Exhibit 99.2

LeRoy Nosbaum Chairman and CEO Steve Helmbrecht Sr. VP and CFO Deloris Duquette VP, Investor Relations Acquisition Announcement February 25, 2007 Itron Actaris

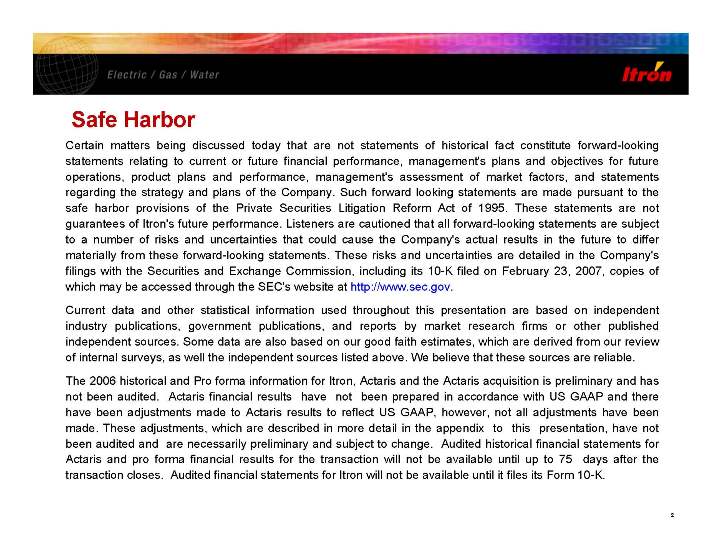

Safe Harbor Certain matters being discussed today that are not statements of historical fact constitute forward-looking statements relating to current or future financial performance, management's plans and objectives for future operations, product plans and performance, management's assessment of market factors, and statements regarding the strategy and plans of the Company. Such forward looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of Itron's future performance. Listeners are cautioned that all forward-looking statements are subject to a number of risks and uncertainties that could cause the Company's actual results in the future to differ materially from these forward-looking statements. These risks and uncertainties are detailed in the Company's filings with the Securities and Exchange Commission, including its 10-K filed on February 23, 2007, copies of which may be accessed through the SEC's website at http://www.sec.gov. Current data and other statistical information used throughout this presentation are based on independent industry publications, government publications, and reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well the independent sources listed above. We believe that these sources are reliable. The 2006 historical and Pro forma information for Itron, Actaris and the Actaris acquisition is preliminary and has not been audited. Actaris financial results have not been prepared in accordance with US GAAP and there have been adjustments made to Actaris results to reflect US GAAP, however, not all adjustments have been made. These adjustments, which are described in more detail in the appendix to this presentation, have not been audited and are necessarily preliminary and subject to change. Audited historical financial statements for Actaris and pro forma financial results for the transaction will not be available until up to 75 days after the transaction closes. Audited financial statements for Itron will not be available until it files its Form 10-K.

Transaction Summary LeRoy Nosbaum Chairman and CEO

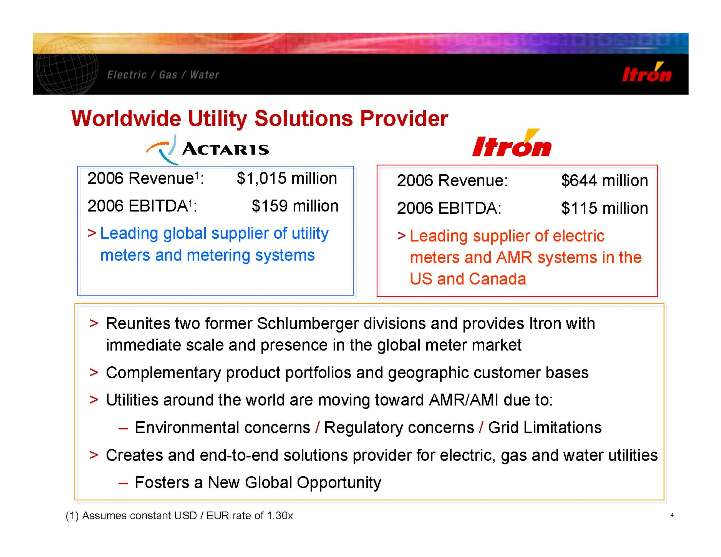

Actaris Itron Worldwide Utility Solutions Provider 2006 Revenue1: $1,015 million 2006 EBITDA1: $159 million > Leading global supplier of utility meters and metering systems > Reunites two former Schlumberger divisions and provides Itron with immediate scale and presence in the global meter market > Complementary product portfolios and geographic customer bases > Utilities around the world are moving toward AMR/AMI due to: - Environmental concerns / Regulatory concerns / Grid Limitations > Creates and end-to-end solutions provider for electric, gas and water utilities - Fosters a New Global Opportunity 2006 Revenue: $644 million 2006 EBITDA: $115 million > Leading supplier of electric meters and AMR systems in the US and Canada (1) Assumes constant USD / EUR rate of 1.30x

Acquisition Opportunity

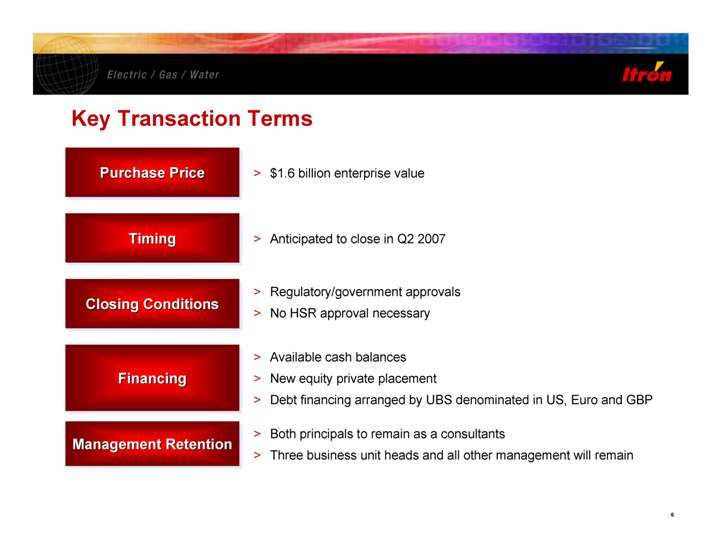

Key Transaction Terms Purchase Price Purchase Price Purchase Price > $1.6 billion enterprise value Timing Timing Timing > Anticipated to close in Q2 2007 Closing Conditions Closing Conditions Closing Conditions > Regulatory/government approvals > No HSR approval necessary Management Retention Management Retention Management Retention Financing Financing Financing > Available cash balances > New equity private placement > Debt financing arranged by UBS denominated in US, Euro and GBP > Both principals to remain as a consultants > Three business unit heads and all other management will remain

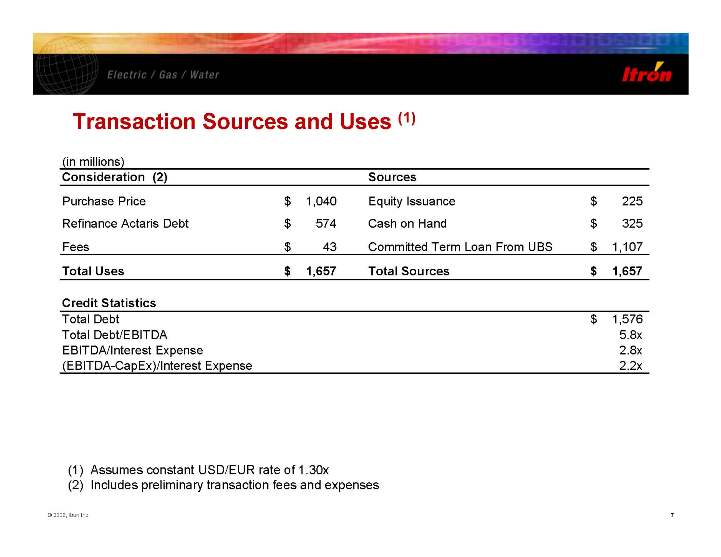

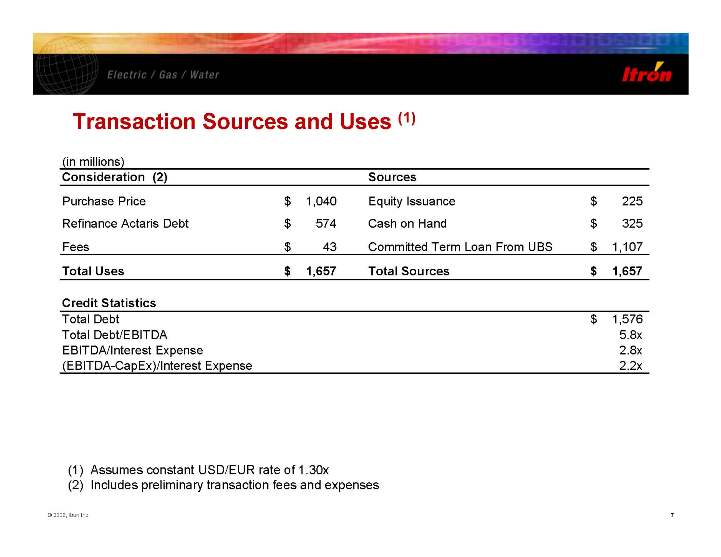

Transaction Sources and Uses (1) (1) Assumes constant USD/EUR rate of 1.30x (2) Includes preliminary transaction fees and expenses (in millions) Consideration (2) Sources Purchase Price 1,040 $ Equity Issuance 225 $ Refinance Actaris Debt 574 $ Cash on Hand 325 $ Fees 43 $ Committed Term Loan From UBS 1,107 $ Total Uses 1,657 $ Total Sources 1,657 $ Credit Statistics Total Debt 1,576 $ Total Debt/EBITDA 5.8x EBITDA/Interest Expense 2.8x (EBITDA-CapEx)/Interest Expense 2.2x

