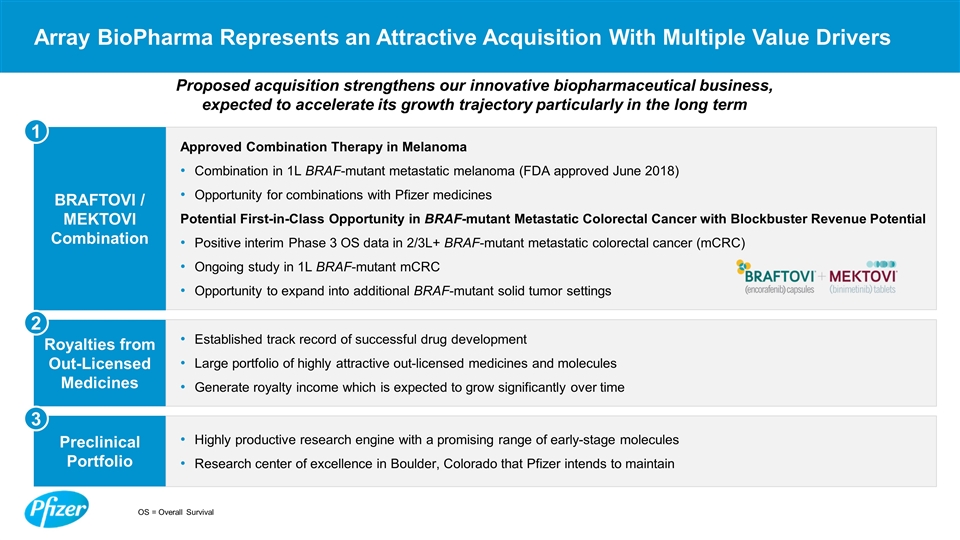

Approved Combination Therapy in Melanoma Combination in 1L BRAF-mutant metastatic melanoma (FDA approved June 2018) Opportunity for combinations with Pfizer medicines Potential First-in-Class Opportunity in BRAF-mutant Metastatic Colorectal Cancer with Blockbuster Revenue Potential Positive interim Phase 3 OS data in 2/3L+ BRAF-mutant metastatic colorectal cancer (mCRC) Ongoing study in 1L BRAF-mutant mCRC Opportunity to expand into additional BRAF-mutant solid tumor settings Array BioPharma Represents an Attractive Acquisition With Multiple Value Drivers BRAFTOVI / MEKTOVI Combination 1 Royalties from Out-Licensed Medicines Preclinical Portfolio Established track record of successful drug development Large portfolio of highly attractive out-licensed medicines and molecules Generate royalty income which is expected to grow significantly over time Highly productive research engine with a promising range of early-stage molecules Research center of excellence in Boulder, Colorado that Pfizer intends to maintain 2 3 OS = Overall Survival Proposed acquisition strengthens our innovative biopharmaceutical business, expected to accelerate its growth trajectory particularly in the long term