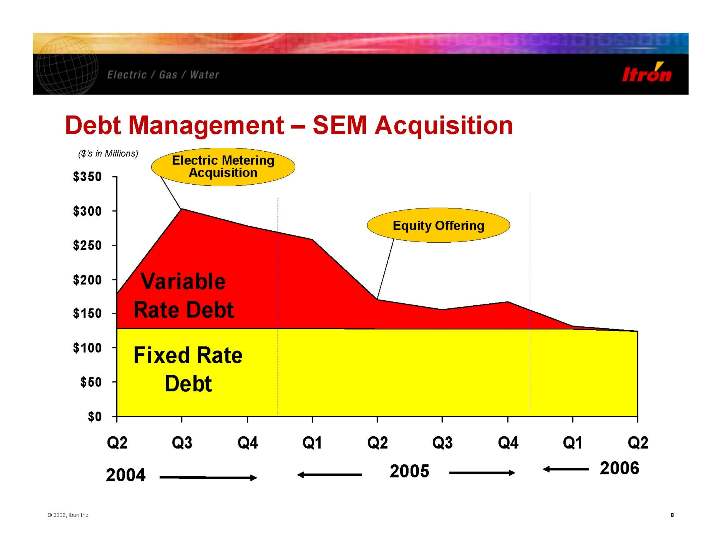

$0 $50 $100 $150 $200 $250 $300 $350 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2006 2005 2004 ($’s in Millions) Debt Management - SEM Acquisition Electric Metering Acquisition Equity Offering Fixed Rate Debt Variable Rate Debt

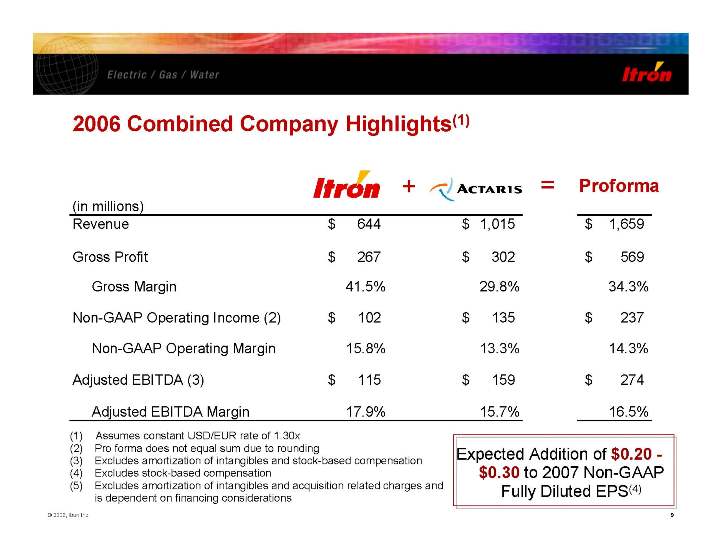

Itron Actaris 2006 Combined Company Highlights(1) + = Proforma Expected Addition of $0.20 - $0.30 to 2007 Non-GAAP Fully Diluted EPS(4) (1) Assumes constant USD/EUR rate of 1.30x (2) Pro forma does not equal sum due to rounding (3) Excludes amortization of intangibles and stock-based compensation (4) Excludes stock-based compensation (5) Excludes amortization of intangibles and acquisition related charges and is dependent on financing considerations (in millions) Revenue 644 $ 1,015 $ 1,659 $ Gross Profit 267 $ 302 $ 569 $ Gross Margin 41.5% 29.8% 34.3% Non-GAAP Operating Income (2) 102 $ 135 $ 237 $ Non-GAAP Operating Margin 15.8% 13.3% 14.3% Adjusted EBITDA (3) 115 $ 159 $ 274 $ Adjusted EBITDA Margin 17.9% 15.7% 16.5%

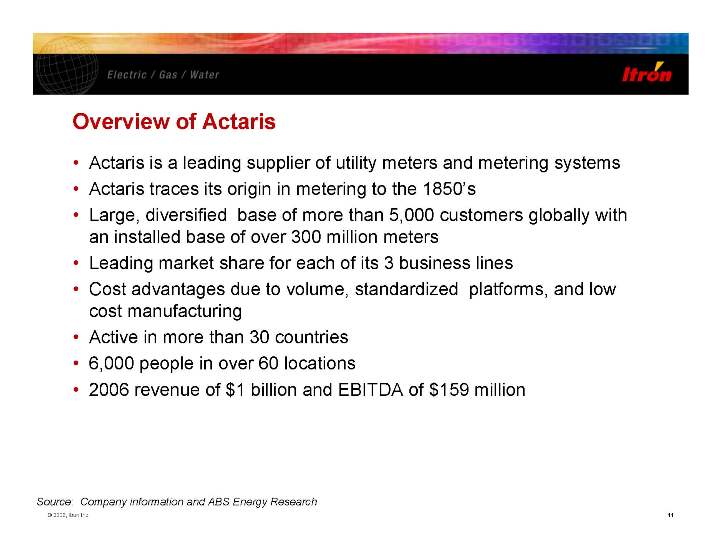

Overview of Actaris • Actaris is a leading supplier of utility meters and metering systems • Actaris traces its origin in metering to the 1850’s • Large, diversified base of more than 5,000 customers globally with an installed base of over 300 million meters • Leading market share for each of its 3 business lines • Cost advantages due to volume, standardized platforms, and low cost manufacturing • Active in more than 30 countries • 6,000 people in over 60 locations • 2006 revenue of $1 billion and EBITDA of $159 million Source: Company information and ABS Energy Research

Electricity Manufacturing Gas Manufacturing Water Manufacturing Heat Manufacturing Other Operations Research & Engineering Key Locations Felixstowe Hameln Barcelona Massy Greenwood Owenton Buenos Aires Chongqing Gödöllö Kiev Argenteuil Karlsruhe Stretford Reims Chasseneuil Naples Oldenburg Adelaide Kuala Lumpur Jakarta Dordrecht Porto Asti Haguenau Mâcon Santiago Americana Campinas Al-Khobar Atlantis 300 860 330 3,310 1,180 # of Employees 300 860 330 3,310 1,180 Actaris Worldwide Footprint

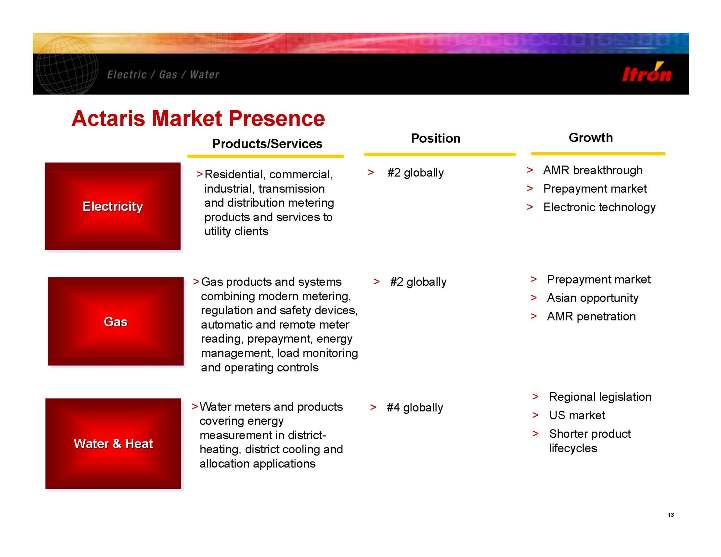

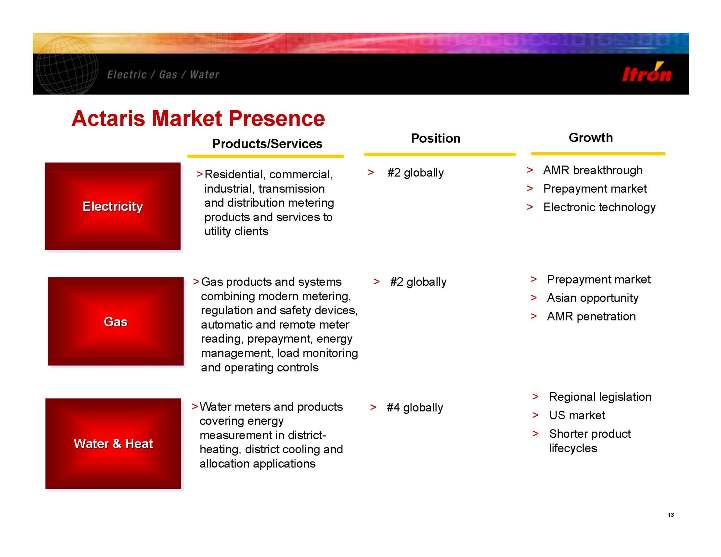

Actaris Market Presence Products/Services >Residential, commercial, industrial, transmission and distribution metering products and services to utility clients Position > #2 globally Growth > AMR breakthrough > Prepayment market > Electronic technology Electricity Electricity Electricity >Gas products and systems combining modern metering, regulation and safety devices, automatic and remote meter reading, prepayment, energy management, load monitoring and operating controls > #2 globally > Prepayment market > Asian opportunity > AMR penetration Gas Gas Gas >Water meters and products covering energy measurement in districtheating, district cooling and allocation applications > #4 globally > Regional legislation > US market > Shorter product lifecycles Water & Heat Water

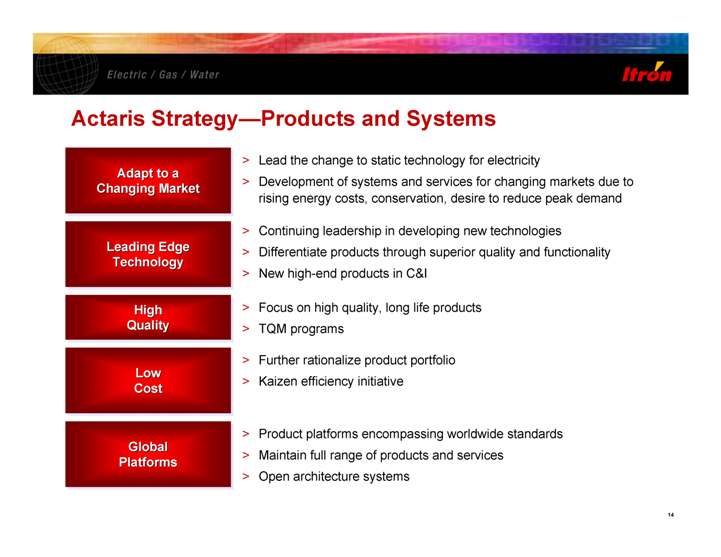

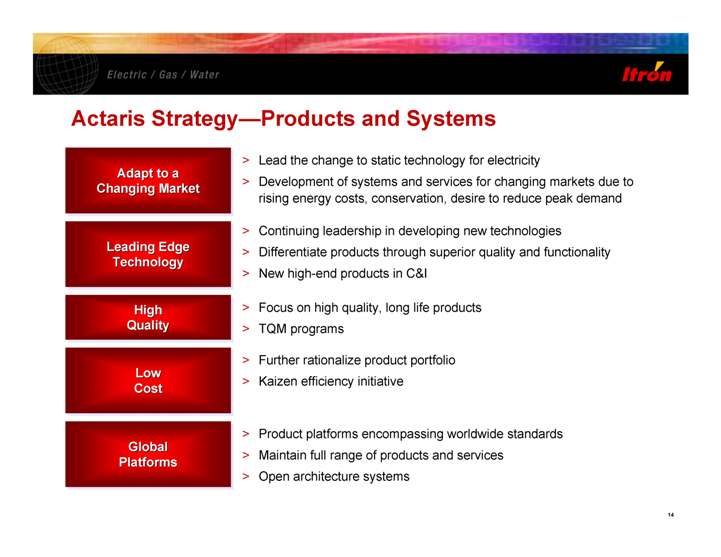

Actaris Strategy—Products and Systems Adapt to a Changing Market Adapt to a Adapt to a Changing Changing Market Market > Lead the change to static technology for electricity > Development of systems and services for changing markets due to rising energy costs, conservation, desire to reduce peak demand Leading Edge Technology Leading Edge Leading Edge Technology Technology > Continuing leadership in developing new technologies > Differentiate products through superior quality and functionality > New high-end products in C&I High Quality High High Quality Quality > Focus on high quality, long life products > TQM programs Global Platforms Global Global Platforms Platforms Low Cost Low Low Cost Cost > Further rationalize product portfolio > Kaizen efficiency initiative > Product platforms encompassing worldwide standards > Maintain full range of products and services > Open architecture systems

Compelling Strategic Rationale Geographic Expansion with Established Sales and Distribution Geographic Expansion with Established Sales and Distribution Geographic Expansion with Established Sales and Distribution Complementary Product Portfolios Allow Synergies in Future Complementary Product Portfolios Allow Synergies in Future Complementary Product Portfolios Allow Synergies in Future Scale and Platform for Innovation Scale and Platform for Innovation Scale and Platform for Innovation Financially and Operationally Strong, Established Company Financially and Operationally Strong, Established Company Financially and Operationally Strong, Established Company Common Heritage - Common Vision

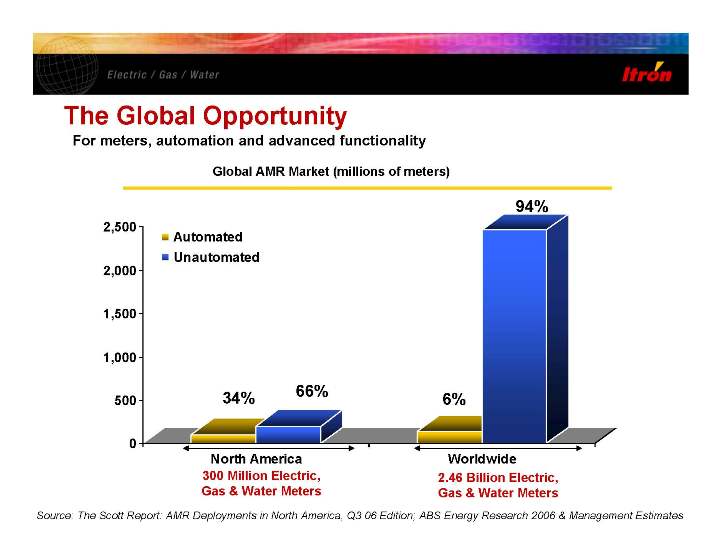

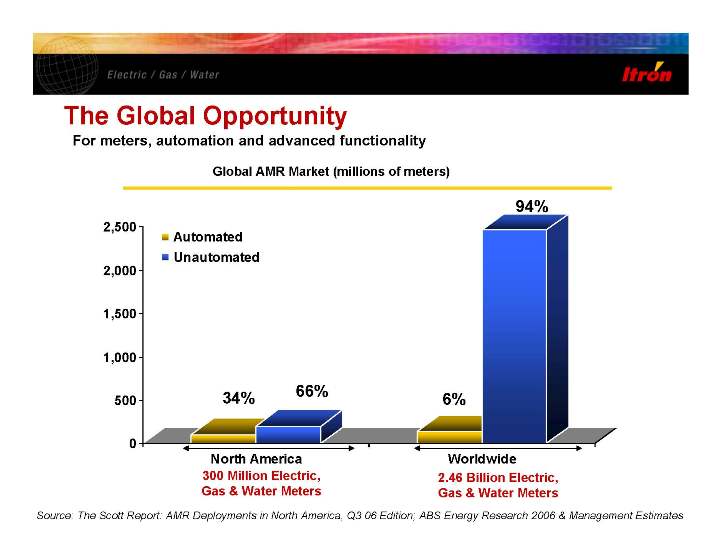

The Global Opportunity Global AMR Market (millions of meters) 34% 66% 6% 94% Source: The Scott Report: AMR Deployments in North America, Q3 06 Edition; ABS Energy Research 2006 & Management Estimates 300 Million Electric, Gas & Water Meters 2.46 Billion Electric, Gas & Water Meters For meters, automation and advanced functionality 2,500 North America Worldwide Automated Unautomated 0 500 1,000 1,500 2,000 2,500

Continued Global Leadership Global Meter Market Shares Global Meter Market Shares AMR—US and Canada Electric Gas Water Elster 4% Hunt 5% ESCO 8% Cellnet 13% Itron 55% Others 15% Source: Scott Report on AMR Deployments, ABS Energy Research, A.T. Kearney, Management Estimates 18 55% #1 #1 #2 #2 #4 #4 16% 20% 11% #1 Electric Gas Water Others 51% Landis & Gyr 14% Dresser 8% Emerson 4% Ester 21% Others 47% Neptune 12% Elster 9% Hydrometer 4% Others 37% Badger 12% Sensus 15% Continued Global Leadership Global Meter Market Shares Global Meter Market Shares AMR—US and Canada Electric Gas Water Elster 4% Hunt 5% ESCO 8% Cellnet 13% Itron 55% Others 15% Source: Scott Report on AMR Deployments, ABS Energy Research, A.T. Kearney, Management Estimates 18 55% #1 #1 #2 #2 #4 #4 16% 20% 11% A leading position in meters globally - Expanding potential markets