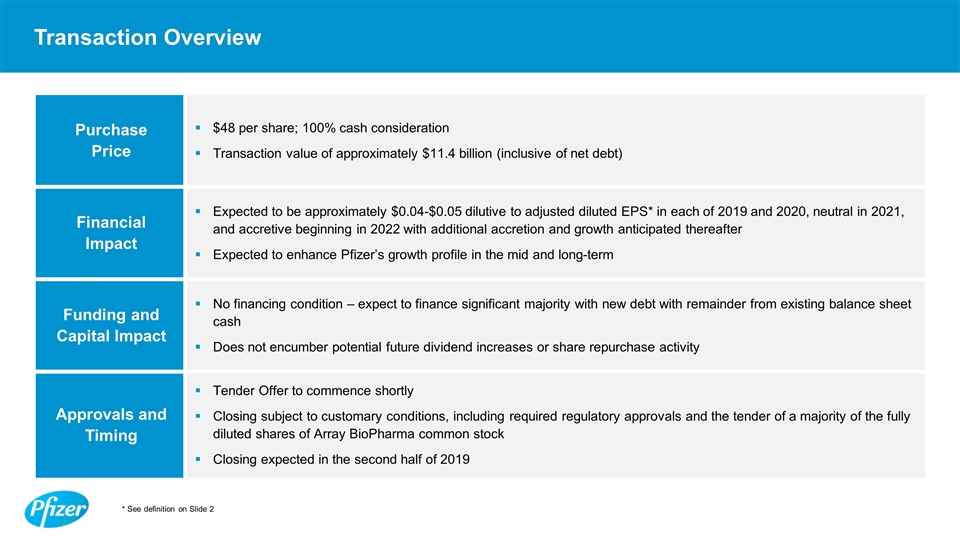

Transaction Overview Purchase Price $48 per share; 100% cash consideration Transaction value of approximately $11.4 billion (inclusive of net debt) Financial Impact Expected to be approximately $0.04-$0.05 dilutive to adjusted diluted EPS* in each of 2019 and 2020, neutral in 2021, and accretive beginning in 2022 with additional accretion and growth anticipated thereafter Expected to enhance Pfizer’s growth profile in the mid and long-term Funding and Capital Impact No financing condition – expect to finance significant majority with new debt with remainder from existing balance sheet cash Does not encumber potential future dividend increases or share repurchase activity Approvals and Timing Tender Offer to commence shortly Closing subject to customary conditions, including required regulatory approvals and the tender of a majority of the fully diluted shares of Array BioPharma common stock Closing expected in the second half of 2019 * See definition on Slide 2

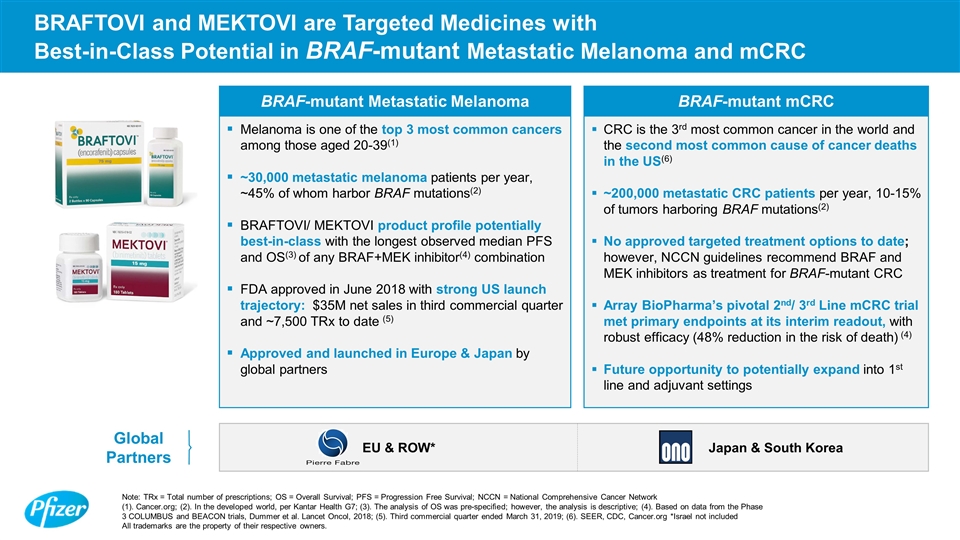

BRAFTOVI and MEKTOVI are Targeted Medicines with Best-in-Class Potential in BRAF-mutant Metastatic Melanoma and mCRC BRAF-mutant Metastatic Melanoma BRAF-mutant mCRC Melanoma is one of the top 3 most common cancers among those aged 20-39(1) ~30,000 metastatic melanoma patients per year, ~45% of whom harbor BRAF mutations(2) BRAFTOVI/ MEKTOVI product profile potentially best-in-class with the longest observed median PFS and OS(3) of any BRAF+MEK inhibitor(4) combination FDA approved in June 2018 with strong US launch trajectory: $35M net sales in third commercial quarter and ~7,500 TRx to date (5) Approved and launched in Europe & Japan by global partners CRC is the 3rd most common cancer in the world and the second most common cause of cancer deaths in the US(6) ~200,000 metastatic CRC patients per year, 10-15% of tumors harboring BRAF mutations(2) No approved targeted treatment options to date; however, NCCN guidelines recommend BRAF and MEK inhibitors as treatment for BRAF-mutant CRC Array BioPharma’s pivotal 2nd/ 3rd Line mCRC trial met primary endpoints at its interim readout, with robust efficacy (48% reduction in the risk of death) (4) Future opportunity to potentially expand into 1st line and adjuvant settings Note: TRx = Total number of prescriptions; OS = Overall Survival; PFS = Progression Free Survival; NCCN = National Comprehensive Cancer Network (1). Cancer.org; (2). In the developed world, per Kantar Health G7; (3). The analysis of OS was pre-specified; however, the analysis is descriptive; (4). Based on data from the Phase 3 COLUMBUS and BEACON trials, Dummer et al. Lancet Oncol, 2018; (5). Third commercial quarter ended March 31, 2019; (6). SEER, CDC, Cancer.org *Israel not included All trademarks are the property of their respective owners. Global Partners EU & ROW* Japan & South Korea