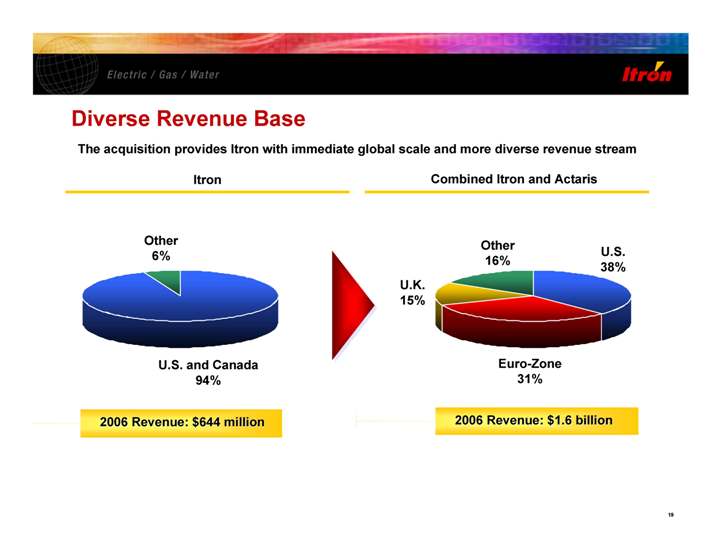

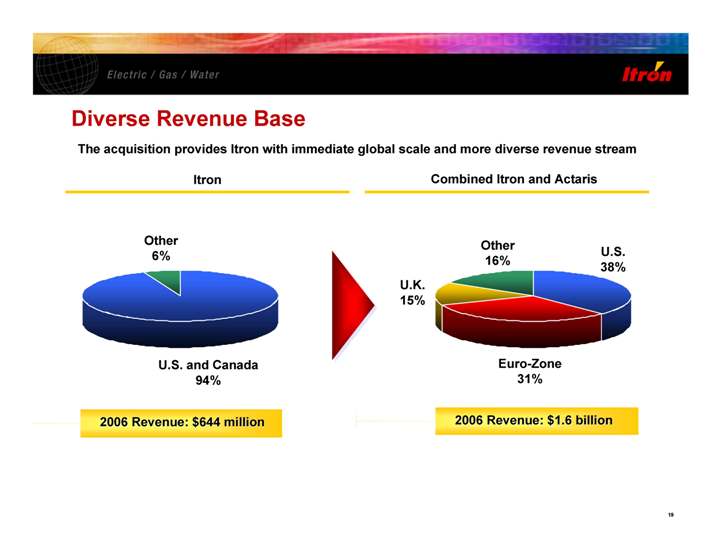

Diverse Revenue Base Itron Combined Itron and Actaris U.S. 38% Euro-Zone 31% U.K. 15% Other 16% U.S. and Canada 94% Other 6% 2006 Revenue: $1.6 billion 2006 Revenue: $1.6 billion 2006 Revenue: $644 million 2006 Revenue: $644 million The acquisition provides Itron with immediate global scale and more diverse revenue stream

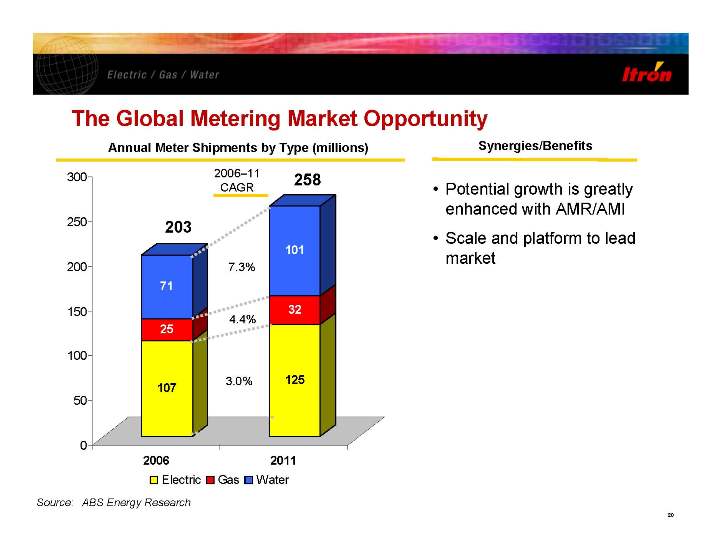

The Global Metering Market Opportunity Source: ABS Energy Research 107 25 71 125 32 101 0 50 100 150 200 250 300 2006 2011 Electric Gas Water Annual Meter Shipments by Type (millions) 258 203 • Potential growth is greatly enhanced with AMR/AMI • Scale and platform to lead market 2006-11 CAGR 7.3% 4.4% 3.0% Synergies/Benefits

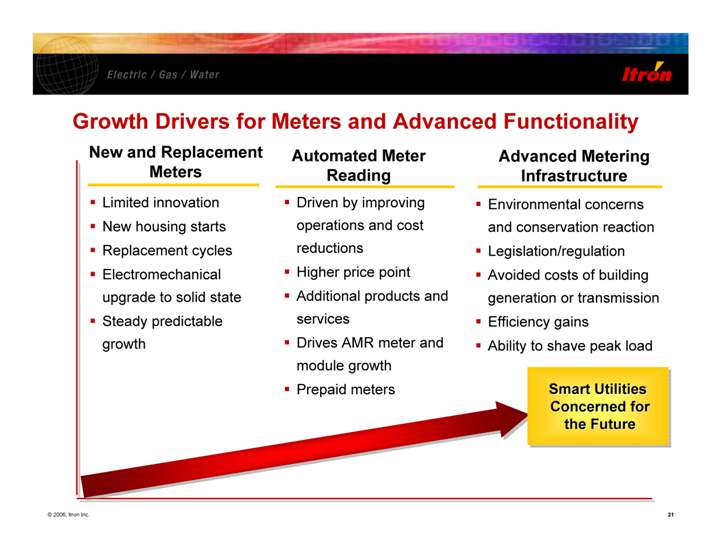

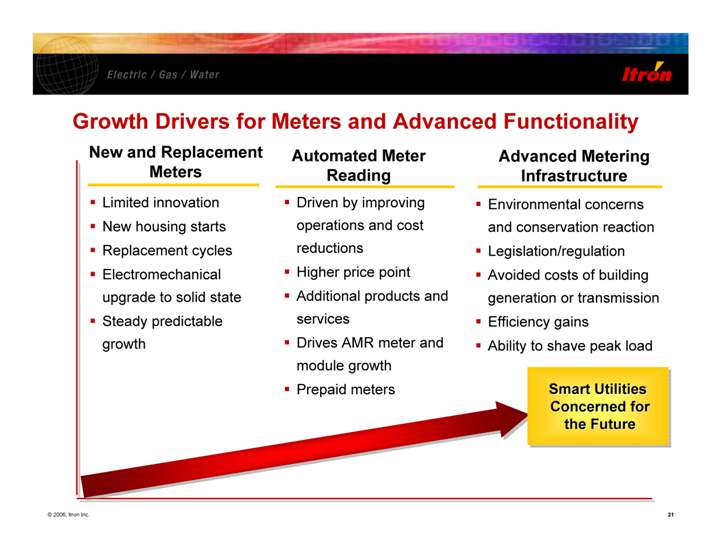

Growth Drivers for Meters and Advanced Functionality Advanced Metering Infrastructure New and Replacement Meters ⑀⍽ Limited innovation ⑀⍽ New housing starts ⑀⍽ Replacement cycles ⑀⍽ Electromechanical upgrade to solid state ⑀⍽ Steady predictable growth Automated Meter Reading ⑀⍽ Driven by improving operations and cost reductions ⑀⍽ Higher price point ⑀⍽ Additional products and services ⑀⍽ Drives AMR meter and module growth ⑀⍽ Prepaid meters ⑀⍽ Environmental concerns and conservation reaction ⑀⍽ Legislation/regulation ⑀⍽ Avoided costs of building generation or transmission ⑀⍽ Efficiency gains ⑀⍽ Ability to shave peak load Smart Utilities Concerned for the Future Smart Utilities Smart Utilities Concerned for Concerned for

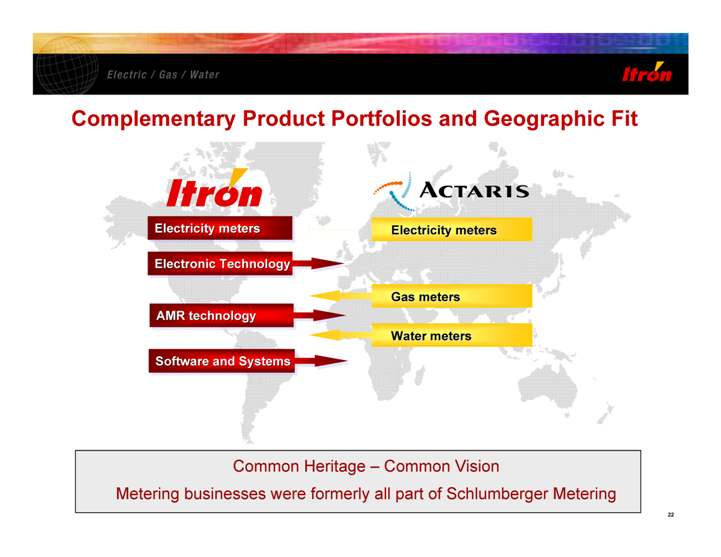

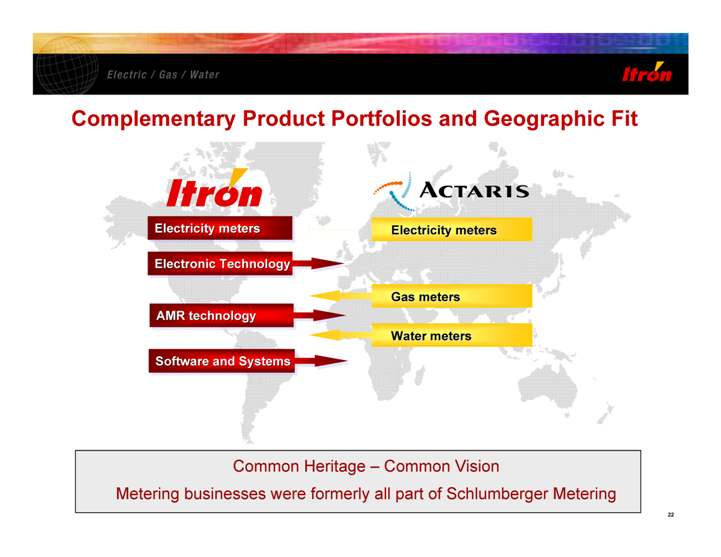

Complementary Product Portfolios and Geographic Fit Electricity meters Electricity meters Gas meters Gas meters Water meters Water meters Common Heritage - Common Vision Metering businesses were formerly all part of Schlumberger Metering Electricity meters Electricity meters Electricity meters AMR technology AMR technology AMR technology Electronic Technology Electronic Technology Electronic Technology Software and Systems

Prominent Global Customer Base Itron Actaris Dominion Energy Duke Energy Progress Energy AEP AQUA Piedmon Natural Gas Con Edison Pacific Gas and Electric Company Constellation Energy Southern Company Xcel Energy DTE Energy Southwest Gas TEPCO cp GDI National Grid Iberdrola Veolia Water EDP Electricdade de Portugal CIS Cordes & Grafe E.ON EDF Electrabel

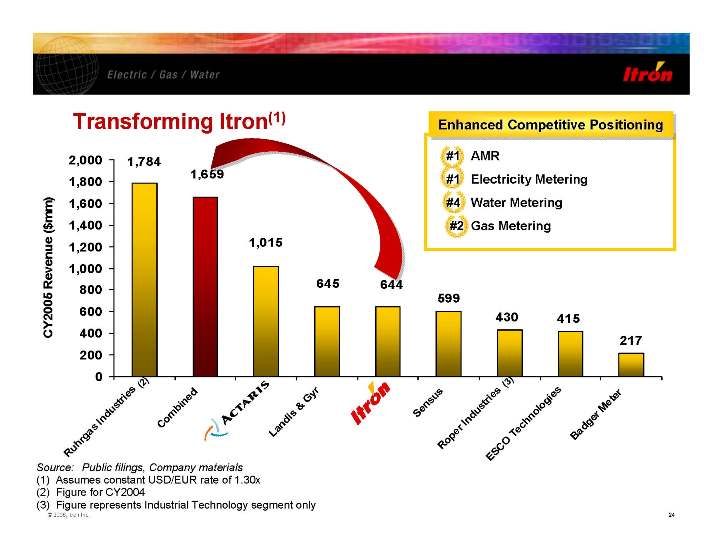

Transforming Itron(1) Enhanced Competitive Positioning Enhanced Competitive Positioning Enhanced Competitive Positioning Source: Public filings, Company materials (1) Assumes constant USD/EUR rate of 1.30x (2) Figure for CY2004 (3) Figure represents Industrial Technology segment only #1 #1 #1 #1 #1 AMR #1 Electricity Metering #4 Water Metering #2 Gas Metering 599 430 415 217 644 645 1,015 1,659 1,784 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 Ruhrgas Industries (2) Combined Landis & Gyr Sensus Roper Industries (3) ESCO Technologies Badger Meter Actaris Itron

Ensuring a Successful Transaction ⑀⍽ Itron and Actaris have a common heritage > Metering businesses were former divisions of Schlumberger > Itron acquired the Schlumberger electricity metering division in 2004 > Cultural and operational fit ⑀⍽ Experienced management teams with significant transaction experience > Many of the combined management team has spent a good portion of their careers already working together ⑀⍽ Geographical and product fit/synergies > Potential to sell water and gas meters into the US > Potential to sell AMR/AMI products and software solutions globally > Ability to capture global synergies • At this moment, the industry worldwide is poised for AMR/AMI expansion

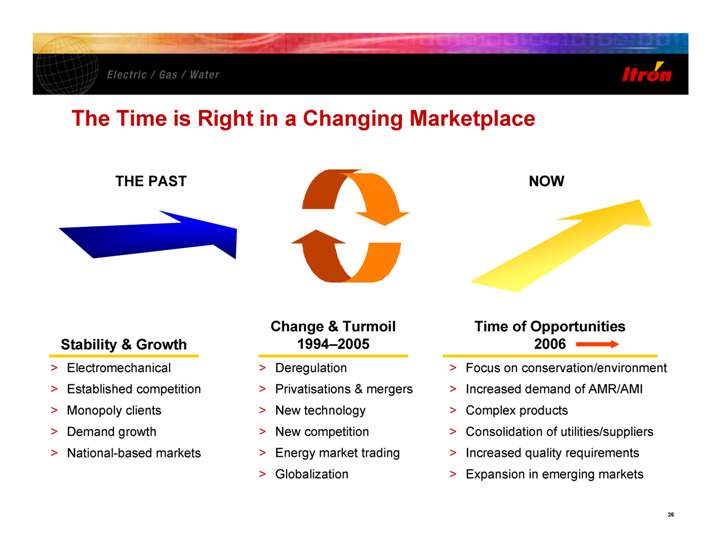

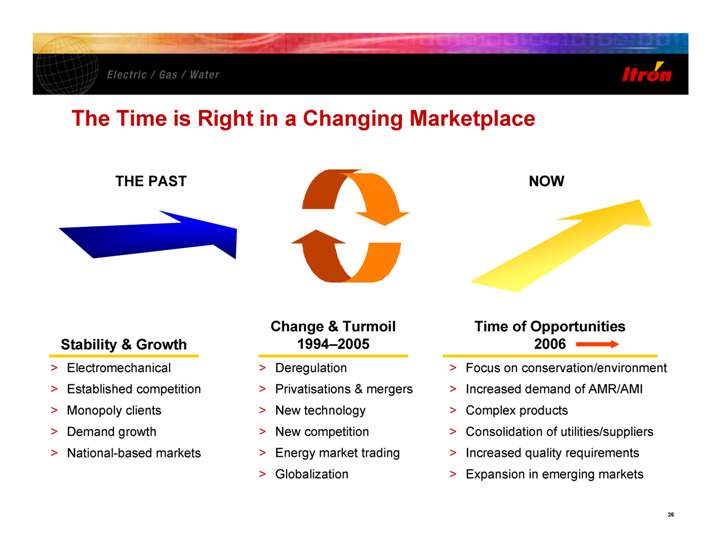

The Time is Right in a Changing Marketplace > Deregulation > Privatisations & mergers > New technology > New competition > Energy market trading > Globalization Change & Turmoil 1994-2005 > Focus on conservation/environment > Increased demand of AMR/AMI > Complex products > Consolidation of utilities/suppliers > Increased quality requirements > Expansion in emerging markets Time of Opportunities 2006 NOW > Electromechanical > Established competition > Monopoly clients > Demand growth > National-based markets Stability & Growth THE PAST

Appendix/Reconciliations

Itron Customers > More than 2,200 handheld meter reading customers in over 60 countries • Hardware and meter data collection software > Electricity meter customers in U.S. and Canada • Nearly every IOU, Muni and Co-Op > More than 1,500 AMR customers • > 55 million endpoints shipped (electric, gas and water) • AMR endpoints shipped to >70% of IOUs • Fixed networks at more than 20 customers > C&I meter data collection software at > 90% of the largest electric utilities in U.S. Well Known Customers Key Highlights Dominion Energy Duke Energy Progress Energy AEP Piedmont Natural Gas AQUA National Grid Con Edison Pacific Gas and Electric Company Constellation Energy Southern Company Xcel Energy DTE Energy cp Southwest Gas TEPCO