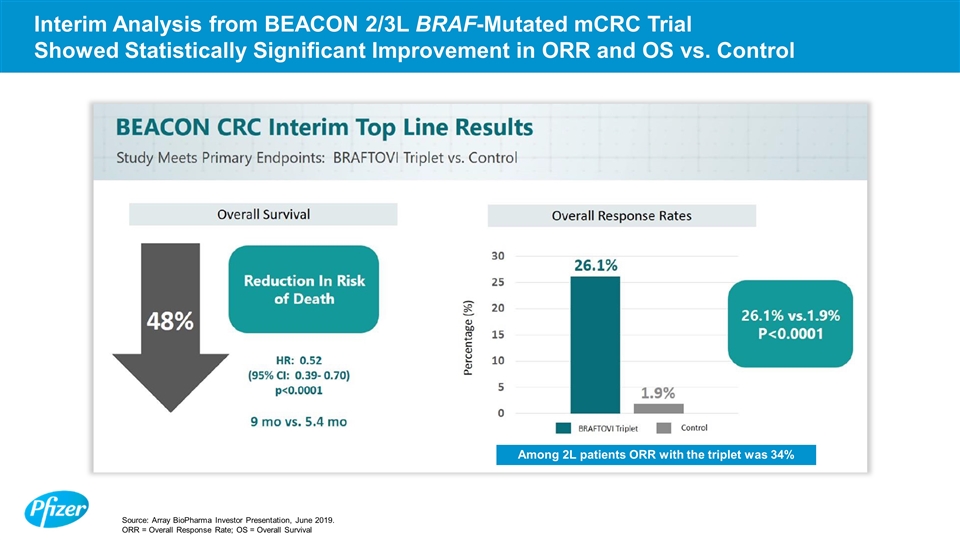

Interim Analysis from BEACON 2/3L BRAF-Mutated mCRC Trial Showed Statistically Significant Improvement in ORR and OS vs. Control Among 2L patients ORR with the triplet was 34% Source: Array BioPharma Investor Presentation, June 2019. ORR = Overall Response Rate; OS = Overall Survival