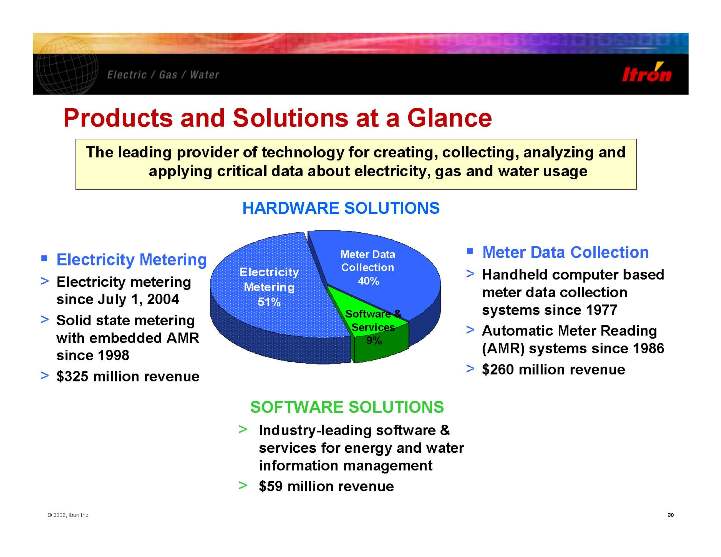

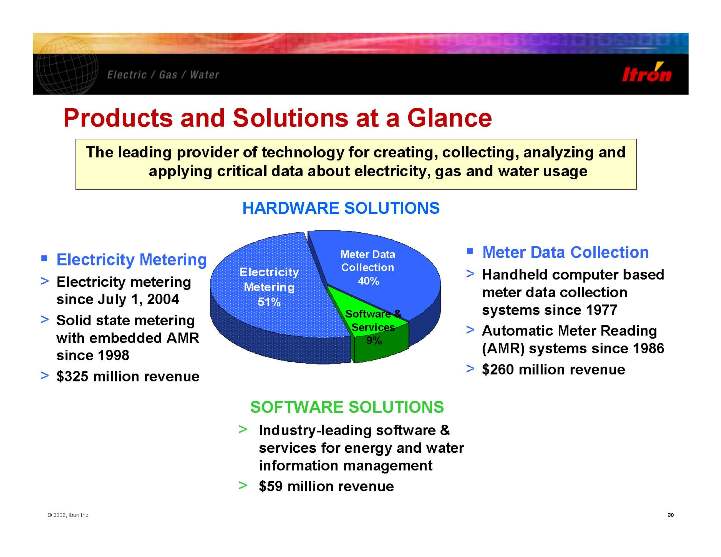

Products and Solutions at a Glance Software & Services 9% Meter Data Collection 40% Electricity Metering 51% HARDWARE SOLUTIONS HARDWARE SOLUTIONS SOFTWARE SOLUTIONS SOFTWARE SOLUTIONS ⑀⍽ Meter Data Collection > Handheld computer based meter data collection systems since 1977 > Automatic Meter Reading (AMR) systems since 1986 > $260 million revenue ⑀⍽ Electricity Metering > Electricity metering since July 1, 2004 > Solid state metering with embedded AMR since 1998 > $325 million revenue > Industry-leading software & services for energy and water information management > $59 million revenue The leading provider of technology for creating, collecting, analyzing and applying critical data about electricity, gas and water usage

Oconee Facility (Electric Meters) ⑀⍽ 106,000 sq.ft. in Waseca, MN > 4.5 million AMR units produced in 2006 6+ million unit capacity ⑀⍽ 317,000 sq.ft. in Oconee, SC > 6.5 million meters produced in 2006 7+ million unit capacity ⑀⍽ Both Facilities: > Highly automated, flexible and scalable > History of cost reductions > Less than 10% labor content Waseca Facility (AMR) Design and Manufacturing Operations Low Cost, High Volume

Software Solutions Approximate Revenue Breakdown in 2006: Licenses = 29%, Services = 32%, Maintenance = 39% >Complex Billing >Residential Energy Mgmt. >C&I Energy Mgt. >Distribution Asset Optimization >Revenue Assurance & Tamper Analytics >Distribution Asset Design & Optimization >Engineering Calculations & Standards Compliance >Designer Productivity >Central Market Forecasting >Retail Forecasting >Wholesale Forecasting Knowledge Applications Knowledge Applications >Handheld Data Collection >Mobile Data Collection >Fixed Network Data Collection >Endpoint Installation >Workforce Mgmt. Meter Data Management Meter Data Management Data Collection & Workforce Management Data Collection & Workforce Management Software Licenses, Related Consulting and Implementation Services >Mass Market Meter Data Mgmt. >C&I Meter Data Mgt. >C&I Collection

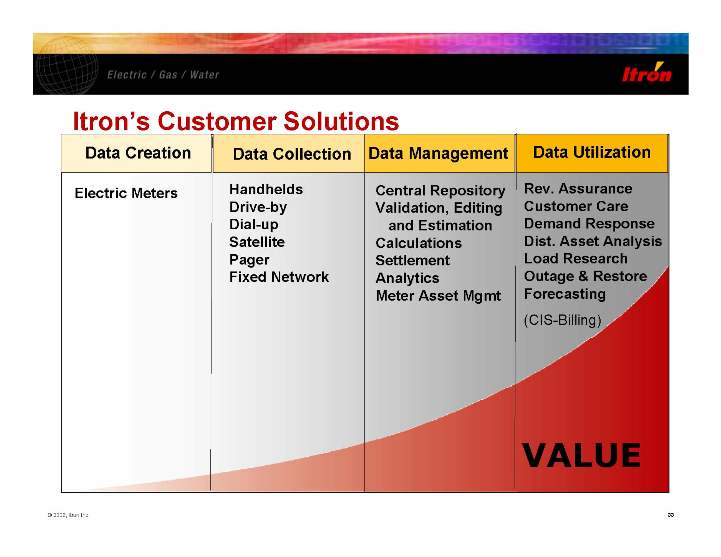

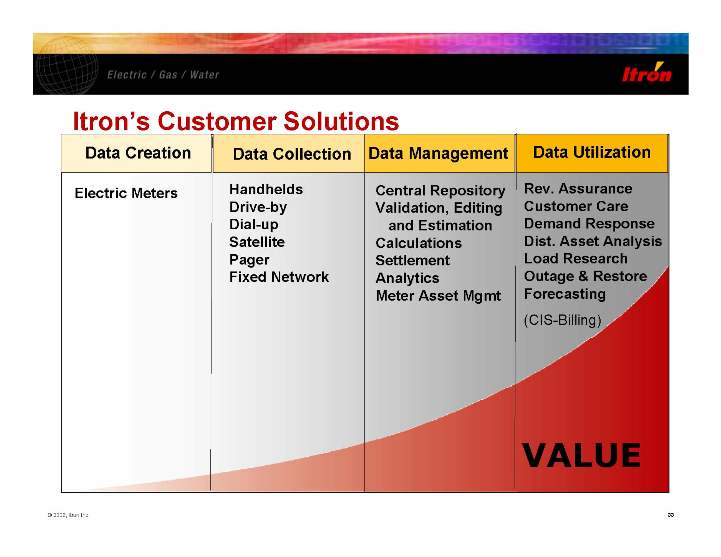

Itron’s Customer Solutions VALUE Data Creation Data Collection Data Management Rev. Assurance Customer Care Demand Response Dist. Asset Analysis Load Research Outage & Restore Forecasting (CIS-Billing) Data Utilization Central Repository Validation, Editing and Estimation Calculations Settlement Analytics Meter Asset Mgmt Handhelds Drive-by Dial-up Satellite Pager Fixed Network Electric Meters

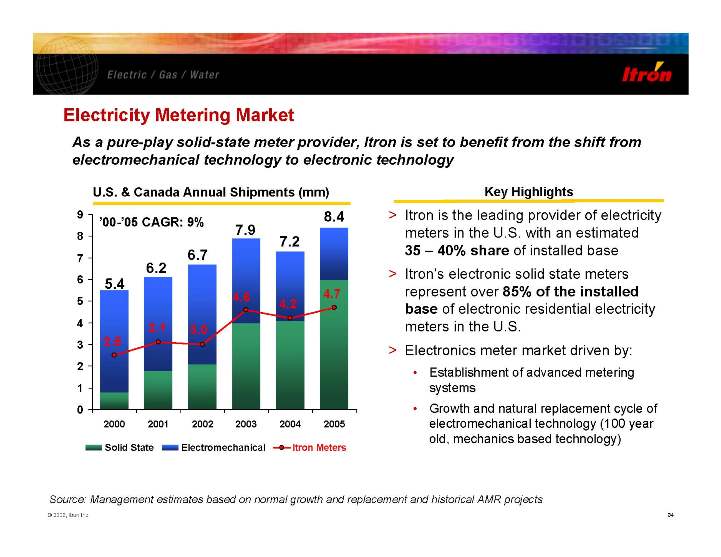

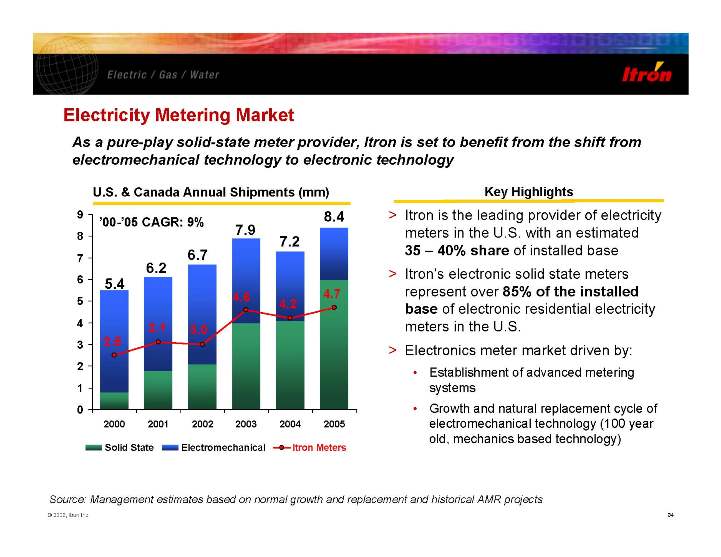

4.7 4.2 4.6 3.0 3.1 2.5 0 1 2 3 4 5 6 7 8 9 2000 2001 2002 2003 2004 2005 Solid State Electromechanical Itron Meters U.S. & Canada Annual Shipments (mm) Key Highlights As a pure-play solid-state meter provider, Itron is set to benefit from the shift from electromechanical technology to electronic technology > Itron is the leading provider of electricity meters in the U.S. with an estimated 35 - 40% share of installed base > Itron’s electronic solid state meters represent over 85% of the installed base of electronic residential electricity meters in the U.S. > Electronics meter market driven by: • Establishment of advanced metering systems • Growth and natural replacement cycle of electromechanical technology (100 year old, mechanics based technology) 5.4 6.2 6.7 7.9 7.2 8.4 Electricity Metering Market ’00-’05 CAGR: 9% Source: Management estimates based on normal growth and replacement and historical AMR projects

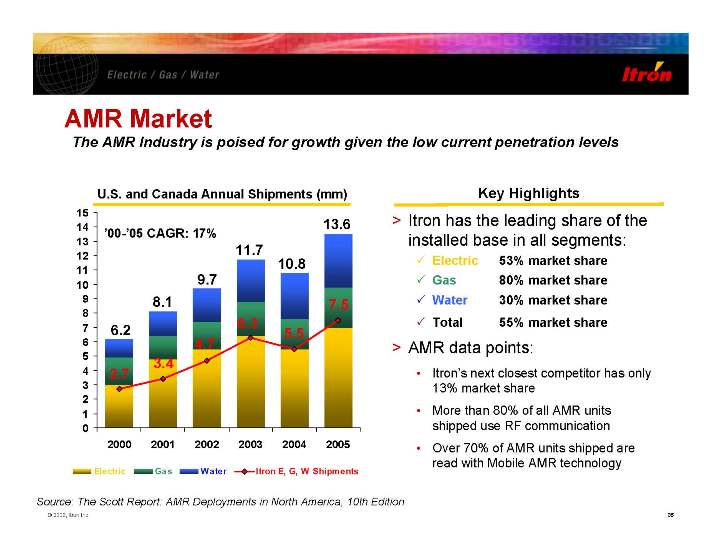

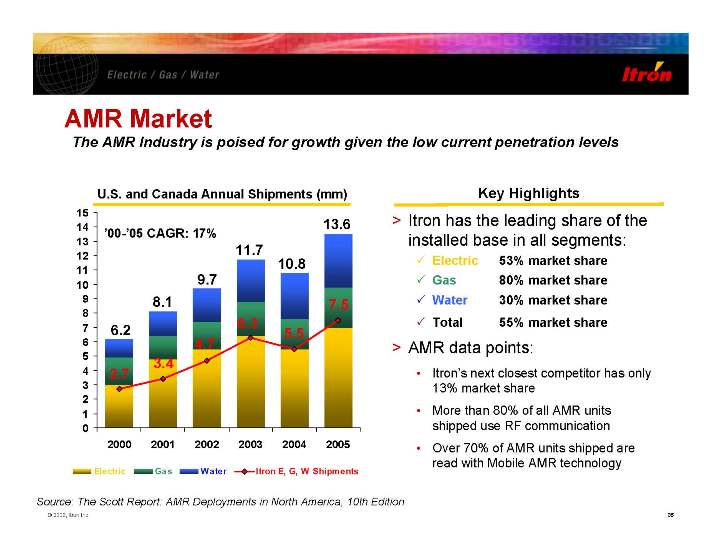

7.5 5.5 6.3 4.7 3.4 2.7 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 2000 2001 2002 2003 2004 2005 Electric Gas Water Itron E, G, W Shipments Source: The Scott Report: AMR Deployments in North America, 10th Edition U.S. and Canada Annual Shipments (mm) Key Highlights 6.2 8.1 9.7 11.7 10.8 13.6’00-’05 CAGR: 17% > Itron has the leading share of the installed base in all segments: 3 Electric 53% market share 3 Gas 80% market share 3 Water 30% market share 3 Total 55% market share > AMR data points: • Itron’s next closest co 13% market share • More than 80% of all AMR units shipped use RF communication • Over 70% of AMR units shipped are read with Mobile AMR technology AMR Market The AMR Industry is poised for growth given the low current penetration levels

Itron is the AMR Market Leader 53% 19% 16% 9% 3% 0% 10% 20% 30% 40% 50% 60% Itron Cellnet ESCO Hunt All Others 80% 12% 6% 2% 0% 10% 20% 30% 40% 50% 60% 70% 80% Itron CellNet AMCO/Elster All Others Electric Gas Water 30% 17% 16% 11% 4% 4% 4% 14% 0% 5% 10% 15% 20% 25% 30% Itron Neptune Sensus Amco/Elster Badger Hexagram Datamatic All Others ents in North America, 10th Edition

Experienced Management Team LeRoy Nosbaum Chairman and CEO LeRoy Nosbaum has more than 30 years of leadership and management experience in the utility industry. Mr. Nosbaum joined Itron in 1996 and has been a director and chief executive officer of Itron since March 2000. Before joining Itron, Mr. Nosbaum was with Metricom Inc., a supplier of wireless data communications networking technology. Prior to his tenure with Metricom, he held management positions with Schlumberger, Ltd. for 20 Malcolm Unsworth Sr. Vice President, Hardware Solutions Malcolm Unsworth spent 25 years with Schlumberger, including 11 associated with the electricity meter business. He was President of the Schlumberger Metering business prior to the acquisition of SEM. He also served as VP and General Manager of Schlumberger’s North America Operations in charge of water, electricity, gas products and the Cellnet business. Philip Mezey Sr. Vice President, Software Solutions Philip Mezey was named Vice President, Software Solutions in January 2004. Mr. Mezey joined Itron in March 2003 upon Itron’s acquisition of Silicon Energy. Mr. Mezey joined Silicon Energy in 2000 as Vice President, Software Development. Prior to joining Silicon Energy, Mr. Mezey was a founding member of Indus, a leading provider of integrated asset and customer management software. Steven M. Helmbrecht Sr. Vice President and CFO Steve Helmbrecht was named Sr. Vice President and Chief Financial Officer in January 2005. Mr. Helmbrecht joined Itron in 2002 with the acquisition of LineSoft Corporation. Prior to joining LineSoft, Mr. Helmbrecht spent seven years with SS&C Technologies, Inc., a software company focused on portfolio management and accounting systems for institutional investors.

Financial Details and Reconciliation

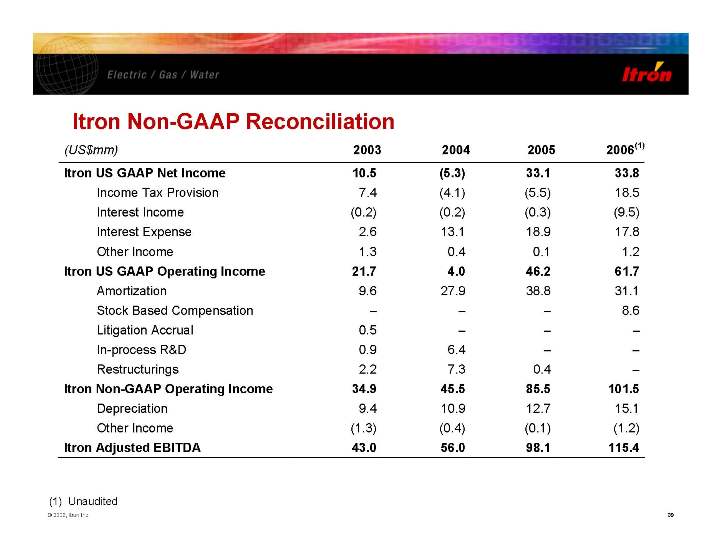

Itron Non-GAAP Reconciliation (US$mm) 2003 2004 2005 2006(1) Itron US GAAP Net Income 10.5 (5.3) 33.1 33.8 Income Tax Provision 7.4 (4.1) (5.5) 18.5 Interest Income (0.2) (0.2) (0.3) (9.5) Interest Expense 2.6 13.1 18.9 17.8 Other Income 1.3 0.4 0.1 1.2 Itron US GAAP Operating Income 21.7 4.0 46.2 61.7 Amortization 9.6 27.9 38.8 31.1 Stock Based Compensation - - - 8.6 Litigation Accrual 0.5 - - - In-process R&D 0.9 6.4 - - Restructurings 2.2 7.3 0.4 - Itron Non-GAAP Operating Income 34.9 45.5 85.5 101.5 Depreciation 9.4 10.9 12.7 15.1 Other Income (1.3) (0.4) (0.1) (1.2) Itron Adjusted EBITDA 43.0 56.0 98.1 115.4 (1) Unaudited