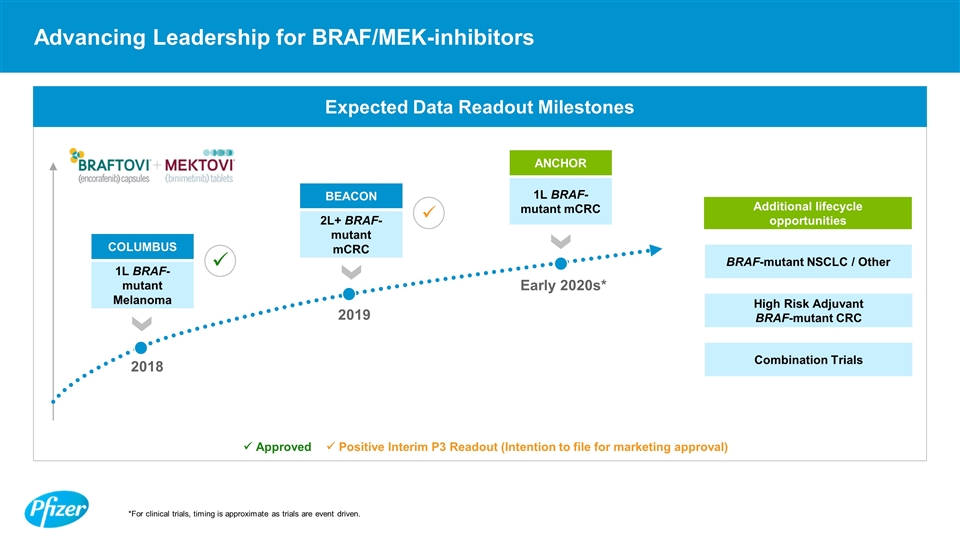

Advancing Leadership for BRAF/MEK-inhibitors *For clinical trials, timing is approximate as trials are event driven. Expected Data Readout Milestones ü Approved ü Positive Interim P3 Readout (Intention to file for marketing approval) High Risk Adjuvant BRAF-mutant CRC BRAF-mutant NSCLC / Other Additional lifecycle opportunities Combination Trials 2L+ BRAF-mutant mCRC 1L BRAF-mutant Melanoma 1L BRAF-mutant mCRC BEACON COLUMBUS ANCHOR 2019 2018 Early 2020s* ü ü

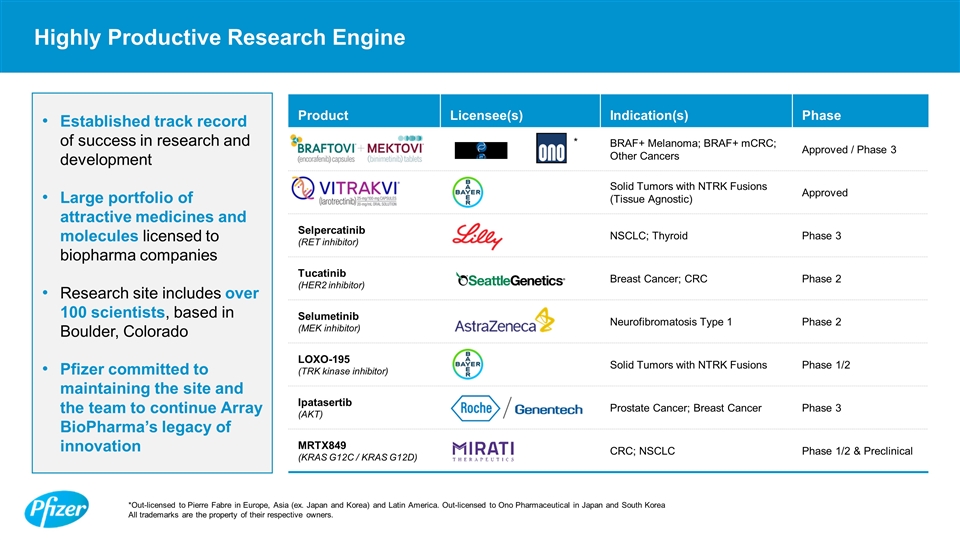

Established track record of success in research and development Large portfolio of attractive medicines and molecules licensed to biopharma companies Research site includes over 100 scientists, based in Boulder, Colorado Pfizer committed to maintaining the site and the team to continue Array BioPharma’s legacy of innovation Product Licensee(s) Indication(s) Phase BRAF+ Melanoma; BRAF+ mCRC; Other Cancers Approved / Phase 3 Solid Tumors with NTRK Fusions (Tissue Agnostic) Approved Selpercatinib (RET inhibitor) NSCLC; Thyroid Phase 3 Tucatinib (HER2 inhibitor) Breast Cancer; CRC Phase 2 Selumetinib (MEK inhibitor) Neurofibromatosis Type 1 Phase 2 LOXO-195 (TRK kinase inhibitor) Solid Tumors with NTRK Fusions Phase 1/2 Ipatasertib (AKT) Prostate Cancer; Breast Cancer Phase 3 MRTX849 (KRAS G12C / KRAS G12D) CRC; NSCLC Phase 1/2 & Preclinical Highly Productive Research Engine *Out-licensed to Pierre Fabre in Europe, Asia (ex. Japan and Korea) and Latin America. Out-licensed to Ono Pharmaceutical in Japan and South Korea All trademarks are the property of their respective owners. *

Key Takeaways Consistent with Pfizer’s purpose: Breakthroughs that change patients’ lives Expands Pfizer’s capabilities in Oncology and brings a range of opportunities to create value Sets the stage to establish leadership for the treatment of people with BRAF-mutated colorectal cancer Augments Pfizer’s R&D efforts in leading the next wave of targeted cancer medicines and combinations Enhances long-term growth prospects Creating shareholder value through disciplined capital deployment

Q&A