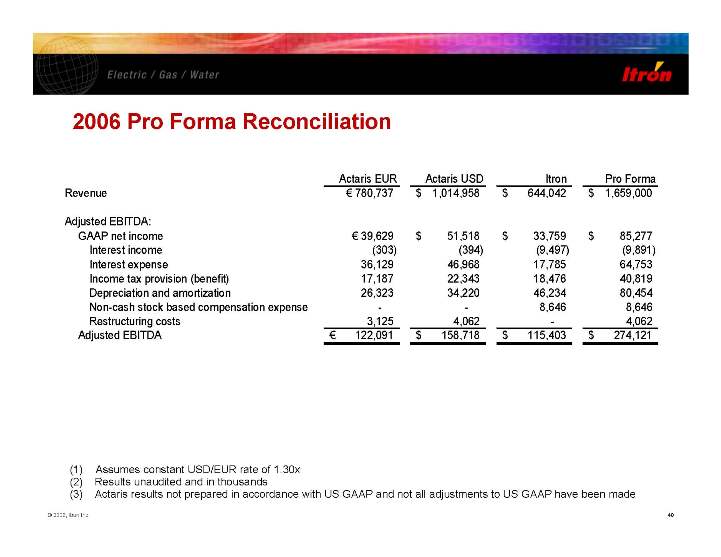

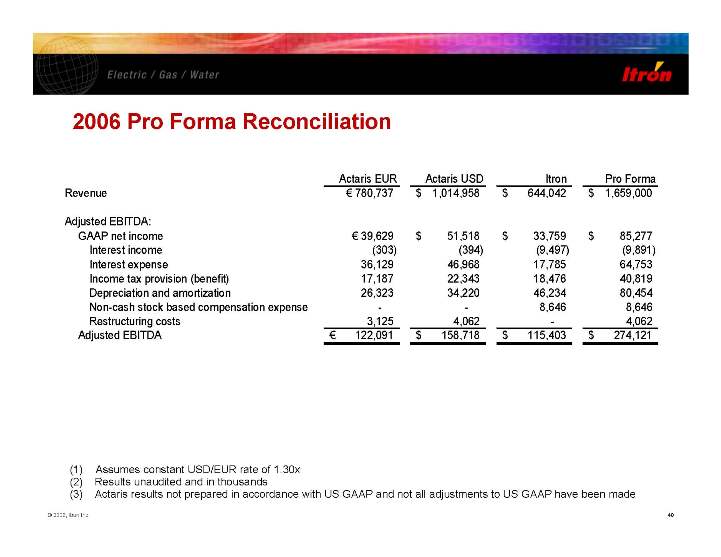

2006 Pro Forma Reconciliation Actaris EUR Actaris USD Itron Pro Forma Revenue € 780,737 1,014,958 $ 644,042 $ 1,659,000 $ Adjusted EBITDA: GAAP net income € 39,629 51,518 $ 33,759 $ 85,277$ Interest income (303) (394) (9,497) (9,891) Interest expense 36,129 46,968 17,785 64,753 Income tax provision (benefit) 17,187 22,343 18,476 40,819 Depreciation and amortization 26,323 34,220 46,234 80,454 Non-cash stock based compensation expense --8,646 8,646 Restructuring costs 3,125 4,062 -4,062 Adjusted EBITDA 122,091 € 158,718 $ 115,403 $ 274,121 $ (1) Assumes constant USD/EUR rate of 1.30x (2) Results unaudited and in thousands (3) Actaris results not prepared in accordance with US GAAP and not all adjustments to US GAAP have been made

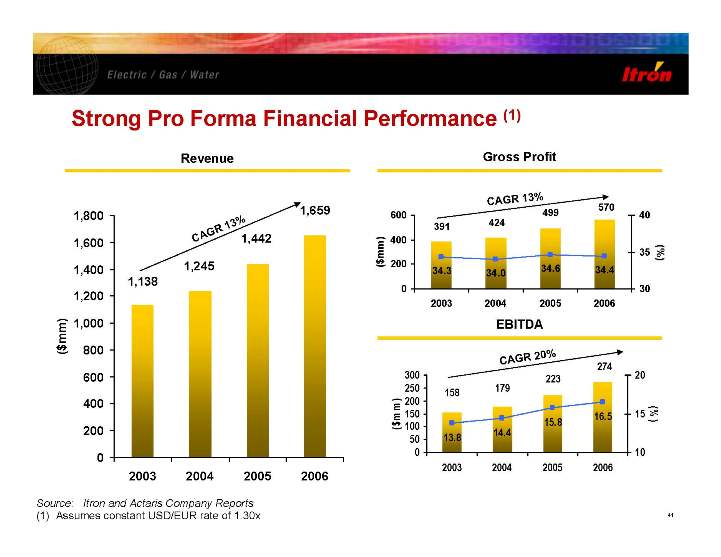

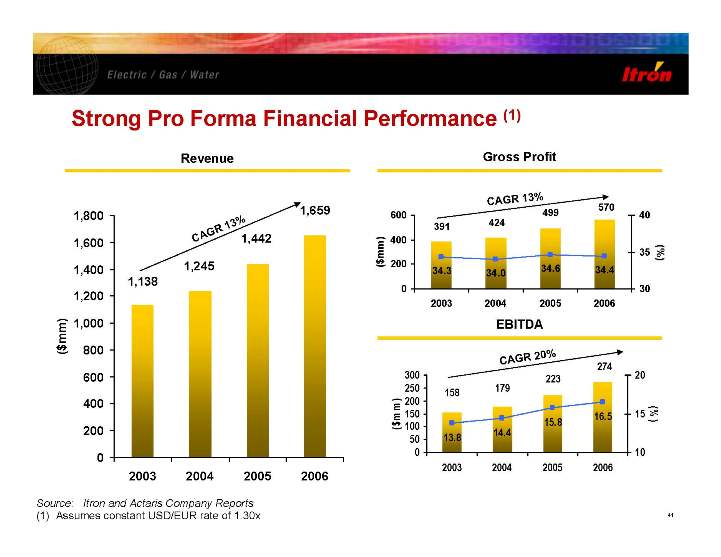

Strong Pro Forma Financial Performance (1) 1,138 1,245 1,442 1,659 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2003 2004 2005 2006 ($mm) Revenue Gross Profit Source: Itron and Actaris Company Reports (1) Assumes constant USD/EUR rate of 1.30x 570499 424391 34.3 34.0 34.6 34.4 0 200 400 600 2003 2004 2005 2006 ($mm) 30 35 40 (%) EBITDA CAGR13% CAGR 13% 274 223 179 158 13.8 14.4 15.8 16.5 0 50 100 150 200 250 300 2003 2004 2005 2006 ($m m ) 10 15 20 (% ) CAGR20%

Trended Pro Forma Revenue 2003 2004 2005 2006 Itron 317$ $ 399 $ 553 $ 644 Actaris 821 846 889 1,015 Combined 1,138$ $ 1,245 $ 1,442 $ 1,659 Gross Profit Itron 144$ $ 171 $ 234 $ 267 Actaris 247 253 265 303 Combined 391$ $ 424 $ 499 $ 570 % 34% 34% 35% 34% Adjusted EBITDA Itron 43$ $ 56 $ 98 $ 115 Actaris 115 123 125 159 Combined 158$ $ 179 $ 223 $ 274 % 14% 14% 15% 17% (1) Assumes constant USD/EUR rate of 1.30x (2) Results unaudited and in millions (3) Actaris results not prepared in accordance with US GAA P and not all a djustmen ts to US GAA P have been made

ƒ Actaris accounting methods differ from US GAAP in the following ways: > Accounting (2004): Actaris has applied a 100% fair value application rather than a 97% fair value according to US GAAP standards. If US GAAP had been used, the goodwill and paid-in-capital would decrease by approximately €7.6mm > Date of Acquisition (2004 & 2005): The sales and purchase agreement to acquire Actaris was signed on June 12, 2003 with a record dated of July 24, 2003. However, management has accounted for the transaction as of January 1, 2003 > Fair Value of Machinery & Equipment (2004): Actaris has deemed that the historical cost of Machinery and Equipment approximates its fair value. US GAAP requires that fair value be the market value of such Machinery and Equipment at time of the acquisition > Contingent Liabilities (2004 & 2005): Actaris accounted for contingencies relating to acquired assets as accruals. Under US GAAP these contingencies would not have been recognized. The corresponding reserves have resulted in an increase in goodwill > Convertible bonds (2005): Convertible bonds exclusively held by the shareholders are presented as a component of Shareholders' equity. US GAAP would present these as liabilities